Home Builders Association of West Florida | April 2024 STD PRSTED U.S. POSTAGE PAID PENSACOLA, FL PERMIT NO.451 CORNERSTONE MAGAZINE Less Money, Less House: How Market Forces are Reshaping the American Home

Failure to call 811 before digging can result in unintentionally hitting underground utility lines, which can lead to injury and inconvenient utility service interruptions.

If you plan to excavate, dig, bore, tunnel, or blast in a location where a buried gas line may be damaged, please call Sunshine State One-Call of Florida at 811 or the toll-free number, 1-800-432-4770, between the hours of 6 a.m. and 5 p.m. CST, Monday through Friday, 48 hours before starting the proposed work.

If there are buried natural gas facilities in the path of your activity, the location of the facilities will be marked by a Pensacola Energy representative at no expense to you. Call

(850) 436-5050 • pensacolaenergy.com

436-5050

(850)

for more information about our conversion rebates or visit our web

at www.PensacolaEnergy.com.

site

CALL BEFORE YOU DIG. KNOW WHAT’S BELOW.

2024 Leadership Board

Dax Campbell President Campbell Construction & Company

Heath Kelly Secretary

Heath Kelly Construction

Lindy Hurd

Austin Tenpenny 1st Vice President Adoor Properties

Paul Stanley 2nd Vice President The First Bank

Past 2nd Vice President/SMC Chair

First International Title

Steve Moorhead Legal Counsel

Moorhead Law Group

Jennifer Reese Treasurer

Reese Construction Services

Kevin Sluder 3rd Vice President

Gene’s Floor Covering

Amir Fooladi Immediate Past President ParsCo

Josh Peden Financial Officer

Hudson, Peden & Associates

SENIOR OFFICERS

Dax Campbell, Campbell Construction & Company, President

Austin Tenpenny, Adoor Properties, First Vice President

Jennifer Reese, Reese Construction Services, Treasurer

Heath Kelly, Heath Kelly Construction, Secretary

Josh Peden, Hudson, Peden & Associates, Financial Officer

Lindy Hurd, First International Title, Past 2nd VP, Sales Council Chair

Kevin Sluder, Gene’s Floor Covering, 3rd Vice President

Paul Stanley, The First Bank, 2nd Vice President

Amir Fooladi, Encore Homes by ParsCo, Immediate Past-President

Stephen Moorhead, Moorhead Law Group, Legal Counsel

ASSOCIATE MEMBERS

Bill Batting, REW Materials

Jim Bouterie, Pensacola Energy

Rick Byars, Florida Power & Light

Mickey Clinard, Renasant Mortgage

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design, Cost and Codes Chair

Shellie Isakson-Smith, SWBC

Mary Jordan, Gulf Coast Insurance, Tradesman/Education Council Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Chair

Marty Rich, University Lending Group

Wilma Shortall, The First Bank

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

Janson Thomas, Swift Supply

BUILDER/DEVELOPER MEMBERS

Chad Edgar, Joe-Brad Construction

Joseph Everson, D.R. Horton

Fred Gunther, Gunther Properties

Drew Hardgrave, Landshark Homes

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Tomas Ondra, Ondra Home Building

Shon Owens, Owens Custom Homes & Construction

Josh Rayls, Holiday Builders

Douglas Russell, R-Squared Construction

Monte Williams, Signature Homes

Anton Zaynakov, Grand Builders

PAST-PRESIDENT/EX-OFFICIO MEMBERS

Blaine Flynn, Flynn Built

Edwin Henry, Henry Homes

Shelby Johnson, Johnson Construction

Russ Parris, Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim, Westerheim Properties

Doug Whitfield, Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

4 | Home Builders Association of West Florida Cornerstone Magazine

2024 Home Builders Association of West Florida Board of Directors

(850) 476-0318 4400 Bayou Blvd., Suite 45, Pensacola, Florida

www.westfloridabuilders.com Cornerstone is published for the Home Builders Association of West Florida by Ballinger Publishing and distributed to its members. Reproduction in whole or part is prohibited without written authorization. Articles in Cornerstone do not necessarily reflect the views or policies of the HBA of West Florida. Articles are accepted from various individuals in the industry to provide a forum for our readers. CORNERSTONE MAGAZINE

32503

April 2024 | westfloridabuilders.com | 5 FEATURES PRESIDEN’S MESSAGE .................................................................................... 6 LESS MONEY, LESS HOUSE: RESHAPING THE AMERICAN HOME ........................ 8 HBAWF News THE FLORIDA LEGISLATURE CLOSED THE 2024 SESSION ................................ 11 BOUGHT A HOUSE DURING THE PANDEMIC? .................................................. 14 EXISTING HOME SALES SURGE TO ONE-YEAR HIGH IN FEBRUARY ................... 16 IMPACT OF THE BALTIMORE BRIDGE DISASTER ON BUILDING MATERIALS ....... 18 HOME-BUYER PREFERENCES SHIFT .............................................................. 19 JENNIFER MANCINI Executive Director jennifer@hbawf.com Publisher Malcolm Ballinger malcolm@ballingerpublishing.com Executive Editor Kelly Oden kelly@ballingerpublishing.com Art Director Ian Lett ian@ballingerpublishing.com Graphic Designer/Ad Coordinator Ryan Dugger advertise@ballingerpublishing.com Editor Morgan Cole morgan@ballingerpublishing.com Assistant Editor Nicole Willis nicole@ballingerpublishing.com Editorial Interns Carey Clarkson Austin Mason Sales & Marketing Paula Rode, Account Executive, ext. 28 paula@ballingerpublishing.com Geneva Strange, Account Executive, ext. 31 geneva@ballingerpublishing.com Cornerstone, the monthly publication of the Home Builders Associa-tion of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsi-bility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure ac-curacy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law. CORNERSTONE MAGAZINE CONTENTS

President’s Message

Dax A. Campbell President

We would like to congratulate longtime member and legal advisor to the HBA Mr. Stephen Moorhead on being awarded the business leader of the year during the 2024 PACE awards. Stephen has been a huge asset to the HBA over the years and his dedication and commitment is unwavering. We are certainly lucky to have him in our corner. Also, would like to thank Mr. Alton Lister for his efforts in Tallahasse during this last session with legislatures. He has worked diligently on behalf of the HBA and we appreciate everything he does.

We recently held a couple round table events with all three municipalities, City of Pensacola, Escambia and Santa Rosa counties and had very successful meetings discussing permitting issues and also some planning and zoning items.

With Q1 in the rear view mirror, I am looking forward to the spring and summer months and hopefully some decline in the rates. Traffic seems to have picked up recently and the warmer temperatures and nice weather are sure to help with buyers on the hunt for new homes.

President Northwest Florida HBA

Dax A. Campbell

6 | Home Builders Association of West Florida Cornerstone Magazine

& Co.

NEW ASSOCIATES: U.S. Lumber Yellow Hat Construction Co, LLC homeOUTLET MOEN Aberfeldy Home Construction WELCOME March NEW MEMBERS

Campbell Const.

LLC

Save the Date! Annual HBA Home & Product EXPO at the Pensacola Interstate Fairgrounds September 14 - 15, 2024.

Less Money, Less House: How Market Forces are Reshaping the American Home

Major home builders are prioritizing narrower houses with fewer doors, windows and cabinets. Median new-home sizes are at a 13-year low.

The new American home is shrinking.

After years of prioritizing large homes, the nation’s biggest and most powerful home builders are finally building more smaller, more affordable housing.

The boom in smaller construction has cut median new-home sizes by 4 percent in the past year, to 2,179 square feet, census data shows, the lowest reading since 2010. That’s helped bring down overall costs and contributed to a 6 percent dip in new-home prices in the same period.

Townhouses, in particular, are increasingly popular, accounting for 1 in 5 new homes under construction at the end of 2023, a record high, according to an analysis of census data by the National Association of Home Builders. To cut costs, companies are building smaller and taller, with fewer windows, cabinets and doors.

Altogether, this wave of new construction promises a crucial first step toward addressing a critical shortage of starter homes that has sidelined first-time home buyers and contributed to inflation.

Even a slightly smaller home can be thousands of dollars cheaper — for both builders and buyers,” said Andy Winkler, director of housing and infrastructure at the Bipartisan Policy Center, a Washington think tank. “This is a trend driven by just how unaffordable housing has become, with sky-high prices, rising interest rates and so few homes for sale.”

Nikki Cheshire kicked off her home search in Frederick County, Va., with a wish list: three bedrooms, an attached garage and a yard for her dog. But she quickly realized she’d have to think smaller.

The stand-alone houses she toured were well beyond her $450,000 budget. Cheshire looked for six weeks, was outbid twice and eventually landed a newly constructed townhouse for $408,000. It checks all the boxes, albeit at a smaller scale — the garage, for example, fits one car, not two. But more importantly, she said, it’s affordable.

8 | Home Builders Association of West Florida Cornerstone Magazine Feature Story

“I looked at so many houses, but so many of them were too big and too expensive,” said Cheshire, 29, who works in corporate communications. “The one I got — yes, it’s smaller and doesn’t have everything — but it’s enough.”

This new trend is an about-face from early in the pandemic, when Americans sought out larger living spaces. Many moved into sprawling homes on the outskirts of town, sending luxury-home prices soaring. Extra pandemic savings, combined with rock-bottom interest rates, made it possible for many families to buy a home for the first time or upgrade to a larger, more expensive property.

As a result, median home prices have jumped a whopping 28 percent in the past four years, to nearly $418,000. At the same time, mortgage rates have more than doubled to almost 7 percent, down slightly from a 23-year high reached in November. Taken together, homes in the United States are less affordable than they’ve ever been, according to Goldman Sachs.

A shortage of homes, especially smaller, more affordable entry-level ones, has added to the problem. Builders for years have focused on more profitable properties, with construction concentrated in two extremes: houses on large suburban lots, or steeland-concrete apartment buildings in urban areas, according to Robert Dietz, chief economist for the National Association of Home Builders.

That has slowly begun to change, as home builders face higher borrowing costs and growing demand for more affordable options. In earnings calls, some of the country’s largest publicly traded home builders have said they are rethinking their plans so they can prioritize smaller, more affordable housing. D.R. Horton, the country’s largest home builder, sold more than 82,000 homes last year, most of them under $400,000 and to first-time buyers. Its lineup now starts at about 900 square feet.

We are continuing to shift … to more and more of our smaller floor plans to address affordability issues in the market,” Jessica Hansen, senior vice president of communications, said in a November earnings call.

Even Toll Brothers, known for its high-end properties with an average sales price of $1 million, is downsizing to lower-priced options, which are also faster to build. Sales of “affordable luxury” homes — starting at about $400,000 — more than doubled in the past year, outperforming more expensive properties.

“With 75 million millennials out there, we were not going to wait for them to hit their 40s and buy their move-up home,” chief executive Douglas Yearley said in a December earnings call, adding that he expects entry-level homes will eventually make up 45 percent of homes sold by the company. “I’m really proud of how … we went after the more affluent first-time buyer.”

The housing crisis has been an ongoing challenge for the Biden administration. In his State of the Union address, the presidentproposed sweeping measures to encourage more entry-level homeownership, including building and renovating 2 million affordable homes and offering $9,600 in tax credits that Americans could put toward a mortgage.

Prices for entry-level homes — which hit a record $243,000 last year, according to Redfin — have risen rapidly since the Great Recession, when homebuilding activity slowed to a halt.

The country added fewer single-family homes in the 2010s than in any decade since the 1960s, according to Daryl Fairweather, Redfin’s chief economist, resulting in a shortage of millions of homes.

“It is clear that there simply aren’t enough homes to accommodate everyone,” said Orphe Divounguy, senior economist at Zillow, which estimates a national shortage of at least 4.3 million homes. “The decline in affordability meant buyers have pivoted to lowerpriced homes, which includes what we could consider starter homes.”

Although price increases for luxury homes have moderated in recent months, entry-level homes have continued to get pricier, in part because of growing demand. Overall, starter home prices are up 2 percent from a year ago and more than 45 percent from 2019, Redfin data shows.

At the same time, borrowing costs have risen sharply since the Federal Reserve began hiking interest rates in early 2022 to bring down inflation.

The housing market has slowed precipitously in response, though the results have been uneven. The wealthiest buyers, who have enough cash to avoid borrowing altogether, have been undeterred by rising borrowing costs. But those on the lower end are having to cut their budgets and downsize their plans.

In Anaheim, Calif., first-time home buyers Anna Kolev and her fiancé began their home search in September and had to rethink their plans every week or two,

April 2024 | westfloridabuilders.com | 9

as mortgage rates fluctuated, with a goal of monthly payments below 25 percent of their salaries.

“We’d have to reevaluate every time interest rates changed or prices started creeping up. It was like, ‘Are we still in the game? Can we still afford this?’” the 29-year-old software engineer said. “We definitely had to temper our expectations of what kind of house we could afford.”

Earlier this year, they bought a three-bedroom house for $910,000. At 1,550 square feet, it’s about 200 square feet smaller than Kolev would’ve liked, but anything larger was prohibitively expensive, she said.

“We compromised on so many things: location, square footage, kitchen,” she said. “But we’re very lucky that we were able to buy at all.”

The acute need for more housing is forcing local governments to rethink zoning laws, lot size requirements and other land-use policies often geared toward keeping smaller homes out of wealthier neighborhoods. Portland, Ore.; Austin; Charlotte; and St. Paul, Minn., have all recently made changes that allow building as many as four homes on a single lot.

Some communities are going even further. Sheboygan County, Wis., is partnering with local employers such as Johnsonville, Kohler and Sargento Foods to build 600 entry-level homes as part of its effort to draw more front-line manufacturing workers to the area. The county will also offer down payment help for the new homes, priced at about $230,000 to $250,000.

Still, housing economists caution this spurt of smaller new homes makes up a sliver of the overall housing market. New construction also tends to be pricier than existing homes, putting it out of reach for many firsttime home buyers.

It’s going to be hard to fix this problem without more existing homes on the market, and clearly that’s a tough thing to solve for,” said Winkler of the Bipartisan Policy Center. “I’m generally skeptical we’re building enough true starter homes to put a dent in the housing shortage.”

Even if the shift holds, it would take years of sustained growth to build enough homes to satisfy demand, he said. Plus, there’s another wrinkle: Americans have long been conditioned to think bigger is better when it comes to housing.

“Smaller homes are cheaper at the moment, for both builders and buyers, but it’s hard for me to fathom this becoming a long-term trend,” he said. “Americans haven’t become suddenly enamored with small houses. They just can’t afford anything else.”

Three years ago, Gary and Christen Powers found the perfect first home for their family: a sprawling 2,200-square-foot new build in Texas City, Texas, with two primary suites, including one for Christen’s aging mother. Then, before they could lock it in, wood prices soared, sending the home’s price tag from $287,000 to $340,000, well out of their budget.

They began looking again — on a smaller scale. Last month, they closed on a home that’s about 25 percent smaller, with three bedrooms instead of four. And, at $273,000, it was under budget.

“It’s on the small side,” said Gary Powers, 56, finance director for an LGBTQ mental health facility. “The bigger thing was finding something we could afford.”

Source: Abha Bhattarai (Washington Post)

10 | Home Builders Association of West Florida Cornerstone Magazine

Feature Story

The Florida legislature closed the 2024 session with the ceremonious dropping of the handkerchief on Friday, March 8. Over the course of the 60-day session, Florida lawmakers passed 325 of the 1,902 filed bills.

The FHBA advocacy team has worked hard to round up a complete recap of important bills that will impact the Florida homebuilding industry. The Enclosed legislative summary gives a high-level overview of a variety of important bills on the FHBA watchlist.

Certainly this list is not exhaustive, nor is it final- as any bill passed during session must still be signed by the governor before becoming a law.

We hope you learn a little more about the legislation prioritized by FHBA this year with this review. Use the table of contents to jump to a section that interests you, and be sure to click on the title of any bill to go directly to the bill text send to the Governor.

To view the Legistlative Summary, visit viewer.joomag.com/2024-fhba-advocacy-briefing/0513345001620413215

April 2024 | westfloridabuilders.com | 11 HBAWF News

EXPERIENCED CONSTRUCTION LAW ATTORNEYS

F r o m n e g o t i a t i n g c o n t r a c t s t o a s s i s t i n g g e n e r a l c o n t r a c t o r s , e n g i n e e r s , a n d s u b c o n t r a c t o r s w i t h c o n s t r u c t i o n - r e l a t e d i s s u e s , w e h a v e t h e r e s o u r c e s a n d e x p e r i e n c e t o h e l p y o u g e t y o u r p r o j e c t s t o t h e f i n i s h l i n e .

T R U S T E D A D V I C E S I N C E 1 9 1 3 8 5 0 - 4 3 3 - 6 5 8 1 E S C L A W . C O M

Bought a house during the pandemic? Here’s how much more that same home would cost today.

The monthly mortgage payment on a median-priced home hit a record high of $2,721 in March.

The pandemic-era buying frenzy in the residential real-estate market helped fuel the so-called lock-in effect, where homeowners with relatively low mortgage rates are stuck with their homes because they don’t want to move to a new house with a much higher mortgage payment.

Those homeowners were lucky enough not to miss the low-mortgage-rate boat, but they’re now sitting in homes that they perhaps would not be able to afford at current rates, the latest Mortgage Monitor report from the data company Intercontinental Exchange ICE, 0.37% suggests.

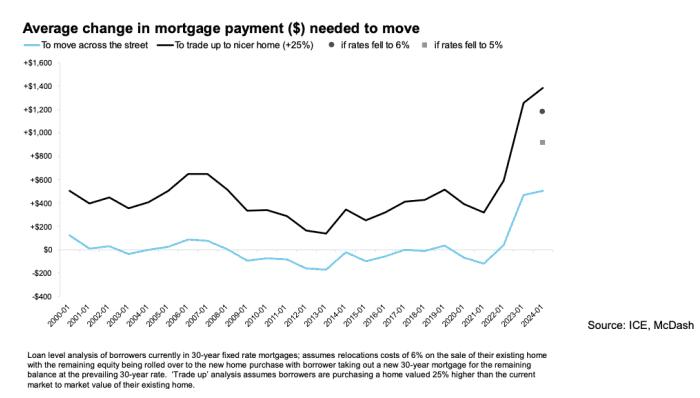

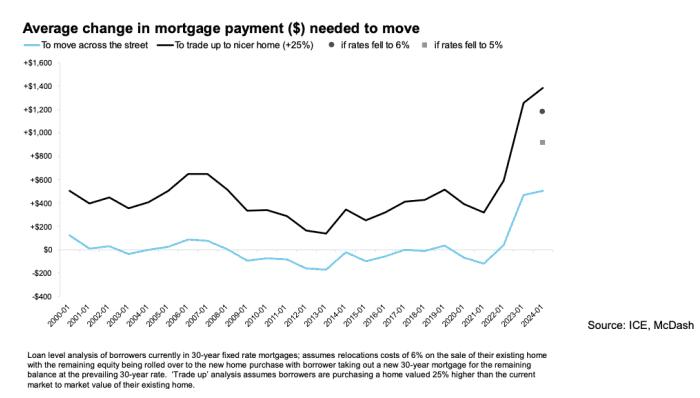

At current mortgage rates and home prices, the housing market has become so much more expensive that in order to buy an equivalent home across the street, today’s mortgage holders would have to pay 38% more, on average, in monthly mortgage payments, according to the report.

That’s an average of $500 more per month for a similar home, ICE found.

The ICE analysis sought to “quantify just how lockedin folks truly are and what kind of rate declines would be needed to shake some of that inventory loose,” said Andy Walden, vice president of enterprise research strategy at ICE, in a statement. “The results were bracing, to say the least.”

The median sale price of a home in the U.S. as of March was $374,500, according to analysis by real-estate brokerage Redfin RDFN, 1.06%. For such a house, a buyer with a 30-year mortgage rate of 6.87% would need to pay a monthly mortgage payment of $2,721 — a record high, per Redfin.

About 23% of homeowners currently have a mortgage rate below 3%, according to a Redfin analysis.

Between 2000 and 2022, before the Federal Reserve’s cycle of interest-rate hikes began, moving across the street wouldn’t have been such a reach financially as a homeowner would have essentially broken even, according to ICE. Today, that move is financially unfeasible. Homeowners who have near-record-low mortgage rates

— such as those who bought with mortgages originated between 2020 and 2021 — would have to increase their monthly payments by 60% to buy an equivalently priced home across the street, ICE said.

Over the previous two decades, buying a home that cost 25% more would have only required the typical homeowner to increase their principal and interest payment by roughly $400 a month, which is around 40%, according to ICE.

Today, that same upgrade move would require the typical homeowner with a low mortgage rate to increase their payment by 103%. That’s an average increase of $1,384 a month, ICE noted — a “jump that highlights the realworld pressures keeping current mortgage holders ‘locked in’ to their homes.”

For homeowners in high-cost markets, any move — across the street or into a bigger home — would be an even more painful proposition because they likely have a larger unpaid balance, which translates into higher borrowing costs.

For instance, to give up their existing mortgage and buy a house that’s 25% more expensive, a homeowner in Buffalo, N.Y., would see their monthly mortgage payment increase by 72%.

But in Los Angeles or San Jose, Calif., that homeowner would see their monthly payment jump by 140% if they wanted to pull off a similar move to a more expensive home.

Housing affordability has become strained, in part, because of the average 30-year fixed-rate mortgage rising from 2% at its lowest point to 7% today, as well as demand for housing vastly outpacing the supply of homes for sale.

Inventory is now lagging 40% behind pre-pandemic averages, ICE said.

“Lower rates would ease the calculation for many and make moves more reasonable,” Walden said. “But the net result continues to be too few homes for too many buyers.”

“Until that fundamental mismatch is addressed, simple supply and demand will continue to press on both inventory and affordability,” he added.

Source: Marketwatch 4/2/24

14 | Home Builders Association of West Florida Cornerstone Magazine HBAWF News

April 2024 | westfloridabuilders.com | 15 HBAWF News 1601975 Home & Auto go together. Like you & a good neighbor. Some things in life just go together. Like home and auto insurance from State Farm®. And you with a good neighbor to help life go right. Save time and money. CALL ME TODAY. State Farm Mutual Automobile Insurance Company, State Farm Indemnity Company, Bloomington, IL State Farm County Mutual Insurance Company of Texas, Dallas, TX State Farm Fire and Casualty Company, State Farm General Insurance Company, Bloomington, IL State Farm Florida Insurance Company, Winter Haven, FL State Farm Lloyds, Richardson, TX Michael Johnson, Agent 3127 E Langley Avenue Pensacola, FL 32504 Bus: 850-478-7748 www.michaeljohnsonagency.com

Existing Home Sales Surge to One-Year High in February

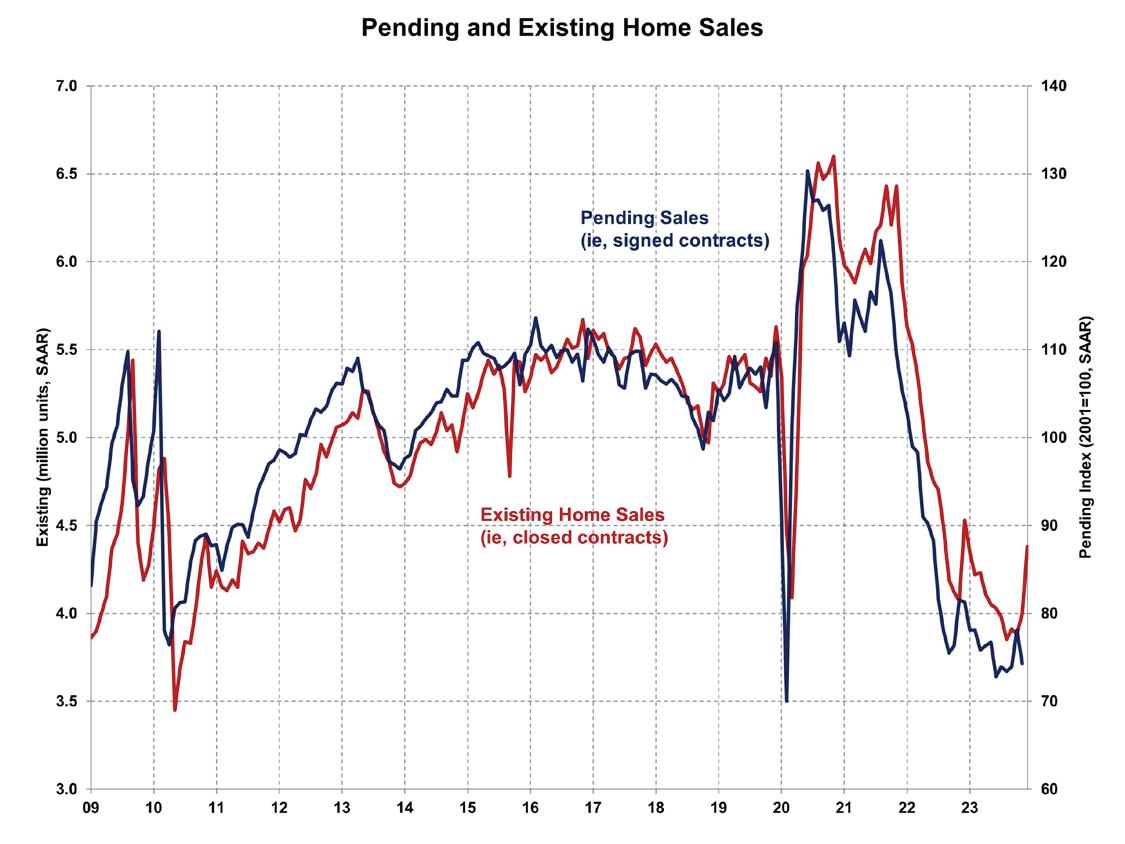

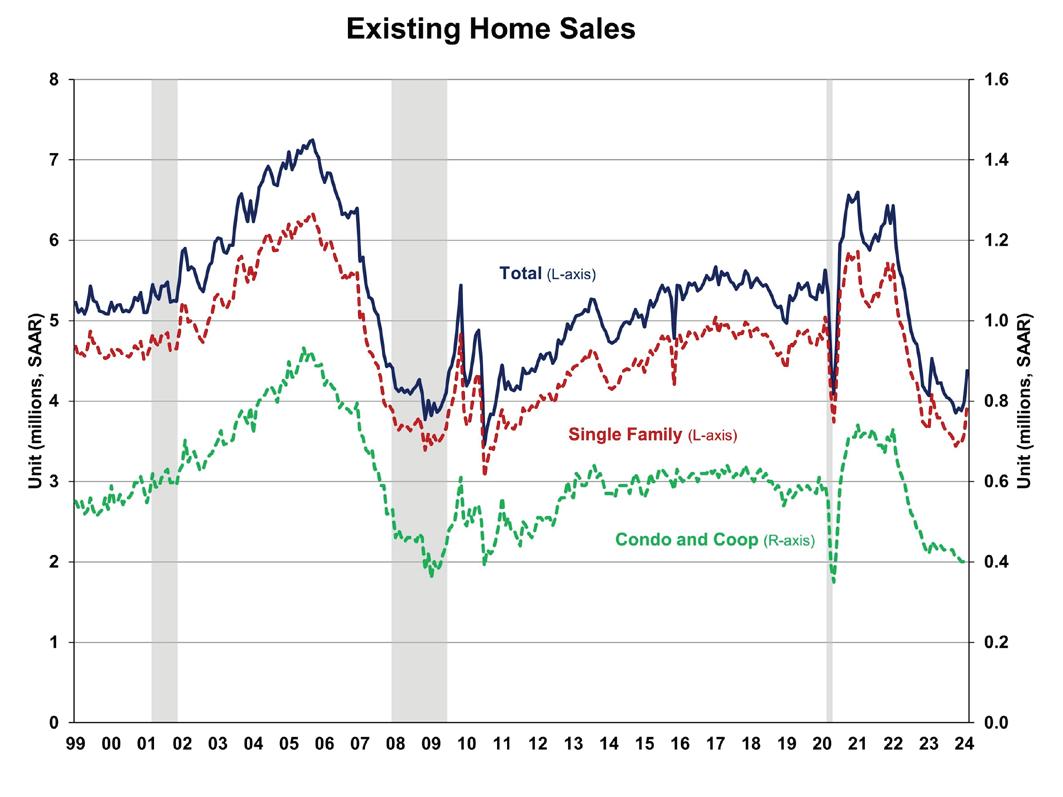

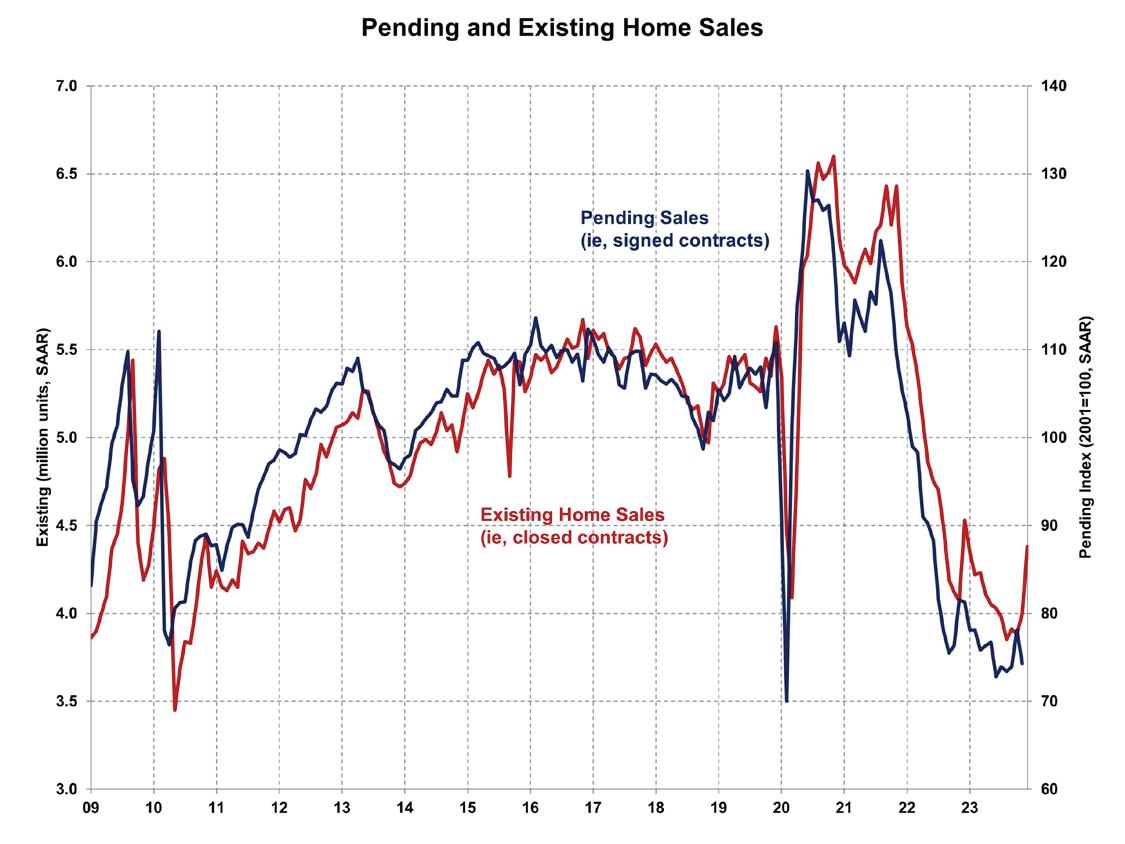

Despite the rising mortgage rates witnessed in February, existing home sales continued to improve and climbed to a 12-month high, according to the National Association of Realtors (NAR).However, low resale inventory and strong demand continued to drive up existing home prices, marking the eighth consecutive month of year-over-year median sales price increases. Recent declines in mortgage rates and a continued improvement in inventory are expected to drive more demand in the coming months.

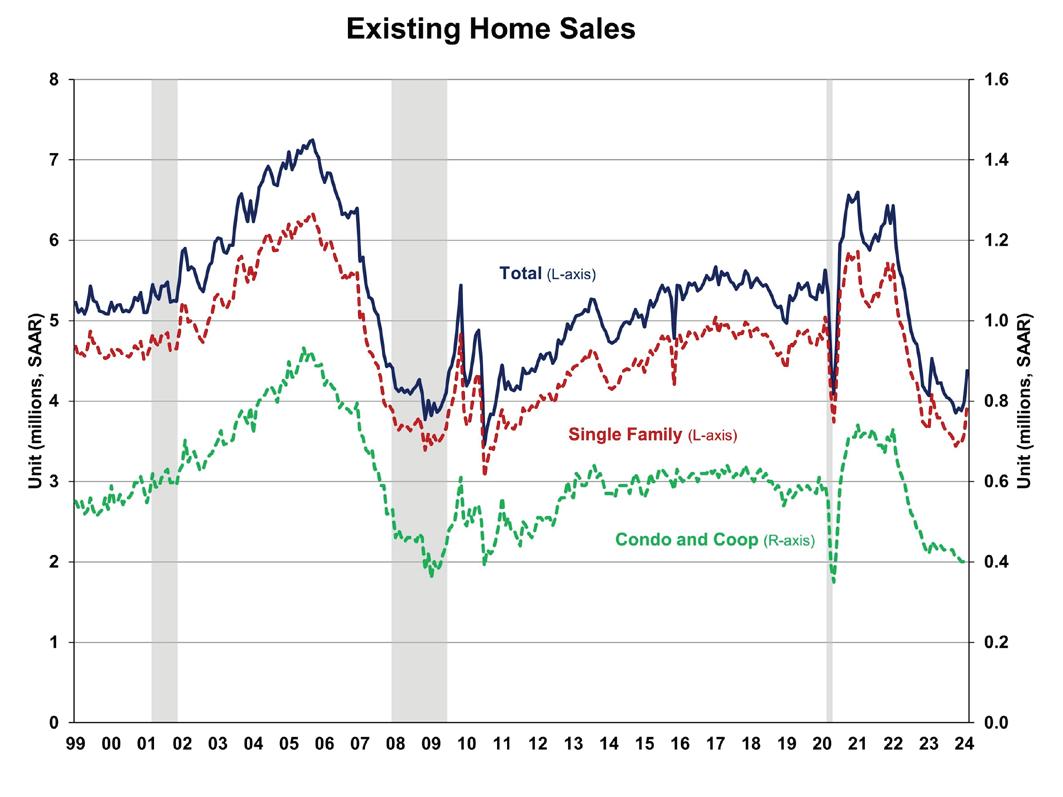

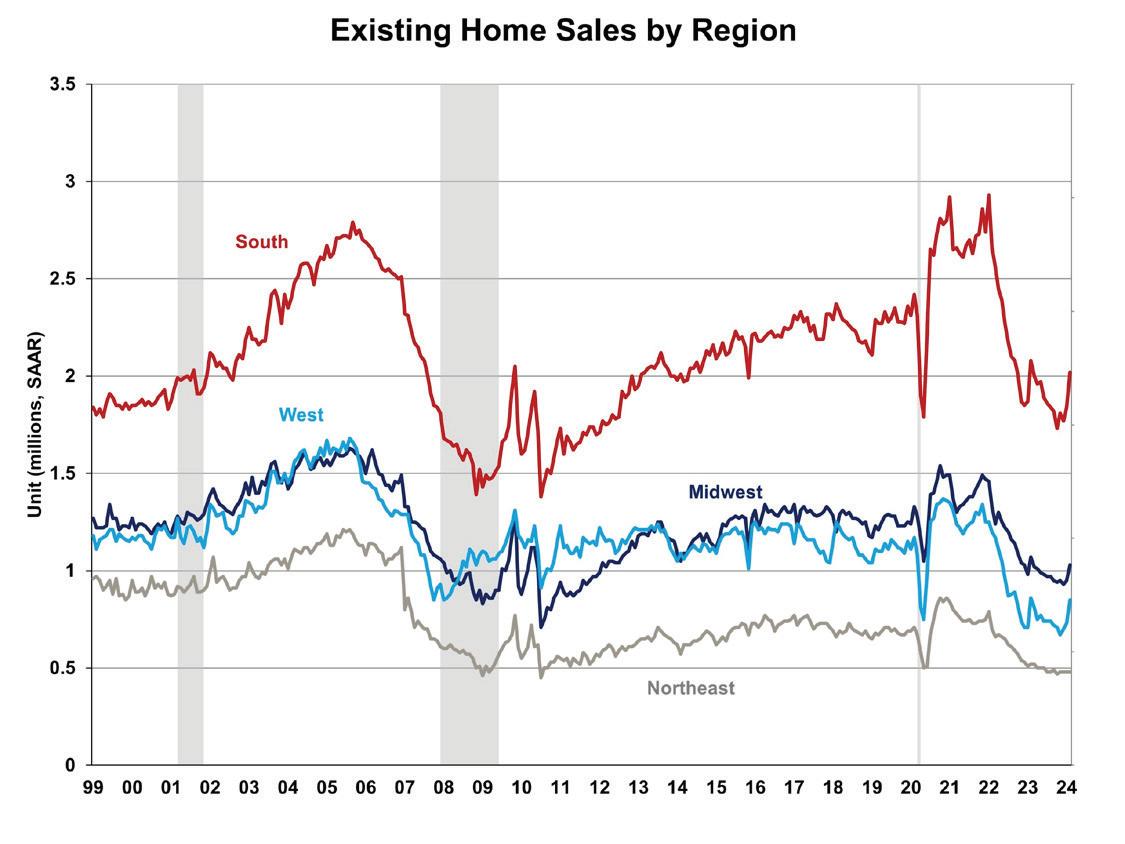

Total existing home sales, including single-family homes, townhomes, condominiums, and co-ops, rose 9.5% to a seasonally adjusted annual rate of 4.38 million in February (as shown below). However, on a year-over-year basis, sales were 3.3% lower than a year ago.

16 | Home Builders Association of West Florida Cornerstone Magazine HBAWF News

The first-time buyer share fell to 26% in February, down from 28% in January 2023 and from 27% in February 2023. The inventory level rose from 1.01 million in January to 1.07 million units in February and is up 10.3% from a year ago.

At the current sales rate, February unsold inventory sits at a 2.9-months supply, down from 3.0-months last month but up from 2.6 months a year ago. This inventory level remains very low compared to balanced market conditions (4.5 to 6 months’ supply) and illustrates the long-run need for more home construction.

Homes stayed on the market for an average of 38 days in February, up from 36 days in January and 34 days in February 2023.

The February all-cash sales share was 33% of transactions, up from 32% in January and 28% a year ago. All-cash buyers are less affected by changes in interest rates.

The February median sales price of all existing homes was $384,500, up 5.7% from last year. This marked the highest recorded price for the month of February. The median condominium/co-op price in February was up 6.7% from a year ago at $344,000.

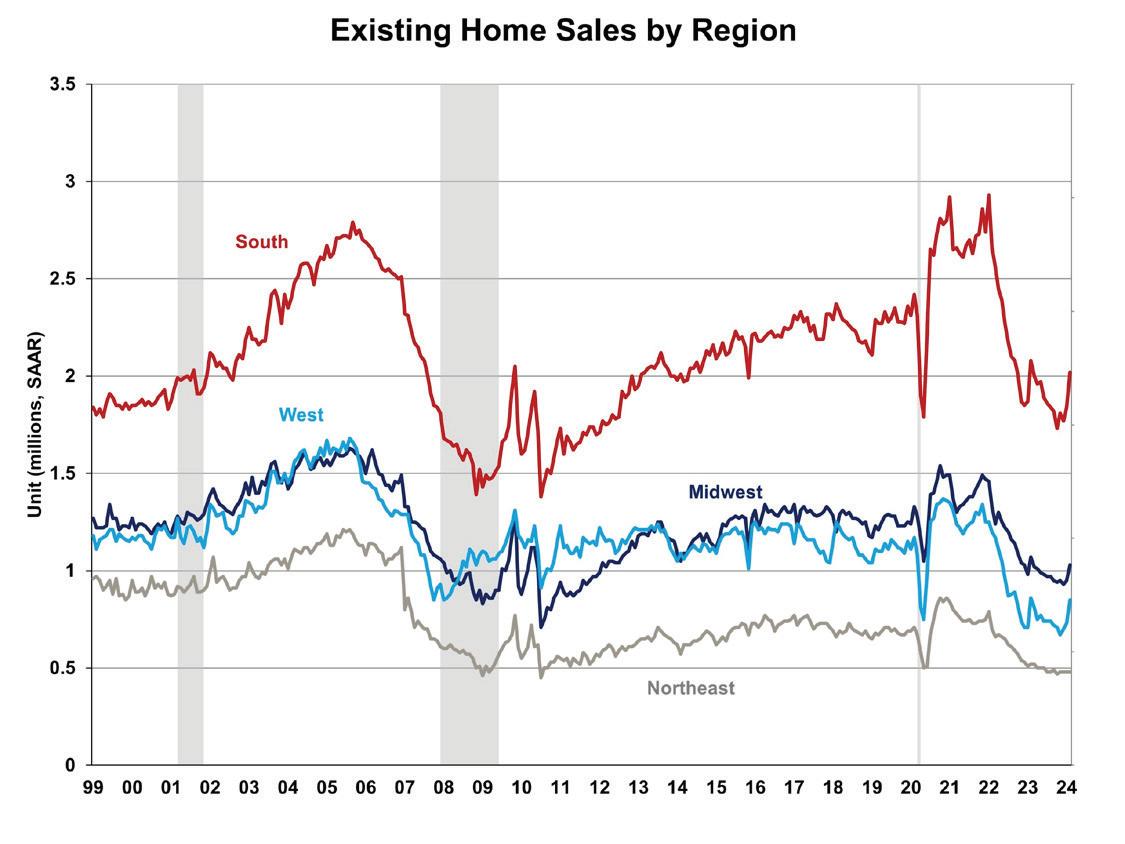

Existing home sales in February were mixed across the four major regions (as shown below). Sales in the Midwest, South, and West increased 8.4%, 9.8%, and 16.4% in February, while sales in the Northeast remained unchanged. On a year-over-year basis, all four regions saw a decline in sales, ranging from -1.2% in the West to -7.7% in the Northeast.

The Pending Home Sales Index (PHSI) is a forwardlooking indicator based on signed contracts. The PHSI fell from 78.1 to 74.3 in January. On a year-over-year basis, pending sales were 8.8% lower than a year ago per the NAR data.

Source : NAHB Eye on Housing

April 2024 | westfloridabuilders.com | 17 HBAWF News

The Impact of the Baltimore Bridge Disaster on Building Materials

The tragic March 26 collapse of Baltimore’s Francis Scott Key Bridge, following a collision with a massive container ship that lost power, is expected to cause supply-chain disruptions.

Imports will not be able to enter the port, and exports cannot leave as the collapsed bridge blocks the primary route into the Baltimore port. Imported commodities from overseas will need to be diverted to other ports of entry.

Based on Census data, the United States imported more than $3.08 trillion worth of goods from overseas. Baltimore imported $58.8 billion worth of goods in 2023, making it the 5th largest port of entry on the eastern seaboard and 15th largest overall in the U.S.

Baltimore’s largest import for 2023 was personal motor vehicles ($22.47 billion import value), followed by heavy duty machinery such as bulldozers and excavators ($3.62 billion). Unwrought aluminum was the 5thhighest valued import for Baltimore at $1.25 billion.

Top imports related to the home building industry include:

• Plywood, veneered panels and similar laminated wood ($425.07 million), which represents 16% of the U.S. total import value for 2023, making it the most important port for plywood imports.

• Gypsum ($23.99 million), representing 14% of the U.S. total import value for 2023 and the highest level of gypsum imports for any U.S. port.

• Sawn lumber ($198.22 million), which represents 3% of the U.S. total import value for 2023, making Baltimore the 11thmost important port for sawn lumber imports.

Other items of note include electrical transformers ($263.74 million), which represents less than 1% of the U.S. total import value.

NAHB will continue to monitor the data and provide updates as they become available.

18 | Home Builders Association of West Florida Cornerstone Magazine HBAWF News

Home-Buyer Preferences Shift as Affordability Challenges Remain

As the housing industry celebrates New Homes Month in April, builders continue to respond to buyer preferences by constructing smaller homes to place homeownership within reach of families planning to buy a home this year. A National Association of Home Builders (NAHB) analysis found that new homes built in 2023 reached their smallest median size in 13 years.

“Homeownership remains a goal for families who are eager to put down roots and have a place to call their own,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “Our nation’s builders are meeting the moment by finding solutions in home construction to allow for more individuals to purchase a home.”

More than a third (38%) of builders say they built smaller homes in 2023, and more than a quarter (26%) plan to construct even smaller this year, according to NAHB. According to NAHB’s latest What Home Buyers Really Want study, there has been a downward shift in buyer preferences for home size in the last 20 years. In 2003, the typical buyer wanted 2,260 square feet; now, that number is 2,067 square feet.

Data from the U.S. Census Bureau confirm new homes have been shrinking for nearly a decade. The average (median) size of new homes built in 2023 fell to 2,411 (2,179) square feet, the smallest since 2010. The drop

was a continuation in a downward trend that began in 2015. The only year that saw home size increase during this period was 2021, due to the pandemic-induced desire for additional space to work/study from home and the low interest rate environment that allowed buyers to purchase those bigger homes.

More than one-third of builders cut home prices in 2023. NAHB expects builders to continue offering smaller homes and more affordable designs as housing affordability remains a barrier to homeownership. Yet builders face supply-side challenges that continue to increase the cost of constructing homes, such as the scarcity of buildable lots, lack of skilled labor and restrictive codes. The median price of new homes in 2023 was $428,200, down 6% from 2022.

“Boosting the nation’s housing supply is key to improving housing affordability,” said Harris. “The residential construction industry is committed to keeping the cost of housing at the forefront of the national agenda and is working with all levels of government and both sides of the aisle so more Americans can achieve the dream of homeownership.”

NAHB members from around the country will discuss housing priorities and affordability solutions with their members of Congress during NAHB’s Legislative Conference, which will take place on June 12 in Washington, D.C.

April 2024 | westfloridabuilders.com | 19 HBAWF News

Learn how to control your energy use and save.

The FPL Business Energy Manager provides customized energy-saving recommendations based on daily, weekly and monthly energy-use patterns. Learn how at FPL.com/MyBusiness

Dax Campbell 850.698.4153 dax.campbellconstruction@gmail.com 103 Baybridge Park Gulf Breeze, FL 32562 LIC CGC - 1517906 As a residential and commercial certified general contractor, we specialize in... • Custom Homes • Remodels • Renovations • Commercial Projects Stop by our office and speak with one of our agents today! gcains.com One Great Team, Amazing Service! Personal service, better understanding of coverages, and secure protection for your most valued assets. 700 New Warrington Rd Pensacola, FL 32506 850-497-6810

Agent/Owner mary@gcainsurance. com

Mary Jordan

Manager

Director of Marketing

Cassy

Smith Operations

cassy@gcainsurance.com Jim Crutcher

jim@gcainsurance.com

Lines Manager

Vicki

Ruschel Personal

vicki@gcainsurance.com

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Club Levels

22 | Home Builders Association of West Florida Cornerstone Magazine

Green Spike 50 Credits Doug Sprague 90.5 Kenneth Ellzey, Sr. 80.5 Russ Parris 73.5 Blaine Flynn 70 Paul Stanley 68.5 Bob Price, Jr. 60 Thomas Westerheim 58.5 Darrell Gooden 52.5 Bill Daniel 51.5 Wilma Shortall 51.5 John Hattaway 50 Life Spike 25 Credits Doug Whitfield 42.5 Amir Fooladi 36.5 Suzanne Pollard-Spann 35 Garrett Walton 32 Bruce Carpenter III 30 Luke Shows 26.5 Steve Moorhead 23 Brent Woody 22.5 Karen Pettinato 21 Larry Hunter 21.5 Taylor Longsworth 20.5 Lee Hudson 19.5 Alton Lister 19 Jon Pruitt 17.5 Milton Rogers 17.5 Doug Herrick 16.5 Dean Williams 16.5 Lorie Reed 16 Martin Rich 15.5 William Merrill 15.5 Kevin Ward 13.5 Rick Faciane 13 Bill Batting 12 Alex Niedermayer 11 Kim Cheney 10 Spike Credits Shelby Johnson 9.5 Mary Jordan 9.5 Kevin Russell 9.5 James Cronley 9 Shellie Isakson Smith 8 Rodney Boutwell 7 Dax Campbell 7.5

SPIKE CLUB

Spike Candidate 1-5 credits Blue Spike 6-24 Life Spike 25-49 Green Spike 50-99 Red Spike 100-149 Royal Spike 150-249 Super Spike 250-499 Statesman Spike 500-999 Grand Spike 1000-1499 All-Time Big Spike 1500+ Spike Club Members and their credits as of 09/30/2023. Statesman Spike 500 Credits Harold Logan 525.5 Super Spike 250 Credits Rod Hurston 432.5 Royal Spike 150 Credits Rick Sprague 210.5 Edwin Henry 201.5 William “Billy” Moore 184 Bob Boccanfuso 165.5 Red Spike 100 Credits Charlie Rotenberry 150 Oliver Gore 115 Ron Tuttle 110 Newman Rodgers IV 102 Ricky Wiggins 101.5 David Holcomb 100.5 If you would like to join the Spike Club or Desire Additional Information, please contact Jennifer Mancini - (850) 476-0318 Alpha Closets......................................... 3 Ballinger Publishing............................21 Better Business Bureau NWFL ........19 Campbell Construction & Company LLC ...................................21 Centenial banck .................................. 20 Force 5 Walls........................................ 23 Gulf Coast Insurance .........................19 Hammond Engineering ......................21 Metal Craft ............................................21 Michael Johnson Insurance ..............15 Pensacola Energy ................................. 2 REW Materials ...................................... 11 West Fraser ........................ Back Cover Advertiser’s Index Please Support Our Advertisers!

force5walls@msn.com force5icf@gmail.com www.force5walls.com 251-213-2423 251-213-9255