www.areadevelopment.com EL UNCLE SAM, FDI, AND CHINA P80 P90 BESPOKE ENERGY STRATEGIES P75 TECH HUBS ARE HEATING UP DEVELOPMENT AREA SITE AND FACILITY PLANNING Q2 2024 P34 P22 What’s Happening in Life Sciences and Biotech

IT’S ALMOST UNFAIR TO THE OTHER 49 STATES ™ For the second year in a row, North Carolina has been named America’s Top State for Business by CNBC. A culture of innovation and a world-class labor force has helped push the state to be the third fastest growing. When outstanding business opportunity is paired with a cost of living 5% below the national average, who wouldn’t want to go All In on North Carolina? AllinNC.com

18 Staying nimble in the face of NIMBYism

In the age of social media outrage, companies need these tangible strategies to assuage concerns about their data center projects.

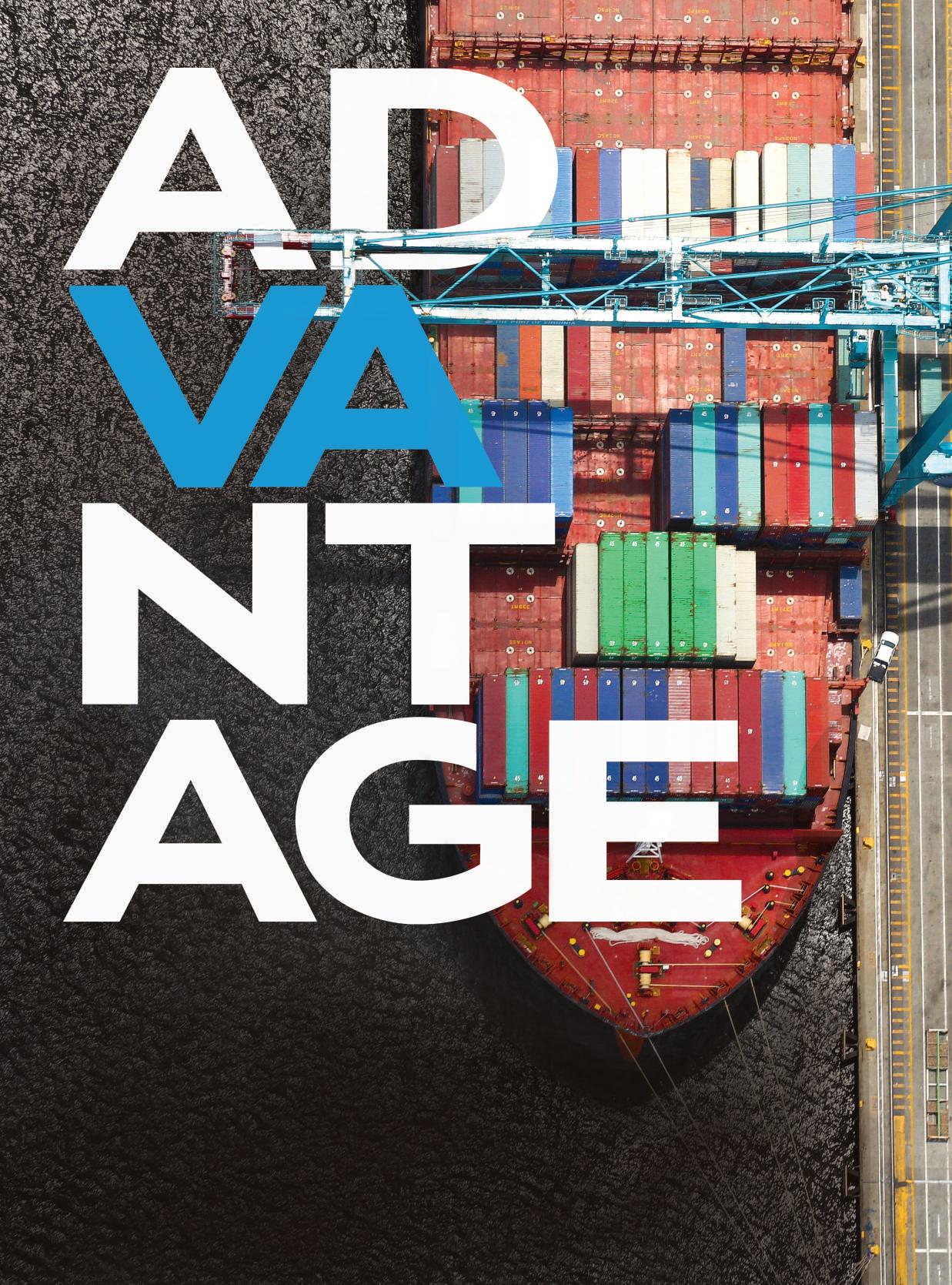

68 A Brave New Shipping World

Geopolitics has gotten more volatile, and global disruptions are forcing supply chains to innovate.

Shovel Season!

Find out which state took home the gold in Area Development’s annual ranking of the top economic development projects in America.

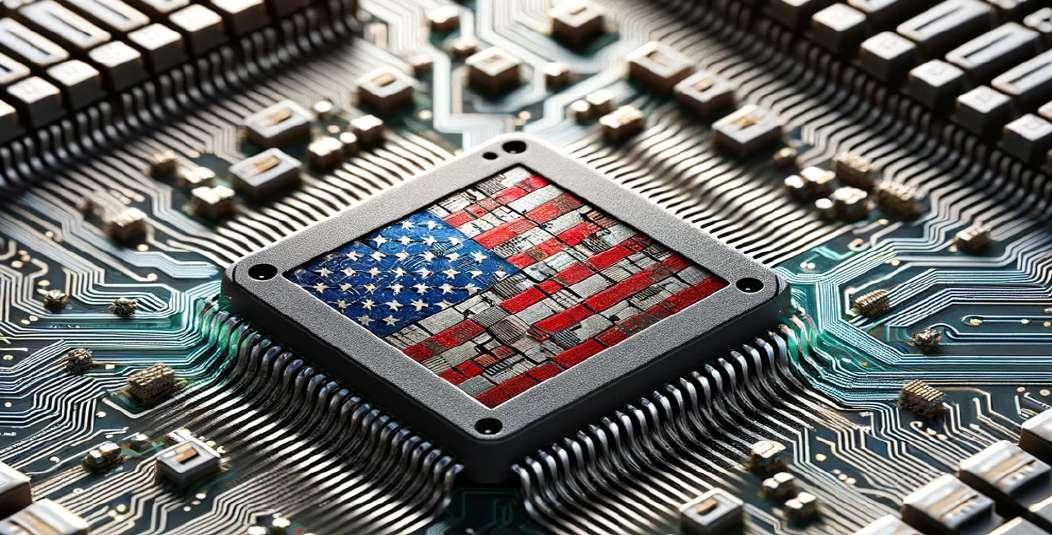

71 Macro Effects of Microchip Investments

Don’t look now, but the CHIPS and Science act is really bringing back manufacturing jobs to the U.S.

86 Around the Horn

Guest Editor Brad Migdal conducts a group chat about the realities of getting energy to new projects.

80 What’s Going on at CFIUS?

One government agency has been flexing its muscle and scrutinizing foreign investments even harder – from one country in particular.

90 Catering to Power

The time is ripe for companies to stop relying on the power grid for their new projects and build their own power supply.

2 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

> AROUND THE HORN Getting Power to Projects: A discussion Guest Editor Bradley Migdal leads an illuminating discussion with, Karla T. Moran Manager ofEconomic Development with the Salt River Project and Coleman Peiffer ofAlliant Energy explore infrastructure challenges and solutions for large-scale manufacturing and data center projects. This conversation has been lightly edited for style and space. Bradley Migdal: From a utility perspective, what are the typical lead times for transformers and other equipment? Bradley: How do you handle upgrades and discussions with new clients? Karla: It’s really about two conversations: one about the necessary infrastructure upgrades and another on resource allocation. If a client is new and not included in our existing plans, we must integrate their needs, which complicates timing. Coleman Peiffer: For significant projects, especially those requiring upgrades like a 345-megawatt transformer, the lead time is about 48-60 months. Smaller transformers are 24-36 months. We can sometimes expedite to about two to three years ifthe end user commits financially. Karla T. Moran: We’re quoting about four years for constructing a substation, mainly due to the long lead times required for transformers and circuit breakers. Especially in our service territory, where data centers commonly exceed 300 megawatts, the demand is massive and comparable to the output ofsome power plants. They require an obscene amount ofpower which are similar in size to some ofour power plants. The infrastructure requirements and upgrades are extensive to meet these power loads. Bradley: When should site selection discussions start? Coleman: The sooner the better, right? The best time to start talking is immediately after identifying potential land. Understanding the site’s power capacity and the timeline for power delivery is crucial. Early discussions help us align on the total power usage and ramp-up period. What we need to know is, what will your total use look like, and then what does that ramp up period look like? That helps us identify ifand how we can hit your electrification date. Karla: In Phoenix, even smaller projects need early involvement due to our rapid infrastructure expansion. We’re meeting with all our city partners on a regular basis to see ifthere’s anything that’s going through rezone that we need to be aware of, or ifthere’s anybody kicking tires on a bigger site, so we make sure we’re part ofthe conversation. I basically tell anybody, if you’re looking at a site, there will need to be some work and upgrades done because the full power capacity is likely not available. 34

Area Development® Site & Facility Planning (USPS 345-510) is published four times per year (Q1, Q2, Q3, and Q4) at Lancaster, PA, by Halcyon Business Publications, Inc., 30 Jericho Executive Plaza – Ste 400W Jericho, NY 11753. Periodicals postage paid at Jericho, NY, and additional offices. Single copies, $20. Yearly subscription U.S. & Canada, $75; foreign, $95.

features

Special Report

CONTENTS

Daniel Kahneman (1934-2024),

Why guest editor Brad Migdal feels

Brad Migdal brings to the table more than 18 years of experience as an expert in corporate site selection. He specializes in working with state agencies and local municipalities and has handled projects for Fortune 1,000 companies across multiple industries, including automotive and consumer products. The Cushman & Wakefield Executive Managing Director, Total Workplace, is a frequent speaker at economic development and real estate conferences. Brad has been featured in the Wall Street Journal and Crain’s Chicago. He previously led the Industrial Site Selection and Business Incentives at Transwestern and has worked with Newmark, PwC, and Deloitte. Brad is also an editorial advisor for Area Development Magazine.

AREA DEVELOPMENT | Q2 2024 3 4 Editor’s Note A farewell from AD Editor Gerri Gambale 6 In Focus Understanding ‘Will Serve’ letters and Right of Way 10 In Focus It’s about time projects were more beautiful 12 Frontline Why you have to plan for climate disaster 14 Frontline Getting your timing right on incentives 94 Ad Index 96 Last Word

energized

electrons. LIFE SCIENCES 22 Five Tips for Navigating Life Sciences Real Estate 30 What to do about labor shortages TECH HUBS 75 America’s New Tech Hubs are Calling for Manufacturers 16 First Person: A Q&A with Tech Hubs Director Eric Smith POSTMASTER: Send address changes to Area Development, Circulation Department, 30 Jericho Executive Plaza – Ste 400W Jericho, NY 11753. Subscribers requesting address changes must provide both old and new addresses. © Copyright 2024 by Area Development® magazine. ISSN: 1048-6534. Printed in the U.S.A. Area Development® is a registered trademark of Halcyon Business Publications, Inc. departments Our comforting conviction that the world makes sense rests on a secure foundation: our almost unlimited ability to ignore our ignorance.

about

Prize

Volume 59 | Number 2 Q2/2024

Nobel

winning psychologist.

Meet our guest editor

EDITORS NOTE

A Final Note

For almost 30 years, I have proudly served as Editor of Area Development and, I hope, have provided you, the reader, with information to help in making your company’s site and facility planning decisions. Of course, there have been changes in the way the information is delivered, with our website adding to what’s included in the print magazine and its many supplements focused on varied industrial sectors, logistics, workforce, and domestic and foreign locations.

Additionally, many factors have changed the field of economic development over the years, including deregulation of the utility industry, the growth of new technologically advanced industrial sectors, sustainability mandates, changing demographics, delivery methods of workforce training, and much more. Nonetheless, our Corporate and Consultants surveys of decision-makers’ plans and site selection priorities — now in their 38th and 20th years, respectively — have remained a highly valued tool for economic development agencies vying for new business to grow their economies.

At this juncture, the time has come for me to segue into retirement with a more limited role and turn over the reins to our new Editor, Andy Greiner, who brings a wealth of journalistic experience and will continue to provide you with the content you expect from Area Development.

Finally, a thanks to all of our readers and to the many contributors to Area Development over the years. It’s been my privilege to serve you while working with our talented staff.

Geraldine Gambale Editor (1996 – 2023)

AREA DEVELOPMENT

Publisher Dennis J. Shea dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Business/Finance Assistant

Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Advertising/National Accounts advertising@areadevelopment.com

Editors Geraldine Gambale editor@areadevelopment.com Andy Greiner editor@areadevelopment.com Staff and Contributing Editors

Mark Crawford Dan Emerson Steve Kaelble

Mark Schantz

In-House Art & Design Circulation/Subscriptions circ@areadevelopment.com

Production Manager Jessica Whitebook jessica@areadevelopment.com

Business Development Director Matthew Shea (ext. 231) mshea@areadevelopment.com

Media Director Justin Shea (ext. 220) jshea@areadevelopment.com

Web Designer Carmela Emerson

Scott Kupperman Founder KUPPERMAN LOCATION SOLUTIONS

Eric Stavriotis Vice Chairman, Advisory & Transaction Services CBRE

Brian Corde Managing Partner ATLAS INSIGHT

Amy Gerber Executive Managing Director, Business Incentives Practice CUSHMAN & WAKEFIELD

Alexandra Segers General Manager TOCHI ADVISORS

Dennis Cuneo Director, Site Selection Services WALBRIDGE

Courtney Dunbar Site Selection & Economic Development Leader BURNS & MCDONNELL

Stephen Gray President & CEO GRAY, INC.

Bradley Migdal Executive Managing Director, Business Incentives Practice CUSHMAN & WAKEFIELD, INC.

Brian Gallagher Vice President, Corporate Development GRAYCOR

Marc Beauchamp President SCI GLOBAL

David Hickey Managing Director HICKEY & ASSOCIATES

Chris Schwinden Partner SITE SELECTION GROUP

Chris Volney Managing Director, Americas Consulting CBRE

Matthew R. Powers Partner ONPACE PARTNERS

Scott J. Ziance Partner and Economic Incentives Practice Leader VORYS, SATER, SEYMOUR AND PEASE LLP

Chris Chmura, Ph.D. CEO & Founder CHMURA ECONOMICS & ANALYTICS

Alan Reeves Senior Managing Director NEWMARK

Lauren Berry Senior Manager, Location Analysis and Incentives MAXIS ADVISORS

Courtland Robinson Director of Business Development BRASFIELD & GORRIE

Dianne Jones Managing Director, Business and Economic Incentives JLL

Joe Dunlap Managing Director, Supply Chain Advisory CBRE

4 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com Q2/2024 2024 Editorial Advisory Board www.areadevelopment.com

Editor

Halcyon Business Publications, Inc. President Dennis J. Shea Correspondence to: Area Development Magazine 30 Jericho Executive Plaza Suite 400 W Jericho, NY 11753 Phone: 516.338.0900 Toll Free: 800.735.2732 Fax: 516.338.0100

Middlesex County, New Jersey, is the ideal destination for your business. Unlock your company’s potential with a location that puts talent and customers from around the world within reach. One-on-one support is readily available to assist businesses in site selection and finding maximum incentives. Request a meeting to learn what Middlesex County has to offer. DiscoverMiddlesex.com/ThriveHere Move Here. Thrive Here. ONE-ON-ONE SUPPORT FOR FINDING MAXIMUM INCENTIVES

‘Will

Serve’ Letters and Right-of-Way Acquisitions in Site Selection

Exploring the nuances of utility commitments and legal access

By David MacNamara, Director, Site Selection and Product Development, KPMG

When it comes to expanding facilities or breaking ground on new sites, there are a couple of hurdles in the utility realm that often get overlooked, yet they’re critical to the success of these projects. Addressing the nitty-gritty of ‘will serve’ letters and rightof-way acquisitions, two aspects that, if navigated wisely, can significantly streamline the process of opening new facilities.

The Ins and Outs of ‘Will Serve’ Letters

‘Will serve’ letters are more than just a formality; they’re a utility’s commitment to deliver the essential services that project decisions hinge on. They are a green light from utility companies, ensuring that water, wastewater, electricity, gas, and broadband will be there when a project needs them, enabling operations to stand-up smoothly.

Getting these letters inhand early may save a lot of headaches down the line. It is a roadmap that not only guides the utility landscape, but also assures investors and stakeholders that each utility company has its ducks in a row. The key is mitigating risks and making sure nobody is caught off guard by utility shortages or delays that may jeopardize project timelines and budgets.

The Road to Right-ofWay Acquisitions

Regarding right-of-way acquisitions, getting the legal go-ahead to use land for installing infrastructure like pipelines, cables, or access roads that are vital for a new facility. It is about carving out a path, quite literally, to ensure that operations have the lifelines they need.

It’s not just about the legal right; it’s about mitigating risk, aligning development goals and knitting strong relationships with the community. Successfully navigating these acquisitions enables the utility to execute the physical groundwork with a key timeline risk preempted, keeping project timeline on-track and fostering goodwill with the local stakeholders.

Tips from the Trenches

• Early Bird Gets the Wor m: Dive into the ‘will serve’ and right-of-way processes at the outset. Early engagement can unveil potential snags, giving ample time to tackle them head-on.

• Teamwork Makes the Dream Work: Foster a spirit of collaboration. Engaging with utility providers, local governments, and landowners early on can smooth out negotiations and speed up the process.

• Knowledge is Power: Leverage the expertise of legal and technical subject matter experts who know the ins and outs of these processes. Their know-how can help sidestep pitfalls and streamline the acquisition journey.

• Clear as a Bell: Keep the lines of communication open and transparent. Straight talk with all stakeholders can dispel misunderstandings and build a foundation of trust and cooperation. Bad news never gets better with time!

• Have a Plan B: Always have a contingency plan. If utility or land-use challenges pop up, be ready with alternatives, ensuring these hiccups don’t derail the project timeline or budget.

While it may seem like ‘will serve’ letters and rightof-way acquisitions are just another item on the project checklist, but they are far

more integral than that. They are crucial steps that pave the way for the successful launch of new facilities. By tackling these head-on with a strategic and proactive approach, the state and community can ensure that facility expansion projects are not just successful, but also set a benchmark for operational excellence and community partnership.

© 2024 KPMG LLP, a Delaware limited liability partnership and a member fir m of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates or related entities.

6 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Heats Up in Virginia Cold Storage Industry

Virginia provides its more than 200 food and beverage processing companies with ample cold storage options.

Whether it’s getting fresh vegetables from farm to table or ensuring vials of essential medicines make it safely from the lab to the hospital, Virginia serves as a backbone of the crucial East Coast supply chain, ensuring that important elements of everyday life get to where they need to be. The expanding ecosystem of cold storage facilities in Virginia is a critical piece of that puzzle.

Virginia’s central East Coast location enables companies to efficiently access major economic hubs east of the Mississippi River and across the continental United States. Located within a one-day drive of nearly half of U.S. consumers, Virginia offers companies a single gateway into critical customer markets along the affluent Northeast corridor, across the high-growth Southeast, and throughout the Midwest. In high-growth manufacturing sectors like food and beverage processing and biopharmaceuticals, demand for cold storage providers to ensure products get from Point A to Point B safely — and at the proper temperature — is skyrocketing.

“Building a fertile ecosystem of state-of-the-art distribution establishments like cold storage facilities is crucial to ensuring the success of the supply chain in Virginia and the world,” said Eric Jehu, vice president of logistics at the Virginia Economic Development Partnership. “Virginia is rising to the occasion by recognizing the needs of these massive manufacturers and making sure the temperature-controlled distribution elements are ready to take those products where they need to go.”

Virginia offers a diverse ecosystem of partners and suppliers for food and beverage processors, including dozens of packagers and bottlers, more than 160 warehousing and distribution establishments, and 43,000

Strategic Mid-Atlantic Location

Located at the center of the U.S. East Coast and within a one-day drive of 47% of the U.S. population, Virginia offers an ideal location to serve East Coast customers or to provide a single gateway to the U.S. market.

farms. More than 200 food and beverage processing companies have chosen to locate or expand in Virginia over the last decade, creating more than 7,900 new jobs and making capital investments totaling $3.4 billion. Virginia’s life sciences sector has also gained significant momentum, with 62 life sciences industry projects announced in just the past five years. Those projects amounted to a $2.5 billion investment in the biopharmaceutical industry, which has acute demand for reliable cold storage.

FreezPak Logistics, LLC, recently announced a $77.5 million investment in the City of Suffolk to construct a 245,000-square-foot cold storage facility to serve the Mid-Atlantic region via The Port of Virginia’s Hampton Roads terminals. Across the Commonwealth in the Northern Shenandoah Valley, WCS Logistics is investing $27 million in Frederick County to build a new 83,000-square-foot cold storage facility with the capacity for over

13,000 pallets to meet increasing demand. There are currently more than 10,000 jobs in the refrigerated trucking and warehousing industry in Virginia. It’s a $1 billion industry that’s continuing to grow. Devoting resources to expand this ecosystem, Jehu says, is part of what makes Virginia a top state for location, infrastructure, and business climate.

“Virginia is responding to manufacturer demand by providing ample cold storage options for rapidly expanding industries,” Jehu said. “This commitment to the manufacturing sector is establishing Virginia as a hub for state-of-the-art, temperature-controlled products. The Commonwealth is actively ensuring that suppliers have every element they need to get their products to market and take their companies to the next level.”

This article was paid for and written by the Virginia Economic Development Partnership and approved by Area Development.

8 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Keeping up with supply chain demand

Today, many high-growth manufacturing sectors are demanding cold storage options. And Virginia is supplying them with just what they need — an expanding ecosystem of temperature-controlled facilities that help ensure that important products, like medications, reach their destination safely and efficiently.

Find your business advantage at VEDP.org

Virginia International Gateway, Portsmouth

Is

this Community Approach

the Blueprint for Sustainable Industrial Development?

Industrial designers are exploring the transformative potential of landscape architecture to harmonize industrial development with environmental sustainability and community well-being.

By Gregg Healy, Executive Vice President and Head of Industrial Services, North America, Savills

By Gregg Healy, Executive Vice President and Head of Industrial Services, North America, Savills

Industrial spaces are more than just functional units, and their designers can aspire to create living ecosystems where green roofs and vertical gardens soften the stark lines of manufacturing plants, solar arrays stretch across warehouse rooftops, and water reclamation systems weave through the premises like lifelines.

The intersection of industrial growth with environmental sustainability is guiding a pivotal shift in the national discourse about industrial building design. The charge is being led by visionaries in the industry like Summers Murphy & Partners (SMP) Landscape Architecture, who have been reimagining how industrial spaces can be both efficient and ecologically harmonious to the communities in which they are located.

“By prioritizing innovative landscape design, we present a forward-looking approach to industrial development that promises a sustainable future across

America,” said Pat Murphy, a founder of SMP with over 40 years of global experience of designing landscapes for residential, office, retail, and industrial spaces to blend with their distinct environments and create a sense of space, which makes them more desired by communities.

The Potential of Innovative Landscape Design

At the core of this transformative vision is the belief that landscape architecture can redefine industrial sites, aligning them with both sustainability and community health objectives. Following this ethos of innovative and responsive design, the objective is for industrial environments to resonate with their natural landscapes — whether in a new development or through redevelopment.

Designers are leveraging native plantings to enhance local ecosystems and biodiversity, establishing green buffers to mitigate the urban heat island effect, and implementing stormwater management practices to protect waterways from industrial pollutants. From incorporating drought-tolerant vegetation in arid areas to designing rain gardens in regions prone to precipitation, the goal is to foster industrial

landscapes that are both resilient and self-sustaining. Not only do these changes offer environmental benefits but also healthier, more attractive workplaces, improving life quality for employees and the broader community.

Envisioning Solar integration and Energy Efficiency

Landscape elements aren’t the only integrations. As part of a holistic site design philosophy, designers envision integrated renewable energy sources within industrial landscapes underscoring a commitment to sustainability. They’re using solar panels and skylights so that industrial facilities can reduce their carbon footprint while bolstering national energy resilience. Green technologies

“By prioritizing innovative landscape design, we present a forward-looking approach to industrial development that promises a sustainable future across America,” said Pat Murphy

can be both aesthetically and functionally woven into landscape designs, offering dual benefits.

Cultivating Spaces for Community Engagement

Industrial developments have the ability to forge deeper connections with their communities. The approach to landscape architecture prioritizes the creation of spaces that are not just functional but inviting and interactive for the public. By integrating walking paths, public parks, amphitheaters, and seeking community feedback in the design process, industrial sites can transcend their traditional roles, becoming valued parts of the communities they serve.

Charting a Path Forward

The aforementioned principles and strategies for sustainable industrial development represent a roadmap replicable across both the United Stated and beyond. Already, many parts of Europe and the Middle East are embracing these elements when designing new large mixedused projects.

This blueprint invites stakeholders from various sectors to champion innovative solutions and practices.

10 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Resiliency: The Case for Fortifying Business against Climate Change

The new frontier in site selection for companies has everything to do with keeping things running during increasingly wild storms and weather patterns.

By Jose Boceiro, Director of Site Selection Incentives and Advisory at Kroll

If they’re not already, site selection teams at Fortune 500 companies should be recalibrating their operational strategies toward sustainable and resilient infrastructure.

The traditional metrics guiding site selection—cost efficiency, workforce availability, and basic utility access—are rapidly being overshadowed by the urgent need for resilience against climate-induced extremities and a seamless integration of renewable energy resources. This shift transcends mere environmental stewardship, and now stands as a strategic necessity to safeguard operational continuity and long-term viability in an increasingly volatile climate scenario.

Climate change and energy volatility are immediate challenges disrupting operations and supply chains with alarming regularity. This new reality necessitates a paradigm shift towards operational autonomy, demanding direct access to renewable energy sources to ensure that business operations can withstand grid instabilities and external disruptions.

This evolution in site selection strategy is not merely about adopting green practices but about fortifying businesses against the unpredictability of tomorrow’s energy landscape.

For those navigating this complex terrain, the integration of sustainable practices into the core business strategy is no longer optional but essential. It entails prioritizing sites not just with the potential for, but with existing access to, renewable energy infrastructures such as solar arrays, wind farms, and microgrids. These considerations must lead the decision-making process, guiding the evaluation of potential sites for expansion or new ventures.

The drive toward embedding sustainable and resilient infrastructure in site selection mirrors broader shifts within the business and environmental landscapes. It is a proactive response to the recognized vulnerabilities of traditional electric grids and the strategic imperatives of renewable energy investments. This approach not only addresses immediate operational needs but also strategically positions companies considering regulatory shifts and growing public expectations for corporate sustainability.

The path to integrating renewable energy and resilient infrastructure into site selection is challenging. Diverse regulatory frameworks and community reactions

present significant hurdles to renewable energy projects across different regions. Despite these challenges, the imperative for resilience and sustainability is reshaping the criteria for site selection, compelling a more holistic view of corporate facility establishment and maintenance in today’s world.

Looking ahead, the integration of renewable energy and resilient infrastructure into site selection practices signifies not just a trend but a fundamental shift in corporate operational philosophy. For C-suite executives and site selection teams, this shift demands a strategic embrace of complexity, informed by a deep understanding of both current energy landscapes and future trends in renewable infrastructure.

In essence, the transition toward renewable energy and resilient infrastructure represents a forward-looking strategy that equips Fortune 500 companies to navigate an uncertain global business environment successfully.

The expertise and insight of specialists in renewable energy and site selection are increasingly vital, offering the knowledge and perspective needed to steer companies towards a sustainable and resilient future. This journey, though complex, underscores a commitment to operational excellence and environmental stewardship, positioning these companies at the forefront of global business leadership in the coming decades.

12 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

MICHIGAN

PURE OPPORTUNITY ®

As a top state for biomedical engineering graduates, Michigan is pioneering the next generation of medicine with advancements in everything from vaccine manufacturing to genomic research. Discover the world-class life sciences talent that make it all possible and seize your opportunity at MICHIGANBUSINESS.ORG

PRECISION

WE MAKE

MEDICINE POSSIBLE.

GENEMARKERS GENOMIC RESEARCH

How to Master the Maze of Federal Funding in Manufacturing Site Selection

What should you consider while working through the complexities of federal incentives and timelines to optimize your facility planning and execution?

By Shannon O’Hare, Executive Managing

Director, Total Workplace, Cushman & Wakefield

Getting through the maze of federal funding and incentives in the world of manufacturing site selection and facility planning is akin to a high-stakes chess game. It’s not just about the allure of the funds; it’s the intricate dance of aligning these opportunities with your project’s timelines and strategic goals. Here’s what this means for you as an executive steering the ship.

Fierce Competition

Finding federal funding is more than just a financial strategy, it’s a test of your project’s flexibility and endurance. Imagine you’ve got your eyes on a juicy grant that seems perfect for slashing your project costs. But here’s the catch — so does everyone else in your industry. The competition is fierce, and the funds are limited. This reality ushers in a period of uncertainty, where you’re left juggling your project plans while waiting on the whims of funding bodies.

And it’s not just the wait that’s testing your patience; it’s the unpredictability of it all. Federal funding comes with its own set of timelines, often misaligned with your project schedules. One day you’re on track, and the next, you’re stuck waiting for that green light from the feds. It’s like being in a holding pattern during a flight, circling the airport, waiting for

permission to land.

But let’s not forget the elephant in the room — the ever-changing political landscape. With each election cycle comes a potential shift in priorities and policies, impacting the availability and structure of these incentives. Today’s funding hero could be tomorrow’s budget cut, leaving you to navigate the turbulent waters of policy changes and their impacts on your project’s fate.

Making Calculated Moves

So, what’s an executive to do amidst this chaos? It’s all about strategic agility. Sure, chase that federal funding if it aligns with your goals, but don’t put all your eggs in one basket. Develop a robust plan that allows for quick pivots and adjustments, keeping your project

viable even when external conditions shift. This means having a clear understanding of your project’s scope, the potential impacts of funding delays, and the broader economic and political context.

Think of yourself as a strategist in this complex game. Your moves need to

Today’s funding hero could be tomorrow’s budget cut, leaving you to navigate the turbulent waters of policy changes and their impacts on your project’s fate.

be calculated, with a keen eye on both the immediate gains and the long-term implications of your funding decisions. This includes considering how these financial plays affect your operational timelines, budget, and overall project vision.

In the end, while federal funding and incentives can provide significant financial relief, they come with a labyrinth of challenges and considerations. The key to success lies in your ability to navigate this landscape with a blend of optimism, realism, and strategic foresight. By staying adaptable, informed, and proactive, you can turn these potential hurdles into steppingstones, leading your project to successful completion and longterm prosperity.

As an executive, your role is to steer your project through these turbulent waters, ensuring that your site selection and facility planning efforts are not just about capturing immediate financial advantages but are also aligned with the enduring strategic objectives of your manufacturing enterprise.

14 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Maryland has a thriving biotech ecosystem that offers the funding, collaboration and resources we need to help us thrive.

Elaine Haynes President and CEO

Kalocyte

business.maryland.gov/sites Get going:

Q&A with Tech Hubs Director Eric Smith

Exploring opportunities for manufacturing growth through the Federal Tech Hubs Program with insights from director Eric Smith on collaboration and regional innovation.

By Area Development Research Desk

Area Development Magazine is fortunate to have an exclusive interview with Eric Smith, the director of the Federal Tech Hubs Program at the Economic Development Administration. Our conversation sheds light on the transformative potential of this program for the U.S. manufacturing landscape. As we explore the strategic initiatives designed to bolster regional economies through technological innovation, our readers—especially manufacturing executives—will find critical insights into how they can leverage these opportunities for growth and competitive advantage.

What specific opportunities does the Federal Tech Hubs Program offer to manufacturing executives looking to innovate and expand?

Eric Smith: The program is explicitly designed to include the private sector in every consortium, meaning there’s a direct pathway for manufacturers to engage with cutting-edge technologies and markets. About a third of our consortium members are from the private sector, emphasizing the significant role industry plays in these hubs. By participating, manufacturers can access new technologies, collaborate on development, and integrate innovations into their processes, driving both regional and industrial growth.

How does the Tech Hubs Program support regions in developing a competitive edge in manufacturing and technology?

Eric Smith: Each designated hub focuses on leveraging its unique regional assets to develop specific technology sectors—from autonomous systems to biomanufacturing. This targeted approach not only fosters specialized expertise but also builds robust supply chains that are regionally integrated. For manufacturers, this means improved supply chain resilience, access to specialized talent, and opportunities to lead in market segments critical to national security and economic competitiveness. By investing in these hubs, we’re positioning regions to attract further private and public investment, enhancing their stature as industry leaders globally.

16 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

What types of technology and industries do these hubs focus on?

Eric Smith: The designated hubs cover diverse areas such as autonomous systems, quantum technology, biomanufacturing, energy transition, and more. We’re aiming to expand this portfolio in future iterations of the program, ensuring that each hub not only contributes to economic competitiveness but also aligns with national security interests.

How can manufacturing executives gauge the program’s impact on their long-term planning?

Eric Smith: Manufacturing executives should look at the program as an opportunity to engage with tech hubs that align with their technological focus and regional presence. By joining these consortia, they can influence and benefit from the hubs’ growth trajectories. Our funding model and consortium structure are designed to facilitate substantial economic activity and investment, promising significant developments for participating businesses.

What challenges has the program encountered, and how are you addressing them?

Eric Smith: Balancing the selection of hubs, given their diver-

sity and potential, is challenging. We address this by ensuring all designated hubs receive benefits, even if they don’t receive direct funding in a particular round. This holistic approach helps mitigate challenges and ensures all participants have the potential to realize growth.

Looking ahead, what are your goals for these hubs in the next five to ten years?

Eric Smith: Our vision is to see these hubs become synonymous with their respective technologies, much like Silicon Valley is with tech innovation. We aim for these hubs to drive significant economic activity, creating high-quality jobs and attracting further investment, thus solidifying their status as centers of industry and innovation.

Any final thoughts for our manufacturing executive readers?

Eric Smith: I encourage all manufacturing executives to explore potential engagements with the Tech Hubs. Whether you’re already involved or considering involvement, these hubs offer a platform for substantial growth and networking. As the program expands, the opportunities for transformative impact will only increase, making now an ideal time to get involved.

AREA DEVELOPMENT | Q2 2024 17

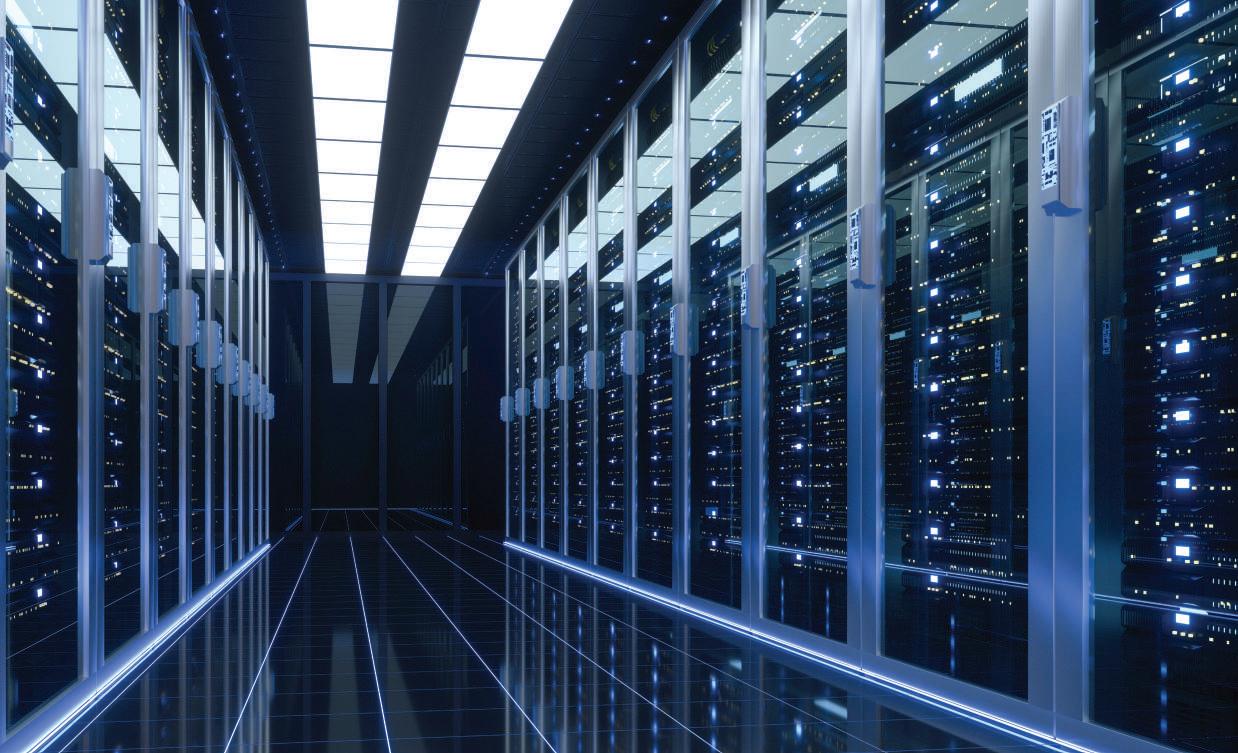

How to Overcome NIMBYism in Data Centers

A guide to turning community opposition into constructive criticism and assuaging fears about data center development.

By Ford Graham, Senior Vice President, Infrastructure and Economic Development and Christopher D. Lloyd, Senior Vice President and Director, Infrastructure and Economic Development, McGuireWoods Consulting

It has been a wild ride in economic development these last few years. In the United States alone, we saw the COVID doldrums of months of nothingness give way to the rush to expand our nation’s warehouse inventory to ensure redundancy in our supply chain. We saw an uptick in onshoring and nearshoring that helped enable diversity of suppliers. And that growth has now been eclipsed by the explosion of megaprojects over the last two years. Fueled by the CHIPS and Science Act and the Inflation Reduction Act, and the administration’s push to lead the world in electric-vehicle-related technology, massive multibillion dollar projects with

hundreds of accompanying jobs became the new norm for many communities.

Unfortunately, in many cases, the companies and their economic development shepherds sprinted eyesclosed into the quagmire of NIMBYism.

NIMBYism, aka Not in My Backyard syndrome, is not new. It is an age-old issue of neighboring property owners/renters wanting things to stay as they are, often paired with a rational concern about the unknown ramifications of a new industrial neighbor.

Unfortunately, our general connectivity to social media and a growing distrust in institutions (federal, local, or

> DATA CENTERS

18 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Louisiana is at the cusp of a growing technology sector, which has a direct impact of $5.3 billion on its economy. Cleco Power’s resilient, reliable and affordable power grid has available capacity at six development-ready sites across the state, with a capacity range of 100MW to 450MW. Additionally, Cleco’s Dolet Hills Solar Facility will have 240MW of green, renewable power available in 2027. Cleco’s service territory is ideal for data centers looking for sites with power redundancy, water supply and fiber availability. Through Louisiana’s $1.4 billion broadband federal funding, every community or technical college in the state has access to fiber optic training programs.

SPOTLIGHT ON SITES

Progress Point and Acadiana Regional Airport

This 45-acre site is located in Iberia Parish, just off of Highway 90 and five miles from the Acadiana Regional Airport in the Lafayette metro region, which also offers seven additional sites varying from 50 to 200 acres.

Beauregard Airport Industrial Site

This 1,188-acre site is a shovel-ready certified site located in Cleco’s Western Louisiana region. It is adjacent to the Beauregard Regional Airport and minutes away from three major highways.

Certified Sites with Extensive Electric Capacity DATA CENTERS Richard Cornelison Director, Marketing and Economic Development 405-823-4135 | richard.cornelison@cleco.com clecodev.com Tech talent pipeline Business Facilities Available acreage Available megawatt capacity Development-ready sites No. 1 1,331+ 1,400+ 6

MISSISSIPPI ARKANSAS SHREVEPORT NEW ORLEANS BATON ROUGE LAFAYETTE ALEXANDRIA BRAME ENERGY CENTER BEAUREGARD AIRPORT INDUSTRIAL SITE FREMEAUX INDUSTRIAL DEQUINCY AIR INDUSTRIAL PARK ACADIANA REGIONAL AIRPORT (7 SITES) PROGRESS POINT DATA CENTER SITES AIRPORTS TRANSPORTATION ASSETS 90 90

TEXAS

otherwise), has led to an irrational proliferation of misinformation and conspiracy theories about economic development projects with proverbial monsters behind every door. As a result, traditional NIMBYism has morphed into BANANA’s (Build Absolutely Nothing Anywhere Near Anyone) and CAVEs (Citizens Against Virtually Everything), and we now see that a small vocal group of media savvy activists can influence political decision-making.

While these challenges are proliferating for projects of all sizes, the proliferation of data centers, pushed by the word’s insatiable consumption of ever-moresophisticated digital media, ever-more-expansive cloud storage requirements, and the growth of AI, has drawn the particular ire of many community opponents. Although there should always be room for a healthy debate over the value of a proposed project’s job creation and investment, the prevailing rhetoric is often less about facts and data, and more akin to who can yell the loudest.

Despite the perceived doom and gloom, there are strategies that local officials, economic developers, and their data-center projects can employ to deal respectfully with these community concerns. Although not a panacea, taking a page out of a traditional, grass roots political campaign plan and implementing it locally to educate and inform about the value that data centers can bring can help smooth the community approval process. Moreover, the concept can be distilled into two core principles: 1) implement a concerted, strategic data-driven effort and 2) start yesterday.

the preferred use. Are jobs a higher priority than capital investment? How do neighbors feel about traffic impacts?

Get to Know the Community

Do your homework on the movers and shakers in the community – who influences whom, which organizations are respected and trusted, and find champions for development.

Gauge True Community Sentiment

Listening to the community is so vital. Often, project developers are so eager to tell their story that they launch immediately into a pitch without seeking input first. Seek out opinions from a variety of stakeholders and work to incorporate reasonable suggestions into the project.

Combat “Dis-” and “Mis-” with Correct Information

It is summarily important to have a thoroughly developed plan in place to roll out the nuances of the project to the public as soon as possible. Key items in this strategy include the development of a website and social media landing pages that provide answers to common questions, arm elected officials with those same questions and answers so they can more thoroughly respond when asked by constituents, host information sessions that are well publicized and open to the public, and participate, in-person, in all scheduled public hearings related to the project and its development.

Valuable, job-creating, tax-generating economic development projects that would otherwise fit perfectly into the fabric of a community, can be delayed or derailed through the efforts of a small but vocal assemblage of misinformed (or misaligned) citizen activists.

Clearly Define the Project

Nothing breeds questions like a changing project scope. Before going public with a project, come to internal agreement on its scope – the size, timeline, potential impacts, and other aspects of the project so the message doesn’t continue to shift thereby causing suspicion.

Highlight the Alternatives

Prepare a comparative pros and cons analysis of data centers vs potential alternative uses for the site and share that information with the public. Review what could also be developed at the site – presuming that development will happen – and go to the community and ask what would be

The boom in megaprojects and the proliferation of data centers in both urban and rural parts of America has led to a surge in NIMBYism. Valuable, job-creating, taxgenerating economic development projects that would otherwise fit perfectly into the fabric of a community, can be delayed or derailed through the efforts of a small but vocal assemblage of misinformed (or misaligned) citizen activists. Economic developers and companies can overcome (or at the very least diminish) negative rhetoric and misinformation by developing and implementing a strategic public engagement plan in the early stages of a project’s life cycle. The larger the scope and impact of the potential project, the greater the need to muster the appropriate resources to ensure that the public is properly informed and engaged.

> DATA CENTERS 20 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

In Odessa, Texas, your business won’t have to stop for natural disasters. And your employees will enjoy sunny days 330 days a year. So you can operate 365 days a year, at least until the next strike from outer space. ONLY ODESSA only-odessa.com Scan to learn more NO MUDSLIDES, HURRICANES OR FLOODS TO DISRUPT YOUR BUSINESS. BUT IN FULL DISCLOSURE, THERE WAS A METEOR STRIKE 63,500 YEARS AGO.

Five Tips to Navigating the Changing Landscape of Life Science Real Estate

In order to navigate the evolving real estate environment, life science companies can reduce their risks with data-driven decision-making and collaboration with developers, policymakers, utility providers, and their industry peers.

By Deborah Boucher, Vice Chair, Cushman & Wakefield

Big Pharma/Biotech has close to $1.5B in dry-powder-cash to burn and in the first 15 weeks of 2024, no less than 41 VC-backed fundings of $50M or more have closed; however, there is a new layer of caution (some would argue it’s a return to proper due diligence attitudes) in the post-pandemic world. Stakeholders in life science real estate face myriad challenges, each intertwined and demanding strategic foresight and adaptation.

By understanding the interconnected nature of market conditions, regulatory shifts, and technological trends, stakeholders can position themselves for success.

that have established infrastructure, a seller/ landlord with deep proof of delivery success in the specific build-type being contemplated, and a municipality with a proven track record of new-project collaboration.

2. The Return of Project Due Diligence

The imperative for life science companies is clear: they must navigate market complexities including the surging availabilities of subleases and the ebb and flow of construction pipelines with vigilance and agility. By understanding the interconnected nature of market conditions, regulatory shifts, and technological trends, stakeholders can position themselves for success. Ultimately, strategic recalibration is not just about reacting to immediate changes but about anticipating and preparing for the future. It’s about embracing change, leveraging opportunities, and charting a course forward that ensures resilience and sustainability in the ever-evolving landscape of life science real estate. Here are five areas to keep in mind while navigating a dynamic landscape.

1. Risk Mitigation Amidst Uncertainty

As high interest rates cast shadows over capital-intensive endeavors, navigating risk becomes paramount. The uncertainty surrounding future revenue streams amplifies the need for meticulous planning and risk assessment at every juncture of decision-making. Nearly all users of life science space look to reduce design and construction risk by seeking out projects

Amidst market fluctuations, returning to fundamentals emerges as a guiding principle. Datadriven decision-making, historically entrenched in the life science sector, gains renewed significance. While it appears that the investor money spigot has turned on again, there is increase scrutiny of what invested funds are being used for. In general, investment to move a therapy through the approval pipeline are more important than making leasehold improvements to an asset that the landlord owns (however, sometimes the latter is required for the former!) Clear articulation of specifications, infrastructure readiness, and early coordination with utility providers can help prevent unexpected delays and increase in cost. Adaptive incentive structures bolster resilience against market volatility.

3. Spotlight on Emerging Trends

We are poised to see incredible advances and value creation in GLP-1 (among other modalities) treatments of obesity, Alzheimer’s, and oncology indications. Developers of real estate and occupiers of those facilities should also be prepared to see technology (particularly from AI, automation, and robotics) advances that impact the footprint of their facilities, impact the amount and types of utilities needed to operate the facilities, and even change the parking

LIFE SCIENCES

22 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

NEW JERSEY HAS SPACE FOR BIG IDEAS.

Explore the dynamic world of life sciences in New Jersey. Our State is committed to fueling innovation and is home to top-notch facilities like the Northeast Science and Technology (NEST) Center and ample, ready-to-use lab spaces. With the highest concentration of scientists and engineers in the nation and attractive economic incentives, New Jersey is where groundbreaking discoveries happen. Join us in shaping the future of life sciences.

ThisIsNewJersey.com

The NEST Experience

Life Sciences Are

With its strong educational and workforce development programs, Kansas continues to draw life sciences companies.

ansas has a well-earned reputation as the epicenter of the Animal Health Corridor, the single largest concentration of animal health interests in the world. It’s home to hundreds of companies that research and produce veterinary pharmaceuticals, specialized food for livestock and pets, and more.

Yet Kansas’ success in animal health is just one of its outstanding bioscience accomplishments.

Companies in Kansas specialize in a wide range of biotech and life sciences areas such as medical device manufacturing, pharmaceuticals, liquid biopsy, contract research, consulting, and bioanalysis services. These exceptional opportunities draw more professionals to Kansas, where they develop cutting-edge technologies and treatments that help people, animals, and other living things.

“Investments by so many innovative businesses in Kansas are a testament to my administration’s success in creating a pro-business economy,” Governor Laura Kelly said. “The business growth we’re seeing proves Kansas is a natural fit for biotech and life sciences in particular.”

Companies recognizing Kansas’ advantages that have made investments across the state include Merck Animal Health, with a $100 million facility expansion/enhancement of its U.S. manufacturing site in De Soto; Pfizer’s manufacturing facility in McPherson, a major supplier of sterile injectables used in hospitals globally; Eurofins Viracor, a global leader in clinical diagnostic services, with a 110,000-square-foot, state-of-the-ar t facility in Lenexa; and KCAS Bioanalytical & Biomarker Services, which chose to expand in Kansas with a new, state-of-the-art, 70,000-square-foot bioanalytical facility in Olathe — now among the largest of its kind in the nation.

Earlier this month, Governor Kelly attended the groundbreaking of the $302 million Wichita Biomedical Campus, a joint venture between Wichita State University, the University of Kansas, and WSU Tech that will bring 3,000 students, 200 faculty and staff, and 1,600 related jobs to Wichita

tion, works to attract and retain talent and companies, and grow funding to further improve the business and research climate.

Education/Workforce Development

Kansas’ strong educational system helps fuel success in biotech and life sciences. The University of Kansas has a high-profile drug discovery and development enterprise. The state also boasts historical agricultural leadership at Kansas State University, with Manhattan serving as home to the USDA’s National Bio and Agro-Defense Facility.

The University of Kansas and Kansas State University both have dedicated incubators in KU Innovation Park and K-State Innovation Campus, built to serve the biosciences and additional industries.

Business also is booming in the Kansas City area, a region that’s a global leader in human and animal health. Bionexus, a nonprofit supporting Kansas City-area biosciences, helps convert emerging technologies from concept to reality. BioKansas, another nonprofit and partner of the Biotechnology Innovation Organiza-

The Kansas Department of Commerce and local economic development forces are fostering a strong overall business climate that’s focused on education, technological innovation, and workforce development, which are needed to grow and future-proof the Kansas economy. It’s working in an unprecedented way, with Kansas recently collecting two Governor’s Cups for the most economic development investment per capita of any state in the nation, and four straight Gold Shovels for excellence in attracting high-value investment projects creating a significant number of new jobs, among other national honors.

And Kansas isn’t slowing down. Rather than just keeping up in a rapidly changing world, Kansas has charged to the front with success in biotech/life sciences and beyond.

To learn more about the exceptional assets Kansas has to offer your company, please visit kansascommerce.gov

This article was paid for and written by the Kansas Department of Commerce and approved by Area Development.

24 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

ratio expectations of a building. Stakeholders will be focused on ensuring R&D and production facilities don’t become obsolete and can produce as much revenue as possible.

4. Diversification and Adaptation

It is vital that life science companies also partner with universities and community colleges to ensure that the workforce they need is being developed.

The evolving landscape demands flexibility and diversification. Developers, once singularly focused on bio manufacturing, now embrace a broader spectrum of industries, from clean tech to advanced manufacturing. This pivot underscores the importance of building flexibility and exit options into the challenging endeavor that is purpose-built life science facility development. Buildings are typically intended to last well over 50 years, yet life science real estate preferences and use are constantly evolving. Owners of life science real estate must be prepared for a facility future that can’t even be imagined today!

5. Collaborative Community Engagement

Collaboration emerges as a linchpin for success. Engaging with developers, policymakers, utility providers, and industry peers fosters synergistic solutions. As the competition for talent remains ever pressing, it is vital that life science companies also partner with universities and community colleges to ensure that the workforce they need is being developed. Companies that are competitors at the pharmacy need to become partners in the local communities they jointly reside in. Sophisticated stakeholders know that when it comes to creating vibrant communities that their employees love and that attract inbound talent to the region, they must work together with their competitors — to some extent — to collectively address challenges and fortify the industry’s resilience amidst uncertainty.

LIFE SCIENCES 26 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Expanding at the Speed of Trust

With its supportive economic development policies, strong infrastructure, talented workforce, and commitment to sustainability, Ohio has become a hub for next-generation biotechnology as well as EVs and other advanced manufacturing.

Amgen’s recent expansion in Ohio has marked a significant milestone in the company’s history due to the strategic selection of Ohio for its newest manufacturing facility and the specific attributes and achievements associated with this state-of-the-art site. The facility, located in New Albany just northeast of Columbus, is a significant commitment by Amgen, featuring an investment of $365 million and employing 400 people in high-skill roles. This initiative is part of a broader strategy to enhance the company’s capacity to produce innovative biologic medicines, specifically targeting a range of serious illnesses.

This Ohio facility stands out for implementing Amgen’s next-generation biomanufacturing technologies, designed to be more environmentally friendly and efficient than traditional biological drug production methods. Using these advanced technologies means the facility is smaller and more flexible while reducing energy and water usage by 75% and 80%, respectively, compared to conventional manufacturing setups. This aligns with Amgen’s commitment to sustainability and its goal of achieving carbon neutrality by 2027.

Amgen isn’t alone with its focus on sustainability. As part of its goal of carbon neutrality for all products and corporate activities by 2050, Honda has a vision to make batteryelectric and fuel-cell electric vehicles represent 100% of its vehicle sales by 2040. Even as Honda accelerates preparation for EV production, the company plans to sustain current internal combustion engine (ICE) and hybrid-electric vehicle production to continue to meet anticipated strong customer demand. The sustained suc-

cess of ICE and hybrid-electric vehicle sales will also support the required investment in the electrified future.

For LG Energy Solution and Honda, it was critical that they had a partner they could trust to help them find the right site with the utility capabilities they needed so they could meet their stated timelines. JobsOhio worked quickly to identify the site in Fayette County, Ohio, and with Honda and their jointventure partner LG Energy Solution to build an economic development project that allowed the partnership to move at the speed they needed to meet Honda’s bold 2050 vision. As a result, Honda and LG Energy Solution committed to a $3.5 billion investment to build Honda’s first North American battery plant that will employ 3,500 Ohioans. As part of the plan, Honda is also adding 327 new jobs at its existing Ohio facilities and investing $700 million to retool those facilities for its electric future.

industry and economic collaboration. Working together at the speed of trust, Amgen successfully opened its Ohio location in record time. “We brought this plant from groundbreaking to licensure in just under 26 months, making it the most rapid site development in our company’s 45year history,” said Robert A. Bradway, Chairman and Chief Executive Officer at Amgen.

Ohio’s talent pool, enriched by numerous universities and technical institutions, provides a steady stream of graduates trained in the high-demand fields of biotechnology, pharmaceuticals, advanced manufacturing, engineering, and technicians.

Overall, Amgen and Honda’s expansion into Ohio reflects the companies’ innovative edge and commitment to patient care and new products and showcases the successful interplay between corporate foresight and state-level economic development strategies. These projects stand as a testament to the power of strategic site selection and the benefits of accessing a skilled and educated workforce, setting a benchmark for

By selecting Ohio for its cuttingedge biologics manufacturing facility, Amgen tapped into a state that prides itself on its strong infrastructure, supportive economic policies, and exceptionally talented workforce. Amgen’s presence also elevates Ohio’s status as a biotech hub, which will likely attract other companies and create a multiplier effect on the local economy.

Honda’s 40-year history in Ohio and the decision to start its move to electrification is a nod to the generations of Ohio workers who bolstered the company’s success in the United States. At the same time, Honda’s vision for carbon neutrality by 2050 is on the path to success as it builds the Honda and LG Energy Solution Battery plant today.

This article was paid for and written by JobsOhio and approved by Area Development.

AREA DEVELOPMENT | Q2 2024 27

Montgomery County, Built for Bio: Maryland

Its robust network of universities and large presence of federal agencies, including the NIH and FDA, have made Montgomery County a prime location for life science firms.

Demand in the life sciences industry has exploded. By 2030, the global market is expected to reach nearly $1 trillion, and Montgomery County, Maryland, is right in the thick of things.

The county has established itself as a prime location for companies in this sector. It is the hub for the third-largest biopharma cluster in the U.S., with more than 300 life science companies and 26,000 employees. Companies like AstraZeneca, REGENXBIO Inc., United Therapeutics, MilliporeSigma and Deka Biosciences Inc., have all recently expanded their operations within the county.

“We have global companies that specialize in gene and cell therapy, biopharmaceuticals, immunology,” says Prayas Neupane, Montgomery County Economic Development Corporation’s (MCEDC) director of Economic Development. “There’s a reason these companies are located here — we have the right talent, the right infrastructure and a highly educated workforce. There’s a lot of synergy between what the county can offer and why the life science companies are here.”

Montgomery County is a strategic location for life science companies. It is home to the NIH, FDA and many other federal agencies. But perhaps more importantly, it has a robust network of universities and a highly educated workforce. With 33% of county residents having an advanced degree, talent — especially within specialized fields such as life sciences — is abundant in the county.

Having access to an excellent talent pipeline is critical for most life science companies. In Montgomery County, Md., this talent is also extremely diverse. In fact, 4 of the 10 most ethnically diverse cities in the entire country are in the county, where over

115 languages are also spoken across top ranking schools. For businesses seeking to innovate, having a diverse and highly educated workforce is a winning combination that gives them a significant competitive advantage.

Then, there’s the life sciences ecosystem — funding from the NIH alone reached $2.7 billion last year, and real estate is still significantly less expensive than other regions. “That’s a driver for growth,” says Pete Briskman, executive managing director and co-lead for the real estate advisory

“We have global companies that specialize in gene and cell therapy, biopharmaceuticals, immunology,”

said Prayas Neupane, Montgomery County Economic Development Corporation’s (MCEDC) director of Economic Development.

company JLL’s Mid-Atlantic Life Sciences practice. “There are purposebuilt developments, new construction, biomanufacturing for later-stage companies, and we have a healthy vacancy level compared to other top clusters.” In the life sciences sector, connections are especially important in real estate. From specialized labs to biomanufacturing to clinical trial space, the complications and expense of build outs can be enormous.

MCEDC is a public-private partnership whose mission is to attract and retain six strategic industries to Maryland’s Montgomery County: technology, hospitality, real estate, nonprofits, corporate headquarters and, of course, life sciences. It makes critical connections for businesses looking to

grow in the county. Neupane and the MCEDC team collaborate with local experts and partners to ensure life science businesses get all of their unique needs met.

Pat Larrabee is one of them. As the founder, president and CEO of real estate consulting firm Facility Logix, she helps life science companies determine what site best suits them and then ensures that the new location continues to meet their needs as the company grows. “Our team has deep science and compliance backgrounds coupled with design and construction expertise,” says Larrabee. “We work very closely with the county and the landlord community to make sure these companies are taken care of.”

Jeff Chod, partner and regional director at construction and property management company Minkoff Development Corp., uses its large portfolio to help life science organizations find alternative solutions to limited capital, often by reusing existing infrastructure from other companies. For example, an earlier-stage business may want to leverage someone else’s lab infrastructure to their initial investment costs. “Like playing matchmaker, we’re able to move companies to create a variety of solutions,” he says, noting a recent short-term lease between one company needing a specialized production area and another with excess capacity that fit the specs for that client.

With a rich talent pool and diverse population, and the global demand for life sciences innovations surging, businesses in Maryland’s Montgomery County are uniquely positioned for success.

Learn more at thinkmoco.com

This article was paid for and written by Montgomery County Economic Development Corporation and approved by Area Development.

28 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

Skilled Talent. Infrastructure. Federal Agency HQs. Discover unique opportunities in Maryland’s Montgomery County. Learn more at thinkmoco.com/site-selection connect@thinkmoco.com Follow us on

LIFE SCIENCES

Mitigating Labor Challenges in Life Sciences Manufacturing

Why executives facing manpower shortages must consider a menu of location planning, automation, and fostering a learning culture to meet current challenges and drive efficiency.

By Adam Bloom, President & CEO of Stevenson Search Partners

The life sciences sector has been pushing the boundaries of medical science, advancing from small molecule drugs to complex biologics and cell therapies. To keep up with all this progress, the manufacturing landscape within our industry has been transforming just as dramatically as the medicines. This evolution is not only a testament to our innovation but also a call to action to address the growing challenge of labor shortages—a pivotal issue that could hinder our progress if left unmanaged. As a manufacturing executive, you play a pivotal role in navigating these changes, ensuring our industry not only meets current demands but also gets these wonderful medicines and technologies to patients who need them.

The Current Landscape of Life Sciences Manufacturing

Today’s life sciences manufacturing is light years away from simplistic assembly lines. Modern facilities are high-tech environments where sophisticated biologics are developed under stringent regulatory standards. The workers in these facilities need a unique blend of skills—they must be as adept with bioreactors and chromatography as they are with regulatory compliance and quality control. The demand for such talent is increasing, yet the supply remains worryingly scant.

The root of this labor shortage is deep and tangled. You have the rapid technological advancements that require continual learning and adaptation from your workforce, skills that are not abundantly available in the traditional pool of talent. Then, you must compete with the allure of other high-tech fields, often with more glamorous perceptions or seemingly better working conditions, drawing potential talent away from manufacturing roles in life sciences. The challenges are big, but there are solutions that can bend the curve in the right direction.

Strategic Location Planning

One of the first strategies to mitigate labor shortages is thoughtful location planning for new facilities. The

choice of location can significantly influence the ease of attracting skilled labor. Proximity to academic institutions can provide a steady influx of fresh talent, eager to apply cutting-edge scientific knowledge. Additionally, regions with a thriving biotech ecosystem offer a competitive advantage by providing access to a pool of workers experienced in highly regulated environments.

Conversely, establishing operations in less saturated markets can reduce turnover rates. In areas with fewer competing employers, employees are more likely to have longer tenures, which enhances continuity and reduces the costs associated with training new workers. However, this approach requires a balanced assessment of the potential challenges, such as the initial difficulty in attracting talent to these lesserknown areas.

Leveraging Technology and Automation

Embracing automation is another crucial strategy. While the upfront costs are significant, the long-term benefits of automation in addressing labor shortages cannot be overstated. Automated systems can take on repetitive, labor-intensive tasks, allowing human workers to focus on more complex and value-added activities. This not only makes better use of scarce talent but also improves job satisfaction by reducing monotony.

Moreover, integrating advanced technologies such as artificial intelligence and machine learning can enhance production efficiency and compliance, reducing the burden on human workers and allowing for a leaner workforce that is easier to maintain.

Fostering a Culture of Continuous Learning and Development

Perhaps the most critical strategy is cultivating a workplace culture that values continuous learning and development. In an industry as dynamic as life sciences, the ability to keep pace with technological and regulatory changes is paramount. Employers must invest in ongoing training and development programs to ensure

30 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

HARNESS THE POWER OF THE TRIANGLE

TAP INTO THE TRIANGLE

In the Research Triangle Region of North Carolina, potential becomes reality. Companies work smarter, driven by a highly educated talent pool, and technology advances faster, fueled by cutting-edge ideas. Home to the largest research park in North America, you’ll find the resources to innovate and the infrastructure to solve global challenges. And with 14 counties fostering a culture of collaboration, there’s miles and miles of room to grow. RESEARCHTRIANGLE.ORG

LIFE SCIENCES

their workforce remains at the cutting edge of scientific and manufacturing advancements.

Additionally, life sciences companies must become adept at ‘re-recruiting’ their own employees—continuously engaging them and reinforcing their value to the organization. This approach not only enhances employee retention but also builds a more committed and motivated workforce.

Building Partnerships and Collaborative Networks

Collaboration across the industry can also play a vital role in addressing labor challenges. By forming partnerships with educational institutions, life sciences companies can help shape curricula to ensure that the skills taught match the industry’s needs. Internships and coop programs can provide students with practical experience and a pathway to full-time employment, creating a pipeline of job-ready graduates.

Similarly, companies can collaborate with each other to develop shared training resources, which can be particularly beneficial for smaller firms that may not have the resources to develop comprehensive training programs independently.

The Risks of Outsourcing

Not every mitigation strategy is a good one. Outsourcing manufacturing processes in the life sciences sector is a common way for companies to manage high costs and the complexities of building and maintaining their own facilities. However, this approach comes with significant

risks. When you outsource, you relinquish control over critical aspects of production, potentially compromising the quality and consistency of the products. This loss of oversight can lead to delays and variability that may not align with the stringent regulatory standards required in pharmaceutical manufacturing.

Outsourcing can also introduce vulnerabilities in your supply chain, making it harder to respond to fluctuations in demand or disruptions in supply. Most critically, dependency on external manufacturers can constrain innovation and responsiveness, delaying the introduction of breakthrough therapies that could significantly benefit patients. These factors make outsourcing a double-edged sword, offering cost savings at the potential expense of product quality and company agility.

What’s Next?

The challenges of labor shortages in life sciences manufacturing are formidable, but they are not insurmountable. Through strategic location planning, the adoption of automation, a strong emphasis on continuous learning, and collaborative industry efforts, we can build a resilient workforce that can support the future of medicine.

Our industry is known for its innovation and resilience, and by applying these qualities not only to our products but also to our manufacturing practices and workforce development, we can ensure that life sciences continue to thrive. As we look to the future, our ability to innovate in how we manage and develop our workforce will be just as important as the innovations we bring to patient care.

32 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

TOUR OUR REGION EXPLORE WITH DATA VIEW 360° IMAGERY Jeffrey Delung Director of Business Development 843-661-1206 | jdelung@nesasc.org zoomprospector.com/nesa Gregg Robinson CEO 843-496-6675 | grobinson@fcedp.com www.fcedp.com AESC FLORENCE SC, USA $3.12 BILLON CAPITAL INVESTMENT Explore Northeastern South Carolina 2,700 NEW JOBS Florence Global Technology Park 1,000+ Acres | 3 Million SF

Economic growth shines at the Area Development Shovel Awards, with states like South Carolina and Louisiana leading the charge. Discover which regions are driving innovation and sustainability in industries from automotive to green technology.

By Steve Kaelble, Staff Editor

34 AREA DEVELOPMENT for free site information, visit us online at www.areadevelopment.com

The pace of outstanding economic news in the past year has been nothing short of breathtaking. Overall, the economy keeps growing at a healthy pace, and economists are coalescing around the conclusion that the mythical “soft landing” has arrived—with inflation tamed, relatively speaking, but with surprisingly low joblessness along with healthy job and gross domestic product growth. The economic-development headlines have been

equally rosy. The past year has seen a long list of announcements of new developments and expansions, some promising eyepopping capital expenditures, and new job opportunities, and many more offering the kinds of smaller but welcome investments that also collectively create local booms. Local booms are what Area Development’s Shovel Awards recognize. Each year, we scan the records of project announcements to see which states are epicenters of growth. Those

AREA DEVELOPMENT | Q2 2024 35

with exceptionally strong activity are honored with Gold and Silver Shovel Awards. Once again, this year, we’ve named a Platinum Award winner to one state with news that’s even beyond Gold-level performance. And, for the first time, we’ve added one more color, a Green Shovel Award, recognizing a healthy concentration of projects that are positive for the health of the planet. As always, these honors are based on information that state economic development officials have shared with us. The details were current at the time they were provided, but as we all know, plans can change, with revisions or delays caused by unforeseen circumstances. Read on for details about the states honored with Shovel Awards and check the related articles for more about some of the busiest areas, such as the automotive sector and earthfriendly initiatives. And now, the envelopes, please…

SOUTH CAROLINA

Platinum Shovel Winner

COMPANYCITY/COUNTY # JOBS INV. AMT. INDUSTRY

AESC Florence, LLC

Albemarle

Cirba Solutions (SC)

e-VAC

Magnetics, LLC (e-VAC)

Nissin Foods

Florence450$810 million Automotive

Richburg300$1.3 billion Energy - Cleantech, Renewable

Columbia300$300 million Automotive

Sumter300$506 million Automotive

Piedmont300$228 million Food Processing

Pallidus, Inc. Rock Hill405$443 million Electronic & Other Electrical Equipment & Components

QTS Data Centers

Scout Motors