ISSUE 6, 2022 AMBIZ MEDIA $20. 00 INSIDE: SURVIVING THE UPS AND DOWNS > PAGE 10 SMART TECH FOR 2023 > PAGE 18 BUILD YOUR NET WORTH! > PAGE 21 A PUBLICATION OF AMERICAN BUSINESS MEDIA Accelerating Women’s Mortgage Careers

MYERS, DIRECTOR OF STRATEGIC PARTNERSHIPS, ROCKET PRO TPO

MALLORY

New England’s top gathering for mortgage professionals returns to Connecticut on January 12–13, 2023. Don’t miss this exciting, informative event. NMP readers like you can attend for free by using the code NMPOCN.

www.nemortgageexpo.com

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

JAN

12–13 2023

Produced By

ORIGINATORCONNECTNETWORK.COM NEW ENGLAND THE MORTGAG E

Title Sponsor

ISSUE 6, 2022 AMBIZ MEDIA $20. 00 INSIDE: SURVIVING THE UPS AND DOWNS > PAGE 10 SMART TECH FOR 2023 > PAGE 18 BUILD YOUR NET WORTH! > PAGE 21 A PUBLICATION OF AMERICAN BUSINESS MEDIA Accelerating Women’s Mortgage Careers

MYERS, DIRECTOR OF STRATEGIC PARTNERSHIPS, ROCKET PRO TPO

MALLORY

How Fairway Empowers Her

Fairway Independent Mortgage Corporation is committed to cultivating, fostering and preserving a culture of diversity and inclusion. In fact, our executive team is 55% female. We believe fair representation across leadership and throughout the employee population is vital for a bias-free workplace.

As a woman, how has Fairway empowered you to succeed?

“Fairway is a great foundation for women! I have personally witnessed so many women become great leaders and mentors to others here. The possibilities are endless at Fairway!”

— Julie Fry, Chief HR Officer

“ W hen a company has more women than men serving on its executive board and in leadership positions across the company, that speaks volumes.”

— Louise Thaxton, AWI Chief Executive Officer & Branch Manager

“I am truly honored to work for a company where both me and my teammates are given every opportunity to succeed. I feel respected and well received when sharing my opinion. I couldn’t ask for more!”

— Ashley Hickmon, Branch Manager

“T hrough our charity, Fairway Cares, Fairway has created a platform that allows me to share my heart for others — leading, loving, growing, caring and challenging others to go further than they thought they could. Fairway has given us a wonderful purpose. Thank you, Fairway.”

— Sherri Anderson, Fairway Cares Chief Executive Officer

4750

Distribution

All rights reserved.FW 1954268

Copyright©2022 Fairway Independent Mortgage Corporation. NMLS#2289.

S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800.

to general public is prohibited.

ARE YOU READY TO BE EMPOWERED? Visit www.fairwayindependentmc.com today.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

Kelly Hendricks

MANAGING EDITOR

David Krechevsky EDITOR

Keith Griffin

SENIOR EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Steven Goode, Katie Jensen, Douglas Page, Sarah Wolak STAFF WRITERS

Tyna-Minet Anderson, Tina Asher, Laura Brandao, Chrissy Brown, Ashley Gravano, Lorie Helms, Dr. Vanessa Montañez, Grace Ragan, Dawn Ryan CONTRIBUTING WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Ben Slayton

FOUNDING PUBLISHER

Submit your news to editorial@ambizmedia.com

If you would like additional copies of Mortgage Women Magazine Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

© 2022 American Business Media LLC. All rights reserved. Mortgage Women Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

The Power of One

Iwas recently catching up on one of my favorite shows and there were a few lines from the dialogue that struck a chord. During one scene, the main female character was talking to a supporting character about a major accomplishment when the supporting character said, “I don’t know how you managed it.” The lead responded, “I was lucky,” and the supporting character’s response was “Women always say that when they’ve done something extraordinary.” As women we often take the back seat to taking credit for accomplishments or brush it off as a “team effort.”

Don’t get me wrong, many of our accomplishments should be shared with the success of a great team, but why is it that when we really have done something extraordinary, we are hesitant to accept the credit? As leaders, I challenge you to recognize the outstanding accomplishments of your staff, peers, and yourself and celebrate them!

As we put together the final issue of 2022, I’ve been reminded how much of a difference one person can make. I had the opportunity to meet Theresa Carrington, founder of Ten by Three. Learning about the difference she has made to help end global poverty has inspired me to rethink my efforts to give back both professionally and personally. As bad as things may seem there is always an opportunity to make a difference in someone’s life. I hope you are as inspired as I am by this amazing company and find ways to support causes such as Ten by Three in your community.

Managing Editor

Mortgage Women Magazine

Mortgage Women Magazine welcomes your feedback. If you have comments, questions, criticisms, praise, or information to share with us and our readers, please write us at Khendricks@ambizmedia.com.

OUR MISSION

Mortgage Women Magazine is dedicated to providing quality informational/ educational content that betters women in the mortgage process at every step. The content is oriented to help women progress their understanding of the residential mortgage banking business and develop their skills at improving efficiency, effectiveness and profitability at all levels.

THE EDITOR

FROM

MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 3

Kelly Hendricks

Christy Moss Focuses On Fixing The Industry

SHE’S OPTIMISTIC TREND OF WOMEN ADVANCING WILL CONTINUE IN YEARS TO COME

By LAURA BRANDAO, Contributing Writer, Mortgage Women Magazine

This month, I have the pleasure of spotlighting Christy Moss. Christy is chief customer officer at FormFree, a company whose technology gives lenders the information needed to understand borrowers’ ability to pay and process mortgage loans in a timely and efficient manner. FormFree is based in Athens, Georgia.

Christy, how did you get your start in the mortgage industry?

A. My first industry role was as an account executive with GE Capital in 1987. While there, I specialized in marketing non-agency products, initially to brokers and later to correspondent lenders and bulk acquirers.

Believe it or not, I literally started because I needed a job and was able to get one from an old-school ad in the paper.

What does being a trailblazer mean to you?

A. A trailblazer is a leader with a clear vision for the future. They are

Blazing a Path … Raising the Bar

Trailblazers

4 www.mortgagewomenmagazine.com

someone whose determination and drive will push others to achieve great things and who will serve as an example and offer support along the way. This person will clear a path for others to benefit their communities.

Where do you see yourself and women in the industry over the next five years?

A. My current focus is on improving the industry-wide adoption of technologies that expand home financing opportunities for underserved communities and educating lenders and borrowers with respect to equitable lending practices. Part of achieving that goal is working with

legislators and regulators to enact policies that will enable more families to purchase their own home.

I see women becoming far more visible in our industry. Over the past five

years I have seen a significant uptick in leadership opportunities for women in the higher levels of our industry, and

CONTINUED ON PAGE 6

“If people like you, they’ll listen to you, but if they trust you, they’ll do business with you.”

MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 5

– Zig Ziglar

TRAILBLAZERS

I am very optimistic that trend will continue over the next five years.

The doors of many organizations are opening wider for women in part due to the efforts of the Mortgage Bankers Association (especially with its creation of mPower) and Mortgage Women Magazine. These platforms are elevating the voices of women in what is still predominantly a male-dominated industry, and it is so encouraging to see the greater professional mortgage community come together to support women in advancing their careers and achieving their goals.

What is your professional superpower?

A. I believe my professional superpower is my ability to connect like-minded people with each other so they can combine their best attributes to the benefit of others in the industry and the community at large.

Being a great “brag buddy” is part of my process for making lasting and successful connections. A brag buddy will impart to others the strengths and achievements of a person they should know better. This is also a wonderful way to encourage colleagues to advocate for themselves and be proud of what they have accomplished.

Tell us something about your career in the mortgage industry that was pivotal to your achievements today.

A. In 2018, I attended an mPower event about finding your voice and advocating for your own worth. The amazing speakers opened my eyes to the potential we all have for controlling our own futures and convinced me that it takes active planning to achieve your goals. I came to realize that not asking for what you need and deserve is being passive, and that means settling for whatever happens to come your way.

Another career milestone for me was earning my CMB (Certified Mortgage Banker) designation from the Mortgage Bankers Association. This is the highest professional designation in our industry. Completing the required

coursework helped me see our business more holistically and got me thinking about new opportunities to improve how we serve our clients.

Another pivotal item was the introduction of Fannie Mae’s Day 1 Certainty, which invigorated my sense of professional purpose. When I worked at Fannie Mae, I had the great pleasure of educating lenders about Day 1 Certainty

and providing technological direction for an initiative that has changed the way we all do business today.

What advice would you give to a woman entering or trying to move up in their mortgage career?

A. First, you must understand your

CONTINUED FROM PAGE 5 6 www.mortgagewomenmagazine.com

“why.” You need to discover what motivates you. Only when you know the destination can you map out where you want to go and how you plan to get there.

Next, become an expert in whatever area interests you. Learn how your field of expertise interacts with the industry as a whole, then develop that expertise to the point that you can position yourself as a trusted advisor to your colleagues and peers. This will inevitably lead to more and better opportunities as you move through your career.

What does success mean to you?

A. I think of success as both a team sport and an individual sport.

If I am helping my team to reach our goals and grow professionally, I consider that a successful outcome.

On a personal front, success means being able to say I am proud of the work I have done and the contributions I have made to my industry and the people in my life (and that I’ve had fun and made new friends in the process!).

What do you enjoy doing outside of the office? Tell us about your family.

A. I have been married for 37 years, during which time we raised a son and a daughter. Our daughter, Jenny Moss is also in the industry working with Depth PR as client services director. Our son,

Morgan, lives in south Georgia with his wife. We have a huge extended family, so much of our off-work time is spent with them. We enjoy family dinners, time at our lake home and watching SEC football with friends and family.

How do you recommend navigating change in an industry that is always changing and growing?

A. I only have one piece of advice for this: keep learning. Read, listen to podcasts, and talk to people. Keep up with technology, market and policy changes and how they impact the needs and challenges of clients. You cannot allow your knowledge base to stagnate if you want to grow professionally in the ever-changing mortgage industry.

Do you think it’s important to have a mentor? Do you mentor and what does it give back to you?

A. Having a mentor is critical to succeeding in any profession, especially the mortgage industry. In fact, having several mentors is even better if you are lucky enough to find them. Mentors offer guidance, perspective and advice that can broaden your base of knowledge and provide you with a way to make better decisions both professionally and personally. A good mentor will use their influence and experience to pull others up the ladder and teach them to

advocate for themselves in a strong and confident voice.

Beyond mentors, we should each have a tribe of people we lean on as we navigate our careers. And, most importantly, we should remember to pay it forward and act as mentors and coaches to each other. A strong network benefits everyone in the circle in many different but essential ways.

What do you want to be remembered for in our industry?

A. I want to be remembered as someone who played a role in democratizing lending and expanding access to home ownership. I want to leave our industry better than I found it, and, for me, that means increasing the number of people who can purchase a home without increasing risk. There is a balance and I want to be remembered for leading the innovation charge to improve access to credit for all.

I believe in a holistic approach to determining creditworthiness that reaches beyond a credit score and tax receipt to consider the entire spectrum of a potential borrower’s financial portfolio. I want to see a person’s income, spending history, rent payments and other factors considered when assessing whether they can borrow and how much. The current narrow scope of assessment limits

CONTINUED ON PAGE 8 MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 7

opportunities for many who might have no trouble affording a home but are denied because they don’t check all the traditional boxes on a lending form.

How do you find your voice?

A. Surround yourself with people who root for you so you can learn to see yourself the way they do. As you gain confidence from your successes, you will begin to understand your worth and be better able to communicate that to others.

What is your biggest fear and why?

A. My fear is that by failing to pivot rapidly, our industry will fail to reap the benefits of policy and technological advancements. These changes appear so quickly, but I fear our industry does not always embrace them in a timely fashion and may risk falling behind as a result.

There are approximately 109 million renters in our country right now. Polls indicate that a full 76% of them want to own a home rather than pay their

landlord’s mortgage. I am concerned that we are not moving fast enough to serve the people who can afford a mortgage because we are mired in old and outdated processes and mindsets when we should be switching to more creative and inclusive policies.

The current market is particularly challenging, with interest rates and inflation in conflict at a federal level. Now is the time for our industry to lead the charge for affordable and fair lending practices using technology we already have at our fingertips and common-sense policies that consider our clients’ entire financial picture, not just outdated plot points on a graph.

We have the tools to make the dream of ownership possible for so many more people if we can only embrace the notion of financial data aggregation and understand our clients in a financially holistic way.

What is your favorite book or podcast that you would recommend and why?

A. Most recently, my favorite book

has been Mel Robbins’ The High 5 Habit. She shares the idea that for others to see the greatness in us, we need to see it in ourselves. The act of high fiving yourself can help you affirm and invigorate you and reminds you of how much you can achieve when you have a positive and motivated mindset.

How do we propel more women into leadership roles within our industry?

A. It is vital that as colleagues and mentors, we take an active interest in the advancement of our peers and helping them to achieve their professional goals.

We should all be watching for opportunities for women to advance and sharing that information with each other along with offering our advice, guidance, and experience. Holding out your hand to pull another up the ladder is a privilege and an obligation that we need to meet to encourage more young women to work toward leadership roles in the future. n

CONTINUED

8 www.mortgagewomenmagazine.com

TRAILBLAZERS

FROM PAGE 7

2022 CE IS NOW IS NOW AVAILABLE AMBIZDISCOUNT USE CODE Would you like to know more about our corporate programs? Or are you a branch manager? Contact Us. VISIT : MORTGAGEEDUCATION.COM (317) 625-3287 TRAIN YOUR COMPANY CALL OR

The State Of The Mortgage Operational Employee

NAVIGATING THE UPS AND DOWNS OF THE MARKET

By CHRISSY BROWN , CMB, AMP, CRU, Special contributor, Mortgage Women Magazine

By CHRISSY BROWN , CMB, AMP, CRU, Special contributor, Mortgage Women Magazine

The mortgage industry has been experiencing some of the most challenging times we have seen. This is due to many factors, but mostly the dramatic swings in volatility. There are countless articles out there surrounding the impact of this market on borrowers, loan officers, fintech, and companies. There are also countless articles out there regarding the numerical stats surrounding layoffs.

The elephant in the room, or the topic no one is truly talking about, is the current mental state of the mortgage operational employee. The anxiety, the “quiet quitting,” the difficulty of the loans coming in, the burnout from 2020/2021 and the impact of the current mental state of sales. All paired with the incredible need for impeccable

quality in this environment.

What do you say? How, as a leader, do you stay transparent with many unknowns? How do you guide them to rise above the turmoil and maintain their jobs? How, as sales folks, do you help your beloved ops staff during these times?

For many of the operational staff, this is their first rodeo with such a market. For those of us that survived the 2008 crash, this feels all too familiar but also very different. What feels the same? The uncertainty of the future of the mortgage divisions of your organizations, the uncertainty of income, and the fear of being laid off. I emphasize “mortgage divisions’’ in that last sentence for a specific reason. During the previous crisis, banks (depositories) had twothirds of the market share. As of 2021, Independent Mortgage Bankers (IMBs) have two-thirds of the market share. There are major differences between the two during hard times.

When I personally was laid off from a bank, in 2008, I was an underwriter at the time. It was very sterile in my organization. None of what was

10 www.mortgagewomenmagazine.com

CORNER CHRISSY'S

occurring to operational staff felt personal. In fact, I was listed on the layoff roster as #197. I realized at that moment I was just a number that had to be eliminated. It can be good and bad to work in such a sterile environment. Again, I didn’t take it personally, but I surely wished someone cared about me and my contributions.

IMBs, for the most part, are privately held. They tend to be the product of the owners’ blood, sweat, and tears. Owners of IMBs truly care about their employees and the culture they have created. If you look at the 2022 Q2 profit report, IMBs

that they do not have depositories to lean back on, higher cost to fund rates and truly at the end of the day, everything they have built and worked for could be dwindled down to nothing. Hard decisions must be made.

This feels very inauthentic to the IMB cultures that have been built. Most IMBs have built a culture of care surrounding their employees and borrowers. Hence why they have been so successful over the years. The “vibe” as a mortgage operational IMB employee feels very “off” during this time. They are questioning the very core of the

wondering why them? They see some of the most respected operational folks in the industry showing “open to work” on LinkedIn. It’s scary.

They are coming off a two-year stint where these folks dedicated their LIVES to closing as many loans as they could. Sacrificing nights and weekends. Balancing at-home learning with the most insane market they have ever experienced. More dedication than I have ever seen in my 26 years. At the end of that rainbow, there wasn’t a pot of gold. Instead, there is intense worry and stress. The biggest concern is, if I get laid off, where will I go? If everyone in the industry is cutting, what will happen to me? The answer, like most things going on right now, is unknown.

DEMAND FOR PERFECTION

lost money per loan whereas banks made a profit. Why is that? They care so much about their employees. It’s hard to bear the realities and make the hard decisions. It feels personal.

IMB CHALLENGES

Some of the challenges that IMBs face, that banks do not, are in the fact

companies they work for. Who are these people I work for? I thought they cared about all of us. They seem so secretive.

The operational employee sees what is going on in the industry. They feel the lack of loans coming in. They see the layoffs. They see some of their competitors merging or closing. They are watching their peers get laid off and

Now let’s pair this with the rising demand for impeccable quality. Quality in this market is VERY important. If a loan is unable to be sold to an investor or an agency, it must go to the scratch and dent market. That market usually runs at anywhere from a 1-8% loss. Some loans right now are running at a 40% loss. We had a loan that closed, and the credit was expired at the time of closing. The S&D bid was a 30% loss. That is a lot of pressure on an already terrified staff. Unfortunately, it doesn’t matter. The average company cannot afford to eat that magnitude

CONTINUED ON PAGE 12 MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 11

For many of the operational staff, this is their first rodeo with such a market. For those of us that survived the 2008 crash, this feels all too familiar but also very different.

of loss often. The demand for salable quality in a market where the origination/loan quality is down is also very challenging. I swear to you, in the last two months I have been brought into some of the most unique scenarios that I have ever seen in my entire career. It’s challenging for borrowers and sales right now. We need to make every loan that can work, work.

The moving interest rate market and the restructuring of loans during this environment makes it very challenging to maintain that impeccable quality. As an operational employee, when you are hyper focused on not making a mistake, you tend to lose the forest for the trees, over condition and become fearful to make a risk decision. That kind of decision-making tends to add to the stress of sales.

STRESSED SALES

The last factor contributing to their strained mental state is the stress that sales are under. Most operational

employees truly care about making their sales partners happy. Most are pushing through these fears to ensure they are taking care of their sales partners and borrowers. Unfortunately, sales folks are under more pressure and stress than they are used to.

In a very generalized statement, I would say that the average Ops employee is more of an introverted personality. They are detail oriented, diligent, organized, factual, reliable, supporting, trusting, objective, consistent, considerate, etc. This is what makes them great at their jobs. In the same generalization, most salespeople are extroverted personalities. They are dynamic, interactive, bold, fast-paced, action-oriented, sociable, focused, friendly, bold, etc. Again, it’s what makes them great at their job.

What we fail to ever talk about is the difference between these two generalized personalities when they are under stress. Under stress, the average operational employee becomes bland, suspicious,

reserved, cold, indecisive, stubborn, docile, etc. Meanwhile, the average sales employee, under stress, becomes controlling, overbearing, intolerant, dramatic, hasty, aggressive, frantic, etc.

The operational employee doesn’t understand those characteristics as stress, as they do not personally deal with stress in that way. They tend to view those characteristics as “personal attacks,” which compiles everyone’s stress. (Disclaimer, there is a difference between natural stress responses and abusive behaviors. We will not tolerate abusive behavior from anyone). Same with sales. When sales see the “stress qualities” from ops, they see them as “not caring”. If both sales and ops could understand how both sides show up when stressed, we might be more gracious with each other and probably more efficient.

OPERATIONS STRUGGLES

The operations employee is feeling all those things. In some cases, they have experienced a loss of income, the perceived “personal attacks’’ from sales, anxiety about their future and their company’s future, pressure of quality, challenging loans, and the feeling as though they do not feel like they are

CHRISSY’S CORNER CONTINUED FROM PAGE 11

12 www.mortgagewomenmagazine.com

So, try and put the anxiety aside. Rise up and push through that final mile. On the other side of this, your beloved cultures will be restored, and life will finally balance out.

working for the “same company” they once prided themselves on.

So, what do you say, as a leader, to an ops employee during this time? I would say that most companies will make it through this storm. People will always buy/sell houses and mortgages will always be needed. We are an industry that provides one of the three basic human needs: food, clothing, and shelter. Everyone will not lose their job during these times.

As hard as it is, I encourage every operational employee to wake up every day and remember that they are professionals being paid to do a job. As an op’s employee, it is our job to extend amazing customer service, despite how the client or sales partner is responding. It is our job to read our AUS feedback, look at the documents, restructure loans and ensure salability and ability to repay.

It is our job to show up and give that 100%. It is our job to continuously improve and demand excellence out

of ourselves. It is our job to realize the difference between sales stress and ops stress. To understand your clients’ needs and frustrations. To understand your sales partners’ needs and frustrations.

‘READ THE ROOM’

As I say to my team, read the room. That is your job. If you find yourself with an abundance of free time, ask to help even if it’s outside of your department. Ask for educational classes and opportunities to learn more about your industry and various positions. Go the extra mile. I know pushing yourselves to go the extra mile, after what felt like a marathon for the last two years, is hard. Unfortunately, no company is choosing hard right now. The market is dictating the hard and it is completely out of our control.

Remember, the market will stabilize, and life will return to a new normal. The anxiety will, once again, dissipate. This industry has unique ebbs and flows. Some refer to it as a feast or famine industry. That is the

reason this industry pays very well.

So, try and put the anxiety aside. Rise up and push through that final mile. On the other side of this, your beloved cultures will be restored, and life will finally balance out. If sales and ops could appreciate and respect the simultaneous stress we are all under, we could truly help each other through these times, instead of harming each other.

As for those of you who are leading an operations team during these times, my heart goes out to you. I have never felt pressure and stress like I have this year. Keep making the hard but necessary decisions, keep leading in confidence and keep acknowledging the daily realities of your operational staff during these times. As an industry, let’s show our leaders some grace. These are some of the toughest decisions they will ever have to make, and I believe everyone is truly doing their best. n

Chrissy Brown is chief operations officer for Atlantic Bay Mortgage.

With women representing more than half of our top Originators, Atlantic Bay is proud of these (and more!) honors for 2022: “Top 4 Best Large Mortgage Companies to Work For” NATIONAL MORTGAGE NEWS (TWO CONSECUTIVE YEARS) “50 Best Companies to Work For” and “Top 100 Mortgage Companies in America” MORTGAGE EXECUTIVE MAGAZINE “Top Mortgage Lender” SCOTSMAN GUIDE ATLANTIC BAY PROMOTES WOMEN’S CAREER GROWTH AND LEADERSHIP, AND IT SHOWS IN OUR SUCCESS. JOIN US. This communication does not constitute a promise or guarantee of employment. Atlantic Bay Mortgage Group LLC NMLS #72043 (nmlsconsumeraccess.com) is an Equal Opportunity Employer. When Women Succeed, Everyone Wins. MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 13

Feeling The Pressures Of Overcommitment

THREE TIPS TO STAY ENERGIZED

By TINA ASHER, Contributing Writer, Mortgage Women Magazine

Irecently slipped back into some bad habits of overcommitting, that held me captive for a bit. As we head into a season of food, fun and festivities, it’s important to remember to take things in carefully, physically, and mentally.

Last month I had to put myself on a “yes” diet. No more filling my plate with saying yes to things that aren’t in alignment with what’s best for me, my family, or my lifestyle. I had a large helping of overcommitments on my plate and it weighed me down. I noticed I became reactive instead of proactive, and I wasn’t enjoying the things I had said “yes” to. I decided to go on a diet and cut some things out of my life.

Maybe you’ve felt that too. This time of the year can be exciting and stressful. Organizations, fundraisers, and activities have ramped up needing volunteers, donations, and commitments to hit their goals, help those in need, and to serve on top of family commitments, and — oh yeah, you probably have a job too!

Fortunately, I was able to make the pivot and you can too.

Here are three simple ways to stay energized when you feel the pressure of overcommitment creeping up.

REFLECT:

• When did you commit to this and why?

14 www.mortgagewomenmagazine.com

Tina Asher

• Choosing to say yes to something in the future because you think you have time later is a trap. There will always be something on your calendar begging for your attention.

• If you aren’t prepared to say yes as if it would begin tomorrow, then it’s a clear no. The things you’re passionate about will be a no-brainer to say yes to and you’ll want to do them right away.

RESET:

• Examine your core values. I spend a lot of time on this with clients to make sure decisions are in alignment with who they say they want to be.

• What are your most important priorities in life? Will this new position, activity, or program enhance your priorities in life or hinder them? For a deeper dive on this I’ve developed a Change Cycle tool to help with this — reply to me and I’ll send you a copy of it.

• Decisions become clearer when you are in alignment with your core values and priorities.

RECHARGE:

• Recognize that if you say no, you’re doing the program, activity, or organization a favor by saying no when you’re not 100% committed to it.

• When you know it’s not the right thing for you and pass on it, the opportunity opens for someone who’s eager to serve. You’ve helped them more with your no than you would have with a half-hearted yes.

• Once you’ve lightened the load and only committed to the things you care most about, you’ll serve at a deeper level and feel more connected to your cause or position.

When I recently let go of a role that I enjoyed but couldn’t fully commit to, I felt I had lost 15 lbs. That was the fastest diet I’d ever been on, and it was done tastefully. I’ll still be able to help the cause, support the team, and be able to be more involved at a different level. What will you take off your plate this year to lighten your load and stay energized? n

Tina Asher is a coach and founder of Build U Up Consulting

No more filling my plate with saying yes to things

EXPERIENCE. SERVICE. RESULTS. (949) 477 5050 www.wrightlegal.net Your Trusted Legal Partner for Litigation, Real Estate, Origination and Regulatory Compliance Services WE’VE GOT YOU COVERED Litigation Regulatory and Compliance Assistance Title Curative and Litigation Private Lender Services Certified Appellate Specialist Real Estate Transactions Commercial Financing Document Preparation Bankruptcy and Eviction Services California Nevada Arizona Washington Utah Oregon New Mexico Montana Hawaii South Dakota We Have Mortgage Jobs. • Branch Manager • Business Development Manager • Client Relationship Manager • Client Relationship Specialist • Collateral Asset Manager • Commercial Loan Officer • Credit Analyst • Licensing Assistant • Loan Officer • Loan Mitigation • Post Closing QC Expert • Loan Administration Manager • Processor • Regional Vice President • REO Closer • Retail Branch Manager • Reverse Mortgage Specialist • Sales Manager • Underwriter • Wholesale Account Exec • And MORE! Resposes are from highly-qualified candidates. Your ad can also be [osted on Indeed and SimplyHired as a FEATURED JOB, on Craigslist in most cities, Googlebase, Oodle, Juju, CareerMetaSearch, TopUSAJobs, Jobalot and MORE! Pay-per-use RESUME BANK. findmortgagejobs.com MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 15

that aren’t in

alignment

with what’s best for me, my family, or my lifestyle.

Strength In Numbers

SEEKING ADVICE FROM THE CFPB

By TYNA-MINET ANDERSON , Contributing Writer, Mortgage Women Magazine

Istarted working in the mortgage compliance world shortly after the creation of the Consumer Financial Protection Bureau (CFPB). As I read through the new rules being implemented, I often discovered ambiguities in the law.

In those early days, I regularly reached out to the CFPB through a reg inquiry. To do so, I would send the law that I believed needed clarification in an email along with my question.

The most frustrating part quickly became the phone call that followed with a CFPB attorney. Expecting clarification, I was surprised the first few times as the attorney on the other end read the law to me word for word, with no additional explanation, the same law that I had sent over in my email and spent days or weeks studying before submitting the question. As they read, I would often interrupt, hoping for clarification, and they would

continue reading or start over.

Needless to say, it didn’t take long before I stopped submitting reg inquiries.

In 2020, the CFPB created a new program, known as the Advisory Opinion Program, which provides written guidance to assist regulated entities to better understand their legal and regulatory obligations. Entities can submit requests for advisory opinions regarding any issue under the Bureau’s jurisdiction that can be resolved through an interpretive rule. Per the CFPB, the purpose of this new program is to help the bureau comply with one of its primary functions, which is to issue guidance to implement Federal consumer financial law. They stated that “providing clear and useful guidance to regulated entities is an important aspect of facilitating markets that serve consumers.”

We recently submitted a couple of questions, going through the process of drafting up the questions, along with any applicable laws.

Then we waited and waited. After the first month passed with no response, I

16 www.mortgagewomenmagazine.com

Tyna-Minet Anderson is vice president of Mortgage Educators and Compliance.

wondered if I would ever hear from them.

Around that time, my friend, Audrey Boisseneu, reached out to let me know they were having someone from the CFPB as a guest on her Mortgage Pros411 podcast and she asked if I had any questions.

Finally, I thought, this is my chance to get some answers. I presented the general topics I had questions about, but I also asked Audrey and Kevin to address the silence from the bureau.

A couple of weeks later, I received a single sentence follow-up to my inquiry asking to set up a call with a gentleman named Mark.

This call was definitely different from the CFPB calls of the original Richard

The first step in seeking clarification is to use the online tool found at https:// reginquiries.consumerfinance.gov.

Simple questions can often be sent in a few minutes’ time. The bureau says that they will respond within 10-15 business days, and if they need more time than that, they will let the inquirer know. Keep in mind that they can’t provide guidance on state or Federal law that is not under the Bureau’s authority; nor can they accept comments on pending rulemakings. Those should be submitted to the public docket.

If you have a more serious, longterm issue that needs clarification, consider utilizing the Advisory Opinion Program. Not many requests are taken

sector. The CFPB looks for trends in the comments as well as areas that may need additional guidance.

Recently, there was a request related to the automated valuation model (AVM) and compliance requirements related to it. It is likely the rules related to AVMs will have a regular impact on you in the business.

Another request that is currently open relates to needed mortgage loan programs. The CFPB is trying to find new opportunities for borrowers to utilize in an effort to promote competition and support household financial stability. If you are interested in commenting on this request or others, you can do so by going to consumerfinance.gov/

Cordray days. Although not an attorney for the CFPB, Mark was helpful in answering my questions to some degree with what he knew, and then guiding my requests down the proper channel. He also volunteered to follow up on outstanding items and future requests to make sure they were answered.

Between the rapid changes in the rates and the program adjustments, the industry needs clarification now more than ever.

up through this new program, but for the ones that are, this program provides written guidance to help those in the industry better understand their legal and regulatory obligations.

A third way to get more clarification is to make your voice heard early in the rule-making process. As part of the process, the CFPB solicits public comments from the public, professionals in the industry, and organizations that support the industry

This experience has taught me that although we can continue sending anonymous requests for our students and clients, there is strength in numbers. Reg inquiries and other requests are tracked; if the CFPB gets a lot of requests, they are more likely to provide an official written FAQ or advisory opinion. n

Tyna-Minet Anderson is an attorney and co-owner of Mortgage Educators and Compliance.

MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 17

Not many requests are taken up through this new program, but for the ones that are, this program provides written guidance to help those in the industry better understand their legal and regulatory obligations.

ASK THE EXPERTS

By LORIE HELMS

Considering lenders just experienced two massive market shifts from historiclevel refi volumes and swift increases in rate hikes, what technologies will be most effective in the coming year?

From boom to bust and back again,

the mortgage industry is no stranger to economic cycles. This cycle, however, has been a seismic wave of uncertainty due to rapidly rising home prices, increasing mortgage rates and low inventory of homes. Through all this, technology is playing a new role for companies across the board. While mortgage companies are being forced to cut back on their

budgets, some are keeping technology investment at the forefront.

Remote work, for example, has become a talent recruitment tool for all businesses, including mortgage companies. As this trend continues, lenders will continue to need automated communications and processes to make sure nothing slips through the

WILL

OF EFFICIENCY

EFFECTIVE TECHNOLOGIES FOR 2023 LENDERS

NEED TECH THAT SQUEEZES EVERY OUNCE

THE MODERN MARKETER 18 www.mortgagewomenmagazine.com

cracks. It means creating queues for each milestone that let the consumer and the operations teams know when action is needed, or a file is ready for review. It means integrating CRM systems with loan origination systems with telephony solutions.

In a higher rate environment with tighter profit margins, lenders will need technologies that minimize the number of touches on a loan file and squeeze every ounce of efficiency from origination to closing to reduce per loan costs. For instance, optical character recognition is a maturing technology that could help the industry start automating some underwriting decisions, speeding the process and reducing costs.

Lenders with technologies that help loan officers continue producing will also have an advantage in today’s more challenging environment, especially when it comes to recruiting. Loan officers are fighting for every loan they can get and are demanding better access to data and lead information, and many are actively looking for innovative lenders that can provide them with an edge.

Because mortgage companies are minimizing their spending in some areas, there is a renewed effort from hackers and cybercriminals to try to find companies with weaker security infrastructure. While the ROI might be difficult to quantify, all mortgage lenders continue to need cybersecurity protocols to prevent system downtime and data breaches. The risks — both reputational and legal — are always going to be there.

Proactive lenders recognize the opportunity technology provides to improve communication, increase efficiency and reduce risks to scale their businesses for the future. So, I’ve asked

other mortgage technology professionals what technologies they see that will benefit their companies and clients into the next year and beyond.

JULIA CURRAN Senior Director, Product & Client Solutions, SitusAMC

The refi boom and the recent rate hikes caused two different problems in the mortgage industry. The historic refinance volume we saw early in the pandemic required lenders to process, underwrite and close loans at a volume no one was staffed for, resulting in massive hiring pushes and signing bonuses to meet demand. The subsequent rate hikes dried up loan application pipelines, forcing lenders to reduce the staff they worked so hard to hire just months earlier. The resulting shift from an incredibly robust market to a near standstill has put budgeting restrictions on mortgage lenders, forcing them to be more selective with where they are spending their dollars — technology and human capital alike.

As the industry finds a new normal, we have an opportunity to become less reliant on manual processes and embrace automation to be able to better handle these market shifts in a rapid and cost-efficient manner and cause less disruption to staffing levels. Implementing tech to automate certain processes will also free up staff to focus on their best use and overall deal making.

In the rising rate environment, originators have had to get more creative with their loan products. This variety helps with volume but puts a strain on the underwriting team to be familiar with multiple guideline nuances. Technology that

can absorb data and run calculations and test thresholds in accordance with guidelines will prove useful. These rules engines can be used independently or in conjunction with data that is sourced electronically from primary sources and fed directly to these engines. This automation reduces the need for human capital while minimizing errors and increasing efficiency.

This coming year, technologies that allow for the automated review of applications to varied guidelines and technologies that support HELOC lending will be a smart investment. People who currently have very low rates on their homes will not want to refinance, but in the coming year, HELOC volume will likely increase dramatically.

As the market shifts from closed end, high interest rate products, origination systems that manage the necessary documentation for HELOCs and correspondingly servicing systems that can handle draws and repayment on these products are two forms of technology that will be in high demand. We’ve seen our own offering in this area — BRES AUS — help support numerous lenders.

ANN GIBBONS

Managing Director, Evolve Mortgage Services

When volumes decrease rapidly, companies are faced with “rightsizing” personnel and reducing expenses to stay profitable. Taking advantage of the slowdown in loan volume to make important shifts in operations can set companies up for success today

JULIA CURRAN

JULIA CURRAN

CONTINUED ON PAGE 20 MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 19

ANN GIBBONS

ASK THE EXPERTS

and tomorrow. When production levels shift, however, it’s the perfect opportunity to adapt digital processes.

A MarketWise Study recently reported that lenders transitioning from paper to hybrid eClosings saved $211.97, or 37%, per loan. Additionally, lenders who closed with a fully paperless remote online notary (RON) eClosing saved an average of $444, or 91%. A full SMARTDoc loan package (not just the eNote) also creates a secure, immutable data set that can be held in an eVault and accessed by warehouse lenders, buyers, and investors to deliver electronic proof of compliance for both the data and the docs.

Shifting costs from fixed to variable also makes sense when volumes have decreased. For this reason, outsourcing origination processes, like underwriting, allow them to be done more efficiently and at predictable costs. In addition, a quality diligence provider can integrate their services with a client’s LOS, allowing for loan files, data and results to be easily transmitted with less risk of error. The use of customized automated underwriting systems created for nonQM markets can also help originators manufacture alternative types of products with certainty while providing users an “agency-like” experience.

Any lender or investor taking advantage of this unique opportunity to expand product lines and aim for a true digital end-toend solution should partner with a trusted, experienced vendor. This vendor should provide an insurance policy that protects investors against

diligence errors and mitigates risk. However, it’s important to shop around for the most effective partner and solutions that provide for more efficiency, flexibility, and scalability and utilize state-of-the-art technology platforms and services.

These market disruptions are an opportune time to review current operating methods and take advantage of the changing environment to adapt new technologies. If now is not the best time to invest in operational efficiencies for the future—following some of the most robust years in mortgage financing—then when?

MARIA MOSKVER CEO, CloudVirga

For lenders to succeed, they must get back to the core principle of our industry — people. Both 2020 and 2021 were a constant race just to keep up, so everything was about managing volume. Moving forward, that paradigm needs to shift to the individual experience of both the borrower and the loan officer if lenders want to be successful long-term and effectively manage the ebbs and flows of our industry. To make that shift, technology should have two key areas of focus: user experience and maintaining existing relationships.

Rates come and go, but lenders will always win with a good experience. A positive experience, and the technology that supports it, will create customers for life and retain the great talent all lenders need to succeed. The focus needs to shift from how we have been doing it to what our people expect and need. The largest lenders have been successful not because they

can momentarily manipulate rates, but because they create a seamless experience and assist loan officers in a way that their competitors have not. In fact, the loan officer experience is the core principle behind the design of our new TPO Platform, which helps lenders level the playing field and compete on a higher level.

The second technological focus should be on managing existing client portfolios and ensuring that the original relationship remains strong. It’s no secret that servicing and past clients are a lender’s strongest hope for continual success, but most have not focused on this as diligently as they should. The past two years have been about managing the moment and not the future. By properly leveraging technology that serves to keep those relationships fresh by alerting loan officers to new loan opportunities, lenders will be able to improve customer and LO satisfaction and set themselves up for success even in the toughest of markets.

Our industry has always been about people, which is easy to overlook during both frantic and slow periods. The key to success is to recognize the importance of people by implementing technological solutions that help create the experience borrowers and loan officers deserve, while maintaining relationships that will carry into the future. n

As CTO, Lorie leads Cherry Creek Mortgage’s IT operations, software development, customer relationship management and security teams. She brings more than 20 years of experience in mortgage technology, as well as a passion for empowering her teams.

Maria Moskver

Maria Moskver

20 www.mortgagewomenmagazine.com

CONTINUED FROM PAGE 19

Your Network Is Your Net Worth

By DR. VANESSA MONTAÑEZ , Contributing Writer, Mortgage Women Magazine

Have you ever heard of the saying, “Your network is your net worth?”

This is a common saying that many of us take for granted because we do not feel it applies to us as women. I firmly believe that using social capital is critical for women’s career success. In a male-dominated work environment, women tend to have fewer and weaker connections than men in the dominant coalitions that provide essential resources and opportunities for top executive positions.

While men use “networking, ingratiation, and self-promotion strategies” (Val Singh et al. 77) to further their careers, women, to their detriment, “prefer to rely on extra high performance and commitment for visibility to their seniors” (Val Singh et al. 77). Women need to cultivate relationships at work and use social

capital to climb the ladder of success. Social capital has gained popularity in business and leadership for the past few decades. Using social capital provides a return on investment through social relations. In addition, there is a benefit from networks or belonging to a membership of sorts. Social networks are valuable to those who belong to them because they provide a return on investment. Roberts (2013) explained,

“High levels of social capital have been shown to have a positive impact on multiple facets of organizational life, including individual career success, compensation and placement, employee recruitment and retention, team effectiveness, interdepartmental resource exchange, product innovation, and entrepreneurship, as well as external relationships with suppliers, regional production networks and other firms” (Roberts 54).

Social capital is made up of nodes connected by a set of ties. Nodes are connected by ties. This creates a network between two individuals.

As more individuals convene, the network expands. Social capital is a structure of how leaders and followers interact and how relationships evolve within the individuals. Some structures are better than others. The ideal structure of social capital is open and diverse.

Within the social capital structure, the network or group must be an open platform where anyone can join. For example, a woman who wishes to join an organization, network, or group to grow her social capital should be allowed to join. Also, the individual or members of the network should be diverse, from different age groups,

CONTINUED ON PAGE 22

USE SOCIAL CAPITAL TO CLIMB THE LADDER OF SUCCESS MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 21

ethnicities, genders, and backgrounds. A diverse organization provides the diversity of thought and ideas.

Where the individuals meet or connect is called a network. The network is the structure of social capital. A network is a group of interconnected individuals. Social interaction is essential to an individual because the greater the number of contacts, the more likely the individual network grows. Individuals can use their networks for personal or professional use, gain access to information, create awareness, influence, or possibly find employment. Social networks are an ongoing process and “provide another avenue for turning resources into capital” (Lin 192). Networks take time to cultivate and grow trust. Keele (1986) defined networks as being composed of weak social ties, exchanging information, and providing support.

Networks enhance the social position and contacts of the individual based on their position and influence. Furthermore, there is a common phrase, “it is not what you know, but whom you know.” The power of networking and building one’s social capital can create benefits. For instance, networks support women’s integration into a maledominated culture while giving them an opportunity for shared powers and confidence to advocate and act for organizational change.

ERGS & MASTERMINDS

Women must join organizations to grow their networks, contacts, and career advancements. For those women that work in large companies, I encourage you to join a business resource group (BRG) or employee

resource group (ERG). Employee resources groups are an employee-led group that fosters inclusivity and builds internal community. Typically, ERG provides personal and professional support to its members. ERGs are meant to be supportive rather than exclusive. Most ERGs are based on volunteers and support organizers with opportunities to create events, educational classes, and networking. For example, you are a woman loan officer who just started at a large bank. The bank has several thousand employees whom you do not know. You only have met your team of ten but not the other departments of the bank. You are a small fish in the immense ocean. How do you venture out safely to meet other team members? You join the women’s ERG. You want to meet other women team members from the bank. Not only do you meet other like-minded professional women but you meet potential new clients. As you grow your lending career, you must grow your networks. Joining an ERG is one solution to meeting others in your organization. Another option, if you work for a small

organization and do not have the resources, is to start your mastermind group of women. A mastermind group is a term coined by the infamous Napoleon Hill. Creating a mastermind group comprises people (usually six to eight) who come together regularly — weekly, biweekly, and monthly to share ideas, thoughts, information, resources, feedback, and contacts. Imagine creating a loose group of leaders you meet regularly for problem-solving, career advancement, brainstorming, networking, or motivating each other, holding each other accountable, and taking action for your goals.

A mastermind group can be composed of people in your industry or profession — or individuals from different walks of life. The choice is yours — just ensure the group is diverse in thoughts and individuals. It can focus on business, personal issues, or both. Nevertheless, for the mastermind group to be influential, those in the group need to be honest and comfortable enough to receive feedback for growth to develop. Therefore, I encourage you to join an ERG or Mastermind group to further your career.

VALIDATE YOUR NETWORK

Networks are at the core of social capital — leaders grow their networks because of their relationships with others. Beyond the size of the network, one needs to validate the quality and structure of the network. First, is the network open, which means there is structural diversity in the network where the members do not all know each other. Second, networks need to be diverse. Wilburn and Cullen-Lester explained that “Much of the work of leadership involves working across vertical, horizontal, stakeholder, demographic, and geographic boundaries for a group and organizational success” (Center

YOUR

CONTINUED FROM PAGE 21 22 www.mortgagewomenmagazine.com

NETWORK

for Creative Leadership et al. 3). Next, networks are profound and leaders who build profound and quality networks are more likely to share and exchange information, resources, and services with actors from varied backgrounds. Finally, women use networking as a tool to grow their social capital.

Research shows that those with more connections and networks get more job opportunities. As a result, they get promoted faster, making more money. They are seen as top talent within their organizations. However, it can be challenging for women to network. Networking is vital for a woman to participate in. In networks, the exchange of information, collaboration, development alliances, attainment of knowledge, visibility, and encouragement are part of a network’s dynamics. (Margaret Linehan and Hugh Scullion)

However, some networks are challenging to penetrate. “Women who have been largely excluded from the informal network, which are traditionally composed of men, cite the existence of the ‘old boy’ network as a primary reason why women are ignored and indeed discouraged from seeking top management positions.”

Women traditionally have been excluded from male outings, which are part of the “old boy” networks, such as golfing, sports activities, hunting, fishing, cigar-smoking, athletic clubs, adult clubs, and drinking. “The negative effects of these covert barriers included blocked promotions and career development, discrimination, occupational stress, and lower salaries” (Margaret Linehan & Hugh Scullion, 2008, p. 35).

Not all exclusions are because of the “old boy” networks. According

References:

to Parker and Welch (2013), women were less likely to connect with people with power and authority. Women have fewer connections and networks because they are less assimilated in male-dominated networks where men are in closely held positions of command and influence. “Even where women have few conflicts, they can

duties” (Weiss 5). Some findings suggested that as female networks become more robust and have more power, more females will reach senior positions with their organizations.

One’s network is one of the most competitive tools for career advancements and breaking the glass ceiling. As women, we need to attend

be hampered in the acquisition of social capital through exclusions from informal male networks”(Fitzsimmons and Callan 361).

DOMESTIC RESTRAINTS

Many constraints of women are also based on additional domestic commitments that interfere when networking events take place. Most networking events occur after working hours, and some women do not have the time to socialize and attend networking events. “Women may not have the same access to social networks as men, Eagly and Carli theorize, because they take on a disproportionate amount of family

Center for Creative Leadership, et al. A Leader’s Network: How to Help Your Talent Invest in the Right Relationships at the Right Time. Center for Creative Leadership, May 2014. DOI.org (Crossref), https://doi.org/10.35613/ccl.2014.1056.

Fitzsimmons, Terrance W., and Victor J. Callan. “CEO Selection: A Capital Perspective.” The Leadership Quarterly, vol. 27, no. 5, 5, Oct. 2016, pp. 765–87. ScienceDirect, https://doi.org/10.1016/j. leaqua.2016.05.001.

networking events that advance our careers. Who is attending? What is the function or event about? What is your purpose for attending? Is there someone you would like to meet? Is the speaker or event relevant to your career? Successful women also put a lot more structure in their day, being proactive with their time, calls, events, and goals. For instance, they set aside time for reflection. That’s when you are envisioning new ideas, goals, and managing your networks and reaching out to relationships that you may have lost contact with. Maintaining authentic relationships is key as your network grows. Remember, your network is your net worth! n

Lin, Nan. Social Capital : A Theory of Social Structure and Action. Cambridge University Press, 2001. EBSCOhost, http://search.ebscohost.com/login. aspx?direct=true&AuthType=sso&db=nlebk& AN=74320&site=eds-live&scope=site&custid =s8865349.

Margaret Linehan and Hugh Scullion. “The Development of Female Global Managers: The Role of Mentoring and Networking.” Journal of Business Ethics, vol. 83, no. 1, 1, 2008, p. 29. EBSCOhost, https://doi.org/10.1007/s10551-007-9657-0.

MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 23

In a male-dominated work environment, women tend to have fewer and weaker connections than men in the dominant coalitions that provide essential resources and opportunities for top executive positions.

A Veteran Move

TIPS AND BEST PRACTICES

FEMALE MORTGAGE PROFESSIONALS CAN USE TO EMPOWER FEMALE VETERANS TO USE THEIR VA LOAN BENEFITS

By GRACE RAGAN , Special to Mortgage Women Magazine

By GRACE RAGAN , Special to Mortgage Women Magazine

veterans and female VA users are expected to double again in the next decade. Unfortunately, despite growing numbers, female veterans continue to underutilize VA care and benefits. As a society, we are quick to thank members of the military for their service, but perhaps a more meaningful way to show our respect and appreciation for their time in uniform would be to make sure they are receiving the full extent of the veteran benefits they have earned and most assuredly deserve.

looking to empower more female veterans to leverage their VA Loan benefits and close more VA loans.

STEP ONE: ASK

This may sound simple, but the first step in making sure a borrower takes advantage of their VA benefits is to ask if she is a veteran! Too many lenders forget or neglect to ask, especially when the borrower is a woman. Many vets don’t even know that they have a VA loan benefit available to them.

According to Military.com, women now make up 15% of active duty and 18 percent of Guard/Reserve service members. Based on recent trends across all branches of the armed services,

As female mortgage lenders, we can do and should do our part to make that goal a reality. As a loan officer who specializes in VA loans, I’ve witnessed some of the lack of education and unfortunate stigmas that contribute to the underutilization of this valuable benefit.

What follows are some tips and advice — based on my own experiences in this important and rewarding market space — for female mortgage lenders

Transitioning out of the military into civilian life can be a chaotic and overwhelming process, and service members have so much information thrown at them that it’s not surprising when they don’t know about or recall learning about their VA loan benefit. Starting the conversation by asking if they are veterans and, if so, helping them understand what that benefit looks like and how it applies to their circumstances,

Grace Ragan, loan officer at Ross Mortgage Corporate

24 www.mortgagewomenmagazine.com

is an all-too-often neglected first step.

CATCH THE TRAIN

Mortgage professionals who aren’t educated about VA loan benefits or are uncertain about how to navigate in this arena, will inevitably steer clients away from them — simply because they themselves aren’t comfortable in that space. That is why lenders who want to get involved in closing more VA loans need to first make sure that they have a strong grasp of the program. You cannot educate clients and fellow professionals until you yourself are comfortable in this specialized product. I was fortunate enough to learn from my mentor Mike Fischer on the Veteran Lending Council, which offers programs for loan officers to educate and advocate for smarter and more engaged military lending.

FIND YOUR PEOPLE

Don’t just educate yourself about VA lending benefits, strive to surround yourself with others who are enthusiastic and passionate about this program. Having a team who is all pulling in the same direction can make an enormous difference. To the extent that you can, look for professional opportunities and environments where you are working alongside supportive fellow mortgage professionals who share your passion and admiration for military service, and who are motivated to help female veterans and educate and empower both borrowers and fellow lenders.

GET OUT THERE

Don’t miss out on valuable opportunities to connect with female veterans through conferences and other special events. I recently attended a conference in Lansing, Mich., focused on the female veteran experience. It was both informative and inspiring.

As a former military brat who grew up

interacting with members of the armed forces, I have a great deal of respect for veterans, and taking proactive steps to learn more about their experiences and to begin to forge great relationships with fellow attendees was both personally and professionally rewarding.

PUSH BACK

To the extent that you can, do your part to address common myths and misconceptions surrounding VA loans. The VA home loan suffers from a lack of understanding, and it is incumbent upon us as mortgage lending professionals to make sure we are doing our part to correct those misunderstandings. That starts with conversations, not only with borrowers, but with our fellow professionals, especially in the realtor community.

experiences of my career. Helping female veterans take full advantage of this benefit they have earned is the best part of my job. Seeing their faces, hearing about how much money they are saving — and what they can use that money for instead — truly never gets old.

For example, one of my recent female first-time homebuyers didn’t know she was eligible for a VA loan benefit, and subsequently, we discovered she had a disability rating that led to even more savings. These firsthand experiences are reminders that the work we do has an incredible impact on the lives of our clients.

I believe that as mortgage professionals it’s not just our job to educate and advocate for VA loan benefits, it’s our duty. For a deserving and fast-growing community of female

The more we can close the information gap, the more all parties will benefit from this unique program.

GET INSPIRED

About 17% of my own customers are VA loan benefit candidates — and that group includes some of the most rewarding and inspiring professional

veterans, I feel like that is the least we can do to give back. n

Grace Ragan is a loan officer who specializes in VA Loans at Michigan-based Ross Mortgage Corporate, one of the top independent lenders in the Midwest.

MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 25

Don’t just educate yourself about VA lending benefits, strive to surround yourself with others who are enthusiastic and passionate about this program. Having a team who is all pulling in the same direction can make an enormous difference.

Capturing The Market

KEYS TO MARKETING TO SINGLE MILLENNIAL WOMEN

By DAWN RYAN , Special to Mortgage Women Magazine

By DAWN RYAN , Special to Mortgage Women Magazine

When it comes to finding lending opportunities in today’s mortgage climate, smart originators leave no stone unturned. They need all the business they can get, and that means appealing to the broadest number of potential homebuyers as possible.

Yet there is a particular market that no lender or mortgage sales professional should ignore right now — the single woman between the ages of 26 and 41. And with this demographic, traditional marketing methods will not cut the mustard. However, there are ways originators can build long-lasting relationships with this audience if they are willing to think outside the box.

GRASPING THE OPPORTUNITY

According to the National Association of Realtors, women are second only to

married couples as the largest segment of homebuyers. This has been true for the past 40 years, in fact. However, as

a customer segment, their numbers have grown while the ratio of married borrowers have actually decreased.

In 1981, roughly three out of four homebuyers were married couples, according to the National Association of Realtors (NAR). Today, only three out of five are. Meanwhile, in 1981, 11% of buyers were single women and 10% were single men. Today, 19% are single women and 9% are single men — which means you are twice as likely to have a single woman borrower than a single man.

There are several reasons why lenders are seeing more single women buyers. One of the most obvious is that the marriage rate has been declining for several decades, and that more people are putting off marriage until they have developed a career or achieved some level of financial stability.

However, family is a motivator for women borrowers. According to NAR,

26 www.mortgagewomenmagazine.com

Dawn Ryan, senior loan officer with Embrace Home Loans

single women who have children or are taking care of siblings or their parents are also more likely to buy a home, so they have a stable place to live. Women are also more likely to sacrifice some of life’s luxuries to purchase a home, such as forgoing entertainment and travel plans.

MARKETING DO’S AND DON’TS

While single women represent a growing segment of homebuyers, lenders and mortgage professionals need to understand that they approach buying and financing a home much differently than men or married couples do. That means mortgage originators need to market to them differently, too.

For example, when marketing to single women, you cannot rely on a single message — you have to include women from all walks of life. Building cookie-cutter marketing messages based on generalizations about single women or Millennials not only doesn’t work but will likely lead to these borrowers ignoring you altogether.

You also should not use traditional messaging about the value of homeownership. Since the beginning or time, homeownership looks different through the eyes of different people. Again, the reasons why a single woman buys a home are often completely different than married couples. For example, a woman may choose to buy a home to be close to family members, whereas the married couple is looking to start a family and the single man is looking to build financial wealth.

Millennials in particular embrace inclusivity more than any previous generation, and truly look at life and their own situation through a very wide and all-encompassing lens. All of this is to say that you should not rely on traditional types of marketing. You need to focus your message not just on the person, but also other aspects, such as the local market or the type of home they want. In general, the greater diversity you have in all aspects of marketing, the better.

It’s also important to view single women not solely through their role as “homebuyer,” but also as working professionals capable of choosing their own path. Think about the mortgage and real estate ads we’ve all seen, where a Realtor is handing the keys

over to a new homebuyer. Too often the Realtor is a man, and while there are certainly many male real estate professionals, this image is not exactly empowering to women, many of whom want to work with other women.

GETTING YOUR MESSAGE ACROSS

When creating your marketing message, think about its significance to your audience. If it’s not relevant to their personal situation, it’s likely to be missed.

Your messaging needs to be concise, too. In fact, this is applicable to most homebuyers. We are all deluged by an enormous amount of marketing

reach borrowers is generally a good idea, the most effective and efficient way to market to single women

Millennials is through social media and other Internet platforms. Millennials in general also view companies that have a strong online presence and use social media, such as Facebook, more favorably than companies that don’t bother to maximize these channels. That means offering to connect on social media, so they can see what you and your company are all about.

They also value companies that share their culture and values, and social media is an invaluable tool for originators to point out the things they care about,

messages daily, so much so that it’s almost impossible to weed through it all to find information that’s truly useful or applicable to our situation. But single women and Millennials

whether it’s extending homeownership to underserved consumers or giving back to the community. Simply knowing that the lender they choose is in business not just to make money is appealing to this group because they believe life is more than that.

particularly appreciate marketing that gets to the point quickly.

While using multiple channels to

Younger borrowers and women also want to know that they are valued as a customer. After receiving a lead from a single woman borrower, that lead should be assigned to one person, so the borrower talks to the same person for every interaction.

CONTINUED ON PAGE 28 MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 27

While single women represent a growing segment of homebuyers, lenders and mortgage professionals need to understand that they approach buying and financing a home much differently than men or married couples do.

Source: National Association of Realtors (NAR)

NOT JUST A SALES FOCUS

While the goal is to sell a loan, making the sale should not be the focus of the relationship with the customer. Instead, the focus should be on offering value and approaching the relationship on the basis of “What can I do for you?” This extends to the types of loan options you’re presenting the borrower, too. You want to always suggest improvements or a superior product that works in their favor. If the

borrower is interested in one loan but a better option is available, bring it up.

Finally, if your borrower “ghosts” you — in other words, you don’t hear from them for a while — follow up with them on social media and ask if they found what they are looking for. Keep in mind that plenty of other originators are competing with you for that customer’s business, and perhaps they did find better financing — or possibly a life or a family situation simply got in the way. Following up

with them shows that you care about the relationship and that you want to make sure that customer was able to reach their goals. Relationship building may not always result in a sale, but it does make building a lasting bond much more likely.

At the end of the day, single women Millennials represent the fastest growing homebuyer segments our industry has ever seen. They deserve our industry’s time and attention, and originators who adjust their marketing to help women reach their goals will find their efforts pay off ten-fold in terms of loyal customers and referrals. No originator can afford to ignore any potential customer. But if they’re looking for growth, the single woman Millennial is where they’ll surely find it. n

Dawn Ryan is a senior loan officer with Embrace Home Loans, a topranked national mortgage lender She can be reached at dryan@ embracehomeloans.com

CAPTURING THE MARKET CONTINUED FROM PAGE 27

Single

Single

All

demographics All

Single Men Single Men 1981 2022 HOMEOWNERS BY GENDER = Married Couples 1981 2022 HOMEOWNERS BY MARITAL STATUS 11% 19% 10% 9% 28 www.mortgagewomenmagazine.com

Millennials in particular embrace inclusivity more than any previous generation, and truly look at life and their own situation through a very wide and all-encompassing lens.

Women

Women

other

other demographics

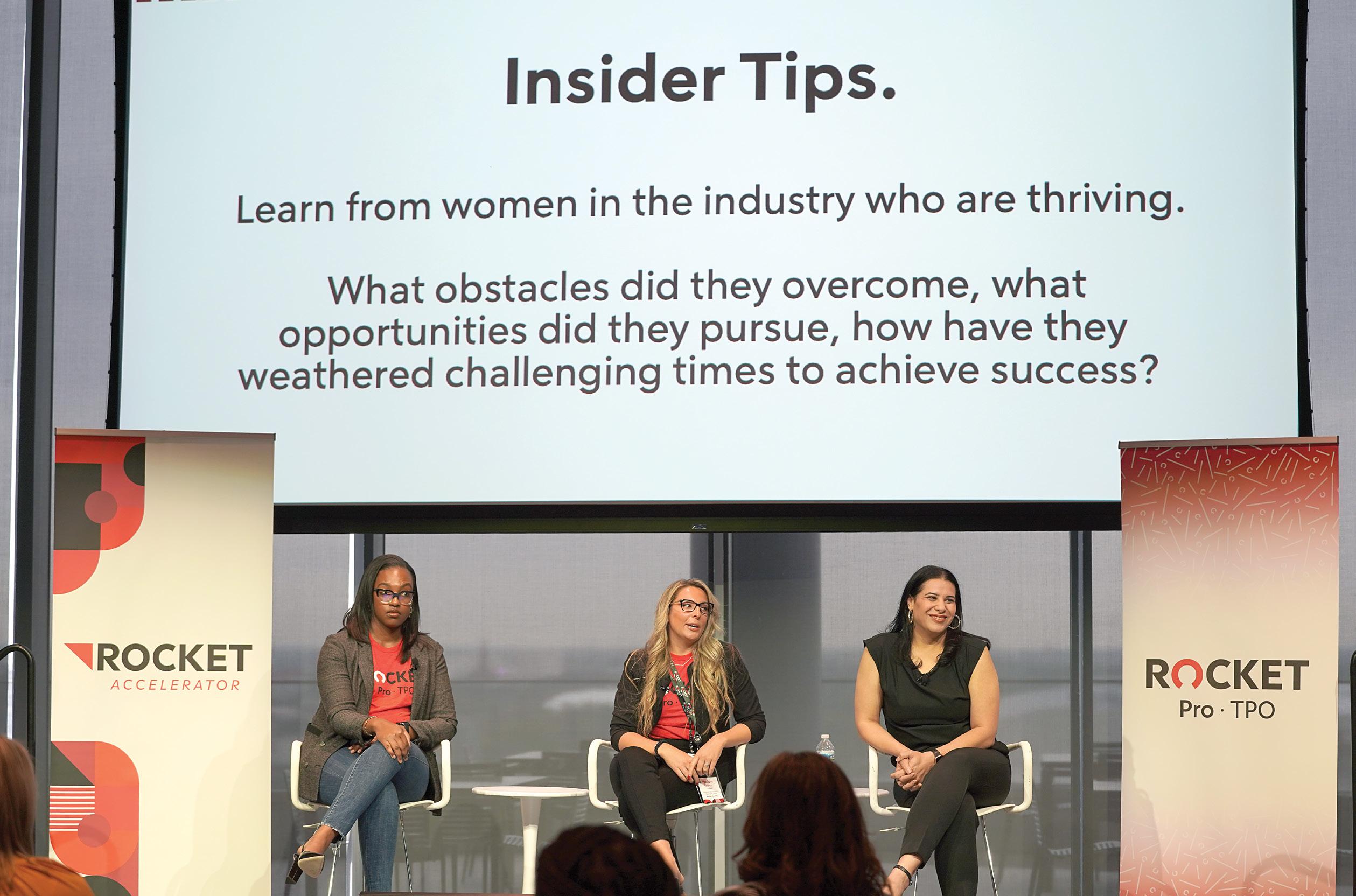

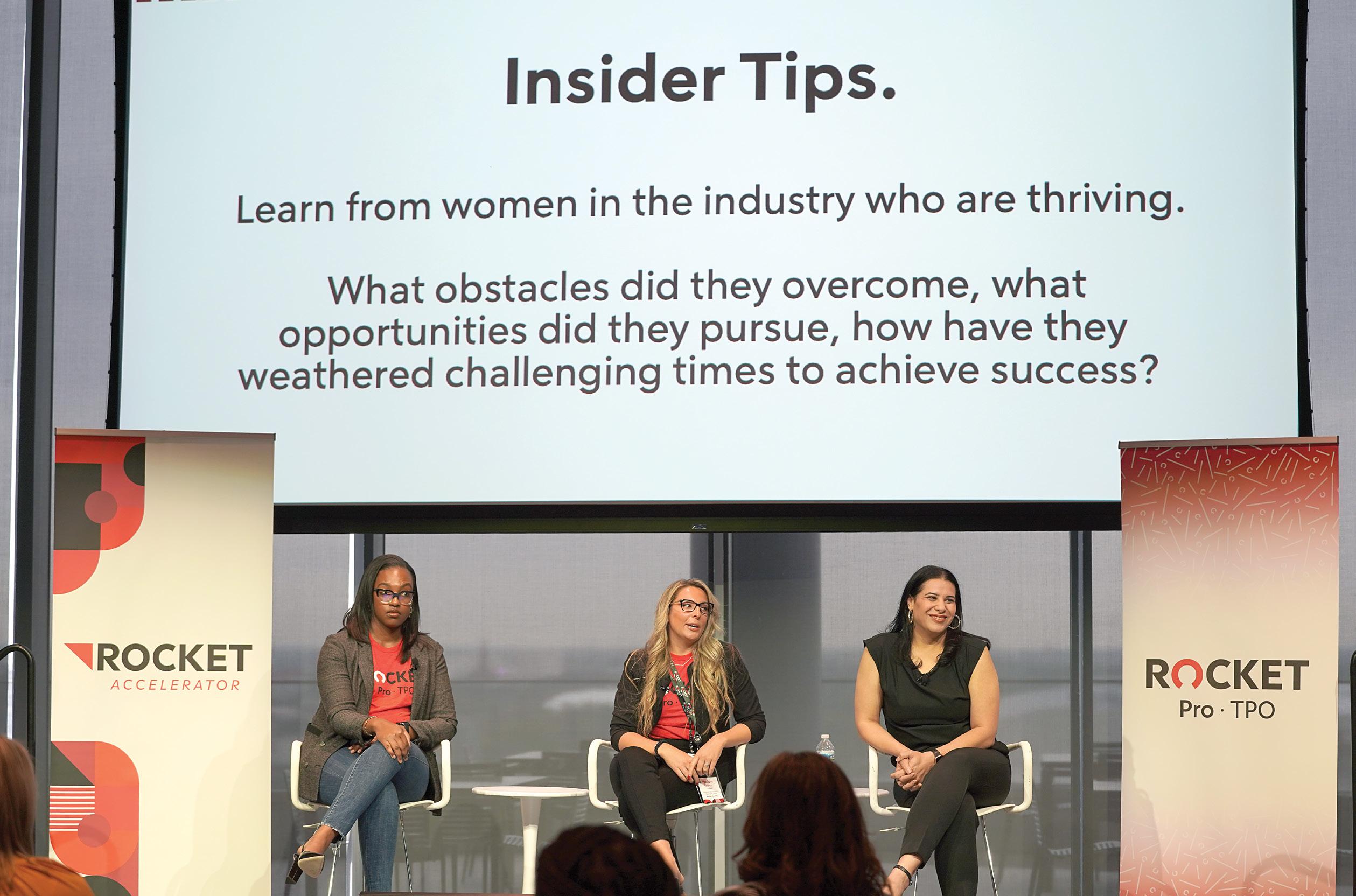

ROCKET ACCELERATOR WANTS TO SEE MORTGAGE INDUSTRY WOMEN ACHIEVE PARITY

By KATIE JENSEN

Mwho has come up through the ranks at Rocket Pro TPO from loan officer to director of strategic partnerships, is spearheading

mortgage industry to achieve higher level positions and higher paying roles.

as a shy, young woman trying to stand out in a room full of men. Even after she attained a leadership position, she

MORTGAGE WOMEN MAGAZINE • Issue 6, 2022 29

Myers, committee board member of Rocket Accelerator, was inspired by her own experience climbing the ladder in CONTINUED ON PAGE 30