How a pastor has found a calling in teaching LOs how to change their thinking

What latest market forecasts show PASTOR-AL PROMOTION

How a pastor has found a calling in teaching LOs how to change their thinking

What latest market forecasts show PASTOR-AL PROMOTION

New homes are actually being built. But are they enough?

How a pastor has found a calling in teaching LOs how to change their thinking

What latest market forecasts show PASTOR-AL PROMOTION

New homes are actually being built. But are they enough?

CONTENTS

COVER STORY PAGE 44

Despite shedding an arm, Norcom is growing a leg. The company relaunched its TPO platform, TPO GO, aiming for over $2 billion in wholesale volume by 2024. With a talented sales team and innovative product offerings, Phil DeFronzo is excited about the future.

STAFF

Vincent M. Valvo CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak STAFF WRITERS

Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully CONTRIBUTING WRITERS

Nicole Coughlin ADVERTISING ASSOCIATE

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Krystina Coffey, Matthew Mullins MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Joel Berman FOUNDING PUBLISHER

Ihave known Phil DeFronzo for decades. A kind and smart man, he has been particularly proud of having created a regional mortgage dynasty. Think, therefore, what he must have been going through as he has had to surrender his life’s work to this punishing mortgage marketplace.

What started as Norwich Commercial became Norcom Mortgage. It expanded from its initial base in Connecticut to retail locations up and down the East Coast, including its southernmost group in Florida. It was an entrepreneur’s pride to watch such growth and success.

But, as we have written extensively about, this marketplace makes the cost of carrying a far-flung retail operation incredibly burdensome. Eventually, Phil saw the writing on the wall. Like many before him, he succumbed to the need to let someone else with existing backroom operations, and an ability

to slice cost to the bare bones, take his baby. A few months ago, CMG became the new owner of Norcom Mortgage.

But for all of his avuncular looks, Phil’s a fighter. While he has given up his retail operations, he is doubling down on reaching originators through his new wholesale division. It won’t be easy. Lots of mortgage companies have opted to try to become a provider of choice for brokers, while behemoth companies shrug them off and continue to pack on market share.

TPO Go, Phil’s new venture, is taking baby steps. But so did it’s predecessor. Starting over, for anyone, is difficult. Phil is determined to make this new approach work. At the very least, we should all be pulling for its success. It is a brutal market, and we are all in need of champions and role models of those who refuse to give in. And in our cover story this month, you will see that Phil DeFronzo is indeed still a man on the go.

VINCENT M. VALVO Publisher, Editor-in-Chief

Submit your news to: editors@ambizmedia.com

If you would like additional copies of National Mortgage Professional, call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

BY DAVE HERSHMAN, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Ibelieve that the skill of public speaking is essential for any loan officer. Why is public speaking one of the most important skills for a loan officer?

• Positive differentiation. Most of our competitors are not effective public speakers. Therefore, by being a good speaker, we differentiate ourselves from the competition. Furthermore, it gives you a platform to demonstrate your leadership and expertise, which are also elements of differentiation. People want to work with those who are experts and especially those who are leaders.

• Effectiveness. Some tools are more effective than others. If you could have 20 real estate agents attending your talk and you deliver a presentation that makes 10 of them want to work with you, this represents the epitome of efficiency. How many oneon-ones with agents would it take to achieve the same results — especially when you consider the time taken to chase the agents to set up appointments?

• Value. Speaking is not only a platform to demonstrate leadership, speaking represents a platform to deliver added value in terms of education.

If you are working inside a real estate office — the importance of public speaking is elevated.

Why? While a street loan office may get an invite to deliver a sales meeting presentation to agents or perhaps a lunch-and-learn, for those serving a real estate office, these events become a regular part of the position. The office may have sales meetings every week, every other week, or once per month. The loan officer may present training sessions as often as weekly as well. The ability to show leadership within the office by presenting valueadded and dynamic presentations is essential. Why are great public speaking skills rare? Because most people are scared to speak in public. This fear is so prevalent that it has its own word: Glossophobia. We also call it “stage fright.” Studies have shown that those who suffer from stage fright get more anxious — not less anxious — as their presentation gets under way. And when it’s over, instead of feeling relief, they feel even more anxious. Thus, if you are afraid to speak in public — you are not alone. Here is the good news: this fear can be overcome. The key to overcoming this fear is a significant dose of practice:

• Start alone — then move up by getting in front of your pet. We are talking about small steps here!

• Move on to your spouse or another key person

The fact that you are not alone in your fear should provide some perspective which will help you move forward.

in your life. Remember, you are speaking every day in one-onone situations.

• Stand-up and give your one-onone talk in front of one person.

• Talk about something you know well. If you are familiar with the topic and talk about it every day — then you don’t have to worry about “remembering” it.

• The topic doesn’t even have to be about work — it can be a hobby like golf or photography.

If you are afraid to speak in public — you are not alone.

Here is the good news: this fear can be overcome.

The key to overcoming this fear is a significant dose of practice.

• Start with a small tidbit — not a full speech. Three things you love about being a loan officer.

• You can build from there — add a point or a story after you have done this ten, twenty or a hundred times.

• Always get feedback — remember practice does not make perfect. Practice makes permanent. You must get feedback so you can make adjustments in the future.

There are organizations such as Toastmasters International and Dale Carnegie that will help you with your quest to become a more effective speaker. Toastmaster chapters are local and are non-profit and thus inexpensive. They are filled with others trying to achieve the same goals as you. It is also a great place to meet new contacts and benefit through networking. If you practice speeches on the topic of mortgages, the members will come to you when they have questions. Want to add some additional synergy? Join with a real estate agent who shares the goal of becoming a good speaker.

The fact that you are not alone in your fear should provide some perspective which will help you move forward. It helps to gain a perspective on your fear. In addition, here are some additional points that may also help you achieve this perspective:

• People in the audience know less than you do. Not only do you need to “dumb your talk down” — don’t worry about the facts and explaining them so much. Keep it so simple like you are teaching a kindergarten class.

• People will remember about two percent of

what you say and that is usually a story. Don’t worry about saying something wrong. They won’t remember.

• People don’t know what you are going to say. So don’t worry about leaving something out. If you forget something — let it lie and come back with an email on the topic.

• People actually like it when you agree with what they believe! That means you don’t have to go out on the limb and challenge them.

• One person in the audience will not like you — don’t focus upon them. Focus upon those who liked you. If you gave a talk to ten people and; – Six were motivated to use you, – Three did nothing, and – One hated your speech.

Would you be better off giving the speech or not? Believe it or not, most speakers would be focused upon the one person who did not like the speech. But that is misplaced energy. The bottom line? Undertaking the objective of becoming a better speaker is well worth the effort, whether you are inside the glass house or on the street. But essential if you are serving a real estate office. n

Dave Hershman is the top author in this industry with six books published as well as the founder of the OriginationPro Marketing System and the OriginationPro’s on-line comprehensive mortgage school. His site is www.OriginationPro.com and he can be reached at dave@hershmangroup.com

BY ERICA LACENTRA, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

The importance of building customer loyalty for a company cannot be stressed enough. Companies that build a loyal customer base can reap benefits like having insulation from competitors poaching business, acquiring repeat business, and having clients that will be their biggest advocates and brand champions. For any company, having customer loyalty is the dream scenario, however it can be challenging to figure out the best way to create a customer experience that drives customers to come back time and time again. Often companies will turn to the creation of a customer rewards program or a customer loyalty program, which, in theory can be a great way to keep customers coming back by providing them with perks and discounts for bringing regular business. When done right, these programs can boost customer satisfaction and improve customer retention. However, it’s important to develop a program that provides customers with rewards they will actually use and truly want. So how can companies

create a customer reward or loyalty program that is more than just a quick gimmick?

When it comes to a rewards program, your mind may immediately go to traditional e-commerce perks like discount codes that give you money off your next order or small gifts to show appreciation for repeat business. However, in the mortgage industry, it’s likely that a company that is looking to build out a rewards or loyalty program will have to think outside the box because standard rewards like a 10% off coupon simply might not be an option.

It’s important that if you are looking to build out a program for your organization, you are thinking about what would actually incentivize your clients to continue to work with you rather than you assuming and offering things that you think might move the needle. Think about what your clients’ pain points are and what you could offer through a rewards program to make their lives easier. For example, if you deal mainly with wholesale clients (like mortgage brokers), they are likely always looking to expand their book of business. What better way to help them expand their client base — while also creating opportunities for you to field that newfound business — than to throw exclusive networking events in their area and invite their ideal customers. You could also identify events that already exist that would provide similar benefits for your clients and cover the cost of their event tickets.

Think about what your clients’ pain points are and what you could offer through a rewards program to make their lives easier.

If you are looking to build out a program, think about what would actually incentivize your clients, rather than you assuming and offering things that you think might move the needle.

Another idea could be to provide a tailored client experience as clients bring more business to your organization. What better way to address customers’ pain points than by providing a higher tier of customer service every time they bring you business? Aside from carving out dedicated resources for these clients, this could be a great opportunity to go that extra mile for your top clients and retain their business and customer loyalty. This category of reward could also include a forum for them to be able to provide product or program improvements and get early access to test things out or access to senior leadership to provide input that could also help your business improve. There are many options that aside from providing an ear and facetime with the appropriate members of your company could be a great perk.

One thing to keep in mind as you are identifying potential rewards is that you are calculating how much business a client would have to bring in to make sure you aren’t breaking the bank with the perks you are providing. One of the best ways to balance out the cost of the reward versus the business you’re receiving is by creating different tiers or levels for a rewards program. By creating different tiers within your rewards program, you also incentivize clients to bring more business to hit higher tiers and receive more substantial rewards. It gives your clients something to work towards and if the perks are enticing enough, it ensures they will keep their business with you to hit those higher tiers. As you are building out a rewards program, conduct a cost analysis to ensure your costs will be

covered at every tier. As previously mentioned, also consider adding rewards that do not have a high monetary cost associated with them to keep reward program expenses down. Review the resources you already have within your organization and connections you have within your industry (think discounts for other services your clients might need) to see how you might be able to tap into those opportunities and offer them as perks. Whatever you do, just make sure you aren’t setting your reward program up for failure by offering rewards that cost you so much that you aren’t making a profit despite the additional business.

When done well, a customer reward program can be a great way to increase client satisfaction and customer loyalty. Avoid hastily creating a program and take the time to develop something that your clients will actually enjoy and provide them with real benefits. If you are struggling to think of rewards that your clients would like and benefit from, a good way to start the development of a program like this is to conduct a customer survey. Ask customers what they like about working with your business and where things could be improved. Asking questions about what pain points they have and what resources they wish they had access to to improve their own business can be a great starting point for developing a rewards program. Listen to what your customers want, avoid gimmicks, and then you can create an impactful rewards program that can pay dividends for your business. n

Erica LaCentra is chief marketing officer for RCN Capital.

Creating a space for the next generation in NMLS education.

Introducing Maximum Acceleration, your new premier provider of continuing education.

We’re not just bringing you a lecture. We’re bringing you the fuel to spark your competitive fire, the plan to win the game on the merits, the confidence to know the rules and master them.

We’re Maximum Acceleration, and we’re where loan originators go to put their career in high gear.

— LaDonna Lockard, CEO

> Barh Dunmore, doing business as Dunmor, appointed Tuan Pham as Chief Marketing Officer, and Steve Huff as SVP, Asset Management and Servicing. Pham comes to Dunmor from CoreVest Finance, where he also served as Chief Marketing Officer. Huff most recently served as Director of Business Operations at Wedgewood.

> Planet Home Lending has hired Bill Shuler as Executive Vice President, Chief Information Officer. Before joining Planet, Shuler was President of WPS Advisors, LLC.

> First Home Mortgage recently announced the appointment of Tim Whittier as its new President.

BY HARVEY MACKAY, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

There is an ancient superstition of the sea that periodically a wave comes along that is greater than any that has preceded it. It is called the Ninth Wave, a powerful culmination of sea and wind. There is no greater force.

To catch the Ninth Wave at the critical moment requires a special skill and daring. You must mount the wave precisely at its peak, and it will carry you a great distance to where you want to go.

There is a great lesson here for grasping opportunities in our daily lives. Opportunity doesn’t necessarily knock on the door; it may be leaning against

the wall waiting to be noticed. It is about being in the right place at the right time with the right qualifications. It often comes disguised as hard work. Opportunity typically favors those who have paid the price of years of preparation.

There are no limits to our opportunities. Most of us see only a small piece of what is possible. We create opportunities by seeing the possibilities and having the determination to act on them. Opportunities are always out there waiting to be discovered.

Take the experience of Edward Lowe who was in the business of producing a clay-based material to soak up oil and grease spills. One day a neighbor asked to use the compound for her cat. Lowe realized he was on to something and started selling his compound to pet stores and soon invented the cat litter industry worth hundreds of millions of dollars.

PEOPLE ON THE MOVE //

> Fidelity National Financial named Jason Nadeau as Chief Artificial Intelligence Officer. Nadeau joined FNF in 2018 and formerly served as its Chief Digital Officer.

> Philadelphiabased Incenter Lender Services recently promoted Sara Parrish to Chief Operating Officer. Parrish will remain as president of CampusDoor, an Incenter subsidiary.

> Asurity Technologies announced that mortgage technology veteran Brad Vasto has joined the company as Senior Vice President — Sales.

> First Financial Bancorp elected Anne Arvia as a new director on the First Financial Board of Directors, following a vote during the company’s annual meeting of shareholders at the end of May.

It’s not unusual to find new opportunities for existing products. For example, Arm and Hammer baking soda is used in more than 50 percent of American refrigerators for odor control, a use that far surpassed its original use for baking.

And don’t forget to look for new opportunities in old places. How about the businessperson who took the average laundromat, crossed it with a beer bar with the motto, “Enjoy our suds while you wash your duds.” It was a runaway success.

Opportunity occurs when you can apply a success from one business to another. Federal Express, now

demand might grow. Encourage feedback from customers to understand their challenges and how your company can solve them.

Train your team on product knowledge, problemsolving, and soft skills like listening, empathy, and communication. Ensure every employee knows your products or services inside and out. Empower employees to think on their feet and offer creative solutions.

The best way to capitalize on opportunities is to be responsive, customize solutions, and follow up. When a client expresses a need, act quickly to show you are eager to help. Tailor your products or services

Opportunity occurs when you can apply a success from one business to another.

FedEx, used the bank’s method of clearing checks overnight to the movement of packages. Founder Fred Smith developed the hub-and-spoke concept where every single package goes to Memphis, Tenn., and then is flown to its final destination.

Television repairman Joe Resnick became frustrated every time he installed a TV antenna. They used to come in pieces, many of which were missing and difficult to assemble on a roof, due to frigid weather. He was determined to create an inexpensive, pre-assembled antenna that was easy to install without requiring the expertise of a specially trained technician. He and his brothers became millionaires, and their TV and radio business empire was worth $45 million. He later was elected to Congress, representing New York’s 28th congressional district. Taking advantage of opportunities, especially in marketing and sales, is all about being alert, proactive, and prepared. First you must identify opportunities through customer interactions, market research, and feedback. Every touchpoint with a client is a chance to learn what they need and how you can help. Stay informed about industry trends and anticipate where

to address the specific needs of your clients. After delivering on a request, check in to ensure satisfaction and explore further opportunities.

Build relationships through personal touch, trust, and networking. Remember personal details about your clients and use that to build a rapport. Consistently delivering on promises builds trust, opening the door to more opportunities. Use every interaction to expand your network.

By staying agile and adaptable, you are ready to pivot your strategy based on new information or changing market conditions.

Remember, opportunities are not just about immediate sales; they are about building long-term relationships that lead to sustained growth. It is not just about what you are selling, but how you are helping clients improve their own business and life.

Mackay’s Moral: Opportunity comes to those who go looking for it. n

Harvey Mackay is a seven-time New York Times best-selling author with 15 books.

ORIGINATOR TECH RESOURCE GUIDE

wemlo

Boca Raton, FL

Area of Focus: Loan Processing

Third-party processing service, wemlo, empowers mortgage professionals through transparent, flexible, and efficient loan processing. To better serve our customers and their borrowers, wemlo proudly offers processing support in 47 states (plus Washington DC) for more than a dozen loan products including Conventional, FHA, Jumbo, VA, and Non-QM.

wemlo.io (866) 523-3876 info@wemlo.io

Licensed In: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, VT, VA, WA, WV, WI, WY

Stockton, CA

Area of Focus: Software

1Solution Mortgage allows you to Originate, price a loan scenario with proposal, CRM, Marketing and more …

• Scenario

• Communication

• CRM

• LOS

• Essentials

• Marketing

• HR

1smtg.com (888) 458-0650 info@1smtg.com

Licensed In: All U.S. States, U.S. Virgin Islands Find the full Originator Tech list on page 65

ACC Mortgage is the oldest NonQM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com (888) 415-1620 support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

We discuss the issues in the industry others may be too wary to touch, and we never let advertise relationships affect our stories.

Find actionable advice from professionals across the industry with tips to further your career, grow your business, and more.

Don’t just read the news — understand it. Find insightful articles from leading industry voices to help digest all the changes in the industry.

BY MARY KAY SCULLY, CONTRIBUTING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Right now, there’s not a surplus of business out there. More often than not, you’re competing for it. So, when that’s the case, why should someone choose you? What would make a potential borrower pick you over anyone else in the business?

People love to say that their customer service is what sets them apart, but I’d argue that’s very easy to say and often difficult to back up. Customer service is more than just calling people back or being knowledgeable. Let’s look at customer service: what it really is, what it looks like in today’s market, and what you can and should be doing to set yourself apart.

Salesforce defines customer service as “the support you offer your customers — both before and after they buy and use your products or services — that helps them have an easy and enjoyable experience with you.” Customer service is ongoing. Before, during, and after someone works with you, their experience matters.

Salesforce’s definition also mentions that “customer

support is more than just providing answers; it’s an important part of the promise your brand makes to its customers.” There is much more to good customer service than just calling people back, having good credentials, or being experienced. It’s all about how you’re supporting customers throughout their journey to ensure that they have the best experience — and the experience that borrowers have working with you is what truly sets you apart. Not to mention, it’s also what leads to those crucial referrals.

When it comes to differentiating yourself in the current market, it’s not about rates or products. In reality, everyone will typically have similar offerings — it’s you that makes the real difference. Think about what makes you unique — what do you have to offer the customer? Is it your credentials or education? Is it your communication style? Is it your level of experience?

These on their own will not set you apart unless you ask yourself two important questions: how and why?

It’s worth putting some thought into how you approach customer service. Forbes reported that brands with superior customer experience bring in 5.7 times more revenue than competitors that

The key to success is about more than simply you getting paid or closing the loan as quickly as possible.

lag in customer experience. They also reported that American consumers will pay 17% more to purchase from a company with a reputation for great service. Again, it’s not simply about your rates or products — it’s also about the customer experience.

The key to success is creating a relationship where everyone benefits. It’s about more than simply you getting paid or closing the loan as quickly as possible. Customers want to leave the interaction feeling valued.

Though it is a transaction, it doesn’t have to feel transactional. One key way to create a better experience is to build a relationship. Don’t just tell your borrowers what to do or what you need from them but give them the why behind it. This not only helps educate them(,?) but empowers them to know what is happening with their loan so they can help you do your job. Rather than thinking of your job as

working for your borrowers, approach it like you’re working with them. This kind of relationship not only builds trust but also can lead to a better experience.

If customers feel valued and enjoy working with you, they will talk about it, whether through word of mouth or on social media. The same goes for a bad experience. People will talk either way. What do you want to be known for?

Ultimately, customer service is all about creating a mutually beneficial experience. When customers are happy — everybody wins. So, in a market where business is competitive, set yourself apart with truly superior customer service. n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum.

Newfi Wholesale Emeryville, CA

newfiwholesale.com (888) 415-1620 support@newfi.com

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, NonQM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8

PCV Murcor Pomona, CA

pcvmurcor.com sales@pcvmurcor.com (855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — An Appraisal Management Company

DESCRIPTION OF PRODUCTS OR SERVICES: Licensed in all 50 states, plus D.C., PCV Murcor provides nationwide appraisal management and valuation advisory for residential and commercial real estate. With a foundation built on 43 years

Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

of experience, PCV Murcor brings a deep understanding of our clients’ goals that complements appraisal modernization. Our use of state-of-the-art AI technology ensures precision and efficiency in every aspect of our service. Experience innovation-powered recision and timetested excellence with unparalleled service and cutting-edge products.

FRIDAY NIGHT RECEPTION & A CAN’T-MISS NETWORKING PARTY

FEATURING THESE EXCLUSIVE EVENTS:

Market activity has been picking up as we transition from Spring to Summer, so keep cool and stay hydrated because home prices continue their ascent. And here’s a spoiler alert, they’re sweltering! The S&P CoreLogic Case-Shiller Index for March 2024 reported a toasty 6.5% annual gain for March, the same increase as the pre-

The report’s 20-city composite index posted a partly cloudy year-overyear increase to 7.4%, up from a 7.3% increase in the previous month.

San Diego continued to report the hottest and highest year-overyear gain among the 20 cities this month with an 11.1%

increase in March. It was followed by New York and Cleveland, with increas es of 9.2% and 8.8%, respectively. That indicates a steamy, show-stopping demand for urban areas, CoreLogic says.

11.1%

From a regional standpoint, the Northeast stood out with an 8.3% annual gain, showcasing robust growth compared to other metro markets. On the opposite end of the spectrum, cities like Tampa, Phoenix, and Dallas are cooling down and experiencing a wind chill after hot activity in 2020 and 2021.

With prices continuing to boil over, Redfin says that the median U.S. home-sale price hit an all-time high of $394,000 during the four weeks ending June 9, up 4.4% year over year—the biggest increase in about three months, and further adding to

cooled down to $2,829, which is $30 below April’s record high. Despite record sale prices, median housing payments have fallen slightly since April, thanks to a decline in weekly average mortgage rates to 6.99%. It’s like a gentle breeze providing relief from the heat.

Tune in to new epiosdes of Mortgage Meteorology every Thursday on The Interest market humidity. However, there are signs that the high-pressure system of home-price growth may soon ease. Like a cold front moving in, asking prices have leveled off, and 6.5% of home sellers are cutting their asking price—the highest rate since the November 2022 low-pressure zone. We’re already seeing price declines in four U.S. metros: Austin, Texas, Fort Worth, Texas, San Antonio, Texas, and Portland, Ore.

gest decline in three months.

But don’t resort to doom and gloom just yet; there’s a silver lining on the horizon. Mortgage-purchase applications are up 9% week over week, indicating a potential warm front that could boost demand.

Meanwhile, the typical homebuyer’s monthly housing payment has Watch it on

For now, high costs equate to a high-pressure system, keeping some prospective homebuyers on the sidelines waiting for the storm to calm. Pending home sales dipped 3.5% year over year, marking the big-

> Construction workers build a new home in 2021 in Houston. Almost 5 million new housing units, mostly single-family homes, have been added nationwide since 2020, according to new data. Texas is a leader with about 806,000 new homes.

BY TIM HENDERSON, STATELINE

The United States has added almost 5 million housing units since 2020, most heavily in the South and

most of them single-family homes, making a housing shortage look conquerable in much of the nation.

Still, even more homes need to be built — especially singlefamily homes, experts say — and continuing high interest rates are hurting potential homebuyers.

Almost half of the housing increase from April 2020 to July 2023 came in six states: Texas, Florida, California, North Carolina, Georgia and Tennessee, according to a Stateline analysis of U.S. Census Bureau estimates to be released in May. That mirrors America’s post-pandemic moving patterns to plentiful suburban housing in Texas and Florida, but also California’s persistent push for more apartments in resistant areas across the state.

Housing experts caution that the supply has still not caught up with demand even after another good year for home construction in 2023. Last year produced the most housing units since 2007.

“One Good Year Does Not Solve America’s Housing Shortage” was the title of a Moody’s Analytics report in January, which found

single-family homes, in particular, remain in short supply.

Moody’s estimated a shortfall of about 1.2 million single-family homes and 800,000 other units,

New housing should continue to arrive at a strong pace for several years because so much construction has already started.

noting that home sales had slowed since reaching all-time-high prices in 2022 as interest rates climbed and made purchases even more unaffordable.

The National Association of Realtors, in a February report, offered a higher housing shortage estimate of about 2.5 million units, mostly singlefamily homes.

Most of the new housing units in recent years have been single-family homes, according to a separate U.S. Census Bureau construction survey through the end of 2023. Production of new single-family homes reached more than 1 million annually in 2022 and 2023 for the first time since

the housing bubble burst in 2007, according to the survey.

Apartment construction is also at historic levels, with 438,500 units built last year, the highest level since 1987. The number of apartments under construction at the end of the year, about 981,000, was an all-time high since the survey began in 1969.

New housing should continue to arrive at a strong pace for several years because so much construction has already started, said Daniel McCue, a senior research associate at Harvard University’s Joint Center for Housing Studies.

“New construction can really only slow overheated rental rates, but it’s really hard-pressed to bring down rents or make things more affordable for people at the bottom,” McCue said. “Our focus is not on the overall shortage of housing units, but on the specific shortage of affordable and available homes for low- and moderateincome people.”

The housing unit data released in May 2024, which tracks changes through the middle of 2023, shows continued increases across the country, with about 1.6 million new units annually for the past two years.

Increases were concentrated in the West and South, with half the 4.8 million new units since 2020 in a handful of states: Texas (about 806,000), Florida (586,500), California (371,000), North Carolina

(270,500), Georgia (200,000), and Tennessee (164,000).

Percentage increases were highest in fast-growing Western states: Utah (up 9% since 2020), Idaho (up 8%), and Texas (up 7%). Five states had 6% growth in housing units: South Carolina, South Dakota, Florida, Colorado, and North Carolina.

Arizona, Georgia, and Nevada — all of which are key swing states in this year’s presidential election — were not far behind, with 5% growth in housing units.

The housing shortage has become a major political talking point, even as states scramble to get more units built and people housed.

Even with Utah’s nationleading growth in housing units for the decade, for example, Republican Gov. Spencer Cox called high housing prices “the single largest threat to our future prosperity” in his State of the State address this year.

“Housing attainability is a crisis in Utah and every state in this country,” Cox said, announcing a plan to build 35,000 small “starter” single-family homes in the next five years.

The Federal National Mortgage Association, known as Fannie Mae, reported last year that the typical homebuyer paid 35% of their income in mortgage payments in October, the highest since at least 2000.

A Utah-based think tank, the Kem C. Gardner Policy Institute at the University of Utah, in a report last year said the pandemic years

brought a boom-and bust-cycle to the state’s housing construction. New permits increased 26% in 2021, only to drop 21% the next year as interest rates climbed. The new U.S. Census Bureau figures show new units in the state peaking at 38,500 in 2022 and falling back to about 30,000 in 2023.

All states saw some housing growth, according to the Stateline analysis and census data, but it was slowest in some states affected by poverty or low population growth. There was only a 1% increase in housing units since 2020 in Rhode Island, Illinois, West Virginia, Connecticut, Alaska and New Jersey.

Alaska Republican Gov. Mike Dunleavy also mentioned housing affordability as one of the biggest challenges facing the state this year in his State of the State address. Dunleavy proposed a state-funded down payment assistance program for first-time homebuyers, and lumber grading changes designed to make homebuilding materials more affordable.

New Jersey Democratic Gov. Phil Murphy mentioned in his State of the State address the state’s low housing stock at a time when tens of thousands of New Yorkers are seeking suburban housing there.

“If our population grows while our housing stock remains steady, homeownership will be a luxury reserved only for those at the top. That is untenable,” Murphy said. n

PASADENA | NOV. 5, 2024

HOUSTON | NOV. 14, 2024

UNCASVILLE, CT | JAN. 11, 2024

Connecting you to the story of your success.

Don't miss out! These recent events were huge successes — providing great educational and networking opportunities. Make plans to attend the next one nearest you!

We want every broker and originator to feel empowered, informed, and connected to the resources needed to develop your career. The Originator Connect Network, the nation's largest producer of mortgage events, is about fostering a community founded on professionalism, collaboration, and personal and professional growth.

To find the next event nearest you, visit:

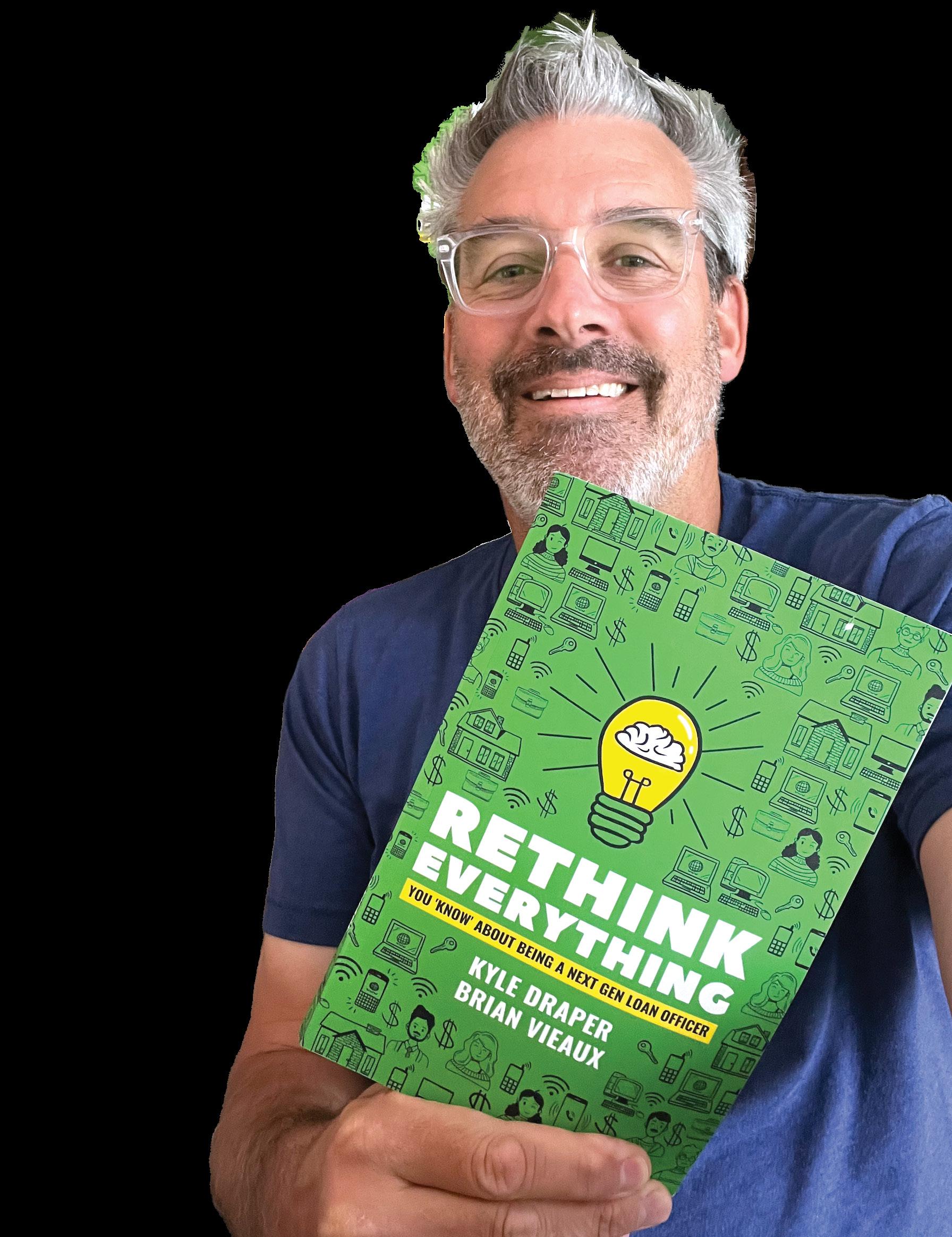

> Kyle Draper, owner and CEO, Kyle Draper LLC and founder, Content Compounding

A Texas coach and former pastor felt a calling, spawning a best-selling how-to for loan officers

BY SARAH WOLAK, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Kyle Draper knows that he doesn’t resemble a typical book author, nor the words associated with one: academic, bookish, serious. Draper, owner and CEO of Kyle Draper LLC, is a keynote speaker and mortgage industry coach who focuses on social media marketing. Draper, a former youth pastor and founder of Content Compounding, a company that helps businesses create and repurpose video content for multiple platforms, wrote his first book “Rethink Everything You ‘Know’ About Social Media” back in March 2023. Draper never intended to become an author. For him, it was divine intervention. “My wife and I were on vacation in Mexico. I couldn’t sleep in the middle of the night. And I felt like God said, ‘Go sit on the balcony and write a book.’ And I thought I don’t know who would want to read anything that I would write,” Draper said. “But I went, I sat on the balcony at 3:00 in the morning, and I wrote two chapters, and then I wrote two more chapters during the rest of our trip. I came back to Texas with four chapters written of a book … I had no idea what I was doing.”

Draper, who is based in the Dallas/Fort Worth area of Texas, continued, “I think there were a lot of people that were like, ‘Did Kyle Draper write a book? I would have never put him in the category of friends of mine that I would see writing books.’ But the outpouring of love and support was unbelievable and just so much more than I could have ever anticipated, and it opened my eyes to the fact that people desired a new style of reading.”

Draper’s book, which he describes as “an adult coloring book,” is a practical guide to effective social media outreach and marketing. Draper exudes fun energy, so he wanted his book to have the same feeling. “We

threw some pictures in there and QR codes to go watch [videos] and I just wanted it to be a really fun read and experience,” he said.

Brian Vieaux, president and COO at financial data platform FinLocker, was gifted Draper’s book in the mail in September 2023 from Scott Payne, chief product officer for CRM platform Shape Software. The book was signed by Draper and included a QR code tucked in the back cover, which scanned to a video message from Payne. Vieaux, who is based out of Michigan, didn’t know Payne personally. But he said “I’ll bite,” and scanned the QR code. “I hope you get something out of this book,” Payne said in the video. Vieaux read the book four times in one week, the

they’d each write a chapter for the book, but didn’t feel like they fell in line with other industry experts. “Nobody wants to hear Kyle or I,” Vieaux said. “I personally haven’t originated a loan since 1993 and Kyle’s never originated a loan.”

The book title both Vieaux and Draper agreed upon was “Rethink Everything You Know About Being A Next-Gen Loan Officer,” which was step one in continuing Draper’s “Rethink Everything” brand. But, the book isn’t just for newbies. “The purpose of that title was not to speak to [a] next-gen loan

“The purpose of that title was not to speak to [a] next-gen loan officer as an age demographic, but to speak more to the way you must evolve if you want to remain relevant as a loan officer.”

> Kyle Draper, owner and CEO, Kyle Draper LLC and founder, Content Compounding

wheels turning in his head with every re-read. “I don’t even know [the author] and I was already packaging a sequel to the book,” Vieaux said with a chuckle. “So I started taking screenshots of the pages of his book and posting them on LinkedIn with my review and commentary, tagging Kyle in every post. After the fourth post, he messaged me to thank me for blowing up his LinkedIn.”

Draper suggested the two meet, so Vieaux invited him to join in on his podcast, Fintech Fridays. (The two now co-host a podcast called Mortgages and More.) After the initial podcast recording, Vieaux pitched his idea: Why don’t we continue the Rethink Everything brand and write a book about rethinking everything you know about originating?

Draper loved the idea right away. Both he and Vieaux knew they wanted the book to be contributed (to?) by people in the industry. They initially thought

officer as an age demographic, but to speak more to the way you must evolve if you want to remain relevant as a loan officer,” Draper explained. “You could be 65, and if you’re engaging with video and meeting people where they are, you may be old by number, but you’re young in the way you’re running your business. We didn’t want a book full of a bunch of 20-something-year-old loan officers [who] don’t know anything because they’ve been doing this for three minutes. We wanted to help people realize that the most gifted people in this space are the older people who have been doing this for 30 years.”

Draper knew five experts he wanted to include right off the bat, and Vieaux had 10 in mind. “Fast forward from then, which was early

“The

vision

that we

had together

was

that this book would be permanently sitting on a loan officer’s desk and anytime they’re in a rut, they can flip it open, go to a chapter, and find some inspiration.”

> Brian Vieaux, president and COO, FinLocker

October [2023] to the second week of November, we had commitments from 24 people to write chapters in the book,” Vieaux said. “We had a group meeting, and somehow we ended up with 37 experts who contributed.”

Vieaux candidly admits that neither he nor Draper edited the chapters as they came in, sans a few grammatical errors here and there. Why? Draper says that he didn’t want to take away any personality embedded in each chapter. They knew each contributor personally and wanted their separate personalities to shine through. “We wanted it to feel exactly the way the author would have said it,” he explained.

When submissions came in, Vieaux and Draper started grouping them by themes, which led to sections titled “The Power of Personal Branding” and “Top Producer Perspectives,” among others. The sections were ordered intentionally, Draper said, noting that they chose to make the first section “Mindset Matters” since “the first approach to becoming a better loan officer is your mindset.”

The first section was intentionally placed at the forefront of the book as a productivity boost. “The vision that we had together was that this book would be

permanently sitting on a loan officer’s desk and anytime they’re in a rut, they can flip it open, go to a chapter, and find some inspiration,” Vieaux said.

The advice to each contributor was to “write about what you know.” Vieaux first approached Mike Faraci, founder and CEO of Red Button Media, who offered to write a chapter on video production. Draper asked industry coach Bill Hart to also write a chapter.

“He is one of the pioneers in the mortgage industry. He’s coached tons and tons and tons of loan officers, and also wrote the foreword to my [first] book,” Draper said. “He asked me what I thought he should write about, and I said ‘For me to tell you what to write about would be cheapening who you are. And so whatever you want to write about is exactly what we want written in this book.’ So those are the only parameters we gave him.”

The book came together relatively fast, Vieaux added, noting that by early December, contributed chapters started to trickle in. Of course, the chapter contributors were responsible for supplying QR codes and videos for their respective chapters.

Do Vieaux and Draper have a favorite piece of

“It’s been so rewarding to see people I’ve known in the industry for a long time posting that they read the book and that they’re rethinking how they go about their business planning.”

> Vieaux

the book or one that they would recommend above others? Each remarked, “That’s like asking me which child I love the most.”

Vieaux says he thinks every LO knows where they fall short. “If you’re a loan officer today and haven’t embraced social media, you’re depending on yesterday’s methods for marketing and building awareness. And that’s okay, people still have success doing that … if you’re that loan officer and that’s your weak spot, I’d say go to the personal branding and social media sections of the book,” Vieaux mused. Draper agrees. “I think the social media section is wildly important because I think that’s where most loan officers fail … they don’t understand how to leverage it correctly,” he reasoned.

The book’s release in March 2024 garnered “overwhelming” social media attention, Vieaux says. “I’d say 60% of [responses] are seasoned loan officers who are probably 10+ years in the business versus newer, younger LOs,” Vieaux said. “But the nextgen loan officer isn’t about age. It’s been so rewarding to see people I’ve known in the industry for a long

time posting that they read the book and that they’re rethinking how they go about their business planning.”

The buck doesn’t stop with one book, both Draper and Vieaux assure. Draper says he’s cooking up new ideas every day, and Vieaux says there will “definitely” be a sequel. “I want to turn this into “I’ve got a book that’ll be very similar to [Rethink Everything You Know About Being A Next-Gen Loan Officer] written from the real estate perspective for realtors,” Draper said. “I’m working right now on two other books that aren’t necessarily loan officer-specific which will be ‘Rethink Everything You Know About Chiropractic’ because I have a lot of friends in the chiropractic space … then that leads to the opportunity for ‘Rethink Everything You Know About Social Media For Chiropractors, for accountants, for roofing companies, etc.”

Draper added that it’s not time to reinvent the wheel. “I think it’s the book that can just keep on giving. We’re also working on a Rethink Everything You Know About CRMs,” he said. “I have people all the time [tell me that they’re] hurt that [they] didn’t get to be a part of that book. I think there are probably four or five editions of this book that every couple of years we’ll put out another one with 39 new perspectives [to] keep it fresh.” n

A warm welcome to you! I’m Kelly Hendricks, the Managing Editor of Mortgage Women Magazine and Senior Vice President of Delmar Mortgage, and it brings me great joy to extend this invitation to you. Throughout my career in the mortgage industry, I’ve been fortunate to have leaders and mentors who played pivotal roles in shaping my journey. I am thrilled to introduce a transformative initiative – the Mortgage Women Leadership Council, created by Mortgage Women Magazine.

In my role, I’ve experienced the challenges that women face in leadership within the mortgage sector. These challenges led to a profound realization — the need for a dynamic network to empower women in our industry. This realization is the driving force behind the creation of the Mortgage Women Leadership Council. I believe in the power of collective support, and I am excited about the opportunity to share and benefit from each other’s experiences.

Our mission is clear: to promote and empower women’s leadership in the mortgage sector. The council aims to create a supportive environment for professional growth, mentorship, and networking. Joining the

council comes with various benefits, including networking opportunities and access to industry-specific professional development resources. We understand the unique challenges women face in mortgage leadership and have tailored mentorship and support systems to address them.

I invite you to join this movement to empower women in the mortgage industry. The Mortgage Women Leadership Council is committed to fostering a welcoming and supportive environment. Your involvement will not only contribute to your personal and professional growth but also play a crucial role in advancing women’s leadership in our industry. To join or get involved, simply click here to apply.

Thank you for considering this invitation to join the Mortgage Women Leadership Council. For further inquiries about the council and details on how to join, please contact Beverly Bolnick at bbolnick@ambizmedia.com. Let’s work together to advance women’s leadership in the mortgage industry — because collective action brings about meaningful change.

Kelly Hendricks Managing Editor, Mortgage Women Magazine

As a valued member, enjoy these benefits:

Access to a Powerful Platform: Amplify your voice and influence through Mortgage Women Magazine, exclusive sponsored programs, email newsletters, and impactful events.

Editorial Opportunities: Showcase your expertise and insights through editorial features in Mortgage Women Magazine, gaining visibility and recognition among industry peers.

Awards and Recognition: Receive well-deserved recognition through our award programs, celebrating your achievements and contributions to the mortgage industry.

Community Support: Become part of a dedicated community committed to celebrating and driving meaningful progress in the mortgage sector. Connect with likeminded women leaders, share experiences, and foster collaborative initiatives.

Mortgage Women Magazine: Enjoy your complimentary digital subscription to Mortgage Women Magazine, the premier publication for women in mortgage. Read advice, learn about industry updates, and take in the inspiring stories of your peers.

Become a member today.

Join us and be a driving force in creating a more inclusive and thriving mortgage industry. Together, as a united community, we believe we can make real change.

Enjoy 1 year of your individual membership free! Use code MWM2024

mwlcouncil.com

BY ERICA DRZEWIECKI, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Like mailing your high school sweetheart a generous wedding present, or sending your first-born child to college to pursue his passion for rocket science after learning his dreams don’t involve taking over the family flower business, sometimes love means letting go.

For Norcom Mortgage CEO Phil DeFronzo, that’s what it was like selling his 25-branch retail division to CMG Financial this year.

“First of all, the salespeople that we have on the retail side were amazing. I mean, they really were some of the best,” DeFronzo said thoughtfully, inside Norcom’s Avon, Conn. home base exactly two weeks after the acquisition was announced.

It’s been 35 years since he and his mother started churning out mortgages from a one-room office behind Avon Appliance. In 2023, Norcom, now headquartered in a 35,000 sq. ft. building on a

He has high hopes for distributed retail in mortgage, particularly for large companies like CMG, which originated over $21.5 billion in 2023.

“I believe what’s going to happen is you’re going to see interest rates drop down a little bit, you’ll see inventory pick up, and a number of loan officers will get out of the business. So if volume goes up 30% and you have 30% [fewer] loan officers, the distributed retail is going to be a great play. People ask me, why are you getting out of it if you feel that way? We just wanted to focus on one thing. You have limited

I felt good about handing over some great friends and great people to a great company. It’s the right thing to do.

> Phil DeFronzo, CEO and founder, Norcom Mortgage

sprawling, forested campus, reported $482 million in loan volume on Modex, with 121 active loan officers and 38 branch locations across the country.

“We’ve been together for 25 years, so they’re really like our family,” DeFronzo said of his former retail team, now tasked with helping CMG pad out its Northeastern footprint.

“We had a focus group recently and were looking at our process and marketing and it was good, but when you went out there and looked comparably to a company like CMG, their marketing platform and what they can give their loan officers, I felt like a parent holding my kids back in a way,” DeFronzo said. “Why am I trying to invest in two platforms? I’m better off focusing on one, and letting the people who are the great producers in our company go with a company that already has the things they need to take their business to the next level.”

resources when you’re not a giant company. Where do you see growth and where can you place those resources? 80% of our volume was TPO, so it made more sense for us to focus on that.”

DeFronzo is now subdividing Norcom’s building into different suites, which will be rented out to several different mortgage-related businesses. CMG Financial is one of them.

“I’ve known Chris George for years. He’s a good guy. It’s impressive what he’s built. I felt good about handing over some great friends and great people to a great company. It’s the right thing to do,” DeFronzo remarked.

CEO of the San Ramon, Calif.-based CMG Financial, George is a former Mortgage Bankers Association Chairman and founded his company in 1993, just a few years after DeFronzo established Norcom.

“Phil and I both started our companies with

> DeFronzo poses on the Norcom campus next to the tree donated by employees in honor of his mother Sophie, who passed away in 2015. Sophie worked with her son when he founded Norcom in 1989 and during the company’s first 20 years in business.

similar roots and a shared passion to give more home buyers access to homeownership,” George said in CMG’s April 11 announcement about the purchase. “Thirty years later, we’re still living out our dreams by helping buyers and owners alike achieve theirs.”

DeFronzo and his team may have shed an arm, but they’re growing a leg.

“I love this business, and I haven’t been this excited in years,” DeFronzo said. “We were able to pick up some amazing account executives, some of the top of the country. We’re kind of blowing it out of the water.”

In 2022 Norcom stripped down its third-

party origination (TPO) platform and web portal, relaunching TPO GO. The sales team is being led by Vice President Trey Van de Bogart, who joined the company in 2020.

“Going all in on wholesale is a huge opportunity,” Van de Bogart told NMP. “It’s very exciting. We have a great product menu, and we want to focus on what we do really well.”

DeFronzo praised the young leader for bringing a different perspective to the role.

“It’s fresh to bring somebody who’s comfortable in processes and systems into the fold,” he pointed out. “We do an amazing renovation business with a lot of different products … Some of the mortgage brokers that we work with are in market areas that standard banks or loan officers don’t support, like

Hartford and New Haven.”

TPO GO is projected to make over $2 billion in wholesale volume in 2024, which would place it among the top 15 wholesale lenders in the U.S.

“Because we have such great people, in the next year we’re going to be trying to get the account executives we have to grow to as much as we can,” DeFronzo said. “We’re going to try to expand out a little bit in markets that we don’t have AEs in that might be good markets for us. We’ll do ongoing training on all different products. We’re positioned to really grow TPO GO.”

Company leaders are looking at opportunities to weave automation more deeply into their business in an effort to double down on efficiency.

“I don’t want it to just be about volume,” DeFronzo said. “You retain employees by giving them opportunities and helping them grow their business and treating them the way that you would want to be treated. And I think that that’s what we do.”

He’ll be the first to admit that it was a risk on Norcom’s part to go hot and heavy on wholesale.

“More to lose, big time. I don’t think the market’s that saturated now, but I wonder three years from now if a big company will just come in and blow people away.”

One of Norcom’s strengths is its boutique product line, specializing in down payment assistance programs, bonds, renovation loans, and FHA lending. That and the personal service.

New Account Executives include Katie Plezia and Barbara Guarino, formerly of Finance of America Companies.

“These are some really amazing AEs that have added a lot of value,” DeFronzo said. “We’re now reallocating resources to that side of the business, and we’re trying to do things that are fun and innovative with TPO GO.”

Broker market share grew to 24.3% in the final quarter of 2023, the highest it’s been since 2009. This is encouraging not only for large non-bank firms like United Wholesale Mortgage — responsible for 48% of the wholesale-broker originations in 2023 — but also for small- to mediumsized lenders like Norcom.

“It seems like the reputation of brokers has kind of healed a bit since the crisis,” DeFronzo said.

“You’ve seen more consumers drawn towards that channel and more educated about what they do. If you’re a small producer doing five- to $10 million a year, it may make more financial sense for you to be a broker and be able to give a lot more options to your borrowers, not only just price, but products.”

But like the tides, the mortgage market and the economy as a whole will always change. It’s been a challenging year for industry professionals. As companies shuttered and people left the business altogether, those who stuck around to ride out the cycles had to be prepared to contract and grow.

“You never know what the next stage is going

said. “The local independent mortgage bank is going to struggle to survive. There [are] a few small, family-run, independent mortgage banks that are holding their own. They’re profitable because they’ve been able to rightsize their volume or operations. That really relegates them to what I call super brokers — almost as small as a mortgage broker, but they have their FHA approval.”

Roque said he’s always admired DeFronzo and what he’s been able to accomplish building Norcom but went on to call the recent sale “risky.”

“You don’t make the kind of money in wholesale that you do in retail or even servicing, so I think it’s a risky move on Phil’s part, but Phil’s a really smart guy.

Retail mortgage lenders need to have scale in order to be competitive and to be successful today.

> Rick Roque, EVP of retail sales, Sierra Pacific Mortgage

to be,” DeFronzo said. “I always tell people that coming out of ‘08, I had the best year I’ve ever had in ‘09 because by then half the people were out of the business. Just be adaptable.”

It’s not hard to tell, he loves this business. DeFronzo’s mother worked with him until she was in her 80s. At 60 years old, he plans on working for at least another decade before retiring.

A lot of strong leaders are selling right now, as retention without growth leads to attrition, according to mortgage banker and entrepreneur Rick Roque, who founded Menlo Capital and recently became Executive Vice President of Retail Sales at Sierra Pacific Mortgage.

“Retail mortgage lenders need to have scale in order to be competitive and to be successful today,” Roque

He’s got a lot of capital,” Roque said. “He’s got other revenue channels outside of wholesale, he’s got his insurance company … I think it’s a risky strategy for sure, but I also think that there are things unique to Phil and NORCOM that help mitigate some of those risks.”

With UWM called to court earlier this year for allegedly scheming with brokers to increase its market share, it could potentially (or eventually) mean more business for smaller companies, Roque said.

“There’s no question that UWM is very much on its heels from a regulatory, scrutiny, and industry standpoint. I think that if for whatever reason there were regulatory or legal pressures for brokers to diversify, then naturally companies like Phil’s are going to pick up on that volume.” n

This month, National Mortgage Professional Magazine features its “Most Connected Mortgage Professionals of 2024.” They are the top industry professionals selected by editors for their participation in the world of social media.

The winners were chosen in part based on the nominations we received and focused on these social media platforms: Twitter, Facebook, LinkedIn, Instagram, YouTube, and TikTok. Winners were not selected based just on their numbers.

All information was supplied by the nominees and reviewed by magazine staff. Social media stats are as of March 29, 2024.

Total LinkedIn Connections: 12,270

Facebook Business Page Likes: 3,448

Total Instagram Followers: 1,698

Partner

Equity Prime Mortgage

What do you find are the most effective strategies for expanding and maintaining a strong network in the mortgage industry?

If you want your connections and business relationships to know who you are, you need to be consistent and stay authentic to your brand, who you are, and your message. Start with, do you know who you are? Once you know what your message is and how you want others to “know” you, you need to get “out there” with that message consistently. Use all modes available to you — not solely a social media platform. Pick up the phone for a chat, place a face-to-face call (video meetings), even leverage the “gold standard” handwritten note for that personal touch. Never underestimate the power of personal connection.

What emerging trends or innovations in social media do you see as particularly impactful for mortgage professionals, and how do you plan to adapt your strategies accordingly?

Video is key. Everyone should have a podcast with a consistent airing schedule. I host a Wednesday Wisdom podcast and have a regularly tuned-in audience. It’s become one of the hallmarks of my brand. I recommend evaluating which social platform serves you as the best resource for the engagement you desire. Lean into that one the most, but still utilize the others (IG, YouTube, LinkedIn, Facebook). Be cautious of AI so you don’t lose your “voice” or uniqueness.

What metrics or key performance indicators (KPIs) do you track to evaluate the effectiveness of your social media activities in building and nurturing your network?

This is an exercise in self-care. On a weekly basis, without fail, I review posts to see what received the most engagement, the most likes, and look for what caused these to rise to the top. It’s important to pay attention to what your connections are drawn to so you can capture their attention in future posts.

Total LinkedIn Connections: 27,629

Total Instagram Followers: 3,002

Number Of X Followers: 2,665

Facebook Business Page Likes: 2,300

President Citywide Home Loans

Throughout his 35-year tenure in the mortgage industry, John Cady has approached his career as a perpetual student, constantly seeking opportunities to learn and grow. Cultivating genuine connections and friendships has been a cornerstone of his networking strategy.

He has always believed in the power of relationships, both professionally and personally, and has actively sought to expand his network by engaging with individuals and companies across the industry. As a result, his network has grown organically over the years, encompassing a diverse array of industry professionals who share his passion for excellence and innovation.

What emerging trends or innovations in social media do you see as particularly impactful for mortgage professionals, and how do you plan to adapt your strategies accordingly?

The most impactful trend in social media lies in personalized content creation and authentic engagement. While AI certainly holds promise, the real power lies in loan officers actively participating in social media platforms, crafting personalized posts, and sharing their expertise through video content. By creating informative and engaging videos where loan officers speak directly to consumers, share educational content, and showcase their expertise, they can build trust and credibility as mortgage providers. In an era where consumers place high value on authentic interactions and expertise, becoming a trusted mortgage influencer on social media is crucial.

What metrics or key performance indicators (KPIs) do you track to evaluate the effectiveness of your social media activities in building and nurturing your network?

By taking a nuanced view of our social media presence, we gain insights into who is truly listening and how our content impacts our business. Our goal is to move beyond static metrics and vanity metrics, using our time on social media to foster genuine connections and build a community around our brand.

YouTube Subscribers: 10,100

Total Instagram Followers: 1,133

Total LinkedIn Connections: 486

Can you tell us about your experience in the mortgage industry and how you’ve built your network over the years?

I have been in the business for just over three years now. I was introduced to it during the refi boom after I graduated from UCSB in 2020. I was looking for a career where I could make a lot of money, help a lot of people, and, most importantly, make an impact.

I saw an opportunity in the mortgage business in the sense that there was a great need for better service and education to the consumer but an even bigger opportunity to better educate and train the loan officer.

As soon as I passed my exam, I began creating content (YouTube videos) for new loan officers on things like how to pass the exam, how to get their license, how to take an application, and much more. I was sharing everything I was learning in my own business as it was happening. I would learn something on Tuesday and make a video on it that weekend. I currently have roughly 10,000 followers on my YouTube channel and I average 1,200 views every 48 hours or 219,000 views per year.

What emerging trends or innovations in social media do you see as particularly impactful for mortgage professionals, and how do you plan to adapt your strategies accordingly?

There are so many upgrades and innovations and trends in technology and social media as a whole that it’s hard to say what comes next or what will be next but I do see us going further and further toward transparency, education, and speed.

Social media has also become a living resume — we have never had that. If someone wants to know about you, they go on Google, YouTube, or Instagram. And even if they don’t see you, that still says something about you.

Total LinkedIn Connections: 29,000 Facebook Business Page Likes: 7,300

Total Instagram Followers: 2,757

Number Of X Followers: 438

Divisional VP of Business Development

American Financial Network Inc.

With over 30 years of mortgage experience, Jonny Fowler has been helping retail mortgage managers build companies since 1998. His passion for the industry is apparent in everything he does, but the introduction of social media into his arsenal has helped him reach even more people.

Fowler is constantly trying to bring value both with referral partners and the loan officers at AFN. Using his expansive knowledge of both industries, he teaches thousands of Realtors how to transform their business using social media. Fowler also provides a constant sounding board for new ideas on lead generation and business. He is always there for anyone who reaches out for help.

What emerging trends or innovations in social media do you see as particularly impactful for mortgage professionals, and how do you plan to adapt your strategies accordingly?

Currently, short-form video is still extremely effective, but it should be used in different ways than just explaining products. Use reels and shorts to talk about how you solve common problems and help your consumers, along with showing yourself in and around your community.

What metrics or key performance indicators (KPIs) do you track to evaluate the effectiveness of your social media activities in building and nurturing your network?

Engagement is key; without it, you are not seen. Look at what you are posting and at what times. You have to know your audience and what they want to see, which will be indicated by your engagement rate.

Total LinkedIn Connections: 21,000

Total Instagram Followers: 189

Founder & CEO Insellerate

Josh Friend began his career as an LO in 1999. Over the past 25 years, he trained thousands of LOs, processors, and managers, and marketed to millions of consumers; with that experience, Friend has dedicated himself to building software for the mortgage industry and enabling lenders to close more loans with Insellerate’s CRM.

Friend dedicates himself solely to helping other lenders succeed through better borrower engagement. He is transforming the borrower and LO experience with his technology company, Insellerate, which enables lenders to achieve higher revenue goals while creating customers for life.

In addition, Friend is viewed as a thought leader within the mortgage and technology space and has been published numerous times in leading real estate finance publications such as National Mortgage Professional, Tomorrow’s Mortgage Executive, National Mortgage News, and Today’s Lending Insight. He is also a recognized speaker who regularly presents at national and state mortgage association conferences. He has been a featured presenter at Lead Generation World, HW ENGAGE Marketing, CMBA Innovators Conference, Rob Chrisman Market Updates, Fintech Hunting Podcast, and the Lend, Laugh, and Eat Podcast, to name a few.

Total LinkedIn Connections: 2,453 Facebook Business Page Likes: 974

Number Of X Followers: 469

Total Instagram Followers: 449

Regional Manager

Citywide Home Loans

Over the past few years, David Hosterman has been nationally recognized as a top loan officer in the country. He has been featured in national publications such as Forbes, CBS Money Watch, The Street, US News & World Report, Lending Tree, Realtor.com, Credit Karma, Trulia, Nerd Wallet, and MSN Money. In addition, he is the host of two Denver-based radio shows on KDMT Denver’s Money Talk 1690 AM.

What do you find are the most effective strategies for expanding and maintaining a strong network in the mortgage industry?

As a regional manager at Citywide Home Loans, I am responsible for ensuring the mortgage process is a smooth and easy experience. My team and I pride ourselves on our excellent customer service and strive to communicate constantly with my clients, Realtors, and referral partners. You can count on my team and I for responsible, honest, and ethical service at every step of the process.

Total Instagram Followers: 24,800 Facebook Business Page Likes: 570

Total LinkedIn Connections: 394

Mortgage Broker

Anna Kara Loans

What do you find are the most effective strategies for expanding and maintaining a strong network in the mortgage industry?

In the mortgage industry, traditional cold calls are being replaced by the warmth of social media interactions, where authenticity reigns supreme. Building trust through authenticity: genuine personalities resonate with people. By authentically sharing your passions and interests, you transform from a mere loan officer into a relatable ally. This authenticity lays the groundwork for trust, the cornerstone of a robust network. By blending social media’s expansive reach with your authentic persona, you create a mutually beneficial scenario. You cultivate a network of connections who genuinely trust and appreciate you, while solidifying your status as a go-to expert in the mortgage realm. So, bid farewell to outdated strategies — authenticity is the new currency in the realm of social media networking.

What emerging trends or innovations in social media do you see as particularly impactful for mortgage professionals, and how do you plan to adapt your strategies accordingly?

Building a personal brand around your expertise by producing high quality content for multiple social media platforms. Creating community by providing value and cultivating trust in your audience.

What metrics or key performance indicators (KPIs) do you track to evaluate the effectiveness of your social media activities in building and nurturing your network?

By using the insights feature and seeing which content is resonating with my audience and shifting my strategy accordingly.

What strategies do you employ to ensure that your social media presence reflects your professional expertise and credibility as a mortgage professional?

My main strategy is always providing value, being honest, and moving with integrity. I do not post for likes or shares.

Total Instagram Followers: 329,000

TikTok Followers: 198,300

Total LinkedIn Connections: 290

Co-Founder

“My plan was to be a mortgage educator, to inform consumers on what a mortgage is,” What’s A Mortgage (WAM) co-founder Minh Nguyen said. “That’s how we came up with a name. When I started making content and putting the consumer first without thinking about getting something back, is when it started working.”

But no one is a natural-born star, and as Nguyen says, it’s okay to be bad at it when first getting started. Just keep posting consistently.

“I didn’t have a good editor, so our clips weren’t amazing. Transitions were horrible. The lighting was bad, everything was horrible,” Nguyen said. “But I posted twice a day and I went live twice a week. It was crappy going live because I only had five people watching me — my mom, my dad, my brother, my business partner, and my business partner’s parents.”

It took Nguyen a while to build up an audience, going from five viewers in June 2017 to 100 or 200 per video in February 2018. All it took was one video going viral — his V-O-E video, where he sings, “Gimme a V, I got your V, I got your V! Gimme an O, I got your O, I got your O!” with a cheerleader-type dance to teach viewers about verification of employment.

It initially got 2,000 views, and after liquidating his house in March to pay off his debts, Nguyen used some of the remaining money to run the video as a YouTube ad in May. He was able to fund nine loans off the proceeds. The rest is history, he says, and he kept building his business from there.