MortgageBanker MAGAZINE

SIGNS OF RECOVERY

5 STEPS TO REMOTE HAPPINESS

Employees and employers are productive away from the office

SIGNS OF RECOVERY

Employees and employers are productive away from the office

A little bump is good for most of us

Non-QM no longer seems to be struggling

DON’T BE GLOOMY

You can fight the media hype about the economy

The Consumer Financial Protection Bureau (CFPB) released a report examining trends in credit reporting of debt in collections from 2018 to 2022. The report found the total number of collections tradelines on credit reports declined by 33%, from 261 million tradelines in 2018 to 175 million tradelines in 2022. The share of consumers with a collection tradeline on their credit report decreased by 20% in the same timeframe.

The CFPB also released additional analysis examining factors that increase the likelihood of inaccurate medical collections reporting and may contribute to the decline in medical collections tradelines.

“Our analysis of credit reports provides yet another indicator that, due to a strong labor market and emergency programs during the pandemic, household financial distress reduced over the last two years,” said CFPB Director Rohit Chopra. “However, false and inaccurate medical debt on credit reports continues to be a drag on household financial health.”

Collections tradelines are furnished to credit reporting companies by third-party debt collectors. Commonly reported collection items include medical, rental and leasing, credit card, and utility accounts. Some third-party collectors work on behalf of original creditors for a fee (“contingency-fee-based debt collectors”) and others purchase accounts outright from creditors (“debt buyers”).

Unlike most other tradelines, debt collection tradelines rarely report positive information like on-time payments, and result in reporting of collections tradelines being almost entirely harmful to consumers. Collections tradelines are visible to potential lenders, employers, landlords, and others who run credit inquiries or background checks. Collections tradelines can limit people’s access to jobs and housing, as well as decrease credit scores and increase the cost of credit. Given the potential damaging impacts of collections tradelines, reporting of inaccurate data is especially harmful.

The report is drawn from the CFPB’s Consumer Credit Panel, a nationally representative sample of approximately 5 million de-identified credit records maintained by one of the three nationwide credit reporting companies.

The Federal Housing Finance Agency (FHFA) announced further changes to Fannie Mae’s and Freddie Mac’s (the Enterprises) single-family pricing framework by introducing redesigned and recalibrated upfront fee matrices for purchase, rate-term refinance, and cash-out refinance loans.

“These changes to upfront fees will strengthen the safety and soundness of the Enterprises by enhancing their ability to improve their capital position over time,” said Director Sandra L. Thompson. “By locking in the upfront fee eliminations announced last October, FHFA is taking another step to ensure that the Enterprises advance their mission of facilitating equitable and sustainable access to homeownership.”

The priorities outlined in the 2022 and 2023 Scorecards for the Enterprises include developing a pricing framework to maintain support for single-family purchase borrowers limited by wealth or income, while also ensuring a level playing field for large and small sellers, fostering capital accumulation, and achieving commercially viable returns on capital.

The pricing changes broadly impact purchase and rate-term refinance loans and build on upfront fee changes announced by FHFA in January and October 2022, which have been integrated into the new grids. The new fee matrices consist of three base grids by loan purpose for purchase, rate-term refinance, and cash-out refinance loans—recalibrated to new credit score and loan-to-value ratio categories—along with associated loan attributes for each.

The updated fees will take effect for deliveries and acquisitions beginning May 1, 2023, to minimize the potential for market or pipeline disruption.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Christine Stuart EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Sarah Wolak STAFF WRITERS

Rob Chrisman, Nir Bashan CONTRIBUTING WRITERS

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin MARKETING INTERN

Submit your news to editorial@ambizmedia.com

If you would like additional copies of Mortgage Banker Magazine Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991

info@ambizmedia.com

You may have noticed many more reports about rising credit card debt, credit card delinquencies, inflation, and the risk of an associated recession. Somehow, and for some reason, people fear inflation. “It will erode the wealth of anyone on a fixed income,” people say. “Inflation will drive rates higher and is bad for lenders like mortgage companies.” Really? There are positives, and it is important for lenders to see those as we enter the Spring of 2023.

First, let’s look at debt – near and dear to lenders everywhere. After someone purchases a house, their largest debt is typically the mortgage. Following only housing debt does not paint the full picture. We need to look at similar debts like student loans, car loans, and credit cards, which put together, are now at similar debt levels as 10 years ago. Most lenders consider the complete debt picture of a potential

borrower, and it turns out it isn’t just millennials that are leveraging themselves up.

The Federal Reserve calculates total mortgage debt at roughly $11.5 trillion. To put that in perspective, while mortgage debt fell from above nine trillion in 2008 down to roughly eight trillion by mid-2013, it has been on the rise ever since. Growing at a steeper percentage over the last five years than any of the other debt classes, it is back to nearly $9 trillion and rising.

Student loan debt, which tends to garner a huge amount of press, has grown at the most linear clip, tripling to nearly $1.76 trillion since 2006.

Student loans are now a larger debt class than credit card debt and auto loan debt combined. Auto loans and credit card debt have followed a similar path over the past 12 years, peaking in 2008, and dipping for a few years, before reaccelerating for at least the last five. Auto loan debt has outpaced credit card debt over that time and is now roughly $1.52 trillion dollars.

That said, individuals, state and local governments, and the Federal government spent 2020 and 2021 refinancing their debt. Families weren’t the only ones obtaining fixed-rate financing at less than 3%. And they are very happy with

their low rates. The same can be said for state governments and the United States.

Which brings us to inflation. The commonly accepted measures of inflation are the Consumer Price Index and the Producer Price Index, both produced by the Bureau of Labor Statistics. Both were tame for many years, with some minor fluctuations. And these minor fluctuations are often caused by a particular commodity, such as oil, rather than the broad index. Prices don’t all rise or fall in unison. In fact, no one knows exactly what causes inflation, what effects it has, what is the best measure of it, what a normal rate is, and how to move it up or down.

Inflation hovered around the Fed’s 2.0% target for several years, but in 2021 began to pick up steam and rise to unacceptable levels. This has made the need for stronger wage growth more relevant for workers. Hourly earnings have been increasing to keep up with 6 or 7% inflation levels.

Lenders should keep in mind that a little inflation is good, and too much is bad. For many years it was “adequate.” At the current time it dominates the Federal Reserve’s thinking. Rising rates will slow the economy. That said, it takes time. And the United States has lost millions of workers. As a result, for example, leisure and hospitality, day care, and other sectors remain short workers. And there is excess savings which is pushing up spending. And firms are holding on to their excess workers in case the recession does not come. So, the impact of rising rates is being muted. In the meantime, inflation remains elevated. So, it will take time. But if the Federal Reserve keeps raising rates into a strongly inverted yield curve, many believe that a recession is virtually guaranteed at some point in 2023.

LENDERS SHOULD KEEP IN MIND THAT A LITTLE INFLATION IS GOOD, AND TOO MUCH IS BAD.ROB CHRISMAN

Your employees’ pets won’t be lonely any time soon.

The COVID-19 pandemic made the mortgage industry work from home. But what was once seen as temporary appears to be a new way of life based on five remote work trends shaping up for 2023.

Yet not just domestic animals benefit. Employers can, too, because flexibility boosts productivity, profitability and happiness.

Robert Half, a recruiting and business consulting firm, conducted a survey of 2,500 U.S. workers and found five key remote work trends taking shape for 2023.

Remote Jobs Aren’t Going Away: Robert Half says nearly half of U.S. workers looked to find a new job in the new year, and over a third of those respondents expressed wanting a position that allows them to work remotely. Nearly 9 in 10 workers considering a job change are interested in hybrid or fully remote positions. And Robert Half reports that these workers have options: 28% of all new job postings in January 2023 were advertised as remote.

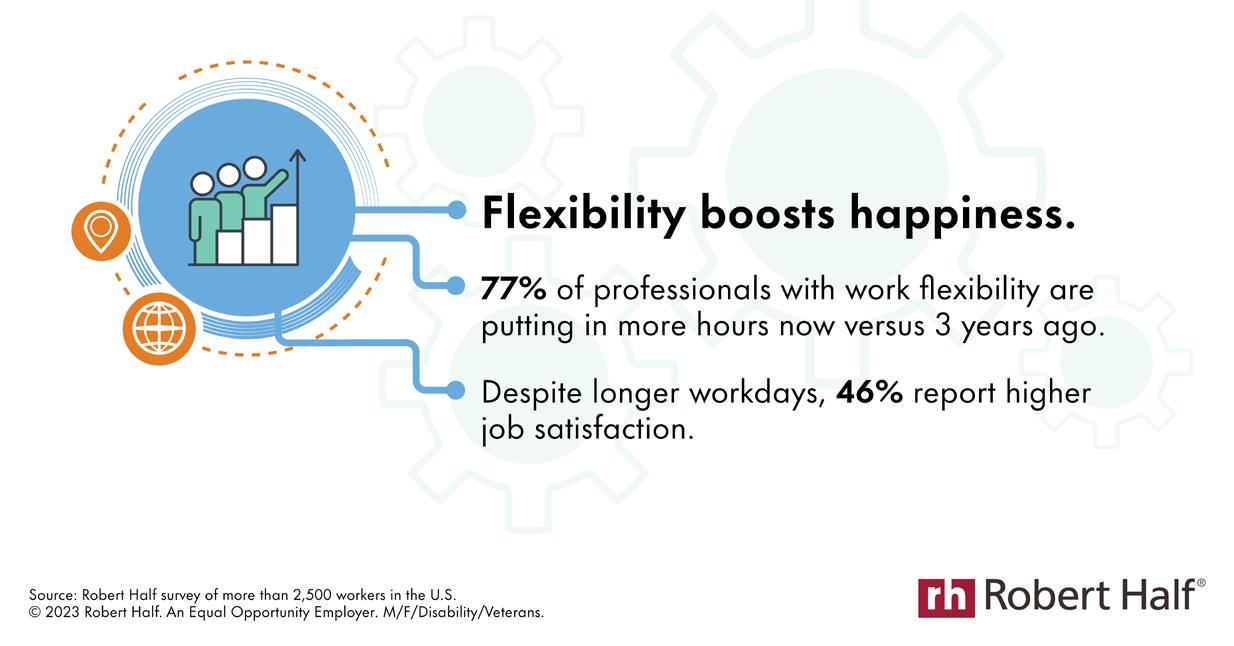

Flexibility = Employee Health: More than threequarters of professionals (77%) who can work where and when they are most productive say that they’re putting in more hours now than three years ago. Despite working longer hours, they’re motivated; 46% report higher job satisfaction.

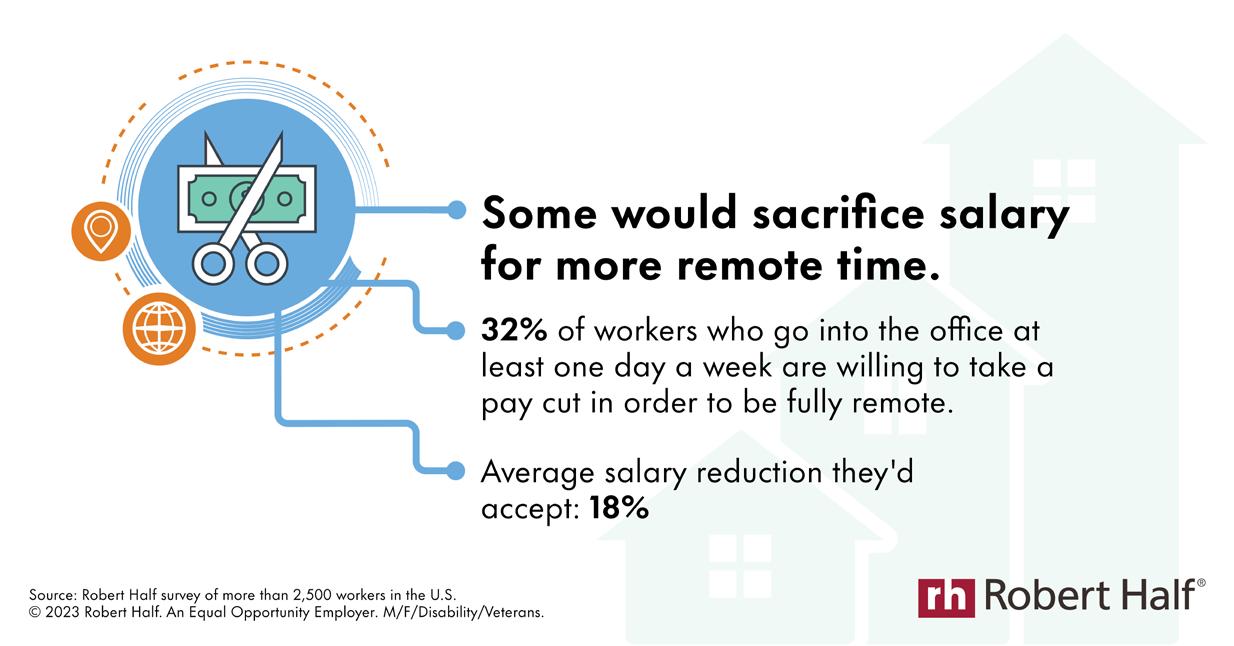

Remote Time Trumps Salary For Some: Nearly one-third of workers (32%) who go into the office at least one day a week reported that they’re willing to take a pay cut for the ability to do their job remotely all the time. Technology professionals (47%), 18- to 25-yearolds (42%), and working parents (41%) are most likely to accept a salary reduction to be fully remote.

Office Camaraderie: Workers also conceded that being in person has benefits, especially when it comes to coworker relationships. Around two-thirds of professionals (65%) said they have more effective relationships with colleagues they’ve met face-to-face

versus those they have not. More workers are comfortable collaborating in person (49%) than virtually (31%).

Equal Opportunities: Most managers (82%) who oversee hybrid teams feel that in-office and remote employees have the same opportunities for career advancement. However, some remote workers are concerned; 42% say that they worry about being visible for project opportunities and promotions.

“Our research shows that remote work is

here to stay. It’s still a tight, candidate-driven market and it’s important for workers to have the flexibility they need for a better work-life balance,” said Brandi Britton, executive director for Robert Half’s finance and accounting practice group. “In addition, remote work has remained popular because career advancement opportunities exist. ... Workers still feel empowered in today’s job market and aside from salary, remote and flexible work options are still atop their wish list when looking at job opportunities.”

Despite the ever-growing offerings of workfrom-home opportunities, many in the industry have firm opinions on their work environments. Corey Vandenberg, an LO who works for Michigan-based Lake State Mortgage, but operates out of Lafayette, Indiana, has been working remotely for about five years, a large portion of that due to the fact that he had a one-person office before the pandemic hit.

Vandenberg said the pros are numerous and the cons are few and far between. “You can work anytime. All the equipment is here. You have comfort, security, and no drive time,” he said.

Dave Cook, branch manager and LO for Denver Mortgage Lounge – a DBA of Luminate Home Loans – says that for him, a hybrid work model has been suitable. “I worked from home at the beginning of the pandemic and I missed that in-person collaboration,” he said. “But I was also surprised to hear big companies aren’t going hybrid and are making their employees all return to the office. Hybrid is a happy medium, and it really depends on the job position that you have to determine whether you really need to come into the office.”

On the flip side, others are teamoffice. DanYell Drummond, who has 20 years in the business and the last eight years working remotely, said she does expect the old-school style of face-

to-face contact with coworkers and borrowers to go away completely.

“LOs have been working remotely for years,” said Drummond, who is based in Utah at Utah Mortgage Loan Corp. “The next generation may not even meet their borrower.” Drummond also said that while remote working allows her to expand her business hours to include personal needs that give her a better work-life balance, she misses the in-person camaraderie that comes with office culture.

Ben Lavender has been an in-theoffice LO for 10 years, and he has no urge to work remotely. “I have the ability to work remotely, but I choose not to,” said Lavender, who writes mortgages for Long Island-based Madison Mortgage. Lavender, who oversees a team of eight other LOs, feels that it’s important to be in the office - especially for less experienced people - to support each other.

“IT’S IMPORTANT FOR WORKERS TO HAVE THE FLEXIBILITY THEY NEED FOR A BETTER WORK-LIFE BALANCE.”Brandi Britton, executive director for Robert Half’s finance and accounting practice group

Successful women are constantly looking to hone their skills, build relationships and better understand how to use and improve their abilities and talents. They want to be able to share their experiences and questions with colleagues who understand, and do it in an environment that helps build connections that last a lifetime. That’s why there’s the Mortgage Star Conference for women in the mortgage profession, a specially-designed hands-on immersion event centered around superior results.

In a market downturn, there’s a constant piece of advice that gets thrown around to originators: diversify your portfolio. Much easier said than done, though, especially if you’re considering getting into Non-QM.

There’s always going to be demand from gig economy workers and the selfemployed to get a non-traditional loan for their homes, but this particular channel faces some ups and downs. Throughout most of 2022, the channel was struggling and Non-QM lenders were going out of business, but this year it could keep lenders and loan originators in business.

Last year, Non-QM got pummeled in the secondary market, mainly because interest rates rose faster than they have in the past 28 years. This triggered a liquidity squeeze, causing NonQM lenders nationwide to face market-to-market losses, layoffs, and even shutdowns in some

cases. However, the latest securitizations from Angel Oak Mortgage and A&D Mortgage signal that the market is finally starting to recover.

“It’s been very tough with a lot of players that have completely left the market,” B. Riley analyst Matt Howlett says. “The liquidity crisis caught people by surprise and some of the weaker play ers have exited. But those people that have sur vived are in a very good position right now.”

Toward the end of 2022, the mortgage rate topped 6% — its highest level since the 2008 global crisis — up from just 3% at the start of the year. This caused a liquidity squeeze in the secondary market, in which Non-QM loans are particularly vulnerable.

Because the GSEs don’t buy Non-QM loans

CONTINUED ON PAGE 12

Debt-service-coverage-rental loans (DSCR) have risen in popularity recently, according to numerous lenders that offer the product, but will they perform well this year if there is a recession?

As volume started to wane with qualified mortgages of owner-occupied single-family residential, many lenders started to pivot to DSCR loans. Most Non-QM and private investor lenders that provide DSCR loans reported back that all is well, even among their short-term rental borrowers.

Why look out for short-term rentals?

Because throughout the pandemic-induced housing boom, many people saw shortterm rentals as a way to make money, so platforms like AirBNB and VRBO blew up quickly. DSCR lenders made programs available for short-term rentals, like those on AirBNB and VRBO, so if the AirBNB bust is going to happen, it would have an impact on these companies.

There’s been a rise in inventory on AirBNB and VRBO, but it seems like the Average Daily Rate (ADR) is still holding. Back in October, numerous AirBNB super hosts started talking about the “AirBNB Bust” in select metro areas, saying they’ve seen fewer bookings.

Reports from other lenders and leasing companies suggest this might be true. In the third quarter of 2022, mega landlords like Invitation Homes saw occupancy drop 60 basis points year-over-year. Also, HouseCanary’s report for the second half of 2022 shows that rental listing inventory is up 93% year over-year and days on market is up 52% year-over-year. Typically, this would bring prices down, causing issues for DSCR borrowers who rely on cash flow, but so far rent prices remain historically high.

But most DSCR lenders and Non-QM lenders that provide DSCR loans say everything is fine.

Over at RCN, these loans are performing just fine.

“We’ve seen performance stay very steady, despite the economic turbulence that we’ve been kind of going through over the last 9 to 12 months here,” RCN Chief Financial Officer Justin Parker said.

From a portfolio perspective, performance of these loans have also remained steady. Parker admits short-term rentals are slowing down a bit in terms of volume and activity, but performance wise, it’s still very strong due to the sizable cash flows attributed to the product type.

RCN does lend on AirBNB and VRBO properties, and Parker says the company

has not seen the effects of an alleged bubble in the AirBNB market.

Analyst Howlett weighs in saying that this increase in vacancies and drop in rental prices are geography-based.

“I think if you looked at San Diego, Seattle, Las Vegas, Phoenix, there could be certain markets where you could see bigger rent declines,” Howlett said. “But from a national basis, the rental market and the single family rental market are in really good shape.”

Still, Parker admits this upcoming recession could have an impact on these DSCR borrowers and their lenders.

“The Fed is pushing for recessionary activity and in times of recession you start seeing a lot of people stop spending and stop vacationing,” Parker said. “So there does become a concern around how much short-term rental activity can you generate not only in a good market, but a down market as well. Do I think that there’ll be some properties that maybe struggle a little bit? Sure.”

Slyusarchuk says he’s not worried, though. DSCR loans only make up a small portion of loans in a pool, and short-term loans are an even smaller portion.

“Most DSCR loans are based on longterm contracts. There are some short-term in the pool. But it’s like, I don’t know, under 10%, something like that,” Slyusarchuk said. “You just have to control how many loans you put in each pool.”

The key in getting these loans to succeed in the secondary market is to ensure sound underwriting.

“Secondary markets are having a tougher time with short-term rentals,” Parker said. “A lot of it really boils down to how you underwrite the property. Some lenders will look at historical income and underwrite it to that. Some lenders use third party sources such as airDNA and they’ll utilize that. And there’s some lenders, like RCN, where we don’t only look at the short term rental, but we also look at the property on a long term basis. We ask the question, ‘what if this property’s utilized on a long term basis, and what do those rents look like?’ And we make sure that when we’re underwriting it, we’re taking all of those things into account.”

“And I think where you see most of the struggles from trading and secondary markets is those that only lean into the AirBNB rental income and don’t necessarily take into account a long-term strategy,” Parker added.

and lenders don’t hold these loans on the balance sheet, the only natural buyer is the wholesale market, Howlett explains. All Non-QM loans need to be securitized and sold to secondary market investors, who are most attracted to loans with higher interest rates (or coupons).

So when rates suddenly shot up, lenders holding older loans with lower interest rates (lower coupons) couldn’t sell or exit them, causing pipelines to freeze. This is what caused shutdowns, bankruptcies, and layoffs across the Non-QM space.

The first sign came when Angel Oak account executives announced on social media the lender would revert all programs and guidelines back to where they were before the pricing and liquidity crisis. Since Angel Oak Capital buys the production, moving guidelines back is a big indication of a comfort level with loan securitization.

“They’re completely correlated,” Tom Hutchens, executive vice president at Angel Oak Mortgage Solutions, says. “We’re increasing the guidelines because there’s been an increase in liquidity in the market. Anytime liquidity starts to shrink, guidelines follow suit. So when liquidity starts to grow, guidelines grow.”

Angel Oak’s first securitization of 2023, the senior tranche of the AOMT 2023-1, received a AAA rating from Fitch Ratings. Namit Sinha, chief investment officer of private strategies at Angel Oak Capital Advisors, said the company is pleased with the execution of these loans and believes Non-QM will have a resurgence this year.

In February, Fitch Ratings gave A&D Mortgage quite the endorsement providing AAA, AA- and A- ratings to the biggest, best pieces of the securitization — especially considering more than 43% of the loan pool are Non-QM loans.

“I can tell you that securitizations on Non-QM are pretty close to securitizations on other classes,” A&D Mortgage CEO Max Slyusarchuk says. “January spreads have tightened a lot due to the fact that the Federal Reserve has been more optimistic and not in hiking mode. So that’s why Non-QM is doing so much better than before.”

Although Non-QM is susceptible to issues when there’s a liquidity squeeze in the market, both lenders maintain that the loans perform well — nearly as well as agency loans.

“Non-QM loans are still viewed by the

end investors as really good loans,” Hutchens says. “If we had just started Non-QM last year, that’d be a different story. But, we have a 10year track record of Non-QM originations and securitizations, and the performance of them kind of speaks for themselves.”

Non-QM’s comeback arrives just in time for loan originators and brokers to add it to their portfolio. Throughout most of the pandemic housing boom, move-up buyers were the center of attention — clean, pristine borrowers with excellent credit looking for a simple conventional loan. They could go to any lender and get what they’re looking for, but now some loan officers are seeing more complex customers knocking on their door, wondering if they could get loans.

Slyusarchuk said borrowers and brokers are willing to embrace non-traditional options, but for smaller lenders it’s still a challenge. Many were spooked due to the liquidity crisis that happened during the onset of the COVID-19 pandemic.

“Some of the lenders originated loans before the pandemic and then pandemic came, and they had to sell at a big discount. It was a huge disappointment,” Slyusarchuk said. “Warehouse lines got scared; everybody got scared.”

Eventually, fears began to taper off and more lenders went back to doing NonQM loans, but in 2022 there was another liquidity squeeze due to rapidly rising rates, and lenders had to sell their loans at a discount once again. So, even though these non-traditional loans are becoming more widely accepted in the broker community, lenders remain hesitant.

“It’s easier for brokers where you lock the loan with a lender and you’re done,” Slyusarchuk said. “But for guys who close on their name and have to be part of the market, it’s a little more challenging.”

But if investor appetite for these loans are increasing, why shouldn’t lenders, brokers, and originators return or begin working in Non-QM? Well, depending on the severity of this upcoming recession in the second half of 2023, it could have an impact on Non-QM.

“They were well-qualified borrowers, typically because they were selling a house that had appreciated in significant value. So, a conventional loan was pretty much the best option. But I think right now you have a real opportunity to explore some NonQM loans as well,” Kellen Vaughan, branch manager for Trademark Mortgage, says. “That’s certainly a conversation that we’re having with a lot of folks, especially those wanting bank statement loans.”

But adding product lines and partnering with new lenders takes time and research. Slyusarchuk says loan originators and brokers need to be well educated on the products and able to recognize a Non-QM borrower right away.

“It’s good, but we have to teach them how to spot the proper customer,” Slyusarchuk said. “It’s not that easy when somebody is narrow minded and has only been doing conforming loans for the past 10 years. You know, it’s a little bit of a challenge.”

Per the last Federal Market Open Committee meeting, Federal Reserve Chairman Jerome Powell expects the U.S. economy to soften in 2023, and achieve its 2% inflation target without a big downturn in jobs and the economy. However, he warned no one should assume that the Fed can protect the economy if default occurs.

Both Angel Oak and A&D Mortgage are predicting the Fed will make a soft landing and the upcoming recession will be mild, but more importantly, that’s what analysts are predicting as well.

Overall, Howlett believes the remaining Non-QM lenders in the marketplace are prepared for this upcoming recession, which is likely to be mild.

“Right now, housing looks like it’s in good shape to handle a rising unemployment rate and it looks like it’ll be a soft landing, at least for the housing market at this point in time,” Howlett said. “But you’re right, I mean, the difference between a soft landing and hard landing could really make or break the model.”

“NON-QM LOANS ARE STILL VIEWED BY THE END INVESTORS AS REALLY GOOD LOANS.”

–Tom Hutchens, Angel Oak

It’s time to let your skills shine. Find resources for breaking through barriers like degree screens and stereotypes. It’s time to tear the paper ceiling limiting STARs: workers Skilled Through Alternative Routes rather than a bachelor’s degree.

Jeff, STAR

Jeff, STAR

I am more than who I am on paper.

Your daily news, industry insight, and professional advice is now streaming. Tune in to The Interest to discover everything you need to know to be a better mortgage professional.

Airs Monday - Friday.

Veterans, when you’re struggling, soon becomes later becomes someday becomes ...when?

Don’t wait. Reach out

Whatever you’re going through, you don’t have to do it alone. Find resources at VA.GOV / REACH

Interfaces (APIs) are all the buzz today – and for a good reason. By enabling connections between programs and systems, APIs help users perform business processes with greater ease and efficiency. Namely, they can help users achieve desired outcomes without paying any mind to the underlying functional and system complexities occurring behind the scenes.

At Black Knight, we have the privilege of delivering APIs that enhance our clients’ business processes across the mortgage life cycle. Notably, we’ve observed the following ways APIs can transform servicing functions for the benefit of both a servicer and their business partners and customers.

Traditionally, interfaces used a “data in, data out” approach, with a lot of intelligence and business functions scattered throughout integrating systems upstream and downstream. However, APIs have flipped the script by exposing neatly packaged business functions, including rules, processes, logic and data. Rather than focusing on what systems can do (i.e., inside-out), APIs focus on what outcomes servicers and their customers are trying to do – such as making a payment or setting up auto-draft. This outside-in view simplifies and streamlines the process of achieving desired outcomes.

Technology evolves quickly, and so do mortgage servicers’ needs. To keep pace with the latest regulatory demands and customer expectations, servicers must be positioned to adapt quickly. Previously, servicers had to manage significant underlying technicalities to implement new functionality and services. However, APIs handle these underlying

details seamlessly behind the scenes. This means that servicers can implement and begin using new features, fast. And APIs are made available in technology agonistic framework, allowing servicers to choose from a wide variety of tech stack.

What’s more, APIs allow technology providers to bring new solutions to the market quicker. That’s why we operate under an “API-first” strategy at Black Knight – which means that our products are developed and enhanced with the power of APIs.

Whether it’s servicer’s frontline employees or back-office staff or their customers, APIs can improve user experiences and drive consistency across devices and channels by acting as the “plumbing” that seamlessly connects everything. Servicers have greater customization power to build their own user experiences, and they can also realize more consistent results across applications thus reducing risk and increasing satisfaction. Plus, APIs offer more possibilities for automation, self-service and real-time engagement, which many of today’s customers expect. Regardless of your unique needs and goals, APIs can help you achieve the precise functionality your servicing business needs, with the power and flexibility to quickly pivot when necessary.

Similarly, APIs can help developers, architects and designers accomplish more with less time and effort. Since APIs are developed using consistent vernacular and standardized guidelines, they are intuitive to use. Essentially, APIs speak the language of mortgage business, rather than the com-

plex language of systems, which makes working with them easier. Additionally, many technology providers catalog their available APIs in a central repository, such as the Black Knight Developer Portal. This gives developers a one-stop storefront where they can search for and browse integration offerings for specific use cases.

Ultimately, APIs can help servicers reduce risk and total cost of ownership. To start, APIs can reduce risk by tapping into both data and business functions. This can result in consistent channel behaviors that are more secure and scales with the needs of the business.

There are also several ways APIs can help servicers reduce their total cost of ownership. They can lessen or eliminate the need to build and maintain wrap systems with specialized subject matter experts to manage the complexity of the integrations. Using APIs reduces the overall technology footprint and helps modernize infrastructure for servicers. And since APIs are typically sold under simplified contracts, they can be adopted more quickly.

Whether it’s accelerating innovation or better serving customers, APIs are helping a growing number of servicers digitally transform their business operations. In today’s market, operating nimbly can be a competitive differentiator. If you haven’t already, consider opportunities to strengthen your tech stack with APIs.

“A LITTLE RECESSION IS GOOD FOR US, AND TOO MUCH IS BAD”

–Kellen Vaughan

The entire nation, not just the mortgage industry, seems to be buying into the media’s gloomy outlook on the economy this year with Google’s most searched terms including recession, housing bubble, and inflation.

The people buying into this housing bubble delusion are most likely potential homebuyers — your clients — and newer entrants into the mortgage industry.

“Some are exiting the business altogether,” Kellen Vaughan, partner and coach for Next Level Loan Officers, said. “I’ll say that a lot of the loan officers in that camp got into the mortgage business in the last 24 months, during the refinance boom. They think the sky is falling.”

Veterans in the industry aren’t buying it, though. Those who actually understand the market see plenty of opportunities coming their way this year.

“Difficult markets are when the opportunities are created,” Shant Banosian, one of the top originators nationwide and Guaranteed Rate’s number one loan officer, says. “So if you show up right now in 2023, you’re going to have an opportunity to really establish yourself as a leader in the industry.”

Of course, origination volume is expected to drop this year with the Mortgage Bankers Association (MBA) forecasting a 15% decline from 2022. But keep in mind,

loan originators, that doing just two transactions a month puts one in the top 15% of income earners in the United States. Of course, this is dependent on the loan size, but for the most part, doing two transactions a month as a loan officer brings in a higher income than most jobs in the U.S.

It means loan officers are sort of stuck, says Barry Habib, an entrepreneur and mortgage coach for MBS Highway.

“They’re still making enough so they have to stay in the game and the alternatives are not great, but they may have created a lifestyle that requires them to make some more money than this,” Habib said.

He encourages loan officers to let their competitors’ heads spin with this doom and gloom until they leave the industry. These refi boom loan originators were never up for playing hardball anyway. The deals they leave behind are up for grabs for the remaining LOs, and many are expected to leave.

Vaughan has already gotten a few calls from real estate agents who were working with a loan officer who left the business and now need to send their clients elsewhere. His Dallas-based branch, Trademark Mortgage, was happy to pick up the extra leads

“That’s why it’s important, now more than ever, to not withdraw,” Habib added. “Really lean in and demonstrate that you understand these market conditions.”

“YOU HAVE TO BE ABLE TO COMMUNICATE THE DATA PROPERLY. AND MAKE SURE THAT YOU ARE SHOWING THEM ALL THEIR DIFFERENT OPTIONS.”

–Shant Banosian

It’s hard to see what’s really happening without any friends with 10 or more years of experience in the industry, so here’s what they’re saying: Inflation is going to drop in a meaningful way over the next few months, bringing down mortgage rates. What this may mean is more buyers entering the market. Habib is the most optimistic, saying, “It will unleash a horde of buyers into the marketplace.”

Inflation slowed on an annual basis for six straight months, easing to levels that existed before the pandemic. Meanwhile, PayScale’s Salary Budget Survey, found on average, a planned base salary increase of 3.8% in 2023.

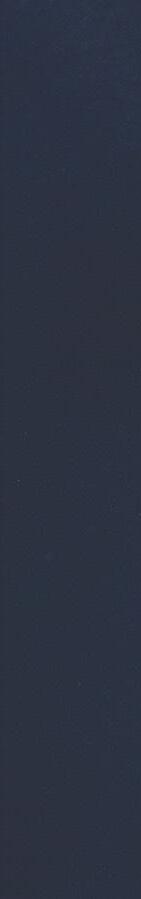

Home prices are not expected to have a major drop due to low inventory levels, but the MBA predicts values will remain stagnant allowing household income to catch up to property values. Redfin, on the other hand, is more optimistic predicting a 4% drop in home values.

Banosian said this year will continue to be a seller’s market because housing inventory is so low, but buyers should have an easier time getting under contract with less competition.

“They’re gonna be able to have things like home inspections, mortgage contingencies that they can utilize to protect themselves,” Banosian said.

But none of this is guaranteed, of course. Zillow economist Orphe Divounguy said this all depends on the severity of this recession and if the Federal Reserve can pull off a soft landing.

“Historical evidence shows that the 30-year-fixed mortgage rate tends to follow the yield on 10-year treasuries,” Divounguy said. “But the yield on 10-year treasuries depends on how investors feel about recession risk, right? So inflation and recession risk is going to play a key role in determining where the 30-yearfixed rate is going to end up.”

Data from the S&P Global U.S. Purchasing Managers Index (USPMI) also indicates a recession is coming. This means the Fed could be forced to pivot

and drop interest rates once again. But economists, like Divounguy, are not quite sure if that will be the case considering consumers have never been in a better position at the start of a Fed tightening cycle.

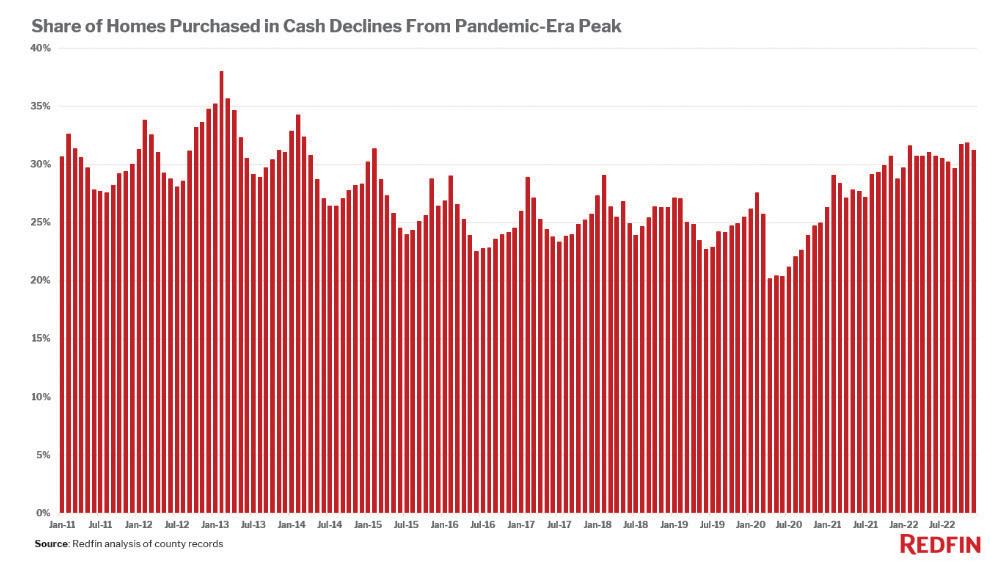

“Consumers were in a much better financial position with extremely high savings before the Fed started raising interest rates,” Divounguy said. “Then we saw savings dwindling rapidly. Right now, the savings rate is below 3%. It was above 7% last year. We’re also seeing credit card balances increase a lot recently. So if the U.S. consumer can weather the storm, then we could still avoid a recession. And if we avoid a recession, then mortgage rates will not decline by much more than they have already.”

Habib is confident the recession will be mild, saying that rates will begin a rapid deceleration on May 10 and cause a resurgence in purchase activity. If rates move down to 5%, he said that should bring one-and-a-half million more people into the market.

Vaughan agrees that a mild recession benefits the industry, but if it becomes too broad, unemployment ratchets up, and consumer sentiment becomes dismal, that could be problematic.

“A little recession is good for us, and too much is bad,” Vaughan said. “So the million-dollar question is where on that scale are we ultimately going to land.”

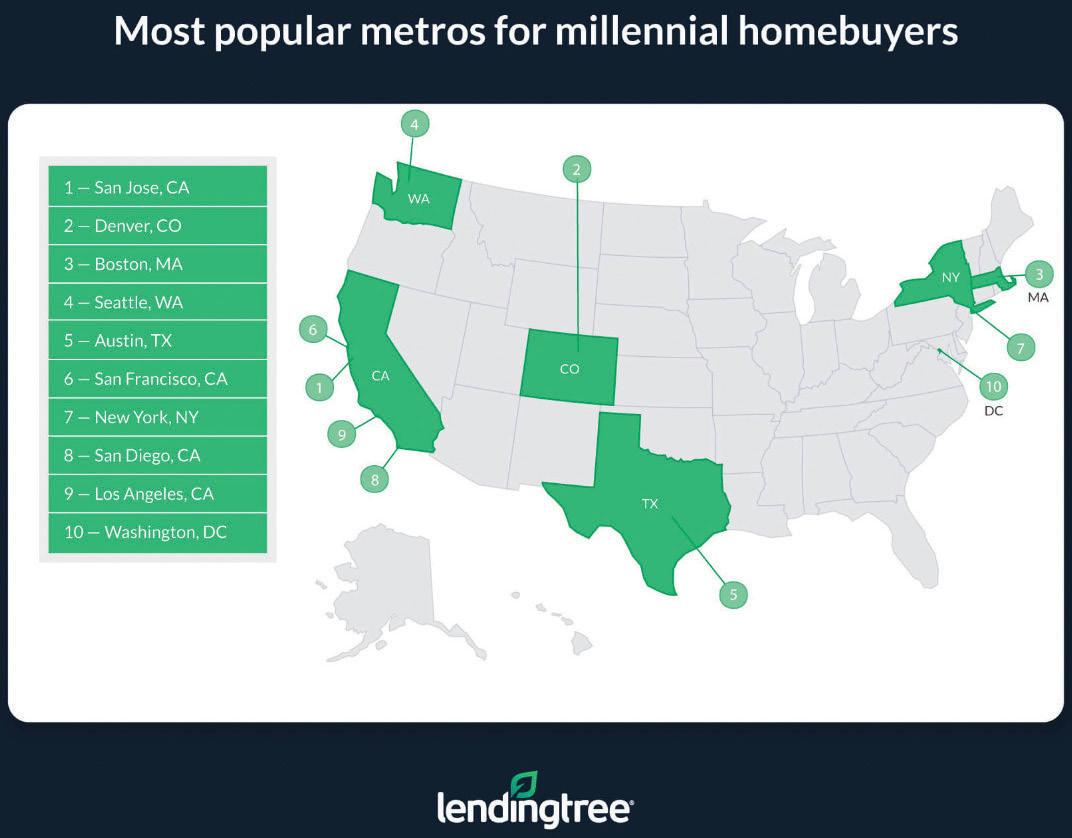

Throughout the past two years, move-up buyers took center stage while first-time buyers were impatiently waiting on the sidelines. Now these move up buyers are comfortably sitting at home paying a 2 to 3% interest rate, and first-timers are gearing up to enter the market.

According to NAR’s most recent data, 31% of purchases are first-time home buyers compared to when rates were at 7.25% and first-time buyers made up 26% of purchases. Now Habib anticipates that the percentage of first-time buyers will continue to increase to 33% or 34% as mortgage rates decline.

Zillow’s Divounguy agreed that this is the best time in three years for firsttime home buyers to get into the market.

“REALLY LEAN IN AND DEMONSTRATE THAT YOU UNDERSTAND THESE MARKET CONDITIONS.”

–Barry Habib

However, affordability remains a main barrier for many purchasers and they’re waiting for rates to stabilize before moving in.

At Vaughan’s Dallas branch, they’ve been seeing more and more first-time home buyers or those who have little to no money to put down and less than perfect credit, looking for FHA loans, USDA loans, and VA loans.

“Just speaking for my business, we wrote less government loans over the last 18 months than we had in my prior 10 years in the mortgage business. So it definitely had an impact,” Vaughan said. “Those who didn’t have 20, 30, 40, or a hundred thousand dollars to bid over asking, they were essentially in a position where they had to rent. And I think that’s certainly softened here, and I believe that to be the case across the U.S.”

Banosian has already seen more buyers flock to his area in Worcester, Mass., which is in central Massachusetts about 50 miles west of Boston. According to realtor.com, Worcester is one of the most affordable cities in the U.S. and a top spot for first-time homebuyers.

“The market’s been super robust,” Banosian said. “Boston and the surrounding suburbs tended to slow down a little bit more. But Worcester was more active over the course of the fall in the wintertime, partly because of the amount of activity and development that has happened in that area is really just drawing people. And it’s frankly just much more affordable.”

During the pandemic, loan officers, real estate agents, appraisers, and nearly everyone involved in mortgage transactions were slammed. There was no incentive in helping harder-to-qualify borrowers when there were already plenty of well-qualified conventional borrowers lined up outside the door. These move-up buyers were selling their homes that appreciated significantly, allowing them to afford the inflated homes on the market.

There was also no incentive to work with non-conforming loans, but this slowdown in business should afford everyone enough time to educate themselves on Non-QM and help those neglected borrowers.

“A lot of lenders and real estate folks were so inundated with super easy clean deals that they weren’t taking the time to really go and unpack complicated or seemingly complicated Non-QM loans,” Vaughan said.

“Now you have a real opportunity to explore some Non-QM loans. That’s certainly a conversation that we’re having with a lot of folks, especially those wanting bank statement loans.”

Habib is also anticipating that debt consolidation and HELOC loans will become more popular given the fact consumer debt reached an all-time high in 2022 and the average credit card rate is over 24%. So if a consumer has a $300,000 mortgage at a 3% interest rate it’d be crazy to refinance. But if they’re dealing with some outstanding debt, they might want to use the home equity line of credit methodology to tie up other loose ends, moving their interest rate from 3% to 5% or 6%.

“If you took an average home, 58% of it is equity and 42% is mortgage. You contrast that to 2008 where only 19% was equity and 81% was mortgage,” Habib said. “There is a tremendous opportunity for equity withdrawal, but in addition to that, you have a lot of opportunity on the purchase side.”

Even these well-established loan officers had their humble beginnings where they grinded to build up referral sources and new clientele. The consensus for the easiest and cheapest way to LOs names out there is by utilizing social media.

Google analytics shows that consumers are using search terms like recession, housing bubble, and inflation, so using those as buzzwords and addressing their concerns is a simple way to gain their attention.

“If we can speak to those people, it will produce a lot of social media activity and we can draw people to the top of the funnel with that,” Habib said. “But we can also have conversations that are more meaningful to our clients and help them overcome their fears. We can also gain more referral sources because potentially those real estate agents they’re working with don’t know how to combat those objections.”

Vaughan uses his colleague Kenneth Travis, coach at NextLevelLO, as a role model for others to follow when trying to build a social media following. He posts consistently, despite the fact he may not have good news to share. Sometimes he posts a silly Instagram reel or TikTok, but it grabs people’s attention and convinces followers that he’s a trusted source.

“The consistent person on social media

will win over the perfectionist every single time,” Vaughan said.

Social media marketing is partially what Vaughan and Travis teach at NextLevelLos, as well as how to take the online, offline. More specifically, how do they turn those conversations, those comments, and those likes into leads, applications, and ultimately close loans.

Most of the content should be geared towards educating the audience.

Additionally, real estate agents are experts at selling real estate, but they may not know a whole lot about securing a mortgage. This is an opportunity for the loan officer to provide value to their referral partners.

“These agents are thirsty for knowledge,” Vaughan said. “They want to be smarter and better at their craft. And the only people right now that are providing them any information is typically their broker or Google, both of which I would say are probably not great sources of mortgage knowledge. So we really make it a great point to be a resource for our referral partners.”

Loan officers can also help their referral partners host first-time homeBuyer seminars. It will help get the word out about loan programs and create opportunities for these renters to become first-time home buyers.

Vaughan also suggests that loan officers look back into their own data and contact people who applied but weren’t able to convert into a homeowner. Now is the perfect time for these clients to get back into the market.

“Education is what people gravitate to when they want to know what’s happening in the market. Whether that news is extremely positive or whether it’s just the truth,” Vaughan said.

Banosian agreed, saying that people are craving advice more so than ever, both real estate agents and consumers. The most important aspect to this marketing tactic is to ensure people see the LO as an expert in the market, he said.

“You have to be able to communicate the data properly. And then two, make sure that you are showing them all their different options,” Banosian said. “That ultimately leads to referrals of friends, family, new business partners, all that kind of stuff, if you become a trusted advisor.

We’re as focused as ever on aligning requirements across the alphabet soup of federal agencies.

I don’t have to tell you that FHA has different rules than Ginnie Mae, which has different rules from Fannie (Mae) and Freddie (Mac), which have different rules from the VA. It’s maddening, isn’t it? And it hurts borrowers.

We’re making this clear to the powers that be. Our message to them is simple. If they align their requirements across the board, we’ll be able to help more borrowers, more quickly, and more affordably, too. Alignment is a no-brainer, and we’ll keep fighting to make it a reality.

We’re also focused on capital standards and requirements for banks and non-banks which service mortgage loans. The current requirements are far too high – and going even higher. At the rate they’re going, they threaten to drive banks and non-banks alike out of the servicing business.

That would be an unmitigated disaster. Who would do your essential work? Who would fulfill the high responsibility of helping people keep their homes? The answer is no one – and the MBA is letting lawmakers know it. We’re talking with FHFA, Ginnie Mae, bank regulators, you name it. And across the board, we’re telling them: Right-size capital standards – and stop this wrong before it’s too late.

Another current focus for us is fixing loan assumption fees. Demand for assumptions is skyrocketing in this time of high-interest

rates, understandably so. Yet the current situation is financially unsustainable, and your companies are losing huge amounts on each transaction.

Fortunately, there’s a simple fix. The VA, FHA, Fannie, and Freddie should increase their allowable fees, and index them to inflation, too. The MBA has formally made this request, and conversations with regulators are ongoing. It’s the only way to ensure we can keep helping so many borrowers – and we won’t rest until you get relief.

The same is true on every other pressing policy issue. The CFPB recently asked for

borrowers need them to keep working.

Whatever the issue, believe me when I say the MBA is talking to the decision-makers, and we know how to get results. There’s no better proof than what recently happened with flood insurance.

Since 2017, the MBA has strongly urged HUD to update its mandatory requirements, and after five years of endless advocacy, we succeeded. Just four months ago, HUD announced that FHA lenders can finally accept private flood insurance policies. That’s good for your companies and the borrowers you serve –and we’ll keep fighting to make this policy even better.

information on mortgage refinances and forbearances, with an eye toward regulation in the near future. We’re pushing back with the message that while streamlined refinances are good, the CFBP should lower costs, not raise them.

And when it comes to loss mitigation, we’re talking all the time with FHA, the USDA, the VA, and FHFA. We’ve asked the VA to create a permanent partial claim program, and when it comes to the GSEs, we support expanding borrower access to Payment Deferral and Flex Modification. The pandemic proved that these programs work – and with a recession on the horizon,

On that note, the MBA has launched a PR initiative to tell your story. We’re touting the millions of people you helped during the pandemic, and the countless ways you keep people in their homes. Our goal is for policymakers to walk away thinking, “wow, thank God for servicers.”

The truth is, you do your work behind the scenes, but you deserve to be at the forefront of the conversation. Through our new campaign, we’ll make sure you are. Like I said, you’re heroes – and it’s time more people, especially those in power, knew it.

WE’RE PUSHING BACK WITH THE MESSAGE THAT WHILE STREAMLINED REFINANCES ARE GOOD, THE CFBP SHOULD LOWER COSTS, NOT RAISE THEM.MARK JONES

Tinkering with credit score brackets and loan level price adjustments to move a few dollars around may not change homeownership rates, or at least that’s the concern of many mortgage professionals. They’re calling upcoming Federal Housing Finance Authority (FHFA) changes a potential epic fail.

The FHFA announced plans last year to make the homebuying process easier – and more accessible – for those with low credit scores, certain first-time homebuyers, low-income borrowers, and underserved communities. The plans largely follow the FHFA’s promise to eliminate fees or match fees for borrowers struggling to purchase homes. The new fee matrices imposed by both Fannie Mae and Freddie Mac consist of three base grids by loan purpose for purchase, rate-term refinance, and cash-out refinance loans— which the FHFA recalibrated to new credit score and loan-to-value ratio categories. According to Fannie and Freddie enterprises, the new loan and credit score thresholds will go into action on May 1. But the new fee guidelines have industry veterans worried about just how effective the LLPAs will be, and whether the changes are punishing high-credit borrowers.

Fannie Mae explained that the adjustments are designed to ease the financial burden off of low-income buyers and buyers with credit troubles. “We partially offset these price reductions with increased pricing for cash-out refinance loans, second-home loans and high-balance loans for higher-income borrowers,” said a Fannie Mae spokesperson. No one was made available to discuss these changes on the record.

Brad Cahoone isn’t convinced that the new plans are fair. Cahoone is the CEO and a mortgage broker at Lewisville, Texas-based Global Home Finance. “The new plans are being advertised as a solution to affordability,” Cahoone said. “[They’re] trying to get people to increase homeownership in lower FICO brackets and get traditionally underserved communities into homes.”

However, Cahoone emphasized that this may not be as inclusive as advertised. “They’ve added new brackets at the high end. It used to be that everyone over [a] 740 [FICO score] got the best price. Now if you have a 760 you get different pricing, and anybody above 780 gets the best pricing,” he said.

Cahoone also went on to say that the new guidelines eliminate the 620-639 credit score bracket.

For lower FICO scores, the changes will be the most noticeable, with improvements between 100-200 basis points improvements on those lower brackets. Cahoone says that equates to 1-2% less in closing costs, or, based on the median home price of last year, an extra $4,000-$8,000 savings. “Those price reductions are gonna mean a lot more affordability so it can be used as a buydown to get a lower rate,” he said.

David Stevens, CEO of Mountain Lake Consulting, is also

apprehensive about the new FHFA guidelines for LLPAs. As the former CEO and president of the Mortgage Bankers Association (MBA) and a senior vice president at Freddie Mac, Stevens says that he’s most reserved about the fact that this is Fannie and Freddie’s first attempt at a cross-subsidy pricing strategy. “[This means] better credit quality borrowers are going to get increases in order to subsidize the fee reductions for lesser credit borrowers,” Stevens says. “For example, a person with less than a 640 credit score on a purchase with 5% down is going to see an improvement in the LLPA by 1.75%. Today it’s a 3.5% fee in that specific bracket, but the new implementation will reduce the fee by half. But at the same time, if you’re a 740-760 FICO score with a larger payment like 15-20%, they are adding three-quarters of a point to all those borrowers.”

Stevens also reminded that the new guidelines impose a 40% debt-to-income (DTI) ratio cap. “If your DTI goes above 40% –which is low even compared to the CFPB – it means all of your debts and your mortgage payments can’t exceed 40% of your gross monthly income,” he said. “It’s going to take a lot of those borrowers who [the FHFA] is trying to help and push them out because lower-income borrowers tend to have high DTI.”

Both Cahoone and Stevens said that the FHFA should focus on promoting affordable housing over the LLPA changes. “I think that right now, [FHFA director] Sandra Thompson is trying to

make the GSEs more aggressive,” Stevens said. “No matter what you do to improve pricing for first-time buyers, juicing the price may not solve the problem. [This may be] an altruistic motive to increase the GSEs’ performance.”

Cahoone said that although he believes the FHFA’s true intention is to fight inflation at the core, the LLPA adjustments could price out more buyers. “When you raise the rates so much like [the Fed] did, 3, almost 4%, you cut out about 7% of the homebuying population every quarter-percent the rate is raised for a given house,” he said. “If you raise rates by 3% that’s that 7% number 12 times over.”

Stevens suggests that the FHFA should consider charging a basis point – basis point and a half – to apply to all scores regardless of income. “They can use that money that they create to have a fund to subsidize first-time buyers in the lower census tracts,” he explained. Stevens also added that other government agencies like the FHA have DTIs of 50%. “And most credit analysts will tell you that DTI isn’t a great reflection of performance because a lot of people have side jobs, cash jobs, a roommate, or parents living with them.”

Fannie Mae, on the other hand, suggests that their practices are well adept to solve the housing crisis and aid lower-income borrowers. The same company spokesperson wrote, “In coordination with FHFA, Fannie Mae will continue to review national pricing levels to ensure safety and soundness, support our affordable housing mission, and consistently provide liquidity to the mortgage market.”

On a larger scale, Cahoone and Stevens alluded to inflation needing to be controlled in order for successful – and affordable – homebuying. “Right now, we’re in an endless cycle of mediocrity,” Cahoone said. “The fact of the matter is that wages need to catch up and then, affordable homebuying could become realistic.”

The FHFA declined to directly comment on the new LLPA standards; however, a company spokesperson said that the organization is dedicated to making sure the homebuying playing field is even and accessible for all borrowers. The spokesperson also reiterated that the goal of the new LLPA standards is not only to adjust to last year’s rapid interest rate environment but to also maintain market stability. “I’m worried that the FHFA tinkering with how the GSEs do business [will] risk all sorts of negative outcomes in housing,” Stevens said. “There’s a lot of work to be done, but this unfortunate approach isn’t going to get us anywhere. It’s another way the FHFA is setting a precedent on tinkering with housing finance for the country.”

“NO MATTER WHAT YOU DO TO IMPROVE PRICING FOR FIRST-TIME BUYERS, JUICING THE PRICE MAY NOT SOLVE THE PROBLEM. [THIS MAY BE] AN ALTRUISTIC MOTIVE TO INCREASE THE GSES’ PERFORMANCE.”

–David Stevens

If these words come to mind when considering your ideal candidate for our “Mortgage Stars” list, then get your vote in and show your support for today’s female leaders in the mortgage profession.

Nomination Deadline: April 2

Winners will be included in Issue 4 of Mortgage Women Magazine. Even better, we’ll be recognizing winners at our Mortgage Star Conference for Women, happening LIVE in New Orleans, July 12, 2023. You can see more at www.mortgage-star.net.

nmplink.com/MortgageStar2023

Scott L. Luna Partner

Scott L. Luna Partner

sluna@ravdocs.com

469-730-4607

Scott Luna’s practice is focused on real estate law with an emphasis on mortgage document preparation and land title issues. Scott managed a successful multistate highvolume title and document preparation business for over 20 years before joining RAV and is recognized throughout the real estate legal community for his expertise. As a past President of the Oklahoma Land Title Association, Scott’s ongoing involvement in the industry adds to his wealth of title-related knowledge. Scott received his Juris Doctor degree from the University of Tulsa College of Law in 1991 after receiving his Bachelor of Science degree from Texas A&M University. Scott is currently licensed in Texas, Oklahoma, Missouri, Minnesota, Nebraska, and Kentucky.

Mitchel H. Kider Managing Partner

Mitchel H. Kider Managing Partner

kider@thewbkfirm.com

202-557-3511

Mitch Kider is the Chairman and Managing Partner of Weiner Brodsky Kider PC, a national law firm specializing in the representation of financial institutions, residential homebuilders, and real estate settlement service providers. Mitch represents banks, mortgage companies, homebuilders, credit card issuers, and other financial service companies in a broad range of litigation and regulatory and compliance matters. He defends clients in investigations and enforcement actions before the Consumer Financial Protection Bureau, Department of Housing and Urban Development, Department of Justice, Department of Veterans Affairs, Federal Trade Commission, Fannie Mae, Freddie Mac, Ginnie Mae, and various state and local regulatory authorities and Attorneys General offices. In addition, Mitch acts as outside general counsel to smaller companies and special regulatory and litigation counsel to Fortune 500 companies.

Gregory S. Graham Co-Managing Partnerggraham@bmandg.com

972-353-4174

Black, Mann & Graham CoManaging Partner Gregory S. Graham has practiced in the areas of real estate, litigation, and bankruptcy law since 1989, and is currently licensed in Texas and admitted to practice before the United States District Courts for the Northern and Eastern Districts of Texas.

Mr. Graham is also currently licensed to practice law in Georgia and has been since 2017. He received his Juris Doctor degree from Southern Methodist University School of Law in 1989 after receiving a Bachelor of Arts cum laude from UT Dallas.

Mr. Graham’s affiliations include the Dallas MBA, where he previously served as a Director & Chairperson of the Legislative Committee; DFW Mortgage Brokers Association, where he previously served as Legal Counsel; MBA; NAMB; Texas AMB prior to its closure; and Texas MBA.

James W. Brody, Esq. Mortgage Banking Practice Group Chair

jbrody@johnstonthomas.com

415-246-3995

James Brody actively manages all the complex mortgage banking litigation, mitigation, and compliance matters for Johnston Thomas. Mr. Brody’s experience centers on those legal issues that arise during loan originations, loan purchase sales, loan securitizations, foreclosures, bankruptcy, and repurchase & indemnification claims. He received his B.A. in International Relations from Drake University and received his J.D., with a certified concentration in Advocacy, from the University of the Pacific, McGeorge School of Law. He was a recipient of the American Jurisprudence BancroftWhitney Award. He is licensed to practice law in California and has been admitted to practice in front of the United States District Courts for the Central, Eastern, Northern, and Southern Districts of California. In addition, Mr. Brody has served as lead litigation counsel for numerous mortgage banking and commercial related disputes venued in both state and federal courts, in a direct capacity or on a pro hac vice basis, in AZ, CA, FL, MD, MI, MN, MO, OR, NJ, NY, PA, TN, and TX.

Attorney

marty.green@ mortgagelaw.com 214-691-4488 ext 203

Marty Green leads the Dallas office of Polunsky Beitel Green, one of the country's top residential mortgage law firms. Mr. Green is an accomplished attorney with more than 20 years of experience in the legal, banking and financial services industries. He is the former Executive Vice President and General Counsel for Dallas’ CTX Mortgage Co. and previously worked with the Baker Botts law firm in Dallas as Special Counsel. In his role as leader of the firm’s Dallas office, Mr. Green advises clients on the latest rules and regulations covering residential lending, in addition to building on Polunsky Beitel Green’s long tradition of delivering loan closing documents with speed and accuracy. Mr. Green is admitted to practice before all Texas state and federal district courts in addition to the U.S. Court of Appeals for the Fifth Circuit. An honors graduate of the University of Texas School of Law, he earned his undergraduate degree at Southern Utah University. Texas Monthly has selected him as a Super Lawyer multiple years.

These attorneys are universally recognized by their peers as setting the highest standard for the legal profession, excelling in all fields — knowledge, analytical ability, judgment, communication, and ethics.Marty Green

Snapdocs, the mortgage industry’s digital closing platform, announced the completion of its integration with Mortgage Cadence, an Accenture company. The integration enables lenders nationwide to use Snapdocs within Mortgage Cadence’s loan origination system (LOS) to streamline the closing process, reduce operating costs, and enhance the borrower experience.

“Lenders must do more with less in this tumultuous market, and conducting eClosings at scale offers a clear way to reduce loan costs, save valuable time, and deliver an enhanced borrower experience,” said Todd Maki, vice president of customer success. “Integrations with leading LOS providers like Mortgage Cadence allow lenders to easily consolidate new technologies into their existing stack, enabling a more efficient and successful implementation and ramp.”

With the new integrated solution, lenders can facilitate digital closings powered by Snapdocs and finalize closing documents without leaving the Mortgage Cadence Platform. Lenders can order required closing documents and data with any version of Mortgage Cadence and securely transmit them to Snapdocs to initiate the closing process. The completed documents are then encrypted and returned to the Mortgage Cadence Platform for secure storage. The result is a faster, more transparent, and more efficient experience for all parties involved in the closing.

“Many joint customers have asked for this integration, so we’re incredibly excited to bring a solution to market that saves lenders time and simplifies closings,” said Jim Rosen, executive vice president of services, Mortgage Cadence. “Working with great partners like Snapdocs paves the way for even more lenders to embrace digital mortgage tools and advances the entire industry toward an all- digital future.”

SOCi Inc., the marketing platform for multilocation brands, has enhanced its best-in-class Social product with additional social compliance solutions, allowing financial institutions to mitigate risks associated with potential social content violations while maintaining brand consistency.

By using SOCi’s social compliance solutions, combined with SOCi Listings and Reviews, corporate marketers and compliance teams can increase local brand visibility, engagements, and customer traffic all while adhering to the regulatory and compliance needs within the industry.

When sharing content to digital marketing channels, it is crucial for marketers in regulatory industries to remain compliant in their messaging to protect their companies from potential risks like steep regulatory fines, suspension, loss of business, or even legal action. SOCi offers the only multi-location marketing platform on the market with one central place to scale compliant, localized marketing across every channel, at every location.

According to a SOCi research report, localized content receives 12 times the engagement rate of more general or non-localized content. This type of content helps to differentiate and highlight local agents and increases online traffic to their pages, not just to corporate pages. Localized content offers a more engaging experience for prospective customers, ultimately driving more revenue and repeat business.

SOCi’s social compliance solutions, coupled with the Social tool, ensure brand and industry regulations are carefully followed, decreasing potential risk with keyword-based policies and allowing corporate and local teams the ability to quickly address post violations in real-time. SOCi’s social compliance solutions save time and eliminate the guesswork for local agents as corporate teams can provide automated content and brand supervision via approved, localized, and on-brand content libraries. Additionally, teams can archive and track all social media activity in one consolidated view.

FinLocker, a pioneer in digital, consumerpermissioned personal financial fitness tools focused on homeownership, has completed an integration with Total Expert, the CRM and customer engagement platform purpose-built for modern financial institutions, to give mortgage lenders, banks and credit unions, and their loan officers, access to a wealth of data-driven insights throughout the homeownership journey of their customers.

The new integration allows for a seamless transfer of data between the two platforms, providing lenders and loan officers with a comprehensive view of their customers’ progression toward mortgage eligibility and homeownership. Data-driven insights at every stage of the homeownership journey, including credit, assets, and goals, will enable loan officers to identify potential roadblocks and take proactive measures to help their customers achieve mortgage eligibility. Mutual customers of Total Expert and FinLocker can now view additional milestones, achievements, and activities as part of their customer contact record in Total Expert.

”The integration is a game-changer for mortgage lenders, banks, and credit unions looking to expand top-of-the-funnel customer acquisition and deliver intent-level data-driven communications to consumers as they progress through the homeownership process using the FinLocker app,” said Chris Hazen, senior vice president of customer success with FinLocker.

”FinLocker has already increased app engagement using Total Expert’s Journeys. This enhanced partnership is a win-win for all parties involved, as it brings together two industry-leading platforms to provide an unparalleled level of service to the mortgage industry and empower financial institutions to provide an unmatched level of service to their customers.”

”FinLocker provides out-of-the-box marketing to make it simple for Synergy One’s loan officers to enroll more prospective homebuyers into the S1 FinFit app through our instance of Total Expert,” said Steve Majerus, CEO of Synergy One Lending.

”As a result of this integration, we have received a 360-degree view of our customers homebuying journey. The data sharing between FinLocker and Synergy One, facilitated by the integration with Total Expert, enables our loan officers to know when a prospective homebuyer has achieved mortgage eligibility milestones. FinLocker’s use of Total Expert to guide homebuyers through their entire homeownership journey using the S1 FinFit app also saves our loan officers time nurturing customers who are 6-18 months from purchasing a home and focus on closing the loans for those homebuyers who are mortgage ready.”

Tavant, a Silicon Valley-based provider of digital lending solutions, and Newfi Lending, a technologyfocused multi-channel mortgage lender, announced the integration of Newfi’s digital mortgage experience with Touchless Lending Document Analysis. This partnership marks Tavant’s official expansion into Non-QM Lending and a significant step in the evolution of Newfi’s business and advancement in the mortgage industry.

Document Analysis is a proprietary product of Tavant’s Touchless Lending automation platform, designed to integrate with existing lender systems seamlessly, including CRMs, Point-of-Sales, LOS, and document management systems. Document Analysis completely transforms document processing by instantly recognizing documents, optimizing document-related workflows, and accurately automating document classification, indexing, splitting, categorization, pairing with borrowers, and data extraction. Leveraging Touchless Documents will provide Newfi with a more streamlined and seamless experience for all involved stakeholders.

Tavant’s partnership with Newfi to integrate Touchless Documents into their digital mortgage experience will feature machine-oriented classification, as well as handle Exception Processing for documents with low confidence rates, allowing for fully end-to-end document processing. Furthermore, documents processed through are sourced from Newfi’s Broker Portal (BLU), which is also integrated with Touchless Lending, specifically the platform’s Origination Experience designed for brokers and TPO partners.

LoanCare, a mortgage subservicer, has launched a proprietary, all-in-one portfolio management solution, LoanCare Analytics. The platform was built to support mortgage servicing rights (MSR) investors with a focus on customer engagement, liquidity, and credit risk.

“Having an all-in-one tool to manage servicing portfolios is more important than ever, as the market continues to move through volatile economic conditions. This is a significant technological advancement for the industry. It offers our clients unprecedented transparency into their loan portfolio and doesn’t require lenders to hire analysts to weed through the information,” said Dave Worrall, president of LoanCare. “Our investment in LoanCare Analytics was rooted in our quest to deliver levels of insight into loan portfolios like never before. Portfolio managers will benefit from real-time analytics when they need to make a quick decision on when they should buy or sell MSRs, without having to mine through millions of data points.”

According to the January 2023 Commentary from the Fannie Mae’s Economic & Strategic Research Group, there has been a recent upward trend in continuing unemployment claims, which despite still being low, historically suggests a broader economic downtown is imminent if there is a meaningful movement off of a cyclical bottom in this measure. LoanCare recognizes this trend and is empowering MSR owners with real-time analytics to make timely, informed decisions and actions as necessary.

LoanCare Analytics accelerates portfolio optimization analysis with extensive views and filtering, enabling MSR owners to connect the dots across their portfolio and take action down to the loan level. No matter the size of the company or level of expertise on the team, LoanCare Analytics can help all take advantage of data analytics to make smarter decisions across the servicing spectrum.

Blue Sage Solutions, developers of the mortgage industry’s browser-based, end-to-end lending platform, announced the availability of LION, its point of sale, as a standalone offering for lenders to use with their chosen loan origination system.

A component of the Blue Sage Digital Lending Platform, LION enables banks, lenders and credit unions of all sizes to provide borrowers with a highly engaged, seamless digital experience while accelerating loan production and reducing costs. LION is highly configurable and supports dynamic workflows for purchase, refinances, and home equity transactions and is accessible from any device, anywhere, anytime.

LION not only reflects and reinforces each lender’s brand, but it can also be easily white labeled to support any number of affiliates and joint ventures to expand the lender’s footprint. And for larger institutions that want to control their own destiny, Blue Sage provides options to allow them to be self-sufficient.

With the LION POS, borrowers can shop and compare mortgage rates and associated closing costs, submit a loan application, auto-generate compliant initial disclosures, and interact with the lender or loan officer once the loan is submitted. Lenders can assign unsolicited loan applications submitted through LION to their sales team for follow up based on their own parameters.

The LION POS is bundled with Blue Sage’s Loan Officer Portal, which optimizes the sales process for sales teams and supports other aspects of loan production, including customer relationship management tools, side-by-side product and pricing quotes, and disclosure generation.

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok

(866) 453-2400 carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers) FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owneroccupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565

info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA