MortgageBanker

Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

president and CEO, Mindy Rothenberger for receiving the Powerful Women of Mortgage Banking Award.

Congratulations on this well-deserved recognition. Your passion, advocacy, and collaboration makes you an inspiration to women throughout the industry.

The October 7, 2022, ECO release includes two Freddie Mac Loan Advisor dashboard additions that give greater insight into income rep and warranty relief and opportunities to originate loans without an appraisal.

Freddie Mac added an offering type to the Income Performance dashboard called “Direct Deposit” to give greater insight into income representation and warranty relief.

Direct deposit – part of asset and income modeler (AIM) – is offered to provide a basis for potential relief from certain selling representations and warranties (R&W) related to the assessed income by using direct deposit data from a borrower’s depository information. By using a history of certain direct deposit income types from the asset verification report, the offering assesses a loan’s eligibility for income R&W relief.

Freddie Mac added a new offering to the Collateral Offerings dashboard for ACE+ PDR (automated collateral evaluation plus property data report) to help identify opportunities to take advantage of the addition.

The offering lets lenders originate cash-out and certain “no cash-out” refinance loans without an appraisal. With ACE+ PDR, additional property information is physically collected on-site by trained data collectors using the proprietary Freddie Mac PDR dataset, in lieu of an appraisal.

Fannie Mae announced the launch of its Multifamily Positive Rent Payment Reporting pilot program, aimed at helping renters build their credit history and improve their credit score. Beginning Sept. 27, 2022, eligible multifamily property owners can share timely rent payment data through a vendor network to the three major credit bureaus for incorporation in the renter’s credit profile. This pilot program is the latest solution among Fannie Mae’s ongoing efforts to bolster equitable access to credit and remove unnecessary obstacles in a consumer’s housing journey, whether they choose to rent or aspire to own a home.

On-time rent payments are rarely included in credit reports and therefore usually do not contribute to a consumer’s credit score, putting many renters at a disadvantage. Positive Rent Payment Reporting aims to accelerate the adoption of rent payment reporting by the multifamily industry, and it complements Fannie Mae’s existing practice of helping lenders incorporate positive rent payments in the single-family mortgage credit evaluation process via Desktop Underwriter. Incentivizing Fannie Mae Multifamily borrowers to adopt Positive Rent Payment Reporting will benefit renters who pay on time each month, including historically underserved groups who disproportionately have lower or no credit scores. Esusu Financial, Inc., Jetty Credit, and Rent Dynamics are approved vendors who will collect the rent payment data from multifamily property owners and format it for dissemination to the credit bureaus.

Vincent M. Valvo CEO, PUBLISHER, EDITOR-IN-CHIEF Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

EDITORIAL DIRECTOR David Krechevsky EDITOR

Keith Griffin SENIOR EDITOR

Mike Savino HEAD OF MULTIMEDIA

Katie Jensen, Steven Goode, Douglas Page, Sarah Wolak STAFF WRITERS

Rob Chrisman, Nir Bashan, Thomas Wade, Curtis Wood, Joe Camerieri, Matthew Falloretta

CONTRIBUTING WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Tigi Kuttamperoor, Matthew Mullins, Angelo Scalise MULTIMEDIA SPECIALISTS

Melissa Pianin MARKETING & EVENTS ASSOCIATE Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Lydia Griffin

MARKETING INTERN Ben Slayton FOUNDING PUBLISHER

Submit your news to editorial@ambizmedia.com

If you would like additional copies of Mortgage Banker Magazine Call (860) 719-1991 or email info@ambizmedia.com

www.ambizmedia.com

© 2022 American Business Media LLC. All rights reserved. Mortgage Banker magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

Banks,credit unions, independent mortgage banks, brokers, vendors, and others in the residential lending business wonder if they will be around in 3-6 months. Has the company managed to cut costs as quickly as revenue and volume has dropped? How much capital might a company “burn through” before things “turn around,” whenever that is? Should we look at merging, acquiring, or being purchased?

M&A tends to heat up when profits decline, such as 2022. During the last few years we saw “IPO mania” as the owners of, and investors in, of those companies “took chips off the table” through public offerings. In 2022 that has changed, and few lenders or vendors are talking about issuing stock. Most lenders hope to break even in 2022, and the number of investors who desire to put capital to work in residential lending has declined. Some have moved from being mortgage bankers to brokering, thereby eliminating underwriters, secondary marketing, and other positions.

M&A talk has only increased this year. Potential buyers are viewing the market shift in terms of adding geographic scope to their originations. “We’re not licensed in Texas, but if we buy this company…” They are thinking in terms of adding market expertise. “Hey, that lender has a well-respected reverse mortgage group.” How long will the seller stay involved? How financially stressed is the seller? Economies of scale, talent acquisition, strategic opportunities, and growing in a

down market are often cited as reasons.

Potential sellers are asking, “We have limited capital; how much do we want to use up surviving?”

“What value do we bring to a potential buyer?” “What are the long-term prospects of our company in this environment?”

“Is my life going to be better?”

“What about my employees?”

“What is my time of life?”

Retirement, preservation of capital, and demands for additional technology are often cited as reasons to sell, and often potential sellers will do their best well advance of any future deals to add production staff to increase value.

The thinking of deal structuring has shifted from IPOs toward “asset sales” as a method of transferring ownership, with the buyer purchasing the entire company. Of course, partial acquisitions also work, with the buyer eventually owning 51% of a company, or some type of modified joint venture arrangement. Stock in the seller can be purchased, companies can be merged. What liabilities are being assumed? If it is treated as an asset purchase, does that include people? Agency approvals? Licensing is important.

Cultural fit between a buyer and seller is paramount in any deal. What difference do great numbers and geographic fit make if the two groups don’t mesh and half the originators quit? Even if the owners get

along, other members of the senior management team should be able to cooperate and have similar values, as should employees. Buyers will want a “no shop” provision for 30-60 days written in to the deal to avoid the seller continuing to look around.

As the deal proceeds, what will the employees be told? Information is important, especially as recruiters will swoop in. Transparency is critical in measured doses. Public announcements are becoming fewer, as those are generally viewed as doing nothing other than promoting the advisors behind the deal and may even have a negative impact on the two lenders or vendors involved in the merger or acquisition.

Buyers and sellers may talk on and off for years, and when a deal is initially agreed to the two parties may agree that “The timing was just right.” But it is not easy arriving at that point. Determining a value is very complicated. Perhaps it is a premium over book value, or an earnings multiple such as 3x or 4x of proforma earnings, not 2020 and 2021, which are unrepresentative, comparable sales, discounted cash flow, and the “build versus buy” discussion are common and all important.

As we head toward the holidays of 2022 and start thinking about 2023, few believe that the residential lending environment will improve. Owners and managers must constantly consider their business models and strategies, and what is best for the long term for the company and its employees. Acquiring, merging, or being acquired are certainly strategies that can be very beneficial if mapped out and executed well.

ACQUIRING, MERGING, OR BEING ACQUIRED ARE CERTAINLY STRATEGIES THAT CAN BE VERY BENEFICIAL IF MAPPED OUT AND EXECUTED WELL.ROB CHRISMAN

Despitewelcome economic indicators that house prices and other key housing costs may be at least peaking, if not falling, the housing market remains a significant pain point for American consumers. Median house prices reached a new record high in June. The sale of new single-family homes has decreased 40% since January. The rental market is particularly hot, with asking rents increasing 23 percent nationwide as compared with 2019.

When considering the economic stresses the housing market presents, Congress, the White House, and the federal agencies will of course be tempted to use the powers they have (and some they do not) to try to give relief to American consumers. Regrettably, however, government

intervention in the housing market has historically done more harm than good. Housing finance was at the center of the 2008 financial crisis that visited substantial economic stress on Americans and spurred dramatic government intervention. Yet more than a decade later, the central actors in the crisis and response – Fannie Mae, Freddie Mac, and the Federal Housing Finance Administration (FHFA) – remain essentially unchanged.

Before Congress and the administration consider further intervention in the housing market, they must first seek to do no harm.

It is important to note that decreasing demand for housing is precisely what the Federal Reserve has set out to achieve in its

battle against inflation. High prices are the most effective way to achieve this. “Shelter,” or housing, is one of the components of the Consumer Price Index (CPI) that tracks the average change over time in prices paid by consumers for a “basket” of goods. The shelter component of the CPI represents one-third of the index and has exhibited an uninterrupted rise in inflation, from 1.6% in January 2021 to 5.7% in July, with no signs yet of peaking.

For the Fed to reduce overall inflation, decreasing the shelter component of the CPI is the single most effective measure to bring down prices across the whole economy, and the Fed has done this by raising the federal funds rate. This causes all other interest rates to rise, including mortgage rates. Higher mortgage rates mean higher house prices, which decrease demand. Decreased housing demand results in fewer people buying housing, or spending capital on housing-related costs, which slows the increase of the shelter component of the CPI.

Higher rates make debt more expensive, which has implications for home purchasing and home construction. Over time, however, house prices will fall in reaction

to decreased housing demand. With that in mind, Congress and the federal agencies would do well to consider what they might do (or, more appropriately, not do) to prevent an overstressed housing market from blowing up or undoing the efforts the Fed has undertaken to cool the economy.

At its core, the stress in the U.S. housing market is caused by supply, not demand. Housing supply is constrained by a dearth of new construction resulting from low labor availability, the high cost of materials, and restrictive local regulations. Existing homes are not returning to the market at typical rates as economic stresses, the low mortgage rate environment, and the unknowns of listing a home in the backdrop of a global pandemic caused homeowners to delay or cancel their plans to list. Housing inventory, while on track to rise, is at historic lows.

The total inventory of homes available for sale fell 26% in January 2021 year-overyear. At its lowest point, the Federal Reserve Bank of St. Louis estimated that there remained only three-and-a-half months of

total housing inventory – in other words, it would be only three and a half months without construction until there would be no homes available in the United States. Housing permits and starts, which have barely recovered from the 2007–2008 financial crisis,

There are very few policy levers that Congress can on to increase housing supply, and even fewer that will operate in a short timeframe. Demand-side subsidies, which in their immediacy continue to prove attractive to legislators, will only increase the population of potential homeowners chasing the same small number of available houses, further increasing prices.

A classic example of demand-side subsidies includes the June announcement by the FHFA of new equitable housing plans for Fannie Mae and Freddie Mac. That there is a clear need for racial equity in homeownership rates is not in question – the gap between Black and white homeownership rates is greater now than in the 1960s when it was legal to deny someone a home based on the color of their skin. But these new housing plans raise a number of difficult questions. When the vast majority of federal initiatives amount simply to demand-side subsidies, home prices will necessarily rise and housing will become even more unaffordable to exactly the communities the FHFA is seeking to serve.

Not only do these programs run the risk of being directly counterproductive, they raise uncomfortable questions about the FHFA itself. Why under the FHFA’s purview have homeownership rates declined, precisely, and why does the FHFA think the answer entails crafting new plans rather than reviewing the success of the overly complex constellation of existing programs seeking to address these issues? The federal government currently provides appropriated funding through more than 30 programs within the Department of Housing and Urban Development, tax credits and deductions for both corporations and individuals, housing programs for veterans through the Department of Veterans Affairs, rural housing programs through the Department of Agriculture, and mortgage insurance

BEFORE CONGRESS AND THE ADMINISTRATION CONSIDER FURTHER INTERVENTION IN THE HOUSING MARKET, THEY MUST FIRST SEEK TO DO NO HARM.

programs through the Federal Housing Administration and government corporation Ginnie Mae.

Such a challenging time for the housing market would not represent the safest testing ground for Congress or the federal agencies to experiment with sweeping changes to how the market operates.

California, New York, and New Jersey all have active bills that would alter foreclosure rules in their states. While legislation that would discourage institutional or out-ofstate investors from purchasing foreclosed properties may help keep homes and commercial buildings in the hands of residents, the bills still represent economic protectionism. Investment that may revitalize communities will be directed elsewhere, driving up competition and prices where it is directed.

The Office for Management and Budget (OMB) recently directed federal agencies to ignore existing medical debt to the fullest extent possible when making lending decisions. This of course will include the FHFA and is likely to apply to the GSEs at the very least by association (although not originators of loans themselves, the GSEs effectively set market standards for loan originators by determining which loans they will buy, with which characteristics, and under which circumstances). Reducing the amount of data available to lenders decreases the quality of lending decisions the agencies make and will not by itself improve consumer creditworthiness; in fact, it far more likely to do the opposite as it may cause Americans to end up even further in debt due to purposefully withheld information.

The FHFA is past due for a decision on its review of alternative credit scoring models. The vast majority of the industry (and federal agencies) has used the FICO Classic scoring model for the last 20 years. Any change to this approach would be costly to the GSEs and private lenders, and those costs would quickly be passed on to consumers.

The United States does not have a functioning

private secondary mortgage market and has a wildly distorted primary market because of Fannie Mae and Freddie Mac. If Congress seeks a healthy and functioning housing market that benefits all participants, then it must continue its efforts to reform the GSEs. But the Biden Administration has reversed these gains, decreasing the amount of capital the GSEs are required to hold and once again allowing them to purchase the riskiest mortgages.

GSE reform is absolutely necessary for the long-term health of the housing market, but the process will be slow, costly, and likely involve a temporary increase in housing prices. Short of the reform the market needs, however, Congress and the FHFA must commit to not increasing the footprint of the GSEs in the housing market.

The FHFA has repeatedly and consistently engaged in mission creep via the mechanism of new pilot programs. These pilots expand the products offered and decrease underwriting standards at the GSEs. While this gets more people into houses, it does nothing to expand housing inventory, and thereby acts as another demand-side subsidy, increasing the costs of housing for everyone.

In July, 10 members of the House wrote to FHFA Director Sandra Thompson, noting “The Enterprises have a history of venturing into new activities and product offerings that go well beyond their congressionally approved roles in the secondary market. The FHFA must do more to ensure there is appropriate transparency regarding any new products or activities that the Enterprises undertake and that these activities do not displace private firms or crowd out private capital.”

The FHFA must undertake to finalize the long-overdue rulemaking on Prior Approval of Enterprise Products, a requirement of the Housing and Economic Recovery Act of 2008 that still has not been brought into law nearly 15 years later.

Fourteen years after the GSEs were brought into conservatorship, they remain undercapitalized. The GSEs enjoy all the opportunities of both private entities and government agencies without the regulation or supervision of either. Former FHFA Director Mark Calabria took a series of extremely important steps along the path to

GSE reform, not least of which was halving the GSEs’ combined leverage ratio (down to a still mind-boggling 500-1). These efforts not been continued, and what’s more, this administration’s FHFA has made the baffling decision to return risk to the GSEs by allowing them to make more toxic loans and hold less capital against that risk.

The Federal Housing Administration (FHA) has significantly expanded its role since the financial crisis and, with the GSEs, guarantees over $7 trillion in mortgagerelated debt to the borrowers least able to repay. The FHA’s book of mortgages is considered so toxic that even Ginnie Mae, the Government National Mortgage Association, has proposed a 250% risk weight on gross mortgage service rights (MSRs) that make up the majority of the FHA’s business. Former FHFA Director Calabria has warned that the FHA is setting the market up for failure with its poor underwriting standards, the risk of which could topple the housing market.

Even in the best of times it can be difficult to parse the wide variety of economic indicators. Depending on interpretation, the housing market is either boiling or has already collapsed. The economy writ large is either strong or in a recession. Against this backdrop, the Fed is attempting to engineer a “soft landing,” decreasing inflation without triggering significant economic collapse.

Part of this effort necessarily involves intentionally making the housing market more hostile for a time, as noted by Fed Chair Jerome Powell. While there is little Congress and the federal agencies can do to improve housing supply in the short term, they could do much in haste and good intentions that would further muddy the economic waters. At worst, further demand-side subsidies would undo the Fed’s efforts, increasing the pain of inflation, the risks of recession, and the length of economic recovery.

Thomas Wade is the direction of financial services policy at the American Action Forum. This article was originally published Sept. 8, 2022. You can read the original version here. https://www.americanactionforum.org/ insight/how-not-to-blow-up-the-housingmarket/

New England’s top gathering for mortgage professionals returns to Connecticut on January 12, 2023. Don’t miss this exciting, informative event. NMP readers like you can attend for free by using the code NMPOCN.

www.nemortgageexpo.com

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

career, but I was also an underwriting manager for a national lender for over a decade. Flipping from sales to operations when my husband and I relocated from Indiana to Georgia, gave me the opportunity to learn operations. I immediately accepted a processing position however within 30 days I was promoted to underwriting, then within a year I was the regional underwriting manager for national mortgage lender. It was another year or less, they asked me to run the operations center which at that time managed both sales and all operations functions. The time spent at the helm managing both teams provided me invaluable knowledge. It was important for me to take some time to sit with every department within my organization and get hands on experience. I felt I needed to fully understand each role so I could have a clear understanding how a change in department may affect another. How can you lead a team if you don’t have a full understanding of what each department’s challenges are? Through this process, I was able to pull my departmental team leads from both sales and ops together to develop best practices for the branch, with the goal of making the process easier on everyone. Since that time, I have maintained all my underwriting DE’s and maintained all my originators licenses. Having the in-depth knowledge of each position, gives me a perspective which few in leadership have. This firsthand knowledge and ability to perform each function of either sales or operations allows me to lead both groups such that they blend like a marriage. Our motto is you can’t be successful without the other. Sales needs ops, and ops needs sales to produce, we all succeed together, or we will all fail together.

Q: You now are the C.E.O. and President of Southpoint Financial. What has that transition been like?

Q: Take me back, how and where did you get started?

“I started as a loan processor for a big subprime lender back in a small town in Indiana. After learning the ropes, I wanted to make the income that all the salespeople were making and have their freedom and flexibility. So I converted to a loan officer and started to learn what all that entailed.

Q: When did you make that connection inside where you knew your passion was empowering women?

“A loan application back in 2003 from a single mother of 3. She was working 2 jobs, had put herself through school, and saved up $5000 to fulfill that American dream of home ownership. She had a few pitfalls in her credit and had been turned down by 2 of the local banks in town. We worked for 2 months together, and finally that day happened where she closed on her first house. As I watched her weep with pride, I knew right then that I can help make an impact on several women’s lives by showing them the path to home ownership.”

Q: Have you executed other roles in the mortgage industry other than origination and processing?

Oh Yes! I believe to be a good leader you must be willing to jump in at any position and know how to perform those functions. I have not only been a top producing loan officer most of my

It is very challenging, especially in this versatile and ever-changing market. We have large goals for not only production and growing employment opportunities in a contracting market, but we are enhancing our customer experience across the board by adding a lot of technology. Our goal is to make a very efficient process for our internal team and our team that works remotely. It is very important to me that we are all integrated regardless of where we physically work daily. Communication with clear expectations is key to success for us. Under promise your internal and external consumer but ensure you always over deliver. We have managed to build a reputation for providing a standard of excellence in our client experience. The core staff have been working together for over a decade now. For me, employee retention through investment in their growth, and keeping a fun environment are mandatory for a company to have longevity. Happy employees are the key to a company’s success.

Q: You’re known around the office as that type of leader that is here when they get here in the morning, and still here when they leave. Even working weekends at times. What drives you this hard?

I want to leave this industry better than I left it and empower as many people as possible along the way to fulfill their dreams, whether that be the dream of home ownership or the dream career opportunity. Every morning I get

up I am thinking of the people that depend on me to make a living that feeds their family, and the customers that are bettering their financial situation using the tools we provide at Southpoint Financial. I want to lead through actions not empty promises. It’s imperative those I work with respect and understand I am willing to do more than I ask of each of them. Leadership is also about servitude. I want staff to follow my lead not follow orders.

Q: What advice would you give women that don’t think they could cut it in an industry like yours?

First of all, anything is possible. I never thought coming from very humble beginnings, I would be where I am today. Without that D1 college degree, I simply do not fit in when you think of the elite. Learn to be ok with not fitting in, stars never do, they shine above the rest anyway. Others’ opinions can offer value feedback for personal growth, but don’t let it define your worth or set limitations on your life. Don’t be so quick to accept failure or defeat because your start was a little lower and my take a little more effort or a little longer than that D1 grad. A great attitude, willingness to engage in a process and learn and most importantly having a great work ethic will win every time. Don’t feel less than because of your gender, race, or social status and NEVER allow anyone to determine your value or limit your goals but you. Learn everything you can to become the expert, knowledge is the biggest gift so pay attention when you are being trained. Lastly when do reach leadership, understand what leadership truly means. Its not about the title, it’s not about the ability to bark orders or make big decisions. Leadership must come from within, you must truly care about others and want to see them achieve success. A leader will be a resource for development and leading the vision for those they lead. Lastly learn to speak less and listen more!!!

Mindy Rothenberger joined Southpoint Financial Services in Aug 2007 and rose through the ranks to her current role as President and CEO. Under Mindy’s leadership, loan volume has increased over 400%, expanded their area serviced to 18 states, and her omni-channel marketing strategy has brought a new dimension to the call center and the remote loan originators. Mindy continues to have her eye set on providing more opportunities in the workplace and customers wanting to improve their financial situation through home ownership. Regardless of working with a first-time home buyer, or coaching staff members, she does it with the intent to inspire personal growth for that individual.

We caught up with Mindy Rothenberger, President and C.E.O. of Southpoint Financial Services, a mortgage lender based in Alpharetta Georgia, for a quick chat about her journey and advice she would give someone coming up today.

Mindy is a 2022 Award Recipient of our 2022 Mortgage Star award.

f your company maintains a website – whether offering financial products or just selling pet stairs – you now need to be familiar with state and federal wiretapping laws.

The term “wiretapping” probably brings to mind images of police detectives or FBI agents huddled in the back of a white panel van or in a dark room with headphones on, listening to and recording conversations among shady characters. What likely doesn’t come to mind are interactive business websites.

Yet a spate of recent class action lawsuits against a variety of business websites

– including cases filed separately in September in Pennsylvania, Washington, and Missouri against Zillow Group Inc., as well as those filed against hardware retailer Lowe’s and travel website Expedia, among others – all cite state wiretapping laws as the basis of their complaints about invading consumer privacy.

The flurry of filed suits followed a federal appellate court decision in August that resurrected an earlier, similar lawsuit in Pennsylvania. Yet that lawsuit, Popa vs. Harriet Carter Gifts, owes a debt to even earlier suits involving Facebook (now Meta) and mobile software company Carrier IQ.

Privacy experts say all of these wiretapping lawsuits have far reaching implications for any business that maintains a website and uses coding, software, or third-party vendors to analyze what clients or consumers do when they visit online.

Just about every company uses some form of data analytics to understand how website visitors interact with a site, but the lawsuits will likely determine where the line is drawn between analytics and compromising privacy.

“The problem for these companies is, the exact moment that technology is allowing this data collection comes at a time when courts and consumers are asking for greater privacy protection,” said David A. Straite, a partner in the New York law firm DiCello Levitt and a certified information privacy professional.

To understand the issues in the lawsuits against Zillow and others, you have to go back to 2011, when lawsuits were filed nationwide against Carrier IQ and various mobile phone companies and services, including AT&T, Apple, Sprint (then Sprint Nextel) and T-Mobile.

The lawsuits followed the discovery by security researcher Trevor Eckhart that Carrier IQ’s software was being surreptitiously loaded onto cell phones. The lawsuits claimed the software logged keystrokes and illegally intercepted private communications, in violation of the Federal Wiretap Act, the Stored Electronic Communications Act, and the Federal Computer Fraud and Abuse Act.

Carrier IQ and the companies that used its software on their phones, meanwhile, claimed it was intended only for network diagnostics.

The class action lawsuits were consolidated in 2012 and eventually settled in 2016, with Carrier IQ and its codefendants agreeing to pay $9 million.

without the user’s knowledge.

Most users, on the other hand, are familiar with “cookies,” the blocks of data that can be placed on devices by websites they visit. In 2012, a lawsuit accused Facebook of using cookies to track subscribers’ internet use even after they had logged off the company’s social media platform.

In February of this year, Meta (Facebook’s parent company) agreed to settle the case for $90 million — 10 times the Carrier IQ settlement.

It should have ended there, but Popa later discovered that NaviStone — a thirdparty digital marketing service hired by the retailer — had tracked all of her interactions with the shop’s website.

Believing her privacy had been compromised, and that NaviStone had “intercepted” her communications with the shop website in violation of Pennsylvania’s Wiretapping and Electronic Surveillance Control Act (WESCA), she sued both the shop and NaviStone.

David A. StraiteThat case “established that if you’re recording keystrokes before someone actually presses ‘enter’ — before they choose to send it — that the average person does not expect those partial thoughts to be sent,” Straite said. “Now you’re seeing technology marching fast ahead. The more basic technology in the Carrier IQ case is now much more sophisticated.”

It’s not just keystrokes being tracked now, he noted, but possibly also cameras recording where your eyes look on the screen. And in many cases, you don’t have to hit the “enter” button for what you type to be tracked. Take, for example, when you start typing something into the Google search bar; you don’t have to hit enter to get suggestions, you get them starting with the first keystroke.

“Individual keys are being transmitted,” he said.

Such keystroke logging is possible on potentially any website you visit, often

Straite, who was co-lead counsel for the plaintiffs in the Facebook case, noted that even before the settlement, the case had created significant law in favor of consumers. In a 2020 opinion in the case, the U.S. Court of Appeals for the Ninth Circuit ruled that unlawfully copying and then selling personal data creates “economic harm.” It also ruled that Facebook was not a party to the communication it intercepted from other websites for purposes of the Wiretap Act, meaning it needed each user’s consent before collecting the data. The U.S. Supreme Court declined to review the case last year, letting the appellate court decision stand.

“This settlement not only repairs harm done to Facebook users, but sets a precedent for the future disposition of such matters,” Straite said.

Which brings us to those pet stairs. In 2018, Pennsylvania resident Ashley Popa used her smartphone to browse the website of Harriet Carter Gifts. She eventually found a set of pet stairs she liked and placed them in her digital cart, but never actually completed the purchase.

The District Court dismissed part of her claim regarding invasion of privacy, but granted summary judgment – deciding the case on its merits without a jury – in favor of the defendants on the claim of violating WESCA.

Popa appealed, and the U.S. Court of Appeals for the Third Circuit ruled in August that the lower court erred by granting summary judgment.

In a decision labeled “precedential” –meaning it potentially has implications for all website privacy disclosures and consent practices – the Third Circuit court ruled that Harriet Carter Gifts and NaviStone were not exempt from liability under Pennsylvania’s wiretapping law simply because NaviStone was intended to receive the communications from Popa’s phone and, therefore, had not “intercepted” them.

The appeals court ruled that the only statutory exception under Pennsylvania’s wiretap law is for law enforcement activity specified in a 2012 amendment to the law. The court also ruled that NaviStone’s alleged interception of Popa’s communications with the gift shop occurred at the point where Popa’s phone was located at the time (in Pennsylvania), and not where its servers received them (in Virginia).

The appellate court also said it was sending the case back to the district court because it had granted summary judgment

DAVID A. STRAITE

“THE PROBLEM FOR THESE COMPANIES IS, THE EXACT MOMENT THAT TECHNOLOGY IS ALLOWING THIS DATA COLLECTION COMES AT A TIME WHEN COURTS AND CONSUMERS ARE ASKING FOR GREATER PRIVACY PROTECTION.”

without addressing the issue of consent.

In a report on the ruling posted to Lexology.com by Kathryn Deal, a partner with the law firm Morgan, Lewis & Brockius in Philadelphia and a former federal prosecutor, she wrote that the appeals court ruling may spark “renewed interest in session replay and other websitetracking claims” under WESCA.

“To mitigate risk of liability and liquidated damages claims under Pennsylvania law, businesses and their digital marketers may want to review their disclosures and online practices to evaluate the strength of other defenses or exceptions to WECSA liability, including prior consent to any third-party data sharing,” Deal wrote.

She was right, of course, given the flood of lawsuits that followed the Third District Court’s ruling.

The lawsuits are all quite similar. Take, for example, the lawsuit filed Sept. 12 in U.S. District Court for the Western District of Washington in Seattle on behalf of two plaintiffs “and all others similarly situated.” The lawsuit names Seattle-based Zillow Group Inc. and Redmond, Wash.-based Microsoft Corp. as defendants.

In this complaint, which mirrors the others, the plaintiffs claim Zillow employs Microsoft and other third-party vendors to “embed snippets” of computer code on Zillow’s website, “which then deploys on each website visitor’s internet browser for the purpose of intercepting and recording” their interactions with the site. This can include recording “mouse movements, clicks, keystrokes, … URLs of web pages visited, and/or other electronic communications in real-time.”

According to the complaint, third-party vendors then use the data to recreate each website visitor’s “entire visit” to Zillow’s website, which is called a “session replay.”

“Microsoft and other Session Replay Providers create a video replay of the user’s behavior on the website and provide it to Zillow for analysis,” the complaint states, adding that this is the “electronic equivalent of ‘looking over the shoulder’ of each visitor to the Zillow website for the entire duration of their website interaction.”

The lawsuit claims this violates the Washington state wiretapping statute, and constitutes an invasion of the privacy rights of website visitors. Lawsuits in other states cite those states’ similar laws.

The Seattle complaint, like the others, makes the argument that website users have “a reasonable expectation of privacy in their interactions with websites.” It states that privacy polls and studies show that a majority of Americans consider “one of the most important privacy rights to be the need for an individual’s affirmative consent before a company collects and shares its customers’ data.”

The suit does note that the computer code used to recreate visitors’ interactions is “utilized by websites for some legitimate purposes,” but adds that “it goes well beyond normal website analytics when it comes to collecting the actual contents of communications between” visitors and the websites.

According to the Seattle complaint, the ZIllow website’s computer code allows the website to “capture and record,” among other things, “the visitor’s personal or private sensitive data, sometimes even

when the visitor does not intend to submit the data to the website operator, or has not finished submitting the data ….”

Straite noted that, while Zillow has posted a privacy policy on its website that states it will “collect a variety of information automatically,” the policy is “incredibly vague.”

“It includes things like search history, what you clicked on, the amount of time you spend looking at parts of the website,” he said. “It doesn’t say ‘mouse movements.’ ‘Session play providers’ doesn’t appear. None of the clear details about what is collected is disclosed.”

Because the policy is vague, Straite said, the typical visitor to Zillow’s website — even if they stop to read the privacy policy, which isn’t a given — likely would not fully understand the data it will collect about them.

“You would think this privacy policy protects your data,” when it doesn’t, he said. “This is a test of how vague a privacy policy can be. If this counts as fair disclosure, we’re in trouble.”

He said courts are increasingly receptive to the idea that “consent is not valid if the use is not explained. Tech companies always say they are collecting to improve their services, but they want more data to sell you more.”

There are those, of course, who believe session replay is not a threat to consumers.

Philip Yannella is a partner and practice co-leader for the Privacy and Data Security Group at the law firm Ballard Spahr LLP in Philadelphia. He believes that a “dark cloud” has been cast over session replay

because it is misunderstood.

“It’s really nothing nefarious,” he said. “It is simply an analytical tool that’s widely used by pretty much every digital content manager in the country.”

Yannella said the goal of session replay is “to try to learn more about user behavior on the websites. Session replay, what it does is basically track users’ clicks, their navigation through the website, any kind of follow through, any links that they’re hitting on the website.”

It then aggregates all of that data, he said, to create, “for lack of better word, a recording of the user’s interaction with the website.”

Yannella cautioned that it does not actually record the user — as in recording his or her face — but everything the user does while on the website. “It can give the impression that somehow your laptop is videoing you while you’re sitting at your computer, but that’s not really what’s happening at all.”

While lawyers for the plaintiffs in the Zillow lawsuits claim that session replay constitutes an invasion of privacy, Yannella says Zillow and other companies will strongly disagree.

“What Zillow would say to the privacy claims is, the user typed in information on the website and they shared that with

the website operator, so there cannot be an expectation of privacy for information that someone voluntarily shares with a website. … The privacy claim may be a bit overstated.”

When asked about the lawsuits, a Zillow spokesperson said the company is aware of them, adding that it takes the privacy and security of users’ information “very seriously.”

“We are transparent with our users through our privacy policy, which explains to users the types of information we collect as they use our apps and websites,” the spokesperson said.

Yannella said consent is the biggest issue in the session replay lawsuits — including the Harriet Carter Gifts lawsuit.

“Most wiretap laws in the United States, including the Federal Wiretap Law, are one-party consent,” he said. “That means that only one party to the communication has to consent to the wiretapping.”

Pennsylvania, he noted, is one of 11 states that require two-party consent.

“Consent doesn’t have to be ‘express written consent,’” he said. “You don’t have to sign a document that says ‘I consent,’ you

don’t even have to click a box that says, ‘I consent.’ Most of these state laws will allow consent to be inferred.”

He said one defense that NaviStone used in the Harriet Carter Gifts case was that it disclosed what it does in its privacy policies, “and the plaintiff should reasonably have expected” to have their behavior on the website tracked, “because that occurs everywhere on the internet. So the plaintiff certainly must have known about this; indeed, they were told about this in (NaviStone’s) privacy policy.”

For Yannella, that is the bottom line. “Everyone does it,” he said. “Everyone is using website analytics, and everyone, pretty much, is working with companies like … NaviStone to enable targeted advertising. So the scope of these lawsuits is wide-ranging.”

The lawsuits have a fundamental flaw, because “plaintiff’s lawyers are attempting to use laws from the 1960s that were developed 25 to 30 years before the commercial internet really came into its heyday, Yannella said. “They’re trying to, essentially, use these new technologies and cram them into these old laws, and these old laws were not meant at all to deal with targeted advertising or website analytics. These things didn’t even exist back then.”

Because of that, it is “difficult to try to make the analogy that targeted advertising is the same as tape-recording a conversation,” he said. “It’s just not”

If the plaintiffs win, he said, “it’s going to have a significant impact on most online retailers; really, on most online companies. Because it’s getting to the core of online commerce. Everyone is doing it this way.”

The end result if the plaintiffs win, Yannella said, is “you’ll see websites and targeted advertisers probably change their approach. If you’re a website operator, you’ll probably have to get (direct) consent and they’ll probably have to do that through some kind of just-in-time consent, like maybe a cookie banner,” which announces that cookies will be installed if the user continues and requires the user to click a button.

“That’s a pretty clear way to button up this issue,” he said, “and make sure you don’t get sued.”

“IT CAN GIVE THE IMPRESSION THAT SOMEHOW YOUR LAPTOP IS VIDEOING YOU WHILE YOU’RE SITTING AT YOUR COMPUTER, BUT THAT’S NOT REALLY WHAT’S HAPPENING AT ALL.”PHILIP YANNELLA Philip Yannella

a ton of emails from around the world on different issues affecting people at work, and one of the most common is a question from folks wondering how to create the best work-life balance possible. It turns out that they come from all walks of professional life – from Fortune 500 companies all the way to independent contractors who run their own small business. It seems that everyone today is concerned with striking a balance.

But far too often, the focus of work-life balance is on the failures of a company or institution to implement a useful program to address work life balance. And the stories are strikingly similar across all companies, sizes and industries. Stories about companies that institute incorrect work-life balance measures such as unlimited PTO still have people missing out on personal life events such as birthdays and kids activities. Plus, people are still burning out despite the companies’ best efforts.

So, what can be done? I have a few tips in this area on how to creatively achieve that coveted work life balance:

I have noticed that all the successful people around me have one thing in common: they all work Saturdays and Sundays. Now you may be thinking that this is not a healthy approach especially in an article about work-life balance, that this is the recipe for burnout, and many other such things. But that misses the fundamental insight that creativity can bring when we look at this issue: It’s all about the individual.

Every approach to a work-life balance is individualized. There is no one size fits all approach. Its success rises or falls depending on the individual and their ability to determine their own work life balance.

Usually, when a rule is made by a company (or government) it is too late – the rule is there because someone already ruined it for the rest of us. And breaking the chains of a mandate intended to help is necessary.

It’s like the old adage, “The road to hell is paved with good intentions” – and so here it is the same with a company mandated worklife balance. Instead, do what is right for you

– and control the work life balance on your own terms to emerge stronger in the long run.

Everything in life involves a tradeoff of some sort – and it is no different here. We are blessed to live in a county where hard work equals results in the long run. And that amount of hard work is determined by us and us alone. You literally get what you give. Yet most work that must be done occurs outside that time frame we deem as traditional or normal working hours. And choosing to work those hours instead of keeping to the 9 to 5 is increasingly important.

NIR BASHAN1890’s industrial revolution days that pre-date modernity in many ways. But this was an era of kids working in mines and people routinely dying on the job. It took many, many blood-soaked decades to get to where we are today. Take for example the Homestead Strike. One of many in that era.

In the 1890s hundreds of steel workers went on strike in Homestead, Penn., after receiving a slash in their pay. So, they walked out and were met with armed resistance trying to break up the strike. Many people died as steel workers and scabs fought a gun battle because of the lower wage demands of the plant owner, who happened to be Andrew Carnegie.

So, what can be done?

Well, you can’t really get something for nothing. Nothing really comes without affecting the balance of something else. If you work all week and you work the weekends, then you may get burnt out. Or you may not.

But the key here is the balance. So, if you find yourself working weekends consistently, try to balance and recalibrate your schedule to do less during the days you are not so busy. I found this works great for me and allows me to be flexible – therein making my own work-life balance.

Now I know you may be saying that you can’t do that! You work a 9 to 5 with strict hours, and you get calls or emails or texts outside those hours and your work-life balance is off. Well, you have the power to do several things to reinstate that balance. For instance, you can choose not to text back after hours. You can choose to turn off your phone after a certain time each evening (I do this– it costs me work sometimes but is better for my personal work-life balance) or you can choose not to attend each and every meeting on your calendar to help balance that work life approach. The choice is yours – and it will involve some compromise.

3. THE 1890S ARE CALLING Today’s work hours are anchored in the

Today stuff like that doesn’t really happen anymore in the U.S. Employment disputes are handled in a far more civilized way, and yet this Homestead Strike paved the way for the modern unions we have today. You see, we stand on the shoulders of giants. Great improvements thought history, some are really not that old like this one from 140 years ago – have paved the way to the work life we have today.

The point is not if unions are good or not – it’s that someone at some time in history has ushered us to the here and now where we can even debate issues such as work life balance. These workers in 1890 were fighting a very real life and death battle. Today our stakes are far lower.

We live in some of the best times humanity has ever seen on earth. Mobility, health, entrepreneurship, and many other conditions of humanity have never soared as high as they fly today. So, instead of looking to others to help solve the work-life issues you face, look within. Set limits on what works for you as an individual and you will find that your contributions will surprisingly improve your day-to-day bottom line.

Nir Bashan is an all-time Top 100 nonfiction book author and speaker. He helps folks become more creative at work.

Texas’s top gathering for mortgage professionals returns to Houston on November 8, 2022. Don’t miss this exciting, informative event. NMP readers like you can attend for free by using the code NMPOCN.

www.txmortgageroundup.com

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility.

CliffordRossi is a veteran of the financial services industry who is now a business professor at the University of Maryland. He shared his views on where the U.S. housing market is headed in the coming months.

Q: Fed Chair Jerome Powell stated that the U.S. housing market will probably go through a ”correction” after a period of ”red hot” price increases. What is your perception of his remarks? Are we headed for a correction?

The first thing to note is that while the housing market is weakening, conditions are very different from those in 2008 during the Global Financial Crisis which was precipitated by a meltdown in the US housing market. Home prices in many markets have been driven up by a number of factors, including an abnormally low level of housing inventory as well as some migration from large urban areas to smaller cities and locations during the pandemic. Home prices in many markets according to my housing market model have been driven well beyond market fundamentals, indicating that with the economy softening we should expect a corresponding decline generally speaking of home prices over time. I believe a ”correction” might be too harsh a term to use in this case, but a number of areas that have seen double digit increases year-over-year may see some significant price declines over the next year.

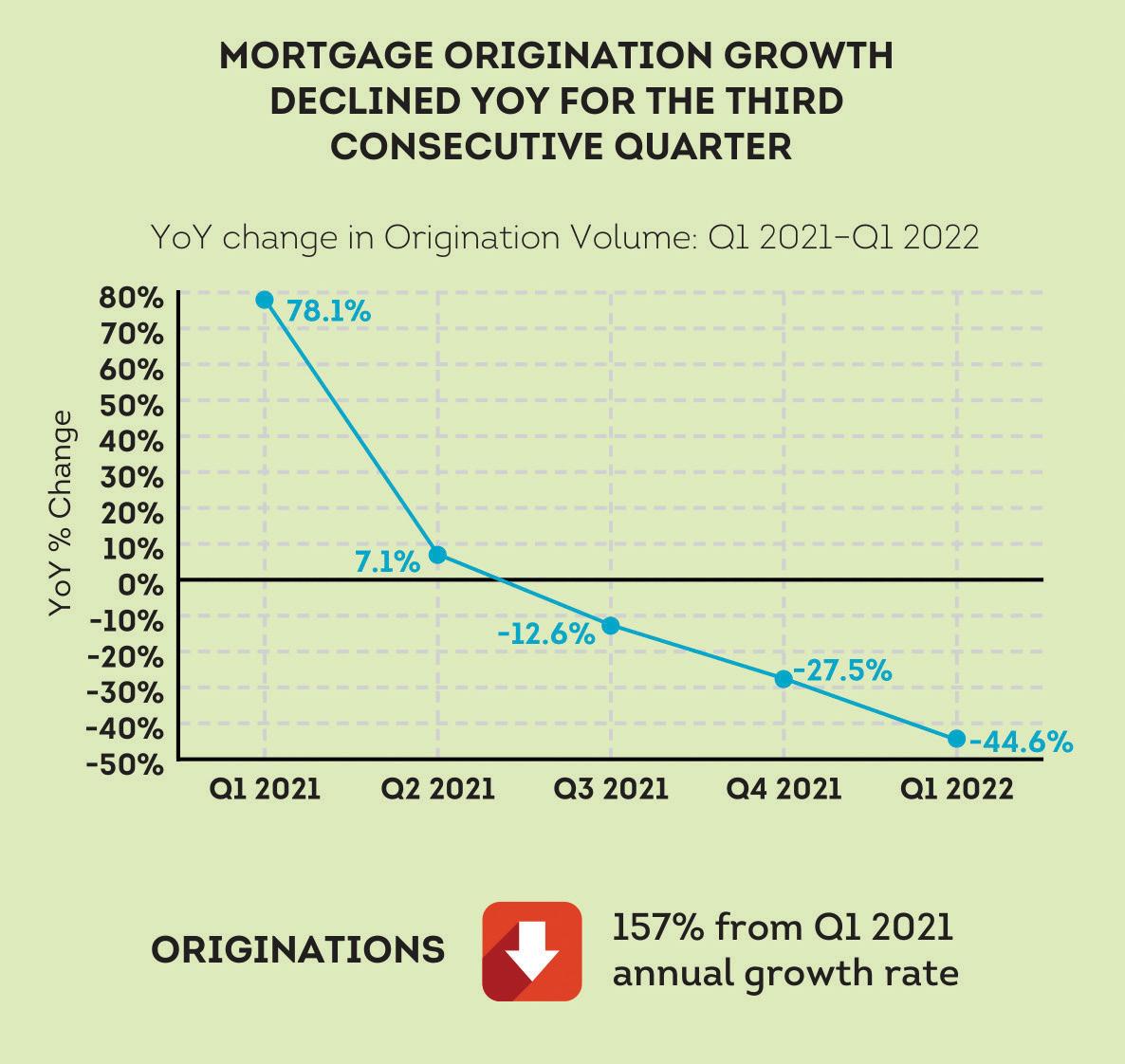

Q: Is a correction necessarily a bad thing? What impact do you see it having on mortgage origination numbers in 2023?

Housing markets are cyclical and like other financial markets there can be periodic pullbacks. Such a reversion to the mean can be beneficial to the extent that it brings home prices back to equilibrium consistent with market demand and supply

drivers. The Fed’s catch-up strategy of boosting interest rates has already had a chilling effect on the mortgage market where demand has fallen off as mortgage rates have risen sharply. I would expect continued weakening of demand over the next 6-12 months as the Fed continues its path toward a more restrictive monetary policy which also includes unwinding its large MBS portfolio.

Q: Are there misconceptions about the U.S. housing market? Is it all bad news ahead?

At this point there isn’t much of a silver lining in the housing market that I see quite yet. A big unknown is the trajectory of the overall economy. If the Fed is unable to engineer a so-called soft landing, I think the housing market could suffer further deterioration in the short-term if unemployment were to rise sharply. If inflationary pressures persist in the economy, the real potential longterm is for a long period of slow growth and higher than normal inflation (stagflation) to take root. Prospective homebuyers, particularly first-time homebuyers and lowand moderate-income households will be challenged by housing affordability issues brought on by higher construction costs and wages that are unable to keep pace with inflation.

Q: What other factors are driving the housing market? You said in July, for example, that bank stress tests could lead to the reduced availability of credit to prospective homeowners.

Some of the effects of the pandemic are still with us. Supply chains that unraveled during the pandemic are starting to come back but slowly and this coupled with rising costs of key commodities and goods for building, remodeling and furnishing homes leads to higher prices. With wages not keeping up with inflation, that reduces borrower purchasing power and when coupled with

MORTGAGE PRODUCT CREATIVITY CAN BE BENEFICIAL AT TIMES, BUT ALSO WIND UP CAUSING SIGNIFICANT PAIN IF NOT CAREFULLY DEVELOPED.

the double whammy of higher mortgage rates dampens housing demand. All of these factors are contributing to abnormal housing market conditions that were already affected by low housing inventory levels.

Q: You might have a good perspective on this from your experience in senior risk management positions at Freddie Mac and Fannie Mae. Does anything need to be done with the GSEs to improve the mortgage marketplace?

Would reforms hurt or help the industry and consumers? The one thing the GSEs and government agencies such as FHA should not do is significantly relax credit underwriting guidelines in an effort to spur market demand. I’ve seen this movie before and it never ends well. Prior to 2008, efforts to provide products such as option ARMs were heralded as affordability products that should never have been provided at scale to the general public. Mortgage product

creativity can be beneficial at times, but also wind up causing significant pain if not carefully developed. These agencies need to assess their appetite for mortgage credit risk and maintain that level while providing access to credit during this period.

Q: What can be done to improve the rental market in the United States? Does anything need to be done? Is it beyond government intervention?

The rental market is a reflection of the state of housing generally and as such presents a real problem in the market today. Unfortunately, I think in the shortterm rental market conditions will remain painfully elevated. The combination of high home prices, low rental housing inventory and a large presence of institutional investors in the housing market have helped distort rental prices over the last several years. Unfortunately, a period of historically low interest rates and excessively and unnecessarily stimulative

fiscal policy contributed to the formation of significant increases in asset prices in many markets over the last few years including equities, fixed-income, real estate and commodities. High inflation and the corresponding low response by the Federal Reserve are forcing a day of reckoning on these markets. The Fed’s course toward stamping out inflation is an unfortunate but necessary path though toward long-term economic and housing market stability.

Clifford Rossi, professor of the practice and executive-in-residence for University of Maryland’s Smith’s Center for Financial Policy, has held senior executive roles in risk management at several of the largest financial services companies. His most recent position was managing director and chief risk officer for Citigroup’s Consumer Lending Group, where he oversaw a global portfolio of mortgage, home equity, student loans and auto loans worth over $300 billion.

By CURTIS WOOD, CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

By CURTIS WOOD, CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

Working together, artificial intelligence and smart contracts are revolutionizing mortgages for customers and lenders alike.

It is inevitable that AI and blockchain will eat the world. Nowhere is that truer than the world of mortgage lending.

The one-two punch of AI’s processing power and blockchain’s decisioning capabilities are automating loan origination in a powerful way.

This new technology is not just digitization. Web3 is repaving the entire street, revolutionizing the world of mortgages—for customers and lenders.

An Uber-like mortgage experience is on the horizon, bringing home lending into the 21st century alongside other apps in wide use today.

For the customer experience, the benefits will be shockingly positive, streaming mortgages directly to their phones—something previously unthinkable without a loan officer. It will also improve affordability, simplicity, and convenience.

Web3 will eliminate the need for a loan officer to process a 1003. If a human is no longer needed to process data, that LOS can power a mobile mortgage where the borrower interfaces with an app instead and can be pre-approved on their own time, not the lenders.

Web3 also has potential to transform processingE with automated conditions clearing by receiving document requests directly from the underwriter via an app instead of a processor phone call or email. Uploaded documents are then processed with OCR programs running on AI

and smart contracts before alerting the underwriter.

Now, Web3 has eliminated the third largest cost to originate a loan, the processor.

Until now, mortgage technology companies have been worried about lender pain points instead of the customers. The fact that the customer experience and complaints haven’t changed much in 20 years is evidence of mortgage technology being focused in the wrong place.

Lenders should be more concerned with delighting their customers with an ideal mobile experience. Steve Jobs said it best when he said that new customer experiences change markets—that’s why he helmed the most valuable company in the world; one that sold a complex product so easy to use it didn’t come with a user manual.

In view of rising mortgage rates, lenders need two things to win the future: an Uber-like customer experience and low rates. Mobile is the only enabler of a new mortgage experience, and Web3 automation drives the ability to lower acquisition costs and offer lower rates. And considering where rates are headed, buyers will be ultra-rate conscious for the foreseeable future.

With this in mind, it’s clear that we’re at an inflection point—some will fail while others scale, and those who leverage Web3 mobile will have staying power for decades–unlike most “digital” lenders today. After all, digital doesn’t equal a mobile mortgage experience.

Looking ahead, advanced LOS automation enhanced with Web3 is already speeding up these processes–and

with startling accuracy. It’s as if AI is the brain of a very smart robot, and a smart contract is the decision-making mechanism–the second key component for solid, reliable loan approvals.

And so, you may ask, why isn’t the AI/ blockchain combo everywhere?

So far, the problem has been this: Attempting to redesign and repurpose the latest mortgage tech for today’s mobile consumer is a lot like turning the Titanic or trying to turn a battleship into a speedboat. It’s easier to start from scratch by rethinking the entire thing.

For the past 20 years, some technology companies have been trying to figure out how to automate loan origination, but the one thing they’ve never moved away from is the trust component placed on that human loan officer, along with the process dependency on the processor. It’s a point of contention with many banks.

The fear is that a lack of human review will increase the inherent risk one engages in when lending—i.e., if you disposition a file incorrectly or render an inaccurate decision of credit, there’s liability. Nobody wants to get stuck in an agreement that they don’t actually agree with, not to mention the monetary aspect of some mistakes.

Ironically, the surest way you can actually lower that risk is to employ a smart contract at precise moments in the lifecycle of data that handle critical qualifying information that impact pricing. Blockchain has no human biases, no data misreads, and is fully encrypted before it’s ever executed. In fact, the blockchain itself doesn’t know what it’s

looking at, as it’s buried in the strictest banklevel encryption.

Despite all the checks a file goes through prior to closing, human error is still the #1 cause of defects, cures, buybacks, and lender liability. This is where blockchain is different: you can trust it. Humans make mistakes, but in code we trust.

Silicon Valley has a lot of smart software engineers with a lot of funding, but the question has to be asked, why hasn’t the industry been impacted with an Uber-like moment yet?

The reason is two-fold: 1) Lender resistance to major change, which impacts the second reason, 2) Mortgage technology companies making software they can sell. This software is not innovative, which is what the industry and borrowers desperately need. This is also why the industry hasn’t been truly disrupted by mobile.

These brilliant engineers operate with the fear that they can’t be too different or else the lenders won’t use them. Even worse, they don’t intimately understand either the mortgage process or the borrower. They have no vision for changing the industry—they just want to alleviate aspects of the journey in order to make as much money as possible as quickly as possible for their VC backers.

The mortgage app of the future is a single, unified tech stack oriented around the underwriter, not the loan officer and processor. No more independent point-ofsale and LOS. Each data touch point will be optimized around Web3 capabilities to automate data faster and better than a loan officer or a processor.

With a Web3 enhanced LOS, cycle times

are reduced, acquisition costs are lowered, and the most important person in the process—the underwriter—is given central status.

Mortgage professionals have been resistant to the very change that would cannibalize the industry, and who can blame them?

As with all advances in automation, there will be impacts to the industry as an estimated 70-80% of mortgage jobs get eliminated, much like robotics replaced the assembly line worker.

The digital mortgage designs that are constructed with a loan officer and processor in mind are doomed for failure. In fact, the key to automating the origination process is to eliminate the historic dependency on the loan officer and the processor.

Very soon, the only two people needed to originate a mortgage will be an underwriter and a closer.

Lenders using a loan officer and a processor will almost always be abandoned for the lower rate mobile option, the same way customers gravitate to Uber, Robinhood, Carvana, and many other apps.

It’s a bittersweet loss because the current customer experience has been a bad tangle in many ways. Banks and lenders info dump with a barrage of emails and documents, creating confusing, stressful, and complex hassles for new buyers. Yes, there are good and bad loan officers. And yes, the good ones know how to manage your expectations and get your deal done—they also know the pitfalls and landmines and how to handle them.

The trouble is—when it comes to loan officers you may not get a good one, and if you get a bad one, then what? You’re stuck.

Web3 is already here, and the more that lenders use it, the smarter these LOS’s will get—a rapid acceleration that will ultimately render the old model obsolete.

It’s important to remember that 5 out of the top 10 lenders in America today were not around 10 years ago. Lenders ignoring this advanced LOS design with Web3 and a new mobile customer experience are the walking dead. They just don’t know it yet.

Curtis Wood, CEO + Founder, Beemortgageapp. com

PennyMac Financial Services, Inc. announced the launch of POWER+ by Pennymac TPO, its next generation broker technology platform. Brokers will now have more speed and control over the mortgage process to deliver an exceptional experience to their customers and referral partners.

POWER+ offers an enhanced guided workflow that is intuitive and significantly speeds up mortgage processing time at every step. This allows brokers to complete loan setup, lock and disclose in a matter of minutes. Additionally, it reduces processing time from loan creation to credit submission by as much as 40%. The platform’s robust contextual validation capabilities ensure Uniform Residential Loan Application (URLA) accuracy before submission. As a result, the loan process is more efficient, precise, manageable and convenient.

Pennymac’s unique, custom fee screen enables brokers to accept, add and edit fees directly onto a screen that looks exactly like a loan estimate. Brokers will have more control with the option to self-serve using Pennymac’s default fees or selecting the platform’s dynamic search feature to pull in fees from over 25,000 settlement service providers across the country. These combined features allow brokers to deliver fee accuracy to their borrowers.

POWER+ also offers the ability to manage and monitor third-party activities. The platform’s settlement agent fee collaboration tool allows brokers, settlement agents and Pennymac to balance the final closing disclosure in a traceable system. Real-time communication with all parties in the balancing process improves transparency, eliminates back-and-forth emails and speeds up the closing process.

title companies to lenders in connection with mortgage payoffs. These scams involve fraudsters impersonating the mortgage lender as part of a real estate closing, in hopes of having the payoff wire transfer redirected to the fraudster’s bank account.

“We’ve helped recover nearly $50 million in loan payoff fraud, and now we have the solution to prevent it,” said Tyler Adams, CEO of CertifID. “For large sum loans such as mortgages, payoff wiring instructions verification has remained a laborious and vulnerable process. Thanks to PayoffProtect, the days of mortgage payoff fraud are finally over.”

”We’ve been able to leverage the platform to create business for our loan officers that may have otherwise been missed. This solution allows us to gain insights on borrowers in a way that we would never be able to achieve organically. Not only does it help us determine that our customers may have a mortgage need, but it seamlessly sets them on a journey, putting our loan officers front of mind,” said Jelaire Grillo, brand ambassador at Prosperity Home Mortgage, LLC. “In the last two weeks alone, Customer Intelligence uncovered 1,200 opportunities we may have never known about and resurfaced customers that many of our loan officers haven’t had contact with in years. We have definitely found the formula to deliver value to our loan officers and empower them to grow their business.”

CertifID, a leader in wire fraud protection, launched another technology solution breakthrough with the unveiling of PayoffProtect, which gives title, escrow and settlement companies peace of mind by preventing property loan payoffs from being sent to fraudsters.

The new PayoffProtect solution combines CertifID’s expert knowledge and suite of intellectual property. The latter includes machine learning capabilities that are now being leveraged to automate and standardize the mortgage payoff demand letter verification process. In more than 95% of cases, the company’s validation engine software authenticates loan payoff wiring instructions.

Developed as a result of CertifID’s intrapreneurial culture, PayoffProtect is designed in response to customer feedback about an unaddressed area of vulnerability for real estate wire transfers. PayoffProtect addresses the sharp increase in fraud surrounding wire transfers made from

Snapdocs, a digital closing platform, has announced an integration with Byte Software.

The integration will enable lenders to use Snapdocs within Byte’s loan origination system (LOS) to streamline and automate the closing process for cost reduction and an improved borrower experience, the companies said.

Snapdocs’ open platform and partnerships with all major real estate technology providers enable lenders to leverage AI to automate time-intensive, error-prone tasks, connect with the largest settlement network, and get to full digital closing adoption with Snapdocs, it said.

“We believe lenders should be able to work out of their preferred platforms while automating closing tasks and delivering a seamless borrower experience,” said Todd Maki, vice president of business development & partnerships at Snapdocs.

“We’re excited to enable Byte lenders to use Snapdocs within Byte’s LOS to digitize their closing process.”

‘Lighthouse,’ A Proprietary App, POS Software Advisors Mortgage Group, based in Ocean Township, New Jersey, announces the release of its new proprietary mobile app and point of sale software called “Lighthouse.” The conception and development of this launch were led by Wayne Steagall, technology director at Advisors.

“Our goal was to build an online application that is completely user friendly and guides the borrower through the process to ensure a stress-free experience on the consumer side,” stated Steagall. “After building a few of these systems before, I was able to leverage that experience in order to develop and deploy Lighthouse for our loan officers in the span of 12 months.”

Sean Clark, vice president of Advisors, said, “We thought the name Lighthouse would perfectly capture the essence of guiding someone into homeownership. Coincidentally, lighthouses have a special meaning to the Meyer/Clark families, so the name is all that more special to us. Bringing this technology in-house and integrating it with our proprietary CRM, AVA, that sits on the Salesforce platform will elevate our customer service to a new level because we don’t have to depend on a third party to solve any issues or questions that may arise.”

Total Expert, the only CRM and customer engagement platform purpose-built for modern financial institutions, has been named the winner of the Innovation Challenge, sponsored by LendingTree, at the 2022 Digital Mortgage conference in Las Vegas, Nevada.

Total Expert launched Customer Intelligence earlier this year to provide lenders with the intent and behavior data they need to connect with consumers at key moments of opportunity. Customer Intelligence allows lenders such as Prosperity Home Mortgage, LLC to identify and close more loans based on customer insights.

The release of the mobile app will allow borrowers to upload documents, check their loan status, and receive push notifications from their loan officer, among other great features. Advisors’ loan officers will be able to issue pre-qualifications from the app which is extremely beneficial to both borrowers, realtors, and the loan officers.

study from North Carolina State University finds that companies can address “quiet quitting” among employees by ensuring employees spend time with other people who identify with the company. The findings can inform everything from office layouts to assigning mentors to new employees.

“We’re not fans of the term ‘quiet quitting,’ since it seems dismissive of employees who are fulfilling their roles in a company,” says Erin Powell, co-author of a paper on the work and an associate professor of entrepreneurship in NC State’s Poole College of Management. “That said, it is clear that companies can benefit significantly when employees go above and beyond what’s required of them. And our study offers insights into what gives employees that sense of purpose and drive that can benefit their employers.”

“Fundamentally, we wanted to know how one’s relationships with co-workers affect the extent to which one identifies with an employer and, by extension, the extent to which one is helpful at work,” says Tom Zagenczyk, co-author of the paper and a professor of management in NC State’s Poole College of Management. “Historically, attempts to explore ‘organizational identification’ – or the extent to which your organization is part of your identity – have focused on how employees perceive the organization’s reputation and how they view

the way they’re treated at work. We really wanted to explore possible social influences.”

To that end, the researchers conducted an in-depth social network study of 91 employees at a company that employs a total of 97 people. Study participants were given a survey designed to capture the role of each employee, how they related to the company, and how they interacted with other employees. For example, questions assessed the extent to which each employee identified with the company; how they viewed their treatment by the employer; how helpful co-workers were; and how they fit into the structure of the organization.

The researchers then used statistical tools to account for potentially confounding variables and to identify factors that affected organizational identification and helpfulness at work.

“One key finding was that a given employee’s organizational identification was similar to the organizational identification of the people who give that employee advice in the workplace,” Zagenczyk says. “In other words, it appears that the people an employee turns to for help at work have a significant influence on how the employee feels about the company.”

“That’s important because it is wellestablished that the more a person identifies with their company, the more likely they are to go beyond the call of duty at work,” Powell says. “And that helps the employer’s bottom line.

“This finding has practical applications, since employers have myriad ways of influencing how employees interact with each other. For example, employers decide where people’s desks or offices are located, they can determine who is assigned to mentor new hires, and so on.”

The researchers also found that, when people occupy similar places in their employer’s social network, they exhibit similar levels of helpful behavior. That was true regardless of how closely the individuals identified with the employer.

“We think this demonstrates that workplace behavior can also be influenced by observing the behavior of peers, regardless of whether they interact directly with those peers,” Zagenczyk says. “This highlights the importance of establishing those positive social interactions we mentioned earlier – the effects can extend beyond the people directly involved in the interaction.

“One reason companies are freaking out about quiet quitting is that many workplaces have moved away from clearly defined job descriptions to adopt team-based, decentralized organizational structures,” Zagenczyk says. “In that sort of environment – in which many tasks don’t fall within any employee’s defined job description – a lack of ‘organizational citizenship’ in employees can really hurt the company. Employers can address this challenge by better understanding the informal social networks that influence the way people feel about their employers. Studies like this one will help managers do that.”

The paper, “Social Networks and Citizenship Behavior: The Mediating Effect of Organizational Identification,” is published open access in the journal Human Resource Management.

ERIN POWELLhttps://onlinelibrary.wiley.com/ doi/10.1002/hrm.22144

EMPLOYEES NEED TO SPEND TIME WITH OTHERS INVESTED IN THE COMPANY

‘WE’RE NOT FANS OF THE TERM QUIET QUITTING, SINCE IT SEEMS DISMISSIVE OF EMPLOYEES WHO ARE FULFILLING THEIR ROLES IN A COMPANY.’