MAY 2021

FRACTIONATED

FEED

Separation Is Ideal for Species-Specific Nutrition PAGE 14

ALSO

An Informed Approach to Antimicrobials PAGE 22

Renewable Diesel Drives Demand for Corn Oil PAGE 28

www.ethanolproducer.com

big ideas

open doors to big solutions POET.COM

When the first POET plant opened over thirty years ago, it opened the door to endless world-changing possibilities. Beyond that threshold we’ve discovered a world of innovative renewable energy solutions. Biofuels, 2 | ETHANOL PRODUCER MAGAZINE | MAY 2021 nutrient-rich proteins and oil alternatives are just the beginning.

THE PREMIER PROVIDER. YOUR TRUSTED PARTNER. Thanks to our integrated platform of railcar products and services, TrinityRail is the industry’s unmatched rail resource, providing the confidence your business deserves. Trust North America’s premier provider of rail transportation solutions to deliver the quality, innovation and expertise you need to meet every business challenge. Every time. Learn more at TrinityRail.com.

ETHANOLPRODUCER.COM | 3

Together, we can partner. Merge ideas for productivity. Innovate to realize greater profitability. Together, we are stronger.

INTRODUCING...

A new ethanol fermentation platform of high performance yeast and enzymes, united for greater value, efficiency and profitability.

#ethanoltogether

See it for yourself. Contact LBDS for your plant demonstration today. LBDS.COM 4 | ETHANOL PRODUCER MAGAZINE | MAY 2021

©2020 Lallemand Biofuels & Distilled Spirits

Contents

14

GREEN PLAINS INC.

22

PHIBRO ETHANOL PERFORMANCE GROUP

28

EAST KANSAS AGRI-ENERGY

MAY 2021 VOLUME 27 ISSUE 5

DEPARTMENTS 6

EDITOR'S NOTE Full Coverage

FEATURES 14 COPRODUCTS

Making A Splash

Ingredient separation optimizes nutrition

By Lisa Gibson

7

AD INDEX

7

EVENTS CALENDAR

8

DRIVE Ready for Another Summer with Year-Round E15

By Lisa Gibson

22

GLOBAL SCENE Europe Still Needs Ethanol By Emmanuel Desplechin

10

GRASSROOTS VOICE Ethanol’s Role in Future Fuels By Brian Jennings

12

BUSINESS BRIEFS

35

MARKETPLACE

Keeping Bacteria At Bay Process changes prompt protocol modifications

By Emily Skor

9

INFECTION

By Susanne Retka Schill

28

MARKETS

Renewable Diesel Rising Development drives DCO prices

ON THE COVER Green Plains Inc. has installed Fluid Quip Technologies’ Maximum Stillage Co-Products technology in five of its plants. The separation the system offers has been crucial to Green Plains’ entrance into new feed markets, executives say. PHOTO: GREEN PLAINS INC.

By Susanne Retka Schill

SPOTLIGHT 34 NLB Corp.

NLB: Celebrating 50 Years of Innovation, Safety Solutions By Matt Thompson

Ethanol Producer Magazine: (USPS No. 023-974) May 2021, Vol. 27, Issue 5. Ethanol Producer Magazine is published monthly by BBI International. Principal Office: 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Periodicals Postage Paid at Grand Forks, North Dakota and additional mailing offices. POSTMASTER: Send address changes to Ethanol Producer Magazine/Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, North Dakota 58203. ETHANOLPRODUCER.COM | 5

Editor's Note

Full Coverage This issue focuses on coproducts: corn oil and feed. But don’t be fooled, these are not your grandfather’s coproducts… I don’t need to tell Ethanol Producer Magazine’s readers that as ethanol margins have dipped, coproducts have become increasingly more essential to revenue streams and bottomlines. I don’t need to tell EPM’s readers that production of high-protein feed and extraction of more corn oil are at the top of producers’ lists of goals. You already know that.

Lisa Gibson EDITOR lgibson@bbiinternational.com

But let’s talk about those strategies. In our cover story starting on page 14, “Making A Splash,” Walter Cronin of Green Plains Inc. dives into the technologies and methods that have led the company to purchase a fish feed company and install Fluid Quip Technologies’ feed system at five of its plants. Green Plains recently purchased a majority stake in Fluid Quip, so it’s not surprising that Cronin sees the technology as a straight path to markets and money. The separation of elements the system accomplishes is what has allowed Green Plains to tailor its feed products to specific species, he says. Still, traditional livestock and poultry are the dominant distillers grains markets, and ethanol producers would do well to understand them thoroughly, nutritionists say. Hire or contract with a nutritionist, form partnerships with industry, they advise. One such team effort has highlighted Ireland’s swine industry as a potential growth opportunity for DDG exports. This feature is packed with feed information and advice for producers. In corn oil, the rumblings of a burgeoning renewable diesel industry and the implications it would have on DCO markets and pricing have producers on the edges of their seats. There’s no denying the opportunity this lays out, and no ignoring the sky-high DCO prices driven in no small part by that expected demand. It’s a fascinating story and it starts on page 28. To round out this issue, we step away from coproducts and deliver some coverage on bacterial control. All aspects of our industry are evolving and that prompts necessary changes in infection control. Ethanol’s ability to constantly improve, taking into account downstream and side effects, never ceases to amaze me. I love this industry. “Keeping Bacteria at Bay” starts on page 22. I am so pleased, and impressed, to see the ethanol industry rebounding and moving forward, forging into new markets, better catering to existing ones and adapting as necessary. The full coverage in this issue of EPM highlights these successes clearly, and I’m eager to release it to you. Stay safe and be well.

FOR INDUSTRY NEWS: WWW.ETHANOLPRODUCER.COM OR FOLLOW US:

6 | ETHANOL PRODUCER MAGAZINE | MAY 2021

TWITTER.COM/ETHANOLMAGAZINE

Upcoming Events

ADVERTISER INDEX 2021 Int'l Fuel Ethanol Workshop & Expo

32-33

D3MAX LLC

18-19

EPM's Digital Press Package

13

Fagen Inc.

24

Fluid Quip Mechanical

20

Fluid Quip Technologies, LLC

25

Growth Energy

21

ICM, Inc.

11

IFF, Inc.

27, 29, 31

Lallemand Biofuels & Distilled Spirits

4

McCormick Construction, Inc.

26

NLB Corp.

34

Phibro Ethanol Performance Group

36

POET LLC

2

Senior Account Manager/Bioenergy Team Leader Chip Shereck | cshereck@bbiinternational.com

Thermal Kinetics

30

Jr. Account Manager Josh Bergrud | jbergrud@bbiinternational.com

Trinity Rail Group

3

Trucent

16

Victory Energy Operations, LLC

17

EDITORIAL Editor Lisa Gibson | lgibson@bbiinternational.com Online News Editor Erin Voegele | evoegele@bbiinternational.com Freelancers Matt Thompson, Susanne Retka Schill

DESIGN Vice President of Production & Design Jaci Satterlund | jsatterlund@bbiinternational.com Graphic Designer Raquel Boushee | rboushee@bbiinternational.com

PUBLISHING & SALES CEO Joe Bryan | jbryan@bbiinternational.com President Tom Bryan | tbryan@bbiinternational.com Vice President of Operations/Marketing & Sales John Nelson | jnelson@bbiinternational.com Business Development Director Howard Brockhouse | hbrockhouse@bbiinternational.com

Circulation Manager Jessica Tiller | jtiller@bbiinternational.com Marketing & Advertising Manager Marla DeFoe | mdefoe@bbiinternational.com

EDITORIAL BOARD

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer. com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-7468385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to lgibson@bbiinternational. com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

July 13-15, 2021 Iowa Event Center Des Moines, IA

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercialscale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies. (866) 746-8385 | FuelEthanolWorkshop.com

Marketing & Social Media Coordinator Dayna Bastian | dbastian@bbiinternational.com

Ringneck Energy Walter Wendland Little Sioux Corn Processors Steve Roe Commonwealth Agri-Energy Mick Henderson Aemetis Advanced Fuels Eric McAfee Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Int'l Fuel Ethanol Workshop & Expo

TM

Biodiesel & Renewable Diesel Summit

JULY 13-15, 2021 Iowa Event Center Des Moines, IA

The Biodiesel & Renewable Diesel Summit is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose, to further the biomass-based diesel sector beyond its current limitations. (866) 746-8385 | BiodieselSummit.com

National Biomass Summit & Expo

JULY 13-15, 2021 Iowa Event Center Des Moines, IA

Please recycle this magazine and remove inserts or samples before recycling COPYRIGHT © 2021 by BBI International

Please check our website for upcoming webinars www.ethanolproducer.com/ pages/webinar

Organized by BBI International and produced by Biomass Magazine, this sister event to the renowned International Biomass Conference & Expo will bring U.S. producers of bioenergy and biobased fuels together with waste generators and biomass aggregators, municipal leaders, utility executives, technology providers, equipment manufacturers, project developers, investors and policy makers. Supported by the attendance of nearly 2,000 industry professionals at Bioenergy Week, the Summit is a can't-miss summer networking junction for all biomass professionals. (866) 746-8385 | NationalBiomassSummit.com

ETHANOLPRODUCER.COM | 7

Drive

Ready for Another Summer with Year-Round E15

Emily Skor

CEO, Growth Energy 202.545.4000

eskor@growthenergy.org

With the second anniversary of year-round E15 just around the corner, prospects are bright for America’s biofuels industry. That’s because, after a year that most Americans would sooner forget, we’re heading into a new summer driving season with fewer headwinds, greater momentum and a groundswell of support for lower-carbon fuels. Motorists are hitting the road again, the U.S. EPA hasn’t rubber-stamped any new biofuel demand destruction and retailers are more excited than ever to offer greater choice at the pump. The bright promise of 2020 may have been dimmed by COVID-19, but now we’re tackling climate change head on and opening the floodgates for E15. That’s why Growth Energy is working overtime to ensure that this EPA upholds President Joe Biden’s promises to restore integrity to the Renewable Fuel Standard and takes advantage of every opportunity to fuel our country’s climate progress with homegrown biofuels. We’re already hearing the same old song-and-dance routine from refiners that hope to derail the growth of higher blends with tired, debunked claims about American biofuels and the obligations of the RFS. Fortunately, the facts are on our side. The Senate already voted once this year, 26-74, to shoot down a midnight-hour attempt by Sen. Ted Cruz, R-Texas, to derail the RFS with a bogus attempt to cap the price of renewable identification numbers (RINs). Now the Biden administration must do the same with strong 2021 biofuel targets that will deliver immediate progress toward our nation’s climate goals. We know what the data shows: an increased share of ethanol in our fuel supply has the power to accelerate our transition to a healthier, zero-emission future. And it’s a move we don’t have to wait for—we can start today with the vehicles we already have. Ethanol reduces greenhouse gas emissions by 46% compared to regular gasoline. Nationwide adoption of low-carbon biofuel blends of 15% can reduce carbon dioxide emissions by an additional 17.62 million tons annually, the equivalent of taking 3.85 million cars off the road. As policymakers look for environmentally conscious options, the solution is clear: ethanol is and will be the driving force behind a healthier, cleaner environment for decades to come. We’re also working closely with retailers, who are pressing ahead to deliver cleaner, affordable options to their customers. Just this spring, the retail market surpassed 20 billion miles driven on E15—a testament to the continued success of E15 at the pump. We hit that milestone, despite a terrible year for the broader economy, thanks to our retail partners who expanded the number of stations selling E15 by 10% in 2020, bringing E15 to more than 2,300 stations across the country. Some retailers are even making E15 the new standard option—a simple switch that promises exciting growth across major markets. Major distributors are getting in the game, too, acknowledging the increasing popularity of E15 and the significant climate benefits it offers. This is only the beginning. Today, we have the opportunity to make E15 the new normal at the pump. And that’s exactly what Growth is doing—with retailers and regulators alike.

8 | ETHANOL PRODUCER MAGAZINE | MAY 2021

Global Scene

Europe Still Needs Ethanol

Emmanuel Desplechin Secretary General ePURE, the European Renewable Ethanol Association

desplechin@epure.org

As pressure to make real progress in the fight against climate change mounts in Europe, there has been increasing talk of banning the internal combustion engine for passenger cars. But don’t start writing any automotive obituaries before stopping for a reality check: Under almost any scenario, including those foreseen by the European Commission, the EU car fleet will continue to need low-carbon liquid fuels like renewable ethanol. The EU is in the middle of a massive re-thinking of its energy and climate policies, including transport decarbonization. To succeed, it must resist the temptation to follow overly dramatic, technology-du-jour solutions such as imposing an immediate switch from internal combustion to electric vehicle power trains, driven by a restrictive approach that considers only tailpipe emissions and misleadingly labels electromobility as emissions-free. Fortunately, the EU has a variety of policy tools it can use to make better use of existing and proven emissions-reduction solutions, including: distinguishing between fossil and biogenic carbon dioxide; setting higher targets for renewable energy in transport in EU Member States; reforming the way energy is taxed so renewable low-carbon fuels are favored over fossil fuels; and creating favorable investment conditions for the growth of advanced biofuels. Making such an immediate impact is important because, until now, the EU’s policies have largely failed to make a dent in Europe’s dependence on fossil fuel in the transport sector—reducing it by just 2.2% since the Renewable Energy Directive was enacted in 2009. That may partly explain why the quick-fix concept of banning petrol and diesel cars makes headlines. The most recent salvo was a call from nine EU Member States for the European Commission to set a date for phasing out the sale of cars with internal combustion engines. The commission has largely remained silent on this idea and other Member States, such as Germany, keep shooting down the concept as unworkable, expensive and potentially socially disruptive. Clearly, electric cars are part of the solution and will grow in importance. But even as their sales rise, there are still concerns about the implications of a massive uptake of electric vehicles—concerns that would be amplified in any scenario involving a prematurely enforced ban on internal combustion engines. These include: a lack of charging and grid infrastructure; an unwelcome reliance on nuclear power and electricity generated from coal, gas and oil; concerns about the sustainability of battery production (most of which occurs outside of Europe); and the social impact of requiring new and expensive technology that may not immediately be within reach of many European pocketbooks. At the very least, EVs should not be considered a miracle solution to road transport decarbonization. The most recent sales data from European Automobile Manufacturers’ Association illustrate the point: While it’s true that electric car sales have steadily increased, Europeans are still buying mainly cars that run on liquid fuel. Nearly half (47.5%) of all new cars sold in Europe in 2020 run on petrol. The fact that these vehicles will be on Europe’s roads for a long time underlines the need for EU transport and energy policy to consider the importance of low-carbon solutions such as renewable ethanol. Low-carbon liquid fuels remain the best way to reduce emissions from these vehicles, including the hybrid-electric (HEV) and plug-in hybrid electric vehicles (PHEV) that have seen increased interest from car buyers. Production and use of renewable ethanol from ePURE members delivered an average of more than 72% greenhouse-gas savings compared to fossil fuels in 2019. Ethanol’s sustainability score keeps improving every year, making it an essential tool for achieving the EU Green Deal. As EU policymakers consider key legislation such as the Sustainable and Smart Mobility Strategy, they should remember that Europe will need more than one solution for decarbonizing road transport in the coming decades. Even as electrification grows in importance, the need for low-carbon liquid fuels will stay significant and that’s what should drive EU policy. ETHANOLPRODUCER.COM | 9

Grassroots Voice

Ethanol’s Role in Future Fuels

Brian Jennings

CEO, American Coalition for Ethanol 605.334.3381

bjennings@ethanol.org

Nearly three years of behind-the-scenes coalition building has paid dividends with the introduction of the “Future Fuels Act” in Minnesota, the first clean fuel standard legislation in a Midwest state. The Future Fuels Act would establish a performance standard for Minnesota’s transportation fuel, requiring annual reductions in carbon intensity (CI) below a petroleum baseline. Sellers of low-carbon fuel meeting or outperforming the standard would receive compliance credits, while sellers of carbon-intensive fuels that underperform generate deficits. To attain compliance, deficit holders would either need to blend low-carbon fuels, such as ethanol, or buy credits from low-carbon sellers. This legislation is modeled after work by ACE and the Great Plains Institute to form the Midwest Clean Fuels Policy Initiative, a diverse coalition supporting a technology-neutral and market-based approach to decarbonize transportation fuels. Rather than having the government pick winners and losers, we support a portfolio of low-carbon fuels and a level playing field to benefit biofuel producers, consumers, agriculture and utilities. We are grateful the bipartisan Minnesota Future Fuels Act is modeled after recommendations our coalition published a year ago, A Clean Fuels Policy for the Midwest. ACE supports clean-fuel policy like the Future Fuels Act because it can help increase the use of E15 and higher ethanol blends. In fact, according to scenario modeling commissioned by GPI and ACE, the quickest and lowest-cost way to achieve a 15% and 20% reduction in the carbon intensity (CI) of Minnesota’s transportation fuel is by increasing the use of E15, E30 and E85. Our analysis forecasts that clean-fuel legislation could increase the average blend of ethanol in Minnesota’s gasoline to 20% by 2030. Even existing clean-fuel programs that are biased against ethanol indicate demand rises. Since California enacted the Low Carbon Fuel Standard in 2011, E85 use has quadrupled, and the state is in the process of approving E15. The Minnesota Future Fuels Act would also reward farmers for climate-smart practices to help reduce the overall CI of corn ethanol. The legislation would require the use of the most recent version of the Greenhouse Gases, Regulated Emissions and Energy Use in Technologies (GREET) model to determine the CI of transportation fuels. The credit market established under the legislation would provide a meaningful return on investment to farmers for practices that sequester carbon in the soil and ensure more efficient use of nitrogen-based fertilizer. In addition to increasing ethanol demand and providing incentives to farmers for conservation practices, clean fuel policy will support economic development. According to an analysis commissioned by GPI and ACE, reducing the CI of transportation fuel in the states of Minnesota and Iowa by 15% from 2021 to 2030 would support 15,000 jobs and generate $10 billion total economic output, including more than $1.5 billion for farmers and biofuel producers. Consumers would also win under a clean-fuel standard. Our analysis shows that gasoline users and customers would receive a total economic benefit of $726 million over 10 years a result of savings from lower-cost fuel blends. Finally, our behind-the-scenes work to win over allies in support of clean-fuel policy has resulted in a diverse and formidable coalition of groups and companies supporting the Future Fuels Act, including the Farmers Business Network, General Motors, Minnesota Bio-Fuels Association, The Coalition of Renewable Natural Gas, The Nature Conservancy, Union of Concerned Scientists, Tesla and Xcel Energy, just to name a few. ACE intends to help keep this coalition together as discussions ramp up about national clean-fuel policy in Congress. Minnesota is not the only state making progress on clean fuel legislation this year. In addition to existing programs in California and Oregon, bills are progressing in New Mexico, New York and Washington. But the approach we are taking with the Future Fuels Act in Minnesota is unique because it promotes E15 and higher blends, takes a genuinely technology-neutral approach—whereas California and other programs tip the scale in favor of electric vehicles—and would benefit agriculture by applying the very latest life cycle science to reward farmers for climate-smart practices. If Congress does take up clean-fuel policy, we want a Midwest state to be the model, so farmers and biofuels are considered part of the solution.

10 | ETHANOL PRODUCER MAGAZINE | MAY 2021

BUSINESS BRIEFS PEOPLE, PARTNERSHIPS & PROJECTS

Elite Octane joins Iowa Renewable Fuels Association Elite Octane, a 150 MMgy ethanol plant near Atlantic, has joined the Iowa Renewable Fuels Association as a producer member. Nick Bowdish, Elite Octane’s president and CEO, will serve on IRFA’s board of directors. Bowdish said he is excited to work alongside the rest of the IRFA board this year to grow ethanol demand across Iowa, especially in light of Gov. Kim Reynolds’ recent introduction of the Iowa Biofuel Standards legislation. If passed, the legislation would set a minimum standard of 10% ethanol and 11% biodiesel sold in Iowa and chart the path to universal availability of gasoline containing 15% ethanol in Iowa. “We share the vision of Gov. Kim Reynolds, IRFA, and the other supporters of the Iowa Biofuel Standards legislation that gasoline containing 15% ethanol should be available for consumers at every Iowa retail station and this bill provides retailers with the support they need

to make it happen,” Bowdish said. “We are looking forward to being a part of the IRFA team as it works alongside the governor and other ag groups to see the passage of this crucial legislation. Upon doing so, Iowa will continue to lead by example as we advocate for other states and countries to offer higher blends of ethanol.” IRFA Executive Director Monte Shaw said IRFA was excited to welcome Elite Octane as a new member. “While Elite Octane has only been in operation for a couple of years, Nick has been an active and staunch supporter of ethanol for many years and we look forward to his voice joining our board of directors,” Shaw said. “He is passionate and driven and as we work this year to pass ground-breaking legislation to boost biofuel demand, IRFA will be that much stronger because Elite Octane is now a part of our team.”

Helm, Viridis Chemical announce marketing partnership Helm U.S. Corp. and Viridis Chemical LLC have entered into an exclusive global marketing partnership for the purchase and sale of USP grade biobased ethanol and biobased ethyl acetate to be produced at the Viridis Chemical manufacturing plant in Columbus, Nebraska. Helm will immediately assume the exclusive responsibility for global sales, marketing and logistics management for both of Viridis Chemical’s products. “We are excited to partner with Helm, one of the world’s largest and most successful independent chemicals marketers,” said Carl V. Rush, Jr., CEO and cofounder of Viridis Chemical. “We see a perfect synergy allowing us to focus on our expertise of producing sustainable and highquality renewable chemicals, combined with Helm’s outstanding marketing capabilities from decades of presence here in the U.S. and around the world.” Oliver Leptien, president and CEO of Helm U.S., said, “Viridis

Chemical’s focus on a high-performing, sustainable product, combined with their structured and visionary approach to sustainable and renewable chemicals led the way towards this value creating partnership. We are convinced that our highly customized market approach and our unique business model will add additional value to these two bio-based

products.” Björn Steckel, executive vice president derivatives at Helm U.S., said, “It is a visible step forward to further increase our product portfolio with sustainable and renewable chemicals. The Viridis Chemical biobased ethyl acetate is a visible differentiator in numerous applications versus traditional fossil-based ethyl acetate.” Viridis Chemical’s Columbus plant is currently undergoing capital improvements that will increase production capacity. The plant is expected to begin production of high-quality USP grade bioethanol in mid-2021 and production of biobased ethyl acetate at a global scale in Q4 2022.

CTE Global names Howes director of business development CTE Global Inc. hired Kevin Howes as director of business development. Howes is a well-known leader in the biofuels market with more than 27 years of professional experience, most recently as chief operating officer of Homeland Energy Solutions in Lawler, Iowa. Howes will be developing and implementing an overall corporate sales and customer support strategy, directly engaging with key strategic accounts translating the company’s business objectives into workable customer solutions that create customer value while driving company revenue. “I am excited for the opportunity to combine my operational experi12 | ETHANOL PRODUCER MAGAZINE | MAY 2021

ence with CTE Global’s continually evolving product line to bring a unique value proposition to our clients,” Howes said. “Kevin is well-known and respected within the biofuels industry and brings a rare combination of technical savvy, customer focus and application experience to the benefit of all CTE Global clients,” Howes said Alex Shifman, president and CEO. “His skill set spans all aspects of ethanol manufacturing processes and we’re really excited that he joined our team.”

$W WKH ODNH 2Q D VFUHHQ )URP DIDU $QG LQ EHWZHHQ

<RX &DQ 5HDFK 7KHP $Q\ZKHUH

'LJLWDO 3UHVV 3DFNDJH

Äõ ÇðäÝêëè Òîëàñßáî ÏÝãÝöåêá

*HW <RXU 0HVVDJH 2XW 1RZ 4XLFNO\ 5HDFK ,QGXVWU\ &RQWDFWV ( $ 6 , /< 7 5 $ & . < 2 8 5 3 ( 5 ) 2 5 0 $ 1 & ( Interested in Advertising? Contact us at 866-746-8385 or service@bbiinternational.com ONLINE | PRINT | DIGITAL | WEBINARS | EVENTS | VIDEOS | MAPS | DIRECTORY

)ROORZ 8V

ETHANOLPRODUCER.COM | 13

Coproducts

MAKING A

SPLASH

Species-specific tailoring in distillers grains opens new markets such as pet feed and aquafeed, expands existing markets and increases product demand. By Lisa Gibson

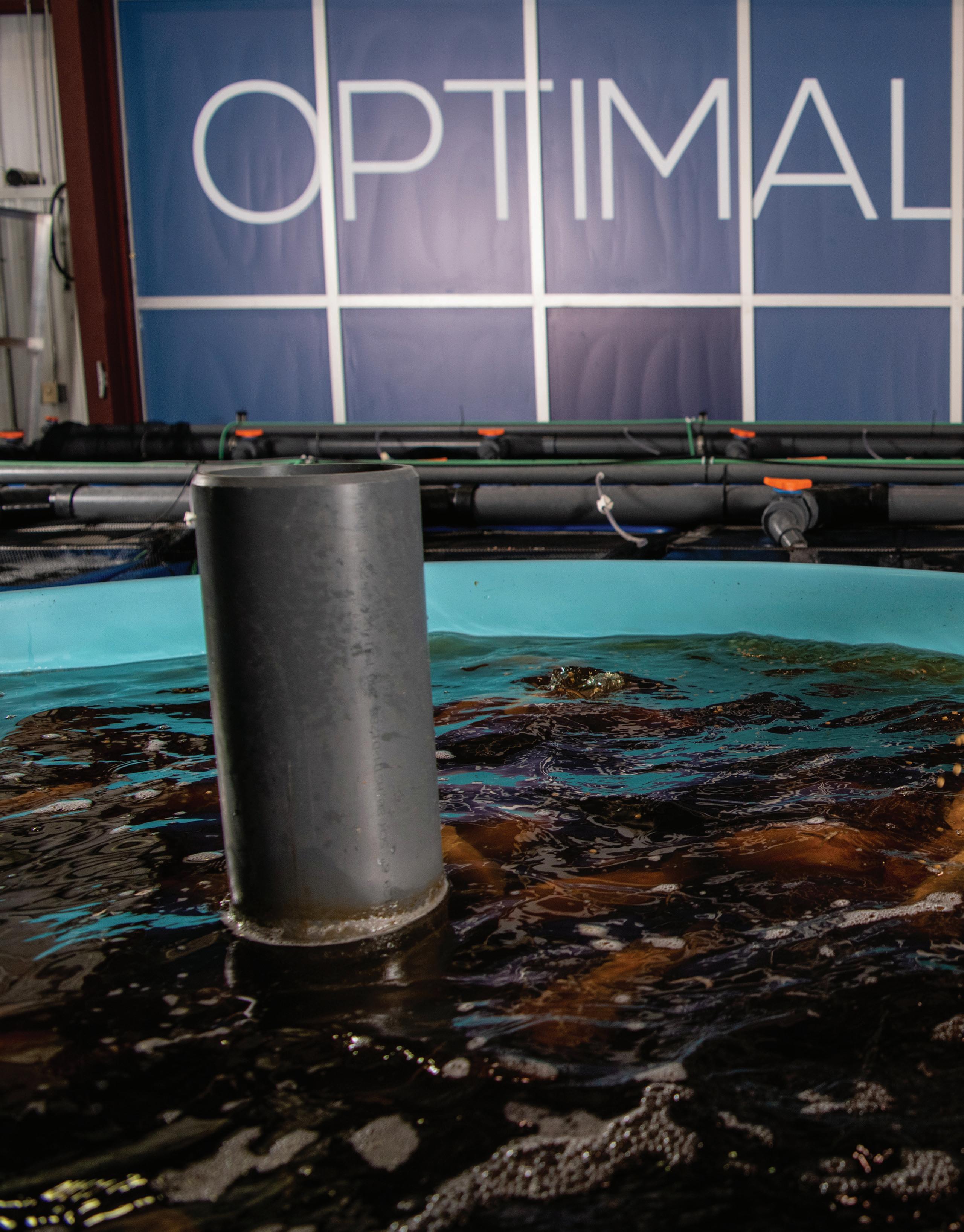

OPTIMIZED OPPORTUNITIES: Green Plains Inc. has purchased Optimal Fish, with plans to expand to a large-scale fish feed supplier. Green Plains says separating elements in feed coproduct streams is key to entering new markets. PHOTO: GREEN PLAINS INC.

14 | ETHANOL PRODUCER MAGAZINE | MAY 2021

Green Plains is also occupying the pet feed market, while maintaining more traditional livestock markets as well. Jerry Shurson, animal nutritionist and professor in the Department of Animal Science at the University of Minnesota, agrees that fish and pet feed hold potential as coproduct markets, especially with technologies that add a significant yeast protein to the feed ingredient. Whether maintaining current markets or enterprising into new ones, distillers grains have become an important revenue stream for ethanol plants. And the opportunities for a polished product are vast.

New Market: Aquaculture

Walter Cronin says Green Plains Inc. is setting itself up to play a major role in a global market he expects the U.S. to dominate in the coming years. As chief

commercial officer at Green Plains, Cronin possesses an advanced knowledge of animal nutrition, as well as a passion for veg oils that likely spills into conversations outside of feed ingredients. Drawing on that expertise, Cronin explains his theory of circulating aquaculture coming to the U.S. in force and shares the methods Green Plains is using to get ahead of it and secure a top spot in the feed market that will sustain it. “The U.S. is going to ultimately dominate in aquafeeds and in aquaculture because of our incredible efficiencies in grain and oil production,” he says, adding that feed hoards 70% of the cost in circulating salmon production. “We’re at an extreme competitive advantage just starting there.”

Green Plains purchased Optimal Fish, a boutique lake and pond management feed company that it plans to scale up, Cronin says. “What we really liked was their science and commitment to quality and innovation. So we’re taking that and scaling that to commercial.” But the key to an optimal fish feed is fractionating, he says. Green Plains uses Fluid Quip Technologies’ Maximum Stillage Co-Products system to accomplish the separation. Green Plains acquired a majority stake in Fluid Quip Technologies in January of this year. “What’s beneficial with MSC protein technology is we basically take the whole stillage that would normally go into a centrifuge and then into a dryer and come out as DDGS, what we’re able to do is fractionate that whole stillage. We end up with a concentrated protein and yeast protein product.” Green Plains has named that product MSC Protein. It consists of 75% corn gluten and 25% yeast proteins. The system spits out a product with protein purity between 50% and 52%, and Green Plains has achieved 58% protein purity in its applications. Cronin believes Green Plains will hit 60%. “Protein purity and the potential for this product is very high,” he says. “Higher protein concentration, higher protein purity are the benefits of isolating yeast proteins in one feed. “The ability of the industry with the MSC technology to deliver this protein concentration—basically that’s what bridges us into the new markets.” ETHANOLPRODUCER.COM | 15

Coproducts In addition to almost ideal protein, the fish feed ingredient coming out of Green Plains’ MSC applications is low in oil, which is the element that holds xanthophylls, an ingredient that causes yellowing in white fileted fish. MSC extracts 50% more distillers corn oil in Green Plains’ applications, removing that element while boosting extraction to 1.2 pounds per bushel. Green Plains’ aqualab completes extensive histologies, analyzing all internal organs of the fish and comparing everything to fish fed other diets. “To date, we’ve gotten a very positive response on MSC Protein and filet coloring side by side with other products and have proven the value in that regard.” One nutritionist says MSC Protein is an optimal fish feed ingredient, Cronin says. Water quality is another important feature customers want in fish feed, he adds. “Water quality is a huge component in life and health of fish. They swim around in their own feces. The impact of the feed on the water quality, the impact of the feed on filtra-

tion systems being used is a key component.” Cronin says Green Plains is working on even more improvements in water quality, but declined to release details. The corn gluten and yeast meal is revolutionary in the fish market, he says, and five of Green Plains’ plants have adopted the MSC technology to produce it. Two more will in the coming months. “Scale is important,” Cronin says. “From the process of meeting with the nutritionists, there’s a scaling hurdle we have to get over. Ironically, the more we produce as an industry, we’ll probably start to drive the price higher because there will be more adoption.” More brands will be willing to buy it with a reliable supply, he adds. “That’s been missing historically but it’s been changing as we grow, as we, Green Plains and others, adopt the technology.”

New Market: Pet Feed

MSC Protein has also made a splash in the pet feed market, where soybean meal is

undesirable as it causes flatulence in dogs. “We have a partner in the pet space who absolutely loves this product,” Cronin says. “He hasn’t given us all the secrets about what makes it a great pet feed.” Yeast for pet health is extremely important, Cronin points out. The benchmarks in that market are shiny coats, bright eyes, firm feces and clean breath. “From our relationship with our pet customer, our product is a winner in all those regards and the process of the higher protein purity and yeast benefit seem to be key elements of the product relative to the feed ingredients it’s replacing.” Beyond an exclusive contract with its current pet feed customer, Green Plains is looking to partner with more pet feed brands, Cronin says. “For protein today, our primary focus is pet feed and aquaculture because the role of the feed ingredient is so important in both of those species,” Cronin says. “We’re working with partners in the poultry space and broiler

Distillers Corn Oil or Liquid Gold? DCO Prices Are at All-Time Highs! Trucent’s mission is to help you maximize and stabilize your corn oil extraction yields. Trucent partners with you throughout your whole process with mechanical, service, and chemical-based improvements. See Trucent in July at FEW Booth #515

Contact Us Today! 16 | ETHANOL PRODUCER MAGAZINE | MAY 2021

www.Trucent.com

734-822-7579

space, and we’re working with partners in the swine space as well.” Post-MSC DDGs still have an important role in beef and dairy cattle, he says. “The biggest complaint is the variation in all the factors: protein, fiber, lipids. It has an extreme range of outcomes. That’s across the industry, that’s across our own internal fleet at Green Plains. And the benefit that we get from the post MSC DDGs is a much lower variation in factors. “We see the benefit on the protein side in entering into new markets, but we also think the post-MSC DDGs is going to be a phenomenal product as well.”

Markets Maintained

MULTI-STREAM SYSTEM: While Green Plains looks toward fish and pet feeds, it maintains its markets in traditional livestock feeds. PHOTO: GREEN PLAINS INC.

|continued on page 20|

)7

(50 $5.

6

3(

(7

$

ETHANOL PRODUCER_HALF PG AD_CERTIFIED TECHNICIANS_03-24-2021.pdf 1 3/25/2021 10:11:42 AM

&,$/,6

7

Swine, cattle and poultry of course represent markets already using distillers grains for feed, wet and dry. “The market for DDGs is pretty much all species but because our swine and poultry diets in North America are fed in dry form, as opposed to liquid feeding systems, a higher proportion goes to (other)

&HUWLILHG ([SHUW 7HFKQLFLDQV )RU WKH /LIH RI <RXU %RLOHU 2XU $IWHUPDUNHW 6HUYLFHV WHDP LV WKH SHUIHFW DQVZHU WR NHHS \RXU ERLOHUV RSHUDWLQJ DW SHDN SHUIRUPDQFH :KDWHYHU WKH QHHG ERLOHU LQVWDOODWLRQ LQVSHFWLRQ WUDLQLQJ URXWLQH PDLQWHQDQFH RU VSDUH SDUWV SURYLVLRQLQJ RXU WHDP LV GHSOR\PHQW UHDG\ <

9,

5< (1(5 72 * &

$Q\ WLPH 9,

(

5

6(

5

7

1RUPDO WLPH & ( ( ;3

ETHANOLPRODUCER.COM | 17

$&( (7+$12/ //& $33529(' 72 *(1(5$7( ' 5,16 )25 &(//8/26,& (7+$12/ 0$'( )520 &251 .(51(/ ),%(5 /($51 025( &RQWDFW 0DUN <DQFH\ 7RGD\ 3KRQH

$W HWKDQRO SODQWV DFURVV WKH FRXQWU\ WKHUH·V DQ HYROXWLRQ JRLQJ RQ 3URGXFHUV DUH GHPDQGLQJ PRUH WKDQ MXVW VWDQGDUG HWKDQRO SURGXFWLRQ IURP WKHLU IDFLOLWLHV 7KH\·UH GHPDQGLQJ QHZ WHFKQRORJLHV WKDW H[WUDFW HYHQ PRUH YDOXH IURP HDFK EXVKHO RI FRUQ ' 0$; GHOLYHUV WKDW FXWWLQJ HGJH WHFKQRORJ\ E\ FRQYHUWLQJ FRUQ ILEHU DQG UHVLGXDO VWDUFK LQ GLVWLOOHUV JUDLQV WR FHOOXORVLF HWKDQRO 7KLV LV D ELOOLRQ JDOORQ SHU \HDU PDUNHW DQG ZLWK ' 0$; HWKDQRO SURGXFHUV FDQ PD[LPL]H WKHLU \LHOG DQG SURILWV

0$;,0,=(

352),76 ' 5,16 &251 *5,1' (7+$12/ <,(/' &251 2,/ 5(&29(5< &251 ),%(5 72 (7+$12/

/ ( $ 5 1 0 2 5 ( $7 ' 0 $ ; / / & F R P &217$&7 86 $7 RU P\DQFH\#G PD[OOF FRP 18 | ETHANOL PRODUCER MAGAZINE | MAY 2021

,QFUHDVH FRUQ RLO UHFRYHU\ E\ ó OE EXVKHO

+LJKHU <LHOGV )URP &RUQ )LEHU $W /RZHU &RVWV

5HSRUW ([DFW &HOOXORVLF 2XWSXW WR 0D[LPL]H 5,16

,QFUHDVH ''*6 3URWHLQ WR PRUH WKDQ

',67,//(56 0$; ' 0 $ ; / / & F R |P19 ETHANOLPRODUCER.COM

Coproducts |continued from page17|

Table 1. Live Performance and Carcass Traits

PLANT UPTIME IS IMPORTANT TO YOU, SO IT IS IMPORTANT TO US. Our full service team of experts have 20 years of ethanol plant maintenance reliability and uptime history. 24/7 support and ready access to a full inventory and all Fluid Quip equipment parts, ensures that you maintain your plant’s uptime status.

PARTS •

OEM Parts Warehouse

•

$1 million+ on-hand inventory

•

Fully stocked trucks

•

Overnight/hot shot shipping

EQUIPMENT SERVICE •

Factory Trained & Certified

•

MSC™ Systems

•

SGT™ Grind Systems

•

FBP™ Fiber By-Pass Systems

•

MZSA™ Screens

•

Paddle Screens

•

Grind Mills

•

Centrifuges

FluidQuipMechanical.com | 920-350-5823 | follow us on i Fluid Quip Mechanical is a division of Fluid Quip Technologies.

20 | ETHANOL PRODUCER MAGAZINE | MAY 2021

Overall performance

0% DDGs

20% DDGs

SEM

P-value1

Number of pigs start Initial weight, kg Market weight, kg Days to market Average daily gain, g/d Average daily feed intake, g/d Feed to gain ratio Carcass weight, kg Dressing percentage, % Backfat, mm Lean yield, % Number of pigs sold

448 40.4 122.2 80 1005 2700 2.58 94.3 77.2 11.3 63.1 422

448 40.6 122.6 80 1007 2720 2.53 98.0 79.7 11.2 61.8 411

0.9 1.1 14 -

0.9360 0.8065 0.7288 -

P<0.05 means significant difference. SOURCE: U.S. GRAINS COUNCIL 1

livestock or poultry than beef or dairy,” Shurson says. Most wet feed goes to local beef cattle feedlots, he says. “It can be used in beef cattle diets in any stage of growth or production but it’s predominantly used for fattening feedlot cattle because of its high energy value. A lot of people continue to think that distillers grains, wet or dry, is a protein source, but it’s really more of an energy source than a protein source.” There’s been a total acceptance in the feed industry of this coproduct, Shurson says. “One of the things we learned last year when the pandemic turned the world upside down for everyone and ethanol plants either stopped producing or shut down partially, was that distillers grains, wet or dry, had become a common ingredient for all livestock and poultry species and the short supply was a wakeup call to tell the ethanol industry that this is valued and needed.” Beyond North America, DDGs from the U.S. are exported to Mexico, Southeast Asia, Korea and other areas, says Reece Cannady, manager of global trade with the U.S. Grains Council. But the USGC recently highlighted a market that gets about 3% of the U.S. DDGs exports: Ireland. Ireland purchased more than 277,000 metric tons in 2020, valued at $64 million. The USGC conducted a feeding trial with a swine farm in the north of Ireland

to test the health benefits of U.S. DDGs over competitor feed grains. Results of the feeding trial showed that the inclusion of DDGS leads to healthier and heaver pigs coupled with a cheaper feed cost. (See Table 1.) “The findings were so good, we actually had to go back and verify again and ask for a double and triple check,” Cannady says. The results led to direct work with the swine industry to answer questions related to nutrition and encourage inclusion in rations, Cannady says. A large Irish feed mill, which produces up to 500,000 tons of pig feed annually, decided to change its feed formula, increasing the DDGs inclusion rate from zero to 15%. This formulation change will lead to an additional demand for 75,000 tons of U.S. DDGs, annually valued at $17.2 million, according to the USGC. “It’s so important to do the feed trials in-country,” Cannady points out. “It doesn’t quite work to use figures from the U.S. You have to use their feedstock and use DDGs within that formula. Then it’s easy to convince people to switch.” But the USGC has encountered an education gap between customers and the product, Cannady says. More webinars are planned with swine producers in Ireland to continue potential market growth. “At this point, we’re still engaging,” he says.

Undervalued Ingredients As dependence on distillers grains as a feed ingredient has grown, livestock and poultry producers will pay more for it, even if the supply isn’t completely secure long term, Shurson says. But the beneficiaries are the livestock producers, he says, as distillers grains are not priced properly in the market. “There’s a disconnect between price and value.” The marketplace, feed ingredients in general on a global scale, is still using measurements like crude fat or fiber, developed back in the 1860s. “People and nutritionists still refer to them today, but they really produce no benefit or value to those of us formulating animal feeds,” Shurson says. “We use digestible amino acids, metabolizable amino energy, we use digestible phosphorous, and so those old measures really are not very well correlated with true nutritional value of these feed ingredients. “So until or if the criteria we use to value feed ingredients changes in the marketplace, we’re always going to have this disconnect. Because as a nutritionist, if I can buy these distillers grains, I know the energy value … and I can put it in the diet and compete with corn and soybean meal and other ingredients, I know it’s helping me reduce my diet costs. “I’m able to buy it because the protein and fat criteria are responsible for undervaluing and underpricing it in the marketplace.”

Problem Solving and Partners

Shurson actively promotes communication between ethanol producers and their markets, to educate both parties. “For these ethanol companies and coproduct producers to really understand and obtain the best value they can for the coproducts they’re producing, they really need to develop a relationship or have a consulting nutritionist or a nutritionist on board that can help guide them through some of these kinds of decisions and applications. “I find that too many ethanol plants kind of expect everybody to embrace and pay top dollar for whatever they can produce coming out the door every day without spending much time on market development and understanding their customers and the animal species’ needs and how they match up with the products they’re producing.” Cronin emphasizes partners, education and expertise, too. “Our commercial process is we love to partner with companies who have the deep understanding of the role of the ingredients. We’re not hanging a shingle out saying ‘For Sale’ on the product. We’re much more interested in partnering in on a per-species basis.”

Partnerships have helped Green Plains optimize its feed ingredients. A partnership with Novozymes helps Green Plains produce even more specialized feed through the use of tailored enzymes, to help solve issues in certain animal diets. “What can we overcome with feed? It’s very problemsolving focused,” Cronin says. “The key to entering into these markets is you have to fractionate the DDGs. You have to give individual species markets the feed ingredient that they want. And that’s what the MSC technology allows us to do.” Lowered carbon intensity scores and sustainability are important factors, too. “These things are all moving so rapidly and the processes and technologies that allow us to do this are moving so rapidly, it’s a very dynamic and exciting time in this industry,” Cronin says. “We’re really moving as an industry very, very quickly.”

A new report from Environmental Heath & Engineering, Inc. found that greenhouse gas emissions from corn ethanol are 46% lower than gasoline, emphasizing ethanol ’s key role in our nation’s climate goals on decarbonizing the transportation sector and reducing GHG emissions. Learn more at GrowthEnergy.org/datahub

Author: Lisa Gibson Editor, Ethanol Producer Magazine 701.738.4920 lgibson@bbiinternational.com

ETHANOLPRODUCER.COM | 21

Infection

Keeping Bacteria AT BAY

Producers modify antimicrobial protocols in response to multiple process and input changes, including new yeast and enzyme offerings, as well as high-protein feed production. By Susanne Retka Schill

While many aspects of the battle against bacterial infections have improved, the evolving process at ethanol plants continues to introduce new challenges. New yeast, new enzymes, new feed coproducts, new cleaning solutions, new tools are all impacting antimicrobial regimes in plants. Long the mainstay of bacterial control in fermentation, antibiotic use at ethanol plants is order of magnitudes less today than it was when Jenny Forbes started working at an ethanol lab in the early 2000s. Forbes is vice president of products and services for Phibro Ethanol Performance Group. Over the years, she’s learned the shotgun approach—throwing more antibiotic in whenever infections threatened—is not necessarily the best approach.

22 | ETHANOL PRODUCER MAGAZINE | MAY 2021

'Rather than overuse a product that’s not doing the job for you, use the right amount of the right active. We suggest customers use antimicrobials in a more informed manner.' Jenny Forbes Phibro Ethanol Performance Group

PHOTOS: PHIBRO ETHANOL PERFORMANCE GROUP

ETHANOLPRODUCER.COM | 23

Infection

“Rather than overuse a product that’s not doing the job for you, use the right amount of the right active,” Forbes says. In analyzing bacterial response to different antibiotics at different doses, Phibro has seen a species or bacterial consortium from one plant respond better to one active, while the same species or similar consortium from another customer does the opposite, she says. “We suggest customers use antimicrobials in a more informed manner.” While plants once relied more on antimicrobials to control infections, producers increasingly have been using new tools to find infection hotspots and fine tuning their clean-in-place (CIP) protocols, Forbes says. “The shortcomings of caustic cleaning have been exposed, and plants are managing their caustic program differently or looking for an alternative.” The hydroxide molecule in caustic that provides cleaning action is unstable, she explains. “It can be consumed quickly in reactions and not be there for cleaning—reacting with residual mash or carbon dioxide.” While some plants compensate by adding more caustic, others are trying alternatives offered by Phibro and other venders. Care needs to be taken in making changes, she adds. She’s seen plants that change cleaning procedures where the infection rate has

24 | ETHANOL PRODUCER MAGAZINE | MAY 2021

gone up, while others switching to a noncaustic cleaning program will see a dramatic reduction in what had become chronic infections. To help find infection sources, Phibro has deployed infrared technology and borescopes, Forbes says. “As plants age, things like valves, level indicators, flow indicators start to lose their integrity and you can have infections where you didn’t before.” For example, valves on propagator or fermentation fill lines might no longer close properly, allowing small amounts of material to seep through, become stagnant and infected. “It doesn’t take much to get a major bacterial infection,” she says. Using infrared technology to observe product flow can help producers find failing valves and places where cleaning solutions aren’t contacting all the surfaces they need to. Borescopes can be run through lines to see whether they are being properly cleaned. If the borescope is covered in slime when it’s pulled out, biofilm is present, she adds. The borescope is also helpful in inspecting the carbon dioxide header off the fermentation tank, she says. “If our evidence shows this is dirty, if there’s mash residue there, it’s worth the investment to get that cleaned out.”

INFRARED INFORMATION: Images taken during CIP show hot solution as yellow and red. The two fermentation blocking valves on the left are leaking, indicated by the hot solution appearing in the pipe below the valve. The blue color on the intact pipe on the right indicates an empty pipe. PHOTOS: PHIBRO ETHANOL PERFORMANCE GROUP

Challenges From New Yeasts, Enzymes

The new generation of enzymes will potentially present infection challenges, Forbes continues. The new enzymes are liberating so much more from the corn kernel that the chances of having food sources for bacteria post-fermentation have increased. “You can now give bacteria a food source in the beer well, whereas 10 years ago, you didn’t,” she says. The newer high-performance yeasts are presenting other challenges. “Some genetically modified yeasts seem very sensitive to the organic acids that are produced by bacteria, Forbes says. “Contamination is much more damaging, so plants have had to be more vigilant on infection management.” The high-performance yeasts produce a lot more ethanol, “but it comes at a cost,” says Allen Ziegler, CEO of Archangel Inc. The company is introducing a new tool to help plants monitor bacteria. GenesisGene gives plants the ability to run rapid bacteria analysis in the ethanol lab by utilizing DNA technology to identify the type and amount of bacteria in a sample. Up to 14 samples can be run simultaneously, with primers chosen to identify specific species or to look for all organic acid-producing bacteria, Ziegler explains. Once baselines are established when the plant is running well, if organic acid levels in samples begin to rise, samples can be pulled from multiple locations in the process flow to compare and quickly determine the problem area. “This technology allows you to identify bacteria type and quantity quickly,” Ziegler says. They’ve found elevated bacteria counts in heat exchangers, ferm fill lines, the CO2 scrubber, even cook. “Some of these bacteria can be very hardy.” Designed to test high-solids mash, Ziegler adds that customers have asked if the GenesisGene can test distillers grains. “It wasn’t developed for that, but it works,” he says. “Plants can test on-site and don’t have to wait to get the results.”

Feed Impacts

The move toward high-protein specialty feeds is another factor prompting ethanol producers to improve their antimicrobial programs. “In the past, if elevated organic acids occurred, it was difficult, time consuming and problematic to pinpoint the source,” Ziegler says. “The on-site methods can only find 1% of the bacteria and are prone to a high degree of error, which often leads to treating the symptom rather than the disease. While there is a potential for auditing under provisions of the Food Safety Modernization Act, the goal for all facilities is to minimize the utilization of antibiotics, and GenesisGene is one tool that can help get you there.” Long-time provider of hops-based antimicrobials BetaTec is seeing increased interest in antibiotic-free treatments, says Jason Lanham, director of sales and market-

VALUE IS... THE RELATIONSHIPS BEHIND THE TECHNOLOGY.

For 25 years, the Fluid Quip Technologies team has continuously developed and created Value for our customers.

fluidquiptechnologies.com I 319-320-7709 I

ETHANOLPRODUCER.COM | 25

Infection

ing for BetaTec North America. In the past couple of years, as ethanol plants begin to produce high-value, high-protein feeds, they are encountering a no antibiotic ever (NAE) movement working its way up the food chain. Poultry producers such as Tyson and Perdue announced, for example, that all branded chicken products are raised with NAE. “We now see ethanol plants testing and finding antibiotic residuals in coproducts,” he says, noting that antibiotic-free DDGS is 100% achievable when using hops technology. As BetaTec reps work with producers in implementing a custom program, they see plants changing all the time, Lanham says. “Plants are constantly trying to increase yield and production efficiency. They’re trialing several technologies throughout the year—different enzymes, different cleaning agents. We can go into five of the same deDNA DETERMINATION: GenesisGene uses DNA analysis to identify the bacteria types and quantities in sign plants—an ICM 50, for instance—and all small samples. PHOTO: ARCHANGEL INC. five potentially use various treatment plans of our product because each may have a differdeveloped a new proprietary blend of hops extract that maintains ent process, including CIP times or even bacteria load variability.” high antimicrobial activity levels in a broad pH range. “Shortly after we introduced our new product, people stopped traveling and the Delayed Introductions ethanol industry experienced a dip in production due to the panA year ago, when the COVID pandemic first hit, BetaTec indemic,” Lanham says. “We instantly saw a halt in all new product troduced FermaHop Pro to respond to some of those industry trials.” As the industry started to adapt to the new norm, BetaTec changes. The company’s innovation team, based in the UK, had relaunched FermaHop Pro.

+$1'/,1* 6725$*( 352&(66,1*

l11oulb1h1omv|u 1|bomĺ1ol Ň ƕѵƒĺƓƕƕĺƓƕƕƓ Ň ƕƖƏƏ ѵƖ|_ ;ĺ Ň u;;m=b;Ѵ7ķ ƔƔƒƕƒ 26 | ETHANOL PRODUCER MAGAZINE | MAY 2021

Introducing the SYNERXIA® Gem Collection The next advancement in high-performance yeasts to make your plant shine. www.xcelis.com

Similarly, Phibro had completed demonstration trials on a new automation technology, trademarked PhibroMat, when the pandemic put the full rollout in slow gear, Forbes says. For years, antibiotic addition has been done manually, but plants are increasingly keen on automation. The new system vends the powdered product into liquid and injects that into process lines. “There are advantages to the plant, BETATEC BLEND: BetaTec was more than just the hands-free addition,” she explains. rolling out its newest offering in It helps with traceability and inventory management, early 2020, when the pandemic paused plant product trials for plus provides a secured storage space for the antimonths. A proprietary blend of hops acids, FermaHop Pro, offers microbial. high activity at a broad range of Archangel’s roll out of its GenesisGene was impH conditions. PHOTO: BETATEC pacted by the pandemic as well, Ziegler says. “The guts of the box is the same as what they use for COVID-19 testing,” he says, which resulted in his equipment orders being diverted to the pandemic response. On the positive side, the efforts to streamline the DNA testing protocols meant a time-consuming centrifuge step was replaced with a simpler, quicker sample separation method. All three company representatives report that producers know from experience that longer hold times and slower product flows increase the potential for infections. So, while responding to the pandemic with slower run rates, bad infections were rare as producers also increased their CIP cycles and upped their antimicrobial regimes. Author: Susanne Retka Schill Freelance Journalist retkaschill@yahoo.com

ETHANOLPRODUCER.COM | 27

Markets

Renewable Diesel

Rising

A projected spike in renewable diesel production, partnered with rising corn oil prices, presents a market opportunity for ethanol producers. By Susanne Retka Schill

PHOTO: STOCK

Energy Corp., which both have ethanol assets, biodiesel producers Renewable Energy Group and World Energy, and petroleum refiners CVR Energy Inc., HollyFrontier Corp. and Phillips 66. The hydrocarbon produced from renewable diesel is Renewable diesel capacity is poised to ex- nearly identical to petroleum diesel, a big advantage. It hanplode in the next few years. Biodiesel Magazine, dles the same, can be pipelined and has no blending limitaEthanol Producer Magazine’s sister publication, tion. Nearly all renewable diesel, however, is blended with reports that at the end of 2020 there were four conventional diesel in order to qualify for the on-again/ off-again blenders tax credit. The $1 per-gallon blenders tax renewable diesel facilities in operation with a to- credit is a major part of the equation driving biobased diesel tal capacity of 553 MMgy. Six more facilities are either (a term that encompasses both biodiesel and renewable dieexpanding or under construction for an additional 2 billion gal- sel) growth. But it’s certainly not the only factor. lons of capacity—a four-fold increase due to come online within a year or two. On top of that, at least five more projects are pro- Demand Drivers posed. Altogether, the 15 facilities represent 5.5 billion gallons of “I see it as a RIN play for some of the really big guys,” potential new renewable diesel capacity, double the U.S. biodiesel says Bill Pracht, CEO of East Kansas Agri-Energy. With a industry’s current size. 4 MMgy renewable diesel plant colocated with EKAE’s 48 Players in the large-scale oil refinery retrofits and new builds MMgy ethanol plant in Garnett, Kansas, Pracht follows marinclude familiar names like Marathon Petroleum and Valero ket developments closely.

28 | ETHANOL PRODUCER MAGAZINE | MAY 2021

A renewable diesel producer may generate multiple RINs (renewable identification numbers used to demonstrate compliance with the Renewable Fuel Standard). Depending on the feedstock and process used, producers can generate advanced biofuel RINs (D5), biobased diesel RINs (D4) or conventional biofuel RINs (D6). Along with the compliance flexibility that some can utilize, RIN markets add an incentive when prices are high. Pracht points out that renewable diesel generates 1.7 RINs per gallon and the current value per RIN is about $1.20, although not so long ago it was 40 cents. The California Low Carbon Fuel Standard is another major driver for renewable diesel. At recent prices around $200 per ton, California carbon credits for a renewable diesel with a carbon intensity (CI) of 45 are valued at about $1.15 per gallon, Pracht says.

DCO Impact

DCO, with its relatively low CI score, is a favored feedstock for biobased diesel, but not the only one, and not the biggest one. Soybean oil supplies the biggest share of the biodiesel market. An analysis by Tristan Brown, “Biomass-Based Diesel: A Market and Performance Analysis,” published by the Fuels Institute in March 2020, breaks down feedstock shares: “U.S. biodiesel producers utilized 12 different lipid feedstocks in 2018, the largest of which were soybean oil (54% of the total), corn oil (15%), used cooking oil (12%), canola oil (9%), white grease (4%), and tallow (3%).” Renewable diesel utilizes the same feedstocks as biodiesel—fats, oils and greases—but will likely result in a different mix because of the carbon intensities of the different feedstocks (soy oil being the highest) and the differences in pretreatment requirements. The renewable diesel process has fewer issues with the high free fatty acid content of used cooking oils and animal fats. DCO is fa-

U.S. biodiesel producers utilized 12 different lipid feedstocks in 2018 SOURCE: FUELS INSTITUTE

3% 4% 3% white tallow other grease

SYNERXIA SAPPHIRE

®

9% canola oil 12% used cooking oil

15% corn oil

XCELIS® Yeasts

54% soybean oil

vored because it’s easier to pretreat and is cheaper than soybean oil. DCO is favored for biodiesel as well. “Biodiesel producers have benefited as the domestic production volume of corn ethanol has increased from 10,938 million gallons in 2009 to 16,061 million gallons in 2018,” the Fuels Institute paper reports. “DCO’s growing supply and persistent cost advantage, combined with a moderate free fatty acid content (10% to 20%) and ability to produce biodiesel with a low cloud point (27 degrees Fahrenheit), has contributed to corn oil’s growing share of the U.S. biodiesel feedstock mix.” While DCO is seeing its share of the biodiesel feedstock mix grow, the surge in renewable diesel demand is still in the future. “We have been watching the renewable diesel and industrial oil market,” says Jennifer Aurandt-Pilgrim, director of innovation and market development for Marquis Energy. “We know there’s a lot of renewable diesel plants coming online. DCO is a consistent feedstock that is a less expensive industrial oil as compared to soybean oil. In addition, they can use it with very little clean up. The problem is that so many renewable diesel plants will be online within the next three years that

The most powerful combination of yield, robustness and enzyme expression in a yeast. www.xcelis.com

ETHANOLPRODUCER.COM | 29

Markets

OIL MARKET EXPLOSION: East Kansas Agri-Energy’s renewable diesel plant converts 4 MMgy of corn oil using hydrogenation technologies similar to petroleum refineries. Renewable diesel production is expected to balloon in the next few years, presenting a market opportunity for corn oil. PHOTO: EAST KANSAS AGRI-ENERGY

there is concern about the availability and pricing of the feedstock.” That demand is not quite there yet, she points out, yet DCO prices have risen from the mid 30-cent-perpound range to 45 to 50 cents. Marquis’ corn oil marketer, Scott Martin, cites several factors behind the price increase: The palm oil crop, which vies with soybean oil as the world’s largest oil crop, was lower than expected, with stocks near 10-year lows; the demand

for soybean exports to China are up, driving up soy markets and stimulating price increases for all oils and crops; and pandemic-reduced demand affected the supply of used cooking oil alongside lower DCO production as a result of lower ethanol production. But even as the pandemic impacts lessen and crop production recovers, Aurandt-Pilgrim doesn’t see the demand for DCO going away. She cites a market analysis projecting a feedstock

30 | ETHANOL PRODUCER MAGAZINE | MAY 2021

supply of 22 billion pounds by 2025 compared to projected demand of 45 billion pounds. “If you do the math of the plants that use DCO as a feedstock coming online and the market production of DCO, they show the biggest risk for any renewable diesel plant that is using oil is the feedstock, because there’s going to be such a demand and higher cost,” she says. Pracht is seeing the impact of the DCO price increase. While EKAE produces a good portion of the DCO used in its 4 MMgy plant at the 48 MMgy ethanol plant, it also buys oil. “We’re at 44 cents per pound today, where in August we were paying 22 cents,” he says. “It takes a little over 7 pounds of corn oil to make a gallon of renewable diesel. At 20 cents a pound higher, that’s basically $1.50 a gallon more for just the corn oil.” Fortunately, he adds, the increased DCO price is being offset by higher diesel prices, alongside strong RIN prices and continued demand in the California market.

Feedstock Risk

Feedstock procurement and logistics is going to be the biggest challenge for the big producers, Pracht says. He compares it to destination ethanol plants that were located far from the Corn Belt with the idea that it’s cheaper to rail in corn to supply nearby markets for ethanol or distillers grains. “We’ve proven destination ethanol plants really didn’t work. It will be interesting

XCELIS® Yeasts

SYNERXIA RUBY

®

RENEWABLE REPLACEMENT: Hydrogen replaces oxygen in the oil molecules creating the diesel hydrocarbon at East Kansas Agri-Energy’s renewable diesel plant. PHOTO: EAST KANSAS AGRI-ENERGY

to see if these destination renewable diesel plants will work.” “While smaller facilities will be penalized on economies of scale, they will benefit enormously from economies of aggregation,” says Michele Rubino, a consultant working with Saola Energy LLC, the technology provider for EKAE’s small-scale facility. Used cooking oil, DCO and animal fats are all widely distributed feedstocks that are difficult and expensive to aggregate, he says. “When it comes to petrochemical resources, the more you want, the less you pay. When it comes to biobased resources, the more you want, the more you pay.” Saola has partnered with Italy-headquartered NextChem to distribute their technology globally, looking at other regional feedstocks such as palm oil mill effluent and the tall oil waste from the pulp and paper industry. The value proposition, Rubino says, is to locate the production facility next to the feedstock, thus securing supply and capturing more of the value now being added by the middleman. “They’re leaving a lot of money on the table,” he says. “If they are selling corn oil at 40 cents a pound, the inherent value is more like 60 cents if they captured it themselves.”

The Saola model recommends 10 MMgy as an ideal size, which will require more feedstock than most individual ethanol plants produce. Thus, aggregation will be required even for a small-scale facility, as well as the refinery-scale renewable diesel plants in development. Aggregation of DCO already is the norm in the ethanol industry, however, because the volumes produced at individual plants are generally too small for unit train economics. In addition, renewable diesel buyers want to buy from bigger players looking for consistency, Aurandt-Pilgrim says, “and consistency allows for optimized pretreatment of the oil to protect their catalyst.” The spring’s strong oil market and news of a big new demand for renewable diesel is having one immediate impact in the ethanol industry, Aurandt-Pilgrim adds. “I think people are paying a little more attention to their oil extraction. It used to be they’d track production and say, ‘Oh we’re down.’ Now, it has more impact on return so the sentiment is, ‘We’re down, let’s figure out why.’”

The new standard in high yield yeast driving plants to the peak of performance. www.xcelis.com

Author: Susanne Retka Schill Freelance Journalist retkaschill@yahoo.com

ETHANOLPRODUCER.COM | 31

*URZ <RXU 1HWZRUN (QKDQFH <RXU .QRZOHGJH

&UHDWH 2QH RQ 2QH

0HHWLQJV 5HDFK

3URGXFHUV 3URGXFHUV 5HFHLYH )5(( 5HJLVWUDWLRQV 5HJLVWHU 7RGD\

)XHO(WKDQRO:RUNVKRS FRP

(9(176 (;3(&7,1*

7UDFNV 7HFKQLFDO 3DQHOV 1HDUO\ 6SHDNHUV 'RQoW 0LVV 2XW 2Q

)(: *ROI 7RXUQDPHQW 7RXUQDPHQW &OXE RI ,RZD :LQ 3OD\LQJ %ODFNRXW %LQJR 1RPLQDWH <RXU 3LFN )RU $ZDUG RI ([FHOOHQFH +LJK 2FWDQH $ZDUG 'HDGOLQH -XQH WK

32 | ETHANOL PRODUCER MAGAZINE | MAY 2021

:RUOG¬V /DUJHVW (WKDQRO (YHQW WK $118$/

-XO\

ÆÇÕ ÏÑËÐÇÕ

ËÑÙÃ

6DYH 5HJLVWHU 7RGD\

'LVFRXQW (QGV )XOO 5HJLVWUDWLRQ 2QO\

1RZ LQ LWV WK \HDU WKH )(: SURYLGHV WKH JOREDO HWKDQRO LQGXVWU\ ZLWK FXWWLQJ HGJH FRQWHQW DQG XQSDUDOOHOHG QHWZRUNLQJ RSSRUWXQLWLHV LQ D G\QDPLF EXVLQHVV WR EXVLQHVV HQYLURQPHQW 7KH )(: LV WKH ODUJHVW ORQJHVW UXQQLQJ HWKDQRO FRQIHUHQFH LQ WKH ZRUOGtDQG WKH RQO\ HYHQW SRZHUHG E\ (WKDQRO 3URGXFHU 0DJD]LQH )URP LWV LQFHSWLRQ WKH PLVVLRQ RI WKH HYHQW KDV UHPDLQHG FRQVWDQW 7KH )(: GHOLYHUV WLPHO\ SUHVHQWDWLRQV ZLWK D VWURQJ IRFXV RQ FRPPHUFLDO VFDOH HWKDQRO SURGXFWLRQ s IURP TXDOLW\ FRQWURO DQG \LHOG PD[LPL]DWLRQ WR UHJXODWRU\ FRPSOLDQFH DQG ƮVFDO PDQDJHPHQW 7KH )(: LV DOVR WKH HWKDQRO LQGXVWU\oV SUHPLHU IRUXP IRU XQYHLOLQJ QHZ WHFKQRORJLHV DQG UHVHDUFK ƮQGLQJV 7KH SURJUDP H[WHQVLYHO\ FRYHUV FHOOXORVLF HWKDQRO ZKLOH UHPDLQLQJ FRPPLWWHG WR RSWLPL]LQJ H[LVWLQJ JUDLQ HWKDQRO RSHUDWLRQV

&R ORFDWHG (YHQWV

-XO\

3URGXFHG %\

'(6 02,1(6 ,2:$

% L R G L H V H O 6 X P P L W FR P

_ VHUYLFH#EELLQWHUQDWLRQDO FRP _

)(: #HWKDQROPDJD]LQH

1DWLRQDO%LRPDVV6XPPLW FRP

Spotlight BY MATT THOMPSON

NLB: Celebrating 50 Years of Innovation, Safety Solutions This year marks the 50th year of business for NLB Corp., the largest manufacturer of high-pressure water equipment and accessories. Rick Sloan, sales manager at NLB, says that during that time—and particularly in the last 10 years—the industry has evolved tremendously, with a focus on automated systems. “The biggest drive behind the move towards automated, or as we term it, hands-free equipment, is really safety,” Sloan says. “What we’re trying to do is get that high-pressure hose out of the operators’ hands.” He adds that many of the largest industrial cleaning contractors in the country have a goal of being fully automated. Many of them, he adds, are at 90% or 95% automation. Those changes have resulted in a safer environment for cleaning, but also bring some advantages for asset owners, including ethanol plants, Sloan says. Manual cleaning might not clean evaporators as well as automatic cleaning does, according to Sloan. Because the operator doesn’t want to pull the cleaning lance out of the tube while it’s under pressure, the end of the tube may not get cleaned as thoroughly, as the operator will turn off the water as the lance reaches the end of the tube. That’s not the case with automated cleaning, Sloan says. “If my tube is cleaner, my heat transfer is going to be better,” Sloan says, which may allow ethanol plants to go longer in between cleanings or see energy cost savings. “Our focus of the last few months has been

NLB 225 Series Diesel Unit PHOTO: NLB CORP.

trying to garner that information so that we can present it to the asset owners,” he adds. Ethanol plants can benefit from automated systems in other ways, too. The systems collect data on the plant itself and the cleaning process—how many tubes were cleaned, what tubes were blocked, how much water was used, etc.—which can benefit both the cleaning contractor and the plant, Sloan says. “I think having that data is important to both the asset owner and the contractor.” NLB’s partnerships with Peinmann, which supplies automatic feeders for cleaning, and with Terydon, which offers a means of controlling those automatic feeders through a tablet, as well as a feature called smart indexing, which allows the system to map the tubes, allows NLB to offer high-tech cleaning solutions to the ethanol industry and industrial cleaning contractors. “We are known for having the highest-quality, longest-lasting equipment on the market,” and the innovation that brings to the industry, Sloan says.

NLB WATER JETTING SYSTEMS.

BEST, MOST CONSISTENT

S

uperior cleaning of evaporation towers and processing systems makes a difference – namely, better heat transfer and longer mean time between cleanings. NLB high pressure water jetting systems feature legendary long-running pumps, coupled with industry-leading Peinemann cleaning systems and wireless control technology from Terydon. The result is high-quality cleaning of ethanol processing componentry and safer cleaning operation without anyone needed inside the dome. NLB cleaning systems are also excellent for removing scale build up in process lines and boiler washdowns, all with the power of clean water. Sales, service and rentals available at any of our eight North American branch locations.

34 | ETHANOL PRODUCER MAGAZINE | MAY 2021

NLBCORP.COM

© Copyright 2021 NLB Corp. | PSaleBund_21_001_v4

CLEANING SYSTEM IN THE INDUSTRY.

Ethanol Producer Magazine's Marketplace

&OHDQLQJ WKH ZRUOG RQH GURS DW D WLPH .XEFR 6HUYLFHV FRQWLQXHV WR EH WKH OHDGHU LQ WKH FHQWULIXJH LQGXVWU\ E\ SURYLGLQJ ZRUOG FODVV VHUYLFH HTXLSPHQW DQG NQRZOHGJH WR RXU FXVWRPHUV &RQWDFW RXU &HQWULIXJH 6SHFLDOLVWV WR KDYH D )5(( TXRWH SURYLGHG WR \RX WRGD\ -' 0XHOOHU MPXHOOHU#NXEFR FRP 5XVW\ 2 %ULHQ UREULHQ#NXEFR FRP &DOO

ZZZ .XEFR FRP %5((1 52$' +286721 7;

BUTTERWORTH CLEANS BETTER w w w. b u t t e r wo r th .co m i nfo @b u t t e r wor th .co m

3URX 0DQXID GO\ FWX ,Q WKH 8 UHG 6 $

1HZ (TXLSPHQW 5HSDLU 5HEXLOG 6HUYLFH 5HQWDO (TXLSPHQW 7UDLQLQJ DQG 0RUH

The Specialist in Biofuels Plant Appraisals • Valuation for financing • Establishing an asking price • Partial interest valuation

Over 50 Years of Experience Call us for a free, no-obligation consultation today.

800-279-4757 | 701-793-2360 www.natwickappraisal.com natwick@integra.net