WEYERHAEUSER IS INDUSTRIAL STRENGTH.

Three Outstanding Sites. One Incomparable Development Partner.

PREFERRED LOCATIONS

Two Florida Approved U.S. Opportunity Zones; Major roadway frontage (U.S. 301 - Hawthorne, U.S. 90 - NFMIP, I-16 - HGMS) and close proximity to interstate systems; NFMIP in Foreign Trade Zone #64 with JAXPORT

ACCESSIBLE TO RAIL

Convenient rail service, with rail spur directly into NFMIP, CSX borders Hawthorne and Georgia Central Railway for HGMS; significant railservice partners, including CSX, Florida Gulf & Atlantic and Norfolk Southern, with main freight lines connecting cities, ports and airports

READY TO WORK

Labor force of well over one million within 60 miles of Hawthorne and NFMIP and served by CareerSource Florida partners; over 450,000 labor force within 60 miles of HGMS with nation’s #1 state workforce training program

SUPER-SIZED AND SHOVEL-READY

Zoned acreage with utilities, approved for millions of square feet (3.5M for Hawthorne, 8M for NFMIP and 17M for HGMS) with parcelsize flexibility; designations include REDI Community (Hawthorne), RAO and CSX Select Site (NFMIP) and Georgia Ready for Accelerated Development (HGMS)

PROXIMITY TO RESEARCH, INNOVATION AND TECHNOLOGY

Hawthorne and NFMIP are close to University of Florida (#5 Public University by U.S. News & World Report) and Santa Fe College (#1 Two-Year College in U.S. by The Aspen Institute); NFMIP also adjacent to Florida Gateway College; HGMS boasts three hometown college campuses, along with Mercer University within 60 miles

hawthorneindustrypark.com

Learn more about all of our industrial opportunities, including Louisiana, North Carolina and South Carolina, at weyerhaeuser.com/land/development-projects

ESG

Deploying Location Strategy + Incentives to Meet ESG Goals

CFOs and business leaders can utilize location strategy as part of their ESG mission through their workforce, workplace, and sustainability strategies, as well as by demonstrating social responsibility and good governance.

18 The Form and Substance of Business Incentives

Government at all levels continues to provide numerous incentives to companies in varied industrial sectors in order to generate jobs and economic prosperity.

Industrial Update: shoot the Equilibrium?

Although the economic need for shorter shipping times will spur companies space around the country.

48 Strategies to Overcome Intensifying Industrial Real Estate Challenges

Companies facing constraints in the industrial real estate market should build extra time into their site searches and widen their geographic areas of search.

51 The Decentralization of U.S. Fintech Hubs

As the fintech sector continues to evolve, it’s primed to serve as a major economic catalyst in already established core, secondary, and emerging markets as well as new locations that offer the fundamentals for its growth.

of insights for assessing a possible location.

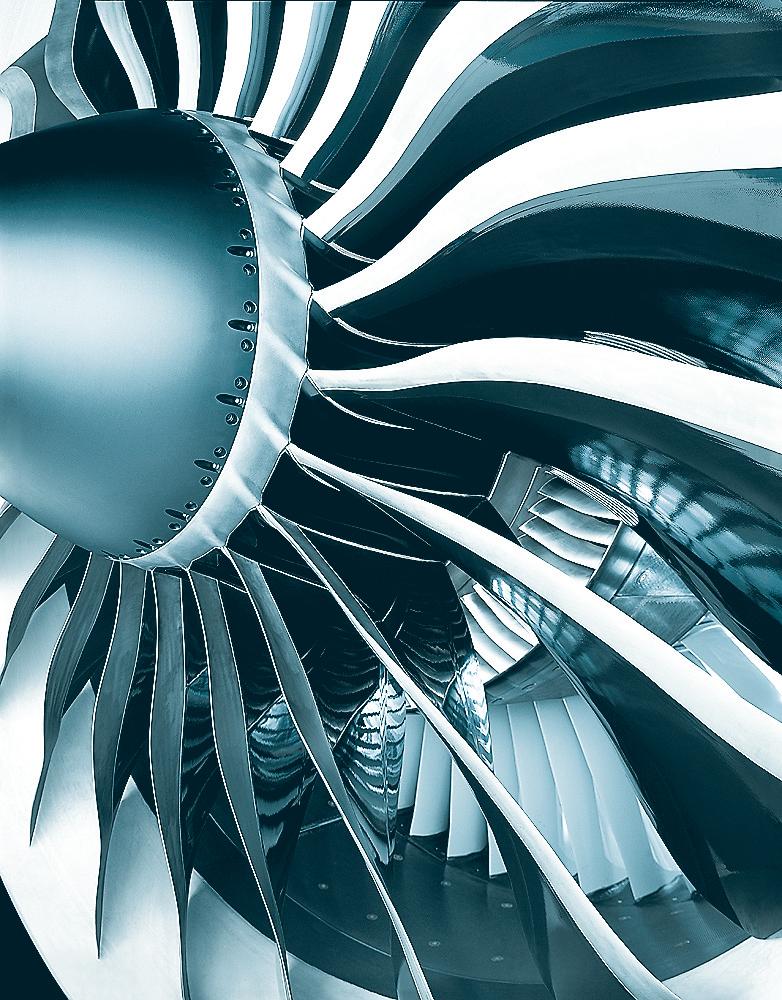

84 The Top Investment Location Prospects for Aerospace Manufacturing

Which are the most promising states and countries for aerospace production in a rapidly evolving sector-wide landscape?

Ohio Moves Business Forward

Nearly

27,000 New Jobs Last Year

$31 Billion in Capital Investment Last Year

You can count on JobsOhio to propel your next venture — from securing incentives in our state’s pro-business climate to acquiring talent from an innovative workforce. Plus, the team at SiteOhio holds an extensive portfolio of buildings and locations primed for the economic growth of trailblazers like you. Intel, Honda, and Ford are just three of the companies that chose to invest in Ohio last year. Are you ready to join them?

Expand your business in the right direction.

We must adjust to changing times and still hold to unchanging principles.

“ ”

Jimmy Carter (1924– ), 39th president of the United States, who served from 1977 to 1981 6

8

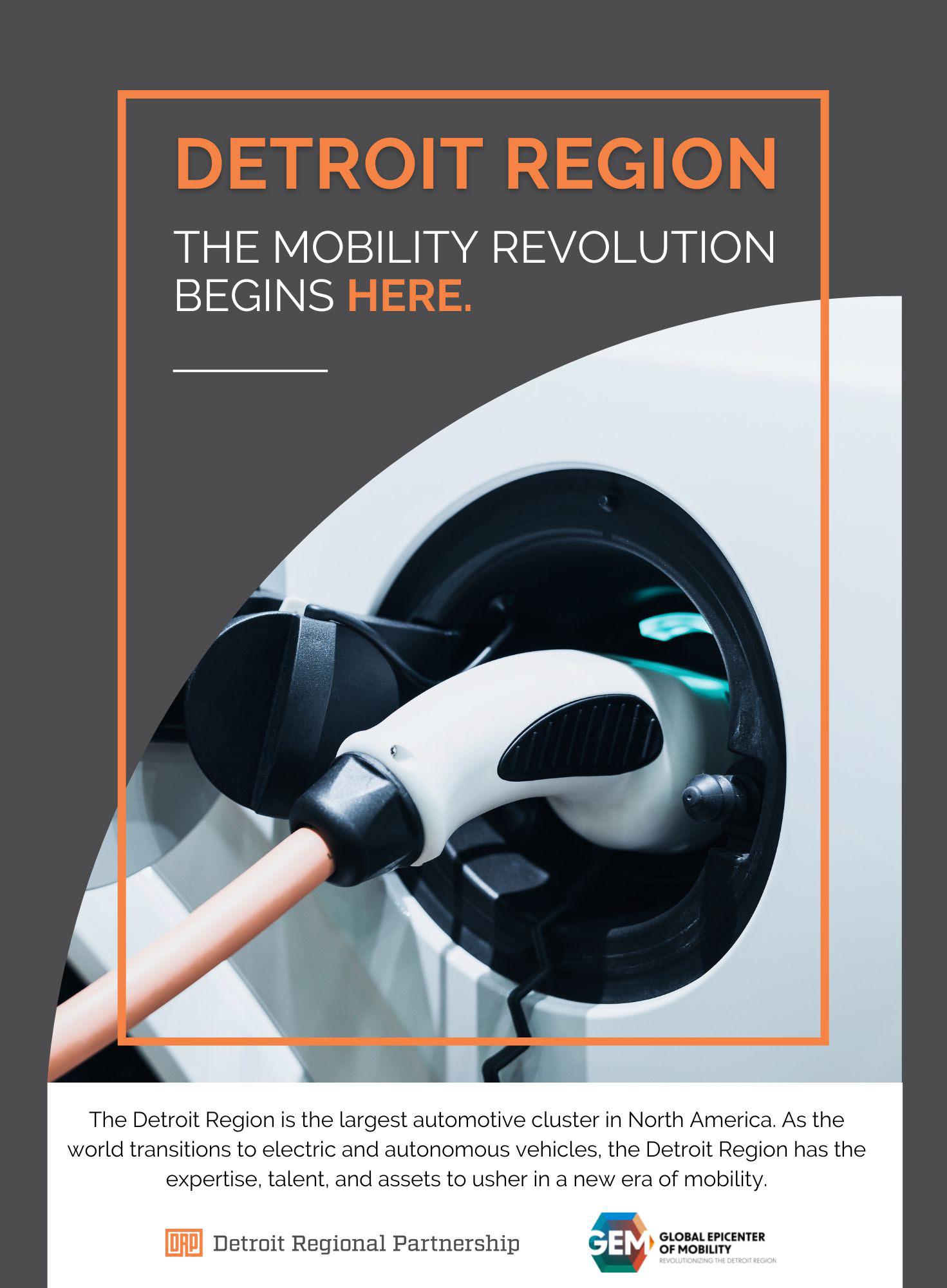

34 Fleet Electrification: Another Big Disrupter

There’s a lot to consider when a company decides to electrify its fleet, including available charging infrastructure and employee training, but the move can reduce costs and help to satisfy ESG goals.

42 Expanding the EV Battery Pipeline

44 Top-Four Location Considerations for EV Battery Plants

Prioritizing needs, identifying unique site constraints, and getting the right people involved from the get-go will ensure the long-term success of your operation.

annual report

14

87

88

54 74

exclusive online content

Companies looking to grow are facing an historically tight labor market and rising costs, but their plans to invest may be buoyed by recent government legislation.

19THANNUAL

ANNUAL CONSULTANTS SURVEY 34

Consultants responding to our survey say economic conditions are affecting their clients’ expansion/investment plans, with labor and energy availability and costs of prime concern.

• Location Factors for a Large Natural Gas User

• Old Tricks, New Methods: Streamlining the FTZ Process with Software

• How Are Economic Developers Partnering to Solve Workforce Challenges?

• What in the World? FDI Trends to Watch in 2023

“With a dedicated workforce, beautiful outdoors and low cost of living, Arkansas is hard to beat.”

Annemarie Dillard Jazic, Vice President Dillard’s

Cautious Optimism for 2023

Rising inflation, supply chain vulnerability, and labor shortages made 2022 a challenging year for manufacturers.

According to software solutions firm Aptean,1 these are the top concerns of manufacturing companies. Those responding to Area Development’s 37th Annual Corporate Survey, the results of which are in this issue, would agree.

Nearly half of the Corporate Survey respondents say economic pressures, i.e., inflation, threat of recession, etc., are their top concern. However, half also say recent government legislation — e.g., CHIPS Act, Inflation Reduction Act — would greatly or moderately affect their investment plans. And of those responding to our Consultants Survey, half also say economic pressures are their clients’ top concern, with three quarters saying recent government legislation will affect their clients’ expansion/investment plans.

While the $50 billion CHIPS and Science Act was formulated to encourage domestic investment in the semiconductor industry, “the legislation may serve as a gateway to increase investment and encourage more domestic production in adjacent industries,” say consultants at Deloitte who have the “last word” in our Q1 issue.

For the first time, our Corporate and Consultants surveys also asked the respondents to rate the importance of DEI and ESG initiatives, with between 40 and 50 percent of each group confirming the importance of these initiatives among the site selection factors. In this issue’s cover story, David Hickey of Hickey & Associates, explains how business leaders can utilize location strategy as part of their ESG mission.

Nearly two thirds of the respondents to our Consultants Survey claim they work with automotive/battery manufacturers on their location and investment projects. We continue our look at the evolving EV/battery sector in a special section in this issue. Fleet electrification is the latest disrupter, which is also helping organizations meet their ESG goals — from last-mile deliverers to utility companies to school districts.

As we move toward the end of 2023’s first quarter, views on the economic outlook continue to diverge. A February measure of CEO confidence by the Conference Board2 indicates that although 93 percent of CEOs are preparing for a recession, they feel it will be brief and shallow. It’s hoped that lessons learned during the pandemic about controlling costs, addressing supply chain woes, and embracing innovation will help business leaders to weather whatever lies ahead.

Editor

1 https://lp.aptean.com/2023_Manufacturing_Forecast_Report_en-us.html?utm_source=harmelin&utm_medium=newsletter&utm_ campaign=IMERP-NA-DA-2023-02-24-HRM12-IndustryWeek_eNewsletter&utm_content=static 2 https://www.conference-board.org/topics/CEO-Confidence

AREA DEVELOPMENT

Publisher Dennis J. Shea dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Business/Finance Assistant Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Advertising/National Accounts advertising@areadevelopment.com

www.areadevelopment.com

2023 Editorial Advisory Board

Josh Bays Senior Partner site selection group

Marc Beauchamp Managing Director hickey canada

Brian Corde Managing Partner atlas insight

Kate Crowley Principal baker tilly capital

Dennis Cuneo Director Site Selection Services walbridge

Courtney Dunbar Site Selection & Economic Development Leader burns & mcdonnell

Brian Gallagher Vice President Corporate Development graycor

Amy Gerber Executive Managing Director Business Incentives Practice cushman & wakefield

Stephen Gray President & CEO gray

David Hickey Managing Director hickey & associates

Scott Kupperman Founder kupperman location solutions

Bradley Migdal Executive Managing Director Business Incentives Practice cushman & wakefield

Matthew R. Powers Managing Director Brokerage jll

Alan Reeves Senior Managing Director Global Strategy Consulting newmark

Chris Schwinden Senior Vice President site selection group

Alexandra Segers General Manager tochi advisors llc

Eric Stavriotis Vice Chairman cbre

Steven Tozier US-East Region Credit & Incentives Leader ey

Editor Geraldine Gambale editor@areadevelopment.com

Staff and Contributing Editors

Lisa Bastian Mark Crawford

Dan Emerson

Art & Design Patricia Zedalis

Steve Kaelble Mark Schantz Karen Thuermer

Circulation/Subscriptions circ@areadevelopment.com

Production Manager Jessica Whitebook jessica@areadevelopment.com

Business Development Manager Matthew Shea (ext. 231) mshea@areadevelopment.com

Digital Media Manager Justin Shea (ext. 220) jshea@areadevelopment.com

Web Designer Carmela Emerson

Halcyon Business Publications, Inc. President Dennis J. Shea

Correspondence to: Area Development Magazine 30 Jericho Executive Plaza Suite 400 W Jericho, NY 11753 Phone: 516.338.0900

Toll Free: 800.735.2732 Fax: 516.338.0100

Chris Volney Senior Director Americas Consulting/Labor Analytics cbre

Dan White Director Government Consulting & Fiscal Policy Research moody’s analytics

Scott J. Ziance Partner vorys

strong

The Magnolia State has been a key player in the automobile manufacturing industry since Nissan established its 3.5 millionsquare-foot assembly plant in Canton in 2003. Since then, Toyota and PACCAR also have established plants in Mississippi. Additionally, Mississippi is home to three of the nation’s largest tire makers, Continental, Yokohama Tire and Cooper Tire.

SEE WHERE MIGHTY MISSISSIPPI CAN TAKE YOU. Visit MISSISSIPPI.ORG/automotive to learn more.

CEOs Are Underprepared for Cyber Threats

New regulations to expand cybersecurity expertise and reporting requirements can only help to eliminate the very real threats companies are facing on a daily basis.

BY FREDERICK JOHNSON, MS, CISA, C|CISO, Vice President, Cybersecurity & Digital Forensics, MARCUM TECHNOLOGY

What do IT systems and water have in common?

Do you know the connection? You will find the answer at the end of this article.

According to the most recent Marcum-Hofstra CEO Survey published in December,1 less than one third (31.8 percent) of CEOs said their company is well-prepared for any cybersecurity threat they might face in the foreseeable future.

That’s a staggering and

sobering message. If you look at how other risks are managed, such as supply chain, market conditions, or higher financial interest rates, there is a much greater degree of focus and success.

It’s difficult to imagine that most CEOs are unaware of cyber threats. You can’t go a day without seeing an article about the latest sensational cybersecurity inci-

threats continue to be treated differently than all other types of organizational risks despite clear evidence that cyber losses can include millions of dollars, penalties, and fines; class-action lawsuits; reputational damage; and lost opportunities. Don’t forget employee attrition — who wants to work for the latest firm to become a media headliner for all the wrong reasons?

A Business Survival Imperative

Even within many large organizations, cybersecurity departments still report into IT, as if security were an IT function (spoiler alert: it’s not an IT problem; it’s a business survival imperative). Cybersecurity needs an

YOU CAN’T GO A DAY WITHOUT SEEING

AN ARTICLE ABOUT THE LATEST SENSATIONAL CYBERSECURITY INCIDENT.

dent. And none of these attacks are limited to a particular size or type of company. Attacks are impactful and pervasive.

Risks due to cyber

equal place in the Csuite. Accept the reality that IT and security have very different focuses, agendas, and KPIs. Recognize the differences, celebrate them, and place security equal to the IT function.

CEOs don’t entirely own this problem. There are many boards of directors with no significant cybersecurity expertise. Where are the board members who were former CISOs and lived through a major security breach? They are the leaders who really know how painful and expensive it is to survive

one, and they have the lessons learned under their belts.

In 2022 the Securities & Exchange Commission proposed new regulations that would greatly expand the cybersecurity expertise and reporting required of public company boards. If approved, there will be a scramble for talent with experience focusing on operating risks, strategic and practical elements of meeting existing and coming regulations, as well as future opportunities that a great cyber posture can provide. This is not to be feared — it will be a good opportunity for forward-acting organizations to get ahead.

Still wondering about the connection between IT systems and water? In 1908, Jersey City, N.J., became the first U.S. city to begin routine disinfection of community drinking water. Other municipalities quickly followed suit. Until then, citizens contracted water-borne illnesses regularly.

A strong cybersecurity capability is the disinfectant all organizations need now. Some day we will look back and shake our heads at the unbelievably slow progress of providing basic sanitation and protection to our IT capabilities, particularly given how dependent we are on them. Elevate your organization’s cybersecurity capability now, and we can all raise a cold glass of clean water to that future.

1https://news.hofstra.edu/2022/12/13/ mid-market-companies-not-fullyprepared-for-cyber-threats-marcumhofstra-ceo-survey

SOMETIMES, ALL YOU NEED IS A CHANGE OF SCENERY

SEQUATCHIE COUNTY, TN

DISCOVER A PLACE WHERE ADVENTURE, BEAUTY, AND PROSPERITY THRIVE. HERE, UNMATCHED SCENIC BEAUTY AND A CENTRAL LOCATION SUPPORT GLOBAL MANUFACTURERS AND GENERATIONS OF SKILLED TALENT. NOW IS THE TIME TO BE IN SEQUATCHIE COUNTY, TENNESSEE.

IN FOCUS

The Facility’s Envelope: A Multifaceted Ecosystem

For infrastructure preparedness, a big picture and narrow focus are equally important.

can lead to missing the forest for the trees.

BY MARC GRAVELY, Founder, GRAVELY P.C.Marc Gravely is the author of the best-selling book, Reframing America’s Infrastructure: A Ruins to Renaissance Playbook.

When discussing infrastructure preparedness, generalizing is necessarily fraught since specialization of purpose is the typical lynchpin issue of infrastructure adequacy. If, for instance, one’s business is computer chip manufacturing, one’s primary, and perhaps overriding concern, is maintaining the integrity of the clean rooms. However, that hyper-focus

A commonplace — and often costly — error leading to infrastructure failures can occur when the owner’s desires for cost control merge with the designer’s or builder’s generic assumption that — even for facilities dedicated to manufacturing specialty products like computer chips — a wall is a wall. That is, a wall (and a roof) serves its pur-

ity will take place inside. True, your computer chip manufacturing facility’s clean rooms absolutely must have an HVAC system that delivers a contaminant-free atmosphere. But the building envelope also must be designed and constructed so that it will not inadvertently foster environmental degradation, shortening the useful life of the HVAC system. Ignoring or giving short shrift to the building envelope as a multifaceted ecosystem — for drainage, air circulation, and energy conservation, to name just three — can result in significant deficits that present fertile ground for litigation-inducing deterioration of other structural components.

didn’t act as a reasonable person in the same circumstances would have done.

Appalling legalese notwithstanding, a trial lawyer’s dream case is one in which a lay jury can appreciate that the error causing the client’s damages is fundamental, easily understandable, and one that the jury members, themselves, likely would not have made. Hyper-focus is something that a jury can understand.

So is the significance of reducing maintenance costs, energy consumption, and environmental impact, all of which are reasons to pay proper attention to the building envelope. It simply makes good sense.

pose as long as it shields the interior from rain, wind, cold, or baking sunshine, and provides a reasonably comfortable space for conducting whatever business activ-

Using the “Reasonable Person” Standard

Law schools teach that the so-called “reasonable person” standard applies to virtually every area of human endeavor, at least insofar as performing below it might result in the imposition of damages following a lawsuit. No matter which of several potential pathways to liability — i.e., various formal causes of action and theories of recovery — is involved, a lawyer is always on the lookout for situations where a lay jury can easily determine that someone “just didn’t act right.” That is to say, they

Picture the plaintiff’s expert witness saying to the jury: “Not only would [insert your choice of envelope-enhancing measures here — say, for instance, triple-glazing the building’s windows] have prevented the moisture accumulation [or another foreseeable malady] that caused the environmental failure we’re talking about here, it also would have saved enough in energy costs to pay for itself in two or three years.”

A jury can get that. A jury will believe that taking those steps is something a reasonable person would have done. Failing to do so equals negligence. Hyper-focus negates ordinary care.

Once they believe that, the defendant is (pardon the legalese) toast.

THE BUILDING ENVELOPE MUST BE DESIGNED AND CONSTRUCTED SO THAT IT WILL NOT INADVERTENTLY FOSTER ENVIRONMENTAL DEGRADATION OF THE HVAC SYSTEM.

TAKE YOUR BUSINESS TO A BETTER PLACE — TAKE IT TO

CONNECTICUT

Successful companies pick the best location for their business, but transformative companies pick the best location for their people.

LEARN MORE AT ADVANCECT.ORG

FRONT LINE

The Growth of Indoor and Vertical Farming

In an attempt to deal with the vagaries of weather and changing climate, farmers are turning to vertical and other high-tech indoor farms.

has advanced, these indoor operations have been attracting more investment capital and becoming larger.

“There is a tremendous amount of experimentation going on,” says Kevin Kimle, Rastetter Chair of Agricultural Entrepreneurship at Iowa State University and director of the Start Something College of Agriculture and Life Sciences program. “There is hardly an ag tech area where there isn’t some sort of play on this going on.”

a differentiated product,” for example, some kind of “artisan” greens, he explains.

BY DAN EMERSONIf you want to see the possible future of farming in the U.S., there are a number of places to look.

One is Morehead, Ky., where AppHarvest has opened a 2.76-millionsquare-foot high-tech greenhouse to grow nonGMO, chemical pesticidefree fruits and vegetables closer to consumers.

AppHarvest has also broken ground on a second similarly sized, controlledenvironment ag facility nearby in Richmond, Ky.

Meanwhile, in Luzerne County Pa., Upward Farms, a Brooklyn-based indoor aquaponics company, is building a 250,000-squarefoot vertical farm facility, where crops are grown in vertically stacked layers. The county has also been chosen by Crop One for its third U.S. vertical farming operation, which will comprise 316,000 square feet.

Another massive vertical farming campus is planned by San Francisco-based

Plenty Unlimited Inc. at the Meadowville Technology Park in Chesterfield County, Va. To be built in six phases, it will encompass 200,000 square feet and

Like any nascent, entrepreneurial industry, vertical farming has had failures as people figure out what will work, says Kimle. The 2020 pandemic was a major setback for a number of smaller indoor growing operations, since restaurants and corporate kitchens were abruptly shut down, Kimle points out. For ex-

The industry is at the “venture growth stage — a lot of emerging technologies and venture-backed businesses with unique intellectual property,” says Djavid Amidi-Abraham, director of consulting for Agritecture, a Brooklyn, N.Y.-based consulting and tech firm. “We’re still in a very risky business environment. It’s similar to other technology boomand-bust cycles.”

Modern, large-scale greenhouses can work in any climate, he says. “The biggest limitation is that in certain hot and mild climates — such as South Florida — they are less efficient. While greenhouses require more square footage, the access to free energy (the sun) is a major advantage over vertical farming. Power use per unit of yield is much lower.”

is projected to eventually produce 20 million pounds of produce annually.

An Attempt to Remove the Risk

For decades, farming has been one of the most financially risky professions. Now, in response to several converging trends — consumer demand for locally grown food, an increasing population, and shrinking arable land — entrepreneurs are removing some of the risk by growing crops indoors, either in so-called vertical farms or in hightech greenhouses that enable growing in any climate. As the technology

ample, Clayton Farms, an operation owned by ISU lost 95 percent of its business “overnight,” he says.

The industry has continued to attract investment capital, “but for every success there are probably one or two startups that didn’t work. Sometimes the founders love the technology but forget that at the end of the day it’s still farming,” Kimle says. “Our existing ag production is really efficient, so you have to have something that is — from a cost perspective — in the range of what people are accustomed to paying. If you don’t, you really need

He says one of the major challenges to startups is the high capital expenditures for labor and energy. Regarding labor “there is a big push” to reduce workforce requirements through improved technology, including automation. On the market side, more widespread adoption of indoor-grown produce by large-scale buyers (retailers and wholesalers) would mean more market demand, he says.

Amidi-Abraham says indoor farming is not a one-stop solution for every farmer, business, or city. “Nor is any one solution in urban agriculture the best. The most fitting urban farming solution truly depends on the city, the culture, and the people involved.”

AS THE TECHNOLOGY HAS ADVANCED, THESE INDOOR OPERATIONS HAVE BEEN ATTRACTING MORE INVESTMENT CAPITAL AND BECOMING LARGER.Shown here is the Plenty facility in San Francisco.

POWERING NEVADA’S FUTURE.

• RELIABLE SERVICE.

• LOW RATES.

• RENEWABLE ENERGY.

• ENVIRONMENTAL PROTECTION.

• INVESTMENT IN OUR COMMUNITY.

At NV Energy, our economic development experts work strategically to facilitate business location and expansion within Nevada. The dedicated team can assist with energy pricing and renewable tariffs, site visits, and all the critical data needed to make an informed decision for business investment in Nevada. Our team will help you manage every step of the site location decision process.

Learn more at nvenergy.com/econdev

YOU CAN COUNT ON US.

FIRST PERSON

What data is most attractive to cyber thieves and why?

Morris: While motives vary by different cyber adversarial groups (e.g., cyber criminals, hacktivists, and nation-states), it’s important to discern those motivations as they highly impact where harmful, disruptive activity will focus. Unfortunately, most organizations need to deal with multiple adversaries at a time, making cybersecurity a difficult job. Cyber criminals typically look for financial gains through intellectual property, personally identifiable information (PII), or business critical data. Hacktivists usually focus on what they can do to disrupt business activities or expose internal organization information. And, nation-states are most likely to target unique intellectual property or access to critical systems

MICHAEL MORRIS MANAGING DIRECTOR IN THE CYBER AND STRATEGIC RISK PRACTICE DELOITTEThe Industrial Internet of Things (IIoT) and cloud technology are expected to further transform and optimize industrial operations of manufacturers. Can you explain the current cyber threat situation for those companies?

Morris: Many IIoT devices were built with a specific function in mind at a time when security wasn’t a high priority. As more and more devices connect to the Internet, organizations’ cyberattack surfaces have grown, and now span all of their critical business areas. As industrial, manufacturing, or other organizations look to defend against cyber threats, they need to begin inventorying and monitoring all of their connected assets, including information technology (IT), operational technology (OT), Internet of things (IoT), and industrial Internet of things (IIoT). Since cyber adversaries will take advantage of any organization’s security blind spots, organizations would be wise to build visibility across all of their tech assets.

What basic elements make up a great cyber defense plan? What extra services should be added for optimal protection?

Morris: There are several basic elements needed for a cyber defense plan. These include identifying core critical systems that have the biggest impact to business success, enabling the monitoring of those systems, and enabling automation to identify anomalous and malicious behaviors to mitigate threats as quickly as possible. Threat actors often leverage a lot of the same technology that cyber risk management programs do, so enabling and building your organization’s security capabilities to counter them as soon as they’re identified is key in protecting the business.

Which cyber services are best to be outsourced, and why?

Morris: There are many cyber services that managed service providers can provide. For example, we’ve seen an upward trend in organizations hiring managed detection and response (MDR) providers to cost-effectively address increasingly complex threat landscapes employing skilled cyber talent that’s often hard to come by in an incredibly tight job market.

Continued on page 53

KENTUCKY’S BUSINESS CLIMATE BRINGS RECORD INVESTMENTS

The state’s site development and workforce programs are among the assets attracting companies to Kentucky.

By Mark CrawfordKENTUCKY JUST CONCLUDED its best two-year period in the state’s history for announced private-sector investment and job creation, including 500-plus new-location and expansion announcements with $21.7 billion in new investment and more than 34,000 full-time jobs.

Companies are attracted to the Bluegrass State because of the pro-business climate, modern infrastructure, and diverse, highly skilled workforce. Kentucky’s state, regional, and local governments collaborate with each other and the private sector to expand the economic base in creative ways, forming strong, lasting economic partnerships.

For example, automotive has long been a key manufacturing sector in Kentucky, and now the state is emerging as an innovative leader in the production of electric vehicle (EV) batteries and other EV-related materials. Since 2020, EV-related investments in Kentucky have totaled nearly $10 billion, including the BlueOval SK and Envision AESC battery plant projects, which are both on track to start operations in 2025.

“As one of the nation’s leading manufacturing centers, BlueOval SK will have bestin-class supply chain management and increase the state’s manufacturing footprint with a $5.8 billion investment,” says Ursula Madden, director of External Affairs with BlueOval SK and BlueOval City.

Build-Ready Program

Kentucky’s success in landing mega-size business projects is in part due to its streamlined site-selection preparation process and the

Build-Ready program, which reduces construction time and costs for industrial sites with communities completing many of the site upgrades beforehand. Preparation can include environmental studies, permitting, utilities, and ground preparation, all of which accelerate a company’s construction timeline. Kentucky currently has 20 Build-Ready sites certified and ready to go. To date, six BuildReady sites have been selected by growing companies, including four in Bowling Green in South Central Kentucky.

“The Build-Ready program is a prime example of how smart product development initiatives can drive economic development and create opportunities,” says Ron Bunch, president and CEO of the Bowling Green Area Chamber of Commerce. “Its impact in South Central Kentucky has been remarkable, including new job creation, increased tax revenue, and a higher quality of life for residents.”

Kentucky Product Development Initiative

The Kentucky Product Development Initiative (KPDI) was recently established by the state to further upgrade industrial sites statewide. The program builds upon the success of the pilot PDI program, which launched in 2019 and quickly proved itself.

A PDI grant for energy infrastructure was critical in Pratt Paper’s decision to select Henderson for its $500 million facility.

“From first visit to announcement took only three months — our ability to meet their timeline was critical,” says Missy Vanderpool, executive director for Henderson Economic

Development.

Thanks to support from Gov. Andy Beshear and the state legislature, KPDI will invest $100 million to upgrade existing sites and is accepting proposals from communities across the state — reflecting the state’s commitment to expanding the competitiveness of its local communities and creating new jobs.

Workforce Pipelines

The Kentucky Skills Network provides workforce solutions such as employee recruitment, customized training, and skills development. In 2022, training was provided to 95,000 workers and 5,000 companies. Additional funding for training facilities and apprenticeship and scholarship programs is available through the Bluegrass State Skills Corporation.

Kentucky is one of only three states selected by the U.S. Chamber of Commerce Foundation to implement its Talent Pipeline Management (TPM) program. TPM’s goal is to develop a diverse talent pool that leverages education and workforce development systems. To date, TPM has launched more than 30 industry collaboratives that are “producing tangible results that are positively impacting individuals, businesses, and communities across Kentucky,” says Makinizi Hoover, strategic advocacy manager for the U.S. Chamber of Commerce.

From speed-to-market initiatives to a commitment to workforce development, Kentucky is helping companies take their business to the next level.

The Form and Substance of Business Incentives

Government at all levels continues to provide numerous incentives to companies in varied industrial sectors in order to generate jobs and economic prosperity.

By George Tobjy, Managing Director of Client Services, Maxis AdvisorsAn incentive award of up to $9 billion in federal, state, and local benefits for Micron’s $100 billion chip fab plant near Syracuse, New York, if employment and investment projections are achieved, has set the high bar for a U.S. project incentives award.

More than $1.3 billion in incentives has been approved to attract Panasonic’s EV battery facility which is projected to create 4,000 jobs in De Soto, Kansas.

North Carolina was successful in bringing Apple’s 3,000 jobs in machine learning and artificial intelligence to Research Triangle Park with the help of an incentives package estimated at $846 million.

While these mega-project announcements and the level of associated incentives awards grab national headlines and are regularly debated on their needs

and merits, each year hundreds of thousands of companies in the U.S. alone will secure some level of business incentive and tax benefit to conduct facility expansions, capital investment, and other employmentrelated activity.

Business incentives, tax credits, and exemptions are regularly provided and deemed absolutely necessary by the federal government, state and local agencies, and other authorities and entities, including ports, airports, utilities, railroads, and workforce training organizations to encourage and support business investment and economic activity in all corners of the country. Our federal system allows state and local governments, and the voters in their states, to set tax and regulatory policies, and the levels of expenditures they feel necessary in their public and social institutions, to develop a healthy and economically productive state and region. In the same vein, state and local agencies are able to determine the levels of government incentives and tax benefits they feel necessary and in the best interests of their citizens to attract and retain companies and generate investment, jobs, and economic and social health for their communities.

Credits and incentives can be defined in three separate categories:

• • Statutory tax credits and exemptions — These federal, state, and local tax benefits are “as of right” based on companies making qualifying investments or conducting required activities to claim the benefits. Regularly claimed statutory benefits include investment and jobs tax credits, research and development credits, targeted hiring and training credits, foreign-trade zone or ports activity credits, employment tax reductions, sales tax exemptions, qualified opportunity and enterprise zone benefits, and others. Other major tax benefits that companies regularly claim include capital gains and

foreign income deductions, property depreciation and business expense benefits, and employer health and pension contribution reductions. While these tax-based benefits do not require pre-approval by economic development or taxing authorities, the level of expertise and rigor required to calculate and determine eligible benefits that can be claimed on tax returns is extensive.

• • Tax credits and exemptions that require pre-approval — While many of these tax benefits fall in the same categories as those above, in many cases the ability to claim benefits on tax returns requires companies to apply for the incentives and secure approval from economic development agencies and tax authorities. Many of the largest announced incentives awards may fall into this category, including property tax abatements and exemptions, income tax credits for capital investments, tax credits and employment tax withholding rebates for job creation, and sales tax exemptions on facility construction and equipment expenditures. Benefits are secured by entering into discussions, submitting required applications, and securing approvals from state and local agency boards or local councils. In most cases, these benefits must be applied for and approved before any commitments or announcements are made by the company on their plans or intention to conduct the project in the state or city. Activities conducted such as signing a lease, purchasing or placing orders for equipment, hiring or posting announcements for new employees, internal announcements to company employees or internal communications that decisions have been made before required approvals have been received can disqualify companies for the incentives. While the qualifying criteria to secure approval of these benefits is based on statutes and regulatory guidelines, in many cases, economic development agencies have discretion on the benefits awards based on the amount required to secure the project and the long-term economic benefits.

• • Other negotiated and discretionary incentives — These benefits often come in the form of direct grants, low-cost or forgivable loans, free or discounted land, utility discounts and rider rates, permit and impact fee waivers, and a range of workforce development

programs. Discretionary incentives are most often programs that have specific legislated allocations and guidelines determining the range of eligible awards based on the project investment and new or retained jobs. In some instances, for the largest, most competitive projects, state legislatures may approve special allocations to provide an award to attract a specific company. A number of states have approved governors’ deal-closing funds, which provide wide latitude on the amount of benefits the state economic development agency can provide to secure a specific project.

Determining Incentives Overall Value

The evaluation of states and regions for projects by companies, i.e., the site selection process, requires a detailed review of a multitude of critical project require-

ments of which the amount of incentives that can be secured is only one — and often not the most important — factor. However, just as the long-term cost of labor in competing locations is critical to deciding the project location, incentives should be fully reviewed to determine their value in the overall project cost calculation and in reducing project investment and long-term tax and other liabilities.

A disciplined approach in analyzing the potential incentives in alternative locations that may be suitable for the project should be conducted before entering into discussions with state and local agencies. Knowing the value of the potential incentives, including the benefits to be realized based on the company’s tax structure or projected tax liabilities in the locations under consideration, is a critical first step. Companies should be clear in presenting their project plans, as well other potential alternative locations for the project, during initial discussions with economic development agencies so that any incentives offers are based on realistic and achievable employment and investment factors and commitments.

The process and timeframe to receive an offer of a

INCENTIVES should be fully reviewed to determine their value in the overall project cost calculation and in reducing project investment and long-term tax and other liabilities.

package of state and local incentives can differ significantly between states and regions. In some instances, companies can receive an offer letter within a couple of weeks by providing basic project specifications in writing or in meetings with the economic development agencies. In other states and cities, a formal offer of incentives will not be provided for several months until project applications are submitted and approved by economic development boards or local agencies. In either situation there can be opportunities to negotiate the award levels, terms, and conditions of incentives packages before a company commits to or announces their project location decision.

Adhering to Project Commitments and Terms

Companies should review and become comfortable with the project agreements, including all project commitments, reporting and compliance terms, incentives payment schedules and fees, default and clawback provisions, and other terms before accepting the incentives and making project commitments, as the likelihood of negotiating these terms is seriously diminished after doing so.

Finally, it can’t be overstated that establishing an internal process to track project employment and investments and accurately meet incentives reporting requirements is the most important part of the incentives process. Companies regularly achieve less than their approved incentives awards or default on their agreements and are removed from programs due to inadequate reporting and compliance procedures.

In recent years, many states and communities have increased the amount of application documentation and detail on such issues as project economic impact, community benefits, projected local labor and workforce participation, ESG and green building commitments, and competing locations prior to approving incentives awards. Similarly, there has been increased rigor and review of qualifying employment and wages, eligible capital investments, and other requirements spelled out in project agreements before compliance reports are approved and benefits paid to companies. States have seen the need to adjust such issues as percentage of time employees are required to work at project sites, or their calculations on employee spending impacts to the local community, as the level of remote workers and underutilized facilities remain stubbornly high. Understanding the level of complexity in securing approvals of both the initial incentives applications as well as the follow-on compliance reporting requirements is important in comparing competing incentives offers.

Unprecedented Financial Support

By all measures, since the start of COVID, the amount of business incentives and funding for companies that has been authorized and awarded exceeds any amount

in our country’s history. Of the $3 trillion CARES Act I and II (the Consolidated Adjustment Act) funding, approximately $1.5 trillion was allocated almost equally to large and small businesses through the Payroll Protection Program, Employee Retention Credit, direct grants, loans and loan guarantees, and tax benefits.

Significant funding for investments in transportation, education, healthcare, energy, and economic development projects has been authorized through the $1.9 trillion American Rescue Plan in 2021. While over $600 billion of the $1.2 trillion Infrastructure Investment and Jobs Act will fund highway, transit, and rail projects, the remainder of the investments will be made to support energy, environmental, water, broadband, port, aviation, and other public/private projects.

The Inflation Reduction Act allocates $369 billion to energy security and climate change projects, including significant funding for solar panel, wind turbine, and renewable battery projects, and individual tax credits for the purchase of solar panels and electric vehicles. Finally, while $200 billion of the $280 billion CHIPS Act is allocated to scientific R&D and product commercialization, approximately $53 billion in federal grants for manufacturing, R&D, and training, and another $24 billion in tax credits is available for direct company funding for semiconductor plants. States and communities are utilizing funds from all of these programs and supplementing them with their own incentives to support private-sector investments in their communities.

While the public benefit and need to award large incentives to a Fortune 500 company is regularly debated, all states and other levels of government routinely provide funding to companies to achieve specific outcomes. Some states and communities focus funding on the needs of small businesses, entrepreneurs and new tech, and emerging industry sectors, including renewable energy, electric vehicles and charging infrastructure, craft brewing, and cannabis. Others award significant incentives to projects by large companies in manufacturing, foreign direct investment, life sciences, and film production projects. As the distribution and logistics sector struggles to find properties and welcoming communities for their facilities, incentives can be challenging for projects in this sector in the near term. Cities and states may see the need to refocus efforts to secure large corporate services and financial institutions to underutilized suburban office properties and struggling downtowns through renewed incentives to attract this sector.

While the need to provide incentives to a specific company or industry sector in a state or city may change based on the economic or political climate, the availability and use of incentives by governments at all levels appears certain to remain to generate jobs and achieve economic prosperity for their communities.

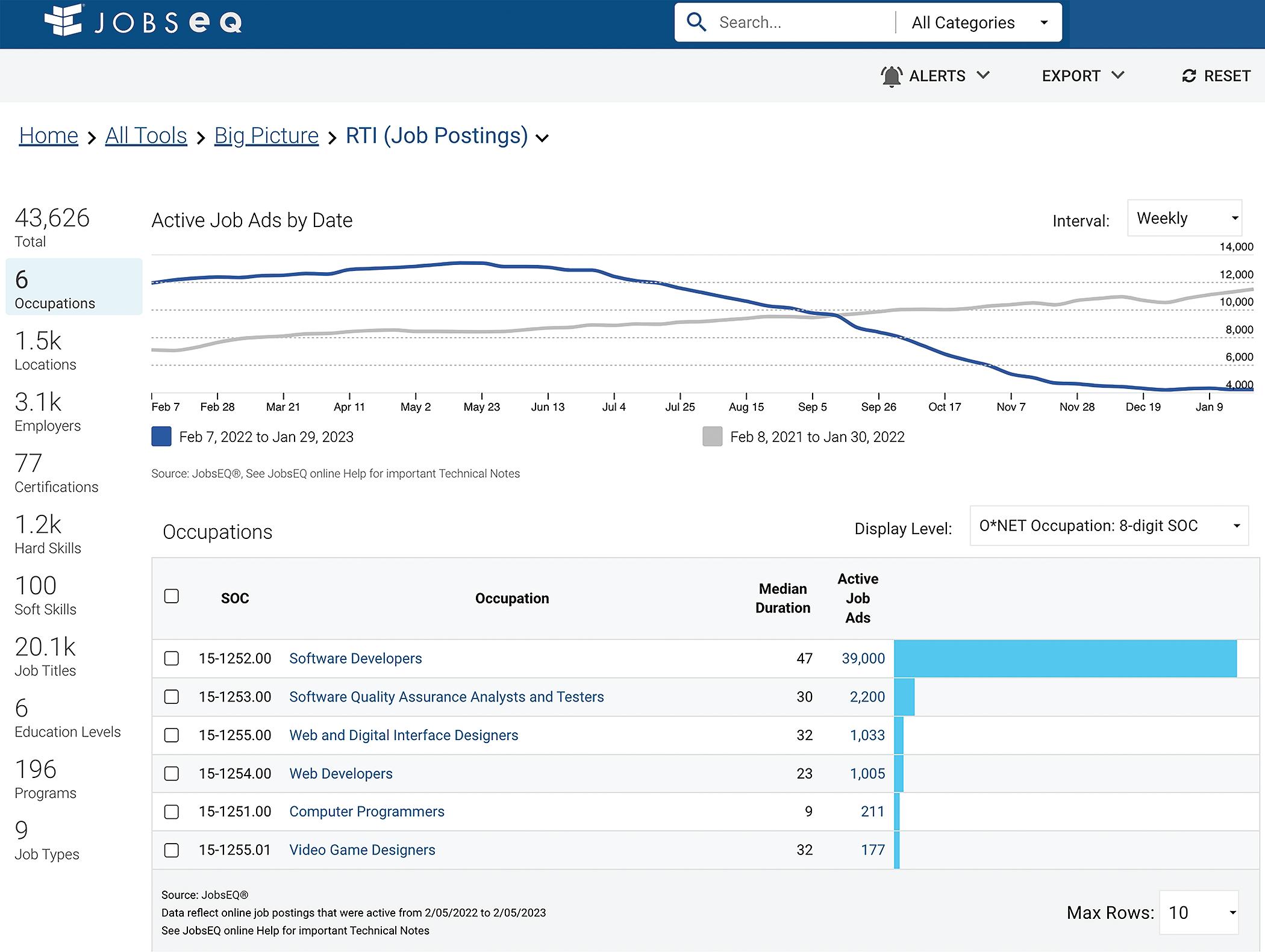

The Value of Job Ads Data in the Location Decision

Non-traditional data aggregated from job ads contain a plethora of insights for assessing a possible location.

By Greg Chmura, Chief Quality Officer, Chmura Economics & AnalyticsJob ads are an important tool for understanding the labor market at a prospective location. Individual job ads — as well as statistics gleaned from aggregating job ad trends — allow for identification and analysis of specific competitors as well as gauging the temperature of the labor market for the talent specific to your project.

Why Job Ads?

First off, consider the information a single job ad contains. An ad typically has the employer’s name, the job title of the position that is being advertised, and the location of the job, at a minimum. Usually, a job description is present that can be used along with the job title to categorize the occupation. Ads also generally contain a variety of job requirements, such as educational background, skills, certifications, and experience.

This information in job ads can be used anecdotally, especially relative to specific competitors, but aggregated statistics of these data can also be used to assess an entire labor market or to compare markets.

Besides the variety of data available, another high value characteristic

of job ads is their recency — these data, depending on the source, could be at or very near to real-time. Some sources also have historical data that allows for the examination of trends over time as well as providing a larger sample size for research.

Identifying the Competition with the Correct Queries

Before diving into the data, a few tips are in order on how to query the ads. First, don’t define your region too narrowly. The location information from a job ad could be very specific, containing a street address, for example. Very frequently, however, the location information is fairly broad — it is common for an ad to simply refer to the entire market area. For example, an ad may state the location as “Atlanta,” meaning the job is located broadly in the Atlanta market area, not necessarily within the Atlanta city limits. When you are doing your research, therefore, it would be a mistake to focus your region too narrowly, which may miss key talent competitors in the larger labor market.

To find your competitors, you’ll query your database for the same talent that you are looking to hire — the second tip is to experiment with

Continued on page 24

Controlled Environment Agriculture TAKES ROOT IN VIRGINIA

Vertical farms and other CEA companies are gaining prominence, and many are finding Virginia offers advantages for growth.

Increasing consumer demand for safe, sustainable, locally grown food is driving interest and investment in controlled environment agriculture (CEA), with a particular focus on vertical farming. Once a niche industry hamstrung by high energy costs, vertical farming has benefited from the widespread availability of cost-effective LED lighting, allowing growers to deliver the exact environmental conditions required by specific plants. Vertical farming allows for year-round growth of clean produce anywhere in the world with unprecedented yield and peak season quality. The process protects plants from disease and stress while providing ideal growing conditions for high-quality, quick-to-harvest crops.

The Virginia Advantage

Virginia’s advantages for CEA companies start with its strategic mid-Atlantic location and infrastructure, ensuring quick access to major consumer markets in an industry where freshness and speed to market are paramount. Virginia also offers access to plentiful natural resources, competitively priced electricity, a skilled talent pipeline, and exceptional partners like the Controlled Environment Agriculture Innovation Center (CEA-IC), a joint project between Virginia Tech and the Institute for Advanced Learning and Research (IALR)

focused on diversifying agribusiness in southern Virginia and increasing net farm income and profitability for both existing and new farmers.

Virginia provides the ideal home for CEA companies with a diverse ecosystem of partners and suppliers, outstanding universities and research centers, and access to supply chains. That’s why San Francisco-based Plenty Unlimited Inc. is building the world’s largest indoor farming campus in Chesterfield County outside Richmond, representing a $300 million investment and more than 300 jobs. The first farm at the site will be completed in 2024 and will focus on Driscoll’s strawberry production — the first to grow indoor, vertically farmed strawberries at scale.

“This campus will raise the bar on what indoor vertical farming can deliver,” said Plenty CEO Arama Kukutai. “The scale and sophistication of what we’re building here in Virginia will make it possible to economically grow a variety of produce with superior quality and flavor. We look forward to continuing to work in close partnership with the government of Virginia as we endeavor to rewrite the rules of agriculture.”

Poised for Growth

Plenty is just one of the companies betting on Virginia as the prime location for CEA operations. New Jersey-based AeroFarms chose Cane Creek Centre, an industrial park jointly owned by the city of Danville and Pittsylvania County, to build its largest, most sophisticated indoor vertical farm to date. Like all AeroFarms facilities, the Cane Creek location uses the company’s proprietary

aeroponic technology to produce leafy greens at a rate 390 times more productive than field growing. The facility helps the company fulfill its production partnerships with major retailers like Amazon Fresh, Fresh Direct, Walmart, and Whole Foods Market.

Beanstalk, an indoor farming startup, chose the town of Herndon in Fairfax County for its first farm, which produces a variety of pesticide-free leafy greens and specialty herbs year-round using proprietary hydroponic growing technology. Other CEA companies to invest in Virginia include Greenswell Growers, which produces leafy greens year-round at its Goochland County facility and has partnered with Goochland High School’s Career and Technical Education Center to create learning opportunities for students, and Red Sun Farms, which derives more than 75% of the water used at its Pulaski County facility from collected rainwater. Richmond-based Babylon Micro-Farms manufactures self-contained, hydroponic vertical farm systems, operated using a cloudbased management program, for use in businesses, schools, hospitals, and other locations.

With population growth and climate impacts placing stress on traditional agriculture, vertical farms and other CEA operations are poised to gain prominence as a major element of food production. Virginia’s combination of location, industry knowledge, affordable utilities, and innovative research and development make the Commonwealth an ideal location for growth — for crops and companies alike.

This article was paid for and written by the Virginia Economic Development Partnership and approved by Area Development.

A top-ranked state for business is now the leading location for the future of farming. Virginia is home to the world’s largest Controlled Environment Agriculture (CEA) facility, with plans to add another that’s even bigger. Looking for a culture of innovation? Find your advantage at VEDP.org.

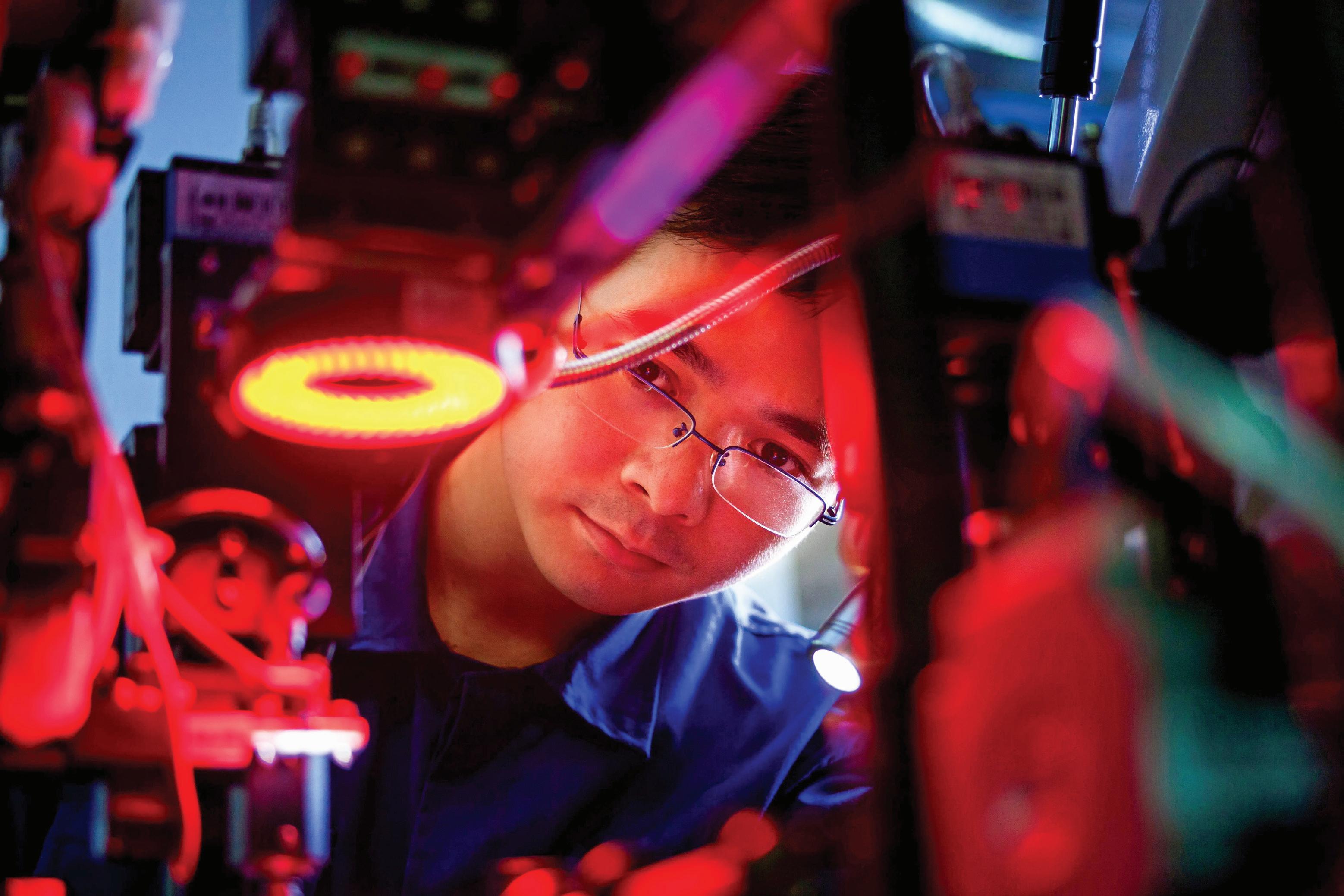

Plenty Unlimited Inc. selected Virginia to build the world’s largest campus for advanced indoor farming, using the advanced technology and patent assets shown here in their California facility.

Plenty Unlimited Inc. selected Virginia to build the world’s largest campus for advanced indoor farming, using the advanced technology and patent assets shown here in their California facility.

how you perform this search, so your focus isn’t too narrow. You can start by looking up job ads with the same job title, but be careful as some job titles may be company- or industry-specific and will miss similar talent described differently. For example, if you only search for “warehouse worker,” you may be missing competitors looking for the same skills under titles such as “material handler,” “warehouse associate,” or “general labor.”

If your database has data organized by an occupational classification system (such as Standard Occupational Classification codes), querying by these occupation definitions may help identify and capture a larger group of job titles similar to your own. Alternatively, you can query by a specific skill unique to the labor force you are targeting, e.g., the ability to drive a forklift may be sufficient for capturing the talent pool you’re assessing.

Once you start querying your job ads data set for the positions you’re looking to hire, you’ll be able to compile

a list of the other employers in the region competing for the same talent. If you’re only looking at currently open job ads, be aware that there may be additional competitors out there that are not currently hiring. Expanding the scope of your search over a longer time period can help uncover the broader competitive landscape. You may already be well aware of some of your competitors because they are in your industry. Often, however, similar talent and skills are competed for across many industries, and this type of competitor search will uncover some surprises.

Filtering your searches by specific requirements may be beneficial in better identifying your talent competitors but be aware you may miss some of the market with only this type of query. You may need to hire some drivers with a Commercial Driver’s License (CDL). Only searching job ads for CDL requirements will find some, but not all of your competitors. There may be some

employers who hire these types of workers but do not specify the requirement in their ads.

It is a similar story with educational levels. While many employers specify the educational attainment needed for their positions, others will not. That missing requirement doesn’t necessarily mean it is not a requirement for the job; that information may have been omitted for another reason, such as the employer thinking it was unnecessary to specify.

Examining Job Ad Texts

It may take a bit of experimenting with your queries to narrow down and uncover your talent competitors in a region. Once you have them identified, you can then go on to the next step of sizing up the nature of their competition by going through the texts of individual job ads.

For specific employers and positions, you may be able to break out the detailed benefits and wage offerings you’ll be competing against. You’ll also be able to assess

large employers in a region with a corporate practice of leaving job ads up for certain lengths regardless of the actual market supply can muddy these duration data. Nevertheless, it is a metric to be considered and taken along with others to inform your decisions and recruiting strategies in a region.

Another aggregate metric is median wages. While many individual ads have wages, the aggregate metric referenced here is the overall average wage in a region based on a collection of ads. These data allow for a broader comparison of wages rather than a simple anecdotal collection of wages. When comparing average wages between two regions, watch out for different characteristics of the ads that may impact those wage comparisons; for example, one region may have more ads for experienced workers versus more entry-level position ads existing in another region. Some parts of the nation have mandated posting wages in job ads, but certainly not all. This could also skew results if employers post very wide wage ranges in areas where such information is mandated.

which skills and backgrounds your competitors are focusing their recruiting on. Even the cultural tone of your competitors may be evident from the job ads. All these details help paint a more descriptive picture of what the competitive landscape looks like and how that may vary from one site to another.

Aggregate Metrics and Cross-Region Comparisons

Certain summary statistics can be compiled from job ads giving further insight into the labor market, which is especially helpful for comparing overall regional dynamics.

The first of these is the median duration a job ad stays online. Positions that are harder to fill are generally open longer than other positions. Comparing the median duration of ads for the same type of job in multiple market areas can give you an idea of the supply-demand dynamic in those areas. If it takes an average of 49 days to fill a software developer job in Seattle versus 19 days in Dallas, this is consistent with the job market — from the employer’s perspective — being better in Dallas since these positions are filled more quickly on average there. Any single data point can be skewed, however, and

Some data sets also include an overall demandsupply metric, such as comparing the number of open job ads to the size of the labor pool. The idea with these metrics is to identify where heavier hiring may be taking place relative to the supply of the workforce. Making this kind of comparison can also be performed using job ads data along with a traditional source of employment data such as the Occupation Employment and Wages data from the Bureau of Labor Statistics. For a given occupation, you may see one open ad for every 18 workers in Region A versus one ad for every 37 workers in Region B; this ratio would imply that Region A currently has a tighter market for this particular occupation — in other words, more competition relative to supply.

Site selection is often an exercise in risk mitigation, and using an additional nontraditional data set like job ads can add significant value in real time to labor market analyses specific to a location and in comparing regions, but keep in mind that a superficial analysis can mask underlying trends and actual market conditions. The considerations and guidelines in this article can help you make the most of this resource when you need trustworthy data to make decisions. n

SOME DATA SETS ALSO INCLUDE AN OVERALL DEMAND-SUPPLY METRIC, SUCH AS COMPARING THE NUMBER OF OPEN JOB ADS TO THE SIZE OF THE LABOR POOL.

Deploying Location Strategy + Incentives to Meet ESG Goals

ESG

CFOs and business leaders can utilize location strategy as part of their ESG mission through their workforce, workplace, and sustainability strategies, as well as by demonstrating social responsibility and good governance.

By David Hickey, Managing Director, Global Site Selection Leader, Hickey & AssociatesGLOBALLY, companies are rapidly adopting a vision and strategy for deploying environmental, social, and governance measures, commonly referred to as “ESG.” With increasing demands from stakeholders and consumers alike, ESG will only gain more

prevalence, from the boardroom to the products and services companies deliver.

For chief financial officers (CFOs) and corporate leaders, balancing capital outlays to meet bespoke ESG

missions can prove to be an incredible challenge. But by leveraging location strategies, with geographic position being paramount, together with funding opportunities available from governments and economic development entities, CFOs will enhance the

tools and financing to support their short- and long-term ESG goals.

Incentives for ESG efforts total more than $1 trillion worldwide. More specifically, when it comes to expenditures for sustainable and energy efficiency technologies and systems, determining the evolution and lifecycle costs, along with economic incentives, directly supports the business case and investment timing. To meet and exceed core goals around people and diversity, equity, and inclusion (“DEI”), deploying labor analytics with statistical forecasting provides the talent intelligence required to develop a workforce that aligns with the company’s vision.

ESG is not the future; it is already happening.

Businesses have been exploring and implement ESG principles touching every aspect — from people to logistics to facilities — whether that be offices, industrial, warehouses, and beyond. The drivers for this movement are not necessarily coming from governmentled regulation, but instead from investors, consumers, and employees.

Studies show consumers are increasingly aware of ESG policies. More than eight out of 10 consumers today believe that companies should be actively developing these policies; and where they shop, eat, and spend money may be influenced by ESG initiatives. Meanwhile, amidst a heightened war for talent, employees indicate they prefer to work for companies that care about these issues.

Thus, with consumers and employees alike becoming increasingly aware of ESG policies and choosing how they buy and where they work accordingly,

the reality of ESG is today. In fact, according to World Economic Forum data, more than 90 percent of companies in the S&P 500 index published a sustainability report.1 Remarkably, that figure is up from only 20 percent in 2011.

Alignment of Location Strategy + ESG Objectives

As CFOs navigate their unique ESG missions, the physical footprint of a business can play a vital role in its ability to meet core objectives. By utilizing location strategy principles and innovative intelligence tools, a business can determine if its current footprint even allows it to meet these core objectives. If not, then these same tools can be used to identify alternative markets and sites that may prove advantageous for the future.

In addition to the footprint, the facility itself plays a major role in meeting ESG goals. As an example, the overall

size of the facility can be impacted by ESG initiatives, such as more parking spaces and infrastructure improvements if there are plans for electric vehicles (EVs). Further, facility planning needs to consider the proximity of resources and infrastructure, such as routing impacts from EV maximum distances, location of alternative fuel sources, recycling facilities, and availability of key resources for long term future. Whether the facility is owned or leased also comes into play as landlords can be a critical partner.

Additional considerations for how CFOs and business leaders can utilize location strategy as part of their ESG mission include:

• Workforce — Recognizing the war for talent businesses are waging around the world, finding talent seems to be an insurmountable challenge for many companies. Add in the targeting of specific cohorts across a wide range of skill sets and occupations,

Opportunities for Grants and Incentives to Support the ESG Mission

ENVIRONMENTAL

Grants, tax credits, and financing on energy-efficient buildings, electric charging stations, carbon recapture, and production of solar and wind technologies

SOCIAL

Tax credits and grants for investments in low-income neighborhoods, transportation infrastructure bonds, and employer-provided childcare facilities

GOVERNANCE

Grants and tax credits to improve work conditions, investments in business practices + ESG reporting

businesses must utilize innovative tools and talent intelligence to develop effective strategies to meet core DEI and social goals.

• Workplace — While finding talent is a challenge today, and will continue to be into the future, retaining workforce is becoming increasingly difficult. Among a number of factors, the workplace itself is becoming more vital to attracting and retaining talent. As the focus turns often to amenities, key aspects and metrics around sustainability and environmental impact are progressively more critical to employees.

• Social Responsibility — How a company navigates the social responsibility of the business today is paramount for consumers and employees, as well as key stakeholders and investors. Where and how a business makes its products and delivers its services needs to be taken into account and assessed core to the company’s wider location strategy across its global footprint.

• Sustainability — Deploying sustainable practices and technologies across a company is vital to successfully meeting ESG goals. Where and when these investments — whether large or small — are implemented must be at the center of the business case and the location strategy. Leveraging creative financial tools and economic incentives, often in partnership with governments, communities, and utility partners, is vital to achieving a bold corporate ESG mission.

• Governance — Location can have an incredible impact on a company’s governance practices. For example, a company will struggle with preserving transparent and ethical business practices if locating in a country with unchecked corruption and feeble labor laws.

Leveraging Economic Incentives — Financial Assistance to Offset Costs

As businesses make significant investments in ESG across their portfolios, creative financial mechanisms and economic incentives need to be evaluated. Many gov-

ernments around the world, particularly in North America and Europe, have allocated over $1 trillion in grant funds and tax incentives to support ESG-related capital and operational expenditures. The accompanying chart illustrates a high-level example of the opportunities for grants and incentives to support the ESG mission.

Across the dynamic North American landscape, federal, provincial, state, and local governments, along with utility companies, have established programs to lead and aid in the ESG mission. Since 2021, over $500 billion was authorized by the U.S. Congress that will support ESG activities and investments. Primarily in the form of tax credits and cash grants, the federal programs are coming out of legislation that includes the Inflation Reduction Act, CHIPS and Science Act of 2022, and the Infrastructure Investment and Jobs Act.

In Canada, federal programs like the Strategic Innovation Fund allocate funding to help businesses with industrial transition and to reduce greenhouse gas emissions. This $8 billion breaks out into three categories for company support:

(1) decarbonization of large emitters; (2) transformation of key industrial sectors; and (3) development of clean technologies.

At the state and provincial level, programs have been established to provide direct incentives for businesses to invest in ESG initiatives. In California, companies can secure robust sales and use tax exemptions for projects investing in alternative energy and advanced transportation through the California Alternative Energy and Advanced Transportation Financing Authority. In Quebec, the provincial EcoPerformance Program provides grants for businesses investing in technologies to reduce greenhouse gas emissions and energy consumption.

In the United States and around the world, utility companies are also developing programs to incentivize companies to deploy sustainable practices, renewable energy systems, and energy efficiency technologies. An example comes from Ari-

With increasing demands from stakeholders and consumers alike, ESG will only gain more prevalence, from the boardroom to the products and services companies deliver.

zona’s Salt River Project, a community-based, not-for-profit organization. Companies investing in EV charging stations can capture up to $15,000 in rebates for fleet electrification with the purchase and installation of eligible technologies.

To reach vigorous sustainability goals, while also addressing significant energy challenges, the European Commission has launched a €1 trillion plus initiative to support businesses and governments and offset environmental and energy efficiency investments. Known as the REPowerEU plan, working in coordination with revised State Aid rules, the funding will be allocated to support reduced energy usage and the production of clean energy, to drive sustainability measures, to diversify energy supplies, and build out governance mechanisms.

At the country and local levels, numerous programs and policies have also been implemented, including a Belgian scheme to accelerate deployment of EV charging stations, a €5.8 billion French program for sustainable building renovations, and nearly €500 million for the installation of renewable energy technologies for businesses in Czechia, just to name a few.

Strategic Recommendation: ESG Checklist for Corporate Leaders

In conclusion, as businesses navigate the development and implementation of their tailored ESG missions, leveraging location strategy and economic incentives will be key to their success. As we work with our clients through these dynamic initiatives, we develop an ESG checklist that is created specifically to meet each company’s ESG vision.

Through this checklist, CFOs and corporate leaders can evaluate the short- and long-term elements of their ESG commitments, with a critical focus on their geographic footprint and capital outlays. From there, we develop a customized strategy for the client to address the where and when to make investments, how to find talent, and what governance mechanisms need to be developed to ensure success.•• 1 https://www.weforum.org/agenda/2023/01/better-business-stakeholder-capitalism-esg/

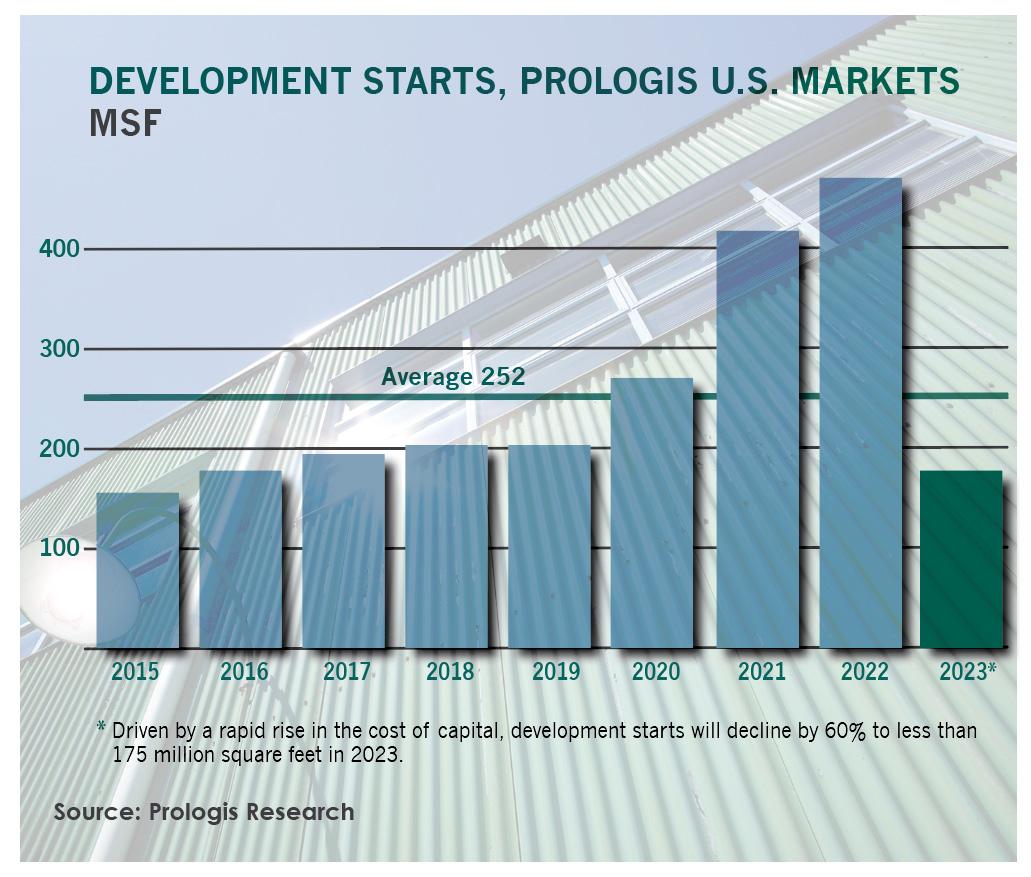

Industrial real estate, particularly warehouse and distribution, has performed incredibly well throughout the past two years. Vacancy rates tumbled from near 11 percent in 2020 to 4 percent by the end of 2022. Rent is up approximately 30 percent during this time. The combination of a positive shock for e-commerce and the exposed weakness in the country’s logistics network has pushed tenants to expand within existing markets and enter into new markets like never before.

Accordingly, investors, lenders, and developers took notice and began to dump unprecedented amounts of capital into providing new and needed inventory. But now, with a softening economy and a bit of a pull-back in the pace of ecommerce’s growth, many are wondering if the industry moved too far and too fast. In other words, did the market overshoot the equilibrium?

Planning Years in Advance

Figure 1 illustrates the substantial increase in warehouse and distribution completions through 2022, as well as our best estimate of what is to come within the next couple of years. It is important to be mind-

Industrial Update: Did the Market Overshoot the Equilibrium?

Although the economic slowdown has some wondering about the health of the industrial real estate sector, the need for shorter shipping times will spur companies to continue to look for space around the country.

By Thomas P. LaSalvia, Ph.D., Director of Economic Research, Moody’s AnalyticsWarehouse & Distribution

Source: Moody’s Analytics CRE

ful that real estate development is unique, as expectations tend to play an outsized role in both supply and demand performance. Stakeholders must plan years in advance for projects to assure proper due diligence and gain necessary approvals; even then, construction can take years to complete. The factory cannot simply be run an extra shift that month to satisfy current demand.

All of this implies that many of the new industrial projects built within the previous few years were in the works prior to the pandemic shock. This also implies that only now will we really begin to see how well the market has performed in terms of estimating demand. Supply will increase another 5 percent or about 400 million square in the next couple of years, with much

of it speculative. We have already seen the likes of Amazon admit that some mistakes were made and expansion was too fast, a potential harbinger for the industry at large.

Is There Trouble Ahead?

Figure 2 presents another early warning sign. After an incredibly solid couple of years, the number of loans with CMBS exposure that are currently watchlisted is increasing, something not apparent for the other major property types. Watch listed doesn’t necessarily mean major trouble ahead; significant near-term lease expirations, not necessarily a concern, can be the cause, but it is an indicator to watch closely.

Given the theme of expectations, the current bullishness of potential tenants in regards to their expected future prospects is vital for filling all of this new space. As Amazon and others have shown, that sentiment can quickly change, hence the near-term concerns of overshooting in the market.

In typical real estate cycle fashion, if companies pull back a bit on their expansion plans, at the same time new speculative supply hits the market, rents, occupan-

cies, and even capital market activity could severely drop. The question becomes, will the economy get bad enough for companies to pull back?

At this point, it is unlikely — at least not bad enough to severely dent leasing activity. Industrial space performance, particularly warehouse and distribution, has historically been highly related to consumption, and maybe now more than ever.

Figure 3 shows that relationship and our current projection for retail spending and warehouse and distribution rent growth at the national level. Note that we do anticipate a slowdown of this activity, but not a crash; in fact, nowhere near a crash. Inflation is slowly but surely being tamed and interest rates have just about peaked. Save for a major supply-side shock, the economy and retail spending will grow slowly, but will grow.

E-Commerce Will Continue to Make Gains

Finally, one important difference between this cycle and past cycles is the mostly agreed upon long-term need for additional industrial expansion within the U.S. E-commerce will continue to make gains in its share of

Shelby County, Indiana

• More than four (4) million Square Ft. planned new warehouse /distribution space available.

• Industrial Sites: 1,500+ acres available

• Convenient access to I-74. - Less than 30-minutes to I-65 and I-70.

retail sales, likely moving from its current 15 percent to at least 20 percent within this decade. Parts of the Inflation Reduction Act and the CHIPS act are clear illustrations for the desire to re-shore manufacturing; and more and more, it seems likely that at least some of the last 50 years of globalization’s growth will be unraveled over the next decade. Additionally, the race to shorter and shorter shipping times will continue to shake up the need for, and location of, industrial space around the country.

In sum, even with a short-term slowdown of the economy, the strong tailwinds will keep pushing companies to look for expansion options, and industrial real estate will remain a preferred asset for years to come. Look for rent growth to decelerate toward long-term averages this year and next, and occupancy rates to remain a shade below recent record highs. The market has yet to overshoot the equilibrium. n

Retail Sales and W&D Rent Growth

FLEET ELECTRIFICATION: ANOTHER BIG DISRUPTER

BY STEVE KAELBLEOn the subject of electric vehicles, or EVs, a few facts often surprise the average person. First of all, they’re not new. The first commercially available electric cars were on the road in the late 19th century, and as many as a third of the vehicles on the road in 1900 were electric. Second stunning fact: by the 1930s EVs were pretty much gone, after oil prices dropped and the Ford Model T made internal combustion accessible and affordable.

Skipping over a century of gasguzzling, the present-day surprise is just how fast EVs are finally driving back into the mainstream. The first Prius hybrid arrived around 1997, the first Tesla Roadster EV a decade or so later. By 2030, it’s expected that 10 percent to 15 percent of commercial and passenger fleets will be electric, and General Motors expects its products to be pretty much all-electric by 2035, among other manufacturers making dramatic shifts to EVs.

The Costs Savings

No surprise, then, that many companies are transitioning their fleets to electric vehicles. “Electric vehicles offer significant reputational benefits,

fuel and maintenance cost savings, support toward meeting corporate climate goals, and safety benefits as well,” says Sara Forni, director, Clean Vehicles, with the sustainability nonprofit Ceres, which three years ago launched a Corporate Electric Vehicle Alliance1 of nearly three dozen companies committed to accelerating the deployment of EVs, starting with their own fleets.

“Electric vehicles are far simpler mechanically and have fewer moving parts than traditional internal combustion engine vehicles, which makes them cheaper to maintain and repair,” Forni says. “On top of that, electricity offers better price and supply stability than petroleum, given its more local and increasingly renewable sourcing.”

She notes that Consumer Reports

studied cost differences last year and tallied significant savings. At the time of the study (using the national average gas price at the time of $4.31 a gallon), the potential savings for going electric was between $1,800 and $2,600 in operating and maintenance costs per vehicle for every 15,000 miles driven.2 That difference obviously varies as gas prices rise and fall — but that gas price volatility also underscores the EV advantage of cost predictability.

Taking ESG Into Account