How a well-intentioned law has become an indefinable nightmare

Nomination Deadline: July 5, 2024

FHFA, the conservator and regulator of Fannie Mae and Freddie Mac, and regulator of the Federal Home Loan Banks, recognizes the emerging and increasing threat to all stakeholders in the housing system due to climate risk and the increased frequency and intensity of major natural disasters. Strong governance is foundational to managing an institution’s risk profile, particularly when the institution must address a constantly evolving landscape of risks. Accordingly, FHFA included the need to identify ways to incorporate climate change into regulated entity governance in its 2022-2026 Strategic Plan. Since 2022, FHFA has established goals for Fannie Mae and Freddie Mac to develop company-wide frameworks that incorporate climate risk into existing governance and risk management structures and decision-making, and to incorporate both short- and long-term strategies into their strategic planning processes.

FHFA established an internal Climate Change and ESG Governance Working Group to evaluate the integration of climate risk into the corporate governance, risk management, and strategic planning structures of the regulated entities, and incorporation into operational and business decision-making. The Working Group meets regularly with the Enterprises and evaluates their progress through the annual Conservatorship Scorecard process, reviewing the establishment of foundational governance structures, decision-making processes, and risk management practices around climate risk. The Working Group also reviews progress made by the FHLBs.

• The Enterprises have developed initial climate risk frameworks that are incorporated in their enterprise risk management frameworks in consideration of the impact that climate change could have on the achievement of their mission, strategy, and business objectives.

• The Enterprises continue to make progress and develop their capacity to measure the effects of climate risks and integrate climaterelated risks into risk management structures:

- Freddie Mac has developed climate scenario methodologies to better quantify the impact of climate events on housing affordability, property values, and credit risk;

- Fannie Mae is working on finalizing climate scenario design and methodology for intended reporting in 2024; and

- Both Enterprises completed exploratory climate scenario analysis exercises on flood risk in 2023.

• To assess and address climaterelated risks and opportunities that could affect their businesses, the

Enterprises have been incorporating climate issues into their corporate strategic plans and planning processes.

• Each Enterprise has completed ESG materiality assessments that inform their ESG and climate strategic planning processes.

• Fannie Mae’s 2023-2025 Strategic Plan includes climate risk management and supporting the housing ecosystem’s adaptation to climate change as priorities.

• The board Risk Policy and Capital Committee has primary oversight of climate-related risks.

• The board Audit Committee provides oversight of ESG-related reporting, which includes climate risk.

• The board Community Responsibility and Sustainability Committee oversees the development and implementation of Fannie Mae’s climate risk strategy.

• There is a newly established Climate Risk Committee at the management level, and Fannie Mae has designated senior executive officers to oversee climate and ESG.

• The board Risk Committee has primary oversight of climate related risks.

• The board Audit Committee provides oversight of ESG-related reporting, which includes climate risk.

• The board Mission and Housing Sustainability Committee provides oversight responsibilities for the development, planning, implementation, performance, and execution of Freddie Mac’s mission strategies and significant initiatives, including the review of sustainability initiatives with climate change implications or impacts.

• reddie Mac has also established several advisory and steering committees at the management level for ESG and climate risk reporting.

Over the last few years, the Enterprises have begun educating staff on the potential impacts of climate-related risks, taking into consideration the interconnectedness and multidimensional nature of climate-related topics that could reach all aspects of the organization.

STAFF

Vincent M. Valvo CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Ryan Kingsley EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki STAFF WRITERS

Alison Valvo DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins, Krystina Coffey MULTIMEDIA SPECIALIST

Alan Nero MEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin

ADVERTISING ASSOCIATE

Lydia Griffin

MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com Submit your news to editors@ambizmedia.com, www.ambizmedia.com

© 2024 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher.

Advertising, editorial and production inquiries should be directed to: American Business Media LLC, 88 Hopmeadow St., Simsbury, CT 06089, Phone: (860) 719-1991, info@ambizmedia.com

58

Meet the trailblazers, visionaries, and legends who are redefining excellence and transforming the mortgage industry.

DON’T OVERLOOK THE OBVIOUS –EMPLOYEES HAVE IDEAS FOR COST SAVINGS, TOO

BY ROB CHRISMAN , CONTRIBUTING WRITER, MORTGAGE BANKER MAGAZINE

Rob Chrisman has been in mortgage banking since 1985 and publishes a widely read daily market commentary on current mortgage events.

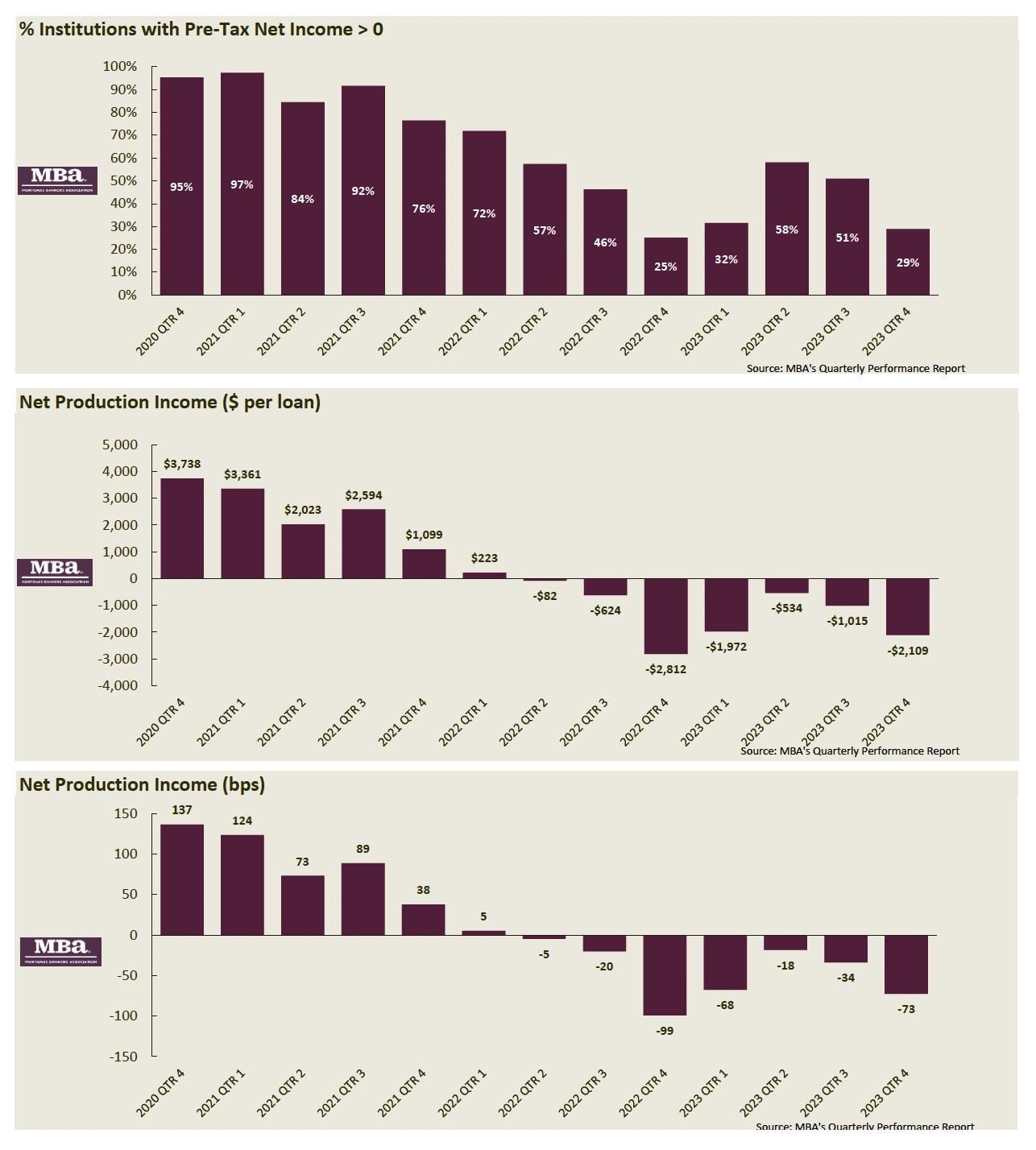

When conducting business reviews, lenders must take into account the huge increase in costs which the Mortgage Bankers Association (MBA) pegged at more than $12,000 per loan in the fourth quarter of 2023. These costs have been thrown into sharper focus with the MBA also reporting that the average pre-tax net production loss was 73 basis points (bps) in the fourth quarter – $2,109 on each loan originated – more than double the average net production loss of 34 bps in the third quarter.

Taking the long view, the average quarterly pre-tax production profit, from the fourth quarter of 2008 to the most recent quarter, is 43 basis points, according to the MBA.

These costs are varied and rising, and impact lenders of every size, from guarantee fees imposed by Fannie Mae and Freddie Mac to compliance, servicing, foreclosure, and buy-back reserve costs. These costs have to be covered by the current fundings and erode the margin and the spread. Some companies’ books of business shape whether they have more or less cost. For example, jumbo and other non-QM loans are not subject to the enterprises’ guarantee fees.

In 2024, lenders have flipped every office couch cushion in case there’s a nickel to be found. Now what? How can different lenders save money in this high cost, low profit environment?

To start, senior management should solicit ideas from employees. Occam’s razor: the best ideas are often the simplest. Hold an “Efficiency Meeting” that includes a round-table discussion covering ideas submitted by employees about how to make their departments more efficient. An initial meeting could be held with no managers involved. Cost savings may not spring from these meetings, but asking employees to engage in cost

considerations helps to demystify these kinds of “back-office” topics.

Loan officers and departments that want to spend money should be required to draft a proposal/ROI for evaluation by management. Custom marketing costs should be given a hard look, as well as comparing marketing pieces to how many loans that marketing produces. Review job ads that can be canceled and any “premium” accounts not being used. Office spaces can be shrunk and shared.

Bringing employees into the cost-management conversation also builds awareness about employees’ strengths and weaknesses, leading to opportunities to increase productivity, thereby increasing the cost-effectiveness of the people already on payroll.

For example, skill-set cross-training can prioritize coverage and empower team members to play to their strengths, while building other proficiencies. Are you minimizing file touches, such as the number of times income is being calculated? Using cheaper resources for parts of the file and re-allocating duties from underwriters to less expensive personnel can effectively trim costs if skill sets have been crosstrained. Without training, these cost-saving measures can increase quality and compliance risks.

Skill-set cross-training goes hand-in-hand with assessing aspects of the loan process that can be streamlined or otherwise made more cost-effective.

For example, credit-pull costs rose dramatically in 2023 and the first quarter of 2024. Processors and loan officers are encouraged to do soft credit pulls first, at a huge cost savings (although the cost of soft pulls has also risen). If one score is below a certain level, stop there. Save the money. As an added bonus, soft credit pulls don’t trigger the credit

bureau selling your lead to another mortgage provider.

Lenders are advised to analyze post-closing conditions and adjust shipping to minimize paying warehouse line fees. Reducing shipping delays helps reduce the cost of warehouse lines. Some lenders automate the conditions’ import from investors into the LOS.

Tolerance cures are another specific area of examination for some lenders when it comes to reviewing the cost of the loan process. Where are these coming from? Why did they happen? How much are they costing? Lenders can create business rules to avoid generating tolerance cures in the first place.

Vendor management is another key area to assess for potential savings, given how much money lenders

loans, if they have the appetite. High balance loan production pricing can be encouraged; negotiations with investors can yield better pricing. Warehouse lines should be scrutinized for savings, as many banks are hungry for business. Run a dual AUS with DU and LP before executing the loan sale in order to maximize options and pricing.

Cost savings can also be found as premium pricing returns to rate sheets, like lenders paying closing costs in exchange for a higher mortgage rate. For example, on a $180,000 loan, a 25-basis point increase on the mortgage rate only adds $25 to a borrower’s monthly mortgage payment. Borrowers may find that an attractive tradeoff to not have to pay upfront closing costs. Lenders can frequently recoup the

“If trained and compliant loan officers add value by educating and coaching their clients, the same is required of effective managers. Manage costs like it’s 2024.”

> ROB CHRISMAN

spend on vendors monthly. Ask your teams: Which vendors truly trim costs and make loan processing more efficient without sacrificing quality and compliance standards?

Automating various loan processes can eliminate the need for certain vendors, lowering overhead costs, especially for CRMs. Some lenders are adopting backoffice software to increase the cost effectiveness of human resource, information technology (IT), and administrative teams, as well as things like travel requests and booking.

In capital markets departments, there are renewed efforts to wring every penny out of loan sales.

Take advantage of CRA credits. The use of bid tapes is encouraged; after getting bid tapes, ask investors in 2nd or 3rd place to step up 4-6 basis points on the

cost immediately by delivering the loan into a higher coupon.

The extreme turbulence in residential mortgage lending from 2020 to 2024 has impacted every industry stakeholder. Changes in the business climate and rate cycle are never easy. If trained and compliant loan officers add value by educating and coaching their clients, the same is required of effective managers. Manage like it’s 2024. Lenders can adopt the technologies that fit the specific needs of their companies, “stepping up their game” with improved efficiency, lower costs, and redirected marketing budgets. Empower, don’t baby-sit employees, which shifts their mindset toward customer service in a purchase environment, adding value for lenders with competitive pricing.

Welcome to The Greatest Mortgage Conference In The Known Universe.

The Originator Connect Conference is the nation’s largest gathering of mortgage professionals, and it returns to Planet Hollywood in Las Vegas this August 15-18 for another fantastic, session-packed event.

Originators attend for FREE using code MBMFREE.

TITLE SPONSOR

FRIDAY NIGHT RECEPTION

NAVIGATING DEFAULT RISK

AMID CLIMATE-DRIVEN DISASTERS

BY JANE MASON SPECIAL TO MORTGAGE BANKER MAGAZINE

Jane Mason is CEO and Founder of Clarifire

Jane Mason is CEO and Founder of Clarifire

The housing market has a natural ebb and flow. Occasionally, however, circumstances spin out of control causing a major market downturn. This occurred in the mid-2000s, and at some point it will undoubtedly happen again. Next time the underlying factors may be far less under control.

Natural disasters are taking a significant toll on the housing industry, and the impacts extend far beyond the number of homes and lives they destroy. Fortunately, there are practical steps servicers can take to weatherproof their operations, helping to keep as many borrowers in their homes as possible while managing the operational costs and complexities.

The first step is understanding what we’re up against.

Over the past several years, natural disasters ranging from wildfires and hurricanes to tornadoes and floods have been increasing in frequency and severity. Unlike economic shifts or downturns in the housing market, which can be somewhat anticipated, most of these catastrophes—like the COVID-19 pandemic—strike with little or no warning. Their impact is often devastating.

The U.S. experienced 28 weatherrelated disasters in 2023 that caused at least $1 billion in damage, according to the National Oceanic and Atmospheric Administration (NOAA). More than 2.5 million Americans were forced from their homes as a result of these storms, with more than one third displaced for longer than a month. Florida, Texas, California, and Louisiana were

among the hardest hit states. Each saw hundreds of thousands of residents fleeing their homes.

Each year that passes the risk from natural disasters looms larger than the last. According to Realtor.com’s recent Housing and Climate Risk Report, nearly 45% of U.S. homes will be at risk from flooding, wind events, wildfire, extreme heat, and poor air quality in 2024. For servicers, a single disaster can trigger a deluge of requests from affected homeowners seeking relief and support. However, very few servicers are prepared to allocate resources quickly and effectively, let alone prepared to handle a deluge of requests for assistance promptly and compassionately.

While the operational risks for mortgage servicers seem obvious, the spike in weather-related events is happening at a particularly precarious time.

“Very few servicers are prepared to allocate resources quickly and effectively, let alone prepared to handle a deluge of requests for assistance promptly and compassionately.”

>JANE MASON, CEO of Clarifire

$99 Billion

Amount insurance companies paid out in claims in 2022

Over the past several months, servicers have experienced a noticeable uptick in defaults and foreclosures due in part to the ending of pandemic-related relief programs, rising interest rates, and lingering inflation. According to the Mortgage Banking Association’s (MBA) most recent National Delinquency Survey, the delinquency rate rose 26 basis points between the third and fourth quarters of 2023. The FHA delinquency rate increased by a concerning 131 basis points.

Though these rates remain relatively low, the figures suggest many first-time homebuyers are having trouble meeting their mortgage obligations while dealing with rising debt and a steady increase in the cost of living – and there’s another trend in the numbers that’s equally troubling.

The growing number of fires, hurricanes, and floods aren’t just hurting homeowners who find themselves – and their homes – directly in disaster’s path. Increasing damage from disasters causes a cascading effect on all homeowners in the form of rising insurance premiums.

As a result, almost every borrower is facing significantly higher monthly mortgage payments, which is likely to push default rates even higher.

In 2022, insurance companies paid out $99 billion in claims related to natural disasters that occurred in 2022, according to a study by Policygenius, an online insurance marketplace. The study also found that insurance premiums rose by an average of 21% from between mid-2022 and mid-2023, compared to a 12% increase during the prior year. In some states, rates increased as much as 35% annually. According to some reports, homeowners have seen tax and insurance costs eclipse the principal and interest portion of their mortgage payment.

Some insurers have stopped writing new policies in states like Florida and California that have been among the hardest hit by disasters.

While those states’ regulators are taking action to keep insurance options open to homeowners, this trend signals a paradigm shift in the housing market that carries significant implications for mortgage servicers. Though, for now, climate change cannot be halted, the growing impact on homeowners and servicers can be mitigated.

For servicers, acknowledging the evolving dynamics of extreme weather includes expecting the unexpected. However, it’s equally important to adopt technologies, new processes, and new mentalities that enhance operational capacity to handle loss mitigation and workout assistance that supports borrowers through financial hardships and disaster-related disruptions.

The first step is optimizing self-service and frontline loss mitigation processes. This

could begin with a thorough review of current policies, restructuring them where necessary to ensure borrowers receive relief options in a timely manner. For most servicers, the key to restructuring lies in workflow automation, rapid accessibility, and technology-powered results.

Today’s automated workflow technology enables lenders and servicers to expedite data collection, verification, and processing so they can respond to borrowers’ needs with greater speed and flexibility. These technologies arm organizations with an assortment of processes that enable them to address the unpredictable— whether a severe weather event or the need to implement ever-changing loss mitigation regulations and guidelines.

Automating routine tasks and leveraging document generation, OCR/AI advancements, case management, and mobile borrower interactions also enhances bulk processing of like

requests and the identification of complexities, which not only reduces costs but minimizes errors, shortcuts, and workarounds that arise during disasters and periods of rising defaults.

Adopting these efficiencies enables servicers to more rapidly identify borrowers affected by natural disasters, facilitating engagement with borrowers and thereby expediting workout processes, helping to manage spikes in defaults. Coupled with system- and human-generated communications that provide borrowers with education and solutions, automated workflows empower servicers to better allocate their human resources for exceptional problem solving and personalized assistance where most needed.

Restructuring creates clear benefits to borrowers, such as the ability to leverage user-

friendly online portals for submitting and tracking the status of their requests and guided processes for what “next steps” may be. Creating transparency between borrowers and servicers becomes more important as the likelihood of financial hardship for borrowers grows.

Flexibility is part-and-parcel of what a servicer’s “preparedness” requires now. Flexibility and automation are not mutually exclusive. We can do very little to interrupt the surge in extreme weather-related disasters and their direct and indirect impacts, but servicers are uniquely positioned to mitigate the financial aftershocks and the growing risk of default that follows. The resilience borrowers and lenders need hinges on servicers’ ability to adapt to the unexpected.

Picture this: You arrive at the historic French Quarter of New Orleans, the scent of beignets and freshly brewed coffee mingles with the soulful melodies of jazz drifting from nearby clubs. Your excitement grows as you approach your destination, the iconic Hotel Monteleone.

Nestled in the heart of the French Quarter, the Hotel Monteleone stands as a timeless symbol of elegance and Southern hospitality. Its grand facade, adorned with wrought-iron balconies and lush greenery, exudes old-world charm and allure. As you

pull up to the entrance, you are greeted by the sight of uniformed bellmen bustling about, ready to assist with luggage and offer warm smiles of welcome.

Stepping into the lobby, you’re enveloped in a sense of luxury and history. The opulent decor, with its marble floors, crystal chandeliers, and rich mahogany furnishings, harkens back to a bygone era of glamour and sophistication. Yet, amidst the grandeur, there is an unmistakable sense of warmth and intimacy, as if each guest is being welcomed into the embrace of a dear friend.

As you ascend the grand staircase, you are struck by the buzz of energy that permeates the air. The sound of lively conversation and the clinking of glasses fills the hallway, mingling with the faint strains of jazz music drifting up from the lobby below. Arriving at the conference area, you are greeted by the sight of attendees from all corners of the mortgage industry, engaged in animated discussions and networking opportunities.

The expo hall itself is a bustling hive of activity, with rows of booths showcasing the latest innovations and services in the mortgage industry. From technology solutions to compliance resources, the array of offerings is vast and impressive. The traveler eagerly immerses themselves in the exhibits, eager to glean insights and make valuable connections with fellow professionals.

Throughout the day, you attend informative workshops and panel discussions, gaining valuable knowledge and industry insights from leading experts in the field. You take diligent notes, exchanging ideas with colleagues and forging new connections that will prove invaluable in your professional endeavors.

As the day draws to a close, you reflect on the wealth of information you have acquired and the connections you have made. With a sense of fulfillment and anticipation for the days ahead, you make your way back to your room at the Hotel Monteleone, grateful for the opportunity to participate in such a dynamic and enriching event in the vibrant city of New Orleans.

The Ultimate Mortgage Expo is a two-day event for the Gulf Coast Region’s mortgage professionals. Since 2013, the Ultimate Mortgage Expo has been providing unique opportunities for brokers, originators, and support staff to build their businesses. This year, we’ve expanded the event, with even more sessions on Wednesday, July 10, plus another incredible networking party. The cherry on top is that all of this is free for attendees, thanks to supporters of the show, who you can meet in the exhibit hall on both Wednesday and Thursday. Just use our code OCNFREE on your registration.

An increasing number of mortgage originators are receiving urgent calls from their borrowers who recently applied for a mortgage. Most originators have been there before.

After courting your borrowers for weeks – sometimes months – gaining their trust and confidence to secure their application, borrowers call in a panic demanding to know why they are suddenly getting dozens, or sometimes hundreds of unsolicited phone calls.

“Did your company sell my data?” they ask. “Make the calls STOP,” they demand. Originators begin asking themselves, future referrals at risk, “Why does this happen to all my best customers?”

Welcome to the world of “trigger leads.”

A trigger lead is created when a lender pulls a borrower’s credit report through a “hard” inquiry. Unlike “soft” credit pulls used for prequalification, hard inquiries create a data sales opportunity for the three major credit bureaus: TransUnion, Equifax and Experian. As a formal indication that a borrower has applied for a mortgage, the inquiry is saleable as a lead to lenders and data brokers.

The credit inquiry triggers the sale of the lead, which triggers the incessant outreach to borrowers.

Some lenders purchase data with defined qualification criteria;

they only want leads for borrowers who meet prescribed marketing and credit standards. Other lenders and/or servicers purchase triggerlead data to monitor the mortgage application activity of their current client base as a method of protecting their servicing pipeline. Data brokers aggregate and sell batches of lead data.

Because there is no limit to the number of times a trigger lead can be sold, borrowers can be inundated with calls from competitors vying for their business. Inevitably, and understandably, this leads to consumer frustration and potential pipeline risk for lenders and servicers. Not only are the incessant calls, texts, and emails intrusive, tainting borrowers’ relationships with originators and lenders, but they can overwhelm or mislead borrowers inclined to second-guess their borrowing decisions.

the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) endorse this competition as a means of potentially saving consumers money by increasing consumers’ access to more financing options.

“

“Not only are the incessant calls, texts, and emails intrusive, tainting borrowers’ relationships with originators and lenders, but they can overwhelm or mislead borrowers inclined to second-guess their borrowing decisions.”

Though trigger-lead data offers lenders a valid and valuable marketing strategy, when cold-calling borrowers, some lenders fall short of making the “firm offer of credit” to the consumer as outlined and required under the Fair Credit Reporting Act (FCRA). Many neglect to check the do-not-call registry, violating borrowers’ stated preferences. Complaints have been reported of callers misrepresenting their rates or even fraudulently posing as the original lender “just following up on their current application.”

> BOB NIEMI

It should be noted, triggerlead sales are neither new nor unique to the mortgage industry. The sale of consumer data generated from credit report inquiries is used as a lead generation and marketing tool for credit card card and auto loan issuers, as well as insurance carriers. Since interest rates began to rise, though, the impact of trigger leads on the mortgage industry has gained attention and controversy.

No matter your stance on whether trigger leads help or harm consumers, or increase lenders’ pipeline risks, regulators have begun to take critical actions that limit how trigger-lead data can be used.

Trigger leads are, in fact, legal. For many mortgage lenders they represent basic competition and comprise a significant portion of their lead generation strategy. Both

In December 2023, the Federal Communications Commission (FCC) finalized a rule that closed the lead generator loophole. Under the new rule, lead generators must obtain the consumer’s consent for each entity that their data will be sold to. Previously, a consumer’s blanket consent allowed the lead generator to sell the trigger-lead data to as many buyers as they could. This change grants consumers more control over their data, but threatens those who rely heavily on trigger-lead data for loan leads. The FCC will also have the ability to ‘red-

flag’ certain phone numbers and require mobile carriers to block texts from flagged numbers. The new rule also clarifies that do-not-call protections apply to text messages, as well as phone calls. These changes, however, will not take effect until January 2025.

As trigger leads currently can’t be prevented, educating borrowers early and often is imperative to heading off their harmful consequences. Warning borrowers to expect phone calls, and ensuring they understand the solicitations are not originators’ or lenders’ fault, can help prevent pipeline risk.

Should borrowers choose to take or respond to an unsolicited call, advise them to do so with caution, applying appropriate due diligence to any offers provided or requests for documentation. Lenders or originators early in the prequalification process with a borrower can educate their borrower on the protections that do exist, such as opting out of prescreen marketing at OptOutPreScreen.com or by registering at DoNotCall.gov to avoid the deluge

of trigger lead-generated phone calls. Such efforts may require repeated reminders, making it advisable to incorporate these practices early in a borrower’s prequalification process.

Lenders and originators who support triggerlead reform can take action by co-sponsoring active trigger lead legislation. House Resolution 7297 in Congress and Senate Bill 3502 in the Senate, otherwise known as the Homebuyers Privacy Protection Act, proposes to eliminate trigger lead abuses while still allowing prescreened reports within appropriate and limited circumstances.

Specifically, the bill would limit the sale of trigger leads to a third party to when:

• The consumer has specifically authorized the solicitation,

• The lead is sold to the consumer’s current mortgage servicer,

• The lead is sold to the consumer’s current bank, credit union or savings institution,

• The third-party lender originated the consumer’s current mortgage, including a mortgage broker, mortgage banker, or lender.

A warm welcome to you! I’m Kelly Hendricks, the Managing Editor of Mortgage Women Magazine and Senior Vice President of Delmar Mortgage, and it brings me great joy to extend this invitation to you. Throughout my career in the mortgage industry, I’ve been fortunate to have leaders and mentors who played pivotal roles in shaping my journey. I am thrilled to introduce a transformative initiative – the Mortgage Women Leadership Council, created by Mortgage Women Magazine.

In my role, I’ve experienced the challenges that women face in leadership within the mortgage sector. These challenges led to a profound realization — the need for a dynamic network to empower women in our industry. This realization is the driving force behind the creation of the Mortgage Women Leadership Council. I believe in the power of collective support, and I am excited about the opportunity to share and benefit from each other’s experiences.

Our mission is clear: to promote and empower women’s leadership in the mortgage sector. The council aims to create a supportive environment for professional growth, mentorship, and networking. Joining the

council comes with various benefits, including networking opportunities and access to industry-specific professional development resources. We understand the unique challenges women face in mortgage leadership and have tailored mentorship and support systems to address them.

I invite you to join this movement to empower women in the mortgage industry. The Mortgage Women Leadership Council is committed to fostering a welcoming and supportive environment. Your involvement will not only contribute to your personal and professional growth but also play a crucial role in advancing women’s leadership in our industry. To join or get involved, simply click here to apply.

Thank you for considering this invitation to join the Mortgage Women Leadership Council. For further inquiries about the council and details on how to join, please contact Beverly Bolnick at bbolnick@ambizmedia.com. Let’s work together to advance women’s leadership in the mortgage industry — because collective action brings about meaningful change.

Kelly Hendricks Managing Editor, Mortgage Women Magazine

Kelly Hendricks Managing Editor, Mortgage Women Magazine

As a valued member, enjoy these benefits:

Access to a Powerful Platform: Amplify your voice and influence through Mortgage Women Magazine, exclusive sponsored programs, email newsletters, and impactful events.

Editorial Opportunities: Showcase your expertise and insights through editorial features in Mortgage Women Magazine, gaining visibility and recognition among industry peers.

Awards and Recognition: Receive well-deserved recognition through our award programs, celebrating your achievements and contributions to the mortgage industry.

Community Support: Become part of a dedicated community committed to celebrating and driving meaningful progress in the mortgage sector. Connect with likeminded women leaders, share experiences, and foster collaborative initiatives.

Mortgage Women Magazine: Enjoy your complimentary digital subscription to Mortgage Women Magazine, the premier publication for women in mortgage. Read advice, learn about industry updates, and take in the inspiring stories of your peers.

Become a member today.

Join us and be a driving force in creating a more inclusive and thriving mortgage industry. Together, as a united community, we believe we can make real change.

Enjoy 1 year of your individual membership free! Use code MWM2024

mwlcouncil.com

Homeowners want to age-in-place. Know the loans that help it happen.BY ERICA DRZEWIECKI , STAFF WRITER FOR MORTGAGE BANKER MAGAZINE

Ever run to open the front door and miss the step down from the kitchen into the living room? Someone in their 70s or 80s could break a hip – or worse – doing that.

Decreased depth perception, muscle mass, and bone density can make normal life around the house potentially more perilous as people age. Despite the hazards, the majority of people nearing retirement age would rather grow old in their own homes than downsize or move into an assisted living facility.

Nearly 80% of baby boomers – those born between 1946 and 1964 – own their homes outright, and the bulk of boomers are still in their 60s, according to Redfin, a digital real estate brokerage. As of August 2023, boomers held approximately $18 trillion in collective home equity, or roughly half the nation’s total housing wealth. Boomers are also much less

likely to have credit card debt or car loans.

Elevated interest rates and high home prices mean this group of empty-nesters are not incentivized to sell their homes and downsize, but rather use their strong financial position to make their homes more appropriately livable as they age. Home renovations and repairs can increase safety and ease mobility, while adding value to the home. Expanding showers, installing handicapped ramps or elevators, and fixing staircases are just a few examples.

A suite of loan products, from 203(k) renovation loans backed by the Federal Housing Administration (FHA) and the U.S. Department of Agriculture’s Sec. 504 Home Repair Program, to reverse mortgages and home equity lines of credit (HELOCs), provide an opportunity for lenders to help older borrowers finance their dreams of –well, continued homeownership.

However, only a select few mortgage professionals are skilled at uniting folks in their golden years with the unique solutions they seek.

Market research firm Morning Consult found that 55% of baby boomers plan to remain in their existing homes as they age, but just 24% are actually preparing those homes for aging.

Furthermore, the older population is also slated to expand; the U.S. Census Bureau indicates that the 60-plus crowd will represent 32% of the total adult population in the next 10 years.

“I think right now you have a major opportunity for renovation loans to continue to grow over the next decade,” says Jeff Onofrio, SVP of renovation and construction lending and originating branch manager of the Onofrio Mortgage Group in Marlton, New Jersey. His company specializes in FHA’s 203(k) and Fannie Mae’s HomeStyle loans, helping borrowers to modernize their homes using future equity.

“A lot of people don’t know these programs exist,” Onofrio says. “Every situation is different. If they’re buying a property and planning to make that their aging-in-place home, it makes potential sense for them to buy the home using a renovation loan.”

That way, he adds, buyers have a budget to make desired improvements before they settle into their new home. “Somebody

moving into a 55-and-older community and they want to customize it their way, that could be a great option for them.”

Typically a bank will value a home based on the present market, but with renovation loans, appraisers wear rose-colored glasses.

“One of the key benefits is that we go off of future value – what the senior is going to do with their loan,” Onofrio explains. “As people get older and they’ve been in that home for 10, 20, 30 years…it becomes in disarray. The opportunity for them to have the work they need projected off the value of the updated home can be a really good opportunity.”

The down payment can be as little as 3.5% for the FHA renovation loan and 5% with the HomeStyle program. The Federal Home Loan Banks and government-sponsored enterprises provide consultants to oversee home projects, which can be helpful for people that don’t know the first thing about knocking down walls.

“We have a HUD consultant who’s going to be the eyes and ears for the Baby Boomer,” Onofrio says. “If they’re not a contractor by trade, it’s good to have somebody there who’s going to be involved and who’s going to have their best interest in mind.”

Seniors 62 and older who qualify for reverse mortgages (in some states, it’s age 55) can make improvements to their homes with equity they’ve built up, remaining in those homes until they die with no financial obligation to anyone all the while.

It might come as a surprise, then, to learn that there are currently only about 200 Certified Reverse Mortgage Professionals

“I think right now you have a major opportunity for renovation loans to continue to grow over the next decade.”

> Jeff OnofrioSenior Vice President Onofrio Mortgage Group

(CRMP) in the U.S.

“The way I think about it is on a regular mortgage, you put your money in through the bank window, the window closes and says, thanks. It doesn’t open back up. You can’t reach back in and get it unless you refinance somehow or maybe sell the home. But in reverse mortgages, that window stays open,” says Christina Harmes Hika, CRMP and president of Reverse Loan Solutions, a division of Amerifund Home Loans.

She hosts a reverse mortgage mastery course every Wednesday from her home base in San Diego, educating loan officers on the intricacies of reverse mortgage loans. “It’s a really complex product,” she says. “There’s no DU system you can run the numbers through and have it tell you ‘all looks good’. It takes a little extra work, a little extra know-how.”

Reverse mortgages only apply to primary residences, so potential borrowers must certify that they live in the mortgaged property for more than half the year.

“This is much more of a retirement planning tool than any other mortgage,” Harmes Hika says. “It’s not intended for people to be able to rent out a property that they’re not living in. It’s intended for seniors to be able to stay in their homes long-term.”

But, the reverse mortgage isn’t for everyone, even if they meet the minimum age and primary residence requirements. Some people don’t have enough equity to borrow against, for example.

“There are people I tell today, ‘I’m so sorry, but this is not a financiallysustainable solution. You probably need to downsize.’ And they didn’t use to do that. They used to just get

“I think in the future we’re gonna see people suing their financial planner because they didn’t bring up the reverse mortgage.”

them into a reverse mortgage because they could,” Harmes Hika says. “Now we have to income- and credit-qualify. And they have to go to a third party, HUD-approved counseling session.”

If a life event caused a potential client to fall delinquent on a bill, that will show up on the now-mandatory financial assessment. Lenders must ensure the person has enough residual income to continue paying their taxes, insurance, utilities, and related costs.

If there are unpaid property taxes or insurance charges, the lender can enforce a Life Expectancy Set-Aside (LESA), withholding a pool of funds from the client’s total available reverse mortgage proceeds to pay for these throughout the estimated life

Borrowers who can benefit from reverse mortgages often don’t know they exist or that they qualify. Sometimes they have been warned against predatory reverse mortgage

“People think that the bank’s going to take

“They have all this equity, so why not use that to help them stay in their house?”

Cicely Carda, LO Amerifund Home Loans

their home, or that they’re selling it somehow –they’re not,” Harmes Hika says. “It’s a mortgage just like any other mortgage, which is a lien on title. The difference is there’s no required monthly mortgage payment. So it gives you a lot of flexibility. And because the home appreciates, they will still have more equity in the future.”

Even if they live to be 120, the line of credit from the reverse mortgage cannot be frozen, she adds. “For a retired person on a fixed income, that could mean the difference between getting groceries that week or not. This is a highly misunderstood, but really amazing product when you find the situations it fits for. And it fits for a whole lot more situations than people think it does.”

mortgage, I’m gonna sue you.’ So they put a law in place saying don’t talk about it at all. That law’s been lifted because it’s a really needed thing. I think in the future we’re gonna see people suing their financial planner because they didn’t bring up the reverse mortgage.”

Perhaps the most significant change was the addition of insurance protection to FHA’s Home Equity Conversion Mortgage (HECM). This protection ensures a borrower won’t lose their house in case of unforeseen circumstances. The most widely-used type of reverse mortgage, HECMs require a full appraisal, no waivers allowed.

“If for some reason we have a 2008 market again, where everybody owes way more than their house is worth, FHA steps in.”

> Cicely Carda Loan Officer Amerifund Home Loans

Many older borrowers have misconceptions about reverse mortgages that predate consumer protections put in place over the past decade.

“Prior to 2011, financial planners were not allowed to talk about reverse mortgages,” says Harmes Hika. “It meets a lot of needs, but they weren’t paid on it, so there was no protection for the risk. ‘You said I should get a reverse

“If for some reason we have a 2008 market again, where everybody owes way more than their house is worth, FHA steps in,” explains Cicely Carda, a loan officer with Amerifund Home Loans in Denver. “If a servicing company goes out of business it automatically transfers and your loan continues on as it was. If my father passes away and for some reason his loan is a higher balance than what his home is valued at, that’s all forgiven. That’s a huge thing, that you’re not leaving your heirs with a big debt.”

Carda practiced selling a reverse mortgage on her father, a retired math teacher who didn’t think it would work for him – until the day it did, several years ago.

“About two weeks later he called me and said, ‘I’m going to do it.’ I was like, ‘What changed your mind?’ And he said, ‘Well, why would I make a payment on my house if I don’t have to?’ He wasn’t looking for additional income, but after the presentation, he wanted it.”

Hands clean of a mortgage payment and tapped into a new line of credit, Carda’s dad is now planning a trip to New Zealand.

“For a long time after we had done the loan he was still telling me how happy he was with it,” she continues. “He’s 73 now and still very happy with it.”

Traditionally, families aim to pay off their mortgage by retirement and pass the house down to the next generation. “That’s not the way the world works anymore,” Harmes Hika says. “They don’t all live on one big homestead. And the kids don’t want the physical home, they want the equity. They want the cash. And realistically, they want their parents to be taken care of.”

Her grandfather died after moving into a new apartment, falling and breaking his neck, so this is a matter close to her heart.

“A reverse would have been perfect for him,” she says. “If I can help one family not experience that because they get to stay in their own home…”

Mortgage insurance protects borrowers so that the lender can’t look to anything other than the property for repayment of the loan. The HECM can even protect a surviving spouse who is under age 62, allowing them to defer the loan until they sell or move.

“There’s also a really cool provision we call

the 95% rule, where the heirs could actually pay off 95% of the market value and get the home, and the rest is forgiven,” Harmes Hika adds.

LOs in their first reverse mortgage rodeo have much studying to do before jumping in the ring.

“Loan officers don’t police themselves well enough in this space, and because there’s no extra licensing required to do a reverse they handle it really sloppy,” Harmes Hika says. “It’s much more of a financial planning tool and it needs to be taken with that gravity. You really are an advisor when you do this product and you need to be knowledgeable enough to be the advisor.”

CRMPs are accustomed to a client’s adult children, accountants, and even friends and real estate agents joining the conversation.

Harmes Hika has a YouTube channel, a Facebook group, and over 1,600 LOs participate in her weekly class. It’s how she debunks misconceptions about reverse mortgages and how she ensures more seniors like her granddad don’t get steered into bad situations.

Since doing reverse mortgages all day, every day, the first chat she has with potential clients is about setting goals.

“If they tell me they’re going to remodel their house and sell within a year or two, I say, ‘Okay, great. Why don’t you go get a HELOC?’ In that case, a HELOC is a better choice.”

Different companies offer jumbo reverse products that allow borrowers to access up to $10 million. That can subsidize the cost of athome nursing care for ailing homeowners.

“The reverse mortgage is paying for the care and their retirement portfolio is staying on

track and has the opportunity to grow,” Harmes Hika says, giving an example of one such client.

Home equity lines of credit (HELOCs) are not only suited for wealthy borrowers or limited to helping those hard up for cash. Carda has a borrower considering buying a winter home in the Southwest with their equity.

“It’s not always out of a dire need,” she says. “Sometimes it’s just, I have $400,000 in equity that’s just sitting there. Might as well use it and not create additional debt for myself.”

Sometimes it behooves a consumer to look into their future, towards other potential borrowing opportunities. A renovation loan or a HELOC today, a reverse mortgage tomorrow.

A younger boomer still building their bucket list might renovate their home now, accumulate more equity, then draw against that equity with a reverse loan in their sunset years.

“I think it’s just a matter of where we catch the customer in their journey,” Onofrio says.

When he does a renovation loan for an existing homeowner, it’s considered a refinance.

“We’re taking your existing mortgage, paying that off, and then we’re setting you up with a new loan that includes the amount that you currently owe plus the renovation budget that you’re going to be using for the modernization of the home.”

LOs who have the know-how to do any of these loans can carve out a place for themselves in the senior borrower market.

“I think becoming someone that really understands how to utilize these products makes you more valuable as a loan officer, so I think they need to try to embrace it and learn as much as they can,” Onofrio points out. “That will ultimately turn into more opportunities for additional sales and for creating better relationships with their agents.”

Property taxes have risen significantly around

the country, and retired folks bear that burden particularly hard.

“They have all this equity, so why not use that to help them stay in their house?” Carda says.

People living on a fixed income don’t need unexpected rises in their monthly bills, which is what can happen when a mortgage amortizes and the payment jumps.

“HELOCs are not inherently bad, but what’s not great is when the wrong financial tool is put into a situation that it’s not a good fit for,”

Harmes Hika says. “A 63-year-old is not in a better position to make a larger payment at age 73.”

She gets calls from LOs who did HELOCs or cash-out refinances with borrowers that left the borrower strapped for cash years later.

“A lot of loan officers don’t know about the reverse and how perfect it is for people of retirement age, so they go to the tools they know. Had they, at that point in time, instead done a reverse mortgage, the person would have qualified. They had enough equity. But because they did a HELOC or a cash-out, now there’s not enough equity. So to even put a reverse mortgage in place, they would have to bring cash to the table, cash that they don’t have.”

An LO once asked her if it was ethical to do a reverse if a client qualified for another product. “I was like, ‘it’s not only ethical, but I think it’s your responsibility to disclose they have this option.’”

Considering the ideal loan products for seniors, Carda casts her vote for reverse.

“Without creating additional debt,” she says, “I don’t see anything that would be as beneficial to seniors as the reverse mortgage is.”

Creating a space for the next generation in NMLS education.

Introducing Maximum Acceleration, your new premier provider of continuing education.

We’re not just bringing you a lecture. We’re bringing you the fuel to spark your competitive fire, the plan to win the game on the merits, the confidence to know the rules and master them.

We’re Maximum Acceleration, and we’re where loan originators go to put their career in high gear.

— LaDonna Lockard, CEO

Sometimes I’m blamed for some of this,” says Paul Hancock, a civil rights attorney who spent more than twenty years in senior roles at the Department of Justice (DOJ) developing and implementing the U.S. government’s fair lending enforcement programs. “But, I think that this has gone really pretty far away from where we started.”

As chief of the Housing and Civil Enforcement Section at the DOJ under Attorney General William Barr, Hancock helped to bring forward the government’s first redlining case in 1992, filed against Atlanta, Georgia-based Decatur Federal Savings and Loan Association. In private practice now as a partner at K&L Gates and consultant for Gate House Compliance, subsidiary of the mortgage advisory firm, Gate House Strategies, he says “there’s no question” lenders are opting not to litigate redlining lawsuits brought against them by the government, even if the government’s legal theory and factual analysis of the cases is wrong.

“Redlining is a terrible accusation,” Hancock says. “It’s a terrible thing to do. It means you’re refusing to make loans in an area based on the racial composition of the neighborhood. Nobody supports that. We abhor it. Our clients abhor it. The question is though: what’s the standard for determining whether you’re redlining or not?”

In October 2021, U.S. Attorney General Merrick Garland launched the DOJ’s Combatting Redlining Initiative, a renewed emphasis on “tackling redlining, a discriminatory practice where lenders deny or avoid providing mortgages or other credit services to neighborhoods based on the race or national origin of the residents of those neighborhoods.” Hancock began warning lenders after this launch that “new kinds” of redlining cases would stem from the new initiative.

As a matter of course, he was right.

In the past three years, regulators have initiated numerous redlining lawsuits – and even more investigations – against depository and nondepository mortgage lenders across the U.S., bringing cases forward under a modern theory of redlining that fair lending and legal experts call untenable. They call regulators’ demands for a racial balance in originations unconstitutional.

“If the government is actually demanding a racial balance in loan originations, saying all lenders in the city of Chicago should make 20% of their loans in minority neighborhoods,” Hancock posits, “that’s a demand for a racial balance that is prohibited by the Constitution. It’s prohibited by civil rights laws. I think that, if tested, it would be rejected by the courts in this context.”

Steve Simpson, director of separation of powers litigation for the Pacific Legal Foundation, a public interest legal organization that advocates

“Under the government’s theory, you can eliminate redlining by just making fewer loans in white areas. You’re not doing any more in minority areas. You’re making fewer loans in white areas and somehow that solves your legal problem. That just doesn’t make any sense.”

> Paul Hancock partner at K&L Gates

> Paul Hancock partner at K&L Gates

for limited government, recently defended Chicago-based Townstone Financial against a CFPB lawsuit accusing the non-bank lender of redlining. A district court dismissed the case, a decision which the CFPB appealed.

Simpson says lending disparities which regulators call “redlining” differ greatly from the literal practice from which the term originated. “Any disparity in a bank’s lending to one group or another is just held to be de facto redlining,” he says. “I just think that’s flawed.” Noting his position in the intellectual minority, he adds that “very few people” care to address the flawed premise driving the government’s approach to identifying redlining. He also predicts there is more fair lending litigation to come, given the Supreme Court’s decision last June to overturn race-based affirmative action in college admissions. “The more it seems clear that the Supreme Court is against race conscious policies,” he continues, “the more in favor of those policies regulators become.”

The term “redlining” derives from the literal practice, employed by the federal government and lenders, of drawing red lines around neighborhoods they would not invest in based on those neighborhoods’ racial composition. The practice was enshrined in the Federal Housing Administration’s (FHA) 1938 Underwriting Manual, which prohibited “the occupancy of properties except by the race for which they are intended,” among other racist housing policies.

Redlining lawsuits against nondepository mortgage lenders are a recent phenomenon; traditionally, only depository banks were audited by federal regulators for compliance

with the 1977 Community Reinvestment Act (CRA), which outlawed redlining and established a framework for regulators to assess depositories’ progress at meeting the credit needs of their entire communities, including low- to moderate-income and majorityminority neighborhoods.

The primary argument against CRA mandates for non-depository lenders is that those institutions do not receive deposits with which they can reinvest in communities. However, non-depositories have always been subject to other non-discrimination and fair lending laws.

Natural disparities will always exist in lending, Simpson says; inferring redlining or intentional discrimination from statistics compounds the problem by propagating the fantasy of an achievable equilibrium. Accusing lenders who originate a below-average number of mortgages in CRA-eligible census tracts of redlining – without demonstrating a lender’s intent to avoid or otherwise restrict access to mortgage credit in those communities – manufactures perceptions of discriminatory lending, while pushing lenders to manufacture their fair lending compliance.

Lenders’ inability or unwillingness to litigate against the government, given the expense, inflates perceptions of rampant redlining and the effectiveness of regulators’ “combatting” efforts.

While the CRA speaks to income, not race, Hancock says, “in most of these areas there’s a great overlap between racial concentrations and low- and moderate-income concentrations. So, the government could analyze a bank’s loan distributions and see if you’re intentionally avoiding doing business in the minority communities of your assessment area. That was the theory.”

By relying on lending disparities to establish patterns of discrimination, regulators’ enforcement of that theory corrupts the original intent of the CRA statute; claiming that lower levels of originations in CRA-eligible census tracts equates

to redlining makes fair lending enforcement – and lenders’ compliance – a data exercise.

“Under the government’s theory, you can eliminate redlining by just making fewer loans in white areas. You’re not doing any more in minority areas,” Hancock says. “You’re making fewer loans in white areas and somehow that solves your legal problem. That just doesn’t make any sense.”

The reputational harm of being accused of redlining lives with lenders, not regulators, Simpson says, compounding the ill-effects of ill-designed efforts to regulate away historical disparities. Simspon calls regulating away disparities in lending “political” – but not in the sense of Democrats versus Republicans.

“Regulators and everybody out there today in various sectors of the economy and finance being one,” he says, “are just falling all over themselves to look like they’re combating inequality.” The Illinois Community Reinvestment Act (ILCRA, see sidebar), which took effect in January 2024, uses proportional loan distributions to assess depository and non-depository mortgage lenders for fair lending compliance, mirroring a 2007 Massachusetts law for supervising non-banks.

“They care about how they’re being perceived or feeling like they’re combating a great social ill,” Simpson believes. “When they actually try to implement these policies, they make no sense, and the real experts, like the Mortgage Bankers Association, who knows what it’s doing and understands all this stuff much better than, in my view, the Illinois regulators, no one is paying attention to them.”

No matter whether government overreach is occurring, says Brian Montgomery, co-founder of Gate House Strategies and former deputy secretary of the Department of Housing and Urban Development (HUD), the Biden administration’s focus on redlining –however defined – makes the issue top-of-mind for mortgage lenders.

Drawing parallels to the heightened focus on cybersecurity given a recent spate of highprofile breaches, “even if there’s a change in administration,” Montgomery affirms, “there will continue to be a focus on this topic, as there should be.” But, a regulatory rat race mostly hurts consumers on account of the added complexities and expenses for businesses’ compliance.

Some states have the benefit of staying reliably “red” or “blue,” but whipsawing regulations means businesses must remain ready to pivot at all times depending on the regulatory priorities of the day. The headaches and expenses that arise can be exorbitant.

“The lenders here are facing an issue,” Hancock adds. “If there is a change of administrations, will they suddenly be tagged for doing what was demanded of them now?”

Lenders must hedge their fair lending compliance to satisfy regulators’ present demands for a racial balance while avoiding future legal liability for doing just that. Under a second Trump administration, the DOJ, the Department of Housing and Urban Development (HUD), and the CFPB would likely look very different. “There could be completely different theories espoused as to not only what the law requires, but what the law permits,” Hancock worries.

Therein lies the untenable nature of the government’s strategy for “combatting redlining.”

“The problem arises when they start inferring discrimination from statistics when they don’t have direct evidence of discrimination,” says Simpson, referencing his work with Townstone Financial. “You end up trying to compel mortgage companies or businesses to lend on the

“Even if there’s a change in administration, there will continue to be a focus on [redlining], as there should be.”

> Brian Montgomery co-founder of Gate House Strategies, former deputy secretary of HUD

basis of race and on the basis of other factors that they’re not supposed to take into consideration, which just creates an equal protection problem [through] perverse incentives and perverse effects.”

The perverse application of the law of unintended consequences means that “any community, or anybody who operates on a community level can ultimately be accused of discrimination,” he continues, “in some sense precisely because they’re operating locally and helping a given population, or they’re operating by word of mouth and just talking to their circles, their friend circles, their community circles” – i.e., referrals, which is how most of mortgage lending works.

Such disparate-impact discrimination is at the heart of regulators’ modern theory of redlining.

Richard Andreano, partner and Practice Leader of the Mortgage Banking Group at Ballard Spahr, a national law firm, says he “probably would not” have appealed the Townstone Financial case up to the Seventh Circuit. Andreano also leads Ballard Spahr’s Fair Lending Team.

In 2015 the Supreme Court ruled in Texas Department of Housing & Community Affairs v. The Inclusive Communities Project, Inc. that plaintiffs must meet a rigorous standard to establish a clearcut case of disparate-impact discrimination under the Fair Housing Act (FHA). The justices even noted that claims based on statistical disparities fail without showing robust causation.

On remand, the U.S. District Court for the Northern District of Texas applied that new standard and found the plaintiff (Inclusive Communities) fell short of showing robust causation. The outcome of these proceedings confirmed that disparate-impact discrimination claims were legitimate under the Fair Housing Act, but that plaintiffs proceeding under a disparate-impact theory face a significant burden of proof.

“It was clear the court was very concerned about the rules in that area,” says Andreano, “and

that if you went too far, were you actually in effect mandating the consideration of race in a way that would appear to be contrary to the Constitution.”

However, in 2013, HUD implemented its own “Discriminatory Effects Rule” to formalize disparate-impact liability. At the time, HUD noted the new rule had “broad remedial intent” and was “imperative to the success of civil rights law enforcement.” Two insurance industry trade groups sued HUD over the rule, arguing the rule exceeded HUD’s authority under the FHA.

Noting the Supreme Court would soon be taking up the issue in Inclusive Communities, a D.C. Circuit Court provisionally agreed with the insurance industry’s challenge. The Supreme Court acknowledged HUD’s 2013 Rule in the Inclusive Communities decision, but did not defer to it. The D.C. Court had to reconsider its ruling on the 2013 Rule following Inclusive Communities.

Before that could happen, a new HUD rule (the 2020 Fair Housing Act rule) was implemented , during the Trump administration, supplanting the 2013 rule. Fair housing groups challenged the 2020 Rule and won a preliminary injunction. The Biden administration then reinstated the 2013 Rule in March 2023 – without revising for Inclusive Communities.

Andreano calls this HUD’s “calculated error” –they reinstated the 2013 Rule almost verbatim.

In September 2023, a decade after the case began, the D.C. Court determined that in light of Inclusive Communities, HUD’s 2013 Rule does not conflict with the FHA when applied to insurers’ underwriting and rating practices. However, the D.C. Court noted that the 2013 Rule may exceed limits laid out in Inclusive Communities.

“By adopting a rule that was adopted two years before that Inclusive Communities decision,” says Andreano, “and then claim that the rules completely consistent with that future decision, was an error. I think you’re going to see this Supreme Court reign that conduct in, saying, ‘No, you have to actually follow our decisions.’”

That calculated error could be amplified if the Supreme Court reverses or narrows the Chevron

Mirroring a state-level community reinvestment law that took effect in Massachusetts in 2007, the Illinois Community Reinvestment Act (ILCRA) was passed in March 2021, but not implemented until January 2024, when regulations for its implementation were passed.

Matt Rohl, who previously served as senior vice president of CRA Development and Emerging Markets for the recently-acquired Draper and Kramer Mortgage Corporation, was installed in January 2024 on the Illinois Mortgage Bankers Association’s (MBA) Board of Directors. He claims Illinois regulators ignored industry concerns about the ILCRA, submitted during the comment period lasting from March 2021 until January’s implementing regulations took effect.

The ILCRA is modeled off the federal CRA, but expands the scope of covered financial institutions to include credit unions and entities licensed pursuant to the Residential Mortgage License Act of 1987 which lent or originated 50 or more mortgages in the previous calendar year which are not covered pursuant to federal law, like independent mortgage banks (IMBs).

Now that regulations implementing the ILCRA

have taken effect, the Illinois MBA’s concerns are being reviewed by state regulators – which is too little, too late, Rohl says.

issue with the ILCRA, Rohl explains, is the narrowing of who receives credit for originating mortgages in CRA-eligible census tracts. Under the federal CRA statute, buying loans underwritten for borrowers living in low- to moderate-income or majority-minority census tracts – i.e., CRA loans – grants CRA credit to buyers of those loans.

Fearing “churning” – a CRA loophole exploited by repeatedly buying and selling the same CRAeligible loans – the ILCRA says only one entity can receive CRA credit for loans underwritten for CRAeligible census tracts in Illinois.

Despite perceptions of CRA pools being riskier investments on account of weaker collateral, CRA loans are highly sought after by investor-entities subject to CRA requirements, Rohl says. Competition for CRA-eligible loans in the secondary market tightens the investor spread, improving pricing in the primary market for borrowers applying for mortgages in those areas.

Eliminating the ability for buyers of CRA loans to receive CRA credit undermines the added value of CRA loans to CRA-minded investors, making for less competitive pricing for these loans in the secondary market. “Saying only the first person can get credit for it actually makes the terms worse for the borrower,” says Rohl.

And the reverse can happen for brokered loans, he says.

Mortgage bankers who broker loans – meaning the loans are underwritten and purchased by a different funding entity – would not receive CRA credit for originating CRA-eligible loans on account of the single-buyer restriction. Only the entity that underwrote and bought the loan would receive credit. Hence, IMBs brokering loans for borrowers in CRA-eligible census tracts, though expanding access to mortgage credit in those communities, would not receive commensurate CRA credit.

“In that situation, the first person that actually dealt one-on-one with the borrower would not get credit for that CRA loan,” Rohl explains. “If I’m an independent mortgage banker and I’m letting you underwrite it, I would get no credit at all,” despite that originating entity directly helping to expand access to mortgage credit in a CRA-eligible community.

Whereasbanks and credit unions with more than $10 million in assets pay an annual fee to regulators that cover expenses related to regulatory audits and examinations – and those with assets under that threshold pay no annual fee – the ILCRA will charge IMBs who originate 50 or more mortgages in Illinois in a calendar year a daily rate of $2,200 for them to be audited.

Those audits could last a day, a week, a month, or more. IMBs not headquartered in Illinois, but who originate more than 50 loans in the state

on an annual basis, will also have to foot the bill for auditors’ travel expenses. An audit that lasts a month would cost more than $60,000, due 30 days from the end of the audit, and audits are expected to happen every two years.

The expense is disproportionate for smaller IMBs, Rohl says, compared to their asset-heavy banking peers. IMBs don’t take or hold deposits. A more fundamental issue with the examination process, however, is the manner in which IMBs are assessed and judged to be either compliant or noncompliant with ILCRA.

By failing to engage with the concerns of the Illinois MBA before the implementing regulations took effect, which “activated” the law passed in 2021, regulators neglected to clarify how IMBs in the state are expected to achieve compliance with the ILCRA, besides proportional distribution.

According to Rohl, “They just put this law into place and said, ‘Well, we’ll talk about it after it’s in place.’” He asks, rhetorically: “Who’s my peer group? What are the percentages I should be doing? That, again, is subjective and wouldn’t really have any precedent until the audits start happening.” He and other fair lending experts fear regulators’ reliance on peer benchmarking can manufacture the illusion of redlining, spurring allegations of noncompliance.

Pretend, for example, an out-of-state IMB wants to open its first branch in Illinois. The IMB gets licensed, recruits a small group of loan officers, and opens an office. The branch originates 100 loans in the following year, and another 100 more loans the year after. Due to where the branch is located and due to where the loan officers live and lend, only a handful of originations each year were from CRAeligible census tracts.

From regulators’ perspective of proportional distribution, that IMB engaged in redlining. “What should the number be?,” Rohl asks. “What should

the percentage of CRA loans versus non-CRA loans be? That’s not in writing. It’s a little subjective.” In this scenario, “redlining” was manufactured by the out-of-state IMB starting to do business in Illinois in the first place.

“Under the government’s theory, you can eliminate redlining by just making fewer loans in white areas,” says Paul Hancock, a civil rights attorney who spent more than two decades at senior levels of the Department of Justice (DOJ) developing and implementing the DOJ’s fair lending enforcement program. “You’re not doing anymore in minority areas. You’re making fewer loans in white areas and somehow that solves your legal problem. That just doesn’t make any sense.”

Given lenders’ ongoing profitability crisis, the threat of unreasonable fair lending enforcement could decrease competition by making the state unattractive for doing business, says Rohl, undermining efforts to reach underserved borrowers, likely making mortgage financing costlier.

“To say that I’m not paying attention to an underserved community,” Rohl explains, “it’s just simply because I don’t have anybody in that community. But, what this law says is, I need to hire and open an office there. That’s the only way I would be able to serve that community.”

“My concern,” Hancock adds, “is that the government has kind of drifted much closer to a demand for racial balance in loan originations, rather than attacking lenders that really are refusing to do business in minority areas.” Demands for racial balance are unconstitutional, he says.

Athird area of the Illinois MBA’s concern over the ILCRA concerns appraisal bias. Rohl says the ILCRA creates regulatory confusion surrounding the federal enforcement of the Dodd-Frank Act

Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).

In addition to establishing the CFPB, the DoddFrank Act was passed in the aftermath of the Great Financial Crisis to implement safeguards in mortgage lending, among other reforms. One such Dodd-Frank safeguard prohibits mortgage lenders from influencing appraisals, in any capacity. The ILCRA makes it the responsibility of IMBs and credit unions to police appraisal bias by denying loans for properties with appraisals that the lender suspects of bias.

However, asking lenders in Illinois to police an aspect of mortgage lending outside their regulatory and professional purview could do more harm than good, Rohl fears.

Differentiating less-than-blatant bias from laziness or inexperience can already be difficult for those well-trained in the discipline. Denying CRA-eligible loans suspected of appraisal bias could open up lenders to accusations of lending bias for wrongly denying applicants. Approving applications for loans they suspect of appraisal bias – but do not deny so as not to court fair lending risk – could make lenders vulnerable to lending risks like repurchase demands.

Ultimately, lenders face a conflict of interest because the ILCRA pushes lenders to write more loans in CRA-eligible census tracts, which are historical hotbeds of appraisal bias. “It’s counterintuitive to the actual federal law, in that case,” Rohl says. “They’re saying that you have to police bias on appraisals, yet you’re not supposed to influence or have anything to do with the appraisal.”

Where Rohl believes the spirit of the ILCRA represents a desire to erase racial disparities in homeownership and mortgage lending, the ILCRA will likely undermine that ambition by pushing IMBs to lend where they are not and adding operational complexities and costs.

principle, a long-standing judicial precedent that says courts should defer to federal agencies’ expertise when interpreting and administering federal statutes and regulations. After hearing oral arguments in a separate case in mid-January, the Supreme Court seems poised to overturn the Chevron principle.

The CFPB appealed its case against Townstone Financial arguing Chevron deference.

“All the redlining claims were brought against banks who had their banking regulator twisting their arm to settle. They settled. They sued the first non-bank, and the non-bank didn’t want to settle, and that’s how we’re finally getting court review of this,” Andreano says. “It just never faced a challenge was the issue. I do think the courts, particularly if Chevron’s thrown out, only if you just modify it, I think that could significantly change how courts defer.”

The same way underwriting standards are set by the government-sponsored enterprises (GSEs), so are default servicing standards. Where fair lending focuses more on the origination side of mortgage lending, fair servicing kicks in after the loan closes, entailing such actions as collection processes, fee assessments, and a waterfall of loss mitigation options.

The problem for many lenders, says

Richard Andreano Partner and Practice Leader of the Mortgage Banking Group at Ballard Spahr

at Community Loan Servicing, LLC (formerly Bayview Loan Servicing, LLC) is that fair lending and fair servicing at many mortgage companies remain disparate processes.

“It doesn’t mean that it’s not a priority,” he explains. “It doesn’t mean that it’s not resource-intensive. It’s just not as mature of a structure and mature from a thought-leadership perspective.” Hence, for mortgage lenders, fair servicing compliance can be more difficult to stay ahead of than fair lending

it and incorporating it into a mortgage operation’s day-to-day activities is not always clear.”

CrossCheck aided Townstone Financial with their data analysis in the process of their defense against the CFPB. These days, data reigns when it comes to staying out of regulators’ crosshairs, Warner says.

Regulators can assess servicing data for fair servicing compliance, looking for patterns that could signal discrimination, such as whether protected class borrowers are being foreclosed on more often

“Fair servicing,” Warner continues, “obviously is not as mature of a process of monitoring as it is on the origination side, and you don’t have a set of data like you have the [Home Mortgage Disclosure Act] data to compare results against. It’s a little more challenging that way. You really have to understand what’s happening within the

Michael Waldron

Michael Waldron, founding partner of Gate House Compliance

Michael Waldron

Michael Waldron, founding partner of Gate House Compliance

operation in order to conclude on anything with respect to the data.”

Problematically, much of the data available to lenders for analysis offers a rear-view perspective. They know where their own loans are written, “but the government is looking at a comparison with other lenders, and you don’t have other lenders’ data until the following year,” says Hancock. When it comes to peer benchmarking, “there’s no way of knowing.”