A PUBLICATION OF AMERICAN BUSINESS MEDIA

Vol. 16, Issue 4 $20.00 APRIL 2024 INFUSE AI

INSIDE: 2024 LEADING LO s : TOP ORIGINATORS

Joe Shalaby, CEO, E Mortgage Capital

STILL SWINGING CEOs Who Still Originate Stay On Top Of Their Game

BRILLIANCE INTO YOUR MORTGAGE STRATEGY ONE-STOP SHOPS REDEFINE THE ORIGINATION LANDSCAPE

RETAIL MARGINS SLAYER A Passion Project That Empowers Consumers DOMINATE THE REAL ESTATE INVESTOR MARKET WITH STRATEGIC MOVES

A PUBLICATION OF AMERICAN BUSINESS MEDIA

Vol. 16, Issue 4 $20.00 APRIL 2024 INFUSE AI

INSIDE: 2024 LEADING LO s : TOP ORIGINATORS

Joe Shalaby, CEO, E Mortgage Capital

STILL SWINGING CEOs Who Still Originate Stay On Top Of Their Game

BRILLIANCE INTO YOUR MORTGAGE STRATEGY ONE-STOP SHOPS REDEFINE THE ORIGINATION LANDSCAPE

RETAIL MARGINS SLAYER A Passion Project That Empowers Consumers DOMINATE THE REAL ESTATE INVESTOR MARKET WITH STRATEGIC MOVES

Easiest P&L in the Industry

9 out of 10 Approved

Average App to CTC in 22 Business Days

Simple Guidelines

Lending in All 50 States

Join Now

in an Uncertain Market

800.400.5451 fnba.com/wholesale Providing Certainty

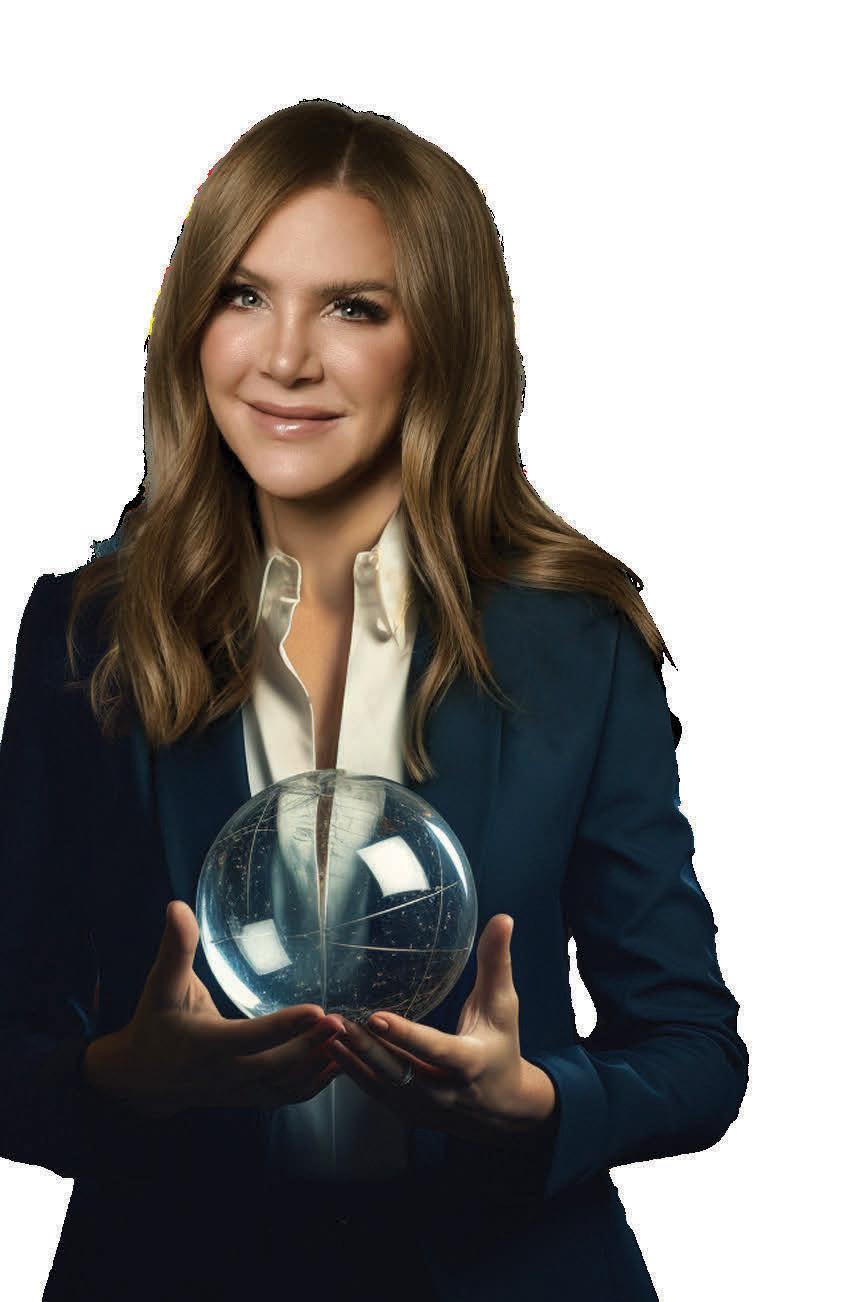

Being in the C-suite doesn’t mean leaving behind the desire to originate mortgages for these top CEOs.

A recent FHA ruling has increased the ability to be a one-stop shop for real estate sales and mortgage originations.

4 Spring Surprise As Spring brings new wonders, mortgage brokers explore fresh approaches. 6 Keep Real Estate Agents Confident Not only must a loan officer keep their own spirits high, but one of their primary jobs is to lift the spirits of the agents that they serve. 8 The Culture Club A strong, understood company culture can play a tremendous role in any organization’s success. 10 The Glut Of Real Estate Agents Hurts LOs It seems as if anybody with a pulse can become a real estate agent, which can affect mortgage loan originators. 14 Non-QM Resource Guide AMC Resource Guide 15 People on the Move See who the movers and shakers are in the mortgage industry. 16 Build-A-Broker: How To Close In The Real Estate Investor Market Coffee is for closers of these Non-QM loans. 19 Originator Tech Resource Guide Wholesale Lender Resource Guide 20 Your First Million Dollars: Use Your Tools Resourceful people can think outside the box and visualize all the possible ways to achieve things. 22 Benchmarks and Best Practices: What To Ask On Gig Mortgages DWR is always a 0% margin. But this strategy aims to provide competitive rates to the marketplace while ensuring the company remains fruitful. 24 My Best Deal: From the brink of foreclosure This former coach was able to save a home before it was too late. 26 Data Bank 28 Direct Wholesale Wants To Slash Retail Margins Dave Zitting claims he has cracked the code to provide an affordable mortgage, minimize company overhead, and earn a profit simultaneously — all virtually. 32 Two Licenses For One Person

38

68 Non-QM Lender Directory 69 Wholesale Lender Directory Originator Tech Directory AMC Directory 70 Facebook Thoughts: Star-Spangled Meow

STORY PAGE 46 WHO PERFORM INTO EXTRA INNINGS

Incorporate AI In Your Brokerage Regulation, compliance, agency guidelines, and a deep enough understanding of the capabilities and risks of Generative AI are some impediments to more rapid adoption.

COVER

nationalmortgageprofessional.com APRIL 2024 Volume 16 Issue 4

nationalmortgageprofessional.com SPECIAL AWARDS SECTION PAGE 53 2024 LEADING LOS: TOP ORIGINATORS 2023's Leading Loan Originators conquered challenges and excelled amidst market turbulence. Read their stories of resilience and triumph. NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 3

CONTENTS

The Rights Of Spring

It doesn't matter whether this is your 29th time welcoming the Spring season or, like me, your 63rd. Spring evokes the same sentiment, the same wonder at the natural world's rebirth. When Spring comes we bask in its ability to make everything come alive again. Yet as often as we see it, we also often see something new. A different kind of flower coming up, a stream that's changed its bed, a forest that's found a new path winding through it; we don't just experience the traditional trappings of the season, we often find new wonders. We may be experienced Spring aficionados, but that doesn't stop us from being gleefully surprised by the gifts delivered by Persephone and Flora.

The point, of course, is to not be jaded that though we may be practiced experts at something, we can't still be surprised and delighted to learn something or find a new way. In the mortgage world, that's demonstrated by the brokers who are part of our cover story this month.

Staff writer Erica Drzewiecki spoke to a number of folks who run large brokerages across the nation. By itself, overseeing and implementing sales strategies is usually more than a full-time job. But she is intrigued by leaders who keep a hand in the origination game, still putting together and closing loans in their own names.

Some brokers refuse to do that, and some loan originators don't want it either. In a marketplace of so few loans, is it really helpful for a manager to be taking deals (and sales commissions) for themselves, instead of feeding the team? That's a real concern. But separating mortgage leaders from the process of actually finding borrowers and holding their hands through the approval and closing process can also be concerning. Shouldn't leaders fully understand what it takes for their LOs to generate and close business?

This is an industry that meets its top capabilities when its origination teams are motivated. Seeing the big bosses walk the walk can't hurt to demonstrate that getting business isn't always about how much business is available, but how available you are to the ideas and tactics needed to succeed.

It's the right way to succeed as a top LO.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak

STAFF WRITERS

Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Regina Morgan

ADVERTISING SALES EXECUTIVE

Nicole Coughlin

ADVERTISING ASSOCIATE

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Krystina Coffey, Matthew Mullins, MULTIMEDIA SPECIALIST

Alan Nero MEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Joel Berman FOUNDING PUBLISHER

APRIL 2024 Submit your news to editors@ambizmedia.com If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com © 2024 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com Volume 16 Issue 4 LETTER

FROM THE PUBLISHER

VINCENT M. VALVO Publisher, Editor-in-Chief 4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

Build your business in the Big Easy!

The Gulf Coast’s premier mortgage event, the Ultimate Mortgage Expo, returns to the stunning Hotel Monteleone in New Orleans. This year, enjoy 2x the exhibit hall, 2x the education sessions, and one incredible networking party.

Originators attend for FREE using code NMPFREE.

The Ultimate Mortgage Expo happens in conjunction with the Mortgage Star Conference for Women

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only.

ULTIMATE MORTGAGE EXPO JUL 10 JUL 11

ULTIMATEMORTGAGEEXPO.COM MortgageStar

DAVE HERSHMAN

Inside The Magnified Environment Of Real Estate Offices

LOs working for real estate companies have to foster upbeat attitudes regardless of reality

BY DAVE HERSHMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

In my last article, I discussed the hiring process with respect to matching loan officers to the different types of origination situations. It is clear that someone who grew up within the industry as an independent mortgage broker is not as likely to fit in the chair of a big national bank. At this juncture, we will continue this discussion as we segue to a particular type of origination — working within a real estate office.

As I mentioned previously, working inside a real estate office has been a big part of my career within the industry. I started as an originator with a real estate-owned firm, became the head of production for that company, and went on to direct a sales force for a larger regional real estate company at two separate times, almost two decades apart.

During my career, I have also been the head of sales and regional director of street and bank origination sales forces. This means I have witnessed

the differences in these environments and especially what it will take to succeed in one versus another. I did not know it at the time because I was a rookie, but the fact that I closed 600 loans (98% purchase) in my first 18 months of originating within the industry could only have happened from within a real estate office.

For many years, I have pondered this question — What comprises the difference between success inside a real estate office vs. on the street?

INSIDE THE GLASS HOUSE

It is here that I will introduce you to the concept of “Inside the Glass House.” Why do I use this moniker? When you work inside a real estate office, everything is magnified. There is no hiding anywhere. This brings us to the essential trait of attitude. Don’t get me wrong, attitude is an essential trait for any loan officer. But for an inside loan officer, you are taking the importance to another level.

On the outside, you can skirt by with a mediocre attitude. You may not shine within the industry. But inside the glass house, anything less than an A+ attitude will stick out like a sore thumb. Let me use the present real estate slump as a primary example. In the past 18 months or so, it has been very hard for everyone to keep their confidence high. There is no doubt that just staying up every day has been

quite a chore for everyone.

Inside the glass house, the task is twice as hard. Not only must a loan officer keep their own spirits high, but one of their primary jobs is to lift the spirits of the agents that they serve. Because if the agents’ attitudes fall with the slump, this will devastate a primary source of business for the loan officer. Business is down, but if the agents check out, business will get even worse. Thus, the loan officer must not only keep his or her spirits high in a tough market but also have the extra task of lifting up those around them — along with the owner, broker, and/or manager of the real estate office.

Attitude is not the only trait that gets intensified inside the glass house. But attitude is of utmost importance and serves as a prime example of the differences between a street loan officer and working inside a real estate office. And it also serves as an excellent starting point for delving deeper into the topic. n

Dave Hershman is the top author in this industry with six books published as well as the founder of the OriginationPro Marketing System and the OriginationPro’s on-line comprehensive mortgage school. Dave is also Senior VP of Sales for Weichert Financial Services. His site is www.OriginationPro.com and he can be reached at dave@hershmangroup.com

6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 RECRUITING, TRAINING, AND MENTORING CORNER

When you work inside a real estate office, everything is magnified. There is no hiding anywhere.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 7

The Importance Of Developing A Company Culture

It can be a means for retaining and attracting top talent

, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Whether you are building out a new company or within an established company, it’s important to consider what your company culture looks like. More than just a corporate buzzword, company culture can play a tremendous role in any organization’s success because a strong culture can help to attract and keep the right employees for your business. Especially in a competitive job market, having an attractive company culture can help your organization differentiate itself and bring in the top talent in the industry. So, what steps should you take to proactively build your company’s culture rather than letting it be shaped accidentally?

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 THE XX FACTOR ERICA LACENTRA

WHAT IS YOUR IDEAL COMPANY CULTURE?

The first step is determining what you want your company’s corporate culture to look like. It can often be a good idea to research other companies in either the mortgage industry or outside of this space and see what their corporate cultures look like to get a more complete picture of what you want your organization’s culture to resemble. As you are planning and researching, think about the following key areas to help guide the development of your corporate culture: your company’s mission and goals, how your company treats its employees, how your organization communicates internally, and finally, general expectations regarding work/life balance. All of these factors will contribute to what your company culture ultimately looks like.

First and foremost, your company’s mission and goals will be one of the largest influences on your culture. A business with a strong mission and clearly stated goals gives its employees a shared purpose and a foundation to work from. A company’s mission and goals provide a

better idea of what employees are working towards and why. General expectations within the organization are better defined.

From there, the next area to focus on is how you want your company to treat its employees. This will be a defining factor in your company’s culture. For example, consider things like whether there will be a strong emphasis placed on employee recognition, will team-building activities be a regular occurrence, will there be employee training opportunities, or will mentorship programs exist? Investing in the happiness and growth of your employees can really improve company culture and also create a culture that is extremely appealing to potential hires.

At the same time, you should also determine general expectations for work/life balance in your organization. Do you plan to offer flexible work accommodations like a hybrid office model? What does paid time off look like? Will it be set or unlimited? Will mental health resources be offered to employees?

departments and employees due to a lack of transparency. This can also cause processes to be siloed, meaning things may be implemented or changed without thinking of the organization as a whole, which can cause major issues down the line. Having more open communication and providing guidelines as to how to best share information in the organization can create a greater sense of community where employees feel well-informed and more connected to the company overall.

COMPANY CULTURE CAN BE A MOVING TARGET

As you work to define or refine your company culture, it’s important to understand that a strong corporate culture is not something that happens instantaneously. The process of creating a positive culture is going to take time. Your company culture is also something that is going to have to be monitored and maintained through ongoing efforts. Once you have determined what you

A positive corporate culture will always be a moving target for your organization, but the benefits of putting in that work will ultimately pay dividends.

Just like how you plan to treat your employees can ultimately create a more positive or negative corporate culture, the way you choose to address employees’ work/life balance can also create a more or less attractive culture overall.

Finally, the last aspect you should consider is how your organization communicates internally. Communication within an organization, or lack thereof, can really hurt an organization’s ability to have a strong culture. If information is not easily disseminated across departments, this can cause employees to be more closed off and think they should be keeping details to themselves. In the long run, this can cause tension between

want your corporate culture to be, you need to promote it continuously and make sure that the efforts you are making reflect what you want the culture to be. From time to time, it’s a great idea to gather feedback from employees about how they feel the culture is in the workplace and if they feel it matches up to what is being presented to them. A positive corporate culture will always be a moving target for your organization, but the benefits of putting in that work will ultimately pay dividends. n

Erica LaCentra is chief marketing officer for RCN Capital.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 9

Self-righteous Or Poorly Trained, Too Many Agents Spoil The Pot

Incompetency runs through the entire real estate business

BY LEW SICHELMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Did you hear the one about the listing agent, who was also the seller, who failed to disclose that he was going through bankruptcy and that the sale had to be approved by the court? The buyer finally closed two weeks later than expected. But the delay cost him $4,000 in temporary housing and extra moving costs. Or the one about the buy-side agent who, one week before closing, admitted to the seller that he forgot to forward to the lender an addendum signed by both parties setting up the closing on the same date the seller was settling on his new place? “This pisses me off so much,” the seller posted on Reddit.com, the social media platform. “Because of his incompetence, we are faced with a possible delay in

closing and having to spend even more money.”

Raise your hand if this kind of thing has happened to you: You’re at the settlement table, ready to close the loan you are making to someone buying a house, the one you worked your butt off on to get it approved. Now you’re ready to go. And then something bad happens. The buyer’s agent or the one who listed the place has screwed something up, and the deal goes haywire. Maybe it closes later that day or perhaps tomorrow or hopefully next week. But maybe the settlement never gets done. All that time and effort goes for naught.

“It happens all the time,” my buddy Chris Carter, a Florida real estate agent and mortgage broker who

THE MORTGAGE SCENE LEW SICHELMAN 10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

“...theagentswhoarethemost difficulttoworkwitharethe oneswhosellthemosthouses.”

writes the popular and informative “Florida Real Estate Blog,” tells me. Most often, he says, “the idiot agent” fails to get the buyer to do the things he needs to do within the contract’s allotted time frames

Carter’s not alone. Years ago, Todd LaBorwit of Topaz Mortgage lost a deal because the listing agent sent the appraiser to the wrong house. And judging from the complaints I see and hear, I’ll bet everyone who has read this far has raised his or her hand.

Incompetency, it seems, runs through the entire real estate business. “Realtors are the worst,” said someone who posted on Reddit. And this guy says he is one. “The worst part of this job is dealing with other incompetent, rude, and unprofessional brokers

who act entitled and self-righteous.”

(FYI: To use the term Realtor to describe all agents is incorrect. Realtors are members of the National Association of Realtors, but not all agents are NAR members.)

Sometimes, the complaints are against male agents, sometimes female.

Sometimes it’s seasoned veterans who draw a client’s ire. Other times, it’s a brand new agent just starting out. But in an interesting and surprising take on the problem, a loan officer who works “with more Realtors than I can count” posted that the agents who are the most difficult to work with are the ones who sell the most houses.

POPULAR DOESN'T MEAN GOOD

“I’ve found that the most successful agents are not only difficult to work with but, in many cases, incompetent,” the loan officer wrote. “Unfortunately, the skills required to be a successful agent are different than the skills required to be a good agent.” The easiest closings, he added, are with agents who sell seven-to-10 houses a year. “They are my favorite to work with because they understand my role and theirs.” Meanwhile, those who sell more houses “often try to tell me how to do my job.”

Let’s stop here for a moment: This is not to denigrate all real estate agents. Many do excellent work, and some often go way beyond their duties, usually to correct the errors made by the agent sitting across the table. But it is to point out how agents of all ilk can score a deal. And then screw it up.

According to a new report from the Consumer Federation of America, half the estimated 1.5 million licensees sell just one house a year, if they sell any houses at all. “Shocking” is the way Stephen Brobeck, a CFA senior fellow and the report’s author, described that 50% finding to me. “And that’s not just new agents, that’s the people whose pictures are on their firm’s websites.”

Worse, many of them, but especially rookies, are ill-equipped to properly serve people who are about

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 11

“There is no other financial services industry or profession where part-time, marginal workers are so ubiquitous.”

> Stephen Brobeck, senior fellow, Consumer Federation of America

12 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

to partake in what is likely to be their largest-ever financial transaction, the study found. They are inexperienced and untrained and likely must have income from other sources to survive.

Most brokerages tend to hire anyone who can fog a mirror and turn them loose with hardly any training other than what they learned to pass their licensing tests, tests that in some places are so simple that, well, why bother? And as a result, the business is overrun with too many agents chasing too few deals.

The high ratio of agents to sales — 1.5 million agents for five to six million sales annually — “virtually guarantees that most agents cannot support themselves only from sales commissions,” the CFA report maintains.

TRIMMING THE FAT

“The residential real estate industry is truly a part-time industry, with most agents working sporadically and holding another job, often full-time,” Brokeck says. “There is no other financial services industry or profession where part-time, marginal workers are so ubiquitous.”

Brokers contribute to the over abundance of agents by continually advertising for new blood, largely, according to the report, because new hires “bring with them new clients, often friends and family members.”

There are other reasons for the glut. For one thing, the turnover rate among agents is high because many realize they can’t make the living they thought they could selling houses; for another, many agents pay “outrageous” fees, according to one agent quoted in the report, to their brokers to cover overhead expenses.

But the report says new hires are not adequately trained or supervised. “Through lax hiring and training, many companies sponsor agents that have too little knowledge and experience to adequately serve consumers,” says Brobeck, who found that nearly all the national and large realty agencies offer training in “the practicalities of selling property” but the courses are typically online and not required.

The study reports that mentoring programs are infrequent. Sometimes, the most senior agents are given the responsibility of looking over the

shoulders of new ones, but they often have too many agents under their wings to adequately oversee them.

WHO'S THE BOSS?

Overall, the report says, the “large majority” of new hires are not adequately supervised.

The study examined the sale records of 2,000 randomly selected agents working for four major companies in four markets — Orlando, Tucson, Minneapolis, and Central Pennsylvania. Nearly half sold only one house in the previous 12 months or none at all, and almost three-quarters of them sold five or less.

The median figure is barely two.

As a result, perhaps, the 2021 household income of agents responding to a NAR survey — likely the most active — was ‘significantly” larger than that generated from their real estate work. Active agents, a limited group working for major firms, reported a median income of $38,000 from real estate but a median household income of $110,000.

Where the extra money comes from is anyone’s guess. But the CFA’s Brobeck supposes that either someone else in the house earns the lion’s share of the income, the agent’s income is supplemented from social security or a pension, or they work at another job, possibly full-time.

Circling back to the lack of training, the report says a new agent is rarely sufficiently prepared to sell someone’s house or help them buy a new one. Some states require additional classroom work to keep a license active. But “a large majority” of rookie agents “apparently are not required” to do more, either by their states or their companies, than pass their initial exam.

The glut of agents practically “ensures that many will not receive adequate personal training or mentorship,” the report says. “Yet, many large firms keep recruiting.” n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 13

Acra Lending

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com (888) 800-7661 sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Champions Funding

Gilbert, AZ

Mission Driven Non-QM + CDFI Wholesale Lender

At Champions Funding, we Non-QM all day, every day! It’s our core business, and we live to serve underserved borrowers through our valued broker partners. We put diversity and inclusion into mortgage lending by empowering the mortgage broker community to provide solutions for non-traditional credit profiles and those who cannot get approved with standard financing. Through our highly coveted CDFI certification backed by the U.S. Department of the Treasury, we can offer our flagship neighborhood products and tap into a $1 Trillion market of historically underserved communities in the country.

Focused on speed to closing (in days, not weeks), smooth processes, and user-friendly access to our underwriting and support teams, we offer modern, flexible, and responsible non-traditional lending solutions.

champstpo.com

(949) 763-9494

Wholesale@ChampsTPO.com

LICENSED IN: AZ, CA, CO, CT, DC, FL, GA, HI, IL, IA, MD, MI, NJ, NC, OR, PA, SC, TN, TX, UT, VA, WA

Find the full list of Non-QM Lenders on page 68

PCV Murcor Pomona, CA

pcvmurcor.com

sales@pcvmurcor.com (855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — An Appraisal Management Company

DESCRIPTION OF PRODUCTS OR

SERVICES: Licensed in all 50 states, plus D.C., PCV Murcor provides nationwide appraisal management and valuation advisory for residential and commercial real estate. With a foundation built on 43 years

Find the full AMC list on page 69

Newfi Wholesale

Emeryville, CA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com (888) 415-1620 support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

of experience, PCV Murcor brings a deep understanding of our clients’ goals that complements appraisal modernization. Our use of state-of-the-art AI technology ensures precision and efficiency in every aspect of our service. Experience innovation-powered recision and timetested excellence with unparalleled service and cutting-edge products.

NON-QM LENDER RESOURCE GUIDE

14 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

AMC RESOURCE GUIDE

HOW

NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE

BUILD-A-BROKER

Lending With A Purpose

YOUR FIRST MILLION DOLLARS

Scrappy Saves The Day

BENCHMARKS & BEST PRACTICES

Gettin' Giggy With It

CAREER TICKER

People On The Move

PEOPLE ON THE MOVE //

> Mr. Cooper Group has found a new president. Mike Weinbach is responsible for leading the company’s operations, including originations, servicing, and technology.

> Sagent, a fintech software company modernizing mortgage servicing for banks and lenders, appointed Chris Marshall as executive chairman.

> Halo Programs has promoted tech entrepreneur

Marc Mandt to the company’s chief technology officer role.

> Non-QM industry veteran Paul Jones is joining Logan Finance Corporation. Jones previously worked as director of Non-QM business development for Paramount Residential Mortgage Group.

SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 15

BUILD-A-BROKER:

The Difference Between Competing And Closing

Master Non-QM/Non-Agency business purpose lending

DPEOPLE ON THE MOVE // BUILD-A-BROKER TOM DAVIS

BY TOM DAVIS, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

uring challenging times in the mortgage industry, it’s always important for loan officers to diversify into new product and

borrower segments where they can compete for new business.

Today, a bright spot for diversification is Non-QM/Non-Agency business purpose lending — or lending to enable real estate investors to invest in properties for non-consumer purposes and earn rental income. Recent data points confirm what most probably know: real estate investors continue to snap up rental properties.

• According to CoreLogic, 26% of purchases were investor transactions in 2023. Real estate investors also accounted for 27% of these purchases in the first three months of 2023.

• A Roofstock study indicates that 10.6 million Americans generate income from 17 million rentals. Brokers and loan officers who embrace and adopt these loans gain the upper hand among their competition. Those who become experts in the different

> A&D Mortgage has added Andrew Taylor and Bobby Frank to its sales team. Taylor was appointed as senior vice president of wholesale lending sales. Frank will be senior vice president of wholesale lending strategy.

product types and how to align them with different borrowers and their scenarios will be better positioned to deliver the right solutions to the right investor at the right time.

WHO COULD BE A BUSINESS PURPOSE BORROWER?

There are two main types of businesspurpose borrowers:

• A natural person borrowing on their own behalf or with a co-borrower.

• Business entities transacting specifically for investment purposes (such as limited liability companies, or LLCs) that are borrowing money on behalf of the LLC. Rental properties under the ownership of non-individual investors, such as LLCs, have risen 18% over a recent two-year period according to the Rental Housing Finance Survey.

> Roy Swan, an executive with more than 30 years of experience in law, banking, and corporate finance, was named to Freddie Mac’s board of directors.

> Mortgage loan subservicer Cenlar FSB appointed Ingrid Jaschok to senior vice president of Default Operations.

HANDS ON PRACTICAL ADVICE

16 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

> Polly, a provider of mortgage capital markets technology, announced the appointment of Troy Coggiola as chief operating officer.

> A&D Mortgage announced the hiring of Tommy Williams, Betsy Marvin, and Lori Welton as account executives. The three all come from Citizens.

SPONSORED BY

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 17

BUILD-A-BROKER

WHAT ARE THE DIFFERENT TYPES OF LOAN ALTERNATIVES?

Loan alternatives for these investors include:

• DSCR (Debt Service Coverage Ratio) loans: These are designed especially for real estate investors and offer the quick close investors need to beat the competition to the offer table. Qualification is based on the projected cash flow of the property to be acquired, rather than on the borrower’s employment information or income analyses.

• Non-QM bank statement loans: These loans are specifically for self-employed borrowers. They are a popular loan for self-employed borrowers who cannot qualify using their tax returns. Instead, Non-QM lenders can calculate income using alternative documentation such as 12 or 24 months of business or personal bank statements, oneyear P&Ls, and 1099 statements to evaluate borrowers’ ability to repay their loan.

These loans offer cash-out and interestonly options for additional flexibility.

OPPORTUNITIES TO MATCH THE RIGHT BORROWER WITH THE RIGHT LOAN

Self-employed property investors: According to Pew Research, there are 15 million self-employed people in the U.S. Even if these individuals are high earners and creditworthy, responsible borrowers, they may not meet traditional agency requirements. For instance, they may take substantial tax deductions, and then can’t use their

PEOPLE ON THE MOVE //

> Massachusettsbased MountainOne welcomed Jason “Jay” Bianchi as assistant vice president, community mortgage lending specialist.

Product diversity is key to offering solutions to the various business purpose borrower types and scenarios.

tax returns to qualify for properties they can afford. Both a Non-QM bank statement loan or a DSCR loan are options for them.

These loans are for residential properties only. However, the cash-out options are helpful for self-employed entrepreneurs who might want to make a separate investment in their business or use the funds to purchase another investment property.

Individual investors with more than 10 financed properties: Fannie/ Freddie loans are not available for borrowers with more than 10 financed properties. A DSCR loan is an ideal option for these seasoned investors.

LLCs: LLCs are only able to receive DSCR financing for real-estate investment purposes.

Investors completing 1031 Exchanges: The efficiency associated with DSCR lending is helpful for real estate investors who need to meet the time requirements to complete a 1031

> Samuel Bjelac has returned to Carrington Mortgage Services to boost its position as a leader in the non-QM lending space. He will be senior vice president of thirdparty originations (TPO).

Exchange transaction. By selling one property and then purchasing another “like-kind property” within a defined time interval, they defer capital gains taxes.

Buyers of non-warrantable condos: Fannie Mae and Freddie Mac have recently narrowed the definition of what they consider a warrantable condominium.

Real estate investors must look at Non-QM/Non-Agency alternatives (DSCR or Non-QM) if they want a mortgage on a non-warrantable unit. Those who have recovered from a credit event: Those who have recovered from a credit event less than seven years ago will not qualify for a Fannie/Freddie mortgage. They are also potential Non-QM/Non-Agency loan candidates.

GAINING PARTNER SUPPORT

Mortgage brokers and loan officers seeking to diversify into these product areas should partner with wholesale Non-QM lenders who demonstrate long-time domain expertise, longevity, and a commitment to training, scenario desk resources, and marketing support. Product diversity is key to being able to offer solutions to the various business purpose borrower types and scenarios. But having access to loan experts and in-house underwriters who can deliver fast answers and guidance makes the difference between competing for these loans and closing them. n

Tom Davis is chief sales officer of Non-QM lender Deephaven Mortgage and has over 20 years of Non-QM experience.

> KeyBank Real Estate Capital welcomed

Jonathan Wood as a senior mortgage banker, focusing on multifamily lending in the Northeast.

HAVE A NEW HIRE OR PROMOTION TO SHARE? Submit the information to Keith Griffin at kgriffin@ambizmedia.com for possible publication. Announcements should include a headshot.

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

18 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

wemlo

Boca Raton, FL

Area of Focus: Loan Processing

Third-party processing service, wemlo, empowers mortgage professionals through transparent, flexible, and efficient loan processing. To better serve our customers and their borrowers, wemlo proudly offers processing support in 47 states (plus Washington DC) for more than a dozen loan products including Conventional, FHA, Jumbo, VA, and Non-QM.

wemlo.io

(866) 523-3876 info@wemlo.io

Licensed In: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, VT, VA, WA, WV, WI, WY

Zero 1 Solution LLC

Stockton, CA

Area of Focus: Software

1Solution Mortgage allows you to Originate, price a loan scenario with proposal, CRM, Marketing and more …

• Scenario

• Communication

• CRM

• LOS

• Essentials

• Marketing

• HR

1smtg.com

(888) 458-0650

info@1smtg.com

ACC Mortgage

Rockville, MD

ACC Mortgage is the oldest NonQM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Newfi Wholesale

Emeryville CA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com

(888) 415-1620

support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

Licensed In: All U.S. States, U.S. Virgin Islands Find the

Stronger Stories

We discuss the issues in the industry others may be too wary to touch, and we never let advertise relationships affect our stories.

Hands-On Advice

Find actionable advice from professionals across the industry with tips to further your career, grow your business, and more.

Industry Insights

Don’t just read the news — understand it. Find insightful articles from leading industry voices to help digest all the changes in the industry.

KNOW

Way more than a magazine.

IT ALL.

nmplink.com/subscribe WHOLESALE LENDER RESOURCE GUIDE ORIGINATOR TECH RESOURCE GUIDE

the full Originator Tech list on

69 NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 19

full Wholesale Lenders list on page 69 Find

page

When Life Hits You Like A Truck, Make Opportunity Fit Your Needs

Think outside the box and visualize all the possible ways to achieve things

BY HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Asmall truck loaded with glassware backed out of a factory driveway into the path of a large truck. Most of the glass was broken in the crash, and the young driver was on the verge of tears. A big crowd gathered, and one gentleman said compassionately: “I suppose you will have to pay for this out of your own pocket.”

100 people dropped bills into the hat. The driver nodded to the retreating crowd and the benevolent gentleman and said, “That’s what I call a smart guy. He’s my boss.”

RESOURCEFULNESS

I value resourcefulness highly in my employees. Resourceful people can figure things out on their own. They find a way to make things work. They find solutions to problems using imaginative methods. They can use resources at their disposal to help them solve problems or overcome obstacles.

Resourcefulness seems to come naturally to some people. They aren’t about to give up just because the odds are stacked heavily against them.

Webster’s dictionary defines resourceful as “… able to deal promptly and effectively with problems, difficulties, etc.” Resourcefulness is a real asset for anyone trying to get the edge over the competition, whether it’s finding a job, keeping a job, making customers happy, or landing a new account.

Resourceful people can think outside the box and visualize all the possible

ways to achieve things. They are scrappy, inventive, and driven to find a way to get what they need and want.

As one of my very favorite authors, Napoleon Hill, said: “A resourceful person will always make the opportunity fit his or her needs.”

WHEN DOWN IS UP

Resourceful people can see the upside of down times. They are not willing to give up just because things get complicated. And here’s a news flash: They are not all geniuses. They just don’t accept defeat easily.

In sales, a common problem is getting to know who the decision maker is and then contacting that person. Do you know anyone who knows that person? How can you get close to the people who know and influence that person?

In doing research for a speech recently, I was talking to a salesperson

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE YOUR FIRST MILLION DOLLARS 20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

HARVEY MACKAY

“The amount of satisfaction you get from life depends largely on your own ingenuity, self-sufficiency, and resourcefulness.”

> William Menninger, psychiatrist and co-founder of the Menninger Foundation

maker was and waited in the lobby and followed him into the restroom. While they were washing their hands, he introduced himself and gave Mr. Decision Maker a quick commercial on their firm. He got the business. The new customer was intrigued by the determination the salesperson demonstrated.

William Menninger, psychiatrist and co-founder of the Menninger Foundation, an internationally known center for the treatment of behavioral disorders, offered this explanation: “The amount of satisfaction you get from life depends largely on your own ingenuity, selfsufficiency, and resourcefulness. People who wait around for life to supply their satisfaction usually find boredom instead.”

MAXIMUM RESULTS

You must be thinking all the time. How can I maximize what I want to

do? How can I get things done? How can I get the information I need? Be resourceful.

Perhaps the best feature of resourcefulness is that it doesn’t have to cost your company any money. Using the brainpower already on the payroll is a great place to start. A company offered a reward of half of whatever savings a viable, creative cost-cutting measure would yield. Did they get any suggestions? You better believe it. And nearly all of them were fairly simple to implement. These folks had been hatching ideas for a long time, but the “We’ve always done it this way” mentality kept them from speaking up.

Resourcefulness doesn’t take long to develop. Observe children. They often find creative ways to get what they want, even at a very young age. And it’s not because they are so cute!

Timmy only had a quarter in his

pocket when he approached the farmer and pointed to a tomato hanging lusciously from a vine.

“I’ll give you a quarter for it,” the boy offered.

“That kind brings 50 cents,” the farmer told him.

“How about this one,” Timmy asked, pointing to a smaller, greener, and less tempting tomato.

The farmer nodded in agreement, and Timmy sealed the deal by placing his quarter in the farmer’s hand. “I’ll pick it up in about a week.”

Mackay’s Moral: Be resourceful or be remorseful. n

Harvey Mackay is a seven-time New York Times best-selling author with 15 books.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 21

Get The Gig With Gig Workers

Your borrowers might be among 39% of American workforce that freelances

With tax season in full swing, let’s talk about calculating tax returns properly — more specifically, how to calculate income for gig workers.

Many Americans are not working the traditional 40-hour-a-week salaried job anymore. According to Upwork’s Freelance Forward report, in 2022, 39% of the American workforce did some sort of freelance work, so you can expect to see some of these workers as your borrowers.

BENCHMARKS & BEST PRACTICES MARY KAY SCULLY BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE 22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

MARY KAY SCULLY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Because their income is variable, it’s going to take some extra preparation and calculation to best support them in the homebuying process. To better work with gig workers, and to grow your business among this group, let’s talk about who they are and the questions to ask them to help you with calculating their incomes.

DEFINING THE GIG ECONOMY

The IRS defines the gig economy as “activit[ies] where people earn income providing on-demand work, services or goods. Often, it’s through a digital platform like an app or website.”

The kind of gig workers that may first come to mind are rideshare drivers and food delivery drivers, but there are a

When working with these borrowers … be prepared with the necessary questions to complete their application and ensure their income can be calculated correctly.

necessary questions to complete their application and ensure their income can be calculated correctly.

To get a basic understanding of your borrower’s income, start by finding out if they own the business. If their share of ownership is 25% or more, it makes a difference in how you’ll calculate.

Next, find out how long they have been receiving this income and if they have reported all of the income on their tax returns. Finally, ask about how steady their income from gig work has been. Have they had any gaps in receiving this type of income?

The answers to these questions will be essential when it comes time to crunch the numbers and calculate their income.

CALCULATING INCOME

good number of services that fall under the gig economy umbrella. It has been on the rise for years but took off during the pandemic as many people lost their full-time jobs and resorted to gig work to make ends meet.

The 2022 Freelance Forward report also found that most gig workers skewed toward younger generations. Freelance professionals in the U.S. workforce represent 43% of Gen Z, 46% of millennials, 35% of Gen X, and 27% of Baby Boomers. Many of these workers have chosen the gig economy because of the earning potential and flexibility it provides.

QUESTIONS TO ASK

When working with these borrowers, you’ll need to be prepared with the

A speedy underwriting process and first-pass approval require that you get the right income on the first try. Following agency guidelines will help you avoid any mistakes. Remember that when a borrower has a 25% or more ownership stake, you will require both personal and business tax returns, which must demonstrate that at least 12 months of self-employed income has been filed. And if your borrower receives a 1099, then the borrower’s personal tax returns are required. Finally, make sure you review the stability of the income — if the income is inconsistent and not stable, it may not be eligible as qualifying income. Your borrowers are changing, and you need to change with them. As more individuals opt for gig work, lenders need to be able to calculate their income accurately and make sure they document their math. Being prepared for the gig economy not only helps get these workers into homes but can help loan officers differentiate themselves as the right resource for gig workers. n

Mary Kay Scully

the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum.

SPONSORED BY

is

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 23

‘Submarining’ The Boss For The Better Good

Name: Ric Beaudoin Job Title: Loan Officer Business: CrossCountry Mortgage

WIN a $100 Amazon gift card!

How much was your best deal?

The loan was probably $180,000 to

What made it your best deal?

The fact is, I was able to help out a single mom with two teenage children in her time of need. It was the highlight of my career and had nothing to do with income or compensation. It was about helping a person in her time of need. Commissions were not an issue for me.

What else was interesting about the deal?

One of my neighbors was about to lose her house. I had coached

her kids. So I ran over to her house on the morning of the foreclosure. I was able to shut it down by purchasing the house myself, which I didn’t have to do. My boss was there to do the same thing and flip it.

In my opinion, I saved the family from embarrassment. She was adamant about staying in the house and raising her children there. Twenty-five years later, she is still in the home. I was able to put together some interesting and innovative financing. She wasn’t savvy about the financial world. She was motivated to keep her home so she followed my lead and mentoring and I helped her with repairing her credit, which is something I pride myself on. Since then, I can’t count how many referrals she has made to me.

When my boss, who owned the mortgage company at the time, found out I had “submarined” his efforts, he wasn’t happy about it, but he understood. n

Have a great story about your best deal? We’re not talking about your biggest deal. We want to hear about your best deal - the one that resonates with you personally, the one that became the story you’ve told again about why you’re in this business. Head over to https:// nmplink.com/bestdeal and tell us the details. You could win a $100 Amazon gift card if your story is selected for publication.

24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

CONFERENCE FOR WOMEN

The most impactful event for mortgage women.

The Mortgage Star Conference for Women returns to the beautiful historic Hotel Monteleone in the heart of the French Quarter of New Orleans. This event brings together the stars of mortgage, for meaningful discussions, insightful presentations, and to celebrate one another. Then, stay for the Ultimate Mortgage Expo, free for Mortgage Star attendees.

Register for free with code NMPFREE mortgage-star.net

JULY 10

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only.

Star Mortgage

— LIVE IN NEW ORLEANS —

26 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 27

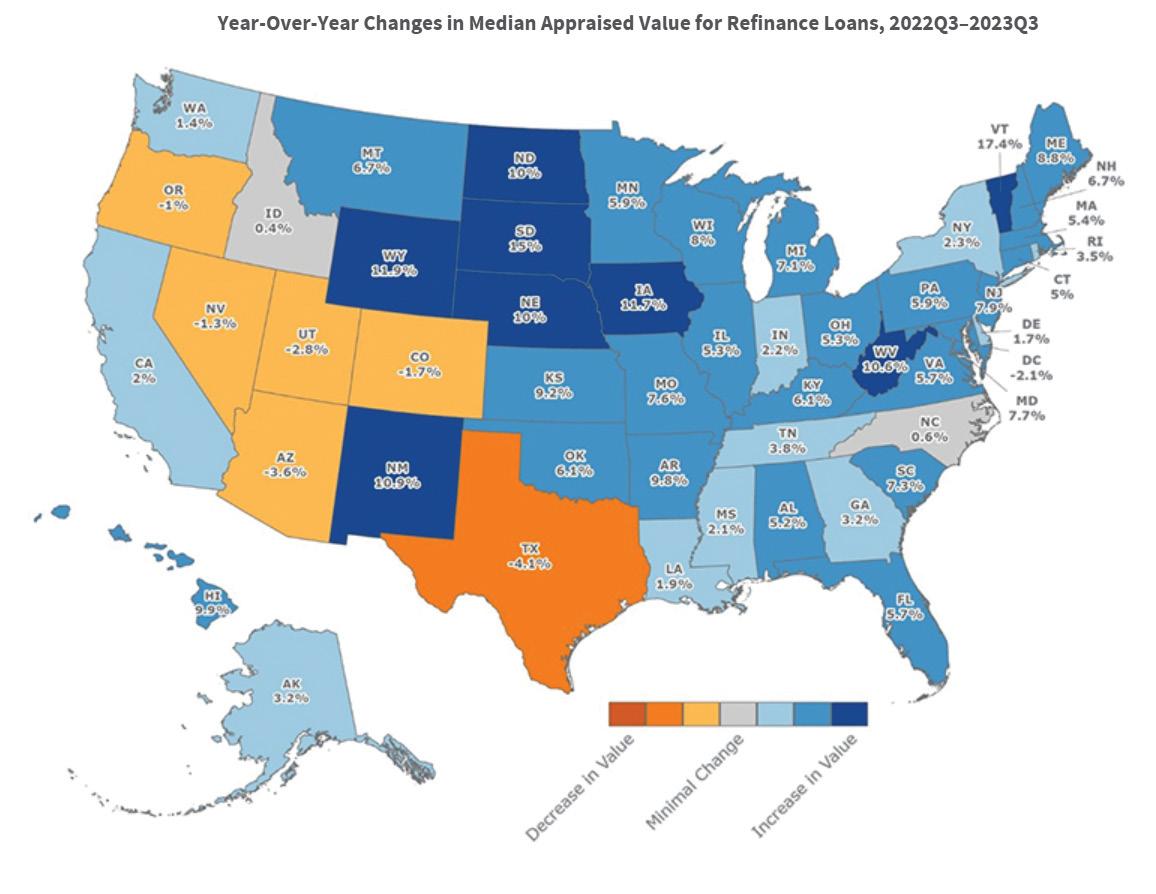

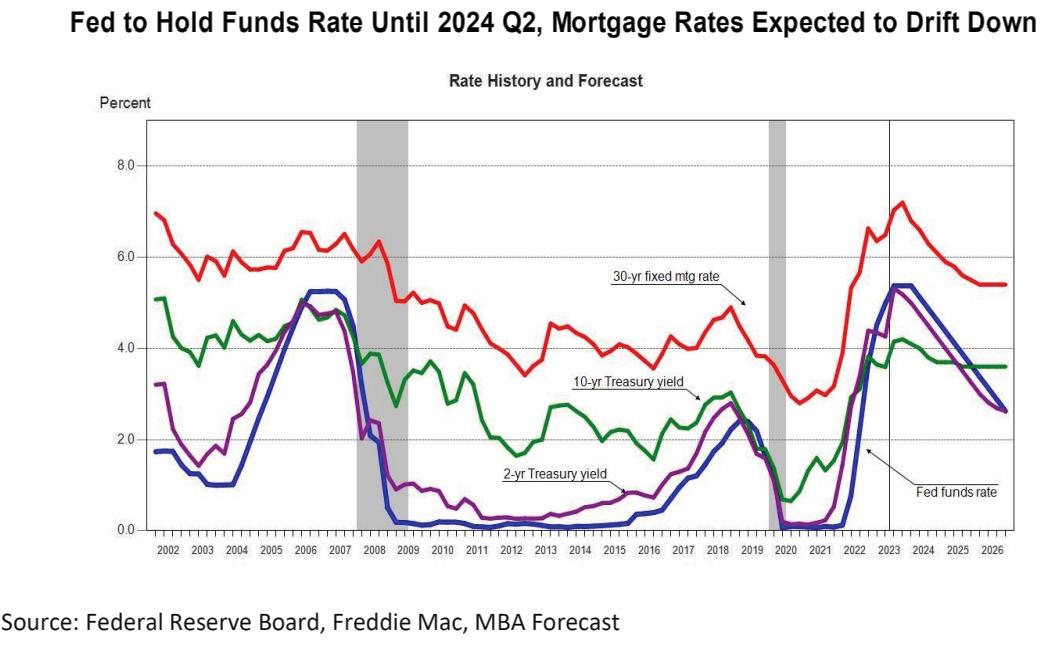

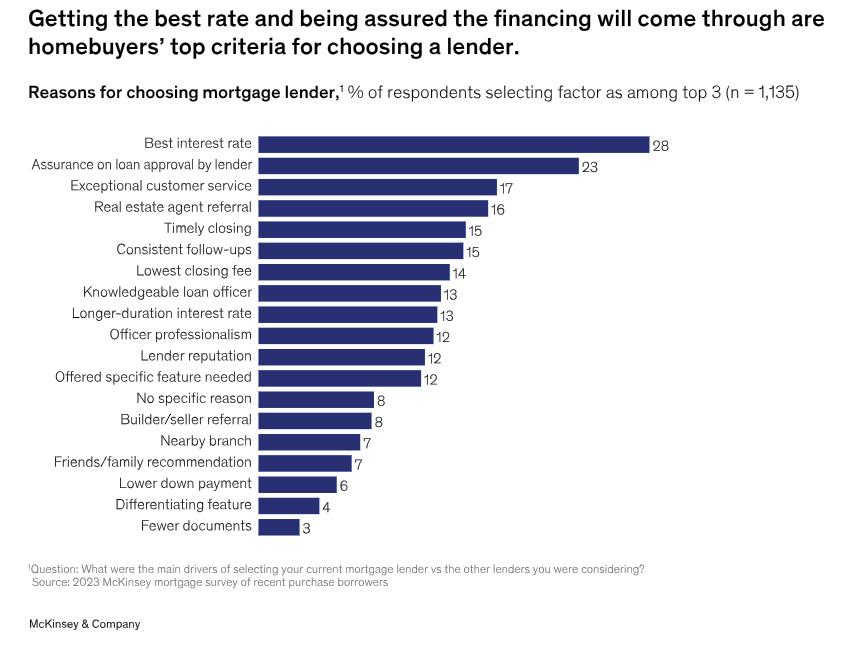

DATABANK

Trimming The Fat

Direct Wholesale Rates is a passion project aimed at cutting the retail margin

28 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

BY SARAH WOLAKI, ASSOCIATE EDITOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

he digital era is here to stay, especially when it comes to the future of securing a mortgage. It may not be a groundbreaking statement, but it’s undeniably the way forward.

Inc. (PRMI) has cracked the code to provide an affordable mortgage, minimize company overhead, and earn a profit simultaneously — all while keeping everything virtual.

This isn’t his first rodeo, either. Zitting started as a loan processor at the tail end of the 1980s — originally just an after-school gig — then became a loan officer at age 18. He co-founded PRMI in 1998 and grew the company to nearly 250 branches and more than 1,500 employees. “We had thousands of square feet of corporate office and hundreds of employees, as well as layers of management,” Zitting said, reflecting on his time as a big boss in the industry. He “retired” from the company in 2018.

Now, Zitting’s sailing a new ship, one that he calls affectionately his passion project. The new company, called Direct Wholesale Rates, soft-launched into the mortgage marketplace about nine months ago, with Zitting taking the helm as executive vice president of mortgage lending. The company, per Zitting, is built on the premise of trimming the retail margin and serving the buyer a wholesale rate directly sourced from United Wholesale Mortgage (UWM).

Here’s where the ship veers in a totally opposite direction than PRMI; Direct Wholesale Rates (DWR) is a completely virtual firm with 10 employees, each paid the same salary and fixed amount per transaction. The entire operation

relies on a secure virtual environment, with employees equipped with secure laptops, docking stations, and rigorous cybersecurity training. Forget a vigorous advertorial budget, too; Zitting says the company has opted for a word-of-mouth and referral partner strategy. The end goal is to bring true affordability to the table without compromising on service quality.

Zitting explained that DWR operates on a borrower-paid model, meaning they charge an origination fee, paid by the consumer, that starts at $1,750 and scales up to and caps at $2,595. “You could have a million-dollar mortgage and that fee wouldn’t go past $2,595,” Zitting said. “We capped [the fee] at $2,595 because we have to stay afloat, and I mapped it out as to what is the most competitive mortgage I can bring to the marketplace but still be profitable.”

To put this in perspective, Zitting says the margin is typically 2.5% for what the lender will make which, in turn, inflates the borrower’s costs. DWR is always a 0% margin. Zitting says that this strategy aims to provide competitive rates to the marketplace while ensuring the company remains fruitful. DWR does not charge discount points for the direct wholesale rate, offering borrowers the flexibility to choose a higher rate to cover closing costs.

NOT REINVENTING THE WHEEL

What DWR is doing is nothing new, Zitting adds. Taking a smaller cut and trimming the fat margin is anything a small, proprietary broker can do. “We’re a federally chartered bank powered by

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 29

SNB Bank, which is a non-affiliate based in Oklahoma and serves 49 states. Essentially, UWM is acting as the lender and we’re acting as a broker,” he said.

So why UWM and not other wholesalers? Zitting credited relationships as the main factor, reflecting on his tenure at PRMI and other ventures like AvenuTech, a revenue flow fintech platform. “We chose UWM because when I built AvenuTech, I worked closely with the wholesale company.”

Direct Wholesale Rates knows its company structure and purpose is replicable; it’s the Costco of mortgages, meaning that keeping fixed operational costs low and barebones lets the customer have more access. “Direct Wholesale Rates is a client who has access to the tools/rates all of our clients have access to,” a spokesperson from United Wholesale Mortgage wrote in a statement to NMP.

“Anybody can do what we’re doing,”

Zitting said. “UWM is offering their price regardless, and you make what you make. We’ve made the decision on our side to give their price to the public. Anyone can copy us.”

Anybody can do what we’re doing. UWM is offering their price regardless, and you make what you make. We’ve made the decision on our side to give their price to the public. Anyone can copy us.

> Dave Zitting, executive vice president of mortgage lending, Direct Wholesale Rates

But so far, this model hasn’t been copied and it’s pretty self-explanatory (why?): DWR is voluntarily taking a smaller share of the crop. “A lot of companies that are legacy businesses didn’t build the business this way,” Zitting explained. “They have office space and layers of management and fixed overhead that our model has cut out. Any incremental fixed overhead costs [we have] had to be scrutinized so that they can scale the business without added costs.”

Zitting knows that this model wouldn’t have been possible at PRMI. “I think the easiest competitor would be a small, proprietary mortgage broker …anybody in the country can do that,” he acknowledged.

TESTIMONIALS

Lynn Butterfield, an associate broker at Coldwell Banker with over 40 years of experience in the real estate industry, uses Direct

Wholesale Rates. He says he’s known Zitting personally for over 20 years, working with him at PRMI. “After he left, there was no reason for me to do business with them anymore,” Butterfield said. “I saw a post on social media about Direct Wholesale Rates, and although we had stayed in touch I wasn’t aware of what he had created, we sat down and talked about his new venture.”

Butterfield emphasized that he’s been in real estate since the crash in 1981 and, of course, the 2008 financial crisis. “I’m very careful as to who I do business with,” he added. “But when Dave told me about [DWR], I decided to introduce him to one of my clients and see what he could do. I trusted him, but I wanted to see it myself.”

Butterfield said his client, an executive for Walmart, was able to save 1% on the mortgage rate after working with Zitting. “What I appreciate about that as a realtor is two things: first, it makes me look like a hero, and second is that I’ve done many transactions with [DWR]

since and the transactions are smoother than with any other mortgage lender that I’ve worked with for 40 years,” Butterfield elaborated.

Butterfield also shared an incident where DWR saved his client’s ability to keep their home. “I had sold a home to an older couple and the wife fell ill and was unable to work,” he said. “They called me up and said that they didn’t want to move but couldn’t afford the home anymore …as a result of working with Dave, he was able to structure a mortgage plan for them that reduced the price to one they could afford it, and my client’s wife can now be comfortable while battling her illness. I never forget people who do those types of things for my clients.”

Joe Weigel, a customer of both Butterfield and Direct Wholesale Rates, and used both for his home search process. “I was able to save more than half a percent on my rate,” Weigel said. “Working with them was easy, and they were always available. They’re a very approachable company.” n

30 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

FLAUNT YOUR NETWORKING SKILLS

Seeking Socially Savvy Mortgage Leaders

How big is your network? Social media continues to grow in its importance in connecting with your peers and clients. Help us celebrate the mortgage professionals who have demonstrated success in growing their social networks with NMP Magazine’s Most Connected Mortgage Professionals.

Honorees will be showcased in the July 2024 issue of NMP Magazine.

NOMINATE TODAY

Get recognized for your connections!

Nominate yourself or another networked individual today.

Submission Deadline: March 29, 2024

ambizmedia.com/recognition/nmp-most-connect-mortgage-pros

One-Stop Shops Are The New Mom-And-Pops

Dual-licensed real estate agents and loan officers argue they make home buying seamless

32 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

BY SARAH WOLAK, ASSOCIATE EDITOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

BY SARAH WOLAK, ASSOCIATE EDITOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

This year will mark two years since the Federal Housing Administration (FHA) allowed “double dipping,” meaning the allowing of dual capacity in a transaction.

Mortgage Letter 202222, which clarifies conflict of interest and dual employment policies for most Title II single-family FHAinsured mortgage transactions, took effect immediately at the tail end of 2022, propping the doors open even wider for LOs and real estate agents to take a holistic approach to homebuying and selling.

Previously, this was not permitted on FHA loans. The letter denotes individuals who have a direct impact on the mortgage approval decision and, therefore, are prohibited from having multiple roles in the transaction, include underwriters, appraisers, inspectors, and engineers.

“Indirect compensation includes any compensation resulting from the same FHA-insured transaction, other than for services performed in a direct role,” the letter stated.

In the past, loan originators and real estate agents operated independently, each with distinct roles in separate companies. Surprise! Loan originators can also be licensed real estate agents, and inversely, pulling double duty in a single deal and earning from both roles.

Those who wear both hats argue that it makes their transaction more seamless when a customer decides to use them as both their LO and real estate agent

and opens the doors for new referral relationships if the customer only uses them for one side of the transaction.

But, of course, limitations come with the deal. For one, customers aren’t expected to use the same real estate agent for their loans, and vice versa. Monica Stone-Huggins, broker/owner of North Carolina-based Main St. Brokers, is a rule stickler regarding dual capacity. “Some of the remaining allowable states for dual capacity may require the disclosure to be generated in writing, and then there are remaining states where the disclosure is not required,” Stone-Huggins explained. “However, I believe dual capacity should always be disclosed in writing.”

Stone-Huggins, who is also licensed as a broker associate and realtor with California-based Everwise Home Loans & Realty, says that the biggest principle is transparency. “If I was a listing agent and a buyer came in and asked if I could represent them as a buyer, I could, but then I couldn’t finance them for the listing,” she said. “So you can represent both sides if you’re a listing agent, but you cannot have dual capacity as lender and Realtor to finance … As a mortgage broker, I may have some lender options that will have an overlay, that they will not allow for dual capacity. Most companies require that you hang both your lending and real estate licenses under the same umbrella. States may require this also.”

ORGANIC ORIGINS

Sdecided to work as both an LO and a real estate agent. Eventually, she wound up working at Everwise.

Now, she runs a boutique brokerage in North Carolina and still keeps her real estate license. “The position I’m in now is that I’m still a broker associate with my company in California where I cover seven states in lending, but I moved to North Carolina to start the firm,” she said. “I stick to the lending side and try to educate [the Realtors] on the lending side so agents are more familiar with the process or the right approach to whoever the lender is. It gives them an edge.”

Of course, Stone-Huggins hasn’t completely cut out her real estate roots. “There are some clients I work with on the real estate side because it worked out that way, but I mostly do lending and help out the agents on their knowledge to best help their clients, whether I’m their lender or not,” she said.

Jamie K. Adams has been a real estate agent for a decade and currently works for eXp Realty and is based in Atlanta, Georgia. Adams started in the corporate banking world in 2001 during her sophomore year of college at California State University, working at the Bank of America call center in Pasadena. After graduating with a business degree and later earning an MBA, Adams stuck with banking, eventually holding positions at several credit unions. To Adams, becoming a real estate agent happened organically.

tone-Huggins started off in the mortgage industry as a lender in 2004 and worked her way through mortgage banking up until the 2008 recession. When she jumped back in the game in 2016 at loanDepot, she said after having a few situations where an LO “dropped the ball” for her clients, she

Up until July 2023, Adams was doing real estate but felt like she was treading water. “The economy was hurting me and I realized I needed multiple streams of income … I didn’t want to put all my eggs in one basket,” she explained. “After managing the back-end support for mortgages [in previous roles], it was an easy segue into becoming a loan officer to do the front-end side.”

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 33

> Monica Stone-Huggins, broker/owner, Main St. Brokers

I do recommend this [dual licensing] for people whose business isn’t major … it’s impossible to make a million dollars in real estate and loans at the same time.

> Jamie K. Adams, real estate agent, eXp Realty

Adams joined NEXA Mortgage shortly after getting her loan officer license. “It was a slow summer because of the high interest rates. In December, I closed two deals and for January I closed three,” she said.

REALISTIC REFERRAL EXPECTATIONS

Adams says, right off the bat, that having dual capacity isn’t for everyone. “You’re going to be OK at both. There are not enough hours in the day. You cannot full-on be a buyer’s agent and be out showing homes, going on listing appointments, and realistically getting a lot of loans,” she said. “Realistically, you can’t do 10-14 loans at once while

appointments.

“You can choose one side for a while, … focus on real estate and refer out business for the loan side. But I do recommend this for people whose business isn’t major. It’s impossible to make a million dollars in real estate and loans at the same time. This is best for people who are looking for a different stream of income, and depending on how the market shifts, you can ramp up your loan business and prepare for that or do the same with your real estate business.”

Brandon Metoyer from Zero Point Mortgage says he only got his real estate license to understand more about the loan process. The Colorado-based loan officer has been in the business for about four years. “Prior, I was a network engineer at

34 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

Metoyer is now a real estate agent through Success Realty Experts and has branded himself as “the face of dual licensing in Colorado” on his social media pages.

When asked if his referral business suffered as a result of him becoming a one-stop-shop for homebuying, Metoyer says that he had been at a previous company that provided leads. “We always had customers,” he said. “But without having leads, my main focus became getting referral partners. My approach now is just focusing on buyers and then, through the buyer, talking to the [real estate] agent they were using. That saved me a lot of time versus trying to show up at open houses with donuts.”

Metoyer says although those referral partners worked out, many have “become scared” of him becoming dually licensed, now viewing him as a threat to their own business. But, that hasn’t stopped the money from rolling in. “I haven’t made less by any means by being dually licensed; I even bought my first house this year,” he said. “As for my referral partners, I find that it’s your

friends and family that use you last because some still see you as someone they watched grow up. So it goes beyond advertising on social media and proving to the general public that I’m a professional and not going to step on another loan officer or real estate agent’s business.”

Adams, however, had a more consistent experience with referral partners. “I do have some Realtors who are sending me business. Could I have more? 1000%. I have 10 years of a network built up,” Adams said. “I think there is some hesitation on sending me loan business since I am a direct competition, but to the people that do send me business, I make it very clear that we have our separate roles. I will not step on your toes, and I will stay in my lane. At the end of the day, it’s about helping the customer. A customer may love me doing their loan but may not want to go out and look at houses with me, we might have nothing in common. The point is I don’t like to overstep bounds.” n

Without having leads, my main focus became getting referral partners. My approach now is just focusing on buyers and then, through the buyer, talking to the [real estate] agent they were using. That saved me a lot of time versus trying to show up at open houses with donuts.

> Brandon Metoyer, real estate agent, Zero Point Mortgage

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 35

BROKER BUSINESS IS BUILT

Welcome to The Greatest Mortgage Conference In The Known Universe.

The Originator Connect Conference is the nation’s largest gathering of mortgage professionals, and it returns to Planet Hollywood in Las Vegas this August 15-18 for another fantastic, session-packed event.

Originators attend for FREE using code NMPFREE.

ORIGINATORCONNECT.COM

AU G 15 AU G 18 HERE.

TITLE SPONSOR PRODUCED BY THE ORIGINATOR CONNECT NETWORK

& A CAN’T-MISS NETWORKING PARTY

FRIDAY NIGHT RECEPTION

FEATURING THESE EXCLUSIVE EVENTS:

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only.

NMLS RENEWAL CLASS

+FREE

When, Where, And How To Incorporate AI Into Your Mortgage Business

38 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024

The impacts and future implications of artificial intelligence and generative AI

BY CHRIS BIXBY AND AJIT PRABHU, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

You cannot turn a page in an industry publication without landing on a story about how Artificial Intelligence (AI), automation, and Generative AI impact the mortgage industry. But that does not mean that all these stories are helpful regarding when, where, and how to incorporate AI into your mortgage or real estate business.

As an early to mid-stage investor in mortgage and real estate technology companies, including AI-led organizations, we frequently assess the use of AI in these sectors and interact with start-ups that develop and assist independent mortgage banks (IMBs), traditional banks, credit unions, and real estate companies with incorporating AI into their businesses.

BIXBY

BIXBY

PRABHU

PRABHU

Through our interactions, we have found that, in these sectors, successful deployment of AI depends upon two factors: (a) management that is informed by a deep enough understanding of the current state of AI and its evolutionary pathways and (b) clear directives from management on the business problem(s) that are best suited for solving with AI. We have also observed that the lack of clarity and understanding between terms such as automation, AI, machine learning (ML), and generative AI contribute to inaction or reactionary action.

ARTIFICIAL VS. AUTOMATED INTELLIGENCE

For example, we asked the management team of an AI-focused start-up a simple question: “Why had the company been using the term “Automated Intelligence” in their older marketing materials rather than the more recent term, “AI” (Artificial Intelligence)?” Management’s response was that most of their early customers were entirely unfamiliar with the term AI and

CHRIS

CHRIS

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | APRIL 2024 | 39

AJIT

using the word “automated” was an easier way to frame their technology solution. From a marketing perspective, that made good sense. But if management begins to look at AI as just a better mousetrap for mortgage automation, they are likely to miss out on much of what the technology offers.

Due to the unprecedented pace at which AI is evolving, our view is that it is essential to shift from reacting to the FOMO (Fear Of Missing Out) flavor of the quarter, such as, ”We need to integrate with ChatGPT (or its equivalent),” to a robust framework for AI deployment which incorporates point solutions, as appropriate.

DIFFERENCES AMONG AUTOMATION, ARTIFICIAL INTELLIGENCE, AND GENERATIVE AI

Automation uses computers and technology to raise human productivity by performing well-understood, manually repetitive tasks.

Automation is generally based on pre-defined and coded “if this condition is met, then take that action” types of rules on the input data. Any changes to the automated process or inputs require some level of rework on the automation rule set. For example, a mortgage application form that has an address written in a format that doesn’t meet the programmed rule set is kicked out as an exception for a human to resolve.

One of the most significant implementations of automation at a broad scale in the mortgage industry was the launch and adoption of the automated underwriting systems (AUS) with Fannie Mae and Freddie Mac in the late 1990s. Desktop Underwriter and Loan Product Advisor provided a level of automation that had not yet been seen and enabled significant efficiencies in the industry by reducing manual effort in the underwriting process.

Artificial Intelligence (AI), in simplified terms, can go further than automation by mimicking the problem-solving and decision-making capabilities that humans use in a particular space, such as mortgage processing. That means AI can solve problems that require some level of cognition. This capability is more powerful than automation.

Machine Learning (ML) is a subset of AI that solves problems by first digesting vast data sets within a specific area (e.g., recognizing cats in images) and creating its own internal mathematical model to “understand” the data set. In this step, known as “training,” experienced developers work with the AI/ML technology to shape the mathematical model to understand and analyze a range of input data relevant to the problem area.

In the cat example, the developers shape the model by iteratively teaching it the difference between “good” vs. “bad” results until the model produces relevant results that are as good or better than a

human is likely to produce. The “learning” aspect is when the underlying model adapts and improves over time with little to no human intervention. In the cat example, the model, as it learns, should be able to recognize cats in previously unseen images.

In mortgage, lenders have traditionally applied ML to solve task-specific problems. One use case is classifying, indexing, and extracting essential data from loan documents/data. The inputs can come from various structured data (e.g., different types of written forms where fields for date, name, address, etc., may not be in the same place on the form) and/or unstructured data (e.g., emails). This use case is an example of where ML shines compared to rules-based automation, as with supervision, the ML-based solution can learn from each exception so that it automatically handles it the next time it is encountered.

GENERATIVE AI

David Karandish, CEO of Capacity, simplifies the different approaches into the following three categories:

• Automation is analogous to ”doing” — the solution executes one or more manual tasks more efficiently

• Machine Learning is analogous to ”thinking” — the solution displays cognitive capabilities to raise both efficiency and effectiveness of the task(s) at hand

• Generative AI is analogous to ”creating” — the solution displays the ability to be creative by synthesizing what it has learned often into net new output