MARKET ANALYSIS

Market Analysis Report

760 Aloha St , Seattle, WA 98109

Developer: Nitze-Stagen

Building Completion: May 20231

Introduction

760 Aloha is a mixed-use office and retail building in Seattle’s South Lake Union (SLU) neighborhood. Currently close to finishing construction, 760 Aloha will be a Class A mixed-use adaptive reuse building The building is approximately 44,392 sq ft in size and is 6 stories high (2 original concrete stories topped by 4 stories of steel frame construction) Typical floor plates of the upper stories offer 8,700 rentable square feet. Ground floor space along 8th Ave has a half-level with the opportunity for 4,947 rentable sf of retail space The design of the building incorporates the character of SLU’s former historic industrial vernacular architecture. The project aims to deliver a modern building that aligns with the older facade of SLU. It is a converted two-story warehouse built in 1949, giving it an industrial style that reflects the neighborhood’s manufacturing past.

Historic Photos2

1 Miller, Brian “Nitze-Stagen’s 760 Aloha Is Open for Prospective Tenants ” The Daily Journal of Commerce, 5 June 2023, https://www djc com/news/re/12157087 html

2 Eden #2 B-14 L-8 & Eden #2 32-25-2 B-14 L-1 to 8 Photograph 760 Aloha Building Works, 1956 http://www buildingwork design/projects/706-aloha/

The building sits on a site zoned SM-SLU 100/95, meaning that it is designated as mixed-use and located in the South Lake Union Urban Village. Zoning height restricts construction to 95’ residential or 100’ commercial above the determined site midpoint FAR for the site has a minimum of 4.5 and a maximum of 6.75. Street level uses are limited to specific retail and pedestrian oriented types and the code explicitly notes: Apparel shops; Asian arts, crafts, and specialty goods shops; Bakeries; Banks; Barbecue shops; Bookstores; Coffee shops; Floral shops; Groceries; Museums; Personal services such as beauty shops and barbershops; Restaurants; Sidewalk cafes; Tea shops; Travel agencies; Variety stores The commercial space use includes less use restrictions, only limits nuisance uses and industrial uses such as general manufacturing (except pharmaceutical manufacturing associated with biotechnology).3 4

3 Seattle Municipal Code: 23 48 005A & B - Uses

4 Seattle Municipal Code: 23 48 005 - Required street-level uses - Per Seattle zoning code 23 48 240 & 23 66 326 for SM-SLU 100/95, concerning pedestrian ground floor access, use along Dexter Ave must be pedestrian oriented retail

Investment Thesis

This adaptive reuse project used the efficiency of adapting an existing building in a great location to try and deliver a Class A office space into the lucrative SLU submarket. The project had great potential and the low commercial real estate cap rate was very promising when shovels hit the ground in July 2020. Not having to do site prep work, extensive demolition, or rebuild a foundation represented a significant savings that could have potentially translated into a higher profit

SLU’s office market is dominated by large leases (of Class A buildings) to major tenants, leaving a shortage of small-format options for supporting businesses, service providers, start-ups, and firms looking for a small local presence. 760 Aloha is a unique small footprint location in SLU offering a flexible office space, classified under Class A buildings with a LEED Silver certification It can cater to a mid-sized tenant by giving an opportunity to lease the entire building creating a mini-campus or multiple tenants the opportunity to lease entire floors to serve the needs of a niche market in a sea of tech juggernauts

The space allows for a creative open plan layout that can accommodate up to 180 people in the office floors or up to 40 people on each floor This would be ideal for smaller scale tech companies or startups that have access to capital and are looking to grow, or for an existing tech firm that is looking to shrink their space footprint but offer workers a space for hybrid work and meetings The layout would allow for an open plan office with enclosed conference rooms, phone booths and a few closed offices, along with shared recreation and collaborative workstations Although the current building does not provide any amenities aside from 24 covered and secured parking spots in the adjacent building and a bike storage room, potential tenants could choose to build the amenities themselves as desired.

The acquisition price of 760 Aloha is $8.5M, and the overall project cost, encompassing land, construction, and financing, is approximately $30M Nitze-Stagen purchase of 760 Aloha occurred during a more favorable economic climate, characterized by lower interest rates and cap rates, along with a higher demand for office space. However, the current landscape of the office market is uncertain, as the influx of new supply is expected to be online in 2025 and many office leases set to expire in the near future We anticipate it may be possible for 760 Aloha to withstand the future economic uncertainty in the market because of the building’s utilization of adaptive reuse and creative floor layout, but there is a rising risk factor given future uncertainty for office space. Creative marketing and aggressively priced rents to attract the specific client with needs fulfilled by this smaller property could save the project from hardship.

Market and Submarket Overview

760 Aloha is located in the Seattle market and in the Lake Union submarket Looking at the Seattle market and the Lake Union submarket for the site, we performed a commute-shed mapping analysis to understand the typical commute that an office worker would have, or who would likely be a retail customer. A Community Analyst Report for King County5 showed that a majority of workers commute less than 24 minutes to work, the largest single group of workers commute 30-34 minutes, and commuting tapers off between 45-59 minutes of travel time These travel times were used to inform the commute-shed distances and retail market area.

Essentially the retail market is the northern portion of Seattle’s CBD including South Lake Union and small portions of Queen Anne The Submarket for the retail space closely resembles the 5-minute walk-shed from the site and it along the Western Edge of Lake Union in a triangle between WA State Route 99, Lake Union, Westlake Ave , and Mercer St Our analysis believes that this would accurately represent the majority of customers who would be stopping into the retail tenant space regularly on a day-to-day basis. WA State Route 99 is both a perceived and real physical barrier that does limit the spatial accessibility to the site which may deter some retail tenants who may desire access to a larger market Lake Union is also a geographical barrier.

5 ESRI 2023 King County Commuter Report Community Analyst King County Commuter Report Redlands, CA: Environmental Systems Research Institute

For the commercial office portion of the building, the largest market extent for office tenants was based on the 45-minute drive commute that effectively stretches from Everett and Snohomish County down to Tacoma and Pierce County along the Interstate 5 corridor and also east along the Interstate 90 corridor.6 The 30-minute commute shed via driving covers the entire City of Seattle. Public transportation also covers a great portion of the city of Seattle and the Seattle-Bellevue area The submarket for the office portion of the building is essentially South Lake Union and potentially the Northern edge of Downtown. Notable is that the Sound Transit 3 initiative passed by Puget Sound voters does have a planned light rail station for South Lake Union that is to be directly South of the site This was excluded from the analysis since it will not be delivered until 2035 at the earliest, but will expand the office market through reduced transportation time and cost in the future and may be relevant for future investors

Map: ESRI Community Analyst commute-sheds of various transit modality

Within the Lake Union Submarket for office tenants is the presence of a number of notable technology firms and bio-technology firms Significant technology firms, such as Apple, Amazon, Facebook/Meta, and Google as well as Biotechnology firms such as Fred Hutch, Bristol Meyers Squibb, and UW Medicine all have offices within a 15 minute walk from the site. SLU is also a powerhouse of global philanthropy with a number of prominent philanthropic organizations nearby, including The Bill & Melinda Gates Foundation, The Paul G. Allen Family Foundation, The Bezos Family Foundation, and The Schultz Family Foundation (in Fremont) Potential office tenants may be interested in the commercial space due to the close proximity to these firms for employment, and also to take advantage of the spillover effects associated with agglomeration. The market and submarket are composed of census tracts with high median incomes and a large concentration of educated individuals which is an ideal pool of talent for any potential employer occupying the space.

6 Mapping analysis performed using: ESRI 2023 Community Analyst Redlands, CA: Environmental Systems Research Institute

Recent Trends

Lake Union Submarket

The CoStar Lake Union Office submarket second quarter 2023 report7 provides details on the price, cap rate, vacancy and absorption in the Lake Union submarket where the building is sited Over the past ten years, Lake Union has represented a fast-growing office submarket, supported by the presence of Amazon headquartered in Lake Union and other technology-focused tenants This presence has brought a tremendous amount of Class A office space to the submarket

The pandemic significantly impacted the historical trends in the Lake Union submarket, primarily due to the tenants’ office workers ability to work from home, which impacted the vacancy rate and rents. As shown in the chart below pulled from CoStar, the historical vacancy rate of approximately 3%- 6% for Class-A office space increased to 10 3% in Q2 2023; in just the past year, it increased by 3.4%. Net absorption is currently approximately -6,000 SF, showing a trend of negative absorption since the pandemic took effect Lake Union Class-A office space rents peaked at the start of 2020, reaching $52 per square foot However, the rents have since dropped in response to the pandemic and now sit at $43.93, in response to the decreased demand from the hybrid office work environment

Chart: Co-Star Lake Union Office Submarket - Net Absorption, Deliveries, Vacancy and Seattle Vacancy for 20238

While demand rapidly responds to market changes, supply lags behind market conditions due to the multi-year effort required to construct real estate and office buildings It is challenging to abort the construction process once it is already underway. Since 2020, approximately 2 million

7 CoStar 2023 Lake Union Seattle Office Submarket Report 2023-05-19 PDF, Seattle: CoStar

8 CoStar 2023 Lake Union Seattle Office Submarket Report 2023-05-19 PDF, Seattle: CoStar

SF of Class A office space has been added to the Lake Union submarket; this submarket already has approximately 17 million square feet of office space, primarily Class A and B office space With the amount of construction recently added coupled with the increasing vacancy rate, sales over the past year have been much lower at approximately $120 million in sales since May 2022, which is 14% of its average yearly sales of approximately $820 million. This decrease in sales reflects the change in demand coming from the technology, life science, and related tenants. In reaction to these factors, the cap rate for Class A office space is 5.4%, increasing from 5 0% just five years ago This reflects the increased risk that exists in the market

Forward Looking Trends

Lake Union Submarket

Looking forward over the coming years of Class A office space in the Lake Union submarket reflects a time of increased risk due to high supply and questionable demand Due to construction already in the pipeline, approximately 1.6 million square feet of office space is expected to be added to the submarket over 2024 and early 20259 As a result, vacancy is expected to spike to almost 16% by the time that the office space is added to the market. Additional subleases on and off market also compound vacancy in the Class A office market This is primarily due to much of the new construction failing to lock in tenants prior to the construction completion, which has not followed the historical trends of the submarket pre-pandemic

In response to the increased supply to meet decreased demand, Class A office rents are predicted to drop to $42 per square foot and stabilize over the coming years Similarly the cap rate is expected to increase to reflect the increased risk and is predicted to rise to approximately 5.8% for Class A office space in Lake Union. Some skeptics are predicting that cap rates may continue to decline nationally, showing how much uncertainty the work from home and hybrid work environment are affecting the market10. However, a 5.8% cap rate is much lower than buildings of lesser quality and the Seattle market as a whole, showing a relative resiliency in the SLU submarket The Seattle market cap rate is predicted to increase to 6 2%, reflecting that Class A office space in Lake Union is of superior value and less risky than other options in the overall area It is also anticipated to hold its value in comparison to Class B and lower-grade buildings

9 CoStar 2023 Lake Union Seattle Office Submarket Report 2023-05-19 PDF, Seattle: CoStar

10 Amsterdam, David. Rep. Capital Markets U.S. Snapshot | Q1 2023. Colliers International, May 16, 2023. https://www colliers com/en/research/dmc-cm-us-snapshot-q1-2023?utm source=google&utm medium=paid search&utm campaign=2023-colliers-leadgen-reports-nat-crereport&utm content=PID0001-v3&ut m term=commercial%20real%20estate%20market&gad=1&gclid=Cj0KCQ jwj ajBhCqARIsAA37s0y58aI0hr nJmx9gdjeeJQr092kC6OtpIY7QYN4pcqKN8nWbaUN7HwgaAoJpEALw wcB

Why

In 2019, when the project was being shopped around as a potential development, the South Lake Union office market had been completely transformed over the course of the decade into a major technology hub and biotechnology research area. The transformation of South Lake Union and overall renaissance over the prior decade had resulted in both technological innovation and urban revitalization Amazon’s decision to locate their headquarters in the neighborhood brought a lot of attention to this transformation and caused a number of other technology firms to also co-locate in this specific neighborhood and the Seattle CBD A lot of innovation and wealth is created specifically in the market of Seattle and more specifically the submarket of SLU.

For many firms, there was a good case to be made for having physical proximity to these tech juggernauts, innovative biotechnology firms, and global philanthropic entities to take advantage of knowledge spillover and decision making power in South Lake Union Leasing space in this market could benefit a firm through the positive effects of agglomeration. This reason alone

Employment in the Seattle market has reached very low levels and even was buffered from the initial shock of the COVID-19 global pandemic in 2020. According to the 2020 census, professional, scientific, & technical services composed 19 5% of the Seattle workforce Computer & mathematical occupations alone composed 11%, and overall information sector employment was above 50%. These tech companies continued to recruit and hire talent over the pandemic with unemployment in the market reaching 3 7% Despite recent layoffs at FAANG companies, unemployment in Seattle is expected to continue to drop.

Occupations composition of Seattle (ACS 5-year Estimate 2020)11

Industry composition of Seattle (ACS 5-year Estimate 2020)12

11Bureau 2020 ACS 5-year Estimate Employment distributed by datausa io, https://datausa io/profile/geo/seattle-wa (accessed May 30, 2023)

12 Bureau 2020 ACS 5-year Estimate Employment by Industry distributed by datausa io, https://datausa io/profile/geo/seattle-wa (accessed May 30, 2023)

At the time this project was being planned, the data shows that vacancy over the course of 2019 hovered around 2%, demonstrating that demand for Class A office space was incredibly strong 13 Net absorption of office space in the submarket also was around net deliveries, confirming that demand was strong. Market rent per sf also peaked in early 2020, with Lake Union 4-5 star rents approaching $52 per sf at the end of Q4 2019.14 Given the state of the market and overall demand for more office space, the market was signaling it was still ripe for more development. Cap rates also were low at around 4%, representing a great overall value for completed projects that could be sold for handsome profits

The project at 760 Aloha was a unique situation that had a lot of risk, but also showed potential through adaptive reuse of the existing industrial building At the time shovels hit the ground to begin construction, the project appeared to be poised to be very profitable Construction in Seattle’s CBD neighborhoods are fairly expensive due to the complex nature of building in densely developed neighborhoods and the restrictions that creates for these projects In a market with strong demand that was still commanding high rents, doing an adaptive re-use project that could lower construction costs through reduced demolition, site prep, and foundation laying could be a big win for constructing more space at a lower cost

However, the current condition of the market is troublesome for commercial office development When the shovels hit the ground, the market was still glowing red-hot, yet a few years later and the shift towards work from home and hybrid work schedules has significantly reduced demand for office space in Seattle as well as in many other US metropolitan markets There are increasing project deliveries scheduled to hit the market in the next year and net absorption in early 2023 became negative15. Cap rates that were between 4-5% in 2019 are now approaching 5 4%, and projected to reach 5 8% before leveling off For 3-star office properties, the cap rate is projected to taper off around 6%. The market conditions have deteriorated quickly, now making the project's success much less certain

13CoStar. 2023. Lake Union Seattle Office Submarket Report 2023-05-19. PDF, Seattle: CoStar. CoStar ’s Office Submarket Report from Q1 2023 shows a graph of Net Absorption, Net Deliveries & Vacancy with vacancy moving between 2% and 4% before returning to approaching 2%

14 CoStar 2023 Lake Union Seattle Office Submarket Report 2023-05-19 PDF, Seattle: CoStar CoStar ’s Office Submarket Report from Q1 2023 shows a graph of Market Rent Per Square Feet with all commercial rents steadily increasing until Q4 2019 / Q1 2020 Lake Union 4-5 Star rents began 2019 at $48psf and peaked at $52psf in Q1 2020

15 CoStar 2023 Lake Union Seattle Office Submarket Report 2023-05-19 PDF, Seattle: CoStar

Feasibility Analysis Cost

The construction cost of the project as projected by the developer Nitze-Stagen in 2019 was estimated at $307psf, for a total cost of $13,911,861 (including 10% contingency and WSTT).16 For constructing a new building, the average cost in the Seattle Core to build a commercial building was $489/SF in 202117. Compared to other commercial projects in the Seattle CBD, this cost is fairly competitive in the overall market Construction in the Seattle Core is considered to be very challenging and expensive due to the density and numerous building constraints Initially, Nietzen-Stagen’s budget projected that their construction budget was going to be $307/SF which would have been approximately 62% of the average construction cost If this was their true construction cost for the project, the adaptive re-use development would be very economical. If Nitze-Stagen was able to deliver the building on or under budget, it could affirm that adaptive reuse projects can be lucrative in saving developers time and money against new-build Reducing construction costs in the Seattle market could translate into higher profit for the developer.

To gain more context about adaptive reuse and construction cost, a meta-analysis was performed against other adaptive reuse buildings in the City of Seattle Data was limited, and the sample size had 9 buildings with project costs and 12 commercial adaptive reuse buildings overall. Buildings that were facadectomies were excluded from the sample, eliminating 4 additional buildings Due to the limited sample size, caution must be given and extrapolation of trends is limited Though given the overall limited amount of adaptive reuse commercial projects in Seattle, the performed analysis does represent a generalized snapshot of the specific adaptive reuse development projects in the market and submarket Sources used to find comparable project hard-costs included architect & engineering project websites, developer project websites, The Daily Journal of Commerce, The Seattle Business Journal, The Seattle Times, Loopnet, King County Parcel Viewer, and various City of Seattle published documents To the best of our knowledge, figures are accurate, though it is possible that some project costs may have not separated out soft costs or financing costs If repeated in the future, better data acquisition would make a significant improvement in the confidence of the results

16 Executive Summary - 760 Aloha - Nitze-Stagen 2019

17 Burke, Katie 2021 Environmentally Focused Seattle Office Trades Hands in $65 Million Deal September 30 Accessed May 15, 2022 https://www costar com/article/557450110/environmentally-focused-seattle-office-trades-hands-in-65-millio n-deal

Overall findings are that there was no clear trend between cost and additions by both square footage added and also number of stories added Adaptive reuse projects are very complicated projects and more analysis about confounding variables in the construction process are necessary, including seismic retrofitting unreinforced masonry buildings and the arduous historic preservation process (a soft cost that would potentially skew hard cost results) Though in comparing 760 Aloha to other adaptive reuse projects in the Seattle area, it is apparent that the project cost per added square foot is competitive at $488/ added sf 760 Aloha was in a cluster of buildings with costs under $500/ added sf Admittedly, it’s likely that buildings with concrete structures are better suited to additions above the original host buildings in a cost efficient manner This was apparent in 760 Aloha where a robust concrete structure was able to support 4 additional floors without additional structure (excluding seismic retrofit) Even without obtaining environmental certification, this construction technique is also inherently green through reduction of construction waste and re-use of building materials Additionally, the character that is preserved with these buildings could be a marketability factor for certain tenants

The developer Nitze-Stagen made the bold claim that the redeveloped floor plates were designed with high efficiency in mind 18 Analysis shows that this is largely true and the typical commercial floor plate is 87% leasable. However, BIMA standards dictate that it is possible to incorporate non-leasable space into tenant leases What is also unique about the 760 Aloha project is that the majority of the resulting building composition will be built as the addition This

18 Executive Summary - 760 Aloha - Nitze-Stagen 2019

is in comparison to other adaptive reuse projects that usually only add a small percentage of square footage.

Revenue

Asking Rent

In order to decipher the asking rent for the space, a set of comparable properties were considered in the South Lake Union and Fremont/UDistrict sub-markets that were similar in size and had a similar tenant profile The three comparable properties used were:

1. 503 Westlake (SLU)

2 Watershed Building (Fremont)

3 Thomas Northlake Building (Wallingford)

The closest comp to 760 Aloha is the 503 Westlake building The co-star report of the property19 shows that it has a similar use profile: retail on the ground level and office on the floors above. Currently, it has a pharmacy in the retail space and a real estate consultant in the office space The building was recently renovated in 2018, though it has class B designation.20 The location, size of the building and amenities are very comparable to the subject property. While 760 Aloha and buildings comparable in size are not traditionally set up for large tech companies that desire open office layouts with large floor plates, it is possible that a particular tennant may be sized to take advantage of the size, as has been the case at 503 Westlake

The Watershed building21 is also a new development, in the Fremont neighborhood. The tenants are in the creative industry and non-profit organizations The leasing activity of this property is very rigorous and it has been able to maintain low vacancy at 4 1%, by lowering its asking rent

The final comp, Thomas Northlake Building22, is the floor comp Its location, construction quality and vintage are inferior to the subject property, therefore, its asking rent sets the lowest limit for our revenue calculation but is less centrally located.

Based on this study, a fair asking rent for the subject property is $40 for office and $36 for

19 CoStar. 2023. Underwriting Report - 503 Westlake Ave N: CoStar

20 Note: Many comparable properties in the adaptive reuse analysis above were also listed as class B designations, but for the analysis we proceeded with the assumption given by the developer as class A.

21 CoStar 2023 Underwriting Report - 900 N 34th St - Watershed Building: CoStar

22 CoStar 2023 Underwriting Report - 100 NE Northlake Way - Thomas Northlake Building: CoStar

retail on a NNN lease structure For a conversative revenue calculation, the first as well as the second floor is being considered for retail. The third, fourth, fifth and sixth floors are being considered for office

Operating expenses and concessions

Based on the NNN lease, the operating expenses can be limited The developer ’s underwriting suggests a general building operating expense as $1.06 PSF in 2020. Based on a nominal expense growth of 3% year on year, a $1.2 PSF for general operating expenses has been considered in the revenue calculation

Rent Growth

The market and submarket rent growth is negative in the current quarter (-0.04%). This indicates that the asking rent will be lower than the past financial quarters. The developer ’s underwriting suggests a rent of $43 PSF in 2020 In the current year the rent would face a degrowth, therefore justifying our $40 PSF assumption. For new tenants the rent growth in the lease terms should be 3%, as assumed by the developer in the project underwriting report

Vacancy

As per the comps, the current vacancy ranges between 25-35% With some exceptional leasing management (such as the Watershed building), the vacancy can go as low as 4% on stabilization. However, as the subject property is going to go to the market in the next month with a 92% vacancy, it is highly unlikely for it to achieve stabilization in the near future As per the current submarket condition, the vacancy rate for stabilized property is 10.3%. Based on this information, for a 5 year holding period, the vacancy rate is assumed to be 25% for the subject property

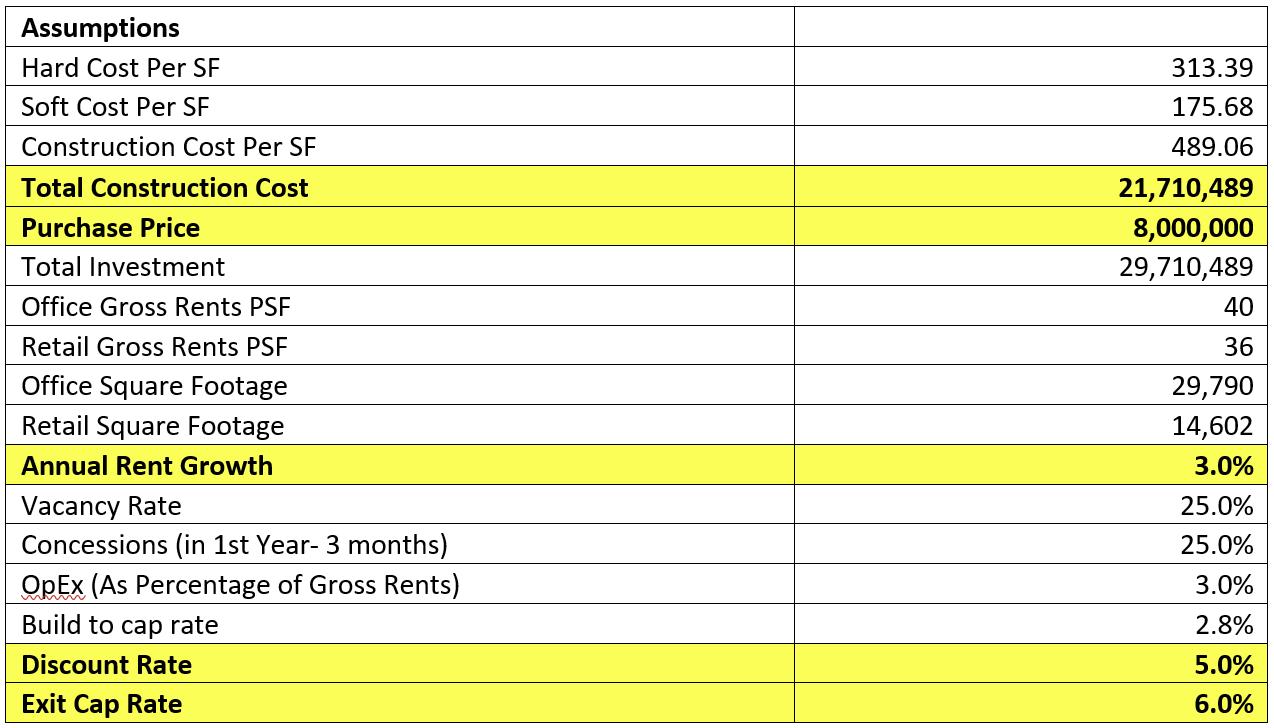

The assumptions for the revenue calculation are as follows:

40 / NNN

per market study

per market study

Return Measures

Based on the development costs as well as the revenue assumptions, the return measures for the development project as are follows:

Acquisition Costs

Hard Costs

Soft Costs (w/fin)

Total Gross Costs

$8,000,000

$13,911,861

$7,798,628

$29,710,489

Rent (office) $40 psf

Proforma:

The internal rate of return (IRR) is a valuable indicator that assesses the success or failure of a project. Nitze-Stagen has just completed the 760 Aloha project and is actively searching for tenants in the market With soft demand in the market, it would be advantageous to lease the property as soon as possible. Uncertainty around return-to-office policies have yet to stabilize and will have a great impact on the future of this project. The project has now been certified for occupancy and handed over to the developer at the end of May 2023 23 We have created a projected financial statement/ proforma for the next five years to evaluate the risks and returns of the project before potentially selling it at the end of 2028 Our analysis considers the projected costs, revenues, and feasibility analysis Additionally, we have factored in a three-month tenant move-in concession offered by the developer and have adjusted the cost in our first-year net rent calculation

The table below provides all the assumptions used in our financial model for the property's pro forma analysis The potential gross income has been adjusted to reflect our assumption about real-world leasing prices for both the commercial and retail spaces in the short-term. A 25% vacancy rate has been assumed amid market uncertainty–it may be likely that the project fails to attract a tenant for some time

23 Miller, Brian “Nitze-Stagen’s 760 Aloha Is Open for Prospective Tenants ” The Daily Journal of Commerce, 5 June 2023, https://www djc com/news/re/12157087 html

Sensitivity Analysis:

In addition to the aforementioned analysis, a traditional What-if Analysis was conducted, focusing on three variables: the office rent escalator, construction cost escalator and the exit cap rate. This analysis examines the impact of these variables on the leveraged Internal Rate of Return (IRR) and Net Present Value (NPV). The results indicate that as the rent escalator increases and the cap rate declines, the IRR experiences an upward trend, suggesting that higher rent escalators and lower exit cap rates can lead to an improved leveraged IRR These findings highlight the potential benefits of adjusting these variables in the investment strategy for the project

Office Rents vs Exit Cap Rates:

Construction Costs vs Exit Cap Rates:

Conclusion

Analysis done for this report concludes that the highest and best use for 760 Aloha is a commercial 6-story building. A strength of this project is its great location in an attractive mixed-use walkable and accessible neighborhood The central location is ideal for most office workers who can commute along the I-5 & I-90 corridors. Through analysis about highest and best use, development cannot take advantage of the relatively high zoning height of SM–SLU 95/100 The developer noted the impediment of an air-rights easement to the neighboring Neptune property significantly affecting developable space. In designing 760 Aloha, Nitze-Stagen had to negotiate additional height to get a partial 6th floor through a small stepback on the 5th floor This height limitation makes building a residential building up to the 95’ zoning height limit infeasible. Without this limitation, it is possible that there could have been a different project that could have been the highest and best use Given this information, building an office building is the highest and best use of the property Ironically, the restrictive air rights easement allowed Nitze-Stagen to build a 6th floor that became one of the property’s best features; an outdoor deck and green roof with a great view The entertaining floor is a major draw that added a lot of value to the project. The submarket itself is favorable for office buildings, being one of the most attractive locations in the Puget Sound region

Due to current trends in the office market, we believe that the project would not be feasible if it were to be built now We applaud Nitze-Stagen for pursuing such a creative adaptive reuse project to lead the market Sensitivity analysis shows that the conditions of the office market in SLU were profitable, but worsening cap rates and softening demand that has occurred during construction has unfortunately changed the financial viability of this project The sensitivity table shows the story of this project and how the market shifted from the bottom left of the table to the top right during the course of construction (changing from a likely profit to a likely loss). The alternative of constructing a 6-story building of an alternative use was considered The second highest and best use in this market would be a multi-family building, but a 6-story multi-family building would not be as profitable in the current market given construction costs and softening rents Additionally, zoning constraints would require an additional 10’ setback24 on the street level along 8th Ave and have onerous facade requirements. If faced with the decision to begin construction today, our group would recommend waiting until market uncertainty for this specific product in the SLU submarket clears Real Estate is cyclical, and it is possible that the ending of this cycle may occur more quickly than in other US markets. Since the building has already been constructed, it is likely to face significant challenges in the near future, making it a risky investment.

Conclusion: Hold & Wait

Bibliography

1 Amsterdam, David Rep Capital Markets U S Snapshot | Q1 2023 Colliers International, May 16, 2023

https://www.colliers.com/en/research/dmc-cm-us-snapshot-q1-2023?utm source=google &utm medium=paidsearch&utm campaign=2023-colliers-leadgen-reports-natcrereport&utm content=PID0001-v3&utm term=commercial%20real%20estat e%20market&gad=1&gclid=Cj0KCQjwj ajBhCqARIsAA37s0y58aI0hrnJmx9gd jeeJQr092kC6OtpIY7QYN4pcqKN8nWbaUN7HwgaAoJpEALw wcB

2 Bureau 2020 ACS 5-year Estimate Employment distributed by datausa io, https://datausa io/profile/geo/seattle-wa (accessed May 30, 2023)

3 Burke, Katie 2021 Environmentally Focused Seattle Office Trades Hands in $65 Million Deal September 30 Accessed May 15, 2022

4 CoStar 2023 Underwriting Report - 100 NE Northlake Way - Thomas Northlake Building: CoStar

5 CoStar 2023 Underwriting Report - 503 Westlake Ave N: CoStar

6 CoStar 2023 Underwriting Report - 900 N 34th St - Watershed Building: CoStar

7. CoStar. 2023. Lake Union Seattle Office Submarket Report 2023-05-19. PDF, Seattle: CoStar

8. Eden #2 B-14 L-8 & Eden #2 32-25-2 B-14 L-1 to 8. Photograph. 760 Aloha. Building Works, 1956 http://www buildingwork design/projects/706-aloha/

9 ESRI 2023 King County Commuter Report Community Analyst Redlands, CA: Environmental Systems Research Institute

10 Executive Summary - 760 Aloha - Nitze-Stagen 2019

11. Miller, Brian. “Nitze-Stagen’s 760 Aloha Is Open for Prospective Tenants.” The Daily Journal of Commerce, 5 June 2023, https://www djc com/news/re/12157087 html