LEGACY OF INEQUITY DEMANDS BOLD STEPS

REAL ESTATE INVESTORS:

Demons Destroying Housing Or Angels Seeking Profits?

APPALACHIA IS AN UNTAPPED FRONTIER FOR LOs

LEAPFROG THE REAL ESTATE AGENT Influencers Solve Lenders’ Transactional Value Proposition GEN Z MAY BE YOUNG BUT IT’S READY FOR MORTGAGES A PUBLICATION OF AMERICAN BUSINESS MEDIA SELLING SHORT Tackling the Sales Training Drought > Pablo Martinez, CEO, Equity Smart Home Loans Vol. 16, Issue 3 $20.00 MARCH 2024

INSIDE: 2024 WOMEN OF INSPIRATION AWARDS

LEGACY OF INEQUITY DEMANDS BOLD STEPS

REAL ESTATE INVESTORS:

Demons Destroying Housing Or Angels Seeking Profits?

APPALACHIA IS AN UNTAPPED FRONTIER FOR LOs

LEAPFROG THE REAL ESTATE AGENT Influencers Solve Lenders’ Transactional Value Proposition GEN Z MAY BE YOUNG BUT IT’S READY FOR MORTGAGES A PUBLICATION OF AMERICAN BUSINESS MEDIA SELLING SHORT Tackling the Sales Training Drought > Pablo Martinez, CEO, Equity Smart Home Loans Vol. 16, Issue 3 $20.00 MARCH 2024

INSIDE: 2024 WOMEN OF INSPIRATION AWARDS

Acra Lending is a registered dba name of Citadel Servicing Corporation, 3 Ada Parkway, Ste 200A, Irvine, CA 92618; (888)-800-7661 (“CSC”) NMLS ID# 144549, Licensed under Arizona Mortgage Bankers License # 1034431, California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act license # 41DBO-74196, Finance Lenders License # 60DB0-94450, CA-DRE #01799059, Florida Mortgage Lender Servicer License # MLD523, Georgia Mortgage Lender License/Registration # 23462, Minnesota Residential Mortgage Originator License Other Trade Name #1 MN-MO-144549.1, Nevada Mortgage Company License # 4449, North Carolina Mortgage Lender License # L-160722, Oregon Mortgage Lending License # ML-5599, Tennessee Mortgage License # 125315, Utah-DRE Mortgage Entity License - Other Trade Name #1 12074249, Virginia Lender License # MC-5845. For mortgage professionals only. This is for informational purposes only. For legal and professional advice on applicable state and local licensing requirements that apply to you, please contact an attorney. Acra Lending is an equal opportunity lender. Rates, terms, and programs subject to change without notice. O er of credit subject to credit approval per applicable underwriting and program guidelines, applicant eligibility, and market conditions. Not all applicants may qualify. Not valid in the following states: AK, ND, and SD. CONTACT US TODAY TO GET STARTED THE INDUSTRY’S LEADING PRIVATE MORTGAGE LENDER SALES@ACRALENDING.COM | WWW.ACRALENDING.COM WHAT IS GLIDE? Glide is an intuitive broker portal platform designed to make your life as a broker simpler and more transparent than ever before Correspond With Us: Seamless communication channels within Glide, ensuring you're always well-informed Upload Files: Conveniently upload and share essential documents securely, reducing paperwork and potential errors View Your Pipeline: Real-time pipeline visibility, enabling you to monitor and manage your files e ortlessly Income Desk: Simplified and fast income calculations Pricing Scenarios: Generate pricing scenarios swiftly, allowing you to present the best options to your clients WHAT ARE KEY FEATURES? at www.alglide.com GLIDE GLIDE WITH ACRA OVERVIEW OR CALL US TODAY! (888) 800-7661 GET STARTED AT ALGLIDE.COM THE FUTURE OF BROKER EFFICIENCY AND TRANSPARENCY

nationalmortgageprofessional.com

4

Paying Attention

The need exists to open our arms and expand our minds to better reflect the mortgage industry’s diversity.

6 Make Sure New Hires Are The Right Fit

In a diverse mortgage environment, MLO recruits are not one-size-fits-all. Make the smart choices.

8 Brokers Need To Analyze The Market For Opportunities

A four-part analysis called SWOT can be a business starter for mortgage brokers.

10

203(k) Financing Could Build Your Business

Much needed help could be coming for 203(k) financing, which until now have dropped in popularity.

14

History Of Inequity Shows Need For Change

The mortgage industry needs more minorityowned brokerages for a more equitable economy.

18

Non-QM Resource Guide

AMC Resource Guide

19 People on the Move

28

See who the movers and shakers are in the mortgage industry.

20

Build-A-Broker: Influencer Leads Weaken Need For Referrals

The success of influencergenerated social media leads at one mortgage company may upend the MLO-real estate agent relationship.

25

Originator Tech

Resource Guide

Wholesale Lender Resource Guide

26

Your First Million Dollars: No Such Thing As Small Moments

Simple acts of kindness can have a meaningful impact.

Benchmarks and Best Practices:

Gen Z Could Be The Greatest Generation

The newest generation of homebuyers comes ready to buy with unique financial circumstances.

30

My Best Deal: Kindness Paid 5X Over Gene Griffin says his Best Deal was free advice that has led to five lucrative referrals.

32

Data Bank

34

The Potential Of Appalachia MLOs might be surprised to find out there is money to be made among the hollers of Appalachia.

42

Tackle 2024 With Understanding Private Investors

In the housing industry, some want them tarred and feathered. But private investors say they’re angels chasing profits.

80

Non-QM Lender Directory

81

Wholesale Lender Directory

Originator Tech Directory

AMC Directory

82

Facebook Thoughts: Meet My Mentor — Richie Rich

nationalmortgageprofessional.com MARCH 2024 Volume 16 Issue 3 CONTENTS

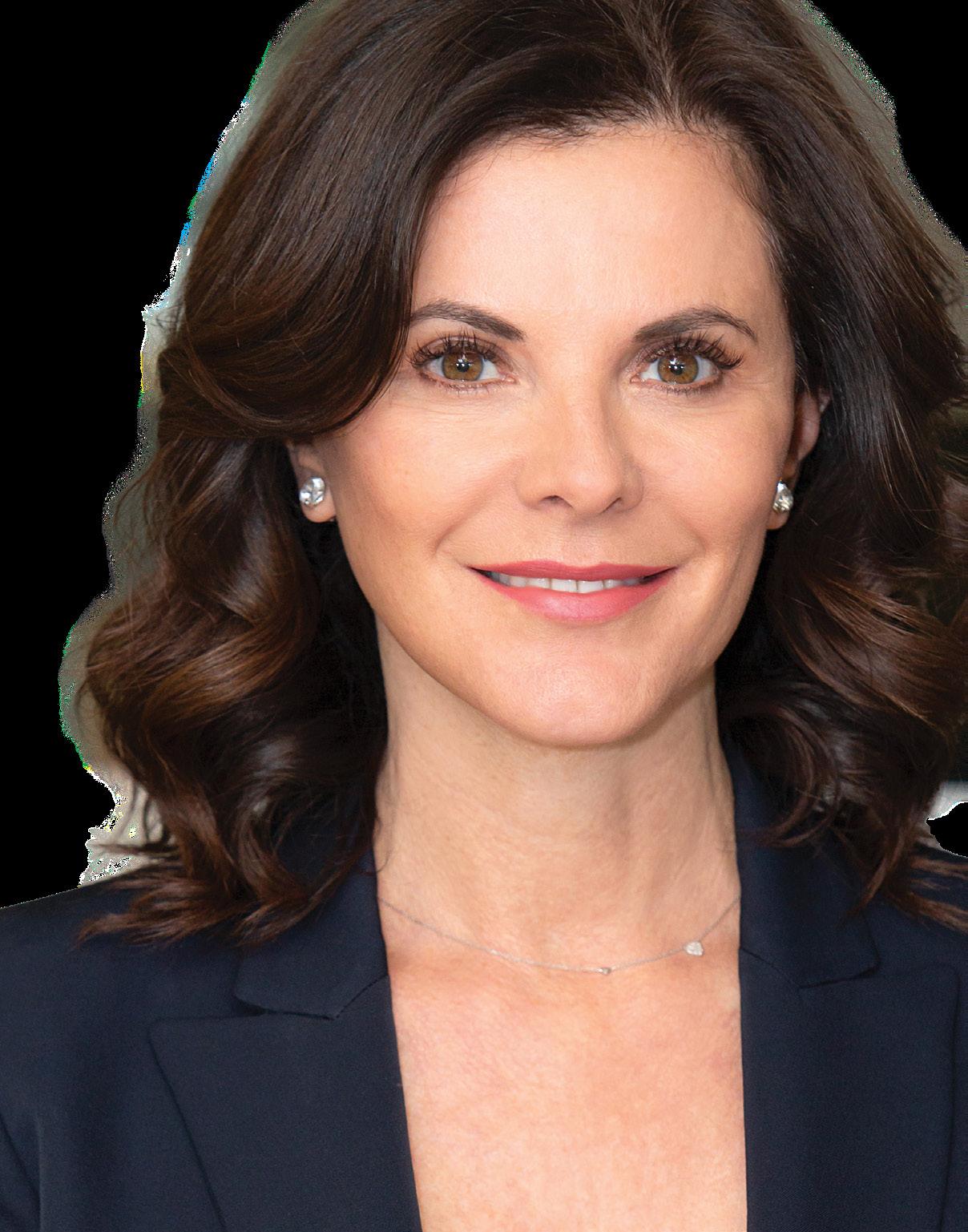

> 40 Under 40 honoree SPECIAL AWARDS SECTION PAGE 56 2024 MORTGAGE LENDING WOMEN OF INSPIRATION Step into the world of National Mortgage Professional Magazine’s 2024 Mortgage Lending Women of Inspiration, where leaders, champions, mentors echo the resounding spirit of these remarkable individuals.

STORY

THE RIGHT TRAINING TO OVERCOME

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 3

COVER

PAGE 50

KNOWLEDGE GAPS Originators are clamoring for more training programs whether they are newly licensed or deeply experienced in the industry

LETTER FROM THE PUBLISHER

Minority Opinions

The great Richard Starkey summed it up pretty well a few decades ago. “I get by with a little help from my friends.”

Our aim here is to give mortgage originators and industry leaders the insight, help, and strategies that they need to be as successful as possible. Sometimes, that takes the form of articles talking about marketing tips. Sometimes, it takes shape as a piece looking at new programs. Occasionally, it’s a look at what the top originators are doing. And every now and then, it means finding inspiration in a song by Ringo Starr.

A couple of months ago, a broker in the Tampa area reached out on our social media channel. He wasn’t particularly happy because a feature we had done on top industry titans didn’t include anyone of color. He was dumbfounded that we could be so blind. And he made that pretty clear in the comments that he left on our post.

This could have been someone we simply ignored. It could have turned into a big social media brouhaha. Instead, I simply called him. I told him I agreed that our selection was probably lacking in diversity. He laughed. He appreciated that we were reaching out. And then he talked about how difficult it was for Black brokers to get a fair shake. I quizzed him a little bit about what he meant, especially since he led the conversation by saying that he did not believe in DEI initiatives.

I thought he made good points. And so I told him that I also didn’t believe that we have a voice like his represented in this magazine. I invited him to write down his thoughts, and boy did he.

His name is Sam Harris, and he’s with Blue Dolphin Financial in Florida. I invite you to read his essay in this issue. I think it is important, frankly, that we look at how we keep the mortgage lending world open to everyone. If we’re here to provide the financing of the American dream for everyone, we need to know how to reach everyone.

Sam has his own ideas. And what he talks about now is just the start. It’s pretty clear none of this goes away forever. We all need to pay attention, and we need to ensure that our arms are open and that we are willing to expand our minds.

Because, after all, without that, how could any of us be national mortgage professionals?

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak

STAFF WRITERS

Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully

CONTRIBUTING WRITERS

Regina Morgan

ADVERTISING SALES EXECUTIVE

Nicole Coughlin

ADVERTISING ASSOCIATE

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Krystina Coffey, Matthew Mullins, MULTIMEDIA SPECIALIST

Alan Nero

MEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Joel Berman

FOUNDING PUBLISHER

VINCENT M. VALVO Publisher, Editor-in-Chief

MARCH 2024 Submit your news to editors@ambizmedia.com If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com © 2024 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com Volume 16 Issue 3

4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

Join Now 800.400.5451 fnba.com/wholesale Providing Certainty in an Uncertain Market Easiest P&L in the Industry 9 out of 10 Approved Average App to CTC in 22 Business Days Simple Guidelines Lending in All 50 States

Watch Who You Hire

In a diverse mortgage environment, MLO recruits are not one-size-fits-all

BY DAVE HERSHMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

After a period of bloating the industry with loan officers and operations staff so that we could keep up with the refinance boom of all times during the pandemic, the industry has shrunk like an accordion in response to the “aftermath.” Interesting word “aftermath” used to describe what has happened in the past two years because of the root of the word — math.

After all, this is all about math. If you cut production by 65%, then you have no chance of making the math work with too many employees. Thus, the accordion analogy, only there was no music coming from shrinking production — only cries of pain.

Since I have been in the industry for over 40 years (yes, I started when I was seven years old) — I certainly have seen plenty of cycles. Following a refinance boom, we saw the bond market sell-off in 1987, as the 10-year Treasury rose to over 10.0% in short order. This led to Black Monday, a stock market crash in October. Plenty of ups and downs and euphoria and pain.

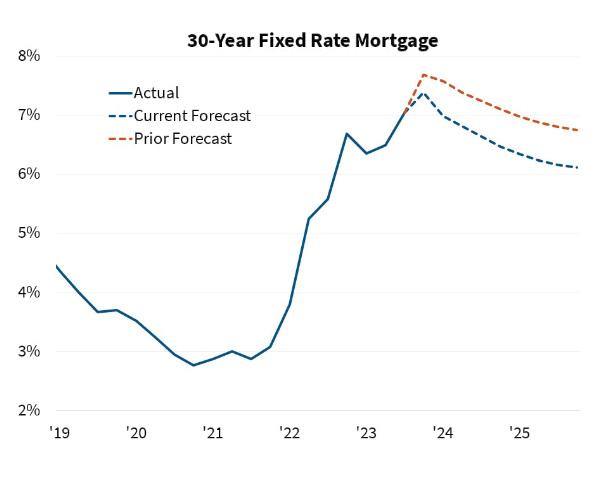

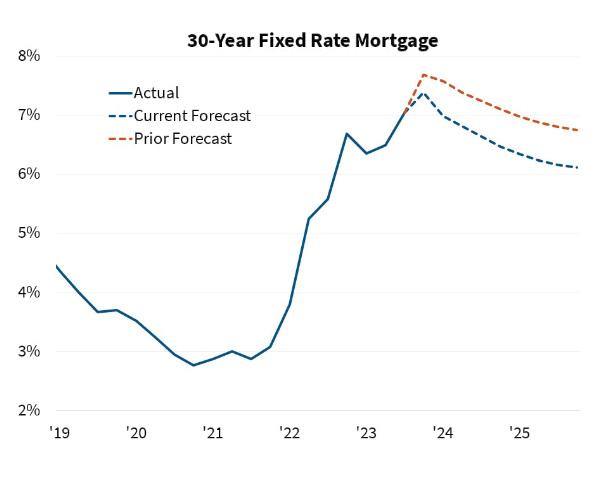

I can’t predict the future, but I do see plenty of chances for a refinance boom coming back, as well as the real estate market rebounding somewhat. It likely

won’t be like the sub 3.0% pandemic days, but people will be able to get out of those 7.5% mortgages. Production will increase enough that we will start hiring again. And this time, we will hopefully be a bit more cautious.

To that I say — watch who you hire. Think of the refinance call centers shutting down and candidates flooding mortgage companies with applications. Yet, the majority of call center loan officers were not a match for street mortgage companies. Many left banks that were deemphasizing mortgage companies to find that going on the street in a major slump was not such a good idea as well.

There are so many different types of mortgage companies:

• Call centers

• Banks and credit unions

• Builder-owned or affiliated companies

• Real estate-owned or affiliated companies.

• Financial services companies

• Independent/correspondent mortgage bankers

• Mortgage brokers

Each does business in a different way, especially with regard to attracting production. And the profile of someone who will fit their model does not necessarily fit another model. Mind you, someone who has all the tools and makeup of a top producer is likely to succeed in any model. But even in this case, there can be conflicts. Someone with a very independent small mortgage broker is not likely to fit in a large formal banking environment.

Even training for each of these models should vary as the way one would approach the business and what is acceptable will vary from model to model. Sitting in a bank branch is not the same as sitting on a builder site or

serving it remotely.

I started in the industry inside a real estate office, and I have coached, hired, and supervised in-house loan officers in this model. It is amazing to me how this type of situation is viewed:

• Loan officers coming in off the street think that it will be “easier” because the agents and managers will support them.

• Managers hiring loan officers think that an average loan officer in another model will thrive in this model because they will have access to real estate agents.

Outside of the aforementioned loan officer with “all the traits of a great producer” — nothing could be further from the truth. That is why I am dedicating the remainder of this year, 2024, to be the year that I deliver the truth to the industry. Sitting in a real estate office or serving a real estate office remotely is not the same job as any other loan officer position in the industry. From a management perspective, the hiring, training, and support will need to be targeted toward what these loan officers do for a living.

In other words, we have to stop painting with a broad brush. This article will be the first in a series of articles that will share the name of my newest training course — Inside the Glass House. n

Dave Hershman is the top author in this industry with six books published as well as the founder of the OriginationPro Marketing System and the OriginationPro’s on-line comprehensive mortgage school. Dave is also Senior VP of Sales for Weichert Financial Services. His site is www.OriginationPro.com and he can be reached at dave@hershmangroup.com

DAVE HERSHMAN 6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 RECRUITING, TRAINING, AND MENTORING CORNER

The majority of call center loan officers were not a match for street mortgage companies.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 7

Navigating The Real Estate Landscape

A SWOT analysis for mortgage brokers could be a valuable tool

BY ERICA LACENTRA, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

As we delve further into 2024, the real estate market remains a dynamic and ever-changing industry, holding both challenges and opportunities. For mortgage brokers seeking to thrive in this evolving landscape, a detailed understanding of the current state of the market is crucial. Using a SWOT analysis allows mortgage professionals to recognize the industry’s Strengths, Weaknesses, Opportunities, and Threats, enabling better planning for the coming year.

STRENGTHS:

The real estate market faced challenges in 2023, with rising interest rates and increased costs. However,

the real estate market, particularly where demand is concerned, and presents big opportunities for mortgage brokers.

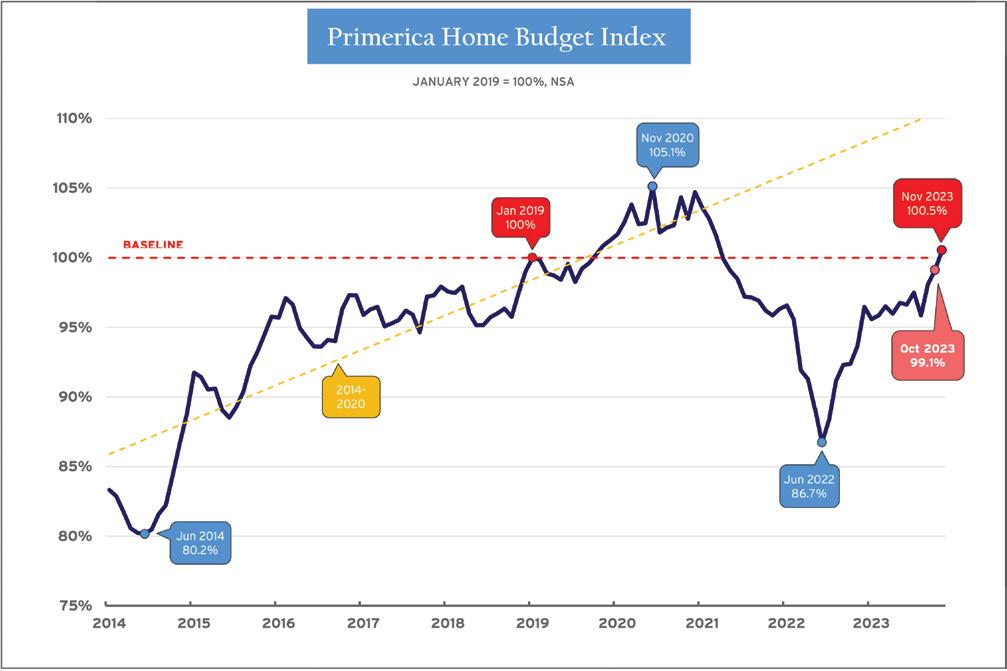

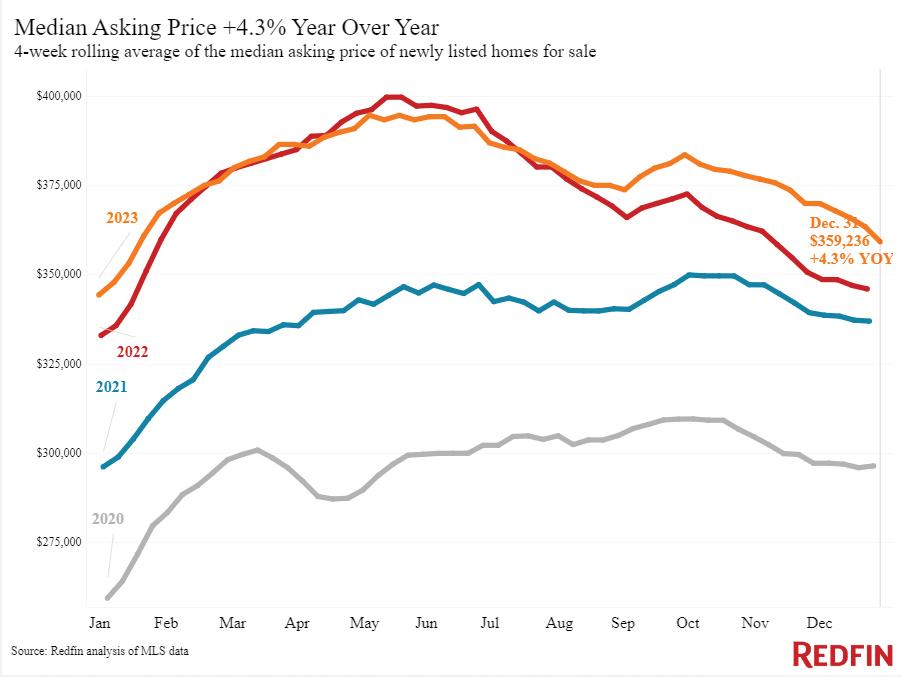

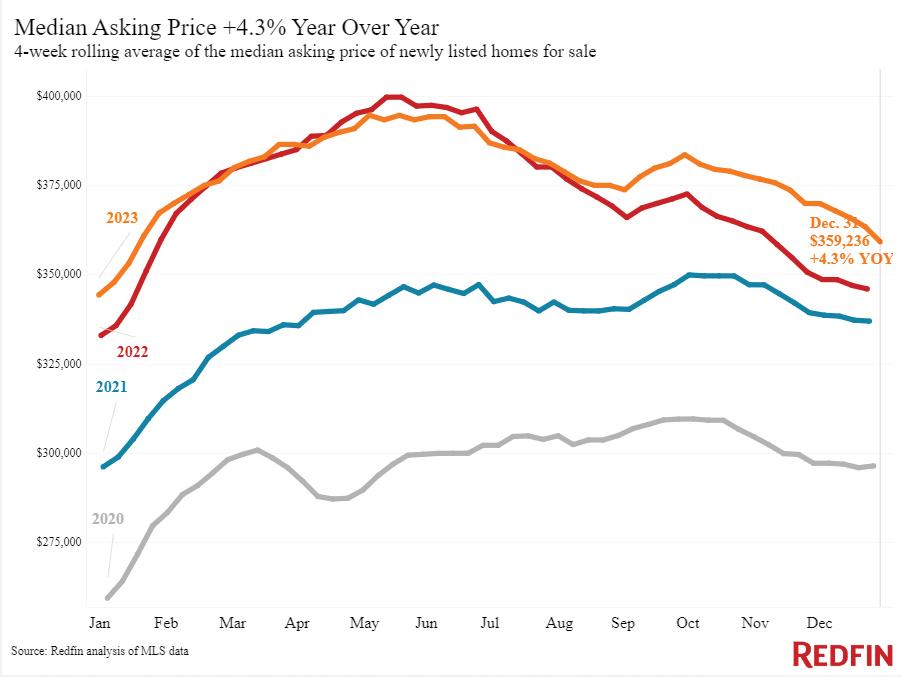

Another area of strength, as suggested by 2024 forecasts, is predicted stability in interest rates and home prices. While opinions on Federal Reserve actions may differ, the consensus is that major rate fluctuations are unlikely. This anticipated stability allows the real estate industry to enjoy a more predictable environment, in contrast to the volatility experienced in 2023. Steady rates and minimal rate adjustments are expected to stabilize home prices.

WEAKNESSES:

Despite optimistic sentiments, there is a concern that affordability remains a notable weakness in the real estate market. Increased home prices, coupled with higher rates, create a barrier to entry for many homebuyers, especially

One of the greatest areas of opportunity comes from a mortgage broker’s ability to leverage the pent-up demand from the past couple of years.

first-time buyers. Affordability concerns also extend to the rental market, affecting landlords as expenses may outpace rental income. This can certainly cut down on mortgage brokers’ pool of potential clients.

Another area of weakness for the real estate industry is caused by general economic uncertainty. Economic volatility, including ongoing geopolitical tensions, poses a potential problem for the real estate industry. Uncertainty in economic conditions can lead to hesitancy among individuals making significant investment or purchasing decisions, impacting investor confidence and overall market stability.

OPPORTUNITIES:

One of the greatest areas of opportunity comes from a mortgage broker’s ability to leverage the pent-up demand from the past couple of years. With predictions of small decreases in home prices and an expected increase in new listings, this is the perfect opportunity for brokers to strike while the iron is hot.

Also, as more individuals recognize these more favorable industry conditions and seek to buy homes, brokers have tremendous opportunities to tap into that business. Additionally, homeowners in areas with soaring prices may look to cash out on their equity, contributing to increased home sales and opportunities for brokers.

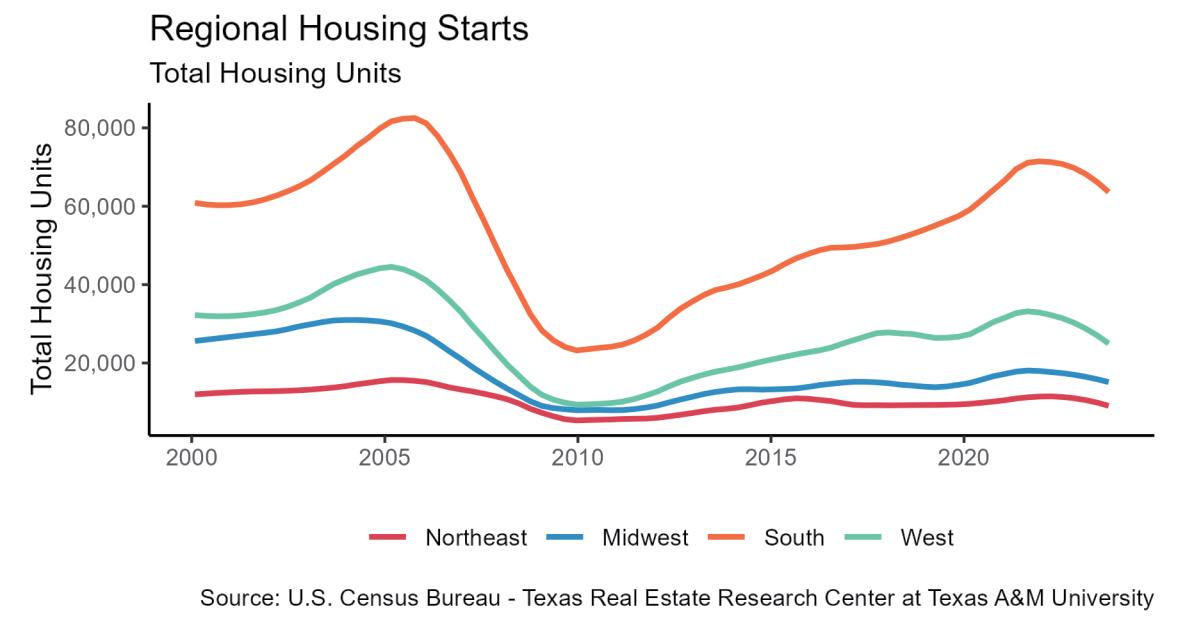

Another major opportunity for mortgage brokers is the potential that exists within new construction. Brokers that recognize the persistent lack of inventory should recognize that a focus on new construction projects could pay dividends in the coming year. Whether large-scale or scatter site developments,

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 THE XX FACTOR ERICA LACENTRA

new construction is predicted to experience a boom in 2024. Brokers can play a crucial role in financing these projects, addressing the ongoing demand-supply gap.

THREATS:

One of the biggest threats that the real estate industry as a whole faces in 2024 is a potential global economic downturn and the impact it would have on this space. The broader economic challenges, including inflation and reduced consumer spending, could lead to a slowdown in the real estate market, impacting both demand and financing and, ultimately, the livelihood of brokers.

Finally, a looming threat for the industry continues to be potential regulatory changes. Brokers who are no strangers to regulatory changes should be aware of and ready to address any proposed legislation that could affect the real estate industry. Specifically, regulatory changes, such as discussions on zoning laws, rent control, and agent commission structures, present a substantial threat to this space. While regulators’ intentions may be positive, sweeping changes can create a challenging environment, hindering progress and posing risks for professionals in the field.

BEYOND THE SWOT ANALYSIS

For mortgage brokers navigating the real estate market in 2024, this SWOT analysis serves as a valuable tool. By strategically leveraging strengths, addressing weaknesses, capitalizing on opportunities, and mitigating threats, brokers can better position themselves for success in a market marked by both challenges and promise. n

Erica LaCentra is chief marketing officer for RCN Capital.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 9

Allowing The ‘Dogs’ To Bark

More lenders need to know about 203(k) financing

BY LEW SICHELMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Demand for houses is such that the relatively few locations on the market these days are either overpriced or in such poor condition that nobody wants them. Otherwise, they’d be sold by now.

As far as pricing is concerned, real estate agent Ronald Goldman of Michael Saunders & Co. in Venice, Fla., has been advising his sellers to adjust their list prices to current market conditions based on real-time statistics, not just in their areas but also in their specific neighborhoods. “The expectations of too many sellers are not aligned with current market conditions,” he confides.

Unfortunately for some sellers, only a good talking to — or perhaps even a swift kick in the hindquarters — can persuade them to be more realistic. Toward that end, a recent event for agents featured a panel of heavyweights who chimed in on “How to Educate Sellers on the Realities of Pricing in Today’s Market.” They offered hands-on strategies that would deliver a positive outcome for both buyers and sellers, they said.

As for the dogs of the market, aka

fixer-uppers, a little relief from Uncle Sam is on the way. Actually, changes proposed in December by the Federal Housing Administration for its moribund 203(k) program may have already been put in place. But as I am typing this for an early deadline, the FHA was waiting for industry comments by early January before making them final.

For the uninitiated, and apparently there are many of you, 203(k) is the FHA’s primary renovation loan product. It allows borrowers to purchase or refinance a house and include the cost of repairs or rehabilitation into a single mortgage. A portion of the loan proceeds are used to pay off the seller or, in the case of a refi, the existing mortgage, and the remaining amount is placed in escrow. Then, the money is released in draws as the work progresses.

The project cost must be at least $5,000, and the total loan amount cannot exceed the FHA’s 2024 loan

“The expectations of too many sellers are not aligned with current market conditions.”

> Ronald Goldman real estate agent

THE MORTGAGE SCENE LEW SICHELMAN

10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

limits, which are now $498,247 in most places but up to $1,149,825 in high-cost markets. A sampling of what kind of work can be undertaken under the program includes improving a home’s curb appeal, installing a new roof or flooring, overhauling plumbing and septic systems, repairing or replacing gutters and downspouts, and making a house more energy efficient. Outside of upgrades or enhancements that don’t improve the actual functionality or attractiveness of the property, i.e., tennis courts, gazebos and swimming pools, practically anything goes. The problem: The program hasn’t been updated for years. And as a result, at least partially, production has taken a nosedive. Between 2012 and 2014, lenders were writing something on the order of 22,000 203(k) loans a year. But in fiscal 2023, a little more than 4,000 FHA rehab loans were put on

Now, though, in what an FHA spokesman told me is “the single most comprehensive proposed set of updates to the program in at least a decade,” the agency wants to put 203(k) back on the map.

To account for today’s higher repair costs, for example, FHA plans at this writing to more than

“More borrowers would opt for 203(k) financing if it was presented to them as an option.”

> Joe Leinan, co-president, Plaza Home Mortgage

double the limit on allowable rehab costs from $35,000 to $75,000 in high-cost markets and to $50,000 everywhere else.

To account for the longer construction periods now common with major repairs, it wants to extend the allowable rehab timeline from six to 10 months for major projects and from six to seven months for the so-called “limited” program, which can be used only for minor renovations and no-structural repairs.

Also on the agenda, the allowable initial draw would be raised from 50% of material costs to 75% to account for higher building product prices. And consultation fees, which often run as high as $2,000, could be included in the mortgage amount for the limited program, as they already are for the standard program.

IMPROVEMENTS NOT LACKING

It’s hard to think lenders would find these improvements lacking. After all, the proposal reflects input the agency has already received from the business over most of last year While some maintain the changes don’t go far enough, most agree they’re going to give the flagging program the boost it deserves.

Jim Bopp, vice president of renovation lending at Planet Home Lending, expects them to go a long way toward making heretofore un-sellable houses

more attractive. The “long overdue” improvements open up inventory that people can buy at a discount because the house is not in move-in condition, fix it up, and be well on their way to home ownership, says Bopp. “They allow solid houses with good bones to be put back into good use.”

Jeff Leinan, co-president of Plaza Home Mortgage, is a big fan of the program, too. And he thinks more lenders ought to embrace it. Not just lenders but also real estate agents. “More borrowers would opt for 203(k) financing if it was presented to them as an option,” Leinan says. “It’s a great opportunity for people to purchase a house and get the financing they need to remodel at the same time. And Realtors don’t market it enough, either. Some people just don’t have enough vision to imagine how the program can work.”

That the program “has not kept up with the times” is unfortunate, Sean Faries, CEO of Land Gorilla, laments, noting that the decline in 203(k) volume is “unbelievable.” He, too, admonishes lenders for not utilizing a program he sees as “10 times” better than Fannie Mae’s HomeStyle program, its chief renovation product.

But even though Department of Housing and Urban Development Secretary Marcia Fudge says the “enhancements” will make home rehab “more accessible for millions” of borrowers, the lenders interviewed for this story say the FHA could have — and should have — gone further.

Land Gorilla’s Faries, for example, would like to see the government loosen the rules. While he lauds the FHA for making the alterations noted here, he feels it has “fallen short” in making those necessary for 203(k) to really be successful. “It has such great potential. But compared to other renovation programs,” he laments, “it is overly complicated. None of the others have a fraction of the detail FHA

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 11

has, but they go a lot smoother.”

In particular, Faries would like to see the agency allow lenders to bring the all-important consultant’s function in-house. Right now, the FHA manages its list of independent consultants, who act as its eyes and ears on the ground, protecting the borrower, the lender, and the government. But, says Faries, “almost all other renovation loan programs do it in-house, and so should 203(k).”

CONSULTANTS NEEDED

Consultants are on Bopp’s list of additional changes he’d like to see, too. At the height of the program, there may have been 2,500 203(k) consultants nationwide. Now, there’s “not even” 900. So the veteran renovation loan professional says he’s “curious” to see what, if any, plans the FHA has in mind to bring on more consultants and better train them.

Also on the Planet Home Lending executive’s wish list: An increase in construction timelines to 12 months and allowing investors back into the program. Investors were suspended more than 25 years ago. But if the FHA were to lift the suspension, Bopp says, professionals could purchase the houses that are so

“So, instead of turning over rocks looking for new products, 203(k) is right here and ready to go.”

> Jim Bopp, vice president of renovation lending, Planet Home Lending

far gone that most home buyers are incapable of tackling on their own.

Overall, though, the lending pros interviewed here are “thrilled” and “amazed,” to use the words of one, that HUD is even listening to them. And they are certain both consumers and lenders will benefit greatly by what’s on tap. In that regard, they want everyone to give 203(k) another look. “The industry needs to re-embrace the product,” says

Plaza Home Mortgage’s Leinan.

Planet Home’s Bopp agrees — wholeheartedly. “Every home buyer who’s frustrated because they’ve been outbid on one or more houses should take another look at listings in their markets that are more than 90 days old. And so should lenders,” Bopp says. “With a 203(k) loan, houses that are not move-in ready or not up-to-date are viable options that give young buyers a great start on the path to building wealth.”

“Everybody is looking for the next hot new program, and I get it,” he says. “But you don’t need to reinvent the wheel. It’s all right here. The guidelines are in place, and there is a robust secondary market. So, instead of turning over rocks looking for new products, 203(k) is right here and ready to go. All you have to do is pull it off the shelf, dust it off, and put it to work.” n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country.

THE MORTGAGE SCENE

12 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.

Listen by following the link or by subscribing wherever you get your podcasts. Available on all major podcast platforms:

14 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

A Critical Juncture

Bold steps needed to foster a more inclusive mortgage industry

BY SAM HARRIS III AND BJ HAMILTON-HARRIS, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

BY SAM HARRIS III AND BJ HAMILTON-HARRIS, SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

The mortgage industry, a cornerstone of the American economy, finds itself at a crucial crossroads. Integral to the aspirations of homeownership for a vast majority of Americans, this sector is now confronted with a pivotal question: Do we maintain the status quo, or do we chart a new path toward a more intentional and equitable future?

This industry’s role extends beyond mere financial transactions; it is a key player in shaping the nation’s socio-economic fabric. Homeownership is not just a financial milestone but also a symbol of stability and a contributor to generational wealth. Yet, the pathway to achieving this dream is fraught with disparities and systemic barriers, particularly for African American communities.

As we stand at this juncture, we must critically evaluate our current practices. My grandfather would say, “You’ve got to stand for something, or you’ll fall for anything.” The traditional models, while successful in some respects, have also perpetuated gaps in access and opportunity. The homogeneity of brokerage ownership and leadership has led to a lack of diverse perspectives, inadvertently creating a system that does not equally serve all segments of our society.

The question is whether we should continue on this well-trodden path or take bold steps toward fostering a more intentional and inclusive industry. By encouraging the growth of brokerages owned and operated by a more diverse group of professionals, particularly African Americans, we can begin to address long-standing inequities. This shift is not just about fairness; it’s about

enriching the industry with a variety of perspectives and approaches, which can lead to more innovative and inclusive solutions for homeownership.

As we delve into this issue, we’ll explore the historical context that has shaped the current state of the mortgage industry, the glaring disparities in representation and ownership, and the potential impact of a more diverse and equitable approach. This exploration is not just an academic exercise but a necessary step towards realizing an industry that is as diverse and dynamic as the population it serves.

HISTORICAL CONTEXT: THE LEGACY OF INEQUITY

To fully grasp the current state of the mortgage industry, one must consider its historical underpinnings deeply rooted in inequality and discrimination. The journey

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 15

begins with the heinous legacy of slavery, which laid the groundwork for systemic economic disenfranchisement of African Americans. This was further perpetuated through Jim Crow laws and Black Codes, systematically denying African Americans the basic rights and opportunities afforded to their white counterparts.

The impact of these practices extended into housing, homeownership, farming, and manufacturing. Redlining, a discriminatory practice where banks and insurers refused or limited loans, mortgages, and insurance within specific geographic areas, predominantly affected African American communities tremendously. This policy not only restricted access to homeownership but also led to the underdevelopment of the neighborhoods, compounding the economic disadvantages faced by residents.

Moreover, the illegal seizure and destruction of over 100 African American communities across the nation represent

The historical context is essential to acknowledge as we discuss the need for change and the path toward a more equitable and inclusive future in mortgage lending, land, and homeownership.

DISPARITIES IN LEADERSHIP AND OWNERSHIP

The mortgage industry is marked by a stark disparity in leadership and ownership, particularly concerning African American representation. In examining major mortgage brokerage firms and banking institutions, it becomes evident that African American leaders are significantly underrepresented, or entirely absent, in many of the top-tier organizations. This dearth of diversity at the leadership level is not just a superficial issue; it has profound and far-reaching implications.

This imbalance extends beyond mere numbers. It reflects a systemic issue

and ownership can bring fresh perspectives, innovative ideas, and new solutions to longstanding problems. In an industry that plays a critical role in the economic health of the nation, embracing diversity is not just a moral imperative but a business necessity.

Understanding these disparities in leadership and ownership is crucial as we explore how to create a more inclusive and equitable mortgage industry. Addressing these gaps requires a concerted effort from all industry stakeholders to foster diversity, not just as a compliance measure but as a cornerstone for a more robust and resilient industry.

A CRITICAL ANALYSIS OF DEI

Over the years, Diversity, Equity, and Inclusion (DEI) initiatives have gained prominence in corporate America, including the mortgage industry. However, the real impact of these initiatives in

The homogeneity of brokerage ownership and leadership has led to a lack of diverse perspectives.

a significant and often overlooked aspect of history. These acts of dispossession and destruction were not only a loss of property but also a loss of community, wealth, cultural heritage, and a sense of belonging, all critical components of the American dream.

The 2007 subprime mortgage crisis is a more recent manifestation of these entrenched disparities. Predatory lending practices targeted at African American communities led to disproportionate rates of high-risk mortgages, foreclosures, and a subsequent devastating wealth gap. This crisis was not an isolated incident but a stark reminder of the ongoing impacts of historical injustices.

Redlining and blockbusting, alongside these events, have contributed to a long history of hindering African American communities’ access to homeownership and wealth accumulation. These practices not only affected the individuals and families directly involved but also had a ripple effect, contributing to the generational wealth gap we observe today.

This legacy of inequity sets the stage for understanding the current challenges within the mortgage industry.

where the decision-making echelons lack the diversity of perspectives and ability to understand the true depth of a multicultural society. The absence of African American leaders means that the unique challenges and needs of African American homebuyers, farmers, business owners, and communities are not adequately understood or addressed. This gap in understanding and representation can lead to a lack of targeted services and support, further widening the ownership gap.

Moreover, the lack of African American ownership in mortgage brokerages is equally concerning. Ownership is a powerful driver of change. Owners have the ability to shape business practices, influence industry standards, and create opportunities for others. The scarcity of African-Americanowned brokerages translates to fewer opportunities for mentorship, fewer role models for aspiring professionals, and less economic investment in African American communities.

This scenario is not just detrimental to African Americans; it impacts the industry as a whole. Diverse leadership

addressing the systemic barriers faced by African Americans continues to warrant thorough examination.

Although politics now play a pivotal role in discouraging DEI, many critical questions arise when assessing current and past efforts: Are they merely symbolic gestures, or do they represent substantive, impactful change? There is a concern that some initiatives may only serve as public relations efforts, offering a veneer of inclusivity without addressing the deeper, systemic issues.

This superficial approach can lead to a false sense of progress, leaving the underlying problems unaddressed, and when we bundle African Americans under the term “Diversity,” which includes all ethnicities and women, why are African Americans often the last group to benefit from resources and opportunities, should any remain?

To evaluate the effectiveness of DEI programs in the mortgage industry, one must look beyond mere diversity statistics. It involves examining whether these initiatives are creating real pathways for African Americans into leadership roles, ownership

16 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

opportunities, and equitable lending practices. Are these programs fostering an environment where diverse voices are not only heard but also have the power to influence and enact change? This involves scrutinizing the recruitment, retention, and promotion policies within firms, as well as their lending practices and community engagement strategies.

THE IMPERATIVE FOR AFRICAN AMERICAN BROKER OWNERS

The striking underrepresentation of African American broker-owners has deep-rooted economic ramifications that continue to foster the essence of redlining. By having a lack of education to truly understand the historical data, experiences (past and present), and the dynamics of redlining, and the lack of representation in the marketplace to understand and work through the challenges faced by African American clients, the gap for

to a cycle of economic disadvantage.

As a mortgage brokerage owner and one who has spent the past five years studying market trends and historical data (when available) and speaking to numerous licensed professionals, my experience and interactions have allowed me to see the mirrored paths and troubling national trend that the industry continues to face. Despite the qualifications and capabilities, many African Americanowned firms continue to find themselves overlooked or considered as a last resort. This experience is is indicative of a widespread systemic issue that affects African American professionals nationwide. Addressing this underrepresentation requires more than passive acknowledgment; it necessitates proactive measures. This could include targeted support for African American professionals entering the industry, financial assistance for those looking to

the mortgage industry should see a landscape where African American professionals are proportionately represented, mirroring their demographic presence in the U.S. population, and playing an intricate part of the housing market as a whole. This vision goes beyond merely rectifying historical injustices; it’s about infusing the industry with a rich tapestry of diverse perspectives and experiences, enriching it for all stakeholders, from industry professionals to homeowners.

This objective embodies the essence of an old African proverb: “If you want to go quickly, go alone. If you want to go far, go together.” The journey towards a diverse and equitable mortgage industry is indeed a marathon, not a sprint. It requires collective action, shared responsibility, and a unified commitment to profound, systemic change. Add the need to move with urgency, combined

Embracing diversity is not just a moral imperative but a business necessity.

homeownership will continue to widen, as lenders and mortgage brokerages alike tend to look at these applicants as more challenging or a higher risk to service (i.e., subconscious redlining).

A closer look reveals that less than 3% of approximately 68,000 mortgage brokerages across the United States are owned by African Americans. This disparity has significant implications for both industry and communities.

The lack of African American ownership in mortgage brokerages does more than just perpetuate a homogenous industry leadership; it leads to a gap in culturally competent services. The absence of African American broker-owners means many homebuyers may not receive the service and understanding required to navigate the complex homeownership process. Furthermore, this disparity reinforces broader economic inequalities. Ownership of brokerage firms not only generates wealth for the owners but also has the potential to create jobs and stimulate economic activity within communities. The lack of African American-owned brokerages contributes

start their own brokerages, and initiatives to ensure fair access to opportunities.

PROPOSED SOLUTIONS: TOWARDS AN EQUITABLE INDUSTRY

To address these disparities, a multifaceted approach is needed. Key players in the mortgage industry, particularly the top 10 percent of lenders, should actively collaborate with organizations focused on supporting African American broker owners, like Aspiring Independent Real Estate Experts (AIREE). This collaboration could include providing targeted financial support, mentorship programs, and business development resources. Additionally, there needs to be a concerted effort to create pathways for African Americans to access capital, a critical component for starting and sustaining a brokerage.

ENVISIONING A DIVERSE AND EQUITABLE FUTURE

As one contemplates the future of the mortgage industry, the ambition should be clear and bold: By the year 2030 and through intentional actions,

with the efforts, trust, and determination to reshape the world’s understanding of the challenges African Americans face and the collective action required to overcome the obstacles.

This path forward is not just a moral imperative but a strategic one. A diverse mortgage industry is a resilient and innovative one, better equipped to respond to the changing needs of a diverse clientele and more capable of fostering sustainable growth and prosperity.

Allies, advocates, and active participants are necessary to effect actual change. For more information or to suggest future topics on the history of the mortgage industry and how it impacts African Americans, email your request to NMP (editors@ambizmedia. com) today. Together, we can create an industry that not only reflects the diversity of our nation but also leverages its strengths. Let’s embark on this journey with determination and hope, knowing that through the collective efforts of the mortgage industry and licensed professionals, we can pave the way for a more equitable and prosperous future for all. n

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 17

Acra Lending Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience.

acralending.com

(888) 800-7661

sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

NON-QM LENDER RESOURCE GUIDE

Champions Funding Gilbert, AZ

Mission Driven Non-QM + CDFI Wholesale Lender

At Champions Funding, we Non-QM all day, every day! It’s our core business, and we live to serve underserved borrowers through our valued broker partners. We put diversity and inclusion into mortgage lending by empowering the mortgage broker community to provide solutions for non-traditional credit profiles and those who cannot get approved with standard financing. Through our highly coveted CDFI certification backed by the U.S. Department of the Treasury, we can offer our flagship neighborhood products and tap into a $1 Trillion market of historically underserved communities in the country.

Focused on speed to closing (in days, not weeks), smooth processes, and user-friendly access to our underwriting and support teams, we offer modern, flexible, and responsible non-traditional lending solutions.

champstpo.com

(949) 763-9494

Wholesale@ChampsTPO.com

LICENSED IN: AZ, CA, CO, CT, DC, FL, GA, HI, IL, IA, MD, MI, NJ, NC, OR, PA, SC, TN, TX, UT, VA, WA

PCV Murcor Pomona, CA

pcvmurcor.com

sales@pcvmurcor.com

(855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — An Appraisal Management Company

DESCRIPTION OF PRODUCTS OR

SERVICES: Licensed in all 50 states, plus D.C., PCV Murcor provides nationwide appraisal management and valuation advisory for residential and commercial real estate. With a foundation built on 43 years

Newfi Wholesale Emeryville, CA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com

(888) 415-1620 support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

of experience, PCV Murcor brings a deep understanding of our clients’ goals that complements appraisal modernization. Our use of state-of-the-art AI technology ensures precision and efficiency in every aspect of our service. Experience innovation-powered recision and timetested excellence with unparalleled service and cutting-edge products.

Find the full list of Non-QM Lenders on page 80

Find the full AMC list on page 81

AMC RESOURCE GUIDE 18 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

SPONSORED

BY

HOW

NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE

BUILD-A-BROKER

Reduce The Cost To Generate Leads And Be More Consultative

YOUR FIRST MILLION DOLLARS

Project Animation And Elation To Close More Loans

BENCHMARKS & BEST PRACTICES

Be Prepared For Gen Z — They’re Buying This Spring

CAREER TICKER

PEOPLE ON THE MOVE //

> Rocket Companies, the parent company of Rocket Mortgage, appointed Jonathan Mildenhall as its inaugural chief marketing officer.

> Mortgage Machine Services, a provider of digital origination technology to residential mortgage lenders, appointed Crystal Stanton to manage customer success and onboarding.

> Incenter Marketing has hired Katrina Orlando as its vice president of sales engagement.

> INB, N.A. in Springfield, Illinois, announced the addition of Brad Dyer as the mortgage sales manager for Central Illinois.

People On The Move NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 19

Hack The Funnel

A "likes" to "leads" to "loans" strategy to get the borrower first

PEOPLE ON THE MOVE //

> Planet Home Lending hired Melony Harpe as vice president, construction sales manager recently.

> Baltimorebased First Home Mortgage Corporation has announced today new growth for its McLean, Virginia branch office through the transfer of loan officer Jonathon Hodgkinson.

> ATTOM, a leading curator of land, property and real estate data, said that Ana Flor has been promoted to chief people officer and Kara Taylor has been promoted to chief marketing officer.

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

BUILD-A-BROKER

20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

SPONSORED BY

BY RYAN KINGSLEY, STAFF WRITER FOR NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Bacon and eggs. Bono and the Edge. Long walks and the beach. Twins. “The idea is to bundle the whole experience,” explains Greg Sher, managing director at the Baltimore-based NFM Lending, who thinks educating borrowers and closing loans should be added to the list of things made to go together.

“We are experts,” he continues. “We’re not going to be pushy. We’re going to drip content on you to educate you, and when the time is right, because you trust us, we’re going to hand over an agent that we trust. It’s all-encompassing, is what’s the utopia.”

As major industry players like West Capital Lending and Rocket Pro TPO begin to build their own influenceroriginator utopias, NFM’s Creator Collective, formerly called the Influencer Division, is a utopia that Sher has been building for nearly three years with the specific intention of courting “digital natives,” that segment of borrowers who have spent nearly their entire lives surrounded by digital devices and the world of social media. The first generation of digital natives is roughly 25- to 35-years-old, but eventually, every future borrower will be one.

Two of the mortgage industry’s enduring challenges are reducing the cost to generate leads and moving beyond a transactional value proposition to one that’s consultative. The Creator Collective solves these twin challenges by enabling NFM’s originators to leapfrog real estate agents in the acquisition funnel, allowing NFM’s originators

“There’s still a lot of value agents can bring, I’m very bullish on that, but they’re in the process of getting phased out.”

> Greg Sher, managing director, NFM Lending

to initiate the homebuying process with borrowers from an added-value position. Influencer-originators in NFM’s Creator Collective hawk homeowner education to generate leads and close loans, building trust with borrowers by addressing a well-documented lack of financial literacy around the homebuying process, particularly among millennials and Gen-Z homebuyers.

“Back in the day,” Sher recalls, “people responded to mailers, rate tables, and real estate agents saying, ‘Here, call this person.’” Those days are rapidly coming to a close. “We’ve never seen a segment of borrowers like this before.” According to GWI, a market research firm, 54% of social media browsers use social media to research products.

Sher’s happy to play by the new rules: since the program’s soft launch in mid-2021, NFM’s Creator Collective has generated over 65,000 leads from mortgage-related posts on social media platforms like TikTok, Instagram, Facebook, and YouTube. From those leads, the company has closed over 1,000 loans representing nearly $400 million in unpaid principal. Sher accepts credit for originating the program but deflects praise for the success they’ve achieved over the past 30 months.

Rather, “the artists” who bring the idea to life every day deserve the applause. After all, it’s because of the team assembled, Sher’s quick to point out, that the strategy works at all; there just aren’t that many mortgage influencers, let alone influencers also licensed to originate. In the two years of the Collective’s existence, NFM has

is a valued member of Charlotte Crown and the local National Association of Real Estate Brokers. Rosa Chavarria has more than 30 years of experience in mortgage banking, including down payment assistance programs. Arthur Green has built strategic partnerships with

like the North Carolina Housing Finance Agency, House Charlotte, and SC Housing to develop financing packages. Brian Jones is the preferred lender for the North Carolina State Highway Patrol Troopers Association.

> SouthState Bank announces expansion of its mortgage team in Charlotte, N.C., in response to the growing population in the area. Charlene Davis

organizations

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 21

BUILD-A-BROKER

From a sample of 10,000 influencer-generated leads, 92% of mortgage-curious Gen Zers wanted to be contacted by text or email; only 8% sought a phone call.

expanded its stable of influencers who originate to 12, not including a few real estate influencers. When it comes to reaching borrowers earlier in the process, “that’s why NFM’s got such an enormous head start,” Sher says.

“And to some degree,” he continues, “why I’m so open about sharing it. We’ve lapped the field 10 times over and I’m not saying that out of arrogance. No, a lot of it is just luck and timing.”

JUST AN OLD-FASHIONED GOOD IDEA

For Sher, a sense of timing meant being strategic about pitching his plans for an influencer division to NFM’s leadership. Lacking proof of concept for a like-to-leads-to-loans origination strategy, Sher built a process for funneling mortgage-curious followers into a pipeline of potential borrowers. The initiative officially launched in January 2022, but as early as March 2021 Sher was Beta-testing this process with the “Michael Jordan” of mortgage influencers: Scott Betley (@ThatMortgageGuy). A licensed originator for more than seven years, Betley commands one of the largest audiences of mortgage-curious followers on the internet with more than one million across all of his platforms.

What first struck Sher about Betley was the sheer volume of engagement he received on his posts. Every engaged

PEOPLE ON THE MOVE //

>

follower was a lukewarm lead in Sher’s eyes. Not only did some of Betley’s videos have view counts in the millions, but many garnered hundreds and thousands of comments. Commenters asked questions like, ‘Do you do business here?’ or ‘Do you do self-employed people?’. Others contextualized the circumstances under which they hoped to attain a mortgage within the next 12-18 months, such as having recently graduated from school or else filed for bankruptcy within the past year. Sher remembers thinking: “This is the future.”

He quickly discovered, though, building something that has never been built before requires a fair amount of troubleshooting. “Because we didn’t know any better,” he admits, “we would take an interested person right into an application. We would send them a link. Well, we got completely bottlenecked with people that didn’t qualify.”

To widen the funnel, Sher started screening leads, establishing workflows based on followers’ answers to intake questions about their timeframe to purchase, income, and creditworthiness. Even then, Sher realized he needed a buffer between the influencers and the intake forms, so he built a call center domestically.

A November report published by NFM reveals some of the data behind how TikTok views translate to leads and then closed loans. In July alone, NFM’s influencers accumulated 30.7 million

TikTok views from Gen-Z users, up 21.8% from June. The 1,401 leads — as in, completed intake forms — generated from those viewers became 24 prequalification applications and finally, 20 mortgage originations. As for added value, twothirds (941) of the 1,401 leads asked to be introduced to a real estate agent.

By exemplifying his own leadership, Sher earned the full support of NFM when he formally pitched his strategy with a process (“of sorts,” he says) already in place.

FIRST-OF-THEIR-KIND BORROWERS

Whether separated by age, income, or ethnicity, different borrowers approach the homebuying process with different expectations for how that process unfolds, including on whose terms. As a matter of fact, a tortoise won’t run on a hamster wheel even if one is placed in its enclosure. Sher believes the homebuying process should match borrowers’ ability to participate in the process. After all, borrowers’ expectations for participation arise from their ability to participate.

As consumers, young millennials and Gen-Z borrowers — the first wave of digital natives to buy mortgages — have different capabilities than their parents and grandparents, made possible by 21st-century technologies. By default, new capabilities give rise to new behaviors and habits, and therefore new psychological

>

Treliant, a consulting partner to the financial industry, has named Laura Huntley

managing director in its regulatory compliance, mortgage, and operations solutions practice.

as a

Service First Mortgage in Texas has added Danelle Rivas to its Austin office.

Mortgage fintech Lower announced the addition of Amir Syed, co-founder of Growth Only Coaching, as its chief growth officer. HAVE A NEW HIRE OR PROMOTION TO SHARE? Submit the information to Keith Griffin at kgriffin@ambizmedia.com for possible publication. Announcements should include a headshot.

>

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

SPONSORED BY

approaches. When it comes to mortgages, Sher describes younger borrowers’ new approach as, “I’m going to dictate; nobody’s going to tell me. I’m going to take somebody that I follow, and I’m going to engage with them and go through the process with them.”

Speaking strictly about those who watched a video, clicked a link, and completed the application process, nearly 40% of the borrowers NFM has closed through influencer-generated leads fall in the 25- to 35-year-old age bracket. Because the program was launched to target that set of borrowers, Sher isn’t very surprised by the numbers. Instead, the success affirms how listening to borrowers can help lenders build up resilience through a forwardlooking origination strategy.

As the mortgage industry has shrunk over the past two years, influencergenerated leads have brought in muchneeded business for NFM. But, in building a lead-gen apparatus for younger borrowers, NFM has also built a system for collecting data on this demographic. Not only do the intake forms create

leads and loan applications, but NFM aggregates responses into data sets that offer unique insights into the behaviors and circumstances of young borrowers. These data have helped NFM hone its strategy with an ever more nuanced understanding of digital natives.

For example, from a sample of 10,000 influencer-generated leads, 92% of mortgage-curious Gen Zers wanted to be contacted by text or email; only 8% sought a phone call. What does this indicate to Sher? Whereas most borrowers used to prefer a phone call for such an important conversation as financing a home, digital natives “are very comfortable clicking. That’s what they want. They don’t want to be bothered,” Sher shrugs. “They want to do things on their time.”

REFERRAL REVERSAL

Of the total set of 65,000 leads, 97.5% want to purchase a home, yet 85% don’t yet have a real estate agent. 93% say they want to be introduced to an agent, demonstrating how early in the acquisition funnel NFM reaches borrowers through social media. “The

business is changing right before our eyes, and we’ve definitely been on the forefront of this evolution.” They’ll continue to be, Sher’s sure, because reaching borrowers earlier in the funnel translates to more control over the process, putting lenders, not real estate agents, in the driver’s seat.

The conventional way people do business in the mortgage industry — i.e., a real estate agent starts the borrower on the homebuying journey and eventually refers that borrower to a lender for financing — is rapidly changing, according to Sher. Technological advancements drive this transition by reshaping the ways and means by which people interact with their environment, including other humans in their environment, across both physical and digital spaces.

In the past decade, social media influencers across many industries have revolutionized how companies reach their target audiences. The ease and ubiquity of screens and Wifi have spawned a generation of consumers too savvy for traditional marketing methods. While the internet makes the universe of mortgage- and housing-related resources available at the swipe of a screen for borrowers, social media helps to channel borrowers toward providers (posters and uploaders) of this information. Armed with the power of choice, borrowers trust social media influencers who answer their questions and, perhaps more importantly, humanize the process. “About two out of every 10 videos should be something personal,” Sher advises.

Take, for example, Jordan Nutter (@ANutterHomeLoan), who only entered the mortgage industry in 2019. She has rapidly succeeded as an influencer-originator, but she picks her priorities: “I’m an originator. That’s how I make my money, support my family, and that’s my career.”

Nutter’s appeal is her balance — a knack for walking the tightrope between coach and confidant, originator and educator. Many of her best-known videos are satirical, in which she reenacts sometimes nonsensical and sometimes uproarious real-life conversations with her clients. While others use the verb “influencing” to describe Nutter’s origination strategy, the essence of her

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 23

> Jordan Nutter, loan originator and vice president of the Influencer Division at NFM Lending

BUILD-A-BROKER

While the internet makes the universe of mortgage- and housing-related resources available at the swipe of a screen for borrowers, social media helps to channel borrowers toward providers.

outreach is “educating.”

Ultimately, young millennials and Gen Zers are making themselves available earlier in the funnel, turning themselves into leads by expressing through follows and likes their desire to get into a home. “You have to know when their hand is being raised,” says Sher. With their 12 mortgage influencers, NFM has spun a digital web for tech-forward, mortgagecurious borrowers to stick to, baited with educational tidbits about housing finance. The way he sees it, that hand is being raised (and the web begins quivering) as soon as a first-time homebuyer turns to their search engine to answer the question, “What’s a mortgage?”

Being available to NFM’s originators earlier in the funnel has reversed referral networks that typically order agentoriginator relationships. “I don’t think the agent will ever be irrelevant,” says Sher, though he predicts that agents will have an increasingly diminished role in assisting borrowers in the future. Introducing borrowers to real estate agents has become part and parcel of NFM’s white-glove service because agents are experts on neighborhoods, school systems, and recent sales, among other important factors for borrowers to consider. “There’s still a lot of value agents can bring, I’m very bullish on that,” Sher affirms, “but they’re in the process of getting phased out” — especially those unwilling to adapt.

A BIG OPPORTUNITY

Despite Facebook celebrating its 20th anniversary in February, using social media to incubate business still feels unfamiliar to many industry old-timers raised on old-school methods like cold calling and classifieds. Graduating from Facebook posts to TikTok videos could be its own badge on LinkedIn. Sher says the badge that no one in the industry

should wear is: “I’m not on social media. I don’t need it.” Those originators and agents actively lose business when they can’t be searched, found, and followed by borrowers on social media platforms.

Influencer-originator competition has increased, though, since NFM launched its initiative in January 2022. What’s A Mortgage, for example, is a team of 15 loan officers that includes Minh Nguyen, an influencer-originator with nearly 240,000 followers across all platforms, and Jide Buckley, who has 365,000 followers on Instagram alone. In December, What’s A Mortgage and West Capital Lending, the top originator for Rocket Pro TPO for 29 consecutive months, announced a partnership for leveraging social media and mortgage education to generate leads and close loans. The influencers will brand Rocket Pro TPO and West Capital Lending.

For NFM, when it comes to actually closing the loans generated from influencer leads, 80% are closed with an originator who was not the influencer with whom the borrower first interacted. Part of this discrepancy is due to licensing constraints, but influencer preferences also play a role. A content creator through and through, Scott Betley prefers to have more time for making videos and studying trends, so he hands off more of his leads to other licensed loan officers on his team. Jordan Nutter, on the other hand, takes hand-holding seriously and prides herself on guiding her followers through the entire process. Either way, they’re all paid on commission.

All of these metrics are tracked, tallied, and reviewed weekly. “It requires a comprehensive back end to even be in this game,” Sher stresses. A persistent challenge he faces is keeping his influencer originators enthusiastic and motivated. Collaborations offer a measure of excitement, but data

analytics and efficient systems directly improve his influencers’ brand-building strategies and conversion rates. “If I’ve got a thousand people raising their hands, but we’re only able to get one to the table,” he levels, “that’s a problem.”

Misinformation about homebuying runs rampant across the internet, especially on social media. Sher points to how “a large percentage of people that are 19 and 20 think that it requires a 25% or 30% down payment, or that you need a perfect credit score. None of that’s true.” Borrowers want someone they trust and like to guide them through the process.

Looking ahead, originators and lenders have the opportunity to become that trusted source. It’s a process-oriented approach to building your brand, growing your business, significantly reducing the costs of generating leads, and realigning originator-agent referral relationships. Don’t follow the business — let the business follow you.

What Sher and NFM have built so far, though, only represents the tip of the iceberg. “You want to talk about opportunity and just how much grander this could be,” Sher posits, “only 18% of the people that go to our form fill it out.” In other words, the 65,000 leads generated so far from influencer content only represent 18%, or slightly less than one-fifth of the followers who made it to the intake form. “So, you can imagine,” he continues, “we’re leaving 82% on the table. We’ve actually had +300,000 people uniquely go to a page where they’ve considered filling it out and raising their hands.” Increasing friction in the funnel, such as by dropping cookies or using chat bots, is one way Sher plans to improve the completion rate for intake forms.

“Are we leading? Yes,” he hedges, “but make no mistake, there’s still a lot of work to do.” n

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

ORIGINATOR TECH RESOURCE GUIDE

wemlo

Boca Raton, FL

Area of Focus: Loan Processing

Third-party processing service, wemlo, empowers mortgage professionals through transparent, flexible, and efficient loan processing. To better serve our customers and their borrowers, wemlo proudly offers processing support in 47 states (plus Washington DC) for more than a dozen loan products including Conventional, FHA, Jumbo, VA, and Non-QM.

wemlo.io

(866) 523-3876 info@wemlo.io

Licensed In: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, VT, VA, WA, WV, WI, WY

Zero 1 Solution LLC Stockton, CA

Area of Focus: Software

1Solution Mortgage allows you to Originate, price a loan scenario with proposal, CRM, Marketing and more …

• Scenario

• Communication

• CRM

• LOS

• Essentials • Marketing • HR

1smtg.com (888) 458-0650 info@1smtg.com

Licensed In: All U.S. States, U.S. Virgin Islands

WHOLESALE LENDER RESOURCE GUIDE

ACC Mortgage Rockville, MD

ACC Mortgage is the oldest NonQM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Newfi Wholesale Emeryville CA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com

(888) 415-1620 support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

Wholesale Lenders

KNOW

Way more than a magazine. Stronger Stories We discuss the issues in the industry others may be too wary to touch, and we never let advertise relationships affect our stories.

Find actionable advice from professionals across the industry with tips to further your career, grow your business, and more. Industry Insights Don’t just read the news — understand it. Find insightful articles from leading industry voices to help digest all the changes in the industry. nmplink.com/subscribe

IT ALL.

Hands-On Advice

Find the full

on page 81 Find the full Originator Tech list on page 81 NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 25

list

HARVEY MACKAY

YOUR FIRST MILLION DOLLARS

Little Things Mean Everything

Magical moments can drive more business to your door

BY HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

One of my favorite sayings is, “Little things mean a lot. Not true. Little things mean everything.”

It is the little things that separate mediocrity and excellence, a little account and a big account.

Years ago, I was calling on the number two envelope user in the Twin Cities. The buyer wouldn’t see me for about a year before I could schedule an appointment. He never bought from me, but I got to know him and built my Mackay 66 Customer Profile on him.

I stopped in one day, but he wasn’t in the office. His gatekeeper told me that his 11-year-old son was hit by a car while riding his bicycle and was in the hospital. I knew from the Mackay 66 that the kid played hockey, and his father was the coach. I went to our professional hockey team and had some of the players sign a goalie stick and shipped it to the hospital with a note. This little gesture made the boy mighty happy. Plus, it resulted in $10 million in envelope business over the years, and they are still one of

I was speaking to a real-estate company and doing my research. I called one Realtor who told me he had a client who was big into Disney collectibles. The Realtor was in a store and found a “Pirates of the Caribbean” coffee table book on sale for a mere $5, so he bought and delivered it. He received 20 transactions from this person, their family, and friends.

You can’t put a price on doing the little things. It’s the little things in life that — all summed together — become bigger and more important than the big things and events.

OF NOTE

When someone calls you on the telephone, you should always greet them with animation and elation and tell them how happy you are to hear from them.

I am convinced that U.S. Presidents George H. W. Bush and Bill Clinton would never have been president if it were not for their short notes. They both were fanatical note senders their entire political lives.

I met President Bush in the airport, and he sent me a thank-you note the next day as a total stranger. Do you think I may have given him a contribution afterward?

Red Buttons was a top comedian in the 1950s and ’60s. He told this story about how all his friends thought he had a phenomenal memory with holiday cards. He explained his strategy: Any time he met someone new, he would fill out a holiday card that night, make notes about their kids or some other salient point, and wait until the holidays to mail it to WOW every new friend.

Motivational author Glenn Van Ekeren told me a story about how one night he was channel surfing and landed on the Discovery Channel show “Dirty Jobs.” In one episode, host Mike Rowe was trying to duplicate the work

of an industrial painter whose job was to paint the inside of the Mackinac Bridge towers in Northern Michigan. His unnoticed job is done to ensure the steel of the magnificent, suspended structure won’t rust from the inside out, compromising the integrity of the bridge. Most of the 12,000 people who cross the Straits of Mackinac daily aren’t even aware that this “little thing” means everything to their safety.

Legendary college basketball coach John Wooden said, “It’s the little details that are vital. Little things make big things happen.”

MAKE SOME MAGIC

You would be amazed at what can happen when you find out what turns every human being on and off. For example, people always ask me how I got to be such good friends with Muhammad Ali. Muhammad was mesmerized with magic, so before I interviewed him for a chapter in my book, “We Got Fired! … And It’s the Best Thing That Ever Happened to Us,” I hired a magician to teach me tricks that I could not only show the Champ but teach him how to master the tricks. This expanded his bag of tricks significantly. Jackpot of jackpots! Instead of a one-hour interview, he kept me at his home for 10 hours.

The so-called little things are not a small part of a happy life. They mean a lot even if they may not always look important.

Mackay’s Moral: The one who removes a mountain begins by carrying away small stones. n

Harvey Mackay is a seven-time New York Times best-selling author with 15 books.

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

26 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

SPONSORED BY

When someone calls you on the telephone, always greet them with animation and elation and tell them how happy you are to hear from them.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024 | 27

KAY

Meet a New Generation Of Spring Buyers — Gen Z

As the oldest Gen Zers turn 27, it’s time to pay them more attention

As we approach the spring homebuying season, there’s a lot of preparation to do. But I’d argue that knowing your buyer is the most important preparation you can make. Knowing who your buyers are can help give you an idea of their wants and needs and how to interact with them to provide a referral-worthy experience. And there is one new set of buyers that loan officers

BENCHMARKS & BEST PRACTICES

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE 28 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MARCH 2024

MARY

SCULLY

MARY KAY SCULLY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

need to spend some time getting to know: Generation Z, or more popularly, Gen Z.

Gen Z includes those born as early as 1997 and as late as 2012, and the oldest of the generation are 27 years old. Already, many of them are entering the housing market. LendingTree said Gen Zers made up nearly 15% of potential home buyers across the nation’s 50 largest metro areas in 2022.

While they share some similarities with their Millennial predecessors, they also have some key differences from earlier generations. According to Forbes, roughly 30% of 25-year-olds (among the oldest of Gen Z) owned their home in 2022, a slightly higher percentage than the 28% of Millennials (born 1981-1996) who owned homes at that age and the 27% of Gen Xers (born 1965-1980), but

lower than the rate for Baby Boomers (born 1946-1964), 32% of whom owned homes at age 25.

With Gen Z showing such promise concerning homeownership, let’s get to know this generation better so you can be prepared for this new set of buyers that are moving quickly into the market.

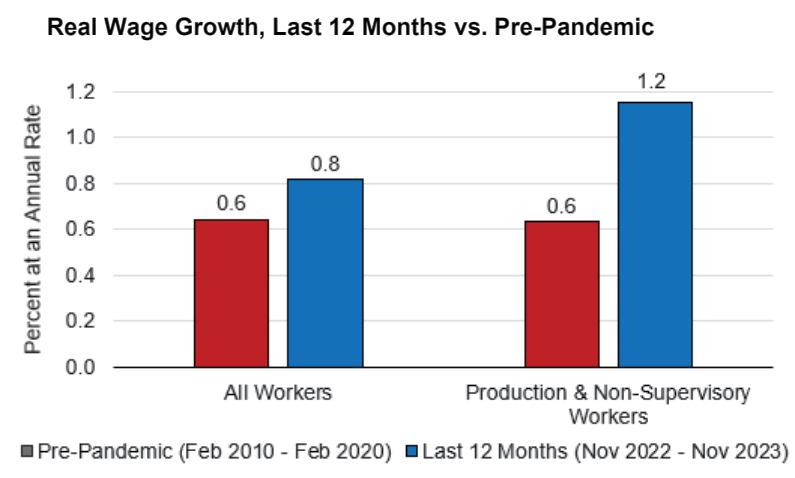

BY THE NUMBERS