are

for more than

via a

are

for more than

via a

We have been on our digitisation journey, as an industry, for… almost 20 years now?

That’s how long ‘fintech’ and ‘digital’ have been part of the financial services lexicon; since we started working with the new ideas that came with those terms.

New business shapes. New tools. New ways of working. New ways of engaging. Nearly two decades since we started staring into the work ahead and the magnitude of the task with varying degrees of enthusiasm.

During this time, the economy has become digital and industries all around us have transformed. And faster than we expected.

FS has changed, too, for sure. We have done a lot of things really well – and, frankly, we don’t celebrate those enough. But we have also done a lot of things less well, mostly for want of trying hard enough or in the hope that if we answered the smaller

questions, it would ward off having to address the big ones. Which it did not. And so here we are.

Now, it’s time for us to double down on those; addressing the things we have not done well. And do better. Fast. Because there’s a lot more coming down the pipe. With Web 3.0, defi and the increasing maturity of the technical arsenal at our disposal, is ‘digital’ even one thing anymore? Was it ever? How does thinking about AI, the environment and the needs of SME customers fit into one set of priorities? Into one head? We have done a lot of things really well and we don’t celebrate those enough. We have also done a lot of things less well

Well, it has to because if you want to play in this space, you need to understand it. Nobody said it would be easy. But the doing … that part doesn’t need to live with one person or with one team. In fact, it can’t. That world is gone (assuming it ever really existed). Multiple teams and multiple organisations need to get on with it now and at the same time.

Because digital is no longer a contained thing. It is the very fabric of the economy. We have some awesome contributors to this issue. Though their reflections and observations, we celebrate the distance our industry has travelled so far. We flag the things we need to think about more thoroughly. And we examine the brand new things rushing towards us.

‘Digital’ has come of age. And there’s a lot of work ahead. So read, enjoy, then roll up your sleeves and get on with it.

Did you recognise Issue 24’s spine tingler? “Hello there” – spoken by Jedi Master, Obi-Wan Kenobi played by actors Alec Guinness and Ewan McGregor.

Banking Circle’s proprietary technology enables Payments businesses and Banks of any scale to seize opportunities, compete and grow. From multi-currency accounts to real-time FX, international payments to local clearing, we’re quick, low-cost, and secure.

Bypass old, bureaucratic and expensive systems and enable global banking services for your clients.

bankingcircle.com

Banking Circle solutions are powering the payments for more than 250 regulated businesses, financial institutions and marketplaces, enabling them to gain access to the markets in which their customers want to trade, via a super-correspondent banking network. Here, Jussi Lindberg, its Chief Commercial Officer, explains the approach

“For payments businesses and banks that want a slice of the global e-commerce market, fast, fairly priced payments services that can be easily integrated into their own platforms are critical,” says Jussi Lindberg, chief commercial officer for Banking Circle.

Overcoming a myriad of challenges is key to capitalising on this opportunity. At the heart of these is legacy. There’s also competition coming from new entrants and continued regulatory scrutiny.

“Banks hold a really fundamental ‘trust contract’,” says Lindberg. “They are ideally placed to give their customers better, faster, more cost-effective services.

“The institutions that want to respond to new market opportunities and work in new jurisdictions tell us that they want to do that without diverting focus and investment from their core business.

“Banking Circle is helping banks to create their niche in the business banking marketplace. Collaboration delivers solutions underpinned by fit-for-purpose tech, supported by regulatory expertise. Banks that might have thought ‘that’s not for us’ previously, now realise how we can help them ‘be more fintech’ without putting the ‘trust contract’ they all treasure at risk.

“We are a genuine partner that allows financial institutions to take care of their business rather than get distracted by opportunities that sit outside of their core. Banking Circle and our bank clients work well together on things like tech capabilities; keeping up with regulatory burden and exploring regions and jurisdictions where they might not be prevalent, but still want to be able to offer a service.

“Banking Circle is almost like a sandbox to test out new propositions, opportunities, markets and jurisdictions. Our regulatory experience and tech capabilities complement banks’ own. Plus our payment rails for 25 currencies and 24/7 liquidity give financial institutions confidence we can handle significant volumes.

“We’re also giving banks a future view. This is particularly important in the area of regulation, whether it’s understanding what’s coming next or having knowledge about new jurisdictions they want to enter.”

Another area where Banking Circle is helping banks is de-risking. Larger banks that serve the smaller Tier 2 and Tier 3 institutions with correspondent banking Banks that might have thought ‘that’s not for us’ previously, now realise how we can help them ‘be more fintech’ without putting the ‘trust contract’ they all treasure at risk services, have found themselves with little choice but to de-risk entire regions, sectors or individual partners. The knock-on effect is that medium-sized banks have seen their correspondent banking partnerships under threat. Small fish in a big pond, the lack of buying power means they find it harder to create a competitive

proposition they can confidently offer to their customers.

Research that Banking Circle released earlier this year found that more than three-quarters of Tier 2 and Tier 3 banks had seen their number of correspondent banking partners rise over the past decade: 65 per cent said they think they have too many banking relationships.

“We have the conversation about de-risking with almost every bank we talk to,” explains Lindberg. “Banks are spreading their own risk by working with a greater number of correspondent banks. But more relationships mean more internal resources to manage these partnerships. It also means additional costs, which, inevitably, pass on to the end customer as well as undermining profitability.”

For banks wanting a slice of the cross-border payments opportunity, without having to worry about legacy infrastructure or risk holding them back, Banking Circle has built solutions from the ground up. The fact that the provider is working with more than 250 financial institutions across the globe is evidence of how it is delivering solutions that are the right fit for the market.

“A number of banks and non-banking financial institutions (NBFIs) are already benefitting from the investment in innovation, accessing fast, fairly priced payment services that can be easily integrated into their own platform,” concludes Lindberg. “With a clear approach to support global finance – not de-risk – our clients trust us, so that their customers can trust them in return.”

Supportive approach: Banking Circle is helping traditional institutions ‘be more fintech’

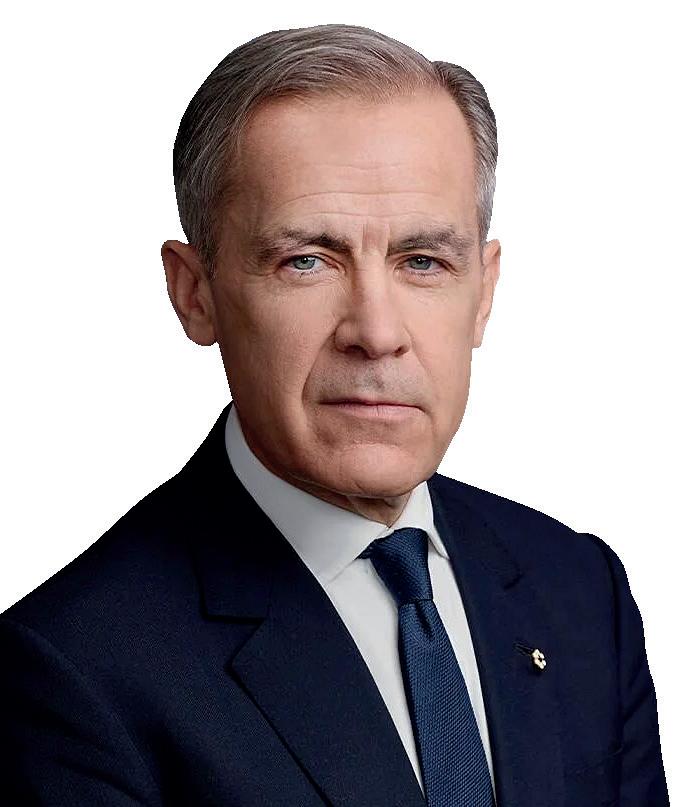

Jussi Lindberg joined Banking Circle in 2022 and is on a mission to tackle financial exclusion. Having worked in global payments and e-commerce for more than 20 years, he has extensive experience of the empowering role of effective, fit-for-purpose solutions. He has held roles in some of the industry’s leading businesses, most recently as senior vice president of business development at Adyen, where he helped elevate the company to become one of the world’s leading payment platforms.

Prior to Adyen, he was at PayPal and eBay, working with hundreds of enterprises to drive growth and improve digital performance.

He is now applying his vision and experience to the new role on Banking Circle’s executive board, helping financial institutions capitalise on the universal benefits of a financial ecosystem that operates in a network of collaboration.

Banking Circle is a fully-licensed, next-generation payments bank designed to meet the global banking and payments needs of payments businesses, banks and marketplaces.

Through its API, it delivers fast, low-cost global payments and banking services by connecting to the world’s clearing systems – enabling its clients to move liquidity in real time for all major currencies securely and compliantly.

The bank processes more than six per cent of Europe’s B2C e-commerce payments flows, equating to more than €250billion in 2021 alone.

In Identity, believes we’ve reached a reset moment –one that could democratise access to critical services. But it will require collaboration

The phrase ‘identity is the new money’ can be attributed to Sir James Crosby from his report on Challenges And Opportunities

In Identity Assurance, published in 2008. It has also been popularised by identity expert David Birch, who published a book in 2014 and a newsletter this year, under that title.

I come back to the phrase often for a number of reasons: firstly, it’s short and pithy, which are the key ingredients for regular re-use in my opinion. And, secondly, because it has only become more apt and accurate as the years have gone by. So much more of life is lived digitally and remotely, and that shift has led to a huge increase in identity-based transactions (and I mean transactions in the broadest sense, not just financial).

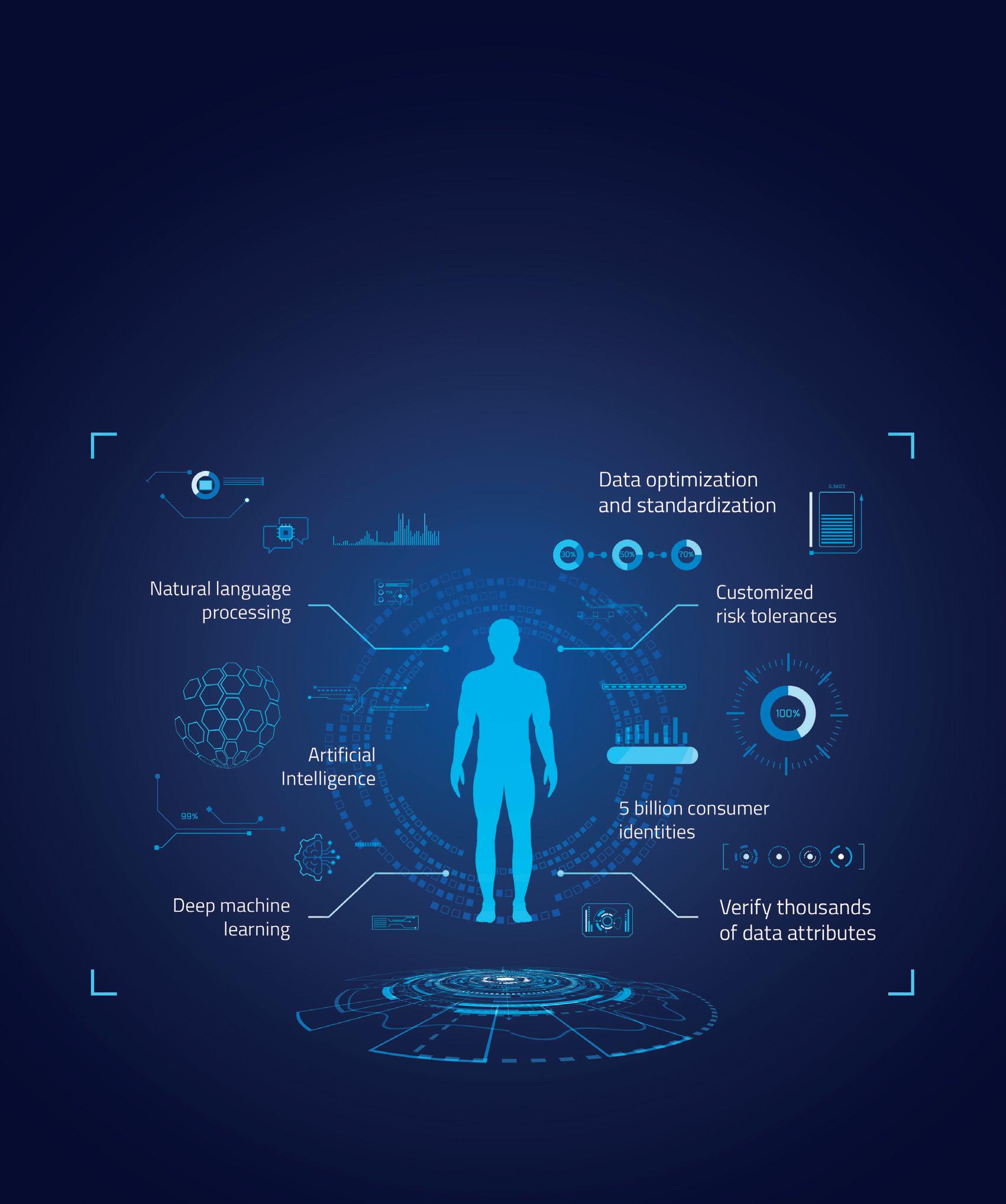

Digital identity is, effectively, a digital representation of an individual, and is a set of attributes that can be authenticated unambiguously through a digital channel to unlock access to critical services.

However, according to the World Bank’s ID4D database, almost one billion people lack a legal form of identity and a further 3.4 billion have some form of legally recognised ID, but limited ability to leverage it in the digital economy.

Advances in technology, decreases in implementation costs and increases in internet access and smartphone ownership, have coalesced into the optimal environment for digital identity to finally flourish. So, have we made progress? Well, yes, because we didn’t have a choice. A certain black swan event forced our hand to make digital identity a functioning reality. The question now is what’s required to make good on the opportunity the pandemic presented us with? Necessity drove innovation, but what should happen next? The answer is collaboration, but collaboration on a scale that is not often seen outside of times of crisis.

Governments worldwide are pouring time, resources and money into developing digital identity systems to allow citizens to easily prove who they are to access digital services; while the private sector is accelerating towards being made up of digital-first organisations. In the UK, we’re seeing cross-departmental collaboration in government to drive the One Login initiative, which aims to provide a single account for citizens to prove their identity and access central government services. In the US, Apple is working with a number of states (starting with Arizona) to allow iPhone users to add their state-issued drivers’ licences to their Apple Wallets. In the EU, the European Commission has suggested the creation of a digital ID wallet (in the form of a smartphone app) that will allow EU residents to access public and private services. Such initiatives all have collaboration as a founding principle and key tenet of their success. But we can’t ignore the proverbial elephants in the room.

Firstly, for all this talk of opportunities, we must acknowledge the risk associated with digital identity, and I think that is three-fold.

The fraud risk. The shift to online transactions has increased the attack surface for criminals, and we’ve seen huge increases in identity fraud, with 79 per cent of global organisations surveyed by the Association of Certified Fraud Examiners stating they’d seen an increase in the levels of fraud since the start of the pandemic.

The security risk. As with all digital technologies, the risk of breaches and/or failures of technology is ever-present. With mass adoption, the potential security risk is further amplified.

The privacy risk. Inherent in digital identity is the requirement to have personal data about an individual. And its collection, storage and use can lead to privacy violations, data misuse and an erosion of trust on the part of the consumer.

While there are technical solutions for some of these risks, others are behavioural and will require robust legal and regulatory frameworks to protect consumers and provide adequate government oversight.

The second elephant in the room is exclusion. At Women In Identity, we look at the risk of further excluding parts of the population through digital identity system implementation. We know simply digitising existing processes will do nothing for those who already struggle to access services. Digital identity solutions are an opportunity to fundamentally rethink access, offering many routes, and ensuring they have parity.

The true value of digital identity will be realised when individuals can transact as citizens and consumers with equal ease, using the same credentials to access all digital services – whether that’s government, financial or otherwise. The only way this becomes a reality is through true cross-sector collaboration.

The UK has become a honeypot for financial fraud, and romance scams in particular. Cecilie Fjellhøy is using a painful experience to drive change, while Feedzai’s Dan Holmes says banks need to step up

If you’ve been keeping an eye on Netflix’s greatest hits, you’ll be familiar with Cecilie Fjellhøy, star of the sensational The Tinder Swindler documentary.

She was caught in an unbelievably complex international online dating scam that saw her defrauded of hundreds of pounds by a playboy hoaxer that she’d had the misfortune to swipe right on – as had, so it turned out, two other women.

Convinced by his jet-setting lifestyle, lavish gifts and impeccable taste, the woman fell head over expensive heels for the purported heir to a diamond fortune – except the family rocks were a fantasy, and each of his victims was footing the bill for his serial seductions.

The story ricochets from penthouse suites to prison stays, heady romance to threats of violence. It is a true-crime rollercoaster that will keep you on the edge of the sofa.

Fjellhøy, a UX designer living in London at the time, was victim of a crime for which the UK appears to be the unenviable capital of the world. A recent report from UK Finance claims that 40 per cent of all those looking for love online have been asked for cash.

In the eyes of Dan Holmes, a financial fraud consultant working for Feedzai, an AI-driven technology company focussed on developing financial crime-fighting products and services, the displacement of fraud to the world of dating and other platforms is partly due to the effectiveness of anti-fraud precautions introduced by the banking industry.

“If you rewind back to 2016/2017, the primary threat that the banks were facing were what we call ‘unauthorised fraud attacks’ – finding a way to compromise a victim’s credentials and using these credentials to perform unauthorised spending. Banks reacted to that, and

there was wide adoption of a whole new array of fraud technology – like device recognition, location analysis, malware detection and behavioural biometric capability – which allowed banks to get a really strong grip on those unauthorised fraud attacks,” he says.

But once online banking systems brought in methods to clamp down on unauthorised use of accounts, it was inevitable that fraudsters’ focus would change. “Rather than the bank’s fraud ecosystem and defence mechanisms being the weakest part of the chain, the fraudsters realised that, actually, the weakest part of the chain now was the victim, the customer themselves.”

‘the card is blocked’, and every time the card was blocked, that meant he was in danger. At the time, I was more fearful of him losing his life. That is how you get brainwashed. It felt like a bad movie.”

She applied for loan after loan, using legitimate, procedurally appropriate and financially approved methods, and transferred those loans to him by her own hand. It’s part of the reason that he’s proven so hard to prosecute.

That was certainly the case with Fjellhøy. Her UK bank account wasn’t compromised, but her trust in others was exploited. As a romance scammer, the perpetrator used tactics that talked to her heart, not her head – claiming he would be in physical danger from criminal gangs if she didn’t help him out financially.

“Back in 2018, I had just moved to a new country, had no family there, few friends, and I met this guy who was promising me this future,” Fjellhøy says.

“I was soon to be 30… it was love bombing. Looking back on the messages between us, it’s ‘I’m stressed’, ‘I miss you’,

First cut is the deepest: Financial crime has ‘devastating financial, wellbeing, social, and emotional impacts’

Technology is in place to discern unauthorised from legitimate transactions, but all that is rendered ineffective when the victim is authorising fraudulent transactions on behalf of the fraudster. Holmes believes that in developing the ability to accurately assess authorised transfers, banks have become experts at detecting just one type of fraud, but ‘in the process have almost been a victim of their own success’.

So, if the very advances in fraud detection and prevention have left user vulnerabilities exposed, how do financial firms evolve their procedures and technology to close the gaps? Part of the answer lies with a holistic approach to anti-fraud protection measures inside the bank, believes Holmes.

In his view, the progression from branch to card-based transactions, to online banking, to mobile banking has been a neat evolution in consumer finance access, but one that is too siloed to be as effective as it could be.

funds, is key. There’s been a lot of talk in the industry recently around what more can be done to A) reduce the amount of mules that come on board at the front end, and then, B) clean-up the bad accounts from a bank’s book. Ultimately, if you can stop the mules, you stop the fraud.

“If we use Cecilie’s scenario, her bank does all the fraud monitoring on that side. But what a receiving bank doesn’t tend to say is ‘does this inbound transaction look normal for that account?’. There’s more we can think about, as an industry, from that perspective, as that’s, ultimately, where the point of compromise is in the scam.”

Having worked in a digital design environment and user interfaces

specifically, Fjellhøy has been vocal about not just how banks should have been able to spot her unusual financial activity, but also how they should communicate with someone they suspect of being a victim of an ongoing fraud.

situations, is in the minority in owning up to having been conned. Even so, there’s very little justice out there. The UK Parliament’s Treasury Committee on Economic Crime, reporting earlier this year, said fraud wasn’t seen as a policing priority.

It all raises uncomfortable organisational and ethical questions for banks. How do you discern harmful and anomalous spending patterns from unusual but harmless purchases? How do you talk to customers supportively about major changes in their spending habits? And all without being a major drain on your workforce?

For Holmes, solutions like Feedzai’s provide an evolved approach to protecting customers like Fjellhøy.

“We’re involved in consolidation of fraud transaction monitoring across the user lifecycle; so not thinking about the user as a card number, a user ID, or a telephone banking number, but as a holistic

“In Cecilie’s scenario, you’ve got one decision engine for lending, another for cards, another for transactions made in online banking, another for events in a telephony channel, and there’s no interactivity between all of these different silos within the bank.

“It sounds rudimentary, but even things like a lending decision, followed by a full payment out of that lending amount that you’ve just borrowed… if there’s no interactivity between those data sources, then it’s very hard for the banks to recognise it,” says Holmes.

And, in his opinion, there should be just as much focus on where the money’s going as where it’s coming from.

“Whenever a fraud happens, somebody is sending a payment from their account to the fraudster’s account; the fraudster’s always got to have control over that beneficiary. So, having a network of ‘mule accounts’, which are essentially the accounts that receive the fraudulent

It was a very clear change in my behaviour… But all the transactions that I did weren’t viewed as a whole Cecilie Fjellhøy, action:reaction Foundation

“It was a very clear change in my behaviour,” she says, “taking up so many loans, suddenly travelling all over the world, business cards, expenses of £60,000 in less than a month. But all the transactions weren’t viewed as a whole.”

It’s estimated that only 15 per cent of victims even report fraud – many are too ashamed or, rightly in most cases, don’t think there’s any chance of getting it back.

Fjellhøy, who’s left her job to set up the action:reaction Foundation to support people who find themselves in similar

user where we can understand what they’ve done, regardless of what channel they’ve executed it on.”

The ultimate vision for this is that banks collaborate and make the connection between potentially fraudulent transactions to build an understanding of what’s really going on. It’s a solution that Holmes believes is best understood by looking at the aviation industry.

“If there’s an accident in aviation, the whole industry comes together to understand what happened, and then they will push fixes out to their respective fleets, to better protect all air travellers. That doesn’t happen in the banking space today. A bank will realise there’s been an attack, it’ll fix it, but it won’t necessarily share that intelligence.”

A holistic approach would also trigger a more detailed, personalised assessment of a potentially fraudulent situation through conversations informed by the identified risk level.

Holmes explains: “It needs to turn into ‘have you done this transaction because somebody has asked you to do it? Have you had a call, out of the blue asking you to send them money? Has somebody approached you on social media, and now they’re asking you to do this?’. That’s a very different, more informative discussion for the bank to have with its consumers.”

And it’s one that could perhaps have prevented Fjellhøy from racking up more than £200,000 of debt.

“The call with the bank was never a long conversation regarding the total spend – just these individual ones,” she says. “Sometimes, I only got a text message. ‘Do you approve this transaction?’ The first company that I had a credit card with, realised after a while that I wasn’t the one using it. And that was good. So they blocked the card, and then they reached out to me. But because I was so scared, because I had lent him my credit card, I felt ‘now I’m the one who has done something I shouldn’t have and they’re coming after me.’

“When they contacted me, unfortunately, I was with the fraudster and he made it feel like it was us against the world. Fraudsters can make you scared of the good people.”

Holmes argues that biometric technology could have raised a red flag had it been employed by the bank.

“You can start to tap into emotions within voice biometrics… for example, ‘yes, this is Cecilie, but can we tell from her voice patterns that perhaps something’s not quite right, relative to what we normally expect to see from her?’. I’m not saying this is a silver bullet, but it’s a step further to better protecting the consumer.”

It seems that a cultural and educational shift will also be important if the UK is to bring down its estimated £3billion fraud bill, where losses suffered per person are higher than in the US, Canada or Australia.

Information campaigns have their role, but, as Holmes says: “It’s difficult to see an advert on Saturday evening, and then recall all that information when you get a call from the fraudster on Thursday.

“But if the bank presents something to the customer at the point of material risk, when they’re about to make the payment, does that force them to remember that advert and say ‘is this a little weird?’”

A national 159 help line was launched across the UK by a number of banks last year, giving consumers an invaluable

opportunity to discuss the specifics of any transactions they’re about to approve. Individual banks have also instituted their own hotlines, including Nationwide, with what it calls ‘increased friction’ to slow transactions identified as fraudulent, so consumers can seek reassurance before their payment is too late to stop.

Fjellhøy believes that counselling and discussion has a big role to play in averting future crime as well as removing the shame associated with it.

“It’s so important to support fraud victims, so they can go to the banks and tell them what happened. We need to remove the stigma, so people aren’t worried about

many of these scams. Simultaneously, the second Economic Crime and Corporate Transparency Bill will enable businesses in the financial sector to share information more effectively to prevent and detect economic crime and allow banks to slow down instant payments if they’re suspicious.

Fjellhøy realised that, in the end, she was never going to get any of her money back. And yet, four years later, the perpetrator is still out there. And, in an ironic twist, Fjellhøy’s attempts to help victims of fraud has itself been exploited by fraudsters.

“There are a lot of fake accounts out there now, pretending that they’re me, trying to defraud people by using my story,” says Fjellhøy. “I get a lot of scam victims contacting me for help and these fraudsters are talking to my followers, saying, ‘if you give us such and such, we can get your money back’. And yet, when I try to have these accounts shut down, the response I get is that the social media platforms receive so many reports, they don’t have time to remove them. There is so much more that institutions – tech companies, not just banks – can do.”

Holmes agrees that more effort needs to be put into bringing ‘different parts of the “kill chain” together to work more effectively as a collective’.

being judged – so they can say to each other ‘I fell for this, and I clicked that link’. I think it will be better for everyone if we were a bit more open and it would be more difficult for the fraudsters to flourish.”

A recent report from Transparency Task Force, a social enterprise group that campaigns for greater transparency in UK financial services, found financial crime had ‘devastating financial, wellbeing, social, emotional and support-related impacts’ and called for reform of the regulatory system and better support for victims.

And there is evidence that banks are beginning to see fraud less through the prism of the P&L and more as a social harm: consumers have had their lives ruined because it’s not possible for them to get lending again, or to take out mortgages. Meanwhile, some consumers have lost their pension pot.

The UK’s Online Safety Bill, meanwhile, proposes to place a duty of care on online platforms like Tinder that are channels for

“Bringing the telcos, the tech giants, the internet service providers, and the banks into a room together, for them to all work more effectively around how they can better protect their respective countries’ consumers from scams, is something that I’d like to see more of.

“I think there are four key takeaways for me, when it comes to better protecting consumers. First, use the right technology – yes – but use layers of the technology. One piece of the kit isn’t going to solve this.

“Second, educate your consumers, to the best of your ability. Do this frequently, do it at the right time; give them the best chance to recognise that something’s happened, so that even if your technology fails, they still potentially get to stop it.

“Third is collaboration, not just across the banks, but all the parts of the kill chain.

“The final one is make sure that whatever authentication strategy you have, whatever conversations you have with customers, reflect the risk that you suspect is in play.

“If you can nail those four things, while you’ll never solve the problem, you’ll give yourself the best chance to limit it.”

The bank will realise there’s been an attack, they’ll fix it, but they won’t necessarily share that intelligence Dan Holmes, FeezaiMatters of the heart: 40 per cent of those looking for love online have been asked for cash

If you see compliance simply in terms of technology, you’ve missed the point – and the power – of transformation, argues Livia Benisty, Banking Circle’s Global Head of Business AML

Fintech has changed financial services. It is a cultural as well as a technological shift. By focussing on the customer and challenging the traditional tech stack required to offer financial products, companies have redefined what people should expect of banks and others offering financial services.

Cloud-based has become the new norm, with traditional banks involved in lobbying more conservative regulators and investigating how to best transfer over. Deals are won and lost on the quality of API documentation. Smart phones, in countries where widely used, are not only the core means through which services are accessed (in the case of retail products) but also our main source of authentication. Web 3.0 will likely revolutionise these changes all over again. And it seems like quite literally everything now has to use AI (even if it doesn’t).

However, for all the advancements we’ve made, there are some ways in which we’ve barely changed at all. Throwing technology at a problem while fundamentally thinking about it in the same way, doesn’t solve that problem, it just hard codes it. One could argue (and I would) that we’ve been so focussed on the product, so obsessed with calling ourselves ‘innovative’ and executing at speed, that we’ve not accounted for the need to embed processes, culture and mindset for continuous change.

Doing things with new technology is not enough to truly do something in a new way; that is the path to us all being the dinosaurs of the future. If we do not consider every element of the company as part of the change we are trying to create, we will be right back where we started: with everything taking forever, demotivated and burnt-out staff, and second- and third-line functions ‘slowing things down’.

While I believe this is the case for several teams, the core of my experience is in AML (anti-money laundering). Long considered a business prevention unit, fintech founders have pushed heavily for efficiency and cost gains in this area. The incredible rise of fintech has meant a parallel market for regtech has blossomed, with this segment raising nearly $19billion in 2021.

The number of solutions on the market would have you believe that every part of regulatory compliance can be automated, with data analysed in nano-seconds, likely by an AI-driven solution that can also make your coffee and sort your love life (assuming a clean data lake, infinite budget and a team of engineers dedicated to this, rather than building product you can actually sell).

One of the most advanced (and money-making) areas of regtech is AML/financial crime. It’s understandable; time to onboard is key to the user experience, fraud losses are expensive and, for the amount spent, knowing that 95 per cent of transaction monitoring alerts are false positives is deeply frustrating for any executive. We have an increasing array of choice when it comes to the technology we can implement to help solve these issues, and fintechs have adopted it in droves.

Of course, the need is real. Much of regulatory compliance consists of data collection and storage before being able to analyse and mitigate risk. Automating collection and being able to analyse vast quantities of data holds huge potential for efficiency gains, improving the customer journey, increasing employee motivation and satisfaction and, of course, improving compliance.

And yet, we continue to organise and treat these teams much as we did

15 years ago. Rather than bringing AML into early-stage decision-making and design, at best we hand over a finished version and tell them to enable it. We instruct them to make the best use possible of an architecture centred around a vision for a particular product offering; business requirement documents (BRDs) that have never been considered in the light of regulatory obligations, changing market forces and the motivations of our workforce.

That’s at best. At worst, we forge ahead and worry about it later.

We know we should think about it, hire for it, but we don’t design for it. To truly solve this problem we need to stop thinking that you can throw technology at it, and start to recognise that great AML is the by-product of a sensibly-thoughtthrough tech architecture that has taken into account different perspectives on what scaling could imply, and how to culturally and procedurally embed the ability to change in a regulated environment.

By including AML as part of a company’s digital transformation from the outset, you end up with a control function that is strategically embedded into the future vision of the company and is adequately prepared for it. In some cases, it may even drive it forward. Here’s what I think that looks like.

1 Good AML is an integral part of your organisational and operational design AML and compliance are not a separate function, like an isolated side box on an org chart. When thinking about the tech structure for the AML function and its associated systems, think about the interactions AML would have in the product lifecycle. There will be interactions with sales and business development teams. There will be an assessment of product market fit (e.g. is this customer an appropriate user of the product and what would expected behaviour look like?).

Any use of AI in AML needs good data. There isn’t AML data and non-AML data. It’s not separate. AML will need to use much of what is collected on a client and their activity. For a bank, this is everything that goes through the core banking platform, treasury function, how the lead was generated, pricing negotiations, etc. This can be embedded

early on, preventing large remediation projects and re-mapping exercises.

Before buying AML tech, identify the several teams and systems AML needs to talk to. All these interactions need to be replicated digitally. At the first stage of determining how to set up the tech stack of a bank, AML has a role to play. Every time that tech stack changes, the downstream impact on AML needs to be a core consideration before go-live. These technological interactions need to be mirrored in processes and rituals that integrate these teams and keep them on the same page. Innovative companies will have ideation processes, product design, brainstorming, testing. Regulated entities will need to bring that into governance frameworks, approval processes, etc. If we can design for that early on – creating interactions, rituals and processes that bring the right people to the table at the right time – we foster a culture of openness to change, inclusion and diverse perspectives.

customer journey and commercial objectives in mind. It takes smart people to build those. Only once that is done can you build your tech to make it happen.

First people, then processes, then tech. Otherwise it won’t work.

We have focussed on technological advancement and creating a better proposition. We’ve instigated cultures of execution, drive, speed. We talk about scaling as a skillset. All of this makes sense and has led to huge successes. And yet, we’ve not realised that to avoid being the clunky, legacy incumbents of the future, we have to build in the ability to change. That ability will keep companies nimble and relevant in the short and long term.

When building processes and systems, do we consider what happens if any of our underlying assumptions or characteristics change? Do we hand people the tools for dealing with the implications? I think we unconsciously build in (at least) an element of rigidity that comes back to haunt us.

Being able to execute and scale doesn’t show an ability to enact and deal with change. You can scale a company and change nothing. It’s a short-term win, which, arguably, works for an industry that is increasingly incentivised by investment rounds and IPOs to act with that timeframe in mind. But it won’t lead to ongoing success.

AML is seen as a blocker when ideas for change come to the team late and sometimes second-hand. Advanced warning makes things move quicker; being made part of the decision-making process even more so. Team members do not then constantly feel on edge about what is coming, and this means they can see themselves as enablers, rather than defaulting to a defensive position when their risk appetite is challenged and they feel unable to feed back.

Particularly when it comes to regulated institutions, there are things that have to be done and governance that needs to be in place. Those things might be mandated by regulation, but there are good and bad ways of achieving compliance. Procedures need to be thoughtful, usable and keep the

It’s about a mindset; open-mindedness and a willingness to embrace change rather than fear it. For a team that’s ready for it, the new product releases, new markets and new pieces of regulation mean a simple process of gap analysis; questions to be answered and processes tweaked. For teams that aren’t, it’s a frightening concept that threatens the way we’ve always done it, usually at a time where we are overworked and overburdened as it is.

When we challenged the fundamental way of doing banking and finance, we never took this thing that causes everyone so much frustration and pain and gave it a seat at the table.

We need to go from caring about AML to designing for it; making AML a core, integrated pillar of the digital transformation we are all so proud of ourselves for achieving. Because it will keep being that overburdensome revenue sucker until we do.

When we challenged the fundamental way of doing banking and finance, we never took this thing that causes so much frustration and pain and gave it a seat at the table

2021 was something of an annus horribilis for many unwitting consumers in the UK, with fraud victims conned out of an incredible £1.3billion.

Digging a little deeper into the data, there were 195,996 separate instances of authorised push payment (APP) scams, which saw Brits tricked into handing over £583.2million last year.

App frauds are usually simple but effective; criminals posing as trusted organisations or financial institutions, persuading victims to make a payment in the belief that their money was in safe hands. These scams often use legitimate platforms to reach victims, borrowing the credibility of the platforms and services they abuse.

The harm is, of course, primarily felt by the individual persuaded to part with their cash through fake calls, text messages, social media posts and seemingly legitimate websites. But banks are also impacted – not only if they reimburse the customer, but also by the detrimental affect it has on consumer confidence in their brands.

Add to the mix a steep rise in the number of digital communications and transactions encouraged by the COVID-19 pandemic, and the environment exists for financial fraud to become something of a national crisis. Institutions haven’t been sitting on their hands, though.

What could be described as a ‘fourth emergency service’ was launched in the UK in September 2021, whereby customers who think they might be being scammed, can call 159 for assistance. The secure number connects to the individual’s bank and is a safe avenue for anyone who believes someone is trying to trick them into handing over money or personal details.

‘Call 159’ was introduced by Stop Scams UK, an organisation created in 2020 to help firms ‘protect customers based on

proactive collaboration, and sharing insights and best-practice’.

To date, Barclays, BT, The Co-operative Bank, Gamma, Google, HSBC, KCOM, Lloyds Banking Group, Meta, Microsoft, NatWest, Santander, Starling Bank, TalkTalk, Three, TSB and Nationwide Building Society have signed up to the initiative, covering more than 80 per cent of primary current account holders and the majority of telecoms subscribers.

Trust is key to all banks but none more so than the one that ranks as the UK’s most trusted financial brand, which is regularly in the top two for customer satisfaction. Nationwide Building Society, with 16 million members, has something of a reputational imperative to address the industry’s authorised fraud crisis. Before joining the Stop Scams UK initiative, it had launched its own Scam Checker service, which encourages its members to check any payment they are worried about, either in branch or by calling a 24/7 freephone number. More than 300,000 of them used Scam Checker last year. Along with additional staff training, awareness programmes and investment in its data-handling infrastructure, Nationwide helped to prevent £97million of attempted card and online transaction fraud in 2021/22.

But it has gone further. Its 2022 annual report describes how the Society has also ‘enhanced our fraud detection system for payments, and improved our scam warnings, to simplify them and to highlight social media scams’.

It continued: “We are educating more broadly beyond our own membership, too, and ran national media campaigns on scams awareness. We are also playing our

part to tackle this growing problem by taking an active role in cross-sector working groups, including campaigning for changes around greater data sharing between financial services providers to reduce payments fraud.”

Nationwide’s approach to fraud prevention clearly has data at its heart. Otto Benz, director of payments, says there is an accelerated move by banks to improve payments data, driven not just by changing consumer habits but also by the urgent need for increased security.

“We are definitely seeing a move away from cash and into electronic payment mechanisms, and particularly account-to-account mechanisms, through open banking,” he says. “A lot of the participants in the payments ecosystem – banks, building societies and others – are refreshing their payments platforms and infrastructures, both to support things like ISO 20022 [the global payments messaging standard] and also their own need to improve resilience.” That plays into consumer expectation, particularly in the UK, for real-time payments to be processed quickly and with minimum fuss. But can speed compromise security? How do you ensure that these ‘fast and frictionless’ payments are not fraudulent?

Benz believes that AI can play a central role, particularly when it comes to fraud based on psychological manipulation.

“A lot of the problems now are social engineering issues, where customers are persuaded to make payments to people who seem reasonable at the time. It’s only when they’re interrupted in their thought process and made to think about whether this is something they really should be doing, that these fraudulent payments

The shocking rise in financial fraud is driving UK banks like Nationwide to adopt a new approach, as its Director of Payments Otto Benz explains

Just providing a standard message, asking somebody ‘are you sure you know this person?’, is probably not good enough to prevent some of the frauds we’re seeing

are stopped. And that’s where I think some of the new technologies can really help, because just providing a standard message, asking somebody ‘are you sure that these are the details of your payment? Do you know this person?’, is probably not good enough to prevent some of the frauds we’re seeing. AI can help with specific interventions, and also putting suitable friction into the payment process,” he says.

Benz believes the standardising of electronic data exchange between financial institutions, under the framework of ISO 20022, will also have an impact. Data provides knowledge, with knowledge comes transparency, and this transparency delivers enhanced security.

“Ultimately, payments is a collaborative ecosystem,” he says. “You need to collaborate on what the format is for a payment, and how it’s best enabled. Underneath it all is a demand for more data in the payment itself.

“The ability to track international payments, end to end, with new guaranteed references, through the unique end-to-end transaction reference (UETR) on SWIFT, is a real benefit. Just understanding who you’re sending your payment to should reduce the effort required to check it – through sanctions processing, for example – because the parties will be more easily identifiable.

“All of these things will improve straight-through processing rates and make it easier to detect any potential issues. Just providing the basic facilities to track for individuals and their financial institutions, will help. For banks, too, it will improve accuracy, speed up processing and reduce costs.

“Institutions still need to innovate to make use of all the data that’s becoming available, though,” says Benz, “and it’s still unclear as to how companies will be able to provide that information to their customers. Despite the fact that this has been coming for several years, nobody’s come out with great use cases to leverage this enhanced data. This is still an opportunity for us in the industry, but it’s not ready yet.”

Anticipating these opportunities, Nationwide has invested heavily in improving its technology estate, much of it architected internally. But it also has key partnerships with external providers.

Only recently, it announced a deal with digital transformation company AND Digital, to improve the data experience of users. AND Digital will look to help deliver real-time information across touchpoints, for both Nationwide employees and members – in person, online or on the phone – through ‘optimising work processes and developing bespoke platforms that require minimal technical capabilities of the user’.

Benz believes that financial institutions will have to continue to evolve to cater for an ever-changing landscape. And whether it be countering fraud, delivering faster transactions or simply communicating better with customers, organisations like Nationwide

have, in many cases, embraced the Cloud to improve their offering.

“We, like many others, have inherited technology infrastructure, which ages over time, and it’s very difficult to cater for the changing types of payments, the changes in the international landscape and also the volume of interactions,” says Benz.

The building society recently upgraded to IBM’s z16 mainframe, which is future-proofed for AI applications and cyber-resilient security. It also maximises Nationwide’s technology options, being suited to hybrid Cloud environments.

Nationwide completed its first Cloud-based payments test through PayUK’s New Payments Architecture programme earlier this year.

“We’ll roll that out and build our new payments infrastructure on that Cloud platform,” says Benz, “to leverage the new payment standards from day one.”

To the rescue: Nationwide is taking a multi-pronged approach to protect its members from fraud

SmartStream’s fully integrated suite of solutions and platform services for middle- and back-office operations are more relevant than ever – proven to deliver uninterrupted services to critical processes in the most testing conditions. Their use has allowed our customers to gain greater control, reduce costs, mitigate risk and accurately comply with regulation.

With AI and machine learning growing in maturity, these technologies are now being embedded in all of our solutions and can be consumed faster than ever either as managed services or in the cloud.

Simply book a meeting to find out why over 70 of the world’s top 100 banks continue to rely on SmartStream.

Back in 1956, physicist Hugh Everett’s ‘many worlds’ theory described how the entire universe exists in multiple states – something he termed the ‘multiverse’. Since then, physicists have proposed many types of multiverses, including parallel worlds.

While these co-exist, physics dictates that ‘no communication occurs between them, so no universe is aware of the presence of any other’. It does, however, support the notion that they can collide!

The principle behind the theory appropriately describes how I view the last 13 years of digital change and innovation across financial services –specifically two parallel worlds that have grown under two very different realities: the fintech and crypto worlds.

The ‘big bang’ that accelerated the growth of both these worlds occurred in 2008. Known as ‘The Global Financial Crisis’, its impact spread across all parts of the financial services industry to devastating effect. It caused deep financial losses, mass unemployment and led to the collapse of significant financial institutions, which resulted in the loss of customer trust in the banking system. This event, combined with the fact that banking had not seen real change for centuries and that the wider world was becoming

increasingly mobile and digitally savvy, created the perfect storm for change.

Fintech describes technologically enabled financial innovation that gives rise to new business models, applications, processes and products that have the potential to change financial markets and institutions. So, you might think the term fintech also describes crypto. One only needs to read crypto community forums to appreciate the disdain with which such an association is viewed, some arguing that fintech is merely iterating on the incumbent rails of traditional finance, while crypto is building something brand new and fundamentally transformational.

Such opinions underline why it’s important that both worlds should always remember their ‘why’. Most companies know what they do and how they do it, very few companies are able to clearly articulate the reasons why they do what they do. By reminding ourselves that the growth of the fintech and crypto worlds were both accelerated from the ashes of the financial crisis, it is fair to conclude that the ‘why’ of both worlds is to restore society’s trust in a broken financial system. Indeed, shortly after the Bitcoin genesis block was mined, its creator, Satoshi Nakamoto, confirmed trust as being the crypto world’s ‘why’. Nakamoto wrote: “The root problem with conventional

currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

Trust here refers to an individual’s reliance on another person or entity under conditions of dependence and risk to take control of one’s assets. It’s how each world has approached the building of trust that really defines how remarkable both are, if you’re gazing from one world to the other.

The fintech world has built trust by adopting a laser focus on disrupting lower-margin business or niche business operations that incumbent banks had previously overlooked. Fintechs have been able to provide individuals with access to lower cost services via well-designed platforms or mobile applications that are easier to access and use.

While trust is one of the central goals of UX design, instilling trust goes beyond this. So, the fintech world also introduced 24/7 customer services via non-traditional channels, such as social media. This empowered customers to expose any failures of those services in real-time and to a wider audience. So, fintechs have been compelled to deal with complaints as quickly as possible, while also demonstrating that they have learned from those failures accordingly.

Beyond societal trust, the fintech world has also been effective in winning institutional trust. This has accelerated from the passing of legislation such as open banking and the revised Payment Services Directive (PSD2), which provided fintechs with unprecedented access to the banks’ customers and their banking data. This has allowed fintechs to build personalised products and services that benefit customers in ways that traditional financial service providers had previously been unable to offer. Personalisation is seen by some academics as a key ingredient of trust because it fulfils the customer need while also creating a feeling of being in control.

Institutional trust has also allowed fintechs to access an abundance of venture capital (VC) funding. In 2021 alone, more than $210billion was invested into the fintech world, which was a 10-fold increase on that invested in 2016. That’s allowed fintechs to acquire the best talent and disruptive minds, which deepens the trust of institutions and investors alike. And consumer adoption of fintech companies and products has grown exponentially as a result, with more than 75 per cent of consumers globally adopting some form of money transfer and or payment service by 2019, according to Statista.

The evolution of the crypto world is diametrically opposite to this. Given the absence of societal and institutional trust, the crypto world’s evolution has been remarkable in that it has been able to build trust through technology. The building blocks of this were created following the release of the Bitcoin whitepaper, which introduced a peer-to-peer electronic cash system, operating without the need for any central authority or bank, using blockchain.

Since its launch, Bitcoin has grown to become a significant store of value with some (myself included) arguing that Bitcoin enhances the properties of gold, making it the ultimate store of value.

Since Bitcoin was launched, the crypto world has introduced thousands of digital assets, each one designed to solve a specific problem within the financial sector and beyond. Like the fintech world, these crypto projects have focussed on reducing the costs and friction that traditional banking had ignored. Well-publicised use cases that the crypto world has improved upon include cross-border payments, trading, fundraising and clearance and settlements.

Indeed, in 2017, Pictet Asset Management believed that by 2022 the underlying technology of the crypto world ‘could reduce global banks infrastructural costs by $15billion to $20billion a year’.

The success of the crypto world is even more impressive when we consider the lack of attention that has been paid to the UX. Early users of crypto will remember the interfaces of products like My Ether Wallet, exchanges such as MT. Gox, and, more recently, lost exchanges such as Cryptopia. The UX designs were terrible, and the personalisation was non-existent.

Furthermore, due to the decentralised nature of the technology, the concept of customer services does not exist. When things go wrong, there is no recourse for crypto users to take, apart from writing an angry Tweet. Trusting the technology is literally the only choice that the users have.

Despite the innovations that the crypto world has unlocked, it has evolved under a constant cloud of uncertainty due to the opposition from banks, regulators, and society alike. Despite this, the crypto world has grown an industry that was worth more than $3trillion by November 2021. With more than 300 million people using crypto

The crypto world has evolved in such a way that it is impossible for the fintech world to ignore it any longer. And so we will begin to witness their inevitable collision today, the crypto world has evolved in such a way that it is impossible for the fintech world to ignore it any longer. And so we will begin to witness their inevitable collision.

By proving that people not only trust technology but also that decentralised technology works, the dynamics of the crypto world will change significantly over the next decade. Not only will we see more institutions utilising the underlying technology, but we will see an exponential increase in the number of people using digital assets as a means of value exchange.

The seeds have already been sown, with the UK government confirming its intention to ‘legislate certain stablecoins, where used as a means of payment’. The Bank of

England’s Financial Policy Committee also made clear this year that if crypto activity is of an economic equivalent to activity undertaken by traditional financial services, the regulatory perimeter should be adapted to ensure it is regulated in the same way.

Once the crypto world achieves regulatory certainty it would be reasonable to expect an exponential increase in societal and institutional trust in the products and services it offers. Indeed, there is reason to believe that its impact will be similar to how open banking and PSD2 supercharged the growth of the fintech world. It would also be reasonable to assume that regulatory certainty would unlock an increase in VC funding that was previously not permitted to invest or felt uncomfortable investing in unregulated activities.

Likewise, this increase in funding and legitimacy would also provide the crypto world with a greater ability to attract the best talent and disruptive minds.

Fintechs should be mindful that if history does repeat itself in this way, then their world might find itself being seen as legacy if it fails to adapt accordingly. And, given that the crypto world is largely built upon decentralised technology, it must be mindful as to how this might impact fintechs’ ability to function. Over the next decade, the winners will be those that can adapt their business models to function seamlessly in networks whilst also remaining true to the ‘why’ that has won the trust of customers.

They will also be aware that financial services will be more than providing customers with frictionless ways to move and access money, it will be about providing customers with a frictionless way of sharing and controlling their data. We have already seen the significant drop-off rates that distrust can cause open banking journeys when customers feel they have no control over their data assets.

Some organisations might lobby regulators in the hope that laws might relinquish the control that customers have, but in doing so we must be mindful that such changes would undermine the reasons ‘why’ both worlds exist – and go against definitions of trust and the open banking standards of customer excellence.

Given both worlds share the same ‘why’, they can only help each other build greater trust by colliding. This will, ultimately, unlock better products and services for society and only benefit the industry as a whole.

A new identity: It's not a case of ‘if ’ but ‘when’ we embrace digital IDs

UL Solutions is one of the gatekeepers to trust in, and global acceptance of, mobile identity, which could make all physical documents irrelevant, says the company’s Sanne Ketelaar

When Sanne Ketelaar indulged her five-year-old son in a game of ‘grocery store’ – that age-old role-play where parents act as the bumbling customer and children play the earnest cashier – she didn’t expect it to be quite so relevant to her grown-up life.

“When I got to the payment, my son held up one of those big, base Lego bricks and said, ‘OK, you can now tap to pay’. I was completely flabbergasted!” she laughs.

But in this game of pretend, it was what happened next that spoke so directly to Ketelaar’s career.

“I’d bought a bottle of wine in his shop, so I said ‘hey, don’t you have to check mummy is old enough to buy this?’ That’s when I had to go and grab my physical wallet and show him my driver’s licence.”

A physical ID that unlocks a citizen’s rights – to consume alcohol, drive a car, draw down benefits or any number of other entitlements – might well be redundant by the time Ketelaar’s son reaches adulthood. And, in her role at the global safety certification company UL Solutions, she will be instrumental in driving that shift.

“Over the past decade, we’ve really seen a rise of convenient digital ways to pay. There’s mobile pay, peer-to-peer apps, and digital banks with no physical offices,” says Ketelaar. “But we still can’t leave our physical wallet at home. For most credentials, we still need to bring our ID card to identify who we are.”

Working in the US-based global testing and certification firm’s identity management and security division, Ketelaar helps oversee certification programmes that are key to the widespread adoption of mobile digital IDs. They promise to do away with those fumble-in-the-wallet moments for many of us, but there’s a much bigger vision driving their adoption. Mobile IDs could be instrumental in helping the United Nations hit its target of providing the entire world with a legal identity by 2030; in giving citizens access to the full

panoply of public and private services from their phone; and in liberating us from the username/password tyranny that is proving so vulnerable to cybercrime.

That’s not to say there are not deeply held concerns over how, and how safely, mobile digital IDs will be delivered, but, given that more than 80 per cent of the world’s population owns a smartphone and it’s the default for managing most of our daily lives, there’s little doubt that these forms of identity will play a big part in our future. Indeed, ABI Research forecasts that more than 850 million citizens will be equipped with a form of mobile identity by 2026, and the EU Commission is aiming for 80 per cent penetration across the EU for its cross-border digital ID scheme by 2030.

Among mobile digital IDs already available, some hold social security numbers and citizenship data; others contain biometric information or your COVID vaccination code. Few have developed beyond the national level, and most aren’t yet available in a mobile wallet – as with your flight or concert tickets, for instance.

In Estonia, citizens have been receiving a digital ID at birth for the past 20 years, and it’s being used as the bedrock of the

country’s drive towards full digital citizenship. In India, a staggering 99 per cent of adults (that’s 1.3 billion people) have now been issued with Aadhaar electronic IDs, used primarily to access benefits and other state services. In Germany, since 2020, people have been able to store the digital version of their national ID card on their phone.

New domestic projects seem to be emerging every week. But if digital IDs are to be as universally recognised and trusted as paper records, they need an agreed international approach, not least to make sure the technology is interoperable – and with robust testing and certification to ensure, for example, that there is no risk of a record of what you do in one area of your life being made visible to another organisation, or, indeed all of your activities revealed to one body, be it a big tech or a government.

The Verifiable Credential Data Model specification, published by the World Wide Web Consortium (W3C), already provides a standard way to express credentials on the web in a way that is ‘cryptographically secure, privacy-respecting, and machine-verifiable’. But the International Standards Organisation (ISO)’s recent ISO/IEC 18013-5:2021 protocol specifically sets a standard for mobile driver’s licences (mDLs) where much of the current activity around mobile ID is focussed.

As one of the third parties used to certify that a vendor’s technology is compliant with ISO specifications, UL Solutions has already published its recommendations on how the two can be made to work together. But the standard around mDLs is important progress, believes Ketelaar, especially in the States.

“When you purchase an age-restricted item in a store, you hand over your entire driver’s licence – which, in the US, has lots of irrelevant information for a cashier to look at, like your height, your address, your weight, your eye colour, and whether you’re an organ donor.

“The ISO standard for mDLs stipulates a data collection limitation. Only your date of birth and a facial image will be requested and shared, and the app will ask you to provide approval to share that data. Plus, you can decide whether or not you let that information be stored – by a store, for instance, for future purchases there.”

As Ketelaar points out, in theory mDLs would mean you share less data with fewer people. The ISO standard also specifies that, when using an mDL, phones should not have to be handed over – itself a privacy violation in today’s world.

Instead, whoever needs to check ID, be they a cashier or a cop, has their own app to scan it with. A final useful specification is that mDLs should work when devices have no internet connection.

Google, which launched an API that supports mDLs in an identity wallet with Android 11 two years ago, has hinted that a mode could one day be built into phones that allows mDLs to be scanned, even when a phone is out of battery. Apple, meanwhile, has already integrated mDLs into its wallet app, which supports the ISO standard in multiple US states.

While, in the US, big techs have focussed on working with federal and the state governments to bring mobile drivers’ licences to market, in the UK, the government has just certified two providers to generate digital ID for use in two specific use cases – applying for

We’ve seen a rise of mobile pay, peer-to-peer apps, and digital banks with no physical offices. But for most credentials, we still need to bring our ID card to identify who we are

a job and renting a house – but it verifies against either a driving licence or a passport.

As we’ve seen with past innovations, big tech integrations are crucial for building trust with consumers. For proof of that, you only need look at biometric technology – the subject of dystopian nightmares half a decade ago, but now a technology that the majority of people use to unlock their phones and approve payments. According to Dentsu Data Lab, 74 per cent of global consumers now have a positive view of the technology.

“I think biometrics will play a key role in future digital identity solutions, helping to combat money laundering and identity fraud,” says Ketelaar. “It’s already happening in US airports, where facial

recognition becomes your entry ticket into an airplane. And we’re seeing some use in financial services, with Mastercard’s new Biometric Checkout programme, for instance, where all you really need is yourself to check out.”

Mastercard has called its initiative ‘smile to pay’, which is redolent of Amazon’s ‘wave to pay’ authentication option, introduced in 2020. The Mastercard pilot scheme is currently taking place across five St Marche supermarkets in São Paulo, in partnership with the Brazilian biometric authentication firm Payface.

With digital ID technology racing down the tracks towards us, the next obvious step is to combine those two separate tasks that Ketelaar experience in her son’s grocery store – ID verification and payment – into one.

In the analogue world, a handful of US city governments have already taken steps in that direction by offering prepaid debit cards as part of a municipal ID card (for people such as immigrants without citizenship who are unable to obtain a state driver's licence) or as part of a driver’s licence card.

Today, virtually every transaction can be handled by a smartphone. Tomorrow, it may just be our fingers and faces that we have to remember to take with us when we pop to the shops. Ketelaar reckons it’s only a matter of time before the technology, regulation and compliance barriers to that are overcome.

“[But] it is key these systems are tested by independent third parties – from a performance, functional, and security perspective – to really make sure they’re working as they should and there is no misuse of the systems or the data that has been collected,” she says.

“In the future, though, I really believe that we’ll be paying with our identity –because why would I need a separate bank account credential to do that?”

It’s a vision of a future that will please those with wallets bulging with plastic, as well as those accustomed to reordering their driver’s licence after a night out.

But it might just be the death of the grocery store game. Which toddler, after all, will derive enjoyment from watching their parents pick up a plastic banana, smile, and walk straight out of their store?

To be capable of eating well in every country across the Asia-Pacific (APAC) region requires a high degree of adaptability.

From chewing through jet-black fermented century eggs in China, to devouring an actively angry live octopus in Korea, it’s an area of rich culinary traditions that have differentiated countries over centuries of development.

Banking options in the region have followed a similar pattern. Try settling by card at a small food stall in Taiwan or Japan and you may be asked to install the popular local telecom operator’s mobile wallet LINE Pay. Alipay and WeChat Pay are dominant in China, boasting as many as two billion combined users, while digital wallet PayTM is India’s chosen payment method. People in the Philippines and Indonesia have no appetite for cards, with penetration at just two per cent, while in Hong Kong and Japan, they gorge on them.

Accounting for financial taste here is hard and can be expensive, which is why banking-as-a-service (BAAS) offered by larger, regulated and often pan-regional institutions, is seen as a huge area for growth in APAC, especially when it comes to cross-border payment solutions.

Trade among APAC economies last year rose to the highest level in three decades, exceeding that of trade with the rest of the world, according to a 2022 report from the Asian Development Bank. It noted that integration among regional economies has continued to deepen, encouraged by regional trade agreements like the Regional Comprehensive Economic Partnership (RCEP), potentially covering 30 per cent of the world’s GDP, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Bottomline’s view is that banks need to keep an open mind as to what technology they build and what services they buy in, to remain adaptable in this changing market. Its mission is to make business payments smart, sharp and secure with

a software-as-a-service (SAAS) offering for all aspects of payments and cash management, including fraud and financial crime management, and sanctions screening.

Eli Shoshani heads up the APAC region for Bottomline and says adoption of Cloud-based technology has been key to its and banks’ strategy there. “We see banks moving away from traditional areas of focus to offer Cloud services. This, in turn, is helping us provide more services to them.

“It is precisely because banks are so highly regulated that they need to go through so many processes to build changes. Whereas, Bottomline, as an established and seasoned service provider, can handle the changes that need to be applied across the whole region at pace,” he adds.

Bottomline’s Universal Aggregator IQ solution delivers a single API-enabled SaaS platform for payments, securities and messaging that helps financial institutions achieve lower costs, wider reach, speed-to-market, industry compliance, greater security and improved risk and treasury management.

corporates want to make payments immediately – the industry no longer has the luxury of T+1 in local or cross-border payments. In a region rich with exotic currencies and plagued by trapped liquidity is the opportunity for multi-lateral platforms and intelligent routing to come to the fore – where you choose the best channel for a payment, based on specific requirements, such as speed, cost, location, or FX rates.

“No payment is ever the same and so the flexibility to choose what matters most and then decide the payment rail is key to operational efficiency – a path recommended by the Bank for International Settlements in multiple cross-border best practice guides.”

The Singapore-based bank DBS is a case in point. It has been diversifying its payment channels for a while, most recently by starting to build its own 24/7 multicurrency payment settlement solution on Partior, the first live permissioned, blockchain-based clearing and settlement platform for commercial bank money – in effect providing immediate cross-border payments to its clients, bank books-to-books.

Payments handling has become more complex for banks as the industry diversifies away from existing infrastructure, particularly in APAC. Shoshani points to schemes like Visa B2B Connect, enabling bank-to-bank transactions with tokenised credentials for business buyers and suppliers, as examples of the proliferating number of alternative payment rails it can offer over a single platform, making it easier and cheaper for banks to access.

“Banks and fintech companies are being driven to build a service to accommodate today’s needs,” he says. “Even large

DBS currently holds the World’s Best Bank and World’s Best Digital Bank titles from Euromoney. More than half its services are now hosted in the Cloud, a technology that has become central to achieving its mission of ‘Making Banking Joyful’. In recent years, that has seen it moving more of DBS’ services to its QR code-based payments app PayLah!, a solution that’s becoming available in 45 countries within APAC, thanks to a tie-up with Union Bank and Singapore’s electronic payments provider, Nets.

For Sandeep Lai, head of digital payments at DBS, embracing the Cloud doesn’t just enable DBS’ customers to enjoy a better banking experience, it also allows it to more easily reach out to customers of other financial institutions via BaaS options and, since November 2021, its API marketplace.

“Where we have a really good product that is better than people can build it, we’ve looked at scaling up and commercialising that software,” he says. “Cross-border payments is one area we

We aren’t competing with the banks, but supporting and complimenting them to provide a better service Eli Shoshani, Bottomline Technologies

started to look at some years back, creating it internally and then commercialising it.

“But it isn’t all one-way traffic. This nimble approach to infrastructure development can make it easier for banks like DBS to utilise the hard work done by others as part of their own product portfolio, too. Because customers sometimes want something that is not our strength, like accounting software, we have partners that offer our payment services with accounting software to SMEs, for example.”

This means smaller banks interested in leveraging secure, regulated solutions, have an increasing variety to choose from that can run parallel to their own tech stack, without tinkering too much.

For Lai, the industry has the potential to pull towards a common goal, best achieved with a nimble and adaptable approach.

of wraparound services to support their payment systems. “If they don’t want to use our anti-money laundering (AML) or sanctions screening, that’s fine, but it’s available to just turn on,” he says. ”We aren't competing with the banks, but supporting and complimenting them to enable them to provide a better service to their clients.”

Once in a while, something really big comes along that demonstrates the wisdom of adopting such an approach. The ongoing global transition to enriched financial messaging standard ISO 20022 is one such. It’s already been implemented by in-country clearing, real-time gross settlement (RTGS) and low-value, real-time payment systems across APAC, in all the large economies as well as the Philippines, Vietnam, Malaysia and Thailand.

Globally, institutions running on SWIFT must all have transitioned to ISO 20022’s XML-based messaging format by 2025. Importantly for APAC operators, the new format allows for character sets 10 times larger than legacy MT messages – useful for non-Latin languages – so the network can carry much more information per payment.

“The needs of bank customers –including corporate ones – will be diverse. They will be looking for efficient cross-border payments, efficient acquiring, good FX rates, reconciliation, cash management and treasury. Ideally, they don’t want to go to hundreds of providers that make it complex, but one that can deliver them all – not necessarily alone, but by orchestrating services efficiently,” he says. “The technical side of that can’t be understated: APIs should be easy to integrate into. So, the discussion won’t be with the CFO, but with the product engineers. As a bank, we’ll have to morph ourselves, that’s what our customers will be looking for.”

Shoshani agrees that the need for change comes from market drivers, and from a bank’s clients: “They are demanding immediate solutions, and there are a lot of competitors in the market coming up with them – fintechs, Visa B2B and other cross-border providers. Banks need to adopt these types of solutions, otherwise they will be left behind.”

Just as consumers can choose which service to take from a bank and which from a fintech, Bottomline offers banks a choice

“At some stage, without the right message types, you will not be able to communicate,” says Shoshani. “This is where we come in, doing the conversion and enrichment, as a service.