REAL ESTATE FREEZE ON FLORIDA INVESTMENTS

BROKER SCHOOL NOW IN SESSION

FLORIDA ORIGINATOR

RISING TIDE OF CHALLENGES

Originators swamped by obstacles to getting deals done timely

ISSUE TWO 2023 | $20 A Publication of American Business Media

2

SPECIAL

023MORTGAGEMASTERS

SECTION

INFO@RCNCAPITAL.COM RCNCAPITAL.COM 860.432.5858 GET READY TO FLIP, NOW LENDING NATIONWIDE! ©RCN Capital, LLC. 2023 All Rights Reserved. NMLS #1045656. RCN Capital, LLC is licensed in AZ (License #: 0932325), CA (Loans made or arranged by RCN Capital, LLC pursuant to a California Finance Lenders Law license # 60DBO-46258), MN (MN-MO-1045656), and OR (ML-5571). This is not an offer to lend. All offers of credit are subject to due diligence, underwriting and approval. Not all borrowers will qualify and not all borrowers that qualify will receive the lowest rate or best terms. Actual rates and terms depend on a variety of factors and are subject to change without notice. ROCK STAR RATES HARD-CORE CUSTOMERSERVICE ELECTRIC LEVERAGES RAISE THE ROOF ON YOUR NEXT RENOVATION!

REAL ESTATE FREEZE ON FLORIDA INVESTMENTS

BROKER SCHOOL NOW IN SESSION

FLORIDA ORIGINATOR

RISING TIDE OF CHALLENGES

Originators swamped by obstacles to getting deals done timely

ISSUE TWO 2023 | $20 A Publication of American Business Media

2

SPECIAL

023MORTGAGEMASTERS

SECTION

From Sea To Shining Sea.

When Sunshine State brokers and lenders need information and opportunity, Florida Originator magazine is there for them. It’s the only mortgage publication that crisscrosses all of Florida, and the only one that lets industry pros from Miami to Jacksonville, from Destin to Key West know it all.

Subscribe today to receive four print issues of the magazine that builds Florida’s broker business. GO TO FLORIDAORIGINATOR.COM NOW

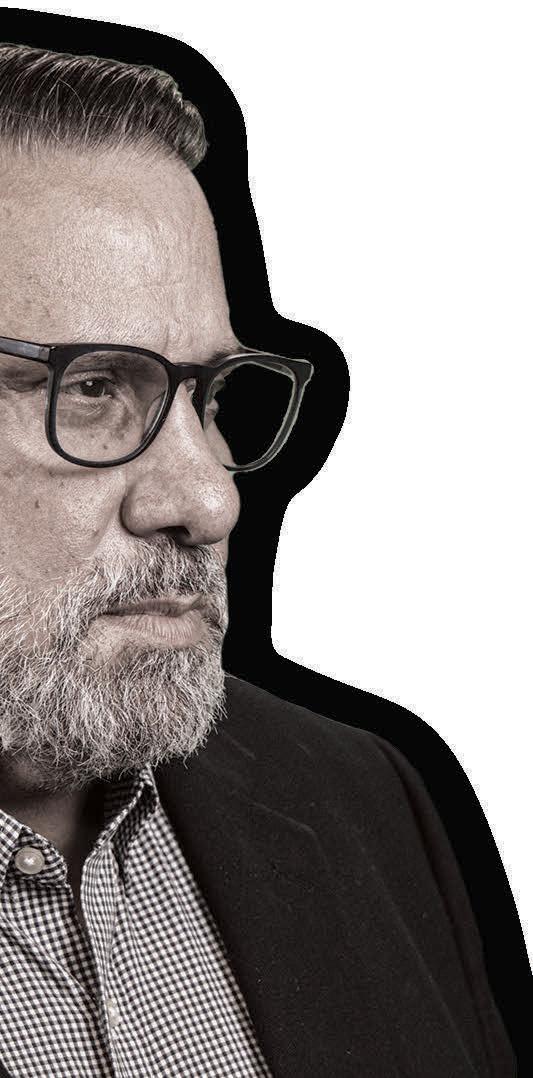

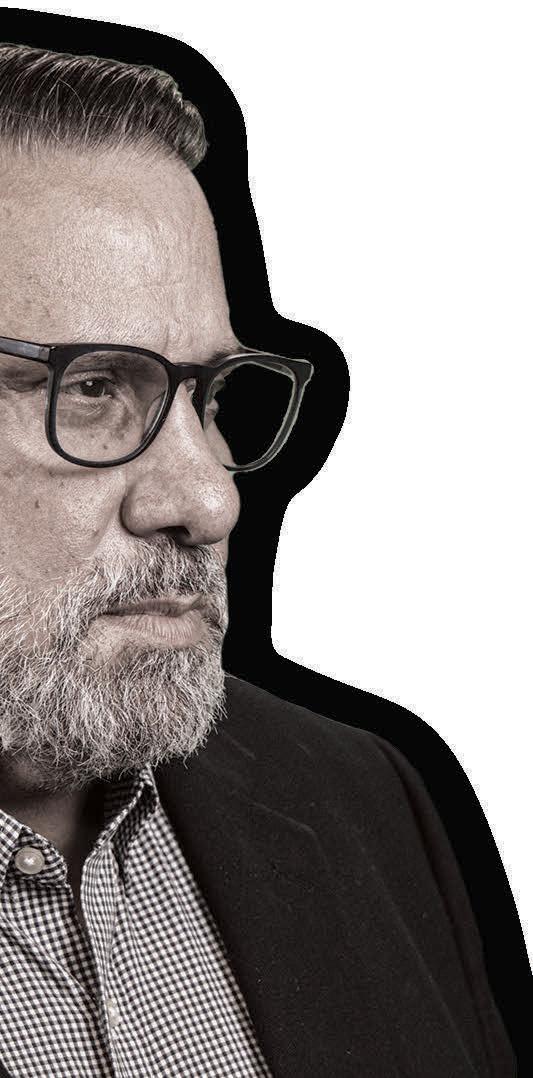

Prepping For 2025

More than 30 years ago, I was standing next to the guy who owned the company I was working at. I was in charge of one of his businesses, and he had a visitor he was showing around. They came up to me, and my boss introduced me to his guest. And then he said something that has stuck with me ever since. “This guy,” he said, pointing at me, “is pretty good at what he does. But when things get tough, that’s when he gets even better.”

I hadn’t realized what he had seen, but after he said that, I went back and thought about it. He was right, but the reasons weren’t as complimentary as one might hope (although I know he meant this as a compliment).

When things are going swimmingly, if you’re basically competent, it’s easy to do well. After all, everything’s on your side. The market is good, the rates are good, and everyone’s hopeful and confident, so business is easy to come by. Some folks maybe capitalize on good times more so than others, but it’s not a great achievement to bask in economic sunshine.

When business gets tighter, harder, and darker, it’s critical to start thinking about how to be innovative, to look at markets in a different light, and to consider what other ways you can generate revenue and sustain income. My boss was saying I was good at that, and I think I still am: I like keeping an open view of what might be coming a year or two out. But I realized that if I were really a good business leader, I would have been thinking about all those things when the market was going great. Instead, I was coasting on easy wins and only turned to a more thoughtful approach when I was forced to. If I’d been better at this earlier, I wouldn’t have had to scramble.

For loan originators now scrambling, we know there are techniques, tactics, and tricks to help secure those loan deals, fewer though they may be. We are glad to tell the stories of LOs who have successfully pivoted. But we’re also impressed by — and delighted to tell the stories of — local originators who laid the groundwork for their success now by being thoughtful and focused two years ago. Many of these success stories share the same characteristics: the LO didn’t just grab the easy money (refinances) but made sure to keep a solid footing with purchase partners, despite that being more time-consuming. Those relationships built then are a bank of profit now.

For many LOs, that’s a lesson to be learned for the next market turndown. For now, the imperative is to know every winning strategy, trend, and insight that can set you up for success. And then to think about what the market will also look like two years from now. The compliment shouldn’t be that we get innovative when we have to but that we never have to scramble in the first place.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Gary Rogo

SPECIAL SECTIONS EDITOR

Mary Quinn

MULTIMEDIA PRODUCER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak

STAFF WRITERS

Regina Morgan

ADVERTISING SALES EXECUTIVE

Nichole Cakirca, Nicole Coughlin

ADVERTISING ASSOCIATES

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins

MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Lydia Griffin MARKETING INTERN

Submit your news to editors@ambizmedia.com

If you would like additional copies of Florida Originator Mangazine Call (860) 719-1991 or email subscriptions@ambizmedia.com

www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Florida Originator Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

Vincent M. Valvo CEO. Publisher, Editor-in-Chief vvalvo@ambizmedia.com

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991

info@ambizmedia.com

4 FLORIDA ORIGINATOR MAGAZINE FROM THE PUBLISHER

A State Of Denial

The Sunshine State doesn’t shine so bright when it comes to closing the deal on mortgages.

6 22

Florida Originator News Bites

A look at the news that’s important for the mortgage industry across the Sunshine State.

Clamping Down On Foreigners

A new state law makes it more difficult for non-citizens to purchase real estate.

Second-Home Sales Suffer

It’s a down market for vacation dwellings due to high prices.

Florida Fights National Trends

Population growth helps Sunshine State battle national economic trends..

People On The Move

A Roundup of Texans landing new jobs or being awarded promotions

Growing New Mortgage Bankers

Miami university partners with industry group to train next generation of mortgage bankers.

30 38

10 24 12 17 18

Frustration Leads To Origination

Reduced to tears by a bad experience, Marsha Gandy became a loan originator.

Fight Insurance Woes

Don’t let loans slip through your fingers: help clients shop for coverage.

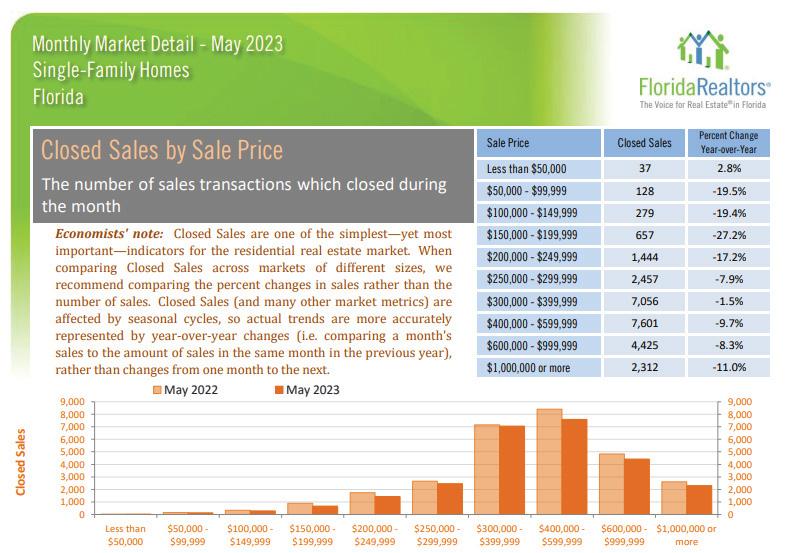

Data Bank

Learn some facts about the leading real estate markets in Florida.

SPECIAL SECTION

40 45

Masters Of Their Craft

Two are honored with the inaugural Florida Originator Magazine’s Mortgage Masters Award for winning in tough times.

ISSUE TWO 2023 5 INSIDE THIS ISSUE COVER STORY

ORIGINATOR 2 023MORTGAGEMASTERS

FLORIDA

FLA. ORIGINATOR

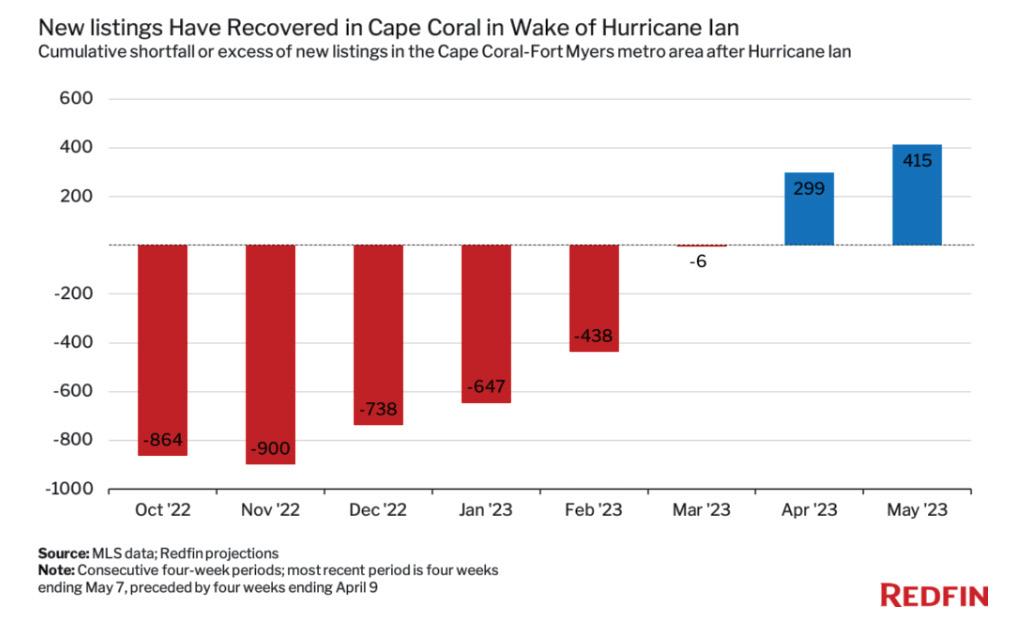

Florida Mortgage Activity Took A Chilly Dip

New data shows that Florida’s largest metro areas slipped down the national list for home buying or refinance activity, according to a Black Knight Inc. report.

The Miami–Fort Lauderdale–Palm Beach metro area slipped from 9th to 10th in the nation between January and February. Meanwhile, the Tampa–St. Petersburg–Clearwater metro also charted down one place to 15th nationally, and the Orlando–Kissimmee–Sanford market fell out of the National Top 20, after charting 19th the month prior.

Mortgage interest rates rose in February after a brief dip, which resulted in a drop in the total number of mortgages taken out nationwide — with a slightly more pronounced decrease in Florida compared to the rest of the country as a whole — according to the latest from Black Knight.

The comparison is based on “rate lock” activity, which analysts rely on to spot trends in real estate, banking, and the overall health of the economy.

The report shows that the number of loans taken out by homebuyers and refinancers decreased overall in February as a result of rising mortgage rates. However, certain mortgage products saw a rise in demand, particularly from buyers who took out larger loans, saw a rise in demand, as certain non-conforming mortgage rates were more favorable than for those who took out traditional loans.

Fed Reserve: Housing Demand Improves Slightly

The Federal Bank of Atlanta reported that housing demand improved

slightly since the previous report as mortgage rates edged lower.

In its report commonly known as the Beige Book, the Fed indicated marginal increases in buyer traffic and sales in January as mortgage rates moderated from the highs experienced in October 2022.

Though down from peak levels, year-over-year home price appreciation throughout the Sixth District was slightly stronger than the nation as a whole.

Affordability remained a significant headwind primarily for entry-level buyers. Also, a larger share of homes sold at a discount from the asking price.

New home builders continued to experience a high rate of cancellations and the majority offered incentives to attract buyers.

Condo Owners Can Get Relief For Repairs With Miami-Dade Program

Miami-Dade County condominium owners facing special assessment payments for structural repairs to their building can seek help through the county’s newly launched loan program.

The program, according to a story in the Miami Herald, allows owners earning less than the area median income — which is $95,620 for singles and $109,200 for couples — to qualify for a zero percent interest rate loan of up to $50,000 to pay for special assessments associated with repairs as a result of building recertification requirements.

At a town hall in Aventura last week, Miami-Dade Mayor Daniella Levine Cava said the collapse of Champlain Towers South in 2021 was only part of the reason for the program. “Unfortunately, it’s a tragedy that brings these things to bear and then we react and

then we do something to try to prevent future tragedies,” Levine Cava said.

Condo owners would have 40 years to pay the loan back with a zero percent interest rate, the Herald said.

The loan program has been allocated $9 million. Owners whose cash assets exceed $50,000 must put down up to 10% of the loan amount. Should the owner sell the condo or it is no longer their primary residence before the loan is paid in full, the balance becomes due.

Broward County’s Sales Down Nearly 32%

Broward County Florida’s February sales decreased 31.6% year-over-year, according to the Miami Association of Realtors.

Existing condo sales decreased 32.4% year-over-year due to lack of inventory and rising mortgage rates.

Single-family home sales decreased 30.5% year-over-year and the current market has lower inventory in specific price points and higher rates.

Total pending sales rose 12.2% month-over-month, from 2,541 in January 2023 to 2,850 in February 2023. Pending sales are an indicator of future sales, but it takes up to 40 days for pending transactions to close and not all pending sales end in deals.

Broward County single-family home

-31.6

> Percentage decrease in year-over-year home sales in Broward County, FL.

ORIGINATOR NEWS BITES

West Palm Beach had the fifth biggest increase (12.8%, up from 11.1%).

> Percentage increase in year-over-year median single-family home price in Broward County, FL, increasing from $519K to $560K.

Million-dollar homes are making up a larger chunk of Florida’s housing stock because many parts of the Sunshine State are still seeing substantial upticks in home values and prices.

Florida was home to six of the 10 metros with the biggest home-value increases last year, and Miami, North Port, and West Palm Beach all saw 5%-plus annual price increases in January.

14.1%

> Amount of Miami homes worth at least $1 million.

7%

median prices increased 7.9% year-overyear in February 2023, increasing from $519,000 to $560,000. Existing condo median prices increased 13.3% yearover-year, from $240,000 to $272,000.

Total active listings at the end of February 2023 increased 79.2% yearover-year, from 4,310 to 7,723.

Inventory of single-family homes increased 93.8% year-over-year in February 2023 from 1,639 active listings last year to 3,176 last month. Condominium inventory increased 70.2% year-overyear to 4,547 from 2,671 listings during the same period in 2022.

New listings of Broward single-family homes decreased 24.2% to 1,248 from 1,646 year-over-year. New listings of condominiums decreased 10.2%, from 2,088 to 1,874 year-over-year.

Percentage Of Miami Homes Worth $1M Or More Show Biggest Increase

Roughly 14.1% of Miami homes are worth at least $1 million, up from 11.5% a year ago, the biggest increase of the metros analyzed in a recent Redfin report. The next-biggest uptick is in North Port (11.3%, up from 9.1%).

Florida homes are holding their value because there’s still healthy demand from buyers, especially out-of-town remote workers moving in from more expensive parts of the country. Five of the nation’s 10 most popular migration destinations are in Florida, despite its status as the most hurricane-prone state in the U.S. Redfin agents report that homebuyers typically move in for the state’s relatively affordable homes, beaches, warm weather, and lack of a state income tax.

> Amount of homes worth at least $1 million nationwide, up from 4.2% just before the pandemic began.

Nationwide, just over 7% of U.S. homes are worth $1 million or more. That’s down from June 2022’s all-time high of 8.6% and essentially unchanged from a year ago — but it’s up from 4.2% just before the pandemic began.

+7.9

Miami, Tampa Tops In Year-Over-Year Home Price Increases

The Miami area and Tampa topped the list of cities with the highest yearover-year increases in home prices in the United States from December 2021 to December 2022.

+15.9%

reported lower prices in the year ending December 2022 versus the year ending November 2022.

“The cooling in home prices that began in June 2022 continued through year end, as December marked the sixth consecutive month of declines for our National Composite Index,” says Craig J. Lazzara, managing director at S&P Dow Jones Indices. “The National Composite declined by -0.8% in December, and now stands 4.4% below its June peak. For 2022 as a whole, the National Composite rose by 5.8%, the 15th best performance in our 35-year history, although obviously well below 2021’s record-setting 18.9% gain.”

+13.9%

According to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, Miami led the way with a 15.9% year-over-year price increase, followed by Tampa with a 13.9% increase. All 20 cities measured

Miami-Dade County Pending Home Sales, Showing Appointments Rise

Two leading homebuying indicators — pending home sales and showing appointments — surged month over month in Miami-Dade County as the resilient South Florida market continues to illustrate its unique market demand in the face of elevated mortgage rates, according to January statistics released Feb. 21 by the Miami Association of Realtors and the Multiple

Listing Service system. Miami real estate, which posted its second-most total home sales in history in 2022 despite mortgage rates more than doubling over the course of the year, can expect to see more closed sales over the next coming months. It takes up to 40 days for pending sales to close and not all pending sales and showing appointments end in deals.

Showing appointments in the Southeast Florida MLS, which is owned by Miami Realtors, jumped 54.5% month over month to 233,144 showings. It marks the most showings in a month since May 2022 (245,225 appointments). Miami-Dade County total pending sales rose 35.5% month over month, from 1,688 in December 2022 to 2,288 in January 2023. It is the first monthover-month rise of total pending sales since August 2022.

“Miami is a unique market because of our high percentage of cash buyers, surging migration, and soaring number of international and domestic buyers,” Miami Chairman of the Board Ines Hegedus-Garcia said.

“Miami is shielded in a sense from interest rate hikes because of those fundamentals. While other major U.S. markets are seeing decreasing prices, the Miami market is still very strong and still appreciating.” b

> Home price increase in Miami from December 2021 to December 2022.

> Home price increase in Tampa during that same time.

Experience the ultimate upgrade of Morgan and dive into the future of personalized assistance with AngelAi. Say goodbye to mediocrity and embrace the extraordinary. This is your chance to soar above the rest and leave your competitors in awe.

Swi . Accurate. Brilliant: Discover the AngelAi Advantage

AngelAi is not just an Ai personal assistant; she is a guardian angel guiding you through the intricate realm of credit and finances. Powered by the brilliance of Ai, AngelAi ensures every decision you make is informed, strategic, and empowering.

Lightning-Fast Answers: Get immediate responses, keeping you steps ahead.

Guaranteed Deal Structuring and Calculations: With AngelAi, your deals are flawlessly executed.

Ai-Powered Marketing and Social Content: Delight clients with stunning content generated by AngelAi.

Comprehensive Loan Services: AngelAi handles it all-processing, underwriting, closing, and more.

Automated Loan Processing and Disclosures: Streamline your loan journey effortlessly.

8 a.m. TRU Approval®: Trust AngelAi for approvals at the speed of light.

40-Minute Turn Times: Experience efficiency like never before.

Lead Management and Building Tools: Dominate leads with AngelAi's comprehensive tools.

Experience the Game-Changing Capabilities at AngelAi.com

Step into the world of AngelAi and experience why top national agents like Josh Altman of Million Dollar Listings have fallen in love with her.

Embrace the Future and Command Success with AngelAi

Join our exclusive workshop and unlock the full potential of Ai's transformative power. Work directly with certified AngelAi trainers and discover how to leverage its vast features. Step into a new era of confidence in your mortgage business.

Scan the QR Code NOW to Sign Up for the live Webinar!

Visit swmc.com/angelai-university/

Your Favorite Ally, Morgan, is Now Stronger, Faster, and, like Always, 100% Backed* No Tough Loans. Close Fast. Earn More. Divorce Your Processor: The Rise of Ai Super Charged Ai Upgrade Morgan is now AngelAi The housing and residential nancing o ered herein is open to all without regard to race, color, religion, gender, sexual orientation, handicap, familial status, or national origin. For licensed mortgage professionals only; not for consumers. For licensing information, go to: www.nmlsconsumeraccess.org (NMLS 3277). Sun West Mortgage Company, Inc. (NMLS ID 3277) in California holds a Financing Law License (#6030119) [Loans made or arranged pursuant to a California Financing Law license], licensed by the California Department of Financial Protection and Innovation, Phone: (866) ASK-CORP, has a DRE Real Estate Corporation License Endorsement (#00793885), licensed by the California Department of Real Estate, Phone: (877) 373-4542. Georgia Residential Mortgage Licensee. Massachusetts Lender License # ML3277.

Josh Altman is a paid spokesperson for Celligence International, LLC, the creators of AngelAi. Million Dollar Listing is an American reality television series that is not a liated with Sun West Mortgage Company, Inc.

Pavan Agarwal

Vacation Home Sales Sinking

Prospective second-home buyers deterred by high costs, slowing short-term rental market

By Dana Anderson, Special To Florida Originator Magazine

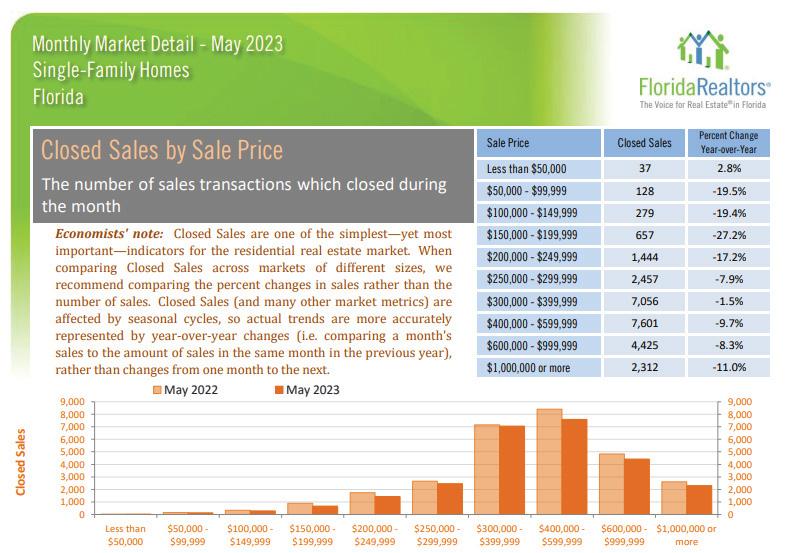

The number of people locking in mortgages for second homes dropped to its lowest level since 2016 in February and remained nearly as low in March. Prospective second-home buyers are deterred by high costs, a slowing short-term rental market, and the declining prevalence of remote work.

Mortgage-rate locks for second homes were down 52% from pre-pandemic levels on a seasonally adjusted basis in March, compared with a 13% decline for primary homes. Second-home rate locks fell to their lowest level since 2016 in February and remained nearly as low in March.

That’s according to a Redfin analysis of Optimal Blue data. A mortgage rate lock is an agreement between a homebuyer and a lender that allows the homebuyer to lock in an interest rate on a mortgage for a certain period of time, offering protection against future interest-rate hikes. Homebuyers must specify whether they are applying to secure a mortgage rate for a primary home, a sec-

ond home, or an investment property. This analysis does not include cash purchases. We define “pre-pandemic levels” as January and February of 2020. We use early 2020 as a comparison point because it provides a baseline for mortgage demand before homebuyer activity fluctuated wildly during the pandemic.

Second-home demand is also down from a year ago and from January 2022, just before mortgage rates started rising from record lows. Mortgage-rate locks

for second homes were down 49% year over year in March and down 71% from January 2022. Mortgage-rate locks for primary homes have dropped 29% year over year and 35% since January 2022.

The drop in second-home demand follows a meteoric rise during the pandemic homebuying boom. Mortgage-rate locks for second homes reached a peak of 89% above pre-pandemic levels in August 2020. At that time, many affluent Americans bought homes in vacation destinations, encouraged by low mortgage rates, remote work, and limitations on traveling from place to place.

A scarcity of new listings, elevated mortgage rates, still-high home prices, and persistent inflation, among other economic woes, are holding back demand for both primary and second homes.

“With housing payments near their all-time high; a lot of people can’t afford to buy one home right now, let alone a second,” said Redfin Deputy Chief Economist Taylor Marr. “Add the recent increase in loan fees,

10 FLORIDA ORIGINATOR MAGAZINE

> Dana Anderson

Mortgage-Rate Locks For Second Homes Are

52% Below Pre-Pandemic Levels

Seasonally adjusted mortgage-rate lock index: 100 = pre-pandemic levels (Jan.–Feb. 2020)

Aug 2020: 189 +89% from pre-pandemic levels

less deterred by rising rates, and we hear a lot from our buyers that they don’t want to wait for perfect market conditions — they are ready to enjoy the benefits of a second home now.”

A variety of factors are causing the outsized drop in second-home demand:

• Many potential second-home buyers are priced out because it’s frequently more expensive to buy a vacation home than a primary home. The typical second home was worth $465,000 in 2022, versus $375,000 for a primary home. Additionally, the federal government increased loan fees for second homes in April 2022.

March 2023: 86.9 -13.1% from pre-pandemic levels

• Vacation-home buyers are quicker to pull back from the market than primary-home buyers because second homes aren’t a necessity.

SOURCE: Redfin analysis of Optimal Blue data

inflation, shaky financial markets, the end of pandemic-related financial stimulus, and many companies calling workers back to the office, and it’s simply a challenging time for most Americans to buy a vacation home.”

But there are still some second-home buyers out there, especially in popular vacation destinations. Redfin agent Van Welborn said some buyers are looking for vacation condos, especially in desirable neighborhoods.

“It’s mostly affluent cash buyers who don’t have to worry about high rates,” Welborn said. “They’re motivated to buy now because they think they can get a vacation home for under asking price — and in some cases, they’re right. There are fewer buyers looking to buy properties to be used as shortterm rentals, though, as they’re finding that the market is saturated.”

“Despite a national cooling in residential real estate, we’re finding that

the luxury real estate market is still in a league of its own,” Pacaso CEO and Co-Founder Austin Allison told Florida Originator Magazine previously. “High-net-worth buyers are not as reliant on financing, so they might be

• Workers are returning to the office. Second homes are less attractive when there’s less time to spend in them. While working from home is more common than it was before the pandemic, the share of job openings that allow remote work has shrunk since early 2022.

March 2023: 47.8 -52.2% from pre-pandemic levels

• Buying a vacation home to rent it out is nowhere near as attractive as it was during the pandemic homebuying and investing boom. Owners of shortterm rentals on sites like Airbnb are reporting a steep decline in business. That’s because many people became vacation-rental hosts during the pandemic, which led to oversupply. Many local governments are also instituting new short-term-rental regulations, like new taxes and stricter permitting. The long-term rental market is also cooling.

• Bank accounts are shrinking as stock markets decline, so would-be buyers have less cash on hand for down payments and monthly payments.

• Many people with the means and desire to buy a second home have already done so, during the pandemic homebuying boom of 2020 and 2021.

ISSUE TWO 2023 11

b

As a data journalist at Redfin, a full-service real estate brokerage, Dana Anderson writes about the numbers behind real estate trends.

“A lot of people can’t afford to buy one home right now, let alone a second.”

Jan-15 Mar -1 5 Ma y-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar -1 6 Ma y-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar -1 7 Ma y-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar -1 8 Ma y-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar -1 9 Ma y-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar -2 0 Ma y-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar -2 1 Ma y-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar -2 2 Jan-23 Mar -2 3 Ma y-22 Jul-22 Sep-22 Nov-22 SOURCE: Redfin analysis of Optimal Blue data Second homes Primaryhomes March 2023: 47.8 -52.2% from pre-pandemic levels March 2023: 86.9 -13.1% from pre-pandemic levels Aug 2020: 189 +89% from pre-pandemic levels 200 180 160 140 120 100 80 60 40 20 0

> Taylor Marr, Deputy Chief Economist, Redfin

Sep-16 Nov-16 Jan-17 Mar -1 7 Ma y-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar -1 8 Ma y-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar -1 9 Ma y-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar -2 0 Ma y-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar -2 1 Ma y-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar -2 2 Jan-23 Mar -2 3 Ma y-22 Jul-22 Sep-22 Nov-22 Blue data Second homes Primaryhomes March 2023: 47.8 -52.2% from pre-pandemic levels

2023:

2020: 189

levels Jan-15 Mar -1 5 Ma y-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar -1 6 Ma y-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar -1 7 Ma y-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar -1 8 Ma y-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar -1 9 Ma y-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar -2 0 Ma y-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar -2 1 Ma y-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar -2 2 Jan-23 Mar -2 3 Ma y-22 Jul-22 Sep-22 Nov-22

March

86.9 -13.1% from pre-pandemic levels Aug

+89% from pre-pandemic

Second homes Primaryhomes

200 180 160 140 120 100 80 60 40 20 0

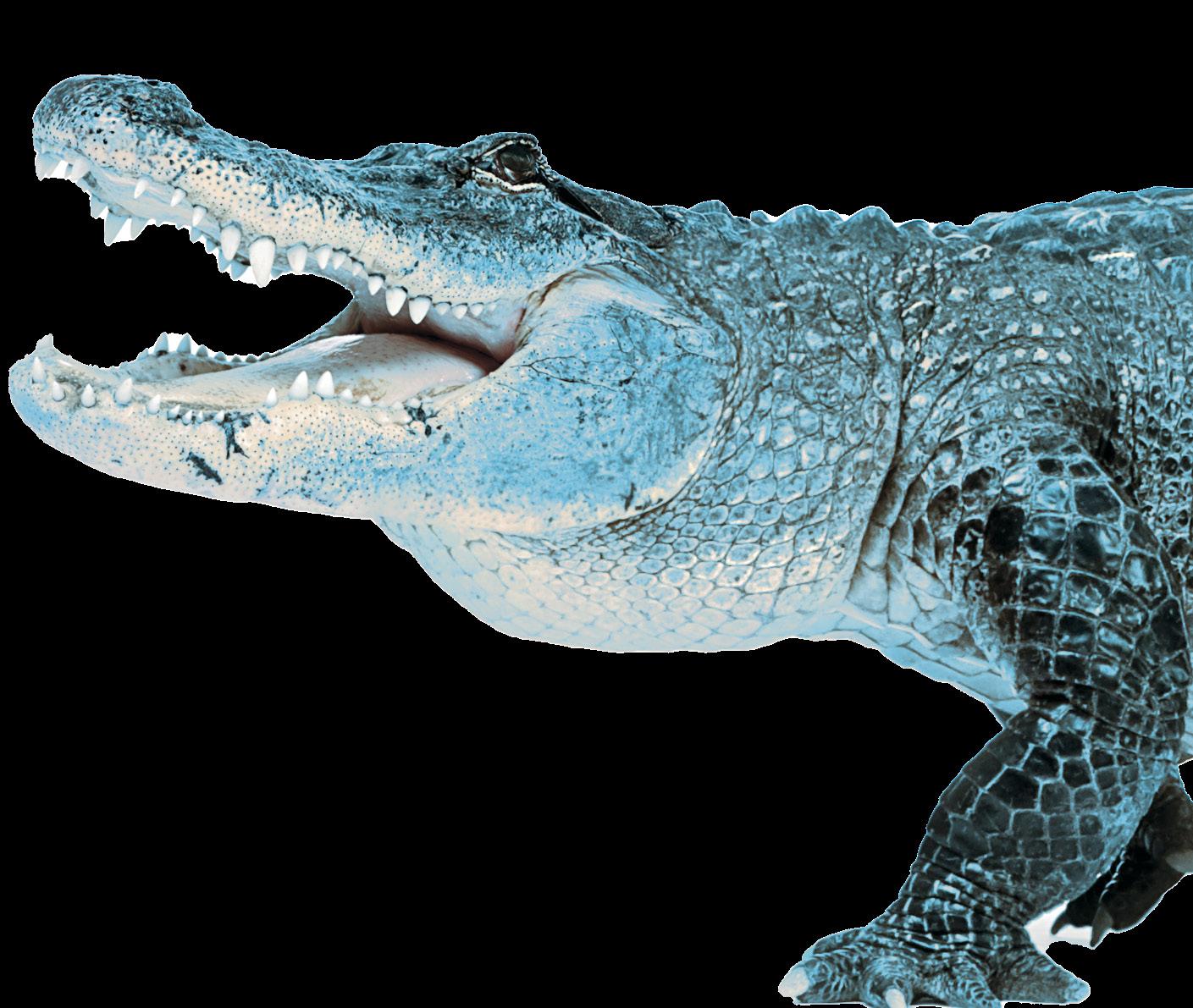

Florida Braced To Weather A National Recession

Continued population growth will act as sandbags protecting state’s economic activity

12 FLORIDA ORIGINATOR MAGAZINE

By Sean Snaith, Special To Florida Originator Magazine

lorida took it on the chin during the 2008-09 and 2020 recessions. But as what may be the most anticipated recession ever closes in on the U.S. economy in 2023, Florida is in a strong position to weather the storm.

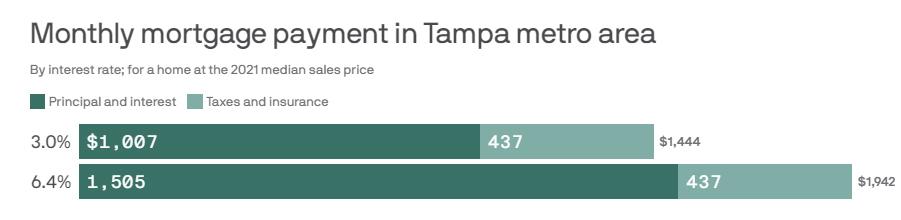

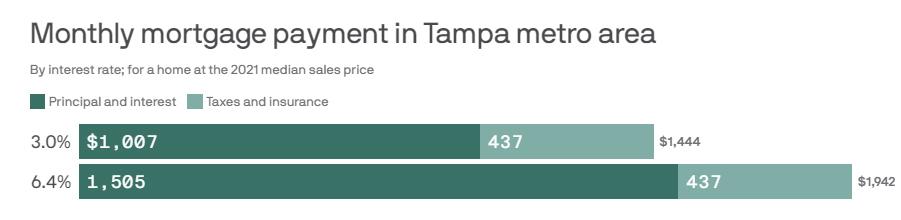

Activity in the housing market has been hard hit as high home prices combined with rising mortgage rates have pushed the size of monthly mortgage payments out of reach of many potential buyers.

Consumer spending on goods has shown signs of weakness as the Federal Reserve continues its fight to bring inflation down to its 2% target.

Because the national labor market remains in a very strong condition, consumers continue to spend on services and experiences, which has reinforced Florida’s important tourism sector.

To be clear, any recession will pull down Florida’s economy. Fortunately, a recession in 2023 in Florida will look nothing like the previous two recessions our state has been through in 2008-2009 (housing collapse) and 2020 (COVID-19 policy).

A recession is never welcome news as always there are those who will experience economic harm, but compared to what our state went through in the previous two recessions, any pain we may have to endure will be far less severe.

If this national economic storm should materialize, it will not be a major hurricane. Florida’s economy is as well prepared to weather it as we possibly could be.

Economically speaking, we have our flashlights, batteries, food, and water. Our gas tanks are full. We have candles as well. Florida’s continued population growth, which led the nation last year, and the associated wealth and income

this has brought to the state will act as sandbags preventing erosion of the state’s economic activity. Record-low unemployment rates and continued job growth thus far will act like storm shutters, lessening the damage that the winds of a recession could do to the state’s labor market.

Like any early storm path and strength predictions, the final outcome isn’t clear. But if we do get “hit,”

the damage to Florida’s economy should be minimal.

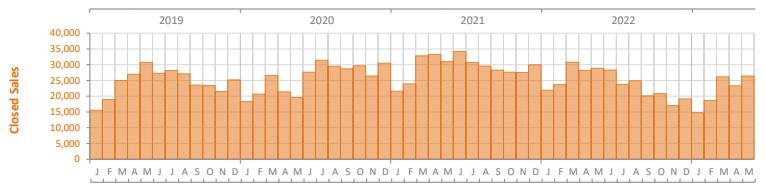

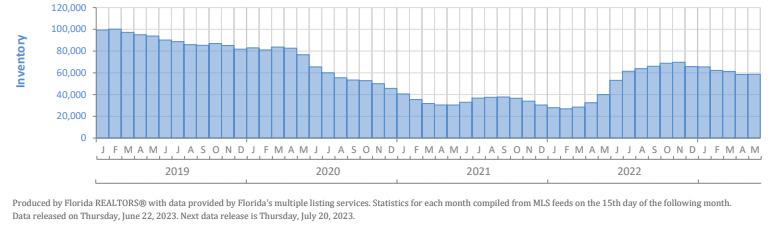

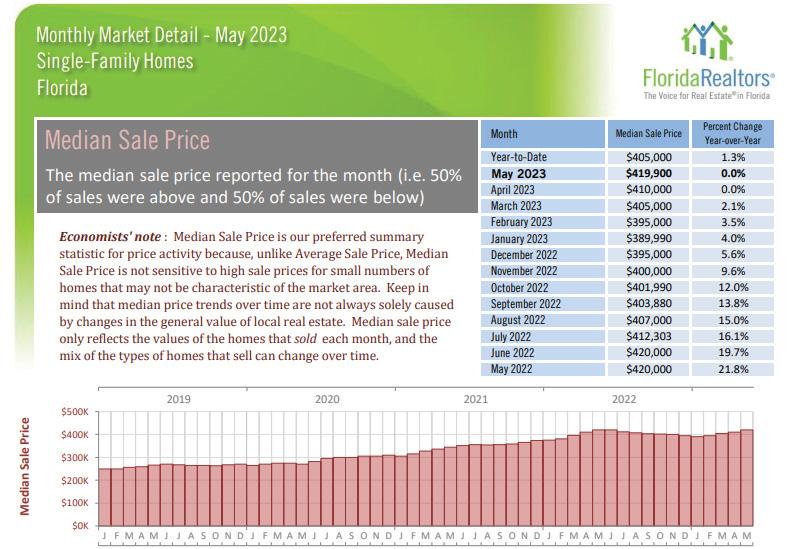

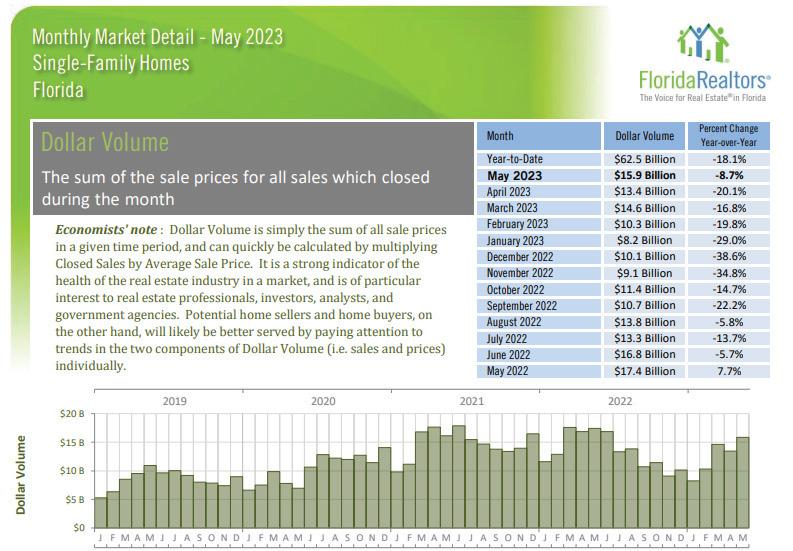

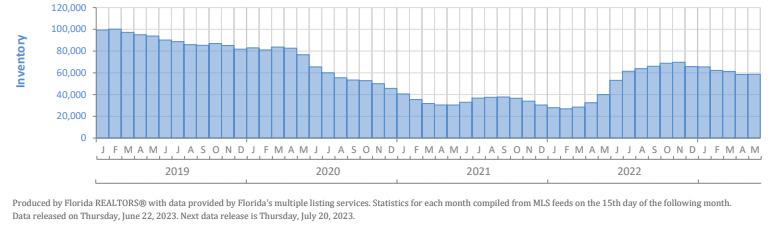

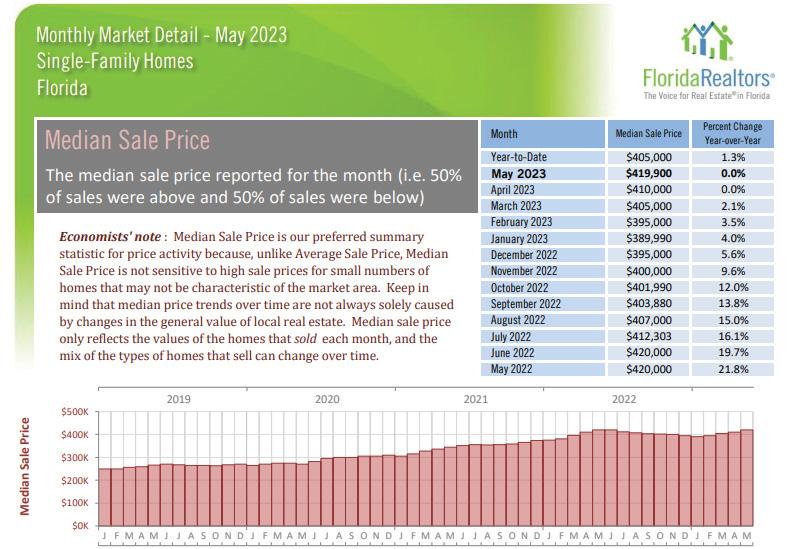

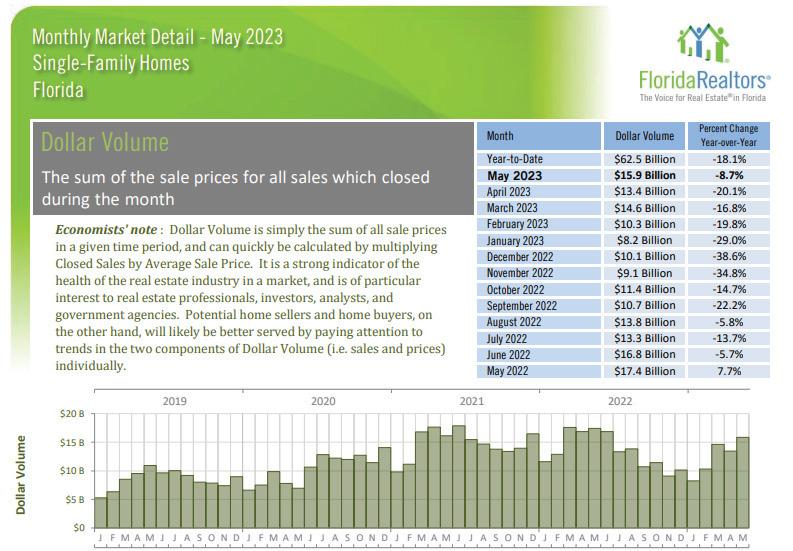

FLORIDA’S HOUSING MARKET EBBS

The February 2023 single-family home report released by Florida Realtors shows a market for existing housing that remains depleted of inventory — a shortage that was responsible for fueling rapid price appreciation over the previous two years. The median price has been pushed $137,200 above the peak price of the housing bubble in June 2006. The median sales price for single-family homes increased by $13,519 in February 2023, year over year, and now stands at $395,000 — a year-over-year price appreciation of 3.5%. Price appreciation in the townhome/condominium market continues as well, with an increase in the median sales price of $25,000 year over year, registering at $315,000 in February of this year. This price increase represents an 8.6% increase in median prices year over year.

Inventories of single-family homes in February are up from 0.9 months of supply a year ago to 2.7 months of supply this year. This indicates an inventory balance that is still skewed heavily in favor of the sellers in the single-family market, according to the Florida Realtors report.

From February 2022 to February 2023, inventories of condominiums rose from 1.2 months to 3.2 months, indicating that the condo market also is still tilted in the seller’s favor. Put another way, severe shortages remain in both the existing single-family home and condo markets.

Distressed sales of single-family homes in the form of short sales remain at very low levels despite the impact of the recession. They have

> Sean Snaith

+149,000

ISSUE TWO 2023 13

> Expected increase in single-family housing starts in 2026, after falling to 137,100 in 2024.

F

decreased from 57 in February 2022 to 17 in February 2023, a decrease of 70.2%. Foreclosure/REO sales have increased year over year by 12.5% versus February 2022. Traditional sales are down 21.3% year over year versus February 2022, as rapid price appreciation exacerbates affordability problems amid depleted inventories that are worsened by higher mortgage rates. Distressed sales of condos in the form of short sales were at very low levels in February 2023. Foreclosure/REO sales are down from February 2022 (-52.5%). Traditional sales of condos are down 30.0% in February 2023 when compared to February 2022.

In February 2023, the percentage of closed sales of single-family homes that were cash transactions stood at 31.3%. For condos, that figure is much higher, 54.6%. The condo market’s shares of cash transactions declined by 1.8% year-over-year while the single-family home market share of cash transactions has declined by 7.4%, which may indicate a decreasing role of cash investors in Florida’s single-family housing market. This is occurring amidst a sharp decline in mortgage availability.

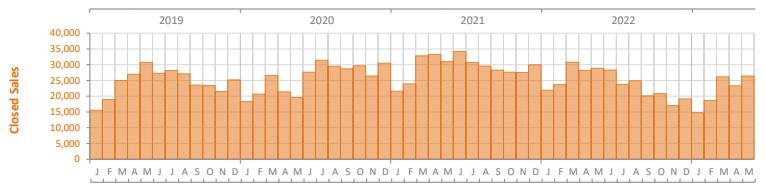

WOBBLING HOUSING MARKET

Sales have been on a strong upward path over the past few years, and the 12-month moving average and monthly sales have greatly exceeded their peak value during the housing bubble. Sales growth coming out of the bottom has been on a stronger trend than the pre-bubble housing market, but over the past seven months, the 12-month moving average is declining sharply. This reflects decreasing affordability in the face of the rapid price appreciation over the past several years; the depleted inventory of houses for sale; tighter mortgage credit markets; and higher mortgage rates for those able to get loans. The COVID-19 plunge in sales during April and May pulled down the moving average in 2020, but the

$395,000

end of their working lives and this bodes well for continued population growth via the in-migration of retirees, as well as job seekers to Florida.

We expect this upward trend in sales to resume as increases in the supply of new housing coupled with the recession will dampen price appreciation in an environment with continuing strength in the demographic drivers of housing demand, despite higher mortgage rates.

Median sales prices for existing single-family homes continue to climb since bottoming out in 2011. The double-digit pace of price increases in 2016 and 2017, which eased in 2018 and 2019, resumed in 2020. Over the past year, the 12-month moving average of median sales prices has risen by nearly $48,000.

Low inventories of existing homes for sale and lagging housing starts growth since 2016 contributed to the environment where home prices rose at a rapid pace. The shortage in the single-family market will be partially ameliorated as high prices, due to the rapid appreciation of the past several years, have prompted some sellers to get off the sidelines. However, the recession will result in a slowdown in housing starts. A tight housing market may be a persistent feature of Florida’s economy over the next several years.

immediate post-shutdown rebound was strong, fueled by pent-up demand and record-low mortgage rates at the time.

The housing market in Florida is wobbling a bit under the burden of high prices and rising mortgage rates. Economic and job growth in Florida is forecasted to slow somewhat as the economy enters a recession. More baby boomers continue to reach the

This period of unsustainable multiyear price appreciation has ended. The recession, coupled with rising mortgage rates and a last-minute rush of sellers trying to get in before the market cools down, will bring an end to the spike in prices. This may lead to some additional price depreciation but not anything compared to the 2008-09 cycle.

Single-family housing starts in 2026 are expected to increase to slightly over 149,000 after falling to 137,100 in 2024. This 2026 level is 54,000 fewer than the 2021 level of starts. b

14 FLORIDA ORIGINATOR MAGAZINE

Dr. Sean Snaith is director of the Institute for Economic Forecasting at the University of Central Florida.

> The median price of a home in February, 2023 — an increase of $13,519, year over year (+3.5%), and $137,200 above the peak price of the housing bubble in June 2006.

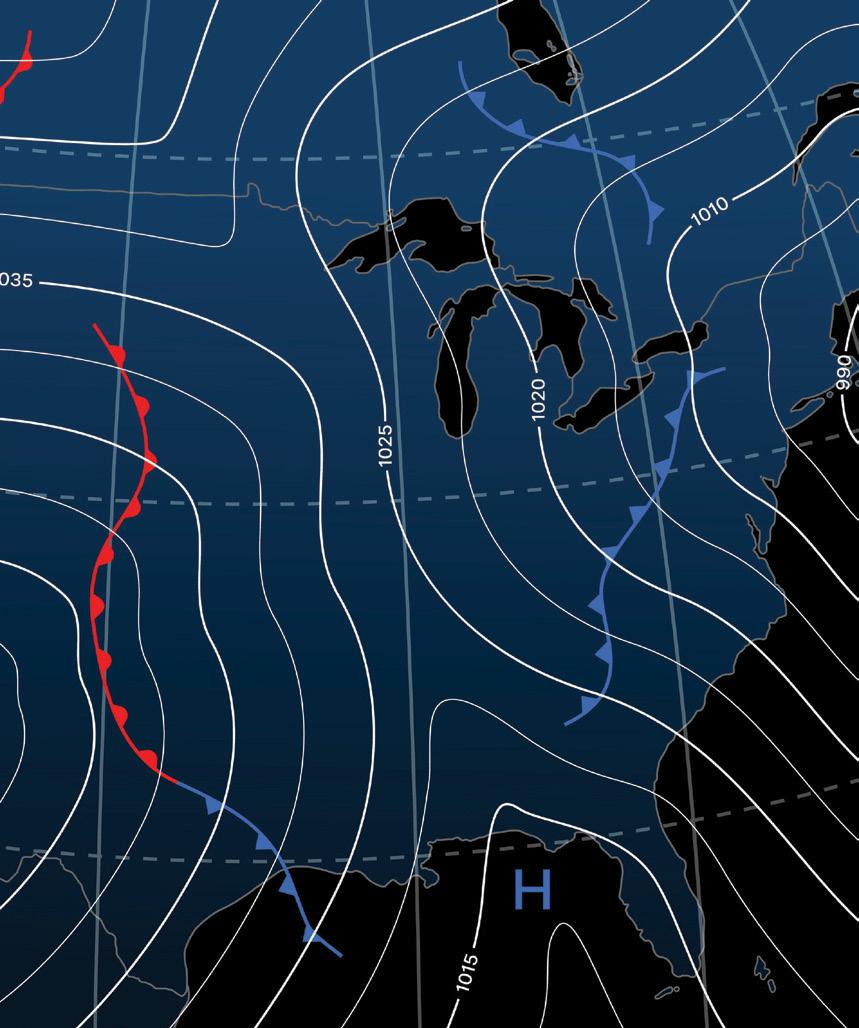

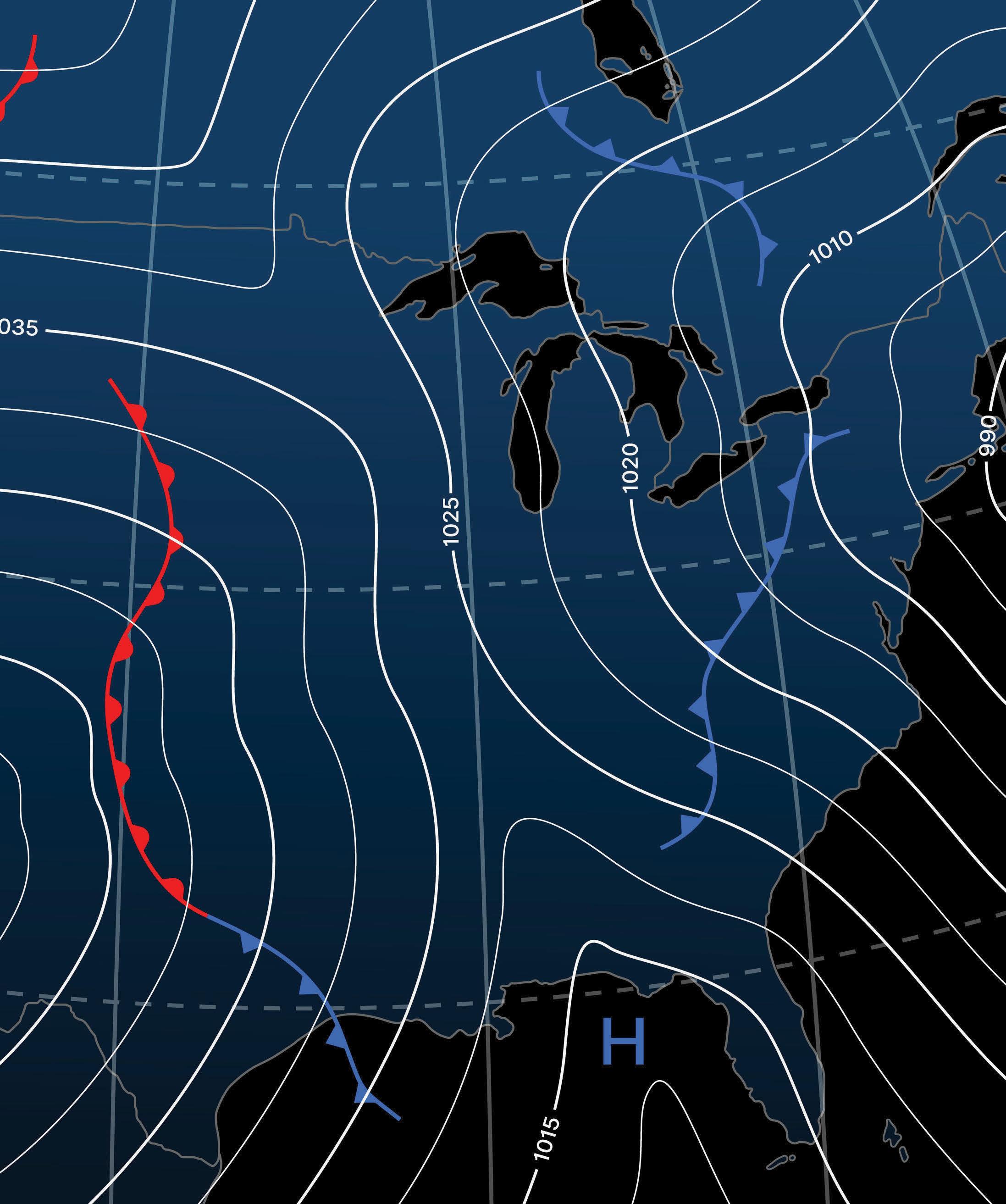

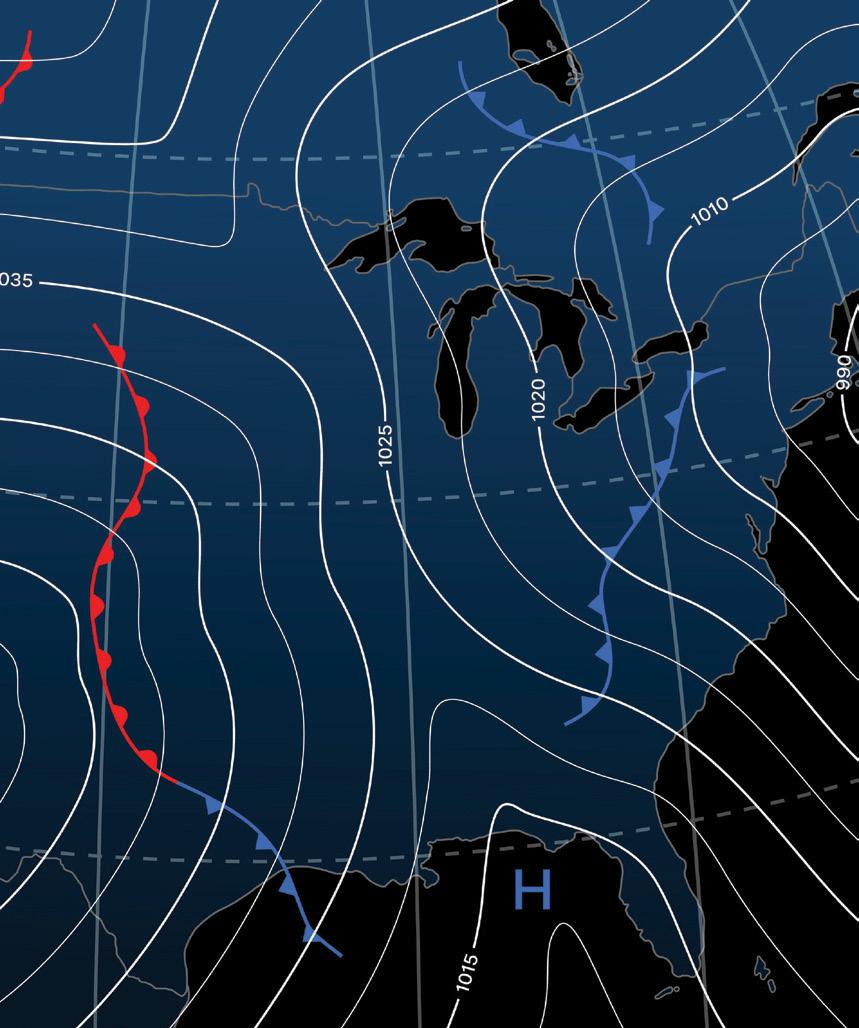

MORTGAGE METEOROLOGY

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING SARAH WOLAK, STAFF WRITER FOR NMP TUNE IN EVERY FRIDAY FOR YOUR WEEKLY FORECAST.

Discover Where Your Competitors Stand In The Mortgage Market

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Mortgage MarketShare Module

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Loan Originator Module

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

GET A FREE MORTGAGE COMPETITOR ANALYSIS

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

BENEFITS

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

NEED MORE DATA?

Inquire about our NMLS Data Licensing and LO Contact Database options.

Moumen Silk was named the branch manager at NFM Lending’s new branch in Orlando.

Kenny Schaaf joined Movement Mortgage in Tampa as a loan consultant. He was the vice president of mortgage lending at Guaranteed Rate in Tampa for two years prior.

Letwiens Gonzalez is the area manager/loan officer for Lenders One at its Walmart-based in-store branch in Orlando.

Dimah Hasan is the area sales manager/ branch manager at the new First Option Mortgage branch in Wesley Chapel.

Shawn Morrow was hired as the area sales manager in November at the St. Petersburg branch of Bay Equity, a full service mortgage lender.

Regional manager Chris Smith is overseeing Waterstone Mortgage Corp.’s office in Tampa. The office focuses on serving customers across Florida and the Eastern Seaboard.

Scott Cooper has transitioned to chief revenue officer at Birchwood Credit Services, a national provider of mortgage credit reporting services, and the promotion of Jen Lord to senior vice president over process, workflow and product.

ON THE MOVE

PEOPLE ON THE MOVE

Moumen Silk

Kenny Schaaf

Letwiens Gonzalez

Dimah Hasan

Shawn Morrow

Chris Smith

Scott Cooper

Jen Lord

A Florida Launch Pad For Mortgage Bankers

MBA, Lennar Mortgage open first mortgage banking program at Barry University

By David Krechevsky, Managing Editor, Florida Originator Magazine

Mortgage originators in Florida won’t have far to travel if they want to move up and become a mortgage banker.

Florida is now home to a first-inthe-nation formal education program focused on developing a group of mortgage bankers.

Miami’s diversity makes it a natural

launching pad for the Mortgage Banker Association’s first mortgage banking certificate program in the nation, called Mortgage Banking Bound.

A strong connection between Miami-based Lennar Mortgage and the president of a university in Miami Shores lead to the new program.

David Upbin, vice president of education for the MBA, said the Mortgage Banking Bound program had a few

false starts before Lennar Mortgage President Laura Escobar brought a proposal to the MBA’s 2022 Independent Mortgage Bankers Conference, held in Nashville, Tenn.

“When we saw it on paper, it was kind of a quick ‘aha’ moment,” Upbin said. “The proposal aligned with the content that we already had on our shelves, … it was almost a 90% match. Knowing that authoring and build-

18 FLORIDA ORIGINATOR MAGAZINE

Barry University Mortgage Banking Bound class.

ing the content is one of the hardest elements of the program, we volunteered to tap into our existing course material.”

THE PROGRAM

According to Tiffani Malvin, director of continuing education and portfolio programs at Barry University, Mortgage Banking Bound was introduced for the first time at the start of the spring semester in January and has 11 students. The program, which costs students $3,000, is 100 hours over 15 weeks, she said, and meets two nights weekly.

The course teaches students about the various aspects of mortgage banking, including loan products, underwriting, loan servicing, regulatory compliance, and marketing, among other topics.

“This is an opportunity to open this up to create a … diverse pipeline to enter the industry,” Malvin said. “There’s a range of careers in the industry, and this program really prepares them for that. It touches on four major elements: loan origination, closing, underwriting, and processing, and each of those areas has a myriad of jobs related: loan originator, loan associate, customer service, and then builds from there into management.”

MBA’s Upbin added that the program is “showing students through this class that no matter what your interests are, no matter what your strengths are — introvert, extrovert, sales ops, technology — that there’s a place for you in this industry.”

In addition to faculty members, Malvin noted that each class is taught by “professionals and experts in the field” — volunteers from southern Florida who are provided by the MBA and Lennar Mortgage who are not paid.

Students also get outside the classroom, Malvin added, including opportunities for internships with lenders that include not just Lennar Mortgage but also Fannie Mae, Marion Bank & Trust, Novus Home Mortgage, and TD Bank.

“We also have an end-of-program networking event and a career fair,” she said, “where students will have an opportunity to talk to organizations that are hiring … so they have a career pathway and opportunities to get a job at the comple-

tion of the program.”

‘WE JUMPED ON IT’

Located on 124 acres in Miami Shores, Barry University was founded in 1940 by the Adrian Dominican Sisters, a Catholic religious institute based in Adrian, Mich. In addition to Barry University, the sisters also sponsor a high school in Illinois, the Rosarian Academy in West Palm Beach, Fla., and Siena Heights University in Michigan.

Escobar suggested using an existing relationship Lennar Mortgage had with Mike Allen, Ph.D., president of Barry University, a private liberal arts school with about 6,000 students located just north of Miami in Miami Shores.

“It became a perfect match,” Upbin said of Barry U. “They’ve got a robust

ISSUE TWO 2023 19

> Tiffani Malvin, director of continuing education and portfolio programs, Barry University

> David Kopp, Ph.D., vice provost of continuing education, Barry University

"No matter what your interests are, no matter what your strengths are — introvert, extrovert, sales ops, technology — there’s a place for you in this industry.”

> David Upbin, vice president of education, Mortgage Bankers Association

executive certificate program and they cater to the types of students that we’re trying to bring into our industry, students that reflect the diverse nature of southern Florida, of this country, and the future homebuyer.”

Danielle Tocco, Lennar Mortgage’s vice president of communications, said the company had been working on the concept of a mortgage banker training program for a couple of years, and decided to enlist the MBA’s help for its educational knowledge and some financial support. She credited the Lennar Foundation, the company’s charitable arm, as a key to making the program a reality.

“The mortgage industry faces an ongoing challenge of finding and retaining top talent,” Tocco said. “As we stopped to think about it, when a young adult graduates from high school and wants to be a doctor, lawyer, teacher, accountant — there is a clear education path

gage industry, where do they start? Are students and young adults aware that there are robust career opportunities in mortgage? That is where the idea for Mortgage Banking Bound came about.”

According to David Kopp, Ph.D., vice provost of continuing education and graduate studies at Barry, said the school has 100 degree programs, ranging from bachelor to doctorate, and “a full panoply of subjects from business to education, to a school of podiatry, to social work, as well as law.”

The university, he said, is “always seeking out continuing education opportunities for our constituents, realizing that many folks are searching not necessarily for a college degree, but for things like credentials and certificates.”

Kopp said that, when the school was presented the opportunity to add the mortgage banking program, “we jumped on it,” believing there was a need for a certificate that would open “a career path that many may not have access to,

as a young adult in 2010 following the devastating earthquake that struck the small Caribbean nation in January of that year.

Over the succeeding 13 years, he has earned an associate degree in biology from Palm Beach State College; transferred to Florida Atlantic University to work towards a bachelor’s degree but had to leave 13 credits shy due to his financial situation; then worked various jobs and started a nonprofit organization to help children back in in his native land.

He also earned a real estate license, working for Exit Realty Mizner in Boca Raton.

Despite how busy he is, he enrolled in the Mortgage Banker Bound program with the goal of adding mortgage banking skills to his real estate work.

“As a [real estate agent], it helps me understand the market enough to explain it better to my clients,” Sanon said. “Just because of that course alone, I was able to get a new client. I sat down and explained how the whole entire process works.”

He had never heard of the MBA before enrolling in the program, which has allowed him to discover “a whole

20 FLORIDA ORIGINATOR MAGAZINE

Chris Sanon is a native of Haiti. He arrived in Orlando,

“Being able to serve other people is one of the main centerpieces of the course. It’s something worth exploring.”

> Chris Sanon, real estate agent and mortgage banker, Exit Realty Mizner

new world that I didn’t even think about. There are so many entry points. It’s way bigger than I expected.”

His goal now, he said, is to add work as both a real estate agent and a mortgage banker. “I can perform both at the same time,” he said. “Being able to serve other people is one of the main centerpieces of the course. It’s something worth exploring.”

Exploring new options is also what attracted Ekaterina Elagina to the program.

A native of Russia, Elagina arrived in the U.S. six years ago with a master’s degree in art criticism and the ability to speak English and Spanish as well as Russian. She has since added a master’s in human resource development from Barry University, and is working towards another in mental health counseling.

She also does charitable work, founding a program to help refugee Ukrainian children settle in South Florida.

With all of that on her plate, she still found herself drawn to the Mortgage Banking Bound program.

“I was really fascinated about this program,” Elagina said. “I really don’t believe that we should limit ourselves and our abilities to help communities and people and families by just sticking to what we were taught in any program.”

USING EXISTING SKILLS

She believes, in fact, that her other training will help her in the mortgage banking industry.

“I would like to work in this industry,” she said. “What makes me really enthusiastic about joining the industry is just having some background and knowledge in multicultural sensitivity and how we can approach different communities, people with different values, people with different incomes, and make it really diverse and inclusive.”

That, ultimately, is the goal for the Mortgage Banking Bound program. Upbin, vice president of education for the

MBA, says the success of the program will be judged in a variety of ways.

“Number one, we want to graduate students that are excited for the industry and get them placed with jobs or internships,” he said. “If we can get 50%, 75% of the students placed, or at least interviewing with our member companies, then we believe that is a success.”

The MBA and Lennar Mortgage have committed to offering the program for the fall semester, and hope to see enrollment grow. The plan is also to expand by utilizing some virtual instruction, which would allow for instructors nationwide to participate.

“If we can see [the number of students] grow into the low 20s, high 20s, we would be absolutely thrilled,” Upbin said. “And to keep seeing diverse job seekers — whether it’s diversity of gender, color, economic backgrounds — if we see diversity of students who are coming into this classroom really committing themselves to learning about the industry and pursuing a career, that is a success for us.”

FUTURE PLANS

The MBA also hopes to expand the program in 2024 outside of Florida to other colleges and universities, but will do so in a methodical way, Upbin said.

“We want to make sure we’re not overcommitting and under delivering,” he said, adding the MBA will seek schools that have “robust certificate programs” and professors with a background in real estate finance.

But he said the MBA also wants to locate the programs “in an area where we know the industry can support hiring. So think of high production, high volume areas, whether that’s Nashville, or Southern California, or Dallas, or Denver. Those are the kind of matches we’re looking for.”

For the pilot of the Mortgage Banking Bound program, though, Miami seems to have been a perfect match. b

ISSUE TWO 2023 21

“What makes me really enthusiastic about joining the industry is just having some background and knowledge in multicultural sensitivity.”

> Ekaterina Elagina, Mortgage Banking Bound student

This Land Is Not Your Land …

Lenders await impact of new state ban on foreign nationals owning property

By Erica Drzewiecki, Staff Writer, National Mortgage Professional

Anew law purportedly to protect Floridians from Communist influence and in-

vestment is slated to impact mortgage professionals and borrowers in the Sunshine State and, potentially, beyond. The law, which went into effect on July 1, was signed by Gov. Ron DeSantis on May 8.

WHAT IT IS

The 2024 Republican presidential candidate’s self-proclaimed “crackdown on Communist China” prohibits foreign entities and officers from China, Russia, Iran, North Korea, Cuba, Venezuela, and Syria from buying property in Florida.

Specifically prohibited is property within 10 miles of any military instal-

lation, airport, seaport, power plant, water treatment facility, or any other critical infrastructure.

“Florida is taking action to stand against the United States’ greatest geopolitical threat — the Chinese Communist Party,” DeSantis said during the bill-signing ceremony.

Amidst the changes adopted to Florida statutes, Chinese citizens with non-tourist visas are restricted to owning one home and/or less than two acres, which must be at least five miles from critical infrastructure. Citizens from the aforementioned countries who are not lawful, permanent U.S. residents are prohibited from real estate ownership altogether.

Foreign principals who acquire agricultural land on or after July 1 may not buy more, must register with the

state, and then sell, transfer, or otherwise divest themselves of the property within three years.

IMPACT TO MLOS

If it was just borrowers at risk of violating Florida law, this article wouldn’t need to be written. Lenders and mortgage loan officers who assist banned buyers are subject to criminal penalties, and the state has the right to seize property improperly obtained by foreign nationals.

“We’re going to prevent ourselves

22 FLORIDA ORIGINATOR MAGAZINE

from making loans that break the law; that’s my most important goal,” says Robert Senko, president of ACC Mortgage, a 24-year-old non-QM lender.

Florida is among ACC’s top three states for loan volume, offering bank statement loans, along with buyer and refinancing options for foreign nationals and Individual Taxpayer Identification Number (ITIN) holders. However, foreign nationals represent just 5% of ACC’s loan volume countrywide.

“I’m not sure it’s going to be a massive needle mover,” Senko says of the new law. “To me it feels more symbolic politically. I don’t anticipate it hurting our business.”

Most non-QM lenders have programs for foreign nationals, while prime lenders typically only offer the option to select borrowers with high net worth who they

cially; where there’s a will there’s a way,” Senko says. “If they have an American friend who buys a property, they could probably work behind the scenes to secure that property if they wanted to.”

ACC requires personal guarantees, passports and other special measures of its foreign clients.

“I’m sure there will be some challenges to it, but our system will flag it,” Senko adds.

LoanStream also has various tools to vet potential borrowers.

“For us if we’re going to do a foreign national borrower they need to have U.S.-based credit,” Fisher says. “I think that right there is going to be a filter for us to see their background activities in the country where they’ve been working and what they’ve been doing.”

religion, sex, familial status, or disability.

Congressional Asian Pacific American Caucus (CAPAC) Chair Rep. Judy Chu (CA-28) was “outraged” by the signing, which she called in a May 15 statement, “the latest state-level effort to restrict the property ownership of Chinese home seekers, who are aspiring small business owners, students, and families seeking to build better lives for themselves here in America.”

Several bills seeking to limit or prohibit foreign investment in the U.S. have been introduced at the federal level in recent years, but none have passed.

“If the federal regulators determine the same (as Florida) then I think that becomes more of a bigger issue than a state-specific ruling,” Senko says. “At this point I’m not overly concerned

deem to be low risk.

Wholesale lender LoanStream does a large loan business in Florida, according to EVP of Non-QM and Jumbo Mortgage Will Fisher.

“This will definitely have an impact; how big of an impact is yet to be seen,” Fisher says. “The one thing we have to be smart about is, do we want to stifle investment in the United States? The one thing that’s been nice about allowing foreign investment is they pick up the slack when our economy isn’t so healthy here, and we don’t have anybody to invest.”

A WILL FINDS A WAY AROUND

As far as banned buyers looking to skirt the books, lenders will have to remain adamant.

“Folks buy stuff with LLCs or commer-

Reviewing the fine print of the new statutes and adjusting business dealings accordingly will be a priority for lenders going forward.

“I think there’s going to be a gestation period for everyone,” Fisher says. “The mortgage industry is very reactionary.”

THE LAW OF THE LAND?

The Florida Asian American Justice Alliance (FAAJA) is working to prove the legislation is unconstitutional, while proponents condone state officials’ decision to limit foreign investments on American soil.

Opponents say the law violates the Department of Housing and Urban Development’s (HUD) Fair Housing Act of 1968, which prohibits discrimination in the sale, rental, or financing of homes because of race, color, national origin,

unless the federal government makes it more prohibitive.”

Canada blamed a spike in home prices since 2020 on foreign buyers flooding the housing market. As a result, the Canadian government passed a law on Jan. 1 banning foreign investors from purchasing residential properties for two years. Exceptions were made for immigrants and non-citizen permanent residents.

For now, potential landowners who fall into one of the prohibited groups can still consider other regions in the U.S. besides Florida.

“Whether you’re Chinese or any ethnicity, you have an opportunity here in the U.S. to buy property as a foreign national,” Fisher says. “Don’t limit your markets; do what you consider best for you and your family.” b

ISSUE TWO 2023 23

“This will definitely have an impact; how big of an impact is yet to be seen.”

> Will Fisher, EVP of Non-QM and Jumbo Mortgage, LoanStream

FromT ears ToT riumph

Marsha Gandy’s journey from first-time homebuyer to loan originator

24 FLORIDA ORIGINATOR MAGAZINE

By Erica Drzewiecki, Staff Writer, National Mortgage Professional

Anightmare homebuying experience led Marsha Gandy down the road to living the dream. Gandy was a successful electrical engineer with international firm CH2M Hill when she discovered her true passion.

“I found myself as a first-time homebuyer in the parking lot of the mortgage company crying,” she remembers. “They kept telling me I needed more money for closing, and I was a young college student and didn’t have more money.”

Gandy earned her Bachelor of Science in Electrical Engineering from the University of Florida and went on to build a successful career in that field. At the same time she was researching and investing in real estate, and was dismayed that her loan originator could not estimate the total cash she needed to close.

“I learned a lot from that experience — what I didn’t want my clients to experience,” Gandy recalls. “I eventually felt someone needed to enter the industry that would work as an educator and advocate for the consumers, which is what I have now done for my 33-year career.”

South Florida Agent Magazine’s Loan Officer of the Year for the 2022 Agent Choice Awards, Gandy has served as SVP of Mortgage Lending at Guaranteed Rate since February 2010. She is the lead of her team, which also consists of a junior, an assistant, and processing staff. Gandy is licensed in 16 states and self-reported closing $57.5 million in loans in 2022.

Gandy is licensed in 16 states and self-reported closing $57.5 million in loans in 2022.

Even during this challenging market, Gandy says she still hasn’t changed her approach.

“It is all about relationships and consistently delivering to my clients as committed,” she says. “Due to the volatile market the consumers and referral partners want the strongest mortgage partner possible to help them successfully navigate the market and their transactions.”

is the grandson of a client she closed decades ago.

“I have now closed several loans for them, as well as their children and now their grandchildren via referral business,” Gandy says.

Lisa Bailey Levy, a real estate agent with EXP Realty, says she was referred to Gandy during a challenging deal and now she won’t work with any other team.

“I was in the midst of a deal that was not going well with a big bank,” Levy recalls. “I was new to the business, and the title company I was working with said you have to call Marsha — she’ll get it done. I’m an absolute control freak. I contacted them, they were on point, and got the deal closed. Their team responds in a timely fashion to everything. I’ve been with them ever since and I don’t go to anybody else. Their team is tenacious … I have had some incredibly challenging deals, but their team does whatever they have to do to get them done.”

Denise Silk, a Remax real estate agent, recalls Gandy saving a deal that could

Gandy says her business is 100% referral-based. What does that mean, exactly?

“That means I am blessed to have three decades of past clients and referral partners that rely on me to deliver successful transactions for them,” she explains. “They continue to refer their clients, in addition, the past clients re turn and also send their family, friends, and business associates to me to make sure they also have consistent successful mortgage closing experiences.”

She’s currently working with a client she closed for the first time 26 years ago and another who

> Marsha Gandy, SVP of Mortgage Lending, Guaranteed Rate

“It is all about relationships and consistently delivering to my clients as committed.”

> Marsha Gandy

have been compromised by a hurricane.

“We were under contract,” Silk says. “While we were waiting to close, a hurricane came through. It was a nightmare.”

Amidst other delayed closings and repeat appraisals, Gandy came through with flying colors.

“We never skipped a beat; we closed on time,” Silk says. “She saved that deal, and that’s when I said, ‘This lady is special.’ I consider her word gold. She is the best loan officer I’ve ever worked with.”

Gandy resides in Boca Raton, where she is a member of Sunrise Rotary Club and a founding member of the Business Networking International All-Stars Group.

Guaranteed Rate Regional Manager Ann Marie Howser met Gandy about five years ago and has been consistently impressed with her ability to cultivate relationships.

“She is definitely a strong individual,” Howser says. “She is always present and available when needed. One of the things that makes her as good as she is is her passion for the business and wanting to get families into homes. She is a driver for success. I’m very proud of her accomplishments.”

Gandy attributes her positive track record to consistency and delivery.

“Consistently delivering the results I promise to each of my clients,” she explains. “I do this with honesty, integrity, and transparency, even when the news is not good. Consumers know when they come to me that my depth of knowledge is unparalleled, and that I will tell them how it is and deliver what I promise. It is a demanding industry. If you’re not doing the right thing by the consumers, you’re not going to last very long.”

The challenge, Gandy says, is getting above the marketing and noise of the industry (social media, television, etc.) to recognize the big picture and “pull back the curtain” for borrowers and agents. Gandy teaches the Situation Mastermind Class, where she walks top real estate agents through the marketing of the mortgage lending in-

dustry to the bottom line of products, costs, benefits, and challenges they need to navigate to meet their goals.

“This industry changes constantly; it’s never boring,” she says. “My goal and intentions are always the same, and that is to provide a consistent, transparent, smooth purchase process

properties from anywhere in the world.

“This year we closed one client on eight loans at one time while they lived in Germany,” Gandy says. “In the past it would have been quite an undertaking, that level of cost and coordination.”

In her free time, this LO enjoys photography and travel. She has visited 19 countries and her work has been featured in art galleries and national publications.

“Currently one of my favorite places to visit is Mount Dora, Fla.,” she says, of the town located northwest of Orlando. “It is a small town, where you can park and walk around all weekend, watch amazing sunsets, have great food and fun adventures.”

Her advice to fresh-faced LOs? To always operate from a place of integrity, and honesty.

for my clients and referral partners.”

Gandy was honored by the “Loan Officer of the Year” award since it came from nominations and votes from fellow industry professionals. “I always feel honored to be recognized by my peers,” she says. “We all work so hard, and we truly appreciate each other and our success because we respect each other and what it takes to be successful in our industry, not to mention to continue that success for over three decades.”

Guaranteed Rate has embraced leading-edge technology, and now has the ability for clients to close on multiple

“Align yourself with a strong originator so you can watch and learn the industry,” Gandy says. “Unfortunately, there is no real training for our industry, and the learning curve is based on real world experience.”

Once you jump the hurdles, she adds, there is no better reward than guiding people through one of the biggest financial decisions of their lives.

“I have the honor and blessing of working with families over the decades and have helped several generations in some families buy real estate,” Gandy explains. “The reward that means the most to me is when I have a parent who sends their child — or a grandparent who sends their grandchild — to me to do their first home. That level of confidence and trust is the biggest reward I can ever get.” b

26 FLORIDA ORIGINATOR MAGAZINE

“I do this with honesty, integrity, and transparency, even when the news is not good.”

> Marsha Gandy

SMASHING T H

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING DAVID LUNA, PRESIDENT OF MORTGAGE EDUCATORS & COMPLIANCE TUNE IN EVERY WEDNESDAY FOR YOUR REGULATORY UPDATE.

Insurance Storms Whip The Sunshine State

As premiums rise, helping borrowers shop their coverage may save your loan

30 FLORIDA ORIGINATOR MAGAZINE

By Ryan Kingsley, Staff Writer, Florida Originator Magazine

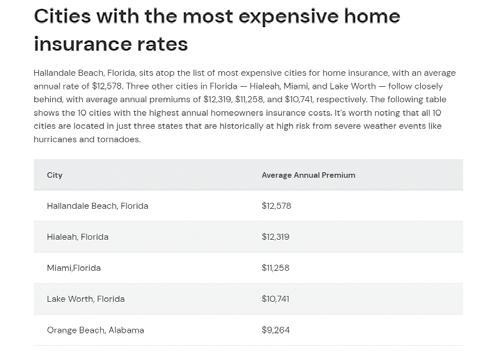

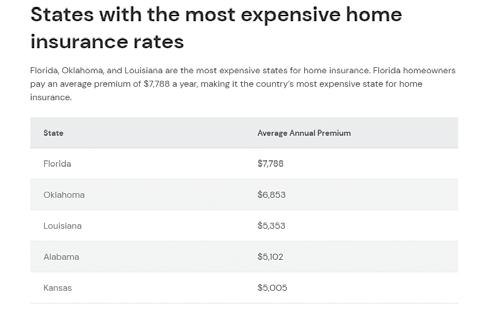

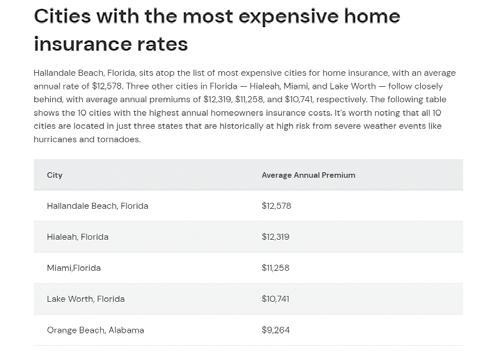

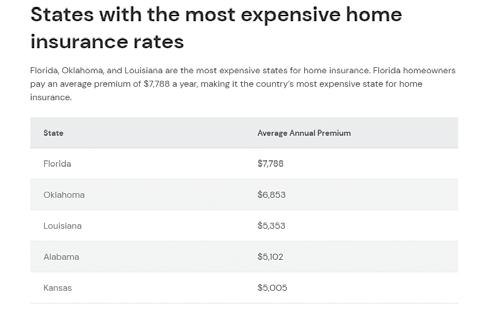

Florida’s affordability crisis is escalating, and mortgage loan originators in the state find themselves in a battle against high interest rates, home prices, and homeowners’ insurance premiums, which are nearly triple the national average and are busting borrowers’ budgets.

The challenges, while new, will worsen, says Cameron Mackie, owner and originator at Rateplicity Mortgage Corporation in Naples, who began to observe the impact of elevated insurance costs on originations as far back as three years ago.

“My question is: Are costs ever going to go down?” he asks. “We’re in a peak of inflation and when things normalize, I just see it as they’re going to continue to stabilize and give some excuse that they’re never going to bring it back down. It’s just something we have to really adjust … and prepare for the future.”

The result of these higher costs on borrowers is that potential homebuyers and investors are being squeezed out of the Florida market by narrowing qualification margins, in particular.

“Unfortunately, I lost a couple of deals (recently) because of the insurance,” says Peter Bitzas, an originator for NEXA Mortgage based in the greater Tampa region. “Not only does it affect people’s budgets and what they want to spend, but it’s also affecting debt-to-income ratios for qualifying — not only on the primary purchase of their home, but also for investors

looking to buy investment properties.”

Over the past year, Bitzas estimates that 10 to 20% of his loan applications have fallen through on account of insurance rate increases.

Rich Williams, principal broker for Florida Mortgage Pros in centrally located Lakeland, has seen a similar impact on origination on account of insurance costs. He calls the situation “unstable, quite unstable” for originators like himself who are seeing home shoppers priced out of the market as interest rates and skyrocketing premiums lay siege to debt-toincome ratios.

Parallel rising home prices, “with the interest rates going up and now with the insurance rates going up as well, it’s definitely affecting origination. … What they’re qualifying for, there’s limited to none or no homes available at those prices,” he says.

AN AILING INDUSTRY

With 8,436 miles of shoreline, Florida is the most catastrophe-prone region in the United States, yet its insurance market is dominated by local insurers too small to accumulate sufficient capital to balance future losses. The market depends heavily on reinsurance, or insurance for the primary insurer to help when claims spike. After back-to-back years (2020-21) of insurance companies experiencing net underwriting losses exceeding $1 billion, reinsurance rates have risen — and swamped — many of Florida’s smaller, private carriers.

ISSUE TWO 2023 31

+33%

> Amount homeowner’s insurance rates in Florida increased, compared to the national rate increase of 9%.

The purpose of reinsurance is to disperse the risk of catastrophe outside of Florida’s borders through the global reinsurance market. In its January 2023 Property Insurance Stability Report, the Florida Office of Insurance Regulation (OIR) indicated that for 2022-2023, the amount of 2022 reinsurance coverage purchased by insurers increased an average of 17% from 2021. However, the cost of that reinsurance has increased by 52% from 2021 figures.

At present, primary insurers are putting 50% of policyholders’ premiums toward their reinsurance costs, up from 30% in 2018.

If the health of an industry can be gleaned from a statistic, since 2017, 14 property and casualty insurers have entered receivership with the Florida Department of Financial Services. Recently, other carriers like Farmers and AAA are opting to leave the state, drop policyholders, not renew policies, or severely tighten policy eligibility requirements, in addition to hiking rates substantially.

The surge of insolvencies has contributed to massive growth in the number of policies that Citizens Property Insurance Corp. — the state-backed insurer of last resort — has had to absorb.

As of September 2022, Citizens held more than one million policies — more than double the number from two years prior: a number predicted to swell to two million policies in 2023.

Meanwhile, the most current data shows 19 insurers are presently subject to enhanced monitoring by the OIR’s Insurer Stability Unit. Referrals to the unit can be triggered by myriad events, including (but not limited to) requesting a rate increase that exceeds 15%, filing a notice that the company intends to not renew more than 10,000 residential property insurance policies within a 12-month period, or filing financial statements which demonstrate the insurer is in an unsound condition, has exceeded its powers, is impaired, or is insolvent.

In 2022, homeowner’s insurance rates in Florida climbed 33% compared to the national rate increase of 9%. In Hillsborough County, which includes Tampa, rate increases have been particularly severe,

and annual premiums for property insurance are estimated to jump from an average of $2,500 to $3,500 in 2023. In neighboring Pinellas County, which is largely surrounded by water and had the highest rates in the state in 2022, premiums are projected to surge from an average of $2,938 to well over $4,000, nearly triple the national rate of $1,428.

Philip La Rue, a homeowner’s insurance agent serving clients in Pinellas County, is optimistic that the state’s insurance reforms will help moderate premium hikes, providing relief to homeowners in the state.

A pair of insurance reform bills Gov. Rick DeSantis signed into law in May and December 2022 seek to stabilize the ailing industry by, among other measures, disincentivizing frivolous lawsuits that are crippling insurers. An Insurance Information Institute study released in June 2022 found that less than 10% of homeowners’ property claims nationwide are filed in Florida, yet the state accounts for 79% of homeowners’ insurance lawsuits.

After a 2017 state Supreme Court decision made Florida a favorable litigation environment by allowing courts to award plaintiffs’ attorneys more than two times their hourly billing rates when courts rule in favor of policyholders, litigation expenses incurred to fight rampant, fraudulent roof-replacement schemes — orchestrated through contractors’ manipulation of assignment of benefits agreements — became a key driver of property insurers’ massive underwriting losses over the past few years.

One of DeSantis’s reforms eliminates one-way attorney fees for property insurance claims, which state regulators expect will have an immediate impact on the industry. One-way attorney fees entitle policyholders to reasonable attorney’s fees in any lawsuit in which any amount of recovery is awarded, granting policyholders leverage to fairly engage in disputes with insurers.

“I think you will start to see insurers come back into the state,” LaRue says. “Maybe not all at once, but I think you will see a trickle of carriers back into the state because of that tightening and getting those fraudulent claims out of there.”

Bitzas, of NEXA Mortgage, disagrees. “I don’t see it getting any better. What happened over in Sanibel last year doesn’t help things. We’re a peninsula. Natural disasters happen.”

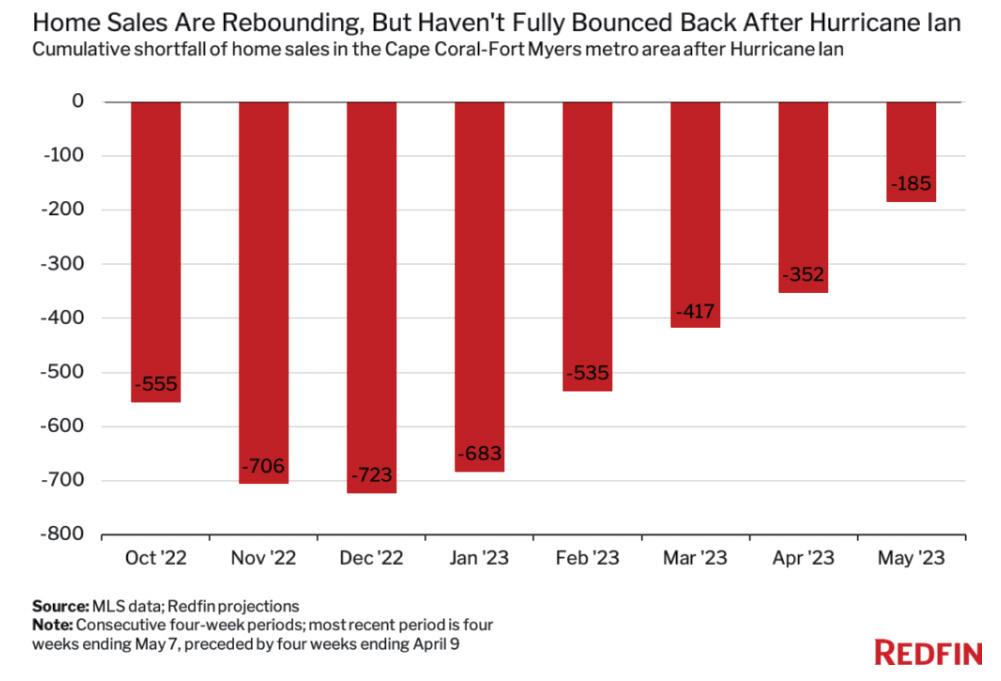

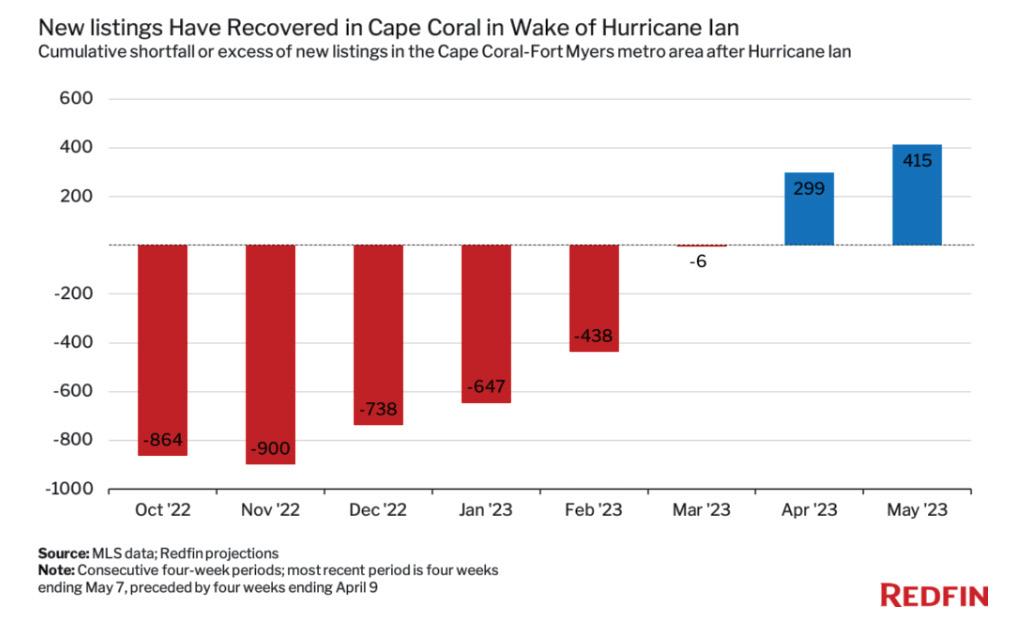

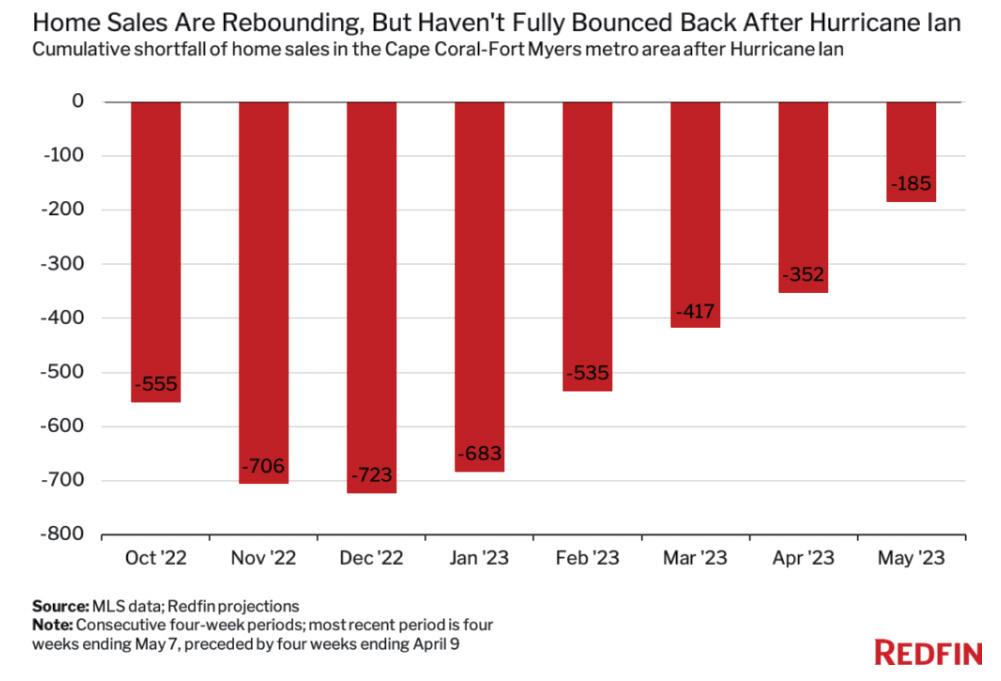

Sanibel Island, off the coast of Fort Myers, took a catastrophic hit from last September’s Hurricane Ian. The Sanibel Causeway, which directly links the island to the Florida mainland, was broken into

32 FLORIDA ORIGINATOR MAGAZINE

“What they’re qualifying for, there’s limited to none or no homes available at those prices.”

> Rich Williams, Principal Broker, Florida Mortgage Pros

six pieces. As many as one in 10 structures on the island were destroyed. At $112 billion in damage, Hurricane Ian was the costliest hurricane in Florida history, and the third costliest in United States history, according to the National Oceanic and Atmospheric Administration.

Williams, of Florida Mortgage Pros, also doesn’t see the situation improving anytime soon.

“If you can’t go through the standard companies that are available, the next step is Citizens insurance, which is the state-funded insurance,” he says. “So, I don’t really see this being resolved quite yet until we get a lot more insurance companies coming back into the market and offering competitive prices.”

In zip codes hard hit by hurricanes or flooding, searching for coverage — let alone affordable homes — can be next to impossible, with carriers unwilling to write new policies for older homes borrowers want to buy in those high-risk locations. Of course, homeowner’s insurance is a requirement for originators to close mortgage loans. Limited options for carriers mean originators have to get creative to help borrowers make the insurance aspect of mortgage applications work.

NEW FLOOD INSURANCE GUIDELINES

As an added hardship, redrawn floodplain maps that the Federal Emergency Management Agency (FEMA) released in Novem-

ber 2022 are forcing many Floridians who’d never had to buy flood insurance add those premiums to their list of monthly bills. The new maps incorporate many non-coastal areas that are now deemed to be at-risk for flooding, such as properties near canals.

According to Alan Crummack, a mortgage broker from Lakewood, depending on the property and where it’s located on the floodplain maps, flood insurance ranges from $485 a year to as much as $4,000, if not more.

“A lot of homes that previously were not in flood zones are now finding themselves in flood zones,” he says. “If you have a mortgage and you’re in a flood zone, even if you didn’t have flood insurance, the lender’s going to require you to get it.”

It’s just another cost for buyers to factor into the affordability equation.

Williams acknowledges that there are companies which may provide insurance on a consistent basis, “but you may try one thing today and it’s not going to work tomorrow. All of a sudden it changes, just stops. The companies are no longer there. They’re dealing with term exposure management. They’re saying, ‘Hey, we’re a little exposed here so we’re no longer writing in this area.’”

Making matters worse, policyholders are paying higher insurance rates for less coverage, according to Rateplicity Mortgage’s Mackie, who’s been analyzing the new policies insurers are writing.

“In the details of what they actually cover

ISSUE TWO 2023 33

“Insurance can be the difference between borrowers getting a house or not getting a house . . . That’s why I always recommend for my clients to get insurance quotes prior to going all the way.”

> Peter Bitzas, LO for NEXA Mortgage

> Alan Crummack, mortgage broker, Rateplicity Mortgage Corporation

now, it’s probably about a 10-25% decrease in coverage; however the insurance premiums have skyrocketed an extra 30%,” Mackie says.

Of particular significance, property insurers have reduced the lifespan of roofs from 20 years to 15 years. Mackie says replacing a roof used to be $30,000-$40,000. With reduced coverage and inflated prices for building materials and labor, replacing a roof can now cost homeowners upwards of $60,000-$70,000. It’s wholly unaffordable, he says, especially for Florida’s large retirement and fixed-income communities.