What goes into a gallon of gas?

What goes into a gallon of gas?

As First National enters a second century of investing in Alaska, you and your financial needs will continue to come first. From buying a home to growing your business, you can count on our experienced team to deliver personalized service and innovative banking solutions to help you shape a brighter future.

FNBAlaska.com

907-777-4362

A widespread misconception in Alaska is that the state’s crude oil is shipped away, refined Outside, and returned to be sold as fuel. The last part is not entirely true, so a fact reported in this month’s cover story bears repeating here: most of the gasoline in Southcentral Alaska (and thus, most gasoline sold in the state) is produced and refined locally.

The refinery in Nikiski does heroic work to keep Alaska’s

motors running, as do the state’s other refiners, distributors, and retailers. To better understand the unsung industry underpinning every mode of transportation, Vitus Energy granted us a closer look at its Midtown Anchorage gas station. We choose to light a candle rather than curse the darkness of another price hike.

But please don’t light a candle next to a gasoline pump.

I’m probably biased, but it’s my experience that Alaskans have very grounded conversations about energy. We won’t dive into a new energy technology unless we check the temperature of the pool or the chlorine content in the water—and, wait, is something living in there? We know that any transition from one energy source to another requires engineering services, construction labor and materials, transportation solutions, maintenance training, funding (probably from more than one source), community buy-in, and the understanding that a change in energy generation may bring a change—positive or negative—in jobs or economic activity. None of Alaska’s rural communities are pursuing solar, hydroelectric, geothermal, biomass, or wind power systems because they’re trendy. They have multiple goals to address, including the reliability of the energy source, the cost to the community, and how energy generation affects their people and their environment.

That thinking isn’t restricted to rural communities. Along the Railbelt, Alaskans are looking at all energy options to find what works best and when. All energy sources have pros and cons, and what Alaskans find in urban and Bush communities is that the best solution often is a combination of hydrocarbons and renewable energy sources.

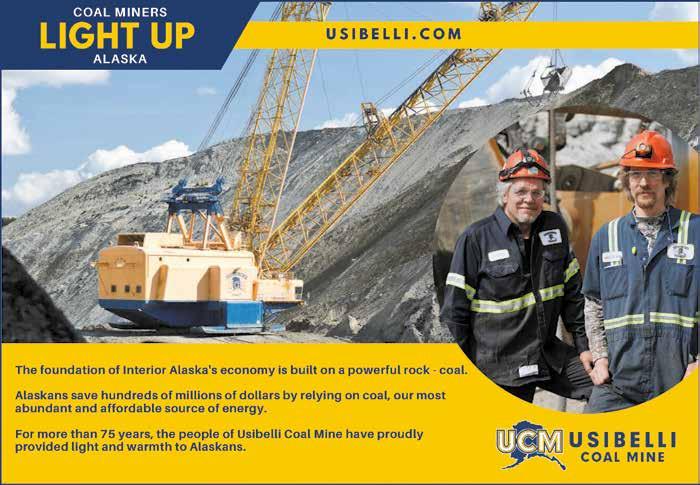

This idea is exemplified by the Alaska Sustainable Energy Conference, taking place at the end of this month. The sponsor list for the conference includes many of the state’s energy utilities, agencies, and producers—including Usibelli Coal Mine, Hilcorp Alaska, the Alaska Oil & Gas Association, and the Alaska Gasline Development Corporation. Alaska’s oil, gas, and coal providers are investing in conversations about a sustainable future—as they should. Natural resource extractors are and should be held to high social and environmental safety standards. And since Alaska’s energy future includes hydrocarbons, even as it adopts other energy sources, those companies’ involvement in conversations about that future is critical.

May has historically been our oil and gas issue, but it’s evolving into an energy issue, which I find exciting. Alaska was built on energy and continues to be an energy testing ground and innovator. With potential geothermal and micronuclear projects on the horizon, Alaska is dipping its feet into every energy pool, testing the waters and exploring the potential of their depths. We’re highly qualified to do it.

VOLUME 39, #5

EDITORIAL

Managing Editor

Tasha Anderson 907-257-2907 tanderson@akbizmag.com

Editor/Staff Writer Scott Rhode srhode@akbizmag.com

Editorial Assistant Emily Olsen emily@akbizmag.com

PRODUCTION

Art Director Monica Sterchi-Lowman 907-257-2916 design@akbizmag.com

Design & Art Production Fulvia Caldei Lowe production@akbizmag.com

Web Manager Patricia Morales patricia@akbizmag.com

SALES

VP Sales & Marketing Charles Bell 907-257-2909 cbell@akbizmag.com

Senior Account Manager Janis J. Plume 907-257-2917 janis@akbizmag.com

Senior Account Manager Christine Merki 907-257-2911 cmerki@akbizmag.com

Marketing Assistant Tiffany Whited 907-257-2910 tiffany@akbizmag.com

BUSINESS

Tasha Anderson Managing Editor, Alaska BusinessPresident Billie Martin VP & General Manager Jason Martin 907-257-2905 jason@akbizmag.com

Accounting Manager James Barnhill 907-257-2901 accounts@akbizmag.com

CONTACT

Press releases: press@akbizmag.com

Postmaster: Send address changes to Alaska Business 501 W. Northern Lights Blvd. #100 Anchorage, AK 99503

AKBusinessMonth alaska-business-monthly

AKBusinessMonth akbizmag

In April, Alaska USA Federal Credit Union began operating under a new name—Global Credit Union— to symbolize its expanded service worldwide and bold aspirations for the future. The name change followed its August acquisition of Spokane, Washington-based Global Credit Union, which created one of the fifteen largest credit unions in the nation.

The rebranded financial institution now operates seventy-nine branches in Alaska, Arizona, California, Idaho, Washington, and Italy; has more than 2,200 employees and 750,000 members; and holds $12 billion in assets. A member-owned, not-forprofit cooperative, Global Credit Union offers a full range of financial services, including checking and savings accounts, consumer loans, real estate loans, mortgage loans, credit cards, business services, and personal insurance.

When the two institutions officially merged last year, Alaska USA was operating sixty-seven branches in Alaska, Arizona, California, and Washington, with nearly 2,000 employees serving more than 700,000 members. Spokane’s Global had 45,000 members, twelve branches in Washington and Idaho, and three additional branches on US military installations in Italy. Although Global was the smaller of the two entities, Alaska USA opted to assume its name for various strategic reasons.

The name “Global Credit Union” supports Alaska USA’s future growth, according to President and CEO Geoff Lundfelt. The appellation is also recognizable, easy to associate, and matches the credit union’s geographic trajectory. “The Global Credit Union name reflects our future and represents the diversity of our membership, which spans all fifty states and over twenty countries,” Lundfelt says. “The new brand is a better representation of the geographical diversity that our membership represents.”

Jettisoning a brand that’s so familiar to Alaskans comes with some uncertainty. However, Lundfelt accepts the risk: “We're changing our name because it's important for the longterm financial health and stability of the organization. This was an inflection point, and I promise you it was not an

easy decision. Important decisions are rarely easy in our personal or professional lives. We're going to be a 75-year-old company this year. We don't manage to financial quarters; we manage to quarter centuries so that we can continue to serve the generations to come.”

The name change ripples down to the credit union’s subsidiaries and other organizations. Alaska USA Insurance Brokers was changed to Global Credit Union Insurance Brokers, and Alaska USA Mortgage Company is now Global Credit Union Home Loans. Alaska USA Financial Planning and Investment Services has become Global Retirement and Investment Services. And the Alaska USA Foundation is now called Global Credit Union Foundation.

Likewise, Global Credit Union unveiled a new logo design that acknowledges and honors its deep roots in Alaska. The “A” in “Global” is a direct nod to the mountainous geography of the credit union's Alaska beginnings. The blue and gold colors are also a gesture to the colors on the Alaska state flag. And the gold “summit” of the letter is an arrow, pointing to the future of its members’ financial well-being.

Other than new signage and letterhead, services for the credit union’s members remain the same. Members can continue to access account information and normal products and services in the same way they always have—in branches, online, and through a 24/7/365 contact center.

Another key aspect that the credit union is not altering is the location of its headquarters. “We are proud of our Alaska heritage,” Lundfelt explains. “Our headquarters will remain in Anchorage. Six of our seven board members reside in Southcentral Alaska. I was born and raised here. Most of our key executives live in Alaska.”

With more than 1,100 Alaska employees, Global Credit Union is

“The merger with Alaska USA and Global allows us to offer membership to all service members, active duty and retired, wherever they may reside… This gives them greater choice when selecting a financial institution.”

Jack Fallis, Regional President of the Pacific Northwest and International Markets, Global Credit Union

a significant employer in the state.

It operates in fourteen distinct communities and maintains a separate foundation, a 501(c)(3) nonprofit that has given millions of dollars back to communities throughout Alaska. The institution also supports other nonprofits and charitable causes to help ensure that Alaska’s communities are better places to live, work, and play. “We run United Way campaigns and support smaller organizations that focus on needs-based charity work with children, including critical issues like food insecurity,” Lundfelt says. “And we support our junior enlisted men and women, making sure those families can put food on the table and provide school supplies for their kids. Our roots are firmly planted in Alaska, and that will not change,” Lundfelt says.

Established in 1948 as Alaskan Air Depot Federal Credit Union, the cooperative expanded into Washington under a merger with Whidbey Federal Credit Union in 1983. It began operating

in California with the acquisitions of High Desert Federal Credit Union in 2009 and Arrowhead Credit Union in 2010. The credit union continued to grow its presence in the Lower 48 with branches in the Phoenix, Arizona area, including seven branches acquired from TCF Bank in 2020.

Last year’s merger further enhanced Alaska USA’s strength in the United States and beyond. The calculated move enabled the credit union to leverage the positive attributes of another complementary institution with a similar focus. Global, like Alaska USA, was initially established to cater to military service members and later underwent a strategic transformation.

It was founded in 1954 as Fairchild Federal Credit Union to serve military and civil service employees on Fairchild Air Force Base. In 1988, the institution changed its name to Global Credit Union to better reflect its diverse membership and enhance potential for growth.

The recent merger expands the credit union’s presence in Spokane, in parts of northern Idaho, and on three

US military bases in Italy. “With that merger came something else incredibly significant: an opportunity to expand beyond our original charter comprised of military members who were on specific installations in Alaska to anyone who works in the US Department of Defense worldwide,” Lundfelt says. “That includes civilians, active-duty military of every branch of our services, reservists and their family members—a group of over 6 million people who can join our organization now.”

Growth means strength—and a strong credit union is good for its members and the communities where it operates, Lundfelt says. “From humble beginnings, Alaska USA—now Global Credit Union—is honored to serve over 750,000 members, a large number of whom live in Alaska,” he says. “We have members who live in all fifty states and in over twenty foreign countries, a growing number of people who understand the benefits of being a member of a financial services cooperative.”

Alaska USA’s consistent expansion has significantly enhanced its ability to

Credit Union 1 is continually growing and adapting to better serve our fellow Alaskans. Whether that’s through cutting edge online services or in-person financial support, we’re here to meet you where you’re at and help you reach for what’s next. YOU are our friends, neighbors and future!

In 2024, we’ll be opening doors at our new Wasilla location.

provide products, services, and other benefits to a broader membership base. Over the years, the credit union has always focused on providing value to its members through competitive pricing on products, as well as superior service in the forms of convenient branch and ATM locations, contact center, and state-of-the-art mobile products, according to COO Elizabeth Rense Pavlas. “Those products and services are expensive to provide, yet we are able to maintain that service model with incredibly competitive pricing because of the scale of our large member base,” she says. “The merger adds to that base and expands our member charter, allowing more people to choose us as their financial institution. It’s a symbiotic relationship where growth does allow for enhancements to what we can provide.”

However, Alaska USA does not grow just for the sake of growth, says Pavlas, a lifelong Alaskan who has worked at the credit union for fifteen years. “We don’t accept every merger opportunity and only expand when it strategically makes sense for our members and for the health of the credit union,” she explains. “I’m proud to be part of the team that is leading us through an interesting economic time with factors the banking industry has never seen before. Our growth is an important factor in our future.”

Former Global President and CEO Jack Fallis says he “could not be more pleased” with the merger with Alaska USA. “The members of Global Credit Union now have a greater number of world-class products and services that the smaller credit union simply could not afford to offer,” says Fallis, who currently serves as regional president of the Pacific Northwest and international markets for the merged credit union. “That—along with our 24/7/365, entirely US-based member call center—offers them personal

“We're changing our name because it's important for the long-term financial health and stability of the organization. This was an inflection point, and I promise you it was not an easy decision.”

Geoff Lundfelt President and CEO Global Credit Union

service and access to information when it’s convenient for them.”

Fallis also emphasizes that the consolidation of the two financial institutions enhances Global’s ability to provide products and services to a broader membership base. “The merger with Alaska USA and Global allows us to offer membership to all service members, active duty and retired, wherever they may reside,” he explains. “This gives them greater choice when selecting a financial institution.”

For seventy-five years, Alaska USA has instituted a variety of practices to help its members reach their financial goals. For example, it was the first Alaska-based financial institution to remove non-sufficient fund fees for members who choose overdraft protection, according to Lundfelt. “We have lowered those costs as well,” he says. “For members looking to save, there are no maintenance fees on savings and money market accounts, and we have increased dividend rates on money market and CDs. The combination of those changes will put over $12 million annually back in our members’ pockets.”

The credit union’s growth—its strength in members—allows it to provide exceptional value to the individuals it serves and give back to the community, Lundfelt says. Its members save on average $175 per year over traditional banks. The institution has raised more than $4 million through the Alaska USA Foundation for organizations supporting children, veterans, activeduty military members, and their families.

For example, the Cash for Cans program, initially created and trademarked by the Alaska USA Foundation, enables the credit union to help raise funds to fight food insecurities in all its markets. “A few years ago, we partnered with other credit unions in Alaska through the Alaska Credit Union League to broaden the reach of this muchneeded program,” Lundfelt says. “We love partnering with our fellow credit

unions in all the states we serve and do so on a regular basis. That’s a wonderful part of credit unions; their whole focus is ‘people helping people,’ which means we work together to better the communities we serve.”

Under its new identity, the credit union is capitalizing on its “strength in members” to provide better rates, lower fees, and the latest in banking technology with accessible, aroundthe-clock, entirely US-based member service. In fact, it recently opened a new 24/7 Member Service Center in Fairbanks—its second in Alaska. “Global Credit Union is positioned to grow with our members, to serve them wherever they are in the world,” Lundfelt says.

In addition, Global Credit Union is currently rolling out new technology in the form of a mobile app that allows users to complete transactions and aggregate all their accounts—even their non-credit union accounts—so they can see a global financial picture of their finances. The new app also provides a variety of budgeting tools to help members manage their money.

While Global Credit Union now represents an institution that is 750,000 members strong globally, its inherent strength stems from one key factor: its focus on each individual member and their specific needs. This includes offering competitive deposit and borrowing rates, reducing and eliminating fees, providing state-ofthe-art online banking technology, and being committed to member service, according to Lundfelt.

“During COVID, when many companies were giving up on providing contact centers staffed by humans, we doubled down, expanding our entirely US-based Member Service Center,” the CEO says. “We’re proud to say that if a member needs a problem solved, wherever they are in the world at any time of the day or night, they can reach us.”

As for the future, Global Credit Union aims to continue enhancing its services and expanding its geographic presence to better serve its members in Alaska and worldwide.

“It’s a symbiotic relationship where growth does allow for enhancements to what we can provide… We don’t accept every merger opportunity and only expand when it strategically makes sense for our members and for the health of the credit union.”

Elizabeth Rense Pavlas COO Global CreditUnion

“People really want to look for a place that they can feel like it’s their home,” says Wasilla dentist Tyler Mann. “People want a personal connection to where they go, so we try to be part of the community and participate in community events. We don’t want to lose that connection.”

To keep the connection with his patients, Mann Family Dental had to expand last fall, keeping pace with the community’s growth. The population increase in the Matanuska-Susitna Borough has brought an increased need for all services, particularly healthcare. For decades, Mat-Su residents seeking medical care had two options: wait to get an appointment with one of the few providers close to home or make the trek to Anchorage, neither of which were always practical. But the Mat-Su’s growing population has allowed the number, type, and availability of service providers to begin catching up with demand.

“You sort of hit critical mass where people are going to want to get their healthcare services where they live,” says Joshua Arvidson, COO of Alaska Behavioral Health, which opened a clinic in Wasilla in April. “I think that’s an evolution in the community—and really a great thing, to have services accessible here. And that can happen now because there’s enough of a population.”

The Alaska Department of Labor and Workforce Development’s (DOLWD) 2016 “Alaska Economic Trends” report showed that the Mat-Su Borough’s population increased by 54 percent between 2000 and 2013. The US Census Bureau reports a 20 percent increase from 2010 to 2020. The 2022 “Alaska Economic Trends” estimated that as of July 1, 2021, the Mat-Su population was 108,805.

All indicators show that Mat-Su’s growth is expected to continue. DOLWD projects that the Mat-Su Borough’s population will increase by 35.6 percent between 2021

and 2050; only Skagway is expected to experience a greater percentage growth, at 45.3 percent. In absolute terms, the Mat-Su Borough’s growth will be the largest in the state, and all the projected growth in Southcentral Alaska over that period is expected entirely in the Mat-Su; Anchorage is projected to experience a 3.4 percent population decrease.

“We’re trying to be where the people need us to be to give them care that’s easy and accessible,” says Cyndi Cielsak, clinic manager for Providence ExpressCare, which opened its Wasilla clinic in 2021. “Being where they need us to be rather than us trying to define all the rules.”

Cielsak says offering care in the MatSu is a matter of meeting patients where they are. More healthcare providers closer to home also means providers can build stronger connections within the community and become more invested in their patients’ lives, which improves care overall.

Providence Alaska Medical Center’s ExpressCare clinic offers patients same-day, episodic care at five express care clinics—three in Anchorage, one in Eagle River, and its newest in Wasilla.

“Episodic care is the little episodes of care that you need to get dealt with that are very, very low acuity,” Cielsak explains. “That could be an ear infection, pink eye, a cold or fever, or maybe you have a rash or some minor irritation.”

Access to primary care services, especially same-day care, is difficult across Alaska, so the ExpressCare Clinic’s goal is to provide that access.

“Primary care is tough, and it’s especially tough if you need same-day or urgent care,” Cielsak says. “It can be something small, but if you need it today, it’s even more difficult, so that’s why we decided to expand our services to the Mat-Su area.”

After COVID-19 pandemic-related setbacks, the ExpressCare Clinic opened in 2021. In addition to treating non-acute conditions, the clinic offers flu, tetanus, diphtheria, and pertussis vaccinations, and it can test for COVID-19, strep throat, mononucleosis, tuberculosis, and pregnancy. Providers can also fill select prescriptions, draw any needed

Mann Family Dental in Wasilla relocated its practice in October and moved into a new, larger building that’s more accessible and more comfortable than its previous location.

Mann Family Dental

Alaska Behavioral Health’s Wasilla clinic opened in April and provides comprehensive outpatient behavioral health services to children and adults.

Mann Family Dental in Wasilla relocated its practice in October and moved into a new, larger building that’s more accessible and more comfortable than its previous location.

Mann Family Dental

Alaska Behavioral Health’s Wasilla clinic opened in April and provides comprehensive outpatient behavioral health services to children and adults.

labs, and make referrals for diagnostic imaging or other care to its urgent care clinic or the emergency room.

The ExpressCare clinic is staffed by a two-person team—one provider and one assistant—or patients can choose to connect with its network of virtual providers. Appointments are scheduled for 20 minutes and can be booked online. Walk-in appointments are available, but because patients will be seen at the next available time slot, Cielsak recommends scheduling an appointment online and waiting at home rather than in the clinic’s lobby.

The clinic near the Wasilla Target store is open daily from 7:00 a.m. to 7:00 p.m. It accepts most commercial insurances, Medicare, Medicaid, and has a self-pay option.

“We like to have you in and out, registered in the door and then leaving within 20 minutes,” Cielsak says. “You can get it done on the way to work, get your prescription filled, and pick it up on your way home.”

On the other side of Wasilla Lake, another primary and urgent care option came to the Wasilla area last summer for patients in the Pacific Health Coalition.

The Pacific Health Coalition represents forty-five participating health plans across the Pacific Northwest and offers cost-effective alternatives to office visits through health centers. In Alaska, that care is provided through the Coalition Health Center (CHC), which has clinics in Anchorage, Fairbanks, and, as of July 2022, the Mat-Su.

“We are thrilled to bring our services to our many clients in MatSu, something we have hoped to do for quite some time,” says Amanda Johnson, CEO of Beacon OHSS, which operates the CHC. “As our clients and partners have grown along with us, it was important for Beacon to continue to offer a convenient and quality option for services close to home.”

Like its Anchorage and Fairbanks counterparts, the Mat-Su clinic on Bogard Road provides primary and preventive care and chronic and acute illness prevention and management, as well as prescriptions, X-rays, and laboratory services. CHC services are available to coalition plan members and

“Primary care is tough, and it’s especially tough if you need same-day or urgent care… It can be something small, but if you need it today, it’s even more difficult, so that’s why we decided to expand our services to the Mat-Su area.”

Cyndi Cielsak, Clinic Manager, Providence ExpressCare

their dependents on an appointment and walk-in basis.

“The time to provide someone with behavioral health services is the day they ask for it, not months later,” says Arvidson. With the April opening of Alaska Behavioral Health’s Wasilla clinic, Mat-Su residents can get comprehensive outpatient services as soon as they need it, without the need for weekly drives to Anchorage.

“It’s something we’ve been working towards for a very long time,” Arvidson says. “We’ve wanted to bring our care to our existing Mat-Su client population for quite some time and also respond to the needs for mental health services. We have families and individuals that drive in [to Anchorage] from the Valley, and that’s just really not realistic.”

The Wasilla clinic, Alaska Behavioral Health’s third in Alaska (it also operates clinics in Anchorage and Fairbanks), is a federally designated certified community behavioral health clinic, or CCBHC, Arvidson explains. CCBHCs operate under standards imposed by the Substance Abuse and Mental Health Services Administration, which focus on providing access to care and offering a full continuum of services centered around evidence-based practices and treatments.

The Wasilla clinic’s services are similar to those offered at Alaska Behavioral Health’s Anchorage and Fairbanks clinics, with slight variations to accommodate the community’s specific needs, Arvidson says. In the Mat-Su, the biggest identified need is for children’s mental health services.

“A lot of needs assessments that have been done by the Mat-Su Health Foundation show a need for children’s mental health, and we’ve gotten that feedback from local providers as well,” Arvidson says. “We’re going to adapt to the needs of the community.”

Roughly half of the services provided at Alaska Behavioral Health’s Wasilla clinic focus on children, Arvidson says, though it continues to serve the whole life span. Most of Alaska Behavioral Health’s services are focused on therapy, “and we do that because that’s what the evidence says is the best frontline intervention for mental health challenges,” he says. The clinic

The Coalition Health Center, operated by Beacon OHSS, opened its Mat-Su clinic in 2022. It offers primary and preventive healthcare to coalition members and their dependents. Beacon OHSSalso offers integrated medical care, an on-site psychiatrist, and primary care for adults.

Having mental health services in the community means better access to services and increased opportunities for community outreach, which means better care overall.

“It allows us to build relationships with schools and the local physicians’ clinics and other things that are really beneficial to patients,” Arvidson says. “It’s not just more connections; it’s better care because it’s in your community.”

Deaths from accidental drug overdoses are increasing nationwide, but nowhere more so than in Alaska. In 2022, the Centers for Disease Control and Prevention National Center for Health Statistics reported that Alaska had a 75.3 percent increase in overdose deaths compared to 2020, five times larger than the 15 percent national increase. The Alaska Department of Health and Social Services’ Opioid Data Dashboard reports 169 overdose

deaths from September 2021 to August 2022. Between December 2021 and November 2022, the MatSu Borough led the state in opioidrelated emergency room visits, at 41.8 per 10,000 visits, nearly 1.5 times the rate of visits in Anchorage, which ranks second.

To help combat these numbers, in November 2022 True North Recovery opened Dylan’s Place, an eight-bed residential withdrawal management program. Located in Wasilla, Dylan’s Place is the first and only residential detox facility in the Mat-Su, and one of only a dozen in Alaska. The facility specializes in helping people with methamphetamine and opiate misuse disorders, but it can help patients detox from any substance, True North Recovery founder Karl Solderstrom said in a video posted to its Facebook page in January.

Located within True North Recovery’s Day One Center, Dylan’s Place offers same-day access and provides people dealing with substance misuse a safe, supervised place to go through withdrawal. In addition to the detox

“We’ve wanted to bring our care to our existing Mat-Su client population for quite some time and also respond to the needs for mental health services.

We have families and individuals that drive in [to Anchorage] from the Valley, and that’s just really not realistic.”

Joshua Arvidson, COO, Alaska Behavioral Health

facility, patients have access to crisis services, treatment assessments, peer specialists, and case managers.

Mann Family Dental opened an expanded dental practice in October 2022, just a few miles from the space it occupied since it first opened in 2017. The location in the North Lakes area, between Wasilla and Palmer, puts it in a community with a larger population than either of the Mat-Su’s main incorporated cities, yet nearly equidistant from both.

The new practice, which takes up the entire first floor of a two-floor building, improves accessibility and is larger than the prior location, making it more comfortable for patients and staff. The extra space also allowed Mann to bring on two additional dentists. He says the expansion was necessary if he wanted to continue to provide the same level of service to his existing patients and treat new ones.

“The practice was getting so big, either I had to cut insurances and become out-of-network for patients, or I had to expand,” Mann explains. “I felt like if I was going to become outof-network, to me it feels like breaking a promise, so I had to make a change.”

Mann Family Dental provides general dentistry to children and adults, which includes preventative care, restorative and cosmetic dentistry, and some orthodontic care. Mann says the clinic gets patients from as far north as Talkeetna, Willow, and Houston because of the lack of providers in those areas. All three of Mann Family Dental’s providers accept Medicaid, which Mann says is becoming a rarity; he estimates Wasilla lost half of its Medicaid providers in the last year.

The new space allows the practice to continue to serve its long-standing patients and accommodate the growing number of people moving to, and seeking healthcare in, the Mat-Su.

“There’s just a need,” Mann says. “There are lots of dentists, and lots of good dentists, in the Valley, but there’s still an influx of people every year.”

Mann practiced in Colorado and New Mexico before coming to Alaska in 2017. His initial plan was to take over a dental practice in Eagle River, but after arriving he chose instead to settle in Wasilla, becoming one of the many Alaskans adding to the Mat-Su Borough’s population growth.

“We felt like the Valley was better,” Mann says. “It felt more like home than anything.”

“You sort of hit critical mass where people are going to want to get their healthcare services where they live… I think that’s an evolution in the community—and really a great thing, to have services accessible here. And that can happen now because there’s enough of a population.”

Joshua Arvidson, COO

Alaska Behavioral HealthPrognosis: population growth of nearly 40,000 by 2050. Treatment: add more healthcare services to the Mat-Su Borough.

By Rachael Kvapil

By Rachael Kvapil

Leave a place better than you found it: the Campground Rule is well known and practiced by anyone who roams the outdoors responsibly. Given that the Latin word for camp is the root of the English “campus,” higher education has assimilated the same ethos.

The three main campuses of the University of Alaska system each have an Office of Sustainability to coordinate efforts to reduce the impact of the institution on the environment and to conserve resources for future generations.

At UAA, the most visible program is gathering, sorting, and processing recyclable paper, cardboard, plastics, glass, aluminum, and even vegetable waste from student food services. The

office calls recycling a “gateway to sustainability.” Other initiatives include testing the efficiency of light fixtures, landscaping with site-appropriate plants to minimize maintenance inputs, and replacing disposable eating utensils with reusable tableware at the dining commons.

At UAS, three buildings at the Juneau campus are heated with air source heat pumps. Also, given the high rate of electric vehicle adoption in the capital city thanks to its abundant hydropower, the university hosts two charging ports.

For UAF, students are leading sustainability. In April 2009, the Associated Students of the University of Alaska Fairbanks (ASUAF) approved a $20 per semester Students Initiative

for Renewable Energy Now fee. They later shortened the name to the Student Sustainability Fee for clarity, and a student sustainability board formed to ensure student control of the fees collected. For five years, the Office of Sustainability funded more than fifty student-led sustainability programs and projects in the areas of energy, waste reduction and recycling, transportation, food, and education. As the budget landscape changed, steps were taken to restructure the program, and ASUAF voted to make the sustainability fee permanent.

The Office of Sustainability’s main mission is to make UAF a model for the Circumpolar North and beyond by incorporating sustainability into

Amanda Byrdcurriculum, operations, campus life, and the greater community. In 2014, the UAF Sustainability Plan outlined ways to develop sustainable practices across campus, and UAF Sustainability Coordinator Christi Kemper says at least half of that plan was implemented.

“Early on, we funded a variety of sustainability projects, including energy projects,” says Kemper. “Now our focus is on a handful of studentrun programs that advocate waste prevention and education.”

There are six main programs overseen by the UAF Office of Sustainability. The recycling program employs students to conduct bin pickups around campus, including the dormitories. A team of students collect paper, aluminum, #1 and #2 plastics, and other items for transportation

to the Fairbanks North Star Borough Central Recycling Facility.

The Green Bikes Program offers students a more affordable and sustainable source of transportation. Students are offered discounts for long-term rentals of commuter bikes, tandem bikes, and fat-tire bikes capable of handling winter snow and ice.

The Nanook Grown program provides gardening education to students each summer from peer mentors that work under the guidance of a horticulture professional. Students gain access to fresh produce through this program, and excess food is used at a weekly market table near the UAF Wood Center or donated to programs that feed community members experiencing food insecurity. The program also offers events like zerowaste cooking workshops and farmto-table dinners.

The Food Pantry program assists students on campus experiencing food insecurity by providing one bag of food per week filled with canned items and shelf-stable foods along with other hygiene products.

The Free Store Program is a central, organized location for the campus community to drop off unwanted items or pick up something without an additional charge. Working under the motto “Take what you need and leave what you don’t!” the goal is to reduce waste, save usable items from landfills, and get items to those who can use them.

Along these same lines, the Upcycle Annex program is a studentrun repair café where people can fix items rather than throw them away. Tools and supplies are provided to students along with the help of volunteers to restore things ranging from household appliances and

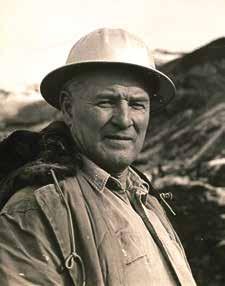

Alaska Center for Energy and Power’s Chris Pike installs a monitoring camera on a solar panel in Kotzebue, 30 miles north of the Arctic Circle. The solar panel is part of the 576kW bifacial array owned and managed by Kotzebue Electric Association.mechanical devices to computers, bicycles, clothing, and more.

In addition to their main programs, Kemper says the Office of Sustainability works with students to develop interdisciplinary internships that incorporate sustainability practices. She says that more businesses are looking for employees who have sustainability skills, whether it’s developing a zero-waste system or finding ways to better use resources on hand. Likewise, she says students are more aware of climate change and are looking for ways to make realistic lifestyle changes to counteract the problem.

Though “sustainable” and “renewable” are two terms used interchangeably when discussing alternative energy, they aren’t completely the same. Sustainability is concerned with living in a way that won’t jeopardize the needs or future generations, whereas renewable energy is any source that can replenish fast enough to keep up with consumption. Many of the popular sources of sustainable energy are also renewable and the primary focus of researchers at UAF, in particular at the Alaska Center for Energy and Power (ACEP).

Chris Pike, a research engineer at ACEP, will be the first to admit there is no magic bullet when it comes to offsetting fossil fuels. Sustainable systems that work well in one region of the state are difficult to implement in another. For instance, Juneau’s coastal environment allows the community to produce nearly all its electricity using hydropower while Interior locations near Healy and Delta Junction are more suitable for wind projects. Pike’s specialty is solar energy.

“What we’re looking at is different than a solar research institute like Arizona State University. Our focus is on cold region and high latitudes,” he says.

ACEP started solar data collection in 2012 when it produced a report on solar thermal systems in the Arctic. In 2017, ACEP published an Alaska solar technology review paper followed by the creation of the Solar Technologies Program, the publication

of "A Solar Design Manual for Alaska," and the construction of the UAF solar test site. Pike says much of this information came from tracking existing solar energy systems. The Solar Technologies Program also conducts field-deployable irradiance measurements, site feasibility assessments, and performance and cost analysis.

Part of the program’s mission is to make sure people have realistic expectations of solar technologies. In Alaska, solar technologies are great in

the spring and summer months but less so in the winter. Currently, there aren’t any feasible long-term storage options that allow people to harvest solar energy in the summer for winter use.

“This means solar panels aren’t generating solar energy during the darkest, coldest parts of the year when we need additional electricity to light and heat our homes,” says Pike. “Researchers are focusing on viable storage methods and have a few possibilities, but nothing that would work in this situation.”

He adds that snow covering solar panels also presents a challenge during the winter.

As the price of solar technologies has decreased, Pike says more people have installed systems. He estimates that most rooftop solar technologies have a ten-year return on investment. As a mature technology, there is already an established process for installing and successfully operating solar technologies. However, Pike reminds existing and potential users that solar alone won’t completely offset fossil fuels.

“If you can successfully implement a system in rural Alaska, you can probably implement it just about anywhere.”

Jeremy Kasper, Director Alaska Center for Energy and Power

“It’s going to take a combination of all the sustainable energies working together,” says Pike. “It might be that you use solar in spring and summer and wind in the winter to create consistent energy.”

ACEP is exploring all those alternatives. Jeremy Kasper, ACEP director, says the main mission of the program is to develop and disseminate robust, costeffective, resilient, and innovative energy solutions for Alaska and beyond by integrating renewable energy resources with existing traditional energy systems.

“Beyond our mission and vision, ACEP is focused on lowering the cost of energy throughout Alaska and developing economic opportunities for the state, its residents, and its industries,” says Kasper.

UAF founded ACEP in 2008. Over the past fifteen years, it has provided resources across a broad spectrum. In the education sector, ACEP works with and supports programs such as Teaching Through Technology, which is a "train the trainers" organization that works primarily with high school teachers. They also provide undergraduate education and internships as well as postgraduate and professional education.

Within the realm of research, ACEP has four primary programs that focus

on the responsible advancement of marine renewable energy; promote commerce and partnerships between Alaska and other Arctic and Pacific regions; optimize diesel-renewable hybrid energy systems for islanded electric microgrids to bring renewable energy options to small communities; and increase understanding of the

Alaska solar resource, identifying new technologies and novel configurations that can improve energy outputs and ease integration concerns.

ACEP also manages several facilities focused on testing energy systems, including the Energy Technology Facility, the Tanana River Hydrokinetic Test Site, and the Solar PV Test Site. Kasper says that the lessons learned through the research and testing process can benefit communities on a global scale.

“If you can successfully implement a system in rural Alaska, you can probably implement it just about anywhere,” says Kasper.

According to Kasper, the three metrics that ACEP prioritizes for any energy system it studies are reliability, resiliency, and economics. He says reliability and resiliency are key in Alaska, as extreme climates require an energy system that doesn’t fail or can be restored quickly. Likewise, high cost of living, in which a large percentage is allocated to energy costs, inhibits economic activity and the adaptation of alternative energy systems.

Kasper says, “By limiting and ideally lowering these costs, we can directly stimulate economic and/or subsistence activity, which increases the viability and sustainability of life in Alaska."

“It’s going to take a combination of all the sustainable energies working together… It might be that you use solar in spring and summer and wind in the winter to create consistent energy.”

Christopher Pike, Research Engineer Alaska Center for Energy and PowerAlaska Center for Energy and Power's Power Systems Integration Lab located in the Energy Technology Facility on the UAF Troth Yeddha' campus in Fairbanks tests renewable energy power systems in a controlled microgrid environment.

Our companies provide engineering, drilling, operations, pipelines, and remote camp services.

Together, they blend expertise and technological muscle in support of smooth, safe, and successful operations in the North Slope oil fields.

The 20MW reactor at Fort Greely was the state’s first— and, for the time being, only— nuclear energy project. From 1962 to 1972, SM-1A provided steam heat and electricity for Fort Greely. Operating costs were too high, though, so the reactor was shut down.

“The control rods, all the radioactive waste, all the radioactive liquids were sent to the Lower 48, but some of the lower-dose materials were left up there for our future efforts,” says Brenda Barber, program manager for the Environmental and Munitions Design Center at the US Army Corps of Engineers (USACE) Baltimore District.

Fifty years after SM-1A was mothballed, USACE is responsible for final cleanup. “These sites have to be fully decommissioned and dismantled within sixty years of initial shutdown. For Fort Greely, that’s 2032,” Barber explains. “Our clock is ticking.”

Engineers encased the SM-1A containment vessel and reactor components in concrete, which makes the decommissioning unusual. “We’re going to have to remove all that concrete so we can gain access to the reactor components and then remove them. So we do have some added complications at Fort Greely,” says Barber.

Last July, USACE awarded a $103 million contract for the decommissioning to Westinghouse Government Services of South Carolina. For comparison, the construction cost of SM-1A and its prototype, SM-1 at Fort Belvoir in Virginia, was approximately $20 million each, adjusting for sixty years of inflation. Who said it was easier to destroy than create?

To shrink the life-cycle cost of the next generation of nuclear power, a separate division of Westinghouse is working on a new system named eVinci. Whereas SM-1A is stationary and medium-sized (hence the designation), eVinci is mobile and smaller than small; it’s considered “micro,” a 5MW reactor that fits inside a 40-foot shipping container.

Westinghouse Vice President of New Plant Market Development Eddie Saab says eVinci is designed to be removed from a site and leave nothing behind. “We believe we will be able to accomplish that with eVinci by making

it transportable,” he says. “There’s more confidence in the back end because of the transportability.”

Instead of monumental edifices, microreactors look more like construction office trailers, and they could be just as temporary.

“Before, everybody was trying to make bigger and bigger reactors; they were trying to contain the cost by making large scale deployment,” says Cristian Rabiti, vice president of business development for USNC. “What happened was, you know, they were not able to control the cost on the building because it was always the first of a kind. So there was an upwards cost escalation, and the benefit of the economy of scale kind of disappeared.”

USNC is a Seattle-based startup that is developing its own microreactor, the Micro Modular Reactor (MMR). The core is buried underground, upright, next to another module that circulates helium coolant. The helium transfers heat to molten salt, which is pumped to a neighboring steam turbine to drive the generator. Molten salt also stores heat overnight to be released during daytime hours.

MMR and eVinci are both designed to be refueled by the manufacturer: reloaded after twenty years in the case of USNC and totally reclaimed and, if desired, replaced after at least eight years in the Westinghouse approach.

The form of the fuel, called TRISO, makes microreactors possible. Tiny spheres of uranium are coated with ceramic, and the composite grains are packed into pellets. “We think that it’s better to have the fuel safe rather than building a safety system around it,” Rabiti says. TRISO has been around since the ‘60s, but recent breakthroughs allowed for scaled-up manufacturing.

Westinghouse needed another innovation to make eVinci possible: heat pipes fabricated to very precise tolerance. “We quickly recognized that the capacity did not exist in the marketplace. To be able to solve that, we have to do it ourselves,” Saab says. The prototype uses heat pipes that are 4 feet long; earlier this year Westinghouse successfully fabricated 12-foot pipes for the next test unit. The commercial model will likely use 22-foot pipes,

assuming they are smooth enough.

Heat pipes are key to the eVinci design. “The air coming in absorbs the heat generated in the heat pipes and goes to a power conversion unit,” Saab explains. “When you pull the heat away from the heat pipes, the sodium goes back to its liquid state from gas and moves back to the other side.” A system driven by simple thermodynamics, with few moving parts, minimizes points of failure in the interest of safety.

USNC has a passive design that relies on high surface area to maximize heat dissipation, which it bills as “walk-away safe,” as bold a promise as the company’s name: Ultra Safe Nuclear Corporation. Confidence, or tempting fate?

“I always say, don't let engineers name a company,” says Mary Woollen, USNC’s director of stakeholder engagement. “And it's funny because we've had some people that love the name, but mostly it's just, sort of, there it is.”

conditions where permafrost is difficult or expensive to excavate.

On the other hand, USNC is using an underground approach. “The main reason is for a design requirement to withstand an airplane crash” or other external hazard, Rabiti says. “We have not yet built one, but from what we’ve discussed [with Alaska construction contractors], it is definitely possible to build the reactor.”

CVEA is interested in siting a pair of MMR reactors in Valdez, connected to its 3,800 customers. The co-op currently relies on the 12MW Solomon Gulch and 6.5MW Allison Creek hydroelectric facilities in summer.

“We have really low rates in the summer,” Million says. “Unfortunately, in the wintertime hydro is not really available. We can get about 20 to 30 percent of our needs with hydro in the winter, but we make up the rest with diesel.”

The CVEA board of directors approved a strategic plan in 2021 to reduce dependence on fossil fuel as backup. “My goal would be to not run it, but ultimately I will never be able to retire my diesel plants,” Million says. “With us being isolated like we are, if our transmission line to Valdez were to go down, I need to have my diesel plant up in the Copper River basin to support our members.”

Woollen and Rabiti were in Alaska earlier this year, making the rounds on wintry roads. They began visiting the state two summers ago, and they found an interested customer in Copper Valley Electric Association (CVEA). Last year, the Glennallen-based utility announced that it would explore the feasibility of deploying MMR as Alaska’s first civilian nuclear generator.

“They actually approached us,” says CVEA CEO Travis Million. “What we found with USNC that was really attractive to us is that they were truly looking to partner with somebody and work collaboratively to try to find a way to make this work.”

The Westinghouse and USNC products are both transportable 5MW modules, yet they differ in key respects. For instance, eVinci sits on a concrete pad, which suits Alaska

The feasibility study was completed last October. Million says, “We found that there are locations that'll work in our service territory where we could site a micromodular reactor. We found the integration into our system would actually work out very well, more or less. We found that social acceptability was pretty good in our service territory.”

However, the economic factors are complicated by the unknown variable of alternative energy grant funding. Furthermore, to make the finances add up, “We would have to sell excess heat in addition to generate electricity because we don't need electricity all the time. We would just need it in the winter months.”

The reactor’s excess heat could be tapped off for a major customer, such as community heat loops, fish processing, or industrial processes.

Until then, “It doesn't make sense and it's too risky for our membership to own and operate the facility,” Million says. “But if we can negotiate a power purchase agreement with USNC that benefits our membership, then we may go forward.”

Meanwhile, at the other end of the Richardson Highway, the US Air Force wants to bring nuclear power to Eielson Air Force Base. Both Eielson and CVEA are on track to have reactors operational by 2027, if at all, so the utility is watching the Air Force process. “We definitely are keeping an eye on it, just from a curiosity standpoint, just to see where they go and who they end up selecting, if they do select somebody,” says Million.

Eielson was selected in October 2021 to host a pilot project for the Air Force’s first (and so far only) microreactor, replacing the base’s coal-fired power plant. A request for proposals closed January 31, 2023, and the project is now in the source selection phase.

Among the potential sources is Westinghouse. “Our technology is

well suited for that application,” says Saab, although he has reservations about the process. “I think the Air Force is going through a first-of-a-kind procurement model; they’ve asked for a power purchase agreement, which for a first-of-a-kind technology can be challenging.” He says Westinghouse provided recommendations to adjust the process, so he hopes for good dialog with the Air Force.

Eielson, Fort Greely, Copper Valley… why is the Richardson Highway Alaska's nuclear neighborhood? Turns out to have the magic mix of off-the-grid and on-the-road.

“We definitely need a certain amount of people to be sure that we have enough demand for those reactors… That is part of the math,” says Rabiti. “And the other thing in this area, [with] the connectivity to the grid, the price of electricity is high. So essentially, it's a kind of mix of two components: the price of electricity and the presence of a large enough base of customers.”

Million also sees the region as a sweet spot. “The fact that we’re on the road system to where a unit could

be deployed and demonstrated and could be easily accessed, I think, was a big driver as well,” he says. “I think the manufacturers right now are wanting something that they can easily get access to and keep an eye on while they're deploying and testing.”

Saab concurs. “Typical first deployments are in areas that are accessible and have an immediate need,” he says. “I do anticipate, and I am hopeful that, as eVinci shows success in Alaska, it unlocks additional opportunities across Alaska, and those end-users or communities can benefit from the technology.”

The day before CVEA announced the feasibility study with USNC, Governor Mike Dunleavy requested legislation, Senate Bill 177, to facilitate the deployment of microreactors. It exempts reactors under 50MW from requiring legislative approval for siting. It also streamlines the requirements for studies, now spread across six state departments, relying instead on work done by UAF and the Alaska Center for Energy and Power.

The key to eVinci is incredibly smooth and durable iron-chromium-aluminum alloy pipes. Westinghouse achieved a milestone this year by manufacturing 12-foot heat pipes; the commercial version will be twice as long.A few months later, Dunleavy signed the bill into law at his first annual Sustainable Energy Conference, where nuclear energy was easily the most common alternative source represented at vendor tables. Westinghouse was there, drumming up interest in eVinci.

“When we look in Alaska, we see remote communities, we see industrial applications where there isn’t an easy connection to the grid to provide that power,” says Saab. Indeed, he says design started with those applications in mind, which led to the 5MW form factor.

Not many off-grid villages need a 5MW power plant, though. Of the fifty-eight communities in the Alaska Village Electric Cooperative, only Bethel uses at least that much power; the rest have generating capacity of 1MW, give or take.

That’s fine, says Saab; eVinci can be throttled down. “The luxury of the technology is the output and the operational life are fairly linear: if there is a need for half the power, for 2.5MW, we can actually run the eVinci for about sixteen years,” he says.

For communities that already have (or hope to install) renewable energy infrastructure, a microreactor can fill the gaps. “It can load follow, so eVinci would make a great partner to a wind or solar

farm where you have some intermittent load and you need a technology to complement it,” Saab says.

But why should Alaska import uranium-fueled modules when the

eVinci microreactor would sit on a concrete pad and, when the fuel supply is exhausted after eight years, the entire site could be restored to greenfield, if desired. Westinghouse

state has more wind, hydrokinetic, and geothermal energy than it can use? Saab views microreactors as a bridge to decarbonization, which would include extraction of critical minerals. “If we want to unlock some of the natural resources in certain regions, you need a technology that can do it safely,” he says.

Partly for that reason, Westinghouse was invited to a recent luncheon at the Alaska Support Industry Alliance, a nonprofit mainly interested in oil and gas development. Alliance CEO Rebecca Logan welcomes nuclear energy to the state’s portfolio. “A huge driving interest is that we have less oil and gas work,” she says. “You’re always looking at where the next jobs are coming from and what new things are coming to Alaska.”

Nuclear energy is not welcome everywhere. Microreactor vendors are quite aware that the power source is a threshold some communities do not want to cross.

Yet pushback in Alaska has been relatively mild, according to Saab. “When we provide the facts and the science, people are open to listen,” he says, adding that skeptics are mainly waiting to see the technology tested somewhere else.

Million has seen a similar reception from CVEA members. “A lot of the people that were either on the fence or adamantly against it were either more open-minded or accepting of it. There are a few groups of people that are just adamantly against anything nuclear at all, and, you know, it's just how it's

gonna be,” he says.

“There will be no reactors anywhere unless you can gain public trust,” says Woollen. “We don't aim to try to change hearts and minds, but I do ask that, I mean, I hope that people can at least listen, try to understand, and then make their judgments.”

If USNC or Westinghouse bring microreactors to Alaska by 2027, Fort Greely’s SM-1A will still be in the demolition phase. Start to finish, the job is expected to take six years.

Meanwhile, the CVEA board is expected to decide late this summer whether to go down the reactor road. “We’re going to continue to have conversations with our membership and any stakeholders who are interested

Above, the idled turbine of the SM-1A reactor at Fort Greely, and the exterior, below left. All remaining radioactive materials were sealed in the core, below right, in 1972, waiting for a demolition contract that was awarded last year.

Above, the idled turbine of the SM-1A reactor at Fort Greely, and the exterior, below left. All remaining radioactive materials were sealed in the core, below right, in 1972, waiting for a demolition contract that was awarded last year.

with our process, and we'll be working with USNC to see if we can develop a contract that works for them and works for our members,” says Million.

The only nuclear power plant to ever operate in Alaska is being decommissioned at the same time the new generation of microreactors is coming to the state. Is that a coincidence?

Saab doesn’t think so. “Our eVinci technology is on its own TRL [technology readiness level] pathway,

and we’re at the point now where we can proactively pursue opportunities in Alaska,” he says.

Yet Barber suggests a way USACE’s work might have contributed to commercial developments. “Likely why you’re seeing what you’re seeing in the microreactor arena is that we were able to demonstrate the lifecycle completion of a reactor,” she says. “When we decommissioned and dismantled the MH-1 on the Sturgis vessel, the Army could demonstrate

that full life cycle cost, so it did provide some input into potentially bringing reactors back online.”

Whichever vendor supplies Eielson, and whether CVEA brings nuclear energy to its Richardson Highway grid, the process is a learning opportunity for Alaska as a whole. Million says, “If it doesn't work for us, but the work that we've done on the front end helps benefit another utility to go forward with it, I look at that as a huge win.”

The cover story for this issue, “No One Likes High Gas Prices,” was inspired by this question: Who actually determines the price of gas? In an election year, the answer is obvious—whichever elected official a person doesn’t support is clearly responsible for unacceptably high gas prices. For those less interested in blame and genuinely curious about the factors behind the cost of retail gasoline, the article features insights from local gasoline retailers who explain that it’s a bit more complicated than the choices of any one individual.

Most conversations about oil and gas, refined or otherwise, require context to fully understand or find a resolution to an issue. “Gasline on Wheels,” for example, looks at how natural gas produced as a byproduct on the North Slope will finally get exported to another market. That market is the Interior, so it’s not quite as far from the Alaska Arctic as some have envisioned, but it’s still a milestone for an industry that’s been reinjecting a perfectly good commodity back into the ground for decades. Has the funding for a massive LNG export project finally come through? No. But it may just be that this step in monetizing North Slope gas will lead to fully utilizing the potential of gas in Prudhoe Bay down the road. Literally.

But oil and gas development is never rushed in Alaska, and the effects of oil and gas activities on Alaska’s economic development are equally long-lived. In “Hydrocarbons Pave the Way for Pick.Click.Give.” we look at just how oil royalties laid the foundation for a statewide charitable giving program that now provides millions of dollars to Alaska nonprofits every year.

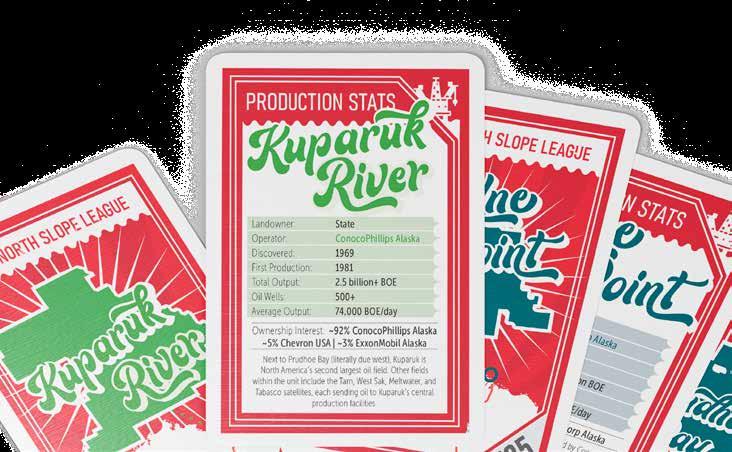

To round out this special section, we also include an article on Pantheon's oil discovery and a look at Hilcorp's plans for 2023 in Cook Inlet. North Slope enthusiasts can check out our update on North Slope activity and, in their 2023 debut, our North Slope Operating Unit Baseball Cards. Like our nation’s talented athletes, it’s worth knowing the stats of the operations that drive much of our state’s economy.

In mid-2022 Hilcorp Alaska notified local utilities that it did not have enough natural gas reserves to commit to new contracts as current contracts expired. At the time, contracts with the oil and gas producer were up for renewal in periods ranging from two to eleven years. Many utilities are already taking action to reduce their reliance on natural gas or to secure contracts with other providers. The Fairbanks North Star Borough’s Interior Gas Utility, for example, has already announced its intent to power the Interior with North Slope natural gas.

Whatever plans Alaska’s utilities implement in the coming years to reduce their reliance on Cook Inlet natural gas, a smooth transition depends on ongoing production, which shouldn’t be a problem.

According to the “2022 Cook Inlet Gas Forecast” published in January 2023 by the Alaska Department of Natural Resources' (DNR) Division of Oil and Gas, there are “significant gas volumes potentially available through additional investment and development in currently producing fields” in Cook Inlet. It estimates 820 billion cubic feet of proved gas reserves in Cook Inlet that is “economic to develop.” The report notes there are “key uncertainties” that affect that estimate, such as costs, production rates, and the individual rate of return a company may need to invest.

The report also estimates that those gas volumes can meet the current level of demand for natural gas until approximately 2027, with this caveat: “This report is not intended to be a

prediction of how Cook Inlet gas supply and demand will play out in future years. Rather, it serves as a tool for understanding Cook Inlet’s capacity to meet natural gas demand under present conditions and assumptions.”

According to Hilcorp spokesperson Luke Miller, the company anticipates spending “hundreds of millions of dollars” in Cook Inlet over the next few years to produce additional gas, but still it urged local utilities to diversify their energy portfolios. Whether or not Hilcorp will be producing the lion’s share of Cook Inlet gas far into the future, it is still investing in its operations there and has submitted Plans of Development (POD) to DNR for 2023 laying out what some of that investment entails. [Editor’s note: As of press time in early April, the majority of the POD were submitted to, but not yet approved by, DNR.]

In its 2023 POD for the North Cook Inlet Unit (NCIU), Hilcorp indicated it had achieved several requirements of its 2022 POD, including mobilizing Rig 151 to the Tyonek Platform in May 2022 to drill several sidetrack wells, five of which were successful. The sixth was an unsuccessful sidetrack attempt of NCIU A-12, and as a result Hilcorp is planning the complete abandonment of the wellbore by the end of June, which is when the 2022 POD period ends. According to the POD, “The plugged back well will be utilized for a future sidetrack opportunity.”

Hilcorp also completed a wellwork and workover program and surface facility operations at the Tyonek Platform.

The 2023 POD, which covers July 2023 through June 2024, states, “In 2023, Hilcorp will continue to build an inventory of future development projects, including grassroots wells, sidetracks, and workovers to increase rate and reserves, specifically to focus on exploitation of potential gas resources within the Beluga and Sterling formations.”

In July it anticipates drilling up to three grassroots wells from the Tyonek Platform, potentially including NCIU A-17 and NCIU A-18, both targeting

Beluga sands. It’s also planning up to two sidetrack wells, one at NCIU B-01A and the other unspecified.

Hilcorp’s attempts to bring the North Trading Bay Unit (NTBU) back into production were frustrated by mechanical issues in 2022. Hilcorp made two attempts to drill NTBU A-10RD2 before notifying DNR in July 2022 that alternative drilling plans were underway

to redesign the sidetrack for another attempt. Hilcorp spudded A-10RD3 in mid-March, drilling operations were underway as of April, and the company anticipated drilling would be complete early this month. Hilcorp believes that NTBU production will be restored in Q3 2023. According to the POD, Hilcorp estimates A-10RD3 will cost more than $8 million. It continues, “At this time, Hilcorp anticipates that the A-10RD3 is sufficiently designed and located to efficiently drain remaining gas reserves associated with the NTBU's Tyonek

formation for the remainder of field life,” and “Hilcorp currently has no plans for further exploration or delineation in the NTBU.”

That said, work will continue in NTBU as Hilcorp executes a plugging and abandonment (P&A) program at the Spark and Spurr platforms in 2024, as they are “no longer suitable for drilling or production operations.”

Hilcorp’s Trading Bay Unit includes the McArthur River Field and the Trading Bay Field. In calendar year 2022, Hilcorp produced 1,049 thousand barrels of oil and 6,593 million standard cubic feet of gas at the McArthur River Field and 311 million barrels of oil and 431 million standard cubic feet of gas from the Monopod Platform that taps the Trading Bay Field.

The 2023 POD for the Trading Bay Unit anticipates that current oil and gas production will be maintained and/or enhanced, “particularly through the drilling of the A-10RD2 from the Monopod.”

According to the POD, “The anticipated sidetrack drilling of the A-10RD3 from the Monopod into the [NTBU], if successful, will restore production to the NTBU. Going forward, Hilcorp anticipates that gas volumes produced from NTBU via the A-10RD3 will satisfy the Monopod Platform's operational fuel demand and will thus eliminate the need to transport gas to the Monopod from the Steelhead platform. This, in turn, will result in a net increase of gas sales from the Trading Bay Unit and extend the operational life of the unit. After sustained production from the A-10RD3 is confirmed, Hilcorp anticipates submitting a formal proposal to DNR to merge the North Trading Bay Unit into the Trading Bay Unit.”

In calendar year 2022, Hilcorp produced 875,600 barrels of oil and 1.3 billion cubic feet of gas at the Granite Point Unit (GPU). In April 2022, Hilcorp added perforation in GP 2413RD2 in the C6 sands, attempting to

return the well to production. Other work conducted, according to the 2022 POD, included identifying rotary development wells targeting gas in the Tyonek formation from the Bruce platform and annual regulatory inspections on current GPU facilities.

For 2023, Hilcorp anticipates that current oil and gas production will be maintained and enhanced. Using Rig 151, it plans to drill up to three grassroots wells from the Bruce platform in Q4 2023 targeting the Tyonek formation. It will also continue to evaluate current GPU well stock for “various rig and non-rig well projects during the 2023 POD period,” which for GPU runs through June 2024.

In June of 2021, the Middle Ground Shoal Fuel Gas System, the subsea pipeline system that provides fuel gas from shore to Platforms A and C in the Middle Ground Shoal (MGS) Unit, developed a leak. DNR approved a suspension of production at platforms A and C as Hilcorp looked into options to repair or replace the system. In March 2022, at Hilcorp’s request, DNR conditionally approved an extension of the suspension of production through December 2022. In November 2022, Hilcorp provided a technical briefing to DNR on options for repair or replacement of the fuel gas pipelines. Hilcorp also introduced

concepts related to repurposing idle platforms, and DNR approved an additional suspension of production through June.

As of the 2023 POD, Hilcorp’s evaluation of the Middle Ground Shoal Fuel Gas System determined that the cost associated with its repair or replacement is not economic as a stand-alone project. In addition, the company found that Platform C has reached its economic limit and won’t be returned to production. Platform A does have potential for reactivation, but not as a stand-alone project. Hilcorp estimates that recoverable reserves associated with Platform A exceed 3 million barrels of oil equivalent, but that does not justify the cost of repairing the subsea system.

Instead, Hilcorp’s 2023 POD proposes a field study on a known gas structure north of the Baker platform, which is located within the current MGS Unit area but may potentially extend farther north to currently nonutilized state leases. The study will identify potential drilling targets and evaluate whether the Baker Platform is suitable for drilling the area or if a new platform would be required. If a new offshore platform is constructed, it would require installation of a new pipeline to shore, which may create a contingency to potentially reactivate Platform A.

Other 2023 POD work includes P&A on wells at the Dillon Platform. Once wells on the platform have been plugged and abandoned, Hilcorp plans to contract the MSG Unit boundary to exclude the leases associated with the platform.

As Platform A awaits the results of the field study, Hilcorp plans to utilize it as an unmanned lighthouse facility, maintaining current wells and production facilities in case the platform may be reactivated in the future. Platform C will also be managed as an unmanned lighthouse facility, and P&A work for wells there will be integrated into Hilcorp’s multiyear P&A program.

In 2022 Hilcorp maintained production from the Lewis River Gas

According to the “2022 Cook Inlet Gas Forecast,” 20 billion cubic feet of proved gas reserves in Cook Inlet are “economic to develop.”

Pool #2 as planned in its 2022 POD, producing 259 million standard cubic feet. Hilcorp’s 2023 POD does not include any exploration or delineation activities, but it does include drilling one well, LRU C-01, spudding in June and targeting Sterling, Beluga, and/or Tyonek Sands.

At its Beluga River Unit, in accordance with its 2022 POD, last year Hilcorp drilled three grassroots wells and one sidetrack, using Rig 147 to target Sterling and Beluga gas sands. In its 2023 POD, with the same goal, Hilcorp anticipates drilling up to five wells: BRU 223-34, BRU 241-23, BRU 213-26, BRU 214-27, and BRU 211-35.

In an amendment to its 2023 POD for Beluga River Unit, Hilcorp requested authorization to drill two grass roots units on K Pad. That project would include the installation of associated tie-in infrastructure including gas flowing, electrical instrumentation, well cellars, and conductors. DNR approved the amendment, with the condition that a certified as-built survey of the project be provided to DNR within one year of placement.

In February, Hilcorp submitted an amendment to its eighteenth POD for the Ninilchik Unit, which is effective through July 31. In the amendment, Hilcorp explains that a recent gas discovery in the Pearl Structure within the unit supports three additional wells to be completed in Q2 2023. The Paxton 12, Pearl 10, and Pearl 11 grassroots wells are being drilled from the Paxton and Pearl Pads, respectively, and will target the Beluga and Tyonek Gas sands located within the Ninilchik Unit.

The drilling requires expansion of the Pearl Pad, located 4 miles northwest of Ninilchik on privately-owned surface lands; the pad expansion will have a footprint of 1.62 acres.

DNR approved the amendment in March.

The following update of oil and gas activity on the North Slope is in no way comprehensive— that’s a tall order for any single article. Instead, we have chosen a few projects and drilling programs that highlight recently completed work from 2022 and anticipated work in 2023.

The biggest news on the North Slope for 2023 is that Willow got the green light from the US Department of the Interior (DOI). Following the DOI’s approval, an environmental group immediately sued to halt the project, challenging the Biden Administration’s decision. While the lawsuit is ongoing, a judge denied the group’s requested injunction to halt work. As of April, the Willow project has broken ground on construction of a gravel road. According to ConocoPhillips, its next steps are continuing a review of the DOI’s Record of Decision (ROD) and advancing an internal approval process, moving steadily toward a Final Investment Decision.

According to ConocoPhillips chairman and CEO Ryan Lance, “This was the right decision for Alaska and our Nation. Willow fits within the Biden Administration’s priorities on environmental and social justice, facilitating the energy transition and enhancing our energy security, all while creating good union jobs and providing benefits to Alaska Native communities.”

The DOI selected Alternative E from the Willow Project EIS, which reduces the project’s footprint from five potential drill sites to three: BT1, BT2, and BT3. In its ROD, DOI further

specified that it “disapproved, rather than defers, drill site BT5 and associated infrastructure.” The three sites may have a combined total of up to 199 wells. The “Approved Willow Project Description” sidebar gives a detailed account of ConocoPhillips Alaska’s authorized plans for Willow.

In February, ConocoPhillips Alaska submitted its twenty-fifth Plan of Development (POD) for its Colville River Unit. According to the POD, ConocoPhillips Alaska completed all approved development plans included in its twenty-fourth POD, including the CD4-597 opportunity well, the expansion of CD4, construction and start-up of the Alpine Power Expansion, and the CD133A disposal well, which replaces the now plugged and abandoned WD03. The company also completed an additional opportunity within the Fiord West Kuparuk participating area, spudding the CD2-361 producer in Q4 2022.

Much of the company’s plans for July 2023 through July 2024 are confidential, but ConocoPhillips Alaska did share that, at the Alpine Pool, drilling will continue for CD2-361 into Q2 of 2023. The company states: “With continued success on both the drilling and reservoir fronts, it is expected that a third well, the CD2-320 injector, will be spud within 2023.”

The POD also gave a summary of the now-completed Alpine Power

Expansion, whose purpose was to meet future power demand. The scope of the project included installing a 16.5MW gas turbine generator, upgrading existing switchgear from 2000A to 3000A, and debottlenecking the fuel gas system to increase flowrate.

ConocoPhillips Alaska’s Colville River Unit produced approximately 657 million barrels of oil in 2022.

According to a March amendment to its 2023 POD, Santos has completed front end engineering and design and made a final investment decision in August 2022 to move forward with the Pikka project. It has updated its POD to include drilling forty-three horizontal wells at ND-B, split into twentytwo production wells and twentyone injector wells for enhanced oil recovery. Also at ND-B, Santos will drill a disposal well to accommodate a grind and inject facility.