THERE IS NO SUCH THING AS FRIENDLY COMPETITION’ UWM Cries ‘Game On’ For Market Share Grab NOVEMBER 2022 Vol. 14, Issue 11 $20.00 A PUBLICATION OF AMERICAN BUSINESS MEDIA SELLING TO MILLENNIALS COMMUNICATE & COLLABORATE SPECIAL SECTION > PAGE 49 AND

©Angel Oak Mortgage Solutions LLC NMLS #1160240, Corporate office, 980 Hammond Drive, Suite 850, Atlanta, GA, 30328. This communication is sent only by Angel Oak Mortgage Solutions LLC and is not intended to imply that any of our loan products will be offered by or in conjunction with HUD, FHA, VA, the U.S. government or any federal, state or local governmental body. This is a business-tobusiness communication and is intended for licensed mortgage professionals only and is not intended to be distributed to the consumer or the general public. Each application is reviewed independently for approval and not all applicants will qualify for the program. Angel Oak Mortgage Solutions LLC is an Equal Opportunity Lender and does not discriminate against individuals on the basis of race, gender, color, religion, national origin, age, disability, other classifications protected under Fair Housing Act of 1968. MS_A723_1221

The Leader in Non-QM Visit AngelOakMS.com | 855.631.9943

THERE IS NO SUCH THING AS FRIENDLY COMPETITION’ UWM Cries ‘Game On’ For Market Share Grab NOVEMBER 2022 Vol. 14, Issue 11 $20.00 A PUBLICATION OF AMERICAN BUSINESS MEDIA SELLING TO MILLENNIALS COMMUNICATE & COLLABORATE SPECIAL SECTION > PAGE 49 AND

4 Say One Thing Much like in politics, wholesale is led by those whose words don’t match their actions. 6 Be Upfront With New Hires Set expectations to keep employees working for you. 8 Make Communication Top Priority Watch for warning signs before things go wrong. 10 Keeping The Trust Passing off mortgages preturbs consumers. 15 People on the Move See who the movers and shakers are in the mortgage industry. 16 Build-A-Broker: Millennial Sales Tips It’s the message that gets through, not technology. 20 Build-A-Broker: Making Your Phone Work Your team’s efficiency and productivity can greatly improve. 22 Your First Million Dollars Training is not education — keep on learning. 24 BENCHMARKS & BEST PRACTICES: Be A Practical Networker Recent workplace flexibility can diminish contact. 26 Non-QM Lender Resource Guide 29 Private Lender Resource Guide 30 URAR lacks discrimination protection 32 Wholesale Lender Resource Guide 33 The Housing Hangover Stability could be on the horizon for 2023. 36 DataBank 38 Hiring In A Time Of Layoffs To make the cut at this company you need to be tough. 70 Non-QM Lender Directory 72 Wholesale Lender Directory Originator Tech Directory Private Lender Directory 74 Facebook Thoughts: Wanted: 5 Friends With No Problems COVER STORY PAGE 40 WHOLESALE AT WAR Is it right to blame UWM for wholesale’s woes? Or is it just a cop out? nationalmortgageprofessional.com NOVEMBER 2022 Volume 14 Issue 11 CONTENTS nationalmortgageprofessional.com SPECIAL AWARDS SECTION PAGE 49 Best Military Lenders A salute to those lenders who go above and beyond to serve military members and veterans. PAGE 57 Best Military Originators Accolades for originators who best serve the heroes who serve us in the military. NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 3

It’s ‘Game On’ For Broker Biz

Perhaps it’s kismet that this issue is coming out right before national elections. Because there certainly seems to be quite a bit of political gamesmanship in the mortgage industry right now.

As interest rates have soared, originators have seen a massive drop-off in volume and income. This has crippled some. But at United Wholesale Mortgage, execs there saw an opportunity for a power play. Give brokers a chance to offer mortgages a half to a full percentage point lower than conventional rates. Brokers were ecstatic over this idea.

Let’s look at this like a campaign rally. Brokers could choose many different lenders. But one of them says, “Pick me and you’ll have more money in your pocket.” That’s the candidate who’s going to be leading in the polls.

Frankly, it’s a brilliant business move by UWM. It ties brokers more closely to the company. It tempts those who haven’t signed up with UWM to do so — and in so doing, have to agree not to do business with UWM’s biggest rivals. The rate cut will eat into UWM’s margins temporarily, but it will ratchet up market share. And UWM benefits for as long as it keeps the cut in place, and even beyond. It can shut down the program whenever it wants, and it has lots more brokers contractually obligated to it.

If you can buy UWM stock, you should do it. Those guys play to win.

COMMUNITY CONTRADICTION

But is this good for the broker community in the long term? Because the action is helping — not causing, but speeding along — the demise of many other wholesalers who not only see a huge drop in volume, but no way to match UWM’s disregard for profits, fleeting though it may be. That means that broker choice is being whittled down right in front of our eyes. And brokers without choice — or with nominal options — aren’t really brokers at all. They’re distributed retail branches, who have to pay all their own overhead.

Last year, UWM said it was taking the high road for brokers, by insisting that they shouldn’t work with certain other lenders. UWM contended that those wholesalers weren’t good for the industry in the long term, and it was working to correct the situation. But now, UWM says it’s only concerned with brokers’ immediate well being. It dismisses the idea that elimination of choice is bad in the long-term for brokers.

Every company has to protect its own. And there’s nothing intrinsically wrong with UWM’s latest stand. But its message is contradictory to what it said last year about protecting brokers. It said then what it thought brokers wanted to hear. It’s doing the same thing now, and expecting to reap the rewards of being inconsistent in the community, but consistent in its game plan to grab more market share.

That’s a lot like the politicians who say one thing and months later take a completely different spin on issues, saying whatever voters want in order to be elected. But watch the polls: that’s a winning strategy, in politics and in business. n

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Dave Hershman, Erica LaCentra, Nick Roberson, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise

MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Submit your news to editorial@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

© 2022 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

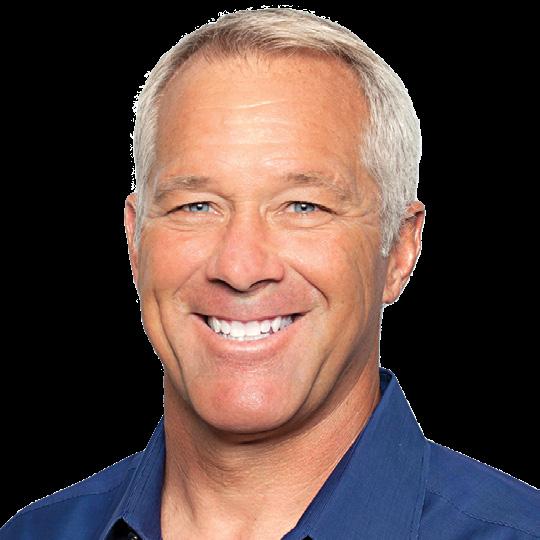

VINCENT M. VALVO Publisher, Editor-in-Chief

Phone: (860) 719-1991 info@ambizmedia.com

NOVEMBER 2022

Volume 14, Issue 11

LETTER FROM THE PUBLISHER

4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

Defining Company Expectations

Standards are set based on expected results upfront before problems arise

BY DAVE HERSHMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

We have spoken about developing a company/ branch culture.

We have also talked about

setting expectations upon hiring a loan officer. The lack of communication of expectations results in expectations that don’t match and thus turnover.

This is the proper juncture to bring up the issue of standards. The standards of your branch/company will be as a result of your expectations. In addition, they set the stage for effective coaching and monitoring — two topics that I have addressed previously.

THE MOST SIGNIFICANT STANDARD?

It is more likely that the branch or company will have a productivity standard than any other standard.

For loan officers this may include volume, number of loans or

gross revenue produced per month, quarter and/or on a yearly basis. For a processor or closer, it may be the number of files that go to closing each month. We will address the question mark after the above caption in a few moments. First let’s address a very central question:

For commissioned loan officers, should there be a production standard?

Some would argue that a loan officer on 100% commission that is not using a desk and is not being provided with benefits, costs the branch nothing. Therefore, any loan brought in is an additional revenue source without adding to the expenses significantly.

In reality, you cannot take a look

DAVE HERSHMAN 6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 RECRUITING, TRAINING, AND MENTORING CORNER

at the costs in monetary terms. The loan officer, especially if less productive, will use resources of the branch — from processing to the manager’s time. There are a limited number of resources and the use of these by a low-level producer may preclude the use of resources for other important tasks such as recruiting.

Another issue is the development of a company culture or atmosphere. Top producers tend to want to participate in an environment in which they are challenged. It is hard to be challenged by those producing one loan each quarter. That is why very productive branches tend to get stronger. And these branches are likely to have significant production standards.

Of course, during the refinance boom of the past few years, few contemplated the “resource” issue. When production wanes we are caught between keeping a loan officer because every loan counts more and realizing that we don’t have unlimited resources.

WHAT COULD BE MORE SIGNIFICANT?

Back to the question mark. What could be more significant than production standards? Believe it or not, there are many standards that are just as important, if not more important. For example:

• Standards for quality. Loan officers that hand in files that are incomplete use up a greater amount of company resources per loans closed. This is especially true if the fallout ratio is high. If the company is constantly processing “air” — then it will be hard to be profitable.

• Standards for ethics. It does no good to produce many loans and then lose your license or perhaps be suspended by a lender.

STANDARDS OF BEHAVIOR

A good example of a behavior standard would be attendance at sales meetings. Are they mandatory? You might point out that 1099 originators can’t be required to attend meetings because they are independent

who participate in the meetings?

Of course, meetings do not comprise the only standards of behavior. How are the employees to dress? Is the office business casual or suits? Can they come in any way they please, even if there are clients being serviced in the office? It may be disconcerting for a loan officer to meet with a top client and other originators are walking around in cut-off shorts.

THE KEY IS COMMUNICATION

It does not help to set standards if they are not communicated, especially up-front. You do not want a loan officer

contractors. You will note that the vast majority of Realtors are also a 1099 status. Yet, you will see that in some offices the vast majority don’t attend the meetings and in other offices, the vast majority do attend the meetings. Making the meeting mandatory is not the issue. The issues are:

• Did you set the expectations at the time of hiring?

• Did you hire the right people? Successful people do the right things and that includes attending meetings that will help in their success.

• Are the meetings helping them and are they interesting? The best people will quickly recognize that poor meetings are a waste of their time.

• Are these meetings imbedded in the culture? Are they held regularly? Are there rewards given out for those

informed of a behavioral standard only after they violate that standard. This issue should be covered as part of the hiring and orientation process. And communication “up-front” is not the only issue. Communication of these standards must be continuous. These standards will only be ingrained into the culture if they are reinforced on a regular basis. n

Senior Vice-President of Sales for Weichert Financial Services, Dave Hershman is the top author in this industry with seven books published as well as the founder of the OriginationPro Marketing System and the OriginationPro Mortgage School — the online choice for mortgage learning and marketing content. His site is www. OriginationPro.com and he can be reached at dave@hershmangroup.com

It does not help to set standards if they are not communicated, especially up-front.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 7

Improving Communication & Collaboration Across Your Organization

Warning signs to identify if your company is having communication issues and what to do

BY ERICA LACENTRA | CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

veryone has heard the phrase communication is key, but this is especially true in organizations where each department is responsible for their own piece of the process, like in the mortgage industry. Especially when volume is high and deadlines are tight, it can be so easy for each department to put on their blinders, keep their heads down, and think only of the tasks at hand that they are responsible for.

However, as we all know, a loan cannot go through the entire origination process smoothly unless all areas of a

mortgage lending company or a mortgage brokerage are communicating efficiently and working in tandem to get that loan to the closing table and beyond.

Companies with siloed processes typically experience a lack of open communication across departments and little thought as to how their piece of the puzzle factors into the overall company vision meaning there is a greater likelihood of choppy processes, avoidable delays, and ultimately unhappy customers. The problem is many organizations don’t even realize they are working in silos until the cracks begin to show and customers and business begin suffering. So, what are some of the warning signs to identify if your company is having communication issues, and most importantly what can be done to improve communication throughout your entire organization before the damage is done?

SHARE YOUR VISION

Have you ever worked in a company where one department or certain employees seem to constantly receive all the accolades and recognition regardless of how much work others are doing to get to the finish line? It can be very easy for businesses to focus on who they view as the “money

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 RECRUITING, TRAINING, AND MENTORING CORNER ERICA LACENTRA

makers” but this mentality is extremely detrimental to the overall success of an organization.

That lack of recognition across an organization is likely to cause animosity and cause departments to fight to share the spotlight, leading to reduced communication across departments and a greater unwillingness to collaborate. This is particularly dangerous to growing organizations as new hires are likely to take cues from more seasoned colleagues, leading to a deeper divide in a company and employees focusing on their task at hand rather than how their work fits into the bigger picture and how their work affects other departments.

If this sounds familiar, you were likely working for a company that lacked vision, or that vision was never properly articulated to its employees. Having a lack of vision in an organization is one of the top reasons why siloed workflows start occurring and communication and collaboration don’t happen. When employees don’t have a common goal to work towards and understand where each department not only fits into the process but the importance of how each department interacts with each other, collaboration and interdepartmental communication simply don’t seem necessary even when this couldn’t be farther from the truth.

Creating a vision and instilling the mentality that each department is critical to the organization’s success is one of the best ways to ensure departments don’t work in silos and are communicating and collaborating. Rather than focusing on individual goals for each department only and having those goals exist in a bubble, departments will develop their goals and objectives to benefit the organization. This often also allows organizations to not only recognize where bottlenecks are occurring, but it encourages departments to work together to figure out how each area can improve efficiencies to make the overall process more seamless and smoother. Working towards a common vision helps organizations look at the bigger picture and builds greater trust between departments because everyone

is looking towards how to reach that goal rather than how their department can be in the spotlight.

UNITE YOUR TEAMS THROUGH TECHNOLOGY AND SOCIALIZATION

Especially with a shift post-COVID to remote work or hybrid work models, many companies have simply failed to acknowledge that employees don’t have as many opportunities to easily communicate with their fellow colleagues. A lack of appropriate technology that encourages or allows for easy collaboration can also be a huge pitfall for companies because employees simply may find it too difficult to accomplish it. While video meetings or company chat services like Teams or Slack may be in use, those tools

projects are in process and providing greater transparency with tools like this can be key when teams cannot always easily collaborate in person.

In addition to adopting better technology, sometimes there really is no better solution than ensuring that cross-departmental interactions are happening. Joint department meetings, cross-departmental training and shadowing, and even good old fashion team-building events can be extremely beneficial to fostering a more cooperative workplace. Cross-departmental training and shadowing can provide new perspectives to improve efficiencies. It can also provide greater context as to how one department affects another and how departments can work together or make that interaction smoother. Encouraging these interactions leave

probably only scratch the surface as to how departments can better interact with each other.

Organizations should be looking at digital collaboration tools to help unite departments whether they are remote or not, foster greater communication, and most importantly develop clear workflows that can give greater visibility across teams. Project management platforms, like Monday and Trello, can be a great place to start for companies that are just dipping their toes into digital collaboration tools. Tasks across departments can be clearly seen so there is no question as to where something like notes can be left along the way to better inform departments that may be picking a task up mid-process, and collaboration can usually happen in real-time to improve efficiencies and keep things moving. Being able to see what initiatives and

lines of communication more open which will ultimately lead to greater collaboration.

DON’T WAIT, COLLABORATE

Lack of communication and siloed workflows can be extremely detrimental to an organization’s success. That’s why whether your organization is big or small, you should constantly be encouraging greater communication and collaboration. Small changes, like what was mentioned above can have a huge impact such as creating more efficient workflows, reducing duplicated work, and creating a much more enjoyable customer experience. So, empower your employees to work together, and get people talking. n

Erica LaCentra is chief marketing officer for RCN Capital.

Creating a vision and instilling the mentality that each department is critical to the organization’s success is one of the best ways to ensure departments don’t work in silos.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 9

All Hands On Deck

Work with others to keep your clients in their homes

BY LEW SICHELMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

It’s no secret that borrowers don’t like it when their lenders, the ones they planned to pay, transfer their mortgages to third party servicers. But when a loan is traded from one servicer to another, it really yanks a borrower’s chain.

That fact was brought home again recently by J.D. Power, which found that the trust factor fell significantly when servicing is sold repeatedly. And that’s on top of the confidence people lose when the originator ships their mortgages off in the first place.

Power’s 2022 Mortgage Servicer Satisfaction Survey, which polled nearly 8,100 borrowers, found that their level of contentment slipped considerably — 130 points on a 1,000-point scale — when mortgages are passed off by the originating lender. And when loans are dispatched again, the satisfaction level sinks by 133 points more.

In total, that’s more than a 25% decline. And by that time, moreover, the level of satisfaction is only about half that of borrowers whose loans were written and administered by the same company, Power says. Indeed, after a mortgage was transferred, only 15 percent of those customers said they were “very likely” to consider

using the original lender sometime down the road.

HIDE, NOT HELP

Is it any wonder, then, that when a borrower finds himself in financial straits and is having trouble making his payments, no matter which outfit is collecting them, he tends to hide rather than come forward and ask for help?

Even when the lender/servicer reaches out, borrowers tend to ignore them.

Part of that, of course, is that many borrowers think they’ll be able to rectify their situations all by their lonesomes. Another part

is that some just bury their heads in the sand, hoping their problems will magically disappear on their own. But some folks just lose faith in the entire process, so much so they think they’ll just be spat upon again.

This all matters because more and more borrowers are finding themselves in financial difficulty of late. In August, the latest figures available as I am typing this on my old Royal Plus, foreclosure notices were filed against 34,500 properties country-wide, according to ATTOM, the real estate data company. That’s up 14% from July, and 118% from August a year ago.

Black Knight also reports that

LEW SICHELMAN 10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 RECRUITING, TRAINING, AND MENTORING CORNER

foreclosure starts bumped up in August. Repo filings were still about half what they were during the pandemic, but up, nevertheless. And it’s likely to get worse, according to LendingTree. By and large, most people are not behind on their payments, the lender-borrower matching service said. But nearly one million face the threat of foreclosure “in the next two months,” the outfit reported in late September.

CONVENTIONAL DEFAULTS

Not to beat this horse to death, but consider a report from Milliman, which now expects conventional mortgages to default at some point in their lifetimes at an increased rate. Already, the actuarial firm says the rate at which loans are late by 180 days or more is rising, mainly at the hands of cash-out refis.

All this begs the question: How can services reach borrowers? And better yet, how can the various players in the home buying process help?

It seems to me that realty agents and loan officers could very well play an instrumental role in bringing clients who have run into financial difficulty to the table to discuss their troubles and figure a way out. After all, there are numerous options available, if only borrowers would sit down and talk about where they stand.

So I asked two different servicing executives — Darrell Neitzel, vice president of operations at Sourcepoint, and Allen Price, a senior vice president at BSI Financial Services — how they can enlist a borrower’s agent or lender (assuming they are trusted) to speak to their former clients on the servicer’s behalf. Both indicated they’d welcome any help they can get.

Of course, you’d need to secure the borrower’s permission to reveal his loan status to his agent or lender, as Neitzel rightfully points out. But it says here that you don’t have to disclose any details when calling them to ask them to reach out to their former clients. Yes, it might be a tacit indication that something’s wrong. But as long as nothing is actually verbalized, it seems kosher to me to make that effort in order to help borrowers save their homes.

Neitzel said the most success he

has had with this approach is when the underlying property is listed for sale. But still, he warns, “third-party authorization from the borrower is required for the agent to learn the details of the loan status.” And Price agreed. “Going around a borrower’s back and doing things they aren’t aware of won’t do the trick,” he said.

LINE OF DEFENSE

At the same time, though, Price believes a familiar presence might just help convince the borrower to speak with the servicer. Indeed, “receiving advice from a familiar voice is often the first step to trusting” the servicer, he said. That’s why agents and lenders might want to advise their clients in advance if they ever find themselves unable to make a payment — or even think they might miss a payment — their counsel is always available.

Tell them that the big bad mortgage company may be big but it isn’t so bad. Tell them the servicer is not interested in taking their homes away from them. Tell them the servicer will listen to their plight and offer different ways to help overcome whatever difficulties

You also can act as a first line of defense against unscrupulous mortgage relief operators who fleece unsuspecting borrowers out of millions every year. The Consumer Financial Protection Bureau has rules to do that, but Uncle Sam can’t stop them all. Like the guys the Federal Trade Commission and the California Department of Financial Protection want to stop from operating an alleged sham mortgage relief operation.

A federal court has temporarily shut down the operation and frozen the assets of the two defendants who supposedly targeted distressed homeowners with their deceptive claims in telemarketing calls, text messages and online ads, often promising that in just three months, they can get consumers’ mortgages modified. In some instances, they supposedly claimed to have ties to Uncle Sam.

NOT LEGIT

For what it’s worth, legit servicers shy away from social media when trying to make contact with bashful borrowers. BFI has found that tracking down borrowers through e-mails, texts and direct messaging doesn’t work

they may have. Tell them to give the servicer a call. And while you’re at it, tell them that servicing is transferred on almost every loan these days so they won’t be so pissed off.

The sooner servicers are able to make contact, the better, so every trusted advisor should not delay trying to help. “You want to reach a borrower and find the cause as early as possible,” Price told me. “It’s like a patient and his doctor; the sooner the diagnosis, the better chance there is for recovery. At the end of the day, building trust through empathy and education improves the chances of keeping borrowers in their homes, which is what everybody wants.”

because “consumers often find these methods suspicious and intrusive,” Price said. “Basically, it’s the opposite of building trust. In fact, they can even hurt a servicers reputation.”

Once contact is made, Sourcepoint operatives “steer away from starting calls with asking for a payment,” said Neitzel. The company starts by saying “we are here to help” and continues to emphasize that “we want you to stay in your home.” And Price said BSI has found that “the more we educate borrowers, the better chance we have to earn their trust and help them.”

CONTINUED ON PAGE 12

You can at a minimum tell your former clients that several different options are available to keep them in their homes.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 11

ALL HANDS ON DECK

That’s where trusted advisors can help as well. Though the specific details are best left to trained workout specialists, you can at a minimum tell your former clients that several different options are available to keep them in their homes, as are a couple of choices if they decide they can’t hack it anymore. At the very least, you can advise them that foreclosure is a process, not an event, that takes months or even years to complete. So depending on where they live, it could take a while. Not as long, perhaps, as the California couple who hadn’t made a payment since 2009. They were finally kicked out of their $1.7 million manse this summer. But they lived, rent free, ever since their mortgage was modified 13 years ago. Obviously, these are not the kinds of borrowers who want help fixing their situations. But there will be thousands of others who need help. And

it may just take a call from their agent or broker to push them along. n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the

housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country. He also has been real estate editor at two major Washington, D.C., dailies and spent 30 years on the staff of National Mortgage News, formerly National Thrift News.

RECRUITING, TRAINING, AND MENTORING CORNER

CONTINUED FROM PAGE 11

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.

Listen by

following the link or by subscribing wherever you get your podcasts.MORTGAGENEWSNETWORK.COM 12 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

Deephaven Mortgage LLC. All rights reserved. This material is intended solely for the use of licensed mortgage professionals. Distribution to consumers is strictly prohibited. Program and rates are subject to change without notice. Not available in all states. Terms subject to qualification. deephavenmortgage.com NMLSConsumerAccess.org MLS #958425 Disclosures & Licenses https://deephavenmortgage.com/disclosures-and-licenses/ deephavenmortgage.com The experts at Deephaven are leading the way. Training and preparation are the key to a fast start in Non-QM. Deephaven’s webinars, tutorials and DIWY (Do It With You) application support will have you ready to enter this booming market in no time. To sign up, contact: info@deephavenmortgage.com Don’t just join Non-QM, take the lead right out of the gate. SCAN HERE TO CONTACT US TODAY

> Texas-based Lone Peak Lending has joined the Panama Mortgage Group and Donovan Stamps will lead the company as president.

> Cenlar FSB, a mortgage loan subservicer and federally chartered wholesale bank, hired Ang Shen as vice president of model risk management.

> Nations Lending has hired Stacey Gross as branch manager for its new Scottsdale, Ariz., location.

> Sales Boomerang and Mortgage Coach announced the appointment of Rich LaBarca to the role of chief product and technology officer.

PEOPLE ON THE MOVE // SPONSORED BY HOW NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE BUILD A BROKER Sell To Millennials! Be Smart On The Phone YOUR FIRST MILLION DOLLARS Don’t Just Train: Educate BENCHMARKS & BEST PRACTICES Healthy Networking Habits CAREER TICKER: People On The Move NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 15

Selling Millennials A Mortgage

LOs find it’s more about the message than the technology

BY DOUG PAGE, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL

Millennials, those nearly 72-million strong digital natives, outnumber aging, analog baby boomers, meaning that if mortgage brokers, originators, and loan officers want to sell this dominating consumer group a loan, they better speak their language, understand their touchpoints, and

know where to reach them.

Born between 1981 and 1996, millennials, the U.S. Census Bureau estimated three years ago, surpassed baby boomers as the country’s largest living generation. They’re also considered the country’s first “digital natives,” meaning they’ve never known a day without the internet, email, and cellular phones. They learned to communicate with their friends and family via email while growing up

and extended it to text messaging and various social media outlets, including Instagram and SnapChat, becoming the country’s biggest digital users.

But there’s something else that gives them added importance for any mortgage broker or loan officer: These digital natives currently comprise 43% of all homebuyers, reports the National Association of Realtors, up from 37% of all homebuyers a year ago.

Often criticized for taking their time

> RiskSpan, a technology and compre hensive data management and analyt ics company appointed Patricia Black as its chief client officer.

> SingleSource Property Solutions, a provider of residential property, has hired Jodi Bell as vice president of national sales.

> Waterstone Mortgage Corporation announced the opening of a new branch in Tampa, Florida, led by Regional Manager Chris Smith

> Total Expert announced that Dan Catinella has joined the company’s executive leadership team as chief lending officer.

BUILD-A-BROKER

PEOPLE ON THE MOVE //

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE 16 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

to grow up and slow to make decisions, millennials are similar to preceding generations: Like baby boomers, born between 1946 and 1964, and Generation X, born between 1965 and 1980, they, too, faced issues and experiences unique to them, including increased college tuition costs, which means they’re likely still paying off student loans, and continue to feel the fallout from the 2008 mortgage crisis and the recession that followed.

REACHING THE MILESTONE

“The 2008 financial crisis, student debt, and then the skyrocketing prices over the past two years have kept them from reaching that (homeownership) milestone,” said Chicago-based generational strategist Katherine Jeffery. “For many, home ownership is important, but some feel like renting is where they will end up.”

Her discovery of how millennials view the possibility they’ll become homeowners was backed up earlier this year by Bankrate, when, in a survey, it learned that 44% of millennial nonhomeowners cited high home prices as the reason they continue to rent.

Lisa Fenske, senior vice president for marketing and communications at Pewaukee, Wis.-based Waterstone Mortgage, echoed Jeffery’s views.

“Their age group — just like any generation — has seen its share of unique challenges. From student loan

debt to unpredictable job security, millennials continue to face some tough obstacles,” she said.

To better understand the best way to approach and sell millennials a mortgage, National Mortgage Professional Magazine surveyed over 300 mortgage brokers, originators and loan officers via email, soliciting them for their best suggestions on working with this generation, many of whom are now in their prime homebuying years.

IT’S THE MESSAGE

One Texas-based mortgage loan officer warns that brokers and loan officers who don’t change their message do so at their peril.

“Millennials are planners, researchers and spreadsheet builders,” said Dallasbased Claire Richard, who is also a millennial and a branch manager for Park Cities Mortgage. “They recognize the importance of building equity and have access to a vast resource, the internet. The best way to encourage millennials to take action is to take a step back and promote no action.

“What I mean by this is that we need to pitch the conversation, not the sale. Pitch your expertise, your likeability, and your availability. Take time to provide different down payment scenarios and define a goal to which they can work. Start by playing the long game,” she added.

For the loan officer that doesn’t recognize how millennials operate, Richard offers this warning: “We must adapt, and we must adapt quickly because if the rate of change outside of our business happens faster than inside the business, we won’t survive.”

MILLENNIALS ARE RESEARCHERS

While there are a variety of views on

> Cenlar FSB, a mortgage loan subservicer and federally chartered wholesale bank, announced that Gary Gaskin has been named vice president of transfer services.

> Planet Home Lending, a national mortgage lender and servicer, has hired Lynette Hale-Lee as western regional manager.

> Gateway Mortgage, a division of Gateway First Bank, an nounced the promotion of Steve Thomp son to regional vice president of the South Texas Region.

> HomeGuide Mortgage, a joint venture partnership between CMG Financial and RE/MAX Gold Nation announced its new venture president, Tim Carroll

SPONSORED BY CONTINUED ON PAGE 18

Katherine Jeffery, generational strategist

Lisa Fenske, senior vice president for marketing and communications, Waterstone Mortgage

“We need to pitch the conversation, not the sale. Pitch your expertise, your likeability, and your availability.”

– Claire Richard, branch manager, Park City Mortgages

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 17

how millennials act before deciding to buy a home, one of the answers received most often from those responding to the survey is that the way millennials conduct research separates them from previous generations.

“We find millennials are information seekers and like to do plenty of research on their own before taking action to speak with a professional,” said Tucson, Ariz.-based Margaret Taylor, a senior loan officer with Nova Home Loans. “This is the generation that has grown up learning from Wikipedia and YouTube as much if not more than they have from traditional education.

“Online content helps them understand what they need to do to be prepared to make a purchase and understanding the steps necessary tend to resonate with them,” she added.

Another mortgage originator

PEOPLE ON THE MOVE //

> Repay Hold ings Corp., a provider of vertically integrated payment solu tions, added Erik Skinner as senior vice president, mortgage vertical executive.

describes millennials as knowing that the sooner they buy, the better off they are financially.

“They aren’t waiting for the marriage, white picket fences and 1.5 kids (before buying a house),” said Peoria, Ariz.-based Loan Consultant Matt Oliver, with the Lund Mortgage Team. “They understand, at a younger age, that buying property is a large step towards wealth creation.”

WHERE TO MESSAGE

While many responding to the survey

agree about where to reach millennials — online, especially on social media sites, like TikTok and Instagram — there are aspects of this generation some mortgage originators and loan officers might find surprising.

“They may be mobile-first digital natives who will expect a seamless online experience, but they also value human connection and one-onone guidance from a trusted advisor,” Anderson said. “First-time homebuyer seminars, workshops, podcasts and in-person consultations are particularly powerful for brands and advisors to demonstrate value and build relationships with potential customers.”

Dallas-based Richard says monthly emails, and the way they are presented, are essential for reaching millennials.

“When crafting your email, you should angle to avoid ‘the unsubscribe button,’”

SHARE CAREER NEWS WITH NMP™

> Consumer lending and real estate ser vices provider loanDepot has appoint ed Gregory Smallwood as chief legal officer and corpo rate secretary.

> Ross Mort gage Corpo ration, head quartered in Troy, Mich., is expanding into Tennes see with local mortgage leading expert Alex Jimenez

Have news of a major new hire or promotion in the mortgage industry? Submit the information to Senior Editor Keith Griffin at kgriffin@ambizmedia.com for possible publication. Announcements should include a headshot. NMP™ has the final determination on which items are published.

BUILD-A-BROKER

SELLING MILLENIALS CONTINUED FROM PAGE 17 BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

Matt Oliver, Loan Consultant, Lund Mortgage Team

Margaret Taylor, senior loan officer, Nova Home Loans

18 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

she said. “You achieve this by keeping your emails concise, visually pleasing, geographically pertinent and engaging. The unfortunate downside of all the wonderful resources millennials have at their fingertips is a short attention span.

“You must hustle harder to stay relevant. Remember, no one needs a loan officer until they need a loan officer and when they need one, it’s your name they should be seeing,” she added.

‘EMPOWER THROUGH EDUCATION’

Any message, says generational strategist Jeffery, must be genuine.

“They want to buy from brands that show authenticity and are somehow making the world a better place,” she said. “If something is going to improve their life or someone else’s, that is a very good thing.”

Adds Sacramento, Calif.-based Matt Gougé, the branch manager at UMortgage, “If you want them (millennials) to act, you have to empower them through education. In the mortgage and real estate space, the content that provides value and educates is the content that gets consumed, shared and engaged.”

But it’s not all about a website, he says.

“Millennials want a combination of high tech/high touch, which means you need to have technology to make

the application and home buying process smooth and easy (but) you also have to insert the human component to advise, listen and guide. It’s a multiprong approach.”

REMEMBER TO LISTEN

Eric Mitchell, an executive vice president with San Diego, Calif.-based Gold Star Mortgage Financial Group, also says listening is important when it comes to engaging with millennials.

“They don’t want to be persuaded or feel coerced,” he said. “They want transparent access to simple information so they can make a decision on their own terms. The company that listens will win them over.”

And the message is crucial, says Waterstone Mortgage’s Fenske.

“One of our biggest challenges is helping millennials understand that their financial situation doesn’t have to be perfect if they want to purchase a home — and that building longterm equity via homeownership is almost always worth the financial commitment,” she said. “This is where transparency comes into play — if we can be genuine, upfront and clear with our messaging, millennials are more likely

to trust us with their business.”

The message also needs to be to the point, says Jim Anderson, senior vice president of marketing at Plano, Texasbased Finance of America Companies.

KEEP IT SHORT

“Brands need to follow the ‘TLDR rule’ (Too Long, Didn’t Read) and build snack size content and video is effective here,” he said. “Finance of America Companies regularly launches campaigns that incorporate videos, infographics and social media to concisely highlight a myriad of financial subjects.”

Anderson also counsels that millennials, like other first-time homebuyers, can be confused about what it takes financially to buy a home.

“If a homebuyer doesn’t understand the different mortgage options available to them or has misconceptions of what it takes to buy a house — for, instance, believing that a 20% down payment is required to purchase a home — then they’re less likely to consider purchasing a home,” he said.

“It’s important to focus on providing guidance and education for these potential customers and work with referral partners like real estate agents and financial planners to reach them.” n

SPONSORED BY

Matt Gougé, branch manager, UMortgage

Eric Mitchell, executive vice president, Gold Star Mortgage Financial Group

Jim Anderson, senior vice president of marketing, Finance of America Companies

KNOW IT ALL. Way more than a magazine. Stronger Stories We discuss the issues in the industry others may be too wary to touch, and we never let advertise relationships affect our stories. Hands-On Advice Find actionable advice from professionals across the industry with tips to further your career, grow your business, and more. Industry Insights Don’t just read the news — understand it. Find insightful articles from leading industry voices to help digest all the changes in the industry. nmplink.com/subscribe

5 Ways Smartphones Can Boost Your Productivity

Use these tips to improve your team’s efficiency and productivity

BY RIEVA LESONSKY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

If you’re a devotee of iPhones, it’s time to get excited—Apple just unveiled its new lineup of smartphones. Since the release of iPhones in June 2007, they have changed how we work and live.

Whether you’re a loyal iPhone user or a fan of Android, there is likely a lot you don’t know about how smartphones can improve your team’s efficiency and productivity.

Here are some tips for how smartphones can boost your business.

READ YOUR VOICEMAIL

A current TV commercial pokes fun at people who leave voicemail messages (“in most cases, a text will do”), implying voicemail is old school. While you may not agree with that assessment, we can all agree that listening to voicemail can

be time-consuming. You can remedy that by using visual voicemail, which instantly transcribes voicemails, letting you check them at a glance.

All iPhones and most Android phones come with a built-in visual voicemail app, or your carrier may provide one. You can get a third-party app if you don’t like the app supplied with your phone. The Android Guy says that while it’s likely, that you won’t need one, “if you’re running an older phone, or don’t have a phone plan,” check out their list of seven best visual voicemail apps.

BUILD-A-BROKER

Rieva Lesonsky

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE 20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

Alternatively, you can use the Google Voice app (available for Android and iOS) to convert your voicemails into Gmail (Google) emails or text messages that you can read later, suggests Todoist.

GET A SECOND LINE

Since weaning off my home landline, my mobile phone is constantly ringing, and I often don’t know if it’s a business or personal call.

To deal with the problem, I’ve considered getting a second smartphone but have hesitated because of the cost. I’m tough on my phones and didn’t want to get a cheap burner phone.

If you identify with this dilemma, you’ll be happy to know it’s not necessary to juggle two smartphones. Sideline, which has been around since 2016, allows you to get a second number for your phone.

Getting that second number saves you the cost of buying a new phone and allows you to separate your work and business lives. Or have another line for any side hustles you’re also operating.

The additional number is fully functional, offering unlimited calls and texts, separate voicemails and contacts, auto-reply, and more. Plus, you can choose your area code to project a local presence in any area you want.

In these days of remote or hybrid work, you might also consider getting a

second number for your remote workers, eliminating the expense of equipping them with a work phone in their homes.

STAY FOCUSED

Smartphones make you more efficient but can also rob you of productivity, constantly tempting you to check emails, social media apps, and news feeds. Focus Mode on Apple devices allows you to turn off notifications with one swipe, reducing interruptions from any Apple device like an iMac computer, iPad, or MacBook laptop. MUO (MakeUseOf) lists several focus modes you can choose from.

For anyone using an Android device, Online Tech Tips says, “if your device

runs Android 10 or later, you can enable Focus Mode manually or configure it to auto-activate on a schedule.”

AUTOMATE TASKS

MUO also shares how using the Shortcut app on your iPhone allows you to automate repeated tasks, saving you lots of time. You can create the shortcuts yourself or download some from the internet.

Samsung phone users can create routines using Bixby, the virtual assistant features.

MUO cautions that Shortcuts need to be updated occasionally due to API changes and the release of new versions.

ADD A VIRTUAL ASSISTANT

Speaking of shortcuts and saving time, adding a voice-activated personal assistant to your phone can save you significant time because the assistants do the work for you. Most can place calls or send texts on your command.

Many phones come with an included voice-activated assistant, like Samsung’s Bixby and iPhone’s Siri. You can add Alexa to your smartphone if you’re an Amazon Echo fan.

In addition to Alexa, there are several virtual phone assistants from thirdparty providers you can put on your smartphone, like Google Assistant and Microsoft’s Cortana. If you want to take it up a notch, check out DataBot, which speaks and understands 13 languages and, in addition to helping you with work tasks, can entertain you with jokes and riddles.

There’s no question that smartphones have significantly impacted small businesses, allowing us to collaborate better, communicate, and save time and money. They’ve made our businesses more efficient and productive, enabling us to do more with less. n

This piece originally appeared on SCORE. org. Rieva Lesonsky is president and CEO of GrowBiz Media, a custom content and media company focusing on small business and entrepreneurship, and the blog SmallBusinessCurrents.com.

Getting that second number saves you the cost of buying a new phone and allows you to separate your work and business lives. SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 21

Education Is So Much More Than Just Training

There are many benefits to lifelong learning

BY HARVEY MACKAY, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL

Afather said to his son, “I’m worried about your being at the bottom of the class.”

The son responded, “Don’t worry, dad, they teach the same stuff at both ends.”

A wise sage once told me, “Education is what you have left over after you have forgotten everything you’ve learned.”

My good friend Nido Qubein, a fellow member of the National Speakers Association and president of High Point University, explained the difference in education vs. training, as he views it: “Training is imitative; education is creative. The difference between a trained person and an educated person is the difference between a parrot and an orator.”

His point was that once you learn a training procedure, you keep repeating it for as long as the task is useful. Training has a beginning and an end. Education, on the other hand, teaches you to develop your own procedures, solve your own problems and move on to other challenges. Education is a process that has a beginning, but no end.

Nido added: “In today’s business world, a well-educated person is far more valuable than a well-trained person. Employees who are welltrained but not well-educated may perform their tasks with skill, but they aren’t motivated to look beyond the specific task.”

MORE THAN A PAYCHECK

Researchers at the Pew Charitable Trust found that a four-year college degree helped protect young people from low-skilled jobs with lesser wages and unemployment. The U.S. Census Bureau estimates that a college graduate earns nearly $1 million more over a career than a high-school graduate.

Nido insists that education is more than a paycheck. He said: “When you get educated, you can become your best self in every possible way. Educated employees become partners. They see themselves as part of the organization. They share its goals, buy into its vision and exult in its success.”

I will go one step further than Nido Qubein. That is that school ends, but education doesn’t. You are not in school once for a lifetime. You should be in school all your life. Education is the movement from darkness to light.

The person who knows how to read, yet doesn’t read, is no different from the person who can’t read.

As you can tell, I’m a big believer in lifelong learning.

A NEW PRIORITY

There is a famous story about Oliver Wendell Holmes Jr., one of America’s most distinguished Supreme Court Justices. Holmes was in the hospital when he was more than 90 years old, and President Theodore Roosevelt came to visit him. As the President was ushered into the hospital room, there was Justice Holmes reading a book of Greek grammar.

President Roosevelt asked, “Why are you reading about Greek grammar, Mr. Holmes?”

And Holmes replied, “To improve my mind, Mr. President.” Ninety … and still trying to learn something new!

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE YOUR FIRST MILLION DOLLARS

Harvey Mackay

22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

Why not make continuing education a new priority?

Education is an investment and never an expense. Consider education a capital improvement. Don’t be ashamed to borrow, particularly to replenish your professional inventory. In fact, self-improvement is the one area in which you should really increase your spending, not decrease it. Please don’t misinterpret these words as pertaining only to a college education. Any education — in the trades, self-guided or purely for a change of pace — is a critical part of our ongoing development. Studies have shown that we use a very small part of our brains, so there is plenty of room for more learning. Don’t cheat yourself out of any opportunity.

UPGRADE YOUR SKILLS

Take courses, either in a classroom or online. Go to seminars. Listen to

educational and self-improvement podcasts. Network at trade group meetings. Upgrade your skills. You cannot ever afford to rest on what you learned in high school or college. Enhance what you already know and pick up new material. Computers. Language. Public speaking. Writing. Continue your education.

Think about it — once you have learned something, it’s yours to keep forever — and use however you wish. You have the capacity to adapt knowledge to various situations, to apply what you have learned and improve an outcome. Your education can pay for itself over and over.

It truly is a gift, perhaps one of the

best gifts you can give yourself. Be generous with yourself!

An anxious mother was questioning Princeton University President Woodrow Wilson, who later became president of the United States, about what Princeton could do for her son.

“Madam,” the exasperated Wilson replied, “We guarantee satisfaction, or you will get your child back.”

Mackay’s Moral: Education is the gift that just keeps on giving. n

SPONSORED BY We’ll Provide Brokers with the Service They Deserve. Loans subject to credit approval. © 2022 Ridgewood Savings Bank. All rights reserved. Ridgewood has given us the opportunity to set ourselves apart from other originators. Their outstanding service helps us exceed our clients’ expectations.” David Khani Patriot One Mortgage Bankers, LLC Lear n more at ridgewoodbank.com Count on our wholesale lending team for mortgage opt io ns with extra flexibility, b ut not extra costs. You’ll have expert support at every step. Bijan Farassat (917) 731-4870 bfaras sat@ridgewoodbank.com NMLS ID# 646654 J oseph Novi ello (718) 240-4780 jnov ie llo@ridgewoodbank.com NMLS ID# 625762

The person who knows how to read, yet doesn’t read, is no different from the person who can’t read.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 23

Healthy Networking Habits

This lost science needs to become part of a regular routine

BY MARY KAY SCULLY, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL

Did you begin your day with a healthy breakfast or an exercise routine?

Maybe even both?

My guess is there’s an even split between those with a healthy routine and those that roll out of bed scrambling for the coffee — and run out the door at 8:15 a.m., hoping they’ll magically make it to work by 8 a.m.

Even still, some of you may be used to starting your day with a healthy routine, but it has fallen by the wayside for one reason or another. Can you think of any areas of your professional life that feel that way?

I think that for many people networking is that lost routine. Herminia Ibarra, a professor of Organizational Behavior at London Business School, said, “Networking is a lot like nutrition and fitness: we know what to do, the hard part is making it a top priority.”

The bottom line is many people are not networking like they once did, especially not in person. Even in 2022, as more people began to gather in person, virtual events

remain popular. A 2021 global survey by Kaltura found that at least 48% of organizations planned to host more virtual events in 2022.

While remote work and events provide us with great flexibility, we may have lost an important element of relationship building. Let’s talk about networking, how it’s changed and why you should get back out there and start meeting people again.

WHAT IS NETWORKING?

Investopedia defines networking as “ … the exchange of information and ideas among people with a common profession or special interest, usually in an informal social setting.”

While that is networking at the surface, it is actually so much more. Especially in our industry, networking is a critical source of business — and good business is something everyone is after right now.

HOW HAS NETWORKING CHANGED?

While you used to be able to meet people at conferences,

trainings, or local business events, many of us have lost that element. With many events being virtual even now, or at least having a virtual option, it’s so easy to opt for the choice to stay home, be comfortable and multitask — but that’s the very issue. It’s hard to network virtually — you don’t just run into people online and you can’t strike up a conversation as casually. It’s also harder to focus on networking if you’re at home and have other distractions pulling your attention away from making connections.

WHAT DO WE DO?

No matter your forum for networking, you must be intentional. Be it remote or in-person, you need to schedule networking time into your day, week, or month.

Be deliberate and purposeful in your communication. This not only goes for business partners, but customers, too — you never know who you may be talking to. While it’s critical to build relationships with realtors and builders, think outside the box too. Consider large employers, trade associations, the local Rotary club,

BENCHMARKS & BEST PRACTICES MARY KAY SCULLY 24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE SPONSORED BY

neighborhood watch groups, or even the new moms club. Connect with a broad array of people and you’ll be surprised at how things line up.

Whoever the person is that you’ve connected with, make a conscious effort to stay in touch and provide value in some way — your business will thank you for it. They won’t all become customers or partners right away, so be patient and persistent. The simple act of being present and intentional in your communication can pay off both in the short term and for years to come.

It’s time to get back out there. Start putting some thought and effort into how you’re connecting with people and building relationships with them. This may push us out of our comfort zone, but what we’ll gain is far more valuable than the comfort we must risk.

Just like you have to make a conscious effort to keep your body healthy, you must be intentional about keeping your business healthy, too. It takes effort, but in the long run, you’ll always be glad you took that extra step. n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum. In this role, she trains over 7,500 professionals per year on a wide range of topics, including TRID, updates to process improvements, and how to navigate and adhere to evolving compliance requirements. With over two decades of experience at Enact, Mary Kay also has served as an E-Business Development Manager, Director of Customer Education and Organizational

Effectiveness, and as a Service Center Manager. Mary Kay is a graduate of the National School of Banking and received an MBA in Business Administration/Management from Fairfield University, Fairfield, CT.

She has held Series 7 and Series 63 (Uniform Securities Agent License). She holds a Six Sigma Quality, Functional Black Belt Certification. Certified Trainer in DiSC Behavioral Profiling. The statements in this article are solely the opinions of Mary Kay Scully and do not necessarily reflect the views of Enact or its management.Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum. The statements in this article are solely the opinions of Mary Kay Scully and do not necessarily reflect the views of Enact or its management.

We Have Mortgage Jobs. • Branch Manager • Business Development Manager • Client Relationship Manager • Client Relationship Specialist • Collateral Asset Manager • Commercial Loan Officer • Credit Analyst • Licensing Assistant • Loan Officer • Loan Mitigation • Post Closing QC Expert • Loan Administration Manager • Processor • Regional Vice President • REO Closer • Retail Branch Manager • Reverse Mortgage Specialist • Sales Manager • Underwriter • Wholesale Account Exec • And MORE! Resposes are from highly-qualified candidates. Your ad can also be [osted on Indeed and SimplyHired as a FEATURED JOB, on Craigslist in most cities, Googlebase, Oodle, Juju, CareerMetaSearch, TopUSAJobs, Jobalot and MORE! Pay-per-use RESUME BANK. findmortgagejobs.com

SPONSORED BY

While remote work and events provide us with great flexibility, we may have lost an important element of relationship building.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022 | 25

Acra Lending

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com (888) 800-7661 sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Angel Oak Mortgage Solutions Atlanta, GA

We offer alternative mortgage solutions for originators throughout the country helping borrowers who don’t fit Agency guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

angeloakms.com (855) 631-9943 info@angeloakms.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC and the District of Columbia

Arc Home LLC

Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions.

When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com (844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

NON-QM LENDER RESOURCE GUIDE

Mortgage News Network’s mission is to use the power of video and podcasts to compliment the written word and inform, educate, enable and empower mortgage professionals with the most relevant, up-to-date information and advances in the mortgage industry. It is our goal to offer worthwhile information to our viewers while delivering it with the utmost professionalism. MORTGAGENEWSNETWORK.COM And … Action!

Civic Financial Services

Redondo Beach, CA

CIVIC delivers fast, honest, simple lending for real estate investors. Description of your products or services.

CIVIC Financial Services is a private money lender, specializing in the financing of non-owner occupied residential investment properties.

CIVIC provides Mortgage Brokers and Real Estate Investors with a fast and cost effective funding source for their real estate investment needs.

civicfs.com (877) 472-4842 info@civicfs.com

LICENSED IN: AZ, CA, CO, FL, GA, HI, ID, IL, IN, LA, MD, MA, MI, MN, NV, NJ, NC, OH, OK, OR, PA, SC, TN, TX, UT, VA, WA, WI

Deephaven Mortgage Charlotte, NC

Founded in 2012, Deephaven is a national, Non-Agency/Non-QM mortgage provider.

A full-service innovator in the NonAgency/Non-QM mortgage space helping millions of Americans unable to qualify for a traditional, government-backed mortgage to achieve their dreams of homeownership. Available through both wholesale and correspondent channels, our differentiator is our borrower-centric culture and service delivery model. Particular strengths include our own in-house underwriting and collaborative teams that directly support our national network of independent mortgage brokers and loan officers.

deephavenmortgage.com (800) 983-0457 info@deephavenmortgage.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WI, WY

First National Bank of America East Lansing, MI

With over 65 years of lending experience, First National Bank of America specializes in Non-QM loans, nationwide.

• Alternative Income Documentation Options

• 12 months only of income history

• Self-Employed/1099

• ITIN or SSN

• Recent Credit Events

Our alternative mortgage solutions are designed to help people turn homeownership dreams into a reality in the Retail, Wholesale or Correspondent space

Visit: www.fnba.com/wholesale www.fnba.com/correspondent www.fnba.com/mortgage

Equal Housing Lender fnba.com/wholesale (800) 400-5451 requests@fnba.com

LICENSED IN: All 50 U.S. States

NON-QM LENDER RESOURCE GUIDE

Non-QM Lender Resource Guide cont’d. next pg. PRODUCTIONS OF AMERICAN BUSINESS MEDIA nationalmortgageprofessional.com/video nationalmortgageprofessional.com/ podcasts/principal nationalmortgageprofessional.com/ podcasts/gated-communities

Global Integrity Finance LLC

McKinney, Texas

DSCR Rental NO DOC Loans

As a direct, private lender, Global Integrity Finance takes a commonsense approach to underwriting, with all approvals made in-house. We are dedicated to providing quick responses to time-sensitive loans, often times with the ability to close in as few as 3 business days. At Global Integrity Finance, we value referrals and our brokers are protected. We are committed to the highest level of customer service, because our success thrives in building relationships.

globalintegrityfinance.com (214) 548-5190

toby@globalintegrityfinance.com

LICENSED IN: AL, AR, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NH, NJ, NM, NY, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VT, VA, WA, WV, WI

Luxury Mortgage Corp. Stamford, CT

Non-QM, Wholesale, Delegated Correspondent, Non Delegated Correspondent

The Simple Access® Non-QM suite of products was built around the idea that it doesn’t have to be complicated to finance a home. We have created a diverse selection of borrower friendly programs that are simple, innovative, and flexible. For more information on our Correspondent division, visit www. luxurymortgagecorrespondent.com

luxurymortgagewholesale.com (949) 516-9710 tpomarketing@luxurymortgage.com

LICENSED IN: AL, AK, CA, CO, CT, DC, DE, FL, GA, IL, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NY, NC, OH, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, WY

PCF Wholesale Tustin, CA

Build your 2022 pipeline with PCFWholesale.com , the home of the EZ DSCR and Alt Choice Non QM Products. We make NonQM E-Z. Direct Wholesale Lender Licensed in 38 States. We love 1-4 and 5-8 unit properties. Ask about our Preferred Lender Program and our on time closing commitments to you!

pcfwholesale.com (714) 955-5700

Marketing@pcfwholesale.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, NV, NH, NJ, NM, NC, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA,

THE COMPANIES AND TOOLS YOU NEED

NON-QM LENDER RESOURCE GUIDE

Find the company and tools you need. Browse through our directories.

When searching for products or services to help your business, browse through our Resource Guides, or find a specific provider through one of our Directories. Originator Tech, Non-QM, Wholesale, AMC. These listings provide quick, easy access to the resources you need, all in one convenient location. FIND IT. Find what you’re looking for. Visit nationalmortgageprofessional.com/ directories

BIAS DISCRIMINATION

URAR

Discriminatory Language Changes Barely Mentioned For New URAR

Focus is on making new form coming in 2024 more user friendly.

BY DOUG PAGE, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL

For all the talk about how critical it is to end biased and discriminatory language in home appraisals, there was little mention of how it would be accomplished during the GSE Update session at the Mortgage Industry Standards Maintenance Organization (MISMO) fall conference in Washington.

Instead, the presentations, given by a panel of Fannie Mae and Freddie Mac executives last week, focused on the structural changes that are expected in the Uniform Residential Appraisal Report (URAR), but didn’t delve much into the bias and discrimination descriptions the Federal Housing Finance Authority (FHFA) says were used in previous appraisals.

Changes to the form, said Denise Rivoal, Fannie Mae’s manager for single-family mortgage business — digital products, are expected to be finalized in 2024.

“The new URAR form will be very user friendly,” said James Babalitis, senior manager for single-family mortgage business — digital products at Fannie Mae. “It will be standardized, well-structured and readable.

“The key thing is the old form had

pages and pages of addenda. In the new report, all the data and photos will be contained in their relevant section,” he added.

He also said the new version of the URAR will be “machine readable.”

The idea behind the changes, Babalitis said, is to create a form that will identify “risk indicators with more discrete data.”

One of the problems with the current form, said Kasie Lynn, a Freddie Mac manager, is that it’s filled with “pages and pages of free form text at the end of the report,” making it difficult to read.

The changes will allow an appraiser “to tell the story of the subject property and (those properties considered to be its) comparables.

“It’s broken down by section so there are pictures of the comparables so you can easily read it and things are more specific. So, if there’s an ADU (accessory dwelling unit) on the property, you’d be able to pull in those fields,” she added.

In addition, Lynn said, the report’s previous pages of addenda will be replaced by commentary that’s relevant to each section of the report.

The only time bias and discrimination was mentioned was when she said, “We have updated the certification language

around bias and discrimination. They’ve been broken out into five different certifications.”

She did not describe what those certifications meant.

Late last year, the FHFA, in a detailed blog piece, provided examples of biased and discriminatory language in appraisals, saying it could be reduced if “more objective freeform text narratives” were used, an approach supported by Freddie Mac.

In its June 2021 Appraisal Update, Fannie Mae provided examples of appraisal phrases it considers “problematic” along with ways it suggests the same information could be described without bias.

The panel’s other topic was the Supplemental Consumer Information Form (SCIF), which the FHFA requires lenders to use for mortgages that are sold to the GSEs.

The purpose of the SCIF, said Rivoal, is to collect information about a prospective borrower’s language preference and any homebuyer education or housing counseling they received.

This will help lenders better understand a prospective borrower’s needs, she said, and lenders will also be required to keep a copy of the SCIF. n

30 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

ACC Mortgage Rockville, MD

ACC Mortgage is the oldest Non-QM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Angel Oak Mortgage Solutions Atlanta, GA

Angel Oak Mortgage Solutions is the leader in the non-QM mortgage space. We offer alternative specialized mortgage solutions for brokers throughout the country helping borrowers who don’t fit conventional guidelines. We are pioneering a fresh approach to today’s mortgage lending challenges helping partners to grow their business.

angeloakms.com (855) 631-9943 info@angeloakms.com

Change Wholesale

Irvine CA

Change Wholesale gives mortgage brokers an unfair advantage to close more loans, faster. Our CDFI certification from the U.S. Department of the Treasury allows us to offer proprietary programs that are tailored to meet the needs of commonly overlooked prime borrowers. Our flagship Community Mortgage requires no income, employment, or DTI documentation. Prime borrowers looking for their dream home or vacation getaway can get approved with just the first page of the bank statement.

Acra Lending

Lake Forest, CA

Acra Lending is the leader in Non-QM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

LICENSED IN: AL, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WA, WV, WI, WY, DC and the District of Columbia

ChangeWholesale.com (949) 255-6085 info@changewholesale.com

LICENSED IN:, AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

First National Bank of America East Lansing, MI

Bio: FNBA is a portfolio lender with over 65 years of experience. We understand that in the Non-QM business, service makes all the difference. That’s why we are committed to providing you with the fastest turn times, exceptional service and loan programs that make growing your business easy!

fnba.com/mortgage-brokers

LICENSED IN: All 50 U.S. States

WHOLESALE LENDER RESOURCE GUIDE

Find the full list of Wholesale Lenders on page 72 32 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | NOVEMBER 2022

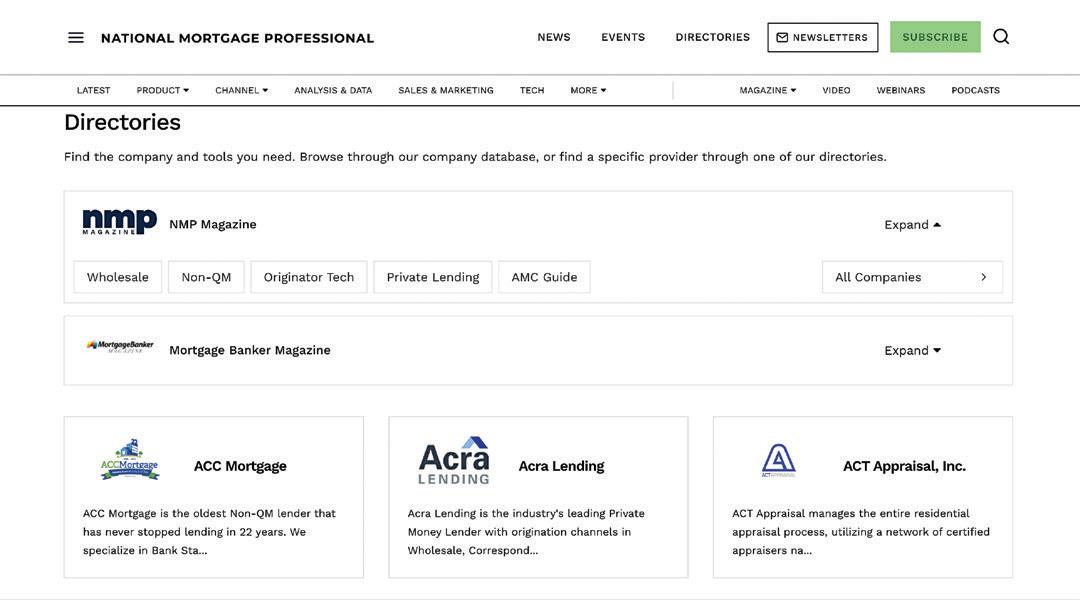

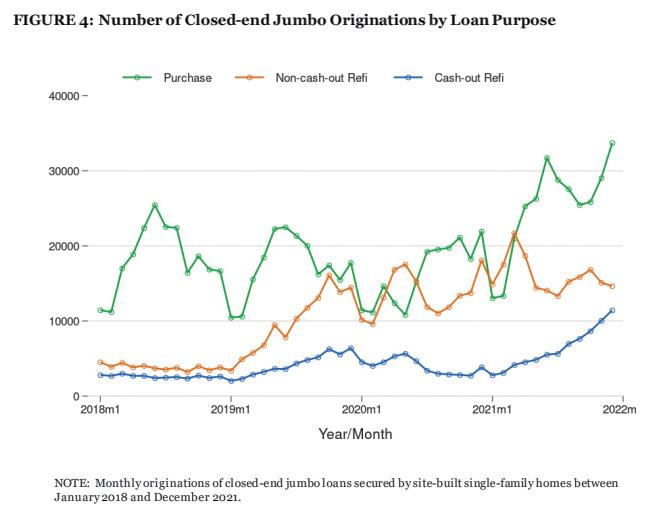

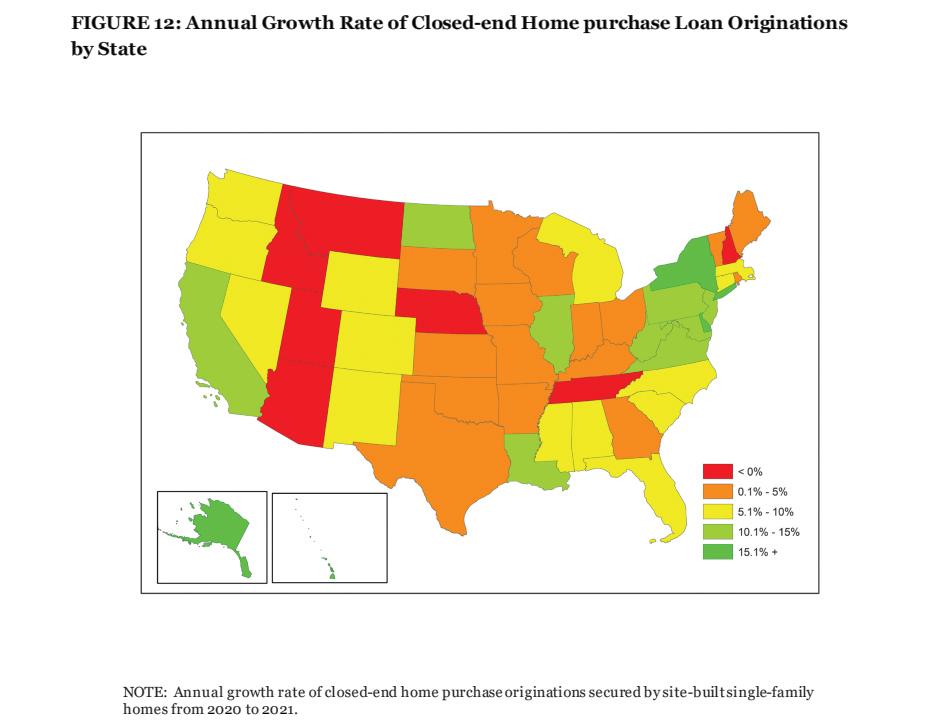

Home Prices Drop But Stability Predicted In 2023

A ‘housing hangover’ after two years of overheated activity.

BY DOUG PAGE, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL

America’s boisterous house selling party — fueled by frenzied demand, increasing prices and cheap money — is kaput, replaced by staggering hangovers for homebuyers and sellers sobering up to high prices,

low inventory, and pricey debt.