GDP Growth Is Stronger Than Expected in the

Second Quarter

page 07

August 2023 | www.westfloridabuilders.com | page 3 Save big with HOT appliance rebates from Pensacola Energy. Save up to $3,000 in COOL CASH with HOT appliance rebates when you convert or replace select household appliances to natural gas. See incentive details at PensacolaEnergy.com, or call 850-436-5050 for details. 1601975 Home & Auto go together. Like you & a good neighbor. Some things in life just go together. Like home and auto insurance from State Farm®. And you with a good neighbor to help life go right. Save time and money. CALL ME TODAY. State Farm Mutual Automobile Insurance Company, State Farm Indemnity Company, Bloomington, IL State Farm County Mutual Insurance Company of Texas, Dallas, TX State Farm Fire and Casualty Company, State Farm General Insurance Company, Bloomington, IL State Farm Florida Insurance Company, Winter Haven, FL State Farm Lloyds, Richardson, TX Michael Johnson, Agent 3127 E Langley Avenue Pensacola, FL 32504 Bus: 850-478-7748 www.michaeljohnsonagency.com

2023 Home Builders Association of West Florida Board of Directors

BUILDER MEMBERS

Fred Gunther, Gunther Properties

Drew Hardgraves, Landshark Homes

Ronnie Johnson J. Taylor Homes

Heath Kelly Heath Kelly Construction

Lowell Larson III, Venture Real Estate

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Shon Owens, Owens Custom Homes & Construction

Douglas Russell R-Squared Construction

Eric Shaffer Shaffer Construction

Casey Smith, DR Horton

Monte Williams Signature Homes

Anton Zaynakov Grand Builders

ASSOCIATE MEMBERS

Bill Batting, REW Materials

Rick Byars, Florida Power & Light

Bruce Carpenter, Home Mortgage of America

Mickey Clinard, Hancock Whitney Bank

Laura Gilmore Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Jill Grove, Pensacola Energy

John Hattaway Hattaway Home Design, Cost and Codes Chair

Chris Thomas, Acentria Insurance

Shellie Isakson-Smith, Supreme Lending

Daniel Monie KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Ric Nickelsen, SmartBank

Zach Noel Clear Title of NW FL

Charlie Sherrill SouthState Bank

Pam Smith Real Estate Counselors, Pensacola Assn. of Realtors Liaison (proposed by PAR)

Janson Thomas Swift Supply

Wilma Shortall, Trustmark Mortgage

Kevin Sluder Gene’s Floor Covering

COUNCIL CHAIRS

Mary Jordan Gulf Coast Insurance Tradesman Education Chair

Suzanne Pollard-Spann Legacy Insurance Brokers Ambassadors Chair

Ex-Officio Members of the Board of Directors

Blaine Flynn, Flynn Built

Shelby Johnson Johnson Construction

Russ Parris Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim Westerheim Properties

Doug Whitfield Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

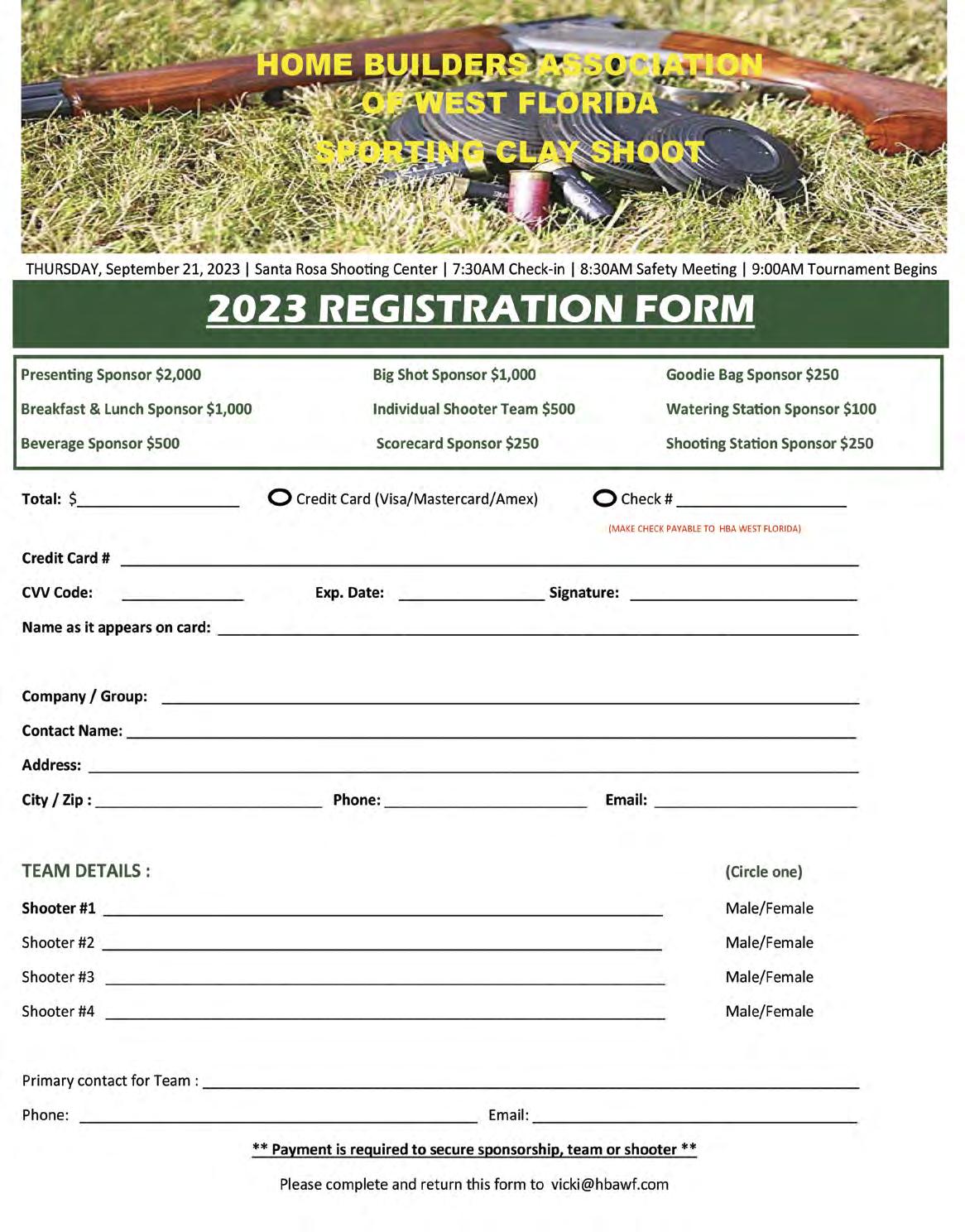

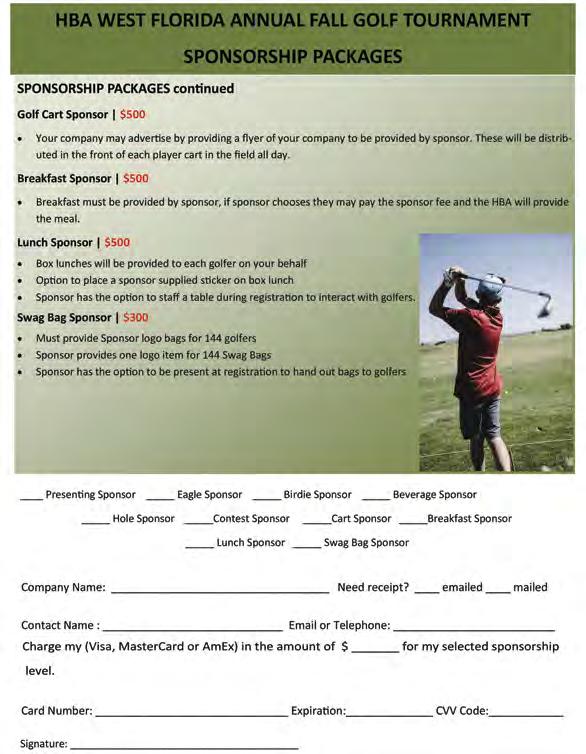

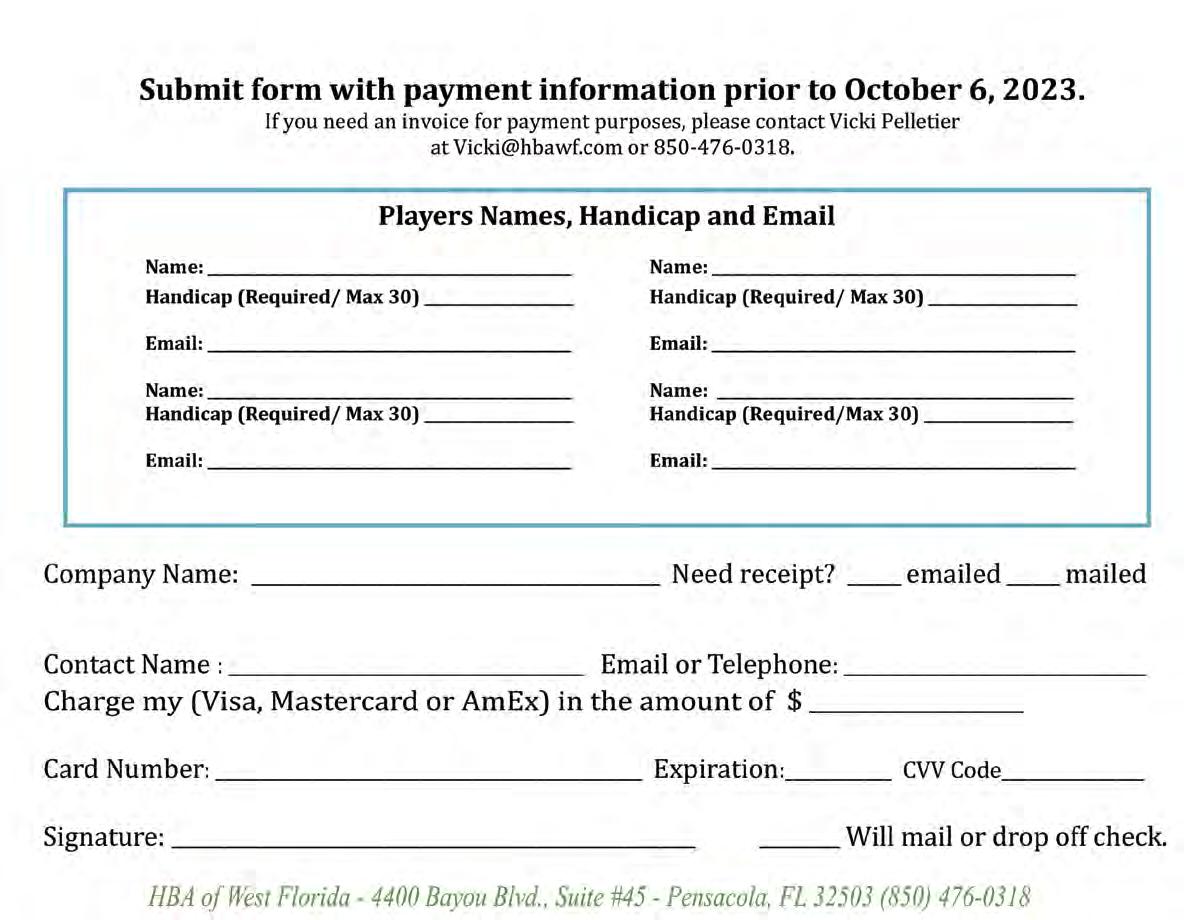

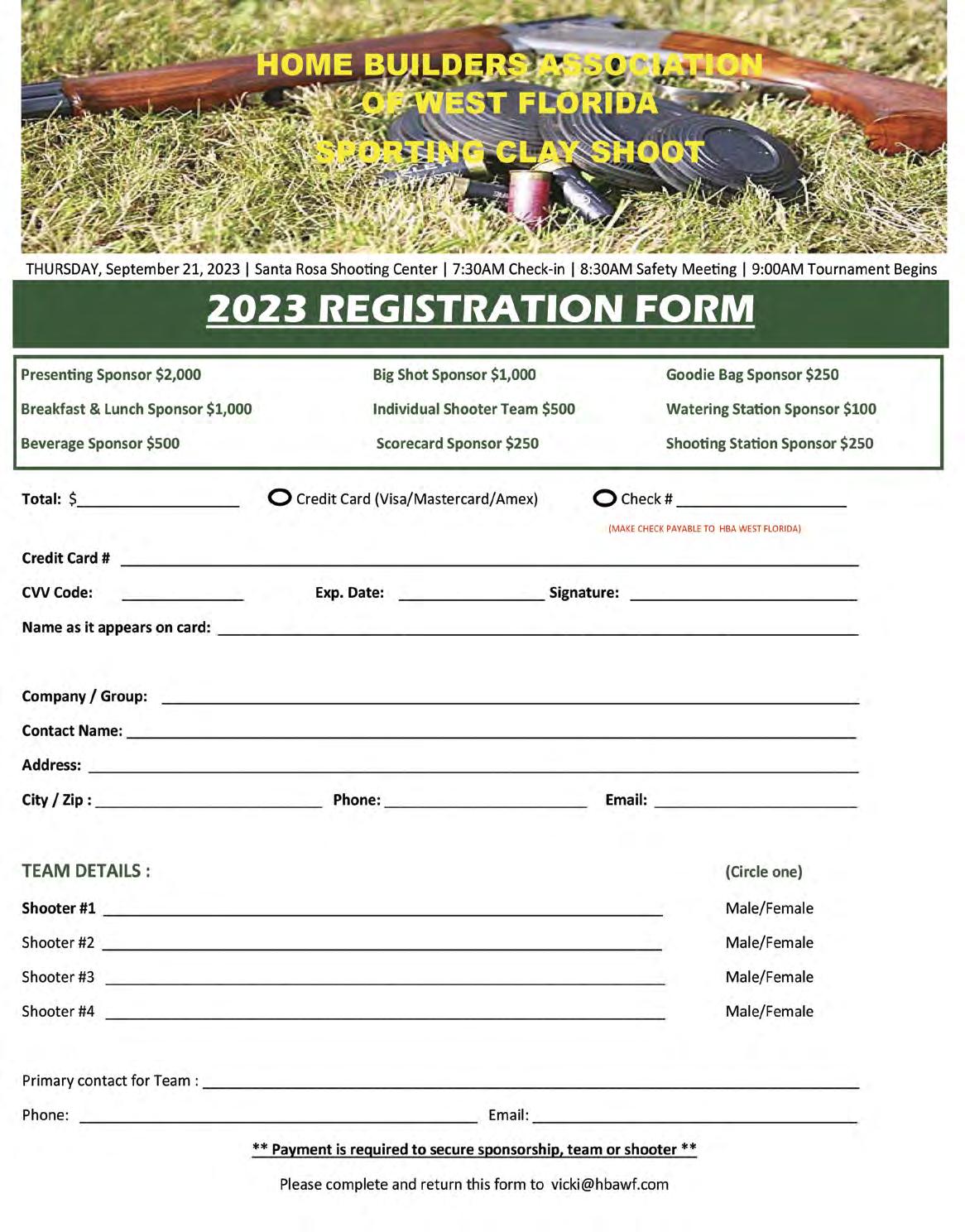

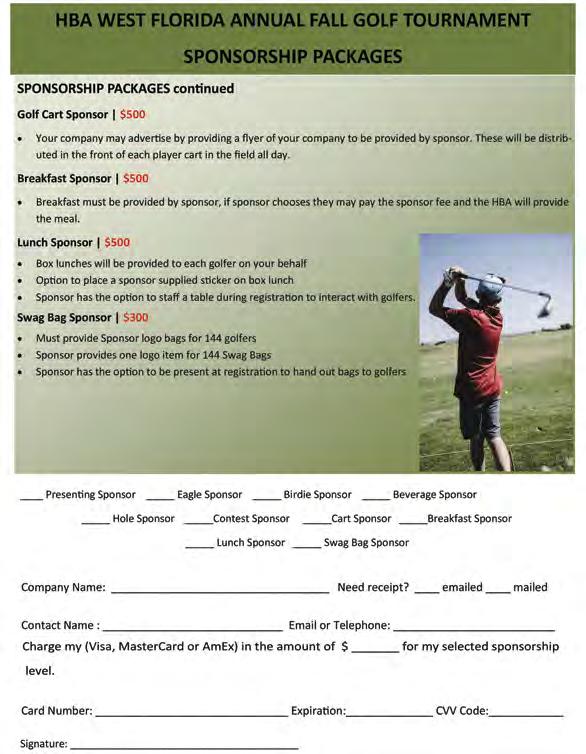

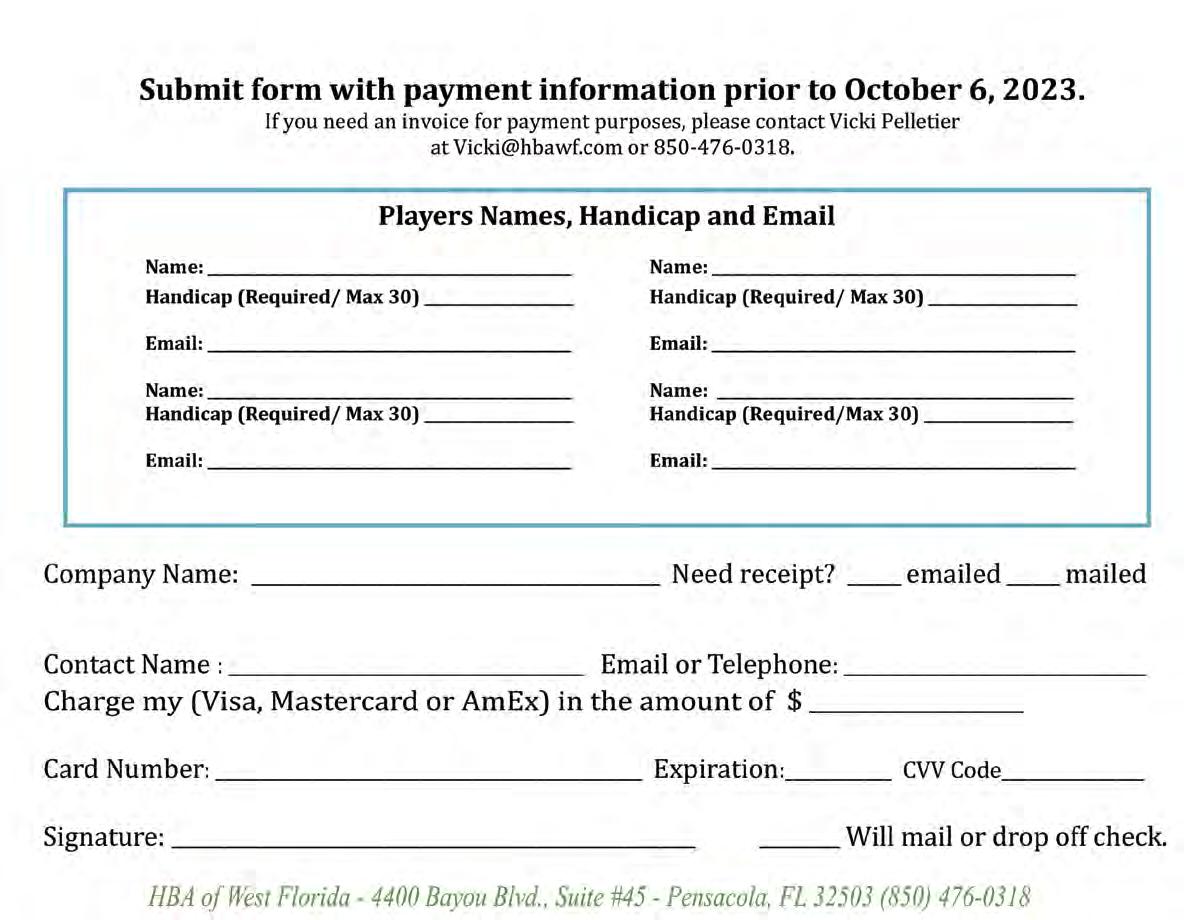

August 2023 | www.westfloridabuilders.com | page 5 Home Builders Association of West Florida | August 2023 | page 4 Cornerstone, the monthly publication of the Home Builders Association of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsibility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure accuracy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law. Cover Story Publisher Malcolm Ballinger Advertising Account Executives Paula Rode, Account Executive ext. 28 paula@ballingerpublishing.com Geneva Strange, Account Executive ext. 31 geneva@ballingerpublishing.com For advertising rates Phone: 433.1166 • Fax: 435.9174 Cornerstone Next Issue: Sept 2023 Edit: August 24, 2023 Display Ads: August 24, 2023 Vicki Pelletier Director of Marketing & Communication vicki@hbawf.com GDP Growth Is Stronger Than Expected in the 2nd Quarter .................................... 07 PRESIDENT’S MESSAGE HBA West Florida Welcomes New Executive Officer: Jennifer Mancini .......................................................................................................... 06 FEATURE STORY Canadian Wildfires Raised Air Pollution Lumber Prices Could Be Next ...................... 08 Homeowners Don’t Want to Sell, So the Market for Brand-New Homes Is Booming .............................................................................. 11-13 HBAWF NEWS HBAWF Sporting Clay Shoot Registration ............................................................... 15 HBAWF Fall Golf Tounament Information and Forms ...................................... 16-17 Top 10 Reasons To Do Business With An Active Associate Member ..................... 19 Get Involved in HBA Councils & Committees ................................................ 19 & 21 Like Us on Facebook .................................................................................................. 21 Spike Club ................................................................................................................... 22 NAHB NEWS Learn Tips to Stay Cool in Record Heat .................................................................... 09 Lot Shortage Eases but Still a Problem Lot Shortage Eases but Still a Problem ..... 17 GOVERNMENT NEWS Bipartisan Group of Senators Warns DOE Not to Make Transformer Shortage Worse With New Efficiency Rule ......................................... 14 Gov. Desantis Signs Measure Banning Local Voter Referendums On Land Development ......................................................................... 18 DEPARTMENTS INDEX Advertisers Index, Web, & Email Addresses ………….....……...........……… 22 2023 Leadership Board Amir Fooladi President Encore Homes Stephen Moorhead Legal Counsel Moorhead Real Estate Law Group Josh Peden Financial Officer/Treasurer Hudson, Peden & Associates Chad Edgar Immediate Past President Joe-Brad Construction Marty Rich Past 2nd Vice President University Lending Group Paul Stanley 3rd Vice President The First Bank Lindy Hurd 2nd Vice President/SMC Chair First International Title Austin Tenpenny Secretary Adoor Properties Jennifer Reese Treasurer Reese Construction Services Dax Campbell 1st Vice President Campbell Construction & Company Cornerstone is published for the Home Builders Association of West Florida by Ballinger Publishing and distributed to its members. Reproduction in whole or part is prohibited without written authorization. Articles in Cornerstone do not necessarily reflect the views or policies of the HBA of West Florida. Articles are accepted from various individuals in the industry to provide a forum for our readers. (850) 476-0318 4400 Bayou Blvd., Suite 45, Pensacola, Florida 32503 www.westfloridabuilders.com

jennifer@hbawf.com

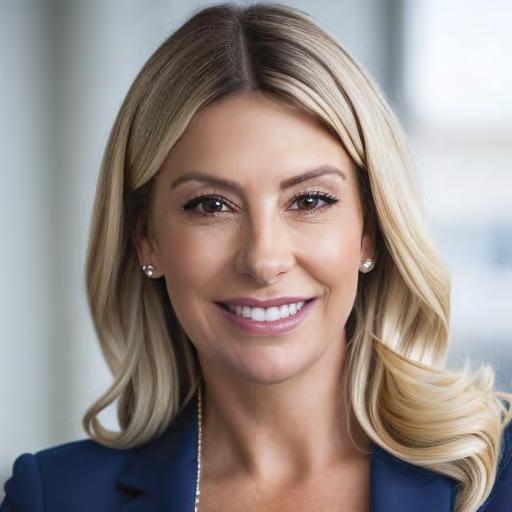

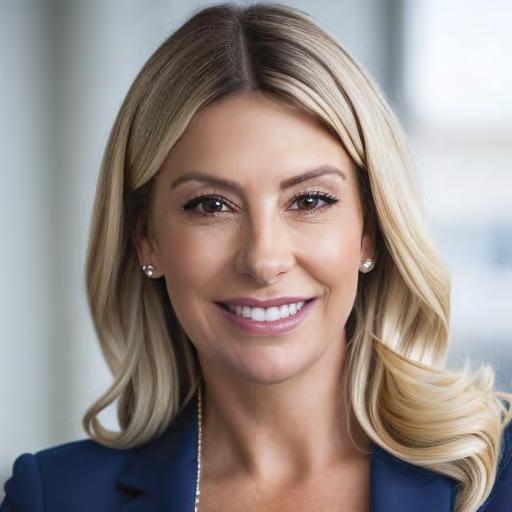

Jennifer Mancini Executive Director

HBA West Florida Welcomes New Executive Officer

Jennifer Mancini

After an extensive search process led by members of the Senior Board, I am pleased to announce that on July 3rd Jennifer Mancini officially took the helm as Executive Officer of the HBA of West Florida. For the past eight years, Jennifer worked in Business Development at Hypower, Inc. in Ft. Lauderdale, one of the largest electrical contractors in the southeastern United States. Hypower’s clients include general contractors, public and private utilities, and developers. During her time at Hypower, Jennifer also managed legislative affairs and served on both the Association of General Contractors (AGC) and Associated Builders and Contractors (ABC) legislative committees. For over 20 years, she has successfully lobbied legislators on behalf of the construction industry at the local, state, and national level. Prior to her position at Hypower, Jennifer was the Executive Director of the National Utility Contractors Association of South Florida (NUCA) from 2002-2015. NUCA is a non-profit trade association representing underground utility contractors, material and equipment suppliers and other industry stakeholders. Jennifer’s construction industry experience, association management skills, and relationships in local and state government made her an exceptional choice for the role of our Executive Officer. Please join me in welcoming her to the HBA of West Florida and thank you for being a part of the next chapter in the story of this great association.

GDP Growth Is Stronger Than Expected in the 2nd Quarter

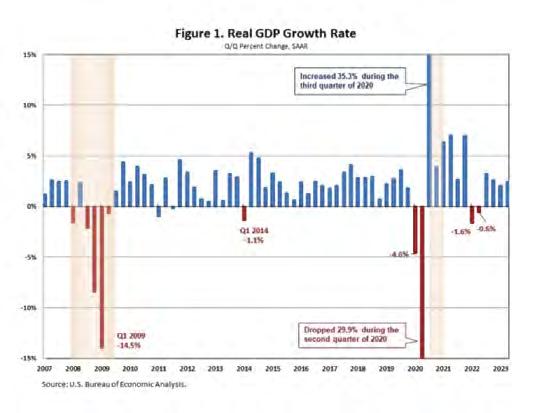

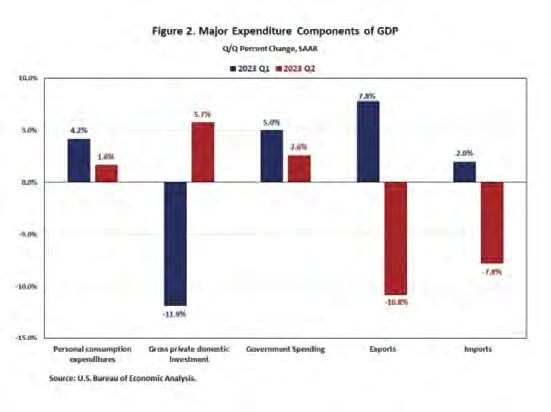

The U.S. economy grew at a solid pace in the second quarter of 2023, fueled by consumer and government spending.

The second quarter data from the GDP report suggests that inflation is cooling. The GDP price index rose 2.2% for the second quarter, down from a 4.1% increase in the first quarter. It marks the slowest annual growth rate since the third quarter of 2020. The Personal Consumption Expenditures (PCE) price Index, capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior, rose 2.6% in the second quarter, down from a 4.1% increase in the first quarter.

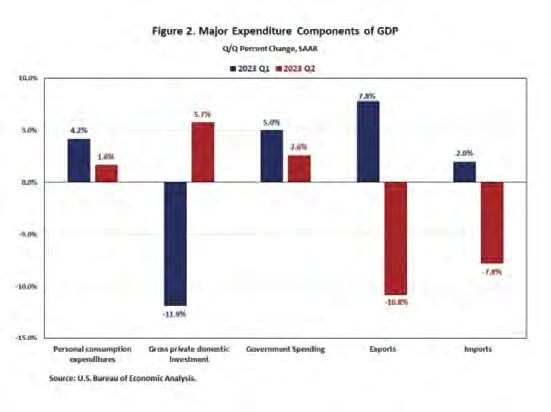

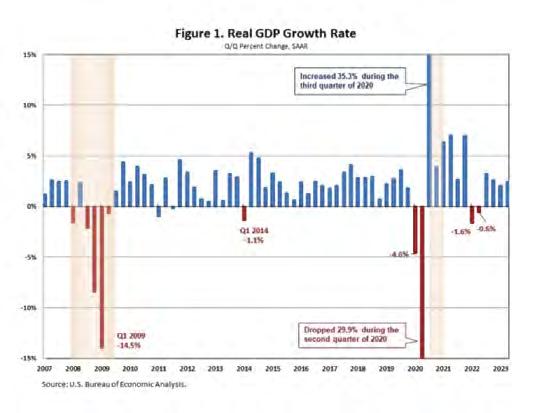

According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) increased at an annual rate of 2.4% in the second quarter of 2023, following a 2% gain in the first quarter. This quarter’s growth was above NAHB’s forecast of a 1.4% increase. (Figure 1)

This quarter’s increase reflected increases in consumer spending, nonresidential fixed investment, government spending, and private inventory investment, partially offset by decreases in exports

and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Consumer spending rose at an annual rate of 1.6% in the second quarter, reflecting increases in both services and goods. While expenditures on services increased 2.1% at an annual rate, goods spending increased 0.7% at an annual rate, led by gasoline and other energy goods (+13.1%).

Meanwhile, federal government spending increased 0.9% in the second quarter, while state and local government spending rose 3.6%, reflecting increases in compensation of state and local government employees and gross investment in structures.

Nonresidential fixed investment increased 7.7% in the second quarter, up from a 0.6% increase in the first quarter. The quarter’s increase in nonresidential fixed investment reflected increases in equipment (+10.8%), structures (+9.7%), and intellectual property products (+3.9%). Additionally, residential fixed investment (RFI) decreased 4.2% in the second quarter. This was the ninth consecutive quarter for which RFI subtracted from the headline growth rate for overall GDP. Within residential fixed investment, single-family structures rose 0.8% at an annual rate, multifamily structures rose 1.5% and other structures (specifically brokers’ commissions) decreased 8.9%. (Figure 2)

Home Builders Association of West Florida | August 2023 | page 6 President’s Message Cover Story

Amir Fooladi

“For over 20 years, she has successfully lobbied legislators on behalf of the construction industry at the local, state, and national level.”

By Jing Fu

Canadian wildfires raised air pollution

Lumber prices could be next

By Adrian Wyld/The Canadian Press/AP

Canadian wildfire smoke continues to blow over much of the U.S., raising air pollution to harmful levels for construction workers. Now, the impact of the fires is likely to raise U.S. lumber prices, too.

Canada’s 2023 wildfire season has been blazing, burning the largest amount of land ever recorded in a single year, said Marcy Nicholson, senior editor at Forest Economic Advisors, a Littleton, Massachusetts- based wood and timber product database, in a report on the Canadian wildfires.

“Unusually warm and dry conditions in many parts of [Canada] have provided fuel for blazes,” said Nicholson. “This has forced thousands of residents to evacuate, caused a scattering of mills to close temporarily and altered some harvest plans.”

By late June, with several months of wildfire season left to go, the burned area has already exceeded the full-year record made in 1995, according to Canadian Interagency Forest Fire Centre data. Canada’s typical wildfire season peaks in July and fizzles out by October, added Nicholson.

That’s bad news for contractors dependent on lumber availability and affordability. The reason why is that Canada supplies approximately 80% of U.S softwood lumber imports, according to Natural

demand for residential properties resulting from current high costs, may result in a slight and temporary increase in lumber prices.”

Alberta and Quebec hardest hit.

The Canadian provinces of Alberta in the west and Quebec in the east have been hardest hit thus far, with roughly 3.8 million acres and more than 3.5 million acres burnt, respectively, according to CIFFC data. Together, they represent more than 40% of Canada’s annual softwood lumber shipments.

That’s a massive hit on Canada’s softwood lumber production, softwood lumber shipments and timber harvest volume, said David Logan, senior economist at the National Association of Home Builders.

Through the first three months of 2023, Alberta and Quebec accounted for a combined 44% of total shipments and 45% of total production, said Logan. That means wildfires in those provinces are affecting a meaningful chunk of Canada’s harvest.

Resources Canada, the Canadian government department responsible for natural resources.

“The enormity of the fires has given lumber prices a boost, though it is too soon to estimate how much of the affected area includes harvestable timber and how much will catch fire in the months to come,” said Nicholson. “It is also too early to know how much of this will need to be quickly salvaged. Some of the largest wildfires are far north, limiting firefighting efforts and opportunities to utilize the burned timber.”

Lumber prices fell 10% in the past year, according to the latest Associated Builders and Contractors producer price index. That provided much-needed relief for contractors, as lumber prices skyrocketed at the onset of the pandemic and remain 26.5% higher than in February 2020. After price drops for lumber in recent months, including a minimal 0.4% dip in June, economists expect that trajectory to reverse course again, said Mark Fergus, executive vice president of Cumming Group, a Seattle-based project management and cost consulting firm, in an email interview.

“Whilst the overall impact on resources is still being assessed, it is expected that the short-term impact of the wildfires will temporarily increase costs,” said Fergus. “The fires, combined with a drop in

“Alberta’s share of pretty much any metric related to softwood lumber has been growing rather quickly in recent years,” said Logan. “If Alberta can’t get back to the trend it was on — whether by natural disaster or public policy — it would bode poorly for lumber prices.

” With several months of wildfire season remaining, Natural Resources Canada forecasts weather conditions to get worse before they turn better with the approach of winter later this year. NRC expects fire weather severity in July and August will be above average for the vast majority of Canada, said Nicholson.

“Weather conditions in Canada are on track to fuel more wildfires throughout the summer,” said Nicholson. “It’s a jaw-dropping forecast that, at times, paints a huge amount of the Canadian map red.”

related illnesses and/or injuries. The toolkit provides key insights on preventing and identifying heat stress and includes downloadable resources and videos available in English and Spanish.

Heat stress can be particularly dangerous because most residential construction professionals are used to working in the heat of summer. But acclimatization within a season is crucial to staying safe. If the normal high temperatures in your area are in the high 80s and a heat wave suddenly brings readings in the high 90s, the first few days are going to be the most dangerous because of lack of acclimatization.

Learn Tips to Stay Cool in Record

Heat

Arecord heat wave is causing the mercury to hit triple digits on many jobsites across the country. Ensuring employees and contractors are regularly hydrated and protected from the sun during hot months is essential to the health and safety of workers.

NAHB’s Heat Stress Safety Toolkit can help members be prepared to take precautions to protect against possible heat

Employers and workers should be sure to have plans in place to provide access to plenty of water and take adequate breaks when needed, as well as access to shade or cool-down areas. Employers and workers should also consider shifting work schedules to times of day when temperatures are lower, such as early morning to midday.

This summer, the Las Cruces Home Builders Association (LCHBA) helped its local community stay cool. The HBA delivered popsicles, cold water and sunglasses to residential construction workers on jobsites. The drop-ins were an opportunity to help workers cool down, but also show appreciation for their hard work, said Nicole Perez, executive officer, LCHBA.

To access the heat safety toolkit and other safety resources, visit nahb.org.

August 2023 | www.westfloridabuilders.com | page 9 Feature Story NAHB News

Home Builders Association of West Florida | August 2023 | page 8

Homeowners Don’t Want to Sell, So the Market for Brand-New Homes Is Booming

By Nicole Friedman | Wall Street Journal

After mortgage rates shot up last year, Ivory Homes, one of Utah’s largest builders, suddenly had few buyers for the hundreds of homes it had under construction. So, Clark Ivory, the chief executive, laid off 9% of his staff, and by January he had slashed construction by nearly 80% from its 2022 peak.

Then, much to his surprise, sales of new homes started picking up. By May, even though mortgage rates weren’t really budging, sales for all home builders were at their highest level since early 2022. Millions of American homeowners have been reluctant to sell because they can’t afford to give up the low mortgage rates they have now. Only 1.08 million existing homes were for sale or under contract at the end of May, the lowest level for that month in National Association of Realtors data going back to 1999.

For many would-be buyers—in Utah and in many other markets—new construction has become the only game in town. Newly built homes accounted for nearly one-third of single-family homes for sale nationwide in May, compared with a historical norm of 10% to 20%. Existing-home sales in May fell 20% year-over-year, while new single-family home sales that month rose 20% on an annual basis.

this year. The S&P Homebuilders Select Industry stock index is up 39.8% this year as of Tuesday’s close, outpacing the S&P 500’s 18.6% gain. Share prices for D.R. Horton, Lennar, and PulteGroup, the three largest home builders, have performed even better.

The pandemic stoked an especially broad housing boom in 2020 and 2021. Many buyers sought larger spaces to spend more time at home, while others wanted to move closer to family. Ultralow interest rates made it inexpensive to finance their purchases.

Home-building activity surged. Mountain West states such as Utah became attractive destinations during the pandemic for people leaving expensive West Coast cities in search of a lower cost of living and an outdoors lifestyle. Home prices in the Salt Lake City area soared 53% between January 2020 and May 2022, on a seasonally adjusted basis, according to Freddie Mac’s home-price index.

That divergence is yet another example of how this housing market is behaving like no other. “It’s such a rare thing,” said Rick Palacios Jr., director of research at Irvine, Calif.-based John Burns Research & Consulting, who predicts the disparity will widen in coming months.

So far, the home-building revival, coupled with financial incentives offered by builders, is providing only minor relief to prospective buyers. Builders aren’t erecting enough homes to offset the shortage of existing ones on the market, meaning buyers in many places still face bidding wars. On a national basis, home prices have only declined a small amount from their record highs in spring 2022. Interest rates have risen in recent weeks to their highest level this year.

For builders like Ivory, though, it has been a lifeline. Builder confidence, which declined every month in 2022, has risen for seven straight months to its highest level since June 2022, according to the National Association of Home Builders.

Investors believe the home-building industry—one of the most sensitive to changes in interest rates—has already gone through its recession and is coming out the other side.

Publicly traded home builders have reported stronger-than-expected results

Family-owned Ivory Homes, which was founded by Ivory’s father, Ellis Ivory, has been one of Utah’s top home builders for decades. Clark Ivory, 58 years old, became CEO in 2000.

In 2006, around the peak of the last boom, Ivory got worried about speculative investing. Ivory Homes started buying less land and paying off debt. To avoid selling to flippers, the company required buyers to sign an agreement that they were purchasing their homes as primary or secondary residences and that they wouldn’t sell for at least a year.

U.S. home prices fell 27% between mid2006 and early 2012, sending ripples throughout the global economy and world financial markets. Ivory Homes stayed profitable between 2008 and 2012, Ivory said.

The pandemic-driven housing boom, Ivory said, didn’t involve as much speculation. Lending standards have improved, and investors have been buying homes to rent out to tenants, not to flip. During the pandemic boom, builders also faced obstacles they didn’t last time around, which kept them from overbuilding: supply-chain issues and labor shortages added weeks or months to their construction timelines. Ivory said his biggest concern, however, is affordability.

August 2023 | www.westfloridabuilders.com | page 11 Home Builders Association of West Florida | August 2023 | page 10 NAHB News Feature Story

continuesonpage12 PlainsmanContractors.com 850-384-2603 |

TOP 10 REASONS TO DO BUSINESS WITH AN ACTIVE ASSOCIATE MEMBER

1. They support the industry at the local, state and national levels.

2. They volunteer time, talent and treasure to help the association accomplish its goals.

3. They recruit their colleagues and business contacts to become members.

4. They serve on committees and councils gaining valuable networking opportunity while helping to advance the association’s mission.

5. By doing so, you increase the value proposition for all membership in our HBA.

6. They are strong supporters of local and state PACs and BUILD-PAC.

7. They are a major source of non-dues revenue through sponsorships, advertising, etc.

8. As industry partners, they are a valuable resource for business and management tips.

9. They are heavily invested in your business success: You win, they win!

10. Why wouldn’t you do business with a member?

Homeowners Don’t Want to Sell, So the Market for Brand-New Homes Is Booming

from page 11

In the spring of 2022, rapidly rising mortgage rates abruptly slowed buying. Prices in Utah and around the U.S. had risen so rapidly that many buyers were priced out.

“It was the third weekend in May last year, and literally the lights just turned off,” said Ryan Smith, president of home building for Denver-based Oakwood Homes, a unit of Berkshire Hathaway that builds in Colorado, Utah and Arizona. “From there, the fight was on” to keep buyers from canceling.

Ivory Homes had 1,089 homes under construction in last year’s first quarter, including 513 that hadn’t yet been sold. “If I made one big mistake in the way I managed through Covid, it was trying to keep up” with demand, Ivory said. “I should have said to myself, ‘We can’t handle this.’”

In the second half of 2022, builders cut prices to attract buyers for their unsold homes or to persuade buyers already under contract not to back out.

Demand rebounded this year in the first quarter. By April, builders forecast a 7% increase in sales for 2023, according to a survey by John Burns Research & Consulting, reversing their forecast of a 9% drop when surveyed in November.

In Daybreak, a master-planned community about a 30-minute drive from Salt Lake City, developer Larry H. Miller Real Estate initially expected to sell 100 to 125 lots this year to home builders, including Ivory Homes. Now it expects to sell 160, according to Brad Holmes, the developer’s president.

“There was no inventory on the existing market, so everybody was being pushed to a new home,” he said.

Ivory Homes has adjusted its building plans to meet current buyers’ tastes and budgets. It is building in a master-planned community called Holbrook Farms in Lehi, a fast-growing city about 30 miles south of Salt Lake City. Lehi and nearby communities are home to the area’s many tech businesses—a major market for Ivory Homes and other builders.

Last fall, Ivory Homes was building three-story homes with three or four bedrooms in Holbrook Farms to sell for up to $625,000. Called EVillas, they had open kitchens and were targeted at firsttime buyers. As demand slowed late last year, Ivory said, the company decided: “We have to hit a lower price point.” It redesigned the E-Villas to offer a two-story version with three bedrooms, priced below $450,000.

Now the two-story homes are now selling better than the three-story ones, he said.

Builders nationwide are focusing on cutting costs and building smaller homes with lower price tags. Nationally, the proportion of new homes sold in May for under $300,000 rose to 17%, the highest level since December 2021.

Home builders also began offering sweeter terms to buyers. About 52% of builders provided incentives in July, up from 43% in July 2022, according to a NAHB survey. Many builders are paying to lower buyers’ mortgage rates, often by a percentage point or more, to help make the monthly payments more affordable.

Some buydowns reduce rates for only the first few years of a loan, but many builders, including Ivory Homes, are offering to lower the mortgage rate for the life of the loan. The temporary buydowns require buyers to qualify for the highest mortgage rate the loan will reach.

The arrangements benefit buyers and sellers alike. Builders would rather pay for lower mortgage rates than cut prices, because price cuts can affect the value of

other homes in the neighborhood. For buyers, a lower mortgage rate can reduce a monthly payment more than a price cut.

Salt Lake City housing prices aren’t rising at the frenetic pace of 2021 and early 2022.

In June, average new-home prices in the metro area fell 11% from the year-earlier period, factoring in the value of incentives, according to a John Burns Research & Consulting survey.

house from Ivory Homes in early July for about $600,000. They opted for a temporary buydown that reduces their mortgage rate for the first two years of the loan, and they hope to refinance to a lower rate as soon as they can.

“I’m hoping we made the right decision,” Luke said. “I don’t know if it was the right time to buy, but rents keep going up.”

Buyers remain sensitive to small changes in mortgage rates, and an increase in the average to above 7% could slow demand, builders say.

The average rate for a 30-year fixed mortgage was 6.96% in the week ended July 13, the highest since November, according to Freddie Mac. A recession, higher unemployment or uncertainty about the presidential election also could spook buyers.

First-time home buyers that tour Holbrook Farms are factoring in a mortgage rate of nearly 7%, according to John Savage, an Ivory Homes sales consultant. With a rate buydown from the builder, their purchasing power can go up by $100,000, he said.

Katherine Luke and Muhammad Salman had been looking to buy their first home in the Salt Lake City area for more than two years. They didn’t find many existing homes on the market within their budget that didn’t need renovations. Earlier this year, they started looking at new homes instead.

“For the price point, it does seem like it makes more sense than trying to renovate an older home,” Luke said. There is more to choose from in the new-home market, she said.

The couple bought a new four-bedroom

Some regional and local banks have been tightening credit for small businesses, which could also threaten some builders’ ability to borrow money for new projects. And while builders’ costs have come down somewhat, largely due to a big decline in lumber prices, they are still higher than prepandemic levels. Federal student-loan payments are set to resume in the fall, which could make it more difficult for first-time home buyers to save for down payments.

Yet others who delayed their home-buying plans in 2022 have grown comfortable with current mortgage rates, real-estate agents and builders say.

“People still need a house, because they got married last year, they graduated college last year, and they’re tired of waiting,” said Barry Gittleman, chief executive of Murray, Utah-based builder Hamlet Homes.

And after two years of robust home sales and high margins during the recent housing boom, builders can afford to keep offering rate buydowns to entice buyers.

“We’re all relieved now that we had a really good first half of the year,” Ivory said.

“This is not a market to be scared about.”

August 2023 | www.westfloridabuilders.com | page 13 Home Builders Association of West Florida | August 2023 | page 12 Feature Story

“There was no inventory on the existing market, so everybody was being pushed to a new home...”

BallingerPublishing.com | 850.433.1166 BUSINESS CLIMATE ON MARKET REAL THIS ISSUE: PENSAPRIDE SUMMER SIPPERS ART OF THE TACO PENSACOLAMAGAZINE.COM

Bipartisan Group of Senators Warns DOE Not to Make Transformer Shortage Worse With New Efficiency Rule

By Robert Walton | Construction Dive

Brief: A bipartisan group of 47 senators has asked the U.S. Department of Energy to tread carefully in advancing new energy efficiency rules for distribution transformers that are in short supply. “Such a standard could come at meaningful cost to grid reliability and national security,” they wrote Thursday to Energy Secretary Jennifer Granholm.

DOE proposed new standards for the transformers in December, to go into effect in 2027. But this is a “strategically inopportune time,” the senators said, and the rule could hinder the nation’s clean energy transition.

A senior DOE official said the agency understands the concern and has been working with the power sector for more than a year to address the issue. The official said that a lack of investment in steel manufacturing, rising demand for transformers and labor shortages are contributing factors.

Insight: Average time for utilities to procure distribution transformers has risen from eight to 12 weeks in 2020 to more than two years, threatening storm recovery and the nation’s electrification goals, the senators warned DOE. Senators who signed the letter include Joe Manchin, D-W.Va., Marco Rubio, R-Fla., and Amy Klobuchar, D-Minn.

“We urge the Department to refrain from promulgating a final rule that will exacerbate transformer shortages,” they wrote. The group wants DOE to “convene stakeholders across the supply chain to develop consensus-based approach to setting new standards.”

The group also requested a briefing with the agency on the path forward for the efficiency proposal, and how to best leverage DOE authority to bolster domestic supply chains.

Similarly, more than 60 House members in April asked DOE to withdraw the proposed rule.

Most distribution transformers use grain-oriented electrical steel cores, or GOES, but DOE’s proposed efficiency rule would largely transition the electric industry to using amorphous steel cores. There is only one domestic manufacturer of each type of steel, however.

DOE is “open to exploring both supply- and demand-side solutions to encourage further manufacturing of distribution transformers,” an agency spokesperson said in response to the senators’ letter.

DOE faces a court mandate to finalize any proposed change to the transformer standard by June 2024. Comments on its proposal were due in March, and supporters of the new rule say it could cut energy waste by up to 50% relative to most current transformer models.

The senators said they appreciate the efficiency benefits but “we believe the most prudent course of action is to let both GOES and amorphous steel cores coexist in the market.” DOE must still go through the comments to understand the market dynamics and run a cost-benefit analysis based on new data that were submitted, the senior agency official said. “So, there’s an opportunity for different variations of what was proposed, or ... maybe we need more information and it’s something we should wait and evaluate later,” the official said.

August 2023 | www.westfloridabuilders.com | page 15 Government News HBAWF News

Home Builders Association of West Florida | August 2023 | page 14

August 2023 | www.westfloridabuilders.com | page 17 Home Builders Association of West Florida | August 2023 | page 16 HBAWF News HBAWF News With our best agents located in Pensacola, you can be sure you’ll... • Get the most value for your money • Secure protection for your most valued assets • Better understand what coverages you have and what is available • Have access to an experienced agent providing you with personal service throughout Florida Mary Jordan Agent/Owner (850) 384-0593 mary@gcainsurance.com Cassy Smith Operations Manager (850) 497-6810 cassy@gcainsurance.com Taylor Bubert House Agent (850) 497-6810 taylor@gcainsurance.com Vicki Ruschel Personal Lines Manager (850) 497-6810 vicki@gcainsurance.com Speak with one of our agents today! One Great Team, Amazing Service! 700 New Warrington Rd Pensacola, FL 32506 Pensacola O: 850-497-6810 Gulf Coast Insurance gcains.com

Gov. Desantis Signs Measure Banning Local Voter Referendums On Land Development

It's one of a fleet of bills lawmakers ushered in to passage this Legislative Session.

By Jesse Scheckner

Voters will soon have little say in how the areas around them change through construction large and small, due to legislation Gov. Ron DeSantis just approved.

The measure (SB 718), which goes into effect Saturday, prohibits voter referendums or ballot initiatives on land development regulation.

That means all decisions over zoning, building approval, annexations and various other pivotal matters related to a county or municipality’s streets and skylines will be left to the members of its local governing body.

Jacksonville Republican Sen. Clay Yarborough sponsored the measure, which cleared the Legislature mostly along party lines in April. Republican Reps. Alina Garcia of Miami and Jennifer Canady of Lakeland carried its House companion (HB 41).

DeSantis quietly signed the measure just before 6 p.m. Wednesday.

Proponents like freshman Miami Republican Rep. Vicki Lopez, a co-sponsor of the House bill, argue localities “should not govern by referendum” and instead operate under America’s true form of government, a democratic republic in which elected leaders make decisions on behalf of the voters who put them into office.

Critics of the change say eliminating voter approval of land development is

a direct countermeasure to the will of voters. Some labeled the measure the “protect developers from citizens” bill and contend it will further shift power from the many to the few, effectively cutting residents out of decisions concerning local growth management and planning.

“We are basically taking away the ability for citizens across the state of Florida to have any input on the character of their community,” said Jane West, director of policy and planning for 1000 Friends of Florida, during a committee discussion of the issue in late March.

Voters in municipalities across the state — including many in South Florida, a hotbed for real estate development — have rejected building proposals in recent years through the soon-to-be banned referendum process.

In November, Miami Beach voters shot down ballot questions that would have allowed construction of a condo and hotel project Miami Dolphins owner Stephen Ross sought on the former Deauville Beach Resort site. Ross, a prolific campaign contributor to both Democrats and Republicans, is among DeSantis’ roster of billionaire donors.

Voters in some municipalities have shown they’d rather have their elected officials decide on development matters. In March, 63% of voters in Pinecrest, a small, affluent village in Miami-Dade County, said “no” to a ballot question asking whether they wanted to require supermajority approval among the local electorate for future zoning and land use amendments.

SB 718 is one of a fleet of bills Republican lawmakers ushered to passage this past Legislative Session that preempt some local control of local issues.

Among them: SB 102, a sweeping housing affordability package that includes a ban on local rent control ordinances; SB 1068, which codifies state standards for delivery drone ports and limits the say local governments have in their regulation; SB 170,

which would create a path for businesses to sue local governments and stop enforcement of ordinances they believe are “arbitrary or unreasonable”; and HB 1417, which would eliminate local ordinances granting residential renters more rights in cases of rent increases and evictions.

Another proposal that would have removed local protections for historic structures in flood-prone coastal areas and allow developers to raze and replace them with far larger, denser buildings crumbled in the waning days of Session. Like SB 718, the bill was interpreted by many as a response to Miami Beach’s rejection of developments in and around the thousands of properties identified in the city’s historic preservation regulations in the aftermath of the Champlain Towers South condo collapse in Surfside.

Several lawmakers, including Miami Beach Republican Rep. Fabián Basabe, say a refined version of the measure is likely to come again next year.

In addition to blocking direct voter influence over local land use, SB 718 reworks how counties and cities must proceed in expanding or contracting municipal borders. In place of a general report on the issue, local governments must produce a “feasibility study” of a proposed annexation or contraction analyzing the economic, market, technical, financial and management impacts of a city boundary change.

The local governing body — a County Commission, City Commission, Town Council, or other such panel — must approve or reject a proposed boundary change within six months of the feasibility study’s completion.

If more than 70% of the land proposed for annexation is owned by individuals, corporations or other legal entities not registered to vote in an area targeted for annexation or contraction, the area may not be absorbed or excised without the consent of at least half the property owners there.

August 2023 | www.westfloridabuilders.com | page 19

Government News

Home Builders Association of West Florida | August 2023 | page 18 Call for a free in home design consultation and estimate 850-637-1000 www.closetsbydesign.com Locally Owned and Locally Operated 40% Off Plus Free Installation Terms and Conditions: 40% off any order of $1000 or more or 30% off any order of $700 or more on any complete custom closet, garage, or home office unit. Take an additional 15% off on any complete system order. Not valid with any other offer. Free installation with any complete unit order of $600 or more. With incoming order, at time of purchase only. Imagine your home, totally organized! Custom Closets Garage Cabinets Home Offices Pantries Laundries Wall Beds Wall Units Hobby Rooms Garage Flooring and more... SPECIAL FINANCING for 12 Months With approved credit. Call or ask your Designer for details. Not available in all areas.

The right lender for building in the Florida panhandle.

With a proven track record and experience in the area, Synovus has become the lender of choice for purchases, construction-permanent and lot loans.

New Members

builder Members

Bock Construction Inc

Kevin Bock - President 8429 East Bay Blvd Navarre, Florida 32566 p 850.529.7949 bockconstruction.net

Swann Homes, LLC

Joel S. Swann

201 Navarre St. Gulf Breeze, FL 32561 p 850.287.4244 swannhomes.net

SPIKE: Wilma Shortall, Trustmark Bank

Weeks Residential Construction LLC

Patrick Weeks 1264 Autumn Breeze Circle Gulf Breeze, FL 32563 p 850-982-9575 dibiz.com/weeksresidentialconstruction

Associate Members

Renee’ D. Wilhoit

NMLS 640470

850-436-2982

reneewilhoit@synovus.com

Lisa Hudson NMLS 664126

850-436-7842

lisahudson@synovus.com

Tracey McClurd

NMLS 664145

850-436-6538

traceymcclurd@synovus.com

Charles Thomas NMLS 938537

850-436-7831

charlesdthomas@synovus.com

Karen S. Welch

NMLS 594834

850-994-2503

karenwelch@synovus.com

Rhonda Holl NMLS 437030

850-837-6525

rhondaholl@synovus.com

Breeze Granite Jonathon Seaton 3013 Westfield Rd. Gulf Breeze, FL 32563 p 850.208.1697 breezegranite.com

SPIKE: Amir Fooladi, Encore Homes

Five Star Custom Rico Bezerra 13874 Red Drume Ct. Pensacola, FL 32507 p 850.346.2701

SPIKE: Amir Fooladi, Encore Homes

MK Weber Engineering LLC

Matt Cullens 26050 Predazzer Ln, Unit B Daphne, AL 36526 (850) 339-0705

SPIKE: Amir Fooladi, Encore Homes

Westwood Stone Company Ben Westwood 2975 W. Navy Blvd. Pensacola, FL 32505 p 850.446.6262

westwoodstonecompany.com

SPIKE: Amir Fooladi, Encore Homes

August 2023 | www.westfloridabuilders.com | page 21 Home Builders Association of West Florida | August 2023 | page 20 Bring a friend to our next meeting! NAHB News Membership For future upcoming events, please call the HBA office at 850.476.0318 Stay up-to-date on news and events Have access to exclusive promotions and giveaways Check out polls and fun facts on the page Have pictures from HBA events? Share them with us! Tag yourself in our photos! facebook.com/HBAWF

Contact us today to learn more about our seamless process.

Synovus Bank, Member FDIC. Loans subject to approval, including credit approval. Synovus Bank is an equal Housing Lender. Find us online at synvous.com/mortgage. Find us online at synovus.com/mortgage. GET INVOLVED HBA Councils and Committees! 850.476.0318

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Club Levels

Spike Candidate 1-5 credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+

Spike Club Members and their credits as of 06/30/2023.

Statesman Spike 500 Credits

Harold Logan 525.5

Super Spike 250 Credits

Rod Hurston 431.5

Royal Spike 150 Credits

Rick Sprague 210

Edwin Henry 201

William “Billy” Moore 184

Bob Boccanfuso 165.5

Red Spike 100 Credits

Charlie Rotenberry 150

Oliver Gore 114.5

Ron Tuttle 109.5

Ricky Wiggins 101.5

Green Spike 50 Credits

David Holcomb 99.5

Newman Rodgers IV 101.5

Doug Sprague 90.5

Kenneth Ellzey, Sr. 80.5

Russ Parris 73.5

Paul Stanley 68.5

Blaine Flynn 68.5

Bob Price, Jr. 60

Thomas Westerheim 57.5

Darrell Gooden 52.5

Bill Daniel 51.5

Wilma Shortall 50.5

John Hattaway 50

Life Spike 25 Credits

Doug Whitfield 42.5

Suzanne Pollard-Spann 35

Garrett Walton 32

Amir Fooladi 33.5

Bruce Carpenter III 30

Luke Shows 26.5

Steve Moorhead 23

Brent Woody 22.5

Karen Pettinato 21

Larry Hunter 21

Taylor Longsworth 20.5

Lee Hudson 19.5

Alton Lister 18

Jon Pruitt 17.5

Milton Rogers 17

Doug Herrick 16.5

Dean Williams 16.5

Lorie Reed 16

Martin Rich 15

William Merrill 15.5

Kevin Ward 13

Rick Faciane 12.5

Bill Batting 12

Alex Niedermayer 11

Kim Cheney 10

Spike Credits

Shelby Johnson

Mary J

Ke James Cr

Shellie Isakson Smith

Rodne

Dax Campbell

Advertiser’s Index

If you would like to join the Spike Club or Desire Additional Information, please contact Vicki Pelletier(850) 476-0318

August 2023 | www.westfloridabuilders.com | page 23 Home Builders Association of West Florida | August 2023 | page 22

Gold Sponsor for the 2020 Dream Home

Closets 23

AlphaClosets.com Ballinger Publishing 12 & 16 850.443.1166 ballingerpublishing.com Campbell Construction & Company, LLC 17 p 850.698.4153 dax.campbellconstruction@gmail.com Closets by Design 19 850.637.1000 closetsbydesign.com Gulf Coast Insurance 17 850.497.6810 gcins.com Mathes of Alabama 09 850.478.7748 mathesgroup.com Michael Johnson Insurance Agency 03 850.478.7748 michaeljohnsonagency.com Plainsman 10 850.478.7748 plainsmancontractors.com Pensacola Energy 02 o 850.436.5050 pensacolaenergy.com Rew Building Materials, Inc. 03 o 850.471.6291 c 850.259.7756 ecbmfl.com Synovus 20 synovus.com/mortgage West Fraser Back Cover westfraser.com/osb

Alpha

850.934.9130