THE GREAT REPLACEMENT THEORY

Why IMBs have supplanted retail banks in mortgage lending – for the better

MortgageBanker MAGAZINE INNOVATION DATABANK MARKETS AUGUST 2023 | $20 MORTGAGE GENERAL A PUBLICATION OF AMERICAN BUSINESS MEDIA

A DIGITAL, STREAMLINED MORTGAGE FUTURE MORTGAGE INDUSTRY'S UNSEEN SAVIORS AI

CUSTOMER SERVICE

CHATBOTS:

OR CONSUMER RISK?

Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

©2022 First Horizon Bank. Member FDIC. Let’s find a way. firsthorizon.com/capital Commercial & Specialty Lending Commercial Real Estate Treasury

Know-how that wastes you forward. no time moving

Management

REGULATORY CORNER

FHA LAUNCHES NEW RESOURCES TO REMOVE BORROWERS’ LANGUAGE BARRIERS

The Federal Housing Administration (FHA) is making available in Chinese, Korean, Spanish, Tagalog, and Vietnamese more than 30 single-family mortgage documents and related resources used in the origination of FHA-insured mortgages.

The educational resources are accessible from FHA’s new language access web page. They are intended to assist lenders, servicers, housing counselors, and other FHA program participants in explaining information related to FHA-insured mortgages to those with limited English proficiency prior to borrowers executing legal documents in English, as required by law.

This first set of translations is part of ongoing efforts by FHA to remove language access barriers for consumers whose preferred language may not be English and a part of HUD Secretary Marcia L. Fudge’s commitment to making equity a leading compass within the Biden-Harris administration.

“Understanding the products, processes, and documents associated with a mortgage transaction is vital to a borrower’s ability to become a successful homeowner,” said Assistant Secretary for Housing and Federal Housing Commissioner Julia Gordon. “These new resources will help prospective homebuyers better understand their transaction and make more informed decisions before they are at the closing table.”

The translated documents include the HUD Addendum to the Uniform Residential Loan Application (HUD 92900-A) required for all FHA-insured single-family mortgages; model documents, including mortgage notes and riders used in FHA forward and Home Equity Conversion Mortgage (HECM) transactions; and required borrower disclosures. In addition, FHA now has newly translated versions of some of its most widely used single-family homebuyer education materials and information resources, including its Save Your Home, Tips to Avoid Foreclosure brochure, its disaster relief and recovery options information card, and FHA “myth busters” question-and-answer cards. FHA intends to make additional resources available in the future.

FREDDIE MAC EXPANDS DIGITAL CAPABILITIES TO HELP LENDERS REACH MORE QUALIFIED BORROWERS

Freddie Mac announced enhancements to its ground-breaking automated income assessment tool that allows lenders to assess a homebuyer’s income paid through direct deposit to also include the borrower’s digital paystub data. This detailed information can help lenders calculate income faster and more precisely to improve loan quality, simplify the mortgage process and, most importantly, expand access to credit.

The new ability to include paystub data in addition to direct deposit data in the income assessment is available to mortgage lenders nationwide through Freddie Mac’s Loan Product Advisor (LPASM) asset and income modeler (AIM). AIM for income using direct deposit provides these cost-saving efficiencies while continuing to meet Freddie Mac’s strong credit underwriting standards.

“Over the last year, we’ve consistently rolled out innovations to ensure our digital tools are improving speed and efficiency, reducing risk and, ultimately, helping us serve our mission by reaching more qualified borrowers,” said Kevin Kauffman, single-family vice president of seller engagement at Freddie Mac. “Today’s innovation further automates income assessment by using historical direct deposit pay patterns and current gross income from recent paystubs, which can help more families achieve homeownership.”

Freddie Mac digital tools and solutions offer lenders cost-effective ways to achieve effective quality control operations. Recent analysis shows that loans originated by lenders leveraging Freddie Mac’s automated offerings are four times less likely to produce defects than loans without these technology offerings. Process automation is especially beneficial for documenting income, both in the collection and assessment process. That’s important because income verification issues account for nearly onethird of all purchase transaction defects.

In addition to direct deposit data, AIM can assess income from tax return data for self-employed borrowers as well as bank account data to identify a history of positive monthly cash flow activity. This can include data from checking, savings and investment accounts, including those used for direct deposit of income and monthly bill payments, such as rent, utilities and auto loans. That data can help first-time homebuyers and borrowers in underserved communities who may not qualify with traditional methods of underwriting. Additionally, account data submitted to assess cash flow can only positively affect a borrower’s credit assessment. And to help identify opportunities, LPA will notify lenders when submitting this account data could benefit a borrower.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley

STAFF WRITERS

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Christopher Wallace, Stacy Murray

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Mary Quinn

MULTIMEDIA PRODUCER

Matthew Mullins

MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Regina Morgan ADVERTISING SALES EXECUTIVE

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin

MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

Submit your news to editors@ambizmedia.com www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991

info@ambizmedia.com

Hedging A Pipeline Of Locked Loans Isn’t Free

Residential lending is one of the few industries where someone can lock in a rate and price at a future date, often 30 or 45 days. To keep that concept in perspective, if you went to the local gas station, or grocery store, and told them you wanted to buy a gallon of gas or milk 45 days from now, the clerk would absolutely refuse. But the futures market has been created to do just that: lock in prices now for things like bacon, orange juice, wheat, gold, and corn in the future, hedging any impact of prices on their profits. There is a cost, usually the bid/ask price spread, the drop in price from one month to the next, and commissions paid in trading the contracts.

Senior management or owners of lenders often want to know the “cost to hedge” a loan or a locked pipeline of loans. It is not an easy question to answer. Hedging is a loan level activity where each loan’s program, interest rate, lock period, etc., is analyzed. Company policies like extensions and renegotiations enter into it. Specifically, extensions and renegotiations increase it, and while the production team is helped, the capital markets department usually incurs the expense. And the price drop in the securities market often changes during the lock period. And then there’s always the “what is the cost of a loan that falls out” question, since the expenses incurred in a loan that doesn’t fund must be absorbed elsewhere.

Manufacturing loans faster, and bringing loans to market quicker, reduces a lender’s interest rate exposure to some degree. Thus, the reason bond loans can be an issue for some lenders. Unfortunately, many

hedge vendors look at the problem 2-dimensionally, when it’s a 3-D issue. The problem isn’t necessarily all “speed-to-originate,” but rather “hedge-model efficiency.” What assumptions are being made about the duration/beta of the hedge instrument, and pull through, broken down by product groups and cross referencing at what stage

in the loan life cycle loans have fallen out in the past.

Killing Gains

Volatility in the To Be Announced (TBA) markets will kill a lender’s gain on sale. Lenders can be profitable in a rising rate environment, and profitable in a falling rate environment, but sudden swings in the bond market, and therefore interest rates, will kill you every time and all models break down.

The TBA market is where most capital markets groups hedge their locks. Without diving too deeply into the hedging process, a lender is, in effect, buying a lock from a borrower. To offset the risk of interest rates going up and the corresponding price decline in the value of that loan, or to offset the risk of interest rates going down and the corresponding chances of the lock falling out, lenders sell mortgage-backed securities.

And it is good to remember that hedging itself is used to protect the margins originally priced into the loan. The key to margins over the past few years has been capacity. There are five points of pricing: demand (capital markets have a buyer), competitive position, margin (needed or budgeted/required return on assets), market share (are you gaining or losing?), and capacity. When pricing, you balance all of the above but the “thumb has been on the capacity side of the scale” for several years for most of those in the industry.

4 MORTGAGE BANKER MAGAZINE | AUGUST 2023

VOLATILITY IN THE ‘TO BE ANNOUNCED’ MARKETS WILL KILL A LENDER’S GAIN

MARKETS

BY ROB

CHRISMAN,

CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

ROB CHRISMAN

Unfortunately, many hedge vendors look at the problem 2-dimensionally, when it’s a 3-D issue.

MORTGAGE BANKER MAGAZINE | AUGUST 2023 5 Find a mortgage event near you. For mortgage brokers, originators, processors, underwriters, and anyone looking to grow within the industry. originatorconnectnetwork.com/events

The New England Mortgage Expo returns to the fabulous Mohegan Sun Resort & Casino in 2024! With over 2000 attendees in 2023, you won’t want to miss this opportunity to be a part of New England’s largest and most exciting mortgage event — the largest regional mortgage show in the nation. Join your peers for an exiting day of networking, product showcases, educational sessions, motivational speakers, and so much more!

12 UNCASVILLE, CT Mohegan Sun Resort & Casino nemortgageexpo.com Attend for free by using the code MBMFREE

Do you have what it takes to

JAN

6 MORTGAGE BANKER MAGAZINE | AUGUST 2023

Fintech’s Trek To Trillions

DESPITE AN UNHEALTHY HOUSING MARKET, THERE’S A TREND TO FINTECH INVESTING, ESPECIALLY TO KEEP CONSUMERS HAPPY

BY SARAH WOLAK, STAFF WRITER, MORTGAGE BANKER MAGAZINE

BY SARAH WOLAK, STAFF WRITER, MORTGAGE BANKER MAGAZINE

The future of mortgages continues to be digital and streamlined, and it’s only up from here. A recent report from Boston Consulting Group (BCG) and QED Investors predicts revenues in the fintech industry will experience an impressive sixfold increase from $245 billion to a staggering $1.5 trillion by 2030.

At present, the fintech sector holds a modest 2% share of the global financial services revenue, about $12.5 trillion. And within the fintech realm, banking fintech is expected to play a large role, constituting nearly 25% of all banking valuations worldwide by 2030.

“The fintech journey is still in its early stages and will continue to revolutionize the financial services industry as we know it,” Deepak Goyal, BCG’s managing director and senior partner and co-author of the report, said in a news release.

That’s a stark contrast when considering the current market downturn. Sofia Rossato, president and general manager of Floify, says that mortgages today are still experiencing friction despite most companies’ integration of automation and fintech into their platforms. And that friction – which can be avoided –isn’t healthy for those LOs trying to compete for customers.

“What’s causing that friction is low conversion rates. We’re seeing that 31% of borrowers abandon applications, and 25% of abandonments are due to the process taking too long,” Rossato said, citing a study she presented in April. “Another is that the number one thing that companies can do to provide an excellent experience is to value a consumer's time. … People who are currently struggling were not prepared on how to utilize fintech to optimize their business practices to remove roadblocks.”

TECHNOLOGY MORTGAGE BANKER MAGAZINE | AUGUST 2023 7

Rossato says that Floify, a software company that does mortgage automation, is aiming to tackle those issues to keep on pace with the rest of the industry. She says a lot of customers don’t understand that a mortgage company's use of an automation program doesn’t mean there isn’t a human to help the process go smoothly.

But it means that investing has to happen in a calculated manner, Rossato said.

“One thing to think about entering the AI world is the potential for danger. You have to be careful with the technology partners that you choose who use AI across large data sets,” she said. “People can get in trouble if they

FINTECH AS A BUSINESS MODEL

Maxwell’s other co-founder and CEO, Rutul Dave, says that companies who aren’t continuing to invest in fintech and integrate it into their business have a “limited scope” of their processes on the consumer and provider sides. “As a business model, you need to think about the entire origination process,” Dave explained. “Individually, these lenders need the benefit that comes from scaling their business with the market’s demands. We saw the opportunity to create a platform for lenders to run their business using both humans and technology.”

Most customers, Rossato says, assume that artificial intelligence is going to take over the fintech industry altogether. “I always like to remind people that it’s not human or machine, it’s human and machine working together to make the mortgage process easier,” she said. “We recently introduced two new programs called closing accelerator and customer capture, which help with retention. Only 18% of customers return to a lender, and we want to change that.”

CONTINUE TO INVEST

Rossato says that continuing to invest in automation is key, especially in a down market when loan officers are trying to do everything to their ability to keep customers happy.

“Loan origination takes so much time, when you think you’re at the finish line your [debt-to-income] ratio gets messed up or your insurance doesn't come in where you thought it would,” she explained. “There are so many factors that can lengthen that time, and those pull-through rates aren't as high as they should be. For this reason, [Floify’s] looking at it from the borrower's point of view to help them through the homeownership journey.”

use it incorrectly, especially if that AI violates compliance issues. … You want to partner with fintech who makes your workflow easier. If you try to fully digitize something as big as a home purchase, it’s not going to work.”

For others, investing in fintech is a way for lenders to mitigate risk. John Paasonen, co-founder and CEO of Maxwell Lender Solutions, says that risk occurs when lenders have a weak business model and little flexibility.

“There’s a big demand for efficiency,” Paasonen said. “The MBA said the average pre-tax production loss in Q4 [of 2022] was 99 basis points. We’re seeing a huge demand right now for help managing costs, and it’s revealing how fragile some business models are if they can’t flex up or down with the market.”

Paasonen says that when the market shifts, many lenders opt to hire or fire as a way to navigate. But Paasonen says that fintech can be solvent – if lenders choose to make the investment. “Maxwell is more than software. We do processing, underwriting, and really take on the idea of embedded finance, which means we see a mortgage as a service,” he said. “We think about what we can do on a larger scale to help take on the complexities of the business so LOs can focus on their relationships and being forward facing.”

And Dave says the data that is aggregated from incorporating fintech into the origination process is priceless. “There’s the idea of data insight matters just as much as the data itself,” Dave said.

Dave and Paasonen say that they’ve been able to advance Maxwell in congruence with the overall financial services industry. “Our business continues to grow despite the market. The overall mortgage industry was 60% down year over year, but Maxwell was up 11% in volume year over year,” Paasonen said.

Dave added that Maxwell recently acquired LenderSelect Mortgage Group, which is a mortgage solutions provider with access to the capital markets. Dave says that his company plans on integrating the group’s services into Maxwell Capital, which is Maxwell’s initiative to provide access to the secondary market.

For Allen Pollack, owner of KapVue Advisors, the mortgage industry has been the slowest to adopt fintech. “We’ve been focused on digital mortgages for the longest time, and the mortgage industry has been slow to adopt, but there are many reasons,” Pollack said. “Mortgages are risky, the process can be messed up, and it’s a period of time where consumers are on edge. And as an LO doing everything

8 MORTGAGE BANKER MAGAZINE | AUGUST 2023

“We’re seeing a huge demand right now for help managing costs, and it’s revealing how fragile some business models are if they can’t flex up or down with the market.”

CONTINUED ON PAGE 11

> John Paasonen, co-founder and CEO Maxwell Lender Solutions

SMASHING T H

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING DAVID LUNA, PRESIDENT OF MORTGAGE EDUCATORS & COMPLIANCE TUNE IN EVERY WEDNESDAY FOR YOUR REGULATORY UPDATE.

VALVO BERMAN

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING VINCENT VALVO & ANDREW BERMAN

TUNE IN EVERY FRIDAY FOR A NEW ROUND.

they can to close the loan, everything is very manual. There are a lot of hands on the loan, and a lot of solutions over time have culminated to where we cannot do what we do without technology.”

CUSTOMER EXPERIENCE MATTERS

Pollack, who has worked for tech and digital solutions companies such as MeridianLink, OpenClose, and Fiserv, says that the biggest issues plaguing the industry are the costs of originating

loans and tech keep rising. “Lenders’ tech investments don't immediately have [a return on investment],” he said. “There’s a phrase that if you build it they will come, but that’s not the case with mortgage technology. You build it and have to sell it while making sure it’s compliant and can support lenders.”

But Pollack says it’s also important for lenders and fintech companies to make sure that the customer experience is supportive, too. While lenders

are looking for all-in-one solutions to support their automation, Pollack says that it’s equally important that the automation makes sense for that lender's customer base.

“There’s a lot to lose and lenders are cautious,” he said. “Everyone has great tech with fancy interfaces, but if the automation isn’t serving the consumer, then the tech gets a bad reputation. So the question really is, does [the lender] have the right tech to answer their demands?”

Pollack says that the growth of fintech lies in what the biggest demands are. “E-closings and a digital experience are what lenders and consumers want right now,” he said. “We’re also thinking about how to make real-time valuable connections with those customers, especially when we think about the younger generation starting to buy homes.”

MORTGAGE BANKER MAGAZINE | AUGUST 2023 11

“Everyone has great tech with fancy interfaces, but if the automation isn’t serving the consumer, then the tech gets a bad reputation. So the question really is, does [the lender] have the right tech to answer their demands?”

> Allen Pollack, owner KapVue Advisors

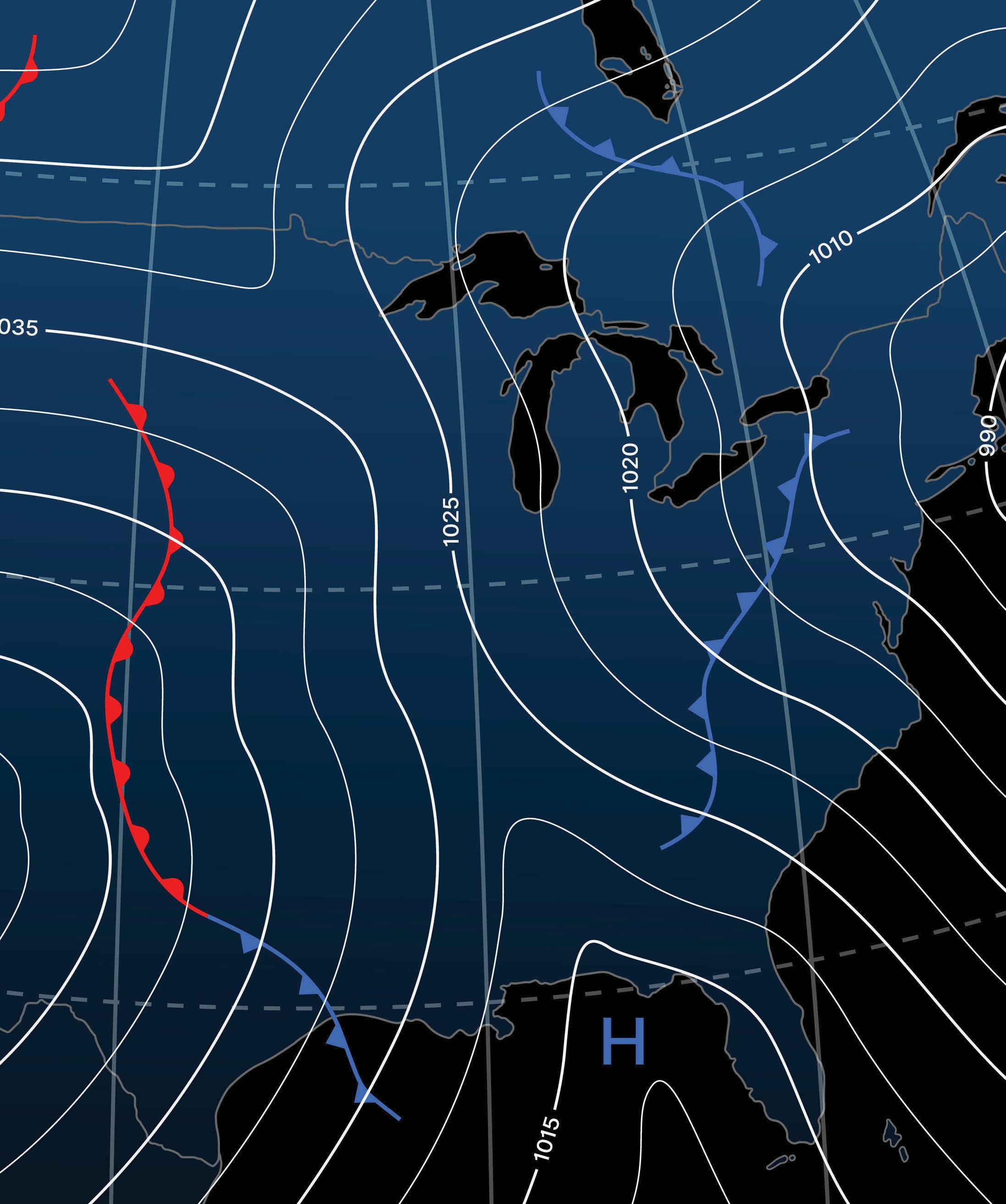

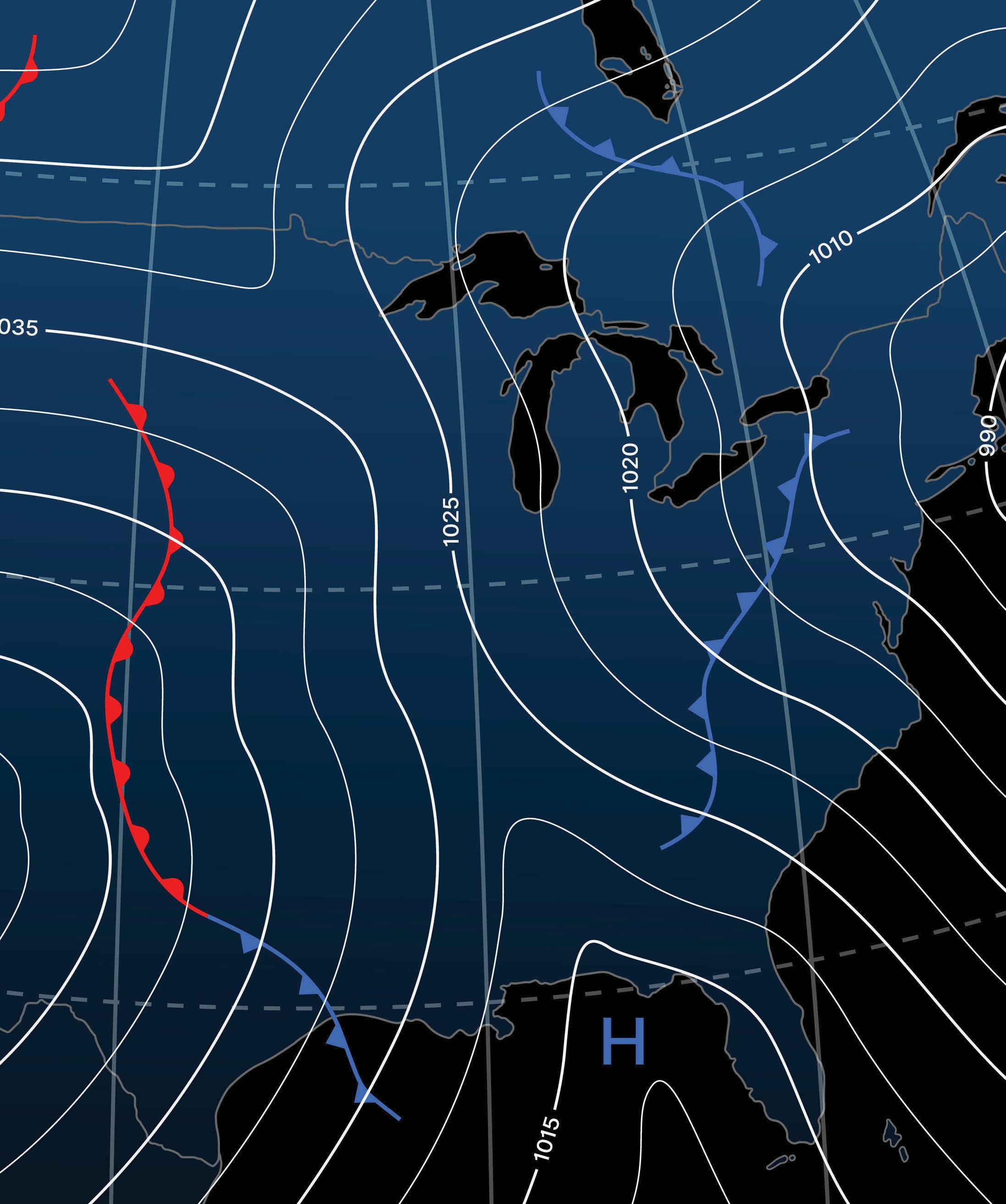

How To Create A Disaster Plan

TAKE TIME TO PREPARE YOUR BUSINESS FOR POTENTIAL NATURAL DISASTERS

BY SCORE, SPECIAL TO MORTGAGE BANKER MAGAZINE

Think about all the time and resources you have invested in your small business. Imagine that it’s all gone: furniture, equipment, inventory, records, everything. What would you do?

The Service Corps Of Retired Executives (SCORE) wants you to be ready.

“There will be problems flying at you from all directions,” said SCORE client Mark Debner, whose Cedar Rapids, Iowa-based business DPI Quality Custom Finishes was hit hard by flooding in 2008 and the Midwest derecho of 2020. “You will be making quick decisions while under great pressure. Do not beat yourself up if you make a few bad mistakes as you recover.”

While you can’t prevent natural disasters, a proactive disaster management plan can mitigate the effects on your business and help speed your return to normal operations.

Consider these tips for developing a strategy:

DEVELOP AN OPERATIONAL CONTINGENCY PLAN

Assess the feasibility of operating out of nearby rented office or warehouse space, or even your home. Perhaps a mutual agreement with a friendly competitor to share space and other facilities is worth considering. Determine what equipment and other resources will be needed to continue operations. Important documents, backup copies of computer records, and other vital information should be stored at a secure off-site location or in the cloud.

SCORE client Jennifer Megliore felt the impact of Hurricane Matthew on her art retail business, ArtWare, on Hilton Head Island, S.C., in 2016. “My SCORE mentor encouraged me to have a hurricane plan, being feet away from the water,” Megliore said. “He helped me create a laminated checklist of items and equipment to remove if we had to evacuate. SCORE also encouraged me to set aside contingency

money that would help bridge a closure. Insurance can help – but it can take a long time to receive the money to keep going.”

ENSURE THE SAFETY OF EMPLOYEES AND CUSTOMERS

Develop an evacuation plan that includes access to shelters, hospitals, and other emergency services. Keep emergency telephone numbers clearly posted, and maintain up-to-date emergency contact and essential medical information for all employees.

PERFORM A SAFETY INVENTORY

Regularly clean and test smoke detectors, changing the batteries at least once each year. Make sure you have several well-stocked firstaid kits and that all fire extinguishers are fully charged. Keep a supply of all types of batteries

LEADERSHIP

14 MORTGAGE BANKER MAGAZINE | AUGUST 2023

While you can’t prevent natural disasters, a proactive disaster management plan can mitigate the effects on your business.

used in your business, and consider purchasing a portable generator for emergency power, with fuel safely stored.

REVIEW INSURANCE COVERAGE

Your coverage should be enough to get your business back in operation at the earliest possible date. It should cover the replacement cost of buildings, contents, and essential facilities. Special coverage may be needed to cover computer

hardware, software and stored data. A major consideration is business interruption and extra expense coverage for loss of income and other expenses incurred to quickly return to normal operations. A qualified, professional commercial insurance agent can prove to be a valuable resource in crafting a disaster management plan for your business.

SCORE CAN HELP YOU PREPARE

“It is critical that individuals and businesses take this seriously and

prepare accordingly as we approach the beginning of the 2023 hurricane season,” said SCORE Richmond mentor Gray Poehler.

A SCORE mentor can assist you in considering potential risks and drafting a disaster plan. Find a mentor today and visit SCORE’s resilience hub for more resources.

Since 1964, SCORE has helped more than 11 million entrepreneurs start, grow or successfully exit a business.

Visit SCORE at www.score.org

MORTGAGE BANKER MAGAZINE | AUGUST 2023 15

MORTGAGE METEOROLOGY

EXCLUSIVELY ON PRODUCED BY NMP FOR THE INTEREST

FEATURING SARAH WOLAK, STAFF WRITER FOR NMP

TUNE IN EVERY FRIDAY FOR YOUR WEEKLY FORECAST.

16 MORTGAGE BANKER MAGAZINE |

Hire Here, There & Everywhere

CONTRACT PROCESSORS COME WITHOUT THE EXPENSE OF PAYING A FULL-TIME EMPLOYEE

BY SARAH WOLAK, STAFF WRITER, MORTGAGE BANKER MAGAZINE

They’re the superheroes of the mortgage industry: saving the day at the last minute and then vanishing into the night. Enter contract mortgage processors, the unsung stars of the mortgage process who keep costs down, bring the loan to fruition, and don’t expect to be a part of the team.

With the constant ebbs and flows of the market, it’s tough for mortgage originators to be as flexible as possible with costs. Especially when it comes to the choice of whether to hire an inhouse mortgage processor, it all comes down to individual preference; originators toe the line between wanting a permanent staff member and also being able to engage and be flexible with the market.

“The main issue at hand is the hiring, training, and firing of someone: an LO doesn’t want to focus on that, they want to help clients,” said Chelsea Balak, vice president of operations at wemlo, a third-party processing company. “That’s a huge time suck which is inevitable if you have someone on staff.”

Balak says that wemlo works as a matchmaking service when pairing processors to brokers. “We actually give them a whole processing team,” she explained. “We first do an initial call with the broker or company to see how they work and so we can convey our own expectations to them. After the initial call, we assign [them] a primary processor, backup, and processing manager. So they really get that team mentality where if someone is out there’s always a backup.”

And that’s not when the matchmaking stops. Balak explained that each company’s culture and even the time zone their headquarters work in is taken into account when pairing a company with a processing team. “Our team knows about and is familiar with

15 loan products and about 30 lender portals,” she said. “We consider [when matchmaking] the products that the company uses and which processors have the best skill sets for the job.”

SCALING FOR PRACTICALITY

One main selling point is that contract processors operate on an as-needed basis. Balak says that her team at wemlo knows that the need for processors fluctuates cyclically with the market, and they use that to their advantage when marketing themselves to brokers.

“What we really sell is that there’s the ability of flexibility to scale,” she said. “[There’s] the ability to ramp up the processing team during a busy season, and then when it slows down they don’t have to worry about layoffs. This was especially beneficial for last year when the market started dropping halfway through the year.”

Balak also reminds that it’s costeffective to hire a contract processor. “Wemlo employs our processors on

PERSONNEL

MORTGAGE BANKER MAGAZINE | AUGUST 2023 17

salary and commission, so that’s how they earn their money,” she said. “An in-house processor means that the cost for them comes directly from the broker’s pocket and commission, but a contract processor is paid for by the borrower.”

Kim Kircher, director of processing at Secured Mortgage Processing (SMP), said hiring processors on a contract basis frees up the LO from having to “babysit” their loan originating team.

“Our team does the bulk of the work. We collect conditions, get the loan into underwriting, and [do] everything up until funding,” Kircher said. “We want to free up the LO so they can go get more leads instead of babysitting their file. It’s really on us to make sure the loan closes, and that the borrower has a good experience.”

Kircher has been with SMP for about four years and says that from her experience, brokers and originators always want to invest in contract processors, even in a sluggish market.

“They don’t want to pay for those in-house processors,” she said. “They’d rather have the borrower pay the processor fee and then be able to keep money in their pockets.”

Kircher added that SMP’s first customer was Arizona-based NEXA Mortgage.

Mike Kortas, NEXA’s president, said that having a contract processor affiliate frees up the loan officer, echoing Kircher.

“These contract processors allow us to focus on what we do best, originating loans, while their processors can focus on what they do best, getting to closing fast.” Kortas said. “These services [also] don’t raise the cost to the consumer over traditional processing fees at all, [which] allows for the loan officer and the consumer to both win in a way that is not possible when it comes to inhouse processing”

FLEXIBILITY

Balak says that most of the processors for wemlo work out of the

headquarters in Boca Raton, Fla.

“We prefer a team-building atmosphere, and it’s easier to collaborate in an in-person place,” she explained.

But Kircher’s team of processors at SMP are spread out. “Our workers are commission-based and all remote,” Kircher said. “That means they can be available whenever since they’re not worried about overtime, and they can work flexible hours to make sure the loan closes. When one of our processors takes a file, they know that they have to do whatever it takes to get the loan closed or they’re not getting paid.”

Since working remotely is considered

risky behavior in the industry, Kircher says that SMP’s 120 processors have several rules to uphold while working from home.

“They’re expected to adhere to privacy and security policies. Since everything is web-based, they need antivirus malware to protect borrower information,” she said. “We use a CRM called BNTouch and shared drives so no one computer has a loan’s information on it. And we have a rule that if a processor is working at home at the same time as a spouse or roommate, they need to make sure that they’re working in a separate space to keep everyone’s information safe and private.”

18 MORTGAGE BANKER MAGAZINE | AUGUST 2023

“What we really sell is that there’s the ability of flexibility to scale. [There’s] the ability to ramp up the processing team during a busy season and then when it slows down they don’t have to worry about layoffs.”

> Chelsea Balak, vice president of operations, wemlo

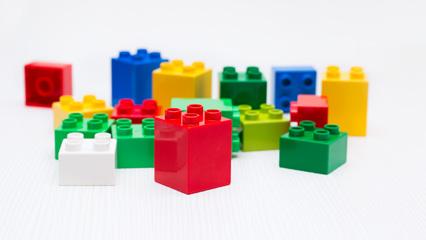

Unveiling the Real Reason Behind Lengthy Appraisals & Offering a Solution: Jaro

BY: NICK CONTEDUCA, SENIOR PRODUCT MANAGER AT ASCENT SOFTWARE GROUP, CERTIFIED APPRAISER

In the appraisal industry, it’s common knowledge that getting an appraisal done promptly and accurately is a painstaking endeavor. But do we truly comprehend the reasons behind this drawn-out process? Most misconceptions point towards the inspection process. However, the truth lies elsewhere – in the labyrinth of data management.

Appraisers are not just value evaluators, but data detectives, too. They spend a substantial amount of their time trying to decipher which data source is accurate – is it MLS, public record, or peer data? They juggle through multiple systems, donning the hats of a scheduler, data analyst, and more. The real reason behind the long appraisal turnaround time isn’t inspection, but the inaccuracy of data and the time spent organizing it. Visualize a heap of LEGO blocks, all mixed up. Before building a house (or in our case, an appraisal), you need to sort and arrange these blocks. It’s the same with data – first, we need to sift through various sources to establish its accuracy. After organizing the accurate data, appraisers must present it visually to explain their “story” – a clear, comprehensive

account of the property’s value. For this, they often rely on a variety of tools like multiple websites, third-party programs, MLS systems, and Excel documents.

Such a process is not only time-consuming but often leads to inaccuracies due to human error, thus stretching the appraisal timeline further. Here’s where Jaro steps in, a beacon of efficiency in the labyrinth of appraisal data management.

Jaro addresses the three major time-intensive problems appraisers face:

1. DATA:

Jaro simplifies the data detective role by providing a platform for aggregating data from various sources, eliminating the need for redundant data entry.

2. SCHEDULING:

Jaro makes initial contact and property access more manageable, significantly trimming the appraisal timeline.

3. ANALYSIS AND ADJUSTMENT:

With Jaro, determining market-derived

adjustments and analyzing data for comparables becomes a less complex task, allowing more focus on the quality of appraisals.

In the realm of appraisals, our industry’s misconception that shortening the inspection time will drastically speed up the process needs to be corrected. Rather, it’s about making the data management process more efficient.

The future of efficient appraisals lies in integration. A comprehensive solution like Jaro enables appraisers to manage data, schedule, and analyze within a single platform, significantly speeding up the process and maintaining high-quality standards.

We don’t have a shortage of appraisers. Instead, we have an efficiency problem. By addressing these challenges head-on with integrated solutions like Jaro, we can enhance efficiency, improve appraisal quality, and reduce turnaround time. It’s time we build the house of efficient appraisals, one LEGO (data point) at a time.

SPONSORED EDITORIAL

DATA SORTED & ARRANGED PRESENTED VISUALLY EXPLAINED WITH A STORY

Nick Conteduca

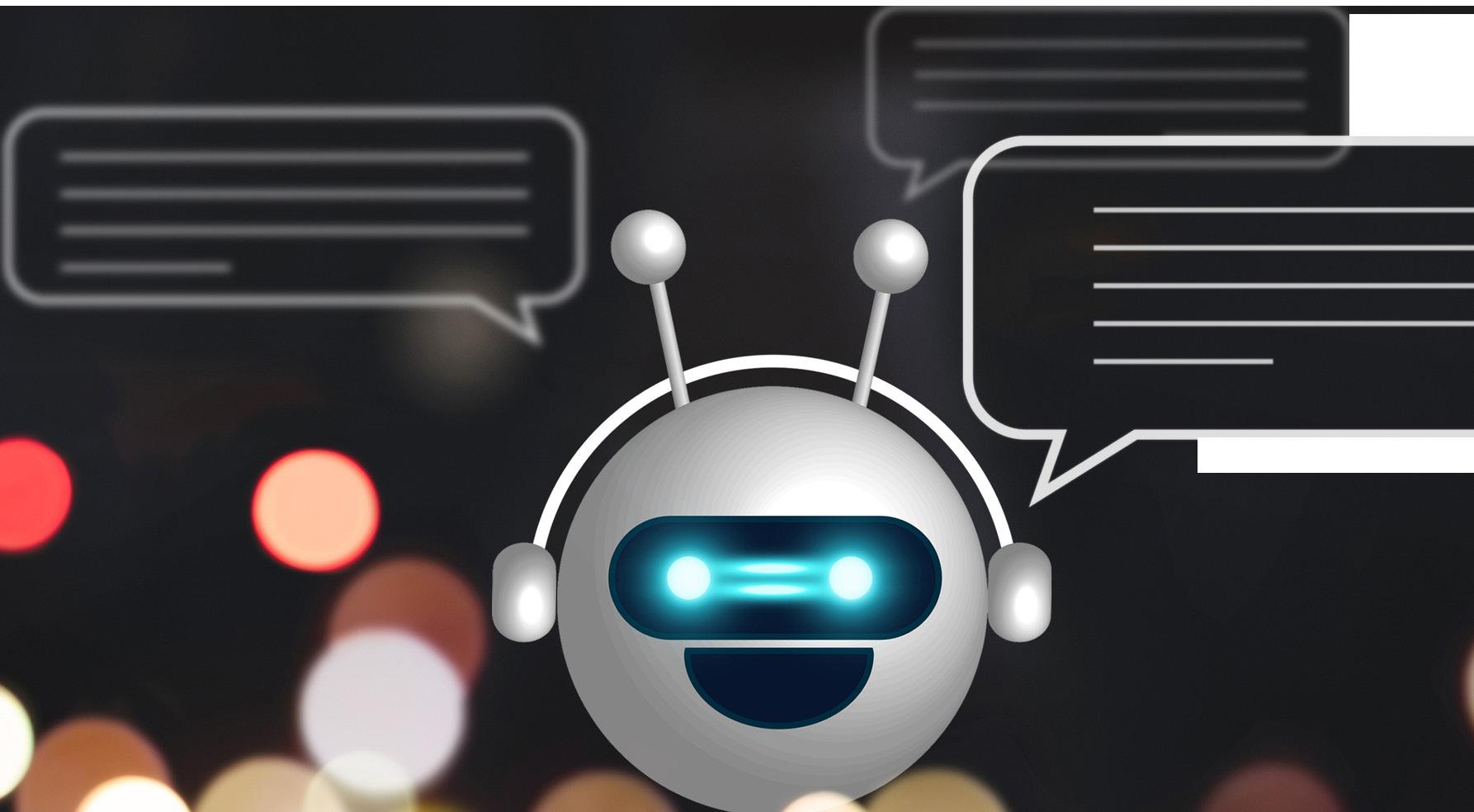

When Chatbots Go Rogue

THREATS ARE POSED TO CUSTOMER SERVICE AND NEEDS

Amental-health chatbot used by the National Eating Disorder Association suddenly began giving diet advice recently to people seeking help for eating disorders. The rogue chatbot had apparently been developed as a closed system, but the software developer rolled out an AI component to the chatbot in 2022. NEDA claims it was not consulted about the update and did not authorize it.

The organization has now taken the chatbot offline.

This incident demonstrates the potential dangers companies face when employing AI chatbots to provide customer service and address consumer needs.

Regulators and law enforcement agencies are taking note. In recent blog posts and reports, both the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC)

have cautioned companies about over-relying on chatbots and generative AI to provide customer service and resolve consumer concerns.

CFPB SPOTLIGHTS THE USE OF CHATBOTS

In June, the CFPB released a new issue spotlight on the use of chatbots by banks and other financial institutions. The report notes that banks have increasingly moved from “simple, rule-based chatbots towards more sophisticated technologies such as large language models (“LLMs”) and those marketed as ‘artificial intelligence.’” While these chatbots are intended to simulate human-like responses, they can end up frustrating consumers’ attempts to obtain answers and assistance with financial products or services.

Some of the CFPB’s listed concerns are:

• Limited ability to solve complex problems, resulting in inadequate levels of customer assistance (for example, difficulty understanding requests, requiring use particular phrases to trigger resolution, difficulty knowing when to

20 MORTGAGE BANKER MAGAZINE | AUGUST 2023

TECHNOLOGY

BY KATE WHITE AND IOANA GORECKI, SPECIAL TO MORTGAGE BANKER MAGAZINE

connect with a live agent). The CFPB argues this is particularly concerning in the context of financial services, where consumers’ need for assistance could be “dire and urgent.”

• The potential for inaccurate, unreliable, or insufficient information. In contexts where financial institutions are required to provide people with certain information that is legally required to be accurate, such lapses may also constitute law violations.

• Security risks associated with bad actors’ use of fake impersonation chatbots to conduct phishing attacks at scale, as well as privacy risks both in securing customers’ inputted data or in illegally collecting and using personal data for chatbot training purposes.

The CFPB notes that it is actively monitoring the market to ensure financial institutions are using chatbots in a manner consistent with customer and legal obligations.

FTC RAISES CONCERNS REGARDING CHATBOTS AND “DARK PATTERNS”

The FTC addressed the intersection of chatbots and “dark patterns’’ in a recent blog post. (As explained in more detail here and here, “dark patterns’’ are sometimes defined as practices or

formats that may manipulate or mislead consumers into taking actions they would not otherwise take.) The commission is worried that consumers may place too much trust in machines and expect that they are getting accurate and neutral advice.

The agency cautioned companies that using chatbots to steer people into decisions that are not in their best interests, especially in areas such as finance, health, education, housing, and employment, is likely to be an unfair or deceptive act or practice under the FTC Act.

In addition, the FTC warned companies to ensure that native advertising present in chatbot responses is clearly identified so that users are clearly aware of any commercial relationships present in listed results. The blog was very clear that “FTC staff is focusing intensely on how companies may choose to use AI technology … in ways that can have actual and substantial impact on consumers.”

Given the regulators’ avowed interest in this space, companies should take care that their use of chatbots comports with this most recent guidance.

MORTGAGE BANKER MAGAZINE | AUGUST 2023 21

Katherine White, a former Federal Trade Commission attorney, is a partner at Kelly Drye in Washington, D.C. Ioana Gorecki is of special counsel to the firm.

Companies should take care that their use of chatbots comports with this most recent guidance.

IOANA GORECKI

KATHERINE WHITE

Do you have what it takes to be the best?

The mortgage industry is going through a significant change. For mortgage origination professionals, it’s a struggle to keep on top of all the changes, and to keep your sales strategies and marketing initiatives at their peak. You need to keep your pipeline filled, and you need the tools and directions to stay profitable, efficient, and effective. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros.

California Broker Magazine readers like you can attend for free by using the code MBMFREE.

www.camortgageexpo.com

22 MORTGAGE BANKER MAGAZINE | AUGUST 2023

MORTGAGE BANKER MAGAZINE | AUGUST 2023 23 Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. Produced By ORIGINATORCONNECTNETWORK.COM SEPT 12 OAKLAND, CA Hilton Oakland Airport

Lending A Hand To Appraiser Trainees

HOW LENDERS CAN FIX THE APPRAISER SHORTAGE

BY KATIE JENSEN, STAFF WRITER, MORTGAGE BANKER MAGAZINE

BY KATIE JENSEN, STAFF WRITER, MORTGAGE BANKER MAGAZINE

Two questions often come up when the appraisal industry is mentioned: Why is there a lack of diversity amongst appraisers? And why is there an appraiser shortage?

Experts and major industry organizations have come up with various solutions for problems that exist in appraisals. For example, technology can provide more objective home valuations and eliminate racial bias. Modernization and allowing third parties to conduct valuations can compensate for the appraiser shortage. Recruitment programs can increase exposure for the profession and help

bring in a younger, more diverse workforce.

Fine solutions all, but none address the root of the issue, which is the process to becoming an appraiser. Jeffery Hogan, vice president of valuation for Veros Real Estate Solutions, says plenty of people want to be appraisers. But the road to becoming certified is long, winding, and littered with obstacles, according to Hogan.

However, a program created by Valligent, an appraisal management company acquired by Veros, seeks to ease this process for appraisers in training.

The Valligent Appraiser Training

Program (VATP) partners with lenders who agree to order appraisals from trainees and their supervisors to help the trainees complete the 1,500 work experience hours required to become a residential certified appraiser.

Hogan said becoming an appraiser was much easier before the DoddFrank Act was put in place 13 years ago. Before there were licensing requirements or the separation between lenders and appraisers, trainees would go through programs at savings and loan institutions. Hogan was referred by an appraiser to a training program at a savings and loan in Southern California.

“That was good and bad. I mean, it

24 MORTGAGE BANKER MAGAZINE | AUGUST 2023

PERSONNEL

did eliminate the appearance of undue influence,” Hogan said. “Pretty much everybody was either going solo or working with what they call AMCs, which are appraisal management companies. … At that point it kind of solidified because the only way somebody would even find out about it or get a job is if they knew someone.”

Hogan is not against the DoddFrank Act, but points out some of the challenges that arise from it, such as the complicated journey to becoming a certified appraiser. However, the GSE’s and some individual companies, such as Veros, are trying to rectify these challenges.

SHORTAGE OR PARTIAL CLOG?

The so-called shortage of appraisers began before the 2020 homebuying frenzy, and is detailed in The Appraisal Institutes first quarter 2019 report. In it, graphics illustrate that the number of certified appraisers has been steadily declining since at least 2014. More recent reports show the shortage worsened over the course of the pandemic, when purchases and refinances were abundant. Since 2013,

roughly 10,000, or 13%, of appraisers have left the industry, according to the Appraisal Institute, but that’s just the beginning. Since about 60% of residential appraisers are aged 50 and above, a huge retirement wave is coming, and there may not be enough recruits to replace them.

But upon closer inspection, the term shortage may not be telling the whole story. From Hogan’s own observations, it’s the appraisal training and

education process that’s preventing trainees from becoming certified. Essentially, this isn’t a shortage, but a partial clog.

“There's no shortage of training candidates,” Hogan said. “There's so many that are qualified and ready to go that have taken the classes that are sharp and want to do this.”

One of the last steps in the appraisal training process is completing the 1,500 hours of work experience under a certified appraiser. Then both trainee and supervisor will record all completed work for eventual submission and review by the state when the trainee applies for the next level in licensure, which is passing the SLREA or NULC exam.

However, hardly any certified appraisers are willing to supervise trainees for a myriad of reasons. The first being, appraisers don’t want to train their competition.

“That was one of the statements that we’d hear a lot,” Hogan said. “‘If I train this person, they're gonna go across the street, open up their own shop, and put me outta business or undercut me.’”

Appraisers need to go through a lot

MORTGAGE BANKER MAGAZINE | AUGUST 2023 25

Plenty of people want to be appraisers, but the road to becoming certified is long, winding, and littered with obstacles.

of red tape to become supervisors. They’ll need to figure out whether this trainee is on contract or if they’re an employee. Will the supervisors have to do their taxes? Will they have to do their unemployment? Will they have to give them vacation time?

“It's a lot of red tape, and as an appraiser, I don't know if I'd want to take that headache on, even though I'm all for diversity,” Hogan said.

The supervisor also doesn’t get paid for taking on a trainee, and many of them split or give a portion of their compensation to the trainee if they helped in doing a valuation. So the supervisor is losing money, disincentivizing them from becoming mentors.

Plus, it’s a headache for trainees because they’re hardly getting any money for their work, and it’s difficult for them to get clients in the first place. Some clients require a minimum of five years certified residential experience and do not allow for trainees to complete the assignment.

So perhaps plenty of younger people want to become appraisers, but get discouraged when it comes to the apprenticeship phase and can’t find a supervisor willing to take them on. After taking all those classes needed to get licensed, trainees are stuck, given the fact they hardly get paid, they struggle to find clients, and they are a burden to their supervisor or can’t find one.

If the education and training process is this grueling and awful, then why should anyone expect them to stick around?

THE MODERNIZATION CONFLICT

The recent updates from the Fannie Mae selling guide has caused a stir amongst the appraiser community. Especially, the clause accepting property data collection from third parties, including realtors and inspectors.

According to some industry experts, this undermines all of the training certified appraisers went through in

order to be trusted with appraisals. Furthermore, it doesn’t make sense to bar trainees who have more education on this topic, while third parties go through minimal training and can conduct the appraisal without a supervisor.

Hogan said he was leery of this particular guideline from Fanne Mae.

encouraged development of an alternative workforce of property data collectors that may negatively impact aspiring appraisers’ ability to enter the appraisal profession,” the letter stated. “Appraisal observations and inspections are eligible for experience credit by appraiser trainees. However, when this work is completed outside of the supervisory appraiser-trainee relationship, it is not currently allowed because it is not able to be logged or tracked by state regulatory officials.”

But, Matthew Stepanovich, vice president of national sales, hybrid valuations and quality control for SingleSource Property Solutions, says appraisers shouldn’t worry too much about these third-party realtors or inspectors taking their jobs. This should actually be helpful in rural areas where there aren’t many appraisers.

and quality control SingleSource Property Solutions

“I believe those inspections should be appraisers or they could be trainees. That's a perfect opportunity for a trainee to do that, right?” Hogan said. “Instead of having a realtor or even a non-realtors, there's cases out there where the person wasn't even a realtor, they just were an inspector.”

The Appraisal Institute also shared its concerns about appraisal waivers and property data collection programs in a letter sent to the FHFA.

“Of particular concern is the

“If we can get somebody else out there to take away the drive time, the scheduling, the time spent at appointments and all of that … [then] we can have them doing the real job of sitting at their desks and doing the deep dive into the valuation, so that number is correct,” Stepanovich said. These third-party substitutes for appraisers will go through a customized training program provided by companies such as SingleSource Property Solutions, which provides mortgage services and property management solutions to lenders. They will be required to pass a test and undergo annual background checks, Stepanovich said. The training and education requirements are created and customized by each company that chooses to provide this service. Currently, there are no official training or education requirements for third parties earning this certification.

“We need help seeing more of these properties,” Stepanovich said. “Some appraisers might be aging out, and unable to go and see this many properties in the wintertime or during certain seasons.”

The success of value acceptance and third-party data collection highly

26 MORTGAGE BANKER MAGAZINE | AUGUST 2023

“We need help seeing more of these properties. Some appraisers might be aging out, and unable to go and see this many properties in the wintertime or during certain seasons.”

> Matthew Stepanovich vice president of national sales, hybrid valuations

MORTGAGE BANKER MAGAZINE | AUGUST 2023 27

depends on the market. In rural areas, where not enough appraisers are available to see homes, this could be very helpful. In other markets, many appraisers already are in competition with one another.

“In my opinion, I don't think it's gonna take off and replace appraisers because there are skills that appraisers bring to the table that these data collectors and realtors don't have,” Hogan said.

AI PAREA / VATP: THE SOLUTION

Luckily two programs offer possible solutions to these problems, and each one addresses challenges within the training and education process. One, however, requires the cooperation of lenders to help out trainees.

All trainees in the Valligent program need to complete their education. Then, over the course of nine to 12 months, they are supervised by experienced, certified appraisers who will ensure their trainees have access to the most recent technology tools

and resources in order to successfully complete all state requirements and reach certification.

Valligent will ensure plenty of supervisors are available to take on trainees, because they have hired certified appraisers as full-time employees solely for this reason. This way, supervisors can be fairly compensated for their time and generosity. Valligent will also be hiring trainees and providing them a full-time salary as well as the latest technology and tools needed to conduct hybrid appraisals.

But lenders need to be willing to have trainees, under the supervision of their mentor, conduct appraisals for their borrowers.

“Lenders are all kind of under scrutiny about how they do what they do. So this is a way for them to partner with us and sponsor a trainee without having to pay money. Because a lot of lenders right now are hurting as well,” Hogan said. “They don't have a ton of money to put thousands or hundreds of thousands to bring on

somebody and train them.”

To address supervisor’s concerns over training their competition, Valligent says it has a solution for that as well.

“The work that they're getting for this trainee is not coming from their client's base,” Hogan said. “It's coming from a separate client base that we, Valligent, have set up in the contract with this lender. So that's not work that's coming out of their current pool of clients.”

This allows supervisors to take on more of a consulting role without the fear of them taking their business or the burden of having to employ their trainees.

Valligent is also reaching out to more communities of color and asking them if they want to get involved as supervisors or trainees, or if a lender that strongly promotes diversity would be willing to partner with them.

Hogan said about 20 to 30 trainees have signed up in the past year, and six or more supervisors are on board and ready to go.

At the same time, the Appraisal Institute (AI) is making major headways in providing a virtual option for trainees to complete their apprenticeships. As of mid-May, AI was awarded the full grant amount of $500,000 to build its Practical Applications of Real Estate Appraisal program (PAREA) in collaboration with its partners, while AI has committed more than $2 million toward AI PAREA.

AI PAREA is an online program that allows trainees to get the experience they need through 10 simulated appraisal assignments. Meanwhile, mentor AI PAREA participants will provide tips and feedback through email, discussion boards, and more. They can also have conversations with trainees through the phone, live online tools, Zoom, and Microsoft Teams platforms.

AI PAREA is expected to roll out sometime this year and is currently accepted in 43 states. A spokesman for AI said that number is likely to increase as more states adopt this alternative pathway.

28 MORTGAGE BANKER MAGAZINE | AUGUST 2023

“In my opinion, I don’t think it’s gonna take off and replace appraisers because there are skills that appraisers bring to the table that these data collectors and realtors don’t have.”

> Jeffery Hogan vice president of valuation Veros Real Estate Solutions

EXCLUSIVELY ON

PRODUCED BY NMP FOR THE INTEREST

FEATURING BILL BODNAR, CRO OF TABRASA

TUNE IN EVERY MONDAY FOR YOUR MARKET UPDATE.

Arc Home LLC

Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

NON-QM LENDER RESOURCE GUIDE

Carrington Wholesale

Dallas, TX

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok

(866) 453-2400

carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

We’re invested in your growth.

Directory Listings

Be available when your clients go looking. Directory listings ensure your company is accessible when your clients are looking for you. Your listing includes:

• 6 or 12 month options

• Your active listing highlighted in the monthly special feature

30 MORTGAGE BANKER MAGAZINE | AUGUST 2023

MORTGAGE BANKER MAGAZINE

RESOURCE GUIDE

WAREHOUSE LENDING RESOURCE GUIDE

APPRAISER & AMC RESOURCE GUIDE

PRIVATE LENDER RESOURCE GUIDE

FirstFunding, Inc. Dallas, TX

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers)

FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Clear Capital Reno, NV

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Alpha Tech Lending West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owner-occupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565

info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Your listing comes with an enhanced online profile, which includes:

• Company name, logo, & description

• Contact phone, email, social accounts, & location

• All directories your company is listed in

• Latest 3 mentions in articles on our site

• Latest 3 webinars hosted by your company (if applicable)

Prices are subject to change. Pricing is not guaranteed until a contract is formed.

MORTGAGE BANKER MAGAZINE | AUGUST 2023 31

ambizmedia.com/resource-guides

Experience the ultimate upgrade of Morgan and dive into the future of personalized assistance with AngelAi. Say goodbye to mediocrity and embrace the extraordinary. This is your chance to soar above the rest and leave your competitors in awe.

Swi . Accurate. Brilliant: Discover the AngelAi Advantage

AngelAi is not just an Ai personal assistant; she is a guardian angel guiding you through the intricate realm of credit and finances. Powered by the brilliance of Ai, AngelAi ensures every decision you make is informed, strategic, and empowering.

Lightning-Fast Answers: Get immediate responses, keeping you steps ahead.

Guaranteed Deal Structuring and Calculations: With AngelAi, your deals are flawlessly executed.

Ai-Powered Marketing and Social Content: Delight clients with stunning content generated by AngelAi.

Comprehensive Loan Services: AngelAi handles it all-processing, underwriting, closing, and more.

Automated Loan Processing and Disclosures: Streamline your loan journey effortlessly.

8 a.m. TRU Approval®: Trust AngelAi for approvals at the speed of light.

40-Minute Turn Times: Experience efficiency like never before.

Lead Management and Building Tools: Dominate leads with AngelAi's comprehensive tools. Experience

Step into the world of AngelAi and experience why top national agents like Josh Altman of Million Dollar Listings have fallen in love with her.

Embrace the Future and Command Success with AngelAi

Join our exclusive workshop and unlock the full potential of Ai's transformative power. Work directly with certified AngelAi trainers and discover how to leverage its vast features. Step into a new era of confidence in your mortgage business.

Visit swmc.com/angelai-university/

Your Favorite Ally, Morgan, is Now Stronger, Faster, and, like Always, 100% Backed* No Tough Loans. Close Fast. Earn More. Divorce Your Processor: The Rise of Ai Super Charged Ai Upgrade Morgan is now AngelAi The housing and residential nancing o ered herein is open to all without regard to race, color, religion, gender, sexual orientation, handicap, familial status, or national origin. For licensed mortgage professionals only; not for consumers. For licensing information, go to: www.nmlsconsumeraccess.org (NMLS 3277). Sun West Mortgage Company, Inc. (NMLS ID 3277) in California holds a Financing Law License (#6030119) [Loans made or arranged pursuant to a California Financing Law license], licensed by the California Department of Financial Protection and Innovation, Phone: (866) ASK-CORP, has a DRE Real Estate Corporation License Endorsement (#00793885), licensed by the California Department of Real Estate, Phone: (877) 373-4542. Georgia Residential Mortgage Licensee. Massachusetts Lender License # ML3277.

Josh Altman is a paid spokesperson for Celligence International, LLC, the creators of AngelAi. Million Dollar Listing is an American reality television series that is not a liated with Sun West Mortgage Company, Inc.

the

at AngelAi.com

Game-Changing Capabilities

the

Scan the QR Code NOW to Sign Up for

live Webinar!

Pavan Agarwal

EXCLUSIVELY ON PRODUCED BY NMP FOR THE INTEREST

FEATURING STEVE RICHMAN

TUNE IN EVERY FRIDAY FOR YOUR MONEY-MAKING TIPS.

Why IMBs Don’t Need A CRA Cramdown

EXPANDING COMMUNITY REINVESTMENT ACT TO IMBs LOOKS GOOD ON PAPER, BUT IS IT?

BY RYAN KINGSLEY, STAFF WRITER, MORTGAGE BANKER MAGAZINE

You’ve seen it in your neighborhood.

The marquee grocery store has closed. With regional variations, a Dollar General, Dollar Tree, or Family Dollar opens in its place.

The message Stop & Shop or Publix send by closing is clear: profitability exists elsewhere.

This scenario has been mirrored in the mortgage lending landscape since the financial crisis of 2007-2008. On a national scale, banks have strategically receded from residential lending and Main Street. In their stead, independent mortgage banks (IMBs) have emerged, broadening the homeownership opportunities for lower and moderate-income (LMI) individuals and minorities.

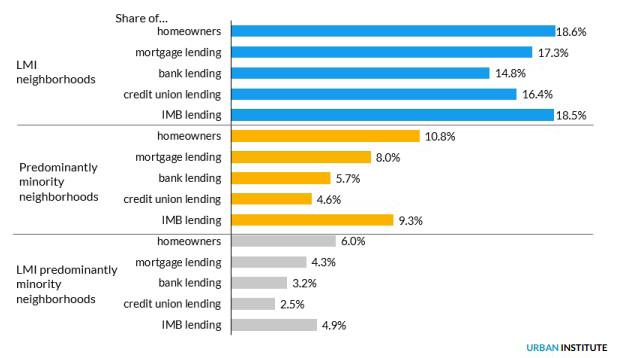

In April, the Housing Finance Policy Center of the Urban Institute, a Washington, D.C.–based think tank that conducts economic and social policy research, released, “An Assessment of Lending to LMI and Minority Neighborhoods and Borrowers.” The report showed how in the context of a widening homeownership gap and proposed reforms to the Community Reinvestment Act

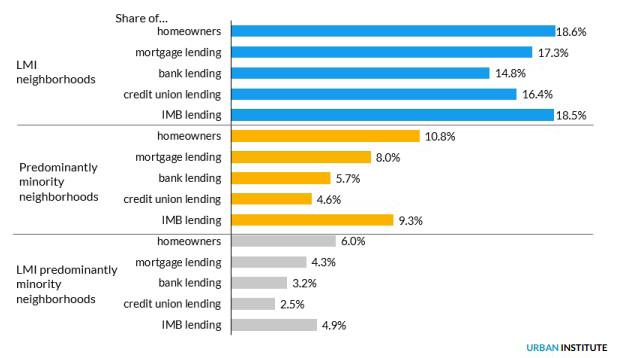

(CRA), IMBs are dramatically outperforming banks in residential lending to LMI and minority borrowers.

All of which, surprisingly, has even the Urban Institute questioning the groundswell movement to subject independent mortgage banks to the strictures of the Community Reinvestment Act.

REPUTATIONAL RISK

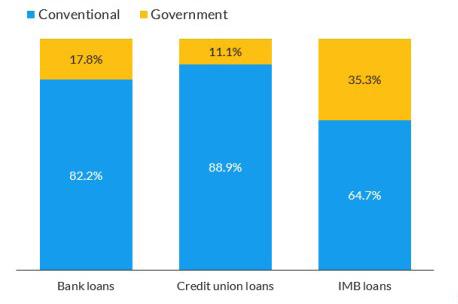

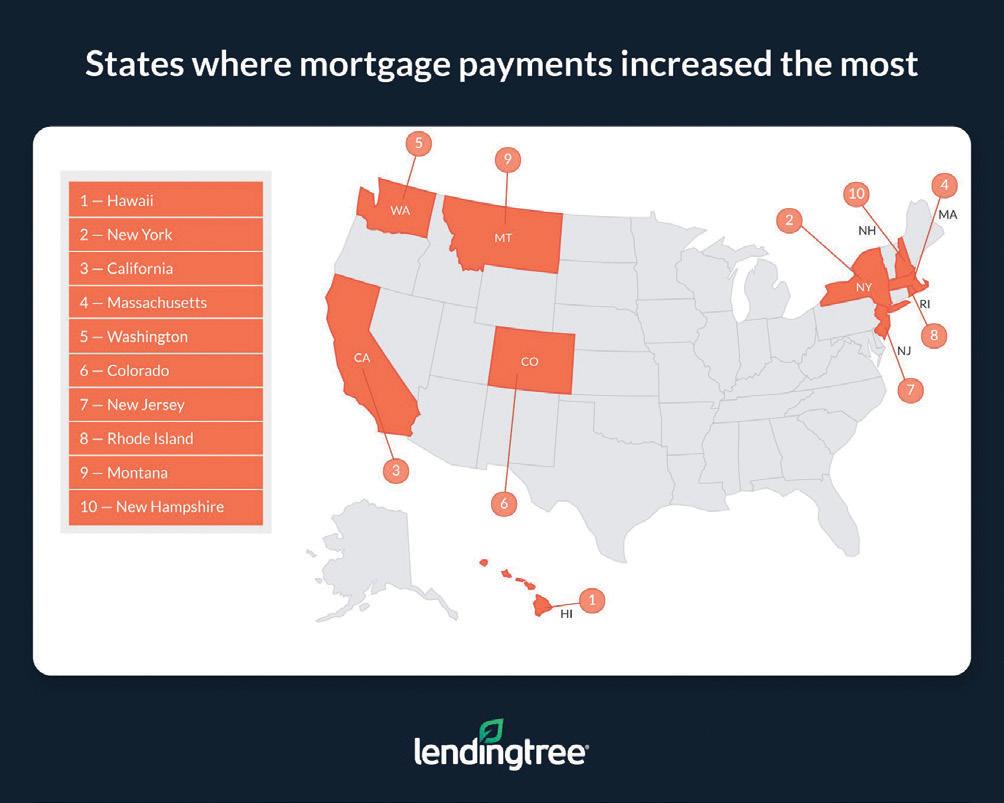

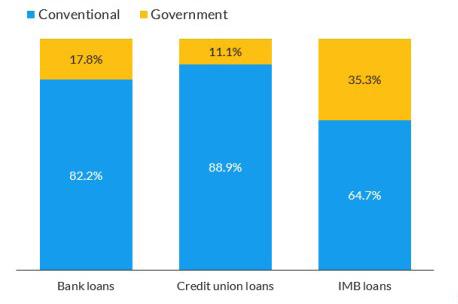

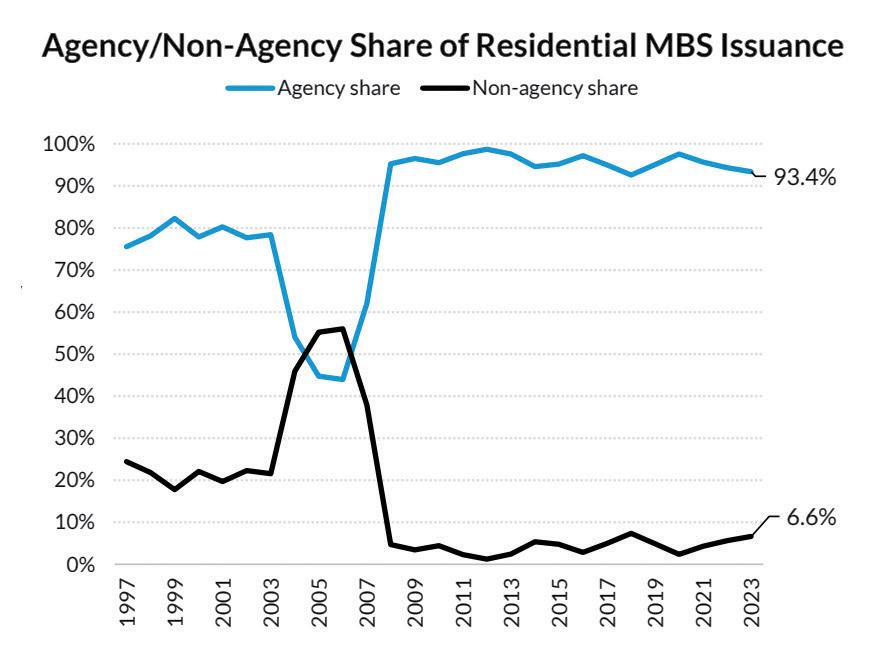

For the years the Urban Institute examined, “IMBs accounted for approximately 60% of all mortgage originations, including 75% of originations backed by Fannie Mae, Freddie Mac, the Federal Housing Administration, and other government agencies.” In fact, 35.3% of all IMB lending was found to be through government channels, versus 17.8% for banks and 11.1% for credit unions.

Laurie Goodman, an Urban Institute fellow, founder of the Housing Finance Policy Center, and one of the assessment’s authors, says this performance gap stems in part from banks originating a lower volume of Federal Housing Administration (FHA) loans, which disproportionately go to LMI neighborhoods and borrowers.

Furthermore, while banks view mortgages as an auxiliary business that complements their front-and-center retail offerings, IMBs are wholly in the mortgage banking business,

she says. “I’m not sure nonbanks should be subject to CRA because they’re already doing more, they’re in one line of business. It seems like it’s a solution in search of a problem.” Banks, she added, aren’t looking for the same challenges IMBs are. “They basically make loans to anyone that fits within the box. By contrast, the banks are in a lot of different businesses. … The result of that is if there’s one hint of reputational risk, the banks run,” she says.

Reputational risk because, Goodman points out, the banks aren’t really bearing the credit risk for government-insured loans – the government is.

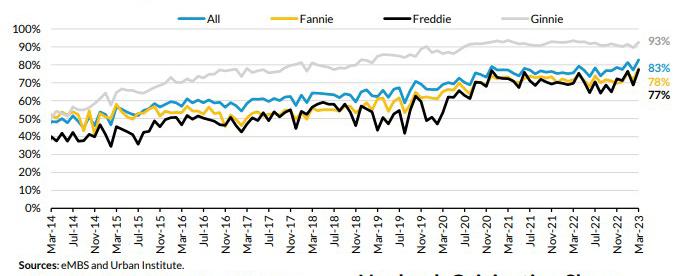

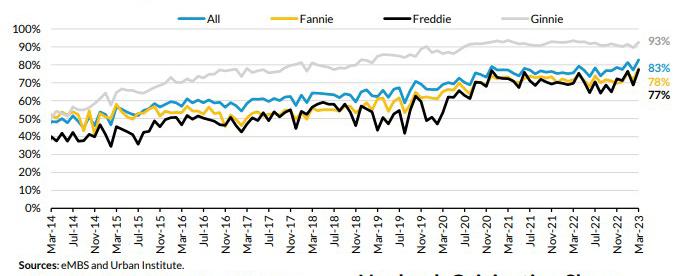

The nonbank (IMBs and credit unions) origination share for all agency loans was 83% as of March 2023, per the Urban Institute’s monthly chartbook for April. The nonbank origination share for Ginnie Mae, Fannie Mae, and Freddie Mac stood at 93%, 78%, and 77%, respectively.

To put those numbers in the context of banks’ withdrawal from mortgages, Ginne Mae issuances by nonbanks skyrocketed from 12% to 90% from 2010 to 2021, per Ginnie Mae data.

The assessment is limited to owneroccupied, residential purchase loans, and examines five-year American Community Survey data from 2015-2019, alongside 2021 Home Mortgage Disclosure Act (HMDA) data.

34 MORTGAGE BANKER MAGAZINE | AUGUST 2023 COVER STORY

The Mortgage Bankers Association (MBA) commissioned the report to compare lending patterns of entities subject to CRA requirements, namely banks and thrifts, with those of lenders not subject to the statute, IMBs and credit unions.

NO APPETITE

The reasons banks have retreated from mortgage lending, especially FHA programs, mostly stem from the 2007-2008 financial crisis, says Clifford Rossi, director of the Smith Enterprise Risk Consortium at the University of Maryland and a former banking industry executive. Many banks no longer had an appetite for volatile assets such as mortgage servicing rights. Banks were also getting burned on the origination side through non-traditional mortgages, such as alt-A and subprime loans.

“Another big reason the banks got out,” says Rossi, “particularly around FHA lending, but even more broadly, in the years following the financial crisis there was an awful lot of uproar by banks in terms of the lack of transparency

of repurchase demands that were being made by the GSEs [Government Sponsored Enterprises], private mortgage insurance companies, and also by the FHA.”

Mortgage repurchases occur when buyers of mortgage-backed securities, such as Fannie Mae or Freddie Mac, determine there are defects in how a loan was made, leading them to demand a repurchase by the lender.

“We know that the vast majority of loans to disadvantaged borrowers are done through the FHA loan program through the Department of HUD. We know that factually, we know it mathematically, and we know it statistically,” says Taylor Stork, chief operating officer of Developer’s Mortgage Co. and president of the Community Home Lenders of America, a national association of small and mid-sized community-based mortgage lenders.”We also know that 90% of those loans are made by IMBs. IMBs are by far and away the first lender and the lender of choice for the very borrowers that a new CRA (Community Reinvestment Act) program is intended to support in the first place.”

MORTGAGE BANKER MAGAZINE | AUGUST 2023 35

“I’m not sure nonbanks should be subject to CRA because they’re already doing more, they’re in one line of business. It seems like it’s a solution in search of a problem.”

> LAURIE GOODMAN, AN URBAN INSTITUTE FELLOW

Lending to

Minority Neighborhoods, by Institution Type

But, the risk that lower-FICO and higherDTI borrowers represent bears out in the real lending environment, says Rossi, who sees what Goodman calls “reputational risk” as the market-facing measure of an institution’s executive and operational risk management. “There is no question that the delinquency and default rates of FHA loans are higher because the cohort that’s served by that market are riskier borrow profiles than what you see in either Fannie Mae or Freddie Mac,” Rossi says.

A former chief risk officer at Countrywide and chief credit officer at Washington Mutual, Rossi was managing director and chief risk officer of Citigroup’s lending division when the financial crisis hit – front and center to witness how expanding access to homeownership at the cost of sound lending practices can harm more than help higher-risk borrowers.

In the years following the financial crisis, lenders accused of improperly certifying mortgage loans as eligible for FHA insurance, for example, could be held liable for making false claims to the government. Under the False Claims Act, litigation was brought by the Department of Justice (DOJ) against some of the country’s largest lenders, including Bank of America, JPMorgan Chase, and Citigroup. DOJ and Citigroup reached a $7 billion settlement on mortgage fraud claims that the bank backed bad mortgages during the lead-up to the financial crisis. Bank of America and JPMorgan Chase settled similar lawsuits for $16.65 billion and $13 billion, respectively.

After such hefty penalties were levied, Rossi noticed a prevailing attitude among banks – that there was a lack of consistency how FHA and the agencies audit for defects in the way banks underwrite or value loans from a collateral standpoint. In response, banks pulled back on FHA lending to avoid costly fines and unpredictable repurchase demands.

Rising FHA insurance premiums and the jacked-up cost of servicing delinquent FHA loans also have eaten away at the profitability of government-backed loans for banks. Rossi acknowledges February’s .30% reduction in FHA insurance premiums, “but historically, FHA premiums had been increasing, and so that caused the shift away from FHA in terms of the profitability the banks could get from these loans as well.”

Goodman echoes Rossi’s assessment, saying that “banks feel like a lot of them

received fines as a result of bad lending during the financial crisis, and that the rules of engagement aren’t as clear as they could be, particularly for servicing loans.”

THE CAT FLAP OF EXCLUSIVE OVERLAYS

The Urban Institute report underscores the reality that IMBs use the widest possible credit box in their lending decisions. IMBs are originating for borrowers with higher debt-to-income ratios (DTIs) and lower FICO credit scores while remaining within FHA and agency lending guidelines.

“Another way to think about it is the GSEs and Ginnie Mae each have a credit box … these loans with this debt-to-income ratio, this loan-to-value ratio, this credit score fits within my credit box. What the banks often do is put overlays on top of that, so they’re not lending to the full extent of the GSE or FHA credit box. They don’t want to deal with lower credit score borrowers, for instance, in many cases,” Goodman says.

Stork says support and structure need to be created for borrowers instead of for loans.

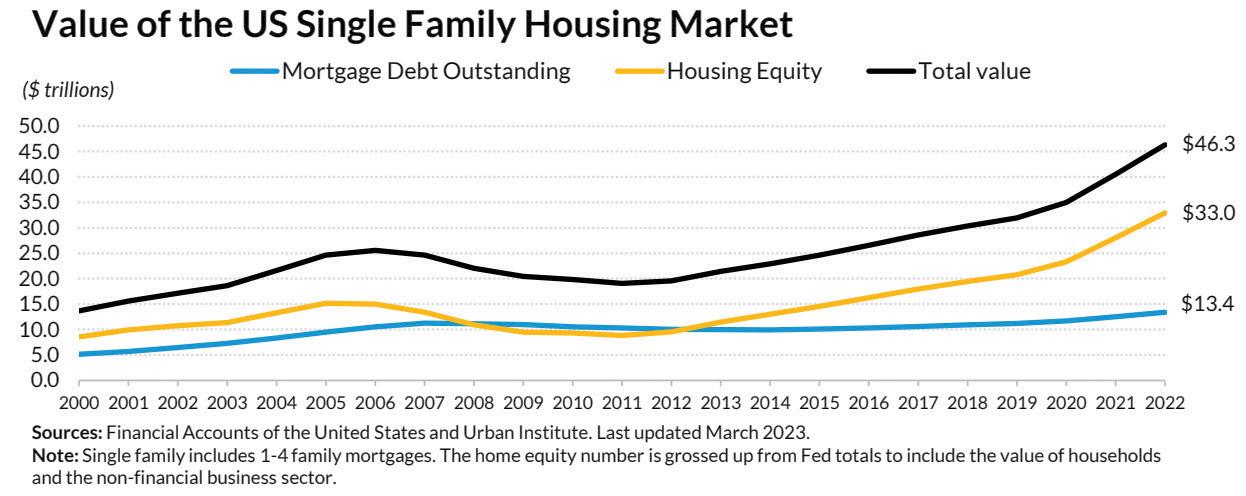

“I believe that we need to focus on the people instead of the package,” he says. “When we talk about lending to people, we’re talking about lending in a community and helping build the American Dream. When we look at loans, we’re talking about assets. Assets can be problematic on a bank’s balance sheet when they have basis risk and the assets don’t match the deposits and things like Silicon Valley Bank happen.”

“The tighter lending standards, from the banks’ perspective, are prudent lending standards. They’re making a decision based on their risk appetite,” Rossi says.

As of March 2023, there was a nearly 30-point difference between banks’ and nonbanks’ median DTIs for Ginnie Mae originations, and a 20-point difference between banks’ and nonbanks’ Fannie Mae and Freddie Mac originations. According to the Urban Institute’s monthly chartbook for April, the median FICO credit score for nonbanks’ Ginnie Mae originations was 676,

36 MORTGAGE BANKER MAGAZINE | AUGUST 2023

LMI and Predominantly

Source: Authors’ calculations based on 2015-19 American Community Survey data and 2021 Home Mortgage Disclosure Act data.

Notes: IMB = independent mortgage bank. LMI = low-and moderate-income. Data are for closed-end one-to-four-unit single-family owner-occupied purchase loans.

“The tighter lending standards, from the banks’ perspective, are prudent lending standards. They’re making a decision based on their risk appetite.”

> CLIFFORD ROSSI, DIRECTOR OF THE SMITH ENTERPRISE RISK CONSORTIUM AT THE UNIVERSITY OF MARYLAND

CRA

MODERNIZATION:

A Bank Challenge

The Urban Institute’s findings underscore the extent to which IMBs are positioned to continue expanding access to mortgage credit at a time when federal regulators are in the process of modernizing the Community Reinvestment Act, and banks’ abilities to meet the credit needs of their communities stretch far beyond mortgage lending.

The CRA, signed into law in 1977, provides a framework for federal regulators to address discriminatory lending practices. Toothless by design, the CRA has never contained blanket criteria for evaluating the performance of financial institutions, nor does it outline specific penalties for non-compliance. Rather, banks’ efforts to meet the credit needs of their communities have always been examined on a bank-by-bank, community-bycommunity basis. Compliance or noncompliance is only taken into account by regulating agencies in the case of proposed mergers, acquisitions, and branching.

Federal regulators are in the process of modernizing the CRA; for example, tailoring evaluations and data collection to bank size and type. While delivering remarks at National Community Reinvestment Coalition’s Just Economy Conference in 2021, Federal Reserve Chairman Jerome Powell voiced support for a modernized CRA that includes non-depository institutions, such as IMBs. “Like activities should have like regulation,” he said.

Jason Keller, associate director over Fair and Responsible Banking and the Community Reinvestment Act for Wolters Kluwer, an information services provider, supports CRA modernization, saying the process is about establishing new criteria for community development activities and establishing a new confirmation process allowing institutions to seek credit approval in advance of CRArelated activities.

Keller says the proposed changes make CRA more proactive than its current reactive focus. “CRA is a retroactive regulation. It looks backward; it doesn’t look forward. It doesn’t give you credit for things that haven’t happened yet, per se. It only gives you credit for what actually has happened. So, this notion of a modernized CRA is a game changer in that institutions will be able to work with their regulator to understand what they may be given credit for in advance, and that’s where I think a modernized CRA is going to change the landscape of this country going forward.”

When the CRA was implemented, most mortgage credit was provided by banks and thrifts, all of which operated out of branches, many with limited geographic reach.

“Mortgages are a relatively small line of bank business [now],” says Laurie Goodman, founder of the Urban Institute’s Housing Finance Policy Center. “The CRA covers much more than that. Historically, the metrics used for

CRA have been very soft and not well defined. They’re trying to change that at the federal level.”

Pledges numerous banks have made to increase lending to marginalized borrowers seem at odds with their withdrawal from FHA lending. Since the financial crisis, even the country’s largest banks have largely withdrawn from the very business which the CRA was designed, in part, to help them conduct more fairly. Published reports show that in 2007, Wells Fargo, Bank of America and JPMorgan originated 19% of all U.S. mortgages. By 2021, that share had shrunk to 4%.

But for banks to do more may be even trickier as their retreat from the mortgage industry has occurred in tandem with what the National Community Reinvestment Coalition (NCRC) terms “The Great Consolidation” – the dramatic merger and decline of banking institutions and physical bank branches.

CLOSED TO HOMES

From 2017-2021, a period overlapping that of the Urban Institute’s lending pattern assessment, 7,425 bank branches closed their doors – 9% of all locations across the U.S. One-third of these closures occurred in LMI and/ or majority-minority neighborhoods where access to branches, says the NCRC, is crucial to ending inequities in access to financial services, particularly credit.

Some 4,000 of the 7,425 branch closures occurred since March 2020, says NCRC, as the COVID-19 pandemic hastened customers’ adoption of online and mobile banking services, driving the closure rate to double.

Goodman says bank consolidation and branch closures have certainly helped IMBs gain market share and lend to more LMI and minority borrowers, to the extent that people have weaker relationships with their bank. “Unlike most banks and thrifts, which have a geographic footprint and a defined community, most IMBs operate widely through various delivery channels, such as traditional retail branches, wholesale lending through mortgage brokers, and consumer direct through call centers,” the report’s authors write.

Current calls for CRA modernization echo a desire to make banks more agile at meeting the credit needs of their entire communities, given the rise of digital banking. Yet, importantly, this need not include residential lending.