Editor: Denise Maguire

Creative Director: Jane Matthews

Designers: Alan McArthur

Neasa Daly

Production Executive: Nicole Ennis

Managing Director: Gerry Tynan Chairman: Diarmaid Lennon

Email: info@ashville.com or write to:

Better Business, Ashville Media, Unit 55, Park West Road, Park West Industrial Estate, Dublin 12, D12 X9F9. Tel: (01) 432 2200

All rights reserved. Every care has been taken to ensure that the information contained in this magazine is accurate. The publishers cannot, however, accept responsibility for errors or omissions. Reproduction by any means in whole or in part without the permission of the publisher is prohibited. © Ashville Media Group 2022. All discounts, promotions and competitions contained in this magazine are run independently of Better Business. The promoter/advertiser is responsible for honouring the prize. ISSN 2009-9118 SFA is a trading name of Ibec.

As I write this, it is now becoming increasingly clear that Ireland is entering a major energy crisis with rapidly escalating concerns in the business community in relation to rising prices and security of supply issues. Please know, my team and I continue to work on behalf of members and businesses across all sectors to advocate for the survival of small rms as they struggle with exceptional energy costs.

David Walsh, Vice President for Original Content in EMEA at One4all, is the front cover story of this issue of Better Business. Read more about One4all’s ambitious plans and the services the company provides to small rms on page 20. Also in this issue, nd out about the latest SFA report which examines the cost of doing business in 2022 for Ireland’s smallest employers.

In this edition, the HR pages provide guidance on the EU Directive on Transparent and Predictable Working Conditions, which is soon to become legislation and the Government’s planned Automatic Enrolment Retirement Savings System.

Elsewhere in these pages you will read about the recently launched 19th Small Firms Association National Small Business Awards 2023 by Awards Patron, An Taoiseach, Micheál Martin TD. e aim of the awards is to celebrate the achievements of small businesses in Ireland and to recognise the vital contribution of the small business community to the Irish economy. Small rms have until October 27th to enter. is magazine contains stories that inform, inspire and entertain. It showcases and celebrates the achievements of small companies, provides advice to help you in your business and keeps you up to date on the latest trends at home and abroad.

Ireland is a nation of small businesses. Of over 267,000 businesses in the country, 99% have less than 50 employees (small) and 92% have less than 10 (micro). ese companies can be seen in every city, town and village in the country and together they provide employment to half of the private sector workforce.

e SFA proudly represents a diverse membership of businesses with less than 50 employees: homegrown and spanning every sector of our economy. Our members can be found in every town and every city in Ireland. We want to make Ireland the most vibrant small business community in the world – an environment that supports entrepreneurship, values small business and rewards risk takers.

Better Business is the magazine of the small business community. We welcome your feedback, suggestions and ideas to info@sfa.ie or on Twitter

@SFA_Irl.

Sven Spollen-Behrens Director, Small Firms Association

Sven Spollen-Behrens Director, Small Firms Association

Big News for Small Business News, views and profiles from SFA members and small businesses in Ireland

The MentorsWork programme is preparing SMEs for the busy months ahead

Ibec’s Chief Economist outlines the challenges facing small firms

Sector Spotlight

The SFA National Small Business Awards 2023 have officially launched

ESI is giving a voice to firms operating within this vibrant, 24/7 sector

David Walsh from One4all on why continual change is key to company success

Breathtaking scenery and goats brought Dara Barrett to Namibia

Four leading law firms on why staff wellbeing is their top priority

Arts and Culture

Alan Shortt has conquered TV and radio, along with the world of communication coaching

David Walsh-Kemmis is keeping it green at Ballykilcavan Brewing Company

Two KeepWell Mark Award winners talk about how to improve workplace wellbeing

The Garden of Ireland is bursting with fun-filled activities this autumn

The SEAI has launched a free online training resource to help businesses reduce their energy costs. The SEAI Energy Academy can help lower energy bills by as much as 10% by educating businesses and employees on changing energy use behaviours - www.seai.ie/ energyacademy/

Learn more about SEAI at www.seai.ie including SEAI’s €2000 voucher towards an energy audit for SMEs with an energy spend of greater than €10,000 per annum.

The Large Industry Energy Network (LIEN) –SEAI members are companies with an annual energy spend of €1 million or more. SEAI works with these companies to improve their energy performance and assist them to lead on the transition and inspire others to take action by sharing their experience. Special working groups within the Network have developed best practice guides on how to manage energy performance. LIEN members report annually on energy consumption and projects undertaken to help increase efficiency.

Companies are eligible if they are spending at least €1 million on energy annually, or are certified to or pursuing ISO 50001 certification.

Irish owned financial technology company Money Jar is to create 100 new jobs to drive expansion of the company, both in Ireland and across Europe. The new roles at the fintech firm include positions for software engineering, compliance and security, product management and design, marketing, sales, account management and customer support. The company said it plans to create 50 of the new jobs by July 2023, with the full amount set to be filled by March 2024. Founded in 2019, Money Jar is the only Irish fintech to offer an Irish IBAN to enable customers to complete their day-to-day transactions online. It is also the only digital current account to offer cash lodgement through collaboration with Payzone and can manage cross-border transfers, allowing transactions in several foreign currencies through its partnership with Currency Cloud. It’s great to see an SFA member grow and scale like this!

This autumn, SFA member Shirley O’Kelly will publish ‘The Story of Timbertrove’. Timbertrove is a unique, awardwinning, 100% Irish-owned family business in the Dublin mountains, owned by Shirley and her husband Henry O’Kelly. This is a story of a small family business with over 30 years’ experience in the design, manufacture and installation of top quality timber products and operators of a Country Store and Café. It examines the challenges of running a small business today – the day-in, day-out grind, the obstacles and hassles. Most of all, it’s the story of Shirley and Henry, of their children, Danielle, Ciara and Conor, who have now joined the business and of O’Kelly’s Sawmills, of ups and downs, good times and bad. ‘The Story of Timbertrove’ is available from www.SuccessStore.com and all good bookshops.

As part of its long-standing commitment to supporting the arts, The Montenotte Hotel, Cork, is delighted to announce the latest Artist in Residence ‘invited’ to the hotel. Nathan Neven, with his collection ‘Wild Life Invited’, will be exhibiting in the hotel from August 1st until January 2023. Now in its fifth year at The Montenotte Hotel, the ‘Artist in Residence’ programme, in association with The Gallery Kinsale, aims to support Irish artists by offering a six-month tenure to showcase in the hotel. Nathan’s art captures the moments of his dreams, his living in Europe and his travel experience, having lived and studied in Paris. The Montenotte Hotel is the perfect destination for art-lovers and culture-seekers, with a new artist to enjoy in-house every six months, further enticing holidaymakers to visit the multi-award-winning, design-led hotel on their next trip to Cork.

Enterprise Ireland provide grant funding up to a maximum of €5,000 to explore a business opportunity or problem with a registered knowledge provider in the areas of sustainability and decarbonisation.

See www.enterprise-ireland. com for more information.

Recent global events, including the invasion of Ukraine, have led to a rise in global energy costs. There are a number of government supports and resources available to help mitigate the impact of these price rises on small firms and to become more energy efficient. See www.enterprise.gov.ie for more information.

For businesses with 10 or fewer employees, the Local Enterprise Office offers two days of intensive mentoring including green transition advice and technical support to a wide range of micro-enterprises with 10 or fewer employees. Green for Micro is free of charge for eligible enterprises and represents the potential for increased efficiencies within companies that adopt these principles.

Champion Green offers SMEs chance to win €50k Blackrock pop-up store https:// businessplus.ie/news/ champion-green-e50kpop-up/

@ChampionGreenie,

@AVIVAIRELAND,

@SFA_Irl,

@RetailExIreland,

@ChambersIreland,

@AnPostRS,

@VisaIreland,

@KilkennyShop,

@Bannerton_PR,

@bobbykerr, #supportlocal

Both the NCSC and the GNCCB @gardainfo have observed an increased trend of the SME sector being targeted by ransomware. We’ve written to @SFA_Irl highlighting the threat as well as providing advice for preventing and mitigating attacks

The new launch of @SFA_Irl (SFA) Strategy document is here! And we couldn’t be more proud of having our Commercial Director, Caroline Ashe, participating in the strategy process. Great work, everyone!

@SBCIreland

#Irish #SMEs need to be more ambitious in terms of #sustainability and #energyefficiency to stay competitive. #Green #Funding is available to support them being more #energy efficient.

@SFA_Irl

@SkillnetIreland

Yala, a recruitment company headquartered in Dublin, has announced a major rebranding which reflects the company’s evolution into a scalable and bespoke, global recruitment service provider. Its new identity, Rent a Recruiter, has officially been launched and marks an exciting new chapter in the company’s history. Rent a Recruiter provides recruitment solutions to a diverse client base across a range of industry sectors, including engineering, financial services, tech, legal, hospitality, public sector, construction and retail. The rebranding activity includes a top-to-bottom redesign of the company’s website, logo, graphics, communications and correspondence. It also reflects the evolution and expansion of its service over the last number of years. In addition, it highlights the company’s talent, innovation and sheer dedication to providing clients with exceptional service.

In May this year, the Registrar of Companies announced that no further Covid-19 annual return extensions will be granted in Ireland. The previously suspended involuntary strike-off procedures have now been recommenced and nearly 270,000 live companies on the register are under scrutiny. It is expected that thousands of companies will be involuntarily struck off the register in the coming months. Additionally, company directors who are considered to be ‘late annual return repeat offenders’ will be prosecuted by District Court, with a maximum penalty not exceeding €5,000.

In response to this situation, the company secretaries at Company Bureau have launched a free Annual Return Late Fee Calculator to easily calculate the outstanding penalty fees for a late Annual Return. This useful tool was developed with accountants and professional intermediaries in mind and is accessible on CompanyFormations.ie. It is important to note that late returns will result in the loss of audit exemption for the next two years, so the late filing of an annual return is a costly burden on small businesses.

This Toolkit provides practical and cost-effective actions that every business can take to support this transformation and build resilience

Visit www.climatetoolkit4business. gov.ie/ for more information.

“The report highlights that Ireland’s smallest enterprises are facing cost challenges in every area of business be it labour, transport, insurance, banking and utility costs.”

Elizabeth Bowen, SFA Senior Executive, speaking on the SFA Cost of doing Business report, read more on page 44

“The SFA National Small Business Awards are as important as ever, as we face the challenges posed by Russia’s immoral invasion of Ukraine. The awards acknowledge innovation, resilience, strength and the importance of the small business sector to the Irish economy and in particular, to the future of the Irish economy.”

Taoiseach Micheal Martin speaking at the launch of the SFA Awards (read more on page 13)

“To safeguard our domestically owned businesses, Budget 2023 must provide certainty on costs and maintaining competitiveness.”

Sven Spollen-Behrens at the launch of SFA Budget 2023 priorities

The latest Global Entrepreneurship Monitor (GEM) report contains encouraging findings about entrepreneurship in Ireland.

Among the key findings of the global survey are:

One in seven people in Ireland aspire to start a business in the next three years

Ireland ranks third in Europe for entrepreneurs with ‘high jobs growth’ expectations

There is an increase in youth entrepreneurship – the proportion of 18 to 24 age group that are early-stage entrepreneurs was 16.4% in 2021, up from just 6.7% in 2018

Ireland has the third highest rate for early-stage female entrepreneurs across European countries

Vivid Edge, a climate action impact company headquartered at NovaUCD in Dublin, has been named the winner of the ESG Finance Award, as part of the inaugural Business and Finance ESG Awards. Attracting over 100 entries from 80+ companies nationwide, the ESG Awards were established by Business and Finance to recognise and celebrate individuals and groups who are actively striving to address environmental, social and governance issues. The Awards, across 14 categories, showcase the successes of ESG initiatives and examples of best practice, as well as highlighting the importance of transparency.

Vivid Edge simplifies the net zero journey for large organisations, saving them time, risk and capital, by delivering energy efficiency retrofits as a service. Vivid Edge funds 100% of the fully installed cost. Customers pay a monthly service fee once installed, with the energy savings often more than covering the fee. This enables these organisations to save energy and cut costs while helping the planet.

More than three in five Irish entrepreneurs are trying to minimise the environmental impact of their business

Two in every three entrepreneurs expect to use more digital technology to sell products or services in the next six months

Given the difficult few years with the pandemic and Brexit, it’s great to see a strong entrepreneurial spirit in the next generation of Irish business owners.

For some businesses, the final quarter of the year could be the most important. With productivity crucial to the growth of businesses, SME owner-managers and leadership teams can avail of the incredible opportunity to have the support of a mentor to help them make the most of the final quarter.

MentorsWork is an award-winning joint initiative from Skillnet Ireland and the Small Firms Association, designed to provide SMEs with the skills and supports to help their business thrive. SMEs choose the priority areas for their business and MentorsWork tailors the programme to suit those unique needs.

Since its initial launch in 2020, the programme has helped over 1,500 businesses across the country. The Government-backed initiative offers a tailored 12-week mentoring programme, targeting core competencies with a one-on-one mentor, as well as a host of valuable business development tools to improve on four key areas – People, Finance and Growth, Digital and Automation as well as Business Processes. MentorsWork has recently expanded to include applications from private sector business with between one and 250 employees across all industries in Ireland. As not all businesses grow at the

same pace, the programme now features a fast-track stream that accommodates the goals of fast-growing start-ups and businesses looking for rapid expansion.

A key success factor of the programme is the in-depth competency assessment as part of the SME’s first step. The results provide the company an insight into the areas of their business that can be targeted for growth or optimisation and give the mentors the opportunity to create a bespoke development plan that suits each SME’s unique growth or operational needs.

Flying into the end of the year, the programme has discovered ways to adapt to the increasingly challenging times to meet the ever-changing needs of small businesses. For example, recognising the growing effect that climate change and green policies are having on SMEs, MentorsWork has a new Green Economy stream, with set intentions to help SMEs navigate how they can adapt sustainable business models and discover ways to leverage and embrace a greener business environment.

With this future direction in mind, MentorsWork will now also be offering continued support through Digital and Green stream Consultancy Services. Open to participants who have completed the programme, this new addition aims to address the implementation of strategies developed through the SME’s initial participation, whilst also helping leaders find new areas of growth within their business.

As businesses fly into the crucial final quarter of the year, SMEs require ever more relevant and targeted support. The MentorsWork application process allows businesses to enrol in the programme and have instant access to over 100 expert-led Masterclasses and peer-to-peer Workshops, as well as a vast library of resources through our personalised online learning platform Percipio.

To learn more or sign up, SME ownermanagers and leadership teams can submit their application for the programme at www. mentorswork.ie

FOR

Towards the end of August, Ibec launched its pre-budget submission, calling on a “robust” response from Government to spiralling energy prices and other immediate inflationary challenges in Budget 2023. With suggested spending and tax measures of just under €2 billion, Ibec’s report states that current inflationary pressures must be matched by a focus on the crucial long-term investments necessary to enhance living standards, overall quality of life and economic resilience.

Get ferocious about your costs. Look at the bottom line in detail and try and get as much out of what you have as possible. Also, make sure you’re talking to your local TD’s to ensure your voice is being heard. There’s going to be huge pressure on Government over the coming months, so it’s important small business makes its voices heard.

Consumer spending and business investment are, says the group, down when compared to the first half of 2022 and that figure is expected to fall further, says Gerard Brady, Chief Economist at Ibec. “The European energy market has deteriorated since the start of the year, a situation that is undermining the recovery momentum that characterised the first half of the year. On top of that, a number of global central banks have signalled that there will be a hike in interest rates and a tightening of monetary policy far sooner than we might have expected. Those two issues will increase pressure on the global economy and place a number of our major trading partners into or close to recession in the coming months,” said Gerard.

Escalating energy costs are currently the number one issue facing small businesses. “We have members looking at increases somewhere between four and five times what they would have paid in a normal year. We’ve also had reports of small shops going from energy bills of €50,000 a year to closer to €200,000.” Large manufacturing companies, who would have been paying €20 million in a normal year, are planning for bills closer to €100 million in 2023. These massive price hikes are being experienced by all firms, across almost all sectors, says Gerard. “Of course, there is a proportion of companies that are better set up to cope with these increases; maybe they have better margins or perhaps they’re not as energy intensive as other companies. Firms with tighter margins, who use larger amounts of energy, are facing into a difficult winter period and as we outlined in our July quarterly report, they will also be adversely affected by lower consumer spending.” To weather the energy storm currently affecting small business, policy intervention is crucial. The State aid approved energy scheme will, says Gerard, provide companies with some relief, but it needs to come sooner rather than later. A much broader suite of supports will be required if the situation deteriorates further during the winter months.

Gerard Brady, Chief Economist, Ibec

Commenting on Budget 2023, Ibec has stated that the underlying strength of the Irish business model and its capacity to generate record tax revenue has put Government in a position whereby it can afford to deliver the correct scale of Budget amidst a challenging inflationary environment.

While Budget 2023 is broadly commended by business, Ibec added caution that if the economic environment continues to deteriorate over the winter, a more significantly expansionary fiscal stance may be needed to robustly protect households and businesses. It stated that Government will need to be flexible and responsive to these trends and further measures to support the economy may well be required as we head in 2023.

Ibec CEO Danny McCoy said: “The strength of the business sector in delivering record tax revenue has facilitated an Exchequer surplus and it is encouraging to see this being used to support households and vulnerable businesses.

“Ibec commends the Budget announcement of targeted use of measures to deliver supports for those most exposed to the spiralling energy costs.

“Business is disappointed to see no extension to the 9% rate of VAT and limited new measures to offset this loss. Ongoing support will be needed in the experience economy to protect viability.”

The challenge for Government is ensuring supports are targeted at people who really need them. The success of that targeting will determine the strength of the consumer economy throughout the Christmas period. “If those supports are spread too thinly, no-one will feel the benefits. Resources are limited so it’s important that supports go to that segment of the public that are really feeling the pain, who don’t have any savings or resources to fall back on. That could be the difference between a positive and negative Christmas from a consumer spending point of view.”

Alongside energy, Government must also introduce measures to control and offset policy-related labour costs which are currently impacting business. “Small businesses are bearing the brunt of so many costs – pensions, minimum wage, living wage, costs related to leave etc. We would suggest that the National Training Fund is used to help business overcome those costs, with a payment break element and a rebate for training, upskilling or productivity vouchers.” With inflation high and uncertainty rising, fiscal policy will need to continue to be flexible to volatile economic conditions throughout this year and next, says Ger.

Ibec also supports a continued increase in the level of the carbon tax, with the proviso that this increase is balanced by offsetting incentives for energy efficiency, the adoption of low carbon technologies and alternative energy sources. Investment must also go to the competitiveness and productivity of sectors worst impacted by Covid such as the Experience Economy. Investment must go into town centres and skills and appropriate use of the €1 billion Brexit Adjustment Reserve to support investment, upskilling and competitiveness in the worst exposed sectors.

For small business to survive, it’s imperative that Government maintains its focus in the longer term. “Taking a longertime view is, I think, key to delivering on the likes of the National Development Plan and improving Ireland’s childcare sector. Without that focus, we’re just storing up problems for the future,” said Gerard.

"FIRMS WITH TIGHTER MARGINS, WHO USE LARGER AMOUNTS OF ENERGY, ARE FACING INTO A DIFFICULT WINTER PERIOD AND WILL ALSO BE ADVERSELY AFFECTED BY LOWER CONSUMER SPENDING.”

THE SFA NATIONAL SMALL BUSINESS AWARDS ARE OPEN TO ALL COMPANIES IN IRELAND WITH UP TO 50 EMPLOYEES AND THE CATEGORIES ARE:

The 19th Small Firms Association (SFA) National Small Business Awards 2023 have been officially launched by Awards Patron, Taoiseach Micheál Martin TD. The aim of the awards is to celebrate the achievements of small businesses in Ireland and to recognise the vital contribution of the small business community to the Irish economy.

Speaking at the launch, Taoiseach Micheál Martin said: “The SFA National Small Business Awards are as important as ever, as we face the challenges posed by Russia’s immoral invasion of Ukraine. The awards acknowledge innovation, resilience, strength and the importance of the small business sector to the Irish economy and in particular, to the future of the Irish economy. Small firms have been central to Ireland’s pandemic recovery and the Government will continue to do everything it can to maintain their competitiveness.”

Free to enter with a prize package valued at €50,000 for all finalists, the Awards are open to all companies in Ireland with up 50 employees who apply before the deadline on 27 October 2022 at www.SFAAwards.ie.

Chair of the SFA, Graham Byrne said: “The SFA has a vision of an Ireland that has the most vibrant small business community in the world – supporting entrepreneurship, valuing small business and rewarding risk takers. The SFA National Small Business Awards are a celebration of the achievements of the 273,000 small firms in Ireland, who collectively employ almost half of the private sector workforce and aim to promote excellence, achievement and innovation amongst small businesses in all sectors and across Ireland.”

Keep up with the SFA Awards on Twitter @SFA_irl and apply now at www.SFAAwards.ie. Find more SFA events at www.SFA.ie/events

MANUFACTURING – supported by permanent tsb FOOD AND DRINK – supported by Bord Bia SERVICES – supported by Sage

OUTSTANDING SMALL BUSINESS – up to five employees – supported by Cisco

INNOVATOR OF THE YEAR – supported by NSAI

SUSTAINABILITY – supported by SBCI

WORKPLACE WELLBEING – supported by DeCare

EXPORTER OF THE YEAR – supported by Enterprise Ireland

RETAIL – supported by One4all Rewards

EMERGING NEW BUSINESS – five winners selected – supported by .IE

is understanding how you perceive yourself, others and the world around you Selfawareness begins with exploring, embracing and enjoying your strengths as well as the weaknesses. It is about recognising whether you underestimate or overestimate yourself. It is about how you see the people and world around you and how you immerse yourself in it. How self-aware are you? Do you see others as your allies or foes?

sets great leaders apart from good and poor leaders. While tangible skills in a profession can be mastered, leaders will struggle when dealing with others if they’re unable to develop their EI skills. We are emotional creatures, regardless of how logical or pragmatic we may see ourselves and/or others. EI is about recognising, managing and regulating emotions in self and others. What do you do when you feel triggered by someone? How do you handle conflict between other people?

Our mindset is unconsciously created at a very young age and for most people, remains very similar throughout life, unless some form of hardship has been experienced which can compel a need to shift the mindset. Mindset shapes our thoughts, our behaviours, our words, our patterns and these form habits in our life. How do you describe yourself? How is your mindset shaping your life?

is the exchange of information between two or more parties using different modes. It might sound simple but more often than not, it is far from simple! Communication is given and received based on our upbringing, our family, cultural background, societal background, education, language, body language, tone, words, mood and emotions. Has anyone ever misunderstood you? Have you ever misunderstood anyone?

are the deep-rooted core principles and beliefs that we live by, whether they are conscious, subconscious or unconscious. Many people live by values that are not theirs and have been passed down through generations. Are your values yours? Do you value your values? Do you live by your values?

are essential to great leadership. These are formed when there is an amalgamation of all of the above traits, namely, self-awareness, mindset, values, emotional intelligence, communication and managing conflict. How meaningful are your key relationships at work? Would you change any of the challenging relationships? Are any of the traits mentioned above causing these challenges?

MANAGING CONFLICT can be tricky to say the least! Whether it is a heated argument or a difference of opinion, most people do not enjoy dealing with conflict or being in conflict. Understanding how to navigate through it can give great leaders that “je ne sais quoi” element. What is your style of conflict? Do you conflict with conflict?

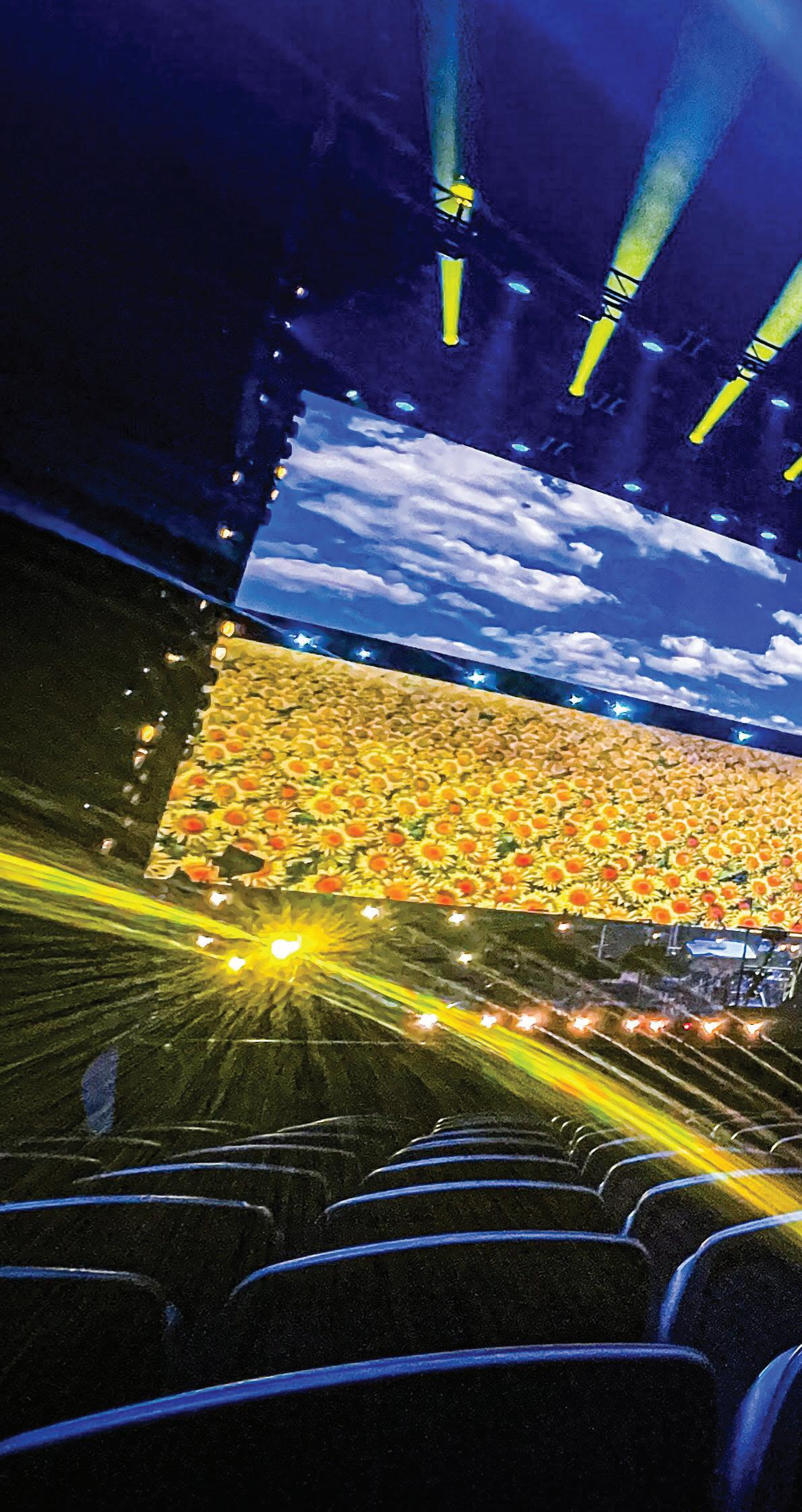

glue that holds Ireland’s events industry together. As a sector, they quite literally keep the show on the road. They were also one of the first industries forced to shut up shop when the pandemic hit. Despite a lack of support from government and a general lack of understanding about how the industry operates, infrastructure firms were nevertheless ready to mobilise straight away when called upon by government to help communicate Covid updates and set up testing and vaccination centres. That lack of understanding from government and the current shortage of skilled staff due to the pandemic prompted a number of event infrastructure firms to form Event Suppliers Ireland (ESI), an organisation that aims to increase visibility around this all important sector.

Grounded within Ibec, ESI was set up to both support and represent the large number of event supplier companies and their employees across Ireland. The lack of a cohesive group and a unified voice was particularly felt during Covid. “I think there was a perception that when everything shut down, the

events suppliers industry could just flick a switch, go home and take up where we left off when normal service resumed. People working in this sector have specific skills and they’re very hard to find. It takes an enormous amount of time and investment to train people, so to lose any of them was extremely difficult,” said Padraig Kilgannon, Managing Director, Total Expo Limited.

Although these companies may differ in the services they provide to the events industry, they all share one characteristic – resilience. “Since I’ve been in the industry, we’ve survived several crises including foot and mouth disease, 9/11 and the ash cloud, both of which brought travel to a standstill. Covid was, of course, the biggest ever disrupter to our industry,” said Paul Murphy, Managing

“RIGHT NOW, OUR INDUSTRY IS HAVING THE PERFECT STORM; THE AFTER EFFECTS OF COVID, BREXIT, THE UKRAINIAN WAR AND RISING ENERGY COSTS. AS PAUL MENTIONED ABOVE, THIS INDUSTRY HAS WEATHERED SO MANY CRISES OVER THE YEARS AND WE HAVE ALWAYS MANAGED TO NOT ONLY SURVIVE THEM, BUT COME OUT STRONGER THE OTHER SIDE.”

Development Director at Actavo Events Ltd. Resilience may be the industry’s key attribute but its main challenge today is attracting and retaining staff. A key role of the new organisation is to raise awareness around the event infrastructure industry and communicate the varied, exciting careers that exist within it. “How do we recruit back into this industry? During Covid we lost hundreds of people, so how do we build the resources that we need to get the sector back on track? I think training and education are key when it comes to building awareness around the event suppliers sector. So many people don’t realise this industry even exists and that’s something that needs to change,” said John Roche, Managing Director at Creative Technology Ireland. Coming together to set up ESI is the first step towards a unified approach around education. At Creative Technology Ireland a graduate programme, in conjunction with sister company NEP Ireland, has proved extremely popular, says John. “We currently have eight paid graduates with us and it looks like they’re all going to stay in full-time employment within the industry. Next year, we’d like to run the programme again, but perhaps with 30 people. It’s an excellent initiative but government support would take it to another level.” Extending the programme to involve other event supplier firms and working together to

Director at Avcom. The pandemic might have shut down traditional event work, but people on the infrastructure side very quickly began setting up test centres for government, while technical people pivoted from in-person events to online events.

“That ability to adapt kept people in employment throughout the pandemic. Having weathered the Covid storm, event suppliers are stronger than ever and we’re still out here fighting,” said Paul.

The most challenging aspects of Covid are, hopefully, behind us but event supplier firms will always have crises to contend with. “Right now, our industry is having the perfect storm; the after effects of Covid, Brexit, the Ukrainian war and rising energy costs. As Paul mentioned above, this industry has weathered so many crises over the years and we have always managed to not only survive them, but come out stronger the other side. With Covid, the government shut down our business, but because our skill set is so transferable, we were then called upon to provide help around the emergency planning piece. We did that unconditionally and we were able to mobilise as and when required. As an industry, we are agile, resilient and flexible and those qualities will allow us to weather any future storms,” said Paul Griffin, Commercial & Business

produce one, unified programme for the industry is also key, says John. “Going forward, it’s about training, educating and working together as an industry to share these skills. That’s the only way we’ll attract and retain talented staff.”

Covid recovery won’t happen overnight, says Paul Griffin. It will be another five years before we reach adequate staffing levels. “In terms of recovery, 2022 has probably been the hardest year. Getting back to business as new as opposed to business as normal is a difficult transition.

At the moment, the industry is running at 120% capacity compared to 2019, but with just 60% of the resources we had back then. To say that this year has been a struggle operationally, not just for us but for our competitors and the companies we work with, would be an understatement. We survived Covid; now it’s about rebuilding.”

There’s a perception that the event supplier industry is best suited to people looking for parttime work. In fact, it’s an industry with fast levels of career progression and impressive remuneration rates. It’s not just jobs for roadies and technicians, says Paul Murphy. Roles within event suppliers firms range from salespeople and project managers to marketing, finance and designers. A large proportion of firms operating in this space are either small or medium sized businesses, so the chances of career progression are even higher. “In addition, employees today want the option of hybrid working and that’s something the industry can offer. There’s also the option of international travel. It’s an industry that has an awful lot to offer.

That vast scope just needs to be communicated to prospective labour.”

That communication piece is where Ibec comes in. As the latest addition to the Ibec/SFA family of networks and trade bodies, ESI is well positioned to communicate the opportunities that exist within the industry. Ibec is currently investigating the possibility of establishing a Skillnet to provide State-funded training and upscaling supports to firms within the events infrastructure sector. A cost saving scheme in the fleet management and motor insurance space for firms is also on the table. “We’re encouraging event supplier companies to join the SFA + ESI network as it’s only by working together and sharing that vital knowledge that the industry’s voice will be heard. We have organised working groups on various key topics within the industry including health & safety, training and upskilling and communications. We’re delighted to have ESI on board, an organisation that truly understands the needs of this vibrant industry,” said Sven Spollen-Behrens, Director at the SFA.

The events suppliers industry is ahead of the curve when it comes to sustainability. International event organisers require a clean, green operation

and most event supplier firms are transforming their business to provide an enhanced eco service. For small companies, putting the resources behind sustainability or health & safety policies can be a big ask. “That’s another reason why we set up ESI, to share our knowledge around these issues. At the moment, the hot topic is energy efficiency. It’s hard for individual companies to navigate those waters on their own. Being part of an association where you can share resources and create policy documents that are transferable across all businesses will only make us a stronger industry that can compete both nationally and internationally for business,” said Paul Murphy.

The ESI has a clear goal and that’s to communicate the vast range of opportunities that exist within the event supplier industry. This is a sector where careers are made, says John. “Employees can climb the ladder very quickly and be earning a very good salary in a relatively short space of time. That’s not something that happens in other sectors. As an industry, I think we’ve done incredibly well to get through Covid; the challenges continue but this is an industry that keeps moving forward. There’s never a dull moment.” ESI is giving a unified voice to event supplier firms and creating awareness around the industry. “All companies within this sector share a common goal and that’s to deliver the event. So, if Padraig needs me to jump in a forklift and move some pallets, or John wants me to run some cable, or Paul needs me to man a camera for 10 minutes so somebody can have a comfort break, I’ll do that. Whatever it takes to get the job done. We work in an exciting, 24/7, vibrant industry and through ESI, we want to make sure more people know about it,” said Paul Murphy.

“BEING PART OF AN ASSOCIATION WHERE YOU CAN SHARE RESOURCES AND CREATE POLICY DOCUMENTS THAT ARE TRANSFERABLE ACROSS ALL BUSINESSES WILL ONLY MAKE US A STRONGER INDUSTRY THAT CAN COMPETE BOTH NATIONALLY AND INTERNATIONALLY FOR BUSINESS.”DAVID WALSH-KEMMIS IS KEEPING IT GREEN AT BALLYKILCAVAN BREWING COMPANY

Atthe 2022 SFA National Small Business Awards, Ballykilcavan Brewing Company took home the much-coveted Sustainability award. An important win for a company that only started brewing beer in 2017. “There has been 13 generations of my family on this farm and sustainability has always been important to us. Financial sustainability was the reason for setting up the brewery in the first place; environmental considerations tie into the running of a farm and I think that element has grown in importance over the past few years,” said David Walsh-Kemmis, Ballykilcavan Farm and Brewery owner.

Ballykilcavan has always been a mixed farm, with woodland, grass for livestock and fields of crops. Located just outside Stradbally in Co Laois and surrounded by prime malting barley, it’s the perfect setting for a beer-making operation. David took over the business in 2004 and after several years farming the land, saw

diversification as a way of sustaining the farm for later generations. An interest in beer sparked the idea for the brewery, which today is located in the farm’s original stone grainstore, which dates back to 1780. As well as producing his own beer, David runs tours where visitors can have a look around the brewery, hear family stories spanning back 380 years and find out how beer is made. He also still works on the farm. “I’m definitely busy! Our tours are taking off and exports are up. We’ve actually doubled the capacity of the brewery to support the export side of the business, going from six fermenters to 12.” Winning the Sustainability award is another string to Ballykilcavan’s bow and will, says David, stand to the business, particularly on the exports side. “When we’re talking to a distributor or importer, we talk about the history of the farm and the family, the fact that we grow our own barley, we take water from our own well, we even grow some hops here too. They’re all really important considerations in the marketplace today and that sustainability piece really stands to us.”

As an Origin Green member, the brewery has set a number of sustainability targets under the headings of energy, water, waste, biodiversity and community. Running a brewery is an energy-intensive business and with energy costs currently so high, it takes a bit of ingenuity to use as little as possible. “Energy reduction starts with the equipment we use. We make sure we have variable drives on all our equipment, which

means that we can run them at exactly the right level rather than having them only switched on or off. A lot of our work involves heating water up and then cooling it back down again. To make that process more energy efficient, the hot water that’s generated is put back into the hot water tank and used either for brewing the next day or for cleaning with. Our cooling system also generates heat so we recover as much of that as possible too.” Regularly servicing every piece of equipment, heating and lighting also goes towards the overall aim of using the least amount of energy possible. An 11 kva solar array on the roof is already allowing the business to generate its own electricity; that’s about to kick up a gear thanks to a new microgeneration scheme which will also see Ballykilcavan exporting energy back to the grid.

Brewing water is sourced from the farm’s

“WE’RE ALSO USING PAPER-BASED AS OPPOSED TO PLASTIC TAPE AND AGAIN, IT’S AT LEAST DOUBLE THE COST OF THE STANDARD VARIANT. WE COULD EARN MORE OF A MARGIN ON A CASE OF BEER IF WE OPTED NOT TO RUN OUR BREWERY SUSTAINABLY. BUT WE PREFER DOING IT THIS WAY AND WHEN IT COMES DOWN TO IT, IT’S THE RIGHT THING TO DO.”

began with a bang at One4all. The company increased its ever-growing presence across Europe by launching in the Netherlands in the first half of the year. Plans are in place to launch in Switzerland in 2023 and later this year, the company is set to bring a different type of offering to the French and Belgian markets. Business is good at One4all, thanks in part to the company’s acquisition by US fintech giant Blackhawk Network in 2019. “The acquisition allowed us to get on board with brands like IKEA and boohoo.com, brands that were traditionally difficult for us to access. I remember a few years back trying to contact people working at these brands on LinkedIn, but it was difficult to make those connections as One4all was considered a small Irish business. Now, we’ve got the resources and the support to expand our presence and continue to develop One4all across Europe,” said David Walsh, Vice President for Original Content in EMEA.

David’s role at One4all is to lead the strategic development of the company’s multistore gift cards, as well as the development and launch of new original content multistore gift cards across Europe. He and the team liaise with various departments within the organisation to ensure the correct distribution, marketing and compliance of products. “The way I look at it, we’re the glue that pulls all the various teams together. At the moment, I’m in the Netherlands with the team to see how we can maximise sales here for the rest of the year.

“OUR ROADMAP OVER THE NEXT TWO TO THREE YEARS IS REALLY ABOUT DRIVING ONE4ALL RIGHT ACROSS EMEA. THERE ARE CHALLENGES OF COURSE; IN SWITZERLAND, FOR EXAMPLE, YOU HAVE FOUR LANGUAGES THAT ARE SPOKEN SO HOW DO YOU ENSURE CUSTOMER SERVICE IS EQUIPPED TO DEAL WITH THAT? WE ALSO NEED TO BE CONSCIOUS OF REGULATIONS IN DIFFERENT COUNTRIES.”

It’s exciting to see an Irish brand like ours expanding and launching into so many new territories.”

Ever-evolving consumer trends dictate offerings from One4all. The retail environment is, says David, constantly changing and adapting to consumer demands and so must we. “We’re always on the lookout for new brands coming onto the market. In every market that we work in, brands will come and go. A good example is Arcadia which was a huge brand and a strong partner of One4all. A changing economy meant they departed the market but then you have the likes of ASOS and Boohoo.com entering the market, along with new bricks and mortar retailers too. So the market is continuously evolving and we constantly strive to partner with these new brands.” The One4all app has further increased the company’s digital presence, allowing users to load their physical cards onto the app. “That can be loaded into Apple Pay so for example, I can be shopping at TK Maxx and my wife could be in Next and we can both be spending our One4all card.” The digital One4all Gift Card is proving particularly popular with corporates who want to reward their staff. According to research from One4all, consistent and proactive recognition and rewards motivate a workforce, particularly in our post-Covid environment. Acknowledging a team’s achievement helps boost productivity and contributes to a company’s overall success; a digital gift card from One4all Rewards can get that message across. “If a company wants to reward its 100-strong staff, they give us their email address or mobile number and we will send each staff member a link to download their digital gift card. Messages to each staff member can be customised too, so you’re not missing that personal touch.” David believes there will always be a place for the physical gift card, particularly for small businesses. “If you think about the type of employment environment we’re in at the moment, employees don’t just want the paycheck. They want the reward and recognition they get from their employer. If you’re giving a gift card to somebody, it’s an awful lot nicer if you can actually give it face to face and shake their hand. I think that’s the approach that small

firms take, perhaps more so than larger businesses.” Making up 80% of all its business, small firms are the backbone of One4all. The company works with small businesses across all industries to create a robust and vibrant reward and recognition programme to the benefit of all. “Put simply, rewarding staff works. It increases motivation and encourages employees to exceed their objectives and goals. It also helps to increase employee retention, which is very difficult at the moment. Even a simple ‘thank you’ works, it doesn’t necessarily need to be monetary. Our incentives team has seen a huge take-up for the digital gift card but it’s probably 50/50 between the digital and physical gift card.”

Back in 2002, One4all started out as a small business. We know what it’s like, says David, to run a small operation where it’s every shoulder to the wheel. “Very few roles within a small firm are black and

keen to return to the office. They wanted to engage with colleagues and have a bit of craic once again, so it’s great that they can do that. It’s about finding a happy medium, adapting to what our staff want and making sure we’re providing that for them.”

Over the next few years, One4all intends to launch its products into several markets including Poland, Austria, France and Belgium. “Our roadmap over the next two to three years is really about driving One4all right across EMEA. There are challenges of course; in Switzerland, for example, you have four languages that are spoken so how do you ensure customer service is equipped to deal with that? We also need to be conscious of regulations in different countries. So while we’re excited about launching in different countries, we haven’t lost sight of the fact that there will be hurdles along the way.” Today, the company’s success is testament

white. Everyone gets stuck in to get the job done. When I started at One4all, I remember once Christmas came around I’d finish my day job and then head to fulfilment and end up packing vouchers into envelopes until that day’s load was finished. We know that in a small business, everyone does a bit of everything so we’re here to try and help with their productivity, reduce their admin and put in place a really good rewards programme that’s easy to run and works smoothly.”

One4all HQ continues to operate a hybrid working approach which is, says David, proving successful with staff. Most are in the office either two or three days a week, but there is no hard and fast rule.

“From employee feedback, we learned that staff that were perhaps sharing an apartment and weren’t lucky enough to have the space to set up a small office were

to its hardworking, loyal staff and a commitment to providing the consumer with an ever-changing product. “We’re so proud of all staff members. They stuck with us throughout Covid and have had the opportunity to further their career, thanks to the acquisition by Blackhawk. There has been a lot of promotion across all departments, which has been great for morale.” From the get-go, One4all’s founder Michael Dawson wanted to create a small Irish brand that would reach new heights. “That’s what we’ve done. We’ve built a substantial product in the UK, we’ve launched in the Netherlands and over the next few years, our suite of products will be available across Europe. In five years’ time, think how great it would be for an Irish person to be holidaying in France to see a One4all Gift Card in the local supermarket. That’s what we’re working towards.”

“PUT SIMPLY, REWARDING STAFF WORKS. IT INCREASES MOTIVATION AND ENCOURAGES EMPLOYEES TO EXCEED THEIR OBJECTIVES AND GOALS. IT ALSO HELPS TO INCREASE EMPLOYEE RETENTION, WHICH IS VERY DIFFICULT AT THE MOMENT.”Ola Dybul

You must invest in your digital presence from the outset. That’s how the majority of businesses are found these days – on the web. No business can afford to ignore it. So while it can be a cost for your business when you are still in the early days, it is an essential expense that no business can do without.

Financial Wellbeing Nick Lawlor Managing Director, Employee Financial Wellness

Focus on your people. We need to remind ourselves that people are our business. Finding and retaining talent is more than paying a decent salary; it’s about their work environment and the support you provide. Supporting your employees regarding their mental, physical and financial health helps create a loyal and happy workforce! Good for employees, customers and your business!

PR Sharon Bannerton CEO, BannertonRelationships are key to an awful lot of business success. There’s much to be said for being human on the journey, making allowances for people, especially when you’ve no idea what’s going on in their lives. Celebrate the wins, see the disasters as a learning opportunity and most of all, be kind to yourself; you often need a friend like you!

There are many definitions, but there’s one thing that all great business leaders agree on, and that’s how success can only come by persevering despite failure.

The best piece of advice I can offer after 19 years running a small business is just be yourself. Play to your strengths and surround yourself with people who can complement those abilities. Entrepreneurs try to do everything themselves, but success comes from knowing what you’re good at and empowering those around you who are good at what you are not.

My advice is find your niche, start small, work hard and accept any help you can get along the way. Attention to detail, treating your staff well and being openminded is crucial. It helps to work in every part of the business; I can drive a forklift and unload pallets so can easily step in if there’s a staff shortage.

Cider Daniel Emerson Owner, Stonewell Cider

To achieve in a small business, one must be objective focused. A negative side effect is tunnel vision which can inhibit the ability to spot a shortcut along the way. Take time to stop, appraise and communicate with your colleagues in business. I am forever astonished at the amount of goodwill, advice and hard won experience that people will share freely.

“No matter what people tell you, words and ideas can change the world”

Robin Williams as John Keating in Dead Poets Society

a

UP WITH FOUR

TO TALK ABOUT TAKING

THE MARKET AND WHY STAFF

IS THEIR TOP PRIORITY

Back in 2001, Anne O’Connell was all set to swap Dublin for New York. After passing the New York bar exam, she secured a role at a small law firm in Manhattan but before she was due to leave Ireland, 9/11 happened. “The September 11 attacks had a huge impact on global travel. It would have been extremely difficult to get a Visa. So instead, I began working in the Chief State Solicitor’s Office, focusing on international litigation and employment law.” Around that time, Anne was involved in a number

of high profile employment law cases, one of which resulted in constitutional changes around citizenship. The next decade was spent in the employment law department at William Fry, followed by a couple of years at a smaller law firm. “I then discovered I had breast cancer. At that stage, I had clients that had come with me from my previous role so I continued working throughout my treatment. I think the work helped keep me going.” Although setting up on her own had never previously appealed, Anne decided to go it alone and in February 2017, established Anne O’Connell Solicitors. “I had friends who set up their own practices, but the amount of admin was always a deterrent. At the time though, I felt the people I was working with didn’t share the same views that I had, so it was time for a change.”

Located on Lower Baggot St in Dublin, Anne O’Connell Solicitors specialises in employment law and related issues. She has three solicitors working with her, along with two trainees, an intern and Harvey the dog, the in-house Wellness Manager. Growth is an ambition going forward but above all else, Anne wants to create an environment where staff feel supported. “I remember my oncologist telling me my cancer was due to stress. I never want any of my staff to feel pressurised or at breaking point. That’s why I got the dog! I’m very supportive when it comes to personal leave and employees can avail of counselling sessions. It’s not about the size of the practice; it’s about having a team that enjoy what they do.” Ensuring consistent quality service to clients is also top of the agenda, something that was recognised at the 2021 Irish Law Awards when the practice took home the award for Employment Law Firm of the Year. “Our approach to clients consistently adapts to their changing needs. I think we differ somewhat from other practices in that we’re constantly thinking of new ways to service our clients to facilitate their budget. We strive to provide the best possible service and that’s what we’ll continue to do.”

“OUR

TO CLIENTS CONSISTENTLY ADAPTS TO THEIR CHANGING NEEDS. I THINK WE DIFFER SOMEWHAT FROM OTHER PRACTICES IN THAT WE’RE CONSTANTLY THINKING OF NEW WAYS TO SERVICE OUR CLIENTS TO FACILITATE THEIR BUDGET.”

important that staff and partners are happy to come to work, for their own wellbeing and also because that job satisfaction feeds into the customer service piece.”

The Dublin-based practice currently has 28 members of staff. Sourcing staff is extremely difficult at the moment, says David. “A lot of the larger firms are actively trying to recruit. They’re in a position to offer higher rates of pay, which makes it difficult to compete. Overall, the market is quite buoyant at the moment but I think that will change in the next six to 12 months as the economy dips.” With a particular specialisation in employment law, David has seen a preponderance of working time cases coming across his desk in recent times. “Employees seem to be concerned with the number of hours they’re working, how many holidays

James Sherwin and David O’Riordan set up Sherwin O’Riordan, a practice specialising in corporate law, commercial litigation, employment law, commercial property and private client advice. Breaking out on their own was a daunting experience, says David. “If I knew then what I know now, it would have been even more daunting! It’s not something I’ve ever regretted though. What we found at the start was that work comes to you from places you’d never expect. Setting up on your own also allows you to venture into areas of law you may not have experienced before.” For over 20 years, David and his colleagues have worked to provide an excellent and personal service to all clients. “That’s something we’re really focused on. I also think it’s really important to mind the people that work with you. It’s so

they’re entitled to etc. Unfortunately, the Organisation of Working Time Act doesn’t really account for small business as it’s very difficult to implement.”

Sherwin O’Riordan doesn’t aspire to be the largest practice in Dublin, but expansion of the business is part of its long-term strategy. “Growth is all about people and that’s why solicitors are being head-hunted by other firms at the moment. There has also been an influx of law firms from other countries, particularly the UK and the US, who have either merged with or bought firms here. They’re also recruiting so it’s a difficult environment when it comes to finding talented staff.” Despite the firm’s success over the past two decades, David doesn’t feel complacent. “I think we provide an excellent service, but we don’t take it for granted. We’ve managed to gain our clients’ loyalty by doing our job properly and will hopefully continue to earn that loyalty into the future.”

“I THINK WE PROVIDE AN EXCELLENT SERVICE, BUT WE DON’T TAKE IT FOR GRANTED. WE’VE MANAGED TO GAIN OUR CLIENTS’ LOYALTY BY DOING OUR JOB PROPERLY AND WILL HOPEFULLY CONTINUE TO EARN THAT LOYALTY INTO THE FUTURE.”

until 1882, O’Connell Bridge in Dublin’s city centre was known as Carlisle Bridge. It’s the name that Carlisle Solicitors took on when the practice rebranded in 2017. Set up by Paul Tracey, Carlisle Solicitors has one main objective and that’s to help businesses get their debts paid. “One of the biggest challenges facing small businesses is debt management and in particular, debt recovery. Ensuring you have the right debt recovery solicitors by your side is half the battle and that’s where we come in,” said Sandrine Greene, Operations Director at Carlisle Solicitors. With almost 30 years under its belt, Carlisle Solicitors has a wealth of experience in debt recovery and enforcement at District Court, Circuit Court and High Court level. “I think we’re quite unique in the legal space in that we consider ourselves more like a business that provides legal services rather than a standard law firm. We really focus

on continuous improvement and innovation; for example, when it comes to technology, we have a best-in-class CRM system. We’ve been entirely paperless for almost 15 years, which is quite uncommon in the legal world.” The practice is also the first in Ireland to have a perfect 100% Gold Standard score in the Q9000 Legal Quality Standard audit since 2017 (“six years in a row, one more year to beat the GAA Dublin team record!”).

Client care is top of the agenda, says Sandrine, as is building relationships with small business. “Our aim is to be their go-to legal partner. Word of mouth is important and that’s why we have so much repeat business from small firms. We take care of their legal worries so they can get on with running their business.” In the current economic climate, particularly after Covid, it’s important that small businesses don’t neglect their debts. “If we were to give any advice at the moment, it

would be not to let debts pile up. Try to keep on top of them and obviously, we are here to help at every step along the way.”

Reconnecting with clients after Covid saw Carlisle Solicitors exhibit at the National Ploughing Championships. Plans are also in place for the team to attend the World Credit Congress in October. “It’s important for us to get out and meet our clients, particularly after the last couple of years. At Carlisle, the intention is really to live by our core values, which are to provide excellent client care, work together as a team and ultimately, do the right thing. We’ve worked hard to build a good reputation; now it’s about building on that foundation.”

“I THINK WE’RE QUITE UNIQUE IN THE LEGAL SPACE IN THAT WE CONSIDER OURSELVES MORE LIKE A BUSINESS THAT PROVIDES LEGAL SERVICES RATHER THAN A STANDARD LAW FIRM. WE REALLY FOCUS ON CONTINUOUS IMPROVEMENT AND INNOVATION.”

Councillor and is involved in various sports and community groups. In 2010, he was appointed a Notary Public for Life for Mayo and Galway. Myles is also a co-founder and member of the Westport Multi Agency Enterprise Group, an organisation that promotes new enterprise and supports established companies.

The decision to set up on his own was made during the recession, however it wasn’t quite the risky proposition that his friends and colleagues thought it to be. “It made sense as we’re quite different to other law firms. We provide specialist legal services to IT and professional service providers.

Before I set up on my own, I was an inhouse solicitor in a large tech company, so I already had that experience along with an established client base.” It was, says Myles, the best career decision he’s ever made.

“Twenty years ago, I couldn’t have dreamed I would be the principal solicitor of my own firm with a team of people that have such respect for each other. The work we do is really interesting; alongside Irish clients, we’ve negotiated contracts in the UK, US, across the EU, the Middle East, Asia and Australia.” Staff wellbeing is just as important as client service. “You get a lot of lawyers working crazy hours. Thankfully, I’ve

Myles Staunton & Co took home the Connaught/Ulster Law Firm of the Year award. “To have received that kind of recognition from a panel of esteemed lawyers was very gratifying. More importantly, it gave the team a great boost; we have a very talented, hard-working team of eight here and so for them to be recognised in that way was very special,” said Myles Staunton, Principal Solicitor.

Myles set up his practice 14 years ago in his hometown of Westport. He’s proud of his roots and of the town he grew up in; over the years he has held the role of Town

avoided falling into that trap. We work 9am to 5pm Monday to Friday, but we work very hard. By 6pm, no matter what’s going on, there shouldn’t be anyone in the building.”

A loyal client base and excellent word of mouth has seen the company thrive over the years. Going forward, the plan is to continue to provide an excellent service to customers, both old and new. “There’s an element of if it’s not broken, don’t fix it. For some, that might not be ambitious enough but I think that sometimes, you have to pinch yourself and look at where you are. Right now, I’m very happy leading a really good team.”

“THERE’S AN ELEMENT OF IF IT’S NOT BROKEN, DON’T FIX IT. FOR SOME, THAT MIGHT NOT BE AMBITIOUS ENOUGH BUT I THINK THAT SOMETIMES, YOU HAVE TO PINCH YOURSELF AND LOOK AT WHERE YOU ARE. RIGHT NOW, I’M VERY HAPPY LEADING A REALLY GOOD TEAM.”

For many Irish companies, 2022 was the year to fully embrace Ibec’s KeepWell Mark Programme, evaluate their systems and implement a customised roadmap detailing how to create or enhance their own internal wellbeing strategy. This year, the KeepWell Mark Awards (September 8th) celebrated all the companies who are excelling in their commitment to workplace wellbeing.

Company of the Year (large) BIOMARIN

Company of the Year (SME) THE CONVENTION CENTRE DUBLIN

Best in Class Leadership DECARE

Best in Class Mental Health

RCSI UNIVERSITY OF MEDICINE AND HEALTH SCIENCES

Best in Class Physical Activity BOSTON SCIENTIFIC GALWAY

Best in Class Nutrition

EXYTE NORTHERN EUROPE LIMITED

To learn more about benchmarking your corporate wellbeing strategy with The KeepWell Mark, visit www.thekeepwellmark.ie and take our mini assessment.

Here, we focus on two SMEs who share their insights and learnings on improving workplace wellbeing.

SME Company of the Year – The Convention Centre Dublin

”We implemented our first wellbeing programme in 2016, but the challenges of the pandemic highlighted the importance of wellbeing for us all.

While businesses across the world had to pause business or shut down, we saw this as an opportunity to open up to one another.”

The Convention Centre Dublin concentrates its Wellbeing Strategy firmly around open communication. Employee feedback is highly valued and employees are encouraged to ask questions. Sitting at the heart of the strategy is The Listening Group. This space allows for ongoing, authentic conversations between all levels. A wide range of issues and suggestions are aired here. Most importantly, employees hear and see that their feedback has been listened to and acted upon through practical outcomes and benefits.

The results of this strong employee engagement programme have seen the sense of employee belonging and trust flourish, increased positive communications on all levels and led to employee-driven operational efficiencies.

“Our KeepWell focus groups have helped us to see what really matters and the things that help to make a meaningful difference in the quality of life of the DeCare Team.

This insight helps people to develop individually, which inspires and drives the team as they lead DeCare’s development and continue to make an impact on society.”

Introducing remote and hybrid working was a challenge that DeCare turned into an opportunity, by listening to their employees. The genuine leadership shown, in the midst of the pandemic, demonstrated an authentic dedication to employee wellbeing. This generated trust and appreciation amongst employees during what, for most companies, proved a fraught time.

Employees displayed gratitude at being able to balance work and family responsibilities and having the trust of management to do so. DeCare continuously invests in its employees’ wellbeing and their potential. Cross-training is an integral part of workforce development. The skills enhancement and learning opportunities mean that employees feel valued and also supports internal promotion. Meaningful changes were made across a range of existing systems and new ways of working were introduced. This significant investment in time and commitment from leadership ensured that the changes were properly supported, resourced and embedded into the culture of DeCare.

implemented legislation and any related government guidance to be published before making any changes.

Many of the requirements in the new Directive are already provided for under Irish Employment Law in acts such as the Terms of Employment (Information) Acts 19942014 and the Employment (Miscellaneous Provisions) Act 2018. Such legislation sets out that all workers have the right to receive a statement of their terms and conditions within a week of starting work. e list of required particulars for all workers and employees includes core terms such as place of work, paid leave entitlement, pay, notice and details of working pattern, including in particular whether it is predictable or unpredictable. Where the work pattern is entirely or mostly unpredictable, the employer must state the number of guaranteed paid hours, the pay for work performed in addition to those guaranteed hours and the reference hours and days within which the worker may be required to work. However, under this Directive the list of information employers must provide to workers and the noti cation obligations has been extended.

e Directive requires employers to provide employees no later than seven days a er their start date the following in writing:

(not just the duration of the contract)

Details and duration of probationary periods

Place of work, or where there is no main place of work, a statement indicating that an employee is required or permitted to work at various places

Title, grade, nature or category of the work or a brief description of the work

e key provisions of this Directive include:

A six-month limit on probationary periods e right of an employee to request to be transferred to a form of work with more predictable and secure working conditions

Training obligations

A ban on exclusivity clauses

EU Member States were given a deadline of 1st August 2022 to transpose the new rules into their national legislation, however, the Irish Government has yet to publish dra legislation implementing this Directive. erefore, employers should wait for the

For predictable working patterns:

> e length of the standard working day or week

> Overtime and shi changes

For unpredictable working patterns:

> e number of guaranteed paid hours per week

> e remuneration for hours worked in excess of the guaranteed hours

> e hours/days within which the worker may be required to work

> e minimum amount of advance notice provided to employees about working hours.

There will be a prohibition on probationary periods exceeding six months unless on an exceptional basis. This is justified by the nature of the employment or the worker’s interests. Absence during the probationary period will justify an extension of equivalent duration. Any probation periods in fixed term contracts must be proportionate to the overall duration. Furthermore, the Directive stipulates that a probationary period will be prohibited in the event of a fixed term contract renewal.

Workers with at least six months service with the same employer and who have completed their probationary period will have a right to request to transition to a more predictable and secure position, provided an opportunity is available. Where an employer declines this request, the employer must provide detailed written reasons, generally within one month of the request, explaining the rationale behind the decision.

Where mandatory training is prescribed under EU law, national legislation or collective agreements, the employer must pay for it. It must count as working time and where possible, it must take place during working hours. The Directive introduces a new requirement that the employer no later than one month of the start date of employment must provide the employee with their mandatory training entitlements in writing.

Any variations to the terms of employment must be notified to the worker at the earliest opportunity and at the latest, on the day on which the change takes effect.

It will become unlawful to prohibit workers from taking up employment with other employers outside working hours, unless this can be justified by objective grounds such as health and safety, protecting business confidentiality or avoiding conflicts of interests.

Once the Directive is enacted, employers must review and update their existing policies

Due to commence in 2024, The Government's Automatic Enrolment Retirement Savings System will provide employees access to a workplace pension scheme, co-funded by their employer and the State

Employees will have a choice of four retirement funds to choose from and if they don’t express a preference, they will be enrolled into a default fund. The scheme is designed to encourage workers to save for their retirement and to allow them to maintain a reasonable standard of living when they reach retirement age.

Employees aged between 23 and 60, with earnings over €20,000, will be automatically enrolled in an occupational pension scheme, however, employees with existing pension schemes won’t be automatically enrolled. Employees who earn less than the income threshold or are aged outside of the 23 - 60 age bracket can opt into the scheme if they wish. Participation in the scheme is optional and employees have the option to opt-out at their discretion.

Contributions will be made by employees and matched by their employers as a percentage of the employee’s gross income. The State will also make contributions towards the employee’s pension fund, providing a top up of €1 for every €3 contributed by the employee. Employer and State top-up contributions will be capped at a maximum of €80,000 of an employee’s gross salary. Employees can contribute on earnings greater than €80,000 if they wish.

Years 1-3 1.5% 1.5% 0.5%

Years 4-6 3.0% 3.0% 1.0%

Years 7-9 4.5% 4.5% 1.5%

Years 10+ 6.0% 6.0% 2.0%

The system is designed to minimise administrative costs and burdens for employers. The Government has advised a Central Processing Authority (CPA) will be established to manage the auto-enrolment scheme. Employers won’t be required to set up and run an occupational pension scheme. The CPA will be responsible for the operation, coordination, supervision and development of the system. Employers will be responsible for recording all the relevant employee data via their payroll system.

Further information and more details on the key features of the Government’s Auto Enrolment Scheme are available at www.gov.ie. The SFA will continue to update members on the introduction of this new scheme.

In September, the SFA launched a new report examining the Cost of Doing Business in 2022 for Ireland’s small business community. The report outlines the range and extent of costs associated with doing business in Ireland and provides insights on challenges faced by our smallest employers.

The total average cost of doing business for all small (10-49 employees) micro (<10 employees) firms is €138,814 per month. The average for micro businesses is €66,426 and €193,535 for small

On average, labour costs amount to 82% of overall monthly business costs. Banking and other costs (5.6%) is second highest, followed by transport/ insurance (5.1%), all property costs (4.9%) and all utility costs (2.4%)

Half (52%) of all businesses with fewer than 50 employees are currently managing debt. Bank loans (63%), other financing loans (28%) and tax debt (22%) are the three biggest forms of debt for businesses

The average debt for micro and small businesses is €80,903, lowest for micro firms at €56,774 and highest for small businesses at

€107,149

Rising business costs is the top challenge facing small

firms

For small firms with rental or lease costs, more than half (55%) have had a rent increase including 20% having spoken with their landlord about the need to increase rent

Small enterprises are under pressure to increase employee wages (56%), provide additional employee benefits (26%) and more remote workings supports (18%).

The report highlights that Ireland’s smallest enterprises are facing cost challenges in every area of business be it labour, transport, insurance, banking or utility costs. Many operate in low margin environments, making it difficult for them to absorb cost increases and demand for value makes it impossible for many to pass the increase onto customers. At a time of high inflation and no end in rising input prices, notably energy prices, the SFA is concerned that we may see viable enterprises closing due to their inability to absorb rising business costs.

Of course, it’s easy to look at these insights and be fearful of what is to come but it is also worth noting the resilience of the Irish business community. More people are employed in Ireland now than ever before. The unemployment rate in July of this year was the lowest it’s been in 21 years. This is incredible given where the economy was a couple of years ago; with the recession, pandemic and Brexit, it’s testament to the resilience of Irish owner/managers.

Looking ahead, indicators suggest a moderation

pay. Whilst many of these additions to the so-called Social Wage have merit on their own terms, these policies will make the business landscape more difficult in the coming months. At a time when many small firms are trying to be competitive, viable and profitable, it is vital that all budgetary measures are assessed for their impact on small firms by implementing an SME Test.

Furthermore, with such low unemployment rates we believe that the National Minimum Wage rate in 2023 should be retained, as a great many small business employers pay high rates. An everincreasing base will lead to wage inflation and job losses. Due to its effect on labour costs and the continued uncertainty of Brexit, particularly around the Northern Ireland Protocol and the continuing war in Ukraine, the phased introduction of the Living Wage should be postponed until 2024 to 2027.

At this juncture, we must continue to prioritise entrepreneurship. SFA would like Capital Gains Tax to be reduced to 20% and the lifetime limit for

"THE REPORT HIGHLIGHTS THAT IRELAND’S SMALLEST ENTERPRISES ARE FACING COST CHALLENGES IN EVERY AREA OF BUSINESS BE IT LABOUR, TRANSPORT, INSURANCE, BANKING OR UTILITY COSTS. MANY OPERATE IN LOW MARGIN ENVIRONMENTS, MAKING IT DIFFICULT FOR THEM TO ABSORB COST INCREASES AND DEMAND FOR VALUE MAKES IT IMPOSSIBLE FOR MANY TO PASS THE INCREASE ONTO CUSTOMERS.”

of economic activity and this could slow the pace of employment growth in the second half of the year and into next year. Therefore, now is the time to control costs here at home and maintain competitiveness in Budget 2023.