Increasing Housing Supply Critical for Fed’s Fight on Inflation

page 07

Fiesta Seafood Grille at the Pensacola Seafood Festival

Seville Square Downtown Pensacola

Friday, September 29th 5:00 p.m. ............................................The District

Saturday, September 30th 12:00 p.m. ..................................Café Single Fin

1:30 p.m. .......................Southern GRIT Culinary 3:00 p.m. .......................Pensacola Smokehouse 4:30 p.m. ....................................A Rustyc Spoon

Construction Law Services

WE'VE HELPED OUR CLIENTS WITH:

•Contract negotiation

•Bid protests

•Construction defect claims

•Project payment issues

WITH THE EXPERIENCED & DEDICATED TEAM AT Emmanuel Sheppard & Condon

•Liens

•Government contract disputes

•Litigation or mediation of construction-related claims

Our firm has helped contractors, developers, engineers and architects for more than 100 years.

Let us work with you to resolve your issues and get your project back on track.

FOR

850-409-6449

Sunday, October 1st 12:00 p.m. .....................Calvert’s in the Heights 1:30 p.m. ...........................Classic City Catering 3:00 p.m. ...............................Sabai on Jefferson

PensacolaEnergy.com

September 2023 | www.westfloridabuilders.com | page 3 Home Builders Association of West Florida | September 2023 | page 2

2

0 2 3

MORE INFORMATION OR TO SPEAK TO

OF OUR ATTORNEYS, CALL OUR OFFICE TODAY.

ONE

ROBERT EMMANUELWES REEDERADAM WHITEJOHN TERHAARALEXIS MAYSCLAY WHITTAKER

2023 Home Builders Association of West Florida Board of Directors

BUILDER MEMBERS

Fred Gunther, Gunther Properties

Drew Hardgraves, Landshark Homes

Ronnie Johnson J. Taylor Homes

Heath Kelly Heath Kelly Construction

Lowell Larson III, Venture Real Estate

Alton Lister, Lister Builders, Governmental Affairs Chair

Kyle McGee, Sunchase Construction

Shon Owens, Owens Custom Homes & Construction

Douglas Russell R-Squared Construction

Eric Shaffer Shaffer Construction

Casey Smith, DR Horton

Monte Williams Signature Homes

Anton Zaynakov Grand Builders

ASSOCIATE MEMBERS

Bill Batting, REW Materials

Rick Byars, Florida Power & Light

Bruce Carpenter, Home Mortgage of America

Mickey Clinard, Hancock Whitney Bank

Laura Gilmore Fairway Ind. Mortgage, Affordable Housing Liaison

Chris Graye, Graye’s Granite

Jill Grove, Pensacola Energy

John Hattaway Hattaway Home Design, Cost and Codes Chair

Chris Thomas, Acentria Insurance

Shellie Isakson-Smith, Supreme Lending

Daniel Monie KJM Land Surveying

Alex Niedermayer, Underwood Anderson & Associates

Ric Nickelsen, SmartBank

Zach Noel Clear Title of NW FL

Charlie Sherrill SouthState Bank

Pam Smith Real Estate Counselors, Pensacola Assn. of Realtors Liaison (proposed by PAR)

Janson Thomas Swift Supply

Wilma Shortall, Trustmark Mortgage

Kevin Sluder Gene’s Floor Covering

COUNCIL CHAIRS

Mary Jordan Gulf Coast Insurance Tradesman Education Chair

Suzanne Pollard-Spann Legacy Insurance Brokers Ambassadors Chair

Ex-Officio Members of the Board of Directors

Blaine Flynn, Flynn Built

Shelby Johnson Johnson Construction

Russ Parris Parris Construction Company

Newman Rodgers, Newman Rodgers Construction

Thomas Westerheim Westerheim Properties

Doug Whitfield Doug Whitfield Residential Designer

Curtis Wiggins, Wiggins Plumbing

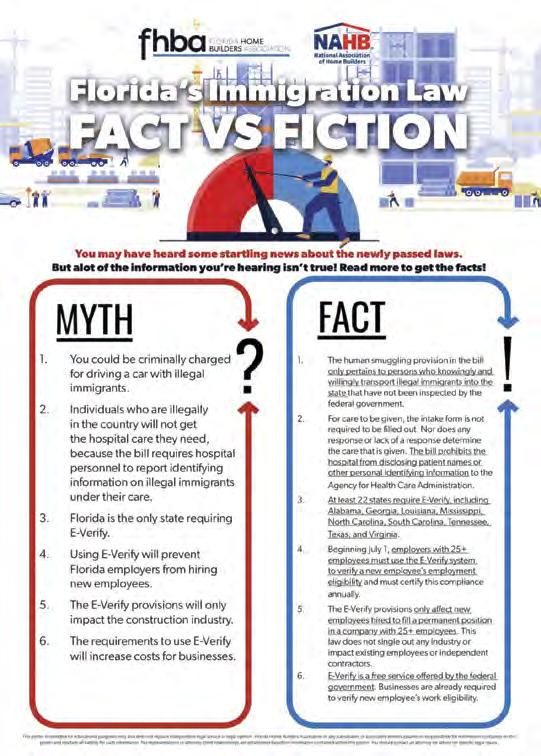

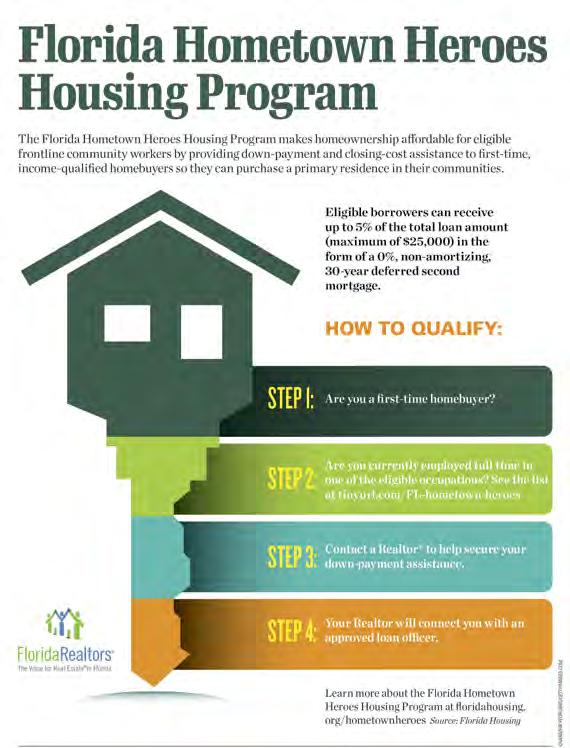

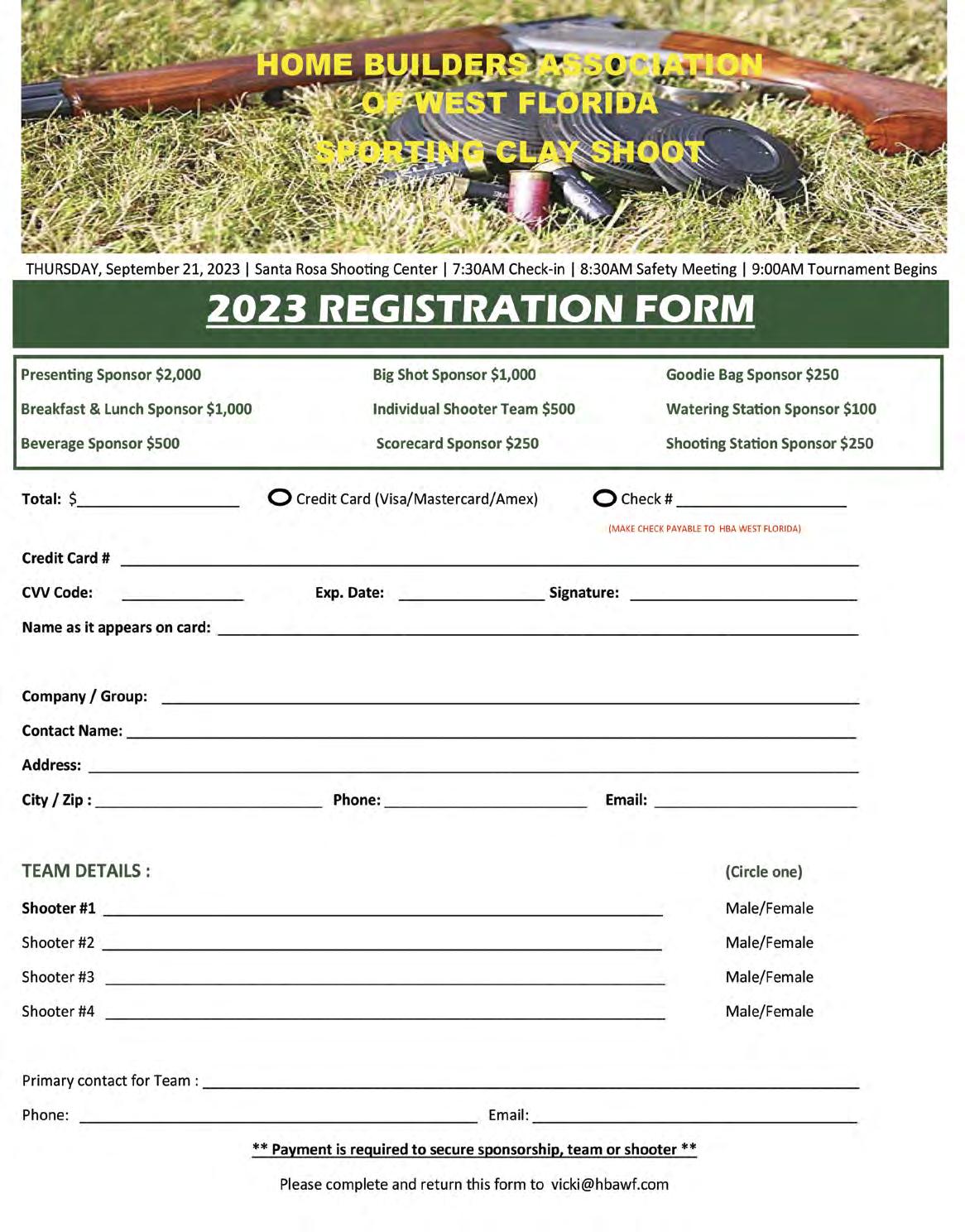

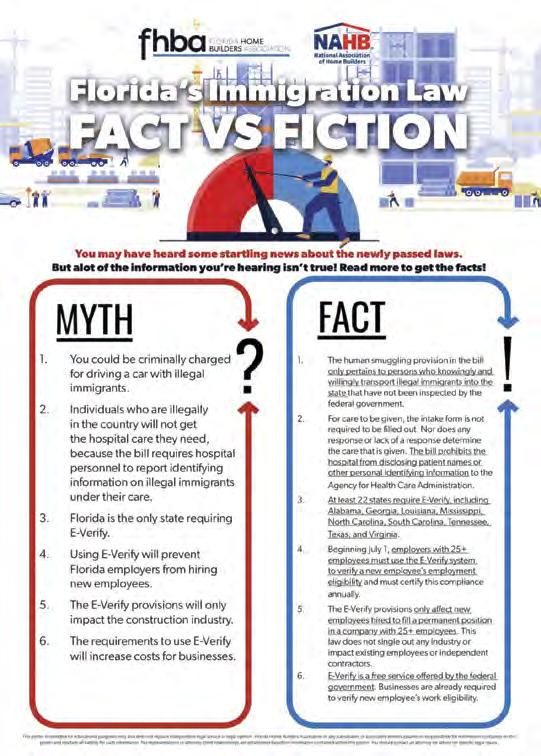

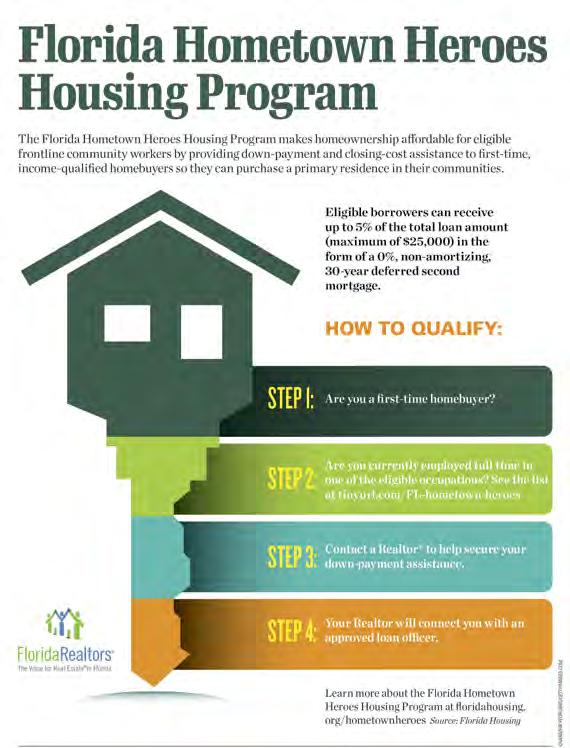

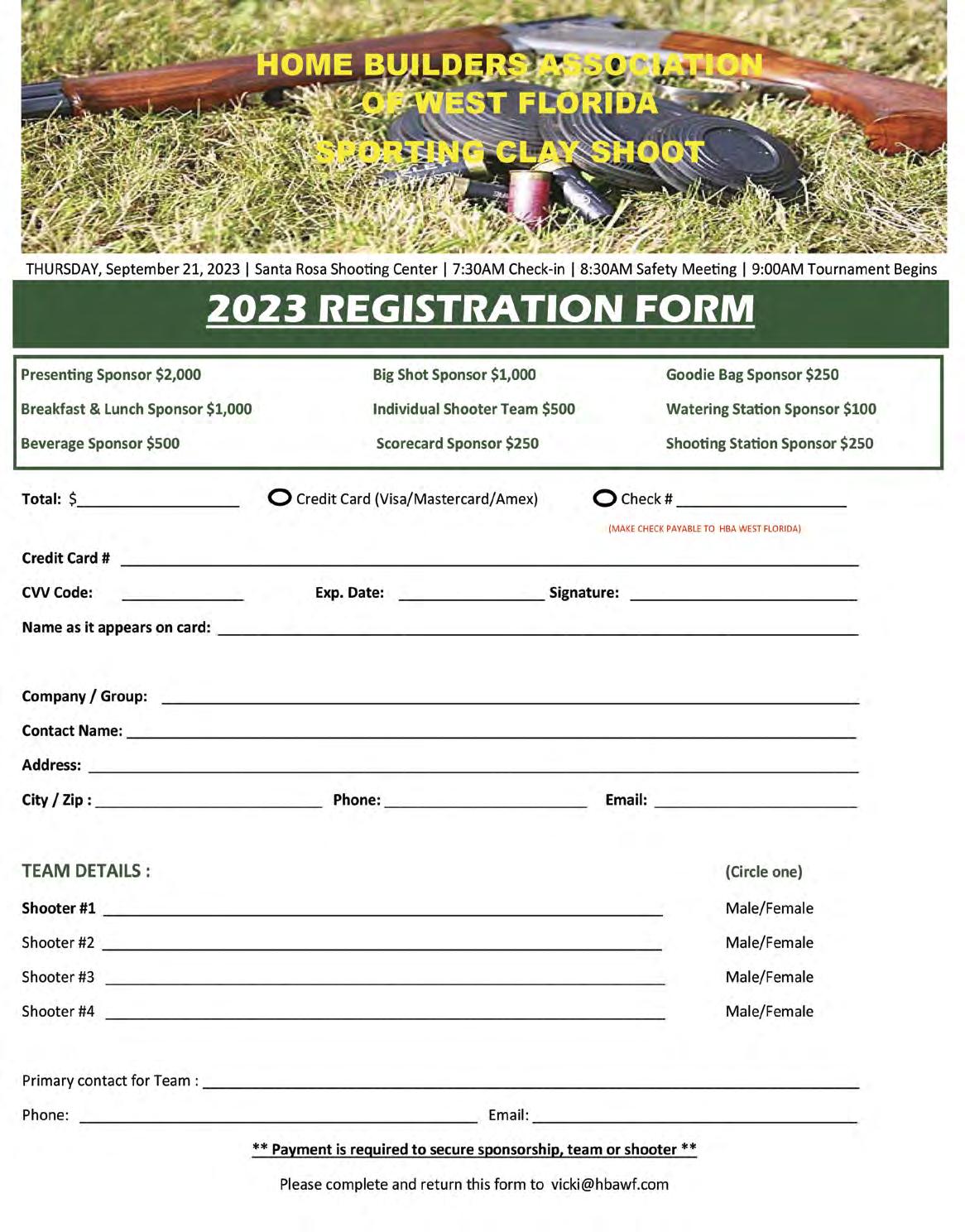

September 2023 | www.westfloridabuilders.com | page 5 Home Builders Association of West Florida | September 2023 | page 4 Cornerstone, the monthly publication of the Home Builders Association of West Florida serving Escambia and Santa Rosa Counties, is published monthly, twelve (12x) per year. Send address changes to HBA of West Florida, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910. Cornerstone, is published in the interests of all segments of the home building industry and is distributed to its members and others associated with the HBA of West Florida. HBA of West Florida and Ballinger Publishing does not accept responsibility for, or endorse any statement or claims made by advertisers or authors of any articles. Every effort has been made to assure accuracy of information, but authenticity cannot be guaranteed. No part of this publication may be reproduced without the written consent of Home Builders Association of West Florida, Copyright ©, 4400 Bayou Boulevard, Suite 45, Pensacola, Florida 32503-1910, 850.476.0318. Advertisers and advertorials in Cornerstone do not constitute an offer for sale in states where prohibited by law. Cover Story Publisher Malcolm Ballinger Advertising Account Executives Paula Rode, Account Executive ext. 28 paula@ballingerpublishing.com Geneva Strange, Account Executive ext. 31 geneva@ballingerpublishing.com For advertising rates Phone: 433.1166 • Fax: 435.9174 Cornerstone Next Issue: OCT 2023 Edit: Sept 24, 2023 Display Ads: Sept 24, 2023 Vicki Pelletier Director of Marketing & Communication vicki@hbawf.com Increasing Housing Supply Critical for Fed’s Fight on Inflation ............................... 7 PRESIDENT’S MESSAGE Home Builders Prompt Legislation Addressing Transformer Shortage .................... 6 FEATURE STORY Rule-Making Begins on Foreign Buyer Law .................................................................. 8 HBA of West Florida Dedicated Board Room to Peaden on August 23 .................. 12-13 Why Houses in America Are Getting Smaller .............................................................. 19 HBAWF NEWS Members Doing Business with Members .................................................................... 7 Top 10 Reasons To Do Business With An Active Associate Member ..................... 14 HBAWF Fall Golf Tounament Information and Forms ...................................... 16-17 HBAWF Sporting Clay Shoot Registration ............................................................... 20 Get Involved in HBA Councils & Committees ......................................................... 21 Like Us on Facebook .................................................................................................. 21 Spike Club ................................................................................................................... 22 NAHB NEWS Upcoming Workforce Development Summit ............................................................ 18 Florida Hometown Heroes Housing Program ........................................................... 18 Florida’s Immigration Law: Fact vs Fiction .............................................................. 18 ECONOMIC NEWS Housing Share of GDP Remains Lower in the Second Quarter of 2023 ................. 10 Lending Standards Continue to Tighten ..................................................................... 11 Construction Job Openings Remain Relatively Unchanged As Housing Market Slows ................................................................................................ 14 DEPARTMENTS INDEX Advertisers Index, Web, & Email Addresses ………….....……...........……… 22 2023 Leadership Board Amir

President Encore

Stephen

Legal Counsel Moorhead Real

Law

Josh

Chad Edgar Immediate Past President Joe-Brad Construction Marty Rich Past 2nd Vice President University Lending Group Paul Stanley 3rd Vice President The First Bank Lindy

2nd Vice President/SMC Chair First International Title Austin

Secretary Adoor Properties Jennifer

Treasurer Reese Construction Services Dax

1st Vice President Campbell

& Company Cornerstone is published for the Home Builders Association of West Florida by Ballinger Publishing and distributed to its members. Reproduction in whole or part is prohibited without written authorization. Articles in Cornerstone do not necessarily reflect the views or policies of the HBA of West Florida. Articles are accepted from various individuals in the industry to provide a forum for our readers. (850) 476-0318 4400 Bayou Blvd., Suite 45, Pensacola, Florida 32503 www.westfloridabuilders.com

Fooladi

Homes

Moorhead

Estate

Group

Peden Financial Officer/Treasurer Hudson, Peden & Associates

Hurd

Tenpenny

Reese

Campbell

Construction

Jennifer Mancini Executive Director jennifer@hbawf.com

Home Builders Prompt Legislation Addressing Transformer Shortage

One of the major issues threatening our industry is the national shortage of electrical transformers. NAHB has sounded the alarm that the Department of Energy’s rulemaking proposal to increase the energy conservation standards for the production of transformers will severely exacerbate the current supply shortage. Noting that it currently takes more than 16 months to produce and deploy new transformers, NAHB warned that the “inability to quickly manufacture and deliver these critical components threatens the ability of the electric sector to service current and planned housing markets.”

At NAHB’s urging, Rep. Richard Hudson (R-N.C.) and Sen. John Barrasso (R-Wyo.) have recently introduced identical House and Senate bills — Protecting America’s Distribution Transformer Supply Chain Act — that would delay for five years any rulemaking on energy-efficiency standards for distribution transformers.

NAHB Chairman Alicia Huey said, “At a time when the home building industry is facing a severe shortage of distribution transformers, NAHB commends Rep. Hudson and Sen. Barrasso for introducing this important legislation. This vital measure will provide needed time to boost output at existing facilities to address the growing supply chain crisis for transformers that has delayed home construction projects across the country and aggravated the nation’s housing affordability crisis.”

The transformer shortage was one of the key topics during the NAHB Legislative Conference in June when more than 700 members discussed vital matters of concern to the housing industry with lawmakers on Capitol Hill.

NAHB continues to work with both chambers of Congress on behalf of our industry to seek additional funding aimed solely at boosting production of distribution transformers to meet market demand. Here in Florida, we face an even higher risk of being impacted by the transformer shortages due to the threat of hurricanes to our infrastructure so this issue is of the highest priority to the Governmental Affairs Committee and Board of Directors at FHBA.

Please visit the NAHB website at www. nahb.org for more information.

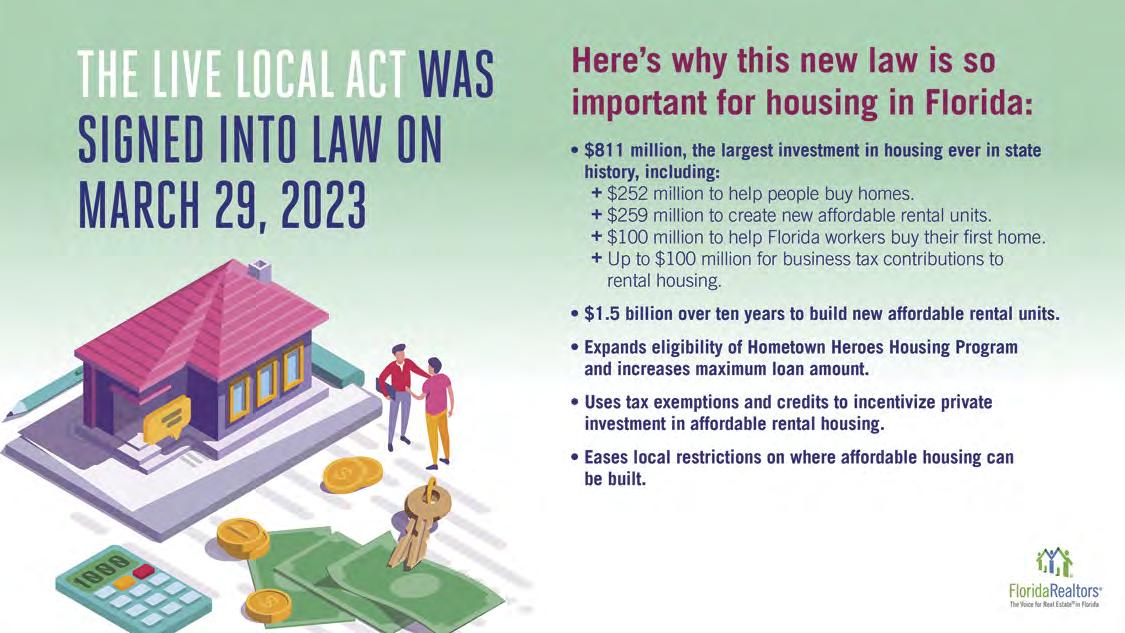

Increasing Housing Supply Critical for Fed’s Fight on Inflation

With shelter inflation accounting for a staggering 90% of the overall inflation rate last month, the National Association of Home Builders (NAHB) is calling on policymakers at all levels of government to take actions that will help boost the nation’s housing supply in order to ease a stubbornly high housing inflation rate that is harming the overall economy.

The July Consumer Price Index (CPI) reading was 3.2%, but data from the Bureau of Labor Statistics show that more than 90% of the headline gain for the CPI was due to shelter inflation, a combination of rent and owner’s equivalent rent, which was up 7.7% from a year ago.

“The Federal Reserve shouldn’t have to fight inflation on its own, as the central bank’s ability to address rising housing costs is extremely limited because shelter cost increases are driven by a lack of affordable supply and increasing development costs,”

said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala.

With shelter costs accounting for the lion’s share of inflation in the economy, and a nationwide shortage of 1.5 million housing units, building more homes is the only way to tame inflation, satisfy unmet demand, achieve a healthy supply-demand balance in the for-sale and rental markets and ease the nation’s affordability crisis.

“Policymakers at other levels of government can help the Fed in the effort to bring inflation lower by improving the efficiency of the residential construction market,” said Huey. “Policy changes such as obtaining a new softwood lumber agreement with Canada, speeding up permit approval times, providing resources for skilled labor training and repealing inefficient regulatory rules will enable more construction and yield more inventory for a market that is critically undersupplied.”

Additionally, higher interest rates are restricting housing supply by making financing for acquiring and developing land more expensive, and increasing the interest rates for construction loans. The rapid increase for mortgage rates is also restricting supply in the short-run via the mortgage rate lockin effect, which causes many home owners to hold onto their existing home to preserve their low mortgage interest rate.

“A focus on policies that will enable builders to construct more homes will help tame inflation by working to achieve a healthy supply-demand balance in the marketplace, move housing and the economy to higher ground and ease the nation’s housing affordability crisis,” said Huey.

Source: NAHB 8/14/23

September 2023 | www.westfloridabuilders.com | page 7 Home Builders Association of West Florida | September 2023 | page 6 President’s Message Cover Story

Amir Fooladi

“The transformer shortage was one of the key topics during the NAHB Legislative Conference in June ...”

If you do business with previous members, please give them a call and reinforce the value of membership as well as the importance of

Members Doing Business with Members

Rule-Making Begins on Foreign Buyer Law

Florida regulators published notices to begin creating rules required under SB 264, the new law affecting sales to some foreign principals.

Two Florida agencies – the Department of Commerce (formerly DEO, the Department of Economic Opportunity) and the Department of Business and Professional Regulation (DBPR) announced plans to propose regulations related to SB 264, a bill passed by the 2023 Florida Legislature.

FREC affidavit rulemaking

DEPARTMENT OF BUSINESS AND PROFESSIONAL REGULATION

Florida Real Estate Commission

RULE NO RULE TITLE

61J2-10.200 Buyer’s Affidavits; Form

PURPOSE AND EFFECT: The Board proposes a new rule that will implement a form for buyer’s affidavits.

SUBJECT AREA TO BE ADDRESSED: To add a new rule that will implement a form for buyer’s affidavits.

RULEMAKING AUTHORITY: 692.202(5)(c), 692.203(6)(c) FS.

LAW IMPLEMENTED: 692.202, 692.203 FS.

IF REQUESTED IN WRITING AND NOT DEEMED UNNECESSARY BY THE AGENCY HEAD, A RULE DEVELOPMENT WORKSHOP WILL BE NOTICED IN THE NEXT AVAILABLE FLORIDA ADMINISTRATIVE REGISTER.

THE PERSON TO BE CONTACTED REGARDING THE PROPOSED RULE DEVELOPMENT AND A COPY OF THE PRELIMINARY DRAFT, IF AVAILABLE, IS: Giuvanna Corona, Executive Director, Florida Real Estate Commission, 400 W. Robinson Street, #N801, Orlando, FL 32801, Giuvanna.Corona@myfloridalicense.com.

The bill impacts buyers associated with a foreign country of concern – China, Russia, Iran, North Korea, Cuba, Venezuela and Syria. The notice published by the Florida Real Estate Commission (FREC) specifies FREC will propose a new rule that will implement a form for a buyer’s affidavit, which is a requirement of the new foreign buyer law. The subject of Department of Commerce rulemaking will be the purchase of real property on or around military installations or critical infrastructure facilities by foreign principals, including definitions, registration requirements, computation of time, fines and liens.

A rule development workshop can be requested and will be noticed in the Florida Administrative register. Currently, there is no preliminary text of the proposed rules available. The notices contain contact names if anyone wishes to comment. The announcements are reproduced below:

Department of Commerce

Notice of Development of Rulemaking

73-1.001 Definitions

73-1.002 Registration Requirements

73-1.003 Computation of Time

73-1.004 Fines

73-1.005 Liens

73-1.006 Rebuttable Presumption

PURPOSE AND EFFECT: To create a rule that aligns with new legislative changes from Senate Bill 264 from the 2023 Legislative Session that prohibits the purchase of real property on or around military installations or critical infrastructure facilities by foreign principals.

SUBJECT AREA TO BE ADDRESSED: Purchase of real property on or around military installations or critical infrastructure facilities by foreign principals.

RULEMAKING AUTHORITY: 692.203(10), F.S.

LAW IMPLEMENTED: 692.203, F.S.

IF REQUESTED IN WRITING AND NOT DEEMED UNNECESSARY BY THE AGENCY HEAD, A RULE DEVELOPMENT WORKSHOP WILL BE NOTICED IN THE NEXT AVAILABLE FLORIDA ADMINISTRATIVE REGISTER.

THE PERSON TO BE CONTACTED REGARDING THE PROPOSED RULE DEVELOPMENT AND A COPY OF THE PRELIMINARY DRAFT, IF AVAILABLE, IS: Karen Gates, Department of Commerce, 107 East Madison Street, Tallahassee, Florida 32399, RuleComments@commerce.fl.gov, (850) 245-7150. The Department of Commerce encourages the public to submit written comments for this rule development. To submit a comment on this rule development, please email RuleComments@commerce.fl.gov. All comments are requested to be submitted by August 14, 2023.

THE PRELIMINARY TEXT OF THE PROPOSED RULE DEVELOPMENT IS NOT AVAILABLE.

Source: Florida Realtors

September 2023 | www.westfloridabuilders.com | page 9 Home Builders Association of West Florida | September 2023 | page 8 Feature Story 1601975 Home & Auto go together. Like you & a good neighbor. Some things in life just go together. Like home and auto insurance from State Farm®. And you with a good neighbor to help life go right. Save time and money. CALL ME TODAY. State Farm Mutual Automobile Insurance Company, State Farm Indemnity Company, Bloomington, IL State Farm County Mutual Insurance Company of Texas, Dallas, TX State Farm Fire and Casualty Company, State Farm General Insurance Company, Bloomington, IL State Farm Florida Insurance Company, Winter Haven, FL State Farm Lloyds, Richardson, TX Michael Johnson, Agent 3127 E Langley Avenue Pensacola, FL 32504 Bus: 850-478-7748 www.michaeljohnsonagency.com

DEPARTMENT OF ECONOMIC

RULE NOS RULE TITLES

OPPORTUNITY

West

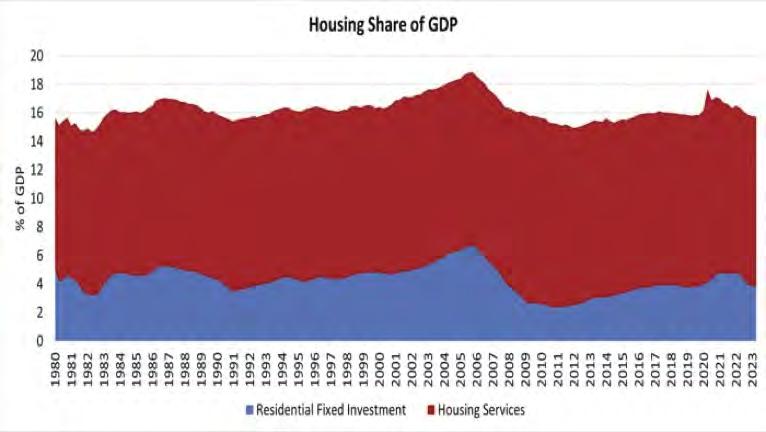

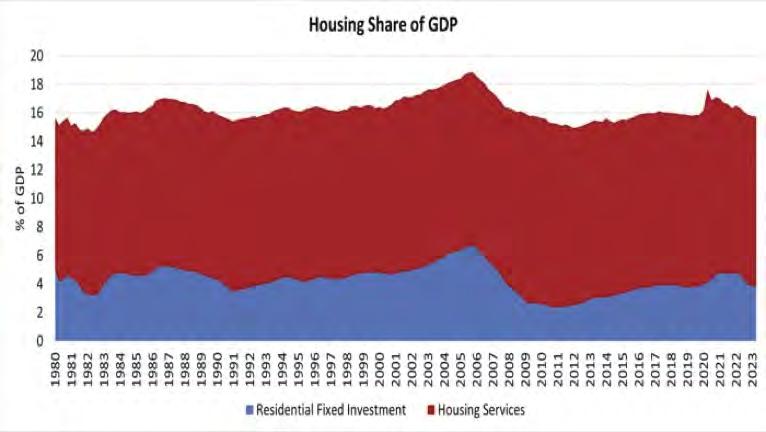

Housing Share of GDP Remains Lower in the Second Quarter of 2023

By Jesse Wade

Housing’s share of the economy remained at 15.8% at the end of the second quarter of 2023. Overall GDP increased at a 2.4% annual rate, following a 2.0% increase in the first quarter of 2023 and 2.6% increase in the fourth quarter of 2022. Despite overall GDP increasing for the fourth consecutive quarter, housing’s share of GDP remained to 15.8% over the course of the quarter.

In the second quarter, the more cyclical home building and remodeling component – residential fixed investment (RFI) – decreased to 3.8% of GDP. RFI subtracted 16 basis points from the headline GDP growth rate in the second quarter of 2023. The last time RFI added to GDP growth was the first quarter of 2021, resulting in nine consecutive quarters where RFI has subtracted from overall GDP growth.

Housing-related activities contribute to GDP in two basic ways.

The first is through residential fixed investment (RFI). RFI is effectively the measure of the home building, multifamily development, and remodeling contributions to GDP. It includes construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes and brokers’ fees.

For the second quarter, RFI was 3.8% of the economy, recording a $1.0 trillion seasonally adjusted annual pace.

The second impact of housing on GDP is the measure of housing services, which includes gross rents (including utilities) paid by renters, and owners’ imputed rent (an estimate of how much it would cost to rent owner-occupied units) and utility payments. The inclusion of owners’ imputed rent is necessary from a national income accounting approach, because without this measure, increases in homeownership would result in declines for GDP.

For the second quarter, housing services represented 12.0% of the economy or $3.2 trillion on a seasonally adjusted annual basis.

Taken together, housing’s share of GDP was 15.8% for the second quarter.

Historically, RFI has averaged roughly 5% of GDP while housing services have averaged between 12% and 13%, for a combined 17% to 18% of GDP. These shares tend to vary over the business cycle. However, the housing share of GDP lagged during the post-Great Recession period due to underbuilding, particularly for the single-family sector.

Lending Standards Continue to Tighten

According to the Federal Reserve Board’s July 2023 Senior Loan Officer Opinion Survey (SLOOS) for second-quarter 2023 bank lending activity, banks reported that lending standards tightened for all residential real estate (RRE) and commercial real estate (CRE) loan categories.

Banks expect their lending standards across all loan categories to tighten further over the second half of 2023. Expectations of more tightening were fueled by increased economic uncertainty and an expected deterioration of collateral values and credit quality of existing loans according to respondents.

As standards tightened, banks also reported weaker demand for both RRE and CRE loans. The net share of banks reporting weaker demand averaged 38.9% across RRE loan categories — a large improvement from the 50.8% and 87.4% averages in fourth quarter 2022 and first quarter 2023, respectively.

A majority (71.7%) of banks tightened standards for construction and land development loans, while 63.3% of banks tightened standards on loans secured by multifamily properties in the second quarter. Additionally, roughly half of respondents indicated weaker demand for these loans in the second quarter relative to first quarter.

September 2023 | www.westfloridabuilders.com | page 11 Home Builders Association of West Florida | September 2023 | page 10 Economic News Economic News

HBA of West Florida Dedicated Board Room to Peaden on August 23

To memorialize the 25-year tenure of its former Executive Director David Peaden, the Home Builders Association of West Florida has announced it will dedicate the “David W. Peaden II Board Room” in a ceremony on August 23, 2023 from 4 pm to 6 pm at the Scenic Hills Country Club, 8891 Burning Tree Rd., Pensacola, FL.

After a quarter-century of outstanding service to the HBA, Peaden resigned earlier this year to become the External Affairs Director of the Escambia and Santa County region for Florida Power & Light (FPL).

“We want to show our appreciation to the work David did for our HBA and the community in a way that will forever preserve his legacy,” said Past HBA President Alton Lister, Lister Builders, LLC “So from August 23 on, everyone who visits our HBA will see a tangible tribute to the incredible impact he made.”

Lister said members of the community who wish to share in honoring Peaden can attend the event by emailing an RSVP to the HBA’s Marketing and Communications Director Vicki Pelletier at vicki@hbawf.com. Lister said the formal dedication ceremony will take place at 5 pm on August 23.

Peaden became the HBA’s Executive Director on November 17, 1997 when he was 28 years old. The Pensacola native graduated from Washington High School and went on to earn a B.A. in Communications at the University of Alabama. He spurred the HBA’s growth in size and stature, inspiring members to effectively engage in industry advocacy, consumer education, and community service.

Jennifer Mancini succeeded Peaden as the HBA’s Executive Director on July 3, 2023.

September 2023 | www.westfloridabuilders.com | page 13 Home Builders Association of West Florida | September 2023 | page 12 Feature Story

Thank You David For All the Years of Service Dedicated to the Home Builders Association of West Florida!

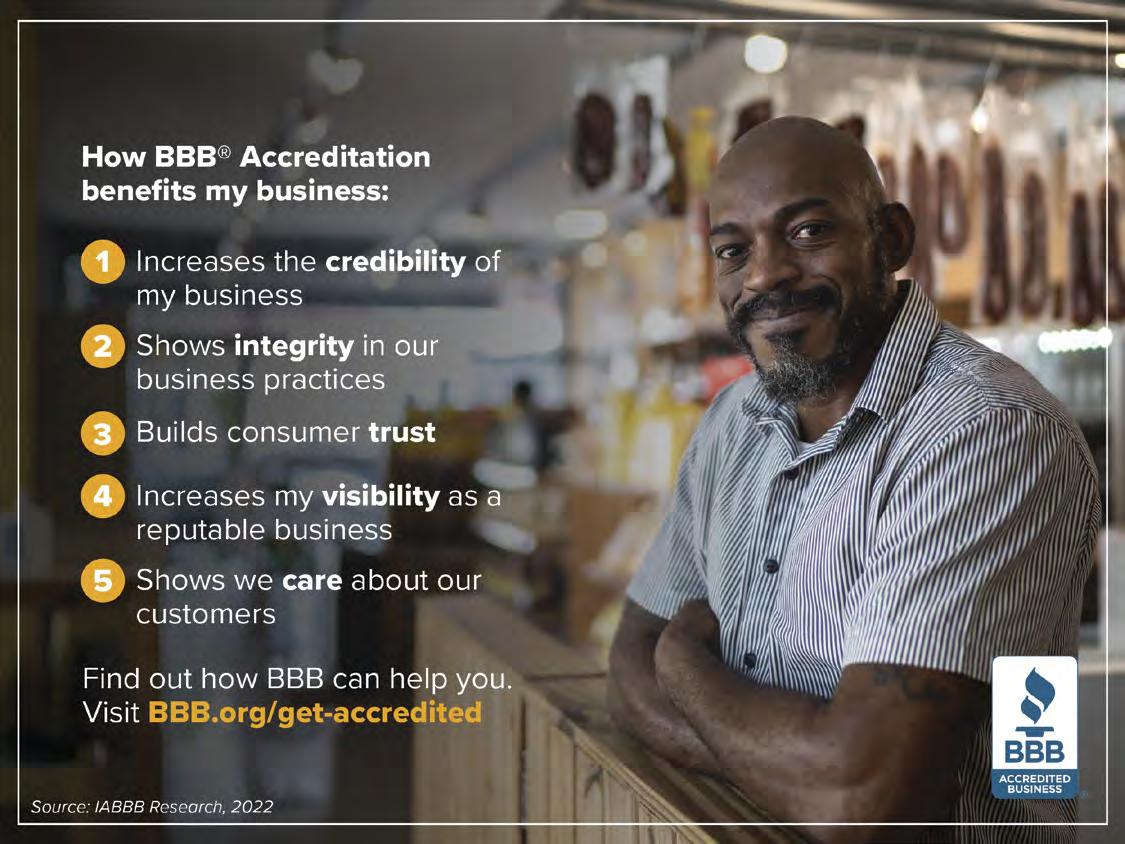

TOP 10 REASONS TO DO BUSINESS WITH AN ACTIVE ASSOCIATE MEMBER

1. They support the industry at the local, state and national levels.

2. They volunteer time, talent and treasure to help the association accomplish its goals.

3. They recruit their colleagues and business contacts to become members.

4. They serve on committees and councils gaining valuable networking opportunity while helping to advance the association’s mission.

5. By doing so, you increase the value proposition for all membership in our HBA.

6. They are strong supporters of local and state PACs and BUILD-PAC.

7. They are a major source of non-dues revenue through sponsorships, advertising, etc.

8. As industry partners, they are a valuable resource for business and management tips.

9. They are heavily invested in your business success: You win, they win!

10. Why wouldn’t you do business with a member?

Construction Job Openings Remain Relatively Unchanged As Housing Market Slows

Open, unfilled jobs for the overall economy continued to move lower in June, falling to 9.6 million. The count of open jobs was 10 million a year ago in June 2022.

The construction labor market saw little change for job openings in June. The count of open construction jobs decreased to 374,000 after a data series high of 488,000 in December 2022. The overall trend is one of cooling for open construction sector jobs as the housing market slows and backlog is reduced, with a notable uptick in month-tomonth volatility since late last year.

The construction job openings rate ticked down to 4.5% in June. The recent trend of these estimates points to the construction labor market having peaked in 2022 and is now entering a stop-start cooling stage as the housing market adjusts to higher interest rates.

Total job openings will continue to fall in 2023 as the labor market softens and unemployment rises. Ideally the count of open, unfilled positions slows to the 8 million range in the coming quarters as the Federal Reserve’s actions cool inflation.

While higher interest rates are having an impact on the demand-side of the economy, the ultimate solution for the labor shortage will not be found by slowing worker demand, but by recruiting, training and retaining skilled workers. This is where the risk of a monetary policy mistake can be found. Good news for the labor market does not automatically imply bad news for inflation.

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. While a slowing housing market will take some pressure off tight labor markets, the long-term labor challenge will persist beyond the ongoing macro slowdown.

September 2023 | www.westfloridabuilders.com | page 15 Home Builders Association of West Florida | September 2023 | page 14 Economic News

BallingerPublishing.com | 850.433.1166 BUSINESS CLIMATE ON MARKET REAL THIS ISSUE: PENSAPRIDE SUMMER SIPPERS ART OF THE TACO PENSACOLAMAGAZINE.COM

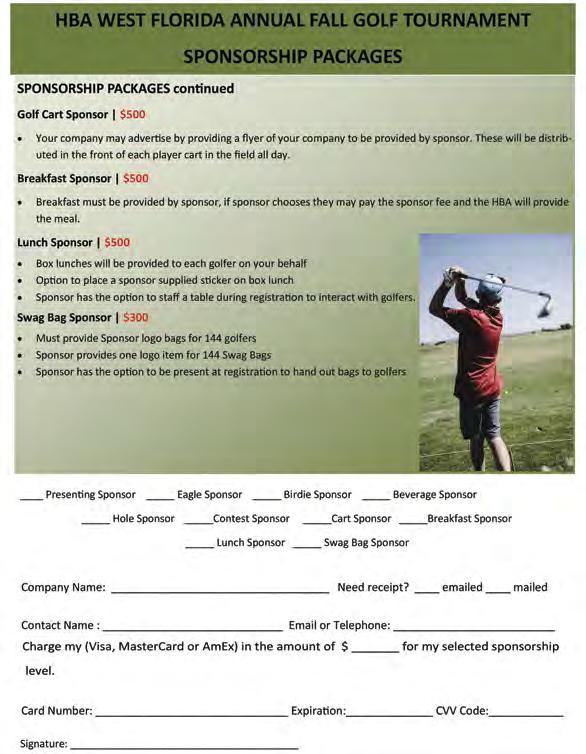

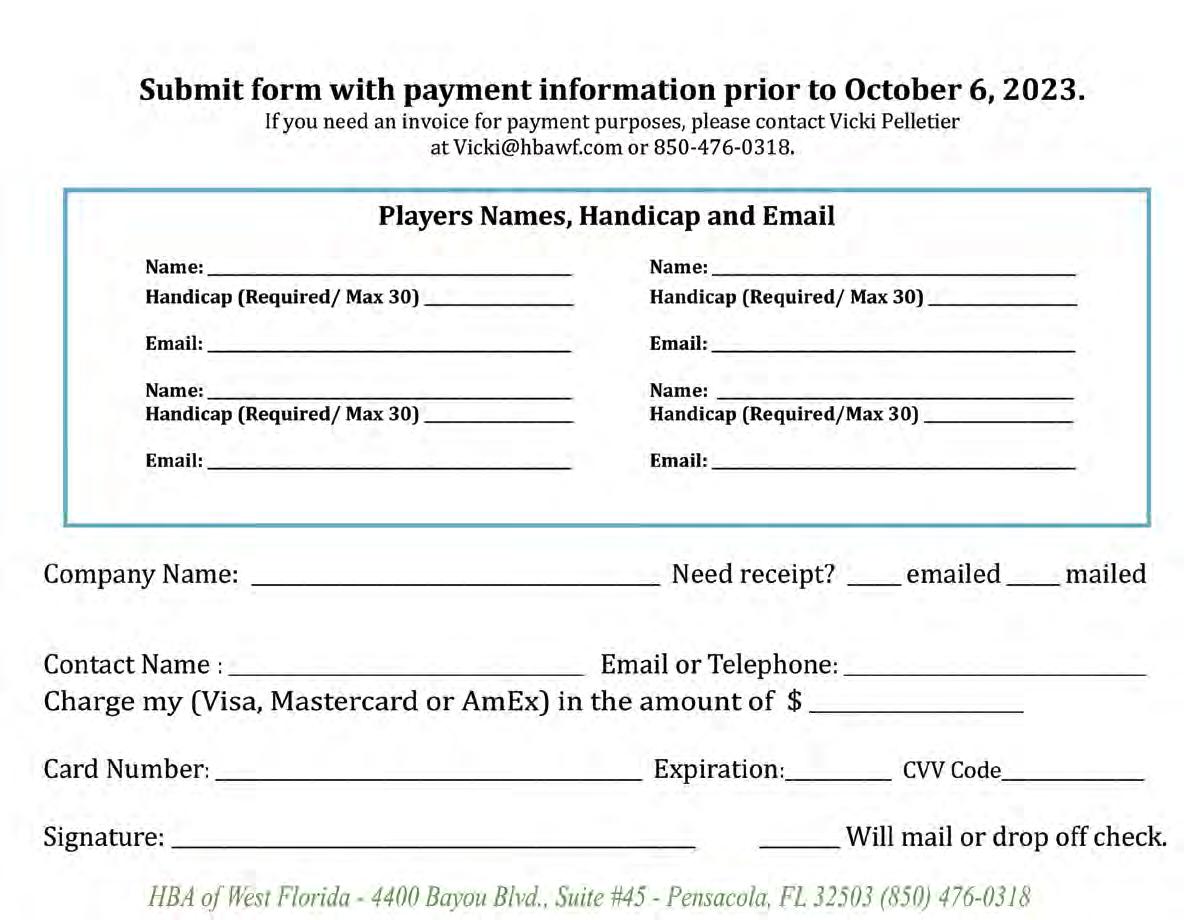

September 2023 | www.westfloridabuilders.com | page 17 Home Builders Association of West Florida | September 2023 | page 16 HBAWF News HBAWF News With our best agents located in Pensacola, you can be sure you’ll... • Get the most value for your money • Secure protection for your most valued assets • Better understand what coverages you have and what is available • Have access to an experienced agent providing you with personal service throughout Florida Mary Jordan Agent/Owner (850) 384-0593 mary@gcainsurance.com Cassy Smith Operations Manager (850) 497-6810 cassy@gcainsurance.com Taylor Bubert House Agent (850) 497-6810 taylor@gcainsurance.com Vicki Ruschel Personal Lines Manager (850) 497-6810 vicki@gcainsurance.com Speak with one of our agents today! One Great Team, Amazing Service! 700 New Warrington Rd Pensacola, FL 32506 Pensacola O: 850-497-6810 Gulf Coast Insurance gcains.com

gies to maximize student access to funding and assistance to further their careers in the building industry. This event is designed specifically for Workforce Foundations and construction training programs.

Don’t miss this meeting, hosted at the beautiful Henderson Beach Resort in Destin, FL, October 16-17, 2023. Your registration fee includes all meetings, a welcome reception on Monday evening and Tuesday morning breakfast.

Please visit www.fhba.com for event registration information

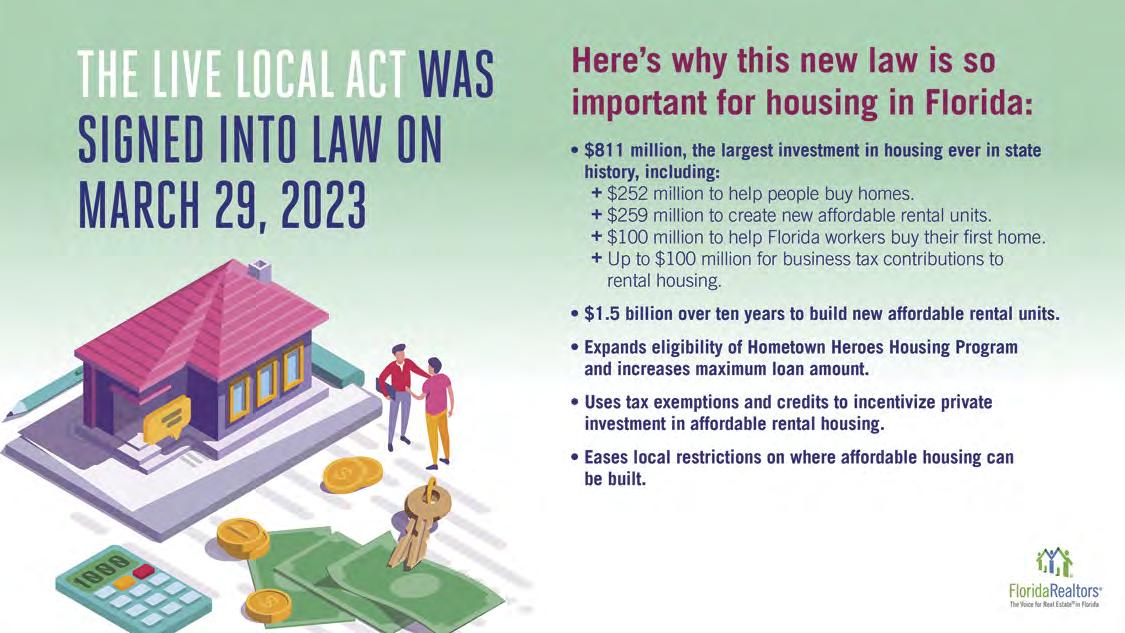

Upcoming Workforce Development Summit

The Florida Home Builders Foundation is celebrating Careers in Construction Month with NAHB this October by hosting our first Workforce Development Summit!

Based on feedback of members and educators, a centralized clearing house for information to help students simply doesn’t exist. Attending this summit will allow you to join leaders from aligned organizations to share resources, best practices and strate-

Why houses in America are getting smaller

Size matters, especially in housing, but preferences can change quickly, and that is the case today. Small is happening in a big way.

For the first time since the recession, home size is shrinking. Median singlefamily square floor area fell from the first to the second quarter of this year by 73 feet, according to the National Association of Home Builders (NAHB) and U.S. Census data. That may not sound like a lot, but it is a clear reversal in the trend of builders focusing on the higherend buyer.

An increase in home size post-recession is normal, historically, as credit tightens and more wealthy buyers with more cash and better credit, rule the market. As with everything else in this unique housing cycle, however, the trend this time is more profound.

"This pattern was exacerbated during the current business cycle due to market weakness among first-time homebuyers," wrote Robert Dietz, NAHB's chief economist. "But the recent small declines in size indicate that this part of the cycle has ended and size should trend lower as builders add more entry-level homes into inventory.”

Sales of newly built homes jumped more than 12 percent in July compared to June, according to the Census, and the biggest increase was in homes priced in the mid to just below midrange. The median price of a new home sold in July fell 1 percent

"At 3 to 3.5 percent mortgage interest rates, you'd think they would be very affordable, but all of the financial requirements for higher FICO scores and larger down payments and all those other things and income ratios have made it harder, even with a low interest rate," said Stephen Paul, executive vice president of homebuilding operations at Mid-Atlantic Builders, also in Maryland. "In our market it's been financing is driving the deals and builders are adjusting their product to meet the affordability issue."

compared to July a year ago. Again, not a huge drop, but a reversal from the recent gains in new home prices.

"The majority of it is a question of affordability," said Bob Youngentob, president

Even luxury homebuilder Toll Brothers, which beat expectations in its fiscal thirdquarter earnings, saw a drop in its average price of net signed contracts. This may be a reflection of more smaller homes selling. With the improving employment market, builders in general are finally seeing more demand for entry-level product. Both Lennar and D.R. Horton are the first of the big public builders to shift focus back to that lower-priced, smaller home.

Paul said he has not seen the return of the first-time buyer yet in his larger homes built further outside the Washington, D.C., area. He is seeing some at smaller townhomes, closer in to the city, but not as many as he would like.

"If you look at what rentals are doing today and the accoutrements that these apartments are putting in, they are making them resortlike. It's not a surprise that millennials might not want to leave the comforts of a rental apartment because they can't replicate that in a home," said Paul.

of Maryland-based EYA, a builder concentrating largely in urban townhomes.

"People want to stay in closer-in locations, at least from our experience, and closer-in locations tend to be more expensive from a land and development standpoint and so, the desire to be able to keep people in those locations is translating into smaller square footages and more efficient designs."

Financing is also playing a big role in home size, even out in the suburbs. Mortgage underwriting, especially for governmentinsured loans, is still tight and the bigger the loan size, the tougher it is to qualify.

Preference also plays a role, as younger Americans seem to be drawn to smaller, simpler living. The tiny house trend has been growing exponentially, as technology allows people to trick out small spaces with big amenities.

Micro-apartments are also seeing big demand. And millennials, too, are far more cautious with their finances, having grown up in one of the worst financial crises in history. They don't seem to crave size as much as they do a smart, high-functioning, environmentally friendly home. In other words, bigger isn't necessarily better.

Source: Diana Olick CNBC

September 2023 | www.westfloridabuilders.com | page 19 Home Builders Association of West Florida | September 2023 | page 18 NAHB News Feature Story

September 2023 | www.westfloridabuilders.com | page 21 Home Builders Association of West Florida | September 2023 | page 20 Bring a friend to our next meeting! HBAWF News Membership For future upcoming events, please call the HBA office at 850.476.0318 Stay up-to-date on news and events Have access to exclusive promotions and giveaways Check out polls and fun facts on the page Have pictures from HBA events? Share them with us! Tag yourself in our photos! facebook.com/HBAWF Alpha Foundations Ryan Sellers - Sales Manager 3723 Hogshead Rd Apopka, FL 32703 p (407) 750-0716 alphafoundations.com New Members Associate Members builder Members NO NEW MEMBERS GET INVOLVED HBA Councils and Committees! 850.476.0318 BallingerPublishing.com | 850.433.1166 PENSACOLAMAGAZINE.COM BUSINESS CLIMATE ON THE MARKET REAL ESTATE SECTION ALSO THIS ISSUE: PENSAPRIDE SUMMER SIPPERS ART OF THE TACO JULY 2023 PENSACOLAMAGAZINE.COM

In construction, a spike is a steel object that is essential to making a building strong. As in construction, the HBA of West Florida sees a Spike as someone that works to keep our association strong. Spikes work on the recruitment and retention of members in addition to keeping members active with the association. Anyone is eligible for Spike status. On Spike credit is awarded for each new member recruited and an additional credit is awarded for that new member’s renewal on or before their anniversary date. If you help to retain a member, you are eligible to receive a half point for each member.

Spike Club Levels

Spike Candidate 1-5 credits

Blue Spike 6-24

Life Spike 25-49

Green Spike 50-99

Red Spike 100-149

Royal Spike 150-249

Super Spike 250-499

Statesman Spike 500-999

Grand Spike 1000-1499

All-Time Big Spike 1500+

Spike Club Members and their credits as of 07/31/2023.

Statesman Spike 500 Credits

Harold Logan 525.5

Super Spike 250 Credits

Rod Hurston 431.5

Royal Spike 150 Credits

Rick Sprague 210

Edwin Henry 201

William “Billy” Moore 184

Bob Boccanfuso 165.5

Red Spike 100 Credits

Charlie Rotenberry 150

Oliver Gore 115

Ron Tuttle 109.5

Ricky Wiggins 101.5

Green Spike 50 Credits

David Holcomb 99.5

Newman Rodgers IV 102

Doug Sprague 90.5

Kenneth Ellzey, Sr. 80.5

Russ Parris 73.5

Paul Stanley 68.5

Blaine Flynn 68.5

Bob Price, Jr. 60

Thomas Westerheim 58.5

Darrell Gooden 52.5

Bill Daniel 51.5

Wilma Shortall 51.5

John Hattaway 50

Life Spike 25 Credits

Doug Whitfield 42.5

Amir Fooladi 36.5

Suzanne Pollard-Spann 35

Garrett Walton 32

Bruce Carpenter III 30

Luke Shows 26.5

Steve Moorhead 23

Brent Woody 22.5

Karen Pettinato 21

Larry Hunter 21.5

Taylor Longsworth 20.5

Lee Hudson 19.5

Alton Lister 18

Jon Pruitt 17.5

Milton Rogers 17

Doug Herrick 16.5

Dean Williams 16.5

Lorie Reed 16

Martin Rich 15

William Merrill 15.5

Kevin Ward 13

Rick Faciane 12.5

Bill Batting 12

Alex Niedermayer 11

Kim Cheney 10

Spike Credits

Shelby Johnson

M

Advertiser’s Index

Alpha Closets 23 p 850.934.9130 AlphaClosets.com

Ballinger Publishing 14 & 21 p 850.443.1166 ballingerpublishing.com

Better Business Bureau of NW FL 11 bbb.org/get-accredited

Campbell Construction & Company, LLC 17 p 850.698.4153 dax.campbellconstruction@gmail.com

Centennial Bank 17 my100bank.com

Emmanuel, Sheppard & Condon 3 p 850.409.6449

Gulf Coast Insurance 17 p 850.497.6810 gcins.com

Michael Johnson Insurance Agency 9 p 850.478.7748 michaeljohnsonagency.com

Pensacola Energy 02 o 850.436.5050 pensacolaenergy.com

Rew Building Materials, Inc. 9 o 850.471.6291 c 850.259.7756 ecbmfl.com

Southeast Mortgage 3 p 850.776.6094 southeastmortgage.com

West Fraser Back Cover westfraser.com/osb

Kevin Russell

James Cronley

Shellie I

Rodney Boutwell

Dax Campbell

If you would like to join the Spike Club or Desire Additional Information, please contact Vicki Pelletier(850) 476-0318

September 2023 | www.westfloridabuilders.com | page 23 Home Builders Association of West Florida | September 2023 | page 22

Gold Sponsor for the 2020 Dream Home

Home Builders Association of West Florida | September 2023 | page 24