38ste jaargang 4 - 2024 In dit nummer : Kasgroenten Veredeling Aardbeien en Asperges #1

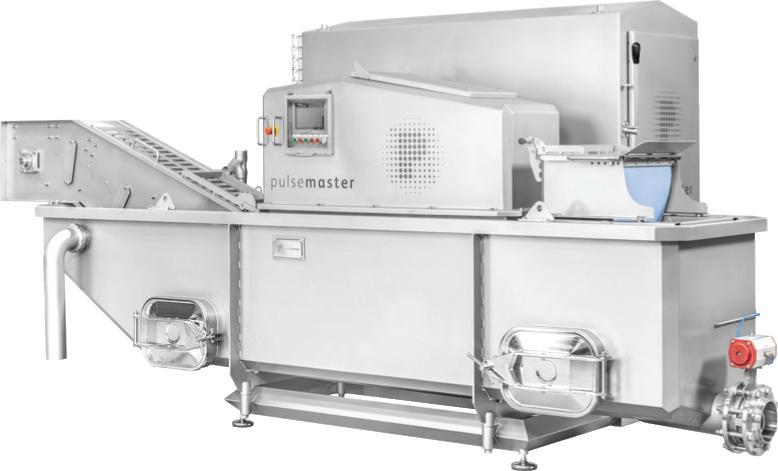

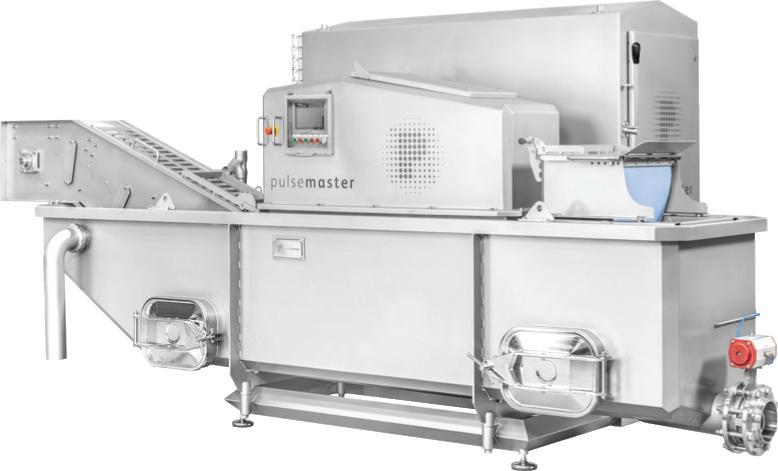

Hapert, The Netherlands & Lohne (Oldenburg), Germany & Woodstock NB, Canada www.pulsemaster.us • info@pulsemaster.us • +31 (0)497 820300 Pulsemaster Puls Generator Pulsemaster PEF-treatment unit Pulsemaster Compact PEF-System Special edition Greenhouse vegetables Independent specialist magazine for the potato, fruit and vegetable trade • Since 1986 May 2024

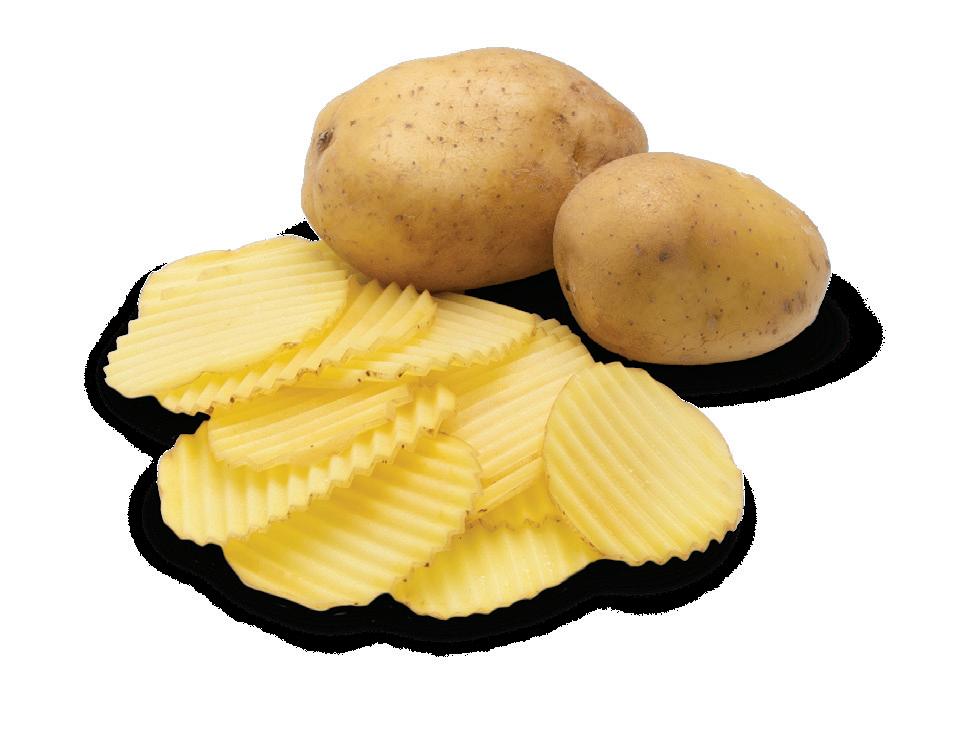

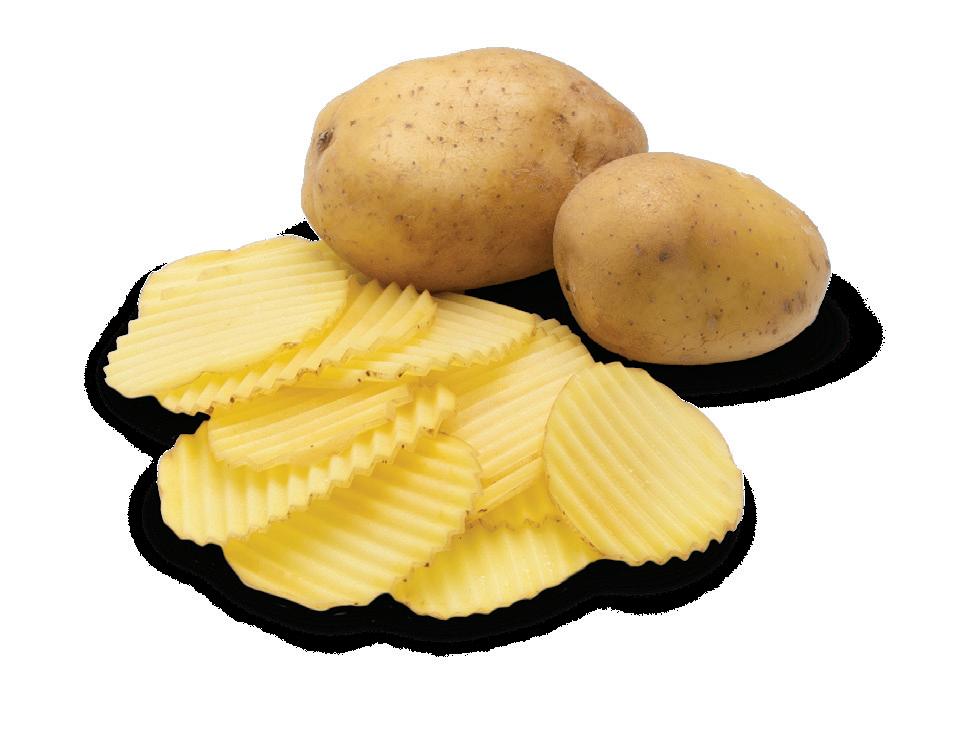

provider of Pulsed Electric Field systems for French fries & chips and for fruit and vegetable processing.

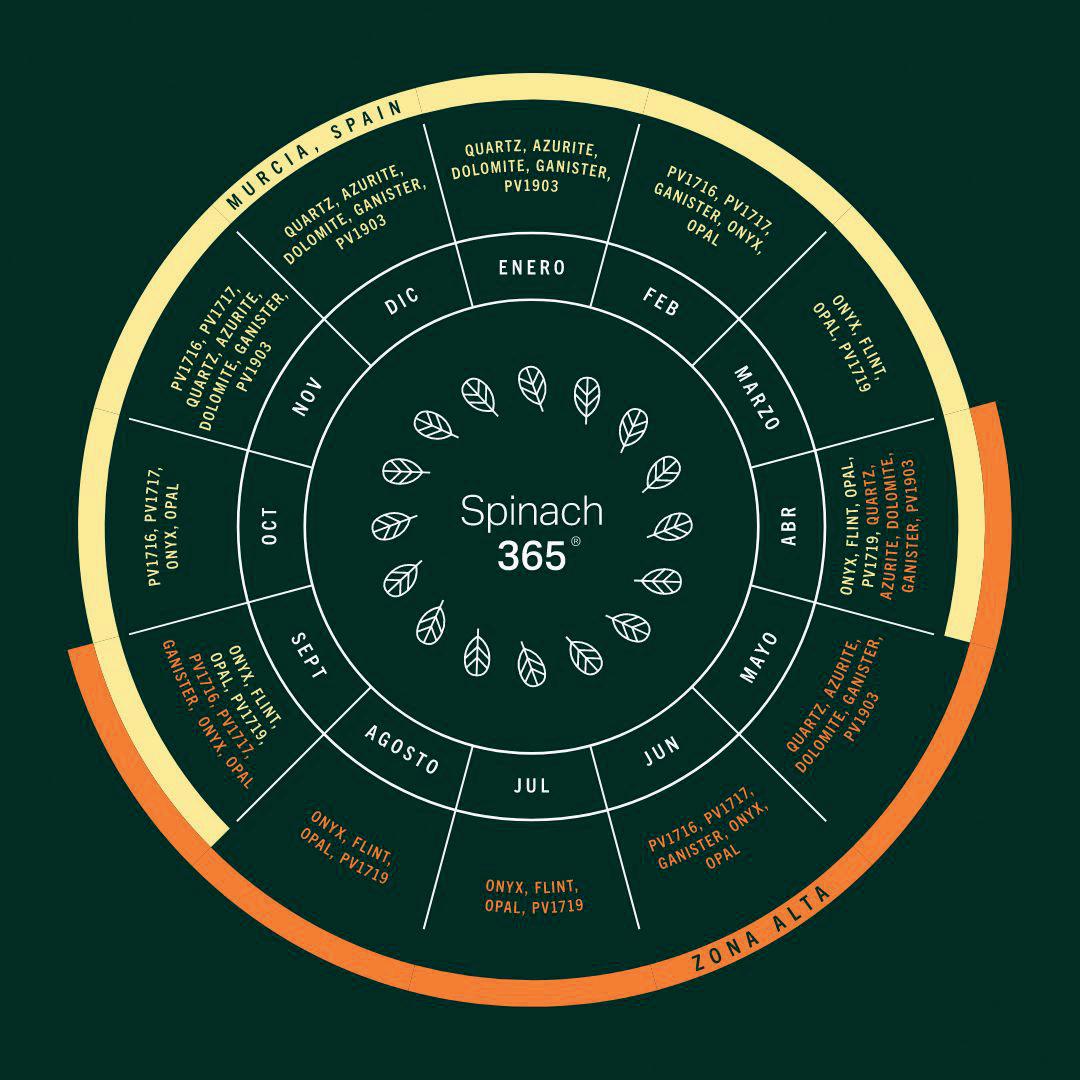

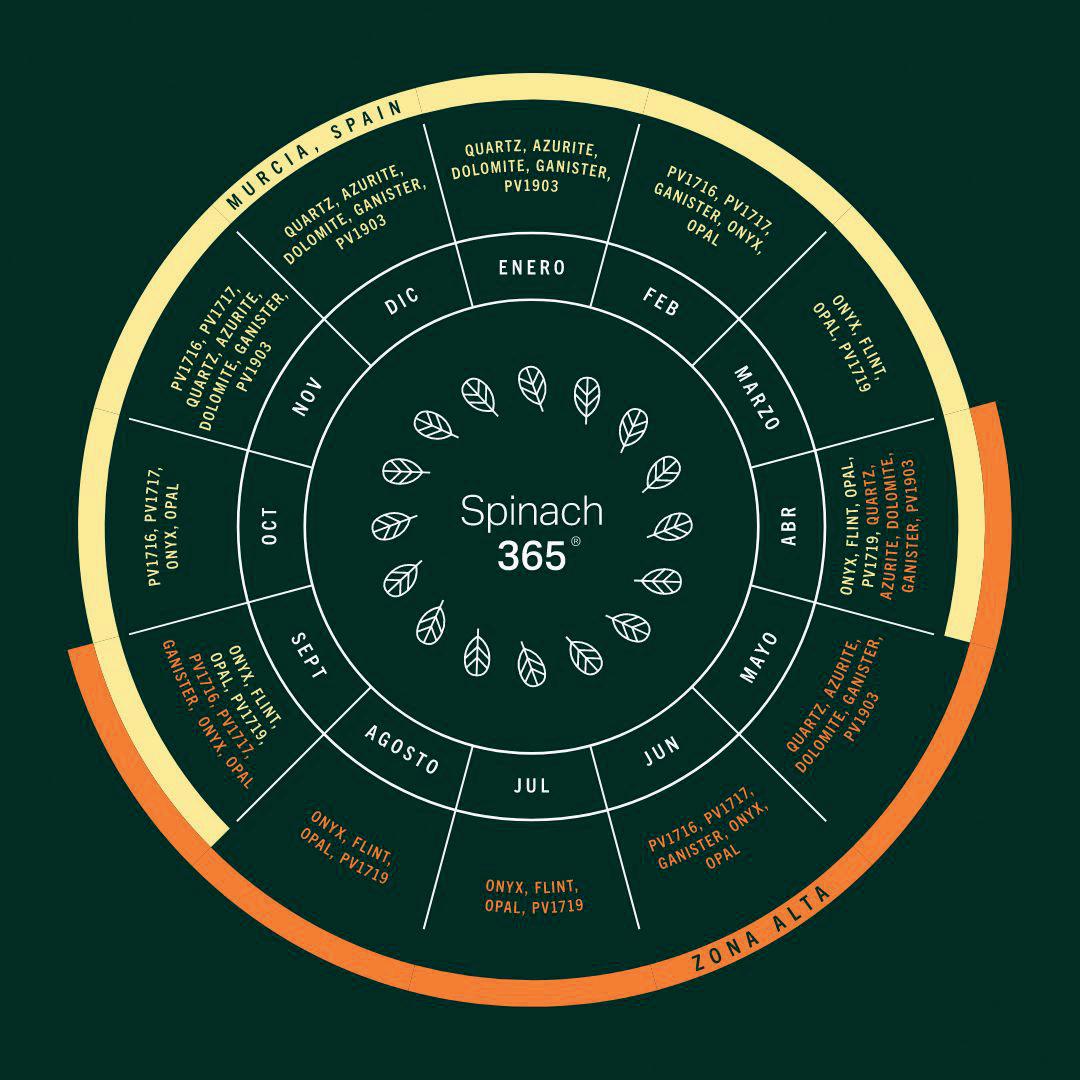

JUNE FEB MAY SEPT JULY MAR AUG APR FLUORI T E , DALLAS DOLOMI T E , Q UARTZ, PV-174 8 , L I GNITE, DALLAS , PV-1716 , QUARTZ , FLUORITE , LIGNITE , DOLOMITE , COCOPAH SUMMERSTONE , KIOWA , OPAL , SKARNE , ONYX , PV1719 OPAL , K I O W A , SKARNE , O N Y X , QUARTZ , PV1 7 1 6 , PV1719 , SUMMERS T O N E KIOWA, PV1 7 1 9, SUMMERS T O N E , SLATE ONYX, O P A L , PV1716, S K A R N E , OPAL, PV1719, SUMMERSTONE, SLATE, PV1901 SKARNE, ONYX, PV1716, SLATE,PV-1901OSUMMERSTONE, PAL,PV-1719, PV-1901, A NATASE PV-1719 , SL ATE , ANATASE PV-1901 , SLATE , SLATE , PV1901 , ANATASESUMMERSTONE , OPAL , PV1719 , S U M MERSTONE , S L A T E , PV1901 O P A L , PV1719 , S K A RNE , ONYX , O P A L, K I OWA, S K A RNE, ONYX, Q U A R T Z, PV1716, P V1719, S U M MERSTONE DOLOMITE, QUARTZ, PV1748, LIGNITE, ONYX, PV1719, FLUORITE,DALLAS FLUORITE, PDOLOMITE,QUARTZ, V-1748,LIGNITE, DALLAS Spinach 365 Focus is in our genes. popvriendseeds.com Deliver what you’ve planned. All year-round high leaf quality spinach with Spinach 365®. OFFICIAL DISTRIBUTOR

du Champ Lionne 8

B-7601 Peruwelz

T +32 (0)69 67 22 70 info@frigorexpress.be

255, Av G. Caustier

F-66000 Perpignan

T +33 (0)468 21 04 33 frigorexpress@orange.fr 557, Avenue des Vergers F-13750 Plan d’Orgon T +33 (0)0967 08 30 31 jean@frigorexpress.fr

ZI St. Michel, Rue des Cerises

F-82000 Moissac

T +33 (0)5 63 04 92 85 jeanluc@frigorexpress.fr Hipokrata iela 21-38 LV-1079 RIGA T +37 (0)127 71 76 49 baltic.office@frigorexpress.lv

I N T E RN AT IONA L R E F R IG E R AT I O N A N D FR E EZ E R T R A N S POR T S T O R A G E C OL D - F R E E Z DAILY GROUPAGE FRUITS & VEGETABLES ER - I N D U S T R IA L G OOD S

Smederijstraat 2 NL-4814 DB Breda T +31 (0)883 97 70 00 rob@frigorexpress.nl Rue

WWW.FRIGOREXPRESS.BE

‚Later switch expected to citrus from overseas‘

The COBANA sales team

7

10

14

Uncertain start, stimulated by OJ concentrate shortage and a changed govt mindset

Expanding South American production aims to secure future supply

“The latest step is the establishment of a fully-fledged branch in Poland”

Owner and Managing Director Markus Schneider

16 The 2024 stone fruit season starts earlier in Spain Spanish stone fruit is increasingly in the hands of large professional companies

18 “Around 60 percent of domestic cultivation now takes place here”

Reichenau-Gemüse invests in organic sweet potatoes

20 “We focus on quality and short lines” Asian vegetables are becoming commonplace

23 “We need to further explore the health benefits and encourage people to keep eating avocados”

Johnathan Sutton, Westfalia Fruit

26 Despite criticism, Dutch glasshouse horticulture offers plenty chances

32 “All the expansion plans, that Dutch greenhouse growers still have, amaze me”

Martin Scherpenhuizen

34 Europe’s tomato greenhouses pick up winter production From hibernation to illumination

36 “As day traders, we excel at fulfilling limited product availability”

Philip van Geest, Van Geest International

38 “We export all over Germany”

Jonathan Vandesande, Frans Michiels Belgium

40 Dutch zucchini growers start doing their own marketing

42 Midi cucumbers: from novelty to fully-fledged product

46 “Without domestic production, imported goods would inevitably be more expensive”

Producer Stefan Scherzer

49 “In the winter, we double our acreage to meet German demand”

John Grootscholten, Daily Fresh Radish

52 “We want to be one of the survivors” Dutch bell pepper sector consolidation

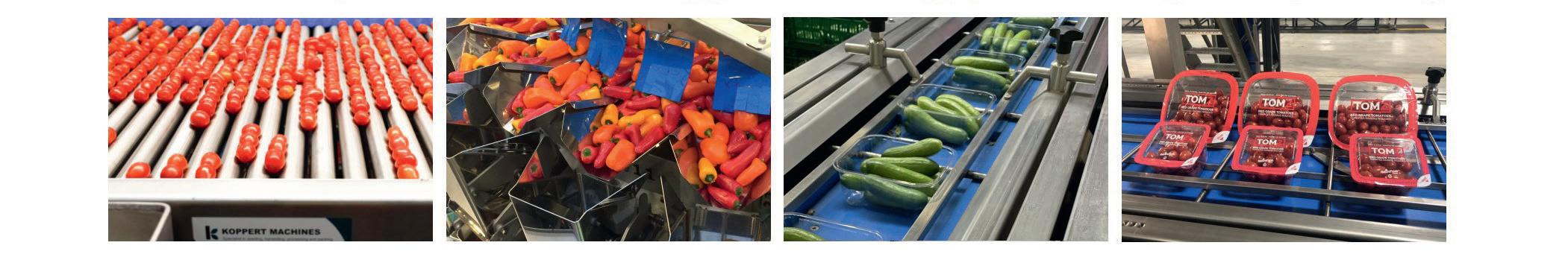

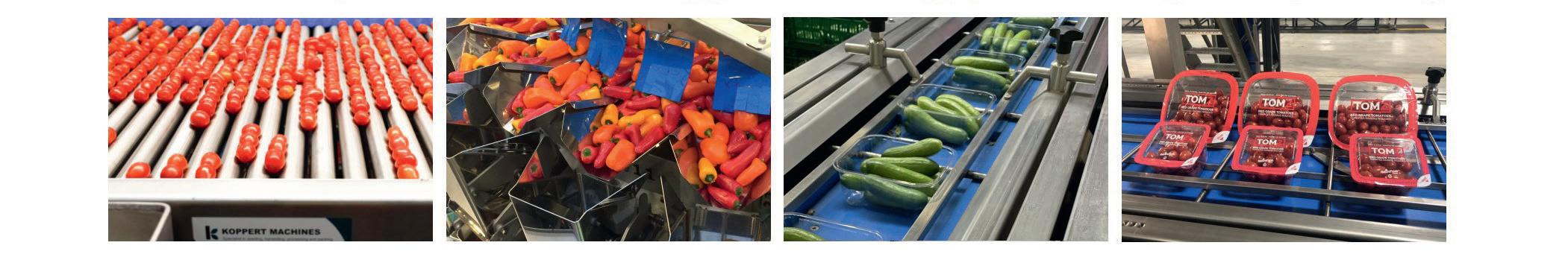

57 “In the early days, anything was possible”

A decade of growing and packaging snack tomatoes

60 “In the Dutch season‘s first weeks, cucumber prices were half that of last year”

Peter Fes, StC International

62 The early Moroccan vegetable industry resists a multifaceted crisis

66 Fighting imports with locally, greenhouse-grown tomatoes

69 “Committing to French production to offer healthy, responsible and local food for all!”

Sophie Thill, Les Paysans de Rougeline

72 Spinach 365®: for year-round consistent quality supply of supermarket spinach

75 “Strawberry sales also ultimately developed in Greece‘s favor”

Carsten Gogoll, Bivano Ltd/Böhmer Frische Ltd.

78 New purple sweet potato variety may drive U.S. exports to Europe

80 “Effectively, it is another business tax, and it is being applied to enable the government to recoup the monies invested in building the government run BCP facilities”

Mike Parr, PLM Seafrigo

83 “Our increased capacity opens doors in our overseas sales markets” Two Dutch companies merge

86 Developments in the vertical farming sector globally, and in Berlin

90 “Six extra cents per kilo would make banana growing sustainable”

Manuel Laborde, Uniban

92 “So far, only two European supermarkets have adopted the Fairtrade method as a benchmark for the price”

José Hidalgo, AEBE

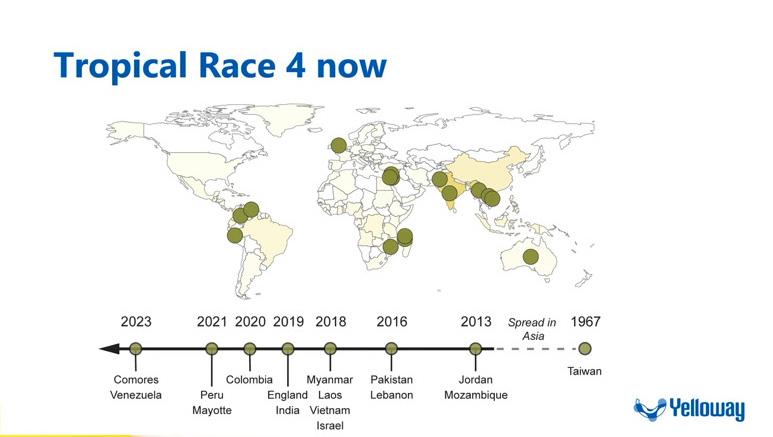

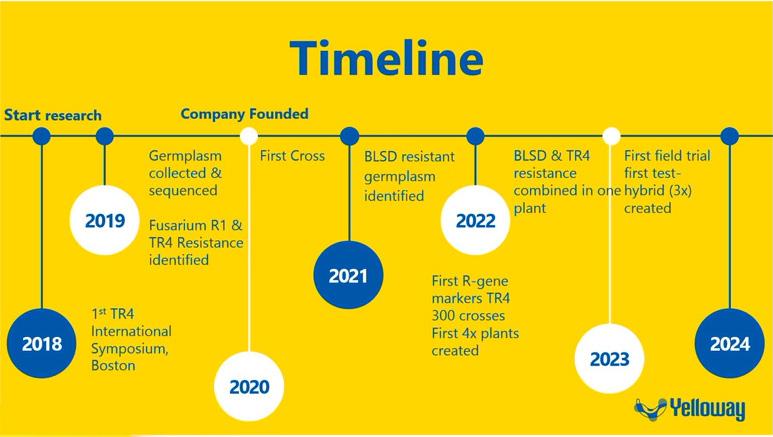

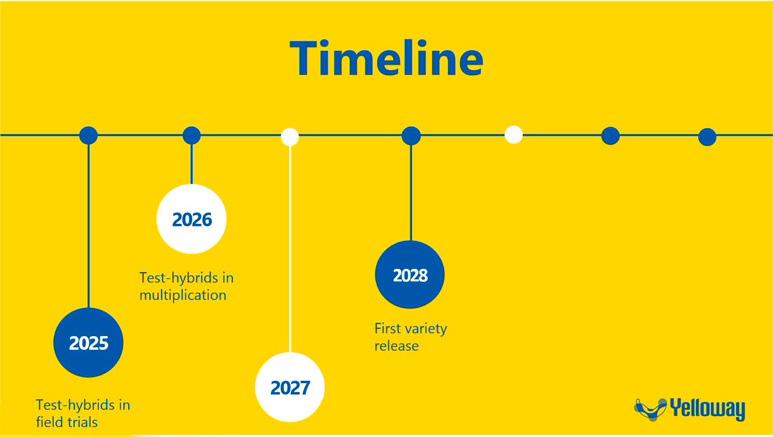

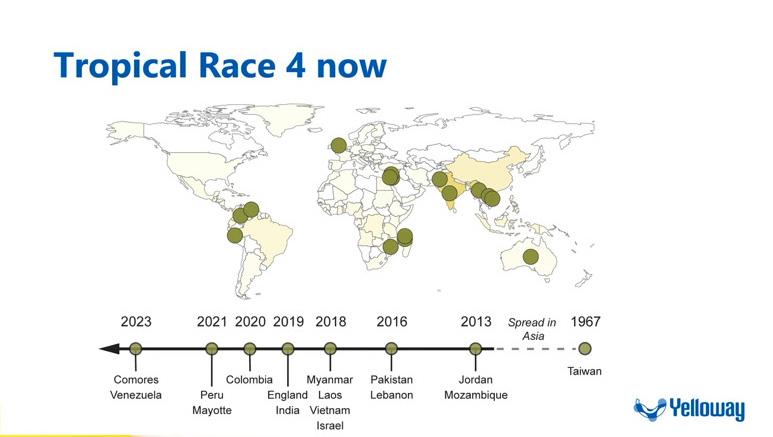

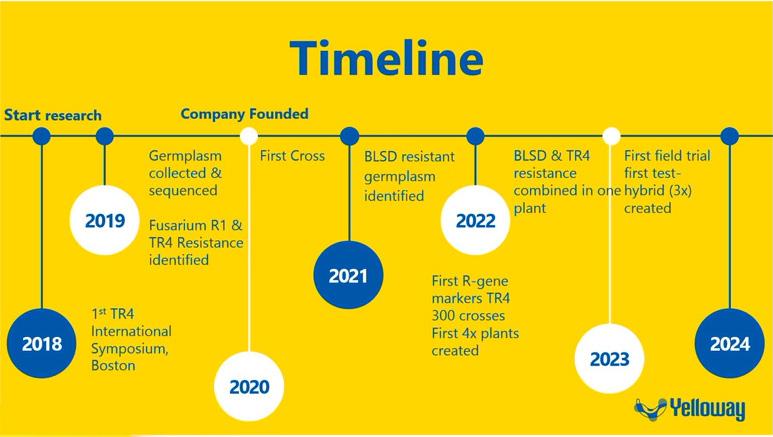

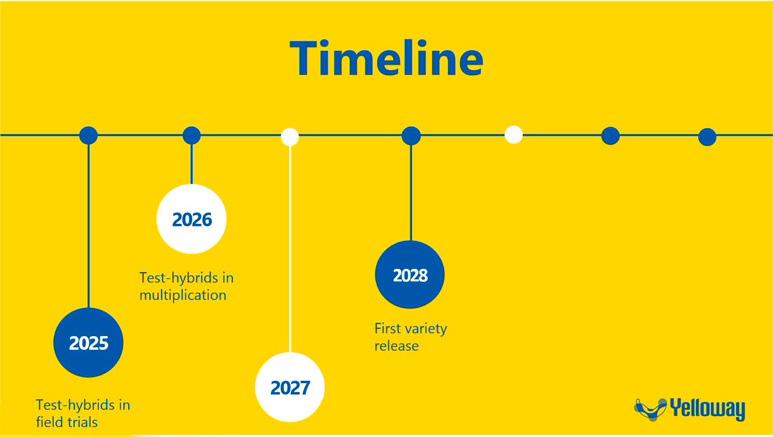

95 “The banana‘s future lies in genetic diversity” Yelloway — a Chiquita, KeyGene, MusaRadix, WUR partnership

99 “Sales are still moving, although it is mid-April with warmer weather” Karlsson Port, Port International, on the demand for bananas

4

4 23 46 69 10 26 57 75 14 40 60 92 Table of Content

101 “When it comes to our clients in Asia, guaranteed quality is essential” Vacuum cooler gets Taste Up herbs all over the world

105 New Rotterdam cold store next step in cold chain integration A.P. Moller - Maersk

107 “Growing in Germany means we can supply them with local celeriac” Paul Heemels, Heemels-Agro:

108 What will the next stone fruit campaign look like?

Raphaël Martinez, Pêches et Abricots AOP de France

110 “All the product groups in which we‘re active have plenty of growth potential”

Ann Celen, Special Fruit:

113 “Opportunites for our soft fruit lie in Germany, too” Leo Klaassen, Limax

121 “New variety flattens out labor peaks” The Greenery about Inspire strawberries

123 “We‘re going to show growers and the market that it‘s genuinely possible”

Roland Sweijen, Limgroup

127 “People call on the trade not to set margins excessively high at the beginning, but to start moderately” Simon Schumacher

131 “Shrinking European asparagus acreage generally creates more demand than supply”

Will Teeuwen, Teboza

133 Despite a certain decline in the area under cultivation, asparagus is still the most important product in Italy

135 “The wet weather has delayed most Dutch asparagus crops by a month” Rick Mengers, ZON

137 “We want to further mechanize our asparagus production for reasons of efficiency and cost”

Mirko Tiemann, Kirchdorfer Spargel & Beerenfrüchte & Co

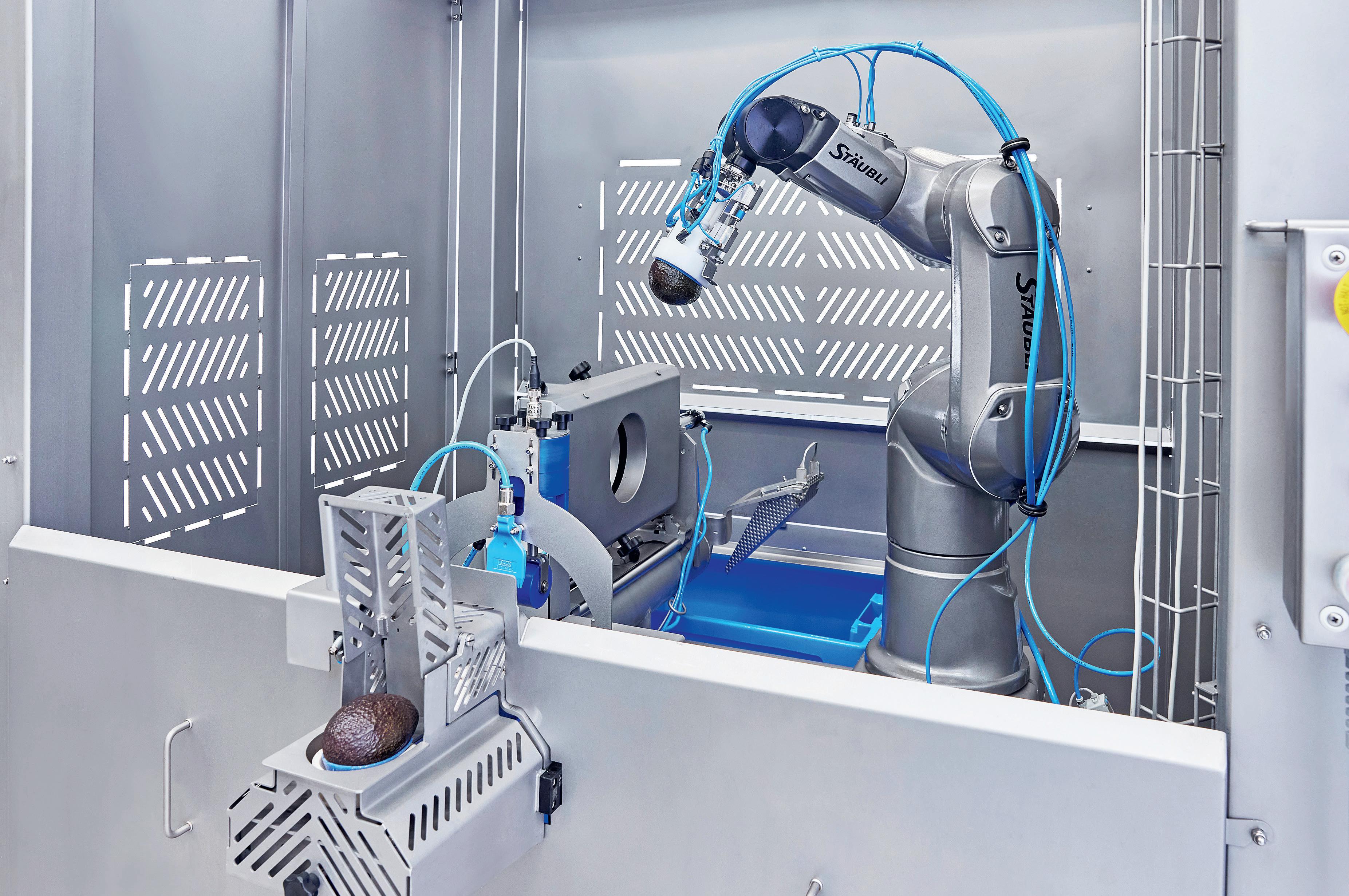

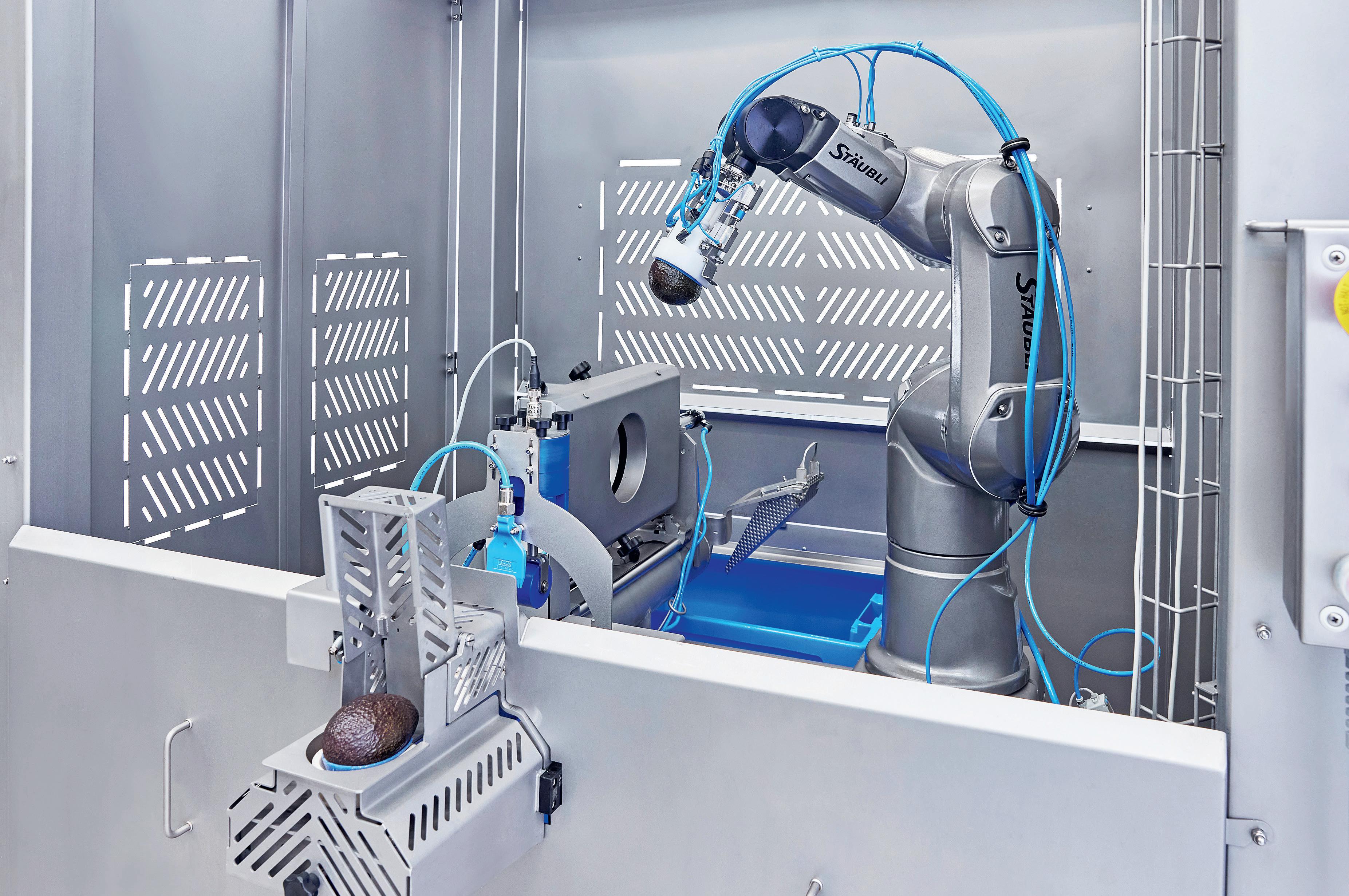

142 Using big data and AI to determine avocados‘ ripeness, also at consumer level

Experience Fruit Quality and OneThird

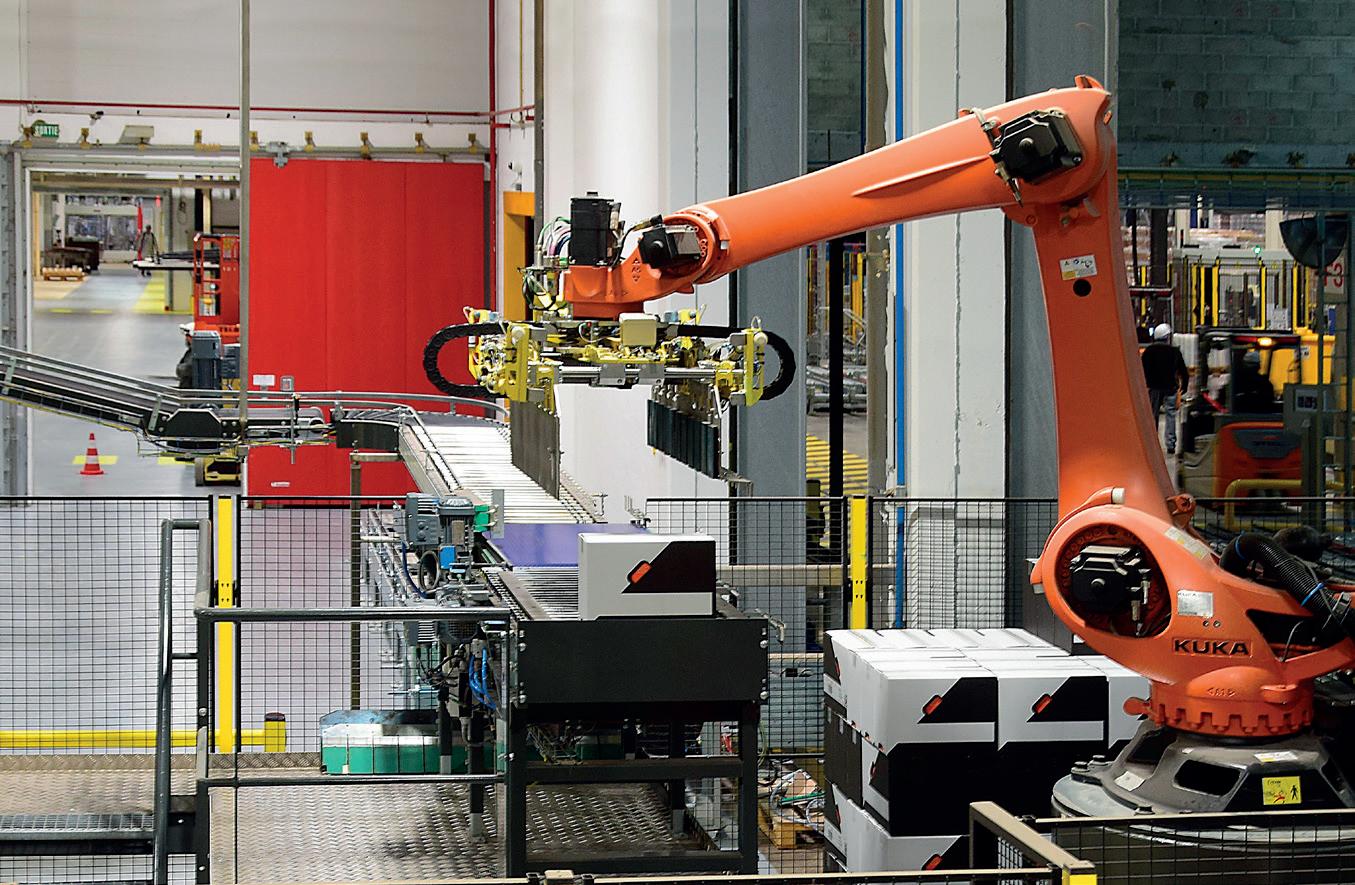

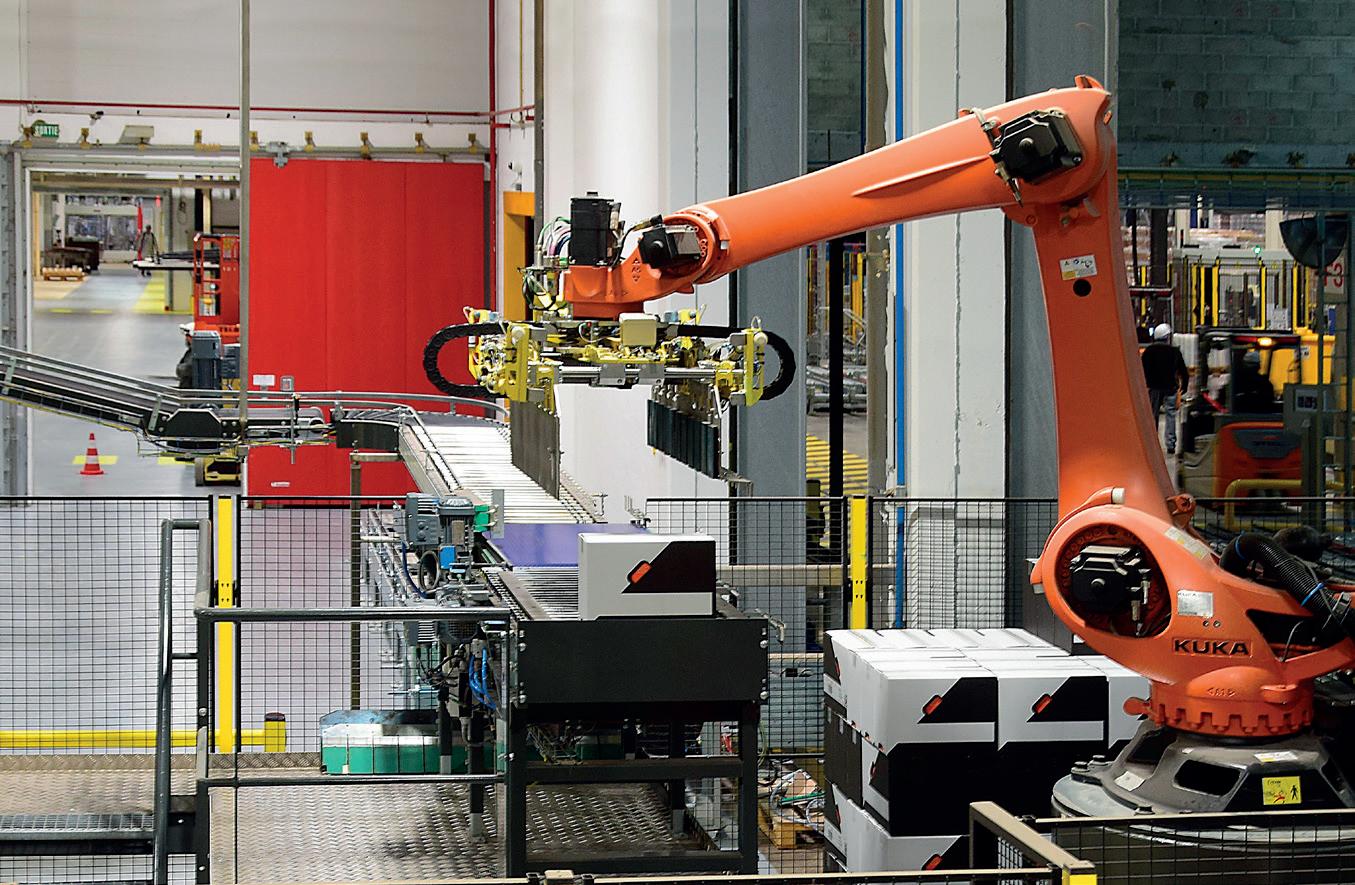

147 “Robots can help you stay competitive” Lazy Foods

151 “Wholesale markets are part of the solution, not the problem” For imports and regional producers, wholesale markets are essential and in times of crisis, a place of food security:

155 “Only a new commodity apple can boost consumption and move the sector forward”

Belgian breeder wants to develop new Jonagold

159 “Shift from‚ dirty‘ to cleaned products”

Xavier Meijers, Eussifruit

160 “Thanks to significant and broad segmentation in the tomato sector, some specialties have not been affected by the dynamics at the beginning of the year”

Carmelo Salguero from Granada La Palma

164 “Breeders are at every chain partner’s beck and call, right down to consumers”

168 Unpredictability takes the lead in reefer transport

170 Does the growing Polish pear cultivation pose a threat to Dutch and Belgian sectors?

173 „Wir sind in der Lage, unseren unmittelbaren Nachbarn innerhalb von ein bis zwei Tagen zu beliefern“

175 “We missed the chance to fundamentally rethink some things” Steve Alaerts, Foodcareplus

179 Sowing tales among the future generation

180 Italian strawberries available earlier than in the past

183 “Those experiences broaden your horizon and challenge you to think differently”

Maurice Beurskens

184 The year 2023 ended on a positive note, and we will only see what 2024 will be like at the end of the year

Exports of horticulture products to Germany are at a standstill

187 “Shouldn’t we be asking if some established varieties should make way for these?”

Nicolas Stevens, Better3Fruit

95 121 179 175 105 131 159 180 110 137 160 187 Onafhankelijk vakblad voor de agf-handel

The COBANA sales team on the marketing of exotics and citrus: ‚Later switch expected to citrus from

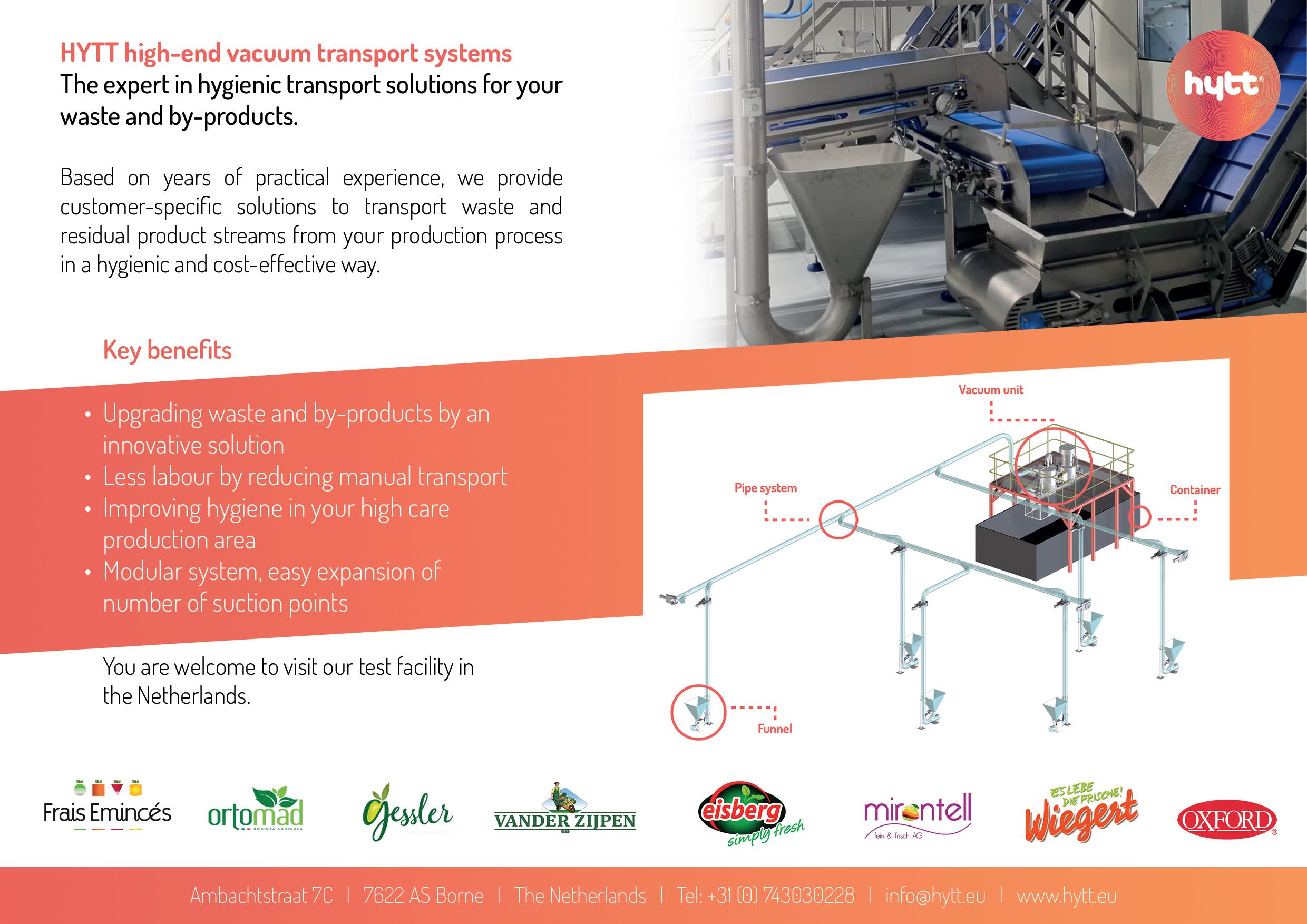

Due to multiple crises and challenges, the global fruit trade is coming under pressure. Especially for overseas products such as avocados, mangoes and citrus fruits, the adversities are leading to challenges in the procurement and logistics of goods. As the main supplier and service provider to German and European food retailers, Hamburgbased fruit trading company COBANA & Co. is also confronted with this problem. At the beginning of the second quarter, the sales team spoke to us about current market developments in the exotic and citrus sector.

AVOCADO: VOLUME PRESSURE ON MEDIUM AND SMALL CALIBER VARIETIES

At the beginning of April, the total weekly volume of Hass avocados on the European market was around 5.0 million boxes. The most important countries of origin are Peru, with more than 2.0 million boxes, and Israel, reports Felix Sperl, product specialist at the company. “However,

the volumes from Israel are slightly lower than in previous weeks, as the season there is now coming to an end. The last shipments are expected around week 19. Meanwhile, Brazil is shipping around half a million boxes this year, which is far more than in previous years. We are also seeing a sharp increase in volumes from South Africa (just under one million crates in total), and Kenya and Tanzania

overseas‘

are also participating with a good half a million crates in total.”

Due to the issues in the Red Sea and alternative shipping routes via the Cape of Good Hope, longer transit times (37 days to Rotterdam) must be expected. Even so, logistics have improved considerably in recent times, with total transit times of around 50 days. Sperl: “Nevertheless, we realize that the situation will not change quickly, as attacks are now also taking place in the Indian Ocean. As a result, the weekly shipments of Kenyan Hass avocados are interrupted in places and the volumes are not as constant as they were before these political and logistical problems. In terms of quality, the Peruvian deliveries are predominantly medium to small-sized (around 70 percent), and the same applies to the previous volumes from South Africa. As the current supply volumes are predominantly from these

4 AGF Primeur 4 • 2024

Exotics

Avocado plantation in Kenya

two source countries, we are assuming that the pressure on smaller caliber fruit will continue in the short to medium term. With the end of the season approaching in Israel, we also cannot rule out a shortage of the larger calibers.”

Sperl also refers to the volume deficit in the Peruvian growing region of Olmos, which will be around 30% in the second quarter. “But even if there is a short-term decline in volumes, we do not see a shortage of goods in Peru in the longer term, at least not to the extent that we initially expected. This is mainly due to the strong start to the season in the Sierra growing region. Finally, we must not forget that there is currently also a high demand for Peruvian avocados in the US.”

MANGO:

THE MARKET IS BEGINNING TO NORMALIZE

In the case of mangoes, we can look back on an extremely difficult campaign in Peru, says product specialist Mario López. This is not only due to the low volumes, but also to quality problems that are occurring this year. According to initial forecasts, Brazil will export more of the Palmer variety at the beginning of this year, followed by the Keitt variety later in the season. “Overall, the current market situation for mangoes is not particularly positive. Both Peru and Brazil are currently shipping goods of fluctuating quality, and sales are very sluggish as well.“

“In contrast to Peru, this year‘s climatic influences in Africa were relatively manageable,” López continues. “It was very hot and, due to the lack of rain, there is slightly more fruit than last year. We therefore expect a good, continuous supply here until May. Additionally, countries such as the Dominican Republic and Costa Rica are producing as well, so we

are less concerned about availability. We assume that prices will settle at a normal level in the coming months and that food retailers will most likely use this opportunity to step up their promotional activities. At the same time, we expect sales to

GROWING PASSION

5 AGF Primeur 4 • 2024

With increasing passion and innovation, we continue our mission to provide the best service to you and your customers. A commitment that will continue to bear fruit in the future. For more information and contacts, please visit www.cobana.com.

increase, as mango is a very popular fruit in summer, especially in Germany.”

Sorting and packing station for mangoes in Brazil

CITRUS FORM OVERSEAS: LATER SWITCH TO SOUTH AFRICA EXPECTED

In addition to mangoes and avocados, citrus fruits from overseas have become increasingly important for COBANA in recent years as well. Due to the good availability of volumes, the Spanish citrus campaign will end later than in the previous year. Accordingly, the switch to overseas citrus, particularly lemons, but also oranges, will take place later this year, predicts Henry Lührs, Overseas Citrus Sales Manager at the company. “In 2023, grapefruits and oranges in particular saw an extreme number of large calibers and fewer normal to small calibers. This year, on the other hand, we are expecting more normal to small sizes from South Africa and Uruguay, which is mainly due to the abundant harvest.”

ENES BV

Venrayseweg 124

5928 RH VENLO

T +31 773961190

F +31 773961198

The grapefruit harvest has now begun in the early regions of South Africa (Mpumalanga, Limpopo) and the first containers are already on their way to Europe, Lührs states. The switch from Europe to goods from overseas is expected to take place in mid-May. “Due to extensive rainfall, however, the grapefruit harvest is off to a slow start. At the beginning, the fruits in the middle of the tree are always picked first, as these are the first to develop color. In addition to this, these fruits are also larger on average than those that grow on the outside of the tree. These fruits tend to be smaller, which is why we are expecting more fruits in the 50/55 grading compared to previous years. This will be particularly noticeable on the European sales market from the end of June, as most of the inside fruit is shipped before

info@enes.nl www.enes.nl

then and the European markets are mainly focused on the 35/40/45 caliber.”

According to Lührs, the situation in the major South African seaports of Cape Town, Port Elizabeth and Durban will also play a decisive role for the rest of the season. “Although operator TRANSNET has invested in the port of Durban, for example, it remains to be seen whether the measures are really sufficient. Also, all three ports are extremely susceptible to wind, which is why there are already delays at the start of the season.”

info@cobana.com

6 AGF Primeur 4 • 2024 Exotics

Einblick in den Sortier- und Verpackungsprozess im Bereich Exoten

Uncertain start, stimulated by OJ concentrate shortage and a changed govt mindset

The 2024 citrus season in South Africa, during which there ought to be no shortage of fruit, contains a number of welcome changes, notably the government’s greater amenability to the idea of outsourcing management of the country’s beleaguered port terminals.

The second factor, playing a particular role this season, is that of juice prices, discussed in greater detail below.

STATE VERSUS PRIVATE SECTOR TUSSLE TURNS A CORNER

The state of South African harbors has become an essential condition to every discussion of the South African citrus.

The Citrus Growers’ Association, in conjunction with the broader fruit export industry, identified a lack of competition among shipping lines as one area where it could make a difference, while not getting involved in commercial matters.

From the end of May until the beginning of September, MSC will run an additional direct shipping service from the ports of

Ngqura and Gqeberha (Port Elizabeth) in the Eastern Cape.

In February, the CGA had announced that through consultants, it had succeeded in convincing Hapag-Lloyd to extend its services in exporting citrus from the ports in Durban and Gqeberha for the same period. A number of producers have already confirmed that it would make use of the new service.

“Hapag-Lloyd’s involvement will make a difference in giving us more options and vessels. It won’t necessarily lower shipping rates, but it creates more competition as we ready ourselves for the volumes on the way,” says Charles Rossouw,

a citrus grower in the central interior of the country.

He points out that during its citrus season, South Africa basically competes with itself with little competition from elsewhere in the Southern Hemisphere.

The other major sea change has been the much-lauded decision to hand the management of Durban Container Terminal Pier 2 terminal to a private company. International Container Terminal Services, Incorporated from The Philippines was awarded the contract, due to have commenced at the start of April. The discontent of organized labor was feared, but has so far not realized.

However, unsuccessful bidders APM Terminals and others have launched a court interdict to challenge the outcome of the tender process, which means the privatization is deferred for the moment.

7 AGF Primeur 4 • 2024

Citrus orchard

South Africa

Nevertheless, Rossouw notes that this points to a fundamental shift in the government’s thinking on the prickly topic of privatization of state assets. This change in the regulatory environment to allow the private sector to manage state assets is a development he finds very encouraging.

Events at the port of Cape Town – which mercifully spared the citrus sector –clearly showed the whole country (for it made headline news) that the government-owned enterprise Transnet was no longer capable of managing ports and its infrastructure. A new CEO has since been appointed, one who bears the approval of the fruit industry, and Transnet has worked hard to at least improve its image.

So the legal impediment to privatization of DCT’s pier 2 is for the moment not holding back major changes there. All equipment still has to arrive, but the CGA has noted it’s hoping for a speedy outcome to the legal challenge.

INVERSE CORRELATION BETWEEN ORANGE AND LEMON JUICE PRICES

A Western Cape packhouse manager says lemon juice prices are now a tenth of what they previously were. “You could always make a few bob with juicing. Not a lot, but always something, at least. Now [lemon] juice is in its glory.”

At current lemon juice revenues, farmers can barely pay their labor and transport costs. Moreover, the impediments to

shipping meant that some farmers who had established lemon orchards during the great lemon expansion over the past decade, never once came to the point of exporting.

At least one citrus producer is now taking out their lemon orchards for these reasons, but that’s not making a dent to the almost 36.8 million 15kg cartons of lemons predicted to be harvested from South African orchards this year.

In the Eastern Cape, growers have had to contend with very high temperatures and scant rainfall, affecting lemon sizes, although volumes of right spec fruit are definitely sufficient, exporters insist, to fill their retail programs.

Similar high temperatures in the north of the country – coupled with localized spots of hail, usual to this area – have also had smaller fruit as a result, but growers there are upbeat about oranges.

“VALENCIAS

AND NAVELS ARE IN A GOOD SPACE”

There is a worldwide shortage of orange juice concentrate. Under these conditions, exports need to compete with the no fuss option of sending fruit in big processing bins to local juice factories.

“Valencias and navels are in a good space,” says a Mpumalanga citrus grower. “When you look at last year, everyone did well with oranges and what helps them this year is the unbelievably good orange

juice prices this year. Farmers are very happy about this.”

In years with a weak orange juice price, producers could decide to let fruit hang (while keeping an eye on the start of tariffs on South African oranges in September) – the way the Spanish season is stretched in Europe – but this reduces the shelf life.

This year will be different: growers of the approximately 84 million cartons of navels and Valencia have strong juice options, which will divert class 2 fruit from exports.

“The start to the citrus season is the same as last year: a very uncertain start, but thereafter it held steady throughout the year.”

He prefers a cautious commencement rather than an overheated market resulting in an oversupply of fruit on the market, remarking that there will be always be demand for freshly harvested citrus with a healthy shelf life.

“I’m cautiously optimistic about the season ahead. As long as we place high-quality citrus while offering a good value proposition on the shelves, we have a reason to exist.”

info@cga.co.za

8 AGF Primeur 4 • 2024

South Africa

A FEW producers who had planted lemon orchards ... were never able to export...

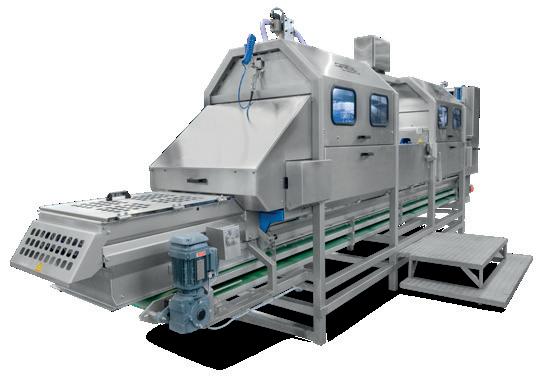

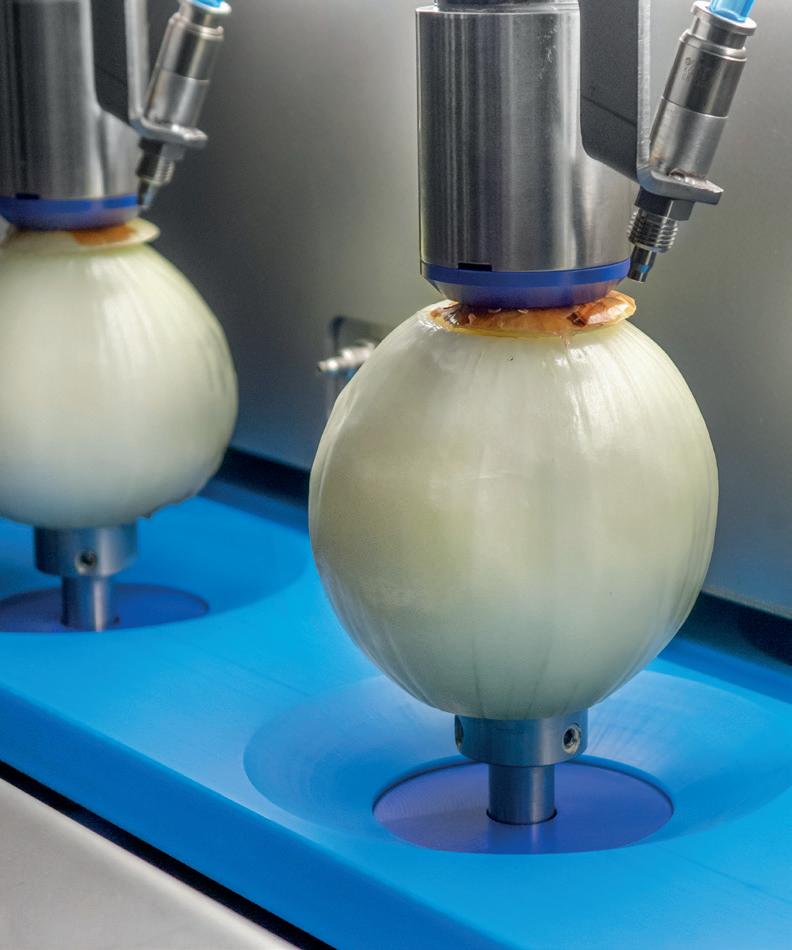

theoniongroup.com

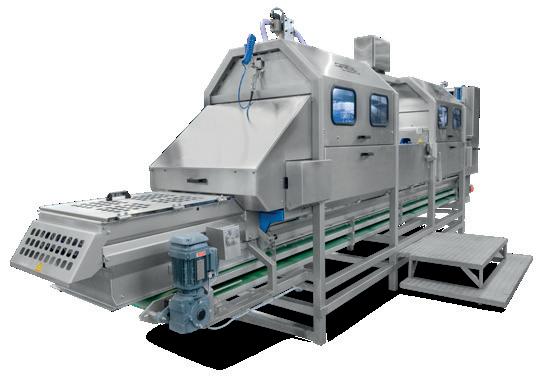

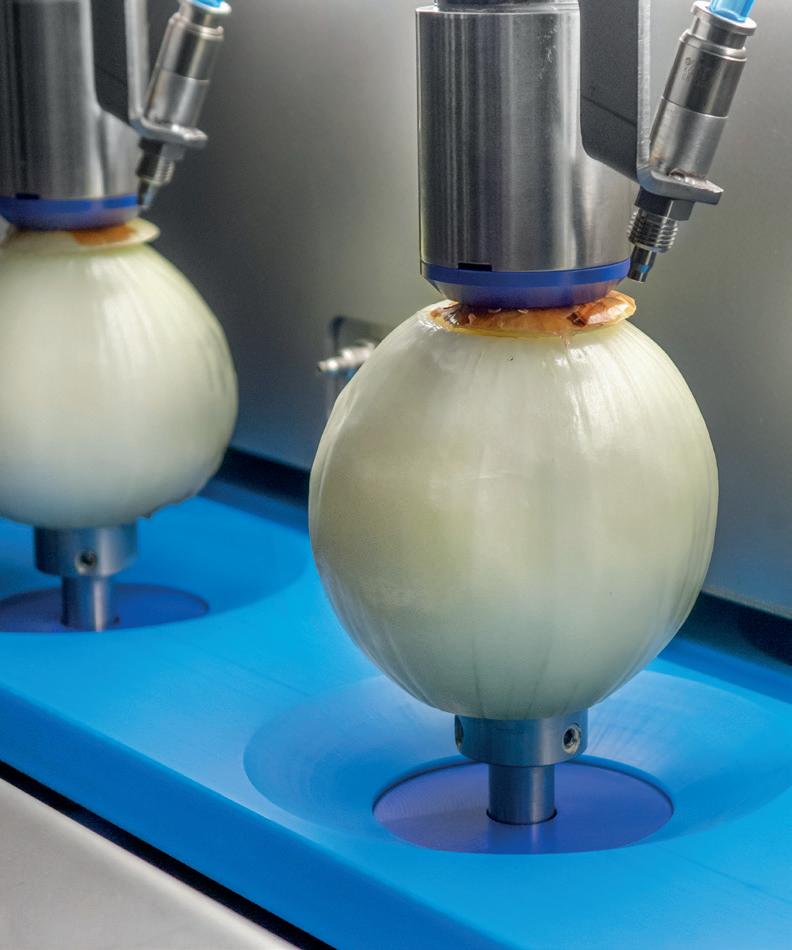

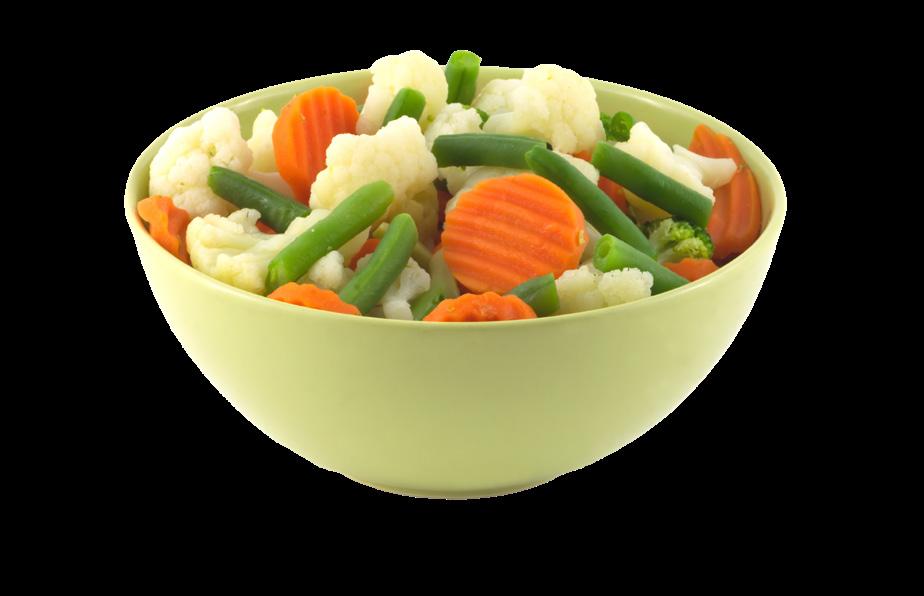

Onions, pickles and other vegetables from TOP are found all over the world year-round processed or unprocessed. We take great pleasure in meeting the demands of food processing companies and growers. The fact that we both grow and process the crops ourselves creates endless possibilities. Discover TOP!

9 AGF Primeur 4 • 2024 We like to support your business

Expanding South American production aims to secure future supply

Europe and the rest of the world need not worry about a scarcity of supply of fresh fruit and vegetables in the medium to long term. Producers in countries across South America are actively expanding and ramping up fruit and vegetable production of different types. This all with the aim to provide the much-needed supply to world markets, while sustainably developing people, their industries, and the environment. The South American governments are hard at work, in tandem with their fresh produce industries, to build and open new ports, to ensure the fresh produce is shipped efficiently to distant markets. There is also vigorous activity to open new markets across Asia, while also expanding market access in Europe and North America. The aim is to gain more favorable terms with the lowering of tariffs, key in this process.

One such industry that is rapidly developing is the exotics fruit industry in Brazil, where they are concentrating

on increasing the production of dragon fruit. Research and extension work to assist small producers is intensive in the

region, says Ricardo Martins, an agronomist at Epagri, the agricultural research and rural extension company in southern Brazil. “We have seen pitaya grown in small areas, but there is great potential for the fruit to be grown in larger areas, given the opportunity to export and industrialize.”

He says because Brazil has a very strong domestic market that is competitive, producers often don’t look further to export markets. “However, with the increase in the supply of fruit, we hope that Brazil will start exporting because in this case, it’s possible to add even more value to the fruit.”

The person known as Brazil’s ‘melon king’, Roberto Barcelos, says the world can benefit from the huge production in his

10 AGF Primeur 4 • 2024 Citrus

country, with currently only about 3% of total production being exported. However, for exports from Brazil to expand more, they need a free trade agreement between Mercusor and the EU. “Our fruit pays 10% duty in the EU. Our other South American competitor countries have 0% tariffs and our grapes pay 14% and from Peru it is 0%. Our melons face a 9% tariff, while other countries from Central America have much lower tariffs. Brazil, in the Southern Hemisphere, is counter seasonal to the Northern Hemisphere. There’s also many local producers in Brazil that must be developed into exporters.”

Colombia, known for their limes, avocados and exotic

fruit, cocoa, and flowers, will see export volumes increase in the next few years, says Juan Pablo Duque, CEO of Equilibria. While others might call it a greenfield project, Duque and his team have designed a large scale limes farming enterprise that will impact many growers in the future. They have planted 300 hectares of limes and work with a community of 330 growers.

“Our ecosystem is designed to empower small-scale producers, providing them with the tools to enhance the quality of their production, increase margins, and promote environmentally friendly practices. Through technology and knowledge, we aim to expand this initiative to 2,000 hect-

11 AGF Primeur 4 • 2024 +32-3-3024563 www.eolisbelgium.com commercial@eolis-be.com WEEKLY, DIRECT and FAST service from ANTWERP to ABIDJAN, TEMA, DOUALA and DAKAR Your refrigerated transport solution

ares, driving sustainable development in our agricultural community. Our ultimate goal is to scale this initiative not only across Colombia but also throughout Latin America.”

Colombia’s fresh produce exports are still small, says Duque with a lot of potential still to be realized. “Our avocado industry is small. Golden berries too as well as limes are very small. About 85% of informal jobs are in rural areas in Colombia. These people have no pensions, no social security and health insurance. When people reach the age of 60 they have to work into their old age. Small growers are normally seen as old, poor and tired. We need to change this and give them opportunities. There’s 6.9 million people living in poverty with 18.3 million living in monetary poverty. According to the World Bank agriculture development is up to three times more powerful to end poverty,” states Duque.

He says to help so many people, a system of big enough scale is needed. “We started with our own nursery to have better

quality trees. It is not common in Colombia for companies to have their own nurseries. We established a very good managed production of lime trees. Now we have the largest nursery in Colombia. We needed knowledge and brought a senior agronomist in Colombia, a lady, on board. We run our operation with an app. We are the only nursery that can upload the needed information, a buyer knows exactly what we did to grow the tree.”

Duque says the key is to have a body of knowledge to guide the many small producers. “We developed a play book, a manual where you have all the information on how to establish a farm from zero to develop it into an export farm. We have videos and a manual that covers everything. We uploaded it to this app for smaller growers, we’re giving free information to increase productivity and quality. We need to train them and make them exportable.”

Equilibria started an export company, built their first production facility, they have a carbon negative operation too.

“We have 180 hectares of forest and conservation. We have a biodiversity action plan. We partner with the foundation of one of the largest company’s in Colombia, where we cover 50 hectares to reforest and have seen an explosion of biodiversity.”

All these efforts, says Duque, go beyond what is needed to only reach global certification. “It is to give supermarkets and consumers the fruit with the EQA quality. That’s quality you don’t see because the world only buys fruit for the quality they see. We need the quality of the unseen. That is fair wages, fair prices for growers that look at the environmental aspects too. We are looking for supermarkets who want to play with these rules. Those who want a more emphatic sustainable food chain. That’s our final goal. This ecosystem will be the key.”

jorge.abrafrutas@gmail.com rsmartins00@yahoo.com.br jduque@equilibria.com.co

12 AGF Primeur 4 • 2024 Citrus

www.originfruitgroup.com

Same trusted faces, a new refreshed look for Origin Fruit Direct

Owner and Managing Director Markus Schneider:

“The

latest step is the establishment of a fullyfledged branch in Poland”

The annual seasonal transition from Spanish to German and Dutch greenhouse strawberries is taking place in line with the time of year. “In Baden, we expect to start the main harvest a week earlier, while in the Rhineland, the start is largely the same as last year. Overall, we are therefore expecting our tunnel strawberry harvest to start around four days earlier,” said Markus Schneider, Managing Director of the Frutania Group.

The price level for Spanish strawberries has been quite good so far. Schneider: “What has caused us problems, particularly from February onwards, are the quality problems, which are clearly due to the extensive rainfall. Although strawberry cultivation is still dominant in Spain, it has become increasingly difficult in recent years. In the German food retail sector, Spanish produce is still offered in April and May alongside the domestic product, although we also supply a significant proportion to other European countries. This is definitely related to the availability of water in Spain. I remem-

ber last year, when the water issue had an impact on quality, especially at the end of the season.” Nevertheless, in other growing countries, such as Greece, it is sometimes difficult to meet the high-quality standards of the German food retail trade. However, Spain has the advantage of a wide range of varieties and special formats, while Greece is mainly dedicated to the cultivation of standard varieties.

Raspberry cultivation is increasingly shifting towards Morocco, which is mainly due to the cost situation in Spain,

Schneider continues. “Although blueberry cultivation in Spain is stable, cultivation capacity in Morocco is also expanding. To date (11.04.2024), the prices for Spanish blueberries have been relatively firm, but the supply of raspberries from Spain is fairly limited.” Meanwhile, almost all German fruit varieties are in full bloom, with a ‚predominantly good fruit set to date‘. “Furthermore, no frost has been reported, which is why we are expecting a good start to the season for now. However, it is still too early to make any statements about the blueberries. According to the weather forecast, there is still a warm weekend ahead of us followed by a colder phase, which would then slow down the vegetation again somewhat. We have also had to cope with some very heavy rainfall, which has made many fruit growers extremely nervous. All in all, we are currently facing very unusual climatic conditions. Nature is exploding, and you can see that not

14 AGF Primeur 4 • 2024

Soft fruit

Die dreiköpfige Geschäftsführung der Frutania-Gruppe: Andre Moog, Holger Hoge und Markus Schneider.

only in fruit growing, but also in the rapid growth of vegetation in general.”

SALES COOPERATION WITH OGM MITTELBADEN

In contrast to the slight downward trend in German strawberry and raspberry cultivation, the Frutania Group‘s cultivation capacity has remained constant in recent years and has even increased slightly for blueberries, Schneider confirmed. At the beginning of April, Frutania also announced a new sales cooperation with Obstgroßmarkt Mittelbaden (OGM). Schneider comments: “Thanks to our cooperation with Fruitfels, we already have a good position in the Oberkirch area. It simply made sense to bundle the volumes and jointly notify and market them to food retailers. With this basic idea in mind, we then decided to take over the marketing of OGM Mittelbaden‘s fruit. We basically have the same products: This means that the product range will not be expanded, but intensified. We also expect further synergy effects in the area of logistics. However, we will only be able to evaluate this in a few months‘ time. In short, thanks to this cooperation, we are now able to move more volumes in the early area.”

INCREASED PLUM CULTIVATION

In addition to soft fruit, the Frutania Group has also recorded nice growth rates in plums, Schneider explains.

“We are seeing steady growth in the premium Haroma variety from covered cultivation. We have expanded the area in recent years and these new plants will now gradually reach full yield. In general, last year‘s plum harvest was entirely satisfactory. We had roughly the same quantity as the previous year, with good demand. We will also stop after the end of the German season and will not import any additional quantities from Moldova or other foreign origins.”

STRENGTHENING POLISH BERRY PRODUCTION

Overall, Schneider is positive about the future. “We are still on course for growth, and we are constantly striving to optimize our operational and marketing structures with the aim of strengthening the marketing of German production.” Nevertheless, the company is also gradually expanding its presence in neighboring countries such as Poland, adds Schneider. “The latest step is the establishment of a fully-fledged branch in Poland to better coordinate the marketing of fruit produced there. Specifically, this mainly involves raspberries, blueberries and strawberries, not so much for the German market, but primarily for the Polish domestic market and for export abroad. Here, too, we are aiming to organically expand our cultivation capacities.”

15 AGF Primeur 4 • 2024

soft fruit specialist: www.frutania.de

The

Frutania-Primeur-04-24.indd 2 18.04.24 11:11

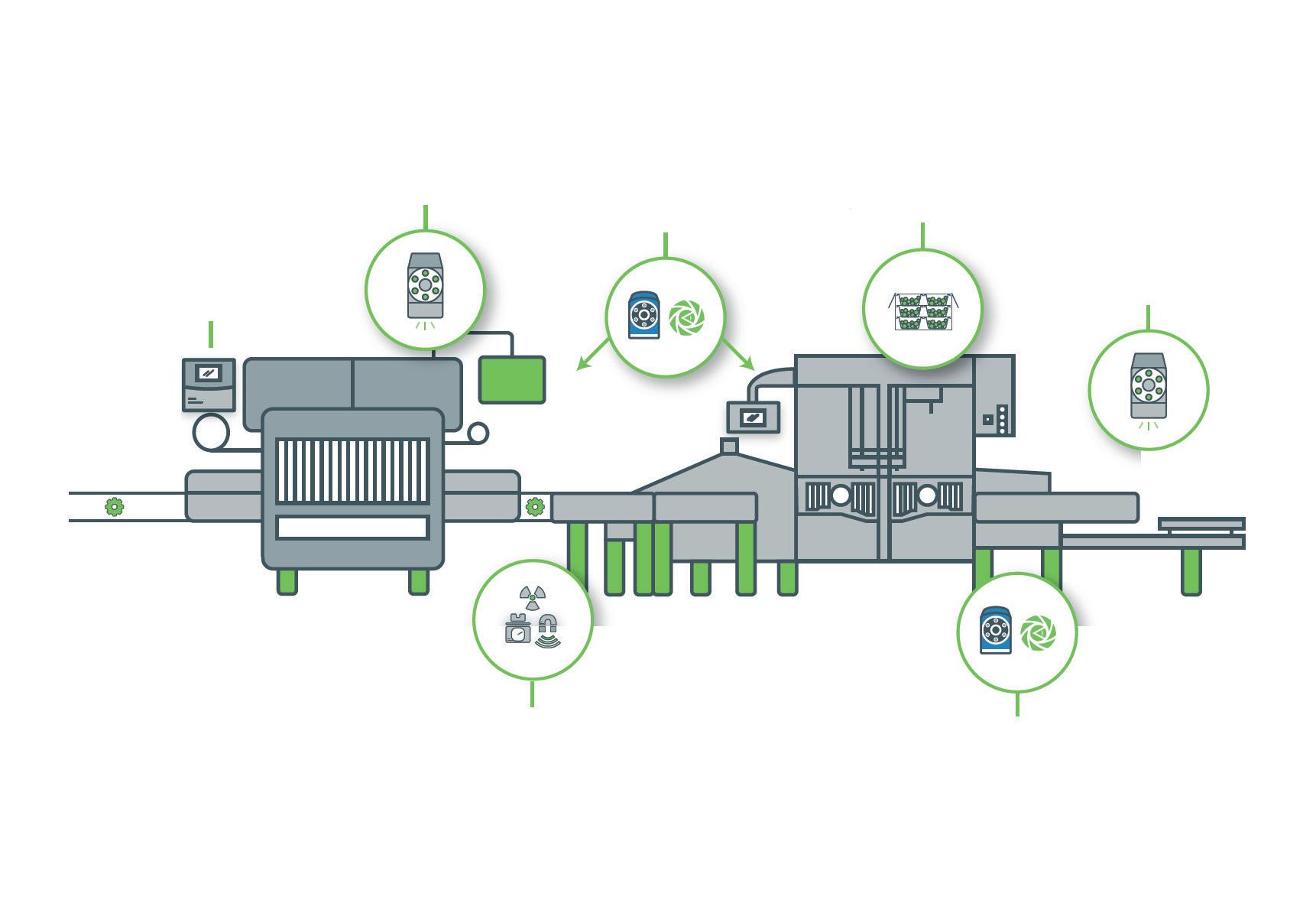

Qualityacross the entiresupplychain

Spanish stone fruit is increasingly in the hands of large professional companies

The 2024 stone fruit season starts earlier in Spain

In the third week of March, the first nectarine harvests began in Huelva and Murcia, the earliest stone fruit production areas in Spain. The country continues to occupy the first position as a supplier of stone fruit to the European Union, at a great distance from other competing member countries. Although Huelva has started a week earlier than last season, Murcia‘s early start of around two weeks has set a historical record for companies such as El Ciruelo, one of the main producers of stone fruit in Murcia and the earliest in the region.

The first batches to reach the market go for really high prices and are sold to the highest bidder, it is not until the end of April when important and consistent volumes start in Murcia. On the other hand, this year Extremadura, especially the province of Badajoz, begins to have significant volumes in mid-May. Furthermore, it will not be until mid-June when the campaign begins to take shape in

Lleida and Aragon, the later areas for nectarine, peach and flat peach.

The advance of the campaign in Murcia this year takes away the fear of the overlap that occurred last year between Extremadura and northeastern Spain. In addition, supermarket chains have valued very positively to start having the fruit earlier this year.

“At the beginning of winter we had a good accumulation of cold hours, much higher than the previous year, followed from the beginning of the year by an advance of heat with higher temperatures than usual, very sunny days and an almost total absence of cloudy days and rainfall,” José Velasco explains, CEO of El Ciruelo.

The Region of Murcia exported around 130,000 tons of stone fruit in 2023, almost 20% of the total exported by Spain. This year, exports are expected to reach between 180,000 and 190,000 tons, especially due to the recovery of the early apricot crop. “The lack of cold weather and bad weather reduced the supply of apricots last year, but this year, if there are no setbacks due to the weather, forecasts point to a harvest of approximately 50,000 tons of apricots,” says Joaquín Gómez, president of Apoexpa.

16 AGF Primeur 4 • 2024 Stonefruit

“Just as for the earlier apricot varieties, there have been sufficient chilling hours, and they are coming in on date, this has not been the case for the mid-season and late varieties, whose flowering has been very irregular due to the excess heat. For this reason, good harvests of nectarine, peach and flat peach as well as early apricot are expected for the moment, while there will probably be less production of later apricot,” says Thomas Chevailler, Technical Director of PSB Producción Vegetal, a renowned stone fruit variety breeder and also a producer and marketer of fruit.

The apricot is the most affected species by climate change, with the consequent increase in temperatures in almost all producing areas, according to the Technical Director of this breeding company.

“Average temperatures have risen faster than predicted. It is very important to plan the planting with the breeder, paying attention to the chilling hour needs of the varieties and to be proactive, considering the changes that are predicted. It is getting more and more complicated for growers to get it right,” Thomas says.

As for Extremadura and the producing areas of Catalonia and Aragon, good crop volumes are also expected. Although there was concern that there would not be enough irrigation water to cover all the needs after flowering, when the fruit has already set, there has finally been enough rainfall to ensure the campaign in the main producing areas, especially in Lleida.

It should be recalled that, at the beginning of the year, the severe drought led

to drastic measures in Catalonia with severe restrictions on the use of water for human consumption and for agriculture. “We have to take advantage of these moments of crisis to think about mediumand long-term solutions, in investment projects to be able to better face these situations of water shortage in the future, with more efficient irrigation systems,” says Manel Simon, director of Afrucat.

Spanish stone fruit is increasingly in the hands of large professional companies In recent years there has been a transformation of the Spanish stone fruit sector, which has gone through a permanent period of price crisis until two or three seasons ago, in which it has shown signs of improvement, explains José María Naranjo, Sales & Market Development Manager at Tany Nature, located in Zurbarán, Badajoz. “Although we had already been seeing gradual changes in the structure of the sector, this trend has been boosted in the years following the pandemic, given the excessive rise in production costs or the shortage of labor, among other factors.”

“From 2000 to 2010, there was a tremendous revolution at the varietal level and a lot was planted. However, not everyone is willing to produce and sell stone fruit because of the technical difficulties involved, the product‘s short commercial shelf life, and the growing competition from other products,” says Rosa Hernandorena, Commercial Director of Viveros Hernandorena, a nursery that specializes in stone fruit, persimmon and almond trees, among other crops.

“Many farms already gave up after the Russian veto in 2014, but since the times of the pandemic, change in the sector has accelerated, and non-specialized growers have been disappearing. Stone fruit cultivation is increasingly in the hands of large companies with a high degree of professionalization and process integration, which plant on demand to meet the needs of their customers while keeping a close eye on the production costs,” Rosa Hernandorena points out.

“In fact, many producers are still uprooting and changing their activity, or have replaced stone fruit for other crops, such as almonds, pistachios, olives or cereals, among others, leading to an atomization of the sector. Moreover, there is a boom in the purchase of fruit producing companies by large investment funds, which are looking closely at the origins. This is something that had already been happening with other crops. The production is increasingly falling into the hands of specialist companies. There are fewer and larger players, and the supply is becoming more concentrated. It is no longer as diverse as it used to be,” says José María Naranjo.

The Spanish stone fruit harvest in 2023 totaled 1,736,914 tons compared to 1,260,635 tons in 2022, reaching levels above the average of the last 5 years, according to figures from the Ministry of Agriculture, Fisheries and Food. Spanish exports up to July were above average in value, while in volume they were below average. Prices were also above average in general, except for yellow nectarines.

17 AGF Primeur 4 • 2024

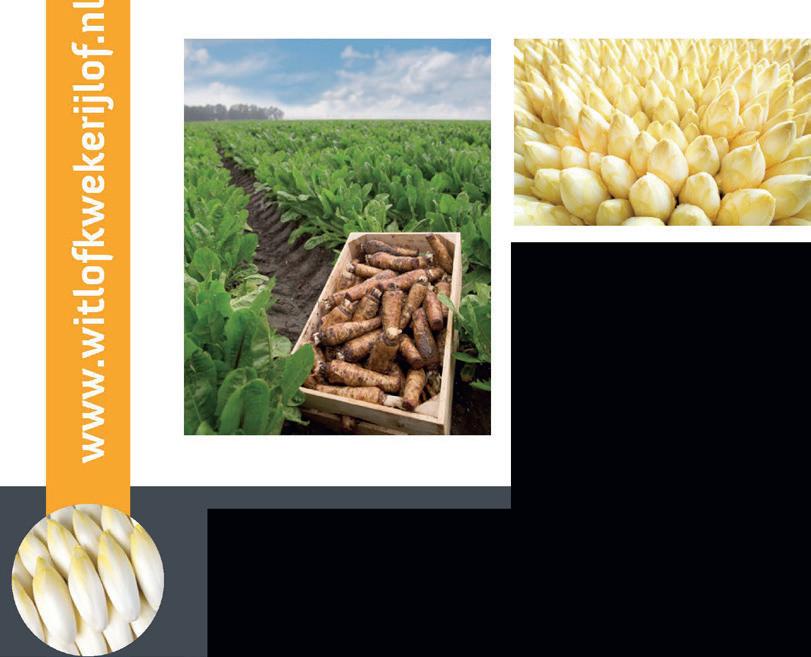

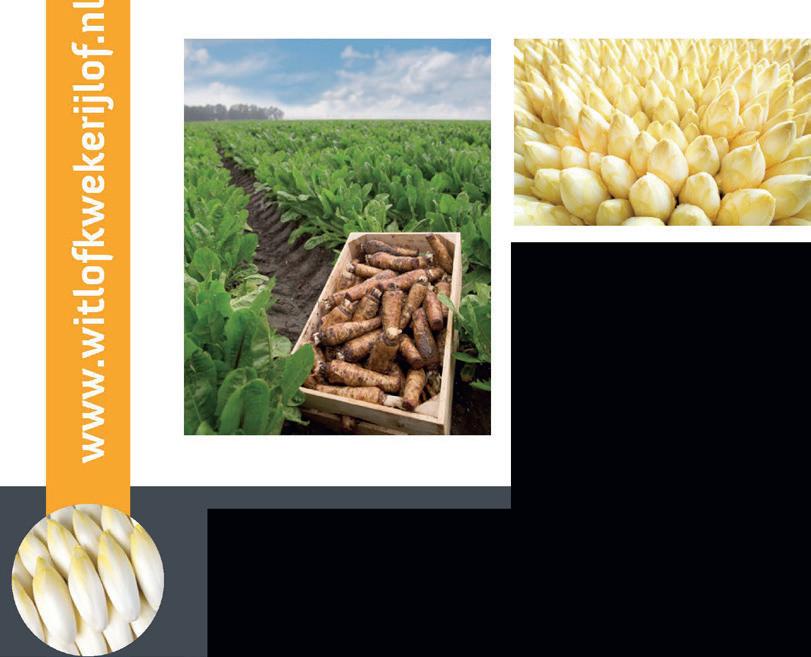

Reichenau-Gemüse invests in organic sweet potatoes

“Around 60 percent of domestic cultivation now takes place here”

In the wake of climate change and high demand in the trade, sweet potatoes are enjoying an increased interest among German growers. At Reichenau-Gemüse eG, Germany‘s southernmost producer cooperative, the heat-loving root vegetable is now very popular as well. The crop has already been cultivated according to organic guidelines for around ten years, but last year the storage technology and capacities were brought to the latest standards. Thanks to this investment, sweet potato producer Benjamin Wagner and Christian Müller, Reichenau’s deputy managing director, expect to be able to supply the trade with Reichenau organic sweet potatoes all year round.

Over the past decade, Wagner has gradually expanded and optimized his production. “Nevertheless, we never had a yield that came close to our expectations, which is mainly due to the short growing season in Germany. Last year, with a net yield of around 2 kg/m², we had a good, marketable yield for the first time. We are also extremely satisfied with the quality and calibers. We have everything from 50 to 900 grams. In a cold year, however, the tubers don‘t get any heavier than 300 grams,” says Wagner, who cultivates the vegetable on 120 hectares. Simultaneously, the innovative organic farmer has also set up his own

Reichenau boss Johannis Bliestle shows freshly harvested sweet potatoes. The tubers are offered at the point of sale as organic and Naturland products. The goods weighing 300 grams or more tend to be best suited for loose marketing, while the goods weighing less than 300 grams are mainly used for packaging.

Sweet potatoes

young plant production, which gives him another advantage over the competition.

YEAR-ROUND SUPPLY SECURITY

Investments have not only been made on the production side, but also at the marketing level, Müller emphasizes. “60 percent of German organic sweet potato cultivation takes place here and is represented by Mr. Wagner. Accordingly, we also have a large tax base that we have to place in the German food retail sector. In addition to loose marketing, we have recently started offering packaged sweet potatoes in 650-gram paper flow packs, which we have also provided with preparation and processing options. This means that we can now also offer retailers a more consumer-friendly packag-

then takes place in May. Harvesting normally follows throughout October, after which the produce is stored. The tubers are then transferred to the curing room: during this process, the sweet potatoes are stored for several days at over 30 °C and a humidity of at least 90 percent. During this time, the tubers heal, the skin becomes firm, and they can then be stored for the coming months. Wagner: “I would prefer to harvest in November. But that‘s too risky for me because a few days below five degrees would be disastrous for the crop.”

Considering the entire cultivation and harvesting process, the sweet potato is an extremely demanding and care-intensive crop, Wagner points out. “This

ing with sweet potatoes in a finer grading, comparable to triplets on the potato shelf. We hope that this will also attract new consumers to the product.”

All investments should bear fruit, particularly in the second half of the season, Müller continues. “Our aim is to guarantee a year-round supply this year thanks to our modern storage capacities. We strongly believe that the last domestic competitors will disappear from the market in March and April, which is why customers outside southern Germany will also increasingly access our goods. This is also necessary, as we cannot market the volume produced here in Bavaria and Baden-Württemberg alone.”

DEMANDING AND CARE-INTENSIVE CROP

The mother plants are produced in December, and the sweet potato seedlings follow in March and April. Planting

means that we are confronted with highcost pressure, with labor costs in particular having an impact. We can‘t compete with cheap imports from abroad in terms of price. We cannot produce at these conditions with our cost structure. In the end, it is the consumer who decides whether they value regional products. At the same time, supply chains from abroad are also becoming increasingly difficult. Ultimately, the shorter transport routes for local produce also play a role in the consumer‘s purchasing decision from a sustainability and ecological perspective, especially for organic products.”

MORE POTENTIAL IN FURTHER PROCESSING

Despite the pleasing growth in domestic production, there are still many countries of origin that want to market their products in Germany. “We are aware of this and also feeling some of this marketing pressure. Organic sweet potatoes

from numerous countries were already on offer at Biofach alone. Of course, we hope that our partners in the food retail sector will remember regionality and long-term cooperation. After all, organic and regional still go hand in hand, and we have the advantage of shorter transport routes and immediate proximity to the sales market. On the other hand, the sweet potato is a stored product for which it doesn‘t matter much whether transportation takes one or two days longer.”

Overall, Müller is confident about the future: “The sweet potato certainly is a trendy product. With a market share of 60 percent, we are already at a very high level. I therefore see less potential

regarding quantities, but rather in the further processing of the sweet potato into by-products such as purées, gnocchi, or dumplings. In this respect, there are many opportunities to make the product more presentable.” Wagner agrees and confirms that he is aiming for further processing on his own farm in the future. “But I‘m also open to other alternative niche crops that require less energy and that we can ideally market all year round.”

info@reichenaugemuese.de

B.Wagner@biogemuesewagner.de

19 AGF Primeur 4 • 2024

Asian vegetables are becoming commonplace:

“We focus on quality and short lines”

In the Netherlands, locally grown Asian vegetables gradually start replacing imports in March. Nothing wild happened in Spain or Italy this winter. It was ‚very easy‘ as far as the trade with Asian vegetables is concerned, said Cees Visser of Asian Crop in early March. We spoke to him while he was on his way from one of his three greenhouses in Velden, the Netherlands, to another. “Driving’s very convenient when I have stuff to take along,” Cees begins.

Does he have a cargo bicycle? Yes, but it usually carries his children, he admits, laughing. However, cycling is not such a bad idea given early March‘s sunny and bright spring days. “It almost seems like summer in the greenhouse. Everything‘s growing now. Then we must be careful not to have too much or too little produce. That‘s where our experience comes into play.”

Of that experience, this Dutch cultivation and trading company has plenty. Back in

1999, Cees‘ father, Leo, traded in a piece of his radish greenhouse to grow Asian vegetables. He had become acquainted with these while traveling in Asia. Today, Cees and sister Daniëlle run the family business. In the winter, they get a lot of produce from Spain, and they ‚cut a little bit‘ in Velden. In the spring, their Dutch greenhouses’ volumes increase again.

That‘s where the focus comes in. “Everything comes together now. December was genuinely cold for a while, but the

plants didn‘t get too cold, so they managed to grow quite well,” Visser explains. In winter, everything grows slower in the greenhouses with their limited heating. “With the first real spring sun, you must always beware of bolting. That‘s why we‘re well busy cutting now.”

HOW LONG WILL IT LAST?

Cees always looks forward to this spring greenhouse cutting. “The product is ultra-fresh. When you get it from Spain, transport takes three days. Even though we have fresh arrivals daily, nothing beats local cultivation,” he says. Last winter, the main concern was whether the trucks in Spain would get stuck in farmer protests.

“We got off reasonably easy, fortunately. We did have to detour, but luckily, our trucks weren‘t emptied out.” The grower understands the reason for the protests.

20 AGF Primeur 4 • 2024 Vegetables

Cees, Leo, and Daniëlle Visser

He also sometimes worries about things like rising costs and having to pass those costs on to end customers. “Sometimes you think, ‚how long will this last?‘ We must guard against competing each other to death,” Cees warns.

In Asian Crop‘s early days, growing Asian vegetables was something unique, but over time, growers have been added. “My father and I have seen many come, but also many go. Some newcomers did stay. A little competition is not a bad thing, as long as it‘s fair. My thought process is, ‚If he can do it for that money, we should be able to do it too.‘ As long as all of us in the chain can earn a living.”

Costs truly started climbing during the pandemic, and that has not abated since. Energy is a concern for the grower who keeps his greenhouses frost-free, especially in the winter, but labor is a concern, too. And then there is transportation. “That cost suddenly spiked during the pandemic. We passed that on in consultation with our customers,” says Cees.

“They weren’t happy but fortunately understood it.” Asian Crop is constantly considering to what extent they can pass on costs without pricing themselves out of the market. “After all, you don‘t want people to end up choosing cauliflower, which is also becoming increasingly expensive, instead of pak choi,” the grower says.

SMALL, UNPRETENTIOUS MARKET

Pak choi is now the best-known Asian vegetable. “That‘s where competition is fiercest. That, and nowadays, Shanghai pak choi are well-established varieties you can also find in the big supermarkets.

There, large supply occasionally depresses prices.” That is not a direct concern for the company. “It was the same when my father started with Asian vegetables. The market was much smaller back then, but when you had product left over, you were better off chopping it up and starting anew. That way, you keep the quality high. Still, growers hate milling good products,” Cees admits.

Specialist wholesalers are Asian Crop‘s top buyers. They don’t sell their products at auctions. “We tried that, but this is not where our buyers are.” Supermarkets have also begun offering more Asian vegetables. Travel-loving young people seem to want to buy the products they got to know abroad at home as well. The Dutch

cultivation and trading company, however, prefers not to serve retailers. “You must be set up for that, and we‘ve been delivering our vegetables directly to clients throughout Europe for years,” Cees explains.

GROWTH IN SERVICE PRODUCTS

In the Netherlands, an increasing number of Asian stores are buyers, whereas Chinese-Indian restaurants are struggling. That was in the news recently, and Cees considers it with a sober perspective. “The good restaurants keep thriving. Besides, there‘s always some kind of shift. Shanghai pak choi is becoming more and more popular in non-Asian restaurants, served alongside, for example, steak.”

21 AGF Primeur 4 • 2024

Asian Crop has three greenhouses in the Netherlands

Cees loves helping out with the cutting when he can

Cees and Daniëlle with the distinctive red and black box in which many Asian vegetables are traded.

As a grower, Cees believes it is vital to continually improve his products‘ flavor and appearance. The company does this in cooperation with breeding companies. “We don‘t focus directly on increased yield with a new variety, but rather quality. You want to stand out with the right traits and keep customers saying, ‚I want the product in that black and red Asian Crop box‘,” he continues.

The grower has not added many new Asian leaf vegetables in recent years. The company‘s website boasts a dozen varieties, in addition to a range of products Cees calls‘ service products‘. Those are renewed time and again, though. “Lately, we‘ve started adding more herbs or, for instance, bitter melon. These aren‘t big sellers, but products with which we complete clients‘ packages.” Asian Crop grows these new niche products itself. “It‘s more of a hobby, but it‘s what I enjoy most,” he confesses.

COMBINED WITH SPAIN

The complexity of modern greenhouse horticulture, however, means he has less and less time for that hobby. “But I still try to help with the cutting when I can.” Regardless, he believes getting into the greenhouse several times a day is essential. “That‘s the only way to stay on top of things. You can never slack off. My sister Daniëlle and I are a good combo, and that works out well,” Cees states, also praising his loyal team. “We have many permanent employees. What we do still takes plenty of handwork. With so many crops, mechanizing, let‘s say, harvesting isn‘t yet an option.”

Asian Crop also does its own packaging. “Mostly, loose, in boxes, but we can do flow pack, too,” he says. It depends on what buyers want, and that still varies. “We‘re close to Germany, where there‘s resistance to, for example, loose pak choi pack-

aging. Yet, it still goes both ways. Sometimes, customers want loose pak choi and then repackage it. The general trend is less plastic. The challenge remains keeping your product fresh. That‘s why we‘re putting increasing effort into keeping lines as short as possible.”

In winter, Spanish cultivation dominates, alongside year-round Dutch greenhouse cultivation. Asian Crop is not currently looking to expand its acreage. “Our current size works well. Winter cultivation is usually costlier here, so the combination with Spain works just right. You‘ll lose that if Dutch greenhouses compete with Spain in winter,” Visser reckons. They briefly considered Morocco, Cees acknowledges when

asked, but transport takes even longer than from Spain.

“That‘s okay with tomatoes, which have a longer shelf life than the products we want to bring here.” Whether the product comes from the Netherlands or Southern Europe, good client communication is crucial. “For optimal fresh produce, if there are sufficient quantities, we‘re happy to deliver more often. As long as buyers let us know, in time, that their stocks are low,” Cees concludes. And that is increasingly happening, thanks to Asian vegetables‘ popularity. A good thing for Asian Crop.

cees@asiancrop.nl

22 AGF Primeur 4 • 2024

Vegetables

0031 320 269 524 info@uienhandel.com • faster switching • reach more traders and buyers • work more transparently • the right buyer and party www.uienhandel.com CONTACT US

Asian Crop packages mainly in boxes, but flow packs like this, with Shanghai Pak Choi, is also possible.

Johnathan Sutton, Westfalia Fruit:

“We need to further explore the health benefits and encourage people to keep eating avocados”

“The demand for avocados is still strong,” says Johnathan Sutton, Group Chief Sustainability Officer with Westfalia Fruit, which has a strong focus on growing and marketing avocados. In addition to catering to consumer needs – the fruit fits a plant-based diet, is healthy and convenient – Johnathan also sees plenty of new opportunities. “We are developing in countries like India. Avocado is a new element to their diet, but we have seen a huge growth.”

Johnathan notes considerable demand in other Asian countries as well. “We are supplying the Asian market, mostly from our Latin American production and established an office in Japan, to serve the Japan-area, Korea, China and other parts of South-East Asia.” Market access as well as phytosanitary demands play a role in supplying those markets, says the sustainability officer. “We gained access to China, India, and Japan. This presents an opportunity for us.”

OPPORTUNITIES IN EUROPE AS WELL

Even with the growth in Asia, Johnathan still sees a lot of opportunity in Europe as well. “Some countries are under indexing against others. Obviously, there is strong demand in the main European countries: Spain, France, Germany. But Italy still has a very low penetration. So, there still is opportunity in mainland Europe.” This is why Mediterranean countries are starting to develop their own industry. “The Mediterranean markets have the right climate; water is available, and closeness to market also plays a role.”

On the production side, Johnathan still sees Columbia, Peru, and South Africa as big drivers, but also notes the development of new production zones. “Newer regions with access to market like Kenya, Tanzania, Egypt, or Morocco are starting to develop their own orchards as well.” It means that a lot of new avocado production is coming to the market, while at the same time the sustainability officer notes that due to the current economic dynamics, consumption is slowing down a little bit. “There is a lot of production, with new plantings coming to maturity as well. Avocados have huge health benefits; we need to explore that further and encourage people to keep eating avocados.”

FLECKED SKINNED AVOCADO

One of the ways to boost consumption is through variety development, Johna-

than remarks. “Recently, we introduced Gem, a Westfalia exclusive variety with a golden flecked skin, which we see as an opportunity to attract consumers to a category that has a variety dominance of Hass and offer them something different to show that some variety developments are coming through.”

Westfalia noticed that in between the green skinned avocado Fuerte and the Hassvariety, there was space for a variety in the middle. “This is why Gem was taken onboard. We have exclusive mar-

Westfalia Fruit recently took a full stake in Euro West. Euro West was founded in 1970 by Piet Vijverberg under the name Revij and taken over in 2000 by his son Marco Vijverberg, who changed the name to Euro West. The takeover symbolizes a long-term

relationship and marks a new chapter in the history of both companies. The company, which traditionally specialized in packaging solutions for fruit and vegetables, has been 51% owned by Westfalia Fruit since 2013.

23 AGF Primeur 4 • 2024

Westfalia Fruit takes full stake in Euro West

Exotics

keting rights in many countries. Additionally, we can also control the growers in terms of where and how much avocado is grown. That means Gem is not flooding the market, but remains a premium product. We are still establishing more growers around the world as we expand the market opportunities in new countries.” Johnathan mentions that while the new avocado is already established in the UK market, it is also sold in Germany, France, and the USA as a bespoke variety.

Reforestation and water— a major focus

“We are really focussing on our green assets: the trees that we have on our farms, our land, and the surrounding areas,” says Johnathan Sutton. “As we know, trees lock in carbon into their root structures, we are diving into that space to understand the value of the tree.”

This leads Westfalia to increase its focus in that area. “In Colombia, we are working on a project with local farmers to reforest. Through tree nurseries we save native species of seeds, bring them back into the nursery and then distribute them to our growers and communities to plant in the areas that may have been stripped of the natural vegetation. And we are doing the same in Peru as well.”

In addition to absorbing carbon dioxide, Johnathan sees other benefits from reforestation.

YOUNG CROP

When developing new varieties, Westfalia emphasizes sticking to natural selection. “We are looking to map the genome. Avocado is a relatively young crop. For instance, citrus cultivation dates back to the ancient Egyptians; the avocado is only about 100 years old. This means that the genetics have never really been mapped. However, we still don’t believe that manipulating the genes is the right approach. That is not how our DNA

is established, we use very traditional breeding. Our founder, Dr. Hans Merensky, comes from a traditional agricultural industry, so, to stay true to our heritage, we will continue to rely on natural crossings. Nonetheless, we like to incorporate the latest science and technology as well.”

Helpful in that process is the fact that Westfalia — that celebrates its 75th anniversary this year — is vertically integrated, notes Johnathan. “We are the only

“In some cases, it also creates wind breaks and barriers from the natural elements. And in Colombia, where it is very steep, by planting trees, we can manage the water flow and reduce soil erosion. So, yes, trees have huge benefits.”

Another major focus for Westfalia is water. “It is necessary to produce the crop, but it is also a very scarce resource. With climate change, the extremes become more extreme. Heavy rains become longer and more unpredictable. So we are exploring ways to use less water in our orchards through better irrigation systems, as well as trying to conserve resources during times that we need them.” Additionally, Westfalia pays attention to genetics to mitigate the impact of extreme weather. “We are the

only company that is both researching plant material and marketing avocados; we are truly vertically integrated. Therefore, we are looking at developing rootstocks that are more tolerant to salinity so we can grow in areas where the water is less pure, as well as examining drought-tolerant root stocks.”

24 AGF Primeur 4 • 2024 Exotics

company to be vertically integrated. We are putting effort into the pipeline and as we develop new varieties and new rootstocks, we will continue to bring them in, but this is not fast.” However, if new varieties are introduced, it is for the long run. “For instance, we are still producing in the areas where we have traditionally grown. Westfalia has

a crop in South Africa that was planted in the 1940s and those beautiful, mature trees are still productive.”

John.sutton@westfaliafruit.com

25 AGF Primeur 4 • 2024 For all your customs formalities for import and export Gebroken Meeldijk 66, 2991 VD Barendrecht T. +31 (0)180 - 690500 | F. +31 (0)180 - 690503 | E. info@straytest.nl WWW.STRAYTEST.NL

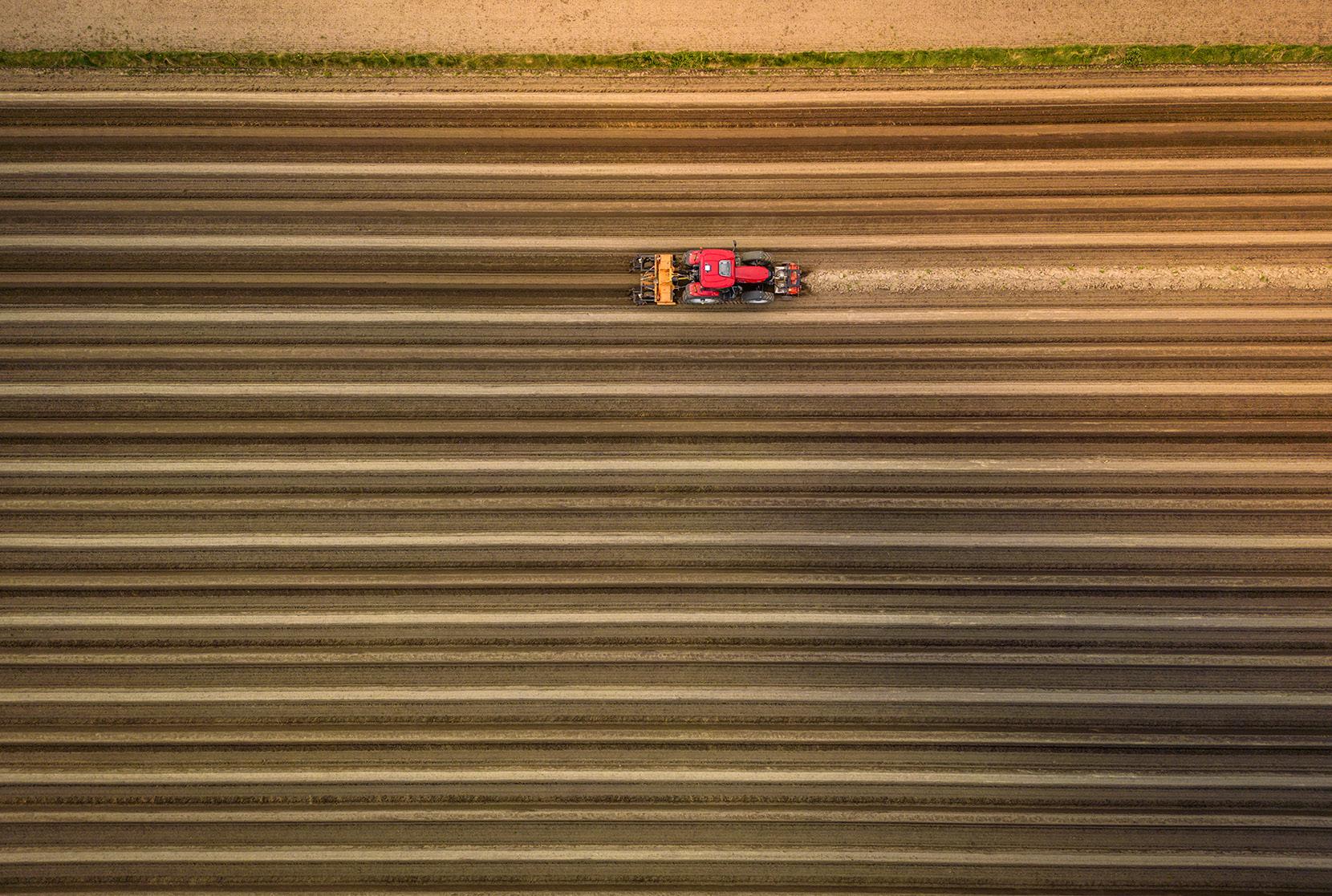

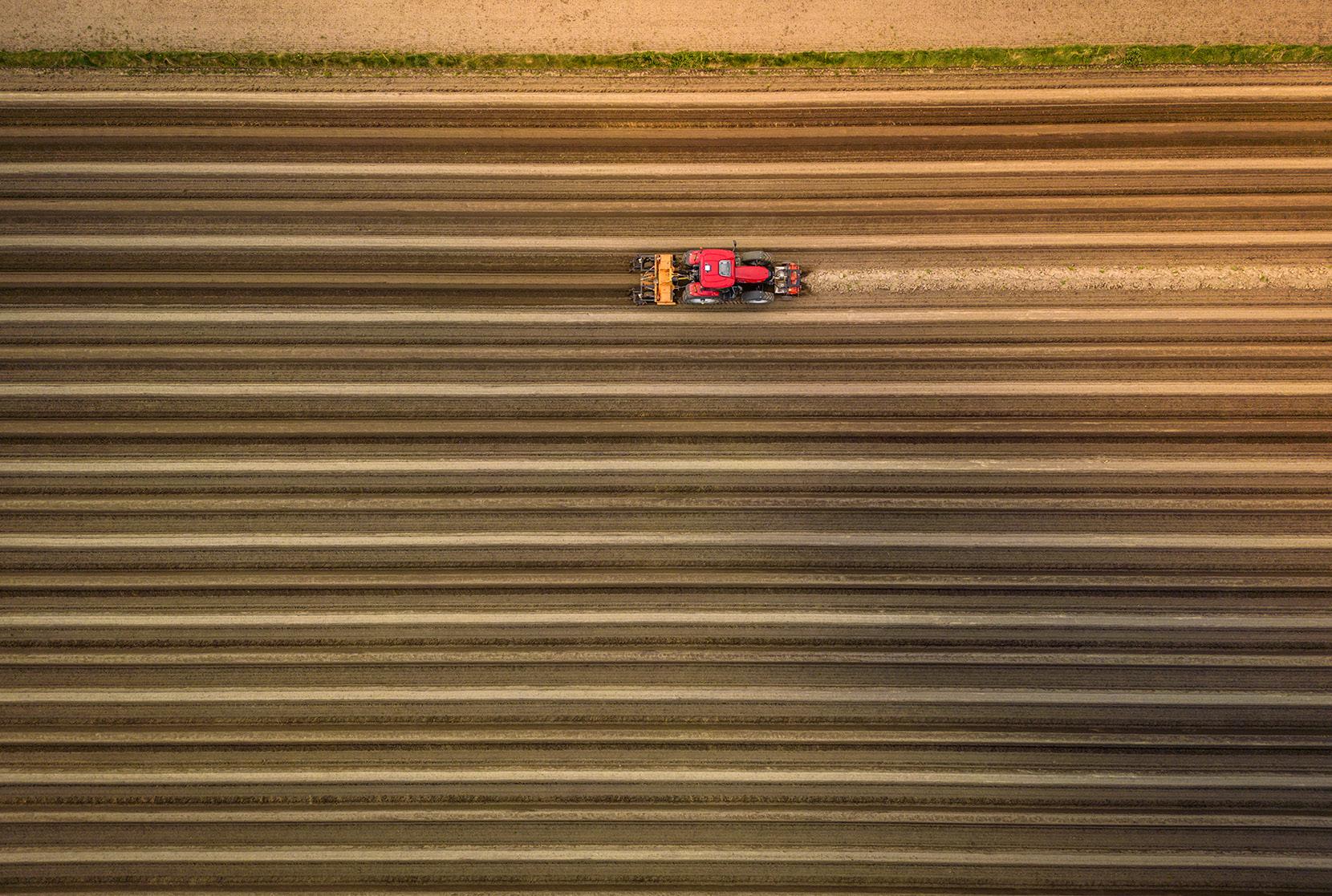

Despite criticism, Dutch glasshouse horticulture offers plenty chances

In 2020, Sir David Attenborough praised Dutch glasshouse horticulture, calling the sector an example for the rest of the world in the Netflix documentary ‚A Life On Our Planet‘. He spoke especially highly of how Dutch greenhouse horticulture managed to grow fresh food very sustainably, efficiently, and safely. In 2021, research conducted by Wageningen University & Research (WUR) confirmed that high-tech greenhouse cultivation is the most sustainable way to produce things like fruits and vegetables.

In recent months, though, that sector has been figuratively under fire by people like Klaas Knot (President of the Dutch Central Bank) and Frans Timmermans (GroenLinks-PvdA party leader and former executive vice president for the European Green Deal). To put it

briefly, Dutch greenhouse horticulture requires quite a lot of space and labor and contributes too little economically. The media also frequently questioned the future of Dutch greenhouse horticulture. A counter-reaction from the sector was, of course, inevitable.

On March 23, the Financieele Dagblad (FD), a daily Dutch business and financial newspaper, interviewed Adri Bom, among others, in-depth. She said, on behalf of Glastuinbouw Nederland‘s chairman, that the sector, indeed, has a future in the Netherlands. On April 2, Lambert van Horen, sector manager at Rabobank, and Peter Ravensberger, a WUR researcher, wrote in the FD that high-tech greenhouses have enormous potential, especially outside the Netherlands. I agree with Adri, Lambert, and Peter and will include you in my considerations.

Theme Greenhouse vegetables 26 AGF Primeur • Greenhouse vegetables • 2024

Ruud van der Vliet is a former Director of Businesses at Rabobank Westland and current Director at Van der Vliet & Van der Oost BV. He specializes in optimizing the value of companies in the Food & Agri sector, particularly in (glass) horticulture. Ruud regularly conducts analyses of companies in the fresh produce and horticulture sectors for Primeur.

ruud@rvdvliet.nl

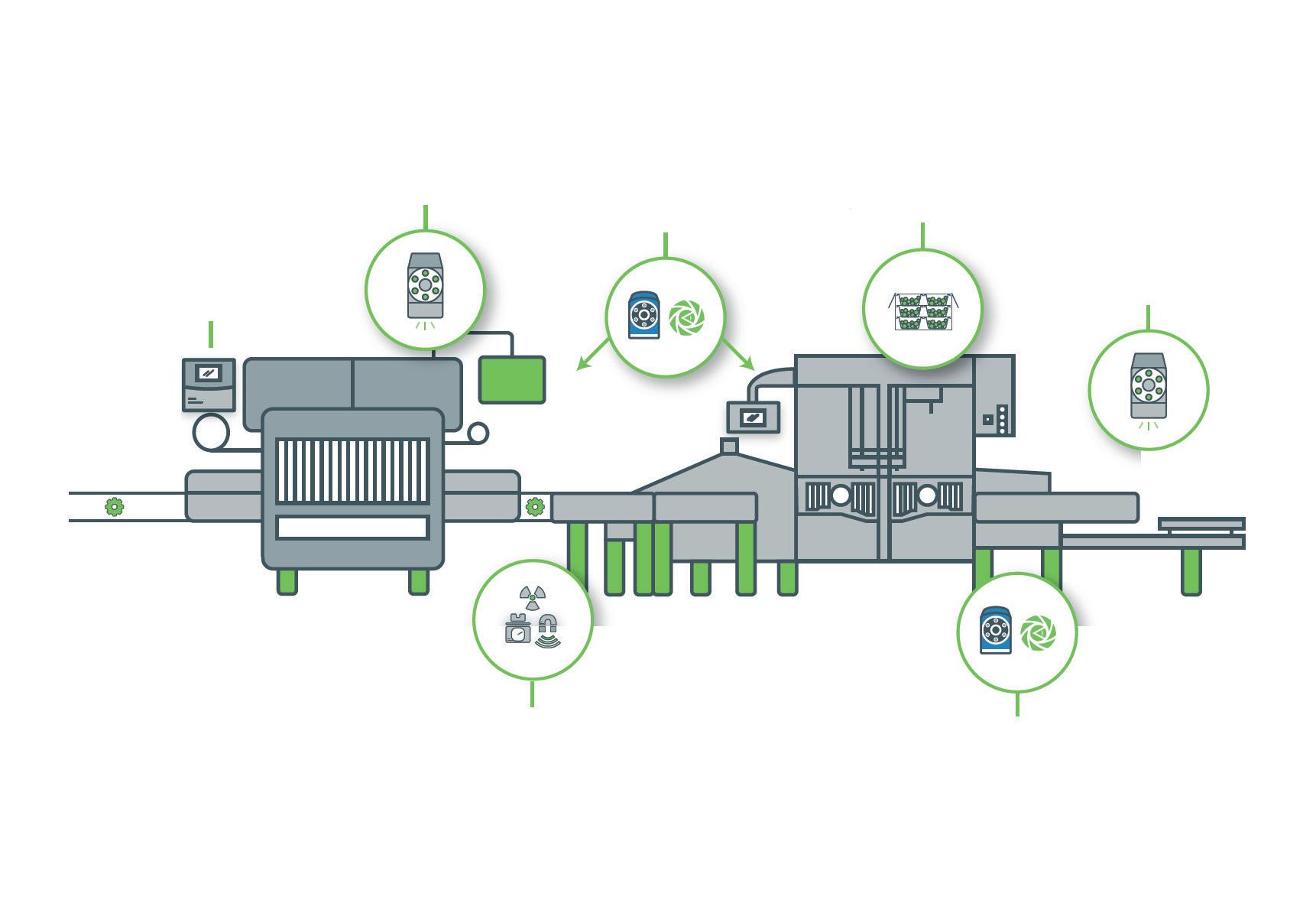

ECOSYSTEM

Dutch greenhouse horticulture is a kind of catch-all phrase. Recent media reports mainly or particularly refer to cultivation or production companies. However, that sector is more of an ecosystem, a chain, or cluster of companies and organizations. From seed companies, young plant breeders, greenhouse builders, other suppliers, and growers to production companies, packers, processors, traders, and logistics service providers supplying supermarkets or food service companies. In this article, the term primarily refers to cultivation or production companies.

Greenhouses were being built in the Netherlands as far back as the 16th or 17th century to grow and protect tropical plants. In the 18th and 19th centuries, technological innovations accelerated. In 1834, British chemist Joseph Paxton invented greenhouse glass, allowing for larger, stabler greenhouse construction. That, in turn, led to further crop cultivation optimization and ensured further growth and modernization of Dutch greenhouse farming. Technological advances such as heating systems, irrigation, and later, artificial lighting were introduced.

MACHINE BUILDING

That made it possible to control the greenhouses‘ climate precisely, extend growing seasons, and cultivate a wider variety of crops. The Dutch sea climate and the clay soil proved to be an ideal combination for many crops. From 1950 onwards, the country’s greenhouse industry proliferated. First, wooden greenhouses were constructed, and from the 1970s onward, increasingly metal greenhouses were built. This unique ecosystem was partly why modern technologies and innovations were put in place. Combined with a focus on efficiency and quality, that makes the Netherlands a world leader in greenhouse cultivation and exports.

• Sustainable, strong design •

• You buy directly from the manufacturer (Helmond – NL) •

• More than 60 years of experience in Food & Agri •

• We produce also big foldable boxes •

Weihoek 11, 4416 PX Kruiningen +31 (0)113-501373

info@burgmachinery.com www.burgmachinery.com

27 AGF Primeur • Greenhouse vegetables • 2024

Big

volume Palletboxes For Transport, Handling and Storage

www.capp-plast.com | verkoop@capp-plast.com T. +31 651 914 888

for the fresh produce industry Bin unloader

Bin fi ller equipped with the latest technology STOCKMACHINE STOCKMACHINE Use the QR codes for more information and view completed projects with these machines on our website!

/

Theme Greenhouse vegetables

That unique ecosystem is often called the ‚Triple Helix‘ model. The Triple Helix refers to the interaction between three vital entities: the government, the whole chain of companies, and educational institutes. That model represents the close collaboration between those three components to promote innovation, growth, and sustainability in the greenhouse horticulture sector.

This government-business-education partnership means an ecosystem grew organically in the past decades, strengthening the Dutch greenhouse horticulture sector‘s expansion, competitiveness, and sustainability. That sector‘s success still hinges on this Triple Helix. You cannot relocate, halt, or dismantle essential

also in the Netherlands the semiconductor industry in Brainport Eindhoven.

These thriving ecosystems stem from comparative advantage. This economic principle states that if, say, tomato production is better in the Netherlands than in Germany, both benefit. Adam Smith introduced that idea, which is known as absolute advantage. Even if one country is better at making two products than another, it pays to specialize in the most advantageous product and get the other elsewhere.

Germans are better at making cars; the Netherlands excels at tomato cultivation. David Ricardo calls that a comparative advantage. It is an important reason

bedding plants/trees, seedlings and saplings, fruits, and vegetables. Growers use most of that area (55%) for soft fruit and vegetable cultivation. Those farms are, on average, almost 5 ha.

That is larger than the average ornamental plant farm. The largest area, 1,700 hectares, includes tomatoes. There were economies of scale and consolidation, especially in vegetable cultivation. The number of 50+ ha greenhouse vegetable farms is steadily climbing. How much space does the Dutch greenhouse horticulture ecosystem need to function properly? Looking at the multitude of ornamental, fruit, and vegetable crops, it seems to require between 5,000 and 10,000 ha.

parts of that structure without consequences. This interaction between government, industry, and educational institutions distinguishes the Netherlands globally regarding greenhouse horticulture.

There are other successful ecosystems. They include Germany‘s automotive industry around Munich, the USA‘s Internet/ICT in Silicon Valley near San Francisco, the Danish wind turbine sector in Aarhus, in Italy, the luxury clothing and accessories in Lombardy near Milan, Spanish olive production and processing and marketing in Andalusia, and

why the Netherlands has become so good at greenhouse horticulture: the country is better at it than many others for several reasons, and, not unimportantly, its neighboring countries also benefit.

A well-functioning ecosystem, however, demands a minimum production area. According to the Dutch Central Bureau of Statistics, the Netherlands‘ greenhouse area has been stable at about 10,000 hectares over the past 20 years. In that time, 2/3rds of greenhouse companies disappeared, leaving about 3,300, with an average size of three hectares, each. That area includes cut flowers, potted plants,

In the coming decades, part of the vegetable acreage, particularly, will probably relocate from the east and west of the country to other parts of the Netherlands, Europe, and/or North Africa. Some greenhouses in the Netherlands‘ east and west will be converted for ornamental or soft fruit crops. The technical lifespan of a high-tech greenhouse is 25 to 35 years (depending on the crop), and many have not been around that long.

CHALLENGES

Dutch glasshouse horticulture faces some tough challenges, mainly sustainability, increased labor productivity, and

28 AGF Primeur • Greenhouse vegetables • 2024

professionalization. It must achieve sustainability in areas like energy, fertilizers, water, crop protection products, and packaging. Greenhouse horticulture has long benefited from an abundance of lowpriced natural gas. The war in Ukraine and the energy crisis highlighted the need to accelerate the energy transition.

Several greenhouse horticulture pioneers already took that step 15 years ago, switching to geothermal energy. There are currently 20 operational geothermal facilities in the Netherlands, covering over 10% of the Dutch acreage. In practice, obtaining concessions, permits, financing, subsidies, and guarantees for a geothermal source is a complex and lengthy process.

When it comes to fertilizers, sustainable options are already being tested, and five years from now, many will be produced using, for example, bioreactors or renewable energy. Dutch greenhouses already reuse much of their water, but improvement is possible. Regarding crop protection products, soft fruit and vegetables are grown in high-tech greenhouses,

using almost only organic agents. Here, some floriculture crops still lag. The great diversity in ornamental cultivation complicates the development of effective biological pesticides for each crop. But that, too, should only take a few years. There is more and more biodegradable packaging, and making all of it so within a few years is practically possible.

Will supermarkets and consumers be willing to fork out more for more sustainable products? Unlikely. Within 5 years, sustainable production or a low CO2 footprint will be a supply condition, though—a ‚License To Produce‘, if you will.

Over the last two decades, greenhouse horticulture in the Netherlands could take full advantage of the availability of relatively cheap labor from Eastern Europe. First, mostly from Poland and now increasingly from Romania, Bulgaria, and outside the EU. But, that force‘s availability and affordability are under severe pressure. That rapidly increases the need for automation and robotization, particularly for repetitive work.

These days, it is easier to justify increasing labor productivity with the help of automation and robotization than it was a few years ago. There are also more and more solutions. In the media, Klaas Knot and Frans Timmermans mainly referred to high energy consumption and low labor productivity. Rightly so, although you can address these issues.

The final challenge? Professionalization. Dutch greenhouse horticulture has always consisted of relatively small companies. It still does. Partly due to auctions and marketing cooperatives, many mainly focused on cultivation and processing and much less on sales, logistics, and marketing. In recent decades, increased scale and consolidation means auctions have all but disappeared, with other business models emerging. Horizontal cooperation in Dutch greenhouse horticulture gave way to more vertical collaboration. Energy management has become more critical. Broader management teams began running into the larger greenhouse companies growing ornamental plants, fruits, and vegetables and fruits.

29 • 2024 For the full assortment of fruit and vegetables Neremstraat 2 3840 Borgloon - België T. +32 (0) 12 67 10 50 belexport@belexport.com www.belexport.com

With specialists, they directed the entire company, including purchasing, energy, labor, cultivation, processing, sales, logistics, and marketing. That consolidation, (vertical) cooperation and/or increase in scale generally resulted in higher profitability and thus increased investment opportunities in, for instance, innovations, automation, and sustainability. That cannot always be done using equity or bank financing. Companies often need external capital to ensure the necessary acceleration. External capital usually involves specialist know-how and structure and, therefore, has a disciplining effect. That had, in practice, led to a noticeable ever-increasing gap between front-runners and the pack.

EARNING

CAPACITY

Successfully running a greenhouse company is no small task. Over the past 20 years, energy management has become an increasingly important operational component. In recent years, sharply increased energy prices, various viruses and pests, and reduced consumer purchasing power have significantly impacted greenhouse farms‘ profitability. As in any other sector, some Dutch greenhouse

horticultural companies are structurally profitable; many are just keeping afloat, while others do not make the grade financially. This third group of businesses stops, is taken over, or goes bankrupt.

Per illustration: the top tomato growers in the Netherlands have generated an average EBITDA/Ha of €300,000, also in recent years. The pack averages €150,000/Ha, and the laggards often considerably less. This difference is evident in many Dutch greenhouse crops. The top companies now hold 50% of the tomato and bell pepper acreage.

Ten years ago, McKinsey conducted a survey about the future of Dutch fruit-vegetable crops, partly at the request of the Netherland Growers Association and Rabobank. At the time, many Dutch vegetable growers could not generate replacement investments and/or necessary innovations from their own resources. Their average earning capacity did not allow for this, and they were highly dependent on banks.

Trade and Retail‘s power and powerlessness of growers and grower associations

created undesirable market imbalances. McKinsey advised growers and producer organizations to join forces, work more closely together on sales, and develop new business models. The goal was fairer pricing. The analysis of Dutch vegetable fruits resembled that of Dutch ornamental horticulture: urgent economies of scale, more sales-related cooperation, and finding new profit models.

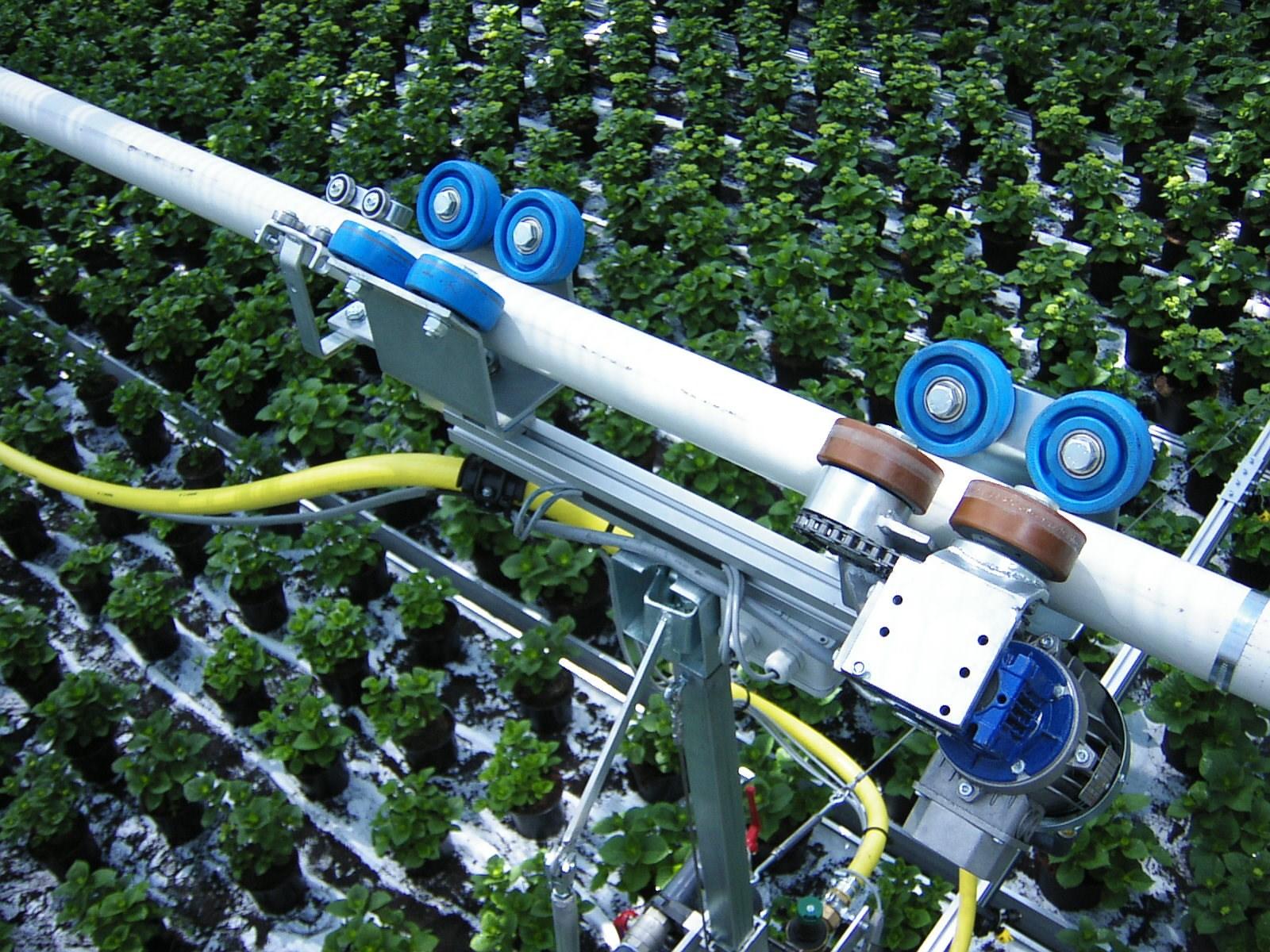

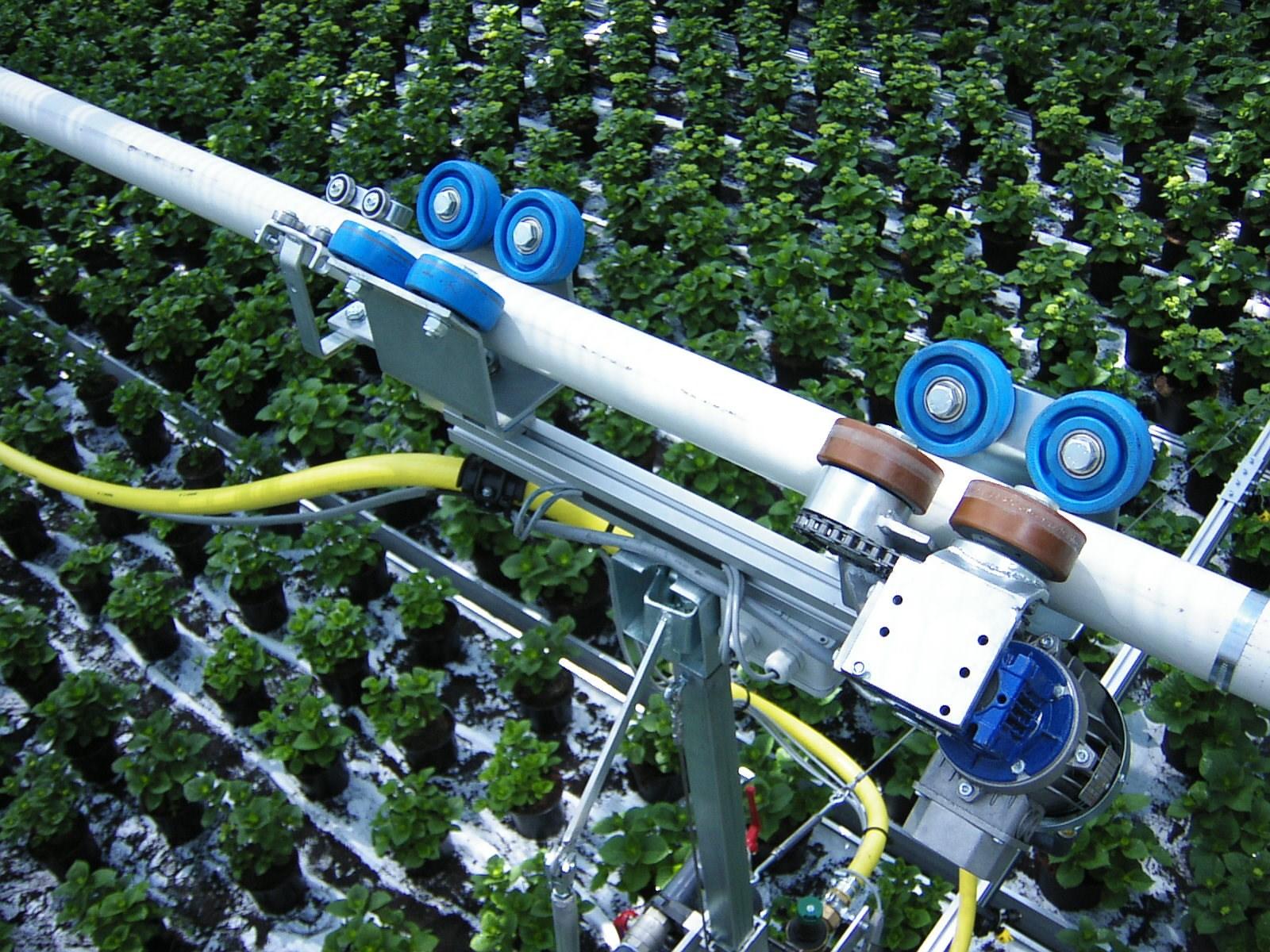

In my opinion, the 2014 McKinsey report‘s advice still stands: a greater focus on (vertical) partnerships, fewer growers associations, more ‚Local For Local‘ production in Europe, further management professionalization, and a more effective Triple Helix.