EV IMPACTS TO WATCH

TACKLING EV CHARGING HURDLES

AEROSPACE LOOKS OPTIMISTICALLY AHEAD

R&D IN THE EV/BATTERY INDUSTRY

DIVERSIFYING AEROSPACE

SITING AN EV MANUFACTURING PROJECT

EV IMPACTS TO WATCH

TACKLING EV CHARGING HURDLES

AEROSPACE LOOKS OPTIMISTICALLY AHEAD

R&D IN THE EV/BATTERY INDUSTRY

DIVERSIFYING AEROSPACE

SITING AN EV MANUFACTURING PROJECT

The sale of electric vehicles is surging worldwide, representing 14 percent of all new cars sold globally in 2022, up from around 9 percent in 2021, and less than 5 percent in 2020, according to the International Energy Agency (IEA).1 The agency reports more than 10 million EVs were sold worldwide in 2022.

In the U.S., just 6 percent of all vehicles sold in 2022 were electric, but that number is expected to increase with government incentives for their purchase, including the EV tax credit provided in the Inflation Reduction Act.2 The Biden Administration has set a goal of having 50 percent of all new vehicle sales be electric by 2030 and adding 100,000 public charging stations across the United States before that time.3

Automakers as well as those companies making the lithium-ion batteries are investing billions of dollars and creating tens of thousands of jobs in building new facilities and/or retooling current production lines to produce EVs and the necessary batteries to power them. When it comes to selecting sites proximity to supply chains and markets, availability of skilled labor, ample power and water supplies, as well as cooperation between community stakeholders must be taken into account. These stakeholders include managers at new or existing facilities who realize they need to incorporate charging stations in order to lure tenants, including corporate EV fleets.

Automakers are also investing in R&D centers, many affiliated with universities. Investments have been encouraged by grants from the Department of Energy for battery manufacturing and recycling.4 Advanced battery technology could be a game-changer for the industry.

Just as the auto industry is evolving, so too is the aerospace industry, and it is faced with the same supply chain and labor challenges. When looking at locations, companies in this sector should realize that markets that do not have an established aerospace industry may present initial hiring challenges, but the opportunity exists for a firm to create its own hub of relevant talent. These companies, like those in any industrial sector, must establish their unique goals in order to make an informed and data-driven location decision.

The long-term impact of the shift to EVs — including challenges sourcing battery materials — will be farreaching.

1 https://www.iea.org/reports/global-ev-outlook-2023/executive-summary

2 https://electrek.co/2022/10/18/us-electric-vehicle-sales-by-maker-and-ev-modelthrough-q3-2022/

3 https://www.whitehouse.gov/briefing-room/statements-releases/2023/04/17/fact-sheet-bidenharris-administration-announces-new-private-and-public-sector-investments-for-affordable-electricvehicles/

4 https://www.energy.gov/mesc/battery-manufacturing-and-recycling-grants

2 8

Property-level Infrastructure planning will bring owners and tenants together to meet their green goals.

As aerospace companies continue to rebound and evolve, they need to establish their unique goals in order to make an informed and data-driven location decision.

11 20 editor ©2023

Understanding the impact of both quantitative and qualitative factors is critically important to the longterm success of your EV-related project.

5 18

Educating young people on STEM opportunities, while closing the gender gap, will spur the growth of the U.S. aerospace/aviation sector.

The location process for EV and battery projects must take into account proximity to supply chains and markets, availability of skilled labor, ample power and water supplies, incentives, etc.

16 PUBLISHED BY 30 Jericho Executive Plaza – Ste 400W, Jericho, NY 11753 516-338-0900 • Fax: 516-338-0100 • www.areadevelopment.com

THE U.S. ELECTRIC VEHICLE industrial phenomenon that began as a trickle has swelled into a tidal wave of investment totaling into the hundreds of billions — assembly facilities, battery cell production and pack assembly, as well as battery cathode, anode, and electrolyte materials and related supply chains — springing up to form a new “Battery Belt” of the U.S.

The historic level of private investment has been catalyzed in part by multiple pieces of federal legislation — the Infrastructure Investment and

Jobs Act, Inflation Reduction Act (IRA), and now CHIPS and Science Act — aimed at strengthening the ecosystem for all things EV and, more broadly, green energy. Rather than spurring new ventures, these federal programs appear to be adding fuel to accelerate the pace of activity.

Even with historic tailwinds, as new factories are constructed and commissioned, EV and battery producers face challenges on several fronts that threaten to complicate or delay full ramp-up, including significant supply

By Lauren Berry, Senior Manager, Location Analysis and Incentives, Maxis AdvisorsThe long-term impact of the shift to EVs — including challenges sourcing battery materials and the increased demand on utility capacity — will be far-reaching.

chain constraints. Furthermore, these projects are creating impacts that reach far beyond auto manufacturing and are accelerating a generational shift under way in the U.S. manufacturing landscape.

Here’s what EV executives are watching for 2024 and beyond:

Generally speaking, the highest value EV components are the materials comprising the battery’s cathode, which typically contain some combination of nickel-manganesecobalt (NMC), lithium-iron-phosphate (LFP), or occasionally lithium-cobalt-oxide (LCO), lithium-nickel-cobalt-aluminum-oxide (NCA), or other formulations. This component, a relatively small part of the vehicle by total weight, dictates the battery’s range, temperature control, and other performance qualities. While NMC is generally understood to have a higher storage capacity and affords a better mileage range, lithium is more widely and cheaply available, leading some automakers to shift to lithium-based batteries.

Regardless of the exact battery formula adopted by a particular OEM, the critical mineral supply chain has been brought to the forefront of the EV world, in part by the IRA’s requirement that in order to qualify for the generous EV

As the consumer shift to EVs continues, a key area of continued growth will be in recycling capacity for end-of-life batteries, particularly for the critical mineral components. Most current recycling producers are processing batteries from electronics, or production scrap material rather than end-of-life EV units, but as larger segments of drivers purchase EVs and more batteries exceed their service life — currently, most batteries have a useful life of 8–20 years, depending on factors such as mileage and weather and use conditions — and become available as feedstock for the circular economy, research suggests that this supply will grow by 25 percent annually through 2040 1

subsidies, automakers must procure significant percentages (80 percent by 2027) of EV components by value from U.S. suppliers or under a free trade agreement. This has spurred a flurry of activity in the mining and chemicals sector as automakers and battery producers jostle for long-term supply contracts for key battery material components.

This dynamic has forged some interesting partnerships with unlikely bedfellows: mining companies and automakers. GM inked a deal in January 2023 with Canadian company Lithium Americas for exclusive rights to lithium mined from the remote Thacker Pass in Nevada; Ford has announced plans to purchase a stake in an Indonesian nickel mine; and Stellantis is investing in an Argentinian copper mine. Mining is still a notoriously risky, boom-and-bust industry, hardly known for the stability or price controls that are hallmarks of the automotive industry, and it remains to be seen how these partnerships and joint ventures will play out.

Exacerbating supply issues are new trade restrictions imposed on exports of key minerals. Developing nations, rich in natural resources but historically challenged by development and governance issues, are moving to protect their resources and demanding a larger share of EV investment in materials processing in return.

Companies such as Redwood Materials, with facilities in Nevada and recently announced in South Carolina, Cirba Solutions in Ohio, as well as Li-Cycle in New York, Arizona, and Alabama are building out capacity to handle the growing battery volume, but much more will be needed. Like mining, recycling as an industry has historically had a poor reputation among regulators and communities, but today’s recycling technologies are highly sophisticated, sustainable, and much cleaner than previous iterations. In order to ensure that we have a resilient and cost-effective supply chain for both battery and EV manufacturing, recycling must be part of the equation.

1 https://www.mckinsey.com/industries/automotive-and-assembly/ourinsights/battery-recycling-takes-the-drivers-seat

In 2020, Indonesia banned the export of unprocessed lithium, leading to billions of dollars of investment in processing capacity, even while the ban has been declared a violation of trade norms by the WTO. In February, Mexico nationalized lithium reserves and awarded control of their processing to the nation’s energy ministry. Several African and Central/South American countries are signaling tightened state control over exports of lithium and other critical mineral reserves are ahead. Producers of battery materials in search of long-term supply relationships must successfully navigate these challenges or find new resources in other countries.

Most of the EV-related projects announced in the past several years have significant electric utility requirements amounting to thousands of megawatts in added new load. This comes at a time when both investor-owned and public utilities are managing their own decarbonization plans, shifting away from coal-fired generation, and integrating new renewable or natural gas assets. In many cases, this has stretched the capacity of existing electric generation and transmission resources.

This tremendous growth has caught up to the limits of our current infrastructure: transformers for new substations have an average 18–24+ month lead time from the manufacturer, limiting delivery of existing capacity to new parks and buildings. Grid interconnections are backlogged — several years in many areas — restricting the ability to bring new generation assets online.

For example, in Texas, the abundance of new wind and solar assets has threatened to overwhelm the existing transmission lines and actually exceeded demand during certain times, leading ERCOT to curtail generation from these assets — by 9 percent for solar and 5 percent for wind in 2022. 1 This is also happening during a time when the U.S. population is shifting south — a slow trend accelerated by COVID in the past three years — further exacerbating the strain on electric capacity.

Much of the investment by OEMs over the past several years has been predicated on the assumption that the transition to EVs is inevitable — still a big gamble, given the skepticism of many consumers. The EV adoption rate has grown exponentially, but — due to factors such as spotty charging infrastructure, vehicle and battery cost and range, and other factors — the total market share is still low at 5.7 percent in 2022. While that share of the overall market is projected to continue to grow in 2023 and beyond, automakers must prove to consumers that these new models not only function

equally and reliably as internal combustion engines (ICE) did, but also provide an improvement over the current models.

Some automakers are betting instead on a hybrid path forward: EV and ICE models. Several new southeastern OEM facilities are being designed to accommodate modular assembly, in which EV and ICE models will be side-by-side on the same assembly line and can be more responsive to customer demand without requiring an expensive retooling process.

While batteries are well suited as a solution for light passenger vehicles, they are insufficient or untenable for many other transportation sectors such as trucking and aviation. These customers require different solutions to lessen their carbon footprint, and significant funding and innovation expertise is being dedicated to delivering new alternatives. Many heavy trucking companies are exploring hydrogen as a potential solution, and hydrogen generation, transportation, and service projects are taking off across the country.

Airlines are also investing in innovation to source new fuels: in February, United Airlines announced a $100 million fund dedicated to new sustainable aviation fuel (SAF) projects to increase the quality and amount of fuels; however, at this stage, it remains to be seen whether these fuels can be scaled on a cost-effective basis to supplement or replace current fuel sources.

While the recent spate of EV projects has generated plenty of headlines and fanfare, the long-term impacts of this industrial boom are far-reaching, creating new challenges and opportunities in sectors such as mining and energy, and catalyzing commercialization of alternative fuel products. The current dynamic environment is a result of the intersection of long-simmering industrial trends, mixed with a shift to EVs, set alight by billions of dollars of federal investment. Understanding how the EV transformation progresses in the next five years requires an understanding of all of these factors, and others, that are shaping the future of this industry. Hold on tight — it’s going to be a wild ride!

1 https://www.pv-magazine.com/2023/07/17/texas-curtailed-9-of-solar-generation-in2022/#:~:text=The%20US%20Energy%20Information%20Administration,otherwise%20could%20 have%20been%20produced

MOST OF THE EV-RELATED PROJECTS ANNOUNCED IN THE PAST SEVERAL YEARS HAVE SIGNIFICANT ELECTRIC UTILITY REQUIREMENTS AMOUNTING TO THOUSANDS OF MEGAWATTS IN ADDED NEW LOAD.

THE WORLD IS IN a race to combat the effects of climate change, and companies are beginning to outline tangible strategies for reducing their carbon emissions. Make no mistake — it’s confusing. Building owners and the tenants that occupy them have struggled to even understand their own baseline carbon output, much less identify the most effective strategies to alleviate it.

In addition to fuel switching from natural gas to renewably-sourced

electric, vehicle electrification is rising to the surface in an impactful way to reduce Scope One emissions — those that are directly owned or controlled by a company. According to a recent study by Europe’s leading clean transport campaign group, Transport & Environment, electric vehicles (EVs) emit three times less CO2 than their gas-fueled counterparts. 1 From owned corporate fleets to personal vehicles to warehouse forklifts, EVs and the infrastructure required to charge them

By Rex Hamre, National Director, Sustainability, JLLare top of mind with real estate owners and tenants. Apartments and retail environments must provide EV charging as a key amenity to attract new residents and shoppers. Industrial properties need to accommodate shorthaul delivery electrification and eventually long-haul trucking solutions, while office buildings need to accommodate a range of needs from fleet electrification to personal vehicle use to talent recruitment.

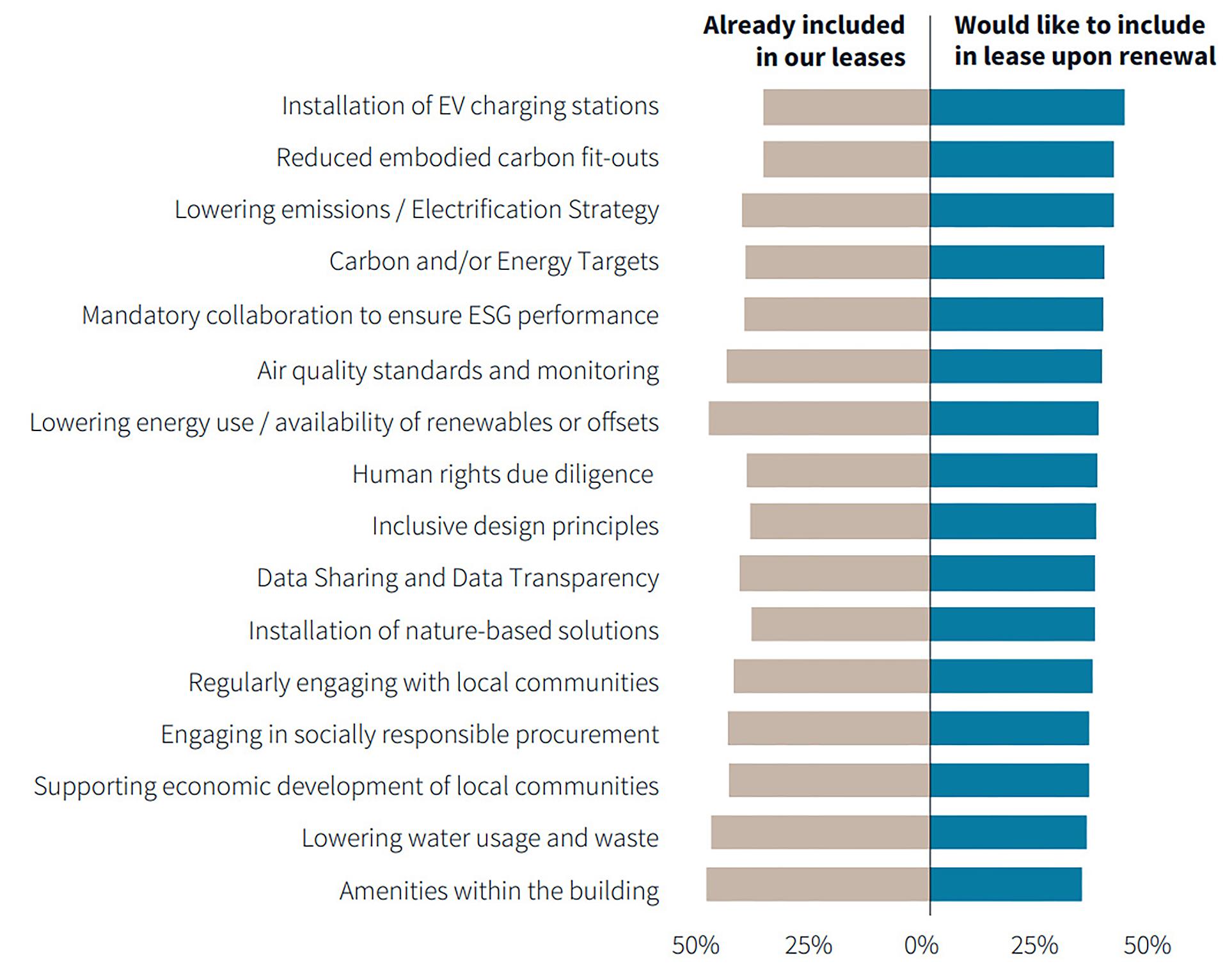

According to JLL’s Green Leasing 2.0 report,2 corporate occupiers specifically are clearly targeting carbon-centered language to meet their net-zero and talent recruitment goals, and EV charging is squarely at the top of the priority list. To make this happen, landlords need to provide the charging stations and the power than runs them, whether that means retrofitting into an existing property or adding to a development plan prior to construction. And tenants need to negotiate into their leases the pricing and parameters around accessing those charging stations. Sounds simple, right?

When negotiating a lease between a landlord and tenant, competing priorities and a desire to avoid risk and unnecessary cost are at play. Both parties need to come together to find mutually beneficial solutions, and green leases are emerging as that critical path forward. This requires a shift from the adversarial and at times contentious relationships that historically existed between owner and tenant.

In a commercial setting, the practical implementation of green leasing is having both sides of sustainability representation at the table with an equal voice. The goal is to align on key issues necessary to operate sustainably — data management, utility use and responsibility, future improvements, and EV charging are complicated issues that require planning and agreement.

Charging infrastructure requires property on which to host charging stations. Therefore, companies leasing space must consider working with property ownership in support of their priorities, whether they are focused more on fleet electrification or the charging of employee owned EVs for recruitment purposes — or both. How can property owners and tenants work together to implement charging infrastructure, define access to it, pay for it, and protect against risk? There are some key questions for landlords and tenants to explore to provide a roadmap to achieving shared goals:

• What types of vehicles are used, e.g., passenger, vans, commercial vehicles, or personal vehicles?

• Are vehicles used all day, every day, or occasionally?

• Do vehicles stay in the general vicinity or travel long distances?

• How often do vehicles return to home base and for what period of time?

• Do vehicles remain overnight or only for loading/unloading?

• Are fleet expansion plans in the works?

• Will the fleet need to be charged overnight?

• What’s their actual usage rate and equipment up time?

• Will vehicles charge while loading to optimize efficiency or will a parking lot be used to enable fleetwide charging overnight?

• How will day-to-day access be managed when there are more vehicles than charging stations?

• How can we encourage users to not “sit” on a station for an extended period of time?

• Will the proposed locations of charging stations accommodate convenience and practicality?

Initially, green leases were proposed as a potential solution to navigating the split incentive problem whereby one party, usually the owner, incurs capital expenses for an energy retrofit,

while the other, usually the occupier, receives the benefit, e.g., reduced operating costs.

It’s complicated when it comes to equitable share of costs for EV infrastructure. The addition of EV charging stations gives a building owner another amenity that requires management, in addition to higher power and operating expenses. The property management team needs to make sure that it’s always engaged, and then it becomes a tenant relationship management challenge because of equipment up-time or user interface challenges.

Let’s not forget the cost of the equipment itself. The most installed EV charging stations are Level 2, which achieve full charge in 6–8 hours, and Level 3, also known as DC fast charging, which provide a full charge in 30–60 minutes. The cost difference between the two is substantial, reaching up to $80,000 or more for fast chargers.

Weighing the upfront and ongoing cost against potential benefits is an important exercise for both parties. Not surprisingly, pricing becomes one of the biggest hurdles of green lease negotiation.

Pricing of the EV charging infrastructure needs to be something built into the long-term management plan for both the landlord and tenant. Perhaps the tenant agrees to pay a higher pro-rata share of the building’s operating expenses for access to EV charging. Alternatively, there could be a split of the upfront capital costs, with the landlord and tenant agreeing on the ongoing charges. Or, depending on a station’s metering capabilities, a tenant can be charged individually only for the actual time they are plugged in. The point is, there is no one-size-fitsall solution — rather, it’s about early and upfront discussion.

The devil is in the details. Careful planning and negotiation are required as we embark on building the necessary structures to accommodate EV charging demand. It won’t be easy. As more companies realize the immediate carbon reduction impacts of electrifying their fleets, demands are steeply rising. As more corporate occupiers seek to provide EV charging to their employees, building owners will need to act fast with infrastructure upgrades and tangible solutions.

There’s so much to gain from working together on the infrastructure planning, from reducing carbon emissions to receiving Inflation Reduction Act tax credits to increasing the value of a property. Green leases are a powerful tool to move us forward because they require early, honest, and ultimately productive communication that achieves results.

1 https://www.transportenvironment.org/discover/does-electric-vehicle-emit-less-petrol-or-diesel/ 2 https://www.us.jll.com/en/trends-and-insights/research/green-leasing-to-deliver-shared-esgvalue-for-owners-and-occupiers

If you want to position your business in the most desirable area of the country right now, the Savannah corridor, take the easy route: use the Georgia Ports’ Site Selection Tool. This robust online resource allows you to easily compare land and building availability, work force readiness, plus, important utility and transportation options.

Real-time data. Really fast. Go to GAPorts.com/SiteSelection and set your sights on success.

THE AEROSPACE INDUSTRY, LIKE most, has experienced volatility within the past few years due to the COVID-19 pandemic, Russia’s invasion of Ukraine, supply chain tensions, and labor shortages, just to name a few. Some of these challenges are still present, while others have dissipated but left long-lasting effects. These continue to be a central obstacle in company operations — all while feeling market pressures to evolve in the digital world. Ultimately, the industry appears to be experiencing a rebound with heightened demand but struggling to keep up — moving from a demandconstrained to a supply-constrained environment.

Perhaps the most familiar variability of the aerospace industry for consumers is air travel during the COVID-19 pandemic. For U.S. airlines, April 2020 saw a 96 percent decrease in air passengers from April of the previous year. 1 In April 2023, U.S. airline passenger volume surpassed April 2019 by 3 percent, 2 likely impacted by easing travel restrictions. Globally, May 2023 saw traffic rise to 96.1 percent of pre-pandemic numbers. 3 Ultimately, U.S. airlines have hit recovery with consumer air travel, while global levels are not far behind.

In addition to the consumer sector, the aerospace industry is feeling demand from defense, particularly

By Liesel Schmader and Alex Dunlap, Senior Consultants, Location Strategy, Deloitte Consulting LLPAs aerospace companies continue to rebound and evolve, they need to establish their unique goals in order to make an informed and data-driven location decision.

following Russia’s invasion of Ukraine. In 2022, global military spending hit an all-time high of $2.2 trillion, with Europe reflecting the most dramatic increase at 13 percent — driven largely by Russian and Ukrainian expenditures. Russia’s spending grew 9.2 percent to $86.4 billion, with Ukraine growing 640 percent to $44 billion. In Central and Western Europe, 2022 was the first time that military spending ($345 billion) reached Cold War levels.4 Finally, NATO has seen an overall 8 percent real uptick in defense expenditure in 2023, versus 2 percent in 2022.5

Heightened geopolitical challenges have also led to sanctions of products exported from Russia, ultimately disrupting the supply chain. Per a 2022 Deloitte survey, 80 percent of manufacturing executives indicated that they have experienced a heavy or very heavy impact on their supply chain by at least one disruption over the last 12 to 18 months. 6 Specific to aerospace, this has affected the industry’s access

to titanium, a critical component to the market. Russia ranks third globally behind China and Japan for the production of titanium sponge, which is produced from two ores that serve as the main sources of titanium. 7 Moreover, the world’s largest titanium producer is located in Russia. 8

Major commercial aircraft makers have relied heavily on Russia for one third to one half of their titanium supply. 9 However, in 2022, two of the largest commercial aircraft manufacturers made the move to cut ties to all Russian-sourced titanium. As a result of these industry adjustments, both suppliers and OEMs have searched for creative alternatives to meet demand. These include opportunities with small and medium suppliers and strategic acquisitions — all while satisfying recent massive orders. Just last month, two of the largest Indian airlines agreed to purchase 1,000 commercial aircraft from manufacturers, the largest single aircraft purchase agreement in commercial aviation history by over 500 planes. 10

incentive packages and a wide-ranging property portfolio, Santee Cooper helps South Carolina

With resources like low-cost, reliable power, creative incentive packages and a wide-ranging property portfolio, Santee Cooper helps South Carolina shatter the standard for business growth.

with the state’s electric cooperatives and other

bring more than 89,000 new jobs to our state. It’s

In fact, since 1988, Santee Cooper has worked with the state’s electric cooperatives and other economic development entities to generate more than $22 billion in capital investment and helped bring more than 89,000 new jobs to our state. It’s how we’re driving Brighter Tomorrows, Today.

MARKETS THAT DO NOT HAVE AN ESTABLISHED AEROSPACE INDUSTRY MAY PRESENT INITIAL HIRING CHALLENGES, BUT THE OPPORTUNITY EXISTS

In addition to supply chain constraints, the aerospace and defense industry is facing challenges to meet demand due to ongoing labor shortages. The industry alone saw attrition rise to 7.1 percent — 2 percent higher than 202011 — with 70 percent of companies experiencing increased turnover.12 For positions requiring security clearance, which further limits the applicant pool, 70,000 cleared roles sit available.13 Finally, the aerospace and defense industry is seeking workers with digital skills, including data, analytics, and automation in order to meet its evolving landscape. Challenges like this present additional complexity to A&D companies looking to stand up new office or manufacturing facilities in the U.S. or globally.

The following is an example of how a namesake in the A&D industry stood up a thriving aerospace hub across a variety of job types in a relatively immature market and how other firms should weigh their project goals into their next site selection.

Nestled on the Georgia coast is the historic city of Savannah. In 1967, Savannah had a population of approximately 150,000 people, and was the 83rd largest city in the U.S. according to the latest census at the time. It was a town known more for its rich Revolutionary War history and ghost tours than being a hub for manufacturing. However, a global leader in the private jet industry made the bold move to move its headquarters to Savannah in 1967, despite there being significantly larger and faster growing metros in the U.S.

The company’s initial employee count of 100 grew to 1,700 within just a few years, and as of 2023 this company employs 10,000 in the Savannah area. 14 Savannah is actually less populated today than when the firm established its first facility in 1967; but even in the wake of this stagnant population growth, in April of 2023, the company announced a 1,600-employee expansion. 15 From initial market entry, the company and suppliers that followed transformed Savannah into a market of aerospace talent, including a density of aerospace technicians 5.4x denser than the national average. Furthermore, the company has created its own educational pipeline through partnerships with the Georgia Institute of Technology, Savannah College of Art and Design, and Savannah Technical College, to name a few.

This case study poses an interesting question for aerospace and defense clients looking to stand up new manufacturing operations. Established aerospace markets can offer immediate access to relevant talent, but with increased competition. Comparatively, markets that do not have an established aerospace industry may present initial hiring challenges, but the opportunity exists for a firm to create its own hub of relevant talent. If a market has the volume of production workers (not necessarily in aerospace) that a company is looking for, many of these skills could be stood up by localized on-the-job training grants, coupled with local

trade school and community college partnerships. This is particularly relevant if the firm has slow and steady headcount growth projections, creates a positive employee culture, and a commitment to be community partner rather than just an employer.

If a firm needs multiple hundreds of aerospace production workers within just a few years ramp-up, it would be bettersuited to a market that has an established aerospace ecosystem. Naturally, an established market will have stiff competition for technician and mechanic type roles not just within the aerospace industry, but all manufacturing. From Deloitte’s due diligence for past clients, interviews have shown that these employees can quickly be $100,000+ annual earners after competitive benefits packages at top aerospace employers. Similarly, competition for engineering interns and other salaried talent from top universities has become increasingly stiff in establish aerospace markets, offering wages and benefits previously reserved for full-time staff.

The point is not to say that an entrant into an established aerospace cluster would be so stifled with competition that it could not hit its growth goals. However, such a firm needs to have a deep understanding of the labor market it is considering, with an honest comparison of how its compensation and brand image will compete, flavored by data-driven analysis and on-the-ground interviews with top employers. A firm that makes an uninformed jump into an oversaturated market may find itself unable to compete for top talent while forced to fork over wages it had not budgeted for. This is why a deep understanding of an aerospace firm’s unique goals, employee growth, and wage competitiveness is crucial for an informed and data-driven site search for its next manufacturing, engineering, or office facility.

1 https://www.bts.gov/newsroom/april-2020-us-airline-traffic-data

2 https://www.bts.gov/newsroom/april-2023-us-airline-traffic-data-78-same-month-lastyear#:~:text=U.S.%20airlines%20carried%2077.5%20million,high%20reached%20in%20 January%202020.

3 https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-marketanalysis---may-2023/#:~:text=Global%20air%20passenger%20demand%20recorded,%25%20 of%20pre%2Dpandemic%20levels.&text=For%20the%20second%20month%20in,rising%20 5.3%25%20above%202019%20RPKs.01/#:~:text=Geneva%20%2D%20The%20International%20 Air%20Transport,%25%20of%20pre%2DCovid%20levels.

4 https://www.sipri.org/media/press-release/2023/world-military-expenditure-reaches-new-recordhigh-european-spending-surges

5 https://www.airandspaceforces.com/nato-member-defense-spending-summit/

6 https://www2.deloitte.com/us/en/insights/industry/manufacturing/realigning-global-supplychain-management-networks.html?id=us:2em:3na:4diUS175670:5awa:6di:MMDDYY:author&pk id=1010737

7 https://pubs.usgs.gov/periodicals/mcs2022/mcs2022-titanium.pdf

8 https://www.forbes.com/sites/willyshih/2022/03/06/the-titanium-supply-chain-for-the-aerospaceindustry-goes-through-russia/?sh=18a5f6ca2680

9 https://www.reuters.com/business/importance-russian-titanium-global-industry-2022-03-01/

10 https://www.reuters.com/business/aerospace-defense/air-india-firms-up-order-with-airbusboeing-470-planes-2023-06-20/

11 https://www.nationaldefensemagazine.org/articles/2023/2/9/special-report-defensecompanies-face-post-pandemic-workforce-shortages

12 https://www.defensenews.com/industry/2022/10/31/labor-shortage-still-pinching-aerospaceand-defense-sector/

13 https://www.aviationtoday.com/2023/06/02/study-highlights-challenges-solutions-to-laborshortages-for-aerospace-and-defense/

14 https://www.savannahbusinessjournal.com/news/manufacturing/may-5---gulfstreamrecognizes-more-than-400-employees-for-more-than-25-years/article_64b73eb8-cbbf-11ec-83e7af019a6605b1.html

15 https://seda.org/2023/04/gulfstream-announcements-expansions-that-will-bring-1600-newjobs-and-150-million-in-capital-investment-to-chatham-county/

AS THE U.S. TRANSITION to electric vehicles accelerates, so does the search for R&D and manufacturing sites. This trend figures to gain momentum during the second half of the decade. The U.S. Bureau of Labor Statistics 1 cites increased consumer interest, government policies, improved vehicle range, and a commitment by automakers among factors driving EV investment.

“If the emission regulations stay in place, electric vehicles will be the

dominant type of vehicle by 2030,” predicts Dennis Cuneo, director of Site Selection Services at Walbridge and a longtime automotive industry consultant and former Toyota executive.

Industry observers cite the I-75 corridor, stretching from Michigan to the Greater Atlanta area, as the primary beneficiary of recent EV site decisions, with projects also percolating in Alabama and South Carolina. Clusters of engineering talent, proximity to OEMs, and state and local incentive programs

By John McCurryMakers of EVs and the batteries that power them are receiving incentives for their R&D efforts as the technology continues to evolve.

Michigan’s vibrant aerospace/ defense sector is growing — for example, nearly 4,000 Michigan prime contractors account for $6.6 billion worth of goods and services to the Department of Defense (DoD). About 155,000 defense-related jobs contribute $31 billion to the state GDP every year.

Much of this sector activity is due to Governor Gretchen Whitmer’s efforts to stimulate aerospace/defense development through proactive discussions with business, government, and DoD leaders. For example, in 2022, Michigan launched a first-of-its-kind aerial mobility corridor study with Ontario to test the cross-border feasibility of commercial drones. “Cross-border partnership is critical across all dimensions of mobility,” said Whitmer. “This project could lead to faster product deliveries and reduced supply chain disruptions in the future, helping us grow Michigan's economy.”

Other recent successes include the National All Domain Warfighting Center, an advanced training facility for the DoD that hosts critical training for all aspects of multi-domain operations, “including the land, air, maritime, cyber, electronic warfare, and space domains,” said Michael Kroll, deputy public information officer with the Michigan Department of Military and Veterans Affairs. The state also looks for creative ways to use existing assets — for example, Selfridge Air National Guard Base will soon become a center for developing and testing hypersonic materials, a top priority for the DoD.

The changing character of war is evident in Ukraine, where the use of drones, electronic jamming, and cyber effects make the battlefield much more complicated. The emerging use of artificial intelligence is also speeding up technological advancements in aerospace/defense, including advanced materials.

Michigan’s Lightweight Innovations for Tomorrow (LIFT) is a DoD manufacturing innovation institute that focuses on “developing advanced materials and systems engineering that will transform aerospace and defense manufacturing in new ways,” said Joe Steele, vice president of communications and legislative affairs for the American Lightweight Materials Manufacturing Innovation Institute in Detroit.

Lightweight, composite materials are also important in drone construction. The Michigan Unmanned Aerial Systems (UAS) Consortium (MUASC) is a UAS flight and ground test center in Alpena that provides 11,000 square miles of airspace dedicated to R&D, certification, and qualification and systems testing for commercial drones.

A big reason high-tech manufacturing industries come to Michigan is the skilled talent and the culture of quality that being an automotive leader has brought to the state. For example, Michigan has the largest concentration of electrical, mechanical, and industrial engineers in

the nation and the sixth-largest advanced manufacturing workforce.

NASA continues to turn to Michigan for its space expertise. In June 2023 NASA partnered with University of Michigan’s Space Physics Research Laboratory to develop sensitive but highly durable equipment for gathering data from the surface of Venus. Challenges include being able to withstand temperatures as high as 900° F. “NASA counts on us to build really good electronics that can do incredible things in the harshest environments," stated Director Patrick McNally.

The future for Michigan’s aerospace/ defense industry is promising, “with strong research, development, engineering, advanced manufacturing, and supply chain management opportunities for both large and small companies,” said Kroll.

For Steele, increased collaboration will be the key to Michigan’s continued success in the industry. “Tremendous work is going on in the state and we have a great number of unique assets, but all this work is not necessarily connected,” Steele added. “A key goal is collaborating more with each other, building on our strengths to create win-win situations and attract more investment to our aerospace/defense sector.”

®

As the global leader in mobility and a top 10 state for R&D, Michigan provides the ideal environment to test and certify the next generation of transportation. From electric vehicles to aerial mobility, anything is possible in the state that’s boldly driving the world forward. Seize your opportunity at MICHIGANBUSINESS.ORG

are among the chief considerations of site selectors. Incentives play an integral role in project recruitment. A recent example is the $1.2 billion package the state of North Carolina gave VinFast, a Vietnamese manufacturer, to build a massive EV factory in Chatham County. 2

CITE THE I-75 CORRIDOR, STRETCHING FROM MICHIGAN TO THE GREATER ATLANTA AREA, AS THE PRIMARY BENEFICIARY OF RECENT EV SITE DECISIONS.

Flexibility in incentive programs is key — specifically for projects that are looking to offset capital investment, according to Monty Turner and Anthony Burnett, leaders of Colliers’ Site Selection team. States and local communities are aggressive and getting smarter, they say. Most are tying their incentives to performance metrics that create win-win scenarios for companies and communities.

Patrich Jett, a senior vice president with Colliers International and chair of its Global Automotive Desk, says there are three real clusters of EV manufacturing: the Midwest, the Southeast, and Texas. “The Midwest is the traditional home for manufacturing labor/engineering talent and proximity to automotive OEMs and has become significantly more competitive on the incentives front in recent years,” Jett says. “Texas and the Southeast tend to have a big advantage when comparing recurring costs and tend to be the most competitive for incentives.”

Cuneo says states are offering a combination of cash grants, refundable cash credits, training programs, and alliances with research universities. When it comes to R&D, incentives offered are similar to those that you would see for a plant, Cuneo explains, “but it’s limited because typically the places you want to put R&D are close to a corresponding university….you don’t want to put it in the boondocks. You have to be able to attract talent, and if you don’t have talent, you need a place you can convince that talent to move to.”

With many battery plants being located in the Southeast — with Georgia, South Carolina, Tennessee, and Kentucky having attracted battery plants — “if they want to attract the R&D as well, they are going to have to put money into their universities to gear toward battery cell R&D,” Cuneo says. The big players in the U.S. in battery cell production are Panasonic, LG Energy, SK Innovation — all headquartered outside the U.S.

Daron Gifford, an automotive industry expert with Auburn Hills, Mich., consultancy Plante Moran, says most states are focusing their incentives on production facilities, rather than R&D, because they are oriented toward job creation. However, Michigan has been successful in creating

new R&D centers because of its large hub of engineering talent, Gifford says.

Jett cites the Detroit Regional Partnership (DRP) as an organization successfully positioning itself to attract R&D and pilot production projects. The DRP highlights Michigan advantages such as the Michigan Public Service commission approving new large-user economic development rates for the state’s two largest electric utilities, DTE Electric Co. and Consumers Energy Co. Both have strong voluntary green energy programs. Other factors include Detroit Metro having the second-largest engineering cluster in the U.S., according to DRP. 3 Additionally, the University of Michigan is home to a battery lab, the Transportation Research Institute, and a new $130 million Electric Vehicle Center.

“The University of Michigan is the premier institution in the U.S. for automotive engineering,” Cuneo adds. “If you are looking for talent, a lot of it in the automotive industry is located in the Detroit area. Toyota’s largest R&D facility outside Japan is located in Ann Arbor, because that is where you can find the talent.”

There are also a growing number of startups in California’s Silicon Valley and the Boston area. Panasonic is partnered with Toyota and they are doing research on solid state batteries as well, Cuneo says. “It would be foolhardy to predict which of the startups will succeed. The Department of Energy has given grants to some homegrown companies, so obviously they hope that some of them will.”

Cuneo says much of the current investment involves companies taking advantage of the Production Tax Credit. “The incentive is huge,” he says. “Any battery cell plant is qualified for this credit. The money doesn’t have to be budgeted, it’s just a tax credit you take. You can sell it if you are not in a taxable position. A lot of the investment over the last year and a half has been driven by that. What we don’t know is whether we will end up with a surplus of battery plants over the next few years. Are we building too many too fast? Nobody really knows the answer to that.”

Battery technology may change in the coming years. Cuneo says Toyota has committed to concentrate on solid state batteries, and by 2026 will be able to produce vehicles that use this type of battery. This could be a game-changer.

“They are lighter, they hold a charge longer, they are less susceptible to fire, and down the road they could be

drive, and how to improve the drive systems beyond just the battery. Then, the next generation beyond that is going to be how to deploy more safety features and automation into the behavior of the vehicle,” he notes.

cheaper,” says Cuneo. “They may be able to produce a vehicle that would have a battery range of 900 miles. Once you get the charge time down, it changes everything. I drive an EV myself. It’s a great car to drive. It’s the quietest car I’ve

Gifford also predicts increased availability of self-driving vehicles. This technology requires major testing in confined environments away from the public. “This won’t happen right away,” he says, “but there will continue to be a need for new R&D facilities over the next 20 years.”

1 https://www.bls.gov/opub/btn/volume-12/charging-into-the-future-the-transition-to-electricvehicles.htm

Amazon and Stuller to CGI and more, see why the nation’s biggest players are choosing to bring their vision of success to life in Lafayette, Louisiana.

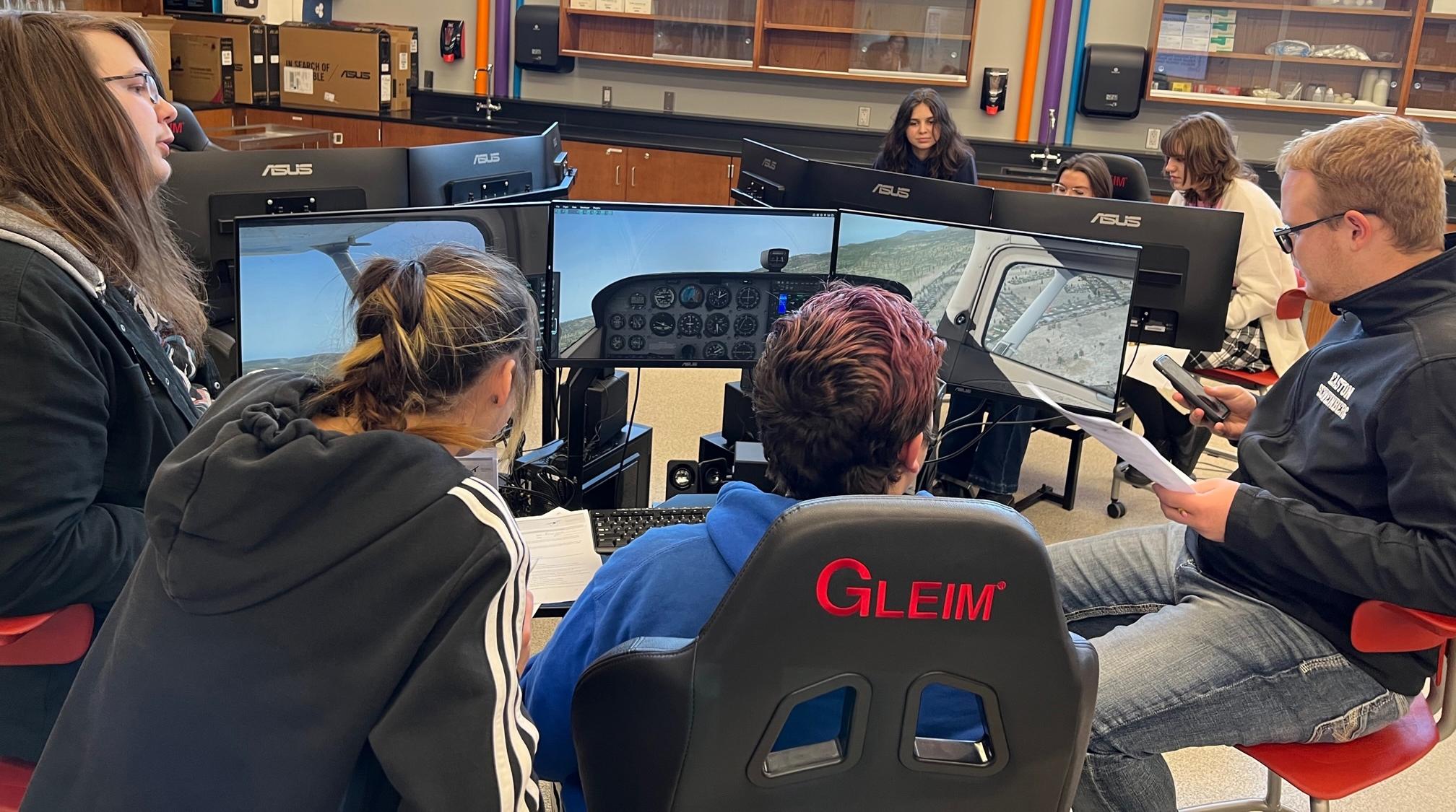

Women in Tech report, 1 45 percent of women technologists say they are outnumbered by men in the workplace by 75 percent or more — a significant increase from the 25 percent who said the same in 2021. This is particularly the case within the aerospace industry. From stereotypes to biases, there is an undeniable perception of this maledominated field that undermines the potential for female success. Breaking these patterns is crucial to empower-

ing women in STEM and closing the gender gap.

In terms of STEM majors, only around 21 percent of engineering majors and around 19 percent of computer and information science majors are women, according to the American Association of University Women. 2 In the aerospace workforce, as of 2021, 13.4 percent of the workforce is made up of women. 3 According to the Pilot Institute, 4 female pilots account for 9.57 percent of the total, with only

By Leshia Pearson, Deputy Director, Aerospace & Defense, Oklahoma Department of CommercePromoting initiatives to educate young people on STEM opportunities, while closing the gender gap, will spur the growth of the U.S. aerospace/aviation sector.

6.34 percent of that percentage being non-student female pilots.

In addition to the lack of diversity within the sector, there is a general workforce shortage nationally. Between 2021 and 2031, the United States will need 3,800 new aerospace engineers every year, according to the Bureau of Labor Statistics. 5 These shortages are contributing to travel disruptions that we’re seeing throughout the world, but efforts to diversify the industry can help to alleviate the crisis and boost our economy.

But how do we solve this massive gender gap? From acknowledging the disparity to educating the youth on STEM opportunities and providing resources in partnership with stakeholders — it’s a multi-faceted approach.

Promoting STEM to youth must start early, even before grade-level education. To achieve this, community-based organizations like YMCA programs and Girl Scouts can serve as an essential starting point to incorporate STEM teachings at an early age. Programs of this kind should also roll into early childhood education and college levels — whether they be extracurricular programming for students, aviationfocused academies, or STEM training courses for teachers. Support at a state level is also a factor that helps to fund programs of these kinds.

As the deputy director of aerospace and defense at the Oklahoma Department of Commerce, my role has enabled me to bring attention to and support programs like these to help make them a reality.

Diversifying Oklahoma’s aerospace industry is imperative for our state, with it being our second-largest industry. We’re home to over 1,100 aerospace entities that employ 120,000. Eighteen Fortune 500 companies in the state are involved in aerospace, and two of the world’s largest MRO facilities are located here. Oklahoma is tackling this gender gap and the overall workforce shortage head-on — either through the deployment of K-12 STEM initiatives, upgrading curriculums across graduate and technical schools, and/ or rolling out customized and complementary workforce training programs available to eligible companies. Concrete examples follow:

• In 2021, Oklahoma opened Camp Trivera, a $12 million-funded STEM camp that is designed to bring science and engineering, math and technology, and the arts to life while offering a fun, outdoor experience for Girl Scouts throughout the state.

• In support of Oklahoma’s teachers, Open for Business Oklahoma’s free “Think Like an Engineer” series offers six science, technology, engineering, art, and math (STEAM) lessons. Their content is designed to help middle school students put textbook concepts into hands-on practice.

• The Oklahoma Aerospace Commission (OAC) distributes $335,000 on an annual basis to fund programs statewide aimed at exposing more Oklahoma youth to STEM careers in the aerospace industry.

• Created by the Aircraft Owners and Pilots Association (AOPA), the “You Can Fly” program offers an aviation STEM curriculum for high schools across the United States. In 2022 Oklahoma had the highest number of high schools in the U.S. offering the AOPA program, rolled out across 56 high schools; that number is expected to rise to 80 in 2023.

• In 2022, Norman Public Schools launched the Oklahoma Aviation Academy, which is themed around aviation and aerospace. Students can graduate with a private pilot license and two years of complete coursework toward their bachelor’s degree in aviation, as well as certifications in UAS (drones). The program includes an MRO-focused curriculum created jointly by Embry Riddle Aeronautical University and ATEC (Aviation Technical Education Council).

Aside from programming, progress can’t flourish without the acknowledgment of females within this sector. In 2017, the Oklahoma legislature passed Senate Bill 230 to officially recognize the contribution of Oklahoma women in the state’s aviation and aerospace industry.

Promoting these initiatives and aiming to close the gender gap in aviation and STEM fields will be our mission for decades to come. Breaking these barriers will not only benefit the aerospace/aviation sector but empower women, creating a positive chain reaction for our country’s aerospace ecosystem as a whole.

1 https://www.skillsoft.com/2023-women-in-tech-report

2 https://www.aauw.org/resources/research/the-stem-gap/

3 https://digitalcommons.unomaha.edu/cgi/viewcontent.cgi?article=1005&context=aviationfacpub

4 https://pilotinstitute.com/women-aviation-statistics/#:~:text=To%20support%20this%20 conclusion%20with,personnel%20for%20the%20year%202022.&text=Data%20shows%20 that%20there%20are,for%209.57%25%20of%20the%20total.

5 https://www.bls.gov/ooh/Architecture-and-Engineering/Aerospace-engineers.htm

The significance of electric vehicle (EV) and battery production has soared with the global shift toward sustainability. Choosing the right site for these projects becomes a critical factor in their success. The site selection process involves a comprehensive evaluation of various factors that can significantly impact the project’s efficiency, cost-effectiveness, and the long-term success of the newly established operation.

The implications of the EV transition are vast. It will include new investment for battery manufacturers, vehicle producers of all types, charging

station producers, and suppliers to all aspects of the above. This is resulting in site selection projects at all points along the supply chain.

This article discusses the key elements executives should consider for EV-related manufacturing projects: infrastructure and utilities, market factors, economic development incentive programs, and a community’s capability.

Different users will present diverse needs ranging from energy and water-intensive battery facilities to

By Shannon O’Hare, Executive Managing Director, Business Incentives Advisory, Total Workplace; and Matt Location & LaborNiehoff, Senior Consulting Analyst,

Analytics; Cushman & Wakefield

The location process for EV and battery projects must take into account proximity to supply chains and markets, availability of skilled labor, ample power and water supplies, financial and other incentives, as well as cooperation between community stakeholders.A rendering of Ford’s BlueOval City battery and manufacturing campus in Stanton, Tennessee

heavy manufacturing with high energy demands. Ensuring a community and site can meet a project’s needs is critical. Access to a stable power supply is particularly critical for battery and EV production, which rely heavily on electricity. Many projects require a robust water supply, waste disposal systems, and other necessary utilities to support daily operations.

Utility providers hold the keys to much of the data required to determine if a community can meet a prospect’s needs. Most available sites are not fully equipped to meet all of a project’s infrastructure needs out of the gate. Due to the scale of these projects and acreage required, many projects are evaluating rural areas and existing roadways and access points are often insufficient. Consideration should be given to timelines to meet a project’s needs, cost of necessary enhancement, and sources of funds to pay for enhancements. In some cases, utility providers can contribute via economic development incentives for a project to decrease extraordinary costs.

Another key step in the process of selecting a new site location is effectively evaluating the factors pertaining to supply chains and labor. Both considerations can thoroughly disrupt an operation if not properly evaluated. In general, supply chain associated costs represent one of, if not the most, significant annual costs for a manufacturing operation. Therefore, when selecting a new site, thoroughly understanding the effects that the location can have on the cost and timing to transport both the inbound inputs needed for the manufacturing process and the outbound delivery of the final goods is critical.

Consideration should be given to alternative strategies and modes of transportation. Could having access to rail on site or a transload facility nearby significantly reduce transportation costs or timing? Could importing raw materials via an alternative port mitigate supply disruptions? The result of the analysis naturally uncovers the sites that appear to mitigate costs, optimize timing, and overall reduce risks of disruptions.

The recovery of the labor markets in the post-pandemic

era has shifted how employees perceive work in today’s economy; therefore, the location factors relating to staffing requirements become critical to the short-term and longerterm success of the operation. Initially developing a staffing model that details the intended number of employees and their desired skillsets by job functions for the operation, and how each job function is intended to grow employees over time, helps inform the process of evaluating the feasibility of a location’s labor market.

Assessing the feasibility of a labor market can take on many forms depending on the various inputs of the staffing requirements, but typically a project can summarize many of the factors into distinct categories pertaining to either supply, demand, scalability, sustainability, or exposure risks. Questions such as the following inform the feasibility of a labor market:

• Is the location within regional proximity of enough workers that have the right skillsets needed for my operation?

• Have comparable facilities demanding similar talent as my business been established in the area, and would I be at risk of competing with them for labor?

• Is there a talent pipeline in the area that could be upskilled to fit my staffing requirements?

• Is the region experiencing positive growth to support my intended business growth over time?

• Is my operation at risk of union organization based on recent union activities in the area?

All are key considerations that can be addressed through a quantitative-based labor assessment. However, equally important is the qualitative data gathered through site reconnaissance and interviews that aim to validate the quantitative data and also supplement the information that is not easily measured by numbers. Naturally, when a project has “boots-on-the-ground” in the communities under consideration it can better interpret things such as quality-oflife factors and the overall community “feel.” The project also can begin to get a sense of how the community will support a project. An overview of the workforce development programs that exist either through the municipality or through a local community college or technical school are examples of qualitative factors that can differentiate a community in the final site location decision. Ultimately, the insights garnered from a quantitative assessment combined with the interpretational data from a qualitative evaluation

UNDERSTANDING THE EFFECTS THAT THE LOCATION CAN HAVE ON THE COST AND TIMING TO TRANSPORT BOTH THE INBOUND INPUTS NEEDED FOR THE MANUFACTURING PROCESS AND THE OUTBOUND DELIVERY OF THE FINAL GOODS IS CRITICAL.

ASSESSING THE FEASIBILITY OF A LABOR MARKET CAN TAKE ON MANY FORMS DEPENDING ON THE VARIOUS INPUTS OF THE STAFFING REQUIREMENTS.

of a location help inform the expected staffing feasibility of a location for a project’s operation.

EV-related projects represent a major undertaking to transform modern transportation. Battery projects represent billions of dollars of investment and the creation of thousands of new jobs. EV-suppliers often have to retrofit existing plants to account for new product lines and retrain workers to be compatible with new technologies. This comes with a big price tag.

Companies are requiring public-private partnerships to make these projects work from a financial standpoint. Projects are tapping into long-standing incentive programs awarded for the typical metrics of job creation and investment as well as EV-specific incentives. Adoption of EV-related incentives has been common across many states in the last few years and can drive material benefits not available under the old-guard standard incentive programs. Communities around the country are competing to win these projects to boost local economies with job creation, investment, and spin-off activity.

Where infrastructure or utilities are not up to par, incentives can also alleviate extraordinary costs. Incentives can be utilized to address shortfalls in capacity or access to put sites on a level playing field or win against similarly situated sites with no access to incentive assistance. Some states are looking to the overall impact of a project on the area and allocating funds to address large-scale issues.

One of the often-overlooked attributes of the incentives process is community engagement. A harmonious relationship with the local community and stakeholders is essential for the long-term success of the project. Engaging with the community early in the site selection process can help identify potential concerns and address them proactively. Community support can minimize potential opposition to the project and lead to smoother operations.

Our final site selection factor is community capability. Consideration should be given to how capable a community is of undertaking a complex EV-related project.

A successful EV-related project involves many community stakeholders: the state, municipality, economic development organizations, politicians, and utility providers, to name a few. Success will be greatest with a community that can demonstrate among its stakeholders aligned priorities and experience working together to achieve common goals. During the site selection process, prospects pay close attention to the interplay between community stakeholders.

EV-related projects require a large investment, and as

such, prospects are extremely risk adverse when it comes to selecting a site. The site selection process for electric vehicle, battery, and manufacturing projects demands a comprehensive evaluation of various factors that can influence the project’s long-term success. Proximity to supply chains and markets, availability of skilled labor, infrastructure and utilities, economic development incentives, and community capability are all crucial elements in making an informed decision.

Molly Howey, President

Ashley Lehman, Director of Business Development

Go Topeka 719 S Kansas Ave., Suite 100 Topeka, KS 66603 Cell: 785.231.4707 GoTopeka.com

Hoyt Strain, Director of Business Attraction Lafayette Economic Development Authority 211 E. Devalcourt St. Lafayette, LA 70506 337-593-1415

hoyts@lafayette.org looktolafayette.com/siteselectors

Susan Proctor, Director, Strategic Initiatives Growth and Development Michigan Economic Development Corporation 300 N. Washington Square Lansing, MI 48913 517-719-0393/888-522-0103

Proctors1@michigan.org Michiganbusiness.org

Trevor Keyes , President & CEO Bay Future, Inc. 812 N. Water Street Bay City, MI 48708 989-892-1400

TKeyes@BayFuture.com www.BayFuture.com

Bill McCall, Economic Development Specialist Santee Cooper One Riverwood Drive Moncks Corner, SC 29461 843-761-8000 ext. 5381 wmccall@santeecooper.com www.PoweringSC.com

We embody Midwestern spirit and grit. Here, businesses believe in the strength of community, knowing your neighbors, and putting in an honest day’s work.

We’ve built our region on the foundation of hard-working people and the blue-collar industries that grew from the abundant natural resources. Today, the region retains its heart while evolving. That means we get business done with talent that is proven, steadfast, and seasoned by hard work.

Trevor

Trevor

Keyes, President & CEO

tkeyes@bayfuture.com (989)892-1400

www.bayfuture.com