Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

Our commercial banking team can help you map the cash moving in, through and out of your business with next-level know-how. So, no matter which way it moves, you can be sure it’s moving you forward.

While the latest data on inflation has provided a reason for optimism, less favorable base effects are likely to slow further progress in reducing annual inflation to the preferred 2% target, according to the commentary from the Fannie Mae Economic and Strategic Research (ESR) Group.

Given the low rate of productivity gains, wage growth appears to remain too high for inflation to near its target rate anytime soon, and so the ESR Group is forecasting another rate hike later this month and even tighter monetary policy through the end of the year. The ESR Group expects the Consumer Price Index, on an annual basis, to end the year around 3.1%, with the core index around 4.3%.

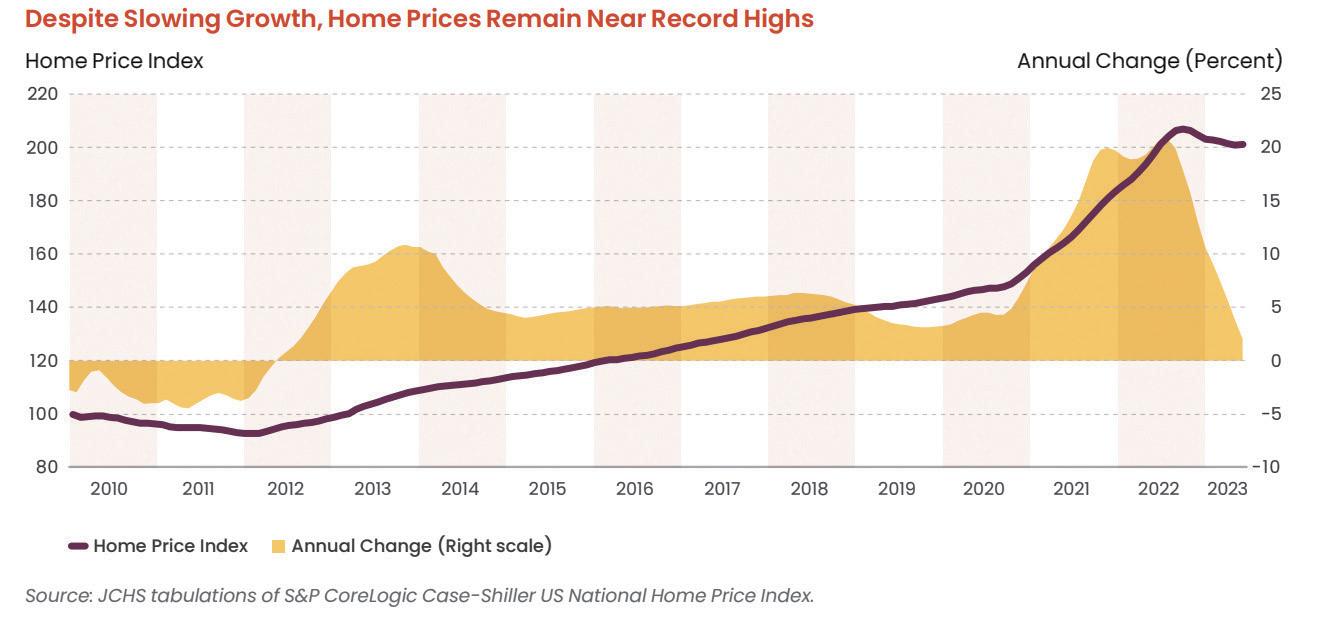

Following an unusually large upward revision to first quarter 2023 gross domestic product, the ESR Group upgraded its expectations for economic growth in 2023 by a full percentage point to 1.1%. However, while noting that the probability of a ”soft landing” may have increased of late, the ESR Group continues to expect a modest recession beginning in the fourth quarter of 2023 or the first quarter of 2024. An extremely limited number of existing homes available for sale continues to be the defining feature of today’s housing market, according to the ESR Group. While total home sales remain near the lowest annual level since 2009, this is not due to lack of demand. Rather, the ongoing lack of inventory, the extent of which exceeded the ESR Group’s earlier expectations, has resulted in significantly stronger home price appreciation than previously anticipated.

Dynamics in the existing sales market have been highly supportive of new construction, though, and the ESR Group has significantly upgraded its single-family starts forecast. Still, given the ESR Group’s expectation of slowing economic activity through the end of the year and into 2024, it continues to anticipate slowing home price growth and a slower pace of starts in 2024.

Freddie Mac released its 2022 Green MBS Impact Report showing the company issued $1.372 billion of Single-Family Green Mortgage-Backed Securities (MBS) for the year. The report provides an overview of Freddie Mac’s Sustainability Strategy and SingleFamily Green Bond Framework, and highlights the estimated impact of the enterprise’s Single-Family Green MBS program.

“Freddie Mac has joined a growing movement of investors and other capital markets participants who are building a more robust market for environmentally focused investments,” said Freddie Mac’s Mark Hanson, senior vice president, securitization. “The size of our Green MBS issuance doubled from 2021 to 2022, reflecting market demand for this type of product and the expansion of eligible collateral to include loans backed by homes with a qualifying Home Energy Rating System (HERS) score. By meeting the needs of green investors in this way, we are making home possible for more individuals and families.”

From its inception in 2021 to year-end 2022, Freddie Mac Single-Family Green MBS Issuance totaled nearly $2 billion unpaid principal balance of bonds. The bonds were backed by more than 6,400 Freddie Mac mortgages secured by newly constructed homes with a qualifying HERS rating, or GreenCHOICE Mortgages® where the proceeds or portion thereof from each refinanced mortgage paid off existing debt that was used to finance the purchase and installation of solar panels.

Freddie Mac estimates that the collateral in its 2022 Single-Family Green MBS issuance:

• Saved enough energy to power more than 2,000 homes for a year,

• Avoided greenhouse gas emissions the equivalent of taking nearly 3,800 cars off the road for a year, and,

• Saved an estimated average of $722 in annual utility costs for each homeowner with a mortgage included in a 2022 Freddie Mac Single-Family Green MBS.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart

NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley

STAFF WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Christopher Wallace, Stacy Murray

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Mary Quinn

MULTIMEDIA PRODUCER

Matthew Mullins

MULTIMEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Regina Morgan

ADVERTISING SALES EXECUTIVE

Nicole Coughlin, Nichole Cakirca ADVERTISING ASSOCIATES

Lydia Griffin MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

Submit your news to editors@ambizmedia.com

www.ambizmedia.com

© 2023 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089 Phone: (860) 719-1991 info@ambizmedia.com

BY ROB CHRISMAN , CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

BY ROB CHRISMAN , CONTRIBUTOR, MORTGAGE BANKER MAGAZINE

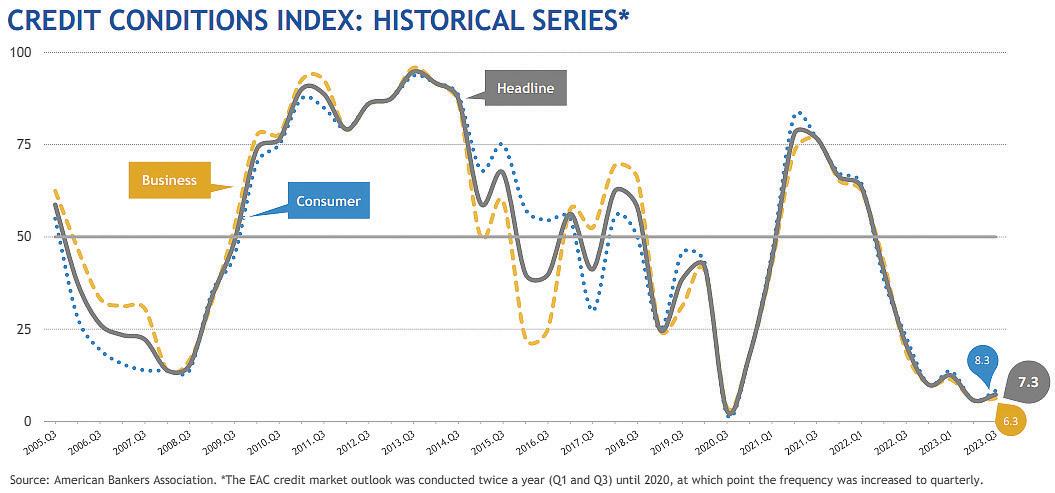

Often times there is a tremendous amount of speculation in the mortgage industry regarding supply and demand, the foundation to any free market. While mortgage activity remains a sticking point for the economic and housing outlook as we move through 2023, recent data indicates that lending standards are easing, and supply is increasing in the mortgage market.

Many research and economic departments focus on residential mortgage debt, of which new issuance has fallen to low levels while the inventory of housing available for sale continues to remain sluggish. If you look at institutional investment, mortgages as a percent of total assets have fallen due to bank-level concerns, summed up by “Do we want to own MBS or jumbo loans in our portfolio?” This brings us to question the

fundamentals of our market, specifically, what is holding down stronger growth in the mortgage market?

When we ask, “Who is the primary driver of supply?” the government-sponsored entities (GSEs) are a good place to start. GSEs have made up the majority of growth in the mortgage lending market, and Fannie Mae, Freddie Mac, and (indirectly) Ginnie Mae, have surged in mortgage originations compared to private institutions. Mortgages originations from private entities, like insurance corporations and affiliate institutions, have fallen to historical lows, mainly as a function of their inherent risk premiums; it’s hard to compete with the GSE’s daily rates. And yet jumbo loans, for example, don’t have fees to guarantee investors of their performance, and may actually offer more attractive rates.

Private securitization, usually comprised of jumbo or non-QM loans, tends to ebb and flow based on the demand by investors. The rates in the primary markets, which move through into the secondary markets, tend to be 1.5-3.0 percentage points above the average rate for GSE (conventional conforming) loans. It’s important to note that the current lending environment remains relatively inexpensive (compared to only a decade ago) and that the percent of loans approved but not accepted has fallen in recent years; this traditionally indicates that borrowers are likely not turning down loans because of any “rate barrier”. As some will note, the Dodd Frank Act and the Volcker Rule place limitations on the risk level associated with mortgage originations

for some lending institutions, and certainly is suppressing mortgage lending growth to a point. And the bank failures in March dampened demand from other banks.

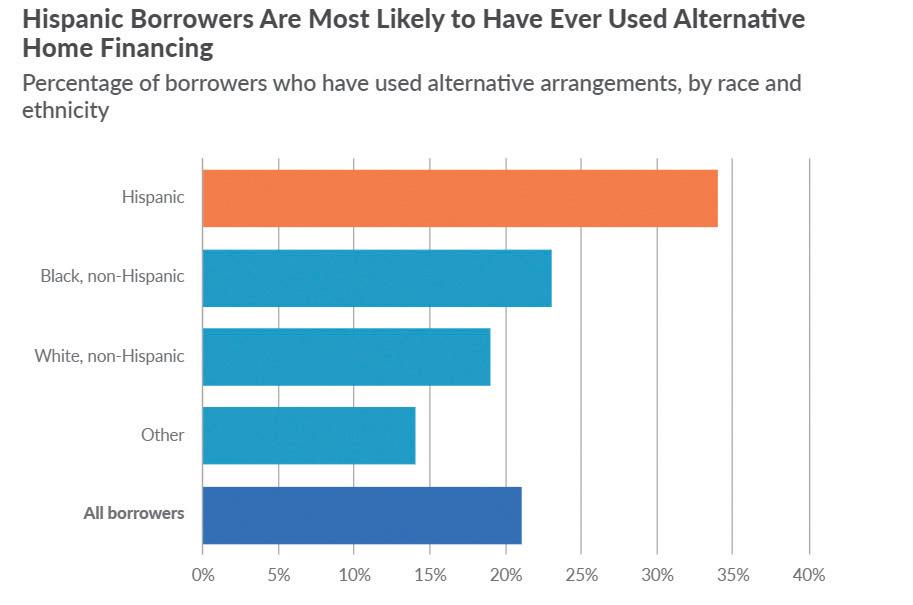

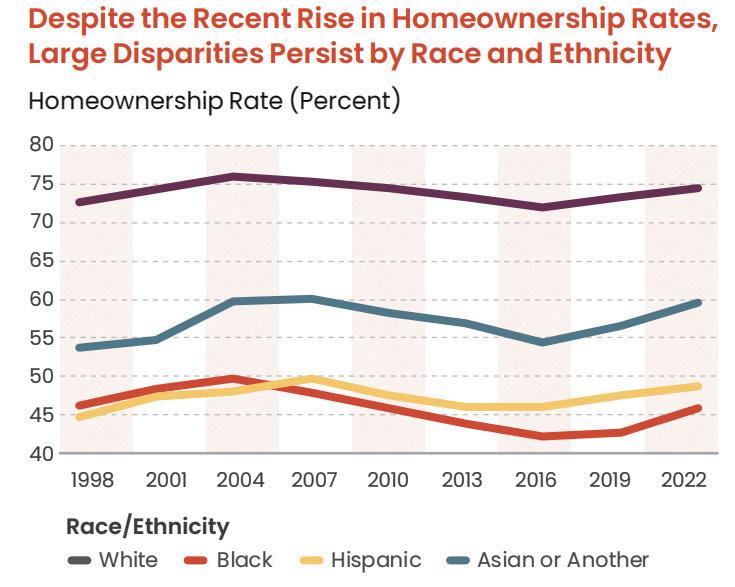

Demand by borrowers for mortgage products could be parsed into a hundred categories, as there are substantial differences among loan applications by income, gender, race, and ethnicity. It’s no shock that the highest income bracket has consistently applied for more mortgage loans than any other bracket. This difference peaked in the 2004-2006 period when the top income bracket applied for more than four times as many loans as any other bracket; the top income bracket tripled the applications submitted by any other bracket in 2013. The second-highest number of loan applications came from the income bracket that was 50-79% of their metropolitan area’s median; it’s intuitive that the lowest income bracket applied for the least number of mortgage loans.

With shifting socio-economic responsibilities in today’s world, demand for loans by gender has shifted over the past few years. Historically, applications have been primarily led by males although there was a brief period from 2005-2007 where females led the number of mortgage loan applications. During this time, the percent of loan application denials by gender was fairly even, leading many to believe that the surge in female loan applications was likely due to increased confidence in loan approval rates for females.

Since the past recession, however, males have applied for more loans and have been denied for fewer. Joint applications for loans have consistently had the lowest denial rates.

But in recent years minorities have driven the demand for home mortgages. This is a reversal from the recession period, where this group saw one of the largest declines in mortgage applications. White/non-native population has consistently applied for the highest number of loans; however, there has been a switch in demand between the Black population and the Asian population. There has been a decrease in demand among the Black population, which, until 2008, had applied for the second-highest number of mortgage loans, while the Asian population has increased demand to surpass the Black population for the second-highest rank. And the Hispanic population has surpassed

the expectations of many in terms of demand for housing and mortgages, and most lenders view this as a growth opportunity.

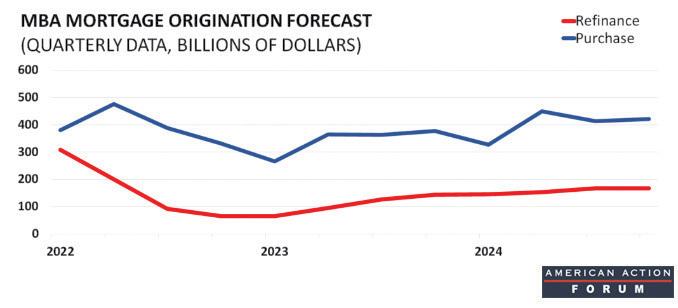

The mortgage market, after peaking in 2020 and 2021, has slowed throughout 2023. Millions of borrowers have 30-year fixed rates around 3% or lower. Popular opinion appears to support an increase in activity in 2024 and beyond as the market gains momentum, consumers adjust to higher mortgage rates, and spending needs require cash out refinances. But of course, these are dependent on many macro factors yet to be determined.

Mortgage supply is a relatively lopsided affair, as it has shifted towards governmentsponsored enterprises, which have received the highest number of applications over the past couple years and have originated the largest number of mortgage loans. Mortgage demand has seen some shifts by income, gender, race, and ethnicity over the past few years, which could be due to multiple factors including denial and lending rates offered. Higher income individuals, usually males, and some minority populations have shown the largest increase in mortgage demand since the credit tightening. If lending standards ease, expect demand to pick up across other categories and spur further growth in the mortgage market.

Mortgage originations from private entities, like insurance corporations and affiliate institutions, have fallen to historical lows, mainly as a function of their inherent risk premiums.

BARRIER TO ENTRY IS STEEP IN THIS DIRECT-TO-CONSUMER ADVERTORIAL METHOD

ne effective strategy for attracting direct-to-consumer business is by promoting rates through rate tables. And it gives consumers a sort of upper hand in their homebuying – or browsing – processes. The tables serve as a snapshot of a company’s best rates and how they compare to others. But a lot goes into rate tables: quality control, advertising, and lead generation.

Adam Stein, managing director of Blue Sky Financial, formerly ran LoanTek, a pricing engine company that specialized in helping connect lenders advertising on rate tables with leads.

Stein says that LoanTek drove the back ends of Zillow, LendingTree, and Bankrate before being sold to the latter. But what Stein emphasized is that he created LoanTek for a shopping experience which was in the hands of the consumer and was clear enough for them to understand on their own. “Think of it like how you shop on Amazon,” Stein offered as a comparison. “When you’re shopping for something commoditized, you compare costs from different vendors on the same platform. That’s how rate tables work.”

Gregg Harris, CEO and founder of LenderCity – a self-described lead generator and lending marketplace – also described rate table shopping as the Amazon of the mortgage industry. Harris decided to break away from advertising with Bankrate after 27 years and create his own rate

“There were nuances I didn’t like with larger rate tables like inaccuracies and misinformation, especially from the perspective of a lead buyer,” he explained. “Some rate tables were inaccessible because of costs. There’s a high barrier to entry.”

Harris wanted to build his own marketplace to customize the needs of lenders working with him. “Typically, [on other platforms] there is a minimum monthly spend, or you as a lender have to be licensed in multiple states, and you select those specific states to get leads from,” Harris said. “What we offer is to pen up the door for

Osmaller lenders. There’s no minimum monthly spend, and you can set daily budgets and when you hit your budget, you get knocked off the table.”

Both Harris and Stein say that even though rates are displayed in real time, there are risks to the game. “Quality control and policing the marketplace are really up to the rate table company,” Stein said. “The only room for fallacy is if the lenders are actually adhering to the rates that they offer, or not. That’s why sometimes companies are tested on whether or not they can prove their rates.” Stein added that rate tables are “driven by a pricing agent and the software can see the price origins from whichever investors are providing them.”

Harris says that for LenderCity, quality control is done by tech but always has a set of human eyes on it, too. He says that LenderCity runs various scenarios to make sure everything is accurate with a lender’s rate information. “Rate tables should be relatively seamless,” Harris said. “Aside from accuracy, It comes down to how competitive you are as a lender. The more competitive and lower the margin, the lower your rate and the higher your chance of landing business.”

Like the market is cyclical, rate tables are too, which goes hand-in-hand with how consumers are approaching rate shopping. Stein says consumer appetite now just isn’t where it should be, and for that reason, lead generation via rate tables is on the slower side. “For example, looking at one lender’s offering on Bankrate, there’s one lender on here offering 5.6% or 5.7% with discount points of 2 points,” Stein said. “How many consumers really want to pay a 2-point discount?

“Think of it like how you shop on Amazon. When you’re shopping for something commoditized, you compare costs from different vendors on the same platform. That’s how rate tables work.”

> Adam Stein

Probably not many.”

Stein pointed out that it’s difficult for lenders to get any positive returns on their investments in this market. “Last year when rates turned, it took 117 days from the time a person hit a rate table until they closed,” he said. “That’s four months before any return on the investment. And there was a ton of breakage in those that would go through because of interest rate complications.”

Stein says that it’s hard now to drive quality traffic or even gauge a consumer’s intent since customers are largely disinterested in the market. “I typically judge rate tables on the quality of the traffic and leads. But right now, lenders need to be careful where they’re acquiring [their traffic and audiences] from,” Stein warned. “It’s slim pickings for customers.”

Harris says that since LenderCity’s official launch date was June 1, he hasn’t seen the impacts of higher rates on his lenders yet since the table is in its infancy.

For Patrick Nolan, rate tables are also used as leverage during lower volume times. Nolan, who is a mortgage loan originator for FSB Mortgage, says that rate tables such as Zillow are a more often a source of information for a consumer to put in an exact loan scenario. “By the nature of the market, [rate tables are] slim profit-margin deals at the most aggressive rates,” he explained. “People who use rate

tables are most likely not first-time homebuyers, they don’t need their hand held and they’re willing to explore and make decisions themselves. The buyer who shops and compares gets a better deal.”

Stein says that the competition is even tighter for lenders. “Other lenders competing against each other are probably tattling each other on competitive margins,” he said. “I’ve also seen a pattern of practice of lenders ratting out each other by saying another lender doesn’t offer those rates.”

And some lenders don’t need to compete. Nolan says that household names like Rocket are less likely to appear on rate tables since they don’t want to lose money on offering consumers lower rates.

Nolan says it’s the midsized lenders – who aren’t household names – that use rate tables to come off as honest and trustworthy. “Up to 75% of consumers buying a house usually take the first mortgage offer without shopping. But if that same consumer were buying a car, they’d probably shop it to death to save even $500,” Nolan said. “The mortgage industry is well aware of that and they take advantage of people not shopping by presenting them with high rates.”

“People who use rate tables are most likely not first-time homebuyers, they don’t need their hand held, and they’re willing to explore and make decisions themselves. The buyer who shops and compares gets a better deal.”

> Patrick Nolan

“Rate tables should be relatively seamless. Aside from accuracy, It comes down to how competitive you are as a lender.”

> Gregg HarrisADAM

STEINManaging

DirectorBlue Sky Financial GREGG HARRIS CEO and founder LenderCity PATRICK NOLAN Mortgage loan originator FSB Mortgage

Do you have what it takes to

nemortgageexpo.com

Attend for free by using the code MBMFREE

JAN 12

UNCASVILLE, CT

Mohegan Sun Resort & Casino

The New England Mortgage Expo returns to the fabulous Mohegan Sun Resort & Casino in 2024! With over 2000 attendees in 2023, you won’t want to miss this opportunity to be a part of New England’s largest and most exciting mortgage event — the largest regional mortgage show in the nation. Join your peers for an exiting day of networking, product showcases, educational sessions, motivational speakers, and so much more!

Find a mortgage event near you. For mortgage brokers, originators, processors, underwriters, and anyone looking to grow within the industry.

originatorconnectnetwork.com/events

Mortgage industry heavyweights are reinventing the lending game, quickly building a third-party originator platform that’s becoming a go-to resource for mortgage brokers, IMBs, credit unions, and community banks. With a toolkit covering everything from processing to funding, their overnight success has created a blooming business ecosystem, like a resilient daisy in the concrete jungle, they’re sprouting success in all directions.

PowerTPO is a subsidiary of multichannel fintech leader Lower.com. “The gentlemen there are very visionary; they’re tech minded and they’re consumer minded,” PowerTPO Executive Managing Director Brett Arsta says. “Our business is to really service the mortgage brokers, so we

built a very strong leadership team that has that same mindset and the same experience.”

Arsta and his business partner, PowerTPO Senior Managing Director Michael George, extracted character leads from their professional ledgers to concrete an enterprise during an unparalleled time.

Company officers each have decades of experience in the mortgage industry, working for many of the top companies. often during the same eras.

Arsta’s career included brokering at Interfirst Wholesale Lending before moving to Franklin American Mortgage, recently purchased by Citizens Bank. He served as senior vice president of wholesale production there for the next 19 years.

“During that time we built sales platforms, technology, relationships, and I loved every part of it,” Arsta recalls. “We became a leader in the business, especially during the financial crisis - when many companies went out of business - we stayed because we didn’t really engage in any of the subprime lending or the alternative lending products. Very quickly we became a small regional player to a national leader in the TPO space. That really was our opportunity to grow and shine, which we did. We built a strong name and brand in the industry that still exists today.”

He met George when they were both working for Franklin. “We helped build that into a national Top 10 wholesale lender,” George recalls. “After I left, I partnered up with Brett at Guaranty Home Loans.”

Guaranty Home Mortgage Corp.

(GHMC) also grew to become an industry powerhouse.

The pair went on to harness their deep-rooted relationships with a wide swath of mortgage professionals when they set out to build PowerTPO with the backing of Lower LLC.

“It took us a little while during the post-COVID pricing wars when rates started going through the roof and companies were shutting down and people were laying off,” Arsta says. “Generally in the midst of tragic situations like that, there’s always an opportunity. So we banded together and brought several great leaders that were either pushed out or looking for a new opportunity to grow in that type of a market.”

“Brett and I worked together to build this from scratch from the very beginning,” George adds. “What separates us is our people, our processes and our partners. We hand-picked individuals who are hands-on to build a top-tier team, and that’s how we’ve grown very quickly.”

PowerTPO had a soft launch in mid2022 before the full launch in October 2022, when the company opened its doors nationally. “With that we’ve added many accounts, and we’ve really grown our mouse trap to be centered around customers and service,” Arsta explains. “I’d say the last 120, 150 days have been exceptional from a volume

perspective, and we’re continuing to see that same trend. With that comes challenges of growth and challenges of fulfillment. We try to bring additional staffing on as we see the need from a volume perspective.”

Since launching in Q3 ’22, PowerTPO has averaged 95% quarter-over-quarter growth in submissions and 102% growth in fundings, according to company reports. Approved TPO partners have grown by 50% each quarter.

“We’ve focused on keeping our price very competitive,” George says. “Our goal here with PowerTPO is to be a national player with a long-term cost structure that can be successful in any market.”

Now it’s full steam ahead for these lender-leaders, as they continue the build-out of PowerTPO and adjust to the elements of an ever-changing arena.

“There’s always moving challenges

“What separates us is our people, our processes, and our partners. We handpicked individuals who are hands-on to build a top-tier team, and that’s how we’ve grown very quickly.”

> Michael George, PowerTPO, Senior Managing Director

in the many different areas of mortgage lending, from warehouse lending and agency requirements, to technology, capital markets, and fulfillment operations,” Arsta says.

“We don’t have the greatest technology that’s out there that many companies have had many years to perfect, but we’re on our way. Competition that’s spent many, many years and millions of dollars getting to where they are provided a very good roadmap for us to get where we are quicker. We’re by no means finished with our technology build or solutions, but we have a very good offering to provide to be a low-cost producer.”

While Lower LLC is headquartered in Columbus, Ohio, PowerTPO operates remotely. This work model, while common for startups, requires employees to remain diligent. “That’s really the challenge, to find people who can set the boundaries and have a private workspace wherever they’re located,” Arsta says. “To ensure that their decision-making is solid, and that they can continue to be efficient in fulfilling loans.”

The sales team has grown by 66% since the beginning of this year. By summer of ‘23 PowerTPO was about 100 team members strong.

“We’re growing daily with a great group of sales professionals as we find the right fit in this environment,” Arsta says. “With the help of all the people who have joined Power TPO, that’s what really makes the difference. It’s the power of all the people that we add

that have the same vision and mission in mind every day.”

Wholesale broker Compass Mortgage writes loans through PowerTPO. “They’re an amazing partner for us,” Broker/President Jamie Brown told Mortgage Banker Magazine. “They are super efficient, very responsive and in touch with all of the latest technological advances available to us.”

This dedication to service stems from their philosophy to approach every loan like it’s the last.

“Level of service is not just an assembly line production unit, but it’s treating each loan with care,” Arsta says. “From a broker perspective, we’re very broker friendly. We’re not out to steal their customers. We’re here to

help them gain customers. That’s our goal every day.”

Covita Lending has been brokering its deals to PowerTPO since the start of 2023.

“Overall, they’ve done a very good job for us on all fronts,” owner and co-founder Steve Beskid says. “They’ve been very strong on the pricing side of things, which has been very helpful.”

Responsiveness is also key to ensuring a strong partnership in this business.

“If we have issues on a file we’ve always got someone we can reach out to,” Beskid points out. “They’ve been able to meet tight timeframes with us and help when we have issues with a third party or an appraisal. They’ve done a very good job as somebody new to the broker space, and I would imagine as time progresses they’re just going to get more efficient.”

In a time when the mortgage industry was scarred by layoffs and companies shuttering, this is worthy of applause.

Arsta’s advice to other entrepreneurial hopefuls vying for success in this business?

“You have to find your need and your niche,” he says. “And our niche is customers that are still looking for a very personal experience along with knowledge and expertise in the field. My approach is relationships and people matter. And our job is to fulfill what’s provided to us and create a good experience for everyone.”

“From a broker perspective, we’re very broker friendly. We’re not out to steal their customers. We’re here to help them gain customers. That’s our goal every day.”

> Brett Arsta PowerTPO Executive Managing Director

Mortgage Fraud is surprisingly common among real estate investors. That is the conclusion of a recent Philadelphia Fed working paper by Ronel Elul, Aaron Payne, and Sebastian Tilson. The fraud is that investors are buying properties to flip or rent out but claim they are buying them to live there in order to get cheaper mortgages:

We identify occupancy fraud — bor rowers who misrepresent their occupancy status as owner-occupants rather than investors — in residential mortgage originations. Unlike previous work, we show that fraud was preva lent in originations not just during the housing bubble, but also persists through more recent times. We also demonstrate that fraud is broad-based and appears in government-sponsored enterprise and bank portfolio loans, not just in private securitization; these fraudulent borrowers make up onethird of the effective investor popula tion. Occupancy fraud allows riskier borrowers to obtain credit at lower interest rates.

One-third of all investors is a lot of fraud! The flip side of this is that real estate investors are much more prevalent than the official data says: We argue that the fraudulent purchasers that we identify are very likely to be investors and that accounting for fraud increases the size of the effec

If investors are a problem, there are enough of them to be a big problem.

lost a ton of money, saw their stock prices plunge, and gave up.

The mortgage fraud paper also provides evidence of investors losing money. In particular, rather than fraudulent investors crowding out the good ones, they are actually more likely to end up defaulting on their purchases:

These fraudulent borrowers perform substantially worse than similarly declared investors, defaulting at a 75% higher rate.

Still, such widespread fraud is concerning, and I hope lenders (especially the subsidized GSEs) find a way to crack down on it. Based on things I see people bragging about

on social media, I’m guessing that tax fraud is also widespread in real estate investing, though I haven’t looked into the literature on it.

This mortgage fraud paper seems like a bombshell to me and I’m surprised it seems to have received no media attention; journalists take note. For everyone else, I suppose you read obscure econ blogs precisely to find out about the things that haven’t yet made the papers.

James Bailey is an associate professor of economics at Providence College in Rhode Island. This piece originally appeared at www. economistwritingeveryday.com.

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.

Listen by following the link or by subscribing wherever you get your podcasts.

Available on all major podcast platforms:

From February 2020 to May 2022, investor purchases of single-family homes grew nationwide, increasing from an average share of 12.4% of homes purchased across the largest 50 metropolitan markets to 20.4%. Over the past year, however, as interest rates rose and house prices declined, investors pulled back from many single-family rental (SFR) markets and investor share fell to 16.2%. Though investor participation in the SFR market varies meaningfully by market, some regional trends are emerging.

Several factors have driven the decline

in investor participation. Investors are responsive to evolving market conditions and likely took the growing uncertainty in real estate valuations and yields as an opportunity to re-evaluate their portfolio allocation to SFR. Further, rising interest rates have made it more costly to acquire investment properties, which has muted commercial real estate (CRE) transaction volume generally and has spilled over into the SFR market as well.

To understand how much investor participation in specific markets has retreated from recent peaks, markets can be placed into one of four categories: Boom-Bust, Boom-No Bust, No Boom-Bust, and No Boom-No Bust. Boom cities are those where inves-

tor participation increased more than average during the pandemic, and bust cities are those where investor participation has declined more than average from the peak.

Memphis and Birmingham, Ala., are two examples of the several Southeastern markets where investor activity boomed during the pandemic. Since then, however, investor activity has retreated significantly in these markets. This boom-bust pattern was most discernable in mid-sized markets that became destinations for people leaving bigger markets.

Between Birmingham’s peak investor share to the most recent measure

in May 2023, investor participation has dropped roughly 15%, while the investor share in Memphis declined by 12%. Investors who got in on the ground floor, so to speak, were able to capitalize on the increase in demand from pandemic migration patterns that favored suburban re-settlement. Since then, however, higher interest rates and inflation in property maintenance expenses, combined with higher home prices, have likely compressed profit margins and limited the upside available to investors in several of these markets.

Attractive home prices and increased housing demand helped drive the boom in investor share in half of all Midwestern markets analyzed. In fact, some of the largest increases in investor activity during the pandemic occurred in smaller Midwestern locales. As people sought out more affordable accommodations during the pandemic, the shift in housing demand to the Midwest drew investors to the SFR market.

Investor participation rates have remained within 3% of peak in markets like Indianapolis and St. Louis as steep costs of living in many coastal markets have pushed investors towards the up-and-coming Midwestern rental market. Compared to peak, investor activity increased in Indianapolis and

portfolio allocation.

Kansas City, Missouri, but has not yet undergone a bust.

Western markets largely missed the pandemic-era boom in investor SFR purchases, except for Salt Lake City and Phoenix. In Las Vegas, San Jose, and Sacramento, the investor share decline from peak exceeded the pandemic increase, resulting in a net decline in investor participation compared with pre-pandemic levels.

One possible explanation for this exception is the pre-existing priciness of many Western markets. Generally, it’s harder for investors to earn a return on investment if they have to buy at a higher price, and higher prices are more prevalent in less affordable markets like those found in California. What’s more, the pandemic-era demographic tended to shift demand away from these pricier markets to less expensive ones from which people could now work remotely. It makes some sense that investors increased their SFR purchases in places that were more affordable and in higher demand.

While West Coast markets like Seattle and Portland are currently at their peak of investor participation, several Northeastern

markets like Philadelphia and New York experienced no significant accelerated investor participation during the pre-pandemic to peak period or a meaningful subsequent decline.

The pandemic changed how we use and demand space. With work-fromhome now an option, residential space can substitute for office space. People began adjusting to this new reality by moving around the country, looking for living options that were more suitable or affordable than what was available in their current location. Investors took notice and purchased SFRs where, generally, prices were affordable and demand for housing was increasing.

Despite some regional variation, investor participation has declined nationally and, in general, the markets that drew greater investor interest during the pandemic have had the greatest correction. What went up is now trending down.

Xander Snyder is senior commercial real estate economist at First American. Juliette Barragan contributed to the original blog.

Investors are responsive to evolving market conditions and likely took the growing uncertainty in real estate valuations and yields as an opportunity to re-evaluate their

Xander Snyder

Arc Home LLC

Mount Laurel, NJ

Multi-channel mortgage leader with exceptional service and comprehensive mortgage solutions. When it comes to choosing your lending partner, there are many things to consider. Our products set the standard in the industry for innovation. Since that innovation is in our DNA, we will always be on the cutting edge of what matters most to you and your borrowers. At Arc Home, our priority is to provide the best customer experience from registration to closing, and we continue to invest in that philosophy every day.

business.archomellc.com

(844) 851-3600

sales@archomeloans.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Dallas, TX

The Carrington Advantage Series is a full suite of Non-QM Loan solutions that “Delivers More” for you and your borrowers. Ideal for borrowers, like the self-employed, that don’t fit Agency or Government Qualified Mortgage standards based on credit quality, property type, documentation type, income documentation, or other borrower situations.

• FICOs 550+

• Primary wage earners FICO

• DTIs up to 50%

• Bank Statements (personal or business) accepted

• We don’t require disputed tradelines to be removed

With the Carrington Investor Advantage (DCR)

• DCR down to .75

• First-time investors are ok

• Only 48 months seasoning for major credit events

• 1x30x12 mortgage history ok

(866) 453-2400

carringtonwholesale.com

LICENSED IN: 47 States (excluding NH, MA & ND.)

Be available when your clients go looking. Directory listings ensure your company is accessible when your clients are looking for you. Your listing includes:

• 6 or 12 month options

• Your active listing highlighted in the monthly special feature

Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors.

*Ease of use (Support staff, technology an other tools to support mortgage bankers)

FirstFunding’s FlexClose Funding program allows our clients to fund outside the Fed wire restrictions. Same day and afterhours funding. Browser-based proprietary platform, customized reporting tools, and a dedicated customer service team.

Conventional Conforming, Jumbo, FHA, VA, USDA, Non-QM

(214) 8217800

firstfundingusa.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Clear Capital is a national real estate valuation technology company with a simple purpose: build confidence in real estate decisions to strengthen communities and improve lives. Our commitment to excellence is embodied by nearly 800 team members and has remained steadfast since our first order in 2001.

clearcapital.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY

Alpha Tech Lending West Hempstead, NY

DSCR Rental NO DOC Loans

Alpha Tech Lending is a trusted direct lender, with over a combined 30 years of experience in the private lending sector. We offer a variety of loan programs for non-owner-occupied residences that are customizable to suit your real estate investment needs. From fix and flips, long term rental, new construction, commercial bridge, and more. We lend to both new and experienced real estate professionals throughout the country. We value long term relationships built on trust. Our brokers are protected.

alphatechlending.com

(888) 276-6565

info@alphatechlending.com

LICENSED IN: CT, DC, DE, FL, GA, IL, MD, MA, NH, NJ, NY, NC, OH, PA, RI, SC, TN, TX, VA

Your listing comes with an enhanced online profile, which includes:

• Company name, logo, & description

• Contact phone, email, social accounts, & location

• All directories your company is listed in

• Latest 3 mentions in articles on our site

• Latest 3 webinars hosted by your company (if applicable)

Prices are subject to change. Pricing is not guaranteed until a contract is formed.

The stomachs of the nation’s largest mortgage banks are rumbling. With firstpurchase originations at historic lows, the likes of Rocket, UWM, and loanDepot are starving. Looking for something to fill their bellies, they’ve turned their gaze to tappable home equity, hoping for a bite at that trillion-dollar apple.

Yet, specialty, nonbank lenders like Spring EQ, Achieve Home Loans (formerly Lendage), and Figure Technologies have been hawking home equity since 2018, when new originations for home equity loans and home equity lines of credit (HELOCs) began to increase for the first time since the 2008 Great Financial Crisis. Now, with other lenders racing to catch up, those home equity innovators who’ve been fine-tuning their algorithms and growing their credit books of business over the past five years have their sights set elsewhere.

“The securitization opportunity, that’s really where our bet is,” says Jerry Schiano, founder and CEO of Spring EQ. In May, the lender closed its second rated home equity securitization – a pool of 2,587 closed-end and open-end second mortgages rated by Fitch Ratings, worth

$232.7 million. All of the loans were originated by Spring EQ. “Securitization of these products is going to be more and more common,” Schiano says.

It’s not a promise, but a strong likelihood echoed by Youriy Koudinov, senior vice president at DBRS Morningstar, the global credit rating agency: “There’s likely to be more securitizations, likely more lenders, and the space will continue to expand.”

Since early 2020, there have been at least 14 home equity securitizations of newlyoriginated second liens and HELOCs representing a total collateral balance of approximately $2.7 billion, according to data provided by Kroll Bond Rating Agency (KBRA). Of these transactions, nine have been rated.

As portfolio lenders like regional banks and credit unions grow increasingly reluctant to put less-liquid assets on their balance sheets, revitalizing securitization channels that have lain dormant since the Great Financial Crisis is becoming more essential to lenders who require the capital to reach more borrowers.

With American homeowners sitting on an estimated $19 trillion of tappable home equity, what’s been originated and securitized up to this point is a drop in the bucket.

“We’re very focused on building a much more active securitization market,” says Jackie Frommer, head of lending at Figure Technologies, “one that investors

understand, one that rating agencies understand, so that we can continue to originate more product and build into the liquidity that hopefully will grow once the securitization markets become more mature.”

That maturity is achieved through one thing – ratings.

In the wake of the Great Financial Crisis, second-lien securitization largely disappeared. A surge in secondlien defaults and the realization that home equity could turn negative poisoned the secondary market. Over the next decade, personal loans and credit cards replaced home equity as the go-to option for borrowers looking to consolidate debt, pay tuition, or make home improvements.

And yet, from 2004-2007, second-lien securitization had been a steady market –approximately $200 billion of second liens and HELOCs were securitized during that period. “Each of those years had quarterly issuance that was over $5 billion. Those were the big years,” says Jack Kahan, senior managing director and head of residential mortgage-backed securities (RMBS) for KBRA.

Rapid home value appreciation during the pandemic and a year of dramatic interest rate hikes now have consumers

clamoring to tap their home equity. By the numbers, it shows: home equity originations jumped 40% in 2022, though that growth has slowed in the first half of 2023.

Nevertheless, for more than a year Morningstar’s Koudinov has been fielding calls from investors asking about the newest vintage of home equity-backed securities. “Earlier this year,” he says, “and really kind of going back to early part of 2022, we’ve been engaged in many conversations with various issuers, both banking and nonbanking institutions, that really came to us and inquired about the ability to rate newly originated HELOCs.”

By the questions they’re asking, Koudinov can tell that the investor interest is genuine.

“They’ve done their homework,” he says.

“They’ve read the reports and then come back and asked very specific questions. Why do you think that this was relevant? How did you go about that aspect of the securitization and so forth? Overall, the level of the preparedness for these conversations was well above average.”

It’s a sign that securitizations will become more common, whenever those investors on the sidelines begin to participate. But, even the analysts at DBRS Morningstar have had to educate themselves on the new home equity products that nonbank lenders were offering to consumers. They’ve been especially focused on understanding how new originations are being underwritten, as well as how third-party due diligence firms are assessing nonbank-originated loan files differently from depositories’.

“Having a rating (from the rating agencies) is very helpful ... It opens up the universe of people who can buy the product (HELOC RMBS).”

> Jackie Frommer head of lending at Figure Technologies

Mark Fontanilla, senior vice president of US RMBS at Morningstar, says the rating agencies aren’t building anything from scratch when it comes to assessing credit risk – the risk characteristics, operational risk reviews, and credit risk assessments are purely fundamental. What’s changed, rather, is the way that these risks are presented to the rating agencies, given the rise of automated underwriting and different borrower profiles from pre-crisis originations.

“This is one of the sectors in the lending industry that will continue to innovate,” Koudinov says, “with regards to underwriting, lending, quality assurance, and so forth. This is, sort of… I don’t want to say the cradle of innovation, but this is where innovation is more visible because there’s a natural cause for it in terms of the

disrupted securitization markets across the entire economy. Last year, skittishness on account of rising interest rates forced Schiano to hit pause on expansion. “Last summer, I actually thought we were gonna grow so fast it would’ve put the company in a dangerous position. So, we slowed back growth and now we’re growing again because we think the market is more stable today than it was last year,” he says.

Just a couple years ago, home equity origination volume was much lower, and most of the loans that Figure originated were sold to credit unions. “There wasn’t as much of a need to have and to demonstrate that you could get a rating because there were investors who were comfortable taking the loans without necessarily having a rating,” Frommer says. That’s all changed, with consumer demand

historical performance and understand the difference in the products.” He says that, despite uncertainty in capital markets, the size of the players who have begun originating to securitize is indicative of the secondary market’s potential.

FirstKey Mortgage, Towd Point Mortgage Trust, JP Morgan, Rocket Mortgage, and Freedom Mortgage, among others, have all achieved or are in the process of achieving rated transactions for second-lien securities.

“These are all issuers who have accessed capital markets through ratings in the past,” says Kahan. “These are larger institutions that I expect are looking to do less of a one-off trade securitization and more of a programmatic securitization where it might make more sense to do the background legwork, to get ratings,

speed and efficiency that’s important to a borrower.”

Since 2018, one of the greatest knocks against home equity lending has been irregular interest from the capital markets on account of securitization channels going dormant. Lenders like Spring EQ have constantly been forced to create their own liquidity through a combination of holding and servicing loans, and selling loans to depositories, credit unions, and Wall Street.

Even so, regional banking turmoil has

rising and rising interest from investors with nowhere to park their money in traditional RMBS now that first-purchase originations are at historic lows.

Though unrated home equity securities aren’t necessarily deficient from a credit perspective, ratings indicate a higher degree of due diligence has been performed on the underlying loan collateral, which is necessary to attract a larger and more diverse pool of institutional investors.

“Both in time and in what the loans actually look like,” explains Kahan of KBRA, “there is a need for education out there for people to kind of dust off their old data sets and understand the

to build an investor space because the expectation would be that they’re going to come with more transactions in the future.”

More lender competition means ratings are becoming even more important for delivering consistency and stability to the secondary market. What’s more, ongoing liquidity constraints with depository institutions means Frommer’s seeing particular demand from credit funds and insurance companies.

“There was a gap for a very long period of time,” she says, “in terms of investors and rating agencies really understanding the product, which is what you need to do to get the product from origination to

Aunique feature of HELOCs, as opposed to closed-end home equity loans, is borrowers’ ability to access their line of credit at their discretion within an established period of time.

A significant challenge for Wall Street, however, has been figuring out how to fund the undrawn portion of open-end HELOCs after the lender sells the loan. As a result, most of the home equity securitizations that have been issued in the past couple of years are comprised of home equity loans, not lines. But, one way lenders are getting around this complication is by having borrowers draw down their HELOCs by 80%-100% at the time of origination.

“What we do,” says Spring EQ’s Schiano, “is we try to place a lot of our HELOCs with depositories because depositories have the access to capital whenever. And if you take a look at us, most of our loans are 80% drawn at origination.”

The challenge of funding the draw particularly impacts nonbank lenders who don’t enjoy the same easy access to liquidity as depositories. For these lenders, the question arises as to who is responsible for funding the borrower when the borrower wants to draw down their HELOC.

With those HELOCs that have been successfully securitized, the risk of funding the undrawn piece has

been somewhat separated from the portion of the HELOC that is drawn at origination.

Usually, the servicer in the transaction, which may still be the lender, advances funds to the borrower who’s making a draw on their HELOC. The servicer gets reimbursed out of the securitization that other borrowers are making payments into – the “waterfall” within the deal – which keeps the pool’s overall balance from changing.

When this happens, the additional draw becomes funded collateral in the pool. “The issue is,” says Kahan, “you can’t just put more collateral into the transaction without there being some sort of parity. Like, where did that money come from, basically?”

In addition to the waterfall, a reserve fund is created in case every borrower in the collateralized pool decides to draw down their HELOC at the same time. If both the waterfall and reserve fund are depleted, the sponsor of the securitization would step in to provide liquidity to borrowers.

One caveat, however, is that the sponsor is typically a nonrated entity. “So, from a ratings perspective,” Kahan explains, “we want to make sure that those first two steps in the waterfall are sufficient to cover potential

future draws or expected future draws because if we’re putting out a rating that’s a single A, AA, AAA, for example, or investment-grade rating, we’re not going to want to be relying on a non-rated counterparty for providing those draws.”

There’s a lack of historical data, currently – given the difference in loan attributes from pre-crisis originations and the newness of the second-lien securitization market –to definitively say whether funding borrowers through the waterfall is the most effective method. Questions surrounding utilization rates, for example, highlight how an inability to fund future draws would directly influence the performance of individual loans, and thus, the securitization overall.

“It’s sort of unclear,” Kahan admits, “whether these risks exist only in abstract or in reality, but if you imagine that the borrower didn’t have their draw funded, there’s two potential bad outcomes. One is, that borrower or multiple borrowers start litigation against the party that they feel owed them the draw. As an investor, as a rating agency, we would want to not have some meaningful risk of litigation and additional costs there. Even outside of litigation, if a borrower feels that the terms of their loan are not being adhered to by the lender, they may feel like they don’t want to adhere to the terms of the loan, and stop paying.”

– RYAN KINGSLEYhaving a successful securitization.”

Many large institutional investors, like insurance companies, require ratings as part of their investing mandate. They won’t play without one.

“Having a rating is very helpful,” Frommer continues. “It opens up the universe of people who can buy the product.”

The universe of investors, however, wants to know more about the universe of borrowers who are tapping home equity in place of cash-out refinances. Kahan remembers how, precrisis, second-liens and HELOCs were originated to the same standards (or lack thereof) as the first-lien market. Alternative documentation and sloppy origination came back to bite borrowers, lenders, and investors.

To date, KBRA has rated transactions for Spring EQ, Towd Point, Rocket, and JP Morgan. In Kahan’s perspective, the methodology for rating second-lien securities isn’t that different from what they use on the first-purchase side: operational reviews of origination and aggregation models; third-party due diligence to ensure underwriting and regulatory compliance; and, modeling of collateral to determine loan samples’ default and severity risk.

“For the most part,” Kahan says, “we’re talking about prime credit borrowers, generally low-CLTV loans, and generally fully-documented income. From an underwriting perspective, there’s not much adaptation that needs to be made because we’re generally talking about prime, full-doc loans.”

Instead, where rating agencies and due diligence firms are having to catch up to speed is in matching the default and severity risk with loan attributes that differ from the pre-crisis era. Notably, combined loan-tovalue ratios (CLTVs) are 20 points lower for home equity originations today than they were in 2006. Weighted average FICO scores are 50 points higher.

Changes in product features and loan attributes directly affect credit performance, Kahan says. “Those are the first questions that we get from the investors: How is this different? How do we think about credit enhancement for these loans in light of what ultimately was not very good performance of seconds and

Part-and-parcel of why loan attributes are changing is an evolving “use-case,” or purpose for home equity loans, both for borrowers and lenders. This has forced rating agencies and due diligence firms to view the second-liens and HELOCs being originated as almost entirely new products, from a liquidity perspective. This is particularly true for HELOCs.

“HELOCs, traditionally,” says DBRS’s

Now, HELOCs offered by nonbank lenders like Spring EQ, Achieve, or Figure are anywhere from 80 – 100% drawn on origination, and these lenders are striving to securitize. “They sort of offer the HELOC product as a mover option in addition to a personal loan, or perhaps in some cases even trade that alternative to a personal loan,” explains Koudinov.

Changes in loan attributes and loan purpose are largely being driven by lenders who are focused on speed to fund, or closing the time it takes to go from application to approval.

“We’re trying to fundamentally change the way people use home equity to help them manage their finances more broadly than how they might have used a cashout refi before,” says Frommer. In April, Figure announced its first rated HELOC securitization, comprised of Class A and B notes, rated AAA and A by DBRS Morningstar, respectively.

A question the rating agencies are trying to answer is whether, in the spirit of efficiency, any due diligence has been lost on the origination side. Figure, for example, leverages automated valuation models (AVMs) to fund HELOCs in just five days.

“This is different than what we saw for most of the second lien and HELOC lending in the crisis,” says Kahan, “where they were mostly simultaneous seconds. They were purchase loans. This was down payment assistance. These were borrowers that didn’t have the equity at the time of purchase.”

Koudinov, “were a product more available to prime and near-prime borrowers. It was extended by banks and credit unions, not so much for the purposes of securitization, per se, but really for the purposes of portfolio retention.”

Pre-crisis, closed-end home equity loans would be fully drawn at origination, while HELOCs were treated more like rainy-day funds to manage cash flows, and drawn down as needed. Depositories had ready access to capital, and borrowers weren’t using HELOCs to capture equity immediately.

The biggest difference that analysts at DBRS have seen from pre-crisis home equity lending to today is also in underwriting. While depositories tend to underwrite home equity loans very conservatively because they hold them as portfolio products, it takes time to understand how AVMs and alternative sources for documenting income and employment affect creditworthiness.

“With efficiency and automated processes and underwriting, there is always a compromise between time and thoroughness,” says Koudinov. “We have an operational risk review process that covers origination platforms and servicing platforms through which we seek to understand not so much the data that’s provided to us, but really the

senior managing director and head of RMBS for KBRA

“There is a need for education out there for people to kind of dust off their old data sets and understand the historical performance and understand the difference in the products.”

> Jack Kahan

loan manufacturing process or HELOC manufacturing process from A to Z.”

It’s a shared responsibility between rating agencies and due diligence firms, says KBRA’s Kahan. Making sure they understand these processes benefits all parties involved, from the borrower to the institutional investor.

“When you have an automated origination file, what does that review look like? What exactly is that third party firm looking at in the loan file? That’s a piece of the adaptation that, frankly, is still going on. How exactly do we get comfortable?

If you see a loan from an originator who’s

performing this automated process and you see one from a more traditional lender, then can you put these on level footing? Do you get the same level of comfort?”

With consumer and investor demand increasing, scaling due-diligence capabilities

will be a critical area to address if the home equity securitization market is to expand. First-lien mortgage securities have larger collateral pools and smaller loan populations than home equity-

backed securities, which makes loan-level due diligence and full appraisals more economical.

The average loan population for the 14 securitizations reviewed for this article was 3,379 loans, with an average collateral pool of $199,029,003. In 2022, the average loan count for first-lien securities was 822 loans, with an average deal size of $429,792,897.

Across the industry, “sampling” presents itself as a clear solution, which involves reviewing portions of the securitized pool and imputing that error rate into the unsampled portion. However, sampling isn’t common in first-lien securitization, and is slow to be adopted for second-lien securitization.

Despite slow adoption, sampling is an efficient and viable way to scale duediligence across the larger loan pools of second-lien securities. “That can come with its own additional expected losses or additional credit enhancement from a rating agency standpoint, but the issuers would think about what their trade-off is there,” Kahan explains.

Sampling by third-party due diligence firms can happen in a variety of ways, says Justin Becker, assistant vice president at DBRS Morningstar. “You have certain originators who choose to do due diligence on a rolling basis, monthly, quarterly. They’ll sample their population and have that as part of their quality control.”

In the case of Figure’s first rated transaction from April, which DBRS rated, “the prospective loans for the securitization were sampled randomly at a percentage that met our criteria and we disclose in our rating reports,” Becker explains. “It’s not to say that those are the only ones they had reviewed by the third-party due diligence firms, it’s just the only ones we were presented with.”

At the end of the day, while lenders want speed, the rating agencies are focused on getting their credit-risk assessments right. So far, they are.

“Thus far,” says Koudinov, “even with expansion, we have not seen any signs of weakness in the collateral pools that we’ve reviewed. I think the transactions we’ve rated had fairly consistent collateral attributes, which is a good sign.”

“With efficiency and automated processes and underwriting, there is always a compromise between time and thoroughness.”

> Youriy Koudinov senior vice president at DBRS Morningstar

SPECIAL ADVERTISING SECTION: ORIGINATOR

COMPANY AREA OF FOCUS WEBSITE

Global DMS Appraisal Management Software globaldms.com

SPECIAL ADVERTISING SECTION: APPRAISER & AMC DIRECTORY

COMPANY AREA OF FOCUS WEBSITE

Clear Capital National real estate valuation technology company clearcapital.com

SPECIAL ADVERTISING SECTION: WAREHOUSE LENDING DIRECTORY

COMPANY AREA OF FOCUS WEBSITE

FirstFunding Inc. Offers warehouse lines to correspondent lenders, community banks, credit unions, and secondary-market investors. firstfundingusa.com

Independent Bank of Texas Mortgage warehouse lines of credit, from $2 million to $150 million, and fund over 200 delegated and non-delegated retail originators. Ifinancial.com

nmplink.com/TheInterest nmplink.com/ThePrincipal nmplink.com/GC

PRODUCTIONS OF AMERICAN BUSINESS MEDIA

Adapting to today’s dynamic mortgage market has changed the way we analyze trends and track competitors. Luckily, we have the tools you need to determine your competitors’ market share and see how individual loan originators are performing in their market.

Our Mortgage MarketShare Module provides real-time market insights on all lenders, helping you easily benchmark your company’s market share, identify new and emerging markets, and measure your sales performance against your competition.

Our Loan Originator Module provides you with access to the largest and most comprehensive loan originator database in the country. Take advantage of this access to identify top-producing loan officers, verify production, and monitor competitors.

To show you just how powerful our modules are, we’re offering a free customized mortgage competitor analysis. Simply visit www.thewarrengroup.com/competitor-analysis and provide us with a few details. You’ll receive an updated 2021 vs. 2022 Quarterly Mortgage MarketShare Report at the company level paired with a Loan Originator Report highlighting top LOs and individual performance.

Visit www.thewarrengroup.com to learn more today!

Questions? Call 617.896.5331 or email datasolutions@thewarrengroup.com.

• Monitor Residential and Commercial Lending

• Measure Sales Performance and Market Activity

• Identify High-Performing Competitors

• Uncover Emerging Markets and New Opportunities

• Pinpoint Top Loan Officers for Recruitment

• Identify and Verify Loan Originator Performance

• Measure Loan Activity Against Competition

• Highlight Success for Market Positioning

Inquire about our NMLS Data Licensing and LO Contact Database options.