Dax Campbell President Campbell Construction & Company

Heath Kelly Secretary Heath Kelly Construction

Lindy Hurd

Austin Tenpenny 1st Vice President Adoor Properties

Wilma Shortall 2nd Vice President The First Bank

Past 2nd Vice President/SMC Chair First International Title

Amir Fooladi Immediate Past President ParsCo

Steve Moorhead Legal Counsel Moorhead Law Group

Jennifer Reese Treasurer Reese Construction Services

Kevin Sluder 3rd Vice President Gene’s Floor Covering

Josh Peden Financial Officer

Hudson, Peden & Associates

2024 Home Builders

Association of West Florida Board of Directors

Dax Campbell, Campbell Construction & Company, President

Austin Tenpenny, Adoor Properties, 1st Vice President

Jennifer Reese, Reese Construction Services, Treasurer

Heath Kelly, Heath Kelly Construction, Secretary

Josh Peden, Hudson, Peden & Associates, Financial Officer

Lindy Hurd, First International Title, Past 2nd VP, Sales Council Chair

Kevin Sluder, Gene’s Floor Covering, 3rd Vice President

Wilma Shortall, The First Bank, 2nd Vice President

Amir Fooladi, Encore Homes by ParsCo, Immediate Past-President

Stephen Moorhead, Moorhead Law Group, Legal Counsel

Bill Batting, REW Materials

Jim Bouterie, Pensacola Energy

Rick Byars, Florida Power & Light

Mickey Clinard, Renasant Mortgage

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design, Cost and Codes Chair

Shellie Isakson-Smith, SWBC

Mary Jordan, Gulf Coast Insurance, Tradesman/Education Council Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Chair

Marty Rich, University Lending Group

Wilma Shortall, The First Bank

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

Janson Thomas, Swift Supply

BUILDER/DEVELOPER MEMBERS

Chad Edgar, Joe-Brad Construction

Joseph Everson, D.R. Horton

Fred Gunther, Gunther Properties

Drew Hardgrave, Landshark Homes

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Tomas Ondra, Ondra Home Building

Shon Owens, Owens Custom Homes & Construction

Josh Rayls, Holiday Builders

Douglas Russell, R-Squared Construction

Monte Williams, Signature Homes

Anton Zaynakov, Grand Builders

PAST-PRESIDENT/EX-OFFICIO MEMBERS

Blaine Flynn, Flynn Built

Edwin Henry, Henry Homes

Shelby Johnson, Johnson Construction

Russ Parris, Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim, Westerheim Properties

Doug Whitfield, Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

Executive Director jennifer@hbawf.com

Publisher Malcolm Ballinger malcolm@ballingerpublishing.com

Executive Editor Kelly Oden kelly@ballingerpublishing.com

Art Director Ian Lett ian@ballingerpublishing.com

Graphic Designer/Ad Coordinator Ryan Dugger advertise@ballingerpublishing.com

Editor Morgan Cole morgan@ballingerpublishing.com

Assistant Editor Nicole Willis nicole@ballingerpublishing.com

Sales & Marketing

Paula Rode, Account Executive, ext. 28 paula@ballingerpublishing.com

Geneva Strange, Account Executive, ext. 31 geneva@ballingerpublishing.com

Cornerstone, the monthly publication of the Home Builders Associa-tion of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsi-bility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure ac-curacy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law.

Dax A. Campbell President

The Annual HBA Parade of Homes is right around the corner. I would like to encourage all builders to participate and to enter all homes available in the Parade. Registration and sponsorship information is available now. The Parade dates will be October 2527th. Please reach out to staff if you have any questions or need additional information.

We are moving full speed ahead for the attainable housing projects in Pensacola and looks like we will be in the permitting phase for one of the projects in July and hopefully break ground before the end of July or early August. We are excited to get started building and hope to get as many members involved in this effort as possible.

We hope everyone has a safe 4th of July and Blue Angels weekend. See you all in August.

Dax Campbell

CamCon Builders LLC

DMC Steel Building & Design

High housing costs are affecting households across the board — from renters to first-time home buyers to current owners, according to the latest Harvard University Joint Center for Housing Studies’ (JCHS) The State of the Nation’s Housing 2024 report. The report highlights the significant jump in both rent and home prices — which are up 26% and 47%, respectively, since 2020 — and primarily affected by a lack of inventory.

Unsurprisingly, the number of households that are cost burdened (i.e., spending more than 30% of their income on housing and utilities) is also growing. Half of all renter households — 22.4 million in total — were cost burdened in 2022, up 2 million since 2019 and the highest number on record.

The number of cost-burdened home owners also grew by 3 million to 19.7 million between 2019 and 2022, with most of the increase among households

“But with concerted efforts by policymakers at all levels of government, together with the private and nonprofit sectors, we have the ability to increase the supply of quality, affordable homes in thriving communities across the U.S. “

with incomes under $30,000, as insurance rates and property taxes have risen. High interest rates are also having a negative impact, as fewer home owners are putting their homes on the market because they have locked in lower interest rates and would face a sharp increase in costs with a new mortgage at the current rates.

Housing demand continues to rise as additional households are formed and seek housing options, putting additional pressure on the market. Generation Z has added 8 million households in the past four years, along with a surge in immigration, which accounted for 3.3 million households in 2023.

Among these challenges, one of the bright spots is the efforts to boost housing supply — even amidst rising interest rates.

According to the report, multifamily completions rose by 22% to 449,900 in 2023, the highest annual level in more than three decades, and the number of units under construction in March 2024 remained near the record high. On the single-family side, new homes have constituted about a third of available single-family inventory since 2021 — a sharp increase from the past four decades, during which new construction made up just 14% of inventory on average.

“It points to the strength of interest in homeownership,” stated JCHS managing director Chris Herbert during a panel discussion following the report’s release, noting the efforts home builders are making to build smaller homes and provide a variety of options where possible.

During the panel, Herbert and others specifically addressed some of the challenges facing housing attainability, highlighting several key issues related to NAHB’s 10-point plan to solving the housing affordability crisis — most notably zoning reform, which is gaining momentum at both the local and state level.

“Addressing these challenges will not be easy,” Herbert noted in a press release. “But with concerted efforts by policymakers at all levels of government, together with the private and nonprofit sectors, we have the ability to increase the supply of quality, affordable homes in thriving communities across the U.S.”

Learn more about NAHB’s solutions to the housing affordability crisis at nahb.org/plan.

Diversifying the construction labor force is a key strategic goal given the ongoing skilled labor shortage. The latest labor force statistics from the 2022 American Community Survey[1] show that Non-Hispanic White people account for the majority of workers in the construction industry (57.5%). However, Hispanics make up close to one-third of the construction labor force (31.1%), followed by Black people (5.1%), and Asian people (1.8%).

The most noticeable recent trend in construction employment is the increase in the number and share of Hispanic workers. From 2010 to 2022, the number of Hispanics working in the construction industry rose from 2.5 million to almost 3.7 million. The share of Hispanics employed in the construction industry grew rapidly over the past decade, from 23.6% in 2010 to 31.1% in 2022. Now close to one-third of workers in construction is Hispanic.

Hispanics are overrepresented in the construction industry, as they make up 31.1% of construction employment compared to 18.7% across all industries in 2022. Non-Hispanic White people account for 57.5% which is about the same as across all industries (58.3%). Black and Asian people are underrepresented in the construction industry.

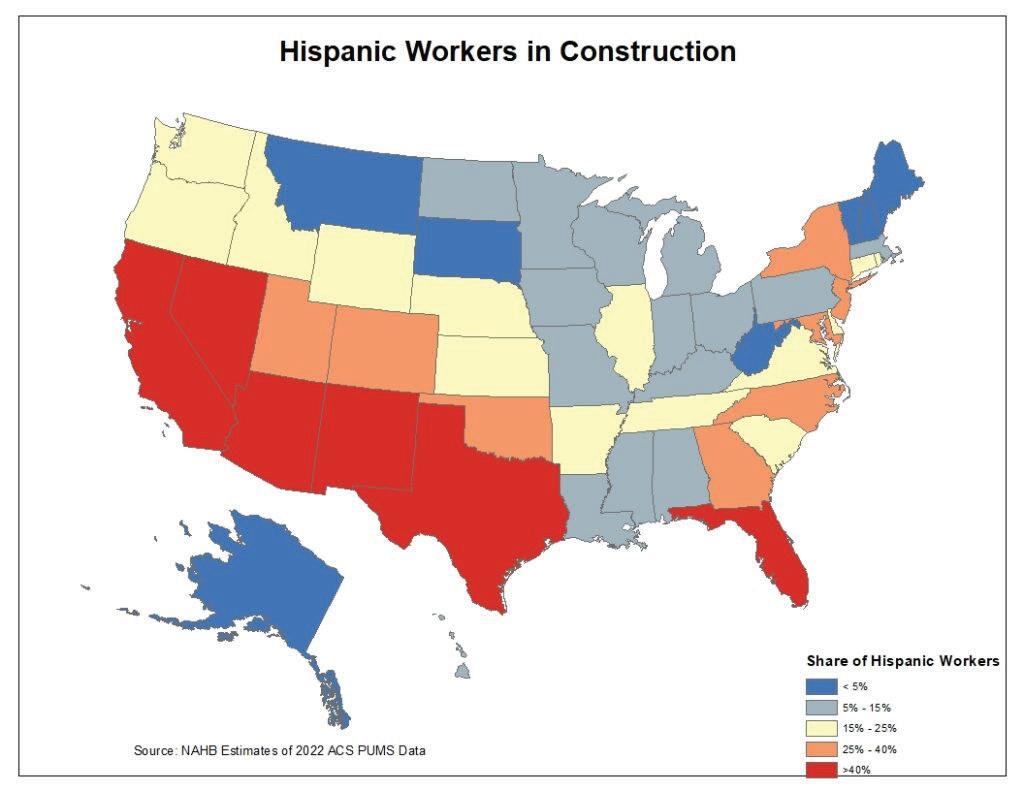

The share of Hispanic workers in construction varies considerably by state, ranging from only 2% in West Virginia, Vermont, and Maine to more than 50% in New Mexico, Texas, California and Nevada. Hispanic workers in the construction industry are more geographically concentrated in the Southern and Western states, where a large number of Hispanic people reside. In fact, 54% of the nation’s Hispanic construction workforce is concentrated in three states – Texas (827,000), California (775,000), and Florida (373,000).

New Mexico also stands out for registering the highest share of Hispanic people in the construction labor force (64%). Texas is next on the list, with Hispanic people accounting for 63% of its construction workforce, followed by California at 58%.

Source: NAHB Eye On Housing

In contrast, the construction industry in the Northeast region relies heavily on non-Hispanic White Americans. Non-Hispanic White people make up more than 95% of the construction workforce in New Hampshire, West Virginia, Vermont, Maine.

Black and Asian people are underrepresented in the construction industry in most states. Black people comprise only 5.1% of the construction workforce, while their share in the US labor force is almost 12%. States with the largest share of Black workers in construction are Mississippi (19%), followed by Alabama (13%), and Maryland (13%). Asian people account for less than 2% of the US construction workforce. However, their share is significant in Hawaii, where 28% of construction workers are Asian.

As the construction industry continues to evolve, staying up to date with the latest trends, technologies, and best practices becomes crucial for success. That’s why we’re thrilled to invite you to the Southeast Building Conference (SEBC) 2024!

SEBC 2024 will take place July 24-25 at the Orange County Convention Center, bringing together industry leaders, experts, and professionals like you for two jam-packed days of networking, learning, and innovation.

Industry Insights: Gain valuable insights in our continuing education sessions and panel discussions on current and future trends shaping the construction industry.

Networking Opportunities: Connect with fellow contractors, suppliers, and exhibitors to forge new partnerships and collaborations.

This year, SEBC returns to sunny Orlando, offering you the perfect opportunity to combine business with pleasure. Enjoy the beautiful surroundings, warm weather, and world-class amenities while expanding your professional horizons.

Continuing Education: Participate in your choice of five education tracks, covering a wide range of topics from project management and sustainability to the latest construction technologies. Plus earn all 14 hours needed for your Florida license renewal!

Expo Hall: Explore the latest products, services, and innovations showcased by leading suppliers and manufacturers in the construction industry at the region’s largest expo!

Early bird registration is now open! Take advantage of discounted rates, including a FREE EXPO HALL PASS and secure your spot at SEBC 2024 today. Visit our website www.sebcshow. com to register and learn more about the schedule, speakers, exhibitors, and special events planned for this year.

SEBC 2024 promises to be an unforgettable experience, filled with opportunities to learn, grow, and connect with industry peers. Don’t miss out on this chance to elevate your career, expand your knowledge, and take your contracting business to new heights.

We look forward to welcoming you to SEBC 2024 and celebrating the spirit of innovation, excellence, and community that defines our industry.

Mortgage rates that continue to hover in the 7% range along with elevated construction financing costs continue to put a damper on builder sentiment.

Builder confidence in the market for newly built single-family homes was 43 in June, down two points from May, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest reading since December 2023.

“Persistently high mortgage rates are keeping many prospective buyers on the sidelines,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “Home builders are also dealing with higher rates for construction and development loans, chronic labor shortages and a dearth of buildable lots.”

“We are in an unusual situation because a lack of progress on reducing shelter inflation, which is currently running at a 5.4% year-over-year rate, is making it difficult for the Federal Reserve to achieve its target inflation rate of 2%,” said NAHB Chief Economist Robert Dietz. “The best way to bring down shelter inflation and push the overall inflation rate down to the 2% range is to increase the nation’s housing supply. A more favorable interest rate environment for construction and development loans would help to achieve this aim.”

The June HMI survey also revealed that 29% of builders cut home prices to bolster sales in June, the highest share since January 2024 (31%) and well above the

May rate of 25%. However, the average price reduction in June held steady at 6% for the 12th straight month. Meanwhile, the use of sales incentives ticked up to 61% in June from a reading of 59% in May. This metric is at its highest share since January 2024 (62%).

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI component indices posted declines in June and all are below the key threshold of 50 for the first time since December 2023. The HMI index charting current sales conditions in June fell three points to 48, the component measuring sales expectations in the next six months fell four points to 47 and the gauge charting traffic of prospective buyers declined two points to 28.

Looking at the three-month moving averages for regional HMI scores, the Northeast held steady at 62, the Midwest dropped three points to 47, the South decreased three points to 46 and the West posted a two-point decline to 41.

HMI tables can be found at nahb.org/hmi.

Up to this point in 2024, the median builder has sold 22% of its homes to buyers who used all cash to pay for them (i.e., did not take out a mortgage), according to a recent NAHB survey. The survey took the form of a special question appended to the instrument used to collect data for the May NAHB/Wells Fargo Housing Market Index.

The percentage of all-cash sales is interesting, in part because it may indicate the availability of mortgage credit. Recently, the percentage has fluctuated directly with interest rates—especially the Federal Reserve’s target federal funds rate. This was discussed in detail in an earlier post on the Census Bureau’s quarterly “New Houses Sold by Price and Financing” release. Briefly, the Census release shows the share of all-cash sales increasing substantially since the Fed began tightening in 2022, reaching a peak of 10.7% in the fourth quarter of 2023 before declining to 6.6% in early 2024.

This is obviously a much lower share of all-cash sales than the 22% median reported in the May 2024 NAHB survey. Before simply concluding that the two surveys contradict each other, we should consider possible explanations.

The quarterly Census report is based on a sample of new homes. The NAHB survey is based on a sample of builders, many of whom tend to be small (see, for example, the recent article on Who Are NAHB’s Builder Members?). Larger builders, by definition, build a disproportionate number of the new homes; so, if larger builders tend to have smaller shares of all-cash sales, the different sampling frames could explain the apparent discrepancy between the Census and NAHB percentages.

This is not the case, however. In fact, in the NAHB survey, it is the smallest builders who show the lowest share of all-cash sales.

There is another possibility, if we get into the Census Bureau’s definitional weeds. The quarterly Census report is based on new homes sold, meaning that a potential buyer has either signed a sales contract or made a downpayment on the home. But this does not cover all new single-family homes. The Census Bureau classifies others as contractor-built or owner-built. On a contractor-built home, the ultimate homeowner hires a general contractor (i.e., builder) to build an

individual home on the owner’s lot. This usually involves a contract to build, but that is not technically the same thing as a sales contract according to Census definitions. On an owner-built home, the owner functions as the general contractor.

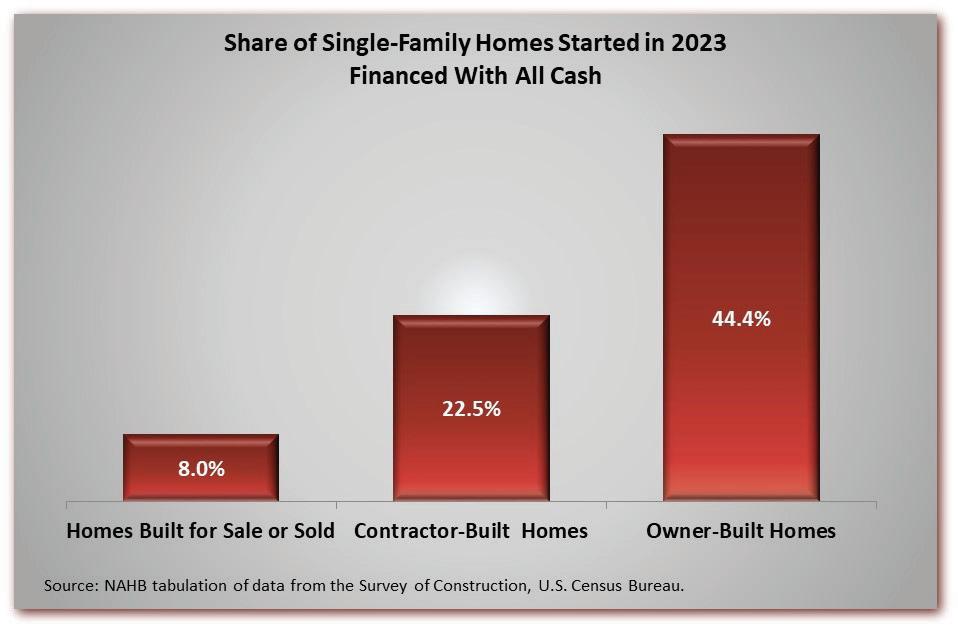

In addition to the quarterly report on houses sold, the Census Bureau produces an annual file from the same underlying data that can be tabulated for all types of new single-family homes. NAHB recently tabulated the 2023 file, and it shows that contractor-built (and owner-built) homes are much more likely than homes built for sale to be financed with all cash.

In NAHB’s latest census of its members, 54% of single-family builders listed their primary operation as singlefamily custom building, which roughly corresponds to building contractorbuilt homes under the Census Bureau’s classification scheme.

To summarize, NAHB’s May 2024 survey shows a median of 22% all-cash sales, considerably higher than the recent peak of 10.7% reported by the Census Bureau in its quarterly release on new houses sold. The discrepancy does not seem attributable to the differences between a survey of houses and a survey of builders but may be largely due to the presence of custom builders in the NAHB survey. These are builders who specialize in contractor-built homes, which are demonstrably more likely to be financed entirely with cash but are excluded from the reports on new houses sold.

The NAHB survey results are therefore useful for timely information on new home financing that includes custom home building.

Source: NAHB Eye On Housing

This on-demand webinar recording features Dr. Robert Dietz, the National Association of Home Builders’ (NAHB) chief economist, and Fan-Yu Kuo, an NAHB senior economist and the association’s senior VP for economics and housing policy. Dietz and Kuo deliver expert analysis and examine key macro issues affecting the U.S. economy and the housing industry, such as:

• The Federal Reserve’s monetary policy and current inflation and interest rate readings

• The influx of legal immigration and U.S. population growth

• The expanding share of new-home inventory compared with existing homes on the market

• Housing’s role in budging stubborn inflation

• Other factors affecting the home building industry

• Plus, there’s a Q+A session with webinar attendees at the end.

Watch this webinar recording to gain a better understanding of the macro-economic factors driving the housing industry in 2024.

The insights you glean into monetary, fiscal, and housing policies will help you prepare your company for what’s to come during the remainder of the year.

The webinar is available on demand offering the latest 2024 housing market outlook. https://www.probuilder.com/webinar-nahb-mid-year2024-market-outlook

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Candidate 1-5 credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+ Spike Club Members and their credits as of 09/30/2023.

Statesman Spike

Harold Logan

Super

Rod Hurston

Royal Spike

Rick Sprague

William “Billy” Moore

Charlie

Kim

Spike

Shelby

Stud-to-plate connectors

Thr eaded rod systems