Plus

Hurdles to

2023 Summer Edition WWW.BIODIESELMAGAZINE.COM

B100 BREAKTHROUGH Optimus Technologies Enabling Cost-Effective Fleet Transitions Page 16

The Intricacies of Biointermediates Page 22

Meeting Rocketing Soybean Demand Page 28

UNISOL ® Powerful Liquid Dyes LEADERS IN COLOR CHEMISTRY

When You Want to Stand Out

6 Editor’s Note

Blazing the Trail to Higher Blends

BY ANNA SIMET

8 Column

IRFA Relaunches on-Farm Biodiesel Credit Program

BY LISA COFFEIT

10 Biodiesel News Roundup

12 Inside Clean Fuels Alliance America

14 Podcast Preview

Featuring Bruce Fleming, Montana Renewables

Advertiser Index

2023 Biodiesel Summit: Sustainable Aviation

Fuel & Renewable Diesel

2023 National Carbon Capture Conference & Expo

2023 North American SAF Conference & Expo

BDI - BioEnergy International GmbH

Carbis Solutions Group, LLC

Clean Fuel Alliance America

Crown Global Companies-Crown Iron Works

Dallas Group of America, Inc.

Desmet Ballestra North America

DSM Food Specialties B.V.

Filtration Technology Corporation

Iowa Central Fuel Testing Lab

Leem Filtration

Oil-Dri Corporation of America

Renewables

FEATURES

16 TECHNOLOGY A Boost for B100

Ambitious carbon reduction goals are driving interest in the use of higher biodiesel blends, and Optimus Technologies’ Vector System is enabling diesel engines to economically transition.

BY SUSANNE RETKA SCHILL

22 POLICY

The Path to Biointermediates

While the U.S. EPA's biointermediate provisions offer the potential to unlock more feedstock options for biodiesel, renewable diesel and sustainable aviation fuel, the mandatory Quality Assurance Plan audit process is still not ready for producers to apply.

BY KATIE SCHROEDER

CONTRIBUTIONS

28 FEEDSTOCK

Challenges Ahead for Soybean-Based Renewable Fuel Demand

Building new renewable fuel plants and increasing the pace of existing crush facilities can set the demand side of the soy biodiesel equation, but the supply side may become complicated.

BY GREG HORSTMEIER

BY GREG HORSTMEIER

SPONSORED CONTENT

30 SPOTLIGHT BDI - BIOENERGY INTERNATIONAL GMBH

Future Feedstock Flexibility with Pretreatment

BY ANNA SIMET

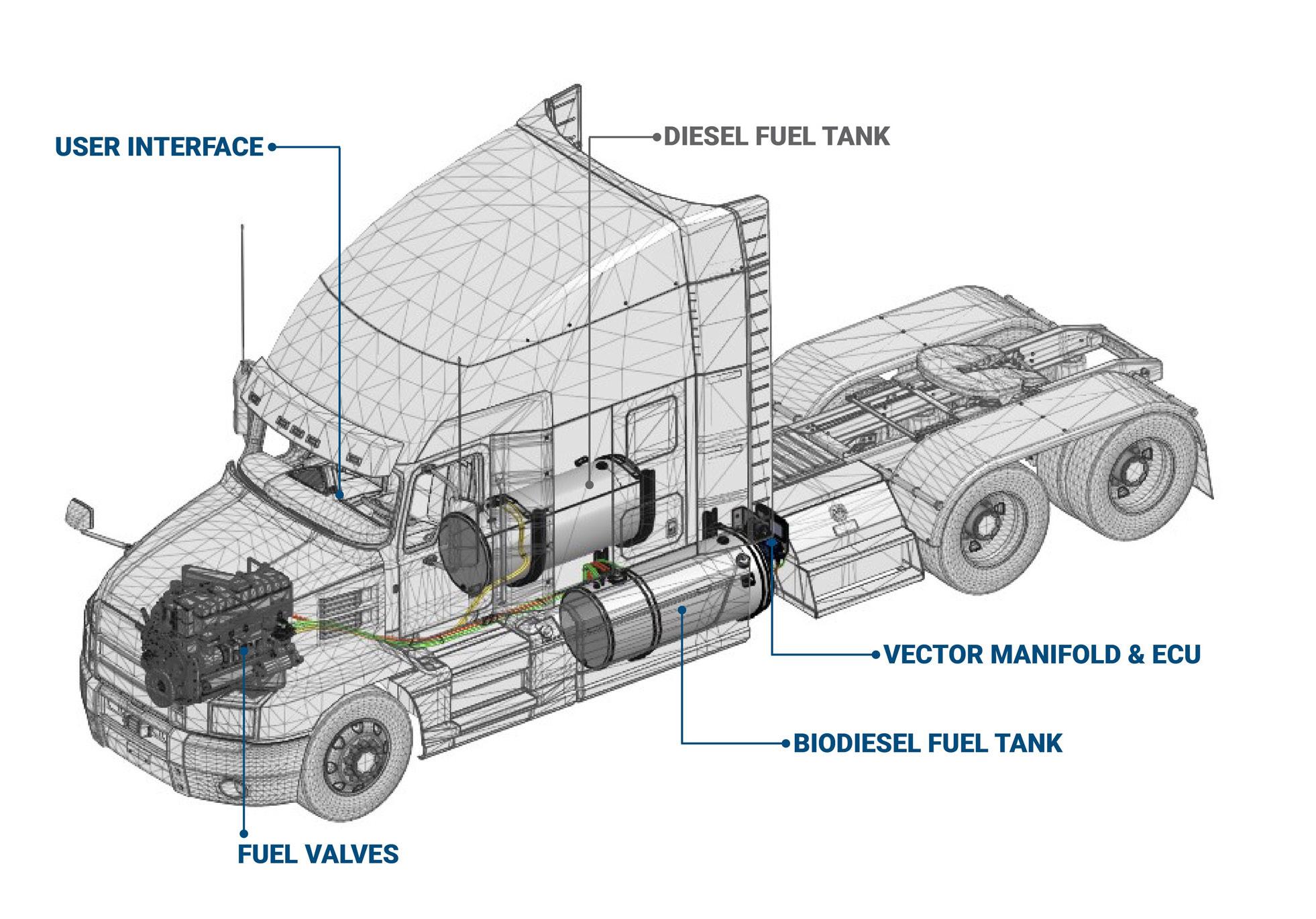

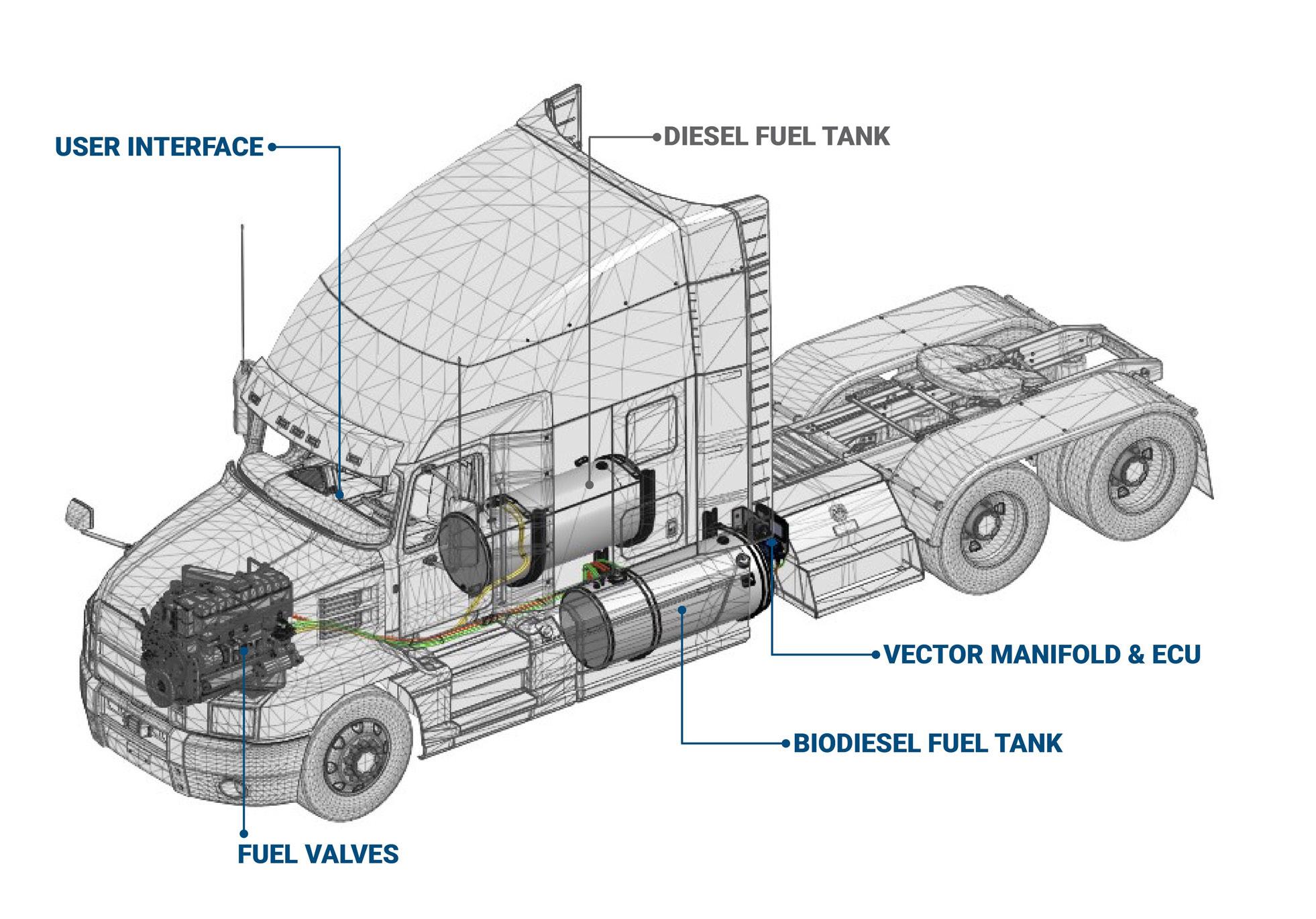

ON THE COVER Optimus Technologies' Vector System, designed for medium and heavy-duty fleet applications, integrates into existing operations to facilitate seamless transitions to B100.

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 4

PHOTO: OPTIMUS TECHNOLOGIES

CONTENTS 2023 SUMMER ISSUE VOLUME 20 ISSUE 2

WWS, Inc. 7 9 34 31 33 5 & 27 21 20 36 19 3 15 18 24 26 2 25 16

SAFFiRE

United Color Manufacturing

2023 Biodiesel Summit: Sustainable Aviation

Fuel & Renewable Diesel

June 12-14, 2023

CHI Health Center, Omaha, Nebraska

The Biodiesel & Renewable Diesel Summit is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose, to further the biomass-based diesel sector beyond its current limitations.

(866) 746-8385 | BiodieselSummit.com

2023 Int'l Fuel Ethanol Workshop & Expo

June 12-14, 2023

CHI Health Center, Omaha, Nebraska

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production— from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies.

(866) 746-8385 | FuelEthanolWorkshop.com

North American SAF Conference & Expo

August 29-30, 2023

Minneapolis Convention Center, Minneapolis, Minnesota

The North American SAF Conference & Expo, produced by SAF Magazine, in collaboration with the Commercial Aviation Alternative Fuels Initiative (CAAFI) will showcase the latest strategies for aviation fuel decarbonization, solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers. The North American SAF Conference & Expo is designed to promote the development and adoption of practical solutions to produce SAF and decarbonize the aviation sector. Exhibitors will connect with attendees and showcase the latest technologies and services currently offered within the industry.

866-746-8385 | www.nationalsafconference.com

2024 Int'l Biomass Conference & Expo

March 4-6, 2024

Greater Richmond Convention Center, Richmond, Virginia

Organized by BBI International and produced by Biomass Magazine, this event brings current and future producers of bioenergy and biobased products together with waste generators, energy crop growers, municipal leaders, utility executives, technology providers, equipment manufacturers, project developers, investors and policy makers. It’s a true one-stop shop – the world’s premier educational and networking junction for all biomass industries.

866-746-8385 | www.biomassconference.com

www.BiodieselMagazine.com 5

EVENTS

BLAZING THE TRAIL TO HIGHER BLENDS

As I write this note, the most-viewed story on the Biodiesel Magazine website this week is “Optimus Technologies closes $17.8m Series A led by Mitsui & Co.” Quite timely with this issue, being that our page-16 cover story, “A Boost for B100,” by Susanne Retka Schill, is largely focused on Optimus and its Vector System. In short, the technology upgrades diesel engines to operate on B100 and does so avoiding the issues that have been historically involved in using higher blends of biodiesel, including cost, ease of retrofit and cold flow. In the story, Retka Schill talks with Optimus CEO Colin Huwyler about the Vector System’s capabilities, extensive testing with industry partners, and how biodiesel’s competitiveness with renewable diesel is going to hold up. Retka Schill also chats with Steve Howell, founding partner of M4 Consulting and senior technical advisor for Clean Fuels Alliance America, about the traction higher biodiesel blends are getting. Says Howell, “What we’re seeing now is that customers want to have maximum carbon reductions, and B20 simply is not enough.”

Moving on to our page-22 feature, “The Path to Biointermediates” demonstrates that while the U.S. EPA’s biointermediate provisions are designed to open up the feedstock supply chain, which the biodiesel, renewable diesel and SAF sectors will all need, it is complicated, and the program has still not completed any registrations. Staff Writer Katie Schroeder provides a well-rounded update in her story, which features commentary from Kari Buttenhoff, partner at Christianson CPAs & Consultants; Matt Herman, senior director of renewable product marketing with the Iowa Soybean Association; and the U.S. EPA’s Robert Anderson, who works on the agency’s fuel compliance issues.

Among other content in this issue is a notice that our parent company, BBI International, has partnered with the Commercial Aviation Alternative Fuels Initiative, or CAAFI, on the firstever North American SAF Conference & Expo, which will be held in Minneapolis, Minnesota, in August. This event will focus on the latest strategies for aviation fuel decarbonization and solutions for key industry challenges, and highlight the current opportunities for airlines, corporations and fuel producers. Learn more at safconference.com—hope to see you there.

Anna

Simet

Biodiesel Magazine

BiodieselMagazine.com

PUBLISHING & SALES

Joe Bryan

Tom Bryan

John Nelson

Anna Simet

Katie Schroeder

Chip Shereck

Bob Brown

Jessica Tiller

Marla DeFoe

Jaci Satterlund

Raquel Boushee

CEO jbryan@bbiinternational.com

President tbryan@bbiinternational.com

Vice President of Operations/ Marketing & Sales jnelson@bbiinternational.com

Editor asimet@bbiinternational.com

Staff Writer katie.schroeder@bbiinternational.com

Senior Account Manager cshereck@bbiinternational.com

Account Manager bbrown@bbiinternational.com

Circulation Manager jtiller@bbiinternational.com

Marketing & Advertising Manager mdefoe@bbiinternational.com

ART

Vice President, Production & Design jsatterlund@bbiinternational.com

Graphic Designer rboushee@bbiinternational.com

Subscriptions Subscriptions to Biodiesel Magazine are free of charge to everyone with the exception of a shipping and handling charge for any country outside the United States. To subscribe, visit www.biodieselmagazine.com or you can send your mailing address and payment (checks made out to BBI International) to: Biodiesel Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Reprints and Back Issues Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 701-746-8385 or service@bbiinternational.com. Advertising Biodiesel Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Biodiesel Magazine advertising opportunities, please contact us at 701-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. If you write us, please include your name, address and phone number. Letters may be edited for clarity and/or space. Send to Biodiesel Magazine Letters, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203 or email asimet@bbiinternational. com.

Please recycle this magazine and remove inserts or samples before recycling

TM

COPYRIGHT © 2023 by BBI International

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 6

EDITOR'S NOTE

JUNE 12-14, 202 Omaha, Nebraska BiodieselSummit. co m

ENERGY INDUSTRY

TO CHANGE All Events For One Registration Price Production Facilities Receive Complimentary Passes 866-746-8385 | service@bbiinternational.com | #FEW23 @ethanolmagazine Produced By

THE

IS ABOUT

IRFA RELAUNCHES ON-FARM BIODIESEL CREDIT PROGRAM

Lisa Coffelt

The Iowa Renewable Fuels Association is giving back to Iowa farmers by supporting biodiesel usage for farm operations via their On-Farm Biodiesel Credit Program. Any farmer within Iowa who purchases a qualifying biodiesel blend can receive up to 50 cents per gallon through the IRFA program, which will be the second year running for this innovative program. This is a great way for farmers to try a B11 blend or bump up to B20. IRFA is thrilled to be able to relaunch this program with $45,000 in available funding for 2023. Last year, we exhausted $35,000 in cash-back credits to almost 100 farmers who used higher biodiesel blends on their farm.

Farmers can earn 25 cents per gallon for filling up with B11 (11% biodiesel) and 50 cents per gallon with B20 (20% biodiesel) up to a maximum credit of $500 per farmer. To be eligible, farmers must meet the criteria and follow the procedures outlined at the link at the end of this article.

Biodiesel is a win for agriculture on multiple levels, as it adds value to soybean oil, corn oil and animal fats. It’s supported by John Deere and CASE IH engines. We are looking forward to putting more money in farmers’ pockets this year as we expand biodiesel distribution.

The Iowa Soybean Association and Iowa Biodiesel Board continue to partner with the program, providing $10,000. Biodiesel producers Western Iowa Energy, Western Dubuque Biodiesel and Chevron Renewable Energy Group each contributed $5,000. IRFA provides $20,000 in funding and manages the program.

Response to the first round of funding in 2022 was positive. “We use biodiesel year-round on my farm—B20 in the summer and B5 in the winter, and have had absolutely no problems,” says Randy Miller, a soybean farmer from South Central Iowa. “The biodiesel credit is just one more example of the benefit that is out there for farmers to get started using biodiesel.”

From prolonging the life of the engine to reducing harmful emissions, biodiesel provides diesel vehicle drivers with many benefits. It can reduce greenhouse gas emissions by up to nearly 90% compared to petroleum diesel. Just as important, by displacing the many toxic, cancer-causing chemicals in diesel fuel.

Iowa has 11 biodiesel facilities with the capacity to produce 410 million gallons annually, making it the nation’s leader in biodiesel production and contributing thousands of jobs and millions in household income to Iowa’s economy. The biodiesel industry accounts for nearly $1 billion of Iowa’s gross domestic product, generates $500 million of income for Iowa households, and supports more than 7,000 job throughout the entire state.

While biodiesel blends are king of the Iowa roads, dye-biodiesel usage lags. IRFA looks to programs like the On-Farm Biodiesel Credit Program to raise awareness of biodiesel while increasing usage of these important Iowa-produced products. Ultimately, by giving back to Iowa farmers who see the benefit in their farm operations, IRFA hopes to increase demand of Iowa agriculture commodities and show how biodiesel is a cleaner-burning, highperformance biofuel made for diesel engines.

Author: Lisa Coffelt lcoffelt@iowarfa.org Iowarfa.org/iowa-on-farm-biodiesel-credit-program/

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 8 COLUMN

BECOME AN

Leading Carbon Capture Business

How Can You Be a Part of the Action?

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the histor y of the broader biofuels industry.

The National Carbon Capture Conference & Expo will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible andthe nancial and marketplace impacts to participating producers.

Iowa Event Center Des Moines, Iowa SAVE THE DA TE Speak. Exhibit. Sponsor. Network Produced By 866-746-8385 service@bbiinternational.com @CarbonCaptureMg

EXHIBITOR CO NNE CT WITH Y OUR AUDIENCE

News Roundup

The U.S. exported 36,718 metric tons (approx. 27.46 million gallons) of biodiesel and blends of B30 and greater in March, up from 29,252 in the same month last year, according to data released by the USDA Foreign Agricultural Service on May 4. During the month, the U.S. exported biodiesel to approximately six countries. Canada was the top destination at 31,587 metric tons, followed by Peru at 4,405.7 metric tons and Germany at 289 metric tons.

The value of U.S. biodiesel exports reached just over $61 million in March, nearly doubling from the previous month at $32.31 million, and up from $46.86 million in the same month last year.

Total U.S. biodiesel exports for the first quarter of 2023 reached 68,203 metric tons at a value of $116.14 million, compared to 71,324 metric tons exported during the same period of 2022 at a value of $108.15 million.

As for imports, the 146,427 metric tons of biodiesel and blends of B30 and greater imported in March was up compared to both the 123,302 metric tons imported in February and the 105,175 metric tons imported in March of last year. The U.S. imported biodiesel from approximately 10 countries in March. Germany was the primary source of U.S. biodiesel imports at 42,825 metric tons, followed by Canada at 40,483 metric tons and Spain at 30,363 metric tons.

The total value of U.S. biodiesel imports reached $256.78 million in March, up approximately $31 million from previous month, and up $94 million from March 2022.

Total U.S. biodiesel imports for the first three months of the year reached 402,766 metric tons at a volume of $737.41 million, compared to 183,878 metric tons imported during the same period of 2022 at a value of $275.23 million.

U.S. operable biofuels production capacity increased in February, with gains for ethanol, biodiesel and renewable diesel and associated fuels, according to data released by the U.S. Energy Information Administration on April 28. Total feedstock consumption was up slightly when compared to February 2022. Biodiesel capacity was at 2.063 billion gallons per year in February, up 12 MMgy when compared to January, but down 169 MMgy when compared to February 2022.

Total soybean oil consumption reached 910 million pounds in February, with 536 million pounds consumed by biodiesel plants and 374 million pounds consumed by renewable diesel facilities. Total soybean oil consumption was at 941 million pounds in January, including 557 million pounds consumed at biodiesel plants and 384 million pounds consumed at renewable diesel facilities. In comparison, soybean oil consumption was at 741 million pounds in February 2022, including 519 million pounds consumed by bio-

diesel plants and 222 million pounds consumed by renewable diesel facilities.

According to the EIA, biofuel producers consumed 404 million pounds of yellow grease, 192 million pounds of beef tallow, 33 million pounds of white grease and 22 million pounds of poultry fat in February. The EIA withheld data on other types of waste oils, fats and greases consumed in order to avoid disclosure of individual company data.

The U.S. EPA on April 20 released data showing nearly 1.91 billion renewable identification numbers (RINs) were generated under the Renewable Fuel Standard in March, up from 1.82 billion generated during the same period of last year. Total RIN generation for the first quarter of 2023 reached 3.63 billion, down from 4.95 billion generated during the same quarter of 2022. Total D4 RIN generation for the first quarter of this year reached 1.66 billion. That volume includes 769.26 million generated for nonester renewable diesel by domestic producers, 547.26 million generated for biodiesel by domestic producers, 171.02 million generated for nonester renewable diesel by foreign entities, 160.62 million generated for biodiesel by importers, 4.64 million generated for renewable jet fuel by foreign entities, and 3.04 million generated for renewable jet fuel by domestic producers.

Total D5 RIN generation for the first quarter of the year reached 47.63 million. That volume includes 21.59 million generated for naphtha by domestic producers, 15.95 million generated for nonester renewable diesel by domestic producers, 7.78 million generated for ethanol by domestic producers, 1.09 million generated for renewable heating oil by domestic producers, 1.08 million generated for liquefied petroleum gas by domestic producers, and 147,104 generated for compressed RNG by domestic producers.

Nearly 1.22 billion D6 renewable fuel RINs were generated in March, including 1.02 billion generated for ethanol by domestic producers and 13.7 million generated for nonester renewable diesel by foreign entities.

Total D6 RIN generation for the first three months of 2023 reached 3.56 billion. That volume includes 3.52 billion generated for ethanol by domestic producers, 39.36 million generated for nonester renewable diesel by foreign entities, and 1.19 million generated for ethanol by importers.

No D7 cellulosic diesel RINs have been generated so far this year.

Cavitation Technologies Inc., a design and manufacturer of innovative flow-through nanotechnology systems for fluid processing applications, announced two purchase orders for its low-pres-

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 10

sure Nano Reactor System from a biodiesel production facility in Colombia, South America, with an expected capacity of 400 metric tons per day. It will be Cavitation’s third installation in the country, the biodiesel industry of which is driven by palm oil.

Optimus Technologies announced a $17.8 million Series A funding round led by Mitsui & Co. out of Tokyo, Japan. The round included participation from one of North America’s largest commercial fleets, Chevron Renewable Energy Group, and Pittsburgh regional investors including: Idea Foundry Inc., Innovation Works, Richard King Mellon Foundation and Urban Redevelopment Authority of Pittsburgh. The capital raise will fund the further development and deployment of Optimus’ Vector System, an advanced fuel system technology that enables heavy-duty diesel engines to operate on B100 biodiesel.

PBF Energy Inc. reported in early May that the renewable diesel production unit under development as part of the St. Bernard Renewables project in Louisiana is mechanically complete. A feedstock pretreatment unit is under construction and scheduled for completion in June. Company officials discussed development of the project during a first quarter earnings call, held May 5. The SBR renewable diesel project is collocated with PBF Energy’s oil refinery in Chalmette, Louisiana. Once fully operational, the facility is expected to have the capacity to produce approximately 320 MMgy of biobased products, primarily renewable diesel. The biorefinery employs Ecofining technology developed by Eni in cooperation with Honeywell UOP

Oleo-X, a producer of premium renewable fuel feedstocks, announced the launch of its renewable diesel and sustainable aviation fuel feedstock merchant pretreatment facility. In addition to the facility launch, Oleo-X announced the appointment of longtime airline fuel executive Sergio Correa as CEO. Located in Pascagoula, Mississippi, Oleo-X's facility has the potential capacity to produce up to 300 MMgy of premium feedstock.

CVR Energy Inc. is continuing to ramp up renewable diesel production at its Wynnewood refinery in Oklahoma. Total vegetable oil throughput during the first quarter of 2023 was approximately 22.4 million gallons, up from 12.8 million gallons during the fourth quarter of last year, according to information released in the company’s first quarter financial report. CVR Energy CEO David Lamp discussed the company’s renewable diesel operations during the company's first quarter earnings call, held May 2. According to Lamp, CVR Energy is completing the second planned

catalyst change in the renewable diesel unit. The company expects to see significant improvements in renewable diesel yield with the new catalyst, he said. Total throughput for the renewables unit is expected to range from 15 million to 22 million gallons during the second quarter

Marathon Petroleum Corp. released first quarter financial results on May 2, confirming the second phase of its renewables conversion project at the Martinez refinery in California is progressing on schedule and expected to be complete by year end. The Martinez project is being developed in partnership with Neste The biorefinery reached full Phase I production capacity of 260 MMgy during the first quarter of 2023. Phase II construction activities are progressing on schedule, according to the company, with feedstock pretreatment capabilities expected to come online during the second half of this year. By the end of 2023, the biorefinery is expected to be capable of producing 730 MMgy.

BBI International recently announced it has entered into a collaborative agreement with the Commercial Aviation Alternative Fuels Initiative to produce the first annual North American SAF Conference & Expo. The conference will be held at the Minneapolis Convention Center from Aug. 29-30, in downtown Minneapolis, Minnesota. This year’s inaugural North American SAF Conference & Expo will provide two days of content for the sustainable aviation fuel industry. The program is set to mirror much of CAAFI’s focus, which is to encourage the development of alternative jet fuel options that promote environmental improvement and energy supply security for aviation.

Calumet Specialty Products Partners LP on May 10 announced the first production and initial shipments of sustainable aviation fuel (SAF) to Shell Trading Co. from its Montana Renewables subsidiary, which operates a biorefinery located in Great Falls, Montana. A celebratory event was held on-site and included participation of key aviation stakeholders, as well as Montana Gov. Greg Gianforte.

In December, Calumet reported the biorefinery had generated a full month of on-spec renewable diesel and had commenced rail shipments of the product. During a May 5 quarterly earnings call, Calumet CEO Todd Borgmann confirmed that the biorefinery’s renewable hydrogen plant was commissioned during Q1, and noted that the feedstock pretreatment and SAF units were brought online in April.

www.BiodieselMagazine.com 11 NEWS ROUNDUP ¦

Donnell Rehagen, CEO, Clean Fuels Alliance America

Clean Fuels Are Solving Heavy-Duty Problems

Clean Fuels Alliance America uses the slogan “Better. Cleaner. Now!” because there is urgency in the mission. Removing a pound of carbon from the atmosphere today is worth more than removing a pound of carbon from the atmosphere a year from now—and certainly, 10 or 20 years from now. Carbon emissions in the atmosphere are cumulative, and time is a multiplier for many of the problems created by greenhouse gases, whether global warming or, on a more personal level, health problems such as increased instances of severe asthma.

Corporations and regulators are realizing that they don’t have to wait years for new technology to meet sustainability goals. Instead, they’re turning to clean fuels to make an immediate impact. U.S. biodiesel and renewable diesel production continue to ramp up, and the upward trajectory of clean fuels will only continue as companies and municipalities increase carbon reduction efforts in their fleets.

We have the solution. Switching to clean fuels is more often than not the fastest, easiest and least expensive way to meet emissions goals, especially in the heavy-duty transportation sectors. U.S. biodiesel and renewable diesel production grew by 500 million gallons in 2022, and the rapid growth is continuing to accelerate. Production for the first quarter of the year was 33% higher than the first quarter of 2022.

Investments in clean fuels are being made on an unprecedented scale. Renewable diesel is coming online quickly as companies have committed $4.5 billion for

Champions, Allies Stand Up for Clean Fuels

By Paul Winters

In fall 2022, the biodiesel, renewable diesel and sustainable aviation fuel (SAF) industry relished the prospect of an upward trajectory for Renewable Fuel Standard volumes. In June, the U.S. EPA had finalized the largest-ever annual increase in biomass-based diesel volumes under the RFS. In December 2022, however, EPA proposed a disappointing three-year RFS rule that would support growth of just 190 million gallons in the biomass-based diesel volumes. The proposal discounted the investments in feedstocks, fuel production and infrastructure the industry is making.

increased crush capacity through new or expanded facilities. Renewable diesel went from less than 500 million gallons of production in 2019 to a projected 3.34 billion gallons this year. The U.S. EIA and researchers at the University of Illinois project close to 6 billion gallons of U.S. renewable diesel capacity will come online in the next few years.

Biodiesel production has also increased, and a recent investment has the potential to push many fleets from lower blends of biodiesel to B100. Optimus Technologies raised $17.8 million to fund the further development and deployment of its Vector System, an advanced fuel system technology that enables heavy-duty diesel engines to operate on 100% biodiesel. The Vector System integrates into existing engines in operation or can be built into new engines as they are manufactured, leveraging the foundational diesel engine for the transition to a low-carbon future.

The world is realizing the potential of clean fuels to solve heavy-duty problems. By the time the industry gathers for the 2024 Clean Fuels Conference in Fort Worth, Texas, a whole new set of opportunities will be on the horizon. We have more hard work to do, but our industry will keep hitting new milestones. We’re proud to be your partner as we lower carbon emissions today, tomorrow and years in the future.

Donnell Rehagen CEO, Clean Fuels Alliance America CleanFuels.org

The U.S. EIA and University of Illinois both foresee rapid growth of U.S. renewable diesel capacity to 6 billion gallons by 2025—on top of the 2 billion gallons of active biodiesel capacity. And U.S. soy processors have announced billions in investments to expand or build new crush capacity.

The U.S. biodiesel and renewable diesel market grew by 500 million gallons in 2022. And U.S. production of both fuels continues to increase. The market is already 33% higher in the first three months of 2023 than in the same time period of 2022. Clean Fuels launched ag-

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 12

INSIDE CLEAN FUELS ALLIANCE AMERICA

gressive efforts to show EPA that their RFS proposal missed the mark. And congressional champions stepped up in support.

In mid-April, a bipartisan group of 37 representatives sent a letter to EPA Administrator Michael Regan, urging him to right-size the biomass-based diesel volumes. “Expansion and investments throughout the biomass-based diesel value chain have been vast over the past several years,” the representatives wrote. “The proposed RVOs do not acknowledge these investments on the ground, undercutting these expansions and unnecessarily putting them at risk—a potential blow to rural economies across the country.”

The same day, a bipartisan group of 16 U.S. senators delivered a similar letter to Administrator Regan. The group emphasized the need to increase RFS volumes to accurately reflect market conditions. “The proposed volumes are inaccurate, would shrink the market, put nearly $5 billion near-term investments to increase crush capacity at risk, and destabilize the development of sustainable aviation fuel. EPA’s proposal sets volumes lower than current blending levels—lower than the added

Forward Motion for Clean Fuels

By Floyd Vergara

As state and federal lawmakers continue prioritizing environmental and energy issues, carbon policies are steering the future of biodiesel, renewable diesel and sustainable aviation fuel (SAF), amplifying an already growing market. While the Renewable Fuel Standard continues to be an important federal policy driving biomass-based diesel production, states are increasingly taking leadership roles developing and implementing their own renewable fuel policies.

Momentum from California’s Low Carbon Fuel Standard continues to build the framework for the success of biodiesel and renewable diesel. Nearly 1.7 billion gallons of biomass-based diesel was used in 2022, displacing nearly half of the entire diesel fuel pool in California and accounting for the largest source of carbon reductions in the program. Carbon programs in Oregon and Washington are expected to see similar results from the increase in biodiesel and renewable diesel consumption, helping achieve carbon reduction targets in the hard-toelectrify sectors.

Nearby, legislation in Colorado would have exempted biodiesel and renewable diesel from the state’s excise tax for special fuels. New Mexico was again on the cusp of passing a Clean Fuel Standard and incentives for blending and selling biodiesel. Although these bills did not pass, they opened the door for future conversations about policies that would help promote market growth.

Last year, various policies supporting renewable fuels passed in Iowa, Illinois and Missouri in the form of tax incentives resulting in an additional 280 million gallons of biodiesel demand. These successes

capacity that is coming online in 2023 alone—and is inconsistent with estimates of production,” the group wrote.

And in May, a group of allied trade associations joined Clean Fuels in a new letter to EPA, highlighting the growing demand for biodiesel and renewable diesel. “The administration’s policies and programs are designed to leverage private sector investments to increase use of clean fuels and decarbonize the nation’s supply chain,” the associations wrote. “The proposed [RFS] volumes are simply inconsistent with the investments our industries have made and plan to make to expand production and commercial availability of these fuels by 2025.”

Clean Fuels continues to engage with EPA to demonstrate the growth of the biodiesel, renewable diesel and SAF industry, as well as the continued availability of sustainable feedstocks like soybean oil. The industry has always outpaced EPA’s RFS volumes and will continue to engage with the agency to ensure the program’s success.

have led to states like Nebraska, Indiana and Michigan to also pursue biodiesel incentives while sparking conversation for a Midwest Clean Fuel Standard.

Moving east, New York, Massachusetts, Connecticut and Maryland continue to study and consider policies for biodiesel, renewable diesel, Bioheat fuel and SAF as they work toward net-zero carbon emissions goals. Making up 40% of the home heating oil market in the Northeast, New York, Connecticut and Rhode Island have enacted Bioheat fuel mandates requiring increasing amounts of biodiesel to be blended with traditional heating oil.

Vermont recently passed legislation adopting a Clean Heat Standard, starting a two-year regulatory adoption process. The legislation would require heating oil dealers and suppliers to buy or sell credits based on the carbon content of their fuel, including biodiesel and renewable diesel. Finally, pending legislation in New York would create a Clean Fuel Standard for all transportation fuels.

These efforts are due in large part to the state soybean and Clean Fuels’ member organizations that work diligently with our state and federal teams to advocate for policy that meets America’s energy needs while adding economic value in our heartland.

www.BiodieselMagazine.com 13

PODCAST PREVIEW WITH BRUCE FLEMING, MONTANA RENEWABLES

Season 2, Episode 2, of the Biodiesel Magazine podcast caught up with Bruce Fleming, executive vice president of Montana Renewables, a newly online renewable diesel and sustainable aviation fuel producer.

BDM: Tell us about Montana Renewables and what led to its inception.

Fleming: Montana Renewables is a wholly-owned division of Calumet Specialty Partners, a public company. The business is in Great Falls, Montana. We’ve got a conventional crude oil refinery that we have reconfigured for renewable feedstocks—we did that over the past couple years. The novel thing that we did is that we maintained as much of the conventional fuel production as possible. We operate in a rural area, so we’re a principal source of supply for the farm and ranch community around us. Unlike a lot of other projects that you’ve heard about, we didn’t simply shut the refinery down—we kept it going as well, so we’re running both businesses. The renewable one is really cool—we’re pretty happy about that, and we’ve gotten a lot of support from the state of Montana. They've been great to work with, and they appreciate the value that this brings to the community.

BDM: Talk us through this project—what are the details, what have you guys been able to do?

Fleming: The refinery has been there for more than 100 years. We haven’t owned it that long, but it has always been a mainstay

of the energy economy in central Montana. The opportunity came about to switch a portion of it to renewable feedstocks—we did this in a way that we can run any renewable feedstock from anywhere in the world—used cooking oil, canola is probably going to be a mainstay for us since it grows locally, tallow, greases from the animal protein value chain, distillers corn oil … any of it. We took a portion of the refinery and converted it, and it took us about two years to get it done—we started it up late last year. So, we’re in the business of producing renewable diesel now. We’ve got renewable hydrogen, which we turned on last month, and we’re just commissioning SAF this week. So, we’re going to have sustainable aviation fuel coming out. At that point, it completes our journey—we’re the largest North American SAF producer. The funny thing is that nobody knows it; it has been missed by a lot of folks ... you’re getting a scoop here—you’re the first to call us about this. We’re operators; we have our head down doing projects, running businesses, making products for customers—we’re not developers, we’re not really marketers. We see lists of North America SAF production and half of them don’t even have us on there at all. And none of them realize there is only one producer right now, that’s World Energy in Paramount, California, and they make 5 MMgy—we’re selling 30 [MMgy]. So just like that, we’re largest SAF produce in North America that nobody has heard of.

BDM: What do you think has been influential to Montana Renewables' success, to get to where you’re at so quickly?

Tune into the podcast at www.biodieselmagazine.com/pages/ podcasts to listen in full.

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 14

PLAY

Bruce Fleming

Don't Miss an Episode:

www.BiodieselMagazine.com 15 PODCAST PREVIEW ¦

Biodiesel Magazine’s recent podcasts: S02 E01 Cracking Down on Used Cooking Oil Theft

Jeff Yasinksi, cofounder and CEO of D&W Alternative S01 E10 Accelerating Clean Energy Transitions with Mobile Fueling

Frank Mycroft, founder and CEO of Booster Interested in being a guest? Contact Danielle Piekarski at dpiekarski@bbiinternational.com

Featuring

Featuring

A Boost for B100

BY SUSANNE RETKA SCHILL

A year ago, Steve Howell was focused primarily on advancing B20. Today, B100 is high on his list, thanks to a favorable 1.3 million-mile fleet trial using new biodiesel technology alongside a proliferation of corporate carbon reduction pledges. “What we’re seeing now is that customers want to have maximum carbon reductions, and B20 simply is not enough,” says Howell, founding partner of M4 Consulting, senior technical advisor to Clean Fuels Alliance America and chair of the ASTM biodiesel task force. “Forward thinking, carbon-conscious customers with fleets—the Amazons, Walmarts and Pepsis—have corporate goals to reduce carbon over time, with some going all the way to net zero. There are a lot of public policy goals targeting 40% carbon reduction in 2030 and 80% carbon reduction in 2050.”

If fleets began using B100, they could attain that 80% reduction tomorrow, Howell says. With biodiesel considered a biogenic fuel, B100 under the U.S. EPA’s Scope 1 greenhouse gas (GHG) protocols provides

a 100% carbon reduction. Under other GHG accounting systems such as Argonne National Laboratory’s GREET life-cycle model, B100 generally provides a 65-85% reduction.

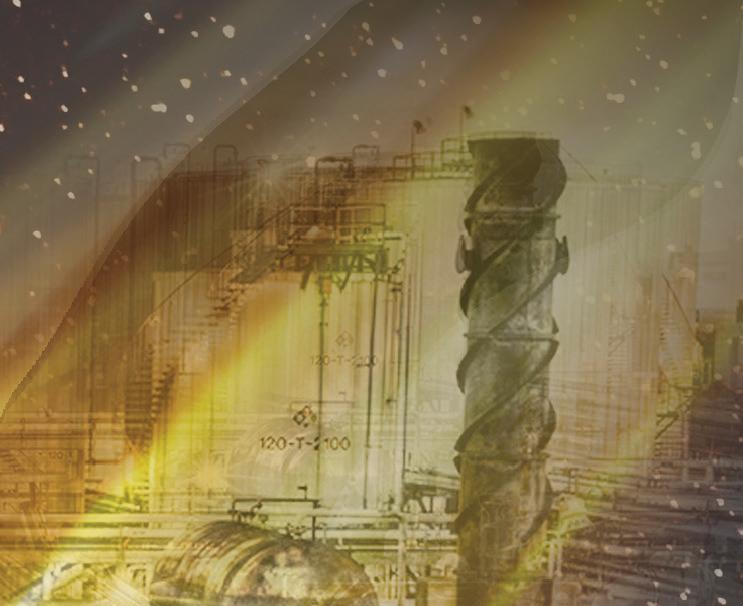

While carbon reduction goals are driving interest, a new technology is solving biodiesel’s biggest problem—cold flow. The fleet trial not only demonstrated the technology works well in all weather conditions, but also dispels other concerns about biodiesel operation in modern diesel engines. The 16-month biodiesel field trial covered nearly 1.3 million miles of on-road operation with 10 Class 8 Mack trucks in Archer Daniels Midland’s trucking fleet. Five were upgraded with Optimus Technologies, Vector System and fueled with B100 to be compared against a control group of five unmodified trucks operating on B11. All 10 trucks operated on similar routes, consuming similar amounts of fuel and were equipped with New Technology Diesel Engines (NTDEs) that employ diesel oxidation catalyst (DOC),

diesel particulate filter (DPF) and selective catalytic reduction (SCR) after-treatment technologies.

Optimus’ Vector System upgrades diesel to operate on B100 while never inhibiting the engine’s operation on traditional diesel, explains Optimus CEO Colin Huwyler. The system involves a series of heat exchangers, pumps, filters and sensors that are the core mechanical components controlled electronically and interacting with the engine’s fuel system controller and after-treatment electronics. “Everything is happening autono-

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 16

The quest for carbon reduction is driving interest in higher biodiesel blends, and Optimus Technologies’ Vector System is enabling diesel engines to transition.

TECHNOLOGY

mously,” Huwyler says, “so the drivers don’t have any interaction. Our software monitors fuel and engine parameters and as soon as the operating conditions are met, it will switch from diesel, which the engine starts up on, over to biodiesel.”

In over-the-road, Class 8 trucks, the larger fuel tank is filled with B100, while the smaller tank holds the regular diesel used for startup and shutdown. For vocational applications like snow plows and garbage trucks, the Optimus retrofit generally involves replacing the fuel tank with a dual-chamber

tank. A 70-gallon fuel tank on a garbage truck, for example, will be replaced with a 100-gallon tank that holds 70 gallons of biodiesel and 30 gallons of regular diesel. Regular diesel is used to start and shut down the engine, Huwyler explains, with most trucks running on B100 between 90 and 95% of the time.

The Optimus system solves the issue with biodiesel’s higher cloud point that causes higher biodiesel blends to gel at much higher temperatures than traditional diesel.

“We circulate the waste heat that comes off

the engine through the heat exchanger where we circulate the biodiesel through,” Huwyler says. “Regardless of ambient temperature, the engine can operate on 100% biodiesel.” Customers have operated the technology down to negative 20 or negative 30 degrees Fahrenheit, he adds.

The 16-month ADM fleet trial demonstrated successful cold weather operations and collected multiple points of performance data. “We saw a pretty dramatic benefit utilizing 100% biodiesel with our technology in engines with diesel particulate filters,”

www.BiodieselMagazine.com 17

IMAGE: OPTIMUS TECHNOLOGIES

Huwyler says. DPF filters essentially collect the soot from combustion, and since biodiesel generates roughly 50% less soot than traditional diesel, that correlated to about 50% improvement in the regeneration cycle of the filters in the ADM trucks running on B100, extending the 110-hour interval to 220 hours. “Any time you can extend those intervals, there is a direct cost savings to the operational aspect of running a fleet,” he says. In addition to the DPF regen benefit, the 1.3 million-mile-trial found no issues with crankcase oil dilution and a slight improvement in fuel economy running on B100.

The ADM fleet trail results counter conventional wisdom that biodiesel’s lower Btu content than petroleum diesel will result in a fuel economy hit, Howell says. The results also address other concerns original engine manufacturers (OEMs) have with higher blends—the biggest being the potential for metals in biodiesel to impact the exhaust aftertreatment used in modern engines. The fleet trial data shows that isn’t a problem, Howell says, “And there’s rationale for that

because biodiesel is really high quality today. The National Renewable Energy Laboratory’s fuel quality study show it’s near zero metals in biodiesel from the get-go.”

The positive B100 findings will improve biodiesel’s competitiveness with renewable diesel, Howell continues. “A lot of the reason companies were looking at renewable diesel was because the OEMs were concerned about the metals in biodiesel, and they didn’t think you could use more than B20. Renewable diesel is distilled, which removes metals, so most OEMs support use of 100% renewable diesel. Now we’re finding out you can use 100% biodiesel too, because our quality has improved so much.”

Biodiesel vs Renewable Diesel

Biodiesel is going to be competitive with renewable diesel, even as RD capacity is scaling rapidly, because it’s less expensive and available, Huwyler says. “Renewable diesel is only really available in California, and a little bit in Oregon and Washington. Because of the substantial price premium for RD

compared to regular diesel, it needs the lowcarbon subsidy in those West Coast markets to be somewhat competitive.” The reality, he says, is that most of the freight moves in the other 47 states where renewable diesel is unavailable and, if it were, would be more expensive.

“The primary users of our technology are large fleets using significant volumes of diesel fuel annually,” Huwyler continues. “If a Class 8 truck is using 10,000 to 20,000 gallons on a yearly basis, paying a premium for renewable diesel on every single gallon for the life of the truck, which might be 10 years, is a substantial increase in cost. With our technology, there is a CAPEX investment—an upfront cost—but then, that ongoing cost is closer to or the same as regular diesel. So, it’s a much total lower cost to deploy a sustainable solution.”

“With the tax incentive and RIN program, B100 is similar in price to diesel,” Howell points out, while renewable diesel can run $1 to $2 more. “With relatively low capital cost you can retrofit, put in an Op-

TECHNOLOGY

timus system and get carbon reduction and meet your goals, with no detrimental effect on the vehicle because the cold flow problems are solved. When an electric bus costs three, four, five times as much as a regular diesel bus, a $30,000 retrofit on a $300,000 vehicle is not very much of a cost.”

Biodiesel has other competitive advantages with RD, Huwyler suggests. While they use the same feedstocks, biodiesel gets almost one gallon of fuel out of a gallon of vegetable oil, whereas the renewable diesel process loses a portion. At the same time, RD energy consumption is slightly higher and its CAPEX is substantially higher than biodiesel. “I think in the future, biodiesel will always have a lower carbon intensity than renewable diesel,” Huwyler says. “And it’s much better suited to regional diversity and to be more distributed throughout the U.S. because you can have smaller, 250 MMgy plants, as opposed to a 1 million-barrel-a-day facility.”

One selling point for renewable diesel is that it is an identical molecule to petroleum

diesel, making it a drop-in replacement for regular diesel. This raises the question whether renewable diesel’s toxicity will be identical as well. One of biodiesel’s advantages over petroleum diesel is its nontoxicity and biodegradability. “It’s much safer for operators and technicians to be around,” Huwyler says.

And, while there may be a claim for RD’s compatibility with existing infrastructure, biodiesel has been around long enough and used widely enough to have infrastructure in place. “Because of how biodiesel is used today, it gets blended with traditional diesel,” Huwyler says. “So, travel centers

Biodiesel that benef it s prof it and plane t?

At DSM we know that producing biodiesel that meets both your profitability and sustainability goals isn’t an easy job. Which is why we created Purifine® PLA1. This proven enzyme can refine feedstock for both FAME and HVO biofuels while meeting the highest purity specifications - including phosphorous reduction. Furthermore, Purifine® PLA1 achieves all this with less chemicals, a reduced carbon footprint and increased oil yield. You can refine feedstocks like vegetable seed oil, both crude and degummed, with minimum loss and process disruption.

In over-the-road, Class 8 trucks retrofitted with the Optimus Technologies Vector System, the larger fuel tank is filled with B100, while the smaller tank holds the regular diesel used for startup and shutdown.

IMAGE: OMPTIMUS TECHNOLOGIES

In over-the-road, Class 8 trucks retrofitted with the Optimus Technologies Vector System, the larger fuel tank is filled with B100, while the smaller tank holds the regular diesel used for startup and shutdown.

IMAGE: OMPTIMUS TECHNOLOGIES

where trucks fuel often have 100% biodiesel that gets blended on site as B5 or B20. Because of that, B100 already exists at truck stops, and to scale up the ability to dispense is really about putting another pump in at the truck stop.”

Infrastructure availability also is a compelling argument when considering other potential competing fuels—electricity and hydrogen. “When looking holistically at what is necessary to reduce emissions and carbon at large scale, electrification or hydrogen requires complete new build out and development of infrastructure,” Huwyler says. “Biodiesel is already at places where trucks are fueling today.”

Nobody really knows how many truck stops already have B100 on site, Howell says. And nobody knows how much B100 gets used today without blending, although he says it’s likely quite small and mostly consumed in underground mines. “They’re at 50 degrees all the time and can use a low cloud point biodiesel, which reduces particulates by 50%. Both John Deere and Caterpillar support B100 in engines with no after treatment,” Howell adds.

Howell sees biodiesel’s value proposition as helping fleets meet their carbon reduction goals. “If you committed to your shareholders to reduce SCOPE 1 emissions

by 50% by 2030, you kind of have to do that. You could meet your Scope 1 emissions reduction tomorrow if you put in an Optimus system and used B100 in your whole fleet,” he says, adding that is part of the reason Optimus just raised $17 million in venture capital.

Optimus announced the new round of financing in April, led by Japan’s Mitsui & Co. The Series A funding round included participation from one of North America’s largest commercial fleets, Chevron Renewable Energy Group, and regional investors in the Pittsburg, Pennsylvania, area where Optimus is headquartered.

“It’s been a really strong year-over-year growth for interest in sustainability and carbon reduction solutions,” Huwyler says. “We’ve seen great growth.” The investment from Mitsui grew out of a project launched in Japan last year, he adds. “We will be expanding in Japan and Asian markets in partnership in Mitsui, and we have partnerships we’re working on now to expand in Australia and South America that we will be announcing in the next months.”

Domestically, the investment from Chevron REG will help create additional demand and volume for the country’s largest biodiesel producer. “It’s really a great set of strategic partnerships that will help grow the

company,” Huwyler says, “but it’s also help to provide mutual opportunities across fleets and large users of diesel fuel.”

Author: Susanne Retka Schill Contact: editor@bbiinternational.com

TECHNOLOGY

It is currently unknown how many truck stops have access to B100 on-site, although the U.S. EPA estimates approximately 823 provide public access to blends of B20 or higher.

PHOTO: OPTIMUS TECHNOLOGIES

The world demands biofuel.

SUPPLY IT.

Secure your competitive advantage with Crown’s continuous process Liquids Pilot Plant.

Innovate and optimize your oils and fats processing by partnering with Crown. Our Innovation Center and new, rst-of-its-kind Liquids Pilot Plant offer renewable fuel (renewable diesel/HVO, SAF and biodiesel pretreatment), edible oil and oleochemical companies access to a continuous process for testing, validating, scaling and commercializing any feedstock into high-value products. The Liquids Pilot Plant is backed by Crown’s unmatched expertise, technology and full-ser vice support. Conduct real-world testing on traditional oilseeds, emerging oilseeds and waste oils in a con dential, risk-free environment.

Lead the oils and fats processing industry with total con dence in your investment.

Renewable Fuels | Edible Oils | Oleochemicals crownsales@crowniron.com | 1-651-638-5407 | www.crowniron.com

Feeding, Fueling & Building a Better World

THE PATH TO BIOINTERMEDIATES

BY KATIE SCHROEDER

The U.S. EPA released biointermediate provisions in July 2022 with the goal of expanding the feedstock pool available to renewable fuel producers. The provisions came into effect the following August, and nearly a year later, there have not been any completed biointermediate registrations.

Identifying Biointermediates

The EPA’s biointermediate provisions defined what a biointermediate is and listed those that are currently recognized by the agency. Last year, the EPA held a biointermediate workshop, in which Robert Anderson described the regulatory criteria that define a biointermediate as found in 40 CFR 80.1401. First, a biointermediate is a feedstock used to make a renewable fuel made from biomass. Biointermediates cannot generate renewable identification numbers (RINs), he explained, and they must be produced at a different facility than the one that produces the finished renewable fuel. “If all the production happens at a single [renewable] fuel facility, then it’s not a biointermediate,” Anderson said.

Before a biointermediate can be used it must be one of the specific biointermediates listed in the EPA’s provisions, follow an EPA approved pathway and be utilized in the production of the renewable fuel listed in the pathway. The different biointermediates that currently have eligible pathways under the EPA’s provisions include bio-crude, biodiesel distillate bottoms, biomass-based sugars, digestate, free fatty acid feedstock, glycerin, soapstock and undenatured ethanol. “It’s supposed to open up the supply chain. And it’s going to bring on products like sustainable aviation fuel (SAF),” says Kari Buttenhoff, partner at Christianson CPAs & Consultants. “So, it’s definitely set up to do that. For biodiesel with the feedstock shortages, if we can open up additional types of feedstocks that were currently not allowed, [that is] definitely a major benefit.”

Buttenhoff explains that though these provisions have the potential to provide a lot of feedstock options for the biodiesel industry and make ethanol-to-jet possible, the mandatory Quality Assurance Plan audit process is not yet ready for producers to apply. She says that the QAP program is currently voluntary

for participants under the RFS, but it has become mandatory for all renewable fuel producers using biointermediates and biointermediate producers. The goal of the QAP program is to ensure that RINs are not double counted. For example, that no RINs are being produced by the biointermediate and all of the RINs are generated from the renewable fuel. Both the biointermediate provider and the renewable fuel producer must go through the same QAP auditor.

One of the limitations of the biointermediate provisions is that biointermediate producers may only sell to one renewable fuel producer,

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 22

Biodiesel Magazine spoke with an auditor and an industry expert about what biointermediates are, potential opportunities and hurdles to participation.

POLICY

Buttenhoff explains. “You can’t sell to multiple renewable fuel plants; you have to choose one person and hitch your wagon to them and that’s where all of your product goes,” she says. However, renewable fuel producers are able to get biointermediates from multiple providers.

Biointermediate producers will need to undergo an engineering review and a list of registration requirements with the EPA, as well as quarterly and annual reporting along with participating in the RIN attest auditing part of the program.

Biodiesel and Renewable Diesel Opportunities

Matt Herman, senior director of renewable product marketing with the Iowa Soybean Association, explains that there are a handful of good opportunities for the biodiesel and renewable diesel industries. Coming from a background of helping producers optimize their technology to be able to meet requirements for as many incentives as possible, Herman sees these biointermediate provisions as a long-awaited open door for technologies and processes that make environmental and economic sense.

The three primary benefits biointermediate provisions could bring to the biodiesel industry include the ability to use free fatty acids and distillate bottoms as a feedstock, and the possibility of using undenatured ethanol as an alternative alcohol for the production process.

Free fatty acids as a biointermediate enable biodiesel producers to send leftover FFAs stripped from the triglycerides to another facility that is equipped to process them into fuel. “That just makes all the economic and environmental sense in the world,” Herman says. “To me, that’s just a huge green light flashing,

www.BiodieselMagazine.com 23

that’s a major win there, and [it’s] one that the industry can immediately commercialize and bank on.”

It remains to be seen whether producers will go through the QAP process for the sake of “capturing value” on tens of millions of gallons when they produce hundreds of millions, Herman explains.

Distillate bottoms are also an exciting inclusion, as it may encourage the production of higher-quality biodiesel with better cold flow properties, which can be more easily blended with renewable diesel. Prior to this rule, the production of distillate bottoms were largely seen as a cost due to lost RIN value. Now, there is the potential to sell it as a feedstock.

This rule may also help the industry achieve a long-time milestone, the production of a 100% renewable biodiesel, Herman explains. “I’m really hopeful about the ethyl ester, butyl ester and renewable methanol for just ... a 100 percent renewable biodiesel, that’s something that I’m really hopeful for,”

he says. “I think the economics, the environmental economics make sense now that the rules are a little bit clearer.”

Undenatured ethanol as a biointermediate is also useful for biodiesel producers, Herman explains, because of the possibility of replacing the alcohol molecule within the production process with renewable alcohols, such as ethanol, which would likely reduce the carbon intensity score of the final fuel, as well as the energy content of the fuel, and positively impact biodiesel’s performance in other markets.

Ethanol Producer Opportunities

Undenatured ethanol as a biointermediate is a “huge deal,” Herman says. From the ethanol perspective, the major opportunity is SAF, and the alcohol-to-jet pathway made available through the inclusion of undenatured ethanol in the provision, according to Buttenhoff.

“I think on its face the industry’s most excited about it because it allows ethanol aggregation,” Herman says. “If you wanted to do something like ethanol-to-jet or upgrade it, which is great, that would end up—as we’ve seen through EPA—falling as a D4 RIN, as we saw with the LanzaJet Georgia pathway. But from the biodiesel side, now we can think about things like ethyl esters and butyl esters, when we’ve been stuck making a methyl ester for a long time.”

The first good sign for biointermediate users was the approval of LanzaJet’s undenatured sugarcane ethanol-to-jet process, according to Herman. This was the first biointermediate-using process that was approved. However, the QAP part of the process, which is needed before producers can start generating RINs, has not yet been completed. “The methodology behind it and the overall process that’s been laid out for the EPA has been approved, now it’s the registration and the biointermediate supplier, the QAP piece and … all

MOR E T HAN A MINERAL

POLICY When

You gain a world-class

of technical service experts to help you make tough decisions and save re nery resources for pre-treatment of oils and fats. LEARN MORE AT OIL DR I.COM /GET MOR E EDI BL E OI LS | BIODI ES EL | RENEW ABLE DI ES EL Proudly Owned and Manufactured in the U.S.A. © 2022 Oil-Dri Corporation of America. All rights reserved.

you c hoose Oil-Dri, you get more t han a reliable adsor bent .

team

of the technical steps that go into it, will now have to take place,” Buttenhoff says.

The primary outlet for undenatured ethanol is SAF, Buttenhoff explains, and the goal is to get the QAP process worked out so that

ethanol-to-jet is workable from a regulatory standpoint.

Hurdles of Implementation

The biointermediates provision has its benefits; however, those opportunities also

come with a significant amount of hurdles. One of these hurdles is the complexity around RIN generation, such as that the renewable fuel producer needs to identify each biointermediate supplier’s feedstock. “There are also

C M Y CM MY CY CMY K WWS-TRADING-ARTWORK-OL.pdf 1 10-03-2019 11:47:15 AM IMAGE: U.S. EPA

some physical handling rules around the feedstock, so the biointermediate feedstock has to be physically segregated from any other feedstocks or products, in its own tank and separate from anything else,” Buttenhoff says.

The rules in place around biodiesel producers using these other feedstocks are challenging, she further explains. “To segregate feedstocks from a biodiesel perspective—everybody co-mingles—it’s almost impossible,” she says. “There are a lot of hurdles from the biodiesel side to actually make this work, which is probably an industry that’s very much in need of additional feedstocks with all the renewable diesel facilities coming up.” Buttenhoff explains that this hurdle may be less of a problem for ethanol producers supplying undenatured ethanol as a biointermediate to a renewable fuel producer.

Another future hurdle may be the shortage of available third-party QAP providers,

providers is that … we have to develop what our processes will be for our biointermediates, and then we have to submit that to EPA, and they have to approve the procedures that we’re actually going to complete in order to audit or Q-RIN that particular product,” she says.

In the past, putting together and getting EPA approval for initial QAP plans took roughly a year and a half, going a little faster for approval of additional plans. The first biointermediate producer will probably take a while to get through the QAP pathway approval process, Buttenhoff explains, because there will probably be some back-and-forth conversation between the EPA and the auditor in establishing the first procedures for biointermediates.

Buttenhoff adds that should the EPA’s RFS set rule pass in June 2023 in its current form, which outlines mandatory QAP for waste feedstock suppliers and biodiesel companies, it could cause the strain on QAP pro-

Herman agrees that the speed of adoption is tempered by the QAP process, since many producers have never been through the process before, and some may not find it worth it for the volume of fuel they would be able to produce.

“I think we’re waiting for the first movers to act,” Buttenhoff says. “It is difficult to be the first one going through a new regulatory process like this one.”

Buttenhoff adds that she hopes in the future, further conversations with the EPA will help tweak the process to be more workable as implementation begins.

Biointermediates may not be the silver bullet that will open the feedstock floodgates, at least not yet. However, the opportunities available may encourage companies such as LanzaJet to begin walking down the long road to biointermediate utilization and RIN generation from fuels that use them.

Elevating Sustainable Fuel for a Better Tomorrow. Ultralow Carbon SAF 35 Billion Gallons of Low Carbon SAF Required within the U.S. by 2050 The SAFFiRE Edge • Ultralow CI Score • Additional Revenue Source • Reduce Operating Costs • Produce High-Demand Aviation Fuel POLICY

CHALLENGES AHEAD FOR SOYBEAN-BASED RENEWABLE FUELS DEMAND

Building new renewable fuel plants and increasing the pace of existing crush facilities can set the demand side of the soy biodiesel equation, but the supply side becomes complicated.

BY GREG HORSTMEIER

Demand for renewable diesel has U.S. farmers excited about the potential for strong soybean prices as much as fuel companies are anxious to turn those beans into fuel for the expanding low-carbon diesel markets. In what some in agriculture see as a replay of the corn ethanol boom,

article

farmers hope to see more revenue from the nonfood demand for their second-largest annual crop. But while there are similarities to ethanol-supported corn prices of the early 2000s, commodity analysts and others say the soybean diesel market has some unique challenges.

Driven by low-carbon fuel standards in California and elsewhere, the production of renewable diesel from soybeans has

more than doubled in the past 24 months, with 2022 production topping 2.2 billion gallons. Federal incentives to blend more renewable fuels are bolstered further along the West Coast by generous state credits to encourage the move away from petroleum. The incentives could lure in enough renewable diesel to dominate the diesel market along the West Coast. The region, which is also the largest renewable diesel-importing

of Biodiesel Magazine

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 28

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views

or its advertisers. All questions pertaining to this

should be directed to the author(s).

DTN FARMMARKET DATA

Acres planted to soybeans in 2022 within a 50-mile radium of proposed soybean crushing plants. This acreage would need to expand and stabilize in many spots to provide the feedstock for renewable diesel production.

SOURCE:

region in the U.S., could soon meet most of its distillate fuel needs from renewable diesel by 2025 if domestic renewable diesel capacity does, in fact, increase as scheduled, according to the U.S. EIA.

Clean Fuels Alliance America says renewable diesel production capacity could hit 5.5 billion gallons by 2026, while a recent study by University of Illinois puts 2023 production expectations at 4.1 billion gallons, with the capacity to produce some 6 billion gallons in 2025.

Will Prices Drive Additional Soybean Production?

While building new plants and increasing the pace of existing crush facilities can set the demand side of the soy biodiesel equation, it’s the supply side that becomes complicated, according to Todd Hultman, DTN lead analyst. “Some studies say the fuel demand for soy oil will require another 12 million acres of soybean production in the U.S.,” Hultman says. “I don’t think we have another 12 million acres of highly productive farmland to shift to beans.”

The largest U.S. soybean crop, at 90.16 million acres (ma), came in 2017. The March 30 USDA Planting Intentions report predicted 87.5 ma will be planted in 2023, essentially flat with the 87.45 ma planted a year ago and slightly under the average analyst predictions of 88.23 ma.

To get to nearly 100 million acres of soybean production will take a massive shift from other crops, mainly corn. And that’s not something Hultman sees happening anytime soon. “The demand for more soybeans (for renewable diesel) is a national need. What happens on the farm, however, is based on local issues. Farmers typically respond to local situations. So, if you’re in an area with historically strong ethanol production or a lot of livestock that demands corn, you’re not going to immediately shift a lot of acres from corn to soybeans.”

Higher soybean prices will be a strong pull to grow more beans, Hultman admits. He sees the increased demand adding as

much as $3, or 15-20%, to the national perbushel-price of beans.

Meal Demand Helps

Hultman says one positive difference between the current soy oil boom and the ethanol boom of the 2000s is the issue of finding a home for byproducts. In the early ethanol days, the grain mash left from alcohol extraction was a problem for plant manager. It took some time for livestock producers to learn to feed, and see the tremendous value, in so-called dried distillers grains.

Soybean crushers, in contrast, have a readymade market for the byproduct of soybean oil creation. Most modern U.S. soybean varieties produce seed that is about 20% oil by weight, with the remaining 80% a high-protein meal. Hultman says soybean commodity groups are already working to expand U.S. meal exports to areas like Vietnam, Thailand and elsewhere, where the meal can be used in feed rations those country’s poultry, swine and fish.

The Reality of Soybean Agronomics

Shifting more corn, sugar beet or wheat acres to soybeans in one particular year is partially a question of higher dollar returns per acre. Keeping that higher number of soybean acres over time is more difficult. “Farmers will respond to whatever economic incentives they see,” says DTN crops technology editor Pam Smith. For decades, Midwestern row-crop farmers have focused on maximizing corn production, while soybeans were treated as more of a second-class crop.

Higher soybean prices, fueled by Chinese demand, has moved more farmers to giving soybeans more management attention, Smith says. In the past decade, that has moved national yield averages from below 40 bushels per acre to around the 50-bushels-per-acre average mark. “Some of that yield boost is due to earlier planting,” Smith says. Planting in late March and April, versus traditional May and June, al-

lows soybeans to mature and be poised to take advantage of late summer rains. Smith says some early-planting farmers have documented a half-bushel-per-day yield loss for every day they’re delayed planting once the ground is generally ready.

That earlier planting, especially in colder, northern fields, wouldn’t be possible without a host of modern seed treatments—small amounts of fungicides, insecticides and growth stimulants layered directly on the seed itself. What those treatments can’t do, Smith adds, is protect seedlings from untimely frosts once they’re out of the ground. Seed treatments also do little when a wet spring, such as northern soybean production areas are having in 2023, delay planting.

Issues with Continuous Soybean Production

A complication with securing an additional 10 million to 12 million more soybean acres isn’t getting the acres one year. It’s keeping them longer-term. When the ethanol boom drove need for U.S. corn, farmers had a relatively easy time responding. To start, the country had been swimming in corn for decades. Corn also performs well in continuous, year-after-year production.

Soybeans, on the other hand, can have a yield drop of 5% or more in the second season of continuous beans, with larger drops in successive plantings, says Smith. Diseases and pests, such as the soybean cyst nematode, build up in fields during soybean cultivation. Fields often need multiple years planted in other crops to reduce nematode numbers and to clean up disease pressure.

In the meantime, Hultman expects higher amounts of raw soybeans will move out of the export channels and be used to feed the new U.S. crushing plants.

www.BiodieselMagazine.com 29 FEEDSTOCK

Contact: Greg Horstmeier Progressive Farmer/DTN greg.horstmeier@dtn.com www.dtn.com

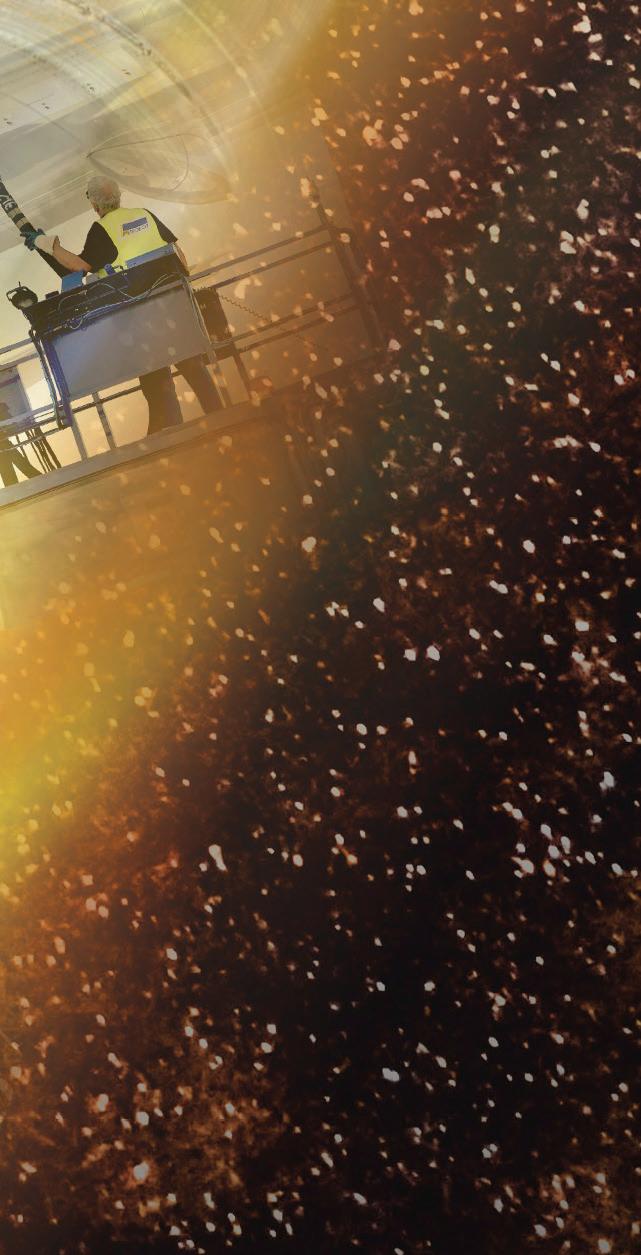

Future Feedstock Flexibility with Pretreatment

BDI BioEnergy’s Manfred Baumgartner discusses how companies can better prepare for the evolving feedstock landscape.

BY ANNA SIMET

With current and future demand for renewable diesel and SAF soaring, so is the number of companies, refineries and other parties interested in partaking in the industry. While some have more experience than others, a crucial factor that all should consider is what might lie ahead in terms of feedstock sourcing, according to Manfred Baumgartner, CEO at BDI BioEnergy International GmbH. “Many want to jump on this train and build a renewable diesel or coprocessing factory, but not everybody has done their homework,” he says. “Some have checked out which feedstocks they can get, others just assume they will be able to get what they want—but it’s limited. All projects that are designed on a basis of relatively good feedstock qualities, I think they will have more problems in the future, as goodquality feedstocks will turn higher in price.”

That’s because good-quality feedstocks require less treatment, smaller investments and lower operating costs. These price increases could force some producers to look at lowerquality feedstocks. “And then, the plant may not be built for this,” Baumgartner says. “We have this discussion with our customers, and some will say they want to be flexible in the future—they want to be able to use everything—and others say they want to start with one thing and focus on that, and see how it turns out.”

Having the ability to adapt to utilize lower-quality feedstocks will be a key parameter in the success of many operations, from BDI’s perspective. The company's proven solution to allow operators to do so is the BDI Advanced PreTreatment Process, which is designed to purify vegetable and waste oils and fats for renewable diesel and SAF production, allowing operators to test and utilize a very wide range of varying-quality feedstocks.

Quality Matters

While used cooking oil (UCO) is one of the most sought-after feedstocks, Baumgartner points out that its quality can differ vastly

depending on its origin and collection method. In China, for example, UCO quality is typically good to average. “There is a large quantity coming from China—some is on the worse side, but on average, the quality is not too bad. Throughout Asia, UCO is sometimes collected by traps in big buildings and skyscrapers, so it can be quite contaminated from impurities in the waste that also goes down these traps.”

UCO in the U.S. is often collected with a lot of solids, mainly vegetable oils from cooking, as collection systems there are also different, Baumgartner says. When it comes to animal fats, the time between creation of the waste and rendering greatly impacts the quality of the feedstock, and the work flow of collection in Europe is quite different than in the U.S. “In the U.S., the animal fat rendering is done in large slaughterhouses with their own rendering facilities in the same building, so there is no time until the rendering takes place and the fat is processed,” Baumgartner explains. “In Europe, in most cases, the slaughterhouses are small and the rendering companies are located elsewhere. There is transportation and logistics in between and it can take a few days. Due to this time, the fat is degrading and the quality is worse.”

The most obvious indication of this is high free fatty acids. “This isn’t necessarily a bad quality, but it’s an indication that the fat has been stored for a longer time,” Baumgartner says. “As a side effect of this aging process, there are also other chemical reactions going on—mainly with amino acids—and then we see an increase in phosphorous, metals, sulfur and nitrogen components … all these parameters are important for the refineries, and the effect of aging raw material is a worse-quality feedstock. That’s why the origin is always important for the trader or the companies who are trading it.”

BDI stands behind pretreatment before beginning feedstock processing. “We know of examples where the plants cannot run at full capacity because the impurities in the waste

oils are so high that they must perform frequent cleaning actions,” Baumgartner says. “Many production hours are lost due to downtime for cleaning actions.”

In addition to the proven PrePurification system, BDI installs all plants with a built-in cleaning in place (CIP) concept. “This means the heat exchanger isn’t dismantled for cleaning—there is a washing circuit, and we see this is an essential unit for having high availability at the end,” Baumgartner says.

He reiterates the importance of producers looking at all types of feedstocks with varying quality. “We ask our customers, what about the future? What will you get, and how will you keep availability high? Again, this is a topic of initial investment versus operability.”

Looking to the Future

As plant sizes increase, refineries require larger amounts of feedstock and a much higher number of suppliers. Baumgartner suggests that in some instances, processing in campaigns—i.e., pure UCO and pure animal fat—may help optimize the plant. “We could reduce operating costs like adsorbent amounts or energy,” he says. “It’s not always the case, but a lot of times it’s possible that the whole plant could be operated in more optimum conditions, with better results at the end.”

The ultimate goal, of course, is to achieve the best results possible. “This is where we have a great deal of experience—how to train our customers how to run the plant with good operating costs,” Baumgartner adds. “We call this analytical management of the production. It includes laboratory tests, analytics of feedstocks and of steering production, planning ratios of the feedstocks and of the products …there are lots of metrics to consider. This is the real knowhow, and we will hand it over to each customer so they don’t need to try to learn it by themselves—they can start optimizing from day one.”

BIODIESEL MAGAZINE l 2023 SUMMER EDITION 30

SPOTLIGHT BDI BIOENERGY

ADVANCED PRETREATMENT PROCESS FOR WORST FEEDSTOCK QUALITIES

customized perfection

measurable solutions for

lowest impurities

www.bdi-bioenergy.com

for highest yield

+2 5 years of experience in pretreatment of waste oils and fats

To succeed in today’s market, you need to connect with your customers at the right time using multiple marketing channels. Biodiesel Magazine offers many opportunities to reach customers wherever they may be. M A R K E T I N G C H A N N E L S Reach Your Customers Across All Contact an Account Manager Today to Build Your Ideal Marketing Campaign: 701-746-8385 ser vice@bbiinternational.com www.biodieselmagazine.com

Biodiesel Magazine’s Webinar Series

PQ

Corporation