Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

The Federal Housing Administration (FHA) is announcing new flexibilities to help senior homeowners with FHA-insured Home Equity Conversion Mortgages (HECMs) who are behind on required property charge payments due to the effects of the COVID-19 pandemic. The new plan allows mortgage servicers to offer eligible homeowners up to five years to repay property charges, such as taxes and homeowners insurance, that the servicer advances on the homeowner’s behalf when the homeowner is unable to make these payments.

“For senior homeowners, recovering from the financial effects of the pandemic may be especially challenging,” said Federal Housing Commissioner Julia Gordon. “The new repayment plan option announced today will give more seniors behind on their property charges the opportunity to fulfill the obligations of their HECM and remain in their homes.”

With the new COVID-19 HECM Property Charge Repayment Plan:

• Borrowers may receive a repayment plan regardless of the dollar amount of property charge payments owed.

• Borrowers can benefit from the use of jurisdictional Homeowner Assistance Funds.

• Servicers can offer homeowners a repayment plan of up to five full years (60 months) regardless of any prior repayment plan usage.

• Servicers can offer the COVID-19 HECM Property Charge Repayment Plan for up to one year after the end of the COVID-19 National Emergency.

• To be eligible, borrowers must attest that they have been impacted by the COVID-19 pandemic, which can be a verbal statement to the servicer.

Homeowners are required to pay property charges as a condition of their HECM. If they are unable to maintain these payments, they are considered in default and their mortgage servicer must advance funds to pay the property charges. Failure to resolve a property charge default can result in foreclosure. To remedy the default, servicers may offer homeowners a repayment plan to repay the advances made by the servicer. FHA’s standard HECM property charge repayment policy only permits 60 months in total to repay property charge advances.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR

David Krechevsky

EDITOR

Keith Griffin

SENIOR EDITOR

Mike Savino

HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak

STAFF WRITERS

Rob Chrisman, Marty Green

CONTRIBUTING WRITERS

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

The Federal Housing Finance Agency (FHFA) issued a final rule for Fannie Mae and Freddie Mac (the Enterprises) that establishes the benchmark levels for their multifamily housing goals for 2023 and 2024 using the new percentage-based methodology outlined in the proposed rule. The housing goals ensure that the Enterprises, through their mortgage purchases, responsibly promote equitable access to affordable housing that reaches low- and very low-income families in multifamily rental properties across the country.

“The multifamily housing goals are one method FHFA employs to ensure the Enterprises remain focused on affordable segments of the market, consistent with FHFA’s statutory duty to promote affordability nationwide,” said FHFA Director Sandra L. Thompson. “The new methodology will make the multifamily housing goals more responsive to market conditions and better position the Enterprises to fulfill their affordable housing mission requirements each year.”

In August 2022, FHFA issued a proposed rule requesting public comments on proposed multifamily housing goals for the Enterprises in 2023-2024, which FHFA considered when adopting the final rule. Under FHFA’s existing housing goals regulation, the multifamily housing goals for the Enterprises include benchmark levels through the end of 2022 that are based on the total number of affordable units in multifamily properties financed by mortgage loans purchased by the Enterprises each year. The final rule amends the regulation to establish benchmark levels for the multifamily housing goals for 2023 and 2024 based on the percentage of affordable units in multifamily properties financed by mortgages purchased by the Enterprise each year.

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin

MARKETING INTERN

Submit your news to editorial@ambizmedia.com

If you would like additional copies of Mortgage Banker Magazine Call (860) 719-1991 or email info@ambizmedia.com www.ambizmedia.com

© 2022 American Business Media LLC. All rights reserved. Mortgage Banker magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

For the last several years, it seems as if the eyes of the financial community, including lenders and their capital markets staffs, have been firmly planted on the Federal Reserve. The U.S. central bank carries out its mission through the actions of its Federal Open Market Committee (FOMC). The FOMC does not set mortgage rates, but the same factors that influence its actions also influence mortgage rates. As 2022 wraps up and we begin 2023, it is good to know what the market is thinking.

The FOMC delivered a 50-basis point (bp) rate hike at its December meeting. Given this move, analysts have revised upwards the median path of the terminal policy fed funds rate to 4.9% by the end of 2023, and continue to see the first overnight fed funds cut coming in 2024. Inflation has been driving the Federal Reserve’s decisions for the majority of 2022, and this focus is expected to continue into 2023.

FOMC statements and the minutes from its meetings should continue to highlight elevated inflation, and participants will still see the balance of risk on the upside. On balance, these changes will allow Fed Chair Jerome Powell to justify the step down in pace while maintaining the Fed’s commitment to fighting inflation. The Fed will enter 2023 just 50 bp shy of where it sees the likely peak, and it will seek more flexibility in its approach. So, it is unlikely at this point that rates will go up much more, if at all.

The “experts” will tell you that a nearly sure sign of a recession is the shape and

slope of the yield curve. In early December the two-year Treasury yield traded at 4.2%, while the 10year yield stood at 3.4%, bringing the difference between the two to 0.84 percentage points. The pattern, known as a yield curve inversion, has preceded every U.S. economic downturn of the past 50 years.

Certainly, the jobs market has been solid in the U.S. as employment is strong. Since jobs and housing drive our economy, the low unemployment rate is a concern for anyone hoping for lower rates. While the data paints an upbeat picture of the state of the economy, some investors are worried that it will also encourage the Fed to keep pushing interest rates higher next year, after taking them from near zero to a range of 4.25 to 4.5% in 2022. Higher borrowing costs, in turn, are expected to heap pressure on the economy and potentially trigger a recession.

Futures markets currently suggest the “terminal” federal funds rate, or the peak in this cycle, will be about 5% in May, from expectations of as low as 4% in September. In

terms of the yield curve, the most basic signal sent by the yield curve inversion is that investors believe the Fed’s increases in short-term rates will be successful in sharply slowing inflation.

Although the degree of the yield curve inversion might not directly predict the extent of the coming recession, the current deepening could have broader ramifications if it leads to changes in investor behavior. And since investor demand for securities backed by mortgages drives the rate-sheet pricing for borrowers, what investors believe is important.

The Financial Times reports, “Many analysts continue to see the policy rate peaking at 4.625% in February. Despite continued high readings, expectations remain firm that job gains slow meaningfully in the prints ahead.”

Thereafter, lenders should continue to see the Fed holding rates steady until December 2023, when it begins to normalize policy in steady 25 bp increments. The Fed is likely to put a lid on terminal rates, while also signaling a long on-hold period. Many think the pricing of nearly seven rate cuts by the end of 2024 is excessive. Put another way, there is a good chance that we’ve seen the high for 30-year mortgage rates.

SO, IT IS UNLIKELY AT THIS POINT THAT RATES WILL GO UP MUCH MORE, IF AT ALL.ROB CHRISMAN

According to a new report from McKinsey & Company, “The Economic State Of Latinos In The US: Determined To Thrive,” if Latinos were a separate company, they would have the third highest gross domestic product (GDP) rate in the past decade. Yet, their spending power lags well behind non-Latinos.

The report says its “research estimates that the Latino consumer base has unmet needs of more than $100 billion currently, and this could grow six-fold to $660 billion if we address the parity gap between Latinos and non-Latino Whites based on share of population.”

The McKinsey authors note, “Over the past decade, Latinos have grown their household consumption to reach a cumulative $1 trillion market in 2021—a 6 percent annual growth rate over the last decade. Their household spend is higher compared to other groups at similar income levels, and yet marketing spend directed at Latinos most likely does not reflect this. Latinos are conscious of their impact, choosing brands that value the environment and their employees, all of which make them more influential than their income levels would suggest.

However, Latino consumers are often highly dissatisfied with the products offered to them—especially compared to their non-Latino White counterparts. This dissatisfaction ranges across product categories, from food and beverages to financial products, which may point to unresolved needs that impact their daily life. If brands address the drivers of dissatisfaction in terms of access and value proposition, there is a collective $109 billion of revenue at stake when considering current spending and future potential should improved products be offered.

According to the McKinsey report, closing the Latino wealth gap would strengthen the existing consumer opportunity by more than 500%.

In a scenario in which Latinos match their spend to their share of the population, Latino consumers would spend around

$554 billion more than today. Closing this gap would require addressing the underlying income and savings gaps between Latinos and non-Latino Whites. Employers and society at large have much to gain from providing Latinos with better jobs that also provide advancement and leadership opportunities.

In pursuing greater prosperity and fulfillment, Latinos increased their share of professional roles to 25% — a five percentage point gain over the past decade. However, Latinos still face barriers in the workplace through discrimination, implicit biases, or a lack of opportunities for advancement in new roles. In fact, if Latinos were represented at job levels in line with their share of the population and paid the same as nonLatino Whites, they would receive an additional $281 billion in annual income that could be further deployed to drive economic growth.

Latino savers have only a fifth of the median wealth of their non-Latino White counterparts, and their savings have been depleted; today, almost half of Latinos have little or no retirement savings. Only 23% of Latinos are considered financially healthy in 2022 compared to 35 percent of non-Latino Whites. Nevertheless, Latinos’ net wealth is increasing at a faster rate (9 percent for Latinos, versus 4 percent for non-Latino Whites), narrowing—but not yet closing—the gap with non-Latino Whites. If the trend continues, Latino households could reach an average net worth of $47,000 this year.

While Latinos have about half as much debt as non-Latino White counterparts, this may be because they find it difficult to access appropriate financial products. Latinos are 1.7 times more likely than non-Latino Whites to be turned down for a loan, and 30 percent are unbanked or underbanked compared to 12 percent of their non-Latino White counterparts.7 For financial institutions, this is a significant opportunity to address an underserved consumer market.

The report also says Latino voices remain underrepresented in the C-suites of corporate America, where product offerings and capital allocation decisions are made, and this is particularly true of Latina women. As a result, Latino

consumers are often overlooked by companies that do not recognize them as a priority demographic. Less than 5% of seats in Fortune 500 boards and in C-suites of corporate America are occupied by Latinos despite this community representing 19 percent of the US population.3 Latina women hold 1% of seats in Fortune 500 boards, the smallest percentage of board seats compared to any racial or ethnic demographic in the United States.

The report’s authors conclude, “The right combination of structural and immediate interventions can accelerate Latino economic advancement and prosperity. Action is needed in several key areas: improving Latino representation and inclusion in decision-making bodies; expanding product portfolios, optimizing value propositions and targeting marketing and sales strategies for Latino

consumers; increasing access to capital for Latino entrepreneurs; improving access to education, reskilling opportunities, and better jobs for Latino workers; and removing bias and discrimination.

“Winning the US Latino consumer, worker, saver, and entrepreneur is an outsize opportunity for organizations that act now and invest in the right people, processes, and systems to serve a market that has not been as visible as its numbers would foretell.”

This report is a collaboration among Ana Paula Calvo, Carolina Mazuera, Jordan Morris, Lucy Pérez, and Bernardo Sichel. It is available here: https://tinyurl.com/38xbfd53

Latinos are a fast-growing population that will represent over 25 percent of the population by 2050 and a significant share of the US labor force. Latinos will make up nearly a quarter of the US labor force by 2030 and nearly a third by 2060.

Latinos are concentrated in low-wage occupations, are less likely to have nonwage employer benefits, and are strikingly underrepresented in higher-paying occupations based on their share of the US labor force.

Latinos are highly entrepreneurial but constrained by lower access to capital, which limits their abilities to start and scale their businesses.

While Latino consumption is growing at a faster pace than that of non-Latino Whites, it still lags well behind Latinos’ share of the US population, constrained by lower incomes and wealth.

Latino wealth has grown at a rate more than twice that of non-Latino White wealth, given low participation in assets that accumulate wealth (for example, stock market) and a lower base ($36,000 for Latinos versus $188,000 for non-Latino Whites)

“Latinos are conscious of their impact, choosing brands that value the environment and their employees, all of which make them more influential than their income levels would suggest.”

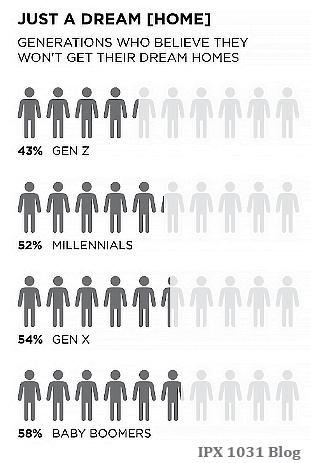

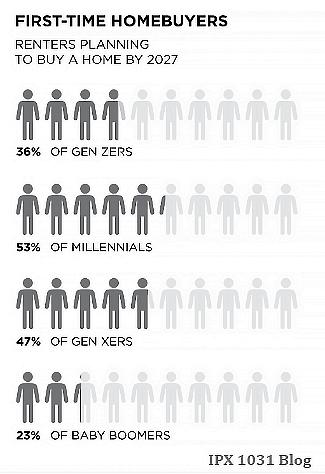

The housing market is in turmoil. This, of course, isn’t news to anyone. However, for young millennials and Gen Z’ers, this housing market is their version of normal.

A survey conducted by Cinch found that roughly 57% of Gen Z homebuyers report their home purchase contracts being canceled – the most out of any other generation in the housing market.

Contracts are simply going haywire. Over half of American home buyers currently in the housing market reported in the same survey that their housing contract has fallen through. Overall, buyers and sellers in the 2022 housing market report 54% of buyers are simply backing out of the contract, while roughly 1 in 5 buyers report canceling the contract due to the fear of an upcoming recession. Cinch noted that over half of the survey respondents were millennials.

About 64,000 home-purchase agreements were canceled in August, according to a report from Redfin. (Those most recent data available.) That’s equal to a hefty 15.2% of

home contracts initiated during the month and similar to the 15.5% canceled in July. A year ago, the share was 12.1%.

With buyers backing out and getting cold feet from the market, homebuying is a new source of anxiety for younger generations. Matt Newman, president of Newman Mortgage Group, said that a fluctuating market is one factor that contributes to canceled contracts. “From what I’m seeing, just like any buyer, they’re extraordinarily sensitive to the overall cost of a monthly payment and interest rate,” Newman said.

Newman, who is based out of Georgia, observed that the largest obstacle for young buyers is the rate of change at which rates are changing. “I think these buyers get sticker shock. With all the changes we’re seeing in the Fed and rates and scaling back quantitative easing and no longer supplementing the market, we’re seeing it’s very hard for any buyers, especially the younger generation who aren’t accustomed to all of this change,” Newman said. “It takes buyers a while to get pre-approved and to find something, and all of a sudden the numbers are totally different.”

On top of rapidly-shifting rates, housing inventory still poses a threat to aspiring homebuyers. Newman said that the biggest

challenge for his Gen Z and millennial customers is the housing shortage itself. “It takes them longer to find the perfect home, so that again is prolonging the homebuying process and giving them more time to have the market change on them,” Newman said. “A lot of the time, pre-approvals need to be lowered as rates shift, which impacts buyers’ budgets, and in turn, they get discouraged.”

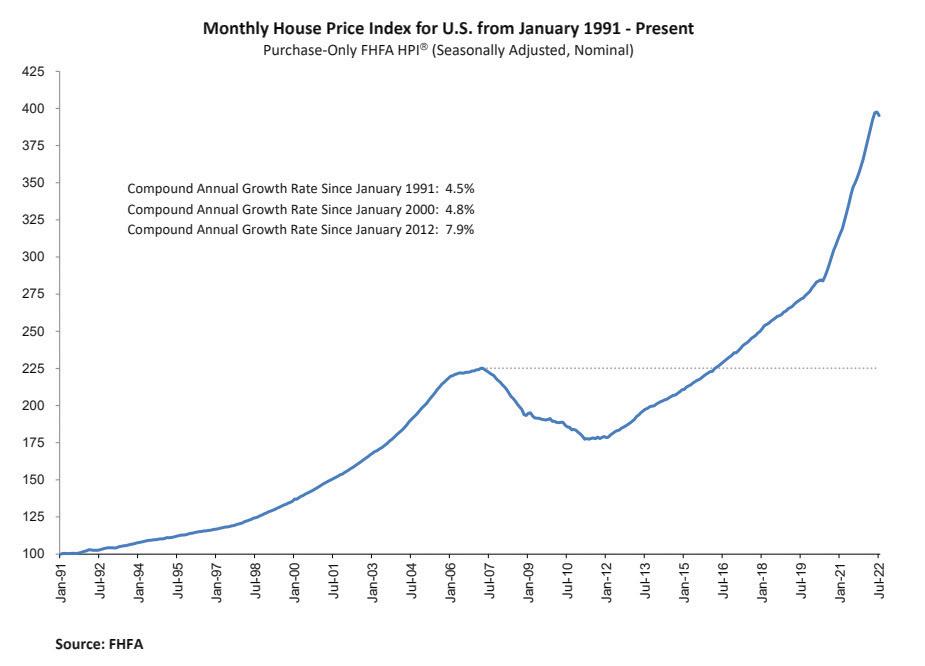

Newman isn’t the only broker who has seen the struggles of young buyers firsthand. Deir Andrade, owner of Da Loan Lady brokerage, described her clients’ feelings and attitudes as being nearly identical to Newman’s clients. “One-half of my Gen Z clients are wanting to buy, and the other half is sorry that they did,” Andrade said. Andrade said that her clients aren’t sitting still in the market and, simultaneously, the market is moving too fast for them. While home prices are reportedly down according to the FHFA, high interest rates are creating a pressure cooker environment and the market hasn’t quite leveled out.

“Gen Z wants out of this market,” Andrade said, noting that most other younger clients who have student debt are struggling to compete in the volatile

market.”These [younger buyers] have a lack of understanding about mortgage rates and managing their debt.”

Samir Dedhia, CEO of LemonBrew, said that he sees the same pattern of “uneducatedness” amongst young buyers. Aside from this observation, Dedhia also remarked that he sees a trend of psychological factors dissuading young buyers from entering the market. “There’s an overall lack of knowledge and education about mortgages and the process,” Dedhia said. “Media coverage [on mortgage rates] psychs them out, and they’re constantly being offered different advice.”

Dedhia noted that Gen Zers and millennials seeking advice on how to navigate the market is often fruitless, as many young buyers are asking their parents–who bought decades ago–for advice. “It was a different market for their parents,” Dedhia said. “Yet, these younger buyers have zero experience and are relying on their parents who bought 20-30 years ago.”

Dedhia said that those who actually have had initial success in submitting a housing contract are backing out due to a plethora of reasons, including inspection issues, rapidly shifting rates and job insecurity.

These insecure buying issues can be avoided. In fact, all three mortgage professionals recommended Gen Z and millennial buyers approach seasoned professionals for buying advice. “I think educating [buyers] upfront and letting them know we have to have more communication between the buyers and the mortgage broker or loan originator,” Newman said. Andrade offered similar advice, and said “They think they know it all, but they need to stop and listen to experienced professionals and brokers.”

Dedhia emphasized that communication issues have long posed a barrier between prospective homebuyers and professionals. “Part of a loan officer’s job should be sitting down with their clients and educating them,” he said. “Understanding their goals and helping them understand what their payments will look like are also key. Let them know other options, such as refinancing, are available, too.”

For young buyers especially, Dedhia recommends keeping at least one year’s worth of savings in reserves. He also encourages buyers to sit down and map out their expenses month to month.

As Dedhia puts it, there’s no shortage of doom and gloom in the industry. “This doesn’t necessarily mean that now is a bad time for these younger generations to keep submitting contracts,” Dedhia said. “A recession may just mean companies are dialing back on their expenses. Right now, we’re in a buyers’ market.”

Newman agreed that now may be a good time for buyers to find relief. “I think that a recession might make it easier for [buyers] because it could mean that rates come back down and hopefully,” he said. “I think there’s a lag effect, but usually when rates go up prices will come down.” However, Newman also warned that credit lending may tighten as a recession looms. “We could get these adverse market changes where the lenders basically tighten up their guidelines, and that could make it harder [to buy],” Newman said. “We saw that this spring and I think that impact – and will continue to impact –some of these generations that are buying.

The above item was originally published at SCORE.org.

As the mortgage industry closes the books on 2022 and begins to look toward 2023, the opening lines from Shakespeare’s Richard III seem particularly appropriate. “Now is the winter of our discontent. Made glorious summer by this son of York.”

To be sure, the real estate and mortgage markets have seen a cataclysmic shift in fortunes over the last 12 months, and it is apparent to everyone in the space that, from a business standpoint, this will be one of the longest and coldest winters in recent memory.

The Federal Reserve’s inevitable and unprecedentedly rapid march to higher interest rates, combined with home prices increasing by huge amounts, makes home ownership affordability the biggest concern heading into 2023. The anxiety over home affordability along with worries about a possible recession have brought the residential real estate market to a virtual standstill. So, the industry, looking squarely at the current reality, has ample reason to view this period as “a winter of discontent.”

The question though, is what to expect from 2023. Will the long, cold winter be a prolonged one, or will it give way to a more glorious summer, through a combination of buyers overcoming their fears and adjusting to the new market, and perhaps the Federal Reserve finding sufficient evidence that inflation is abating to pause interest rate increases or even reduce rates?

As I look to 2023, my crystal ball tells me that it will indeed be a long, cold winter, but by the middle of the year, mortgage markets will have stabilized, and we will be in a much more normalized real estate market, albeit one constrained by low supply and buyer/ borrower reluctance. Here is what I see:

Interest rates will peak in early 2023 before retreating to the 5s before year-end. The Federal Reserve increased rates by 50 basis points at its December meeting, but Chairman Jerome Powell also noted the Fed is beginning to see some signs of progress in its fight against inflation. However, the Fed

made it clear to the market that it intends to stay the course with additional, smaller rate increases still necessary. But it will also give hope that a potential pivot may be in the cards, as it remains nimble in their approach based on incoming data.

The residential real estate recession that has slowed home sales to a crawl will spread to the rest of the economy, and job growth will shrink dramatically in the first quarter of 2023 as housing’s economic multiplier effect evaporates. It is important to remember that when home sales stall, so does the sale of carpet, furniture, draperies, linens, and everything else that fills a new home. Considering that, by some estimates, housing (in one way or another) equates to as much as 20% of the economy, it is hard to envision the slowdown in housing sales not having a more profound impact on the broader economy.

Inflation pressures will ease, and the primary economic concern will turn to the depth and duration of the impending recession. In my view, a recession is inevitable at this point, but I think the Federal Reserve’s policy will, to a large extent, determine whether it is short and shallow or deeper and more prolonged.

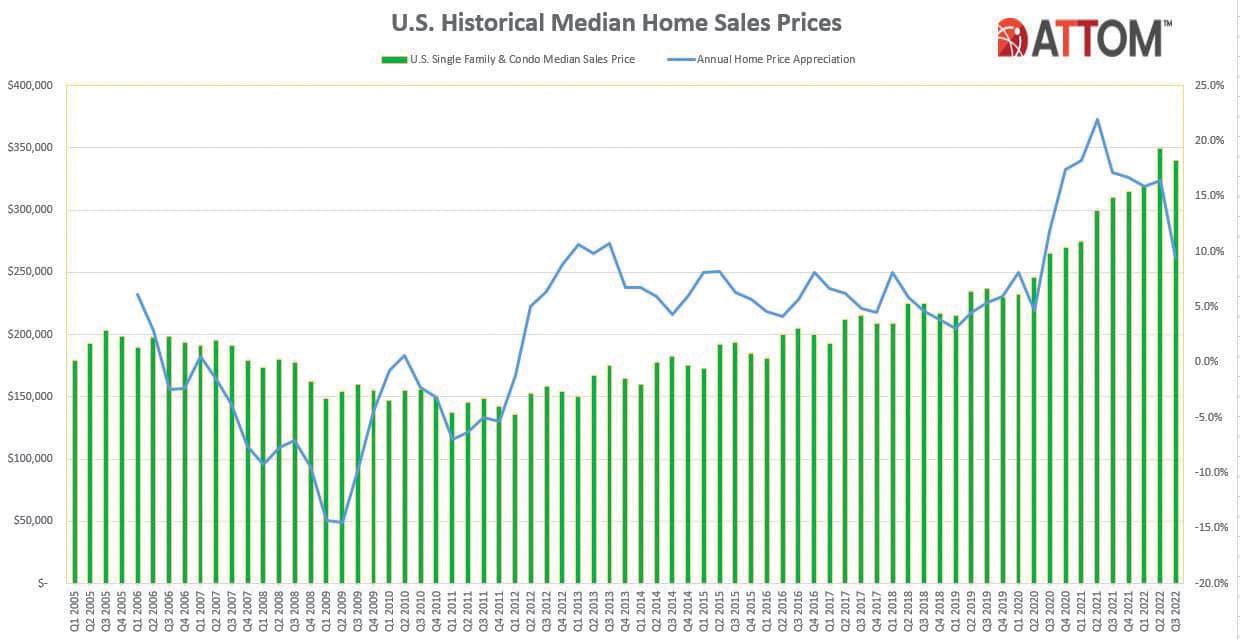

Home prices will fall from their peak in the first and second quarters of 2022, but will still show a year-over-year increase from 2021 prices. It is important to remember that home prices in most markets rose substantially and in large chunks, sometimes over a very short window. I think most markets will give back the last three-to-six months of gains that the market euphoria generated, but I don’t see a broader collapse in prices simply because such a collapse would require a flood of sellers to the market. Since most of those sellers are locked into extremely low

interest rates, most will lack the motivation to put their homes on the market. That said, motivated sellers who have a reason to sell (perhaps because of divorce, death, job loss, or other life events) might have to reduce prices to move those homes. Since the most recent sales always reset the market because realtors and appraisers use them to establish values, those sales will quickly become the comps for future sales, creating a cascade of downward price adjustments last seen in late 2021. So, a market adjustment is certainly in the cards, but I expect sellers with low interest rates who lack a compelling reason to move to stay put and provide a floor to the future downward price adjustments.

Builders, mortgage companies, and real estate professionals will become more creative in finding ways to sell homes, and an improving interest rate environment, combined with increased inventory and somewhat lower prices, will become catalysts to re-energize the market. Expect the sales pace to recover gradually, beginning with the spring market and accelerating moderately throughout the rest of 2023. With lower prices and interest rates off of their highs of around 7%, an interest rate starting with a 5 will look much more compelling to buyers because they will no longer be comparing it to a rate starting with a 2 or a 3. As long as we aren’t staring at a recession with an uncertain end in sight, I expect a much brighter (although perhaps not glorious) market by the summer of 2023.

Marty Green is a principal at Polunsky Beitel Green LLP, where he leads the firm’s Dallas office. In 2022, he was appointed to the Finance Commission of Texas by Gov. Greg Abbott.

“BY THE MIDDLE OF THE YEAR, MORTGAGE MARKETS WILL HAVE STABILIZED, AND WE WILL BE IN A MUCH MORE NORMALIZED REAL ESTATE MARKET.”

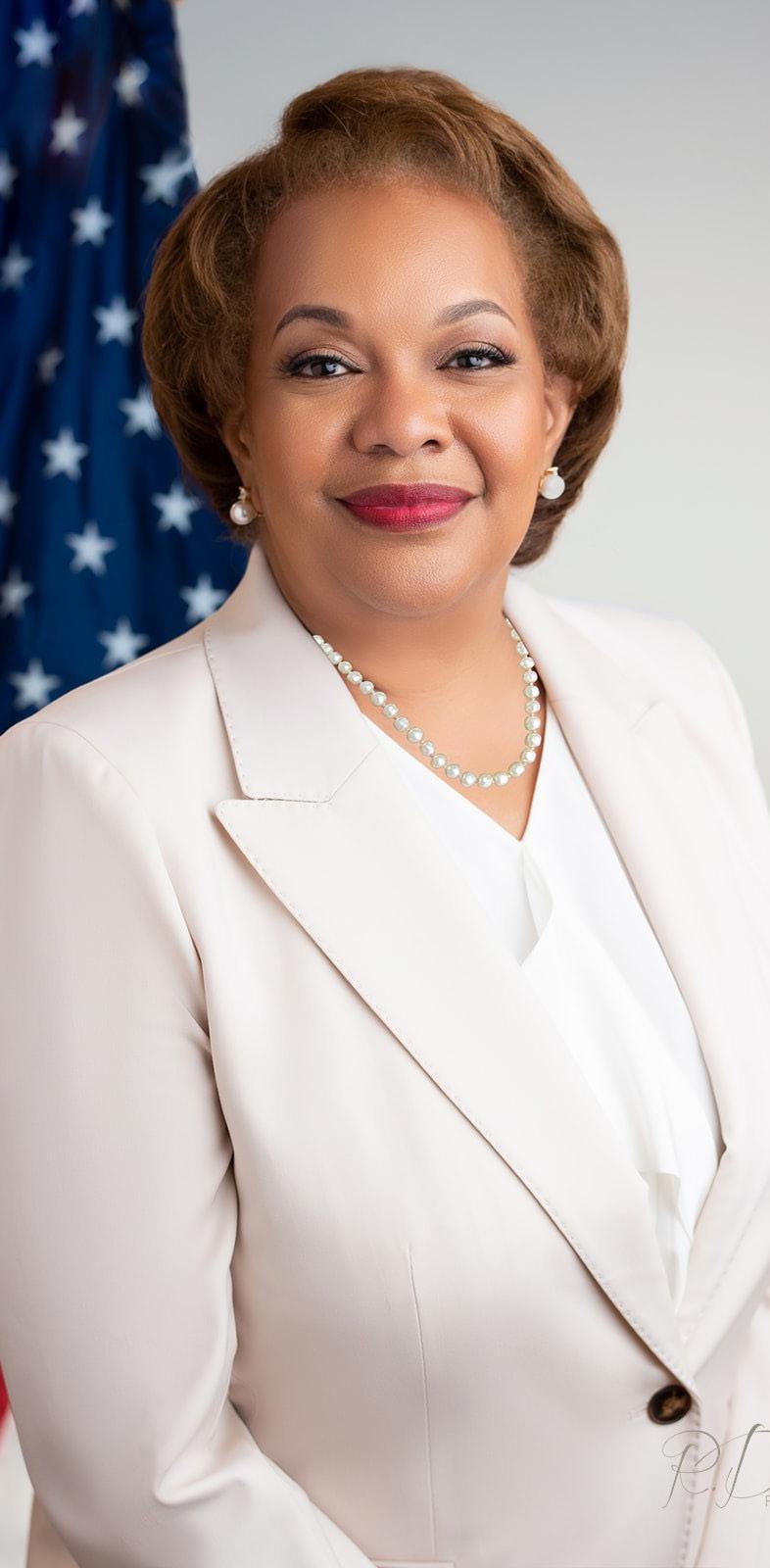

If anything shines through during an interview with Federal Housing Finance Agency (FHFA) Director Sandra Thompson, it’s her enthusiasm and optimism for the agency’s mission.

In an interview with Mortgage Banker Magazine, she discussed her goals for the FHFA, how it’s helping first-time homebuyers, and appraisal bias.

“I just believe, with everything I have, that everybody deserves decent and affordable housing, whether it’s a home they purchase or an apartment they live in,” she said. “And just to have this opportunity is just a blessing for me personally and professionally because I never would’ve expected to have this opportunity.

“I’m just so grateful for it,” she continued, “and I really want to make a difference in communities across the country.”

Thompson is the first Black director (and sixth director overall) of the FHFA, an agency that came about as a result of the 2008 financial crisis. She graduated from Howard University in Washington before beginning a 23-year career at the Federal Deposit Insurance Corporation. Her time at the FDIC included leading the agency’s examination and enforcement program for risk management and consumer protection at the height of the 2008 financial crisis.

She parlayed that experience when

she joined the FHFA during the Obama Administration in 2013. In her first role, as deputy director, she oversaw housing and regulatory policy, capital policy, financial analysis, fair lending and all mission activities for Fannie Mae, Freddie Mac and the Federal Home Loan Banks.

Prior to being confirmed by the U.S. Senate as director of the FHFA in June 2022, she served as the agency’s acting director for the previous year.

As for what she hopes to accomplish during her time leading the FHFA, Thompson said, “I’m just really hopeful that, at the end of my tenure, I can look back and, using my metrics, say, ‘Here’s where we were and here are the policies we implemented. And based on that we’ve increased housing in rural areas, or we’ve decreased the time to appraisals in rural areas and we’ve just made a more efficient and equitable industry.’”

Toward that goal, the FHFA recently announced a new policy discontinuing upfront fees for certain first-time homebuyers, low-income mortgage borrowers, and those from underserved communities. Thompson defended the policy, saying it’s not a “silver bullet” but it’s better than “doing nothing.”

“We think the policy provides a savings, on average, of about $800 in upfront fees,” she said on Wednesday. “It’s not a silver bullet but it is part of the solution that we have for lowering some of the barriers to homeownership.”

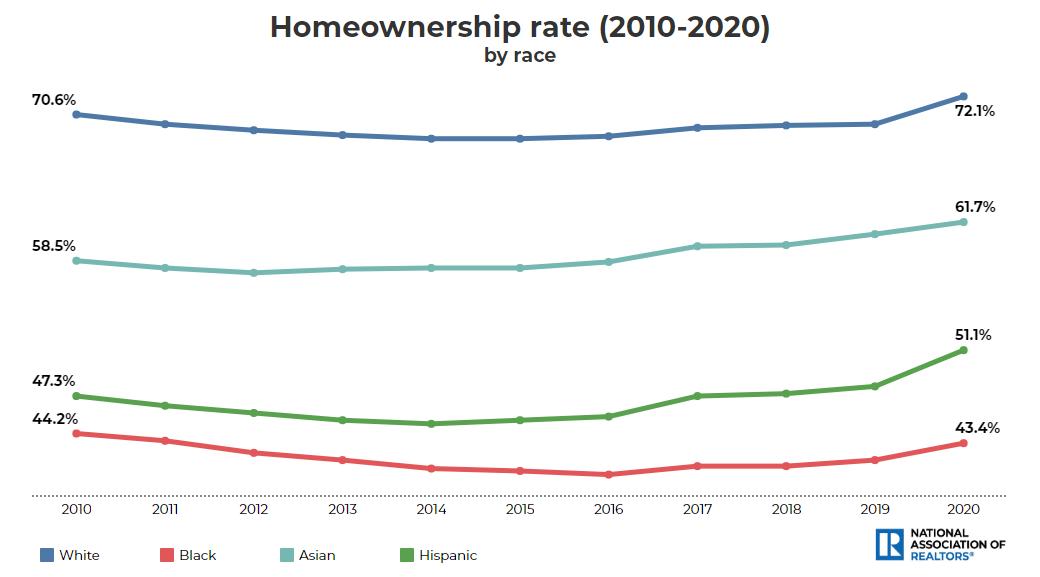

Information from the National

Association of Realtors shows that while the homeownership rate for Blacks increased in 2020 to 43.3%, it’s lower than it was 10 years ago. In the same time frame, the homeownership rate among whites, Asian Americans and Hispanic Americans increased to 72.1%, 61.7% and 51.1% respectively.

Overall, the homeownership rate among all Americans is 65.5%.

One of Thompson’s former colleagues, David Stevens, who served in the Obama Administration as the U.S. assistant secretary of housing and Federal Housing Administration (FHA) director, applauded the policy but said its impact will be marginal due to increased mortgage rates and higher home prices.

When told about this critique, Thompson’s enthusiasm jumped through the Zoom screen when she replied, “Marginal impact is better than no impact!

“And we really think that a decrease in upfront fees and borrower costs is certainly better than an increase or doing nothing,” she added, saying the FHFA thinks 1 in 5 borrowers will be eligible for the new policy.

At least one independent mortgage broker shares Thompson’s optimism for the policy.

“I think (the policy change) is a good thing because ultimately those fees get passed along to the consumer and it determines how much (of a mortgage) someone is able to qualify for because it affects their mortgage payment,” said

mortgage broker Shawn Williams, president of College Park, Md.-based Fortis Mortgage. “I haven’t put my finger on how much of an impact it will have given interest rates, but it is going to make houses more affordable for minorities and low-income borrowers seeking to buy.”

One of the things that impressed Stevens was that the policy came from her, not the Biden Administration.

“It really reflects Director Thompson’s mission that she has vocally promoted since she took (her current) role,” he said. “She has been very public about wanting to expand home ownership opportunities, particularly for African Americans and Latinos.”

“We did not get any push from the Biden Administration on this policy,” Thompson confirmed during the interview. She went on to emphasize that the FHFA is an “independent agency and our independence is valued.”

Asked how the FHFA will measure the policy’s effectiveness, she said, “I look at the numbers. Strictly the numbers. If you don’t have measurable, quantifiable goals, then, there’s absolutely no way to evaluate whether a policy has been successful or not.

“We’re fact driven, and we want to make sure that we’re measuring these initiatives that we’re putting in place,” she added.

“One of the things I committed to as acting director, and you can see this in the scorecard that we publish,” Thompson continued, “we placed a pricing review as a priority in the 2022 scorecard and the strategic plan.”

‘I LOOK AT THE NUMBERS. STRICTLY THE NUMBERS. IF YOU DON’T HAVE MEASURABLE, QUANTIFIABLE GOALS, THEN, THERE’S ABSOLUTELY NO WAY TO EVALUATE WHETHER A POLICY HAS BEEN SUCCESSFUL OR NOT.’

SANDRA THOMPSON

In its announcement eliminating upfront fees, the FHFA said it’s doing away with fees for the following:

First-time homebuyers at or below 100% of area median income (AMI) in most of the United States and below 120% of AMI (Area Median Income) in high-cost areas.

HomeReady and Home Possible loans (Fannie Mae and Freddie Mac’s flagship affordable mortgage programs).

The Enterprises’ HFA Advantage and HFA Preferred loans; and Single-family loans supporting the Duty to Serve program.

The FHFA says its new fees for cash-out refinance loans will begin on Feb. 1, 2023.

In making the policy change, the FHFA said, “the pricing changes build upon the upfront fee increases for second home loans and high balance loans announced earlier this year. The FHFA will continue to review and update the pricing framework to meet the objectives set in the 2022 Scorecard to support core mission borrowers, while fostering capital accumulation, achieving commercially viable returns, and ensuring a level playing field for all sellers.”

In November, the FHFA, in its annual report on single-family guarantee fees charged by Fannie Mae and Freddie Mac, says they cover the credit risk as well as the administrative and operational costs the GSEs incur when they acquire singlefamily homes from lenders.

For all loan products combined, the average single-family guarantee fee increased by 2 basis points to 56 points in 2021. The upfront portion of the fee, which is based on credit risk attributes, increased by 2 basis points to 123 basis points in 2021.

The average guarantee fee in 2021 on 30year fixed rate loans rose by 1 basis point to 59 points, while the average guarantee fee on 15-year fixed rate loans rose by 6 basis points to 42 points. Fifteen-year loans were disproportionately affected by the adverse market refinance fee because 15-year loans were more likely to be refinance loans. This fee was eliminated on Aug. 1, 2021.

In addition, she said, since the “enterprises (Fannie Mae and Freddie Mac) are accumulating capital and we want to make sure they’re achieving some viable returns on that capital. So, there are a number of strategic priorities that we have, and we believe that the pricing changes that we have made and will make are going to further our publicly stated goals.”

When asked if these consumers would be better served if the FHFA borrowed from the Veterans Administration and allowed them to receive mortgages that didn’t require a down payment, Thompson said, “What’s easy isn’t always what’s best.”

She cited the 2008 mortgage crisis as a reason not to pursue such a policy.

“We saw a number of zero down payment mortgages,” Thompson said. “We saw some of those predatory

products.

“And we’ve got a mission here (at FHFA) as a safety and soundness regulator, to make sure that the (GSEs) are operating in a safe and sound manner,” she added.

Fannie Mae and Freddie Mac have been in conservatorship since 2008. The FHFA acts as the conservator, overseeing the two entities on behalf of the federal government.

Asked if a down payment makes someone a better borrower, Thompson said, “Sometimes it does help, when you have equity and you know that you’re working for something.

“All circumstances aren’t the same,” she continued, “but it would be our preference to have a low down payment.”

Other changes to GSE-purchased mortgages included using two different credit score providers, FICO 10-T and VantageScore 4.0 instead of the Classic FICO score, which should also help

first-time homebuyers.

“These new and updated credit score modeling systems factor rental payment histories,” Thompson said. “They also take into consideration payments that borrowers make for utilities and telecoms.

“These are things that are not included in the Classic FICO score,” she added, saying the GSEs have been using the classic version for about 20 years.

When asked what the FHFA was doing to stop appraisal bias, Thompson said her agency joined PAVE, a task force of 13 federal government agencies led by U.S. Housing and Urban Affairs Secretary Marcia Fudge and Susan Rice, the director of the Domestic Policy Council.

“We’ve joined with the other federal agencies in notifying The Appraisal Foundation that the current nondiscrimination standard is inadequate and needs to be revised,” Thompson said.

She says the FHFA has more than 23 million appraisal records that are available to the public.

“It’s aggregated data but the public can access statistics from more than 23 million appraisal records that we have,” she said, adding that the public can compare appraisal gaps in minority neighborhoods nationwide.

“We’ve got a lot of information and it’s

not just these anecdotes that we hear about, people whitewashing their house or removing pictures or doing things to neutralize their home so that a potential buyer has no basis for making any decisions based on race,” Thompson said. “Not to say that it happens all the time, but these are the things we’ve heard. They’ve been in the newspaper, and they’ve been seen on television.”

One of the issues she mentioned during the interview was the composition of the home appraisal workforce, saying that Fannie Mae and Freddie Mac support The Appraisal

Diversity Initiative, which “is looking to bring diversity into the appraisal profession,” she said.

“According to labor statistics it’s one of the least diverse professions in the country,” Thompson said.

She also said Fannie Mae is working on diversity through its Future Housing Leaders Program, “which provides opportunities for diverse candidates to enter the housing and mortgage industry.” Freddie Mac “is working on improving access to capital for diverse (real estate) developers” through its Develop The Developer program, Thompson said.

BY STEVE GOODE, STAFF WRITER, MORTGAGE BANKER MAGAZINE

BY STEVE GOODE, STAFF WRITER, MORTGAGE BANKER MAGAZINE

ortgage fraud is not sexy. But it is costly and expensive. How costly and expensive, one might ask?

For every $1 lost to fraud at financial institutions, it costs $4.23 to address it, an increase of 16.2% from 2020. At mortgage firms the cost was $4.20 and at banks the cost was $4.36.

Overall the cost is up almost 20% in the U.S., according to the LexisNexis Risk Solutions 2022 True Cost of Fraud study.

The cost of fraud is related to labor and investigation and fees incurred during the application/underwriting/processing stages, legal fees and external recovery expenses.

The study also found that fraud attack volume continues to rise as criminals use stolen or fake identification to open new accounts. For mortgage institutions application fraud was also an issue.

The study, which surveyed about 500 risk and fraud executives in financial and lending companies in the U.S. and Canada, did not include insider or employee fraud.

Considering that about 6 million existing homes changed hands this year and another 685,000 new homes were

DIRECT-TO-CONSUMER

Msold, the money lost to fraud adds up. Some speculate that the losses are in the billions of dollars.

And that leads to a second question: why is it happening?

The answer, in the view of the folks at LexisNexis, lies in what has become a new favorite among lenders for its moneysaving capabilities, and among younger buyers, many of whom prefer on-line transactions.

Analysts said that customers want “a friction-less online experience in which companies they frequent recognize them, no matter the device they are using and expect access, convenience and consistency across all touch points throughout the process of buying a home.”

Relying on the responses of more than 500 risk and fraud executives in the mortgage industry, analysts determined that the bulk cost of fraud comes from consumers trying to buy a home through online and mobile transactions. Directto-consumer and correspondent lending are the leading transaction types and they also lead the way in the largest portion of fraud costs and average monthly attacks. Respondents reported that a sizable

portion of fraud losses in the depository sector also came from constructionrelated loans.

Dawn Hill, director of real estate fraud and identity strategy at LexisNexis Risk Solutions, said that that while you can’t predict the future, it’s safe to say that the movement toward online and mobile transactions will continue to grow and that mortgage originators, as well as servicers and title companies will need to protect against fraud. Firms using a multi-layered solutions can lower fraud costs while improving identity verification and adding AI and machine learning also help, according to analysts.

“A successful fraud detection and prevention approach involves an integration of technology, cybersecurity and digital experience operations in a way that addresses the unique risks from different transaction channels and payment methods, as well as by individuals and types of transactions,” Hill said in the report.

The challenge, in Hill’s view, is identification verification, which is contributing to customer friction, the inability to detect malicious bots and being able to distinguish between legitimate and fake customers.

But, Hill said, those who do engage in best practices can lower the cost and volume of successful fraud while improving their ID verification and fraud detection effectiveness.

That doesn’t mean that LexisNexis analysts expect the issue to go away anytime soon though, as the pandemic and a growing mobile channel have added to the increased risk of fraud, especially with call-center and phonebased interactions.

“Fraudsters are always one step ahead,” Hill said. “They’re financially motivated.”

AND CORRESPONDENT LENDING ARE THE LEADING TRANSACTION TYPES AND THEY ALSO LEAD THE WAY IN THE LARGEST PORTION OF FRAUD COSTS AND AVERAGE MONTHLY ATTACKS.

They also warn that businesses that don’t embrace changing technology will be left behind and that customer expectations must be balanced with fraud protection, as cybercriminals continue to become more sophisticated in their use of bots and synthetic identities.

“It would behoove the industry to think like fraudsters,” Hill said.

The growing occurrences of global data breaches doesn’t help, as criminals use the dark web to get the information they need to masquerade as customers and commit fraud.

But there were categories that experienced increases year over year.

The included: income fraud risk, up 27.3%; property fraud risk, up 22.6%; ID fraud risk, up 4.7%; and transaction fraud risk, up 1.6%.

According to the Corelogic report, industry experts say their number one concern going forward is income fraud and that they are including insiders, such as loan officers and mortgage brokers who could alter documents in order to process a mortgage as part of that concern.

And when they go up and people can’t sell their homes, Berg said, that’s when more serious fraud occurs, such as straw buyers, or a lender taking advantage of someone who isn’t financially literate.

Another problem, she said, is that fraud doesn’t alway present itself immediately.

“It could be a year or two before you identify fraud,” she said.

Berg said the most important things for lenders to remember is that the tone starts at the top and not to rely on process over common sense.

“Do the smell test,” Berg said. “Does this transaction make sense?”

Kip Mendrygal is a Dallas-based attorney who speaks frequently on the subject of mortgage fraud. A partner at Locke Lord, Mendrygal specializes in white collar investigations and defense involving public companies and financial institutions, corporate executives and high profile individuals involved in a variety of highly sensitive civil, criminal and regulatory investigations.

He is often called on to speak to groups about what happens when fraud investigations go bad.

“These investigations can whip-saw,” Medrygal said, “and companies can find themselves under investigation and getting charged.”

Mendrygal said it’s typical to expect that some borrowers lie, but added that some lenders do too.

“Lenders need to focus on finding it up front. “You spend money at the application stage,” she said, adding that it could be something as simple as checking how long an email address has been in existence.

Corelogic, a fintech company that provides financial, property and consumer information to the mortgage industry, has its own take on the issue of fraud.

In its most recent annual fraud risk report, released in September, analysts there said that, while overall fraud is down 7.5% year over year (company officials said some of the decrease may be due to a change in the way the company analyzes statistics) they expect it to go up in the future.

Analysts said that income sources have no definitive source of truth and that the rise in remote work has made that even more difficult.

“There is no simple solution to income fraud, but we continue to build our techniques and data to identify high-risk situations,” the report said.

According to the report, analysts are also keeping a close eye on increased risk in multi-family mortgage applications, and noted that the risk of fraud is 4 times higher than for single-family homes.

Mortgage rates also drive different types of fraud, according to Bridget Berg, a principal at Corelogic and one of the leading fraud risk experts in the mortgage field.

When rates are low, occupancy fraud is more prevelant.

“They know or they turned a blind eye and made it last longer,” he said.

Next thing you know, Mendrygal said, is the company that reported the fraud is under investigation for not being diligent.

That’s where he comes in.

“I help the mortgage industry design compliance programs,” he said. “I tell them do what you do with more force because when the crap hits the fan you need to show you bought in.”

Others warn against trying to be the good guy who gets a mortgage application over the finish line because a borrower was so close and seemed like a worthy risk.

If or when it goes bad, experts say, that borrower will point the finger at the good guy and say they never should have been qualified for the loan.

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.

These attorneys are universally recognized by their peers as setting the highest standard for the legal profession, excelling in all fields — knowledge, analytical ability, judgment, communication, and ethics.

sluna@ravdocs.com 469-730-4607

Scott Luna’s practice is focused on real estate law with an emphasis on mortgage document preparation and land title issues. Scott managed a successful multistate highvolume title and document preparation business for over 20 years before joining RAV and is recognized throughout the real estate legal community for his expertise. As a past President of the Oklahoma Land Title Association, Scott’s ongoing involvement in the industry adds to his wealth of title-related knowledge. Scott received his Juris Doctor degree from the University of Tulsa College of Law in 1991 after receiving his Bachelor of Science degree from Texas A&M University. Scott is currently licensed in Texas, Oklahoma, Missouri, Minnesota, Nebraska, and Kentucky.

Mitchel H. Kider Managing Partner

kider@thewbkfirm.com 202-557-3511

Mitch Kider is the Chairman and Managing Partner of Weiner Brodsky Kider PC, a national law firm specializing in the representation of financial institutions, residential homebuilders, and real estate settlement service providers. Mitch represents banks, mortgage companies, homebuilders, credit card issuers, and other financial service companies in a broad range of litigation and regulatory and compliance matters. He defends clients in investigations and enforcement actions before the Consumer Financial Protection Bureau, Department of Housing and Urban Development, Department of Justice, Department of Veterans Affairs, Federal Trade Commission, Fannie Mae, Freddie Mac, Ginnie Mae, and various state and local regulatory authorities and Attorneys General offices.

In addition, Mitch acts as outside general counsel to smaller companies and special regulatory and litigation counsel to Fortune 500 companies.

ggraham@bmandg.com 972-353-4174

Black, Mann & Graham CoManaging Partner Gregory S. Graham has practiced in the areas of real estate, litigation, and bankruptcy law since 1989, and is currently licensed in Texas and admitted to practice before the United States District Courts for the Northern and Eastern Districts of Texas. Mr. Graham is also currently licensed to practice law in Georgia and has been since 2017. He received his Juris Doctor degree from Southern Methodist University School of Law in 1989 after receiving a Bachelor of Arts cum laude from UT Dallas.

Mr. Graham’s affiliations include the Dallas MBA, where he previously served as a Director & Chairperson of the Legislative Committee; DFW Mortgage Brokers Association, where he previously served as Legal Counsel; MBA; NAMB; Texas AMB prior to its closure; and Texas MBA.

James W. Brody, Esq. Mortgage Banking Practice Group Chair jbrody@johnstonthomas.com 415-246-3995

James Brody actively manages all the complex mortgage banking litigation, mitigation, and compliance matters for Johnston Thomas. Mr. Brody’s experience centers on those legal issues that arise during loan originations, loan purchase sales, loan securitizations, foreclosures, bankruptcy, and repurchase & indemnification claims. He received his B.A. in International Relations from Drake University and received his J.D., with a certified concentration in Advocacy, from the University of the Pacific, McGeorge School of Law. He was a recipient of the American Jurisprudence BancroftWhitney Award. He is licensed to practice law in California and has been admitted to practice in front of the United States District Courts for the Central, Eastern, Northern, and Southern Districts of California. In addition, Mr. Brody has served as lead litigation counsel for numerous mortgage banking and commercial related disputes venued in both state and federal courts, in a direct capacity or on a pro hac vice basis, in AZ, CA, FL, MD, MI, MN, MO, OR, NJ, NY, PA, TN, and TX.

Green Attorney marty.green@ mortgagelaw.com 214-691-4488 ext 203

Marty Green leads the Dallas office of Polunsky Beitel Green, one of the country's top residential mortgage law firms. Mr. Green is an accomplished attorney with more than 20 years of experience in the legal, banking and financial services industries. He is the former Executive Vice President and General Counsel for Dallas’ CTX Mortgage Co. and previously worked with the Baker Botts law firm in Dallas as Special Counsel. In his role as leader of the firm’s Dallas office, Mr. Green advises clients on the latest rules and regulations covering residential lending, in addition to building on Polunsky Beitel Green’s long tradition of delivering loan closing documents with speed and accuracy. Mr. Green is admitted to practice before all Texas state and federal district courts in addition to the U.S. Court of Appeals for the Fifth Circuit. An honors graduate of the University of Texas School of Law, he earned his undergraduate degree at Southern Utah University. Texas Monthly has selected him as a Super Lawyer multiple years.

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions.

When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com (844) 851-3600 sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok (866) 453-2400 carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers)

FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800 firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owneroccupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com (888) 276-6565 info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Stratton Equities is the leading Nationwide Direct Hard Money & NON-QM Lender that specializes in fast and flexible lending processes. Our Hard Money and Direct Private Money loan programs support the following investment projects:

• Fix and Flip

• Soft Money Loans

• Cash Out — Refinance

• Fixed Commercial Loans

• Commercial Bridge Loans

• Bridge Loans

• Stated Income/ No-Income Verification Loans

• Rental Loans

• Foreclosure Bailout Loan

• NO-DOC

• Blanket Loans

• Fixed Rental Programs

• Multi-Family Loan

No Upfront fees! No Junk Fees! No Tax Returns!

strattonequities.com (800) 962-6613 info@strattonequities.com

LICENSED IN: All States except for: AK, ND, NV, SD, UT