SHOWS: BAAFEX BRINGING A BIZAV EVENT BACK TO ASIA REGIONS: SAUDI ARABIA IS OPENING THE DOORS TO BIZAV PEOPLE: JIM VIOLA'S PARTING INTERVIEW AS VAI CEO

Special Report: Rotorcraft OEM Update

SHOWS: BAAFEX BRINGING A BIZAV EVENT BACK TO ASIA REGIONS: SAUDI ARABIA IS OPENING THE DOORS TO BIZAV PEOPLE: JIM VIOLA'S PARTING INTERVIEW AS VAI CEO

Special Report: Rotorcraft OEM Update

Aerial resources from all over joined together to fight the devastating fires

Scan the QR code to see the mission

22 Special Report—New Rotorcraft: Some new tech, some old

4

Bizav groups fear ‘profound’ disruptions with tari s

6 Fatal accident streak thrusts aviation safety into spotlight

8 Gulfstream closes a chapter with rollout of the last G650

10 Hero pilot apprehends teen gunman at Arkansas airport 12

BAAFEx: Asian business aviation gets its own trade show again 14

BAAFEx: Southeast Asia’s business aviation sector on the rise

BAAFEx: Rising wealth in India drives demand for personal air mobility

Business aviation steps up in Los Angeles wildfire fight

BY AIN STAFF

President Donald Trump followed through on campaign promises to impose certain tariffs. But some were implemented and others delayed, creating uncertainty about ramifications for the aviation industry.

On February 1, the White House issued an executive order imposing 25% tariffs on goods from Canada and Mexico—both nations vowed to retaliate—but paused implementation for 30 days to negotiate trade and border security. The U.S. carried through with a 10% tariff on products from China, which retaliated with its own levies. Another executive order on February 10 imposed a 25% tariff on steel and aluminum imports.

Details on the implementation of any of the tariffs were not immediately available, and industry associations were still assessing the impacts at press time. However, they expressed concern about underlying difficulties surrounding tariffs, saying they could disrupt a highly regulated industry and hamper jobs and economic growth.

“Critical to this essential industry is a complex, highly regulated global supply chain, supported by a number of bilateral agreements that are required to meet stringent safety standards while ensuring the

Suppliers such as Pratt & Whitney Canada could be a ected should proposed tari s become a reality.

reliable flow of highly specialized goods,” NBAA said. “Disruptions to this system have profound consequences, and workarounds that meet the exacting regulatory requirements take months or years to establish.”

GAMA agreed: “Tariffs would affect the intricate and very complex global supply chain that can take years to establish given that it relies on suppliers with unique capabilities that are highly regulated and therefore cannot be easily replaced.”

Even where alternatives exist, manufacturers cannot quickly switch suppliers without FAA approval. This compromises contracts and may affect quality, GAMA said.

Montréal-based Bombardier held off on providing guidance for this year as it usually does when releasing year-end results. “In light of the current tariff threat, not providing guidance is the most responsible and transparent thing for us to do,” said company president and CEO Éric Martel. “There is a lot at stake for our industry.”

He noted that Bombardier has 2,800 U.S.-based suppliers across 47 states that create tens of thousands of U.S. jobs, adding that it would have an equally significant impact on both sides of the border. z

Bombardier’s deliveries last year scaled up by eight units to 146 aircraft and revenues beat guidance at $8.7 billion as services business jumped by 16%. Bombardier delivered 73 Globals and 73 Challenger 3500s and 650s last year. This marks two fewer Globals from 2023 but a 10-aircraft jump in Challengers. However, shipments missed guidance for 2024 of 150 to 155 deliveries with continued supply-chain “headwinds.” In the fourth quarter, Global deliveries dipped by three, to 29, while Challenger shipments increased by four, to 28.

Embraer Executive Jets inked a $7 billion deal with Flexjet that includes firm orders for 182 aircraft—a mix of Phenom 300E light jets and Praetor 500 and 600 midsize jets—and options for another 30, as well as enhanced services and support. Deliveries are set to begin next year and run through 2030. The order represents Flexjet’s largest in its three-decade history and will nearly double the size of its fleet by 2031. Flexjet was the fleet launch customer for the Embraer Legacy 600 in 2003, Phenom 300 in 2010, Legacy 450 in 2016, and Praetor 500 in 2019.

Honeywell’s board of directors revealed plans for a full separation of Automation and Aerospace Technologies. This follows a previously announced plan to spin o Advanced Materials. The three companies will be separate and publicly listed, and the separation is expected to take place in the second half of 2026. Aerospace Technologies will continue to build on the division’s propulsion, cockpit, and navigation systems, and auxiliary power systems products. Aerospace had revenues of $15 billion in 2024.

BY AIN STAFF

A spate of high-profile fatal aircraft accidents in late January and February has brought the U.S. into the deadliest period for aviation in more than two decades, claiming the lives of a combined 85 people on board and on the ground. While all disparate, the accidents have shone a public spotlight on aviation in the U.S. after a 15-year period that many would have called the safest in the industry.

The accidents prompted a pledge from 30 aviation associations to recommit their safety efforts and calls for full funding of critical FAA air traffic control (ATC) systems, controller staffing, and the NTSB.

In the aftermath of the accidents—particularly the January 29 collision of a PSA Bombardier-built CRJ700 regional airliner and U.S. Army Sikorsky H-60 Black Hawk that led to 67 fatalities—lawmakers on Capitol Hill stressed the importance of letting the NTSB complete its investigations before drawing conclusions about causes.

Even so, speculation swirled after the CRJ/Black Hawk midair collision above the Potomac River by Ronald Reagan Washington National Airport (KDCA), with scrutiny on ATC staffing. The FAA, meanwhile, barred helicopter flights on specific routes by KDCA unless specifically authorized. In those cases, fixed-wing flights are held off to avoid mixing the two types.

The CRJ, with 64 on board, was on short final into DCA and circling to land when it collided with the Black Hawk, which was carrying three people on a nighttime training mission. The NTSB recovered the flight data recorder and cockpit voice recorder of the CRJ as well as the Black Hawk’s combined FDR/CVR. A controller at DCA, in communication with both aircraft, had advised the Black Hawk to wait for the CRJ to pass. The Black Hawk affirmed the instruction.

On January 31, a Med Jets Learjet 55 on medevac duty crashed shortly after takeoff from Northeast Philadelphia Airport (KPNE). The Mexico-registered twinjet was headed to Missouri’s Springfield-Branson National Airport (KSGF) and went down in a neighborhood less than three miles from KPNE. All six on board died in the crash, along with one person on the ground.

This was followed by the February 6 crash of a Bering Air Cessna 208B Grand Caravan into an ice floe in Alaska’s Norton Sound, killing all 10 on board. Then on February 10, one person was killed and three injured when a Learjet 35A believed owned by rock musician Vince Neil suffered a landing gear collapse after touching down at Scottsdale Airport (KSDL) in Arizona and careening into a parked Gulfstream G200. z

The landing gear failed before a Learjet 35A collided with a Gulfstream G200 in Scottsdale, Arizona, leaving one dead and several injured.

Gulfstream Aerospace’s large-cabin deliveries jumped by 32.6% to 118 in 2024 as the company spooled up deliveries of its new G700 flagship. However, despite “stunning” results, Phebe Novakovic, chairman and CEO of Gulfstream parent General Dynamics, noted that revenues and earnings were lower than anticipated for its Aerospace group, including both Gulfstream and Jet Aviation. In all, the manufacturer handed over 136 aircraft in 2024, a 22.5% increase over the 111 in 2023. That also reflected a four-unit decline in G280 deliveries to 18 in 2024.

Business aircraft charter flights from French airports will be subject to a steep increase in passenger taxes beginning March 1 in a move the European Business Aviation Association warned could threaten operators based in France. Under a budget pushed through by new French Prime Minister François Bayrou, charter operators may be obliged to collect taxes ranging from €210 to €2,100 ($2,200) per passenger. The new “taxe sur les billets d’avions” levy was proposed in October 2024.

The FAA issued a notice reversing Notam terminology from the December 2021 “Notice to Air Missions” to the previous “Notice to Airmen.” In 2021, the term was changed to be gender-neutral and to account for the growing number of unmanned drone operations. The agency ordered that all directives and publications be updated “as soon as practicable.” The International Civil Aviation Organization’s definition of Notam remained the same after the 2021 FAA change, with the “Notam” used as a word, rather than acronym.

BY CHAD TRAUTVETTER

The model that redefined the ultra-longrange (ULR) business jet segment—the G650/650ER—is now out of production.

Gulfstream Aerospace announced in February that the last one, a G650ER model, had rolled off the production line at the company’s Savannah/Hilton Head International Airport campus in Georgia. It will undergo completion at Gulfstream’s Appleton, Wisconsin facility before being delivered to a customer later this year.

Gulfstream launched the G650 program in March 2008, unveiled the first prototype (dubbed T1) in September 2009, and flew T1 two months later. On Sept. 7, 2012, the G650 obtained FAA certification.

The G650 and its longer-legged (7,700 nm) G650ER sibling will be succeeded by the G800, which is poised to enter service later this year.

“With the G650 and the follow-on G650ER, Gulfstream created the large ULR segment,” JetNet iQ director Rollie Vincent told AIN . “With almost 600 jets in service today, there is nothing diminutive about this family of business jets. With service entry in 2012, the G650 quickly established itself as the aircraft of choice

for many corporations, high-net-worth individuals, and governments needing the capabilities of a high-speed wide-cabin intercontinental jet. The ER version, introduced in 2014 and perfectly timed to capture demand from customers seeking access to the farthest corners of the world, became the high watermark in Gulfstream’s portfolio.”

“Since their inception, the G650 and G650ER have become the industry standard that all others have followed, recently surpassing a staggering one million flight hours,” said Gulfstream president Mark Burns. “Beyond the program’s innumerable accolades and 125+ world speed records, innovations introduced with the form, fit, and precision manufacturing process of the G650 laid the groundwork for today’s next-generation Gulfstream fleet.”

The Rolls-Royce BR725-powered G650 won the prestigious Robert J. Collier Trophy in 2014.

“While this will be the final G650 produced, the fleet’s high utilization and dispatch reliability mean these aircraft will serve customers for decades to come,” Burns added. z

Textron Aviation experienced a challenging 2024, marked by a labor strike and subsequent production disruptions. Textron Aviation delivered 32 jets and 38 commercial turboprops in the fourth quarter, down from 50 jets and 44 turboprops during the same period in 2023. In the quarter, the company reported revenues of $1.3 billion, down $242 million year over year. For the full year, the company delivered 151 jets, 70 Caravans, 13 SkyCouriers, and 44 King Airs, a decline from the 168 jets, 79 Caravans, 18 SkyCouriers, and 56 King Airs delivered in 2023.

Turkish defense group Baykar expects to close its acquisition of Piaggio Aerospace in the second quarter after signing a preliminary contract for the Italian group’s assets. Piaggio and Baykar said the deal will close once all remaining conditions have been met, including approval from the Italian Presidency of the Council of Ministers, which has veto powers. On December 27, the Italian government’s Ministry of Enterprises and Made in Italy department authorized the transaction.

Airbus has acknowledged that its plans to bring hydrogen-powered airliners into commercial service will not be achieved by the 2035 target date set when the company announced the ZeroE project in September 2020. The European aerospace group confirmed that the work is taking longer than expected but did not specify an adjusted timeline. According to reports by French news agency AFP, Airbus told o cials at the Force Ouvrière trade union that the objective could take five to 10 years longer than first anticipated.

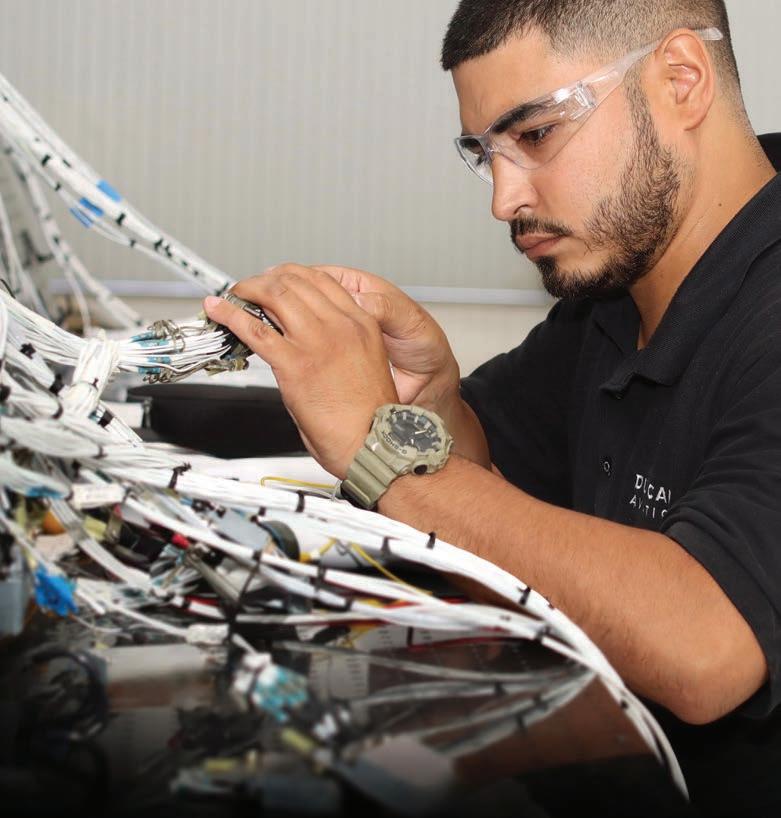

A growing training footprint, expanding your reach to world-class training. CAE’s investment in the future of business aviation training is unmatched. New state-of-the-art facilities in North America, Europe, and Asia, combined with recent technology upgrades to our training devices, provide unprecedented access to our pilot and maintenance technician programs, meeting our customers’ essential needs globally.

Today and tomorrow, we make sure you’re ready for the moments that matter.

BY CURT EPSTEIN

Tuesday, February 4 started out as a relatively normal morning for Justen Spinks, chief pilot for Wholesale Electric Supply’s flight department that is based at Signature Aviation at Texarkana Regional Airport (KTXK) on the Texas-Arkansas border. It was 7:30 a.m., and Spinks had just learned that the day’s scheduled flight in the company’s Cessna Citation XLS+ had been canceled.

“I was kind of getting ready to maybe head to the gym and call it a day since our flight canceled when I heard a lot of commotion,” he told AIN.

As he got up from his desk to see what was going on, several FBO workers ran into the hangar offices and told him there was a gunman in the terminal. Moments earlier, a teenager carrying an assault rifle had entered the FBO, placed a gun on the counter, and informed a customer service agent that he wanted an airplane. Under the guise of assisting with his demand, the agent managed to get away and alert the police as the gunman forced open a door to the ramp and left the building.

“I had windows looking onto the ramp and spotted him,” said Spinks, who joined the people fleeing out the back of the hangar into a parking lot behind it. “I keep a pistol in my truck and I was able to see [the gunman] while standing behind my

truck, and I could see that I could make my way back into the hangar.”

Gun in hand, Spinks crept back into the hangar and cautiously peeked around the corner. “He was crouched down, maybe getting into the backpack when I saw him. That’s when I came around the corner [and] pointed my gun at him… I think I surprised him. I walked toward him as briskly as I could and he complied.”

At Spinks’ command, the teen lay on the ground and kicked the loaded rifle out of reach. “He kept his hands behind his back. I searched him at one point, kept my knee in his back, basically sat on him and held that position pretty much until officers arrived.”

During the wait, Spinks conversed with his captive. “I noticed at that time he was a young kid and I asked him, ‘Why did you do this?’” His response was chilling. “He started telling me that he either wanted to go to jail or wanted to be killed.” The youth went on to describe his troubled home life and interactions with child protective services.

After a matter of minutes, authorities arrived and took the suspect into custody. That night Spinks slept less than an hour, his mind churning over the day’s events. “I guess I just realized how bad it could have been,” he said. “I’m just so glad I didn’t have to kill a 15-year-old kid.” z

Two years into its Take O 2027 plan, Daher continues to step up e orts to improve productivity in its aircraft and aerostructures manufacturing activities. Announcing a 9% revenue hike in 2024 to $1.8 billion, chairman and CEO Didier Kayat told reporters that it faces ongoing challenges to become more competitive as it deals with inflationary pressures. Last year, the group’s Daher Aircraft division delivered 82 turboprop singles (56 TBM 960s, 15 Kodiak 100s, and 11 Kodiak 900s), an 11% increase from 2023, and logged net orders for 100 TBMs and Kodiaks in 2024.

Textron Aviation has delivered its first Cessna SkyCourier to Canadian operator Air Bravo. The Ontario-based passenger, cargo, and air ambulance services provider will deploy the turboprop twin as an aerial freighter. The aircraft can carry three LD3 shipping containers with 6,000 pounds of payload capability. The aircraft, which features single-point pressure fueling, received FAA certification in March 2022, followed soon after by its first delivery. In passenger configuration, the SkyCourier— launched in 2017—and has seating for 19.

Boom Supersonic successfully broke the sound barrier for the first time on January 28 with its XB-1 flight demonstrator, accelerating beyond Mach 1 three times. The XB-1 took o from the Mojave Air and Space Port in California—in the same airspace where Chuck Yeager first broke the sound barrier in 1947. The XB-1 first flew on March 22, 2024. It is a one-third-scale demonstrator for the Overture, a planned 80-passenger commercial airliner designed to cruise at a speed of Mach 1.7 to a range of up to 4,250 nm.

BY CHARLES ALCOCK

Singapore’s Changi Exhibition Centre is set to stage the Asia-Pacific region’s first dedicated business aviation trade show since April 2019, when the most recent edition of the Asian Business Aviation Conference & Exhibition was held in Shanghai. The new Business Aviation Asia Forum & Expo (BAAFEx) will run from March 4 to 6 against a backdrop of strong market growth that has been sustained in many countries since the end of the Covid pandemic.

According to management consultancy Alton Aviation, there has been a strong

uptick in business jet departures across the region. “[Traffic] is almost double what it was in 2019, and the region has seen the second highest growth rate after Latin America, far exceeding [that of] North America and Europe over the past five years,” managing director Adam Cowburn told AIN

The Alton team, which advises multiple companies on business aviation opportunities worldwide, has seen especially dynamic market expansion in India, where strong economic growth has boosted personal and corporate wealth and demand for private aircraft, including through charter services. Between 2019 and 2024,

the number of business jet movements at Indian airports reportedly grew by around 27%.

That said, Asian business aviation has a long way to grow to match activity levels in the West. Alton pointed out that while Mumbai is the busiest airport for the sector in the Asia-Pacific region, it would not make the list of the top 100 business aviation airports in the U.S.

In more mature Asia-Pacific markets such as Singapore and Hong Kong, Cowburn reported “some pullback from

the post-Covid highs,” but with wellestablished business aviation support infrastructure. From a lower base, there has been impressive growth in Southeast Asian countries such as Thailand and Vietnam.

Alton, which helps investors respond to the dynamics of local markets, advises clients that the region is not without its challenges. These include regulatory processes that can be constrained by the bandwidth of local agencies and establishing local operations.

According to BAAFEx organizer Experia Events, which also stages the biennial Singapore Airshow at the purpose-built Changi site, there were around 1,200 business jets based in Asia-Pacific countries at the end of 2022, ranking it as the industry’s third largest region behind Europe and North America. The company said the fleet in Southeast Asian countries has been growing annually at around 5% in recent years.

Global aircraft charter operators such as Vista, Gama Aviation, and TAG Aviation Asia are included on the show’s exhibitor list. According to Vista, in the first three quarters of 2024, the number of flights it operated in the Asia-Pacific region increased by 20% year over year.

“We have been waiting for half a decade to finally have a dedicated business aviation show back in Asia,” said Vista’s chief commercial officer, Ian Moore. “AsiaPacific is one of the fastest growing regions at Vista, and Southeast Asia is playing a key role in Vista’s expansion in the region.”

The Europe-based operator will exhibit one of its Bombardier Global 7500 jets at BAAFEx, with the static display at Changi also featuring models such as a Gulfstream G450 operated by Amber Aviation.

Other BAAFEx exhibitors confirmed as of press time include Boeing Business Jets, Lufthansa Technik, Glenair, MedAire, Viasat, Gogo Business Aviation, Honeywell,

and the Bermuda Aircraft Registry. Several charter operators based in the region are also included in the lineup, including China’s Sino Jet, Air 7 Asia, Phenix Jet, Ivy Aviation, Jet Set, and Premier, as well as FBOs and MROs such as Hong Kong Business Aviation Centre, Universal Aviation Japan, and ExecuJet Haite Aviation Services China.

“The response from the major aircraft manufacturers, aircraft management companies, and operators to BAAFEx 2025 has been very positive,” said Leck Chet Lam, managing director of Experia Events. “We have [also] worked to sign up companies representing the entire business aviation ecosystem.”

According to Cowburn at Alton, the proliferation of Asian high-net-worth individuals has been the main driver of business

aviation market growth in that part of the world. “There is a clear correlation between [national] GDP, and the numbers and aggregate wealth of individuals, and once you get past a point of critical mass, the appeal [of this mode of transportation] grows,” he commented.

However, the sector’s growth trajectory is by no means uniform. Cowburn pointed to countries such as Japan where factors such as a more egalitarian culture and high-speed trains have somewhat suppressed demand for private aviation. In China, he pointed to “a double-whammy of underwhelming economic performance and strong [government] oversight [of private wealth]” as speed bumps to the industry’s growth there.

Another factor is that the Asia-Pacific region lacks the highly-developed

network of smaller, local airports offering more convenient access for business aviation trips.

At the major airports, where most private flights originate, there remains a lack of dedicated infrastructure and specialist support for operators and their customers—all of which feed into the growth opportunities the new BAAFEx show is looking to exploit.

The new event features a three-day conference program covering multiple aspects of business aviation, including the charter market in Asia, the passenger experience, women in aviation, maintenance providers, airports and FBOs, sustainability, and safety. Planned presentations also include a new Asia Business Aviation Market Outlook and panel sessions on China and Southeast Asia. z

BY JENNIFER MESZAROS

manager of sales at Phenix Jet’s Seletar Airport office in Singapore.

terms of flight volume and the total number of aircraft in the region.”

Despite uneven economic development across the region, Southeast Asia’s business aviation sector is gaining traction, driven by a rising population of ultra-highnet-worth individuals (UHNWIs), luxury tourism trends, and increased corporate and government demand for private, flexible air connectivity. Industry leaders highlight that while pandemic-era disruptions destabilized commercial networks, they also reshaped regional travel priorities, fueling long-term interest in business jets.

“Up to the pandemic, the business aviation market in Southeast Asia experienced steady growth, driven by expanding local economies and China’s growing business jet market,” said Hibiki Umemoto, branch

“During the pandemic, the market saw a boom from 2021 to 2023, but growth has normalized in 2024. There is clear expansion in Southeast Asian markets, both in

As a high-end provider of aircraft management, AOC services, charters, and acquisition support, Phenix Jet reports that it operates approximately 25% of all its private and commercial flights to, from, or within Southeast Asia. With a fleet featuring the Global 7500, Boeing Business Jet, Gulfstream G650ER, and an executive Airbus H175 helicopter available for charter in Southern France and the Mediterranean, the company logs 9,000 to 10,000 business jet departures monthly across Asia-Pacific.

Observing similar growth, Paul Desgrosseilliers, general manager of ExecuJet Haite General Aviation Services, cites data showing a 30% year-over-year rise in flights between China and Vietnam

in 2023 and 2024, with Indonesia trailing closely at 25%. Both Malaysia and Thailand recorded approximately 15% annual increases, while the Philippines saw a modest 6% to 7% uptick. In contrast, Singapore remained stagnant.

For Desgrosseilliers, the rise in flight activity reflects a broader business narrative, driven by Chinese companies’ growing focus on Southeast Asia. He emphasized markets like Vietnam as increasingly attractive destinations for businesses expanding regionally and diversifying supply chains—a trend that aligns with China’s push to enhance economic engagement in the region.

“This is a business story. Chinese companies are seeing opportunities in markets like Vietnam and Indonesia,” he told AIN. “Looking at the data and seeing a 30% yearon-year increase, it really shows China reaching outward for additional investment opportunities.”

Having weathered the pandemic—a period that saw many aviation competitors scale back or shutter operations—ExecuJet Haite has capitalized on post-crisis growth. In April 2024, it opened a purpose-built MRO facility at Subang Airport near Kuala Lumpur, supporting Dassault, Bombardier, and Gulfstream aircraft with a full suite of MRO services. This was followed by the September 2024 launch of a new MRO at Beijing Daxing International Airport, and a month later, business jet ground handling services at Beijing Capital International.

Beyond China, Carlos Brana, executive v-p of civil aircraft for Dassault Aviation, noted that Southeast Asia is attracting heightened foreign investment from South Korea and Japan. This influx, he said, is driving regional production capacity, export growth, wealth creation, and global business linkages. “These trends are all positive for business aviation,” he added.

Echoing these sentiments, Sino Jet

president Jenny Lau attributed sector growth to regional economic development and geopolitical stability, emphasizing that economic expansion continues to drive private jet demand.

With dual headquarters in Hong Kong and Beijing, Sino Jet also navigated the pandemic’s challenges, aided in part by its global presence and luxury offerings. In 2019, the company opened its first o ffi ce outside Greater China, in Singapore. Last December, it partnered with ground handler Jetex, based at Al Maktoum International Airport, to establish its Middle East international headquarters.

Today, Sino Jet operates in more than 20 cities worldwide, including Europe and North America, offering aircraft management, charter flights, ground handling, FBO services, and luxury travel. Its fleet of more than 40 aircraft is 90% composed of large-cabin jets from Gulfstream, Bombardier, Dassault, Airbus, Boeing, and Embraer.

For five consecutive years, SinoJet has maintained the largest business aviation fleet in the Asia-Pacific region.

“The most significant growth potential in Southeast Asia’s business aviation market is tied to the robust expansion of regional businesses and the swift ascent of ultrahigh-net-worth individuals,” Lau told AIN “These clients are increasingly seeking premium, bespoke travel experiences, with a particular focus on the efficiency and security offered by business aviation services.”

In looking at ultra-high-net-worth individuals, a 2024 Knight Frank Wealth report ranks Singapore as Southeast Asia’s top market for UHNWIs, placing it 17th globally with 4,783 UHNWIs in 2023. Hong Kong follows closely at 16th.

Other regional entries include Indonesia (24th, 1,479 UHNWIs), Thailand (26th, 889), Malaysia (29th, 754), and Vietnam (30th, 752).

Globally, the U.S. dominates with 225,077 UHNWIs and the highest count, trailed by China (98,551) and Germany (29,021).

Against this backdrop, global charter company VistaJet, operating in Asia-Pacific for roughly 15 years, has seen growing demand across its three membership types—Program, VJ25, and Corporate. Ian Moore, chief commercial officer, noted that the Program membership is particularly gaining popularity, thanks to its guaranteed availability, consistent fleet, and fixed hourly rates.

“Up to Q3 2024, total hours flown in Asia-Pacific were up 14%, with total legs up 20%. The Program membership grew by 15% from Q1 to Q3. Southeast Asia has seen moderate growth in terms of total hours and legs, around 1% to 2% for the entire year, but our program membership grew by 11%.”

In Southeast Asia, there is a noticeable trend toward charter services over ownership, with business jet ownership remaining relatively subdued compared to more mature markets such as North America, Europe, and the Middle East, explained Yvonne Chan, regional director–AsiaPacific for Universal Aviation.

“This could be due to global economic and geopolitical uncertainties. Operating costs have also skyrocketed since coming out of lockdown, brought about by inflation and supply chain issues,” she said, adding that the region is also seeing a move towards larger, longer-range aircraft.

While Singapore is hailed as the region’s business aviation hub, it has no registered business jets, Chan noted. Despite this, the city-state leads with approximately 80 aircraft based there.

Looking at the region, Desgrosseilliers explained there were approximately 282

registered business jets in Southeast Asia by the end of 2023, with the total potentially reaching 300 by late 2024. In individual markets, Malaysia has roughly 50 business jets, while Indonesia, Thailand, and the Philippines each have around 40 to 50, with slight fluctuations.

In terms of emerging markets, Vietnam now has eight to 10 business jets, a significant increase from pre-pandemic levels when it had virtually none. There is also growing activity in Laos and Cambodia, although these countries are still seeing only single-digit numbers, he said.

While the pandemic has brought new entrants to private aviation, industry stakeholders won’t have to wait long for updated figures. Data from Asian Sky Group on regional fleet numbers is set to be released in March 2025 at the inaugural Business Aviation Asia Forum and Expo (BAAFEx) in Singapore.

Hosting the event is Experia Events, the organizer of the biennial Singapore Airshow, which views BAAFEx as an opportunity to unite the business aviation community. Speaking to AIN , the company’s managing director, Leck Chet Lam, highlighted that Southeast Asia is in growth mode rather than just recovery, which is unlocking new opportunities.

“There are inward investments into this part of the world, and there are also outward investments into the rest of the world,” Leck said, pointing to key economic dynamics.

Indeed, Southeast Asia—home to nearly 700 million people—continues to demonstrate resilience, even as growth trajectories vary across the region. A December 2024 McKinsey & Company report attributes this momentum to robust exports, surging investments, expanding industrial output, and stable consumer spending in most markets.

The report also emphasizes the region’s escalating role in global trade and supply chains, driven by geopolitical realignments, infrastructure modernization, and deepening economic integration. Bolstering this ascent is the Regional

LECK CHET LAM MANAGING DIRECTOR, EXPERIA EVENTS

Comprehensive Economic Partnership (RCEP)—the world’s largest trade bloc, spanning China and ASEAN nations— which is reducing tariffs, streamlining cross-border commerce, and cementing Southeast Asia’s position as a critical nexus linking East Asia, South Asia, and global markets.

Despite rising investments, Moore echoes Chan’s view that aircraft ownership is declining, with most opting out unless

they fly more than 500 hours annually. “Typically, most people fly less than 250 hours per year,” he added.

Phenix Jet’s Umemoto sees most of these flyers as private end users, who make up a larger share of the region’s market than corporate users. He also noted that while approximately 80% of flights in Southeast Asia are regional routes with flight times under three to four hours, end users generally prefer mid- to longrange jets.

Leck and Moore attributed part of this trend to the luxury leisure sector. For VistaJet, this means focusing on cabin enhancements to ensure a continuation of members’ lifestyles while in the air.

“High-net-worth individuals are expecting more than just going from A to B. They want to go from A to B, then to C, and have amazing, unique experiences along the way. There are so many assets you can purchase,

With light weight, small volume, outstanding environmental robustness and unmatched performance, LITEF’s LCR Family of Inertial Systems delivers value to the operators of all types of civil and military aircraft.

so many houses and cars you can own. But it’s experiences—and unique experiences— that are really driving high-net-worth individuals in this sector today.”

With a diverse fleet of 215 aircraft, anchored by its flagship Bombardier Global 7500 ultra-long-range business jets—set to be showcased at BAAFEx—VistaJet emphasizes global connectivity. The demand for intercontinental reach and cabin versatility is also reflected by other operators, whose members prioritize aircraft capable of connecting Southeast Asia with key global economic hubs.

“In the case of Sino Jet, our clients place a high value on range and space, which is why large business jets are a popular choice among them,” Lau said. “Frequently requested models include the Gulfstream G650, G550, Bombardier Global 7500, and Dassault Falcon 8X.”

This trend is also observed on the ownership side, where Chan and Brana have seen an increase in owners purchasing larger aircraft.

“Original equipment manufacturers report that regional owners will be taking new aircraft in the next four to five years, which will cause a spillover for Singapore,” Chan said. “The boom in charter and

medevac operations will also see the introduction of more operators in Singapore and the region.”

Brana added that owners are primarily large enterprises with global operations. “They need range, and they require comfort and productivity on long-haul flights—typically 10 hours or more,” he said, highlighting that Dassault’s new long-range jets, the Falcon 6X introduced at the end of 2023, and the 8X, which entered service in 2016, meet these demands.

The Falcon 10X, expected to enter service in 2027, will set a new standard for long-range comfort, productivity, and efficiency, Brana said.

Meanwhile, for island hoppers, Desgrosseilliers noted that the Philippines and

Indonesia somewhat buck the regional trend due to their vast geography, with operators favoring smaller aircraft such as Textron Aviation’s Cessna and Beechcraft models.

Beyond personalized services and global connectivity, Lau emphasized the growing importance of integrating technology, prioritizing environmental sustainability, and diversifying services.

“These trends highlight not only the evolving needs of the market but also the future trajectory of the business jet service sector,” she said, noting that Sino Jet is an example of this shift. Among its initiatives, the “Digital Sino Jet” program aims to enhance operational efficiency, while “Green Sino Jet” focuses on sustainability through energy conservation and new energy aircraft development.

While operators are adapting to shifting market demands, countries have been slower to respond, often grappling with capacity constraints, workforce shortages, and infrastructure limitations.

In Singapore, the market is oversaturated with ground handlers and supervision companies, Chan explained. Aircraft parking remains a major challenge, and land scarcity restricts expansion. Tight airspace around Seletar Airport, coupled with night curfews and limited training hours, further complicates operations. She added that lengthy approval processes for charter flights reduce flexibility, making it harder for operators to meet demand. Meanwhile, the introduction of a minimum departure flight charge at Seletar has coincided with a drop in traffic, adding financial strain on operators.

“We know that operators and clients are complaining that operating in and out of Singapore is getting more expensive.”

In Thailand, Chan said business aviation growth is restricted by airport and regulatory constraints, including a limited number of approved entry and exit points.

BY CHARLES ALCOCK

India’s exceptional economic performance that has spawned a burgeoning population of high-net-worth individuals is driving strong growth in the business aviation sector, according to Delhi-based private charter operator JetSetGo, which is intently focused on efforts to expand its fleet. The company is also investing management bandwidth in plans to launch new advanced air mobility (AAM) services that could include urban and regional flights using new eVTOL and hybrid-electric aircraft.

According to accountancy group Deloitte, India’s gross domestic product is expected to grow at a rate of between 6.5% and 6.8% in the current financial year, rising to between 6.7% and 7.3% in the following 12-month period. While still below the World Bank-logged rate of 7.6% in 2023, the growth is more than double that of the U.S. and well above the anemic state of Europe’s economies.

Today, JetSetGo’s fleet consists of 10 jets including a Cessna Citation CJ2, three Hawker 800XPs, a Hawker 750, a Hawker 900, a Gulfstream G200, a Dassault Falcon 2000, an Embraer Legacy 600, and a Bombardier Global 6000. It also operates a pair of Leonardo AW109 helicopters.

These aircraft are primarily managed on behalf of their private and corporate owners, with spare capacity made available through the charter market. Based mainly on its core fleet of Hawkers, JetSetGo— which was formed in 2012—has introduced a jet card program and, according to the group’s chief strategy officer, Jonathan Sumner, it is now exploring how block flight-time o ff erings—potentially including fractional ownership—could support

the addition of new-build business jets. “There is enormous untapped potential for us to provide what is essentially personal air mobility, but [with current business aircraft] the entry price is very high,” Sumner told AIN . This has prompted JetSetGo’s intense interest in what new aircraft could enable in terms of economies of scale that would reduce the price point for alternatives to road and rail connections.

JONATHAN SUMNER CHIEF STRATEGY OFFICE, JETSETGO

In January, JetSetGo signed a memorandum of understanding with Japanese start-up SkyDrive to explore the business case for deploying its in-development SD05 threeseat eVTOL aircraft for short hops around cities in India’s Gujarat state. The business jet operator has also started a partnership with Embraer spinoff Eve Air Mobility to prepare for the deployment of its Vector urban air traffic management software platform to support eVTOL operations in Indian cities.

JetSetGo has already made provisional commitments to buy Overair’s larger Butterfly eVTOL aircraft and Horizon’s Cavorite model—both of which have longer range than the SD-05. In January 2024, the company signed a sales agreement with Electra Aero covering possible orders for

its hybrid-electric nine-passenger blown-lift wing short takeoff and landing aircraft, which it views as being suitable for new routes of up to around 500 kilometers (270 nm).

“We’re now seeing an extension of wealth growth outside India’s tier one cities into the tier two and three cities, and that is driving demand for better air connections,” Sumner explained. “We’re seeing growth in private jet demand because there is a service gap for flights where airlines don’t want to go.”

While efforts have been made to use helicopters to fill this gap, it has proved challenging to scale up operations at affordable rates for flights. This is where JetSetGo sees an opening for the new electric and hybrid-electric aircraft it expects to see entering the market from around 2028.

The company has not yet determined how this aspect of its fleet diversification will be funded. For now, its focus is defining the right business model with what Sumner called “a laser focus on the early adopter customer.”

“Outside the U.S., India is probably the best opportunity to see how the new [AAM] model could work,” said Sumner, who is a former managing director of private charter flight platform Victor and a veteran of air taxi start-up Farnborough Aircraft. Between 2001 and 2004, Farnborough Aircraft had tried to bring the F1 Kestrel light aircraft to market at the height of the very light jet revolution that never came to fruition.

A big factor in JetSetGo’s optimism is the current Indian government’s resolve in boosting airport infrastructure and encouraging air transport growth. “Over the past year, we’ve seen all the major [aircraft] OEMs taking India seriously, whereas before we were struggling to get on their radar,” Sumner concluded. z

BUSINESS JETS BASED IN ASIA 2023 VS 2024 GLOBAL FLEET OF

In Southeast Asia, large-cabin jets dominated at 55.4% of the market share in 2024. Large-cabin jets were also the only aircraft category to see a year-over-year (YOY) drop in market share from 2023. Activity across all models was up 2.1% in 2024.

BREAKDOWN OF 2024 BUSINESS AVIATION FLIGHT ACTIVITY BY COUNTRY FOR SOUTHEAST ASIA AND A YEAR-OVER-YEAR COMPARISON OF MARKET SHARE FOR EACH COUNTRY FROM 2023. BUSINESS AVIATION FLIGHT ACTIVITY ACROSS ASIA 2023 VS 2024

BY MATT THURBER

With the exception of the still-developing urban air mobility segment, rotorcraft development remains a slow and steady activity. Few new aircraft are under development and some, such as the Bell 525 and Leonardo AW609, seem stuck in endless certification delays. There are bright spots, however, and we expect to hear some interesting news from rotorcraft OEMs at this month’s Verticon show (formerly HeliExpo). Meanwhile, here is what is going on at the rotorcraft OEMs.

Airbus Helicopters is taking a break from development of the CityAirbus eVTOL aircraft. While it plans to continue flying the prototype electric aircraft this year, the company is also pausing the program due to a lack of progress in battery technology.

Apart from that, Airbus Helicopters is committed to innovation and its roadmap focuses on short-term solutions for the in-service fleet of more than 12,000 helicopters; testing of new technology that will be ready for market demand and customers’ future needs; and longer-term “disruptive mobility solutions of the future.”

“We are convinced that innovation is always the best way to continue to bring value to our customers,” said CEO Bruno Even.

Work continues with three research rotorcraft—FlightLab, DisruptiveLab, and PioneerLab—for testing new technologies that could make their way onto existing helicopters plus evaluating “disruptive” technologies for future aircraft such as fixed-wing or eVTOL types. Last year, the high-speed compound rotorcraft Racer

exceeded its 220-knot target speed by flying at 227 knots. Flights will resume this year.

In Marignane, France, the FlightLab H130 platform has tested a rotor strike alerting system, a HUMS for single-engine helicopters, and fly-by-wire simplified flight controls. The Vertex demo tested new flight sensors, high-speed computing, and a new human-machine interface designed to “enhance safety, reduce pilot workload, and explore automation features” for VTOL aircraft.

DisruptiveLab flights in 2023 logged 42 hours toward maturing new technologies to improve performance and reduce emissions as much as 50% with a parallel hybrid propulsion system that recharges the battery in flight. Major modifications are planned this year in preparation for the next flight test campaign.

An H145 serves as the PioneerLab platform but it is also acting as a twin-engine FlightLab. The focus of testing in Donauwörth, Germany, is on systems and airframe improvements including autonomy. Testing will include a lidar-based rotor strike alerting system in hover operations; lidar-based wire detection; automatic takeoff and landing; sensors and image processing to enhance situational awareness; active trim actuators to enable tactile cues and optionally piloted vehicle operations.

Airbus Helicopters is working with Garmin to certify a three-axis autopilot for the H130, and that is expected to be approved and available this year.

The Garmin autopilot features progressive resistance on the cyclic as the pilot approaches pre-defined limits; visual and audible alerts for speed or altitude exceedances; and a level button to return to straight-and-level flight.

Meanwhile, larger helicopters in the Airbus family are seeing growing success, with the new five-blade H145 securing 300 orders during the past two years and delivery of the 2,000th in December 2024.

The H160 fleet exceeds 30, and last year, Airbus lowered the H160’s empty weight and fuel consumption to increase range by 60 nm and payload by 220 pounds.

Last year, the Super Puma made a significant comeback, and Airbus already has booked a contract for 12. “We are committed to this product,” said Even, “and I’m optimistic we’ll be able to confirm this positive trend in the years to come.”

Bell delivered 172 aircraft in 2024 and signed up fleet sales that include ten 525s to Equinor and fifteen 407GXis to Global Medical Response.

A major milestone for Bell remains certification of the fly-by-wire, super-medium 525. Former president and CEO Mitch Snyder in early 2023 said he expected the FAA to certify the 525 by the end of that year. Last year, new Bell president and CEO Lisa

Atherton said that certification was going to take place by the end of 2024, but that has pushed into 2025. The Equinor order is expected to begin deliveries in 2026, according to Bell, and this would require EASA certification.

In addition to fly-by-wire flight controls, with which Bell has much experience on the V-22 tiltrotor, the 525’s main rotor gearbox has no high-speed drives and uses independent and redundant reduction and accessory drive gearboxes.

Power is provided by two GE CT7-2F1 turboshaft engines, each delivering 1,979 shp for takeoff and 1,714 shp max continuous power.

With a maximum cruise speed of 160 knots, the 525 can carry up to 16

passengers and two pilots. Maximum range at full gross weight is 619 nm. Avionics are Garmin’s G5000H integrated suite with touchscreen controllers.

Bell is producing the 525 at its Amarillo, Texas assembly center.

Other Bell developments include new upgrades such as the BasiX-Pro glass cockpit for the 412 and 429 and EASA certification of Garmin’s GFC 600H helicopter flight control system in the 505.

Since Surack Enterprises bought Enstrom Helicopter in May 2022, the Menominee, Michigan-based helicopter manufacturer has resumed manufacturing helicopters

and developing upgrades. Before Chuck Surack—a longtime helicopter pilot who learned to fly in an Enstrom 280—rescued the company, it had filed for Chapter 7 liquidation bankruptcy after 64 years in business. Enstrom has made more than 1,300 helicopters, most of which are still flying, and the employee ranks have grown to 165 from 135 before the bankruptcy.

“Chuck is very committed to seeing this company get back on its feet,” said Charles Wade, senior v-p of product, sales, and customer experience. “He’s got a vision of what he wants; that’s what we’re working towards.”

Enstrom manufactures three helicopters, the turbocharged piston-engine F28F and 280FX and the turbine 480B. The 280FX is a more aerodynamically refined version of the F28F and also is equipped with touchscreen Garmin avionics.

A key upgrade program for Enstrom is the crash-resistant fuel system (CRFS) for the 480B, and work on this project is ramping up. Enstrom was working on the CRFS before the bankruptcy, so that put a bit of a slowdown into the process.

Another program is the Garmin G500H TXi touchscreen display with Howell Instruments engine display, expected to enter service in June. The avionics have been demonstrated in the 280FX but are intended

for the 480B. In addition to the G500H TXi, the package will include the GTN 750 touchscreen GPS com/navigator or the GTN 650 as an option. “We’re evaluating our options on the 280FX,” Wade said. “We’re trying to make sure it’s price-sensitive.”

Last year, Enstrom announced a Genesys three-axis autopilot for the 480B, and this is available in two configurations.

The original is the legacy 480B with an Aspen Avionics primary flight display and the newest version with the Genesys autopilot is being certified with the G500H TXi. This will make the 480B qualified for IFR training.

Development of the HX50 single-engine light helicopter is proceeding, and Hill Helicopters founder and chief engineer Jason Hill last October revealed key targets for the program. The company has taken on the challenge of building its own turboshaft engine and plans for first run of the GT50 engine on June 28, first flight of the HX50 on December 20, and start of production on Dec. 7, 2026.

Based at a 76,000-sq-ft production center in Stafford, UK, Hill is developing two versions of the helicopter, the experimental amateur-built HX50 to be followed by a certified HC50. Both will feature

modern avionics and a stability augmentation system as well as a fully articulated rotor system.

“The comprehensive testing of the GT50 engine is underway, and we are progressing through the necessary stages to meet Part 33 [certification] requirements,” the company told AIN

Three prototype HX50s are under construction and will be used for flight testing. Hill said the timeline for certification of the HC50 is one year following the HX50’s start of production in December 2026. “These prototypes will complete all the testing required for certification. Our plan is to achieve type certification first, immediately followed by production certification, to ensure a smooth transition from development to manufacturing.”

Plans call for the HC50 to be certified by the UK CAA followed by the FAA, Transport Canada, and other regulators.

In addition to the HX50’s airframe,the rotor blades are all-composite. Flight controls will be mechanical and augmented by a hydraulic system. All airframe structures will be manufactured at the Stafford facility, where a composites testing lab has been built to test and validate materials and processes.

“Using the dual-role model with the HX50 being in the permit-to-fly/

AIN Media Group is excited to announce our inaugural

March 27, 2025 | The National WWII Museum | New Orleans, LA

Join us for AIN’s FBO Dinner & Awards Gala, a prestigious event dedicated to celebrating excellence in the business aviation industry, as we announce the top performers from our survey.

The event will take place on Thursday, March 27th, 2025, from 6 pm to 9 pm in the U.S. Freedom Pavilion at The National WWII Museum in New Orleans. This exclusive evening will feature a formal dinner and an awards ceremony.

This event promises to be an unforgettable night of networking, recognition, and celebration among the leaders in aviation.

amateur-built category and the HC50 being fully certified ensures the quickest way to market,” the company explained. “This comprehensive expertise, combined with our commitment to leveraging the latest technologies, positions us to achieve certification within our projected timeline.”

Two major programs are underway at Leonardo. The AW609 is working towards type inspection authorization (TIA), the next milestone in the tiltrotor program, following a number of achievements in the past 12 months. Meanwhile, the light- single AW09, formerly the Kopter program, has completed some key tests on its path to the marketplace.

Leonardo has secured more preliminary sales contracts and added several more distributors for the AW09 along with firm customer orders. Recent achievements include the completion of engine icing tests, phase 2 bird strike testing, all main and tail rotor blade fatigue tests, and the first engine start of the Tie Down helicopter.

Engine icing tests were conducted with Safran, which makes the AW09’s Arriel 2K engine. For the phase 2 bird-strike tests, engineers tested a second bird-strike location on the helicopter’s canopy.

EASA flight testing for certification began in May 2024, and Leonardo expects the helicopter to receive approval under CS-27 regulations this year.

An AW09 can seat up to eight passengers and features a Garmin G3000H avionics suite. With a maximum speed of 140 knots, it will fly up to 430 nm or five hours. Maximum weight with internal load is 6,284 pounds and with an external load is 6,614 pounds. Sling capacity is 3,300 pounds.

In early February, AW609 tiltrotor aircraft 5 marked a significant step in the long-running program, the first flight in the U.S. in that aircraft by the FAA pilot who will conduct TIA flights. The FAA pilot had previously flown in aircraft 4 in Italy. During that week, Leonardo’s AW609 team delivered the risk management process and existing test risks to the FAA, and this paves the way for the FAA test pilot and test engineer to “participate in onboard flights,” according to Leonardo.

Aircraft 5 will be used for TIA flights and has flown 62 hours for key certification tests, including handling qualities, avionics systems performance, and cold weather operations down to -10 degrees C.

In Italy, Leonardo has been running tests of a digital twin version of the AW609. Activities and maneuvers were first flown with the digital twin on the

AW609 development/engineering simulator in Cascina Costa and then later flown in the prototype aircraft.

These tests included the first ship trials on an Italian navy aircraft carrier in the second quarter of 2024, under a working group formed to study tiltrotor potential. Included in the group are the Italian navy, army, and Italy’s customs police, and the intent of the testing is to evaluate the potential of tiltrotors’ capabilities in complementary operation with existing assets, according to Leonardo. “The assessment performed by the working group would help to define the benefits for logistic transport (vertical takeoff/landing, longrange, fast point-to-point connection with above-the-weather cruise) and, later in the future, maritime surveillance (vertical takeoff/landing, fast transfer to patrolling area, and larger area coverage).

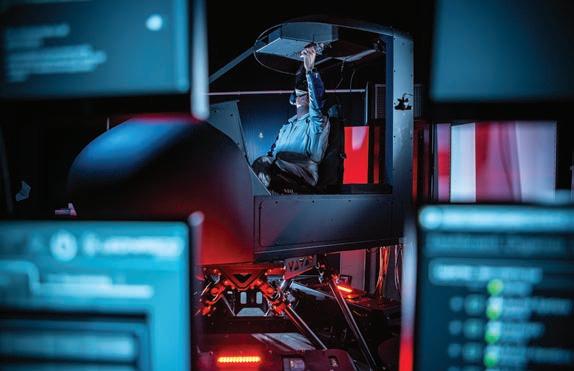

Leonardo’s virtual extended reality (VxR) helicopter flight simulation training device has achieved FAA Level 7 approval, “marking a historic milestone as the firstever VR [virtual reality]-based training device to attain this level,” according to the Italian rotorcraft manufacturer. With a motion base and VR technology, the VxR can replicate single-engine and light twin-engine helicopters at a fraction of the cost of a full-flight simulator.

Capable of replicating the AW09, AW119, and AW109 helicopters, the VxR uses previously qualified level-D full-flight simulator flight dynamics and performance data and cockpit components. VxR simulators can be connected so flight crew can train together on the same mission.

Mesa, Arizona-based MD Helicopters exited bankruptcy in late 2022, having delivered just five helicopters that year. New investors and leadership have since turned the company around, although sales haven’t accelerated as quickly as projected, with just nine helicopters delivered in 2023. Numbers for 2024 weren’t available at the time this was written.

However, the company has focused on supporting the more than 1,700 MD helicopters still operating. To that end, it has launched an AOG team, smoothed out the parts supply chain, and built up a strong field support team. In addition to establishing a goal of 95%-plus spares fill rate within 24 hours, MD has also been working on ensuring that more than 1,000 unique spare parts are available on the “never-out” list.

The latest program update for MD Helicopters involves a ramp-up of its 530E to 530F conversion program. The first conversion was completed last October for the Cleveland Police Department. Upgrades add 350 pounds to internal load and 200 pounds external and a 5,500-foot increase in hover out of ground effect, thanks to a larger Rolls-Royce 250-C30 engine; longer main and tail rotor blades and tail rotor drive-shaft; extended tail rotor gearbox; modified tailboom; and new vertical and horizontal stabilizers.

MD Helicopters sees strong demand for these upgrades and plans to release more performance improvements for the MD 500D, MD 500E, and MD 520N.

Under the leadership of president and CEO

David Smith, who took over the position in early 2024, Robinson Helicopter has

purchased a drone manufacturing company—Ascent AeroSystems—and further moved into exploration of electric and hydrogen power for its traditional helicopters. The helicopter manufacturer

is also providing support to Skyryse’s efforts to obtain supplemental type certificate approval for a fly-by-wire version of the R66 helicopter and Rotor Technologies’ conversion of the R44 into a

remotely operated utility or agricultural spray helicopter.

Robinson has partnered with United Therapeutics on the development of a hydrogen-powered R44 and R66, and progress continues on that program. “My team and the team at United Therapeutics that’s doing the development work…everyone’s learning quickly,” he said. “There’s a lot of things to learn…particularly around cooling, that are very important parts of keeping fuel cells working nominally. The design is quite clean. [But] it still has another generation to go before [it’s ready]. So we’re actively working through that.

“We’re going to make this an initial proof of concept, to maximize its learning, and then take that and do the application in more detail with the authorities. We’re in good discussions with them so far, so there is lots of good progress on that.”

Skyryse’s work involves removing all the conventional controls from an R66 and replacing them with a fly-by-wire control system managed with a single control and two screens. “We’re cheering them on,” Smith said. “We’ve got a lot of work ahead of us to make sure that we’re ready to support them in the next phase, where they’re taking on aircraft and modifying them in larger volumes. We’re ready to support them in that.”

Helicopter fly-by-wire is not an easy change, and long delays in the certification program of the Bell 525 suggest that there is a big learning curve for all involved, especially the FAA. “Fly-by-wire is many great things,” he said, “but it’s also challenging and particularly in helicopters where the time constants are so much faster. In fixed-wing, system response has time that the aircraft doesn’t immediately go into an unstable condition. In helicopters, it’s a different matter entirely. We’ve seen attempts in the past to go to fly-bywire. Airbus jettisoned it on the H160; the Sikorsky S-92 had an attempt to do it and

backed away. The Bell 525 has taken so long, at least partially due to the fly-bywire content, so it’s a long road. But we’re very supportive of Skyryse and are trying to help them do it as safely as possible.”

Another fly-by-wire program that Robinson is supporting is the Rotor Technologies R44 remotely piloted helicopter. “We love their product and team,” he said. “They don’t need a lot of help, but they want to productionize, and that’s our end of the world.”

Another area of opportunity for Robinson is in pilot training and the growing application of virtual reality technology in flight simulation. “I see this as an enormous opportunity,” Smith said. “We have more than 100 dealers and 400 service centers, and many of them would host a device and train their customers. We’ve got to make it easy for them to do that.”

The Robinson team is working on a training product, details of which Smith wasn’t ready to reveal when interviewed in February.

For bringing e ff ective simulator-based training to the helicopter market, the key is not expensive, regulator-approved programs with simulators that cost hundreds of thousands and millions of dollars. “The

future is not regulated training; it is gamified, immersive training that changes how pilots make decisions,” Smith said.

Having run a large OEM-based fixedwing simulation network, he added, “Not one of them felt like I was making pilots substantially better or pause about their own judgment. They always were trained for proficiency in maneuvers and systems knowledge. That’s important. You have to do that. But I think that if you look at the data, the things that kill the pilots in my [helicopters], my customers, it’s decision making, and it’s a mix of human factors, mission preparation, and flight into IMC happens because of improper weather planning or the limitations of decision making in the moment.

“I think our e ff orts with simulation are going to go right at the teeth of that, solve the problem of how do you simulate to make pilots think twice about their preparation. That will make an enormous difference on safety. It won’t solve everything, nothing will, but that will solve something that nobody else is solving right now.”

An avid gamer, Smith said, “I study all these game companies and how people sit in front of screens and play games for forever and ever, and there’s no intrinsic

Here the whole ecosystem comes together to connect, share and shape the future of European Business Aviation. There’s nowhere better for exhibitors to go to market or for visitors to gain knowledge and experience new products or services. And don’t miss the plentiful opportunities to network with the community, hear insights from thought-leaders and reach new customers.

Tickets available at ebace.aero

return on that, no credit, no hours get gathered.” But if passionate people are competitive and the games are engaging, then creating a leaderboard might motivate them to improve. “[If] you’re in the bottom quarter, who isn’t going to go back into the machine and try again?” he asked.

“When our simulation product that we’re working on hits the market, it will be something that will change safety and change the expectation of general aviation. That’s my goal, that general aviation should be safer because we don’t have all the same regulatory complexities and burden that a big airliner has. We should be better than that. And that’s where we’ll set the bar.”

As for an entirely new helicopter, all Smith would say is, “Robinson has more than doubled its engineering staff in the last 12 to 18 months. We’ve got folks in every discipline required to develop the next generation of Robinson product. They’ve been hard at work, putting in long hours to build a product that will give more capability to our customers. There’s a lot to that, and it’s not just one product that’s on the roadmap. It’s intended to go after places where we see really significant needs not being met in the market. And I think what Robinson produces are extremely affordable, field supportable, simple aircraft to maintain, operate, and fly, and you’ll get that in bigger doses in the months ahead.”

Schweizer, which produces the pistonpowered S300C and S300CBi light helicopters, supports the more than 1,200 model 269 (Hughes 300) helicopters that are still flying. Since 2018, when the company was created to buy the assets of the 269 program from Sikorsky in 2018, it has built up its product support activities and parts supply chain.

One of its biggest upgrades was approval for a CFRS for the S300C and S300CBi. Schweizer has 16 service centers

worldwide and its helicopters are used primarily for civil and military pilot training, cattle mustering, and fishspotting.

A turbine version of the iconic 300—the S333—is also available and in service, but there is no plan to manufacture more without firm orders, according to Schweizer president and CEO David Horton.

A refurbishing program for 300s has proven popular, both for helicopters owned by the factory and those that customers want to have refurbished. This brings older helicopters up to fresh standards with new canopy and door plexiglass, fresh upholstery and paint, new main and tail rotor blades, and an overhauled or new engine plus many options. Schweizer also offers a certified preowned helicopter program with factory inspection of the aircraft and optional add-ons such as avionics upgrades.

The 300CBi is targeted at the training market with a lighter maximum takeo ff weight, lower horsepower rating, and lower direct operating costs. With a higher horsepower rating, the heavier 300C can fill more missions, including training that requires more power such as at higher altitudes. Operating costs are lower than other helicopters, he explained, because none of the parts have calendar limits. “Everything

is limited by the hours flown, to the individual components based on their time in service. There’s no single point where the helicopter is required to have a complete overhaul. We replace various components when they’re due, and the helicopter remains in service.

“We have a very safe product,” Horton said. “It has a fully articulated [rotor system] with an independent cyclic and collective for the student and instructor, like what you’re going to see when you fly EMS or law enforcement or for a tour operator in a larger turbine.”

The Sikorsky Innovations unit continues exploring rotorcraft technology and future designs that could someday reach production. Meanwhile, the company is focusing on continual improvement of its largest civil helicopter, the S-92, of which some 300 are operating, 80% in offshore oil and gas flying. One recently retired with 30,000 hours logged, averaging more than 2,000 hours per year of reliable service.

“We now have a growing segment, which is VIP and head of state,” said Leon Silva, v-p commercial programs. Thirteen countries operate the S-92 for flying leaders, including the U.S. with the VH-92A,

which is slowly taking on more presidential flights as it transitions into the Marine Helicopter Squadron One role. “We anticipate that to be one of our growing markets. For that mission, it’s very comfortable and we can put restrooms in them.”

This year, Sikorsky expects to receive certification for the S-92’s Phase 4 gearbox. To create the gearbox, the company leveraged all the improvements and learnings from the past 10 years as well as Sikorsky’s experience making the massive CH53K gearbox plus $100 million in development.

The key feature of the new gearbox is a secondary oil system, which allows it to continue operating for more than seven hours after failure of the primary oil system. “Historically, that’s a 30-minute requirement,” said Silva. “This enables the aircraft and people in it to return to any location, using all the fuel available on the aircraft to bring it safely anywhere. This is a significant step in improving the S-92.”

The Sikorsky S-92A’s Phase 4 gearbox should receive FAA certification this year and features a secondary oil system.

In the latest configuration with the new gearbox, the helicopter will become the S-92A+, but the improvements will also be offered as an upgrade kit for any S-92. The upgrade includes a 1,200-pound maximum takeoff weight increase to 27,700 pounds, with structural changes to accommodate the higher weight. Lighter seats will also be offered along with an avionics management system software upgrade to version 11.0.

On the innovation front, Sikorsky has completed lab testing of a hybrid-electric powertrain using its own resources to design and build motors, power electronics, and flight controls. A GE turbine engine and turboelectric generator power the powertrain.

“We are in the next product cycle for Sikorsky,” said Igor Cherepinsky, director,

Sikorsky Innovations. “We are looking at what we’re going to launch next. We have not been ignorant of eVTOLs and propulsion system electrification.”

Sikorsky specializes in super-medium and heavy rotorcraft, so it is looking at those sizes or in the class of its intermediate twin-engine S-76. “We’re looking at what hybridization electrification brings to those platforms,” he said.

The tilt-wing HEX is how Sikorsky is testing these systems. As an uncrewed aircraft, the HEX allows for “rapid design integration migration so we don’t have to worry about safety to human beings as we go explore that configuration,” Cherepinsky explained. Additionally, the drivetrain uses the GE engine and turbogenerator and Sikorsky’s 1.2 MW triple-redundant electric motors, power electronics, and fly-by-wire flight controls. “We have experience in making transmissions,” he said, “so making motors was not a long stretch. We were pretty well poised to do that design work quite well.”

Before building an airframe, Sikorsky is building a power systems testbed that hosts all the components and will be used for ground and some hover testing. “We intend to fly that asset,” he said, either late this year or early next year. Once that flight testing is done, those components will be moved into a complete HEX airframe.

Another configuration will be more conventional—a single-rotor, hybridelectric helicopter. “We’ve been flying

single main rotors for many years,” he said. “We understand their advantages, and for a whole bunch of missions, nothing beats a very low disk loading. The very large single main rotor that spins relatively slow, it’s extremely efficient. That’s why single-rotor helicopters exist.”

The HEX rotors are quite large. “They’re certainly larger than the eVTOL [designs] and that’s because we want to take advantage of larger rotors as we understand them,” Cherepinsky said. “There’s still distributed electric propulsion, but distributed in a different manner [hybridelectric instead of batteries]. Both of these aircraft that we’re talking about are fairly agnostic to the source of power because we’re being pragmatic and we would like to launch the product. Turbines are the best at converting stored energy into mechanical energy. That’s why we are talking about hybrid-electric distribution today.

“We also have done quite a bit of work on fuel cells. We understand where that is, and hydrogen has a place in aviation. It remains to be seen how big and where that’s going to go, but both of these aircraft are up for

that. And, last but not least, when solidstate batteries or other technology like that matures, there might be an option.

“We even looked at the same vehicle having different sources of power. For example, some of our customers fly S-76s. They may fly fairly short missions that might be within the range of future batteries. Our future hybrid-electric product for those customers might be, here’s a batterypowered aircraft that gives you 150 nm of range. For other customers, like offshore oil or VIP transport with longer legs, you end up with hybrid-electric aircraft [that are] turbine-powered or hydrogenpowered. The neat part is the actual air vehicle remains the same. Now you’re talking about options for powerplants.”

When it comes to manufacturing, Sikorsky is designing in commonality between the two designs that will make manufacturing more streamlined and keep costs down.

“There’s a huge transformation happening with our manufacturing facility,” Cherepinsky said. The all-composite HEX with its 37-foot wingspan has no expensive and time-consuming castings or forgings. Motor housings are made with additive manufacturing by Sikorsky at its Stratford, Connecticut headquarters. “It’s not just hybrid-electric that’s enabling these new products, but definitely a manufacturing

revolution that’s helping quite a bit,” he said.

A further twist to simplifying manufacturing is integrating batteries into the structure, as structural elements themselves. “Obviously, any hybrid-electric system needs some energy storage, so how do you integrate that with structure? All of the big power buses that are carrying these megawatts of power are also structural. As we’re making them, we can make them do exactly what we need, which saves a lot of weight.”

Such a highly integrated vehicle extends to the computing elements as well, not just for flight controls but motor controllers and avionics. “It’s a much more integrated vehicle management system,” said Cherepinsky. “The whole aircraft is sort of a flying computing cluster, where, if failures occur, different nodes can pick up different functionality.”

None of this work is being done outside the purview of potential customers. “We always organize a customer advisory group,” said Silva, and these include a diverse cross-section of potential buyers and operators. “On a fairly regular basis, we give them an update. We ask them for their feedback, and that is one of the ways that we shape the future to make sure we land with something that is going to meet their expectations. But folks who participate in a group like that are also influenced by their

limited experience. So when we’re trying to push technology to the next level, [it may be] beyond what they’re imagining. It’s a balancing act. We don’t just build what the customers think should be the next thing, because they don’t always have the full toolset to recognize or appreciate the full potential of doing something new. So it’s a little bit of a balance.”

“We’re not just looking at traditional helicopter missions,” Cherepinsky added, “but looking to advance mobility in both civil and military markets and what you can do with vehicles that can go from downtown New York to downtown Chicago at almost business jet speeds but are able to hover and land in the middle of [downtown]. If you look at the logistics space and how we’re all used to the immediate delivery of things, we believe that these kinds of vehicles will help streamline the flow of goods for both civil and military customers.”

Both the HEX tilt-wing and the single-rotor configurations are candidates for product launch, although they are aimed at different markets, Cherepinsky said. “We hope to make a product launch in the next year or two. I promise the next helicopter is going to be very different for both commercial and [military] customers. And you [will] see a lot of jaw drops when they see what that looks like.” z

Paris International Air and Space Show is flling up very quickly.

Don’t be left in transit

BY PETER SHAW-SMITH

Red Sea International Airport, shown here while under construction, opened in September 2023.

The Kingdom of Saudi Arabia has long been regarded as the jewel in the crown of the Gulf region’s business aviation market, albeit a jewel that has often seemed quite unobtainable due to an array of complex obstacles. As has happened in China, albeit in a different context, anti-corruption initiatives—epitomized by the 2017 arrests of prominent ultra-high-net-worth Saudis— have resulted in private aviation maintaining a distinctly low profile.

More recently, there have been signs of hope for companies waiting patiently for improved market access, with Saudi regulators seemingly following directives from the very highest echelons to be more open to outsiders. The Kingdom’s spate of high-profile investments in projects on its Red Sea coast and efforts to attract major

sporting and cultural events appear to be fueling a renewed focus on the market.

These changes were openly discussed during a panel session at the MEBAA business aviation trade show held in Dubai in December. Industry leaders broadly welcomed improved prospects for exploiting opportunities in Saudi Arabia, with some caveats about how the country’s General Authority for Civil Aviation (GACA) is managing changes to the general and business aviation sector.

“Saudi Arabia is a large country—the size of mainland Europe,” said Khalid Alnatour, CEO of Aloula Aviation. “It needs a lot of connectivity. It is the world’s 17th-largest economy. That type of economy and the [inherent] growth in the next five years is, I think, half the job.”

GACA was revamped in 2021 under new president Abdulaziz Al-Duailej. Try as his team might, it was not until 2024 that a new general aviation plan was announced. Saudi Arabia’s primary aviation focus has always been commercial aviation, as the advent of Riyadh Air, the revamp of Saudia, and a 330-million-passenger target by 2030 make clear.

It was not until 2011 that Saudi Arabia’s civilian aviation sector was removed from defense ministry control.

Nonetheless, the recent progress has been welcomed; GACA was long perceived as too rigid. For instance, it has only been since 2021 that the time needed to obtain an air operator certificate has

been cut down to a reported six months.

In December, GACA announced a new directive approving annual permits for private aircraft owners that should reduce bureaucracy. The permits apply to domestic or international aircraft used for personal, non-commercial purposes, provided they meet the approved requirements.