A hazard insurance GSE solves the HOME INSURANCE CRISIS

THE MORE THE FED SAYS ... the less it means?

A hazard insurance GSE solves the HOME INSURANCE CRISIS

THE MORE THE FED SAYS ... the less it means?

How Peak Residential generated hundreds of loans and went full-del in just 1 year

What does THE NAR SETTLEMENT REALLY MEAN FOR YOU?

In February 2024, we issued Selling Guide Announcement SEL-2024-01 and Servicing Guide Announcement SVC-2024-01 to clarify various existing lender and servicer responsibilities related to monitoring and verifying property insurance coverage.

The clarifications were made to long-standing policies in our Guides that are intended to ensure the borrower has sufficient property insurance coverage in the event of a loss, and the February announcements did not change these policies. Among other things, we removed coinsurance requirements and reinforced the requirement to obtain the replacement cost value and confirm the policy provides for replacement cost coverage.

The June 1, 2024 effective date was intended to provide advance notice to accommodate lenders’ and servicers’ internal governance processes. Following these announcements, we have heard concerns from industry partners about lenders’ and servicers’ ability to comply with our long-standing policy to obtain the replacement cost value, which is necessary to confirm the minimum required coverage amount in our Guides is met.

In light of the unique nature of these concerns, in coordination with Freddie Mac and FHFA and until further notice, we have decided not to cite findings for noncompliance related to obtaining property insurance replacement cost values for the purposes of determining coverage amount sufficiency, including any failure to obtain lender-placed insurance for a coverage shortage due to failure to utilize replacement cost value. During this period, we will conduct additional research and industry engagement to evaluate the reported obstacles to lenders’ and servicers’ compliance with our requirements related to replacement cost value.

We are taking this extraordinary step because of the critical role played by replacement cost value in determining the amount of property insurance coverage that protects both the borrower and the owner of the related mortgage loan. To that end, we look forward to engaging productively with stakeholders over the coming weeks.

Lenders’ and servicers’ obligations under Selling Guide A2-1-03, Indemnification for Losses with respect to a loss resulting from insufficient insurance coverage remain unchanged. Also, servicers must still obtain lender-placed insurance when the borrower does not maintain an active property insurance policy. Additionally, citation of findings related to noncompliance with our flood insurance requirements is not impacted by this Notice.

We will communicate any applicable updates at a future date.

Vincent M. Valvo CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Ryan Kingsley EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki STAFF WRITERS

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins, Krystina Coffey MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin ADVERTISING ASSOCIATE

Lydia Griffin

MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com Submit your news to editors@ambizmedia.com, www.ambizmedia.com

© 2024 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher.

Advertising, editorial and production inquiries should be directed to: American Business Media LLC, 88 Hopmeadow St., Simsbury, CT 06089, Phone: (860) 719-1991, info@ambizmedia.com

Peak Residential achieves the extraordinary by establishing a fully delegated retail mortgage bank in under a year— an unparalleled feat in any market. >>

Rob Chrisman has been in mortgage banking since 1985 and publishes a widely read daily market commentary on current mortgage events.

BY ROB CHRISMAN , CONTRIBUTING WRITER, MORTGAGE BANKER MAGAZINE

In “the old days,” investors in the bond market, lenders, and loan originators would watch for the money supply figures released every Thursday. Then, attention shifted to the unemployment data on the first Friday of every month. This was how people tracked the health of the American economy and consumer.

Watching the data is every bit as important today as it was then. However, the way the market interprets that data is different today, influenced by the constant parade of Federal Reserve officials speaking around the nation – not only meeting every month or two at the Federal Reserve’s Open Market Committee (FOMC). What should residential lenders know about how we reached this point, and why are the rates borrowers see so dependent on these Fed speakers’ thoughts and actions?

The Federal Reserve System, created more than 100 years ago, is the “central bank” of the United States. Its primary purpose is to enhance the stability of the American banking system. This central bank carries out its mission through the actions of the FOMC, comprising the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and the presidents of four other Federal Reserve Banks who serve on a rotating basis.

Of all the Fed’s activities and announcements, it is those of the FOMC that regularly make financial news headlines, such as the decision to leave rates unchanged in recent meetings. The FOMC does not set mortgage rates, but the same factors that influence its actions also influence mortgage rates. As we move through 2024, it is important to know how the Fed operates and how the market interprets Fed actions. After all, its actions

directly impact the interest rates that borrowers see, influencing demand.

It is unquestionable that real estate, housing, and the financing of homes have been core components of the U.S. economy for hundreds of years. Over just the past several years, it quickly becomes apparent how the Fed has taken an active role in moving rates in response to other economic data – like employment rates. For example, the Federal Reserve announced QE1 (quantitative easing) in late November of 2008 with a specific goal: supporting the housing and financial markets by way of large-scale asset purchases. The announcement of the program set off widespread buying in the TBA (To Be Announced, where specific pool attributes aren’t known) markets, and within a month, mortgage rates had fallen by almost one percentage point.

In early 2014, the FOMC was purchasing $85 billion a month in bonds. It was expected to “taper off” the QE1 policy and begin reducing its purchases, thus driving up long-term rates and therefore reducing residential lenders’ volumes. Prices of securities are determined by supply and demand, and ratcheting up demand of securities directly impacts the price. Lenders were worried about replacing income caused by interest rates moving higher and volumes dropping due to the Fed’s activities.

Specifically, the quantitative easing programs had a role in encouraging (or discouraging) the refinance market and the overall economic impact on the nation. However, fears of a recession prompted the FOMC to reverse its plan of gradually raising interest rates and begin lowering rates, causing the 30-year mortgage rate to drop from nearly 5% in November 2018 to 3.5%

at the end of August 2019.

The coronavirus crisis in the U.S. triggered a deep economic downturn as people “hunkered down” and increased people’s desire to hold deposits and only the most liquid assets. The Federal Reserve intervened with a broad array of actions to keep credit flowing to limit the economic damage from the pandemic, including large purchases of U.S. government and mortgage-backed securities (MBS) and lending to support households, employers, financial market participants, and state and local governments through 2020 and into 2021.

Lenders, of course, took note of the Fed’s appetite for mortgage-backed securities. In the summer of 2021, the Federal Reserve’s nearly daily purchase of assets, either through buying securities backed by U.S. Treasuries or securities backed by residential mortgages underwritten to Agency standards, had become the center of attention for investors. The Fed’s activities were also of interest to every lender, originator, and borrower. Mortgage rates were low –arguably unnaturally low – in part due to this constant buying. As the years went on, the financial markets grew accustomed to, and began relying upon, the Fed’s moves and the Fed’s speeches, dubbed, “Fed Speak.” Fed officials, for their part, seemed very open to “being on the stump” and speaking about the economy.

prospective borrower, a lower-rate mortgage increases the borrower’s disposable income and ability to buy a home. It is safe to assume that the increase in disposable income garnered by the mass refinancing wave also contributed as a stimulus to the overall economy.

Remember that one of the purposes of the U.S.’s central bank is to increase the stability of our financial system. Sudden moves have the opposite impact. When the Federal Reserve began reducing its billions of daily and monthly bond purchases, long-term rates indeed rose, and lenders struggled to replace this income (when interest rates rise, banks holding the fixed portion of the contract lose money on a mark-to-market basis, meaning, the bank is receiving a lower rate than what the market is offering).

“Watching the data is every bit as important today as it was then. However, the way the market interprets that data is different today, influenced by the constant parade of Federal Reserve officials speaking around the nation ...”

> ROB CHRISMAN

Investors and economists watch any speeches or policy statements from the Federal Reserve for any indication that recent data, including faster-thanexpected inflation and slower job growth, will change easy-money policies. MLOs should be aware that many economists expect the Federal Reserve to begin reducing rates some time in 2024, but the Fed has made it clear that it is not in any great hurry. In general, investors expect the Federal Reserve to stay the course in its battle to tame inflation.

Currently the Federal Reserve owns over $7 trillion in fixed-income securities, which, in terms of MBS, includes around a quarter of total MBS outstanding… the proverbial 800-pound gorilla in the MBS marketplace. Should the Fed decide to actively sell its holdings, the laws of supply and demand suggest that prices will drop, and mortgage rates will increase. As any mortgage loan officer (MLO) will tell a

We should keep in mind that the reasons that cause the FOMC to act are just as important, if not more so, than the actual actions of the FOMC. The markets look to the Fed as having the best research ability, the best sources of information, and the brightest minds in making decisions. Lenders and the markets using the Fed funds rate is a relatively simple gauge of economic strength or weakness. Although the Fed does not set mortgage rates, the data and logic informing its actions can also move interest rates.

Creating a space for the next generation in NMLS education.

Introducing Maximum Acceleration, your new premier provider of continuing education.

We’re not just bringing you a lecture. We’re bringing you the fuel to spark your competitive fire, the plan to win the game on the merits, the confidence to know the rules and master them.

We’re Maximum Acceleration, and we’re where loan originators go to put their career in high gear.

— LaDonna Lockard, CEO

Welcome

The

Originators

TITLE SPONSOR

FRIDAY NIGHT RECEPTION

BY CLIFF ROSSI, SPECIAL TO MORTGAGE BANKER MAGAZINE

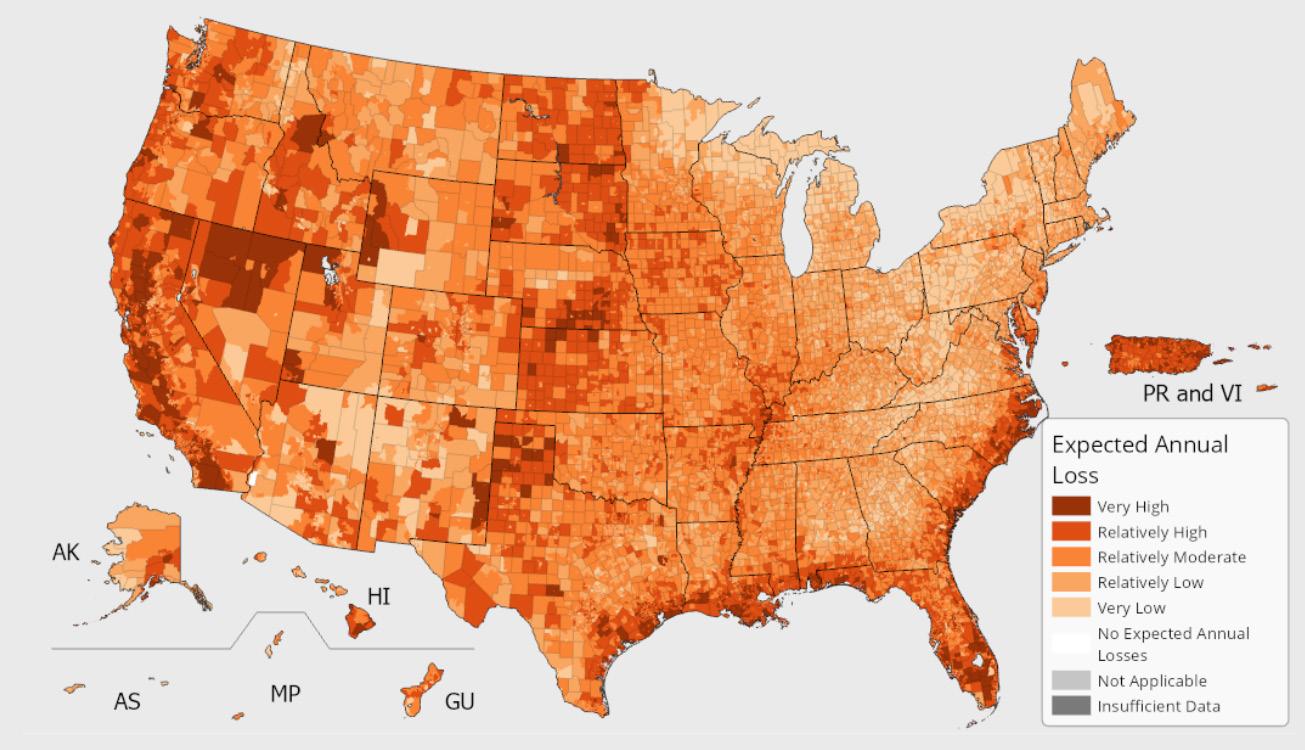

Whether termed “climate change” or “extreme weather,” an increasingly unstable environment is damaging homes and other property at an accelerating pace faster than observed in decades.

The magnitude of these risks, as seen in Figure 1 on the following page, grows for homeowners, insurers, lenders, and investors across the country at the same time that solutions to the impending insurance crisis are lacking. Piecemeal approaches are unlikely to provide a longlasting solution.

Meanwhile, the rise in the frequency and severity of natural disasters has underscored a form of market failure that suggests a fully private solution will be unable to provide long-term premium stability and availability of homeowners insurance. A nationwide solution is needed to tackle what is essentially a nationwide problem. >>

SOURCE: FEMA NATIONAL RISK INDEX

That solution is the Federal Natural Hazard Insurance Corporation – a privatepublic approach to providing homeowners insurance across all natural hazards and states that would address myriad failures in today’s insurance market.

As a new, federally chartered governmentsponsored enterprise (GSE), the Federal Natural Hazard Insurance Corporation (FNHIC) would carve out natural hazards from existing homeowners’ policies, offering a separate policy based on a property’s exposure to the specific natural hazards in that location. The Federal Emergency Management Agency’s (FEMA) National

Flood Insurance Program (NFIP) would be absorbed into this new GSE and form the basis for a broader set of insurable hazards to be incorporated into these policies. Private carriers would continue to offer and underwrite a standard homeowners insurance policy for risks unrelated to natural hazards while the FNHIC’s policies would be distributed by a network of insurers as the NFIP’s program is today. To reduce the FNHIC’s loss exposure and allow insurers and reinsurers to participate in this market, Climate Risk Transfer Securities (CLRTs) would be sold to private investors at tiers commensurate with their risk appetites.

Necessarily, such a major overhaul of how homeowners insurance is priced and provided in the U.S. would have significant implications for all market participants and the process of passing a chartering bill that implements such a program would be financially, politically, and operationally challenging, to say the least. However, examining the merits of this structure –and the challenges such a program would confront—requires an understanding of the issues driving the breakdown in the delivery of homeowners insurance today.

The combination of state insurance commissions’ general reluctance to allow rate increases, increasingly frequent and increasingly severe weather events, rising rebuilding costs and rising reinsurance rates have made it extremely difficult for private insurance companies to charge what it costs to absorb these losses while still earning a fair rate of return.

Most residential property insurance is provided by private insurers, with flood insurance primarily offered through the NFIP. Private insurers get their rates approved annually in each state where they do business. All states cap the amount that insurance rates can increase annually, but to different degrees.

Large, national carriers must navigate the rate approval process of many state insurance commissions. However, individuals on these commissions are typically appointed by the Governor or another governmental entity. Thus, the

range of these commissions’ perspectives on rate-making and consumer protection varies widely by state.

As the variation and uncertainty in premium determination impacts insurers’ ability to charge a price commensurate with the risks taken in that state, pressure on premiums has been mounting in the past decade due to an escalating frequency of natural disasters and claims.

At $65 billion, the property and casualty insurance sector experienced the highest catastrophe losses in a decade in 2023, according to data from AM Best, a credit rating agency that specializes in insurance. That same year, the National Oceanic and Atmospheric Administration (NOAA) recorded 28 separate natural disasters exceeding $1 billion in damages.

The escalating frequency and severity of disasters leads to an increased number of claims and for higher amounts. The escalating costs of rebuilding – which is estimated to have risen by as much as 55% from 2019 to 2023 on account of a shortage of supplies and skilled labor – make claim amounts larger still, driving up policy rates even more.

Further squeezing insurers’ financial performance is the rising cost of reinsurance, a standard mechanism insurers use to offload portions of their insurance-in-force to, among other reasons, realign their risk profiles or reduce capital. Property catastrophe rates have increased 50% in 2024 according to Gallagher Re, one of the largest global reinsurance brokers.

When insurers cannot charge fair prices commensurate to the costs they’re absorbing, they exit the market altogether, as has occurred in Florida and California.

Insurers can choose to absorb some of these costs, but investor pressures limit this as a viable long-term strategy. The breakdown in the provision of homeowners insurance has adverse spillover effects on all market participants, but first of all, consumers, as at the ground level losses hit homeowners in the form of higher annual premiums or policy non-renewals.

According to Insurify, the cost of the average homeowners policy in the U.S. in 2024 is $2,522, up 27% from 2021 to 2024. For a borrower applying for a $350,000 loan with a household income of $107,000 and a 7% 30-year-fixed mortgage rate, that represents roughly one month’s payment of principal and interest payment, or adds 2.4% to their debt-to-income (DTI) ratio.

In states with above-average insurance costs like Florida, where rates are 4.6 times the national average, the same mortgage and

income would push the DTI ratio up 11%. For low- and moderate-income borrowers this becomes more problematic because those borrowers face difficult choices between other necessities and paying their insurance premiums.

Consider that Freddie Mac’s Home Possible program for low-income borrowers allows DTI ratios up to 45%. Sharp increases in the cost of homeowners insurance has a disproportionate impact on these borrowers’ budgets. It also simply makes homeownership less affordable in a market environment where affordability is an acute problem for the majority of homebuyers.

In the event of a lapse in coverage, such as when carriers exit a market or stop writing new policies in certain high-risk areas, servicers force place insurance, which is usually more costly for the homeowner and may carry less coverage with higher deductibles, depending on the policy. Such policies may be provided by public insurance pools such as California’s FAIR

The average homeowners policy in the U.S. in 2024 is $2,522, up 27% from 2021.

Plan for wildfire and Florida’s Citizens Property Insurance Corporation (CPIC). However, pushing homeowners into those state plans threatens to overburden those ‘insurers of last resort.’

Both the FAIR Plan and CPIC have been under severe financial pressure in recent years, needing to assess higher rates themselves on homeowners and taxpayers as private insurers exit high-risk areas. With roughly 1.2 million policies, Florida’s CPIC is trying to reduce its exposure.

The FAIR Plan is one major wildfire short of insolvency, the insurer’s president announced in March. Insolvency would trigger a state-wide assessment on millions of current policies of $2 billion or more. Downstream from insurers and homeowners are investors. Credit and mortgage-backed security (MBS) investors are necessarily impacted by borrowers’ and properties’ insurability as a lack of coverage impacts the distribution of collateral risks. The largest credit investors in the mortgage market are the government-sponsored

enterprises (GSEs), Freddie Mac and Fannie Mae, who require insurance coverage for every mortgage they back.

For properties located in FEMAdesignated Special Flood Hazard Areas (SFHA), the GSEs require flood insurance policies to be carried as well.

Over time, the financial burden of rising insurance premiums on homeowners raises delinquency and severity risk for the GSEs. Furthermore, there is a real potential for home price corrections in high-risk areas, reducing the major buffer that reduces mortgage default—namely the borrower’s equity stake. Those risks may be manageable now, but they may not be if a sizable portion of the GSE’s borrowers are unable to secure insurance at any cost.

The questions these not unlikely, nearfuture concerns raise are myriad: would the GSEs be forced to reduce their footprint in those markets, exacerbating rising costs of homeownership in major markets like California and Florida, thereby destabilizing house prices in these areas and beyond?

How would investors in credit risk transfer securities (CRTs) and MBS respond to such a major disruption in the housing market?

Today, no policy or regulatory mechanisms to address these possibilities exist because no entity at the national level has such authority. Inherent market failures, the centrality of the housing market to the economy, and the lack of a coordinated, national solution to a nationwide problem demand a new approach to the way homeowners insurance is structured and delivered.

Here, the FNHIC and Federal Insurance Office (FIO) offer a nationwide solution. FNHIC’s mission would be to provide fairly priced insurance coverage from natural hazards to all homeowners with or without mortgages. As a federally chartered GSE, the FNHIC would require regulatory oversight at the national level. Naturally, the FIO could assume this safety and soundness role, but would require a substantial injection of resources and authority.

Separately, the NFIP would be reorganized out of FEMA and into the FNHIC, a move that would start the process of realigning technical and financial resources sufficient for accurately measuring, pricing, and managing the risk of a major insurance portfolio.

In the FNHIC’s initial phase (three to five years), flood insurance policies would continue to be provided in a similar manner as today with private insurers acting as brokers and the FNHIC providing coverage. Risk-based pricing under the NFIP’s Risk Rating 2.0 would continue, and potentially expand during this phase. At the same time, with the FIO’s oversight, the FNHIC would begin building the infrastructure and analysis

for expanding coverage to other hazards.

By year five, the FNHIC would begin offering a more comprehensive product that captures a property’s risk from natural hazards in that area based on probabilistic catastrophe risk models. This work would require the addition of actuaries and scientists to FNHIC equipped with the expertise to develop models used in assessing and pricing such risks.

All homeowners would carry two insurance policies: the first would be a standard homeowner’s policy, similar to what they have now but excluding natural hazard coverage for perils such as wind, hail, wildfire, or hurricane; the second would be a hazard insurance policy the FNHIC. The standard policy would continue to be underwritten and sold by insurers with no role for the FNHIC in that market. Standard homeowners policies should become cheaper since the hazard coverage would be removed from these policies and become embedded in the FNHIC policies.

Meanwhile, those private insurers would act as brokers for the FNHIC for the hazard policies, similar to their current role for the NFIP. Hazard policies would price risk on the individual property level, but pricing tiers would broadly distribute that risk geographically. The FNHIC would provide for some cross-subsidization of low- and moderate-income homeowners that would be transparent and separate from insurance pricing.

Investor properties and second homes would carry higher premiums, and owners of properties located in known high-hazardrisk areas would be incentivized to invest in resilience and risk mitigation improvements through the pricing of their FNHIC hazard coverage. Properties subject to multiple claims for the same hazard such as hurricanes

or flooding without corrective actions would be subject to significant premium increases and/or coverage limitations.

Concurrent with the development of business and risk infrastructure needed to implement its mission, the FNHIC would develop systems and capabilities to systematically distribute its risk to the capital markets. Structurally, this would borrow from the credit risk transfer (CRT) program implemented by Freddie Mac and Fannie Mae for transferring credit risk to private investors.

Climate risk transfers—CLRTs—would resemble CRTs in terms of their sequential loss pay structure, with multiple tranches featured. A conceptual representation of how the CLRTs would work is shown in Figure 2

Policy cash flows would be pooled each month providing the market with a continuous flow of securities for investors (reference pool in light

blue). That cash flow, given the FNHIC’s scale, would provide ample liquidity, making CLRTs attractive to the investors who would bid on tranches of CLRTs, as in today’s CRT market.

A CLRT would be created by allocating claims from policies in a sequential manner, as shown on the right side of Figure 2. To ensure the FNHIC’s risk aligns with that of investors, the FNHIC would take a small first loss and sideby-side catastrophic risk positions (designated by the gray boxes). Private investors would invest in the tranches (shown in the dark blue boxes) that best align with their risk appetite. Insurance companies would be natural investors in junior and mezzanine tranches while reinsurance companies could step into senior tranches.

Such structures offer benefits such as providing insurance and reinsurance companies with greater stability of cash flows associated with natural hazards, something that extreme weather events are impacting under the current insurance model. These structures also balance private insurers’ loss

SOURCE: FEMA NATIONAL RISK INDEX

of market share of insuring natural hazards by allowing them to purchase the risk on the back side of the market. CLRTs would provide catastrophic risk protection by the FNHIC, the optimal entity for absorbing that risk given its GSE status.

These structures raise the question of whether an implicit or explicit guarantee would be provided on the FNHIC’s debt. A case could be made for either option. The existence of some form of guarantee would lower the FNHIC’s debt costs but raise its risk to taxpayers in the event of a major catastrophe. Policymakers could consider alternative models to a purely federal, GSE structure, though. A cooperative-style, private model would have insurers and reinsurers inject capital into an entity that pools catastrophic risk. That structure would reduce taxpayers’ exposure but may not provide adequate coverage at the scale required.

To illustrate the mechanics of the CLRT security, consider a reference pool with a notional value of $500 million consisting of FNHIC insurance policies with broad

geographic distribution and $400,000 per home in coverage against natural hazard risk. Homeowners incur deductibles ranging between $1,000 and $10,000. The CLRT has a one-year term reflecting homeowners policy terms, though the issuance of an annual policy could be revisited by FNHIC – offering multiyear policies could add more stability to the homeowner and the CLRT market.

The FNHIC takes the first 50 basis points of losses on the pool. The junior tranche takes the next 100 basis points, the mezzanine tranche absorbs the next 300 basis points of losses, and the senior tranche takes the last 200 basis points for a total loss subordination of 650 basis points (6.5%), before the FNHIC picks up any catastrophic losses.

The structure assumes the FNHIC would take 500 basis points (5%) of the losses in each of the private tranches. A summary of the notional value of each tranche and loss allocation is shown in Figure 3

If over the course of a year actual losses were 5%, the FNHIC would absorb the first $2.5 million of loss. The junior tranche would take $4.75 million in losses (adjusted for the 5% side-by-side risk by the FNHIC), with the

mezzanine tranche picking up $14.25 million and the senior tranche taking the remaining $2.38 million. In this example, the FNHIC bears a total of $3.62 million ($2.5 million first loss plus $1.12 million in side-by-side losses for each of the private tranches).

Each tranche investor would bid on their CLRT tranche based on their assessment of the distribution of losses that could be realized.

The FNHIC would stabilize the market for homeowners insurance by providing greater certainty to insurers and reinsurers by way of their participation in CLRTs. Over time, this should lower the cost of homeowners’ policies and ensure that no homeowner can be dropped from a policy based solely on the location of their property. It should also ensure that, in the near-term, no regions of the country are completely devoid of catastrophic, natural hazard-related coverage.

While private insurers would still need to seek approval from state insurance commissions on standard homeowners policies, the issues they face today in obtaining rate approval on policies related to natural hazard exposures would no longer exist given the FNHIC’s national hazard insurance preemption. Another benefit of the FNHIC model is that it removes taxpayers from the direct exposure to natural hazard losses on flood insurance by folding the NFIP into the FNHIC.

Over the years, NFIP has significantly underpriced the costs of flooding such that the program is roughly $20.5 billion in debt to the U.S. Treasury. Moving the NFIP off of the government’s books will reduce that direct exposure. Establishing the FNHIC as a standalone, publicly traded GSE would ensure

its operational solvency while maximizing returns for shareholders. That structure, in turn, would reduce long-term exposure to taxpayers from indirect losses.

The GSE model also provides a mechanism for offering subsidies to low- and moderateincome homeowners that today are unavailable. A national hazard insurance program would reduce risks to the housing GSEs and other credit investors, as well as provide certainty surrounding the availability of homeowners insurance for the housing finance system. The FNHIC would eliminate the need for state-run property insurance programs, providing significant savings both for consumers and taxpayers while reducing state-by-state exposures.

Establishing the FNHIC carries a number of financial, political, and operational challenges.

The financial requirements to capitalize the FNHIC would be daunting, to say the least. To gain a sense of the magnitude of cost, consider that between 2014 and 2023 insured losses associated with natural disasters ranged from $29.9 billion in 2015 to $163.9 billion in 2017, according to the Insurance Information Institute’s figures. Losses averaged $78.3 billion annually over that period.

Assuming a stress loss that is three times the average in order to approximate an extreme outcome, the total stress losses for natural hazards would be roughly $235 billion annually. By comparison, the cost to recapitalize Freddie Mac and Fannie Mae has been estimated at $150 billion. The largest U.S. initial public offering (IPO) to date was Alibaba Group Holding Limited, in 2014, at $22 billion in 2014. These reference points underscore the heavy up-front financing

requirements to get the FNHIC off the ground.

Congressional approval would be required to create the FNHIC’s charter and place the NFIP under control of this new GSE. In a stable political environment, compromise would be needed for such a transformational change in the way insurance for natural disasters is conducted. In the current climate of extreme partisanship, passing the FNHIC chartering bill would (likely) be extremely difficult.

State commissions would presumably voice strong opposition to what would be perceived to be federal preemption of their rights to regulate insurance terms in their states. And yet, as outlined, states would benefit from no longer having to prop up insolvent state-run programs.

For existing property and casualty insurers, the FNHIC model presents a mixed bag of outcomes. The fact that insurers would no longer have to submit rate plans to multiple state insurance commissions would relieve companies from a substantial regulatory burden. Though the industry might view the FNHIC as a competitive threat, taking away a major portion of their business, private insurers would hopefully realize that they can continue to invest in this business via CLRTs with greater certainty about potential losses than they currently experience.

Reinsurers would likewise benefit from having a backstop on catastrophic losses via the FNHIC.

A final obstacle relates to the operational infrastructure required to set up the FNHIC, integrate the NFIP, expand the business to incorporate other hazards, and issue CLRTs. The technical and system infrastructure to manage this new enterprise would be

Over the years, NFIP has significantly underpriced the costs of flooding such that the program is roughly $20.5 billion in debt to the U.S. Treasury.

As the pace of extreme weather events continues to increase across the country, this trend in the homeowners insurance market is

significant. Likewise, building out the regulatory oversight beyond the current structure of the FIO would be a sizable task.

Despite the challenges of implementing the FNHIC, such obstacles must be weighed against the many benefits that a national level hazard insurance program would offer, like:

1. Cost savings for all stakeholders,

2. Consistent availability of hazard insurance,

3. The reform of an inefficient and politically infused state-level rate commission process,

4. Improvement in the ability of insurers and reinsurers to manage their potential loss exposure from natural hazards, with greater certainty by way of CLRTs,

5. The elimination of state-run insurance programs,

6. The reform of a federal, agency-run flood insurance program,

7. And the development of a true nationwide insurance program able to accommodate a changing climate.

For these reasons, a national hazard insurance program is a sensible and worthwhile effort to tackle. An increasing number of homeowners will find themselves in an annual insurance lottery, of sorts—not knowing whether they will be summarily dropped by their insurance carrier or what the magnitude of their premium increase will be. Major announcements of insurance companies withdrawing from markets coast-to-coast are forcing homeowners and their mortgage servicers to scramble to

find alternative coverage, which usually raises costs for less coverage.

As the pace of extreme weather events continues to increase across the country, this trend in the homeowners insurance market is unsustainable because the national market for homeowners insurance is fundamentally broken. Incremental changes to the existing homeowners insurance market will be insufficient to tackle the central issue affecting today’s market, namely, that uncertainty in the frequency and severity of natural hazards is disrupting the ability of insurers and reinsurers to reliably estimate the range of loss outcomes. Constraints on their ability to charge rates consistent with their costs and losses exacerbate the problem.

The housing market will continue to see more homeowners insurance policy cancellations and increasing premiums as the environment grows ever more unstable. The problem exists at a national level and therefore demands a combined public-private solution.

Creating a federally chartered hazard insurance GSE overseen by a federal insurance regulator provides the best path forward to ensuring the availability of affordable and fairly priced homeowners insurance. While the path to a new era in property insurance will not be easy, the benefits to homeowners, taxpayers, and the housing and insurance markets far exceed the costs and impediments associated with implementing this new structure.

Clifford Rossi (PhD) is the Director of the Smith Enterprise Risk Consortium at the University of Maryland (UMD) and a Professor-of-the-Practice and Executive-in-Residence at UMD’s Robert H. Smith School of Business.

MORTGAGE BANKER MAGAZINE

Market activity has been picking up as we transition from Spring to Summer, so keep cool and stay hydrated because home prices continue their ascent. And here’s a spoiler alert, they’re sweltering! The S&P CoreLogic Case-Shiller Index for March 2024 reported a toasty 6.5% annual gain for March, the same increase as the pre-

The report’s 20-city composite index posted a partly cloudy year-overyear increase to 7.4%, up from a 7.3% increase in the previous month.

San Diego continued to report the hottest and highest year-overyear gain among the 20 cities this month with an 11.1%

increase in March. It was followed by New York and Cleveland, with increas es of 9.2% and 8.8%, respectively. That indicates a steamy, show-stopping demand for urban areas, CoreLogic says.

11.1%

From a regional standpoint, the Northeast stood out with an 8.3% annual gain, showcasing robust growth compared to other metro markets. On the opposite end of the spectrum, cities like Tampa, Phoenix, and Dallas are cooling down and experiencing a wind chill after hot activity in 2020 and 2021.

With prices continuing to boil over, Redfin says that the median U.S. home-sale price hit an all-time high of $394,000 during the four weeks ending June 9, up 4.4% year over year—the biggest increase in about three months, and further adding to

Tune in to new epiosdes of Mortgage Meteorology every Thursday on The Interest market humidity. However, there are signs that the high-pressure system of home-price growth may soon ease. Like a cold front moving in, asking prices have leveled off, and 6.5% of home sellers are cutting their asking price—the highest rate since the November 2022 low-pressure zone. We’re already seeing price declines in four U.S. metros: Austin, Texas, Fort Worth, Texas, San Antonio, Texas, and Portland, Ore.

Meanwhile, the typical homebuyer’s monthly housing payment has

cooled down to $2,829, which is $30 below April’s record high. Despite record sale prices, median housing payments have fallen slightly since April, thanks to a decline in weekly average mortgage rates to 6.99%. It’s like a gentle breeze providing relief from the heat.

For now, high costs equate to a high-pressure system, keeping some prospective homebuyers on the sidelines waiting for the storm to calm. Pending home sales dipped 3.5% year over year, marking the big-

gest decline in three months.

But don’t resort to doom and gloom just yet; there’s a silver lining on the horizon. Mortgage-purchase applications are up 9% week over week, indicating a potential warm front that could boost demand.

BY BOB NIEMI CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

The news stories, podcasts, webinars, and forecasts predicting the precise outcome of various lawsuits and settlements stemming from investigations into anti-competitive practices concerning how real estate agents list homes for sale and receive commissions at closing have been – it seems – unending.

In those stories, podcasts, webinars, and forecasts, a lot of misinformation has been passed around about what has become known as “the NAR Settlement.” This misinformation has increased confusion for everyone involved in the home-buying transaction, while conflating the issues and solutions being discussed.

Pending, so-called copy-cat lawsuits in several states seek to right the perceived wrongs from the alleged anti-competitive policies with the intent of compensating sellers who may have never been aware of these long-standing industry practices. The NAR Settlement itself is not yet finalized.

Understanding what exactly was being alleged, investigated, settled, reopened, and potentially settled again is key to measuring the impact on all mortgage stakeholders. Taking a deeper look at the “NAR Settlement” reveals that, for the industry, this settlement means much more than just commissions.

In November 2020, the DOJ simultaneously filed a lawsuit and proposed a settlement against the NAR.

The complaint detailed how NAR policies were followed by locally affiliated Realtor associations, how local Multiple Listing Services (MLS) were operated, and the policies and procedures by which local Realtors listed available homes for sale.

It is important to clarify that the real estate agents included in the allegation were only those licensed real estate agents who are also members of the National Association of REALTORS, thus authorized to use the title, “Realtor.”

The DOJ alleged that the NAR policies for Realtors and their MLS operations established and enforced illegal restraints on the way Realtors compete. Mainly, the complaint details allegations that the NAR’s rules, policies, and practices were anti-competitive, preventing prospective homebuyers from learning how much their buyer agent could earn from the home purchase. The DOJ also said that commission-concealment rules permitted some buyer agents to imply their services could be free.

Given that the MLS system could allow the buyer agent to filter MLS listings by the amount of buyer agent broker commission, the DOJ also worried that agents might only show or prioritize those listings where they might make more money. This would amount to the real estate agent version of steering—where consumers would only view homes where the agent makes more money.

A DOJ review of policies that limited listing access to only agents who work with the local NAR-affiliated MLS was found and alleged to be in violation of the Sherman Antitrust Act.

At the same time the suit was filed, the DOJ and the NAR appeared to settle the case with

a proposed consent decree in which the NAR agreed to modify rules to correct the alleged conduct, specifically by removing the ability to filter available listings by compensation offered. However, the DOJ reserved the right to review and approve the updated NAR rules and required the NAR to institute new internal policies, including the hiring of an Antitrust Compliance Officer.

Subsequently, the DOJ went to court and withdrew this initial settlement in July 2021. Though the NAR challenged this action, and initially won in January 2023, the DOJ appealed the lower court’s decision and an appeals court ruled in favor of the DOJ in April 2024.

Meanwhile, a class-action lawsuit (Burnett v.

“

Selling agents must also clearly disclose to sellers, and obtain their seller’s approval for, any payment or offer of payment that could be made to another agent, broker, or representative acting for a buyer.

BOB NIEMI, CMB

Director of Government Affairs at Weiner

Brodsky Kidder PC, Chair of the American Association of Residential Mortgage Regulators

National Association of Realtors) was filed in Missouri in 2019 against the NAR and several large real estate brokerages. That lawsuit focused on NAR compensation policies that essentially dictated that home sellers must pay the commissions for both their listing Realtor and the buyer’s Realtor.

Plaintiffs alleged that this was, in a sense, conspiring to pay inflated commissions. However, the suit went beyond the DOJ’s allegations to also allege that the NAR rules require Realtors to list homes on the MLS to be able to sell a home, in violation of antitrust laws

More cases followed in South Carolina, Texas, Georgia, Florida, Illinois, Pennsylvania,

California, and New York. These cases followed similar plaintiff arguments against anticompetitive practices with a few settlements having been reached, which included some changes to local industry practices after findings that agent practices of cooperative commission were, in fact, anti-competitive. In mid-April, a proposed settlement of $418 million in the NAR case was announced.

This proposed settlement for NAR and its Realtor members is what most industry watchers refer to as THE settlement, including numerous NAR member brokerages with transaction volume of $2 billion or less in 2022.

Though denying any wrongdoing, the NAR agreed to pay $418 million over four years to settle the Burnett class-action. The proposed NAR Settlement received preliminary court approval on April 24, 2024, with the final approval hearing scheduled to take place on November 26, 2024.

However, this case does not release all real estate agents or all real estate brokerage companies from legal liability, which may allow some cases to continue and others to be filed. Also, the DOJ wild card has yet to be played.

Though not all of the outstanding real estate agent commission and MLS-listing lawsuits have been finalized, some relevant changes are already being made by the NAR, member brokerages, and Realtors in order to comply with the Burnett settlement and DOJ findings.

First and foremost, cooperative commission or the sharing of the commission paid by the seller from the proceeds of the sales price is not

banned. A common myth is that the NAR settlement means sellers will no longer pay for the buyer’s agents.

In fact, this practice can continue if the seller agrees that their selling agent may consider compensation to a buyer’s agent. Notably, no offer to a buyer’s agent can be communicated anywhere within the home listing on the MLS. The NAR and Mortgage Bankers Association (MBA) websites both highlight the removal of cooperative compensation offers from the MLS listing as a major modification. The DOJ just affirmed this position, in late May stating

that offers of agent compensation should not be made anywhere, but certainly not on the MLS.

Another change is that buyer agents will need to enter into an agreement with the potential homebuyer prior to showing them any homes. This agreement must clearly disclose the amount of compensation the buyer’s agent will receive or detail how the amount of compensation will be determined and paid. This will be new for buyers and buyer agents and your customers should not be caught illprepared.

Selling agents must also clearly disclose to sellers, and obtain their seller’s approval for, any payment or offer of payment that could be made to another agent, broker, or representative acting for a buyer. The settlement does not prevent a seller from agreeing to pay a sales concession to pay a buyer’s closing costs, though recent comments by the DOJ raise a question how those might be communicated and if the concession payment can include the cost of the buyer’s agent.

To comply with the proposed settlement, the NAR has instituted both system and policy changes for Realtors and local MLS members to comply with, adopting practices that align with the proposed settlement. To be seen is how agents, real estate companies, local NAR associations, and the MLS can implement and complete these changes by the NAR-imposed deadline of August

Despite everything you read and hear, these settlements are not final, and more twists may come from the DOJ. The NAR proposed settlement does seek a compressed implementation timeline for updating decades-old policies and deeply ingrained industry practices. Those efforts will also likely provide some local fireworks when local MSA and Realtor associations update their systems, bylaws, and implement training for their local real estate agents.

First, the final approval hearing for the NAR Settlement is not scheduled until November 26, 2024. This is a long period

of time for the DOJ to file comments, monitor compliance, and request further modifications.

The hearing could be anti-climactic, when compared to the twists and turns in the journey to the proposed settlement in the first place. However, the DOJ is still reviewing industry practices and has recently commented that they neither support nor oppose the proposed NAR Settlement, and may provide comment on other lawsuits. Considering they already settled once and then appealed and introduced more allegations, there may be a wild card yet to play.

Second, your past customers will not be receiving a windfall to spend over the holidays or on a second home. Like the paltry payouts of many class-action lawsuits, consumers who sold a home during the covered period may be entitled to a payout that has been initially estimated at just $10-$20.

Also, be prepared to educate your buyers on the new reality of buyer agent compensation. Plan for the hard conversation to both inform and prepare your buyers on the cost of their real estate agent before looking for homes. These will not be the easiest of discussions and originators need to stay aware of the latest developments and prepare for how to best train customers from the beginning.

Lastly, there will be sellers who agreed to pay and sellers to outright refuse to pay buyer agents. In either case, counsel your buyers and help them prepare for all possible scenarios, negotiations, and account for contingencies where they may be responsible for paying their agent at closing. And, of course, as you watch the headlines for more twists, turns, and fireworks, beware the misinformation.

A warm welcome to you! I’m Kelly Hendricks, the Managing Editor of Mortgage Women Magazine and Senior Vice President of Delmar Mortgage, and it brings me great joy to extend this invitation to you. Throughout my career in the mortgage industry, I’ve been fortunate to have leaders and mentors who played pivotal roles in shaping my journey. I am thrilled to introduce a transformative initiative – the Mortgage Women Leadership Council, created by Mortgage Women Magazine.

In my role, I’ve experienced the challenges that women face in leadership within the mortgage sector. These challenges led to a profound realization — the need for a dynamic network to empower women in our industry. This realization is the driving force behind the creation of the Mortgage Women Leadership Council. I believe in the power of collective support, and I am excited about the opportunity to share and benefit from each other’s experiences.

Our mission is clear: to promote and empower women’s leadership in the mortgage sector. The council aims to create a supportive environment for professional growth, mentorship, and networking. Joining the

council comes with various benefits, including networking opportunities and access to industry-specific professional development resources. We understand the unique challenges women face in mortgage leadership and have tailored mentorship and support systems to address them.

I invite you to join this movement to empower women in the mortgage industry. The Mortgage Women Leadership Council is committed to fostering a welcoming and supportive environment. Your involvement will not only contribute to your personal and professional growth but also play a crucial role in advancing women’s leadership in our industry. To join or get involved, simply click here to apply.

Thank you for considering this invitation to join the Mortgage Women Leadership Council. For further inquiries about the council and details on how to join, please contact Beverly Bolnick at bbolnick@ambizmedia.com. Let’s work together to advance women’s leadership in the mortgage industry — because collective action brings about meaningful change.

Kelly Hendricks Managing Editor, Mortgage Women Magazine

As a valued member, enjoy these benefits:

Access to a Powerful Platform: Amplify your voice and influence through Mortgage Women Magazine, exclusive sponsored programs, email newsletters, and impactful events.

Editorial Opportunities: Showcase your expertise and insights through editorial features in Mortgage Women Magazine, gaining visibility and recognition among industry peers.

Awards and Recognition: Receive well-deserved recognition through our award programs, celebrating your achievements and contributions to the mortgage industry.

Community Support: Become part of a dedicated community committed to celebrating and driving meaningful progress in the mortgage sector. Connect with likeminded women leaders, share experiences, and foster collaborative initiatives.

Mortgage Women Magazine: Enjoy your complimentary digital subscription to Mortgage Women Magazine, the premier publication for women in mortgage. Read advice, learn about industry updates, and take in the inspiring stories of your peers.

Become a member today.

Join us and be a driving force in creating a more inclusive and thriving mortgage industry. Together, as a united community, we believe we can make real change.

Enjoy 1 year of your individual membership free! Use code MWM2024

mwlcouncil.com

BY ANDREW RHODES , SPECIAL TO MORTGAGE BANKER MAGAZINE

The national shortage in housing inventory has been a constant theme in conversations about housing market troubles over the past couple of years. Supply constraints in conjunction with steady demand have kept property values elevated despite the Federal Reserve’s raising of its benchmark rate in an effort to combat inflation.

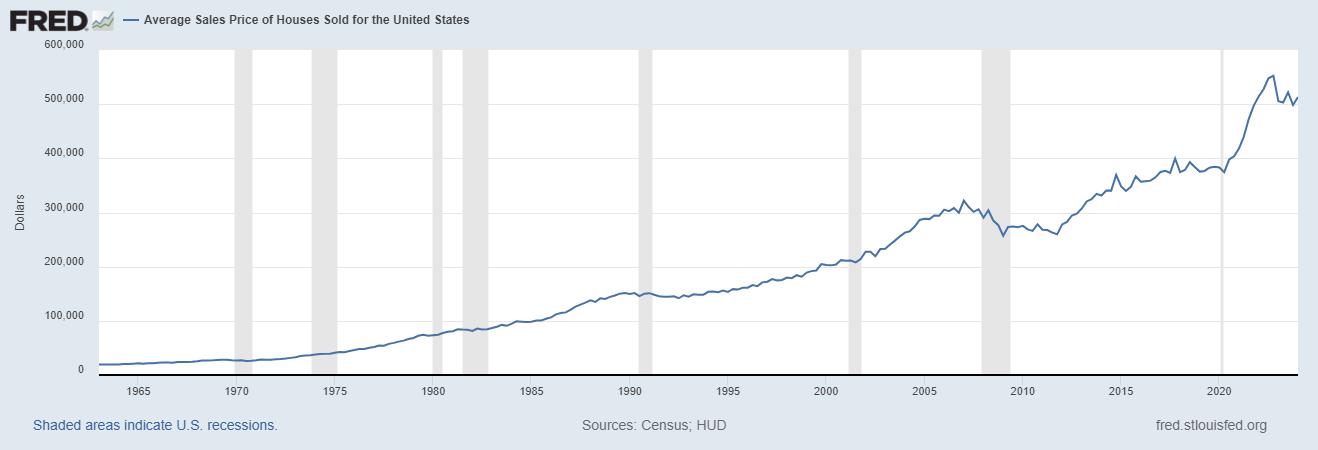

Looking at the average home sales price from the St. Louis FED, prices have declined by roughly 7.5% from highs in the fourth quarter of 2022. Yet this decline follows a substantial ramping up of the average home sales price during the pandemic. Even with this slight contraction, since 2022 homes have overall appreciated in value over the past four quarters. See Figure 1.

Over the past decade builders have often been put in the hot seat for not keeping pace with average development to accommodate population

growth. There are many factors as to why builders have pulled back on development; from postGreat Financial Crisis wariness to labor shortages to the increase in building costs resulting from supply-chain disruptions during the pandemic.

See Figure 2.

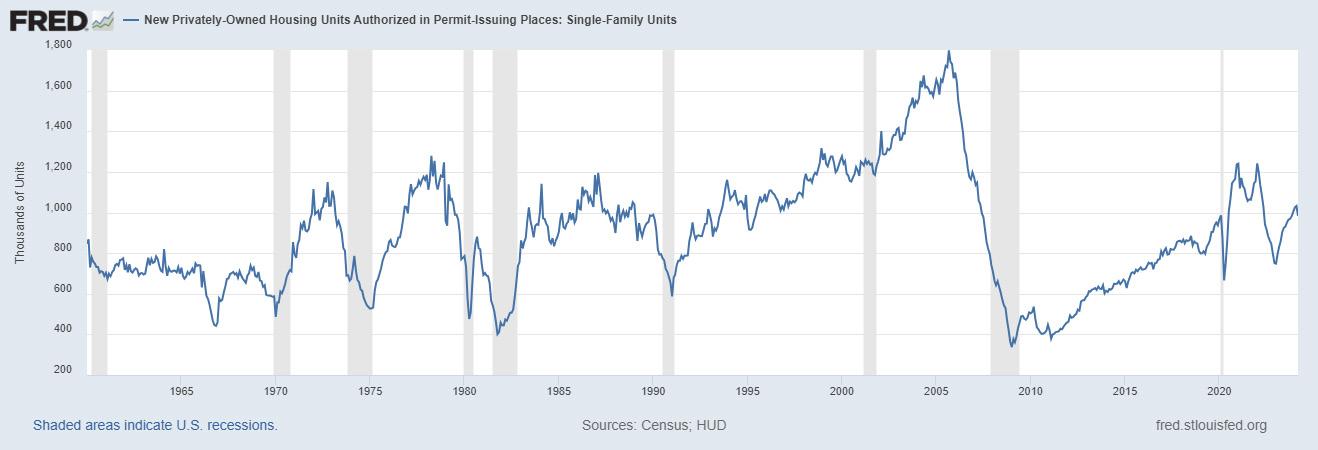

Though down from all-time highs, current inflation trends have still made the construction of new homes very costly. The decrease in overall production is inherently tied to the declining number of permits being issued. Though there has been a steady increase in new construction permits issued since the end of the Great Financial Crisis, the behavior still lags prior growth cycles. The pace of inflation subsiding to the Fed’s 2% goal will hopefully spur development, including an increased issuance of new construction permits.

See Figure 3.

Nevertheless, these trends in housing supply

and demand, average home sales prices, and permit issuance tell a different underlying story–one that gets to the heart of how the housing market operates—that being, why people would want to buy homes in the first place.

The mindset of many homebuyers changed during the pandemic, a time when historically low borrowing costs and a shortage of homes caused a surge with sustained upward pressure in property values and led to more inventory being outright purchased and taken off the market.

Why is this the case more so now than in the past?

Historically low borrowing rates and surging home prices made more buyers focus on equity accumulation and monetization of their properties. Renters who clogged cities moved out to the suburbs during the pandemic for more space, drawing down inventory in those communities.

This brought along with it the motivation for home ownership as a way to build equity. It also meant people who already lived in those communities could buy revenue generating rental properties at a huge discount. See Figure 3.

The ubiquity of rental platforms like AirBnB and VRBO, as well as the development of

FIGURE 3:

NEW PRIVATELY-OWNED HOUSING UNITS AUTHORIZED IN PERMIT-ISSUING PLACES: SINGLE-FAMILY UNITS

property management technology and solutions, have made land-lording much more accessible to a broader set of investors. Low borrowing costs during the pandemic made accessing financing to purchase a first, second, or third rental property much more feasible as well.

Surging home values meant investors could purchase properties not only for their cash flow, but also to capture the equity rapidly accumulating in the home. Housing demand surged for many reasons during the pandemic, but one of the main reasons was that extremely low borrowing costs made investing in real estate as a way to generate

revenue and build equity that much more accessible—and therefore more attractive—to the average mom-and-pop investor.

Data from Harvard University’s Joint Center for Housing Studies show the share of single-family homes purchased by investors averaged a steady 16% from 2017-2019, the three years immediately preceding the pandemic. Investor activity rose quickly in 2021 before peaking at roughly 28% of sales in the first quarter of 2022, remaining relatively high since then.

Recent data from CoreLogic, a data analytics and market intelligence firm, show the share of

FIGURE 4: HOUSING INVENTORY: ACTIVE LISTING COUNT IN THE UNITED STATES

single-family home purchases that were made by investors was 28%, 27.3%, and 28.7% in October, November, and December 2023 respectively— eclipsing the previous all-time high of 28.3% in February 2022. The investor share rising above 30% in 2024 is a distinct possibility.

Mom-and-pop investors—those who own fewer than 10 rental properties—control roughly 80% of the single-family home rental market. These investor-purchasers, whose activity accelerated during the pandemic, are now paying back very low-rate mortgages on rental properties that have largely only continued to rise in value because housing inventory remains so constrained.

Here’s the catch: many other non-investorpurchasers bought or refinanced into super-low mortgages that they do not want to give up. That “lock-in effect,” as it has been called across the industry, could incidentally turn more regular homeowners into single-family rental investors.

Even if mortgage rates drop by 150 basis points, and even if those homeowners would like to move for work, family, or other reasons, homeowners may come to realize that they can continue paying off the low-rate mortgage to keep that home as a single-family rental. Losing those listings would exacerbate the long-standing inventory shortage.

Recent trends in homeownership have significantly reshaped buyers’ mindsets, leading to a reduction in housing inventory. Real estate investment, facilitated by historically low interest rates and the rise of platforms like AirBnB, has helped to drive up property values while transforming homes in the minds of many buyers into revenue-generating assets.

This shift has not only drawn more players into the market, but has also led to a decrease in available inventory for sale as investors and new homeowners alike hold on to their properties

Homeowners may come to realize that they can continue paying off the low-rate mortgage to keep that home as a single-family rental.”

Andrew Rhodes Senior Director, Head of Trading at Mortgage Capital Trading

longer. Looking forward, the key question remains whether adjustments in financial policy and a potential easing of inflation will spur further new construction development, offsetting the loss of inventory to investor-purchasers who make up roughly a quarter of home-buying activity.

As we keep an eye on these evolving trends and await a future interest rate cut from the Federal Reserve, it is crucial for potential buyers, investors, and policymakers to understand the complexities that continue to shape the housing industry. Understanding these dynamics will enable more strategic decision-making in a sector that remains pivotal to economic stability and personal wealth accumulation.

Many of the affordability constraints impacting buyers today are driven by basic supply-anddemand economics. In this low supply environment where borrowing costs are elevated, cash- and equity-rich investors have the upper hand in many transactions, especially against less-well-heeled first-time homebuyers.

CHARLY BATES

Peak Residential Branch Manager

Peak Residential CEO

LISTEN TO THE AUDIO VERSION

COVER STORY

Peak Residential went full-del in less than a year – in the worst market in decades

BY RYAN KINGSLEY , EDITOR , MORTGAGE BANKER MAGAZINE

KKriss Bates has retired twice from the mortgage industry, first in 2018 and then again in 2022. Now back in the mortgage game he blames his son for disrupting the promise of first-light fishing at his lake house and spending more time with his grandkids.

“He’s the guy that came up with this crazy idea,” Kriss says, motioning toward Charly Bates sitting opposite his father in our interview.

Their latest partnership began in November 2022 after the Federal Reserve hiked its benchmark interest rate for the sixth time in eight months, pushing 30-year-fixed mortgage rates above 7% for the first time in 20 years. Monthly existinghome sales had already fallen by more than a third from the prior November.

“He came to me,” Kriss recalls, “and asked, ‘Why don’t we start our own company?’ And I go, ‘Well, you know, I’m retired.’” Still, Kriss thought about it. Then he called John Suggs, a friend and former colleague from Academy Mortgage Corporation.

Suggs knew “the industry was crashing,” he recalls. Then the Executive Vice President of Risk at Loan Simple, Suggs had laid off 25 of the

31 people in his department since the beginning of the year. Having also been laid off twice before in his career, he already had been entertaining a separate opportunity to open a retail shop. That opportunity fell through, however, and Suggs trusted Kriss, believing they would succeed in their partnership.

Nineteen months later, the Yuba City, Californiabased Peak Residential is defying odds during the worst mortgage industry slump in decades.

“As far as the markets go,” said Suggs, “I do believe it was the best time to do it because it’s just like stocks. You buy low and you sell high.”

It helped, too, that Kriss and Charly had been in business together before—long before Charly floated the idea of opening a mortgage company in the worst market in decades. In fact, they first worked together at Jasper’s Giant Hamburgers, a 1950s-style diner that Kriss opened and owned, and Charly managed, back in the 1990s.

Their transition to the mortgage industry was quite accidental. Kriss sold the restaurant in 1997 when an acquaintance who frequented a nearby Saturday night cruise-in offered Kriss a job at PNC Mortgage. Charly went, too.

From Area Manager at American Home Mortgage to District Manager at GMAC Mortgage to Regional Manager, Division Manager, then Vice

President of Production at Academy Mortgage Corporation, Kriss spent the decades spanning 1998 to 2018 climbing ladders up and across the industry. Where Kriss went, Charly opened and managed branches, focusing on operations.

Their final stint together at HomeTown Lenders motivated Kriss into a second (brief) retirement.

“The last two companies we worked for,” he explains, “everything was going great. Then they keep increasing the corporate margins, so the rates in the field get higher and higher. You either have to not do the loan or you take the loan short, so the branch starts losing money.” Charly knew—as Kriss knew, and as the rest of the Bates family knew— they could run a better company by correcting others’ mistakes.

“You can ask people that have been doing loans for 20 years and they still don’t know how things work,” says Branden Bates, Charly’s brother and Peak Residential’s capital markets manager. “We just wanted to try something different.”

“Different” fails to capture the distinct mission upon which the Bates team embarked.

Founded in November 2022—just after that phone call to Suggs—Peak Residential is a fully delegated retail mortgage bank that the Peak team stood up in less than a year. An unheard of accomplishment, as far as they know, no matter the market. Beginning with eight loans in February 2023, the company peaked with about 60 loans in June and July. Now licensed in 16 states, Peak closed $146 million across 408 units last year during the worst market in decades.

Prepping for volume to return in 2024, the partners allotted a year to have full FHA, VA, and USDA approvals in hand. And they did, passing all 15 FHA test cases without issue, a process that is particularly stressful for startup mortgage companies because

each file can trigger an automatic buyback—and an uninsured FHA loan is worth nothing in the secondary market.

Beyond strategy, seed capital, and many sleepless nights, though, opening a fully delegated mortgage bank in less than a year required that thing which cannot be tallied on rate sheets or scorecards— the prevailing belief that only this team could have done what it did.

“There was never a doubt in my mind that this would not succeed because of the men that started it,” says Chrissy Kopp, Peak’s underwriting manager. Having worked with the Bates team for 18 years, she adds, “They don’t know how to fail.”

It is challenging to overstate the amount of industry experience assembled at Peak. But, that

Chrissy, Peak's underwriting manager, has worked with the Bates for 18 years. "There was never a doubt in my mind that this would not succeed because of the men that started it. They don't know how to fail."

Charly invites community members to a monthly foodtruck lunch in the parking lot of Peak Residential. It's the soft politics of building a company with staying power.

concentration of competence powered their rapid development into a fully delegated shop. Much of the team has been working in the mortgage industry for more than 20 years. Most have been working with the Bates team for at least 10. Their operations manager even married in.

“People that we used to work with, they’re seeing our pre-approvals out there and we’re winning the deals,” says Allyson Bates, Branden’s wife, who also manages the company’s credit policy department. “We can take everything that we’ve learned from all of these companies, learned what worked, what didn’t work, and really provide a better option for the loan officers.”

Their timing was not perfect though, Suggs admits. “This year was supposed to be the year that everything rebounded, right?” Volume remains elusive, but the Peak team is not waiting around. They’ve hired loan officers. They just opened a branch in Nevada. They did enough business last year to earn a $10 million warehouse line increase. Investors are calling.

“We’re ready to go now,” Charly says. “We’ve got all our approvals. We have 11 or 12 investors that we sell to, $40 million in lines to fund off of. We’re hedging and selling our loans in the secondary market. We’re ready to get it done.”

Everything has an exception. Everything is not a ‘No,’” says Suggs, Peak’s President, who is based in Scottsdale, Arizona. When he consulted with mortgage start-ups in the past, that was the out-of-the-box advice Suggs gave to clients hitting roadblocks over licenses and approvals. “You got to know how to get around it, and what the requirements are for that as well.”

It’s old advice, really: You have to know the rules before you can break them. But, it makes all the difference when time is of the essence—and time was of the essence for Peak Residential.

“Simply the act of applying with FHA, applying with VA, USDA, all of those government agencies,

every single one of those states, you think you can just go get your mortgage license, but you can’t,” Suggs explains. Each state has its own requirements and approval timeline, and insurance, surety bonds, and registered agents must be addressed. “Most people have never been through that.” Suggs has.

Opening a fully delegated mortgage bank is normally an incremental process. Broker for a year to demonstrate competence and build a book of business. Transition to non-delegated, allowing investors to underwrite, but closing with your own funds. Jumping to delegated means hiring in-house underwriters while still selling to investors. Next stop, hedging. Next stop, selling-direct to Fannie and Freddie. The pinnacle, servicing your own loan portfolio.

“Kriss kind of pushed me,” Suggs says of his business partner who wanted a mortgage company

in one year, not four. “He was like, ‘No, I want to do it all, like all at the same time.’” In Yuba City, located 40 miles north of Sacramento and home to roughly 80,000 residents and half-a-dozen broker shops, the company wanted to be competitive on pricing.

Most of all, though, the partners wanted to be ready for when mortgage volume returned. That required condensing the typical four-year process.

Suggs brings a lifetime of business lessons to the new venture. As chief credit officer for Ford Motor Credit Company in the early 2000s, Suggs was tasked with starting an FDIC-insured bank that would have been called the Ford Credit Bank. The project had been underway for more than three years when the Great Recession struck. Millions of dollars later, the bank plan was iced.

“It was a great, great first lesson,” recalls Suggs,

who served for six years as chief credit and risk officer at Academy Mortgage Corporation following his tenure with Ford, then two years as vice president of process management at V.I.P. Mortgage. In 2019, Suggs was hired by HomeSmart, the largest real estate firm in Arizona, to start a mortgage company. A year later, Minute Mortgage was launched.

Now he applies his acuity to designing strategic shortcuts for Peak.

Approval from the FHA usually takes around four months and requires companies to prove with audited financials that they have a net worth of $1 million. “The first thing that we did,” Suggs says, “is we put a million dollars in the bank in November and we found a CPA firm that would audit that million. There were no expenses, no revenue, no nothing, and we paid them $3,500.”

Most companies are not auditing financials immediately. Instead, they’re putting money

in the bank so they can apply for licenses and pay vendors, only auditing their financials after they’ve actually started doing business. By midDecember, however, Peak had audited financial statements for November. “Even though they’re blank, it didn’t matter,” Suggs says.

The next strategic shortcut was getting the company’s first license in Colorado. “It was the simplest one,” says Kriss. “It took one day to get licensed. That gave us access to Comergence, and to be able to get lines of credit established, aggregators to sell to.” Comergence is an application system that roughly three-quarters of the industry’s investors and bankers use. By getting licensed as quickly as possible, Peak could begin conversations with counterparties while applications in states with longer timelines worked through the process.

Peak Residential’s main market, for example, is California. Even there, Peak was approved in three months, as opposed to the usual six. “Kriss called his politicians,” Suggs says.

Common industry knowledge says it takes two years to get Fannie-Freddie approved, but Freddie can be more lenient. “If you want Freddie,” Suggs says, “you do not need to wait two years. But, you need $3 million in the bank, $3 million in cash, and of course you need a strong résuméd team.” Peak was close to attaining Freddie approval, but fell short as production volume declined—shorting their bank balance—through the late summer and early fall of 2023.

“They wanted to see a little more money in the bank,” Suggs says.

Ask a mortgage broker to unbutton his shirt and you’re likely to read, “Brokers are better,” tattooed over his heart. Charly calls it “the cool tagline that’s out there” while acknowledging that retail shops and brokerages can coexist in the mortgage business. However,

Headquartered at their main branch in Yuba City, Calif., Charly says "a lot of the rhetoric out there right now is that retail lenders are evil because they've inflated margins." Peak's corporate margin on every loan is 50 bps, with an additional $650 corporate fee.

in starting Peak Residential, Kriss and Charly knew they had to differentiate the company from brokers and from traditional retail shops.

Where do most brokers fall short? Customer service. Traditional retail? Competitive rates.

“A lot of the rhetoric out there right now is that retail lenders are evil because they’ve inflated margins,” Charly says. “It’s not all true. There are different companies out there and we’re one of them. We’re trying to provide the service you get from a more traditional retail lender, but with the pricing and control you can get in the broker world. In some aspects it’s almost like we’re hybrid.”

And, the way Kriss and Charly saw it, going fully delegated as quickly as possible was how. “If we’re not delegated,” Kriss explains, “it’s a little better than brokering, but you’re still dealing with underwriters that you have a hard time talking to and discussing things with. They’re adding conditions for feel-good things.” So, they hired two underwriters and two closers who they had worked with for years.

As a start-up shop chasing the best of broker pricing and the best of retail service, Peak Residential takes a “back to basics” approach. The company invested in technology, but not every bell and whistle: Encompass for their loan operating system (LOS), Surefire for customer relationship management (CRM), and LenderLogix for accepting online applications. What else do you really need to originate, Suggs asks? Profitable branches can do their own marketing.

Doing more with less also explains the company’s secondary marketing strategy. Transitioning to capital markets after 23 years as a loan officer has been a dramatic shift for Branden. The company doesn’t have $200,000 to hire a capital markets expert. “We still, obviously, can sell investor-specific in certain scenarios, but ideally you want to see if you can make a little money off your money. That’s essentially what hedging is,” Branden says. “I’m good with numbers. I can learn things online. I can go to these seminars. We can join up with a hedging

“If the markets don’t change, if we don’t grow substantially, then we have some decisions to make about what we want to be. Right now, we want to compete."

JOHN SUGGS Peak Residential President

group. They can teach us things. And that’s what we did.”

Building the capacity within the company even without the loan volume to make much money from hedging prepares Peak for a return in volume while continuing Peak’s growth plans.

“I don’t want to be able to hedge,” Branden continues. “I want to know everything about hedging. I knew everything about loans. My goal is to get the same way about hedging, that way I know that when people are locking loans with me, we’re making more money, not so I can go buy a car, but so I can help them get better rates, so we can help them get better marketing.”

While a down market is possibly the best time to put such plans in motion, it’s also a good time to shop; there’s more room in negotiations when everyone is a little desperate. “When the market’s down,” Suggs says, “we can get a lot of things cheap. We can even get approved. I think it’s a little helpful to get approved by people, your bankers and such, because they’re hurting as well.”

Where larger lenders may chase production over profitability, Kriss believes that companies pushing too hard for growth can let expenses get out of control too quickly. “I was pushed as a regional, as a divisional, and as a VP, to hire people,” he says. “Hire, hire, hire.” At Peak, he wants to hire people who meet the company’s profile. “We’re not going to take risks on people that have bad reputations.”

In a down market, Peak also has an advantage keeping costs under control because the company is building everything from scratch everything but their close-knit team. Without middle management, “fancy corporate headquarters,” leases on under-utilized office space, contracts on under-utilized tech, or teams of staff, Peak hires as needed, leaning on collective experience (hooks lining the wall for the many hats Peak’s employees wear).

To achieve broker-comparable pricing, the corporate margin on every loan is 50 basis points, with an additional $650 corporate fee per loan.

“That takes care of all our corporate employees and it covers the expenses,” Kriss explains. Originators net an average of 150 basis points per loan. The company’s twin paradigms are ratesheet transparency and keeping it lean—the Bates team has been burned by back-office antics too many times to do so themselves.

“Even as VP of production at Academy,” says Kriss, “I couldn’t get a straight answer on what the corporate margins were. I’d ask the head of capital markets, he’d tell me one thing. Head of secondary tells me another thing. The owner of the company would tell me another thing.” At Peak, the Encompass pricing engine is configured to show every margin on every rate. “They’ll see the branch margins, the corporate margins. They’ll see all the investor hits on their loans. If we’re going to mess with margins, they’re going to know right away,” Kriss says.

Lower corporate margins grant branches more operational liquidity. Branch managers are asked to be more entrepreneurial, Charly explains, than perhaps would be expected at a traditional retail company. Branch managers set their own margins, run their own P&Ls, and hire as their markets and margins require and allow.