INDEX/EVENTS

EDITOR'S NOTE

It’s All About Carbon Reduction Now

By Tom BryanGRASSROOTS

Ethanol: A Pathway to Reward Climate Smart Agriculture

By Brian Jennings

By Brian Jennings

DRIVE

Driving Market Expansion for Biofuels

By Emily Skor

By Emily Skor

GLOBAL SCENE

COP27: Where Urgency, Realism and Ethanol Can Meet

By Andrea Kent

BUSINESS BRIEFS

MARKETPLACE

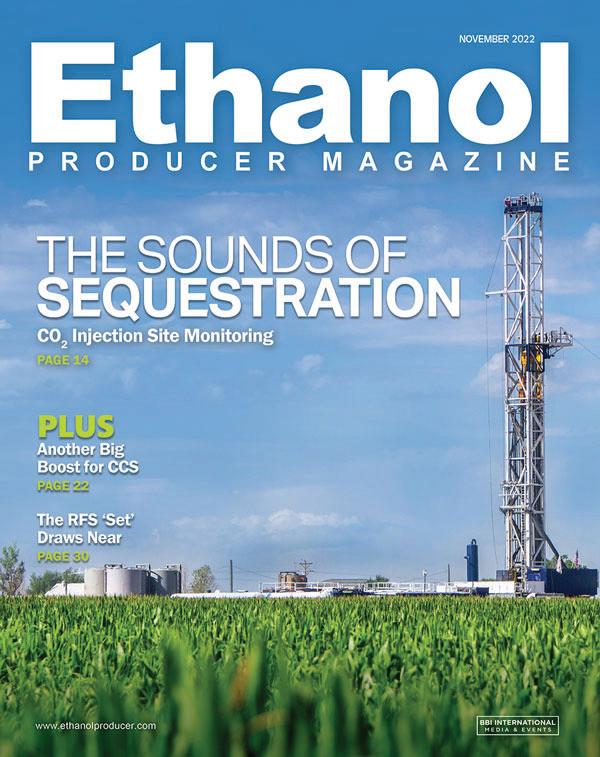

The monitoring technology behind ethanol plant CCS

By Katie Schroeder

By Katie Schroeder

A Big Lift for Carbon Capture New legislation makes projects more attractive

By Katie Schroeder

By Katie Schroeder

More Specialized HPLC reference materials have become customized

By Tom Bryan

By Tom Bryan

Setting Up the RFS After 2022 Industry awaits next era of RFS administration

By Luke GeiverMore Ethanol Needed North of the Border Top U.S. export market may get even better

By Luke GeiverHow seismic technology safeguards sequestration

By Katie Schroeder

By Katie Schroeder

Before and while carbon capture and sequestration (CCS) injection takes place, underground conditions are analyzed and monitored to make sure the geology required for safe, permanent CO2 storage exists and remains stable over time.

Maybe once a decade, new technologies, new markets—or both—come along that push ethanol production to a higher level. Corn oil extraction and high-protein feed are two good examples, the former having already made the industry more financially stable and the latter on the same trajectory. But it may be fair to say neither compares to the unprecedented opportunity of carbon capture and sequestration (CCS), for plants that can do it.

For most producers, the CCS opportunity is only possible through CO2 aggregation via pipelines, which, in turn, can’t be built unless all landowners along their proposed paths comply with easement requests. The irony about landowners opposing CCS pipelines is that many of them are farmers that benefit from corn ethanol production. And no matter what anyone says, the principal driver behind biofuels, today, is carbon reduction. So, if 40 percent of the U.S. corn crop is being used for ethanol production, American corn farmers are already among the most significant players in climate change mitigation in the world. Plus, with incentives for climate-smart farming practices finally coming to fruition, allowing an underground CO2 pipeline to route through your farmland seems like an easy way to more deeply engage in low-carbon agriculture. It’s tough to understand how anyone sees it differently, but some do.

In the meantime, ethanol producers with the right geologies under their plant, or nearby, are ready to capitalize on their good fortune. They will be the earliest beneficiaries of the enhanced CCC incentives in the Inflation Reduction Act, which we explain in “A Big Lift for Carbon Capture,” on page 22.

Just before that story, you’ll find another piece on CCS that is most applicable to those studying carbon capture— or already doing it, like North Dakota’s Red Trail Energy LLC, which started injecting CO2 into the ground this past June. Red Trail is doing CCS independently, but not alone. The plant is leaning on numerous partners for things like geologic analysis and well-site engineering to post-injection seismic monitoring and CO2 plume tracking. “Sequestration Sensors,” on page 14, explains how plants like Red Trail will watch, study and even “listen” to their injection reservoirs.

From carbon capture we jump into operations with “Making Standards More Specialized,” on page 26, which profiles a leading supplier of ethanol plant lab supplies that, together with a top manufacturer, has been improving HPLC reference materials and mobile phase products through customization. Tailored lab products are a good thing, and here to stay.

On page 30, you’ll find a timely article about the forthcoming U.S. Renewable Fuel Standard “set,” which will govern the EPA’s administration of the RFS post-2022. As we report in “The Road Ahead for the RFS,” the landmark policy is not expiring, but simply replacing its statutorily defined annual volume requirements with a new set of determining factors that will be used—with significant discretion by the EPA—to make future decisions about the program.

Canada has its own biofuels program, the Clean Fuels Regulation, which supports domestic biofuel use through both in-country production and imported U.S. ethanol. As we explain in our anchor story, “More Ethanol Needed North of the Border,” on page 34, the recently updated CFR is expected to increase ethanol use in Canada through carbon intensity caps on gasoline starting in 2023. Already the top taker of U.S. ethanol, Canada’s more ambitious CFR should, at the very least, keep U.S. exports up north at their current levels for some time.

President & Editor

Tom Bryan | tbryan@bbiinternational.com

Online News Editor

Erin Voegele | evoegele@bbiinternational.com

Staff Writer

Katie Schroeder

katie.schroeder@bbiinternational.com

Vice President of Production & Design

Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer

Raquel Boushee rboushee@bbiinternational.com

CEO

Joe Bryan | jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales John Nelson | jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader Chip Shereck | cshereck@bbiinternational.com

Account Manager

Bob Brown | bbrown@bbiinternational.com

Circulation Manager

Jessica Tiller | jtiller@bbiinternational.com

Marketing & Advertising Manager

Marla DeFoe | mdefoe@bbiinternational.com

Marketing & Social Media Coordinator Dayna Bastian dbastian@bbiinternational.com

Ringneck Energy Walter Wendland

Little Sioux Corn Processors Steve Roe

Commonwealth Agri-Energy Mick Henderson

Aemetis Advanced Fuels Eric McAfee

Western Plains Energy Derek Peine

Front Range Energy Dan Sanders Jr.

2023 Int'l Fuel Ethanol Workshop & Expo 19

CPM

CTE Global, Inc.

D3MAX, LLC

Enertech Solutions, Inc.

Fagen, Inc.

Fluid Quip Mechanical

Fluid Quip Technologies, LLC

Growth Energy

ICM, Inc.

IFF, Inc.

Lallemand Biofuels & Distilled Spirits

MicroSeismic, Inc.

NLB Corp.

Phibro Ethanol

Syngenta: Enogen

Rail Group

Victory Energy Operations, LLC

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscrip tions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. You can also fax a subscription form to 701-746-5367. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-746-8385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space.

Iowa Events Center, Des Moines, IA (866)746-8385 | NationalCarbonCaptureConference.com

Produced by Carbon Capture Magazine and BBI International, the National Carbon Capture Conference & Expo is a two-day event designed specifically for companies and organizations advancing technologies and policy that support the removal of carbon diox ide (CO2) from all sources, including fossil fuel-based power plants, ethanol production plants and industrial processes, as well as di rectly from the atmosphere. The program will focus on research, data, trends and information on all aspects of CCUS with the goal to help companies build knowledge, connect with others, and better understand the market and carbon utilization.

Cobb Galleria Centre, Atlanta, GA (866) 746-8385 | BiomassConference.com

Now in its 16th year, the International Biomass Conference & Expo is expected to bring together more than 800 attendees, 140 exhibitors and 65 speakers from more than 21 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming—powered by Biomass Magazine—that maintains a strong focus on commercial-scale biomass production, new technology, and near-term research and development.

CHI Health Center, Omaha, NE (866) 746-8385 | FuelEthanolWorkshop.com

From its inception, the mission of this event has remained constant: The FEW delivers timely presentations with a strong focus on commercial-scale ethanol production—from quality control and yield maximization to regulatory compliance and fiscal management. The FEW is the ethanol industry’s premier forum for unveiling new technologies and research findings. The program is primarily focused on optimizing grain ethanol operations while also covering cellulosic and advanced ethanol technologies.

CHI Health Center, Omaha, NE (866) 746-8385 | BiodieselSummit.com

Please check our website for upcoming webinars www.ethanolproducer.com/pages/webinar

The Biodiesel Summit: Sustainable Aviation Fuel & Renewable Diesel is a forum designed for biodiesel and renewable diesel producers to learn about cutting-edge process technologies, new techniques and equipment to optimize existing production, and efficiencies to save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers and producers to advance discussion and foster an environment of collaboration and networking through engaging presentations, fruitful discussion and compelling exhibitions with one purpose, to further the biomassbased diesel sector beyond its current limitations.

A few years ago, ACE began alerting our industry that it would be a matter of if, not when, Congress would enact legislation designed to address climate change and reduce greenhouse gas (GHG) emissions.

Knowing climate legislation could impose costs and regulatory burdens on ethanol producers and farmers, ACE also began strategically and proactively promoting corn ethanol as part of the climate solution. Whether working to improve and update lifecycle models such as GREET, which are used to determine the carbon intensity of fuels like ethanol, or highlighting how ethanol is the only low-carbon fuel able to achieve both net-zero and net-negative GHG emissions, ACE has methodically been laying the groundwork for ethanol producers and farmers to benefit from new clean fuel markets.

Our latest mission involves a phrase that is all the rage these days; “climate-smart agriculture,” which is just another way to describe farming practices that help sequester carbon in the soil or reduce GHG emissions. Examples include a farmer switching from conventional tillage to reduced tillage, adopting 4R nutrient management or planting cover crops.

No matter what they are called, farmers obviously incur a cost, and sometimes an initial yield hit, to make these changes in their operations, so they must be able to get a return on their investment in order to monetize the practices in a marketplace.

At the moment, farmers are getting inundated with offers from private companies that want to take credit for things like reduced tillage in voluntary carbon markets. The trouble is, the meager payments offered by these companies do not cover a farmer’s cost to adopt the practices, and they pale in comparison to what farmers could potentially earn through a clean fuel or low-carbon fuel market.

ACE believes farmers should have the opportunity to monetize climate-smart practices by selling their corn to an ethanol plant which has a pathway into a clean fuel market at the state or federal level, where carbon credits fetch significantly greater value than in voluntary programs, generating more than enough revenue to justify making changes to their farming practices.

California’s Low Carbon Fuel Standard represents the largest existing clean fuel market, but, California has not yet allowed carbon credits for ethanol based on climate-smart farming practices. We are determined to change that. ACE is currently engaging California market regulators, as well as those developing legislative proposals for new clean fuel markets in Midwest states such as Nebraska and Minnesota, to enable ethanol producers and farmers to generate carbon credits based on things like 4R nutrient management and reduced tillage.

In terms of value, we did an analysis to show what the maximum potential economic benefit would be for ACE member plants and the farmers supplying corn to them if the full suite of climate smart practices were monetized in a clean fuel market, and the number is just shy of $1 billion per year.

While we continue working to establish new clean fuel markets at the state and eventually the federal level, Congress and President Biden recently took historic action on climate change through the so-called Inflation Reduction Act. This legislation will provide half a billion dollars for E15 and E85 infrastructure, invest $18 billion to support climate-smart agriculture practices and help us measure and verify the GHG benefits of these practices, reward fuels like ethanol with a new clean fuel production tax credit based on carbon intensity as measured by the GREET model, establish a new sustainable aviation fuel tax credit based on carbon intensity and give a big boost to projects which capture and sequester carbon. This bill does not contain everything on our wish list, but it provides incredible incentives for farmers and ethanol producers looking to capitalize on carbon intensity.

Had ACE been standing on the sidelines these last few years, not engaging policymakers about how corn ethanol is part of the climate solution, others would have filled the void to position us as part of the climate problem. I am proud to work for members who chose to engage. We made the right decision. Our proactive approach is beginning to pay big dividends, to create new opportunities for farmers and ethanol producers.

Emily Skor

Emily Skor

The summer driving season may be over, but market development opportunities for higher bioethanol blends are growing faster than ever. In just the last few months, Growth Energy celebrated major new investments in higher biofuel blends, hosted an exciting retailer retreat, and even welcomed a new vice president of market development to the team. With this summer’s spike in fuel costs and the conflict in Ukraine, regulators are recognizing what we already knew—market expansion of biofuels has the power to drive down prices at the pump, provide greater energy independence and help us reach our climate ambitions.

To realize that vision, U.S. Department of Agriculture Secretary Tom Vilsack announced $100 million in new infrastructure grants to support sales of higher biofuel blends through the Higher Blends Infrastructure Incentive Program. The $100 million will be available in competitive grants for projects aimed at expansion of sales and use of renewable fuels. To help retailers navigate the program, the Growth Energy Market Development team hosted a webinar in partnership with USDA and CSP ahead of the program announcement.

To officially announce the new HBIIP investment, Secretary Vilsack and U.S. Sen. Tammy Duckworth visited a Casey's in LeRoy, Illinois, to highlight the economic and environmental benefits of higher blends of biofuels. It was a welcome announcement for retailers across the country who will be able to expand options at the pump and offer consumers a cleaner, more affordable fuel. Secretary Vilsack also reaffirmed the USDA’s ongoing commitment to ensuring a new wave of growth for higher biofuel blends, and our team at Growth Energy is already working hand in hand with our retail partners to help them take full advantage of this opportunity.

As part of that effort, we hosted a retailer retreat immediately after the announcement. Attendees of the retreat represented more than 7,000 retail sites and 13 billion gallons of fuel annually. Together, the Growth Energy team and retail leaders discussed the current retail environment, E15 market and supply expansion, and the USDA’s new grants.

But leaders at the USDA are not the only ones supporting biofuels infrastructure. Earlier this summer, President Biden signed into law the Inflation Reduction Act, an initiative that includes key provisions to expand the use of low-carbon biofuels, including investments in infrastructure. This law will help maximize our industry’s contributions to a cleaner future and jump-start climate progress, providing $500 million in funding for additional biofuels infrastructure through 2031.

Our team at Growth Energy could not be more optimistic about the recent progress in market development—not only on the federal side, but also within our own team. Just last month, we announced that retail leader Jake Comer has joined us as vice president of market development. Comer will lead the domestic market expansion of higher ethanol-blended fuel and bolster our market development efforts with cutting-edge consumer engagement initiatives. He brings more than a decade of retail fuel experience, having served in leadership positions on the fuel teams at Kum & Go, Murphy USA and, most recently, at Casey’s where he served as director of retail fuels.

This progress is a welcome step forward for the biofuel industry, but we won’t stop there. We will continue to remind lawmakers of the many ways this industry is doing its part to ensure we meet this administration’s climate goals and push them to support pro-biofuels legislation. In the months ahead, we will also work with our retail partners to make sure our support among voters translates into concrete action on a permanent E15 fix, so drivers can access lower-cost E15 year-round, nationwide in the summers to come. With so many new infrastructure investments now underway, those opportunities have the potential to drive more growth than ever before.

Board Member and Past President

Renewable Industries Canada

Vice President of Industry and Government Affairs Greenfield Global Inc. 833.476.3835 andrea.kent@greenfield.com

Balancing between anxiety and optimism is especially difficult in climate policy, and a theme that will likely define November’s COP27 meeting. There is a compelling stage for this UN Climate Change Conference (COP27) in Sharm El-Sheikh, Egypt; a plot which (to borrow from Dickens) is the best and worst of times.

The good news is that recent landmark climate policies in North America are ushering in a new era. Canada finalized its national Clean Fuel Regulations, and the U.S. Inflation Reduction Act was passed in September. It's a level of climate ambition not seen since the Paris Climate Accord was signed. The bad news is that this comes when the world is facing natural disasters, ongoing geopolitical conflict, market uncertainty and record-setting inflation following the global pandemic. It’s a daunting duality, and navigating a way forward requires understanding speed and scale. Two things that biofuels producers know well.

Making Fuel Cleaner, Now

Time is of the essence. On this, the world’s foremost scientists and economists agree. Canada, the United States and a growing list of countries are committing to net-zero greenhouse gas (GHG) emissions by 2050. Moreover, to limit average global temperature increase to 1.5ºC we need to quickly cut GHG emissions 45 percent from 2010 levels by 2030. Hitting these targets is vital as greenhouse gases do not disappear quickly, and the longer we wait, the worse climate change becomes.

Fortunately, ethanol gives the world an immediate solution. Ethanol is unique: it works in existing vehicles, uses current infrastructure and is affordable. This combination is rare today and crucial to reaching a 45 percent reduction by 2030. Importantly, it is also a central pillar of the Canadian CFR.

Canada’s CFR requires GHG reductions on a lifecycle basis, accounting for emissions from production to end use, and establishes a credit market. The Analysis from Environment and Climate Change Canada expects an average of 15 percent ethanol blends in Canada by 2030.

Making Tomorrow’s Clean Fuels for Land, Sea and Air Building a net zero world by 2050 means leveraging everything we can today. For example, North America’s ethanol has a reliable base of production that has been doing the heavy lifting on environmental progress for decades, while continuing to adopt new technologies efficiently and for the long term. This proven capacity creates a natural synergy with the new U.S. IRA.

The IRA provides a bounty of infrastructure investments and tax credits. From a regulatory perspective, it is a model for widescale decarbonization without a federal carbon price. For the biofuels industry, this will unleash opportunities in carbon sequestration and utilization and stimulate further production of lowcarbon fuels, including both sustainable aviation fuel and for the growing low carbon marine fuels sector.

The dualities of climate are hard. But rather than exist as opposites, they can work together. At COP27 and beyond, regulators should reach for the possible while leaning into the practical. This requires balancing policies that limit the worst emissions with programs that reward the best innovations. After all, the lowcarbon fuel producers of today can also lead the way in making the net-zero fuels of tomorrow, and North America’s biofuels industry is leading the charge.

Our full service team of experts have 20 years of ethanol plant maintenance reliability and uptime history 24/7 support and ready access to a full inventory and all Fluid Quip equipment parts, ensures that you maintain your plant’s uptime status.

Green Plains Inc. recently announced changes to its executive leadership team. Patrich Simpkins has transitioned from chief financial officer to chief transformation officer; Jim Stark has transitioned from executive vice president to chief financial officer of both Green Plains and Green Plains Partners LP; Jamie Herbert joins the company as chief human resources officer; and Grant Kadavy joins Green Plains as executive vice president of commercial operations.

Simpkins will execute on the company’s roadmap to accomplish “the most comprehensive organizational transformation in the history of Green Plains Inc.” Stark will lead all aspects of finance and accounting, including IT and investor relations. Herbert will lead all human resource activities and Kadavy will lead all commercial activities, including sales, trading and distribution, across all platforms.

Parts

•

Aurora Cooperative Elevator Company and KAAPA Ethanol Holdings LLC have announced a joint venture involving Aurora Cooperative’s ethanol and grain facilities located west of Aurora, Nebraska. The joint venture plans to make significant investments with the goal of increasing production and efficiency at the ethanol facilities, so that both plants remain top destinations for area corn.

Aurora Cooperative Board Chair Bill Schuster said, “We are looking forward to a partnership with KAAPA Ethanol at our ethanol and grain facilities. KAAPA has a track record of operational expertise and strong financial performance. We believe this partnership will strengthen the future of the ethanol plant for our farmer-owners.”

The Minnesota Bio-Fuels Associa tion has appointed Brian Werner as its new executive director.

Prior to joining MN Bio-Fuels, Wer ner was the deputy legislative director and senior legislative assistant for renewable energy and agriculture for Minnesota Sen. Amy Klobuchar. During that time, he supported Klobuchar’s work to protect mandatory funding for Farm Bill energy title programs, maintain stability in the implementation of the Renewable Fuel

Standard, provide economic relief for biofuel producers negatively affected by the coronavirus pandemic and secure fed eral investment in biofuel infrastructure.

“We are excited Brian has joined our team. With his leadership, we will con tinue to advance renewable ethanol and renewable energy,” said Brian Kletscher, president of MN Bio-Fuels’ board of di rectors.

The Renewable Fuels Association elected officers and its board of directors at its annual membership meeting in Sep tember. Erik Huschitt, CEO of Badger State Ethanol, was elected chairman of the organization, replacing Jeanne McCa herty of Guardian Energy Management.

“I am humbled and honored to be come chairman of the Renewable Fuels Association, which continues to lead our ethanol industry with an amazing [CEO], a fabulous staff, and members who are

tremendous Americans representing their plants, businesses and communities,” Huschitt said.

RFA’s board also elected Jeff Oest mann, CEO of Granite Falls Energy, as vice chairman. Retaining their current positions in board leadership for 2023 are Rick Schwarck, president of Absolute En ergy, as board secretary, and Mike Jerke, CEO of Southwest Iowa Renewable En ergy, as treasurer.

“Renewable fuels offer climate benefits, rural economic opportunity, and a key source of domestic energy.”

Learn more at GrowthEnergy.org/GEBS

— EPA Administrator Michael Regan Growth Energy Biofuels Summit, Sept. 13, 2022

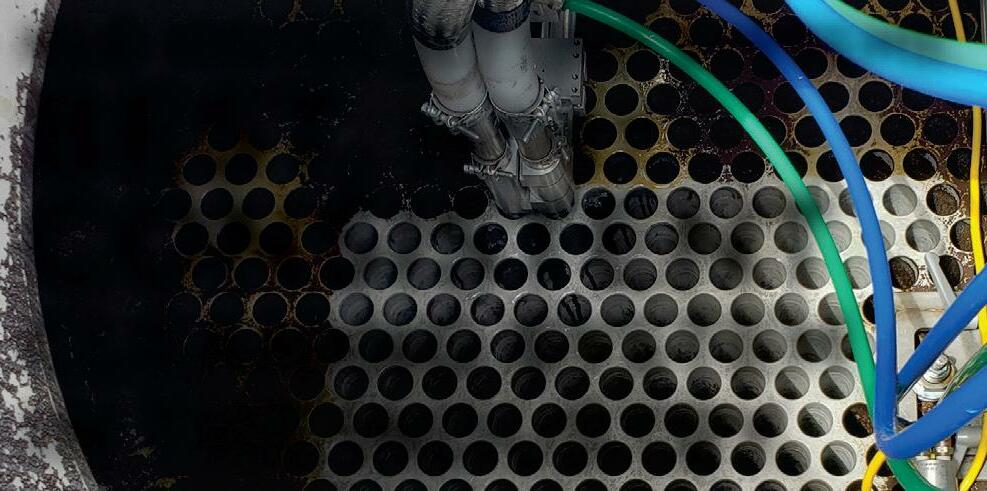

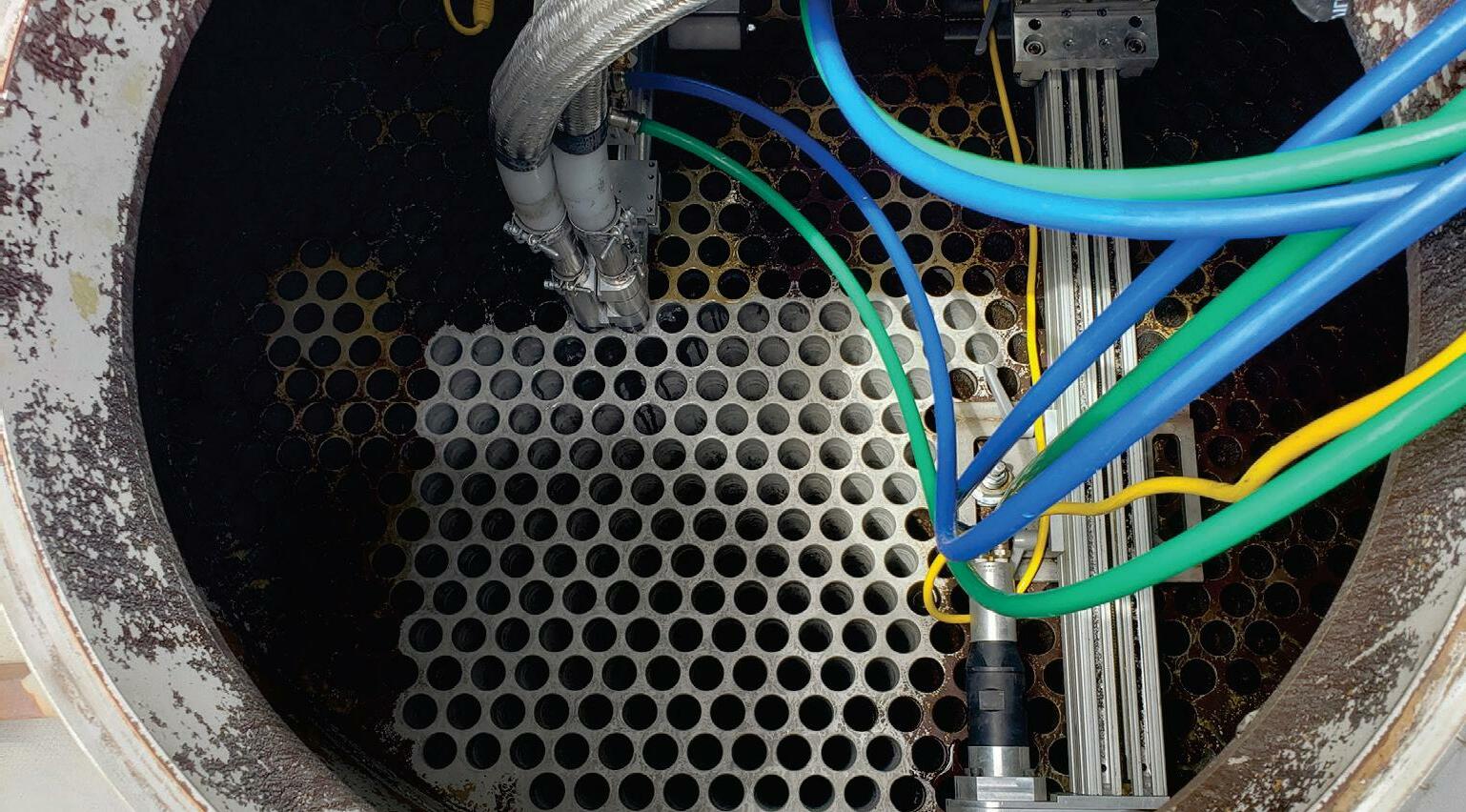

With CCS expanding rapidly, there is an accompanying need for technology to monitor the CO2 underground. A North Dakota ethanol producer, environmental researcher and a geophysicist explain how it’s done.

By Katie Schroeder

By Katie Schroeder

As the number of new and proposed carbon capture and sequestration (CCS) projects in the United States surges—with about 75 ethanol plants alone now pursuing it—new services and technologies are being intro duced to producers in the space. With test wells and injection sites being built, and several projects in the permitting phase, under construction or already functioning, there is an immediate need for well-site moni toring technology that observes the CO2 to make sure it stays where it is sequestered.

The state of California, a major market for ethanol producers, as well as individual states and the U.S. Environmental Protection Agency, have rules in place requiring entities sequestering CO2 to verify that it is staying underground. Red Trail Energy LLC in Rich ardton, North Dakota, started injecting CO2 on June 16. Explaining the technology Red Trail uses and the regulations surrounding CO2 injection, Kent Glasser, plant manager, and Dave Burns, an environmental manager with the state who worked on the project, tell Ethanol Producer Magazine the company has been injecting roughly 450 tons of CO2 every day since mid-July.

The passage of the Inflation Reduction Act has made CCS look more attractive from an economic standpoint, boosting 45Q tax credits from $50 per ton to $85 per ton. The legislation also gives producers an option to directly sell their tax credits to interested par ties on a one-time basis (a buyer cannot resell credits).

But even prior to the passage of the IRA, Red Trail already saw value in CCS due to the 45Q tax credit and opportunities in low carbon intensity ethanol in California, Glasser says. Red Trail also recognized its unique op portunity given that the plant is located on top of the Broom Creek formation. “The Broom Creek Formation is kind of like a honey hole for carbon sequestration,” Burns adds.

John Hamling, assistant vice president of strategic partnerships with the Energy and Environmental Research Center, has been involved with the Red Trail project for the past five years. EERC is also the leader of the Plains CO2 Reduction Partnership, which focuses on “advancing commercial CCS throughout a 10-state, four Canadian province region.” EERC has played a major role in assisting Red Trail in navigating the process leading up to injection. “We worked with Red Trail Energy as the first CCS project that’s permitted and operational under a state primacy program,” Hamling says. He explains that since Red Trail was the first CCS project to be built and permitted under North Da kota’s state primacy—meaning that the state issues permits for Class VI wells and not the EPA—EERC worked closely with them on site development, including many aspects of permitting and incentive program compli ance, while offering insight on the operation from a geological perspective.

In 2021, the U.S. Department of Energy released a funding opportunity announce ment looking for a company that would de velop a turnkey service business that utilizes passive seismic to monitor CO2 sequestration. MicroSeismic was awarded the grant in Feb ruary 2022. Peter Duncan, geophysicist and CEO of MicroSeismic, explains why moni toring technology is important and the speci fications the DOE requires.

Long before injection begins, there are several preliminary steps that need to be taken, including site screening, site charac terization and permit development alongside ensuring compliance with incentive programs such as 45Q tax credits and the California Air Resources Board’s LCFS markets, according to Hamling.

Site screening involves determining if the geology near the plant is conducive to CO2 storage. Hamling explains that Red Trail’s site used pre-existing work from the PCOR Part nership and state geologic studies done for oil and gas developments. He recommends that

parties interested in sequestration utilize this type of data from public resources. The geol ogy must have a rock formation which has space between the grains for containing CO2, that also being deep enough to keep it in a dense phase so that it behaves like a liquid allowing for more storage. There also needs to be “adequate confinement zones” above and below the permeable formation to con tain the CO2, and they check for any potential leakage pathways that would allow the CO2 to get out. Site characterization requires collect ing site specific data, Hamling says. Producers will drill appraisal wells, do well testing, collect measurements of the subsurface and more. All of the information gathered is necessary for permitting and ensuring compliance with incentive programs.

“It’s a multi-stage process, generally— the geological storage component takes sev eral years to step through each stage of the process,” Hamling says. “And because Red Trail Energy was located in an area where we had already done preliminary work, we were able to work with them to get the first CO2 storage project permitted under state primacy.

Ethanol producers have an advantage when it comes to carbon capture because the CO2 is 99 percent pure coming off fermen tation, Glasser explains. However, the CO2 needs processing prior to injection to further purify, cool and condense it into liquid form so it can be pumped into the ground. The two key steps to liquifying CO2 are compressing it to a high pressure and making it very cold. “It just depends on the balance and combination of how much pressure, how cold it needs to be,” Glasser says.

The CO2 is transferred from the CO2 scrubber off the fermentation tank, then goes through subcooling prior to compression, so that it doesn’t heat up too much. After com pression, it goes through dehydration to get rid of any moisture. Then, the CO2 is cooled to the point where it changes state from a gas to a liquid. Once the CO2 is liquified, it is dis tilled to remove any lingering impurities and goes through a carbon filtration system. Af terwards, it is transferred and injected via high

is often deployed pre- and hyphenate

pressure pumps into a well that, in Red Trail’s case, is nearly 6,500 feet deep.

There are three goals the DOE requires technologies to meet, Duncan explains. The first is detecting and evaluating whether there is a possibility of CO2 injection creating any kind of seismic event or earthquake. Sec ondly, the technology must be able to make sure that the CO2 does not crack the cap rock keeping the CO2 underground. Duncan explains that though the CO2 is not being in serted in the ground under high pressure, the fluid will seep into preexisting fractures in the rock and reduce the friction holding the rocks together, which may cause the cracks to shift. Finally, the technology must provide verification of the CO2 “plume” spreading throughout the reservoir as it is injected.

Essentially, he explains, they are trying to solve three problems. “The problem of is there induced seismicity? Or is there poten tial for induced seismicity? Is the CO2 staying in place in the reservoir? And, where in the reservoir is it going? Well, how do we know when the reservoir is full? Those three areas people are investing a lot of technical trials into,” Duncan says.

During CO2 injection, there are several different monitoring plans Red Trail needed to create, Burns says. The plant created a monitoring plan for the state, assisted by the EERC, as well as a MRV for the EPA at the federal level. In early September, Red Trail had another monitoring plan under submis sion in California to access the state’s low carbon fuels program.

Burns explains that Red Trail has a partnership with Japanese company RITE, which uses a surface orbital vibrator technol ogy to model the CO2 plume and watch for any induced seismicity. “If the CO2 plume moves out there, they’ll see a change in the vibration, and they’ll model that to see where the plume is going to be,” he says. The EERC also monitors the well using nodes on the surface.

They also had to do multiple tests to acquire a baseline of the soil isotopes and

Dave Burns, North Dakota Industrial Commissionthe Fox Hills Aquifer, the deepest freshwater aquifer in the area, to make sure there aren’t any changes happening due to injection. “We have a third party come and take those [soil gas] samples … [and] we had to take an iso tope test of the CO2 coming off our plant, so if there’s a lot of that CO2 in the ground then they’ll be able to trace it back to our source through isotope monitoring,” he ex plains.

There is no singular technology that checks all the boxes for monitoring, Hamling says. In today’s current regulatory landscape, a monitoring strategy is necessary. “But the purpose of monitoring is two-fold,” he says. “You need monitoring data to inform how you operate the site; you also need monitor ing data to demonstrate to regulators and in centive programs that the CO2 you’re inject ing is staying stored permanently and that it’s staying within the permitted area.”

Passive seismic technology listens to the earth and the sounds it makes, then uses those readings to learn and map what is go ing on beneath the surface. MicroSeismic de veloped its technology in working with the oil and gas industries, and when those indus tries took a hit in 2019-’20, moved toward utilizing its technology to detect sinkholes before they cause damage.

“The monitoring, measurement and verification plan that people are putting in place are really directed, as I said before, at these three issues: number one, the seismic ity; number two, the integrity of the cap rock that is keeping CO2 below ground; and three, where that plume is going in the ground to make sure it’s not leaking out around the edges of the reservoir and getting up to the surface,” Duncan says.

At the beginning of a project, Micro Seismic assists in evaluating the sequestra tion site by cementing six to twelve geo phones less than 300 feet underground to check for signs of active faults. “The way you do that is to listen, because those fractures are causing little mini earthquakes. Now, I’m talking about seismic events that are kind of equivalent to the pop sound that happens when you take a can of Coke and drop it from your waist onto a cement floor,” Dun can says. These geophone stations wirelessly transmit data back to MicroSeismic where they are monitored 24/7.

They will listen for six months, and if they detect any active faults in the area, the injection point will be relocated. Once injec tion does start, MicroSeismic would increase the number of geophones to between 50 and 100, with about three to five stations per mile. They are able to use the “pops and pings” they hear to understand what is go ing on underground. As injection starts, they will use the data gathered to set up a sort of “traffic light system,” he explains. This warn ing system feeds back to the operator to give them an alert if problems arise.

“If all we’re hearing are little, tiny pops and pings that are kind of random around then it’s green light. If the size of those pops and snaps increases, or they start to be con centrated in a particular area that seems re lated to the injection, then we might go to a yellow alert level, and at yellow alert level we probably recommend some other kinds of geophysical investigations,” Duncan says.

“And if we were to see large events that are suggesting there’s going to be a seismic event that could be felt at the surface or that the cap rock is being broken or that the fluids are leaking, which then would be indicated by a flurry of events of increasing size, con centrated in a given area, then we might go to a red alert level at which point they would

'If the CO2 plume moves out there, they’ll see a change in the vibration and they’ll model that to see where the plume is going to be.'

MicroSeismic, a leading provider of passive seismic technology, provides 24/7 underground monitoring of carbon capture and sequestration projects for interested ethanol producers.

MicroSeismic CEO and geophysicist Dr. Peter Duncan has nearly two decades of experience working with passive seismic technology. “Passive seismic is imaging the earth without using dynamite or vibrators the way conventional seismic does, but just listening to the earth, the squishy sounds that come from the earth, to develop some knowledge of the interior,” he explains.

His company started out using this technology for enhanced oil recovery and later sinkhole detection. However, after winning a grant from the U.S. Department of Energy this year to develop technology for monitoring carbon capture and sequestration wells, the company has opened a new division called CO2SeQure for its CCUS focused services. This technology helps ethanol producers fulfill three key objectives for producers to qualify for tax credits and meet environmental regulations: monitoring, measurement and verification.

MicroSeismic’s BuriedArray® utilizes geophones equipped with wireless technology and cemented less than 300 feet under ground to collect information about the sequestered CO2 and the geology surrounding it, allowing the producer to confirm that the CO2 plume is not moving outside the targeted formation, monitor caprock integrity to make sure that there are no cracks that would allow it to escape, and measure any microseismic events to make sure the injected CO2 is not causing any induced seismicity.

“I have been blown away by how big the pipeline is for proj ects, and how interested a broad cross-section of the industry is in understanding what we’re doing and how that can assist them in getting their permits to practice,” Duncan says.

Tech probably slow down or stop injection for a period of time until they could figure out what’s going on.”

For any ethanol producers who are con sidering carbon capture and storage onsite, Hamling encourages them to keep in mind that getting approved to build a storage facil ity is a multi-year process. He also suggests that they reach out to those who have worked in that space, as well as checking into regional CO2 partnerships, like the PCOR Partnership to understand the storage potential near their plant. “These projects take time to develop and permit,” Hamling says. “Each project has site specific considerations, so being able to characterize and understand, you know, the specific site relative to the project is impor tant for moving projects forward.”

Author: Katie SchroederContact: katie.schroeder@bbiinternational.com

LISTENING LONG-TERM: To monitor CO2 injection sites over their lifecycle, MicroSeismic uses multicomponent geophones, which are cemented in shallow boreholes. Each station is equipped with a telecommunication device that collects and transmits data to a central processing facility for real-time analysis. The geophone array is typically installed before injection begins to calibrate baseline ambient microseismicity, and remains in place post-injection.

The landmark Inflation Reduction Act is expected to have major impacts throughout the renewable energy industry, including carbon capture, utilization and sequestration (CCUS). The legislation increased the existing 45Q tax credits and extended the window of time for CCUS projects to take advantage of these credits. Lee Blank, CEO of Summit Carbon Solutions, outlines the impact the provisions in this legislation have on the company’s planned pipeline.

“It is great certainly for Summit Carbon Solutions, but I think more importantly it’s really a statement about the overall industry and, as I think about what the Inflation Reduction Act has done, it’s really given a landscape for carbon sequestration and storage of carbon, it’s really given it a framework and the ability to do something very substantial,” Blank says.

Elizabeth Burns-Thompson, vice president of government and public affairs with Navigator CO2, explains that the increase in 45Q tax credits may help stimulate interest in CCUS, while further helping facilities that have already signed on to aggregation projects like Navigator’s planned Heartland Greenway pipeline. “I think it’ll help provide stimulant to the handful of plants left in the space that haven’t committed to one type of an aggregate project like ours, or those that happen to be on top of the geology to be able to do this type of sequestration on site,” she says.

By Katie SchroederAlthough the increase in CO2 valuation per pound is increased, Burns-Thompson explains that the uptick in tax credits will go solely to the plants shipping their CO2 on the Heartland Greenway. The financial opportunity for Navigator is found in the potential for additional shippers due to increased interest in CCUS.

Brian Jennings, CEO of the American Coalition for Ethanol, explained that the IRA, which is more technically the budget reconciliation legislation for fiscal year 2022, will have a far reaching impact on the ethanol industry beyond CCUS. In an Ethanol Producer Magazine podcast in September, he explained that the legislation provides U.S. Department of Agriculture funding for climate smart agriculture programs, sustainable aviation fuel (SAF) tax credits and half a billion dollars to the USDA for biofuels infrastructure.

Jennings also explained that the legislation implements a tax credit for ethanol producers based on each facility’s specific carbon intensity score, ranging from 20 cents per gallon to over a $1 per gallon. “The lower your carbon intensity is as a biofuels producer the more lucrative tax credit you can receive over the course of 2025 to 2027,” he says. “That is really going to help producers recoup the expenses they incur for adding these technologies that reduce carbon intensity.”

The improvements made to the 45Q have a positive impact on CCUS projects. “This budget reconciliation legislation really

improves on that credit to make these projects much more doable, there’s so much in there to like,” Jennings says.

The IRA increased 45Q tax credits for carbon capture and sequestration from $50 per metric ton to $85 per metric ton; and it also extended the deadline for qualifying projects to start construction by seven years, from January 1, 2026, to January 1, 2033. This is good news for those building huge multi-million dollar projects, Jennings explains, since they can qualify for 45Q tax credits as long as they start construction before 2033.

This extended timeframe also allows for projects such as the Heartland Greenway to operate in phases, Burns-Thompson explains. “You don’t want to rush construction, you don’t want to rush the permitting processes,” she says. “Now, you do want to make sure there is effective permitting in a way that can allow for us to actually move forward. It should be thorough, but it shouldn’t be impossible.”

The concept of permanently sequestering CO2 thousands of feet underground has gained a lot of interest from many ethanol producers due to the uniquely pure CO2 that comes off the fermentation step of ethanol production. Many ethanol producers signed on to CCUS aggregate projects in hopes of acquiring 45Q tax credits and possibly selling the ethanol in a low carbon fuel market.

Alongside boosting the sequestration credits, the IRA also increased tax credits for beneficial utilization, jumping from $35 to

The Inflation Reduction Act provides substantially enhanced benefits to U.S. carbon capture, utilization and sequestration projects. It should be ample incentive for developers to get more dirt moving.

$60 per ton, which may spark interest in CO2 utilization research. Although the industry is still in its infancy, Burns-Thompson explains that there is already a strong market value for CO2 utilization—such as within the bever age industry for carbonated drinks, dry ice and food processing—and that market has potential to grow with new innovations. “That byproduct could potentially have an extreme amount of value, especially when you look at all of the very interesting and new technologies that are being explored in laboratories all across the country,” she says.

While up until this point, sequestration and utilization have frequently been seen as opposites, this does not need to be the case, Burns-Thompson explains. Techniques such as turning CO2 into bioplastic essentially keep it out of the atmosphere, and other technologies are in development. “Is there a way that utilization also achieves the goals of not releasing it back into the atmosphere? I think technology is showing us that it can actually be the case,” she says.

The IRA also made updates to the fi nancing structure around CCUS projects, explains Aaron Hood, chief financial officer with Summit Carbon Solutions. “Summit can directly collect tax credits from the fed eral government for a portion of the time of the tax credit, which is a major change. Today, you have to enter into a tax equity partnership with a tax—a bank or a financial institution that has a well known tax appe tite, and those transactions are pretty com plicated,” Hood says. Simplification of these financing structures gives projects a wider array of options as far as financing sources.

The other provision in the IRA that changes the financial structure of CCUS is the implementation of direct sale for tax credits, which allows the proprietors of the tax credits to directly transfer them or sell

them once, avoiding a complicated tax eq uity structure, Hood explains.

Dave Locascio, attorney with Hogan Lovells law firm in Houston, has been prac ticing law within the energy industry for 30 years, working with oil producers, oil and CO2 pipeline projects, and, gas and power companies. He also has some experience with CCUS, due to his experience over the past nine years with the now idle Petro Nova CCUS/enhanced oil recovery project, which is at a coal plant in southeast Texas.

“For players who may not have the tax able income to use tax credits themselves, there’s a one-time sale option to sell it to somebody who could use it. And so that’s a way for those players to monetize the tax credit,” Locascio says.

Burns-Thompson explains that as a common carrier, Navigator CO2 plans to help producers understand this market and “helping our customers and our ship pers navigate all of the different facets of both the component pieces of the IRA and also making sure that they’re maximizing the value of basically the carbon economy broadly.”

Increased tax credits will help carbon capture and sequestration projects look more attractive to investors, Locascio ex plains. With so many companies aiming to be carbon neutral by a certain date and builders needing private equity, there is po tential for a mutually beneficial situation. “I think these look attractive if you can pro vide the credit, they provide returns. They provide the upside that makes it attractive to private equity,” he says.

CCUS has the potential to reduce etha nol’s carbon intensity outside of the ethanol plant in fertilizer and other agriculture re lated industries. Burns-Thompson explains that the fertilizer plants that participate in CCUS can help reduce the carbon intensity of the corn production it is used for by cap turing their CO2. “If you think about what this technology could mean from an integra tion of potentially lower carbon or no car bon fertilizer going onto the farm to begin with, they are then producing the crop at a lower carbon intensity score and then [ex tending] into the value-added manufacturers like the ethanol producers that are linking up with our project or others that are also ben efitting from carbon capture technology and further driving down the carbon intensity scores,” she says.

Hood highlights the importance of the IRA for the agricultural industry. “We’re really an agriculture focused company,” he says. “The goal is to decarbonize agriculture and, for us specifically, to continue to lower the carbon intensity of the ethanol space, which is an important part of the corn sec tor—ethanol uses 40 to 50 percent of the corn produced. So we think that the Infla tion Reduction Act also brings in post com bustion CO2 gathering as opposed to just CO2 from fermentation, and we think that is a great opportunity for our plants to con tinue to lower the carbon intensity of the ethanol they produce, which will be great for farmers.”

We are only seeing “the tip of the ice berg” in the world of CCUS, according to Burns-Thompson. Carbon reduction is big ger than transportation fuels and is becom ing an increasing focus in many industries, she explains. Locascio highlights that there is interest from industry players who are choosing to be greener due to carbon neu trality goals.

“We’re more hyper focused on it in the fuels sector based on what you do and what I do, but carbon is being looked at every where,” Burns-Thompson says. “From kids’ toys to what you buy on the internet, and my Google Maps tells me the lowest carbon intensity route with a little leaf next to it. There is definitely value associated with the carbon intensity of these products and or services that are being provided, and so this

COLLECTIVE CI REDUCTION: Fertilizer plants (left) participating in CCUS can help reduce the carbon intensity of corn by capturing their CO2. Likewise farmers switching from conventional tillage to reduced tillage (right), adopting 4R nutrient management, or planting cover crops can also bring down the CI of ethanol's principal feedstock.

is part of quantifying of that, and it’s going to keep getting more hyper local down to the farm gate level, I believe, as well. You neces sarily need the infrastructure to be able to support that at the processor level to allow folks to recognize those benefits.”

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

PHOTOS: (LEFT) STOCK, (RIGHT) R. MURPHY

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

PHOTOS: (LEFT) STOCK, (RIGHT) R. MURPHY

With an impeccable production partner, deep roots in ethanol and a customer base looking for tailored HPLC products, Enertech Solutions is elevating reference materials through customization and robust accreditation.

By Tom BryanEnertech Solutions is best known as a responsive provider of ethanol plant lab supplies from everyday consumables like vials and filters to containerized liquids like buffer solution and sulfuric acid. But for half a decade, pro ducers have also turned to the Ohio-based company for specialized high performance liquid chromatography (HPLC) products, in cluding mobile phase bags and ethanol-spe cific reference materials, or “standards,” that can be tailored to each customer’s unique analytical needs.

Jeffrey Smith, Enertech’s president, says the company’s growing volume of business in both areas is the result of building strong relationships with producers.

“We partnered with Dr. Dan Bigger staff, of Charleston, South Carolina-based o2si—ISO accredited to 9001, 17025, and 17034—with the idea that there was a better way to provide calibration standards to the ethanol industry. This better way focused on supplying custom, made-to-order standards at prices and turnaround times comparable to off-the-shelf suppliers. Concentrating su perior technical skills with world-class cus tomer service has allowed the partnership with o2si to make that idea a reality and be

come a leader in custom ethanol calibration standards. This commitment to excellence has driven our growth into expanded mar kets, including organic and inorganic calibra tion standards, innovative laboratory prod ucts and specialty reagents and solutions.”

The HPLC is the heart of every ethanol lab; it’s the eyes and ears of the entire pro cess and gives daily critical information that directs the entirety of plant operations. Eth anol plants use HPLC to monitor environ mental compliance, process conditions and the progression of ethanol fermentations— the conversion of sugars to ethanol, ethanol breakdown to acetic acid, yeast health and more. The process tracks analyte molecules as they separate and flow through an HPLC column; the analyte is characterized by com parative analysis to a manufactured reference standard. Reference materials have been used for decades, but until recently didn’t always offer the precise results ethanol producers wanted. The problem with established cata log standards, Smith says, is that a one-sizefits-all approach was too often not meeting the needs of an increasingly diversified etha nol industry producing not only fuel ethanol, but specialized alcohols and a wide range of high-value coproducts.

It is very difficult for an ethanol plant to carry out an optimization to get even 0.2% more alcohol out of a batch if the facility’s reference standards have the slightest vari ability. “But that’s what we make possible,” he says. “Those very tight optimizations call for reference materials that are absolutely dead-on accurate.”

To be clear, there is not a crisp line between a catalog standard and a custommanufactured one, says Bezhig McMurtrie, a former ethanol plant lab manager who now works in sales and customer support at Enertech. “Actually, from the moment a producer accepts formulation, that new stan dard is officially their catalog item,” she says. “But, if over time that standard no longer fits their needs, it can be changed. So, think of it as a catalog standard that’s flexible.”

For those not familiar with the HPLC process, Biggerstaff explains that it’s not just a matter of designing singular reference stan dards for ethanol producers, but whole cali bration sets that synchronize with a plant’s analytical objectives and fermentation pro files. “Early on, a standard calibration routine with, say, 13 components to it, would sim ply have higher and higher concentrations [of the same makeup], so everything kind of scaled the same in those calibration sets. That was standard operating procedure,” he says. “But actual fermentations have very

high starch and sugar and very low ethanol when they start. Later, the ratios change with each level, so that they end up being high ethanol, low sugars. We’ve designed calibra tion sets to mimic the fermentation process so the actual responses and accuracies for those runs and calibration points are essentially dead on to what’s happening in the fermenter. That was not being offered to ethanol producers previously.”

McMurtrie concurs, saying that when she was working in ethanol production, and an early customer of Enertech’s reference stan dards, her lab followed the exact model de scribed by Biggerstaff, dropping sugars from high to low and ethanol from low to high— across a five-level calibration set, achieving an ideal R2 of 1.0. “It was phenomenal for a fer mentation set with that many components,” she says. “And there was nothing like it on the market.”

McMurtrie adds, “There should never be mystery peaks in reference standards, yet we

see that with some of the products available to the industry. When they show up, they can interfere with the integration of intended analytes.”

McMurtrie also ex plains that most reference standards on the market are still made with the average fermentation profile in mind, but it’s hard to find an “aver age” plant these days. “Everyone in the etha nol industry knows each plant is very unique, in so many ways,” she says. “Custom standards allow producers to focus on specific compo nents and ranges that are relevant to their own products and operation.”

She continues, “There was a time when the standards available to producers only went to, say, a 12 percent ethanol. The market out grew that, but it took time for that manufac turing response to happen, for the market to catch up with rising performance standards in ethanol production.”

Furthermore, McMurt rie says, a decade of diversification in ethanol production has resulted in roughly 200 U.S. ethanol plants with uniquely diverging pro

cesses, products and test ing methodologies, which makes customization vital.

“There are a lot of fron tiers to explore with analyt ics right now, and the way the industry is diversifying so rapidly, we can’t pos sibly sit back and expect a one-size-fits-all standard to meet the needs of anyone, let alone the whole industry,” she says. “We need to get out front with our custom ers pushing the limits of processing, and help them develop these processes optimally, so they are not flying blind.” McMurtrie adds that this includes not only HPLC standards but also standards for gas chromatography (GC) for denaturant, fusel oils and other impuri ties that are needed in the U.S. Pharmacopeia (USP) market, as well as ion chromatography (IC) standards.

The reference standards Enertech deliv ers to ethanol plants are not only tailored and

custom formulated to the needs of today’s producers, but backed by very high levels of accreditation, pre-delivery analysis and man ufacturing quality control.

Biggerstaff explains that accreditations associated with the production of reference materials are largely rooted in quality assur ance but deliver the tangential benefit of legally defensible product analytics. “If any analytical number generated from a method finds its way into legal action for any reason, whether its regulatory, a trade dispute or whatever, being able to defend that reference material in court is absolutely vital for the producer that generates that data,” he says, detailing o2si’s reference material accredita tions, specifically ISO 9001 (for overall qual ity management) and ISO 17025 (for quality control lab), which guarantees the supplier is using documented data quality, validated methods, validated instruments, proper training and numbers that are traceable back to National Institute of Standards and Tech nology (NIST) calibrated weights.

In addition, the company adheres to ISO 17034 for the actual manufacturing of the reference materials. “And what that says is that we’re making products in essentially the same manner and level of quality as NIST—which is the gold standard,” Bigger

staff says. “So, the whole process is highly documented. Everything is traceable. Every thing is analyzed.”

Those accreditations set Enertech apart, Smith says. “We’re the only game in town with this level of accreditation behind our standards along with the gravitas of custom ization behind them,” he says. “They’re refer ence materials you can take to court, literally, if you need to. Producers want traceability— on the alcohol side and the feed side. Trac ing back to NIST is important, but you need more than that. What are your accreditations and your auditing regimen? In all those areas, we’re ahead of the curve.”

In addition to industry-leading accredi tations, Enertech’s reference materials are manufactured by o2si with exacting levels of neat material characterization—including detailed breakdowns of purity and impurity levels in each component of a standard— along with uncertainty budgets, or error spreads, which are increasingly important to producers exporting ethanol or making USP alcohol or grain neutral spirits.

“If you want to sell your product into new or special markets, you’ve got to pro vide that,” McMurtrie says. “It’s especially true with higher-grade alcohol. There is zero room for error when it comes to alcohol for

healthcare products or consumables; ISO accreditation lets you operate confidently knowing your data is going to be defensible.

It’s the foundation of quality assurance. ” Smith and Biggerstaff agree that their ability to elevate, change and expand the ex isting catalog of ethanol plant HPLC refer ence materials has been a story of custom ization, producer engagement and rigorous manufacturing discipline.

“The amount of technique and knowl edge and training that goes into making a reference material is incredibly complex, es pecially as it relates to reducing error to the smallest amount possible,” Biggerstaff says. “It’s very important that we get it right be cause people rely on us for their livelihoods, their health, their safety. Regulatory, policy and product quality decisions are based, in part, on the work we do. So, every single step we do is incredibly important, from the ini tial QC of the neat material, to the mixing, the bottling, the labeling, how we ship it— everything—it all has to be done right. After all, these reference materials have a major impact on not only ethanol production, but the world around us.”

Author: Tom Bryan Contact: editor@bbiinternational.com

Starting now, the U.S. EPA—with input from other agencies—will have new guideposts and increased interpretive authority for determining the annual renewable volume obligations of the RFS.

By Luke GeiverStarting in 2023, the Renew able Fuel Standard’s yearly re quired volumes will no longer be based on the firm statutory in struction of federal law. The U.S. Environmental Protection Agency, along with the U.S. Department of Agriculture and the U.S. Department of Energy, will be determining—with new formulas not pre scribed by Congress—renewable volume obligations, or RVOs. The change marks the first time since the formation of the RFS in 2005 that yearly RVOs will not be deter mined strictly by legislative instruction.

The EPA was authorized to set annual biofuel blending requirements through 2022. For 2023 and beyond, however, the agency is required to establish volume requirements according to a specific set of alternative fac tors. Ethanol trade groups emphasize that the RFS is not expiring, but entering a new phase in which the EPA, with support from the USDA and the DOE, has more leeway in its administration of the program. The upcoming “set” rule will be the first annual RVO rulemaking under which the EPA ex ercises this discretion.

By the time this article is published (or very soon after), the proposed RFS volume obligations for 2023 may be out, thanks to the work of groups like Growth Energy, the Renewable Fuels Association, the Clean Fu els Alliance and others. In late July, Growth announced that its efforts to push the EPA to move forward with determining volume re quirements had proven successful. Through a consent decree agreement, the EPA pub licly went on the record, agreeing to offer proposed volumes for 2023 by November 16, 2022. That agreement also states that by June 14, 2023, volume requirements under the RFS will be finalized. With the first step of the RFS reset locked in, the question for producers, blenders, renewable identification number (RIN) traders and every other entity impacted by the historic and long-tenured positive influence of the RFS is a big one. What exactly is going to happen?

Joe Kakesh is the general counsel for Growth and has been heavily involved in working with the EPA to get to this point with the deadlines for 2023 RFS RVOs. Kakesh is no stranger to the workings of Washington or in navigating several of the

departments that impact the greater biofuels industry. Prior to joining Growth, he worked in the environmental law sector, gaining ex perience with the Clean Air Act, RFS and other regulatory programs administered by the EPA, USDA, FDA, DOE and oth ers. According to Kakesh, getting the EPA to set deadlines for deciding on 2023 RVOs was the first win. Now, his team—working in tandem with the other trade groups—will continue to push the EPA to take advantage of the full potential offered by the RFS as it relates to the federal government’s overall climate goals.

“The RFS to date has been one of the most successful clean energy solutions,” Ka kesh says. “But it still remains somewhat un tapped as a climate solution.”

The 2023 RVOs should reflect the abili ty of the RFS to become a major tool for the

push by the U.S. to reach its climate goals, he says. Because the program deals with renew able fuels and has been around since 2005, it is hard to argue that the RFS is anything but a proven tool that still works well Kakesh believes.

“We should be taking full advantage of renewable fuels through the RFS,” he says. “Farmers and producers are ready now.”

The potential impact of greater—or even firmly set—RVO volumes next year, or in the years after, can make a dent in the car bon reduction efforts of the U.S.

RFA President and CEO Geoff Coo per agrees. During a virtual briefing about the RFS set held by Fuels America in late September, he said a strong set rule can help meet the Biden administration’s decarboniza tion goals. “We think EPA has an enormous opportunity with this rulemaking process to

further decarbonize our nation’s transporta tion fuels, and ... I want to remind everyone that the RFS is the only statutory program on the books today that requires fuel decar bonization.”

Kakesh says the industry needs to tell the important part of the ethanol story as it connects to the climate goals that will guide U.S. policy across multiple sectors for years to come. The story of ethanol should be about how it provides a robust contribu tion to lowering greenhouse gas emissions, lowers fuel costs and plays a strong part in the long-term climate strategy of the U.S. According to Kakesh, that storyline is what should happen as the EPA’s decision on 2023 RVOs plays out. But, he points out, there are many factors that impact what ultimately will happen.

To arrive at significant RVOs through the RFS for 2023 and beyond, the EPA has publicly stated it will utilize six factors to aid in the process. The first factor is the impact of production and use of renewable fuels on the environment, including on air qual ity, climate change, conversion of wetlands, ecosystems, wildlife habitat, water quality and water supply. The second relates to how a renewable fuel can impact U.S. energy se curity. The expected annual rate of future commercial production of renewable fuels, including advanced biofuels such as cellu losic or biomass-based diesel, represents the third factor. How renewable fuel impacts U.S. infrastructure, including deliverability of materials, goods and products other than renewable fuel, along with the sufficiency of infrastructure to deliver and use renewable

fuel, is the fourth area the EPA will look at. The cost of renewable fuel to consumers is the fifth. And the sixth factor is the impact of renewable fuels on job creation, the price and supply of agricultural commodities, rural economic development and/or food prices.

In addition to those main six factors, the EPA has already stated that it also has “the authority to consider other factors.” The agency has already considered some of those factors, including the intertwined na ture of compliance with 2020 to 2022 stan dards, the size of the carryover RIN bank, how the entirely retroactive nature of the 2020 and 2021 standards—as compared to the partially prospective nature of the 2022 annual and supplemental standards—affects the feasibility of compliance, the supply of qualifying renewable fuels to U.S. consumers, soil quality, and environmental justice.

There is an important element to all of the factors, especially those main six, accord ing to Kakesh.

“The key is that not all six factors are equal,” he says.

The EPA has addressed that important fact. “While the statute (to determine the RVO volumes) requires that EPA base its determination on an analysis of these fac tors, it does not establish any numeric crite ria, require a specific type of analysis (such as quantitative analysis), or provide guidance on how EPA should weigh the various factors.” The department also says that it is not aware of anything in the legislative history of EISA (the Energy and Independence Security Act created in 2007 under President George W. Bush as an expansion of the RFS) that pro vides authoritative guidance on these issues. With the lack of precedence or past guidance on how the EPA might weigh the factors in making its decisions, the agency says it has “considerable discretion to weigh and bal ance the various factors.”

Many, including Kakesh, believe the leading factor the EPA will weigh above all others is the environmental benefit of biofu els versus fossil alternatives. for that reason, the decision makers need to see the environ mental benefit of ethanol. That starts with using the latest science, modeling or testing, all of which Kakesh says, “show the ben

efits.” The issue, however, is that the EPA’s latest science on modeling GHG emissions linked to ethanol production hasn’t been up dated since 2010. Thankfully, Kakesh says, there has been some work on that front.

Although the last time the EPA updated its lifecycle emissions modeling related to ethanol was in 2010, there has been work to bring modern science and testing on the subject into the EPA’s view. In March, EPA hosted a virtual public workshop on biofuel GHG modeling. The purpose of the work shop was to solicit information on the cur rent scientific understanding of GHG mod eling of land-based crop biofuels used in the transportation sector, according to the EPA. The meeting shows the interagency connect edness that will come in the 2023 RFS set.

Along with the EPA’s Office of Transporta tion and Air Quality, the USDA and DOE also participated in the workshop.

The purpose of the three-day workshop, which included industry experts talking or giving presentations on a range of subjects, was three-fold. First, the EPA wanted com mentary on what sources of data exist and how those data sets can be used to inform the assumptions that drive GHG estimates. Second, EPA wanted to know how it should best characterize the sources of uncertainty associated with quantifying the GHG emis sions associated with biofuels. And third, EPA wanted to know what models are avail

able to evaluate the lifecycle GHG emissions of land-based biofuels, and “if those mod els meet the Clean Air Act requirements for quantifying the direct and significant indirect emissions from biofuels.”

Roughly 25 speakers offered slide-deck insight on a range of topics during the work shop. One particular session, “Overview of Modeling Frameworks of Crop-Based Bio fuels,” offered a glimpse of what Kakesh and the ethanol industry believes is the latest science. Although multiple models exist, and can model the GHG emissions associated with crop-based biofuels, there is one that is the most accurate, Kakesh says.

Michael Wang, senior scientist and the director of the Systems Assessment Center at Argonne National Laboratory, provided an update on the GREET model (Green house Gasses, Regulated Emissions and En ergy Use In Technologies).

The GREET model is a one-of-a-kind analytical tool that simulates the energy use and emissions outputs of various vehicle and fuel combinations. It was started in 1995, but updated and expanded every year since by the DOE’s Office of Energy Efficiency and Renewable Energy.

During his presentation on GREET, Wang provided information that directly shows the impact corn-based ethanol can have on GHG emissions. Corn ethanol car bon intensity (CI) scores have decreased by 23 percent over the last 15 years. In techni cal terms: 14gCO2e/MJ. In 2019 alone, corn ethanol CI shows a 44 percent reduction

Impact on the environment

Impact on U.S. energy security

Expected annual rate of production

Sufficiency of infrastructure

Cost to consumers

Jobs, commodity supply and food prices

compared to fossil fuel baseline (including land use change). Since 2005, corn farming also shows a GHG reduction of 15 percent.

Other models showing the lifecycle analysis were described during the work shop. There was a varying level of consensus on which specific LCA numbers related to biofuels or corn-based ethanol should be ap plied by the EPA when it decides how much biofuel should be required for the next RFS. Growth offered clarity to that point. “As sev eral workshop presenters noted, it will not be possible to resolve every uncertainty related to biofuels LCAs in the time remaining be fore EPA must promulgate upcoming major rulemakings,” the organization wrote in its comments to the workshop.

To aid the EPA in its quest for the best science, Growth offered a study from EH&E, a multi-disciplinary team of envi ronmental health scientists and engineers with expertise in measurements, models, data science, LCA and public health. The study,

“Carbon Intensity of Corn Ethanol in the United States: State of the Science,” provid ed a meta-analysis of available LCA meth odologies. The study gave a central estimate LCA for corn starch ethanol of 51gCO2e/ MJ, or 46 percent below the 2005 petroleum baseline. Numbers that clearly show the pos itive impact of ethanol in any discussion on climate goals and overall CI reduction.

Kakesh believes the EPA will set vol ume requirements for the next two years. The current administration’s goal of getting to net zero carbon by 2050 is not possible without biofuels, he adds. The experience of the EPA to set 2020 to 2022 RVOs will help in their efforts to set 2023 and beyond. And work on looking at LCA models and other issues will also help, Kakesh says of those March workshop presentations. After the November numbers are provided, the pro posed volume obligations will be reviewed

until June 2023, at which time, the EPA will have to finalize RVOs.

There are new biofuels related propos als floating through Washington, but until they evolve, the RFS remains the main po litical driver of direct biofuels production in the U.S. The RFS is, in fact, at a pivotal point, Kakesh says. The work of getting the EPA and others to set decision dates and hold workshops on modeling and GHG reduc tion scores is a major accomplishment for Growth and others. The work to maintain and heighten the impact of the RFS on the potential for continued—and possibly in creased—ethanol production, may not have reset anything quite yet, but the work to date has set the stage for a new era of RFS ad ministration that takes fuller advantage of the benefits of ethanol.

Author: Luke Geiver Contact: editor@bbiinternational.comWith its new Clean Fuels Regulation in place, Canada is calling for more domestically produced biofuels while leaving the door open to U.S. ethanol.

By Luke Geiver

By Luke Geiver

Canada has made its thoughts about ethanol clear. In July, its fed eral government put in place a long awaited and anticipated new Clean Fuels Regulation framework. The revised CFR framework in creases incentives for the adoption of clean fuels, technologies and processes. The regula tions also require liquid fossil fuel suppliers to reduce the carbon intensity (CI) of the gaso line or diesel they supply over time. The new plan necessitates the use of renewable fuels, namely ethanol and biodiesel. Both biofuels offer near- and long-term options for Canadi an fuel suppliers in need of solutions that can help them lower the carbon intensity score of the products they sell. Starting in July, 2023, suppliers must use more ethanol.

The CFR sets CI limits for gasoline at 91.5 grams of carbon dioxide equivalent per megajoule (gCO2e/MJ) in 2023. The CI limit steadily becomes more stringent through 2030, when the limit is set at 81 gCO2e/MJ. For diesel, the limit starts at 89.5 gCO2e/MJ in 2023 and intensifies to 79 gCO2e/MJ in 2030 and thereafter. Canada’s government estimates that approximately 2.2 billion liters (581.18 million gallons) of additional low-CI diesel and 700 million liters (185 MMgy) of additional ethanol will be needed in 2030 un der the CFR.

Renewable Industries Canada, one of the main industry groups working to make the CFR possible starting in 2017, said the the new framework “will be instrumental in send ing a clear signal to investors that Canada is ready for more clean and more cost-effective low-carbon fuels, like ethanol and biomassbased diesel.”

Based on future projections from the federal government, combined with state ments like that from RICanda, it’s clear how important ethanol will be to the country, and why U.S. producers need to take note.