Builder Confidence Moves into Positive Territory in June

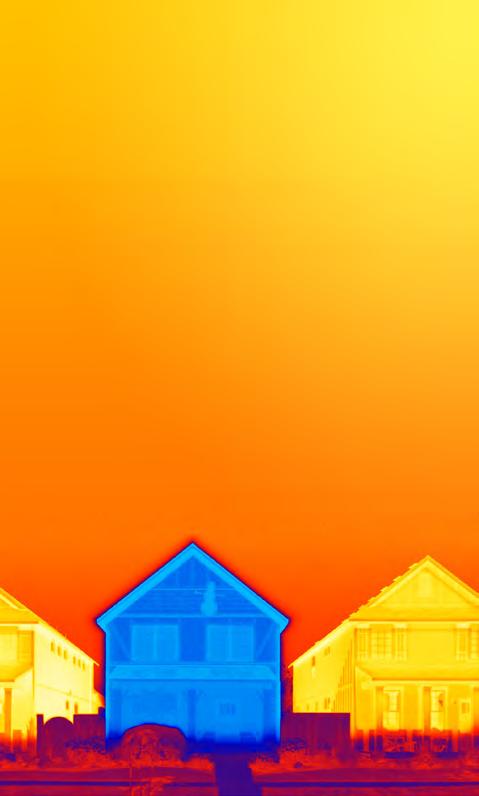

Typically, natural gas customers do not lose service at all during severe weather and no special storm prep is required. All natural gas lines are buried, so outages are rare and typically caused by uprooted trees puncturing the line. Since there are so few outages, Pensacola Energy is very quick to respond.

Most natural gas appliances work even when the power is out, providing comfort for your family during and after the storm, when you need it most.

Natural gas ranges and ovens – cooking functions work normally, without power.

Natural gas grills – function normally, without power and without the worry of running out of gas.

Natural gas tank water heaters – function normally, without power.

Natural gas firepits and fireplaces – function normally, without power and without the worry of running out of gas.

Natural gas outdoor lighting – functions normally, without power.

Natural gas whole house generators – restores electricity to the structure within 30 seconds after a power failure.

Fred Gunther, Gunther Properties

Drew Hardgraves, Landshark Homes

Ronnie Johnson J. Taylor Homes

Heath Kelly Heath Kelly Construction

Lowell Larson III, Venture Real Estate

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Shon Owens, Owens Custom Homes & Construction

Douglas Russell R-Squared Construction

Eric Shaffer Shaffer Construction

Casey Smith, DR Horton

Monte Williams Signature Homes

Anton Zaynakov Grand Builders

Bill Batting, REW Materials

Rick Byars, Florida Power & Light

Bruce Carpenter, Home Mortgage of America

Mickey Clinard, Hancock Whitney Bank

Laura Gilmore Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Jill Grove, Pensacola Energy

John Hattaway Hattaway Home Design, Cost and Codes Chair

Chris Thomas, Acentria Insurance

Shellie Isakson-Smith, Supreme Lending

Daniel Monie KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Ric Nickelsen, SmartBank

Zach Noel Clear Title of NW FL

Charlie Sherrill SouthState Bank

Pam Smith Real Estate Counselors, Pensacola Assn. of Realtors Liaison (proposed by PAR)

Janson Thomas Swift Supply

Wilma Shortall, Trustmark Mortgage

Kevin Sluder Gene’s Floor Covering

Mary Jordan Gulf Coast Insurance

Tradesman Education Chair

Suzanne Pollard-Spann Legacy Insurance Brokers Ambassadors Chair

Ex-Officio Members of the Board of Directors

Blaine Flynn, Flynn Built

Shelby Johnson Johnson Construction

Russ Parris Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim Westerheim Properties

Doug Whitfield Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

If you do business with previous members, please give them a call and reinforce the value of membership as well as the importance of Members Doing Business with Members

Limited existing inventory combined with solid demand and improving supply chains helped push single-family starts to an 11-month high in May. Overall housing starts in May increased 21.7% to a seasonally adjusted annual rate of 1.63 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The May reading of 1.63 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 18.5% to a 997,00 seasonally adjusted annual rate. However, this remains 6.6% lower than a year ago. The multifamily sector, which includes apartment buildings and condos, increased 27.1% to an annualized 634,000 pace.

“Mirroring rising builder sentiment, single-family permits and starts increased in May as builders boosted production to meet unmet demand,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a custom home builder and developer from Birmingham, Ala. “Despite elevated interest rates that make the cost of housing more expensive, the lack of existing home inventory in most markets is leading to increased demand for new construction.”

“The May housing starts data and our latest builder confidence survey both point to a bottom forming for single-family residential construction earlier this year,” said NAHB Chief Economist Robert Dietz. “There have been some improvements to the supply-chain, although challenges persist for items like electrical transformers and lot availability. However, due to weakness at the start of the year, single-family housing starts are still down 24% on a year-to-date basis.”

And while single-family starts are down 24% year-to-date, single-family completions are down just 1.2% as projects started at the end of last year finish. Of note, the May housing data shows that the number of single-family homes under construction is down 16% compared to a year ago at 695,000, while the number of apartments under construction is up 17% to 994,000—the highest level since September 1974.

Dietz also noted that the May housing data signals a positive development on the inflation front. “Additional housing supply is good news for inflation data, because more inventory will help reduce shelter inflation, which is now a leading source of growth for the CPI,” he said.

On a regional and year-to-date basis, combined single-family and multifamily starts are 11.0% lower in the Northeast, 15.0% lower in the Midwest, 12.3% lower in the South and 24.7% lower in the West.

Overall permits increased 5.2% to a 1.49 million unit annualized rate in May. Single-family permits increased 4.8% to an 897,000 unit rate, but are down 25.5% year-todate. Multifamily permits increased 5.9% to an annualized 594,000 pace.

Looking at regional permit data on a year-to-date basis, permits are 21.1% lower in the Northeast, 24.7% lower in the Midwest, 16.5% lower in the South and 24.1% lower in the West.

Solid demand, a lack of existing inventory and improving supply chain efficiency helped shift builder confidence into positive territory for the first time in 11 months.

Builder confidence in the market for newly built singlefamily homes in June rose five points to 55, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This marks the sixth straight month that builder confidence has increased and is the first time that sentiment levels have surpassed the midpoint of 50 since July 2022.

“Builders are feeling cautiously optimistic about market conditions given low levels of existing home inventory and ongoing gradual improvements for supply chains,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “However, access for builder and developer loans has

become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows.”

“A bottom is forming for single-family home building as builder sentiment continues to gradually rise from the beginning of the year,” said NAHB Chief Economist Robert Dietz. “This month marks the first time in a year that both the current and future sales components of the HMI have exceeded 60, as some buyers adjust to a new normal in terms of interest rates. The Federal Reserve nearing the end of its tightening cycle is also good news for future market conditions in terms of mortgage rates and the cost of financing for builder and developer loans.”

Dietz further noted the Fed and Washington policymakers must factor into consideration how the state of home building is critical for the inflation outlook and the future of monetary policy.

“Shelter cost growth is now the leading source of inflation, and such costs can only be tamed by building more affordable, attainable housing – for-sale, for-rent, multifamily and singlefamily,” he said. “By addressing supply chain issues, the skilled labor shortage, and reducing or eliminating inefficient regulatory policies such as exclusionary zoning, policymakers can play an important and much-needed role in the fight against inflation.”

And in another sign of gradual optimism for the state of demand for single-family homes, the June HMI survey shows that overall, builders are gradually pulling back on sales incentives:

• 25% of builders reduced home prices to bolster sales in June. The share was 27% in May and 30% in April. It has declined steadily since peaking at 36% in November 2022.

• The average price reduction was 7% in June, below the 8% rate in December 2022.

• 56% of builders offered incentives to buyers in June, slightly more than in May (54%), but fewer than in December 2022 (62%).

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three major HMI indices posted gains in June. The HMI index gauging current sales conditions rose five points to 61, the component charting sales expectations in the next six months increased six points to 62 and the gauge measuring traffic of prospective buyers increased four points to 37.

Looking at the three-month moving averages for regional HMI scores, the Northeast edged up two points to 47, the Midwest increased four points to 43, the South moved three points higher to 55 and the West posted a five-point gain to 46.

HMI tables can be found at nahb.org/hmi. More information on housing statistics is also available at Housing Economics PLUS (formerly housingeconomics.com).

Amir Fooladi

“Despite elevated interest rates that make the cost of housing more expensive, the lack of existing home inventory in most markets is leading to increased demand for new construction.”

have left housing affordability conditions considerably lower on a year-over-year basis,” said NAHB Chief Economist Robert Dietz. “While affordability posted a gain in the first quarter, it is still well below the breakeven point of 50. The lack of housing units is the primary cause of the nation’s housing affordability challenges, and the best way to reduce housing costs and fight inflation is to put into place policies that will allow builders to construct more attainable housing.”

The HOI shows that the national median home price fell to $365,000 in the first quarter, down from $370,000 in the final quarter of last year. Meanwhile, average mortgage rates were 6.46% in the first quarter, down from a series high of 6.80% in the fourth quarter. The U.S. median family income rose 7% from 2022 to 2023, from $90,000 to $96,300.

Solid nominal wage gains (unadjusted for inflation) combined with lower mortgage rates and home prices helped to boost housing affordability at the start of 2023, but ongoing building material supply chain issues and expected wage growth cooling signal ongoing concerns for affordability conditions in the year ahead.

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI), 45.6% of new and existing homes sold between the beginning of January and end of March were affordable to families earning the U.S. median income of $96,300. This is up from 38.1% posted in the fourth quarter of last year, which was the lowest level since NAHB began tracking affordability on a consistent basis in 2012. However, the first quarter 2023 HOI reading remains significantly lower than the first quarter 2022 score of 56.9%, a reminder of ongoing housing affordability challenges.

“An uptick in housing affordability in the

first quarter of 2023 corresponds to a rise in builder sentiment over the same period as well as an increase in singlefamily permits,” said NAHB Chairman Alicia Huey, a custom home builder from Birmingham, Ala. “And while buyer conditions improved at the beginning of the year, builders continue to wrestle with a host of affordability challenges. These include a shortage of distribution transformers and concrete that are delaying housing projects and raising construction costs, a lack of skilled workers and tightening credit conditions.”

“Elevated interest rates and higher home prices coming out of the pandemic

The Most and Least Affordable Markets in the First Quarter

Lansing-East Lansing, Mich., was the nation’s most affordable major housing market, defined as a metro with a population of at least 500,000. There, 87.5% of all new and existing homes sold in the first quarter were affordable to families earning the area’s median income of $97,800.

Top five affordable major housing markets:

1. Lansing-East Lansing, Mich.

2. Scranton-Wilkes-Barre, Pa.

3. Rochester, N.Y.

4. Toledo, Ohio

5. Pittsburgh, Pa. Meanwhile, Cumberland, Md.-W.Va., was rated the nation’s most affordable small market, with 93.5% of homes sold in the first quarter being affordable to families

Top five affordable small housing markets:

1. Cumberland, Md.-W.Va.

2. Elmira, N.Y.

3. Kokomo, Ind.

4.Springfield, Ohio

5. Wheeling, W.Va.-Ohio

For the 10th straight quarter, Los Angeles-Long Beach-Glendale, Calif., remained the nation’s least affordable major housing market. There, just 4.1% of the homes sold during the first quarter were affordable to families earning the area’s median income of $97,500.

Top five least affordable major housing markets—all located in California:

1. Los Angeles-Long Beach-Glendale

2. Anaheim-Santa Ana-Irvine

3. San Diego-Chula Vista-Carlsbad

4. San Francisco-San MateoRedwood City

5. San Jose-Sunnyvale-Santa Clara

The top five least affordable small housing markets were also in the Golden State. At the very bottom of the affordability chart was Napa, Calif., where 6.6% of all new and existing homes sold in the first quarter were affordable to families earning the area’s median income of $129,600.

Top five least affordable small housing markets—all located in California:

1. Napa

2. Salinas

3. San Luis Obispo-Paso Robles

4. Santa Maria-Santa Barbara

5. Merced Please

Violations of safety rules on jobsites are now more expensive as the Labor Department late last week announced its annual cost-of-living adjustments to OSHA civil penalties for 2023. The new penalty amounts are effective Tuesday, Jan. 17.

OSHA’s maximum penalties for violations will increase from $14,502 per violation to $15,625 per violation. The maximum penalty for willful or repeated violations will increase from $145,027 per violation to $156,259 per violation.

Visit the OSHA Penalties page and read the final rule for more information.

The safety of residential construction workers is a top priority of NAHB and should be the top priority of every builder, remodeler and contractor. The most common types of construction site injuries are fall injuries. This aligns with OSHA’s most-cited violations on jobsites.

Top OSHA violations for fiscal year 2022:

1. Fall Protection – General Requirements: 5,260 violations

2. Hazard Communication (Chemicals): 2,424

3. Respiratory Protection: 2,185

4. Ladders: 2,143

5. Scaffolding: 2,058

6. Lockout/Tagout: 1,977

7. Powered Industrial Trucks: 1,749

8. Fall Protection – Training Requirements: 1,556

9. Personal Protective and Lifesaving Equipment – Eye and Face Protection: 1,401

10. Machine Guarding: 1,370

Protect your workers and your bottom line with free safety resources from NAHB.

By Jesse Wade

By Jesse Wade

While single-family home building has slowed significantly from pandemic-fueled highs because of higher interest rates and construction costs, the slowdown is less pronounced in lower density markets. On the other hand, multifamily market growth remained strong throughout much of the nation, according to the latest findings from the National Association of Home Builders (NAHB) Home Building Geography Index (HBGI) for the first quarter of 2023.

Across the singlefamily market, the 4-quarter moving average of the year-over-year growth rates have all fallen to negative levels from one year ago. The largest decrease in the growth rate was in Large Metro – Outlying Counites which fell from 17.4% in the first quarter of 2022 to -22.3% in the first quarter of 2023. All markets had a negative growth rate in the first quarter of 2023 with Micro Counties being the highest at -2.9% and Large Metro –Core Counties having the lowest rate at -25.6%.

Over the past four years rural markets have exhibited particular strength. The rural (Micro Counties and Non Metro/Micro Counties) single-family home building market share has increased from 9.4% at the end of 2019 to 12.0% by the first quarter of 2023. The largest decrease in singlefamily market share between the end of 2019 and the first quarter of 2023 was in Large Metro – Core Counties, which fell 2.7 percentage points from 18.4% to 15.7%. The combined Large Metro areas (Core, Suburban and Outlying) market share has fallen for seven consecutive quarters to a share of 49.7%. This is the first time the combined Large Metro market share has fallen below 50.0% market share since the inception of the HBGI.

Meanwhile, the multifamily construction market remains strong with all HBGI markets having positive growth rates in the first quarter of 2023.

Large Metro – Core Counties had the lowest multifamily growth rate at 3.2%, up from 1.5% from the fourth quarter of 2022. For the 7th consecutive quarter, Large Metro – Outlying Counties had the highest growth rate at 24.5%.

The multifamily market share for Large Metro – Core Counites increased in the first quarter of 2023 after losing market share for all of 2022, now standing at 37.5%.

Since the first quarter of 2020, Small Metro –Core Counties market share has increased 3.0 percentage points from 20.6% to 23.6%. This was the largest increase between the first quarter of 2020 and 2023 for any of the HBGI markets. Over the same period, the largest decrease in market share was in Large Metro – Core Counties which fell 4.7 percentage points.

The first quarter of 2023 HBGI data can be found at https://nahb. org/hbgi.

Pensacola Energy sponsored a fantastic and well-attended event at the Calvert’s, a popular restaurant with a English themed pub style. A special thanks to Jill Grove, Marketing Manager at Pensacola Energy and her excellent team for putting this great night together.

By David Logan

By David Logan

According to the latest Producer Price Index report, the prices of inputs to residential construction less energy (i.e., building materials) decreased 0.1% in May 2023 (not seasonally adjusted), following a 0.2% drop in April. The index has gained 0.3%, year-todate, a stark contrast from the 10.2% and 4.9% YTD increases seen in 2021 and 2022, respectively.

The PPI for gypsum building materials fell 1.1% for the second month straight and is down 0.4%, year-to-date. Gypsum building materials prices are 4.0% higher than they were a year ago but at the lowest level since July 2022.

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) decreased 3.1% after increasing 6.2% the prior month. Softwood lumber prices have declined 10 of the past 12 months and are 41.9% lower than they were one year ago.

increase in nearly a year. RMC prices have risen 2.8% YTD—the same increase seen through May 2022—and are up 13.0% over the past 12 months.

Steel mill products price growth continued to accelerate in May as the index rose 5.2%. This comes on the heels of 3.5% and 1.0% increases in April and March, respectively. after climbing 3.1% in February and March combined. The PPI for steel mill products declined eight consecutive months ending in January, falling 27.9% over that span. However, prices have climbed 12.4% in the four months since.

Ready-mix concrete (RMC) prices were revised down for April in the latest release. As a result, prices declined last month for the first time since March 2022. Unfortunately, price growth returned in May as the RMC index increased 1.6%–the largest monthly

The PPI for goods inputs to residential construction, including energy, declined 0.5% as energy prices drove the index lower. The index has declined 2.7% over the past 12 months but is 36.0% higher than it stood in January 2020.

Gypsum Building Materials

The price index of services inputs to residential construction decreased 1.0% in May after rising 0.5% in April. Prices have declined 12.4% over the past year but have been relatively stable in 2023, down just 0.5% through May.

The annual State of the Nation’s Housing report from the Harvard Joint Center for Housing Study (JCHS) highlights the growing housing affordability crisis, despite a slowdown in housing prices.

“Rent growth slowed over the past year, and home prices declined in a number of areas,” said Daniel McCue, a JCHS senior research associate, in a press release. “Nonetheless, housing costs remain well above pre-pandemic levels thanks to the substantial increases over the last few years.”

McCue noted that although home prices grew 1%, compared to 21% in 2022, they are still nearly 40% over prepandemic prices. Rent growth followed a similar pattern, with 4.5% growth in 2023 compared to 15% in 2022, but up 24% since the pandemic.

Higher interest rates have also eroded housing affordability in the past year, with payments on the medianpriced home increasing from $2,500 to $3,000. As a result, mortgages originated to first-time home buyers dropped 22% in 2022, including a 40% year-over-year drop in the fourth quarter.

continuesonpage16

from page 15

Inventory has also had an impact on home prices, as single-family housing starts dropped 10.8% last year. Although multifamily construction has remained strong, the JCHS report indicates that rising vacancy rates, along with higher interest rates and tighter lending standards, suggest a forthcoming slowdown in multifamily construction.

NAHB Chief Economist Robert Dietz highlighted the key factors contributing to these issues in a recent press release.

“Shelter cost growth is now the leading source of inflation, and such costs can only be tamed by building more affordable, attainable housing – for-sale, forrent, multifamily and single-family,” he stated. “By addressing supply chain issues, the skilled labor shortage, and reducing or eliminating inefficient regulatory policies such as exclusionary zoning, policymakers can play an important and muchneeded role in the fight against inflation.”

Panelists during JCHS’ report release event also echoed these messages with a call not only to invest in housing and the skilled labor shortage, but to address burdensome regulations that may prevent or hinder development.

“Housing crises don’t just naturally happen,” stated California Sen. Scott Wiener. “The housing crisis in California was engineered because of layers of bad policy.”

“Housing is a crucial engine of economic growth, and investments in this important sector pay broader dividends,” Chris Herbert, JCHS managing director, noted. “As the pandemic highlighted, high-quality, stable, and affordable housing is foundational to widespread well-being and, as such, both merits and necessitates greater public attention.”

More details, including the full report, are available at jchs.harvard.edu.

1. They support the industry at the local, state and national levels.

2. They volunteer time, talent and treasure to help the association accomplish its goals.

3. They recruit their colleagues and business contacts to become members.

4. They serve on committees and councils gaining valuable networking opportunity while helping to advance the association’s mission.

5. By doing so, you increase the value proposition for all membership in our HBA.

6. They are strong supporters of local and state PACs and BUILD-PAC.

7. They are a major source of non-dues revenue through sponsorships, advertising, etc.

continuesonpage06

Obtaining lots for new homes remains a challenge for many of NAHB’s builders, but the shortages are not as widespread as they were in 2021, according to responses to the May 2023 survey for the NAHB/Wells Fargo Housing Market Index (HMI).

Nearly half (42%) of single-family home builders characterized the supply of lots simply as low, and another 25% said the supply was very low. That total (67%) is down from 76% who reported shortages in the September 2021 survey, but is still the second highest incidence of lot shortages on record since NAHB began collecting the information in 1997.

The current percentage of builders reporting a shortage of lots is particularly high relative to the current level of production. Over the past six months, total housing starts have been hovering around an annual rate of 1.4 million. In comparison, in 2005 when total housing starts peaked at more than 2 million, 53% of builders were reporting lot shortages.

One factor contributing to the lot shortage is availability of credit for developers. Loans to develop new residential lots were becoming both harder to obtain and more expensive over the prior year. Government regulation — which can lengthen and complicate the lot development process and add to its cost — is another factor. An NAHB study found that government regulation is responsible for roughly 42% of the cost of a lot for the average new single-family home.

8. As industry partners, they are a valuable resource for business and management tips.

9. They are heavily invested in your business success: You win, they win!

10. Why wouldn’t you do business with a member?

Every week during National Safety Month, NAHB and other partners will focus on a different aspect of jobsite safety. This week is mental health and substance abuse.

Everyone agrees that substance abuse carries a very real safety issue on jobsites. But how should you address an employee or contractor that you suspect is impaired? And is your goal to treat them and have them return to work safely as soon as possible?

1. They support the industry at the local, state and national levels.

2. They volunteer time, talent and treasure to help the association accomplish its goals.

3. They recruit their colleagues and business contacts to become members.

Lisa Hudson NMLS 664126

850-436-7842

lisahudson@synovus.com

Tracey McClurd NMLS 664145 850-436-6538

traceymcclurd@synovus.com

Charles Thomas NMLS 938537 850-436-7831

charlesdthomas@synovus.com

Karen S. Welch

NMLS 594834

850-994-2503

karenwelch@synovus.com

Rhonda Holl NMLS 437030

850-837-6525

rhondaholl@synovus.com

NAHB has numerous resources that can help identify and address substance abuse issues and create a path for return to work, including resources for tackling Opioids in the Home Building Industry and a video toolbox talk on Substance Misuse.

Mental health issues may not be considered a safety concern, but workers

who are distracted by or fatigued due to their mental health circumstances may pose a real danger to themselves and others on jobsites.

Although mental health is a tricky issue for many, the most powerful and direct first step to addressing them with a worker is a simple, “How are you doing?” When someone knows they are supported, seeking professional help is much easier.

NAHB also has resources to help home builders navigate these tricky conversations. Check out the various resources on the Mental Health and Wellbeing page, and watch the video toolbox talk on Mental Health, also embedded below.

It can be difficult to talk about mental health and substance abuse, but in an era of labor shortages and heightened stress, it’s a business necessity to keep workers safe and on the job.

4. They serve on committees and councils gaining valuable networking opportunity while helping to advance the association’s mission.

5. By doing so, you increase the value proposition for all membership in our HBA.

6. They are strong supporters of local and state PACs and BUILD-PAC.

7. They are a major source of non-dues revenue through sponsorships, advertising, etc.

8. As industry partners, they are a valuable resource for business and management tips.

9. They are heavily invested in your business success: You win, they win!

10. Why wouldn’t you do business with a member?

NAHB Chairman Alicia Huey issued a letter this week to the Environmental Protection Agency (EPA) and U.S. Army Corps of Engineers (Corps) requesting them to finalize a revised regulatory definition of “waters of the United States” (WOTUS) that clarifies the limits of federal jurisdiction under the Clean Water Act (CWA) consistent with the U.S. Supreme Court’s holdings in Sackett v. EPA.

“Since the Sackett decision was announced on May 25, 2023, the Corps headquarters has placed a nationwide freeze on processing requests for approved jurisdictional determinations (AJDs) under the CWA 404 federal wetland permitting program,” Chairman Huey stated in her letter, “Last week, the agencies announced the current nationwide halt on AJDs would remain in place until the agencies propose a revised WOTUS sometime prior to Sept. 1,

2023. Halting AJDs leads to permitting delays and places another barrier on the nation’s home builders’ ability to provide safe, decent and affordable housing.”

With no post-Sackett interpretive guidance more than a month following the SCOTUS decision, home builders and developers face three options:

• Attempt to determine whether their activities require a CWA Section 404 wetlands permit and risk subsequent CWA enforcement action if they interpret Sackett differently than the federal regulators.

• Accept a preliminary jurisdictional determination (PJD), allowing federal regulators to assume that the wetlands or water features on or near the property are jurisdictional in order to process requested CWA Section 404 permits.

• Wait until the agencies figure how to address Sackett to take action.

“These options are extremely frustrating and costly to the U.S. home building industry, and none is appropriate or acceptable,” Huey noted.

The agencies intend to make changes to the 2023 revised definition of WOTUS consistent with the Sackett ruling and issue a direct final rule by Sept. 1, 2023.

But, as Huey stated, “Land acquisition, permit processing and home building cannot be paused until Sept. 1; we desperately need interim guidance from the agencies now.” NAHB supports the agencies’ plan to promulgate a new WOTUS regulatory definition consistent with Sackett, but there is an immediate need for interim regulatory guidance to lift the nationwide suspension of issuing AJDs and provide affected landowners, including home builders, certainty over whether their lands may be subject to CWA jurisdiction. For more information, visit nahb.org.

Spike Credit: Amir Fooladi, Encore Homes

Rebol Battle & Associates (Engineers/Surveyors)

Jason R. Rebol - Managing Partner 2301 N. 9th Ave. Pensacola, FL 32503 p (850) 438-0400

Spike

Spike Credit: Amir Fooladi, Encore Home

NAHB Chairman Alicia Huey issues a letter to the EPA and U.S. Army Corps of Engineers

If you do business with previous members, please give them a call and reinforce the value of membership as well as the importance of Members Doing Business with Members

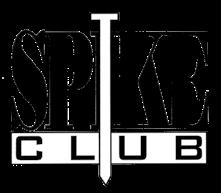

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Club Levels

Spike Candidate 1-5 credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+

Spike Club Members and their credits as of 05/31/2023.

Statesman Spike 500 Credits

Harold Logan 525

Super Spike 250 Credits

Rod Hurston 431.5

Jack McCombs 303.5

Royal Spike 150 Credits

Rick Sprague 209.5

Edwin Henry 201

William “Billy” Moore 184

Bob Boccanfuso 165.5

Red Spike 100 Credits

Charlie Rotenberry 150

Oliver Gore 114.5

Ron Tuttle 109.5

Ricky Wiggins 101.5

Green Spike 50 Credits

Newman Rodgers IV 100.5

David Holcomb 99

Doug Sprague 90.5

Kenneth Ellzey, Sr. 80.5

Russ Parris 73.5

Paul Stanley 68.5

Blaine Flynn 68

Bob Price, Jr. 60

Thomas Westerheim 57.5

Darrell Gooden 52.5

Bill Daniel 51.5

Wilma Shortall 50.5

John Hattaway 50

Life Spike 25 Credits

Doug Whitfield 42.5

35

Alpha Closets

Lorie Reed 16 Martin Rich 15

William Merrill 15

Kevin Ward 13

Rick Faciane 12.5

Bill Batting 12

Alex Niedermayer 11

Kim Cheney 10

Spike Credits

Shelby Johnson 9.5

Mary Jordan 9.5

Kevin Russell 9

James Cronley 9

Rodney Boutwell 7

If you would like to join the Spike Club or Desire Additional Information, please contact Vicki Pelletier(850) 476-0318