Dax Campbell President Campbell Construction & Company

Heath Kelly Secretary Heath Kelly Construction

Lindy Hurd

Austin Tenpenny 1st Vice President aDoor Properties

Wilma Shortall 2nd Vice President The First Bank

Past 2nd Vice President/SMC Chair First International Title

Amir Fooladi Immediate Past President ParsCo

Steve Moorhead Legal Counsel Moorhead Law Group

Jennifer Reese Treasurer Reese Construction Services

Kevin Sluder 3rd Vice President Gene’s Floor Covering

Josh Peden Financial Officer

Hudson, Peden & Associates

2024 Home Builders

Association of West Florida Board of Directors

Dax Campbell, Campbell Construction & Company, President

Austin Tenpenny, Adoor Properties, 1st Vice President

Jennifer Reese, Reese Construction Services, Treasurer

Heath Kelly, Heath Kelly Construction, Secretary

Josh Peden, Hudson, Peden & Associates, Financial Officer

Lindy Hurd, First International Title, Past 2nd VP, Sales Council Chair

Kevin Sluder, Gene’s Floor Covering, 3rd Vice President

Wilma Shortall, The First Bank, 2nd Vice President

Amir Fooladi, Encore Homes by ParsCo, Immediate Past-President

Stephen Moorhead, Moorhead Law Group, Legal Counsel

Bill Batting, REW Materials

Jim Bouterie, Pensacola Energy

Rick Byars, Florida Power & Light

Mickey Clinard, Renasant Mortgage

Laura Gilmore, Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Thomas Hammond, Hammond Engineering, Civil Engineering Liaison

John Hattaway, Hattaway Home Design, Cost and Codes Chair

Shellie Isakson-Smith, SWBC

Mary Jordan, Gulf Coast Insurance, Tradesman/Education Council Chair

Daniel Monie, KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Zach Noel, Clear Title of NW FL

Suzanne Pollard-Spann, Legacy Insurance Brokers, Ambassadors Chair

Marty Rich, University Lending Group

Wilma Shortall, The First Bank

Pam Smith, Real Estate Counselors, Pensacola Assn. of Realtors Liaison

Chris Thomas, Acentria Insurance

Janson Thomas, Swift Supply

BUILDER/DEVELOPER MEMBERS

Chad Edgar, Joe-Brad Construction

Joseph Everson, D.R. Horton

Fred Gunther, Gunther Properties

Drew Hardgrave, Landshark Homes

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Tomas Ondra, Ondra Home Building

Shon Owens, Owens Custom Homes & Construction

Josh Rayls, Holiday Builders

Douglas Russell, R-Squared Construction

Monte Williams, Signature Homes

Anton Zaynakov, Grand Builders

PAST-PRESIDENT/EX-OFFICIO MEMBERS

Blaine Flynn, Flynn Built

Edwin Henry, Henry Homes

Shelby Johnson, Johnson Construction

Russ Parris, Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim, Westerheim Properties

Doug Whitfield, Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

Executive Director jennifer@hbawf.com

Publisher Malcolm Ballinger malcolm@ballingerpublishing.com

Executive Editor Kelly Oden kelly@ballingerpublishing.com

Art Director Ian Lett ian@ballingerpublishing.com

Graphic Designer/Ad Coordinator Ryan Dugger advertise@ballingerpublishing.com

Editor Morgan Cole morgan@ballingerpublishing.com

Assistant Editor Nicole Willis nicole@ballingerpublishing.com

Sales & Marketing

Paula Rode, Account Executive, ext. 28 paula@ballingerpublishing.com

Geneva Strange, Account Executive, ext. 31 geneva@ballingerpublishing.com

Cornerstone, the monthly publication of the Home Builders Associa-tion of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsi-bility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure ac-curacy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law.

Dax A. Campbell President

As we transition into the Fall season, we are excited to share some updates and insights with you. This month we are excited for the upcoming Home and Product Expo at the Pensacola Interstate Fairgrounds on 9/14-9/15. I encourage everyone to come out and see all the vendors and hear about new building techniques, products and materials. Take advantage of this opportunity to enhance your skills and knowledge of our industry.

We encourage all members to participate in local events that promote the home building industry and the HBA, your involvement does make a difference.

• Clay Shoot on September 26th

• Parade of Homes Awards Party on October 23rd

• Parade of Homes on October 25th-27th

• Fall Golf Tournament on November 8th

Dax Campbell

CamCon Builders LLC

DMC Steel Building & Design

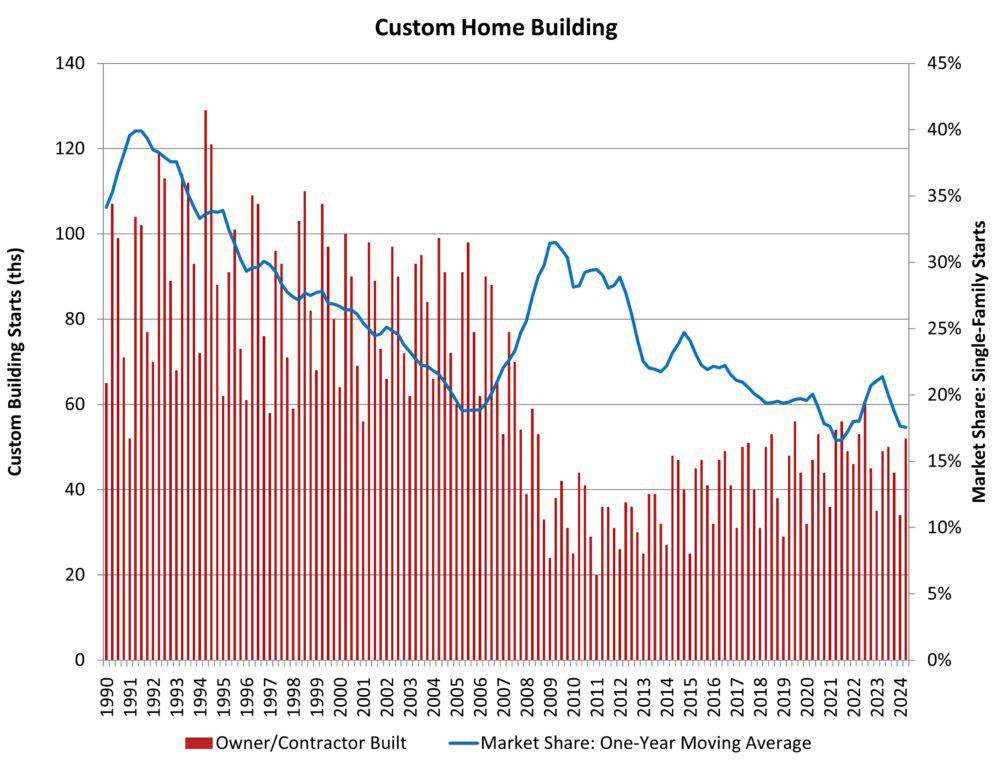

NAHB’s analysis of Census Data from the Quarterly Starts and Completions by Purpose and Design survey indicates gains for custom home building after some recent slowing. Custom home building typically involves home buyers less sensitive to changes for interest rates.

There were 52,000 total custom building starts during the second quarter of 2024. This marks an almost 6% increase compared to the second quarter of 2023 and the best reading since the third quarter of 2022. Over the last four quarters, custom housing starts totaled 180,000 homes, a 5% decline compared to the prior four quarter total (189,000) due to weakness in prior quarters.

After share declines due to a rise in spec building in the wake of the pandemic, the market share for custom homes increased until 2023 and then entered a period of retrenchment. As measured on a one-year moving average, the market share of custom home building, in terms of total singlefamily starts, has fallen back to just under 18%. This is down from a prior cycle peak of 31.5% set during the second quarter of 2009 and a 21% local peak rate at the beginning of 2023.

Note that this definition of custom home building does not include homes intended for sale, so the analysis in this post uses a narrow definition of the sector. It represents home construction undertaken on a contract basis for which the builder does not hold tax basis in the structure during construction.

Source: NAHB

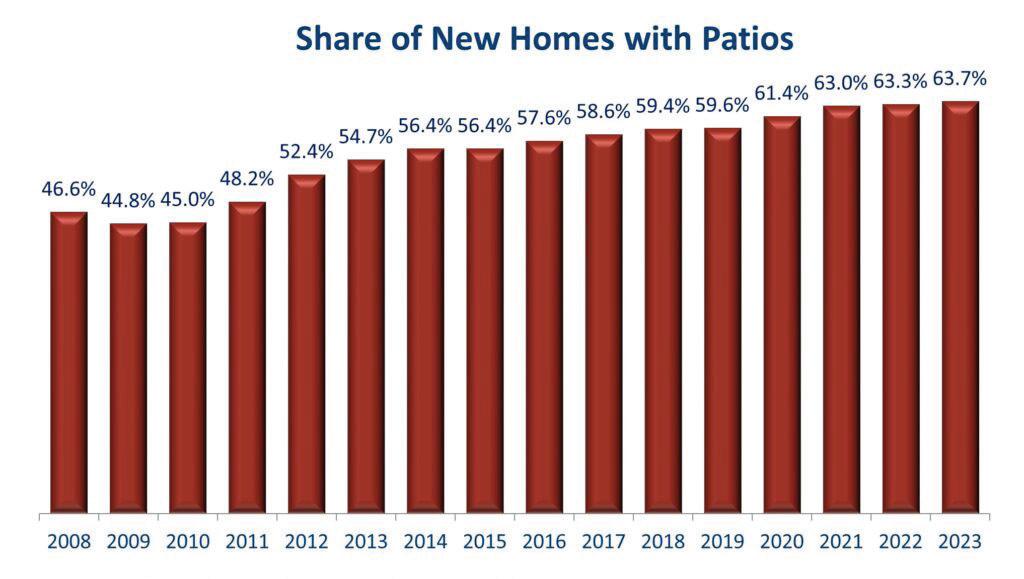

The share of new homes with patios increased to yet another record high in 2023. Of the roughly 950,000 singlefamily homes nationwide started during the year, 63.7% came with patios. This is up from 63.3% in 2022 and marks the eighth consecutive year the percentage set a new record high. The source for these numbers is NAHB tabulation of data from the Survey of Construction (conducted by the U.S. Census Bureau with partial funding from the Department of Housing and Urban Development).

Historically, fewer than half of new homes came with patios during the 2008-2011 period of extreme weakness in housing markets. But soon thereafter, the share jumped to 52.4% in 2012 and has been climbing ever since. The percentage has now increased in thirteen of the past fourteen years. The only exception was 2015, when the percentage was unchanged.

While patios for new homes have generally become more common over time, the parts of the country where they tend to be most common have remained consistent. At the low end, only 17% percent of new singlefamily homes built in New England and 20% in the Middle Atlantic came with patios in 2023. At the high end, the incidence of patios on new homes was over 80% in the West South Central and close to 70% in the South Atlantic and Mountain divisions. The geographic tendencies are similar to the ones reported in last year’s post.

Additional detail on the characteristics of new-home patios is available from the Annual Builder Practices Survey (BPS) conducted by Home Innovation Research Labs.

For the U.S. as a whole, the 2024 BPS report (based on homes built in 2023, like the SOC-based statistics cited above) shows that the average size of a new-home patio is about 290 square feet, but with considerable geographic variation. The average is over 400 square feet in the East South Central and about 380 square feet in New England; but under 200 square feet in the West South Central, and only a little over 200 square feet in the adjacent West North Central division.

In most parts of the country, poured concrete dominates all other building materials used in new-home patios. In the East South Central, for instance, poured concrete accounts for over 90% of new-home patios on a squarefoot basis. To the extent that there are exceptions, they occur on the east coast. In the South Atlantic, concrete and brick pavers each have about a quarter of the market, and poured concrete has less than half. In New England, the market is more or less equally divided among poured concrete, concrete pavers and natural stone. In the Mid-Atlantic, brick pavers are the most popular choice for new-home patios by a substantial margin.

Source: NAHB

Permits YTD as of July 2024. (Valuation in thousands for MSA , County Valuation is USD)

The U.S. Department of Commerce today raised tariffs on imports of Canadian softwood lumber products from the rate of 8.05% to 14.54% following its annual review of existing tariffs.

Although NAHB is disappointed by this action, this decision is part of the regularly scheduled review process the United States employs to ensure adequate relief to American companies and industries impacted by unfair trade practices.

The Department of Commerce initiated its fifth administrative reviews of its softwood lumber antidumping and countervailing duty orders in March 2023 and announced its preliminary findings of these reviews at the beginning February 2024. On Aug. 19, the agency issued its final results on antidumpingand countervailing duties averaging a combined total of 14.54%, and these higher duties are now in effect.

For years, NAHB has been leading the fight against lumber tariffs because of their detrimental effect on housing affordability. In effect, the lumber tariffs act as a tax on American builders, home buyers and consumers.

With housing affordability already near a historic low, NAHB continues to call on the Biden administration to suspend tariffs on Canadian lumber imports into the United States and to move immediately to enter into negotiations with Canada on a new softwood lumber agreement that will eliminate tariffs altogether. And we continue to work with our allies in Congress to put pressure on the administration to take action.

Source: NAHB

NAHB’s Professional Women in Building (PWB) Week (Sept. 9-13, 2024) celebrates women as a vital part of the residential construction industry.

Join NAHB for a week of inspiring content including Shop Talk discussions, blog posts and social media shout-outs that showcase the achievements of women across all areas of the industry, as well as NAHB’s combined efforts to promote, train, advance and welcome more women to the field.

Each day of PWB Week will highlight a different area of focus. Check out this year’s lineup:

• Monday, Sept. 9: Support the residential construction industry’s next generation. PWB Week content will include a Q&A featuring the NAHB Student Chapter president at Norfolk State University.

• Tuesday, Sept. 10: Join our Shop Talk “How to Recruit and Retain Women in the Residential Construction Industry” at 11 a.m. ET. Also, celebrate Tradeswomen Tuesday by reading profiles on women working in various trades.

• Wednesday, Sept. 11: Learn about women making an impact in the industry as we feature PWB award winners from over the years.

• Thursday, Sept. 12: Join our Shop Talk “Allies for Women in the Residential Construction Industry” at 11 a.m. ET.

• Friday, Sept. 13: Wrap up the week celebrating PWB members and local councils with a social media takeover. Follow the hashtags #NAHBWomenInBuilding and #NAHBWomenInBuildingWeek and join the conversation.

• Visit nahb.org for more information.

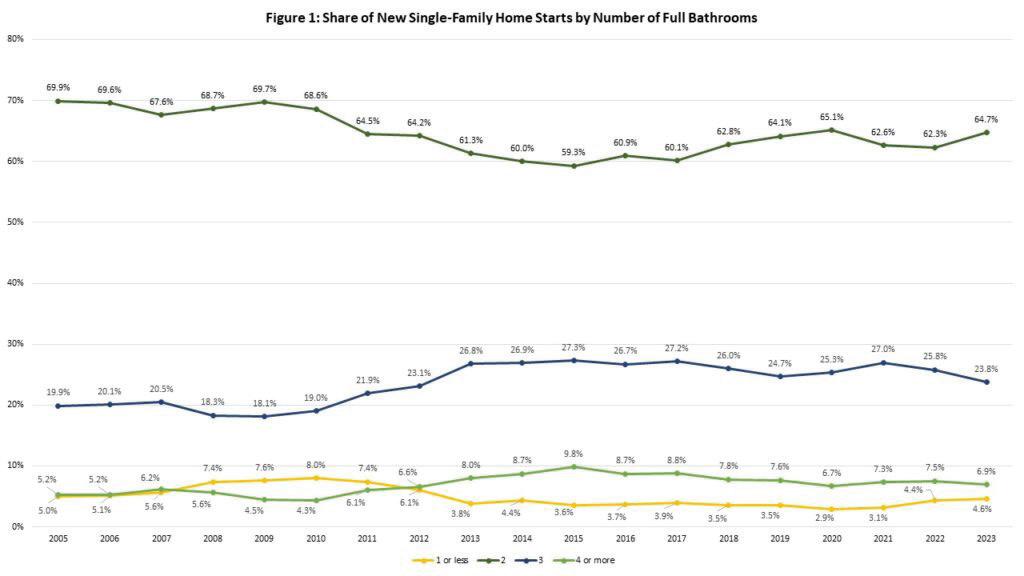

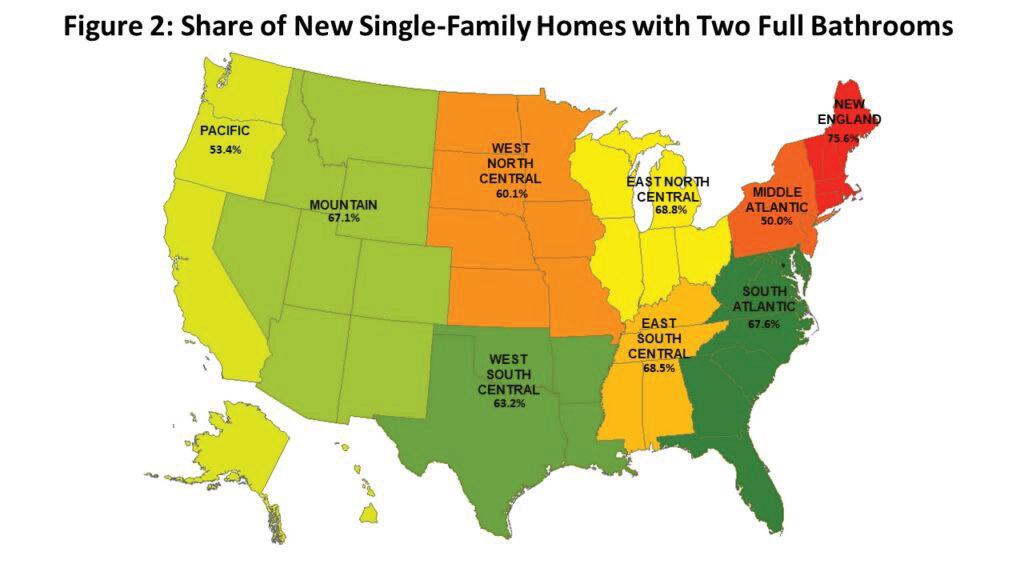

A majority of single-family homes nationwide started in 2023 continued to have two full bathrooms according to the latest release of the Census Bureau’s Survey of Construction. According to the latest data, 64.7% of new single-family homes started in 2023 had two full bathrooms, 23.8% had three full bathrooms, 6.9% had 4 or more full bathrooms, and only 4.6% had one full bathroom or less.

The recent data features the largest increase since 2018 in single-family homes with two bathrooms, as the share increased from 62.3% to 64.7%. This reverses the trend of the past two years when this share consecutively decreased. The share of single-family starts with 3 full bathrooms fell for the second straight year, down to 23.8%, while the share of single-family starts with 1 full bathroom or less rose to 4.6%, the third straight increase. Single-family homes started with 4 or more bathrooms share decreased to 6.9%, after increasing the prior two years.

Across the U.S., the New England census division had the highest share at 75.6% of new single-family starts having two full bathrooms. This share jumped by 22.2 percentage points from 2022, and this was the first time since 2017 that the New England share was the largest in the nation. The lowest share census division was the Middle Atlantic, with 50.0% of new single-family starts reporting two full bathrooms. The share of new single-family started with two full bathrooms fell 9.2 percentage points from 2022 in the Middle Atlantic.

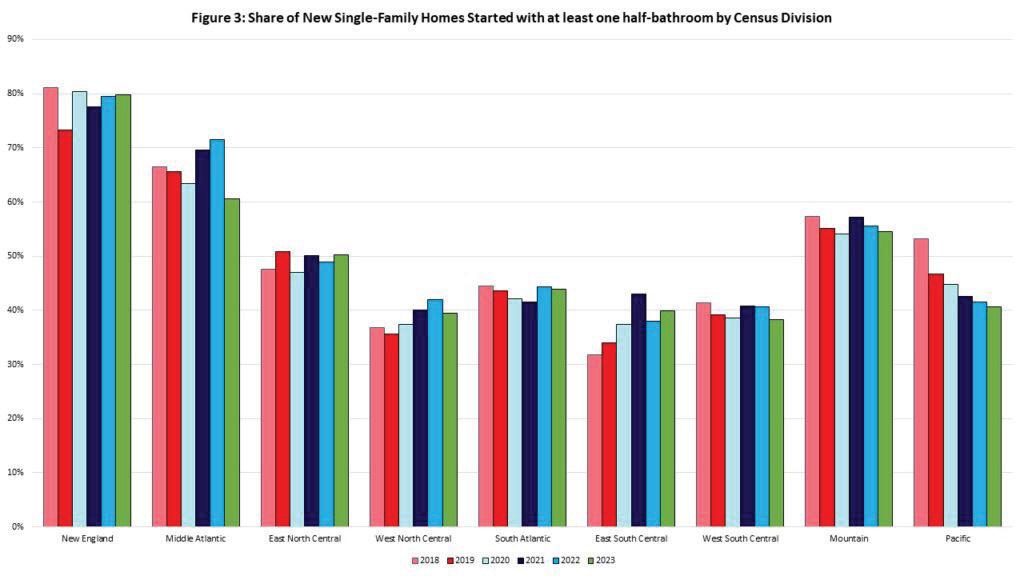

Most new single-family homes started in 2023 have no half-bathrooms at 54.7%. Following closely is the share of new single-family homes with one half-bathroom at 43.8% . New single-family starts with two or more half-bathrooms had a small share of 1.5% in 2023.

Half-bathrooms are historically prevalent in the New England census division as 79.8% of new singlefamily starts had at least one in 2023. Half-bathrooms were the least common in the West South Central, with only 38.3% of new single-family starts reporting at least one half-bathroom. A trend of note is in the Pacific, where the share has fallen for five consecutive years, from 53.2% in 2018 to 40.7% in 2023.

Source: NAHB

Thank you to this year's presenting Sponsor

BREAKFAST/COFFEE SPONSOR $500(2)

• Sponsors provides breakfast / coffee for participants

• Sponsor will be verbally recognized at event

• Sponsor logo displayed on table signage

• Recognition on HBA Website, Cornerstone and Facebook

BEVERAGE SPONSOR $500 (2)

• Sponsor will provide sodas and beer for awards lunch

• Sponsor will be verbally recognized at event

• Sponsor will have signage at event

• Recognition on HBA Website, Cornerstone and Facebook

PRIZE SPONSOR $1000 (1)

• Sponsor will be verbally recognized at event

• Sponsor may present awards to tournament winners

• Sponsor will have signage at event

• Recognition on HBA Website, Cornerstone and Facebook.

SCORECARD SPONSOR $350 (4)

• Company name and logo on all tournament scorecards

W WATER STATION SPONSOR $250 (2)

• Sponsor may set up a table and provide drinks and snacks and may promote their business during the event, NO ALCOHOL ON COURSE

S STATION SPONSOR $150 (8)

• Sponsor will have signage at a shooting Station

DOOR PRIZE SPONSOR (No limit)

• Donate a door prize for the raffle

To register click or scan below

This on-demand webinar recording features Dr. Robert Dietz, the National Association of Home Builders’ (NAHB) chief economist, and Fan-Yu Kuo, an NAHB senior economist and the association’s senior VP for economics and housing policy. Dietz and Kuo deliver expert analysis and examine key macro issues affecting the U.S. economy and the housing industry, such as:

• The Federal Reserve’s monetary policy and current inflation and interest rate readings

• The influx of legal immigration and U.S. population growth

• The expanding share of new-home inventory compared with existing homes on the market

• Housing’s role in budging stubborn inflation

• Other factors affecting the home building industry

• Plus, there’s a Q+A session with webinar attendees at the end.

Watch this webinar recording to gain a better understanding of the macro-economic factors driving the housing industry in 2024.

The insights you glean into monetary, fiscal, and housing policies will help you prepare your company for what’s to come during the remainder of the year.

The webinar is available on demand offering the latest 2024 housing market outlook. probuilder.com/webinar-nahb-mid-year-2024market-outlook.

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Candidate 1-5 credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+ Spike Club Members and their credits as of 09/30/2023.

Statesman Spike

Harold Logan

Super Spike

Rod Hurston

Royal Spike

Rick

William “Billy” Moore

Charlie

Kim

Spike

Shelby

Michael Johnson, Agent

3127 E Langley Avenue

Pensacola, FL 32504

Bus: 850-478-7748

www.michaeljohnsonagency.com