Q1 2023 LOWER MANHATTAN REAL

Lower Manhattan’s office market continued to show signs of struggle in the first quarter. Leasing totals declined from the end of 2022 and vacancy rates remain stubbornly high, particularly in Class B properties. The district’s ongoing challenges are mirrored across all Manhattan submarkets as the city’s office market navigates continued macroeconomic uncertainty. Though office leasing is still trying to find its footing, other sectors of Lower Manhattan’s economy continue to mount a recovery. Median apartment rents dipped slightly but remain high as Lower Manhattan remains a residential neighborhood of choice. The hospitality industry has reason for optimism, with new hotels opening, travel increasing and positive momentum in both hotel occupancy and room rates. Fourteen retailers have opened so far in early 2023, similar to rates seen at the end of last year, and another 16 recently announced plans for new storefronts in Lower Manhattan.

Leasing fell significantly across all Manhattan office markets during the first quarter. Prospective tenants continue to delay or forego new leasing amid ongoing macroeconomic headwinds and the persistence of hybrid work. Lower Manhattan recorded 500,000 sq. ft. of office leasing according to CBRE — the second consecutive quarter in which leasing activity declined, and the lowest quarterly total since the first quarter of 2021. Leasing activity fell by 36% from the previous quarter and remains 51% below the five-year quarterly average.

Midtown saw 2.52 million sq. ft. of leasing activity in the first quarter, down 2% from the previous quarter and 31% behind the five-year quarterly average. This is the second consecutive quarter below 3 million sq. ft. and the secondlowest quarterly total since the spring of 2021.

500,000

Square Feet Of New Leasing In The First Quarter — 51% Below The Five-Year Quarterly Average

Midtown South recorded 832,000 sq. ft. of leasing in the first quarter — down 22% from the previous and 33% below the five-year quarterly average. Leasing in Midtown South has now fallen below the five-year quarterly average in three out of the last four quarters.

Renewals accounted for 340,000 sq. ft. of first quarter leasing, up 85% from the first quarter of 2022 and more than three times the levels seen in the previous quarter. Law firm Cadwalader Wickersham & Taft signed a 225,000 sq. ft. renewal at 200 Liberty Street, downsizing from its previous 348,897 sq. ft. footprint. Cadwalder’s renewal was the second largest deal in Manhattan during the first quarter. Other large tenants to recommit to Lower Manhattan include Stripe, the payment processing technology firm, which signed a one-year extension of its 115,000 sq. ft. lease at 199 Water Street, The King’s College, which renewed its 52,542 sq. ft. lease at 52 Broadway, and the Brennan Center for Justice, which renewed its 49,885 lease at 120 Broadway.

The tech and creative sectors continued to drive relocations to Lower Manhattan. Stubhub signed a lease for 44,000 sq. ft. at 3 World Trade Center, relocating and consolidating from multiple locations in Midtown. StubHub’s lease brings 3 WTC to nearly 90% leased. MakerBot Industries, a 3D printing technology company, signed a lease for 30,467 SF at 100 Pearl Street, relocating from 1 Metrotech Center in Brooklyn. Two advertising agencies signed leases totaling 19,000 sq. ft. at 75 Broad Street, both relocating from Midtown South. Finally, Kain Capital LLC, a financial services firm, signed a 4,700 sq. ft. lease at One World Trade Center, relocating from Midtown.

Moves within Lower Manhattan also accounted for a sizable share of leasing during the first quarter. Revlon signed a lease for 68,518 sq. ft. of DailyPay sublet space at 55 Water Street, relocating and downsizing from its previous 106,915 sq. ft. footprint at One New York Plaza. Axsome Therapeutics, Inc., a biopharmaceutical company, relocated from 22 Cortlandt Street to a 48,486 sq. ft. space at One World Trade Center. Community Access, a mental health services nonprofit, consolidated its offices at 32 Old Slip and 80 Broad Street into a 16,242 sq. ft. space at One State Street Plaza.

Other notable deals executed in the first quarter include telecommunications firm MetTel Inc.’s 50,079 sq. ft. lease at 55 Water Street and Capstone Investment Advisors’ 40,716 sq. ft. lease at 7 World Trade Center.

According to Cushman & Wakefield, Lower Manhattan’s overall vacancy rate inched down by 10 basis points (bps) to 22.6% in the first quarter after reaching a record high at the end of 2022. Overall vacancy remains slightly higher year-over-year, reflecting several large blocks of space that entered the market last year. Across office-class types in Lower Manhattan, Class A vacancy fell slightly from the previous quarter to 22.5%, though it grew by 0.8% yearover-year. The class B vacancy rate was 24.4%, up 1.4% year-over-year.

Amid sluggish leasing activity, the addition of new direct and sublease spaces outpaced new leasing in the first quarter. Though flight to quality continues to drive new leasing, Class A and overall vacancies in the World Trade submarket (consisting of mostly newer buildings in and around Brookfield Place and the World Trade Center campus) increased by 9.4% and 8.2%, respectively, growing to 20.2% and 18.5% as nearly 151,000 sq. ft. were added to the market in the first quarter. Additionally, Lower Manhattan now contains two submarkets with vacancy rates above 31 percent: the Financial West submarket (roughly west of Broadway, south of Liberty Street) is now 33.2% vacant. This is a slight improvement from the previous quarter, but still the highest vacancy among all Manhattan submarkets. In the Insurance District (roughly east of Broadway, north of Maiden Lane), vacancy rates grew to 31.8%, up 30 bps from the previous quarter.

Though Lower Manhattan’s vacancy rate remains the highest in Manhattan, the borough’s other markets are also experiencing stubbornly high levels of vacancy. Class A vacancy rates were above 21% for the second consecutive quarter and overall vacancy rates were above 22% for the second consecutive quarter across all Manhattan office markets at the beginning of 2023.

Midtown’s overall vacancy rate was flat over the previous quarter but increased over the past year from 21.2% to 22.1%. Class A office vacancy in Midtown dipped slightly to 21.4% as direct space was removed from the market, while class B office vacancy grew slightly to an all time high of 23.8%.

Source: Cushman & Wakefield

Source: Cushman & Wakefield

Midtown South’s overall vacancy inched up slightly to 22.5%, driven by an uptick of sublease supply coming onto the market. Class A office vacancies in Midtown South fell slightly to 22.5%, however, as 360 Park Avenue South was taken off the market due to renovations, and Class B office vacancy rose by 1.3% year-over-year to 24.4%.

Lower Manhattan asking rents grew slightly in the first quarter after recording six consecutive quarters of falling rents, reflecting higher-priced space entering the market in the World Trade submarket. Though rents in Midtown and Midtown South grew over the past five quarters, diverging from patterns seen in Lower Manhattan, rents in Midtown South dipped for the first time since the third quarter of 2021. Meanwhile, both overall and Class A rents inched up modestly in Lower Manhattan and Midtown.

According to Cushman & Wakefield, Lower Manhattan’s overall average asking rent grew slightly over the previous quarter, but fell by 1.5% to $56.3 per sq. ft. over the past year — the sixth consecutive quarter below $60. Direct asking rents slid by 2.6 % over the past year to $59.65 per sq. ft.. Class A asking rents grew by 1.5% over the past quarter to $59.86 per sq. ft., but remain 2% lower than at the beginning of 2022. Class B average asking grew slightly over the previous quarter to $52.24, but fell 40 bps year-over-year.

Both overall and Class A office rents in Midtown increased over the past quarter to $76.95 and $83.77, respectively, due to higher-priced space entering the market at Five Manhattan West and 1440 Broadway. In Midtown South, overall asking rents dipped 1.7% over the quarter to $75.4 per sq. ft., driven by lower-priced space additions in the Hudson Square/West Village submarket, though they grew nearly six percent yearover-year. Class A rents in Midtown South rose 2.6% over the past year to $92.64.

$59.86

Lower Manhattan Class A Rent — Up 1.5% From The End Of 2022

Source: Cushman & Wakefield

Development Site Sales

45 Broad Street: Madison Equities revealed it sold its interest in the development site at 45 Broad Street to development firm Gemdale for an undisclosed amount. Madison Equities purchased the site for $86 million in 2015 with plans to build a 226-unit condominium building, but foundation work stalled at the onset of the pandemic. Gemdale’s updated plans for the site call for a 60-story, 150 unit condominium development.

33 Peck Slip: Sono Hospitality, a South Korea-based hospitality group, closed on the purchase of the 66-room Mr. C Seaport hotel at 33 Peck Slip from the Ghassemieh family, who previously owned and operated the hotel in partnership with Cipriani. Sono purchased the hotel for $60 million, or just over $900,000 per room. Sono rebranded the property as the 33 Seaport Hotel

Historic Front Street: The portfolio of buildings at 213-217 Front Street, 214 Front Street and 236 Front Street/24 Peck Slip was listed for sale by owners The Durst Organization and Zuberry Associates for $87 million. The portfolio contains 95 rental apartments and 15 retail units across more than 140,000 sq. ft.

241 Water Street: The 32,000 sq. ft. building that housed the Blue School was listed for sale for $28 million. The Blue School, a private school operated by the founders of the Blue Man Group, has occupied the space since 2011. The Blue School is set to close at the end of the academic year.

2 West Street: A judge ordered an auction for the 298-room Wagner Hotel at 2 West Street with a reported opening bid of $60 million. Urban Commons, which owns the hotel, filed for Chapter 11 bankruptcy in November 2022 after reportedly defaulting on a $96 million loan. Urban Commons originally purchased the hotel for $151 million in 2018.

65 West Broadway: The construction site at 65 West Broadway was listed for sale by Cape Advisors. Plans for the site call for a 10-story, 68,000 sq. ft. residential building containing 23 condo units and ground floor retail space. Construction on the site began in 2017, but has been stalled since 2019. An asking price for the site has not yet been disclosed.

125 Maiden Lane: The United Nations International Children’s Emergency Fund (UNICEF) listed its 70,000 sq. ft., three-floor office condo for sale at 125 Maiden Lane. UNICEF is seeking to reduce its footprint as hybrid work has pushed the organization to reconsider its space needs. An asking price has not yet been disclosed. UNICEF originally purchased the condo in 2007 for $29.9 million.

Fourteen retailers opened in the early months of 2023, down from the 19 that opened in the fourth quarter of last year. About half were food and beverage businesses, including:

• Galerie bar and lounge at the Smyth Hotel at 85 West Broadway;

• Henry’s Sandwich at 82 Fulton Street;

• KBOB Korean Barbeque at Urbanspace at 100 Pearl Street;

• Liberty Bagel at 32 Broadway;

• Siena Bakehouse at 94 Greenwich Street;

• Playa Bowls, a smoothie and acai bowl shop, at 46 Fulton Street;

• Paris Baguette bakery at 55 Fulton Street within Fulton Market;

• London and Martin Co., from the team behind Broadstone, at 6 Stone Street in the former Murphy’s Tavern Space;

• Sammy’s Taqueria at Gansevoort Liberty Market in Westfield WTC; and

Several notable retail stores also opened in the first quarter, including:

• A long-awaited, 42,000 sq. ft. new Whole Foods location at One Wall Street, whose opening fulfills an enduring desire among neighborhood residents for onestop, high quality grocery shopping in Lower Manhattan;

• No. 1 Caviar, a gourmet caviar boutique, at 14 Wall Street;

• The Daily Grocer, a subscription-free, on-demand meal kit store;

• Burte Lash & Nails at 67 Liberty Street; and

• Area 70 Pine fitness studio at 70 Pine Street.

Additionally, 16 retailers announced plans in the first quarter to open storefronts in Lower Manhattan. Among those who announced during the first quarter are:

• CompletePlayground, a nonprofit family activity center, will open a 40,000 sq. ft. facility at 30 Broad Street in the former New York Sports Club space.

CompletePlayground offers programming for children through classes in gymnastics, martial arts, rock climbing, dance and other activities;

• Municipal Credit Union at 270 Broadway, relocating from nearby 2 Lafayette Street;

• Golfzon Social, a indoor golf-simulator studio featuring a bar and restaurant, at 200 Liberty Street in Brookfield Place;

• Seaport Pizzeria at 64 Fulton Street in the former Justino’s space;

• Hutch & Waldo, an Australian health foods restaurant, at 300 Vesey Street in Brookfield Place;

• Brickyard Craft Kitchen and Bar in the former Barleycorn space at 23 Park Place; and

• Barcade at 53 Park Place in the 7,500 sq. ft. former Amish Market space.

Sadly, 25 Lower Manhattan retailers closed in the first quarter. Notable closures include:

• Bellini Italian restaurant at 33 Peck Slip in the former Mr. C Seaport hotel;

• Lekka Burger, the popular vegan burger joint 81 Warren Street;

• Wall & Water modern American restaurant at 75 Wall Street, after operating for 13 years;

• A longstanding Papaya Dog at 46 Fulton Street; and

• Accents New York stationery store at 102 North End Avenue, after operating for 11 years.

Finally, two major Lower Manhattan retailers that were thought to have permanently closed during the pandemic are slated to reopen:

• Century 21 will reopen its flagship department store at 22 Cortlandt Street in Spring 2023, in partnership with Legends Hospitality. Century 21 will shrink its footprint to 100,000 sq. ft. over four floors from its previous 200,000 sq. ft; and

• Delmonico’s is poised to reopen later this year at 56 Beaver Street after closing at the onset of the pandemic.

Lower Manhattan welcomed 7.4 million tourists (defined as those traveling to Lower Manhattan from outside the tristate area) and 12.1 million total unique visitors in 2022 as domestic travel returned and most remaining international travel restrictions were lifted. Though still far below 2019’s 14 million tourists, 2022’s tourism number was more than double the visitation seen in 2020. The share of international visitors nearly doubled to 55% from 28% in 2021. Following Latin America’s lead in 2021, the bulk of international traveler origination shifted back to traditional western European markets in 2022. Asian tourism continues to lag behind its 2019 levels due in large part to ongoing travel restrictions and geopolitical issues.

56.7 million visitors came to New York City in 2022, or 85% of 2019 visitation levels, and more than double the 22.3 million in 2020. Looking forward, international travel is expected to steadily increase, and New York City Tourism + Conventions forecasts that domestic travel will exceed prepandemic levels later in 2023.

The current hotel inventory in Lower Manhattan stands 9,343 rooms across 44 hotels, including three hotels that opened in the first quarter:

• The Fidi Hotel opened at 11 Stone Street. The 232room hotel contains the MINT Bar and restaurant,

• German hotel brand Motel One opened its first US location with the 326-room Cloud One Hotel New YorkDowntown at 133 Greenwich Street, rebranding from the former Courtyard WTC; and

• 33 Seaport Hotel opened at 33 Peck Slip with 66 rooms, rebranding from the former Mr. C Seaport hotel.

There are over 940 hotel rooms across five hotels under construction or in development in Lower Manhattan. One new hotel containing 70 rooms is expected to open later in 2023:

• The Warren Street Hotel, a new boutique hotel operated by Firmdale Hotels, is expected to open later this year at 86 Warren Street.

Citywide hotel occupancy metrics remain below prepandemic levels, and occupancy dipped slightly from the previous quarter across Manhattan hotel markets. Despite the slight quarterly decline, citywide occupancy levels rose by 4% over the previous year and Lower Manhattan recorded levels 10% higher than those of the first quarter of 2022, when the spread of the Omicron variant broadly disrupted hospitality and tourism. Citywide average daily room rates remained 30% below 2019 levels, and fell 5% year-over-year. Meanwhile, Lower Manhattan saw average daily room rates rise 15% higher than at the beginning of 2019 and 8% higher year-over-year at $222 per night, likely spurred by the recent addition of new luxury properties to the neighborhood’s hotel inventory.

7.4 MILLION

Tourists Visited Lower Manhattan in 2022 - 30% More Than In 2021.

12.1 MILLION

Total Unique Visitors Visited Lower Manhattan in 2022 - 59% More Than In 2021.

Hotel Occupancy in Lower Manhattan and New York City

Source: CoStar/STR

$222

Lower Manhattan Hotel Average Daily Room Rate

Hotel Average Daily Room Rate (ADR) in Lower Manhattan and New York City

Source: CoStar/STR

Lower Manhattan has 34,243 units in 345 residential buildings. There are 5,776 units in 18 buildings under construction or planned for development, with about 87% currently planned as rental units and 22% as condos.

In early 2023 construction wrapped up on 566 units at:

• One Wall Street: Macklowe Properties finalized construction on converting the landmarked office tower into 566 condominiums. The building offers 157,000 sq. ft. of retail, including a 44,000-sq.-ft. Whole Foods, 74,000-sq.ft. Lifetime Fitness and Printemps, a luxury French department store, spanning 54,365 sq. ft. over two levels. Printemps is expected to open in spring 2024.

Later in 2023, one additional residential development is expected to wrap construction and open, bringing another 58 units onto the market:

• 1 Park Row: developed by Circle F Capital, the 100,000 sq. ft. development at the corner of Park Row and Ann Street will yield a new 23-story, 58-unit condo tower and feature 13,500 sq. ft. of retail space. This is the last parcel along Park Row left for development after J&R Music and Computer World’s closure in 2014.

Over the next several years, three new developments containing nearly 1,240 new units are expected to finish construction, including:

• 7 Platt Street: Moinian Group is currently building a new 250-unit tower that will also contain a hotel component. 7 Platt Street is expected to finish construction and open in 2025;

• 8 Carlisle Street: North Carolina-based developer Grubb Properties plans to build a 50-story building containing 22,000 sq. ft. of ground-floor retail and 400 residential units. 8 Carlisle, which is set to receive tax abatements under the recently expired 421a program, will include a mix of affordable and market-rate rental units. 8 Carlisle is expected to finish construction in 2025; and

• 160 Water Street: Vanbarton Group is currently working to convert the 24-story, 482,000 sq. ft. office building into a 586-unit market rate rental building. Construction is scheduled for completion by late 2025.

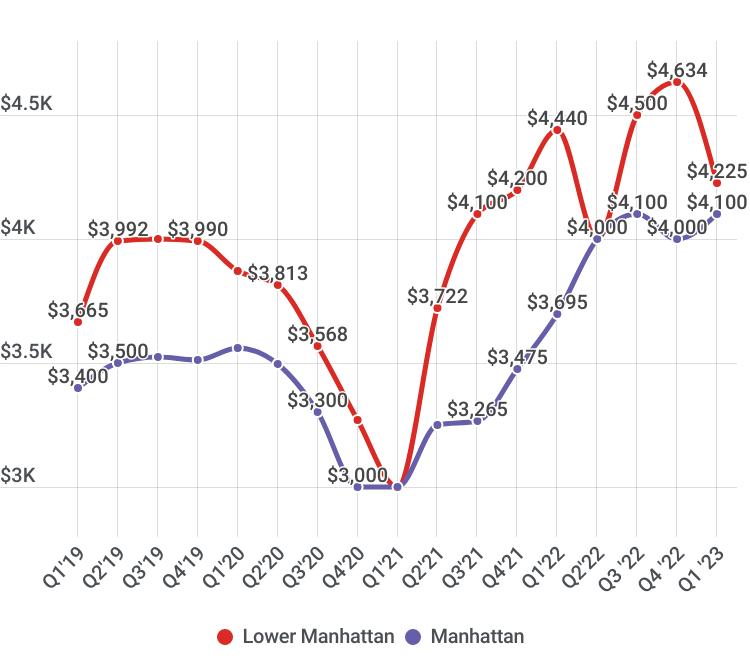

Median Residential Rental Price

Source: Miller Samuel/Douglas Elliman

According to residential statistics published by Miller Samuel/Douglas Elliman, the median rent in Lower Manhattan fell by nearly 9% over the previous quarter to $4,225 after reaching a record high of $4,634 at the end of 2022. Though median rents are still nearly 6% higher than before the pandemic, the first quarter saw an increase in leasing discounts for the first time in a year, and available units sat on the market an average of 22 days longer than in the previous quarter, suggesting that rents may have reached a plateau in the higher end of the market. Manhattan’s overall median rent, however, rebounded to a record high of $4,100, on par with prices seen in the third quarter of 2022, after dipping slightly at the end of last year. Manhattan overall median rents were 2.5% higher than in the previous quarter and nearly 17% higher than pre-pandemic Manhattan’s overall median rent has now surpassed pre-pandemic rates for five consecutive quarters. Demand and prices appear poised to increase further amid an ongoing supply shortage and competition from would-be homebuyers who have remained in the rental market due to increased interest rates.

$4,225

Median Rent in Lower Manhattan — 9% Below The Record High At The End of 2022.

The sales market was more tempered in the first quarter in Lower Manhattan as median sales prices declined. The median sales price for co-ops and condos in Lower Manhattan fell to $1.19 million, down over 5% year-overyear and over 42% below the record high seen at the end of 2022. Sales volume in Lower Manhattan rose nearly 16% over the previous quarter, driven by sales at One Wall Street, but fell over 27% year-over-year. Conversely, median sales prices across Manhattan were down 2% over the past quarter and 10% year-over-year at $1.075 million. Sales volumes are down 12% over the quarter and 38% year-overyear amid tight inventory and increased rates.

Median Residential Sales Price

Source: Miller Samuel/Douglas Elliman

Ronald O. Perelman Performing Arts Center

Construction on the Ronald O. Perelman Performing Arts Center topped out in the spring of 2021. Exterior facade work of the 4,900 marble panels wrapped in early 2022. The approximately 110,000 sq. ft. cube-shaped building will feature three theaters of varying sizes which can be combined in different seating configurations and formats for an array of unique performance environments. The project is anticipated to open in September.

Site 5

A partnership between Brookfield and Silverstein Properties received approval from the Port Authority and Lower Manhattan Development Corporation (LMDC) to develop Site 5 at the World Trade Center, also known as 130 Liberty Street. The site recently served as a Port Authority police depot and the southernmost area continues to function as a temporary public plaza. The proposed 1.56 million-sq.-ft. tower is expected to include approximately 1,300 rental apartments, of which at least 25% will be affordable. LMDC approved an override to city zoning rules in order to build a tower larger than local regulations allow. Construction may commence later in the year.

In December Pace announced plans to renovate One Pace Plaza, adding new academic spaces, a modernized residence hall and a new performing arts center. The renovation will include the reconstruction of the lower floors of One Pace Plaza East and upgrades to the dormitory building at 182 Broadway. Construction is expected to start in the fall of 2023 and be completed in early 2026.

Construction continues on Pace’s new, 215,000 sq. ft. tower (which will be known as 15 Beekman Street) that will house a residence hall, dining facility, library and academic and classroom spaces. Construction on the new tower began in early 2021, with occupancy planned for fall 2023. The new tower replaces two buildings at 126-132 Nassau Street and 15 Beekman Street that are now demolished.

The new building will serve as a replacement for Pace’s 50-year-old tower at One Pace Plaza East. 15 Beekman Street will be the third property SL Green has built for Pace in the neighborhood. The developer previously built dorm buildings at 33 Beekman Street in 2015 and 180 Broadway in 2013.

Broadway Bicycle Lane Fortified

The New York City Department of Transportation is continuing to add concrete barriers to fortify half (20 miles) of the City’s dedicated bike lanes by the end of 2023. In one of the first projects, concrete barriers were installed along Broadway bike lane, between Barclays and Morris Streets.

Reconstruction of Front Street between Old Slip and John Street began in January 2020 and is scheduled for completion in Fall 2023. Greenwich Street reconstruction, between Barclay and Chambers Streets, began in early 2022 and will be completed in November 2024; the adjacent sidewalks at 240 Greenwich Street will also be redone in tandem. Vesey Street reconstruction, between Church Street and Broadway, began in September 2022 and will be completed in September 2024. Nassau Street reconstruction, between Pine Street and Maiden Lane, will begin later in 2022. These projects, each lasting two years, will replace all underground infrastructure, including water mains, sewers, electric, gas and other utilities, as well as construct new streets and curbs.

The city began work on the streetscape and public-realm enhancement project along the Water Street corridor in May 2021, which is estimated to be completed in 2024. The $22.8 million project will transform two temporary public plazas at Coenties Slip and Whitehall Street into permanent public spaces featuring new landscaping, seating and concessions. The project will also plant street trees, rebuild sidewalks and enhance pedestrian safety from Whitehall Street to Old Slip.

In July 2022 the Battery Park City Authority (BPCA) closed Wagner Park to begin work on the $221 million South Battery Park City Resiliency Project. Plans for the project call for the demolition and reconstruction of Wagner Park and the Wagner Park Pavillion, ultimately elevating the park by 10 feet and installing flood walls, berms and other resiliency infrastructure from the Museum of Jewish Heritage through Wagner Park and Pier A, moving along Battery Place over to Bowling Green Plaza. In December 2022 a state Supreme Court judge issued an injunction following a lawsuit arguing that the BPCA failed to consider less expensive and invasive alternatives. Work has halted and the park remains closed pending the BPCA’s appeal of the ruling.

Work continues on parts of the Financial District and Seaport Climate Resilience Master Plan, a resilient infrastructure plan released in 2021 to protect Lower Manhattan from future flooding. The master plan is part of the larger Lower Manhattan Coastal Resiliency strategy, with active capital projects in Battery Park City, The Battery and Two Bridges. The plan calls for the creation of a twolevel waterfront park that extends the shoreline of the East River by up to 200 feet.

The upper level will be elevated by 15 to 18 feet to protect against severe storms, while doubling as public open space. The lower level will be a waterfront esplanade raised three to five feet to protect against sea level rise, while offering access to the East River shoreline. The flood defense infrastructure is projected to cost $5 to $7 billion and could be in place by 2035, pending funding and prioritization by regulatory agencies.

Alliance for Downtown New York 120 Broadway, Suite 3340 New York, New York 10271

The mission of the Alliance for Downtown New York is to provide service, advocacy, research and information to advance Lower Manhattan as a global model of a 21st century central business district for businesses, residents and visitors.

downtownny.com/business/research-statistics