INNOVATION DATABANK MARKETS

GLARING NEED

ON A GOLD

NOW’S A BAD TIME TO TRIM TECH

THE MODERN FANNIE

MAE

Make money off equity in an origination wasteland

The Federal Housing Finance Agency (FHFA) issued a Request for Input (RFI) on Fannie Mae and Freddie Mac’s (the Enterprises) single-family pricing framework. The RFI solicits public feedback on the goals and policy priorities FHFA should pursue in its oversight of the pricing framework.

FHFA also seeks input on the process for setting the Enterprises’ single-family upfront guarantee fees, including whether it is appropriate to continue to link upfront guarantee fees to the Enterprise Regulatory Capital Framework (ERCF), which was established in 2020, and has a significant impact on the risk-based pricing component of the Enterprises’ guarantee fees.

“Through this RFI, FHFA seeks input on how to ensure the pricing framework adequately protects the Enterprises and taxpayers against potential future losses, supports affordable, sustainable housing and first-time homebuyers, and fosters liquidity in the secondary mortgage market,” said Director Sandra L. Thompson. “We are committed to being transparent and to considering views from a diverse set of stakeholders and market participants.”

Guarantee fees are intended to cover the Enterprises’ administrative costs, expected credit losses, and cost of capital associated with guaranteeing securities backed by singlefamily mortgage loans. In 2022, the Enterprises began using the ERCF for measuring the profitability of new mortgage acquisitions, among other purposes, and FHFA began taking a series of steps to update the Enterprises’ single-family guarantee fee pricing framework to align the pricing and capital frameworks better.

The updates are intended to increase support for creditworthy borrowers limited by income or by wealth, while ensuring a level playing field for small and large sellers, fostering capital accumulation, and achieving commercially reasonable returns on capital.

FHFA invites interested parties to provide written input, feedback, and information on all aspects of this RFI by Aug. 14, 2023. Comments may be submitted via FHFA’s website (select “Enterprises’ Single-Family Mortgage Pricing Framework” from the pull-down menu) or mailed to the Federal Housing Finance Agency, Office of Capital Policy, 400 7th Street, S.W., Washington, DC 20219.

Freddie Mac announced enhanced access to Mortgage-Backed Securities (MBS) analytics data through its Clarity Data Intelligence (Clarity) tool.

“With Clarity, Freddie Mac MBS investors now have easy, efficient access to critical performance data through the same centralized hub our Credit Risk Transfer (CRT) investors have enjoyed for years,” said Mark Hanson, senior vice president for securitization at Freddie Mac. “The ability to reach this information through a single signon should be a time saver for anyone with interests in both our CRT securities and MBS.”

MBS investors can register for a Clarity account via the Clarity webpage. Clarity account holders have the option to choose between CRT or MBS portals. Key data on the MBS portal includes:

• The New Daily Prepayment Report, with Cumulative Daily Voluntary Payoffs by Cohort;

• Affordable and Green MBS Issuance Volume; and

• Structured Transaction Issuance Reports.

Investors with questions about the MBS portal or Freddie Mac’s mortgaged-backed securities can contact Freddie Mac Investor Relations at investor_inquiry@freddiemac.com.

For CRT related inquiries, investors may contact clarity@freddiemac.com.

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart EDITORIAL DIRECTOR

David Krechevsky EDITOR

Keith Griffin SENIOR EDITOR

Mary Quinn MULTIMEDIA PRODUCER

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley STAFF WRITERS

Rob Chrisman CONTRIBUTING WRITER

Gary Rogo

SPECIAL SECTIONS EDITOR

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Steven Winokur

CHIEF MARKETING OFFICER

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins MULTIMEDIA SPECIALISTS

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

Submit your news to editors@ambizmedia.com

www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

Residential lenders, whether depository banks, credit unions, independent mortgage banks, or brokers, were always concerned with when refinances would dry up. Per the MBA’s application data, refi percentages of total locks are down in the 20s, meaning that more than 70% of apps are for purchases. Lower volumes and margin compression

is still the name of the game here in the summer of 2023. So now what?

Practically everyone benefited from a solid 2020 and 2021. Years’ worth of volume and income were crammed into those years, and now lenders and originators are paying the price. For lenders and vendors to have spent all their income on compensation and benefits for employees or owners during those years would have been near-sighted.

Certainly, lenders “took chips off of the table” but many reinvested profits back into their companies, whether it was in signing or retention bonuses, new technology to help the manufacturing process, increased warehouse lines, or expanded business channels.

The business environment has changed. For lenders to be able to create, find investors for, and roll out new products is critical. As 2022 wound down and into 2023, “old” products were rolled out. Buydowns, for example, are a critical part of any lender’s arsenal. Basic VA loans are widely used for home purchases.

But 2023 has been, in part, dominated by bank news, and not in a good way. From a revenue and expense perspective, depository banks borrow money (from depositors) at one low rate of interest, and lend the money out again at another, higher rate of interest. The difference is income for the owners and/or shareholders.

Non-depository mortgage banks use their warehouse lines as a source of funding. If there is a positive spread between the cost of the warehouse line and the mortgage rate, the mortgage bank can use this as income. But banks have curtailed their collective purchases of mortgagebacked securities, and had to increase the rates they pay their depositors.

With the decline of buying MBS, banks and credit unions have shifted to increasing their portfolio lending in their footprint. Branch loan originators are only too happy to be able to offer products such as jumbo programs not offered by the bank through its correspondent or wholesale channels.

For independent mortgage banks, lenders are negotiating warehouse line expenses or shifting mortgage rates, which are, of course, problematic and subject to market forces. Residential lenders can make money in a variety of ways, including origination fees, yield spread premiums, discount points, closing costs, mortgagebacked securities, and loan servicing. Lenders may also get money for servicing the loans they package and sell via MBS.

In addition to the loan origination fee and possibly the discount points, an ap-

plication fee, processing fee, underwriting fee, loan lock fee, and other fees charged by lenders are paid during closing. Another source of income for both IMBs and banks is in the sales execution of the mortgage, or pools of mortgages, aka “Gain on Sale.”

After closing on different types of mortgages, lenders will group together loans into mortgage-backed securities (MBS) and sell them for a profit. (Companies should do their best to limit pricing concessions and free extensions, or at least track them to identify dollar amounts and sources.)

despite bank and credit union comp plans being far less. Direct loan production costs come in terms of expenses, followed by marketing, travel, and entertainment. Costs to service the servicing portfolio are included, if the company is servicing, as are general and administrative expenses.

So, the areas of cutting costs are somewhat limited, especially when producers, whether they are retail loan officers or TPO account executives, are held in high regard. Although easier said than done, lenders should try to improve efficiency or the amount of “friction” between application and funding & servicing. How productive are processors, underwriters, doc drawers, and funders? Certain tasks are outsourced to lower-cost providers.

Originators are encouraged to improve their sales, retention, and referral techniques. As an analogy, if you buy a Ferrari, you’re not going to forget what kind of car you own. But the same brand identity doesn’t exist with mortgages. Most people who financed their home don’t know the individual or company they used. Recognition is even worse when they obtained the loan through a mortgage broker, who in turn placed it with a mortgage banker, who then sold it to an aggregator, and who may use a subservicer! How does the borrower remember you? Any loan officer building their brand and marketing to their previous clientele for refinances should keep this in mind.

On the expense side of the income statement, lenders’ largest expense is typically salaries, commissions, and benefits. Few IMBs seem to be cutting commissions in the summer of 2023,

Lenders earn income in a limited number of ways, and they spend money in a limited number of ways. Running an efficient operation is not rocket science, but it does take knowledge, discipline, and a lack of fear of making wise, yet occasionally difficult, decisions in the face of diminishing margins and production volume. The industry has been through business cycles before and will go through them again. Growing volume and margins may be difficult but maintaining market share through increasing revenue or decreasing expenses can be done.

As an analogy, if you buy a Ferrari, you’re not going to forget what kind of car you own. But the same brand identity doesn’t exist with mortgages.

Lenders are facing increasing pressure to modernize their home lending operations, lower costs, and reduce risk following a rapid rise of interest rates and resulting cooling of the housing market. This renewed focus on process enhancements has highlighted the appraisal process as a glaring area for improvement.

While having a third-party assessment of a home’s value is critical to ensuring that lenders extend the appropriate amount of credit, there are several pain points in the current workflow. Appraisers, who have significant influence in the process, are susceptible to human error and bias

that can put banks at greater financial, regulatory, and reputational risk. At the same time, technology solutions to determine valuations are insufficient and generate their own challenges. Mortgage bankers should think carefully about how to manage these risks and improve efficiency.

Here are the challenges mortgage bankers face.

Appraisers can have a direct impact on a mortgage banker’s financial risk due to the human error factor inherent in the current appraisal environment. Traditional appraisal inaccuracies (especially overvaluations) risk lenders’

bottom lines. Appraiser subjectivity has been a persistent issue leading banks to over-extend credit to borrowers.

In reviewing over 300,000 assessed in-person appraisals, the Mortgage Outlet found 39% had data inaccuracies. At the same time, a more pernicious issue can occur when appraisers use their considerable power in the mortgage origination process to intentionally inflate valuations, which is a form of mortgage fraud.

As an example, eAppraiseIT conducted more than 260,000 appraisals for a large U.S. bank. Ultimately, the partnership led to litigation. It was stated that the bank’s loan officers pressured the company to select certain appraisers,

leading to inflated property valuations and more mortgage business for the bank that subsequently failed. The settlement included $4 million in civil penalties and $3.8 million in costs from litigation. While the monetary impact in this case was relatively small, the incident bruised the reputation of the bank and eroded confidence in its practices.

These types of inaccuracies can lead to losses for mortgage banks during periods of economic contraction and increased defaults. The risk is even greater in situations where there are intentional data discrepancies. Overinflating home appraisals is a form of mortgage fraud that could lead to seri-

ous legal implications and significant financial consequences. Guidelines vary by state, however, overinflated and inaccurate appraisals can expose lenders to default risks, regulatory penalties, and financial risks.

After the financial crisis, provisions that require appraisal independence changed many aspects of the appraisal process. These regulations were implemented to prevent lenders and other parties from influencing the appraiser’s valuation and to ensure the appraisals are objective and accurate. However, the underlying process still requires local presence, making it difficult for lenders to monitor and oversee the appraiser’s work.

Ensuring that the appraisals are accurate and bias-free is essential to current and prospective homeowners of all races and income levels. However, given the subjectivity of the traditional appraisal process, racial or ethnic bias may occur, whether intentionally or not. Lenders have suffered reputational and financial penalties over the years due to discriminatory practices. According to a 2021 Freddie Mac study, homes in Black and Latino neighborhoods are significantly more likely to appraise lower than the contract sales price than those in White areas. Studies like the one Freddie Mac conducted

have shed light to this bias that exists in the appraisal process.

Identifying and exposing bias in the appraisal process is critical to obtaining a fair valuation for minority homeowners. Although it’s required that the appraiser document the factors within the appraisal report used to value the property, there are still ways for appraisers to omit or misinterpret information intentionally and unintentionally. Despite the appraiser’s responsibility to ensure an accurate valuation, the lender is ultimately accountable for the lending decision. It is still exposed to reputational, financial, and regulatory risk if the value is deemed inaccurate.

To address the shortcomings of traditional appraisal methods, many lenders use Automated Valuation Models (AVMs) in their appraisal process, a practice that has only become more common over the past few years. AVMs use advanced analytics to evaluate the available data on a property and predict its value.

While AVMs can provide a quick estimation for prequalification or appraisal comparison –sometimes even used as the only appraisal in certain scenarios - there are drawbacks to this technology. AVMs have a high maintenance burden, as the models are highly complicated and require updates to keep up with evolving market conditions. Since these models rely on complex calculation meth-

ods with numerous variables, lenders often look for third parties with expertise in building and maintaining these models.

While third-party providers offer a convenient solution, lenders who rely on these vendors often cannot fully understand or explain how valuation decisions were made to consumers. This opacity may mask issues like inaccuracies in inputs, or ineffective calculation methods that may not be readily apparent, posing potential regulatory issues if the lender cannot explain their lending decision. Last, some data has shown AVM tools can actually perpetuate and exacerbate bias issues. According to a study done by Urban Institute in 2020, AVMs in majority-Black neighborhoods produce larger errors, as a percentage of the underlying sales price, than AVMs in majority White neighborhoods. This is a weakness users of AVMs should be clear-eyed about. While machines should be able to process valuation data faster and more accurately than humans, these technologies are still far from perfect. Without proper governance, controls and data reviews, AVMs may put banks at risk of creating systematically over- or under-valued estimates.

With several systemic discrepancies in the appraisal process, there is a great opportunity for mortgage companies to improve their processes.

Lenders should consider creating robust dashboards to evaluate and compare appraisers on overall performance, including quality, service, and cost.

Regulatory pressures are unlikely to lessen, even in a tightening mortgage environment. With human error and the complexity that may be present in valuation models, lenders should seek additional risk and control measures that improve oversight and transparency into the valuation process. Artificial Intelligence (AI) can be used to analyze large amounts of data to identify potential bias, under- or over-valuation, as well as using “Learning and Adaption” to identify outliers and emerging risks. This allows lenders to focus their resources where they are needed most and improve the overall accuracy of valuations.

tential issues that need to be addressed.

However, AI effectiveness relies largely on the quality of the data and the algorithms used and if not assessed thoroughly, it has the potential to mimic and even perpetuate human and societal bias. Therefore, lenders must establish robust data governance and validation processes to ensure that the data used for the analysis is accurate and reliable.

Creative technology investments can give lenders the ability to have meaningful oversight in the mortgage origination process by creating frameworks to monitor appraisers’ behavior. Creating analytical models – potentially leveraging AI tools

these trends and metrics is a powerful tool for lenders to assess the integrity and performance of the appraisers/appraisal management companies (AMCs). The ability to monitor appraiser activity may help banks identify appraisers who have shown instances of bias or overvaluations in their appraisal reports.

Lenders must consider an end-to-end process covering everything from monitoring, review, and enforcement and the specific data they have available to establish baselines and compare appraisal performance. Policies must clearly define the lender’s processes and procedures to add an appraiser/ AMC to their panel, reconsider a value, or remove an appraiser/AMC.

Lenders must treat appraisers/AMCs consistently based on defined standards with supporting documentation to support corrective actions. With AI’s ability to evolve and improve over time, lenders have a powerful tool to continuously improve appraisal accuracy and service levels while reducing valuation risks.

should include model competition to determine which models and methodologies perform best under a variety of conditions and geographies.

The mortgage origination industry is confronting some concerning headwinds in 2023. Addressing the shortcomings of the appraisal process is a challenging but critical step to helping protect lenders not just survive but thrive. Fortunately, the available AI tools may be part of the solution. They can increase productivity and speed and extract insights from data that are not otherwise humanly possible at scale. By leveraging these tools, establishing strong policies, and implementing robust, multi-dimensional scorecards to monitor appraisers/AMCs, banks can maintain confidence in valuations used in mortgage underwriting.

Leveraging AI to automate routine tasks can free reviewers to focus on more high-value and complex tasks. Using the AI model, lenders can evaluate the appraised value and provide alerts on areas of concern within the appraisal. This allows the underwriter or appraisal review team to increase their focus on po-

-- to monitor and compare appraisers can help identify overvaluation patterns and/ or bias that may expose the lender to financial and reputational risk.

Lenders should consider creating robust dashboards to evaluate and compare appraisers on overall performance including quality, service and cost. Aggregating

Banks should consider reevaluating their appraisal automation tools on a periodic basis to maximize the efficacy of estimates and minimize risk. Thorough model and vendor reviews can evaluate the data elements available vs. those being used and determine how banks can improve the accuracy of model outputs, as well as identify systemic bias. Thoughtful reviews

Additionally, mortgage bankers can establish periodic reviews of AVM models and the risk and control frameworks around them. These measures enable banks to reap the benefits of a more profitable book of mortgage business. At the same time, they can ensure that they are doing the right thing by their homeowners by providing accuracy and avoiding the unconscious and conscious bias that can emerge when individuals make decisions in a vacuum.

If these words come to mind when considering your ideal candidate for our list of Powerful Women of Mortgage Banking, then show your support for today’s female leaders in the mortgage profession and submit your nomination today.

Nominations Close: Friday, July 28, 2023

Some of the exceptional women who were honored in 2022 include:

Earning the stamp of “modernized” typically indicates a significant savings of time and money. This rule holds true for Fannie Mae’s Modernization Initiative, according to industry experts, who say the changes the enterprise made earlier this year to its selling guide have proven gainful for watch and wallet, expanding valuation product options for lenders and borrowers.

“When a lender takes advantage of the product eligibility from the GSEs, loans, in most cases, will only require a data collection inspection, which will save hundreds of dollars and several days per transaction,” says Kristin Gruidl,

senior product manager of Veros Real Estate Solutions, the collateral valuation partner for Fannie Mae, Freddie Mac, FHA, and VA. Fannie Mae touted the updates as a way to help lenders, appraisers, and risk investors manage collateral risk more effectively, with higher appraisal accuracy, lower costs, and increased speed of loan decisioning for consumers.

“It’s a part of our ethos to make sure we’re keeping up and staying at the forefront of where the industry is headed and trying to be thoughtful in helping the industry meet its goals,” said Sean Pyle, president of appraisal manage-

“We are beginning to see more valuation products available along the full spectrum of loan risk.”

> Kristin Gruidl, senior product manager, Veros Real Estate Solutions

ment and property valuation provider Valutrust Solutions. “There have certainly been efforts by companies like ours and others to prepare for this.”

Weighing the advantages of risk vs. risk aversion, some early adopters have already seen cost reduction benefits, while others are awaiting more data.

“The movement from both Freddie and Fannie to look to have a little bit of an alternative process for gathering property data and using that property data in the overall process, I think that’s a potentially big issue and big change in our industry,” Pyle said. “We’re just on the very forefront of it in our opinion. There’s some programs that have just moved out of pilot. I think there’s a lot of lessons to be learned and a lot to be sorted out so we can ensure we don’t introduce any additional risk into the industry, but I do think the GSEs have been thoughtful about that.”

Ultimately, the best avenue in which to achieve valuation is a decision lenders need to make on behalf of each consumer.

“I think really understanding where the benefit can come from in the consumer experience and trying to marry that with possible improvements within their own operations can be something that will ultimately lead lenders to success in this process,” Pyle said.

Veros first partnered with the GSEs during the mortgage meltdown of the late 2000s, building the Uniform Appraisal Dataset and Uniform Collateral Data Portal.

“Those initiatives really started the appraisal modernization efforts,”said Gruidl, who manages the company’s appraisal modernization products. “Continuing to support the current

efforts was a no-brainer. We are proud to be a part of the continued effort to standardize and collect data that will help improve collateral valuation risk management.”

The changes expand product options beyond the traditional appraisal or appraisal waiver. In fact, the latter term has been replaced by ‘value acceptance’ under the new guidelines, to better reflect the technology- and data-driven process.

Valutrust Solutions provides appraisal management services on a nationwide scale.

“For us as a company, it’s not torn our attention away from our core fundamentals, it’s another offering that we have for lenders to meet them where they want us to meet them,” Pyle said.

Lenders now have the option to use analysis of third-party data collection to confirm property eligibility without the need for an appraisal. In addition, an attestation letter from the borrower/builder verifying completion of repairs can now be submitted in lieu of the traditional Appraisal Update and/or Completion Report (Form 1004D).

“We are beginning to see more valuation products available along the full spectrum of loan risk,” Gruidl said. “With the inspection-based appraisal

waiver programs now offered by both GSEs, the prescribed data requirements bring much more consistency and standardization to the data. This aligns well with the digital mortgage many lenders are pursuing. Borrowers find it more convenient as scheduling inspection times with busy appraisers can be challenging, and their out-of-pocket appraisal cost is much lower. Appraisers focus on the more complex and higher-risk assignments to ensure loan quality for all involved.”

The $500-$700 appraisal is being superseded in many instances, with a $200-$250 data collection report. Occasionally, an upgrade to a hybrid appraisal could be required, according to Gruidl, but cost and time savings can still be achieved.

Bifurcation, or splitting the inspection and appraisal processes apart, is not a new concept.

“What’s being done now is an attempt to make that property inspection data collection process more consistent and open up the pool of people who could perform that function,” Pyle explained. “Then that data could feed into a valuation process that may or may not be performed by the person who collected the data.”

Lenders are also now completing a minimum number of pre-funding loan reviews monthly, equal to 10% of the prior month’s total closings or 750 loans, including both full-file reviews and lower-cost component reviews. The time frame for the post-closing QC cycle has been shortened from 120 to 90 days, with individual component deadlines eliminated. The shorter cycle allows errors to be detected more quickly, preventing them from being duplicated.

“I think really understanding where the benefit can come from in the consumer experience and trying to marry that with possible improvements within their own operations can be something that will ultimately lead lenders to success in this process.”

> Sean Pyle, president, Valutrust Solutions

OCN MODESTLY PRESENTS:

In 2022, we had a record turnout for our best event … yet. Let’s just say, you won’t want to miss this year’s Originator Connect and these exclusive programs:

Free NMLS Renewal * Build-A-Broker Non-QM Summit

Private Lender Forum & so much more!

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

As technology continues to advance at a rapid pace, it may be a shock to some that mortgage companies are actually trimming their tech budgets. But it’s not in favor of a more stripped-down approach to their operations, it’s because, in a defined downturn, budgets are being slashed.

Candor Technology, an artificial intelligence firm that specializes in mortgage tech, recently trimmed its small staff but did not specify the number of employees affected. And San Franciscobased Blend Labs recently conducted a fourth round of layoffs since April 2022, the mortgage technology company said in a regulatory filing.

And it’s not just mortgage tech that’s feeling the burn. Job recruiting firm Indeed chopped over 2,000 jobs, storage and data chipmaker Marvell cut 320 positions, and MeridianLink reduced their staff by 9% – all within the first quarter of the year.

The mortgage industry is one that tends to rely on technology for loan efficiency. So it’s seemingly contradictory

that tech is often the first on the budget chopping block, and now it’s forcing LOs to go old-school.

Brandie Young, Candor’s former chief marketing officer and a board advisor at ClearCloser, says that the tech that exists today came from an “exuberant” market between 2020 and the onset of 2022.

“When a tech is built, it’s built to suit what’s happening today in the current market

“While the hypothesis might support that it can create equal value in a down

market, that’s not always the case,” Young explained. “The soft [return on investment] is what caused a lot of lenders to slash their budgets down to the core of what they need.”

Young also says that even though there has been a strategic drawback in tech services, it’s not necessarily bad.

“What I’m seeing with the people I’m working with is a big advantage at being able to look at issues with hindsight, because now they can look at it with an extremely opposite market from what we had before and understand what they did and didn’t do,” she said. “Things that are bad [at] the moment always end up being good long term.”

Gaurav Nagla, product manager at Blend, says that even though they’ve had to resort to layoffs, it doesn’t mean that the company isn’t making itself an asset to the mortgage industry.

“We’re seeing financial institutions take advantage of the current lowvolume environment to implement and adopt product features that they couldn’t do during high-volume times,” Nagla said. “Tech companies that dem-

“We’re all affected by [the market]. It’s the same sandbox we’re playing in.”

> Curt Tegeler CEO, WebMax

onstrate the value they create not only for the mortgage lenders but also for other players can position their services as ongoing assets to their customers.”

As Nagla puts it, tech companies aren’t immune to the business challenges and effects of the global market. Because of pacted for every player in the ecosystem, and tech companies are experiencing the -

“The first things they usually cut are website services or point-of-sale platforms,” Brown said. “But on the other hand of that, some companies make the choice to engage more with technology companies because they understand that by leveraging the technology [for automation], they can save money internally.”

Brown says that WebMax offers multiple products and one of them, enterprise website solutions, is usually what gets dialed back the most during a downturn. “Companies are deciding that maybe they don’t need websites for every user,” he explained. “So they’ll drop their 100 licenses down to 40. But we’re still there in the background because everyone needs a website. It’s just fewer licenses and less business.”

innovative solutions, they entiate themselves andtrition is a large trend and slash their budgets.

Curt Tegeler, CEO of WebMax, says that customers are simply asking for relief. “We’ve seen customers that we’ve had for 10-15 years asking for extra time for their payments,” he said. “And we’ve had other customers get acquired by other companies, but they’ve been helping us get our foot in the door by recommending our services. It’s a time where tech is helping each other out.”

Competition is involved, too. Tegeler says that all tech companies are competing for mortgage companies’ limited budgets. “We’re putting our name out there and making sure to highlight our product differentiators,” he said. “And now we’re advertising that it’s a good time to check out our company: we can meet their budgets, we can defer payments. … We’re smaller and nimble.”

Brown and Tegeler also acknowledged the loan officer pool shrinking as a factor contributing to a tight market and tighter budgets. “Companies have lower production than they did a year ago. It costs money to hold on to a loan officer,

and many officers are leaving on their own,” Tegeler said. “We’re all affected by [the market]. It’s the same sandbox we’re playing in.”

Tegeler acknowledged that WebMax, too, has scaled down to fit the needs of the current market.

“We’ve had to decrease our physical space, our marketing dollars, the amount of conventions and conferences we’re going to, how much we’re going to spend at said conferences. .. We’re looking at everything,” he said. “And we haven’t been bashful in calling up our vendors and asking for help and relief. We’re a young company, we were a start-up in 2015, and we have partners who have been kind enough to help us. Anybody that tells you that they’re insulated from the market, it’s not true.”

In a down market, both Brown and Tegeler say that it’s a good time to sit back and reevaluate your company’s needs and workflow. Young agreed. She said that she’s seeing many tech companies tinker around with what will bring them the most productivity. “I think that technology that offers flexibility at the loan level is what will be successful,” Young said. “Speed is important. … I think we’ll see individualized component services where we’ll see a lot of emergence. I think people – lenders – will be rethinking workflow and bring it back to the manufacturing process to where it makes sense to get individual components managed more efficiently.”

And in the downtime, customers’ satisfaction and needs are still at the forefront. “Ultimately, we will get caught up,” Tegeler said. “We try to leverage the relationships that we have now at the grassroots level. We’re trying to follow our loan officers and hope that they recommend us to their new lenders. We also try to focus on customer retention – what are their needs? Even though the market is tight, we’re still trying to differentiate ourselves from the competition.”

Young added, “Efficiency has been a big buzzword, but it’s all true that we need to do things better, right, and fast so we can truly use our time well.”

In a down market, it’s a good time to sit back and re-evaluate your company’s needs and workflow.

Veterans, when you’re struggling, soon becomes later becomes someday becomes ...when?

Don’t wait. Reach out .

Whatever you’re going through, you don’t have to do it alone. Find resources at VA.GOV / REACH

Arc Home LLC

Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok

(866) 453-2400

carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

Be available when your clients go looking. Directory listings ensure your company is accessible when your clients are looking for you. Your listing includes:

• 6 or 12 month options

• Your active listing highlighted in the monthly special feature

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers)

FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owner-occupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565

info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Your listing comes with an enhanced online profile, which includes:

• Company name, logo, & description

• Contact phone, email, social accounts, & location

• All directories your company is listed in

• Latest 3 mentions in articles on our site

• Latest 3 webinars hosted by your company (if applicable)

Prices are subject to change. Pricing is not guaranteed until a contract is formed.

American homeowners are sitting on a gold mine of home equity, thanks to skyrocketing property values. Gold mines, if the old Westerns are to be believed, are prone to attracting attention.

That’s why lenders, scrambling to offset a significant drop in purchase and refinance originations last year, have turned their sights to this mountain, $19.5 trillion dollars high.

While homebuyers may be struggling with availability and rates, homeowners are sitting on a fortune in tappable equity that overshadows Japan's annual gross domestic product by almost four times, says Joe Mellman, senior vice president and mortgage business leader at TransUnion.

“That figure doesn’t represent total home equity, but tappable home equity held by consumers with credit profiles that would qualify and enough ownership in their homes that they wouldn’t exceed the 80% combined loanto-value ratio,” Mellman says.

Jerry Schiano, a former New Penn Financial executive and founder of home equity lender Spring EQ, doesn't mince words, "First mortgage business is dead."

The reasons are obvious.

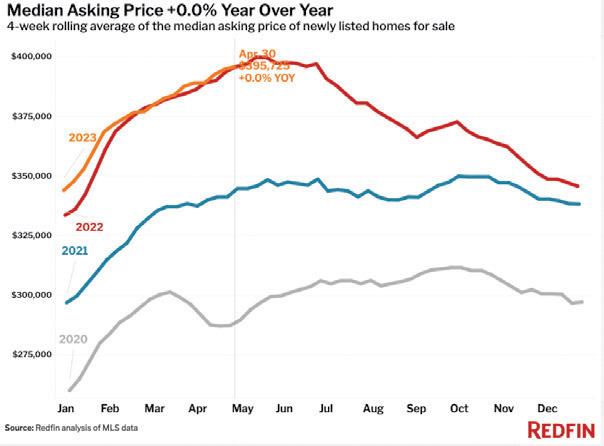

“One, we’ve seen a run-up in home price appreciation. Two, recently, until the last year or so, consumers would tap home equity through cash-out refinances. Because of where the rates are, refinancing your first mortgage just doesn’t make sense right now because nobody wants to go from a 2.5% to a 6.5% [mortgage rate] to get $50,000 or $100,000,” Schiano says.”I think there is some consumer education needed to get consumers to understand that home equity is a viable option through either a HELOC or home equity loan.”

One thing's for sure - with non-mortgage consumer debt on the rise due to inflation and dwindling pandemicera stimulus funds, industry experts say HELOCs and home equity loans represent a win-win for financiallystretched consumers and lenders hungry for new loan portfolios.

“It’s not for the faint of heart and that’s really the challenge of this business, why more people haven’t gotten into it,” Schiano says.

HELOCs and home equity loans are typically more affordable for borrowers than other options like credit cards or personal loans. For the most part, HELOC rates have remained between 6.8% - 8.4% this year. As of midMay, the average APR offered on new credit cards was 23.98%, according to LendingTree.

Tappable home equity has increased by $3.4 trillion in just the last three years, according to Black Knight, a data analytics provider for clients in the housing industry.

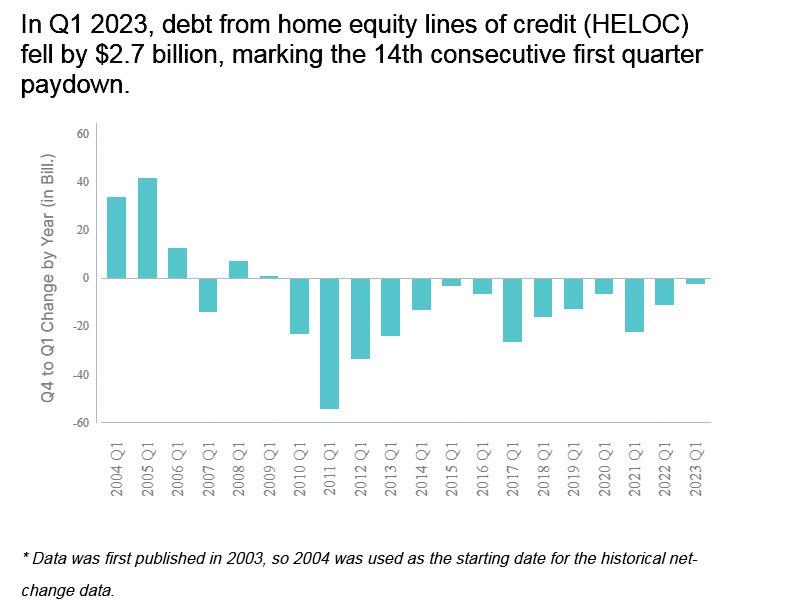

Meanwhile, home equity line of credit (HELOC) originations rose 7% year-over-year in the fourth quarter of 2022 and home equity loan originations jumped 31%, according to TransUnion’s Q1 2023 Credit Industry Insights Report. HELOC originations totalled 299,000 units in the fourth quarter of 2022, while home equity loan originations reached 264,000 units.

TJ Milani, chief operating officer of Figure Technologies and chief financial officer of Figure Lending, says the bad economics of cash-out refinances in a higher interest rate environment have driven the recent surge in home equity loan originations. At the same time, the last decade has seen more transformation in the home equity

marketplace.

“There’s been a lot of innovation historically, or trying to do innovation, on the first mortgage product with other different fintechs. On the equity release and second lien products, there really hasn’t been,” Milani says.

It created opportunity for nonbank lenders to get into the space dominated by retail banks and credit unions.

“As interest rates rose for this specific product, it made it much, much more attractive for consumers. A lot of the folks that actually do these products aren’t the big banks really. It's a lot of the community banks that serve their consumers in specific markets,” he says.

Milani predicts tighter credit conditions for smaller, regional banks due to recent turmoil in the banking industry, in addition to higher interest rates, will continue to work in the favor of nonbanks stepping into the home

equity lending space.

“I think there really is a macro trend given what happened with SVB and First Republic and Signature and all these guys. I think there's going to be a significant pullback in access to credit across some of these smaller and regional banks. That's ultimately, and unfortunately, going to hit products like this. So, I think the time is ripe, given where interest rates are making cash-out refis less attractive, given the secular change that's going on with banks and their liquidity positions, given the rise in technology within these products. I think, in general, the next 3, 4, 5 years are going to be super, super valuable for this market.”

Consumer surveys that TransUnion conducted show the primary reason homeowners tap into home equity is for home improvements. The second is to pay off higher-interest-rate, non-

mortgage debt – such as credit cards, personal loans, and even auto loans – with APRs “quite high” compared to a couple of years ago, Mellman says.

But, as Schiano sees it, the borrowers who would or could tap equity aren’t the size of the entire tappable-equity market. Some people own their house free-and-clear and have a lot of savings, but much of society does not.

“If you look at the home equity marketplace,” he says, “a number of people take out home equity lines just in case, in case something happens. And then there’s a number of people who take out debt consolidations. They’re two different aspects of that tappable equity marketplace, with two different reasons for borrowing. If we do a debt consolidation loan, which is a good percentage of our loans, we make sure we pay off the debts we’re consolidating because if you’re a personal loan company, they’ll do a debt consolidation loan, and then they give somebody $15,000 because the person says they want to consolidate their debt. But they’re not really paying off those debts, they’re counting on the customer to do that. What we do, as a part of our process, is pay off those debts.”

Tom Finnegan, a principal at Stratmor Group, a mortgage advisory firm, makes the case that home equity lending provides an opportunity for lenders to reach potential borrowers whose properties have appreciated, but are reluctant to sell and give up their lower rate. When mortgage rates are up, a home equity loan or line of credit offers borrowers with rates less than 3% the chance to access cash.

Banks and credit unions have always been

in the equity business, but independent mortgage banks (IMBs) have not traditionally offered home equity products due to the minimal commissions for originators and irregular investor interest, Finnegan says. However, Finnegan believes IMBs now have an opportunity to get creative and bill themselves as organizations that want to work with their customer base through all interest rate cycles.

31%

“Today they might be just needing some equity and some cash to send the kids to school or something, but later on they may be trading homes, downsizing … there may be a full, rate-reduction refi if rates ever go down again, and you could consolidate that debt in. There may be opportunities down the road if you believe in a customer-for-life or client-forlife strategy. Making sure that you can serve their needs with this particular touch point, today, certainly would accrue to your longterm, customer-for-life strategy.”

One option Finnegan sees is for IMBs to partner with local or regional banks as investors who would be able to hold the loans on their balance sheets. Some loan officers may view home equity lending as a distraction from the goal of a first mortgage loan plus a full commission, but training LOs on home equity products can help institutions improve their client-for-life strategies and increase revenue at a time when many lenders – and originators – are hurting.

Or, look to the near term.

“If a first-mortgage company is trying to sell cash-out refinancing, it’s not a slow market, it’s a dead market,” Schiano says. “We tell our mortgage banking customers, mortgage brokers, just because mortgage rates have changed, it doesn’t mean that people don’t have a need to consolidate their debt. So, the mortgage originators can decide to not participate in that market, and they can focus on purchase-money loans, but the competition there is fierce, and the margins are tight, and there’s still more originators than there are loans.”

In a down market, or even a vibrant market, originators should be in the business of adding value to their customer base, Schiano believes, echoing Finnegan’s emphasis on customerfor-life strategies. “If it’s the right thing to do to give somebody a home equity loan, rather than a cash-out mortgage, they should do the right thing. And then, if they do the right thing – and maybe I’m old-school – I believe if you treat people right, they come back to you time and time again.”

In Spring EQ’s third business channel they

partner with large first-mortgage companies who don’t want to fully get into the home equity business. Schiano tells these partners that carrying home equity products keeps customers – and business – in-house.

“Sometimes, offering the home equity line helps solidify the sale for cash-out refinancing because, basically, you’re giving people alternatives. The companies that don’t do that are basically telling the customer, ‘Boy, why don’t you go get a home equity quote outside of us, and then if you don’t like that, come back to us.’ I think it’s a consultative selling approach that even in good times people should use it. Now, they should do it completely, in this time, because this is the product – they’re not going to sell the other product, not enough.”

A HELOC study which Stratmor conducted showed that the top-three motivations for lenders to offer home equity products were: meeting borrower needs; supporting customer relationships; and, providing LOs with all products available.

of pandemic-era stimulus money.

Milani acknowledges that there’s been a drop so far in 2023, but with a market this massive, doesn’t see the cooling off as cause to worry. Rather, he sees a market that’s sensitive to interest rates and fears of a possible impending recession.

“It's such a big market and we've barely cracked the surface of what we're doing. I think there's just a ton of room to grow. If this was a $12 trillion market and there were $3 trillion of originations already, I'd tell you differently, maybe. But, a lot of folks are sitting on equity in their homes. A lot of folks still have various needs. And with credit card rates at 27% and personal loan rates at 18, 19%, and even first mortgage rates at 6%, this is a very good alternative product.”

In addition to affordability, an attractive feature of HELOCs is flexibility, Schiano says.

“It depends on what the customer wants. HELOCs are IO (interest-only) payments,

or contact with their previous mortgage loan officer, that the right discussion points – not scripting but the right counseling occurs with the potential customer, no matter what touch point they enter.”

Mellman, for his part, sees a huge opportunity for lenders to use data like TransUnion offers to identify individual borrowers who might benefit from home equity products.

Doing so would allow lenders to adopt a tailored approach for educating consumers about their options.

“Educate consumers on how much home equity they have, and when you combine that with other data assets like how much debt they’re sitting on, what interest rate that debt is, then you can do the simple math and do a value proposition for each consumer. Ryan, you can save $300 a month; Joe, you can save $250 a month.”

Though down from $210,000 early last year, Black Knight analyses from April show the average mortgage holder still has $178,000

These responses imply that lenders offer home equity products primarily in support of their customer-first orientation. Unsurprisingly, many borrowers aren’t aware of equity as an option.

TransUnion’s Mellman identifies a dearth of knowledge among consumers about what home equity products are available and who qualifies as a primary obstacle for lenders.

“There’s not big awareness on home equity as a lending class on the whole. Older people like me can remember when home equity was a standard product that was often thought of in the same vein as a mortgage or a credit card. The industry has to remember that there’s a whole generation – basically since the great financial crisis to now – where home equity has not been a common product.”

The volume of home equity originations rose 53% year over year in 2022, but, curiously, the trend has not continued through the first few months of 2023. Meanwhile, consumers’ non-mortgage debt has been increasing with inflation, added costs, and the spending down

so they have lower monthly payments and conceptually, they could draw more. But, HELOCs have seen a run up in interest rates because prime keeps going up and up and up and up. Maybe it's stopped now, whereas the closed-end loans, whatever you lend to somebody is the rate throughout the loan.”

Open-end lines of credit can be drawn against for multiple purposes over a period of time, as well as acting as a liquidity safety valve for borrowers worried about month-tomonth cash flow. Because closed-end home equity loans are typically fixed-rate products, the flexibility and variable interest rates of HELOCs may be more attractive to borrowers if and when rates go back down.

As to why some consumers might be less eager to tap equity, Stratmor’s Finnegan thinks there may be a reticence among borrowers who remember the housing crisis of 15 years ago and are wont to put their house on the line. This makes consumer education of paramount importance, “depending on how the customer enters the bank, whether it’s through the web

in tappable equity to borrow against while retaining a 20% equity stake in the home. Yet, as interest in home-equity products increases, Mellman believes lenders should know that it’s not just mortgage holders who are tapping home equity, but also consumers who own their properties free and clear.

“That is a group of consumers that oftentimes are not in the conversation," he says. "While they don’t quite do the volume that mortgage holders do, they still do significant volume on starting to tap their home equity. It’s an important consideration to have for the lending community.”

At Spring EQ, the priority for originators is always affordability and debt ratios for consumers. Prioritizing borrowers’ best interests in origination is part-and-parcel of being a good credit brand, Schiano says. The key to any borrowing – be that a credit card, auto loan, first mortgage, or home equity – is to make sure people can afford the product and understand the ramifications of their borrowing decisions.

“It’s such a big market and we’ve barely cracked the surface of what we’re doing. I think there’s just a ton of room to grow.”> –TJ Milani

It’s time to let your skills shine. Find resources for breaking through barriers like degree screens and stereotypes. It’s time to tear the paper ceiling limiting STARs: workers Skilled Through Alternative Routes rather than a bachelor’s degree.

Jeff, STAR

Jeff, STAR

I am more than who I am on paper.

for

The mortgage industry is going through a significant change. For mortgage origination professionals, it’s a struggle to keep on top of all the changes, and to keep your sales strategies and marketing initiatives at their peak. You need to keep your pipeline filled, and you need the tools and directions to stay profitable, efficient, and effective. We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros.

Mortgage Banker Magazine readers like you can attend for free by using the code MBMFREE.

www.ultimatemortgageexpo.com

We’ve brought together the best in the business to create a top tier event specifically designed for mortgage origination pros. Mortgage Banker Magazine readers like you can attend for free by using the code MBMFREE.

JULY 11 NEW ORLEANS, LA Hotel Monteleone

www.ultimatemortgageexpo.com

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

Produced By ORIGINATORCONNECTNETWORK.COM

Produced By ORIGINATORCONNECTNETWORK.COM

COMPANY AREA OF FOCUS WEBSITE

Global DMS Appraisal Management Software globaldms.com

SPECIAL ADVERTISING SECTION: APPRAISER & AMC DIRECTORY

COMPANY AREA OF FOCUS WEBSITE

Clear Capital National real estate valuation technology company clearcapital.com

SPECIAL ADVERTISING SECTION: WAREHOUSE LENDING DIRECTORY

COMPANY AREA OF FOCUS WEBSITE

FirstFunding Inc. Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors. firstfundingusa.com

Independent Bank of Texas Mortgage warehouse lines of credit, from $2 million to $150 million, and fund over 200 delegated and non-delegated retail originators. Ifinancial.com

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.