DREAM WEAVER

When Sunshine State brokers and lenders need information and opportunity, Florida Originator magazine is there for them. It’s the only mortgage publication that crisscrosses all of Florida, and the only one that lets industry pros from Miami to Jacksonville, from Destin to Key West know it all.

It was just about a half decade ago that our company launched the Suncoast Mortgage Expo in Tampa. We've added to that with our annual Coastal Connect Mortgage Expo in Jacksonville. These amazing shows for the state's origination community now reach more than 1,000 live registrants each year, and we deliver free NMLS license renewal classes to more than 300.

Of course, we love Florida. And so does the mortgage world, which counts the Sunshine State as one of the nation's three top markets for home lending.

That's why we decided it was time to go above and beyond. Our conferences deliver great education to the attendees, including information on new products and services to expand your lending opportunities, as well as insight into regulations and economics that will change the way you make a living.

But only so many folks can make it out in person. We want to be sure that all originators and mortgage pros in the region have a chance to keep fully informed, and to get access to stories of your compatriots who are conquering the market.

That's why we launched Florida Originator, the only magazine looking at the mortgage origination market in Florida. You'll get stories on interesting industry participants, details on alternative lending products that can keep you in the game, and regulations that will affect your business practices. We'll have hands-on practical advice on how to manage your business and your career, and all focused specifically on originators from the panhandle to Key West.

This quarterly magazine is brought to you by the same people who produce National Mortgage Professional magazine, Mortgage Banker Magazine and Mortgage Women Magazine. These publications are created, written and edited independent of any association or sponsor, so the only allegiance is to our readers. Complimentary digital editions are provided to every active NMLS licensee in the state, and hard copy editions are available at our live Florida conferences and via subscription.

We're looking forward to having the eyes of the Alligator State on us. As always, we're here to write the story of your success.

Vincent M. Valvo CEO. Publisher, Editor-it-Chief vvalvo@ambizmedia.comSTAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Sarah Wolak

STAFF WRITERS

Nicole Coughlin, Nichole Cakirca

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise

MULTIMEDIA SPECIALISTS

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

Lydia Griffin

MARKETING INTERN

Submit your news to editors@ambizmedia.com

If you would like additional copies of Florida Originator Mangazine Call (860) 719-1991 or email subscriptions@ambizmedia.com

www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Florida Originator Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991

info@ambizmedia.com

A look at the news that’s important for the mortgage industry across the Sunshine State.

Look ahead for a strong second half in the market

A strong return on investment is possible on Florida real estate in 2023.

A Roundup of Texans landing new jobs or being awarded promotions

The luxury second-home market continues to be a money maker.

Learn some facts about the leading real estate markets in Florida.

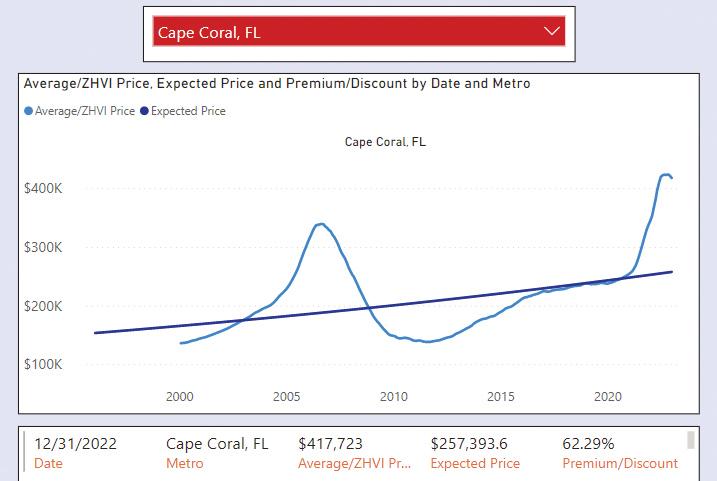

While a U.S. housing correction has started, home prices are still rising in many areas, according to a study from researchers at Florida Atlantic University and Florida International University.

The average home price increased between September and the end of October

in 64 of the 100 largest housing markets, including Chicago, Dallas, Memphis, Philadelphia and San Jose, Calif.

“We hear how slow the U.S. housing market is,” said Ken H. Johnson, Ph.D., a real estate economist in FAU’s College of Business. “But consumers are still buying and selling, and that activity is keeping prices elevated in a lot of metro areas.”

Johnson and Eli Beracha, Ph.D., of FIU’s Hollo School of Real Estate, analyze longterm pricing trends back to 1996 in 100 markets to determine the most overvalued areas. The data covers single-family homes, townhomes, condominiums and co-ops.

Cape Coral-Fort Myers is the nation’s most overvalued market, with buyers paying 67.68% more than they should, based on the market’s pricing history. Four other Florida markets are also in the top 10, along with Atlanta, Charlotte, Las Vegas, Ogden, Utah; and Boise, Idaho.

Jacksonville and Miami will be two of the hottest housing markets in 2023, according to a recent Zillow forecast.

Zillow measured the 50 largest U.S. housing markets on price growth, inventory, jobs and demographics to determine its rankings.

Jacksonville was ranked sixth and Miami eighth in the forecast.

“Record-breaking home value growth ended in 2022, fueled in large part by the highest mortgage interest rates seen since 2008, though the story is varied across markets,” the report said. “Some, like Miami, have seen very slight home value declines, with prices even rising in some recent months.”

Charlotte, N.C., was ranked No. 1 in the report.

Sean Snaith, director of the Institute for Economic Forecasting at the University of Central Florida, says the housing market is slowly improving.

“The housing market is not as severely tight as it was six or eight months ago, that being said, it’s still a very tight housing market,” Snaith told WMFE’s Talia Blake when discussing what central Florida residents can expect in 2023.

But even with more houses becoming available, Snaith says, “They’re still below what would be considered a balanced housing market.”

Snaith expects home prices to gradually come down this year.

When looking to buy a house in Central Florida, Snaith says there are a few steps you can take to find an affordable place. “Of course, the biggest one is to have a larger down payment on the home, so you’re borrowing less money,” he says.

If that’s not an option, Snaith says look for a house outside the Orlando metro. “The farther out, you tend to get from the center of the metropolitan economy, prices tend to decline,” he says.

A new study finds that post-storm price hikes could be a key driver of so-called climate gentrification in Florida.

The study, published in the Journal of Environmental Economics and Management, found that Florida home prices were 5% higher in the three years following a hurricane, the USTimesPost reported. Hurricane-troubled housing markets attracted rather than deterred wealthier residents.

The researchers examined hurricane data from NOAA and housing information on Zillow and Florida tax returns from 2000 to 2016. “Using mortgage application data, we find that incoming homeowners have higher incomes during this period, leading to an overall shift toward more affluent groups,” the authors wrote in their abstract. This is a sign of a climate gentrification if wealthier people move into areas after extreme weather event disturbances. Gentrification can also occur when wealthier people move into low-income communities seeking relief from long-term climate problems such as floods.

The researchers estimated that the shortterm rise in prices could be due to the drop in housing supply caused by storm damage. They also found that home prices return to pre-hurricane levels but never go below. During these three years when the real estate prices are higher, the wealthier buyers are those who can afford to buy homes.

More than 23% of all mortgage holders in the Miami area were 65 or older in 2022, the second highest percentage in the U.S., according to Lending Tree and reported by the Islander News.

Miami (23.52%) trailed only San Diego (24.18%) and was just ahead of Las Vegas (23.51%). The average of the 50 metro areas studied was 18.96%.

Lending Tree, an online loan marketplace for mortgages, analyzed the latest U.S. Census Bureau in its research, which showed more than 10 million seniors across America are still paying mortgages. What the report also showed specific to Miami: Median value of homes owned and occupied by those 65-plus was $334,300; median value of all owner-occupied hous-

ing units was $362,500; median monthly housing costs for mortgaged homes by those 65-plus was $1,682; median monthly housing costs for all owner-mortgaged units was $2,005.

The Homan Group Exp Realty in Hernando County has chosen CPF Mortgage as its preferred lender.

The Homan Group has 30 team members and focuses on Hernando County and surrounding markets. Thomas Homan Jr. handles day-to-day operations and believes “CPF can help us get to the next level of growth by providing their 5-star experience, technology, and consistent process to our agents and clients.”

Justin Kelly, president and CEO of CPF Mortgage, said, “The Homan Group has a lot to offer clients in their market, and we believe our team, process, and the fact that we are an independent mortgage lender

and broker can help them grow and scale in 2023 and beyond.”

After decades of rapid population increase, Florida now is the nation’s fastest-growing state for the first time since 1957, Forbes reported. That’s according to a new report from the Census Bureau’s Vintage 2022 population estimates. Florida’s population increased 1.9% to 22,244,823

+1.9%

> Florida’s population growth to 22,244,823 between 2021 and 2022 to make it the nation’s fastest-growing state for the first time since 1957.

between 2021 and 2022, surpassing Idaho, the previous year’s fastest-growing state.

For the third most-populous state to also be the fastest growing is notable because it requires significant population gains. In the post-World War II era after 1946, Florida’s percentage increase in population each year has fluctuated but has always been positive.

In the 1950s, as air conditioning became more prevalent in warmer parts of the country, Florida’s annual population growth averaged 6.1%. It hit 8% in both 1956 and 1957, near the peak of the baby boom, marking the last time Florida was the fastest-growing state — until now, Forbes noted in its report.

During that decade, Florida’s growth far outpaced the national rate, which was between 1.5% and 2% each year that decade. An annual population growth of 8% is exceptionally rapid and translates to a population doubling roughly every nine years.

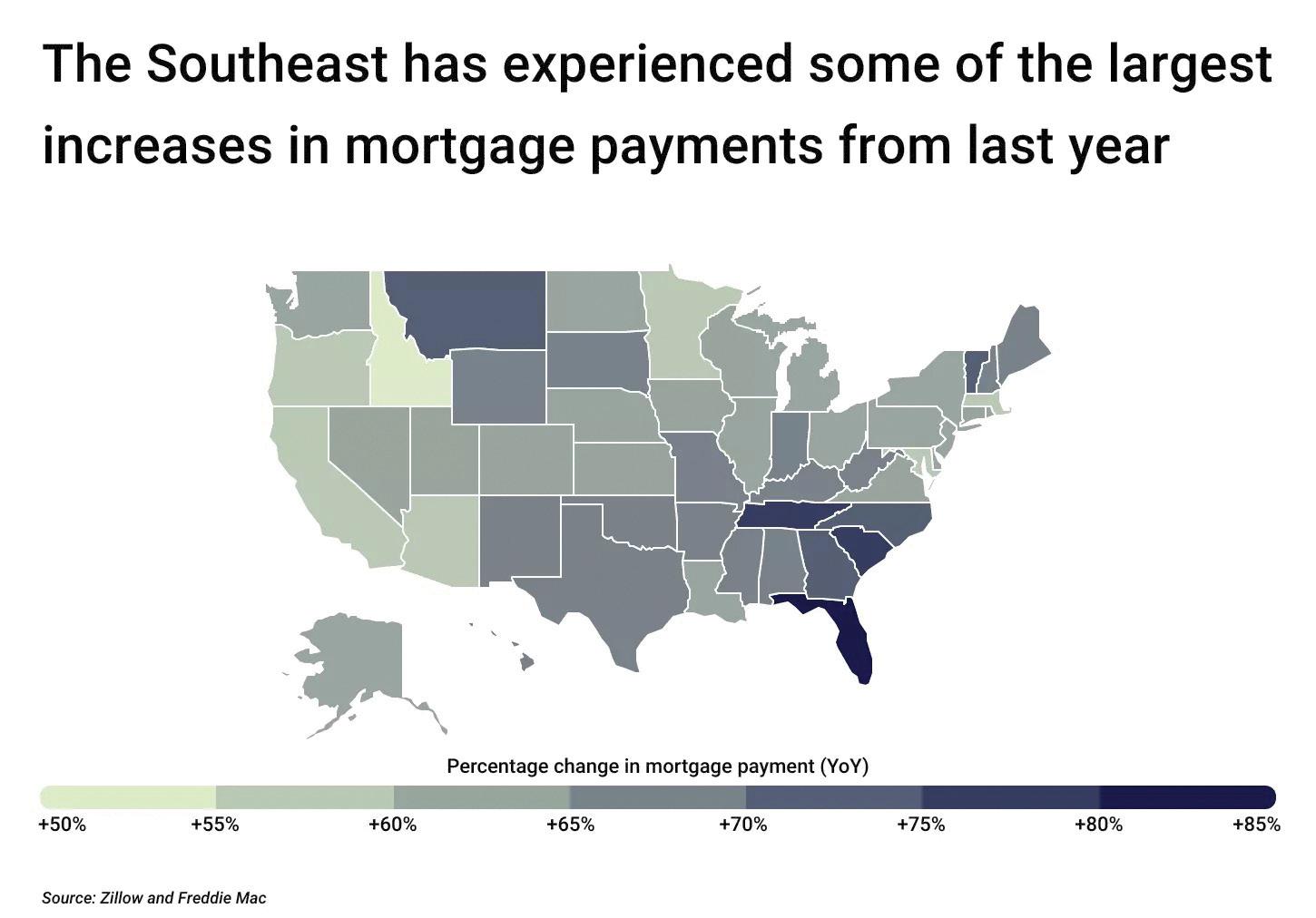

Researchers at Construction Coverage have determined that Florida homebuyers have been the most impacted by rising interest rates. Mortgage payments for a median-priced home in Florida have increased by over 80% from 2021, according to a report on KSJB-AM.

Construction Coverage analyzed the latest data from Zillow and Freddie Mac in compiling its rankings.

Among large metros where homebuyers were most affected by rising interest rates, the Miami-Fort Lauderdale-Pompano Beach area was ranked No. 1 with a 83.9% increase in mortgage payments year-over-year for a median-priced home and a total increase in mortgage payments of $1,101. Tampa-St. Petersburg-Clearwater was ranked second (79.9% and $876 increases); Orlando-Kissimmee-Sanford was third (79.4% and $894); and, Jacksonville fourth (78.0% and $832).

Seven Florida metros were among the top 15 midsize areas most impacted: 1, Naples-Marcos Island (94.4%); No. 2

+80%

> Increase in mortgage payments for a median-priced home in Florida from 2021, making Florida homebuyers the most impacted by rising interest rates.

Ocala (91.0%); No. 3 Cape Coral-Fort Myers (84.7%); No. 4 North Port-Sarasota-Bradenton (83.6%); No. 6 Port St. Lucie (80.9%); No. 11 Deltona-Daytona Beach-Ormond Beach (77.8%) and No. 13 Lakeland-Winter Haven (77.2%)

The Villages (93.4%) was the most impacted among the small metros. No. 4 Sebastian-Vero Beach (84.2%), No. 5 Punta Gorda (83.2%) and No. 9 Homosassa Springs (81.5%) also were in the top 15 most impacted.

Ivory Cooks, a board member of the Master Brokers Forum, a network of the top real estate professionals in South Florida, and a Realtor-associate with Coldwell Banker Real Estate, said agents and prospective buyers need to consider “outside-the-box” solutions in this time of uncertain South Florida inventory and rising interest rates.

Writing in South Florida Agent magazine,

35%

Cooks offers four suggestions: 1. Rent now/ buy later; 2. Buy small/get bigger; 3. Buy now/refi later; 4. Fix it up now/profit later. Cooks writes that many national experts believe housing prices go down when rates go up, but he doesn’t believe that will apply dramatically in South Florida, where cash is king and interest rates have a muted impact. Based upon October 2022 home sales data from Florida Realtors, 28% of single-family homes and 49% of condos/ townhomes were purchased with cash, and, according to Attom Data Solutions, in the last quarter 35% of all single-family home and condo sales were all-cash.

But, he writes, escalating interest rates do impact most local buyers, even those in the luxury sector in which he specializes.

Miami was ranked as the fairest city for Native American homebuyers, according to a comprehensive study by FairPlay.

National Mortgage Professional published the results of the study, which evaluated publicly available data to identify the fairest cities and fairest lenders in the United States. The data analyzes loan records from 2021 for four protected groups: Black, Native American, Hispanic, and female borrowers. Overall, Native American homebuyers were approved for mortgages at 81.9% the rate of white homebuyers.

Tampa was ranked fifth and Miami seventh in the fairest cities for black homebuyers. Black homebuyers were approved for mortgage at 84.4% the rate of white homebuyers - the highest rate ever.

Miami was ranked the ninth fairest cities for female homebuyers. In 2021, female homebuyers were approved for mortgages at 99.2% the rate of male homebuyers — the highest rate ever. No Florida city was ranked in top 10 fairest for Hispanic homebuyers. In 2021, Hispanic homebuyers were approved for mortgages at 88.7% the rate of white homebuyers. b

You need to keep your pipeline filled, and you need the tools and directions to stay profitable, efficient, and effective. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros. Florida Originator Magazine readers like you can attend for free by using the code FOMFREE.

Look to the near-term past to see the near-term future. At least that’s the perspective of economists surveying the Florida real estate market for 2023.

Everyone knows the details of the past few years: In 2021 historically low interest rates fueled a buying frenzy that drove up prices to the point that many first-time homebuyers couldn’t compete with buyers offering tens of thousands above asking prices.

Then in 2022 the Federal Reserve’s Open Market Committee got serious about bringing down inflation and ramped up the fed rate, which led to mortgage interest rates more than double in a matter of months to levels not seen since the turn of the century. Mortgage costs shot up and shut out more potential buyers, while sales inventory dropped because potential sellers were locked into low-rate mortgages and had no desire to trade in for the higher rates.

So what’s in store here in the Sunshine State in 2023?

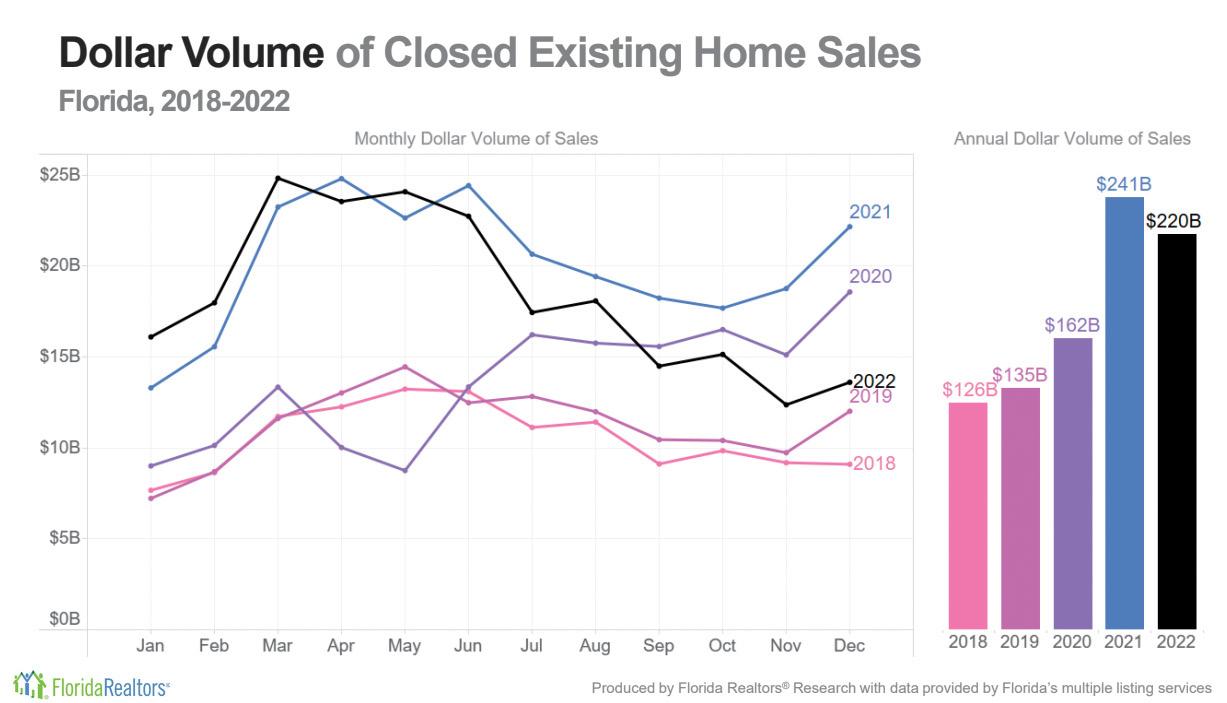

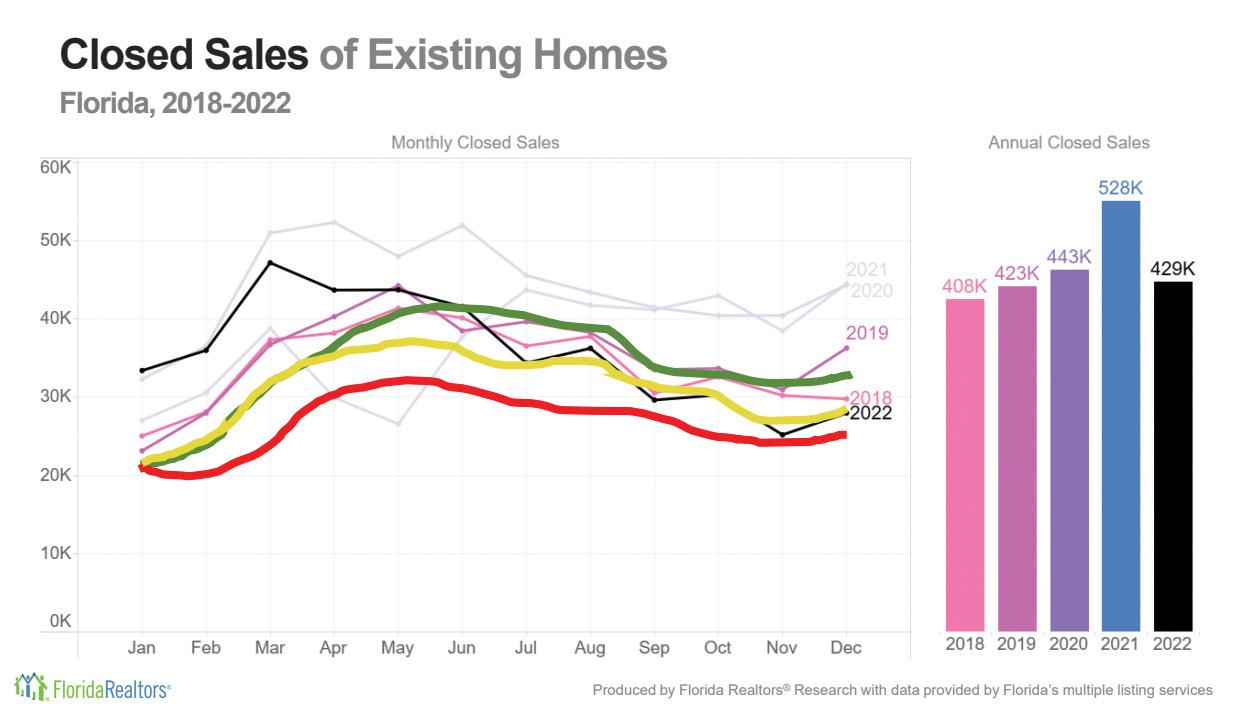

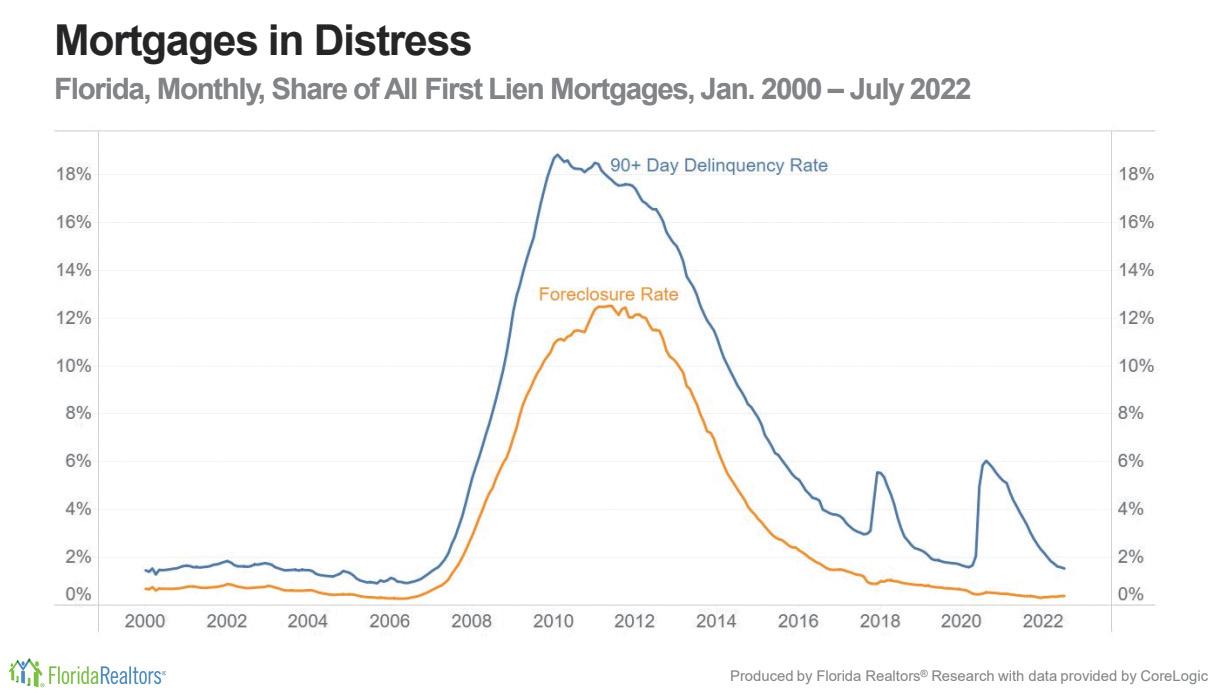

Economists for the trade group Florida Realtors expect this year to look more like 2018-19, with supply and demand finding more of a balance and no major correction in pricing.

The typical buyer in 2023, they say, will be very well-qualified as banks aren’t going to be taking on high risks and interest rates will continue to

inch up as long as the Fed’s plan to curb inflation shows progress. However, affordability will continue to be a major issue for first-time homebuyers.

Brad O’Connor, chief economist for Florida Realtors, which hosted the

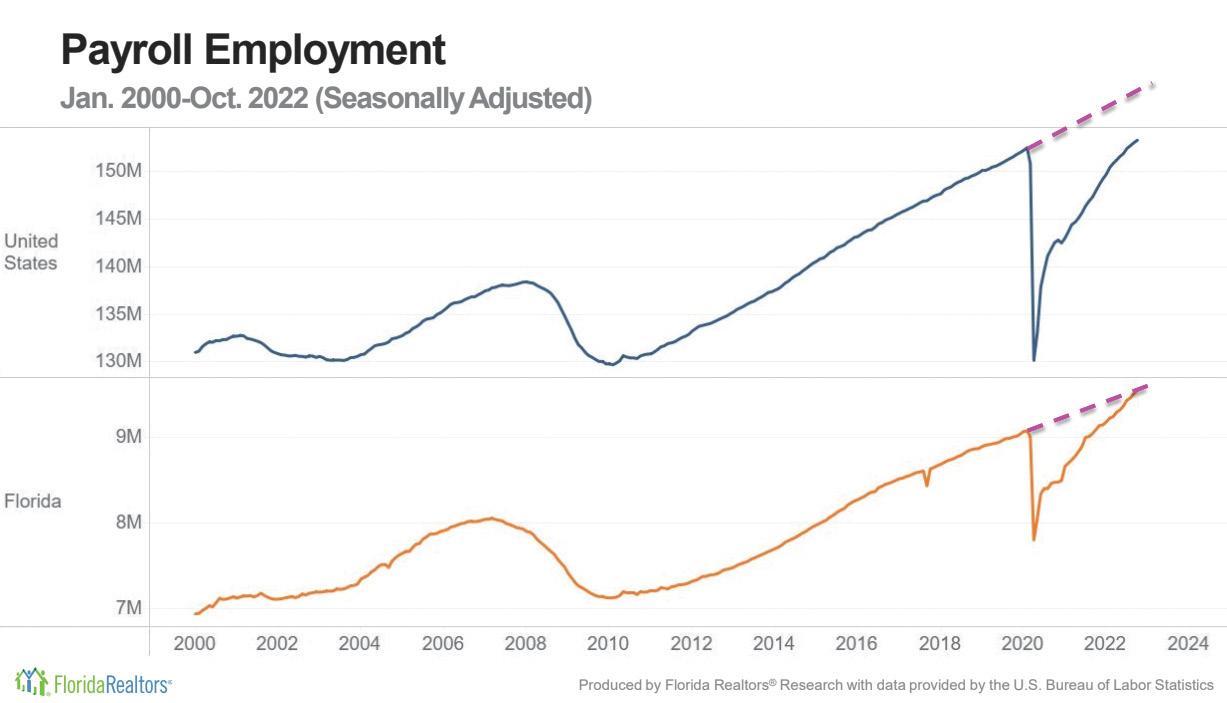

healthy and diverse, with employment rates outpacing the rest of the country. That job growth is driven by financial services, education and health services, as well as state and local government work. The leisure and hospitality sector is also rebounding and a surge in in-migration — a daily net of 1,100 people according to the US Census — has led to a diversified workforce.

On the downside, supply chain and labor market shortages, high oil and gas prices and high inflation continue to be a challenge. The state was also rocked by hurricanes Ian and Nicole, and there are ongoing challenges in the international travel sector. The economists say there was possibly a hidden silver lining to the dual natural disasters: recovery can be an economic engine.

But there’s another issue lurking as well: prohibitive homeowner’s insurance rates.

2023 Florida Real Estate Trends summit in January, said he expects housing sales to continue to be off by 35% to 40% early this year compared to 2022’s peak, but added that trend will reverse somewhat in the second half as long as mortgage rates stay where they are now or begin to move lower.

According to Florida Realtor’s economists, the state’s economy is

“It’s a real problem and it has been for a while. The primary issue is excessive litigation. We get 80% to 90% of all the litigation in the country,” O’Connor said. “Louisiana and Texas get hurricanes too, but they don’t have the same issues we do.”

O’Connor said the issues of a lack of competition for insurance and high litigation costs aren’t going to go away overnight, but he is encouraged by recent work to address the issue by the

“A recession would have to be really bad, and we don’t see that.”

– Brad O’Connor, Florida Realtors Economist

Florida legislature during a recent special session. “I think they’ve taken good steps,” he said.

As mentioned above, higher mortgage rates are likely to discourage both would-be buyers and sellers from making a move in 2023. Florida Realtors predict that the situation will lead to fewer pending sales, and as a result, fewer closed sales. Silver lining — a softening in prices is possible as sellers are forced to accommodate buyers facing higher rates. Those accommodations would include a return to concessions and accepting reasonable offers.

The new housing market won’t help much either as high cancellation rates have caused builders to pull back, exacerbating an already-low supply of units.

Florida Realtors economists have THREE pieces of advice:

• Avoid comparisons to the boom years and look instead at the monthly and annual numbers to get a broader picture of the marketplace when it was still somewhat normal;

• Look again at 2018-19 to know what the normal transaction pacing should be, because even though it’s taking longer to sell a home than during the last few years, they are selling more than 30% faster than they did pre-pandemic;

• And take the time to understand your market to ensure that you know what’s really going on. Your clients will benefit from your local knowledge so make sure you use your local association as a key resource to understanding what’s happening.

O’Connor added that a 1 or 2 percentage point drop in mortgage rates — which is possible if the FOMC backs off after two more expected small increases — is foreseeable and will get millenials and retirees back into the mood to buy.

But a price crash is not in the cards unless the economy takes a nosedive. “A recession would have to be really bad, and we don’t see that,” he said. b

Two Florida metropolitan areas are among the best when it comes to return on investment in housing.

Fort Myers, at 85.4%, and Port St. Lucie, at 84.8%, were the fourth and fifth hottest markets, respectively, for return on investment in areas with populations over 200,000.

According to ATTOM, a leading nationwide curator of real estate data, in its year-end 2022 home sales report published in January, home sellers nationwide realized a profit of $112,000 on a typical sale, up 21%, from $92,500 in 2021 and 78%, from $63,000 in 2020. The profit figure marked the highest level in the U.S. since at least 2008.

Prices were also up at least 10% in more than half the country, according

to ATTOM, as most markets again hit new highs. All but two of the 157 markets saw median prices rise and median values shot up 10% in 85 of those metros. The median home price hit $330,000, an all-time high.

Florida scored the top five in the biggest year-over-year increases, led by Naples, up 26.9%, Fort Myers, up 26.7 %, Lakeland, up 25.7%, Port St. Lucie, up 24.6% and Ocala, up 23.8%.

Two Florida metros also factored into the largest median price increases in geographical areas with a population of at least 1 million people. Tampa led the way at 21.9%, with Orlando in fourth place, up 17.7%

According to ATTOM, Florida also scored nine of the top 10 increases in returns on investment. Fort Myers came in at the top, with ROI increas-

ing from 51% in 2021 to 85.4% in 2022. The remainder were: Ocala, 49.7 % ROI to 82.4%; Naples, 44.7% to 77.4%; Port St. Lucie, 62.8% to 84.8%; Miami, 42.9% to 64.1%; Orlando, 42.2% to 62.2%; Tampa, 53.8% to 73.8%; and Jacksonville, 43.7% to 58.4%.

So the news wasn’t as bad as it seemed at the end of 2022, but Rick Sharga, ATTOM's executive vice president of market intelligence, did echo the old saying that all good things must come to an end.

“It seems pretty likely that home seller profits peaked for this cycle in 2022,” Sharga said. “Median prices have declined since mortgage rates doubled between January and October and are likely to decline further in many markets across the country in 2023, reducing profitability for home sellers.” b

Research shows $1 million buys a lot less than it used to

The year 2022 saw the U.S. enter into a recession, as property prices rose drastically as a result of inflation. For 2023, the financial experts at IBRinfo.org have revealed their property inflation predictions. New data released by the firm also shows $1 million buys a lot less than it used to in three Florida cities.

Before analyzing the data for 2023, it’s important to establish the relationship between inflation and property prices. Inflation refers to the rate at which ‘purchasing power’ drops and prices for goods and services rise to the point that they are no longer affordable for the majority of people. This ultimately has a knock-on effect for the property market as house prices increase, and mortgage interest rates climb in an attempt to bring inflation back down to more manageable levels.

In 2022, home prices increased by over 6% compared to figures from 2021, according to Forbes. This led to far fewer homes being sold, as the majority of people are unable to afford these higher

prices. This has resulted in the supply of homes for sale being far greater than the demand for homes to buy.

IBRinfo.org expects to see things remain relatively the same throughout 2023, as inflation is gradually reduced. Unfortunately, although the rate of inflation is being brought down slowly over time, there is unlikely to be any major financial relief to come to the housing market in the next year. Nationally, mortgage rates will remain almost twice as high as those in 2021, with the typical payment increasing to $2,430 — up 28% (Realtor. com). Across the U.S., home prices will rise another 5.4% in 2023 — with a few select areas seeing prices reduce from those in 2022.

IBRinfo.org predicts that house prices in Florida will remain the same in 2023 rather than decrease due to the consistent demand for properties in this state. House prices remained slightly below the national average throughout 2022, with median house prices sitting at $382,000 compared to the national me-

Unfortunately, although the rate of inflation is being brought down slowly over time, there is unlikely to be any major financial relief to come to the housing market in the next year.

dian of $385,000. This is expected to continue throughout 2023.

Unlike other states, the property market in Florida is expected to grow in 2023, with house prices in major metropolitan areas such as Miami projected to increase by 9.8% in April 2023 (CoreLogic). By the end of 2023, IBRinfo.org expects mortgage rates to level out at 5% due to an increase in cash buyers, placing less strain on money-lending markets.

+285.7%

property price data per square foot for these cities, taken from both Zillow and Redfin, spanning the first eight months of both 2012 and 2022. They then calculated how much square feet of property you could buy with $1 million in each city.

comes to a close. House prices will steadily decline in some areas, whilst mortgage rates will remain high overall.

IBRinfo’s research into the rise of home prices in a decade found that properties in both Tampa and Orlando cost just over $70 per square foot in 2012 and over $200 in 2022, highlighting how quickly and drastically property prices have risen in just 10 years.

Across the U.S., IBRinfo.org’s team of experts expect to see inflation remain high throughout the entirety of 2023, with a very gradual decrease as the year

Despite some states seeing house prices starting to fall, purchasing power will continue to decline in 2023 due to increased interest rates, leaving the demand for housing at a similar rate to 2022.

The website also conducted research to establish the difference between property values in 2012 and 2022.

To do this, they compiled a list of the biggest cities in each of the 50 states by both size and population. They then used

The research aimed to identify how much property $1 million was worth in 2012 and 2022. Despite being only 10 years between the two sets of price data collected, the differences between the figures were fascinating.

Three Florida cities made the list.

In Jacksonville in 2012 $1 million would buy 15,152 square feet, but that number in 2022 was 5,316 square feet., a decline of 9,836..

In Orlando in 2012, $1 million would buy 13,889 square feet, but that number in 2022 dropped to 4,533, a decline of 9,356. Tampa was close behind. In 2012, $1 million would buy 12,658 square feet, but that number dropped to 3,955 in 2022, a decline of 8,704. b

The turbulent mortgage market is creating an opportunity to upgrade how we originate mortgages. The answers all revolve around technology and enhancing the origination experience. New tech will lower personnel costs, speed loan delivery, capture application data faster with greater accuracy, and allow more effective marketing including post-close communications.

That’s why you need to be part of the incredible OriginatorTech Live conference. Built off of more than three years of impressive online events, OriginatorTech Live now gives the power players in the field a chance to come together, understand the forces changing the marketing, sales, and delivery channels, and see in-depth hands-on demonstrations of the most compelling products on the market today. You will also hear case studies from origination experience lenders sharing the impact of tech on their organizations.

Mortgage banking executives, broker-owners, top producers, CIOs, and more will walk away from this gathering with more tools, more insight, and more ability to outpace the competition.

We’re at the fun and exciting Linq Hotel and Casino in the heart of the Las Vegas Strip. Join us March 22-23 for the one conference sure to show you a path to the ultimate origination experience.

March 22-23, 2023

The Linq Hotel + Experience, Las Vegas originatortech.live Register for FREE with promo code NMPFREE

Planet Home Lending, a national mortgage lender and servicer, has added a team in Kissimmee. It will be led by Retail Branch Manager Ricardo Maldonado

Freedom Mortgage, based in Boca Raton, has named Mike Mell as senior vice president of wholesale lending.

First Community Mortgage has named Joe Farro producing branch manager of FCM’s Riviera Beach/ Singer Island office.

Comerica Bank has named Andrew Raines its senior vice president, retail regional director for the North Texas, Arizona and Florida region.

Embrace Home Loans announced that James “Jace” Stirling has been named regional sales manager for the company’s Southeast region.

Tampa-based Pineywoods Realty announced the promotion of Ashley Savala to managing broker of record.

University Lending Group has announced Pamela Bousquet as executive vice president and national production manager.

The country’s housing market is experiencing a downturn, but the luxury second-home market saw big gains last year with Osceola County, Florida, in the number two spot. Following up at the number four spot was Indian River County, Florida.

According to Pacaso, a real estate platform that helps people buy luxury second homes, the average home

price in Osceola County last year was $1.65 million. Just south of Orlando, home to the city of Kissamee, the county saw a 6.1% increase in rate locks in 2022. Its close proximity to Florida’s East Coast beaches is another selling point.

The average luxury second-home price in Indian River County was $1.73 million. Home to Vero Beach on the Atlantic Coast, the county saw a 2.8% increase in rate locks.

The percentage of rate locks in Osceola County was 26.8% as of late 2022. Indian River was close behind at 26.4%. To determine the top U.S. markets, Pacaso analyzed second-home mortgage rate lock data — an indicator of second home buying activity.

“Despite a national cooling in residential real estate, we’re finding that the luxury real estate market is still in a league of its own,” Pacaso CEO and Co-Founder Austin Allison said.

“High-net-worth buyers are not as reliant on financing, so they might be less deterred by rising rates, and we hear a lot from our buyers that they don’t want to wait for perfect market conditions — they are ready to enjoy the benefits of a second home now.”

However, the luxury second-home market isn’t going at warp speed as it was in 2020 and 2021. In the third quarter of last year, Picasso laid off about 30% of its workforce citing declining prices for luxury second homes and an unstable economy in which a “global recession now seems likely” as reasons for the move.

But there are a few places still bucking that trend and one of them is Osceola County.

A previous report from the company about attitudes of second home buyers found that two-thirds of them want the commute to be four hours or less to their second home and 87% want to drive it. For loan originators that means your potential client might be closer than you think. b

‘Buyers … don’t want to wait for perfect market conditions — they are ready to enjoy the benefits of a second home now.’

– Pacaso CEO and Co-Founder Austin Allison

By David Krechevsky, Editor, Florida Originator Magazine

By David Krechevsky, Editor, Florida Originator Magazine

For the housing market, the years 2020, 2021, and 2022 were a roller-coaster ride.

At the start, home sales roared skyward thanks to low interest rates, and the COVID-19 pandemic induced city dwellers to seek leafy suburbs so they could work remotely, creating competition for properties the likes of which had never been seen.

That was followed by the worst inflation in 40 years, which led the Federal Reserve to raise its benchmark rate at a pace not seen since the 1980s, resulting in climbing mortgage rates that sent home sales and refinancings plummeting.

Through it all, however, there was one constant: Matt Weaver seated in the roller coaster’s first car, his name topping the list of purchase mortgage loan originators in Florida.

Weaver, vice president of mortgage sales with the Matt Weaver Team at CrossCountry Mortgage in Boca Raton, led the Sunshine State in purchase loan originations in 2020 and 2021, and led both Florida and the nation in 2022.

According to the Nationwide Multistate Licensing System (NMLS), Weaver closed 1,145 purchase loans valued at over $335 million in 2020; 1,436 purchase loans valued at more than $476 million in 2021; and 1,393 purchase loans valued at nearly $521 million in 2022. For each year, he led Florida in both closed loans and volume.

Florida Realtors reported that closed sales were down 18% in 2022. Sales increased around 13% in 2021 and 5.8% in 2020 in the Sunshine State.

The question is, how did Weaver remain at the top even as the housing market changed so drastically, and so quickly?

To understand his methods and the reasoning behind them, you have to know their origins.

Weaver began his career in the hous-

ing industry by getting his real estate license around the same time he graduated high school at 18 years old.

His desire to be an agent was formed as a kid.

“Real estate agents … would send postcards to my parents’ house, and when I was age 10, 11, 12, I would collect the cards,” he said. “I thought they were like celebrities.”

At 16, he worked at a deli in Pompano Beach — one of several restaurants owned by his parents, Les and Maria Weaver — where he would regularly serve lunch to a top-producing real estate agent named Mike Canaan. “He convinced me to go out and get my real estate license,” Weaver said.

He worked for Coldwell Banker for four years, and quickly learned what motivates people to buy.

“I understood at a young age that monthly payments, mortgage financing, the amount of money you need to buy — [that’s what] motivates people to buy,” he said. “I also recognized during that time that most people were unaware of just how simple it was to buy.”

Weaver said a mortgage advisor made weekly presentations at his real estate office, which soon made him realize that mortgage lending was a better fit for him. He began studying for his licenses. “It was just a natural move for me,” he said. “So when I was 21, I was no longer in real estate.”

He became a loan originator.

He spent most of his initial time in his new career originating refinance loans, he said.

“And then 2008 came,” Weaver said. “We all know the story. That actually became an opportunity for me, because we ended up transitioning to a full documentation lending environment.”

Instead of just handing mortgages to anyone with a heartbeat, which ultimately crashed the housing market, lenders now had to award loans based on fully documented income and credit histories.

“I just knew there had to be a better system,” Weaver said. “I said to myself, loan originators are not going to gather the appropriate documents from buyers and properly pre-approve them in order to buy a home, because every originator in the country was used to writing a loan for anyone that existed.”

Weaver also knew that a lack of documentation effort on the part of loan originators would frustrate real estate agents, because he had experience on both sides.

“I immediately said I want to specialize in working with real estate agents, and I’m an ‘all-in’ person,” he said. “When I go in one direction, I’m going to go that direction all the way.”

He decided to develop his own system for documenting and pre-approving borrowers. “I said to myself, I want

“If you said to me, ‘your business has to convert 100% to refinance business for the next 10 years,’ I’d retire today. I have no passion for it.”

to develop a system that’s accountable, that’s thorough, that serves the real estate agent to the highest and best.”

Based on his experience as a real estate agent, Weaver knew he could maximize an agent’s “most precious asset” — their time — by making sure a client is both thoroughly pre-approved and thoroughly informed, “so they’re aware of everything before shopping for a home.”

With his pre-approval process, agents knew anyone who went through it was able to buy a home, he said. There was just one problem.

“In 2010, when I launched this hard and fast process, a lot of agents didn’t want to use me,” he said. “And the reason is because they were not burned yet. … We came from a non-documentation lending environment, so everyone could do a loan and no one had a bad reputation yet. So when we converted to a full documentation lending environment, it took a while for it to permeate through the industry.”

Weaver said it took a couple of years of agents getting burned by clients being turned down for loans before his system caught on.

He also developed a systemized offer process “that delivers timelines that virtually no other offer can match,” naming it the “seven elements of structuring a winning offer.” He declined to provide specifics about each element, but did say the process has multiple components and is “a scripted offer process” that real estate agents can adopt.

“We were doing things that were completely unorthodox, which is really what we specialize in,” he said. “We do things that people don’t do. In fact, we try to do the opposite of what others do. And we started winning against multiple offers in high numbers.”

Through 2010, 2011, and 2012, he said, “we started dominating in those markets by being the source of how an agent can win.”

He brought his system to CrossCountry Mortgage in 2018, and says he and his now 41-member support team have built a strong reputation for accountability, clarity, and working in the best interest of his clients — the real estate agents.

“We know exactly who our customer is, and that’s the biggest challenge among loan originators,” Weaver said. “Most loan originators don’t know who their customer is. Our customer is the real estate agent. Period, end of story.”

To Weaver, “singleness of purpose” is the key to his continuing success.

“Singleness of purpose is our No. 1 competitive advantage against loan officers,” he said. “Because if you have singleness of purpose and a singular customer that you focus on, all you’re doing is thinking about how to best serve them. And it’s all about them.”

He notes that this laser focus on real estate agents has served to keep his business steady, even as the market rides the roller coaster.

“You know, it’s interesting. Interest rates go down, most loan officers change their customers,” he said. “They refinance people, right? Then interest rates go up and they call real estate agents. In what business does that even make sense, that whatever the economic factors are changes someone’s business plan? That’s not a business plan. That’s just winging it and going with the wind.”

As evidence of his singleness of purpose, he points to 2020 and 2021 as “probably the highest application years for refinance business.” And yet, he had one of the lowest percentages of refis compared to purchase loans in the U.S.

The NMLS numbers back that up. In 2020, refis made up just 18% of Weaver’s total of originated loans. That fell to 15% in 2021, and just 7.6% last year.

“I genuinely love working and winning with [real estate] agents,” he said. “It’s a

true passion of mine. If you said to me, ‘your business has to convert 100% to refinance business for the next 10 years,’ I’d retire today. I have no passion for it.”

That singleness of purpose provides another benefit, Weaver said: The ability to think.

“We can genuinely take time to think about how to best serve [agents] and how to give them the right tools that can increase and enhance their business, which will in turn enhance and increase your business as a loan originator,” he said. “But if we’re waking up and not having any time to think about the customer we serve, well, then what value are you?”

He said if you ask loan originators to articulate the value they bring to their customers, and they can’t do it, then they have to “go back to the basic fundamentals and create those.”

For Weaver and his team — which includes underwriters, processors and facilitators — one value they offer to real estate agents is having someone available from 8 a.m. to 9 p.m. 364 days a year;

they all take only Christmas Day off.

“Our busiest days are the Fourth of July and Memorial Day,” he said. “Those holidays are very busy for us. … A client can call up at 8 p.m. on a Saturday night and we are assisting them live. Think about the power of that accessibility alone.”

Weaver added that accessibility doesn’t mean he has no life. Married, and with two children ages 12 and 9, he still spends plenty of time with them thanks to his team’s rotating schedule.

He adds value for agents in other ways, including via a variety of educational and training opportunities, he said.

“We are constantly helping our agents by giving them the right information, the right education in terms of mortgage, finance, the right training on how they can best maximize their opportunities in any given market,” Weaver said.

The bottom line, he says, is also a mantra for his team: “Winning is the only option. Period.”

“That served as an incredibly powerful affirmation that we embodied,” he said. “And our job, our mission, was to outpace the decline in mortgage originations.”

“You see,” he continued, “we’re not accepting what the external factors are. There are still buyers. There are still sellers. And our job is to help the agent that gets in between. And so we have to now double down and triple down on our activities, but you’re okay with doing that because winning’s the only option.”

He added that, without that strong mindset, someone might look at the successes achieved in 2020 and 2021 and just accept those as great years.

“You might say, ‘You remember the good old times?’ I don’t wanna remember the good old times,” Weaver said. “The times are now. And, for us, 2020 and 2021 was a benchmark. We’re not going below that. That’s ridiculous. If you’re not growing, you’re flat. And if you’re flat, you’re dead.” b

“Most loan originators don’t know who their customer is. Our customer is the real estate agent. Period, end of story.”

It’s no longer possible for mortgage originators to rely on gut instincts, especially in a market like this, that requires being at the top of your game.

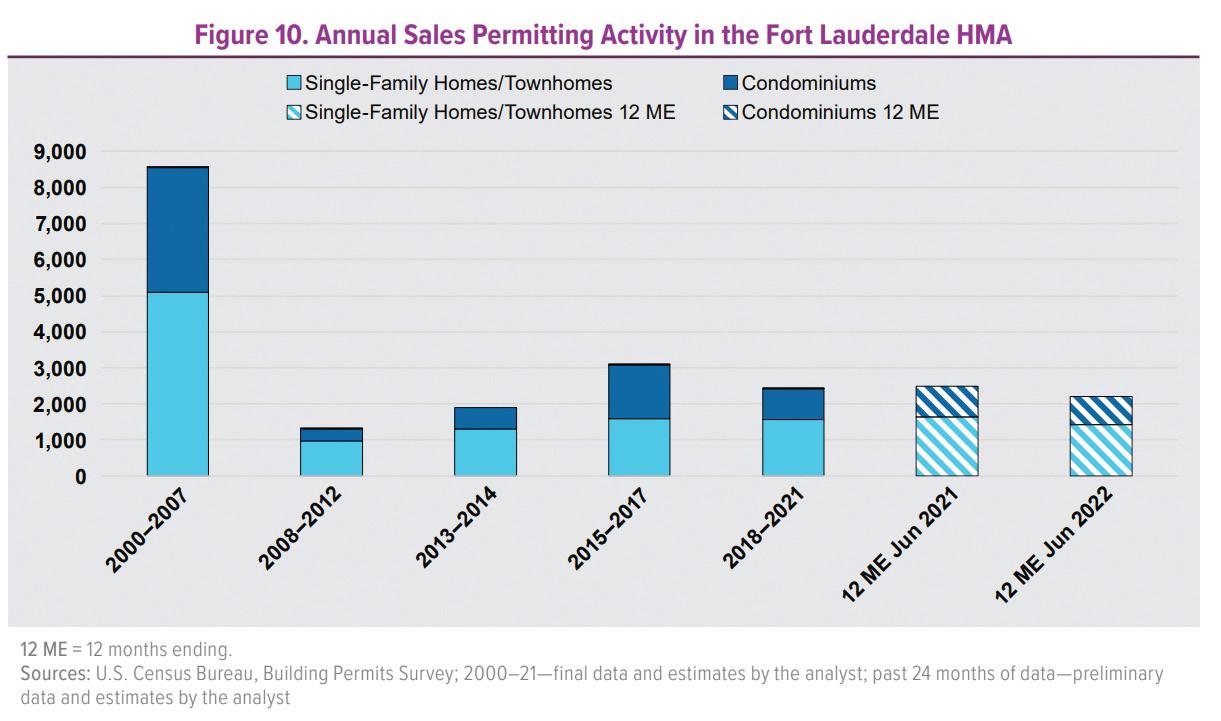

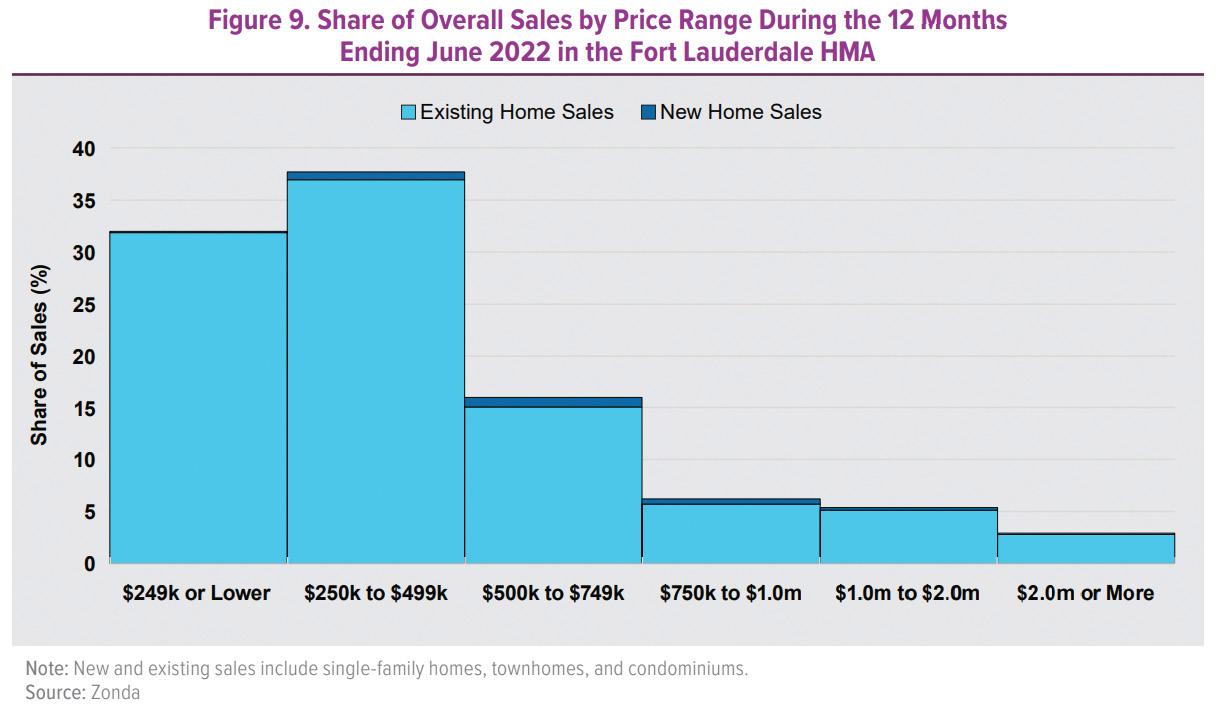

To keep you better informed, Florida Originator Magazine tracks information provided about the Sunshine State from various data sources.

Research compiled by Florida Realtors shows the growth in active listings is particularly strong along the bottom half of the major west coast towns along with an active swath of activity through the center of the state.

To give you the most complete detail, Florida Originator looks beyond the traditional sources. Construction Coverage compiled data from Zillow and Freddie Mac to determine on a regional level. The Southeast has experienced some of the largest increases in mortgage payments from last year with

a median-priced home in Florida increasing by over 80% from 2021.

Data can also help originators know that 2022, while difficult, was better than recent years, including 2018 and 2019. It’s never easy to see income drop but veterans point out (and the data

supports it) that this is a cyclical business.

We’ve also found that the Real Estate Initiative at Florida Atlantic University can be a wealth of information along with Hollo School of Real Estate at Florida International University. We scour this source

of market information so you can focus on what’s important: originating loans for your clients.

Interested in other data? Know other data sources we should befollowing? Drop anoteto

Senior Editor Keith Griffin at kgriffin@ambizmedia.com

In 2022, we had a record turnout for our best event … yet. Let’s just say, you won’t want to miss this year’s Originator Connect and these exclusive programs: Free NMLS Renewal * Build-A-Broker Non-QM Summit Private Lender Forum & so much more!

See the full lineup of events and reserve your spot for free using our code FOMFREE at originatorconnect.com.

MARCH APRIL MAY JULY

MARCH 22 — MARCH 23

Las Vegas, NV | originatortech.live

This event connects customer experience-obsessed executives and originators with best-in-breed tech vendors and lenders helping to dominate or disrupt their markets. The winners of the next booms will be sharing and mapping out their tech stack upgrades at this event.

APRIL 25

Jacksonville, FL | originatorconnectnetwork.com/events/coastal-connect-mortgage-expo

Keep your pipeline filled, and gain the tools and directions you need to stay profitable, efficient, and effective. We're bringing together the best in the business to create a top tier event specifically designed for mortgage origination pros.

MAY 16

SUNCOAST MORTGAGE EXPO

Tampa, FL | originatorconnectnetwork.com/events/suncoast-mortgage-expo

Join us for the third annual Suncoast Mortgage Expo in sunny Florida that will motivate originators, drive your business forward with new tools, and energize and educate on ways to propel volume to new heights.

JULY 13

ULTIMATE MORTGAGE EXPO

New Orleans, LA | originatorconnectnetwork.com/events/ultimate-mortgage-expo

It's the Gulf Coast's premier event for mortgage eoriginators. Great education, amazing opportunities, music and networking, all in the embrace of the Big Easy.

AUGUST

AUGUST 18

Las Vegas, NV | originatorconnect.com

Be part of the nation’s largest and most innovative mortgage conference focused solely on the origination community at brokerages, banks and credit unions. A three-day weekend event that motivates originators, drives your business forward with new tools, and energizes and educates on ways to propel volume to new heights.

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.