ISSUE 13

RSA R45.00

INSIDE

The African Development Bank’s new report calls for bold policy actions How Africa can capitalise on its mineral wealth to develop an electric vehicle value chain

ISSUE 13

RSA R45.00

The African Development Bank’s new report calls for bold policy actions How Africa can capitalise on its mineral wealth to develop an electric vehicle value chain

Try and try again Entrepreneurs know that failure is sometimes necessary —here’s what we can learn from it

The president of IRMSA is helping to make a difference in how risk management is perceived both in South Africa and globally

Reliable measurements are vital not only to verify that products and services comply with the legislation that exists to protect the consumer and our environment but also to support trade and industry. Reliable measurements in analytical testing laboratories can only be achieved through the use of accurate measurement standards also known as reference materials (RMs).

The National Metrology Institute of South Africa (NMISA) established its reference material production facility to provide laboratories with Africarelevant RMs. These RMs are used for quality control, method validation and to establish measurement traceability. The use of RMs and regular participation in proficiency testing allows laboratories to demonstrate continued analytical competence.

The Reference Material Production Facility is equipped with state-ofthe-art equipment that allows the Institute to process diverse materials according to the requirements of the international standard ISO 17034 for reference material producers. The various equipment available in the facility makes it possible for the Institute to mill, mix, sieve, freeze-dry and package different materials in suitable packaging for an extended shelf-life, and store them in temperature-monitored refrigeration facilities.

NMISA is a leading National Metrology Institute (NMI) in Africa.

We shorten the traceability chain for NMIs on the continent, by providing excellent and internationally recognised quality-certified RMs. Through this facility, the Institute aims to enable fair trade by ensuring labs that are involved in testing and calibration have access to our reference materials which are sustainable, affordable and easily accessible.

The showcase instrument in the reference material production facility is the patented Resodyn Resonant Acoustic Mixer ™ (RAM) 5, possessing multiple functional benefits over other traditional mixers. This production-scale state-of-the-art technology is designed to mix notoriously difficult substances without the need for impellers or agitators. The RAM uses sound energy to effectively and efficiently process powders, pastes, liquids, and combinations thereof with breakthrough speed,

The

(RAM) 5 uses sound energy to process powders, pastes, liquids, or combinations thereof effectively and efficiently with breakthrough speed, quality and repeatability.

quality and repeatability. The RAM 5 is complemented by a laboratoryscale benchtop mixer, the LabRAM II unit, which is used for visualising the mixing behaviour of materials, during small-scale research and testing. The mix parameters can then be scaled up to the RAM 5 for pilot-scale production. Materials produced here, are analysed by the NMISA materials characterisation unit, where a host of analytical techniques such as Scanning Electron Microscopy and Xray Photoelectron Spectroscopy (XPS), Particle Size Distribution (PSD) and Xray Diffraction (XRD) are applied.

One of the many benefits of the RAM 5 is that it uses less energy, making it a green technology. Fundamentally, this machinery uses low-frequency (sound) waves to achieve resonance and once this is achieved, it requires less energy to mix chemicals. It is built on flexible and universal processing options like vacuum,

Resonant Acoustic Mixertemperature control, and customised mixing vessels. The other benefit is that it does not, like other mixers, have blades. This means it does not have a lot of contact with the material whilst mixing. It, therefore, does not require a lot of cleaning, making it easy to maintain.

The applications of this technology are endless. This mixing technology can benefit, among others, the nanotechnology, pharmaceuticals, mining and energy sectors. Its advantages extend to a myriad of uses and applications such as dental products, batteries, ceramics, lubricants, pigments, adhesives, sealants and advanced materials to list but a few.

The technology can contribute significantly to the cosmetics space, especially the essential oils market, making it easy for clients to blend their essential oils with other materials such as moisturisers and creams or blends with other oils. This is further supported by NMISA’s essential oils testing services offered through the Africa Reference Institute. The ARI provides supporting information about the material that has been tested and the content of the test certificates. In this instance, clients can benefit from more than just using the acoustic mixer. There are also services available to bottle and label these products, as the production facility label printer complies with the Globally Harmonized System of Classification and Labelling of Chemicals (GHS).

Various Industries are supported including:

• Additive Manufacturing

• Adhesives and Sealants

• Advanced Polymer Systems

• Batteries

• Biotechnology

• Ceramics

• Chemicals

• Cosmetics

• Dental Products

• Electronics Materials

Since the acquisition of the technology in 2017, NMISA has found great value in contributing to fields such as feed additives, predetonation mixes and biofuels. For the most part, the Institute has been using the technology which provides the best performance in terms of homogeneity and reproducibility for reference materials production.

NMISA prides itself on being a “one-stop shop” for metrology services in Africa. Not only can the Institute prepare and mix products for clients through the reference material production facility, but it can also meet clients’ additional needs for calibration and analysis through other services from the Physics and Electromagnetism (PEM) and Chemistry, Materials and Medical Metrology (CMM) divisions. Analysis and calibration training is provided through our recently established Training Centre.

• Energetics: Explosives

• Energetics: Propellants

• Energetics: Pyrotechnics

• Lubricants

• Nano-Materials

• Pharmaceuticals

• Pigments

• Sintered Materials

As an entity funded by the Department of Trade, Industry and Competition (the dtic), NMISA recognises the importance of making these technologies available to all potential users that would otherwise not have access due to cost and infrastructure constraints. This enables NMISA to assist potential users to develop innovative products that they otherwise may not have been able to. Access to NMISA’s technology also means access to the Institute’s skills and expertise, providing a boost to entrepreneurs and Small and Medium-sized Enterprises (SMEs) in South Africa and on the continent. African countries no longer need to turn to international partners when these measurement solutions are available in South Africa

NMISA remains dedicated to supporting trade and industry, enabling new product development and manufacturing, supporting entrepreneurs and SMEs, creating employment and enhancing the African economy. Contact us at ReferenceMaterials@nmisa.org to find out how our measurement solutions can benefit you.

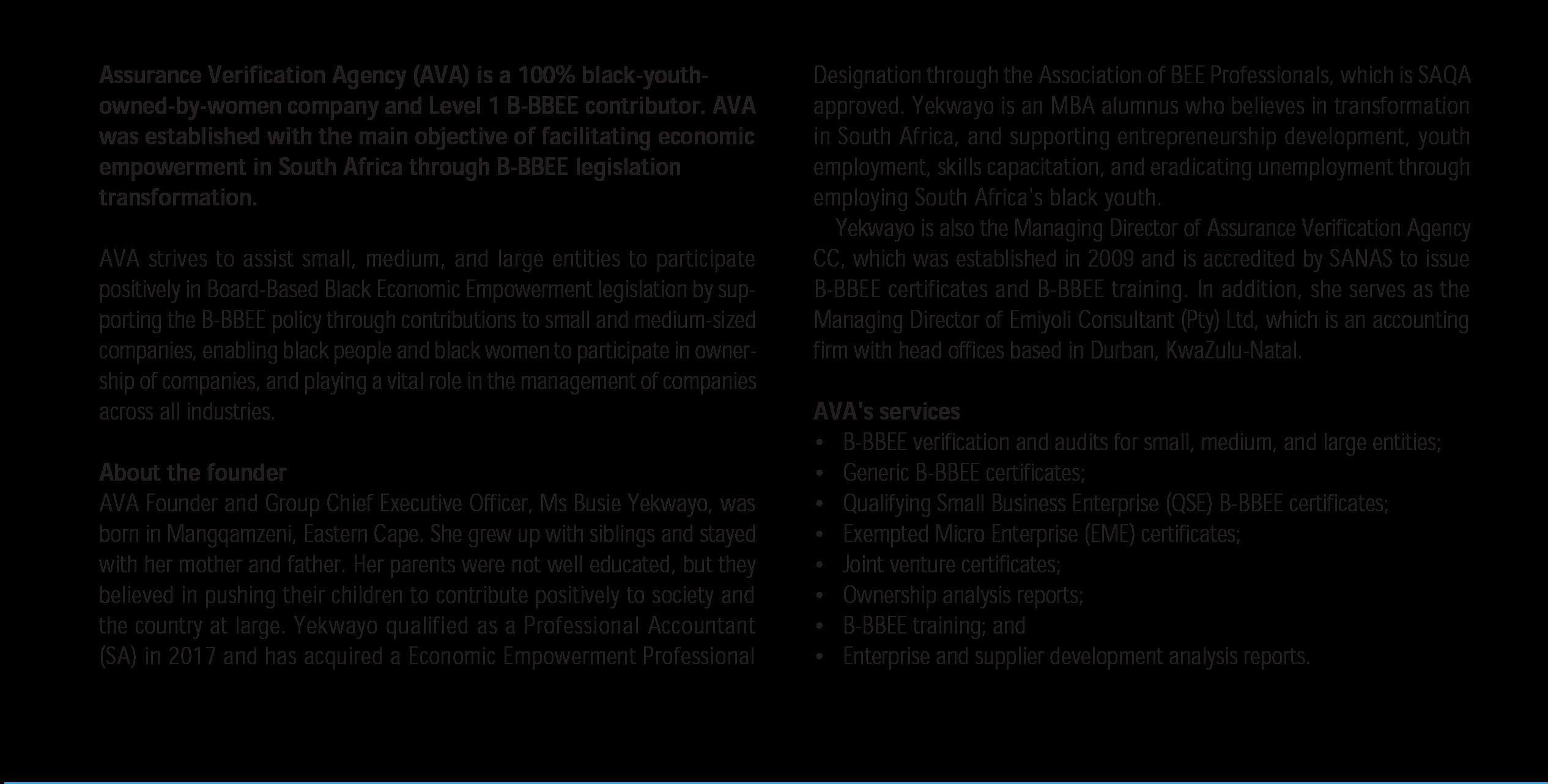

The Resonant Acoustic Mixer (RAM) 5 LabRAM II acoustic mixerWelcome to the inaugural African Business Awards, South Africa’s premier awards for leaders & businesses in South Africa. The result is that committed South Africans, from across all sectors, are motivated to pursue equally impressive success. All individuals and organizations are honored for their contribution to the South African economy.

8 FROM THE EDITOR

Please your star player

10 MEET UP

Rub shoulders and conduct business with the high-flyers in African business

16 BUSINESS TRAVEL: BACK IN .THE AIRPLANE SEAT

Companies and individuals should consider the changed playing field before resuming business travel full throttle

20

Risk professionals need to continuously assist their organisations in identifying what potentially lies ahead: risks (threats and opportunities), prepare them to respond and navigate through disruptions, and accelerate their organisations out of disruptions and launch them into the new reality. The Institute of Risk Management South Africa is dedicated to the advancement and practice of the risk management profession and accreditation. Its president Thabile Nyaba is helping to make a difference in how risk management is perceived both in South Africa and globally.

RENEWABLE ENERGY: UNDER THE SUN

Solar mini grids could power half a billion people by 2030—if action is taken now

24 GAS: SETTING SAIL

The MSGBC region’s first hydrocarbon production is officially drawing near, opening up new opportunities for broader economic growth

28

OIL: SCRAPING THE BARREL

Why peak advantage is the defining upstream challenge of our time

32

How Africa can capitalise on its mineral wealth to develop an electric vehicle value chain

36 SUPPLY CHAIN: MATERIAL IMPACT

Supply chain management in Africa needs a rethink. COVID-19 changed everything—or did it?

40

SKILLS DEVELOPMENT: EMPOWER THE PEOPLE

Addressing skills shortages in the South African renewable energy sector

44 TRANSPORT: CLIMATE-FRIENDLY RIDES

eWAKA is spearheading sustainable mobility to enhance Africa’s economic prospects by harnessing the power of electric vehicles

48

HUMAN CAPITAL: CULTURE CHANGE

How to keep your hybrid teams in a toward (engaged) state and switched on

52 INFRASTRUCTURE: WHO WILL WIN

Africa’s ports race is hyped as ‘development’, but also creates pathways for plunder

68

56 ECONOMICS:

The African Development Bank’s new report calls for bold policy actions to help African economies mitigate compounding risks

60 BANKING & FINANCE: TAKE INTO ACCOUNT

Digital banking is the in-thing, but it excludes many users in Tanzania and Senegal

64 ENTREPRENEURSHIP: TRY AND TRY AGAIN

Entrepreneurs know that failure is sometimes necessary—here’s what we can learn from them

68

MANUFACTURING: RISE OF THE MACHINES

What employees think about the consequences of automation and increased use of robots

72 AGRICULTURE: MORE GROWTH .REQUIRED

Digital solutions are boosting agriculture in Kenya, but it’s time to scale up

76

Kenya and South Africa offer insights into digital economy challenges and alternatives

Welcome to African Business Quarterly 13, our first edition for 2023. How time has flown. It seems just an instant ago we were ringing in the new year. Yet, here we are in March, approaching the end of the first quarter.

It has been a frenetic time as deadlines have had me hopping. Fortunately, I’ve been able to slip in some downtime with relaxing weekends away—they are a buffer against the ravages of the stresses of today’s fast-paced world.

Alas, weekends don’t last, and soon it’s back once again to deadlines, meetings and interviews in short order. However, my short breakaways not only help refresh me but also remind me that once in a while we need to take a step back from our busy lives. As South Africans, we face daily pressures (stage 6 loadshedding, among others) and often forget to take care of our health and maintain the work-life balance.

As American stand-up comedian Katt Williams said, “you got to please your star player”—that’s the person in the mirror, YOU. There are enough haters out there looking to do you dirty. So this year, take control and blossom.

I wish you all a prosperous and fulfilling 2023.

PUBLISHER

MANAGING EDITOR

COPY-EDITOR DESIGN

EDITORIAL SOURCES

Donovan Abrahams

Ashley van Schalkwyk ashley@avengmedia.co.za

Tania Griffin

tania@avengmedia.co.za

Christine Siljeur

Kauthar Renamé

TheConversation.com

AfDB, World Bank Group Energy Capital & Power Enel Green Power SA

Kaspersky SA, eWAKA

Wood Mackenzie

Brian Eagar, NJ Ayuk

PHOTOGRAPHIC SOURCES

PROJECT MANAGER

ADVERTISING SALES

Adobe Stock

Donovan Abrahams

Lunga Ziwele

Viwe Ncapai

Carl Chothia

Andre Evans

Charlton Peters

Mphumzi Njovana

ACCOUNTS

CLIENT LIAISON

ONLINE CO-ORDINATORS

HR MANAGER

PRINTER

DISTRIBUTION DIRECTORS

PUBLISHED BY

Benita Abrahams Bianca Alfos

Majdah Rogers

Majdah Rogers

Ashley van Schalkwyk

Freddy Shikwambana

Colin Samuels

Print on Demand

www.abizq.co.za, issuu.com

Donovan Abrahams Colin Samuels

Aveng Media

ADDRESS: Boland Bank Building, 5th Floor, 18 Lower Burg Street, Cape Town, 8000 Tel: 021 418 3090 | Fax: 021 418 3064

Email: majdah@avengmedia.co.za

Website: www.avengmedia.co.za

DISCLAIMER:

© 2023 African Business Quarterly magazine is published by Aveng Media (Pty) Ltd. The Publisher and Editor are not responsible for any unsolicited material. All information correct at time of going to print.

The Southern African Gas Association ensures persons working in the natural gas, liquid fuels and biogas environment are trained and competent to undertake work which complies with the local regulations and health and safety standards in order to provide safe and efficient operations from point of supply to users in the residential, commercial and industrial markets within Southern Africa. Covers applications in Industrial Thermoprocessing (TPE), Compressed Natural Gas (CNG), Liquified Natural Gas (LNG), Biogas, Liquid Fuels, Natural Gas Vehicles (NGV) and Fuelling Stations

The Southern African Gas Association ensures persons working in the natural gas, liquid fuels and biogas environment are trained and competent to undertake work which complies with the local regulations and health and safety standards in order to provide safe and efficient operations from point of supply to users in the residential, commercial and industrial markets within Southern Africa. Covers applications in Industrial Thermoprocessing (TPE), Compressed Natural Gas (CNG), Liquified Natural Gas (LNG), Biogas, Liquid Fuels, Natural Gas Vehicles (NGV) and Fuelling Stations.

1. Establishing bilateral agreements

1. Establishing bilateral agreements

2. Representation at the SADCSTAN

2. Representation at the SADCSTAN

3. Collaboration with Government and Industry Stakeholders on Regulations, Health and Safety Standards

3. Collaboration with Government and Industry Stakeholders on Regulations, Health and Safety Standards

4. Ensuring safety through training and skills development

4. Ensuring safety through training and skills development

5. Ensuring competent persons licenced to work on gas

5. Ensuring competent persons licenced to work on gas

6. Practical assessments of competencies and compliance requirements for gas systems; installation, operations, maintenance, commissioning, start-up and shut down activities and much more. . .

6. Practical assessments of competencies and compliance requirements for gas systems; installation, operations, maintenance, commissioning, start-up and shut down activities and much more. . .

www.sagas.co.za

Equipment Safety

Compliance verification of equipment used in natural gas, liquefied petroleum gas (TPE applications), liquid fuels and biogas industrial applications, locally manufactured, imported or supplied prior to being placed in the market Includes NGV, CNG/LNG industrial and fuelling stations

Compliance verification of equipment used in natural gas, liquefied petroleum gas (TPE applications), liquid fuels and biogas industrial applications, locally manufactured, imported or supplied prior to being placed in the market Includes NGV, CNG/LNG industrial and fuelling stations

Preventing the supply and installation of sub-standard equipment.

16 & 17 March

Cape Town International Convention Centre, South Africa

www.gtreview.com

Over two days, this one-of-a-kind event will welcome around 650 participants from the region’s trade, commodity and export finance community. Delegates will gain unrivalled insights into the latest trends and developments impacting African trade, export and infrastructure financing through an extensive programme of more than 60 expert speakers, while the exhibition hall will provide an invaluable opportunity for participants to network and connect with industry leaders, peers and potential clients.

28 & 29 March

Kigali Convention Centre, Rwanda

microfinancetechsummit.com

Microfinance is considered a tool to alleviate poverty in Africa, as it contributes a big percentage toward access to finance for many Africans. This summit aims to create and strengthen bonds between microfinance institutions and technology companies, bringing them together along with more than 500 of the most senior representatives from banks, regulators and policymakers.

29 March

2023

Protea by Marriott Hotel Johannesburg Balalaika

Sandton, South Africa

www.mncapitalgroup.com

The Africa ETFs Investment Conference will bring together key institutional investors and asset owners, index providers, ETF issuers, asset managers, exchanges, technology solutions providers, registered investment advisers, academics and more to explore new opportunities for achieving superior investment performance through the utilisation of an ever-expanding array of indexes and tradable index products.

29 & 30 March

Indaba Hotel, Fourways, Johannesburg, South Africa

www.tci-sa.co.za

Financial services firms such as banks, insurance companies, fintechs and other service providers are facing more complex regulations than ever before—making today’s corporate environment more complex and demanding than at any point in history. This conference will focus on bringing the main role-players from banks, insurance companies, financial services, services providers and government together at one forum to discuss and learn how they can tackle the challenges faced by financial institutions on meeting regulatory and reporting requirements. The conference programme will analyse the effect of a change in laws and regulations that could potentially cause losses to your business, sector or market.

29 & 30 March

The Maslow, Sandton, Johannesburg, South Africa

itnewsafrica.com

IoT Forum Africa is the premier African event on the Internet of Things. It will bring together business leaders, government functionaries, IT decision-makers, technology service providers and IoT experts to equip attendees with the knowledge and tools needed to plan and implement successful IoT projects. This year’s topics include: industrial IoT; IoT strategy; Big Data and IoT; smart cities; ethical IoT; and cybersecurity.

24 & 25 May

Cape Town International Convention Centre, South Africa

marketingindaba.com

This popular marketing conference will again inform and inspire the professional marketer as well as those keen to get fresh ideas on marketing their products and services. Delegates will get the opportunity to listen to more than 14 marketers and industry leaders covering an array of current topics of the marketing discipline.

ith the turmoil in the global economy, the political landscape and the fallout from the COVID-19 pandemic, many questions have been raised regarding the value proposition of risk management. This is because seemingly well-run corporates have failed during this period—and are still failing—despite perceived good leadership, good governance, good risk management, compliance and reporting.

The answer is clear: “Leadership can no longer rely on past habits and behaviour to address unprecedented modern crises. They need foresight skills and responsiveness to crisis and disruption. That is why Risk professionals need to continuously assist their organisations in identifying what potentially lies ahead: risks (threats and opportunities), prepare them to respond and navigate through disruptions, and accelerate their organisations out of disruptions and launch them into the new reality. Organisations need to be enabled to respond, adapt and thrive; to create and preserve value as we continue to operate in times of unprecedented risks, uncertainty, and disruptions. Risk management therefore, can no longer be dealt

Wwith in isolation but needs to be integrated with strategy, performance and resilience”

This is where The Institute of Risk Management South Africa (IRMSA) plays a huge role. IRMSA is dedicated to the advancement and practice of the risk management profession and accreditation, through research, promotion, education, upliftment, training, guidance and strong relationships with other institutes and associations. It not only promotes and supports the interest of its members, but also protects the public interest.

It was formed in September 2003 through the amalgamation of the Society of Risk Managers and the South African Risk & Insurance Manager Association. It is the only professional body for risk management in South Africa, recognised as such by the SA Qualifications Authority in 2012—representing individuals and companies committed to the enhancement of the risk management discipline. Since its inception, IRMSA has shown a commitment to ethical and visionary leadership, growing the profession even through the challenges of the recent years.

IRMSA is a member of the International Federation of Risk Management and Insurance Associations (IFRIMA), the international umbrella organisation for risk management associations, representing 20 organisations

and over 30 countries around the world. With its roots going back to the 1930s, and its development through the discipline of insurance and risk management, IFRIMA is uniquely positioned as a leader in risk management and the application thereof, providing a forum for interaction and communication among risk management associations and their members.

IRMSA has a training centre that enables continuous personal development opportunities for the risk management community, and an opportunity to write the IRMSA Board Exams. The institute awards two designations: the Certified Risk Management Practitioner (CRM Prac) as well as the Certified Risk Management Professional (CRM Prof). The IRMSA designation certification ensures a national standard is created and maintained in terms of the competencies and knowledge required from designations. Furthermore, the designations ensure IRMSA continues to uplift risk professionals and the profiles of its members, maintaining a code of conduct for the risk management profession.

The IRMSA Centre of Excellence was established to collaborate with risk professionals and business leaders in both the private and public sectors—including small, medium and micro enterprises (SMMEs)— to transform risk management into a key component of excellent decision-making. By doing so, the institute’s offering includes insights, advice and coaching on how to design, implement and mature risk management in practice through IRMSA’s extensive strategy, risk and resilience knowledge.

As president of IRMSA, Thabile Nyaba is helping to make a difference in how risk management is perceived both in South Africa and globally

We need to evolve as an institute, professional body and profession—and IRMSA does not shy away from responding to these challenges

Thabile Nyaba has been the president of IRMSA since 2020, but was already involved in IRMSA governance structures for five years prior to that appointment. Her overarching goal is to support the IRMSA team, board and other volunteers to continue to grow and develop the organisation for its members— both individuals and organisations. “Continuous learning, unlearning and relearning is key to our future growth, no matter the role one plays within the organisation,” she says.

She is committed to building riskintelligent organisations and has led teams in various organisations that have been voted industry leaders in risk management. She is currently a chief risk officer at Old Mutual Insure as well as the chair of the company’s Women’s Network and Transformation & Responsible Business committee. In addition, she has her own NGO focusing on connecting youth with opportunities.

“I am a woman of many passions and I have my family who keep me grounded—as a Mother, Wife, Sister, Friend and Daughter,” says Nyaba. “My strength is unleashing the greatness in those I serve, using happiness, authenticity and passion.”

Being president of IRMSA, she adds, has allowed her to help make a difference in how risk management is perceived—both in South Africa and now globally, through her recent appointment as a board member of IFRIMA.

In the busy, fast-paced environment of risk management, IRMSA is a pioneering collaboration in addressing the compounding and influential risks. It focuses on building long-term relationships with its stakeholders in the private sector, public sector, academies and SMMEs. “Our stakeholders include all our members and non-members alike, our community of risk professionals and fellows, and all those who offer their expertise and time (for free) to lead and capacitate our varied committees that direct and operationalise IRMSA,” explains IRMSA president, Thabile Nyaba.

What sets IRMSA apart in its field, she says, is that the institute “continuously has the difficult conversation with ourselves, asking and answering the uncomfortable questions to keep us relevant, future-fit and sustainable. As the professional body representing risk practitioners in South Africa and striving to be a thought leader in risk management, consequently, means we need to evolve as an institute, professional body and profession—and IRMSA does not shy away from responding to these challenges,” asserts Nyaba.

2022 was a productive year for IRMSA. Notable among its achievements was the release of its new integrated risk management framework: a thought leadership concept that enables organisations—through the integration of strategy, risk, and resilience—to improve decision-making and respond, adapt, and thrive in uncertainty (irmsa-guideline.co.za).

There was also the publication of the IRMSA Risk Report: South Africa Risks 2022 (www.irmsarisk-report.co.za/2022). “This has become one of IRMSA’s flagship deliverables,” says Nyaba. “The purpose of this report is to allow business leaders to have insights into the risk landscape in which South Africa exists and its people function, to be able to use this information as input into their strategy setting and execution processes, while integrating effective risk management—leading to quality decision-making.”

The next edition of the IRMSA Risk Report, the ninth, will be released in June 2023.

Nyaba says her tenure at IRMSA has been “colourful and fascinating”. “On a personal level, it has provided me with an opportunity to meet and interact with great minds from different business sectors across the country and globally.

On a professional level, she believes that during her tenure IRMSA has been able to demonstrate both agility and adaptability in any situation. She cites a few examples:

“How we responded to one of the worst humanitarian crises impacting the entire world allowed me to put all my leadership and risk management skills into practice. Like most organisations, our operations were impacted, and we had to step up and level up for our members, their organisations and our staff. Between the Exco and Board, we had to be decisive, flexible, agile and be able to adapt to ensure the resilience and sustainability of IRMSA.

“During COVID-19, we were among the first to move all activities onto digital platforms. IRMSA was proud to work with Food Forward SA, supporting this nongovernmental organisation in assisting disadvantaged families with access to food. This initiative also allowed us to introduce a positive community focus into our response strategy and we really appreciated the support we received from members and our staff.

“Our continued growth in volunteers and our ability to support and demonstrate the elevated role of risk management in organisations has been extremely rewarding. I believe business leaders, more than before, appreciate the role of risk management, the insight and support they receive from the risk management profession to better navigate and thrive through and beyond crises/disruptions.”

Nyaba adds that IRMSA’s relationship with the South African government through the Presidency has also been strengthened. IRMSA obtained a special invite to the Forum of South African Directors-General, where it was agreed there would be collaboration in professionalising risk management.

“Overall, during my tenure, we’ve continued to be at the forefront of assisting our members build resilience for their organisations, recrafting risk management to look beyond strategy and performance. We have and continue to navigate through today’s volatile, multifaceted and complex environment. We enable our members to

be forerunners who bring the risk hindsight, insight and foresight to their organisations.”

She feels her biggest responsibility as a leader is to first lead herself through her own personal mastery and “spend more time on the balcony instead of the dance floor” to have a full perspective of what is happening with and around her and the people she leads. “I have also learnt that the highest calling as a leader is to develop and create more leaders.”

Depending on the situation and season, “I lead from the front, sometimes from the side and even from behind in some cases, allowing those I lead to lead in their own areas of expertise while capitalising on their strengths. I always aspire to create an enabling working environment for people to excel while also having fun. My motto is, ‘show me your team and I will tell you what kind of leader you are’.”

Nyaba has a passion for people. She describes it as having a “gift” that enables her to get the best out of people—and this has provided her with much satisfaction over the years. “Mentoring youngsters and great talent within the risk management fraternity, guiding and connecting them with others in our profession and supporting them through growth opportunities is so rewarding.”

How is Nyaba ensuring IRMSA is futureready and remains at the top of its game? She says recent years have proven that risks are interconnected and don’t occur in silo; they break through predefined areas of expertise and responsibilities, yet also bringing opportunities. “This means we need to continue and be relentless in the technical support we offer our risk management community to enable it to be relevant in practice and application of risk management. Similarly, to our aspiring risk professionals, we need to continuously enhance and develop our offerings and qualification to ensure we produce risk professionals who are equipped to manage evolving threats and opportunities.”

She concludes, “All this calls for a team that is agile, innovative and solutionsoriented, and this is top of mind in building on to our culture. IRMSA is relevant to helping modern organisations overcome realworld risks and challenges in meeting their business objectives.”

To find out how you can become a member of IRMSA, visit www.irmsa.org.za/page/membership.

IRMSA believes that integrating strategy, risk, and resilience improves decision-making.

Companies and individuals should consider the changed playing field before resuming business travel full throttle

“The approach to post-pandemic business travel should be as considered as the time and effort invested in return-to-office strategies.”

Travelling for business—locally and globally—is starting to pick up rapidly again in the wake of the pandemic, as companies once more start dispatching employees to the in-person conferences, events and meetings that were the normal order of business pre-2020.

However, business travel and its impact on the traveller have changed from the way things were before, and anyone embarking on a business trip for the first time in years should take heed of changed circumstances and impacting factors so as not to get caught short, a leadership expert says.

“Most business travellers can attest to a little bit of shock to the system during their first couple of trips and in-person events—and that it is not just a case of getting on the bicycle again, with muscle memory making the ride a smooth one,” says Advaita Naidoo, Africa managing director at Jack Hammer Global, Africa’s largest executive search firm.

She says companies and individuals travelling would do well to consider the changed playing field before resuming business travel full throttle, as it can mean the difference between a successful mission or a waste of time and money.

“The approach to post-pandemic business travel should be as considered as the time and effort invested in return-tooffice strategies. We are still in the try-out phase of best practice in terms of hybrid working, and now business travel is also being thrown into the mix.

“The factors that impacted the return to the office also come into play when making decisions about business travel,” Naidoo continues. “Take, for instance, the personal ecosystems and logistics of the business traveller. Previously, frequenttraveller working parents for the most part would have had a smooth-running machine back home to ensure children were taken care of while they were away. Chances are, circumstances have changed, and support systems may no longer be there, or of the same quality they were before.”

The cardinal rule of getting back in the business travel swing of things is to allow more time than before—from planning to execution, adds Naidoo.

She says the following considerations should be taken into account by companies and employees:

Planning a successful trip is harder than before. Internationally, regulations have become more onerous, while across the board the lay of the land can change at the drop of a hat. Flights may be cancelled without warning, airport staffing may be inadequate, delays may mean connecting flights are missed, and rules and regulations for entry to a country may change regularly. So plenty of time should be allowed to plan a trip in detail, while allowing more time for the actual travel should challenges arise. Additionally, having a dedicated and alwayson travel agent is advisable in today’s volatile travel market.

Companies must be sensitive to the current circumstances of their ambassadors. It is not fair to assume that a previous star representative may be as happy as before to spend days and weeks away from home, or can be sent abroad with only days’ notice. It is important to get input from people before they receive travel assignments, to consider what support they may require to ensure a successful trip.

Seasoned business travellers previously were able to catch that early morning flight effortlessly, land at their destination, catch the necessary transport to their meeting or

conference, and proceed to shoot the lights out networking or presenting to among tens, hundreds or thousands of people on behalf of their company.

It is ludicrous to assume the same level of efficiency and performance at this stage, not only because the trip itself is likely to be much more onerous, but also because inperson networking is a muscle that has lost its strength as a result of three years of Zooming and Teamsing.

Allowing additional time for transitioning from the travel leg to the networking leg is helpful if possible—and, just the understanding beforehand that the experience may be exhausting and challenging is helpful to put the attendee in a better and more realistic frame of mind.

“Just like we have recognised that seeing our colleagues in-person for particular activities has benefits that can’t be replicated if we all just work remotely forever, so it is important that we again meet our peers and business partners outside our computer screens for conferences and meetings. Sure, transactions can be concluded on screen, but relationships most definitely are built in person,” says Naidoo.

“Getting back to business travel is, however, a matter that requires more than just the booking of a plane ticket and registration for the event at this stage. But knowing what you’re up against, planning more carefully than before, and cutting yourself some slack when navigating the first few trips as a company and as a traveller will help smooth the path toward normalcy again.”

We have a range of in house developed and tested products from Bituminous emulsion binders to blended Lignosulphonates and Polymers

than 40 years of experience in Total Dust Management. Our Total Dust Management services include dust and road management for opencast and underground mines, treating in excess of 13 000 000m² of mine haul roads. We offer full dust suppression services for material handling applications.

TOTAL DUST MANAGEMENT

Our Dust Control Management System consists of a range of environmentally friendly dust suppression products, with a comprehensive stabilization and continuous maintenance programme catering to our pit port requirements.

The robust sealed haul road surfaces allow optimal production for haul trucks and other vehicles to operate safely in all weather conditions. This is achieved with greater fuel efficiency, safety, and mechanical wear. Water saving remains one of the biggest benefits in employing Dust-A-Side and in excess of 90% saving has been recorded on certain mines

WHY CHOOSE US

A safer working environment | Effective dust suppression | >90% water savings

Reduced rolling resistance | Decreased diesel consumption | Increased tyre life

Improved hauling cycle time | Reduction of HME repairs and maintenance budget

No recapping required | Reduced production downtime after rain

No investment in road maintenance equipment | Increased productivity

Proven return on investment (ROI)

Dust-A-Side have a complete range of dust suppression products to provide the most operationally and cost effective solution across any operation. They can be used – effectively and economically – in a wide range of applications such as semi-permanent roads, temporary roads, underground work areas, process plants, transfer points, stockpiles, rail veneering, construction sites and more.

THERE ARE TWO DISTINCT PHILOSOPHIES TO CONTROL DUST WITH WATER SPRAYERS DURING MATERIALS HANDLING PROCESS

PLANT & PROCESSING

Dust Suppression Systems

Fog Cannon Technology Stockpile Sealing

UNDERGROUND MINING

Haul Roads

Dust Suppression Systems

Before you decide on a dust control system it is important to understand the difference between a dust prevention and dust suppression system. A lot of operations will require both, however the performance of the overall system and the effectiveness of controlling dust will be determined by whether or not the system is configured for your specific needs.

1. Low pressure (< 10 bar) and high water volume systems can be employed. This treatment philosophy is referred to as dust prevention. The spray system will discharge water directly on the material at the beginning of the transfer point. Being low pressure, the flow of water and droplets sizes are much bigger and hence referred to as wetting systems.

2.On the other hand, dust suppression systems (also known as misting systems) employ high pressure (> 50 bar) and low volume of water in the form of a fine atomised mist to capture dust that is already airborne and bring it back to the source.

Dust suppression and dust prevention systems are not exclusive; many operations have both systems configured to effectively control dust.

While dust prevention can be used in materials handling operations, dust suppression is the preferred option, owing to low water consumption, especially in areas where water is scarce. This option also minimizes water addition to material.

Dust-A-Side

FOG CANNON SYSTEMS FOR MINING AND INDUSTRIAL PROCESSES

Fog cannons (sometimes known as mist cannons) are an effective option for dust suppression in mine sites, quarries, construction sites, demolition sites and other industrial areas. This is because they can be easily setup, are portable and are ideal for tackling visible dust.

A fog cannon pumps highly pressurised water through a series of jet nozzles, turning water into mist through atomisation which is dispersed through the air by a powerful fan.

BENEFITS OF USING DUST-A-SIDE

FOG CANNONS

- Very effective at supressing airborne dust

- Significant reduction in water usage compared to low pressure watering systems

- Ensures coverage of large areas

- Easy to install and position

- No harsh chemicals are released into the environment

Menlyn Piazza 2nd Floor, Cnr Glen Manor and Lois Avenue, Menlyn, Pretoria, 0063, RSA +27 (0) 12 648 8900 | info@dustaside.com

Solar mini grids could power half a billion people by 2030—if action is taken now

Solar mini grids have become the leastcost way to bring high-quality 2 4/7 electricity to towns and cities off the grid or experiencing regular power cuts.

Solar mini grids can provide high-quality uninterrupted electricity to nearly half a billion people in unpowered or underserved communities and be a least-cost solution to close the energy access gap by 2030. But to realise the full potential of solar mini grids, governments and industry must work together to systemically identify mini grid opportunities, continue to drive costs down, and overcome barriers to financing, says a new World Bank report.

Around 733 million people, mostly in sub-Saharan Africa, still lack access to electricity. The pace of electrification has slowed down in recent years, due to the difficulties in reaching the remotest and most vulnerable populations, as well as the devastating effects of the COVID-19 pandemic. At the current rate of progress, 670 million people will remain without electricity by 2030.

“Now more than ever, solar mini grids are a core solution for closing the energy access gap,” says Riccardo Puliti, Infrastructure vice-president at the World Bank. “The World Bank has been scaling up its support to mini grids as part of helping countries develop comprehensive electrification programmes. With $1.4 billion across 30 countries, our commitments to mini grids represent about onequarter of total investment in mini grids by the public and private sector in our client countries.

“To realise mini grids’ full potential to connect half a billion people by 2030, several actions are needed, such as incorporating

mini grids into national electrification plans and devising financing solutions adapted to mini grid projects’ risk profiles.”

The deployment of solar mini grids has seen an important acceleration, from around 50 per country per year in 2018 to more than 150 per country per year today, particularly in countries with the lowest rates of access to electricity. This is the result of falling costs of key components, the introduction of new digital solutions, a large and expanding cohort of highly capable mini grid developers, and growing economies of scale.

Solar mini grids have become the leastcost way to bring high-quality 24/7 electricity to towns and cities off the grid or experiencing regular power cuts. The cost of electricity generated by solar mini grids has gone down from $0.55/kWh in 2018 to $0.38/kWh today. Modern solar mini grids now provide enough electricity for life-changing electric appliances such as refrigerators, welders, milling machines or e-vehicles.

Mini grid operators can manage their systems remotely, and paid-smart meters enable customers to pay as they use the electricity.

Connecting 490 million people to solar mini grids would avoid 1.2 billion tonnes of carbon emissions.

Further acceleration is needed, however, to meet Sustainable Development Goal 7. Powering 490 million people by 2030 will require the construction of more than 217 000 mini grids at a cumulative cost of $127 billion. At current pace, only 44 800 new mini grids serving 80 million people will be built by 2030, at a total investment cost of $37 billion.

Produced by the World Bank’s Energy Sector Management Assistance Programme, the new handbook, Mini Grids for Half a Billion People: Market Outlook and Handbook for Decision Makers (bit.ly/3CILvZW), is the World Bank’s most comprehensive and authoritative publication on mini grids to date.

It identifies five market drivers to set the mini grid sector on a trajectory to achieve full market potential and universal electrification.

• Reducing the cost of electricity from solar hybrid mini grids to $0.20/kWh by 2030, which would put life-changing power in the hands of half a billion people for just $10 per month;

• Increasing the pace of deployment to 2 000 mini grids per country per year, by building portfolios of modern mini grids instead of one-off projects;

• Providing superior quality service to customers and communities by providing reliable electricity for 3 million incomegenerating appliances and machines, and 200 000 schools and clinics;

• Leveraging development partner funding and government investment to ‘crowd in’ private-sector finance, raising $127 billion in cumulative investment from all sources for mini grids by 2030; and

• Establishing enabling mini grid business environments in key access-deficit countries through light-handed and adaptive regulations, supportive policies, and reductions in bureaucratic red tape.

World Bank Group

www.worldbank.org

The National Energy Regulator of South Africa (NERSA) ensures the orderly development of the energy sector, mainly through licensing, setting and approving of prices and tariffs, compliance monitoring and enforcement, and dispute resolution in the electricity, piped-gas and petroleum pipelines industries.

NERSA endeavours to be more innovative and agile in ensuring that we continue to make a valuable contribution to the socio-economic development and prosperity of the people of South Africa, by regulating the energy industry in accordance with government laws, policies, standards and international best practices in support of sustainable development.

NERSA is a regulatory authority established as a juristic person in terms of section 3 of the National Energy Regulator Act, 2004 (Act No. 40 of 2004).

NERSA’s mandate is to regulate the electricity, piped-gas and petroleum pipelines industries in terms of the Electricity Regulation Act, 2006 (Act No. 4 of 2006), Gas Act, 2001 (Act No. 48 of 2001) and Petroleum Pipelines Act, 2003 (Act No. 60 of 2003).

NERSA’s mandate is further derived from written government policies and regulations issued by the Minister of Mineral Resources and Energy. NERSA is expected to perform the necessary regulatory actions in anticipation of and/or in response to the changing circumstances in the energy industry.

The Minister of Mineral Resources and Energy appoints Members of the Energy Regulator, comprising Part-Time (Non-Executive) and Full-Time (Executive) Regulator Members, including the Chief Executive Officer (CEO). The Energy Regulator is supported by staff under the direction of the CEO.

The MSGBC region’s first hydrocarbon production is officially drawing near, opening up new opportunities for broader economic growth

Image source: www.bp.com/fr_mr/mauritania/home.html

A new era of energy security is in sight for the region at a time when global markets are in a constant state of volatility

Project partners bp and Technip Energy announced at the start of 2023 that the floating production, storage and offloading (FPSO) vessel officially left China, heading toward the Greater Tortue Ahmeyim (GTA) development on the maritime border of Senegal and Mauritania.

The MSGBC (Mauritania, Senegal, The Gambia, Guinea-Bissau and Guinea-Conakry) region’s first hydrocarbon production is officially in sight, signalling new opportunities for widespread economic growth on the back of energy security and industrialisation.

On 20 January, the FPSO vessel officially left China, bound for Senegal and Mauritania via Singapore. Its departure from China followed three years of construction and successful sea trials, with the facility—comprising eight processing and production modules and measuring 270m in length, 54m in width and 31.5m in depth—set to accommodate 140 people onboard while processing gas for the GTA’s associated floating liquefied natural gas (LNG) facility.

Rahman Rahmanov, bp’s vice-president of Projects for Mauritania & Senegal, said: “We are developing one of the world’s most unique and innovative gas projects, and the FPSO forms one of the most important components. Achieving the successful sail-away of the GTA Phase 1 FPSO is a testimony to the tremendous partnership with our contractors Cosco Shipping and Technip Energies.”

Representing a critical part of the wider GTA development, the FPSO vessel (bit.ly/3Hs4JGA) will enable the processing of up to 500 million standard cubic feet of gas, as well as the production of 2.3 million tonnes of LNG per annum (mtpa) as part of the GTA’s first phase of development. In its second phase, this figure will increase twofold, with up to 10mtpa set to be produced.

Speaking to the achievement, Gordon Birrell, executive vice-president of Production and Operations at bp, stated: “This is a fantastic milestone for this important project,

which is a great example of bp’s resilient hydrocarbon strategy in action. The team has delivered this in a challenging environment, including through COVID-19, always keeping safe operations at the heart of what they do.

“With the continued support of our partners—Societé Mauritanienne des Hydrocarbures (SMHPM) in Mauritania, Petrosen in Senegal and Kosmos Energy—we remain committed to helping both countries to develop their world-class resources in a sustainable way.”

Jointly developed by operator bp; Kosmos Energy; Mauritania’s Ministry of Petroleum, Energy and Mines; Senegal’s Ministry of Petroleum and Energies; as well as Mauritania’s SMHPM and Senegal’s national oil company Petrosen—with Technip Energies (bit.ly/3XUHM4w) having been awarded the engineering, procurement, construction, installation and commissioning contract—the GTA, as the largest hydrocarbon development underway in the region, is on track for first production by Q3 this year with the departure of the FPSO vessel.

The project itself is set to transform the regional energy space by introducing a longterm and viable supply of natural gas, thereby opening up opportunities for power generation, industrialisation and revenue generation via exports. Up to 15 trillion cubic feet (tcf) of recoverable reserves will be maximised at a time when global stakeholders are looking at capitalising on African gas resources.

However, the celebration of first gas does more than demonstrate the resilience of the respective governments to monetise offshore gas resources. Quickly following the start of the GTA, Senegal’s pioneer oil development—the 100 000 barrel per day Sangomar Project— is also set to see first production, further solidifying the commitment of both the energy majors involved and regional governments.

In early December 2022, project developer Woodside Energy announced that the FPSO vessel had completed construction for the Sangomar Phase 1 Field Development (bit.ly/3Eo3MNQ), with production now on track for late-2023.

With these developments, a new era of energy security is in sight for the region at a time when global markets are in a constant state of volatility. For Africa, first production at the GTA and Sangomar will kickstart industrialisation and electrification, triggering opportunities across multiple sectors of the economy. For the global energy sector, a new supply of oil and gas will be on the market, enabling the transition away from Russian dependency and advancements in stability.

What’s more, the success of both GTA and Sangomar are set to create a ripple effect of project takeoffs across the region, with project developers hoping to mirror the success of these pioneering projects. Notably, GTA’s neighbouring development—the 13tcf Mauritania-based BirAllah project, representing the largest deepwater gas discovery of 2019—has long been slated as a follow-up to the GTA project itself. Following first production from the GTA, interest is expected to turn to BirAllah, with project developers looking toward a final investment decision (bit.ly/3xy5Te7).

Similarly, the bp–Kosmos partnership has earmarked this year for the securing of the FID of Senegal’s 20tcf Yakaar-Teranga project (bit.ly/3XB54fK), a promising new development located in the Cayer Profond Block to the south of the GTA.

As such, the success of first hydrocarbon production will trigger growth across the entire energy industry and wider economy, with details of these benefits set to be unpacked during the 2023 edition of the MSGBC Oil, Gas & Power Conference and Exhibition (bit.ly/3kcOx2O) taking place in November in Mauritania.

During the 2022 edition, project developer Kosmos Energy delivered an update on the GTA project, and now, during the 2023 edition in November, relevant parties will not only celebrate first production but also discuss what happens next as well as the progress of other developments.

2023 is set to be the year of first hydrocarbon production for the MSGBC region, but 2024, the start of a new era of multi-project takeoff.

The world is not going to run out of oil (or gas) anytime soon.

Total discovered and prospective oil (and gas) resources are more than double the likely demand to 2050. The upstream industry is able to prioritise advantaged barrels to produce lower cost, lower carbon options.

Meanwhile, much of the world’s vast stock of disadvantaged resources can happily stay in the ground. Over two-thirds of commercial undeveloped resource is at risk of never being developed.

Such apparent bounty creates the impression that the industry can relax. Far from it. Truly advantaged resources, with low breakeven (resilience to low prices) and emissions (sustainability in scope 1 and 2 terms) are anything but plentiful. As things stand, we see enough to satisfy only about half of our base-case oil and gas demand forecast to 2050. Even our much lower accelerated energy transition (AET-1.5) demand scenario—which lays out what is needed to achieve the most ambitious targets of the Paris Agreement, keeping emissions within 1.5 °C of pre-industrial levels and reaching global net zero by 2050—will require some disadvantaged supply.

This problem of ‘peak advantage’ looms ever larger and presents a huge and urgent call to action. As recent supply interruptions serve to remind us, we neglect the upstream at our peril. Oil will continue to need huge and sustained investment.

Upstream companies must act now. We see three main investment themesto mitigate this coming shortage of advantaged resources:

New fields are generally more advantaged than old. They enjoy high utilisation of facilities and modern decarbonisation technologies. Exploration is one relatively small but valuable source of new fields, and high-impact wildcatting may persist for far longer than is widely believed.

Technologies such as facilities electrification and methane escape abatement can improve the emissions of older assets without raising costs too much.

Companies can invest to cut oil demand by growing their green energy businesses, including biofuels.

Even together, these three remedies will not be enough to fix the whole upstream industry. Its outlook becomes steadily more challenging as environmental, social and governance (ESG) pressures increase while inventory inexorably matures. We expect a widening diversity of upstream strategies as companies choose between flight or fight.

Those contemplating a retreat from upstream may view peak advantage as a validation of speedier withdrawal. That would leave more opportunity for others opting to double down on the sector.

Most of those sticking with upstream will strive to prop up their portfolio quality as they deplete inventory. Competition will surely intensify as companies scramble for a dwindling pool of advantaged assets. There is simply not enough for everyone to maintain current performance, let alone improve it.

In and of itself, peak advantage will do little to accelerate the wider energy transition. It may support higher prices, but will otherwise not substantially erode oil demand. Peak advantage is a problem that increases the costs and emissions of the industry without making it much smaller.

If we are indifferent to resource quality, we have plenty of oil to go around. We estimate total discovered and prospective resources at more than 2 trillion barrels. That is double our basecase energy transition outlook (ETO) cumulative oil demand forecast to 2050. It is triple oil demand to 2050 under our AET-1.5 scenario. These estimates of resource surplus are before the inevitable upward creep of volumes in many assets that we expect from appraisal success and improved recovery. With so many options, plenty of the world’s discovered resources will never be produced. Many of its prospects will never be explored.

Unsurprisingly, hardly anyone talks about peak oil supply anymore. An industry that once fretted it would run out of oil has flipped to worrying it may have to leave much of its resource in the ground.

It was the emergence of tight oil more than a decade ago that did most to ease those supply concerns. Here, it seemed, was an almost limitless new resource to fix the problem over the medium term. Then oil markets increasingly reckoned the energy transition would erode much of long-term demand anyway.

But has the oil industry really secured long-term supply? Not if tight oil is the only new remedy. We now know much more about the likely scale of global tight oil. Production has grown to around 10 million barrels of oil a day from reserves of around 150 billion barrels. Such reserves equate to four years of global oil demand. If peak oil supply was ever a problem, then tight oil has only delayed any such shortfall by a few years.

The peak oil narrative of yesteryear worried about the wrong problem. Abundant resources meant we were never in danger of running out of oil (or gas) in the foreseeable future. But we do have an issue with the affordability (defined by low costs and breakeven) and emissions (defined by low scope 1 and 2) of known resources.

Forget peak oil supply. ‘Peak advantage’ is set to become the defining challenge for the upstream industry over the coming decades.

The world is far from the end of the hydrocarbon era. Under our base-case ETO forecast, oil demand peaks in the 2030s before declining slowly to 94 million barrels a day in 2050.

This demand forecast and investment horizon outlook (bit.ly/3kbW3vj) presents a huge call to action, requiring a very active national and international oil company upstream industry over the next three decades. Supply from existing proven developed fields will dwindle to just 10 million b/d by 2050 without future capital investment (left-hand chart).

‘Most likely’ oil supply from all known onstream and undeveloped commercial fields will still only be 40 million b/d in 2050 (righthand chart). Many of these fields are outside the energy super basins (bit.ly/3XEZIiN) that have ready access to decarbonising factors that best enable advantaged supply.

Oil demand under our AET-1.5 scenario is some 20 million b/d lower than that of our ETO by 2035, but will still be 33 million b/d by 2050. Responsible companies hoping for this much better climate outcome face a difficult planning challenge, given the wide difference in demand scenarios.

The relentless harvesting of advantaged resources leaves ever fewer attractive options remaining. Historically, this situation was largely resolved by full resource replacement from a vibrant exploration sector. But the industry’s capacity for exploration has been permanently reduced, with investment down by more than 70% in a decade. There can be no return to the widespread wildcatting seen before.

The implications of peak advantage are profound and varied:

• Life will become steadily more difficult for responsible operators that care about cutting emissions. That includes almost the entire industry, given the widespread emphasis on ESG factors.

• Competition for the dwindling pool of advantaged opportunities, including high-

impact exploration, will surely intensify.

• Industry-leading cost and emissions targets will become steadily harder to achieve. For example, TotalEnergies requires new upstream investments to break even below US$30/barrel and emit less than its current portfolio intensity of 20 kgCO2e/boe. Equinor requires its overall emissions intensity to be less than 10 kgCO2e/boe.

• The decarbonisation of low-cost but high-emissions resources must become a growing investment theme. New technologies could become the game-changers here. But an equivalent theme of investment in currently unaffordable low-emissions resources is unlikely, as high costs are hard to improve through investment.

Peak advantage threatens to raise the long-term emissions intensity of the upstream industry. And because it barely

erodes demand, peak advantage brings precious little upside from a climate perspective:

• Direct implications for oil demand are modest. Perhaps full consideration of scope 1 and 2 emissions in supply cost curves and price modelling would point to higher costs. These may nudge prices upward, but any demand impact would probably be marginal.

• Higher emissions intensity increases ESG headaches for producers and consumers alike.

• Upstream companies can also work on alternatives to reduce oil demand. Their most effective demand lever is to boost investment in low-carbon energies, including biofuels.

Extracted from Wood Mackenzie’s report, “Scraping the barrel: Is the world running out of high-quality oil and gas?”, by Andrew Latham, vice-president of Energy Research, February 2023

Sekta is an industrial services force that reflects the maturity of our society and a genuine understanding of the pivotal role we play in it. We provide services to the energy, petrochemical, oil and gas, mining, construction, food and beverage sectors. Our services support an industrious nation and the African continent, so that we can continue to develop in prosperity and pride.

www.sekta.co.za

info@sekta.co.za

Sekta is a specialised industrial services group.

B-BBEE Level 1 -

51% black women owned

African countries should move closer toward a thorough capitalisation of their mineral resources

Africans need to pay critical attention to Africa’s position as a key source of critical minerals. Climate change and energy poverty are two sides of the same coin.

Let’s not forget, Africa is blessed with some of the world’s largest reserve of metals and minerals needed for batteries, including lithium and cobalt—making the continent a key supplier for the global energy transition. The African Energy Chamber believes that when we process these minerals in Africa, we rapidly eliminate emission-spewing shipments of the continent’s minerals and commodities.

As the entire global transportation marketplace marches toward an increasingly electrified and battery-powered future, many countries across the African continent stand at the threshold of profound economic opportunity. Now is the time to take action and decide whether or not Africa steps across it.

Countries around the world are encouraging their citizens to transition to electric vehicles (EVs) for both transportation and shipping. In many cases, governments are mandating their adoption by setting firm dates for total bans on gasoline-powered cars and trucks. Considering these circumstances, demand for EV batteries and the raw materials used in their manufacturing process will likely increase exponentially in the years ahead.

Africa supplies a significant portion of the metals critical to producing the lithiumion batteries that power EVs: namely cobalt, manganese and phosphorus and, to a lesser extent, lithium, iron, copper and graphite. Unfortunately, African mines export most of the minerals extracted to Europe and China, where much of the work that adds to their value takes place. Processes such as beneficiation—the treatment of raw, mined materials to improve their physical or chemical properties—and the smelting and refining that occurs before EV battery assembly, cannot be performed in Africa because there is no infrastructure for it.

To begin the process of building the required infrastructure, African countries should move closer toward a thorough capitalisation of their mineral resources. As noted in our newly released report, “The State of African Energy: 2023 Outlook”, “They can benefit from value-creation investments by developing the right market to support local demand for these metals, the right infrastructure to create an industrialisation ecosystem, and the right capital markets to stimulate the much-needed investments across the battery value chain.”

Ongoing developments both in Africa and abroad have the potential to bring the concept of a fully integrated African EV value chain into reality.

The first of these developments is the war in Ukraine. Russia holds a sizeable market share of the global metal production industry. The country is a net exporter of aluminium, copper, pig iron, direct reduced iron, iron ore and nickel. Russia also produces 37% of the world’s palladium supply and 11% of its platinum— metals essential to the worldwide production of catalytic converters.

Focusing specifically on EV components, Russia also produces 17% of the global supply of high-purity nickel used in battery manufacturing and 4% of global copper— amounts that establish the nation as one of the world’s most prominent metal suppliers.

Russia’s invasion of Ukraine caused numerous countries to impose import bans on Russian commodities. International companies, independent of their home countries, also initiated ‘self-sanctions’ on Russia by withdrawing their operations from the nation or restricting the sale of their goods within its borders. While the United States and the European Union have yet to announce any sanctions on Russian metal, this status could change in the near future as the continued tensions in Ukraine do not suggest any coming de-escalation.

Africa could potentially fill the gaps left by a Russian absence from the global mineral supply chain. South Africa, Zimbabwe and Madagascar can collectively supply iron ore, nickel and the platinum group metals, while Zambia and the Democratic Republic of the Congo can provide copper.

Africa’s own demand for Russian imports of steel and aluminium could be affected by sanction-induced complications. Investing in African infrastructure and developing a domestic supply chain would add diversity to the global metals trade and safeguard it against any future political upheavals or military conflicts.

Another promising development is Africa’s burgeoning EV industry. Rwanda and Ghana have declared their intentions to make the transition from gasoline-powered vehicles to EVs, while Rwanda and Kenya have committed to incentivising domestic production. Egypt aims to produce 20 000 EVs per year beginning in 2023. Namibia has a goal of 10 000 EVs by 2030, and South Africa expects to see 2.9 million by 2050.

While much of the conversation about EVs pertains to four-wheeled cars, motorcycles and tuk-tuks have always been more popular transportation options in Africa. The global EV market recognises this preference. In 2021, 44% of all two- and three-wheeled vehicles sold were electrically powered.

Previously, Africans had no choice aside from imported e-bikes and trikes, but now companies like Lagos-based Metro Africa Xpress (MAX) are manufacturing them at home. MAX’s newest model, the M3, is a low-cost, long-range motorcycle capable of carrying heavy loads. MAX expects upward of 70% of sold units to serve as commercial taxis.

This increased level of EV adoption, whether brought on solely by consumer choice or encouraged by government policy, will inevitably bring about increased demand for EV batteries. This demand could be satisfied by domestic mining and manufacturing—two links in a larger, fully African EV value chain.

The ratification of the African Continental Free Trade Agreement primed industries across the continent to establish a network that could leverage the expertise and resources of its individual members to create an EV battery manufacturing chain capable of servicing the needs of both African and global markets. Proceeds from this arrangement could fund enhancements to African infrastructure—an evolution that would, in turn, attract further international investment.

To properly seize the opportunities in front of us at present and to ensure the success of this endeavour, it is imperative that we acknowledge past mistakes and current conditions. An undertaking of this scale will require collaboration between governments, cohesive policy agreements, and uniform tax incentives. We cannot progress without commitments to improve roads, expand ports, and provide reliable and affordable electricity. We must also address the glaring workers’ rights issues affecting the subcontracted miners currently labouring at the foundation of this proposed value chain.

If we can work together to resolve these complexities, Africa will be ready to step into a bright, sustainable and profitable future.

NJ Ayuk Executive Chairperson African Energy ChamberAfrican countries should move closer toward a thorough capitalisation of their mineral resources

Tiefenthaler Africa is a specialist law firm - dedicated to providing legal solutions and innovation within the energy, mining, engineering, and construction industries.

Power & Energy projects comprise of a complex array of contract documents, field-specific issues and challenges. Our firm has decades of specialist experience, knowledge and first-hand understanding of the implications of these types of contracts, so as to critically evaluate the different constituent parts of such contract documentation, identify risks and to draft and negotiate the relevant terms and conditions.

Having been involved in many of the largest and most complex projects across the African continent including the Middle East, Australia, Europe and Asia, our specialists possess a wealth of expertise in strategic procurement, contract drafting and negotiating, and dispute resolution.

We regularly provide legal advice, due diligence, support, training and strategies on Procurement, Contract Development, Project Risk Management, Contractual Claim Services, Adjudication, Arbitration and Litigation to lenders, borrowers, sponsors, financiers, developers, contractors and employers associated with Power & Energy projects, Independent Power Producers (IPP), Public-Private Partnerships (PPP) and the Renewable Independent Power Producer Programme (REIPP).

While our clients’ success will always be the best measure of our achievements, we’re proud to say the calibre of Tiefenthaler Africa and its people has been recognised by a number of prestigious national and international peer-reviewed awards and directories.

changed everything—or did it?

OVID-19 has laid bare the vulnerability of the supply chain model that has dominated the way African firms have organised their production. In this model, firms rely on multiple suppliers, many of which are located far away (mostly in China).

With goods stuck at factories and ports around the world and shortages emerging, the pandemic disrupted the supply of most essentials. It also exposed the weakness of global interdependencies. Foremost among these were, of course, the essential medical devices needed to save people’s lives (bit.ly/3VAzTkh). Shortages were apparent also in many food items, consumer electronics and other necessities.

As we leave behind the worst of the pandemic and African managers across

industries prepare for the post-COVID era, there is a need to reconsider the underlying logic of supply chains. That means rethinking the trade-offs between the benefits of globally dispersed production and the need for secure supply and quick delivery.

Three things should guide managers in this:

• Short-term versus long-term effects of COVID-19 on the organisation of production and delivery;

• Changes imposed by the pending African Continental Free Trade Area (AfCFTA); and

• Green industrialisation—sustainable growth (bit.ly/3MDnqbo).

As an international business professor with several decades of experience in researching supply chains in an interconnected world (bit.ly/3ENcBlh), I have come to realise these are the issues that should shape supply chains in the post-COVID era.

Digitisation created new opportunities to co-ordinate activities and communicate with consumers in more efficient ways than was previously conceived

Before COVID-19, the patterns of production and supply of most products were largely based on the benefits that could be derived from cross-country variations in costs and resources. The gains of low-cost trade enabled companies to move products across countries at low cost. The pandemic outbreak challenged this logic.

The need to secure supply and ensure speedy delivery—especially, for example, of medical supplies—replaced the cost, skills and resource availability considerations that guided supply chain arrangements in different times.

As managers reconfigure their supply chains for the post-COVID era, they ought to distinguish between short-term changes imposed by the pandemic and lasting ones that cause structural changes to the way supply chains operate.

Shortages of supply and bottlenecks in production are likely to end. In fact, some of them are already disappearing, so there may not be a need to introduce major changes in response.

In parallel, many of the traditional benefits of supply chains have remained in place. There are still economic reasons to follow many pre-COVID practices and resume some production routines that prevailed in this era. Country differences in costs, skills and resource availability continue to offer compelling reasons for supply chain operations.

In contrast, the growing digitisation of some supply chain transactions and the greater virtualisation of economic activity that took place during COVID-19 appear to have left a lasting effect. For example, digitisation created new opportunities to co-ordinate activities and communicate with consumers in more efficient

ways than was previously conceived, and to reduce costs.

These developments are likely to shape the supply chains of the future and should be reflected in the reconfiguration of supply chains.

The free trade agreement among all African countries has immense economic significance. If successfully implemented, it is likely to change the rationale for local and regional organisation of production and supply across the continent.

High trade costs in Africa—by some measures, five times higher than those elsewhere (bit.ly/3D2NbyK)—have undermined the benefits of separating production activities across countries and supplying distant markets.

In July 2022, the AfCFTA Council of Ministers announced an initiative on guided trade (bit.ly/3D5R7yy): a pilot phase that allows seven African countries to begin trading under the new regime.

By reducing the cost of cross-border activities, the agreement removes many barriers and increases potential gains from the separation of production activities across African countries. Low-cost trade makes it economically viable to connect separately located production facilities. This increases the potential advantages of specialisation and scale. It changes the economic rationale for the organisation of production.

Low trade costs among African countries can also transform a continent of 55 mostly small countries into a single market of 1.4 billion potential consumers. This market size is only slightly below those of India and

China. It enables firms to reach out to remote consumers and reap the advantages of scale.

The need to rethink supply chains opens opportunities for green industrialisation.

African firms are well positioned to join ‘green global supply chains’ as suppliers of key natural resources. These include, for example, scarce minerals like cobalt and lithium that are abundant in many African countries and are in high demand in many green industries. They can leverage their favourable access to these key natural resources, creating their own supply chains or supplying those controlled by others.

There is another advantage for African firms in these kinds of supply chains: Being at early phases of industrialisation, they do not carry the burden of the past, as do many of their counterparts in other parts of the world. They do not have to cope with sunk costs of changing old infrastructure and equipment that is expensive and difficult to replace.

As I have laid out, these contemporary developments call for rethinking fundamental decisions related to the configuration and management of supply chains in Africa.

The choices managers make in relation to these developments will have a material impact on their competitiveness and financial performance. African managers should embrace them heartily.

Lilac Nachum Professor: International Business City University New YorkLow trade costs among African countries can transform a continent of 55 mostly small countries into a single market of 1.4 billion potential consumers.