STAR BRIGHT

MEET THE INSPIRATIONAL 2024 MORTGAGE STARS

SUCCEEDING WITH A SUPPORT SYSTEM

FIND YOUR COMMUNITY WITH THE MORTGAGE WOMEN LEADERSHIP COUNCIL

BYE COFFEE RUNS, HELLO CORNER OFFICE

KATE DEKAY LEADS WITH CONFIDENCE

STAR BRIGHT

MEET THE INSPIRATIONAL 2024 MORTGAGE STARS

SUCCEEDING WITH A SUPPORT SYSTEM

FIND YOUR COMMUNITY WITH THE MORTGAGE WOMEN LEADERSHIP COUNCIL

BYE COFFEE RUNS, HELLO CORNER OFFICE

KATE DEKAY LEADS WITH CONFIDENCE

IRENE AMATO embodies the grit and grind of New York City while reshaping the landscape of the mortgage industry

We hope you've enjoyed recieving complimentary editions of Mortgage Women Magazine. Beginning in 2025, new issues will be exclusive to members of the Mortgage Women Leadership Council.

Mortgage Women Magazine is now the official magazine of the Mortgage Women Leadership Council. Membership not only guarantees your subscription to the digital magazine but also provides you with a wealth of benefits designed to empower and elevate women in the mortgage industry. These include access to a dynamic network, editorial opportunities, awards, community support, and much more.

Join us in this exciting next chapter by becoming a member of the Mortgage Women Leadership Council and ensure you stay connected and informed.

This month, we are thrilled to shine a beam on the incredible winners of the 2024 Mortgage Star Awards. These remarkable women light up our profession with their innovation, dedication, and leadership. Their stories of success and perseverance are sure to inspire you.

In addition to celebrating our award winners, we are excited to highlight the inaugural in-person meeting of the Mortgage Women Leadership Council. Launched earlier this year, this dynamic network is dedicated to empowering women in the mortgage industry by providing a platform for mentorship, collaboration, and professional growth. The council envisions a supportive environment where women can thrive, collaborate, and succeed. Through mentorship programs, educational resources, and networking events, the Mortgage Women Leadership Council aims to contribute to the advancement of women in

mortgage leadership positions.

As a special offer, subscribers of Mortgage Women Magazine can join the Mortgage Women Leadership Council for free for the first year using the code MWM2024. Sign up today at www.mwlcouncil.com/join and become part of this empowering community.

We encourage our readers to stay tuned for more updates on the Mortgage Women Leadership Council and to actively participate in our mission to empower and elevate women in the mortgage industry. Together, let's celebrate excellence and build a more inclusive future for the mortgage profession.

Thank you for being a part of Mortgage Women Magazine. We hope you enjoy this issue and continue to find inspiration and support within our pages.

Kelly Hendricks Managing Editor, Mortgage Women Magazine

VINCENT M. VALVO

CEO, PUBLISHER, EDITOR-IN-CHIEF

BEVERLY BOLNICK ASSOCIATE PUBLISHER

KELLY HENDRICKS MANAGING EDITOR

ERICA DRZEWIECKI, KATIE JENSEN, RYAN KINGSLEY, SARAH WOLAK STAFF WRITERS

TINA ASHER, LAURA BRANDAO, JACK DUNN, ASHLEY GRAVANO, MARY MARGARET HOGAN

CONTRIBUTING WRITERS

ALISON VALVO

DIRECTOR OF STRATEGIC GROWTH

NICOLE COUGHLIN

ADVERTISING ASSOCIATE

JULIE CARMICHAEL

PROJECT MANAGER

MEGHAN HOGAN

DESIGN MANAGER

STACY MURRAY, CHRISTOPHER WALLACE

GRAPHIC DESIGN MANAGERS

NAVINDRA PERSAUD

DIRECTOR OF EVENTS

WILLIAM VALVO

UX DESIGN DIRECTOR

ANDREW BERMAN

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

KRYSTINA COFFEY, MATTHEW MULLINS

MULTIMEDIA SPECIALIST

MELISSA PIANIN

MARKETING & EVENTS ASSOCIATE

KRISTIE WOODS-LINDIG

ONLINE ENGAGEMENT SPECIALIST

Irene Amato embodies the grit and hustle of New York City while reshaping the landscape of the mortgage industry.

BY SARAH WOLAK

6

The True Version Of You

Bringing your best self to the workplace means being your most authentic self.

8

Kate Calls The Shots

Kate deKay went from answering phones to leading the charge at Eustis Mortgage.

14 Curiosity Didn’t Kill The Cat

Admitting “I don’t know” is a power move, not a weakness.

18 Uncharted Waters

Harness lending ingenuity and good relationships to expand into new territories.

22

Clearing The Hurdles

Compliance solutions for appraisal bias in lending aren’t out of reach.

24

Reject Workplace Tensions

Take inventory of which aspects of your life can be controlled.

27

Pockets Of Possibility

Empowered individuals and teams thrive in environments that embrace diversity.

49 Mortgage Star Awards

Celebrating the women who inspire others.

34 Finding An Online Groove

Adding a pinch of personality to social media posts goes a long way.

70

Leading Ladies

A newly-formed council aims to combat burnout and champion women’s empowerment.

BY ASHLEY GRAVANO, CONTRIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

Authenticity means you’re true to your own personality, values, and spirit. You do not pretend to be someone who you think you have to be in order to impress your friends, colleagues, and family members. It means being comfortable with letting go of the emotions that you feel when you think you’re being judged if you are

truly being your authentic self. Let’s be honest, it’s exhausting.

At work, we wear many different hats. Some days we’re in sales, some days we’re in operations, and most days we’re in multiple positions in one day. In life, we are different people in different situations that may explain a little bit more: when you’re home you’re one version of yourself, when you’re with your friends you’re a different version of yourself, and when you’re at work, I like to think you’re a combination of both. My kids always made jokes that I have 3 versions of myself — they even mocked me (in a good way) on my work voice versus my ‘mom’ voice. If you Google being authentic or being your true self it will pull up thousands of articles. How do you not get lost or confused if you’re trying to uncover your true self? We all want our personality to shine and we want to be “real,” and you can and should!

Now of course it goes without saying that there is a certain way you need to act in certain situations, but you should always in my opinion be yourself. People want to be friends with, and work with, the best true version of you, not the version that has been created to fit in. We can all agree that sometimes we prefer to just fit in because it is easy, and requires less work and less emotion.

If you are ready to be your true authentic self, face it head-on! It will take a lot of self-reflection and won’t happen overnight.

Here are steps you can take to be your true self:

IDENTIFY your values.

IDENTIFY who you want to be.

IDENTIFY who you have been and what you would like to change. Be consistent with how you portray yourself.

BE CONFIDENT in yourself.

LET YOUR PERSONALITY

SHINE bright and don’t let anyone take away your sparkle!

FACE YOUR FEARS of taking off your mask.

IDENTIFY YOUR CIRCLE

— are there relationships that are holding you back?

So what does being authentic mean to you? If you are afraid to be your true authentic self what is holding you back? I encourage all of you to dive deep into this.

Ending this article with how my dear friend explains being authentic!

“Being my authentic self means that I am able to show up in any situation, whether it be at work or outside of work, or on social media, as 100% me. I am able to be true to who I am without the pressure of feeling that I have to act a certain way, or the pressure of having to be perfect. Being able to make a mistake or a poor decision and holding myself accountable for it. I’m fortunate to be able to walk into my workplace every single day as the same person, right before and right after I walk through that door. It’s one of the best feelings, knowing I can be 100 percent me, 100 percent of the time!” ■

KBY LAURA BRANDAO, CONTRIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

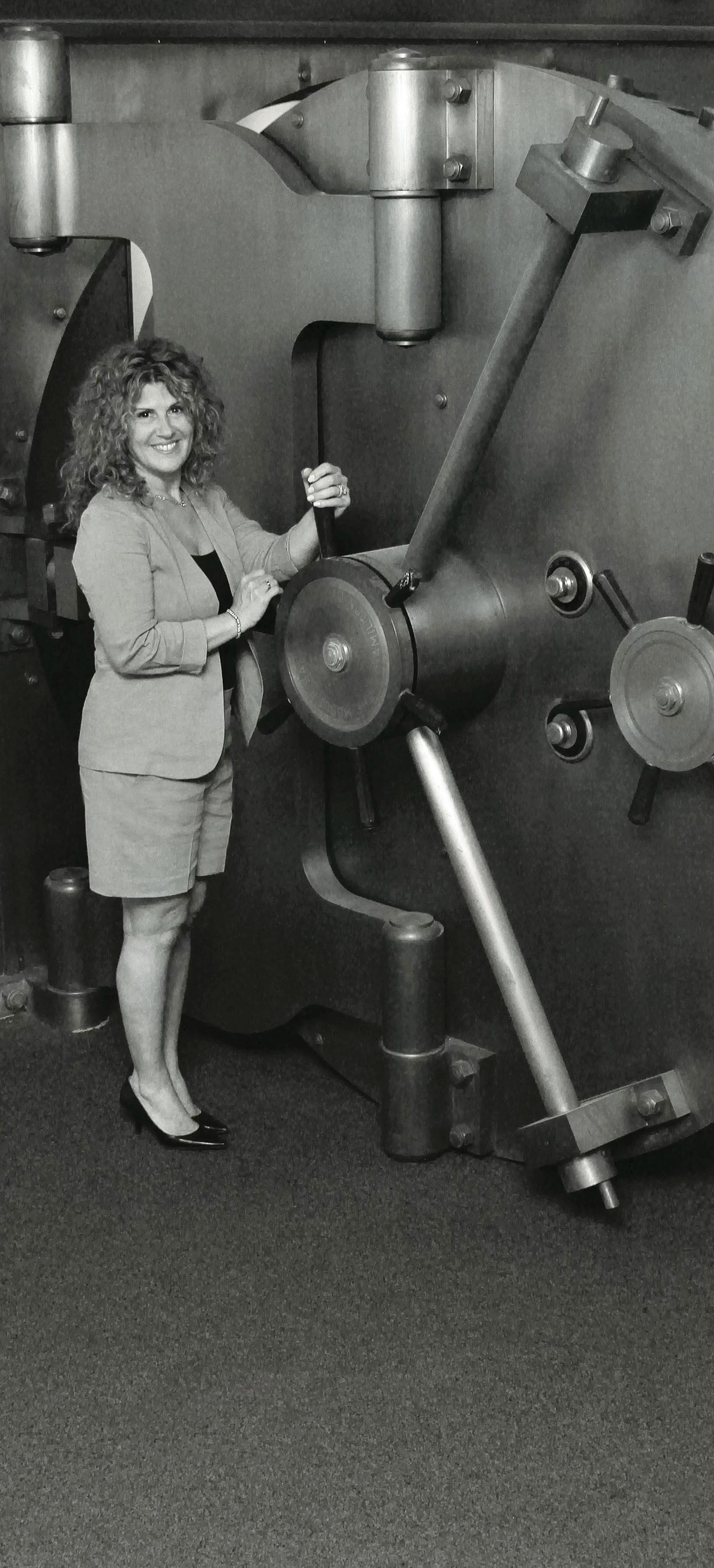

ate deKay is the CEO of Eustis Mortgage in New Orleans, Louisiana. She is a married mother of three and was born and raised in New Orleans.

ing I needed to move into a loan officer role.

mosphere, making every effort to get to know the people who work for me.

How did you start in the mortgage industry?

KD: When I was a teenager, I worked in the Eustis office as a receptionist and filing clerk in the summers and then came back after my education and a brief stint in the non-mortgage world, to start as a loan processor. I worked as a processor for a few months, gaining the understand -

At the reception desk, I had a bird’s eye view of the life of a loan officer in the late 1990’s. Our company uniquely had mostly female sales leaders, and I remember watching them walking into the office with confidence each day, always dressed impeccably and multitasking with apparent ease. It inspired me to see that women can have a career in a high-pressure role. They were great role models, proving what women were doing in an industry that was heavily male dominated at that time.

KD: I see a trailblazer as someone who recognizes the authority and influence that is a part of their role and uses those to foster growth, improvement, and positivity in the people around them.

▶ KATE DEKAY, CEO OF EUSTIS MORTGAGE

In 2017, I purchased the majority shares in Eustis Mortgage and became the CEO. I grew up in this business, so it was a natural fit for me. This is and has always been a family-based company and I still put high importance on creating a family at-

A trailblazer needs to be authentic and demonstrate humility and empathy while encouraging the same in others who are looking up to them. Someone who can encourage others to become the very best version of themselves while breaking through traditional norms and being willing to take a risk in their quest for excellence makes a trailblazer so important to our future. Working hard is always a part of trailblazing, but working at

your best while staying genuine and humble makes a trailblazer unique.

Where do you see yourself and women in general in the industry over the next 5 years?

KD: I am confident that we will see women taking on leadership roles in much greater numbers in the coming years. I have seen significant progress in that regard in just the last 2–3 years.

I became CEO of Eustis Mortgage when I was 8 months pregnant with our third child. It was also during a time when our company was facing numerous challenges.

I believe stepping up at that time and taking the opportunity that presented itself made a significant impact on my career and gave me a greater sense of

What advice would you give to a woman entering or trying to move up in their career?

KD: I would say take opportunities when they arise. Don’t put it off and think something else may come along if your circumstances change. If you take the leap and later discover the result is not what you want, you can always change your decision. What

You deserve it. You are capable. You have support. Remember to hold your ground and keep your decisions real.

Women have a unique and valuable perspective and set of skills to offer, and our industry seems to recognize that. I see many companies taking the opportunity to promote women into roles that allow them to shape policies and process and make decisions that have real impact.

Tell us something about your career in the mortgage industry that was pivotal to your achievements today.

achievement and confidence.

I was experiencing the physical and emotional stresses of pregnancy and raising a young family and then added a huge new professional challenge to my plate. I could have said no and passed on the offer, and it might have been understandable given the circumstances, but I am not a person who steps back when opportunity knocks, so I dove in with the understanding that my maternity leave would be short, and my workload would increase.

you can’t do is go back and find an opportunity available that someone else took when you did not.

Women are being offered more and more leadership and impactful roles in our industry and I want to see them take those opportunities and run with them as far and as fast as they can go.

I had a mentor contact me when I became CEO, and she told me that I deserved my new role and that I was fully capable of handling everything that

would come with it. The quotation at the beginning of this article is exactly what she told me and it’s something important we must remind ourselves of when opportunities present themselves.

Those words are key to remaining successful in your career. Don’t question if you deserve something or not. Society can place unrealistic pressures on us that force us to question this, but I challenge you to remember you are deserving and capable.

Having a good support system in place that can be there to allow you to take what comes without hesitating is also crucial. Your decision should never have to be about logistics but about progress and taking the chances you deserve and have earned through your hard work. That support is key both internally in your organization and externally with your friends and family.

I took a risk and gained a healthy measure of confidence from making that decision. Learning what you are capable of will take you further and higher as you take each step in your career. Use that confidence to help you grow personally and professionally and always keep it real!

Lastly, find something that lets you decompress. I use exercise as my “me” time. That time may not seem relaxing to many, but it allows me to focus on a singular goal and zone out without needing to be the decision maker for an hour of the day. Whatever activity you choose, make sure it is one that lets you disconnect from the stresses

of work and home and take a breath.

To be honest, I am not always the best at balancing work, home, and life in general. But I do try to make sure there is time for me and that I stay grounded to avoid burning out. I remind myself that I am important and there are many families that depend on me, at home and at work, and who deserve the best version of me I can offer them.

What does success mean to you?

KD: For me, success is measured by the growth, fulfillment, and well-being of my team members.

The ultimate achievement as a leader lies in the capacity to shoulder the responsibility for, and serve as a steadfast support for, both our clients’ families and the families within our organization.

I also firmly believe that success is not simply found within the walls of an organization but also spreads outside to the community and beyond our industry.

Our business is and should be about the goal of allowing access to home ownership for anyone who wishes to attain it. In every community, all over the country, being able to purchase a home and feel pride in that accomplishment is what I see as the ultimate success. And, in my role, encouraging and empowering my employees to strive for the success they aspire to, is what I work for every day.

Where do you see yourself professionally and personally in the next five years?

Professionally, I want to continue to grow our company and empower our employees in their careers with us. We have always been a family company and I want to continue that legacy and provide an environment for people to grow and be their very best. I am not a person who believes in setting financial targets as goals, but rather to foster a workplace that provides support, opportunities, and a healthy atmosphere.

I currently serve on both the Mortgage Bankers Association and The Mortgage Collaborative boards. Organizations like these cultivate great professional growth, and I am enthusiastic about dedicating more time here in the future.

Personally, I want to continue to watch my kids grow and thrive. Knowing my oldest will be 18 in 5 years is a daunting thought, but I want to continue to put in the effort to maintain our family life and make it happy and healthy for all of us.

What do you enjoy doing outside of our industry?

KD: Most of my time outside the office is spent with my kids. I make every effort to attend each recital, sporting event, and any other activities they are involved in. With three kids, there are lots of things to keep up with.

I also volunteer my time with charitable organizations in the city. I work with

▶EUSTIS MORTGAGE TEAM ENJOYING TIME TOGETHER WHILE NETWORKING AT A PARTNER EVENT.

one that helps foster children, Raintree Children and Family Services. Raintree helps with building and supporting foster families of kids with needs in New Orleans. One service Raintree provides that is very close to my heart is the foster girl’s home, which helps teen girls transition to adult life, making sure they get all the educational opportunities they need to succeed, and supporting them emotionally through the changes that come with having to move on to the next phase of their lives.

I also serve on the board of the Youth Empowerment Project of New Or-

leans, who work with groups that support after school and educational programs for underprivileged youth in the city. It would be great to continue to dedicate time to these organizations.

Do you have anything else you’d like to share with the readers?

KD: Don’t pass up opportunities when they come, build a support system, and set your mind to recognizing how capable and deserving you are of accepting a new challenge.

My career has been a series of opportunities that I took, despite perhaps my circumstances not always being ideal. If you wait for the perfect moment, you could miss many moments you could not have predicted in your wildest dreams.

Find a group of like-minded women to keep you motivated and on the best path, especially those women that help build you up and remind you of how worthy you are of the successes you achieve. Be present and engaged in all things and you will find that inspiration flows both ways. ■

learning — and the unknown — in mortgage marketing is scary, but it’s also a journey of self-discovery

BY MARY MARGARET HOGAN, CONTRIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

It’s a valid statement and don’t let people convince you otherwise.

In a rapidly changing industry, driven by an ever-changing market and an ever-evolving technological age, there is no way to know everything. Saying “I don’t know” too often feels like an admission of defeat. However, if given the proper attention this statement can be reframed into an opportunity. By acknowledging areas or subject matters that fall outside your existing knowledge, you have unlocked an uncharted territory — a chance to learn something new and empower yourself through education.

For folks who are just entering or new

to the professional marketing sphere particularly, it can be overwhelming. Not only do we have to be experts on all things marketing, but we also must become experts in our given industry, which is quite a tall order. That’s a lot of learning to be done. For this reason, it is important to first take the steps to advance your expertise in both domains and early on.

The good news: there are plenty of resources available! First, let’s acknowledge you’ve already started the work. By diving into Mortgage Women Magazine, a reputable publication, focused on empowering women in this space, congratulations that you’ve started

your self-education journey. Finding publications and written works that are not only informative but also spoken from the perspective of someone who has a similar background to yours is a great way to start. Gaining insight from a female perspective or someone who has a career path or philosophy you’d like to emulate is invaluable, and often a source of encouragement, if not anything else. They listened, they learned, and now they’re sharing their insight so you can too.

We’re fortunate enough to be in an industry where these educational tools are not only extensively available but often free and extremely ac-

cessible. If reading isn’t your niche, tap into the world of podcasts! There are so many podcasts streaming that provide insight into the world of marketing, real estate investing, entrepreneurship, and more! Podcasts are an excellent resource, too, because here you can find the people who fit your learning style and match your desired tone. Podcasts such as “The Marketing Millennials” and “The Marketing Meetup” provide intel from a broader marketing perspective with episode titles that can lead you to your answers instantaneously. Meanwhile, podcasts like “Uncontested Investing” and “The Lender Lounge” feature hosts with experience

in the real estate industry that cover a range of topics such as investing tips, market updates, relationship management, and more.

If you find yourself craving more of the typical classroom environment of learning, you are not alone! With a little research, you’d be surprised how many in-person educational opportunities there are for both the realm of marketing and the real estate industry. Of course, there are the more obvious speaking sessions at trade shows about the state of the market, incoming technological advancements, and other real estate-related insights. But did you know there are entire conferences focused on furthering your marketing education? (If you didn’t know, remember that’s okay!)

Marketing conferences such as Exhibitor Live! and INBOUND are perfect events to explore to meet like-minded lifelong learners eager to solidify their knowledge of their craft in marketing. Within these exhibition halls, you have the rare opportunity to meet people in your field from various industries and find commonalities in your pain points, successes, and more, which is arguably

sometimes the most valuable sources of education. Many of these conferences end up serving two purposes — immersing attendees in a world of the extensive potential of marketing as well as providing classroom-like sessions that ultimately earn you credit for a certification. In the case of Exhibitor Live! for example, audiences are surrounded by diverse industries of event marketing, and ultimately, given the opportunity to work towards a certificate in trade show management. And if a certification or a degree is what motivates you more to embrace your empowering path to self-education, then so be it! Sometimes we all deserve a gold star for going above and beyond on our voyage of deeper learning.

Now, you’ve done the reading, found your podcast, and signed up for a few webinars to continue your quest for knowledge! What more could one possibly do? This question has an easy answer: Listen. Soaking up all the readily available knowledge within your internal and external workday cannot be underestimated. You may be surprised at the sources of knowledge one can find on a given person’s team or just in a department next door. For instance, you might find yourself one day struggling to properly market a new appraisal offer due to a lack of comprehensive understanding of the standard appraisal process, hindering your ability to begin crafting material for the new promotion. This provides the perfect time to pursue some intel from a trusted and experienced source and all you needed to do was ask.

However, no matter how accessible the

knowledge within your work environment may be, this is typically the time and place where shame makes its grand entrance. Yet, this is where the most important skill of a person in their pursuit of knowledge comes into play: Bravery. As you are seeking this educational growth, it is crucial to never be afraid to ask questions. When you hear something unfamiliar or particularly confusing, it’s time to be bold, ignore any self-doubt, and ask for further information. Of course, there are instances that would register as not the time or place to dive in on a particular subject, but just be sure to jot the question down. You’d be surprised to see how many professionals in this space have a list on their Notes app comprised of questions and vocabulary entitled “Things to Look Up Later.” There is no shame in not knowing something, but there is a major disadvantage presented when you don’t investigate further.

If there’s one takeaway from this that you should add to your belt of newfound knowledge, it’s this: Step into the role of a life-long learner and bravely do so! There are always

more questions to answer and ways to broaden your expertise, but they rely on an enduring passion for seeking out new knowledge and opportunities for growth. Now, we’ve covered a lot of resources and avenues to empower ourselves in solidifying our expertise. But where does one begin? A good place to start: “I don’t know.” ■

Fastapp AMC, a leading appraisal management company, delivers coast-to-coast coverage to manage your appraisal needs.

Our skilled team of specialists stand unmatched in handling NON-QM, DSCR, and short-term rental loans, with their deep understanding of market trends and complex financial landscapes.

Dedicated 1-1 Service. Your account manager and executive management team are never more than a phone call away.

We're not just a service provider, we're partners in your success, offering personalized, one-on-one service with a keen eye for precision and reliability that meets your distinct needs.

With the seal of approval from over 80 wholesale lenders, Fastapp AMC stands as a beacon of trust and credibility in the industry. Our mission is to refine and expedite your appraisal process, delivering services of the highest caliber that propel your business forward. Experience the Fastapp AMC difference today.

Ryan Andrews Natalie Dennis

2081 Business Center Drive STE 280 Irvine, CA 92612 949-676-0111

IBY SHELLY GRIFFIN, SPECIAL TO MORTGAGE WOMEN MAGAZINE

n a challenging mortgage market filled with obstacles, mortgage brokers and loan officers can either throw up their hands or find new ways to get around the hurdles and keep growing.

problem-solving through utilizing non-QM.

▶ SELF-EMPLOYED BORROWERS, SUCH AS REAL ESTATE INVESTORS, DOCTORS, LAWYERS, & SMALL BUSINESS OWNERS ARE POTENTIAL LEADS FOR NON-QM LOANS.

That is what lending ingenuity is all about, and outstanding mortgage women are harnessing it every day. Yes, they realize that limited inventory, higher interest rates, margin compression and bank consolidation could block their success. But by using their own ingenuity and partnering with a mortgage lender focused on lending ingenuity they are moving ahead. By lending ingenuity, we mean a combination of innovation, adaptability, agility, and

Part of their success comes from tapping into solutions that can help them reach into new markets that could really use their services.

Consider self-employed borrowers. According to Pew Research, there are approximately 15 million self-employed individuals across the United States. Many of these borrowers could be ready to purchase a home and afford what they want, but they might not qualify using their tax returns due to the deductions they take. In this case, they would require a Bank Statement loan. Many lenders might turn them away. Others will quickly pivot to a Bank Statement option because they have the ingenuity and access to the product to do so.

Consider business purpose real estate investors — the individuals or corporations, such as limited liability companies (LLCs) that want to purchase homes for income-generating purposes. These represent a significant market. Consider just a few statistics: According to CoreLogic, in September 2023 alone, investors made 28% of single-family-home purchases.

• Close to half of the 49.5 million rental housing units in the U.S. are in one-to-four-unit properties, and individual investors own about 70 percent of them, according to the 2021 HUD/Census Bureau Rental Housing Finance Survey.

• In both these situations, prospective borrowers either may not qualify for an Agency loan or may prefer an alternate product that empowers them to move with more speed and agility.

Whatever the reason, mortgage women who pivot into the Non-QM market can find multiple opportunities to expand their revenues.

Non-QM loan products are a study in ingenuity themselves. These products are tailor-made for borrowers who need out-of-the-box solutions to purchase or refinance a home. Non-QM underwriters are unique in that they are experts in unique circumstances. They conduct manual application reviews where they not only evaluate borrower income but also assess the borrower’s financial holdings such as marketable securities (stocks/bonds), retirement accounts, and rental income. Non-QM underwriters have the flexibility to allow gift funds to be applied to the down payment or as

cash reserves that may be required for loan approval. They have the ability to take the borrower’s entire financial picture into consideration and are free to be more collaborative and responsive. While traditional mortgage underwriters can take several weeks to make a determination, Non-QM lenders can respond within 72 hours or sooner. This is particularly important in a market where self-employed borrowers and business owners must compete with homebuyers securing traditional mortgages. Having a fast answer from underwriting on a bank statement loan application can make the difference between getting, or not getting, the deal done. It takes a certain type of ingenuity to do this.

A combination of 12–24 months of bank statements, 1099s, and P&L statements can be used for self-employed borrowers in lieu of tax returns. Real estate investors with complicated documentation or more than 10 financed properties have options outside of submitting tax returns also. They may be well-suited for a Debt Service Coverage Ratio (DSCR) loan. To qualify for a DSCR loan, they don’t need to produce salary/bank statement information at all. Instead, they can qualify solely on the basis of the rental income that the subject property will generate. That makes approvals more streamlined — offering an additional advantage to business purpose investors who want to secure their next property before a competitor does.

When innovative mortgage women enter this segment for the first time, having expert partners will only en-

hance their ingenuity to say yes to borrowers they once turned away. It is helpful to seek out Non-QM partners that:

• Have a long-term history of innovation exclusively in the Non-QM/ Non-Agency space, working both with brokers and correspondents.

• Provide multiple Non-QM webinars and training programs for their partners, as well as marketing support.

• Can consistently pivot at a moment’s notice, make exceptions, and change underwriter guidelines based on new market conditions.

• Structure their internal teams so that they can work collaboratively with their partners on every individual transaction.

• Offer a live scenario desk to help brokers maximize options for each borrower based on different products, features, and terms.

When women lenders partner with the right lender they will understand what lending ingenuity means and additional business opportunities follow. The first step is to be open to the new and different — bolstered by Non-QM partners with the same mindset. ■

Shelly Griffin is Senior Vice President of Client Development at Deephaven Mortgage.

Introducing Maximum Acceleration premier provider of continuing education.

We’re not just bringing you a lecture. We’re bringing you the fuel to spark your competitive fire, the plan to win the game on the merits, the confidence to know the rules and master them.

We’re Maximum Acceleration, and we’re where loan originators go to put their career in high gear.

— LaDonna Lockard, CEO

BY ALLISON SCHILZ AND DANIELLA CASSERES, SPECIAL TO MORTGAGE WOMEN MAGAZINE

FAIR LENDING and appraisal bias remain a continued focus for financial regulators. Creating a strong compliance framework in this area is paramount for mortgage lenders. This year, a national mortgage lender settlement in an appraisal bias lawsuit and the Federal Financial Institutions Examination Council’s (FFIEC) publication of an examination framework for valuation bias provide actionable guidance for lenders as they develop internal controls to prevent, identify, and address appraisal bias claims.

The FFIEC issued a statement in February 2024 on Examination Principles Related to Valuation Discrimination and Bias in

Residential Lending, outlining how institutions will be examined in compliance examinations and safety and soundness examinations when it comes to appraisal bias. Mortgage lenders can utilize principles from the FFIEC’s compliance framework to develop best practices as further discussed below.

Moreover, in March 2024, national mortgage lender loanDepot settled an appraisal bias lawsuit filed with the U.S. District Court for the District of Maryland (“Settlement”). The DOJ and CFPB had filed a statement of interest in the case asserting, among other things, that a mortgage lender violates both the Fair Housing Act (FHA) and Equal Credit

Opportunity Act (ECOA) if it relies on an appraisal that it knows or should know to be discriminatory. LoanDepot agreed to enhance its practices around reconsideration of value (ROV) and internal compliance controls. These requirements can be instructive for mortgage lenders looking to create a compliance framework in this area. In addition to having a fair lending policy that specifically prohibits appraisal discrimination, the settlement terms require: (1) establishing reconsideration of value (ROV) practices and policies; (2) internal review of appraisals for indicia of discrimination; (3) regular fair lending and ROV training for credit, valua -

tion and customer services staff; (4) statistical analysis of HMDA data for appraisal practices by protected class including ROV outcomes by protected class and data at the individual appraiser level; (5) establishing appraisal standards prohibiting the use of appraisers previously found to have engaged in appraisal bias or flagged for problematic practices in statistical analysis, and requiring in appraisal management company (AMC) contracts that appraisers receive fair housing training and certify they have not been the subject of an adverse bias or discrimination finding.

Though expectations in this area continue to evolve, the FFIEC compliance framework and recent settlement provide a blueprint for mortgage lenders to establish a comprehensive internal compliance framework to prevent, identify, and address appraisal bias issues. Mortgage lenders can mitigate appraisal bias by implementing a compliance management system that includes the following elements:

Lenders should establish a ROV framework that is documented in policies and procedures. It should emphasize clear consumer communication of the right to an ROV, adherence to required timelines in the process, and identification of roles and

responsibilities and regular training for key internal stakeholders.

All relevant stakeholders in the organization, including credit, valuation, loan originators, and customer service staff should receive training on fair lending principles and the ROV process.

Lenders should develop testing to ensure that the ROV process is implemented as outlined in its policies and procedures, including an analysis of HMDA data to review whether ROV outcomes are statistically different based on protected class designations. In addition, the organization should establish a process for reviewing, tracking, addressing, monitoring, and handling collateral valuation complaints, including discrimination complaints, across all channels (letters, phone calls, in-person, through regulators, through third party service providers, via email and social media).

Lenders should establish standards for engaging with appraisers and AMCs, including prohibiting future

engagement with appraisers that have been flagged during the appraiser monitoring and testing process. Regulators require lenders to have effective processes to manage third party risks, including performing due diligence and monitoring third parties such as AMCs or appraisers for compliance with anti-discrimination laws. In contracting with AMCs, lenders should set clear expectations around the prohibition of appraisal bias, ensure AMCs are requiring appraisers to take state-mandated bias training, and prohibit them from hiring an appraiser that has been found to have engaged an appraisal bias (or even someone that has a pending appraisal bias claim). Lenders should require the AMC to promptly report to the lender any complaints regarding appraisal bias.

As with an institution’s overall compliance management system framework, documenting the board of directors and senior management’s involvement in a lender’s compliance program and third-party oversight practices related to appraisal bias demonstrates a commitment to advance equity in the appraisal process. ■

Cindy can’t leave her work as an engineer, work that she now finds unfulfilling, because she’ll lose her tenure. Her thought: “I have no control over the system.”

John’s co-worker doesn’t take feedback well, so John works at home each night “cleaning up” the co-worker’s projects so their unit will look better. His thought: “I can’t control how other people are.”

Tracy wants to be promoted to senior management but has been told she doesn’t have what it takes to make the leap. Her thought: “I can’t control what others think of me.”

It’s true. It’s not possible to control a system, another person’s behavior, or others’ impressions. But that doesn’t mean that Cindy, John, or Tracy have no control over their situation. What they — and we — can control ultimately has more power to affect a situation than any control we might try to exert over others.

Consider the power available when we pay attention to these areas — things you can do something about:

BY TINA ASHER, CONTRIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

YOUR WORDS. Spoken or written, the words you choose impact your lives and the lives of others. John, for example, could learn ways to approach his colleague that stand a better chance of being heard. (Consider reading Non-Violent Communication by Marshall Rosenberg or Taking the War Out of Our Words by Sharon Ellison.) His cover-up doesn’t help the co-worker, and it takes away from John’s personal time with his wife.

YOUR BELIEFS. You can always change your beliefs. Cindy, for example, might want to examine her belief that the only way she can feel financially secure is to have tenure. Or her belief that doing something else that’s fulfilling and stimulating won’t provide well enough for her.

YOUR ACTIONS. You alone, are responsible for what you do. Tracy, for example, can find out exactly what leadership and/or managerial qualities her superiors think she lacks. She can take courses to learn skills. She can work with a coach to bring out leadership qualities or to look at other work possibilities.

YOUR VALUES. What’s important to you is your

choice. No one can tell you what to value. Where you truly tap into power is when you align your values with your actions.

YOUR WORK. Although many of us complain of being stuck in a job or profession, you do get to choose what your work in the world is. Everything is a choice.

YOUR FRIENDS. Those you associate with say a lot about what you think about yourself. You can choose to have friends who support you and who mirror your best qualities or who bring you down.

YOUR TIME. Though it sometimes feels like you have no choice, you do choose daily how you spend the 24 hours given to you.

YOUR BASIC HEALTH. While you can’t control your genetic make-up, you can choose to exercise, sleep enough, eat healthy food, get routine check-ups, etc.

When you look at these options, you can discover a baseline to empower your day. It becomes clear that you can take control of your life, so where will you begin? ■

Pavan Agarwal CEO and Founder

Establishing a culture where everyone has an opportunity to make an impact is paramount to the success of any business, including those in the mortgage space. Individuals and teams are empowered to contribute when an organization cultivates an environment that celebrates the diverse skill sets and perspectives of their workforce.

Aligned with these values, it’s critical that organizations position their strategies and approach to an inclusive workplace through the lens of multiple groups, viewpoints, and intersecting experiences. For women in our industry, it’s important that they know there are visible growth op-

BY ERICA RESTICH, SPECIAL TO MORTGAGE WOMEN MAGAZINE

portunities, access to resources, and organizational policies that support their current and future experiences.

To achieve this, buy-in and support from every level of an operation is necessary. Your organization must be an active partner to advance inclusion, and promote effective ways to recruit, develop, and retain underrepresented groups in our industry, including women.

It is essential that this commitment extends to every level of your organization. To that end, at ServiceLink, more than 50% of our leadership is comprised of women. According to Zippia, 35% of top management positions were held by women in 2022.

However, in 2023, women held only 10.4% of leadership positions in Fortune 500 companies. Yet, statistics show that companies with women executives are 30% more likely to outperform other companies.

This reinforces the need for companies to position their inclusion strategies as business priorities. As employee experience and inclusion director at ServiceLink, I found that it is vital to take a holistic approach to inclusion, where we align with industry best practices but fit them around the needs of our company, employees, and partners, which leads to greater innovation and team performance. To succeed, we constantly challenge our-

selves to be better. No matter where you are in the process, here are strategies and best practices that I found helpful for establishing a plan of action to advance our inclusion goals.

You don’t have to reinvent the wheel for this one. In fact, it’s helpful to reference industry leaders in the field and customize best practices to meet the needs of your organization.

At ServiceLink, our proprietary inclusion benchmark serves as a unified strategy and tracks companywide progress within identified key areas of inclusion. Our benchmark was guided by the design parameters set forth by leading organizations and indices such as the Mortgage Bankers Association’s DEI Best Practices.

To craft an inclusion benchmark, engage with organizations who are the experts in the field. Ask questions. Then cater these recommendations to meet the needs of your organization. Stay true to your organization’s goals and mission and hold the company accountable to meeting the priorities laid out through your benchmark.

Ensure that every division has a stake in the plan. Set goals and strategies that can be implemented at all levels, from executive leadership to management and individuals. At ServiceLink, we created an executive steering committee that oversees our inclusion benchmark. The committee is comprised of senior executives from multiple business lines. Partnering with decision makers has helped to ensure inclusion is embedded into existing and future operational strategies. Their buy-in

reinforces our culture and creates excitement surrounding our plans.

Our inclusion benchmark is designed to align with industry best practices while leaving room to innovate new ideas unique to our organization’s needs. We regularly look at where we can advance efforts that make an immediate impact, while also working towards long-term goals by taking incremental steps that lead to sustainable change and lasting outcomes. Concentrate your efforts on core areas that will have the most impact for your business. For us, these include workforce, workplace, and community.

Focus on sourcing the best possible talent for your organization, drawing from large and diverse candidate pools to widen your talent pipeline. At ServiceLink, we actively partner with organizations such as the National Association of Minority Mortgage Bankers of America (NAMMBA) to advance efforts around recruiting and retaining underrepresented groups within the industry.

Promoting ServiceLink-produced thought leadership pieces featuring inclusion topics impacting the mortgage and finance space helps extend our efforts beyond our organization and is another way to reach a broader candidate and talent pool. Elevating your visibility throughout the industry and community helps to establish credibility and reinforces your culture and values to candidates.

Representation across several demo-

graphics is key to building diverse and innovative teams. Recruiting early talent to the industry is an additional focus and is reflected in our decades-long workforce model within our flood division. We partner with local colleges and universities to offer flexible part-time roles to students who are looking to gain insight into the field. This approach has also expanded to other groups such as moth-

▶EMPLOYEES ARE FIVE TIMES MORE LIKELY TO CLIMB TO THE NEXT LEVEL IN THEIR ROLE WITH A COMPANY MENTOR.

ers and retirees and can easily be replicated in other companies.

Create strategies to develop, engage, and retain talent you already have. How are you engaging with them? Provide your employees with the resourc-

es to succeed, such as mentorship programs. Our ServiceLink Mentorship Program has hosted around 200 employees, and roughly 90% of participants have stated that the experience has supported their growth and development at the company. Effective and accessible mentoring relationships are critical to supporting the advancement and retention of women in our industry. Employees are five times

more likely to climb to the next level in their role with a company mentor. Women have accounted for over 60% of mentee roles who have completed our mentorship program, despite the research showing that on average only 42% of women have a professional mentor, according to Gallup. Increasing access to career development opportunities is important to retention and is part of the reason the average tenure for both men and women at ServiceLink is 14 years.

Evolving our ServiceLink onboarding experience has been an important focus to ensure our new employees feel welcomed, understand our values, and are confident that they can be successful in their roles. Defining your culture of belonging and inclusion for new hires on Day One is critical. Ways to do this include providing managers with resources to support their new employee’s onboarding experience beyond Day One orientation.

Regularly review policies to ensure they are inclusive, transparent, and accessible to employees. At ServiceLink, this has included assessing items like our reasonable accommodations process, training methods, evaluating job description language, reinforcing pay transparency practices, accessible technology, and promoting opportunities for employees to share feedback about their employee experience. Look at your current policies and practices with fresh eyes and champion inclusion by updating

areas where invisible barriers may exist to create an even greater level of trust and equity for your employees.

Ensure that your organization is making a sustainable, positive impact in the community. At ServiceLink, one way this comes to life is through promoting employee volunteerism. Employees are provided with up to two additional days of paid time off each year to spend volunteering at organizations they are passionate about. Make sure that your employees know that their interests matter. Company-sponsored volunteer activities also provide employees with an impactful way to make a difference. From making care packages for veterans, scarves for children in the hospital, to hosting high school students during the nationally recognized Disability Mentoring Day, strive to give back in several community areas.

Take steps to actively participate in opportunities that promote inclusion in the industry. Show up to demonstrate your commitment and make a difference. From increasing access to the appraisal profession, expanding efforts around supplier diversity, to championing women leaders, we continuously work to engage and participate in these critical areas to amplify inclusion throughout the industry. ■

Erica Restich is the employee experience and inclusion director at ServiceLink.

A warm welcome to you! I’m Kelly Hendricks, the Managing Editor of Mortgage Women Magazine and Senior Vice President of Delmar Mortgage, and it brings me great joy to extend this invitation to you. Throughout my career in the mortgage industry, I’ve been fortunate to have leaders and mentors who played pivotal roles in shaping my journey. I am thrilled to introduce a transformative initiative – the Mortgage Women Leadership Council, created by Mortgage Women Magazine.

In my role, I’ve experienced the challenges that women face in leadership within the mortgage sector. These challenges led to a profound realization — the need for a dynamic network to empower women in our industry. This realization is the driving force behind the creation of the Mortgage Women Leadership Council. I believe in the power of collective support, and I am excited about the opportunity to share and benefit from each other’s experiences.

Our mission is clear: to promote and empower women’s leadership in the mortgage sector. The council aims to create a supportive environment for professional growth, mentorship, and networking. Joining the

council comes with various benefits, including networking opportunities and access to industry-specific professional development resources. We understand the unique challenges women face in mortgage leadership and have tailored mentorship and support systems to address them.

I invite you to join this movement to empower women in the mortgage industry. The Mortgage Women Leadership Council is committed to fostering a welcoming and supportive environment. Your involvement will not only contribute to your personal and professional growth but also play a crucial role in advancing women’s leadership in our industry. To join or get involved, simply click here to apply.

Thank you for considering this invitation to join the Mortgage Women Leadership Council. For further inquiries about the council and details on how to join, please contact Beverly Bolnick at bbolnick@ambizmedia.com. Let’s work together to advance women’s leadership in the mortgage industry — because collective action brings about meaningful change.

Kelly Hendricks Managing Editor, Mortgage Women

As a valued member, enjoy these benefits:

Access to a Powerful Platform: Amplify your voice and influence through Mortgage Women Magazine, exclusive sponsored programs, email newsletters, and impactful events.

Editorial Opportunities: Showcase your expertise and insights through editorial features in Mortgage Women Magazine, gaining visibility and recognition among industry peers.

Awards and Recognition: Receive well-deserved recognition through our award programs, celebrating your achievements and contributions to the mortgage industry.

Community Support: Become part of a dedicated community committed to celebrating and driving meaningful progress in the mortgage sector. Connect with likeminded women leaders, share experiences, and foster collaborative initiatives.

Mortgage Women Magazine: Enjoy your complimentary digital subscription to Mortgage Women Magazine, the premier publication for women in mortgage. Read advice, learn about industry updates, and take in the inspiring stories of your peers.

Join us and be a driving force in creating a more inclusive and thriving mortgage industry. Together, as a united community, we believe we can make real change.

Enjoy 1 year of your individual membership free! Use code MWM2024

IBY JACK DUNN, CONTRIBUTING WRITER, MORTGAGE WOMEN MAGAZINE

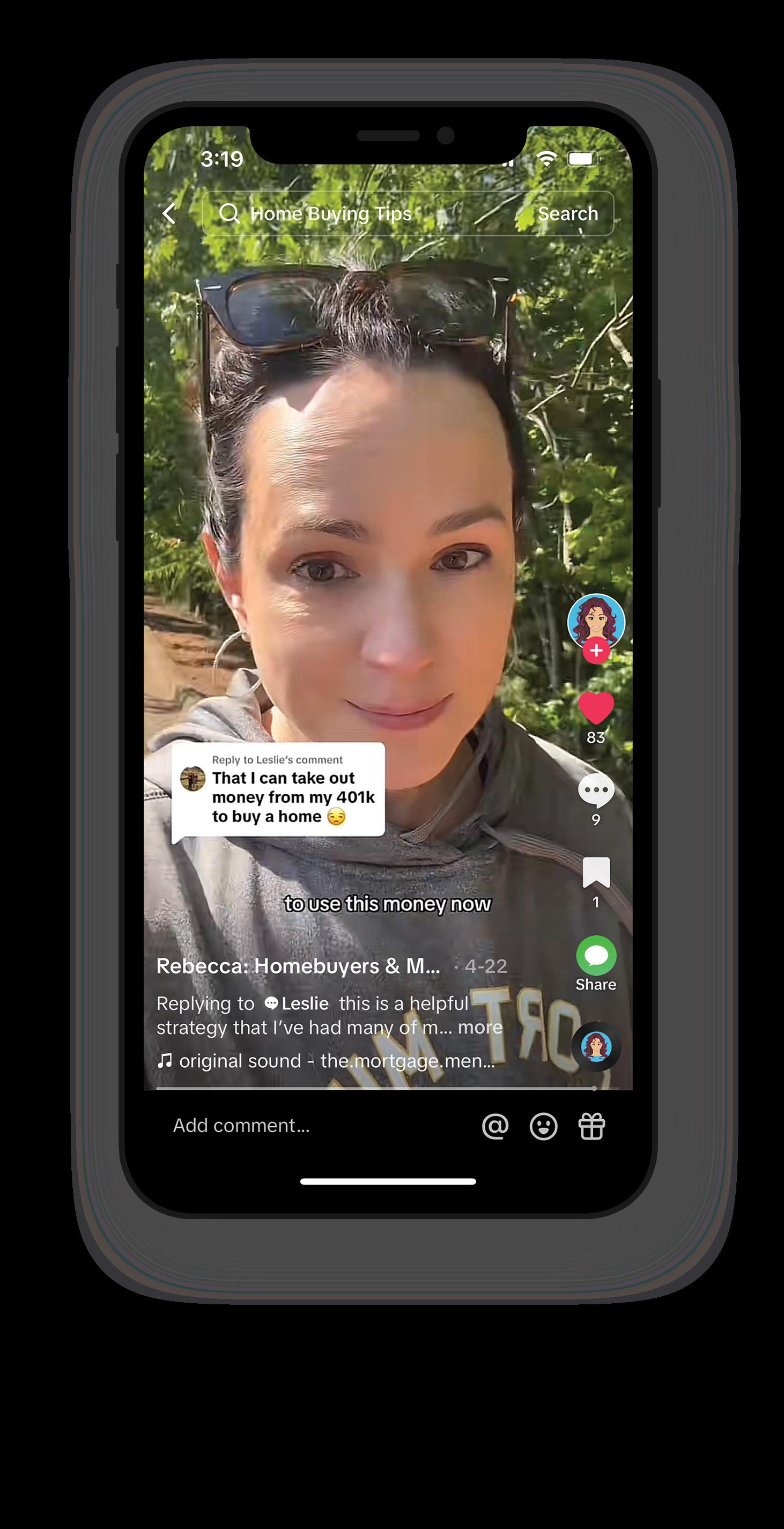

n an era where digital presence often equates to professional prowess, the mortgage industry is having a tough time fitting in. Most good salespeople want to be on social media and are cognizant of the power it possesses. However, finding the right message and medium to send it can be challenging in such an arduous profession lacking a remarkable product to market. After all, loan officers are selling a service, not just a loan product that is offered by most lenders.

So how can loan officers transition from starting with no followers and mediocre content to building a strong online presence and trustworthy brand that customers can depend

on? Rebecca Richardson, The Mortgage Mentor, has built her following through multiple digital channels. She knows the ins and outs of social media and how to establish your voice on highly saturated platforms, such as TikTok and Instagram.

Richardson was first exposed to the world of real estate at a young age. Her father was a real estate attorney, and Richardson herself started her career as a financial planner. After a poor first-time homebuying experience, she realized she could make a difference as a loan officer.

“We bought our first home before I became a loan officer,” Richardson

said. “It was a good financial decision but not a positive experience. It really kind of killed that joy of buying a home, primarily because of the loan officer.”

Richardson’s early experiences with the mortgage process helped her find her voice and brand. As The Mortgage Mentor, she strives not to educate her clients on just their loans but to help them understand the entire mortgage process.

“For me, a lot of it comes down to empowering people so they have their own knowledge they can trust,

▶ REBECCA RICHARDSON HAS BUILT HER BRAND AS THE MORTGAGE MENTOR AND AMASSED OVER 161.4K FOLLOWERS BETWEEN INSTAGRAM AND TIKTOK.

▶ RICHARDSON SAYS THE TRICK TO GETTING COMFORTABLE ON CAMERA IS ABOUT SELF-ACCEPTANCE, AS WELL AS TRIAL AND ERROR.

instead of just hoping that they have somebody trustworthy,” Richardson said. “I think that comes through authenticity. Being genuine, being sincere, but also being strategic. It’s making sure the decisions that we make benefit us today but also will benefit us in the long run.”

Richardson’s videos on TikTok are clear, concise, and easy to follow. Of course, she covers all the typical loan officer topics, such as down payment assistance options, smart ways to drop PMI, and new programs for first-time homebuyers. So what makes her content unique?

Richardson is able to captivate her audience through her personality. Among the informative and educational videos covering the loan process or the mortgage industry, she posts funny, quick-hitting videos that help tell her story. These videos could be a life update or an honest reaction to industry news. Richardson even posted a video where she stitched together footage with another loan officer, setting their information straight in fact-orfake style. (A “stitch” is a creation tool that allows you to combine another video on TikTok with the one you’re creating. Duh, right?) She says that by posting original content consistently, she was finally able to start seeing traction.

“Who are you as a person and why do you care about what you do? Then, what do you know and how can you help? That’s what it really boils down to,” said Richardson. “As long as that’s being done consistently then somewhere between that three to six months is when you start to get traction. Because in the simple act of doing, you get better at it. You can experiment.”

Richardson continued to emphasize the importance of adaptability and paying attention to what people are saying.

“Listen to what people are asking or what gets engagement. Not just views, but also likes and actual interaction,” she said. “Then you start to get that confidence of ‘Oh, this is my voice on social’.”

If Richardson appears to be comfortable on camera, it’s probably because she is. However, even she will admit it takes some commitment. Not everyone is comfortable with picking up the phone, turning on the camera, and pressing that daunting red button while speaking to nobody but yourself. Richardson has advice for those individuals.

“Just turn your camera on, you know?” Richardson said empathetically. “It comes back to self-acceptance. An easy step is turning on your camera for video conferencing.”

Here, Richardson expressed the importance of desensitizing yourself to the camera.

“I think the second level of that is just experimenting [with] recording yourself,” she said. “I absolutely had this fear. I can’t tell you how many times I would have to do a take before I thought I could live with it. I wasn’t even happy with it; I could just live with it.”

Almost everyone struggles with seeing themselves on camera at first, and Richardson was no exception. But like she said, there’s always the next take!

You’re being vulnerable, and it’s an act of service for your community. You’re spreading information.”

Richardson also urged loan officers

unique problems. If you only create general content, you’re not answering any specific questions.”

Many loan officers get lost in the mix of trying to attract every buyer with broad content.

“It’s that whole ‘niche to get rich’ idea. You need to let people know why you are their perfect match to solve their unique problems.”

“First of all, it’s not Facebook live, and it’s not like we’re going live on national news,” Richardson proclaimed. “So if you hate it, delete it! That’s also the beauty of editing. If you mess up, just do it again and cut out the bad parts.”

Richardson concluded that it’s important for loan officers to understand exactly what they’re getting themselves into before jumping into social media. There will be setbacks, ups and downs, and plenty of doubts. The right mindset, however, can propel you forward.

“Yes, we do this for business, but I think it is an act of vulnerability,” Richardson said. “So it’s important to go into it with that understanding.

REBECCA RICHARDSON

to focus on their target audience and make content unique to them.

“Loan officers need to make content for their potential client, ideally their client avatar,” she said. “It’s good to have general content, but I think too many loan officers are scared to make specific content, whether it’s for investors, firsttime homebuyers, Veterans, or whatever it may be. Have a couple client avatars and speak directly to them.”

Finding a distinct segment of the market that you are passionate about can help identify your target audience, or client avatars.

“It’s that whole ‘niche to get rich’ idea,” Richardson continued. “You need to let people know why you are their perfect match to solve their

Others get distracted with the idea of making content to bolster their own image and gain followers, losing sight of the original goal.

“Don’t make content for yourself or to blow up your own image. What will your ideal client think when they see that content? I think that is the ultimate question,” Richardson said. “Can you solve their problem, or are you just trying to attract buyers?”

Social media can help loan officers expand reach and visibility, build trust and credibility, and generate referrals and repeat business. However, when used incorrectly and inconsistently, it becomes nothing more than a mere distraction, diluting brand presence and diminishing potential opportunities. Richardson underscored two important questions to ask yourself when building your online brand or simply before your next post.

“Who are you making this for, and what will they think when they see it?” Richardson concluded. ■

Jack Dunn is a marketing manager at Delmar

Mortgage.

First Horizon Corporation announced the promotion of Tracy Bell in early April 2024 to the role of Chief Investment Officer at First Horizon Advisors Inc., the Wealth Management subsidiary of First Horizon.

In her new capacity, Bell will oversee the investment team at First Horizon Advisors and spearhead the bank's Women & Wealth client initiative.

With 27 years of experience in investment management, gained from esteemed institutions like Regions, Sterne Agee Asset Management, and IBERIABANK, Bell has been a pivotal figure at First Horizon Advisors since assuming the role of Director of Equity Strategies in 2020.

Bell, who is based in Alabama, authors investment publications and frequently serves as a speaker across the First Horizon footprint and as a subject matter expert in the media. Bell serves on the board of directors and is the past treasurer for Girls, Inc. of Central Alabama. She has previously been an industry mentor for student teams from The University of Alabama, Samford University and The University of

West Alabama, competing in the CFA Institute Research Challenge.

Maximum Acceleration LLC, a leading provider of mortgage education nationwide, announced the appointment of LaDonna Lockard as its new CEO.

With over twenty years of experience in the mortgage industry, including twelve years specifically focused on mortgage education, Lockard brings a wealth of knowledge and expertise to her new role. Prior to joining Maximum Acceleration, she served as the Executive Vice President at Mortgage Educators & Compliance.

Maximum Acceleration stands out as a cutting-edge provider of NMLS-approved courses for mortgage continuing education. The company is renowned for its commitment to excellence in mortgage strategies and performance, demonstrated through a series of live workshops and symposia aimed at elevating industry standards.

“I believe in the power of education, and I believe we have a duty to bring next-generation techniques to deliver

content in ways originators respond to,” Lockard said. “The mortgage education industry is becoming cookie-cutter, with too many providers offering the same limited scope. And too many are giving up on in-person CE. That's not our plan here. In-person CE, when done right, will help MLOs grow, not just check the box for what’s required.”

The Federal Housing Finance Agency (FHFA) announced Tracy Stephan will assume the role of Chief Artificial Intelligence Officer (CAIO), in addition to continuing her role leading the FHFA Office of Financial Technology.

“Establishing a Chief AI Officer underscores FHFA’s commitment to understanding new developments in technology and the marketplace and incorporating those insights into our day-to-day work,” said FHFA Director Sandra Thompson. “Through her role leading the Office of Financial Technology, Tracy has been a leader in FHFA’s work on AI and she is well prepared to lead this into the future.”

Per the FHFA, the CAIO will manage AI risk, promote AI innovation, and lead effective AI governance per the Executive Order 14110 on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence, as well as the related Office of Management and Budget Memo on Advancing Governance, Innovation, and Risk Management for Agency Use of Artificial Intelligence.

The Hollywood, Florida-based A&D Mortgage announced the arrival of Catrina Hegarty as an account executive.

Per a release from A&D, Hegarty brings to A&D Mortgage a dynamic blend of marketing acumen and mortgage industry expertise, having most recently led business development at Neat Loans. With a career spanning over two decades, Hegarty’s previous roles included director at Argus Research and account executive positions at EquiFirst Corporation and NovaStar Mortgage, focusing on strategic market analysis and customer-focused sales.

Real estate valuation firm Walitt Solutions welcomed Certified Residential Appraiser Stacy Caprioli as Senior Valuation and Regulatory Consultant.

Walitt Solutions Valuation and Compliance Consultant Joshua Walitt announced Caprioli joining the team in a post on LinkedIn this week.

“Caprioli has been a dedicated member of the appraisal profession for the last 18 years with a comprehensive depth of experience,” Walitt said. “We are excited to add her expertise to the support we provide clients.”

Caprioli began her career performing mass appraisal and public sector commercial inspection work, later focusing on repurchase demands, quality control, compliance, and modernization. Her emphasis continues to be on the equity of access to the appraisal profession, Walitt said.

“So incredibly excited to join the Walitt Solutions team and be able to assist in educating, advocating, and developing growth for the valuation profession,” Caprioli said in response to the company’s announcement.

The Federal Housing Finance Agency (FHFA) recently named Debra Chew as Deputy Director of the Office of Minority and Women Inclusion (OMWI).

Chew will continue in her role as Deputy Director of the Office of Equal Opportunity and Fairness (OEOF). OEOF was created in January 2020 to elevate the importance of Equal Employment Opportunity (EEO), Alternative Dispute Resolution, and anti-harass-

ment functions within FHFA and reaffirm FHFA's commitment to a workplace free of harassment and discrimination.

“Debra’s work in EEO, and her vast experience in diversity, inclusion, and civil rights, have immensely enhanced the culture and daily work of the agency,” said FHFA Director Sandra Thompson. “I look forward to the indispensable perspectives she will bring to the FHFA Leadership team.”

Geneva Financial announced the appointment of Jessie Ermel to its leadership team as Chief Compliance Officer. As CCO, Ermel will drive quality control and compliance for the company's mortgage operations.

Ermel joins Geneva Financial with a proven track record of success in navigating complex regulatory landscapes. Her addition to the team marks a significant milestone in Geneva’s commitment to maintaining the highest standards of compliance and legal integrity.

“We are thrilled to welcome Jessie Ermel to the Geneva family as our new Chief Compliance Officer,” said Telle VanTrojen, COO and partner at Geneva Financial. “Jessie’s extensive experience and dedication to compliance excellence make her an invaluable asset to our organization. Her leadership will undoubtedly propel Geneva Financial to new heights.” ■

Irene Amato, a Bronx native, evolved from robocalling at GMAC to founding A.S.A.P Mortgage, a flourishing company named after her children and inspired by the relentless spirit of New York City.

BY SARAH WOLAK, STAFF WRITER, MORTGAGE WOMEN MAGAZINE

Irene Amato, the CEO behind A.S.A.P Mortgage and a quintessential New Yorker through and through, is a machine, mastering the art of having lived several lives and still having the gusto to embrace new endeavors. To put it into perspective, Amato went from robocalling customers in a cubicle to running a tanning salon and, eventually, her multibranch mortgage company.

Born and raised in The Bronx, Amato’s journey is as bold and diverse as New York City itself. With a voice as raspy as the subway echoes, she commands attention and respect in every room she enters. And being from the city that never sleeps, it’s a miracle that she even lets herself rest. “Four to five hours is enough sleep for me,” she says.

The spirit of New York’s hustle and bustle culture influences Amato’s ship-steering of her company. Named after her three children — A.S.A.P stands for Alexa, Stephanie, and Peter — her business has a double entendre: although it’s named after what drives Amato to be her best, “A.S.A.P” also is her guarantee to customers that they will get their mortgage as soon as possible.

A.S.A.P Mortgage had humble be-

ginnings in 2001, operating out of Amato’s basement while her three children ran around. Flash forward to present-day where A.S.A.P boasts an average loan size of over $420,000 last year, with the company producing north of $140 million across five branches. Its website touts an average of 15 days to every close and was named by Westchester Magazine as both “The Best Mortgage Broker in Westchester 2015” and as a best place to work in 2022, citing perks such as monthly, complimentary professional social media photo shoots and company retreats to spots like Fort Lauderdale and Miraval Arizona Resort & Spa in Tucson. With Amato as the face of the company, A.S.A.P’s reviews are peppered with mentions of her name: “Irene runs a great office,” and “Irene was helpful [from] start to finish” are just a few of the 5-star ratings from recent customers.

Amato grew up with what she describes as a “rough childhood,” losing both of her parents at a young age. With college not being on the table, Amato was expected to go to work and support herself. Two weeks after graduating high school, Amato got her first job at GMAC Finance. Working in a cubicle and tasked with rob-

ocalling GMAC customers defaulting on their car loans,

Her managers criticized Amato for taking too long on her phone calls. After weeks of harassment and getting written up four times, her head boss called her into his office. What he discovered was that Amato’s call logs showed a promising recovery rate; everyone Amato talked to wasn’t getting their cars repossessed “He asked me, ‘What are you doing differently? Others are doing more calls but are getting repossessed,’ and I told him that I was trying to get to the root of the problem. I took the time to figure out why people were late on their payments and how GMAC could help,” she explained. “He offered for me to take my manager’s job, but I declined. I knew the corporate world wasn’t for me when I felt judged for trying to help people.”

After quitting the robocalling gig and briefly working as a bookkeeper, Amato embraced the gnarly trends of the 1980s and opened her first tanning boutique called Endless Summer Tanning Salon. “I did it all myself, even without a dollar to my name,” she said. “I leased the equipment, put up sheetrock, and had a friend help me with the electric.”

Amato sold that salon, opened another in Yonkers, and sold that one when

she was pregnant with her first child.

In the 1990s, Amato raised her three young children and did bookkeeping for a payphone company. When that company went under, Amato briefly opened her own company of the same kind. “I didn’t want to be a slave to a business,” she explained. “I wasn’t helping people and I wanted to do that.”

So, she turned to mortgages.

After joining the industry officially in 1996, Amato tucked five years of experience under her belt and made her debut as CEO of her own company in 2001. After originating up until 2017, Amato is now the face of her company, networking with real estate agents and passing business onto her team, which is about 30 employees across seven branches. It’s what she’s wanted ever since her days of bookkeeping.

“I’ve always wanted to be the owner because I knew what it was like to work those long hours and do the dirty work,” she says. “Now I have the freedom to choose. I can work from home, be on the road for appointments, or go visit my branches. It’s very in tune with what I’m feeling,

▶ IRENE NAMED A.S.A.P MORTGAGE AFTER HER CHILDREN, ALEXA, STEPHANIE, AND PETER, AND ALSO REPRESENTS THE PROMISE OF A FAST CLOSE TO HER CUSTOMERS.

It’s not about

it’s

IRENE AMATO

and I’ve built my life that way.”

Amato’s home office tells a lot about her “why” — the reason that she does what she does. The recipient of many accolades such as both “Best Businesswoman” and “Best Mortgage Broker” by Westchester Magazine, her walls don’t reflect one of an award winner. Amato instead has family photos and collages each of her children made when they were in the fourth grade on the wall. A quote on the wall by author R.S. Grey reads, “She believed she could, so she did.”

“One of my company’s taglines is ‘Your home, our heart,’ and it’s because we focus on our impact and our ‘why’ we’re in the business,” Amato explained. “Loan originators don’t realize how much of someone’s life they have in their hands and they’re trusted with, and I think they take that for granted. It’s not about how

much money you make it’s about the lives you change.”

Amato boasts her top-tier team as being part of her “why.” “I’m not looking to be the biggest or make the most money; I’m looking to build the best team, and that means everyone being in sync with the company’s core values,” she said. “My company has long-term retention. My operation manager has been with me from the start. Most of my employees have been here for about 10 years.”

Jennifer Maldonado is one of those employees. “I have worked with Irene for 10 years and have known her on a professional and personal level more than twice as long,” she said. “Irene’s work ethic in the industry is unmatched. For [herself] and each person that works with her, taking an application and completing the mortgage is not a transaction. Irene truly

gets to know her clients and what is important to them to ensure that she advocates in their best interest.”

Maldonado, a branch manager for the company’s Cortlandt Manor, New York, office, noted that she looks up to Amato in the workplace. “I admire that Irene is a forward thinker for the positive good. She questions the commonalities and challenges herself and those around her to rise up, do better, and be better,” she said. “Customer service and direct honesty to the client are Irene’s strengths and the reason why clients will refer their family and friends.”

John Ferrara, branch manager for A.S.A.P’s Fort Lauderdale location, has worked with Amato for just over five years. What he says Amato brings to the table, other than a strong company culture and environment, is her values. “She has very high family values,”

he said. “That reflects deeply in her business and to her employees. She’s a straight shooter and tells you as it is.”

Amato admits that being a CEO is more than a full-time job. “It’s juggling a lot of hats, and it is draining. But most people assume I never have time for myself, but they don’t see when I come home, shut off my phone, and turn on Netflix,” she said. “I sometimes stay home for a whole day to recharge my battery … I’m a homebody at heart. But I arrange my calendar so I still enjoy my life. I never have a day filled from 8 a.m. to 8 p.m. If I have a heavy morning, I want a lighter schedule at night. And I allow time for things that aren’t mortgage-related.”

Amato remembers what it was like “being a slave to the business” and does activities outside of pricing loans to allow for her other passion projects. For one, Amato loves to write, and she’s commanded authorship from her hobby, being a member of the Forbes Business Council — which includes submitting pieces for the publication — as well as writing a book called “Home At Last,” a homebuying guide. “I saw a lot of firsttime buyers and renters being misled,

and I felt they needed something to give them the raw truth and hold them accountable,” she said. “[The book includes] the things that are needed from you as a buyer or from the lender … for anyone that’s read that book, the bar has been raised in terms of customer service.”

Amato didn’t want to see another generation of first-time homebuyers feel dumb for asking questions or, worse, afraid of asking them altogether. “It’s not just for first-timers either. There are tips for veteran buyers, divorced buyers, single buyers, and people who assume they can’t buy without a partner,” she said. “Clients don’t deserve to be put in a box.”

The same principles Amato details in her book also apply to another side hustle: life coaching for clients and non-clients concerned about how to navigate complex issues surrounding home buying and abstract concepts such as goal-setting.

But Amato wasn’t satisfied with just coaching and the book. She had intentions to write and publish a memoir, but her book writer, Robert Schork, passed away in his sleep shortly before the book was finished. Grappling with grief and unsure how to move forward, Amato subconsciously pulled parts of her memoir and transformed them into a series of

vignettes and wrote a script for a play, using themes such as loss, narcissistic relationships, bullying, and addiction. “I wanted to create something that didn’t tell people how to feel, I wanted whoever was in the audience to feel something and walk out of there identifying with something,” she said.

Amato wrote feverishly and came up with “The OH Show,” a motivational speaker-style play that talks about what Amato sums up as the good, the bad, and the ugly. Her daughter directed it, selecting acquaintances and local actors to play parts. “I chose the name because the word ‘Oh’ is used differently in every scene, whether it’s a surprised ‘Oh!’ or a sad, exaggerated ‘Oh …’,” she said. “At the end of the show, I came out as the keynote speaker and shared my story.”

The show had a one-time date at the Paramount Hudson Valley Theater in Peekskill in November 2023. Amato anticipated that she would be lucky if 50 people came. She wound up with an audience of 400. “I had no expectations going into this. I wanted to share my story because, from a distance, it looks like I have it all together,” she said. “But that’s not true, and how can I empower people unless they know that and know what I went through? I want people to feel like they can do what I did, too.” ■

In 2024, we’re especially proud to highlight the women who excel despite the unique challenges they face in the workplace. Presenting this year’s selection of Mortgage Stars — Women Who Rise Above The Rest.