PLUS ACE Conference Highlights from Omaha

PAGE 28

CI Calculator Assigns Numbers to Change

PAGE 34

Merchant Capture, Sequestration and Next-Gen Transformation

PLUS ACE Conference Highlights from Omaha

PAGE 28

CI Calculator Assigns Numbers to Change

PAGE 34

Merchant Capture, Sequestration and Next-Gen Transformation

When you need safe, sustainable transloading solutions, there’s only one name to trust – TRANSFLO. With over 50 years of experience, we make doing business easy. Ready to move with confidence? See what we can do for you.

Calculating

President & Editor

Tom Bryan tbryan@bbiinternational.com

Online News Editor Erin Voegele evoegele@bbiinternational.com

Associate Editor Katie Schroeder katie.schroeder@bbiinternational.com

Vice President of Production & Design Jaci Satterlund jsatterlund@bbiinternational.com

Graphic Designer Raquel Boushee rboushee@bbiinternational.com

CEO Joe Bryan jbryan@bbiinternational.com

Vice President of Operations/Marketing & Sales John Nelson jnelson@bbiinternational.com

Senior Account Manager/Bioenergy Team Leader Chip Shereck cshereck@bbiinternational.com

Account Manager Bob Brown bbrown@bbiinternational.com

Circulation Manager Jessica Tiller jtiller@bbiinternational.com

Marketing & Advertising Manager Marla DeFoe mdefoe@bbiinternational.com

Ringneck Energy Walter Wendland Little Sioux Corn Processors Steve Roe Commonwealth Agri-Energy Mick Henderson Western Plains Energy Derek Peine Front Range Energy Dan Sanders Jr.

Atlanta, GA (866) 746-8385 | www.biomassconference.com

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. Powered by Biomass Magazine, the conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming, maintaining a strong focus on commercial-scale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

Omaha, NE

(866) 746-8385 | www.fuelethanolworkshop.com

Now in its 41st year, the FEW provides the ethanol industry with cutting-edge content and unparalleled networking opportunities in a dynamic business-to-business environment. As the largest, longest running ethanol conference in the world, the FEW is renowned for its superb programming—powered by Ethanol Producer Magazine —that maintains a strong focus on commercialscale ethanol production, new technology, and near-term research and development. The event draws more than 2,300 people from over 31 countries and from nearly every ethanol plant in the United States and Canada.

Omaha, NE (866) 746-8385 | www.sustainablefuelssummit.com

Please recycle this magazine and remove inserts or samples before recycling

Customer Service Please call 1-866-746-8385 or email us at service@bbiinternational.com. Subscriptions Subscriptions to Ethanol Producer Magazine are free of charge to everyone with the exception of a shipping and handling charge for anyone outside the United States. To subscribe, visit www.EthanolProducer.com or you can send your mailing address and payment (checks made out to BBI International) to: Ethanol Producer Magazine Subscriptions, 308 Second Ave. N., Suite 304, Grand Forks, ND 58203. Back Issues, Reprints and Permissions Select back issues are available for $3.95 each, plus shipping. Article reprints are also available for a fee. For more information, contact us at 866-7468385 or service@bbiinternational.com. Advertising Ethanol Producer Magazine provides a specific topic delivered to a highly targeted audience. We are committed to editorial excellence and high-quality print production. To find out more about Ethanol Producer Magazine advertising opportunities, please contact us at 866-746-8385 or service@bbiinternational.com. Letters to the Editor We welcome letters to the editor. Send to Ethanol Producer Magazine Letters to the Editor, 308 2nd Ave. N., Suite 304, Grand Forks, ND 58203 or email to editor@bbiinternational.com. Please include your name, address and phone number. Letters may be edited for clarity and/or space. TM

COPYRIGHT © 2024 by BBI International

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.

After covering ethanol production for two decades, there’s a certain depth of knowledge retained about the plants, the people who run them, and the products they make. You tend to know who’s who, which plants produce what—at what volumes and with who’s technology. You can rattle off the names of facilities that sell wet distillers grains, for example, or high-protein coproduct. You know the specific LLCs of the plants and their parent companies—and even their startup years and original nameplate capacities.

All that’s expected of longtime industry reporters. You pick stuff up. But one thing that’s always sort of alluded me is knowing precisely what ethanol plants capture their fermentation CO2 for merchant use, which seems especially relevant today with more than half the plants in the nation capturing their CO2 or actively planning to.

The era of carbon capture and sequestration (CCS)—utilization aide—now involves over 80 U.S. ethanol plants, most waiting to join one large, interstate aggregation effort—the Summit Carbon Solutions pipeline—but many others intent on doing CCS alone, onsite or close to their plant. Our team at Ethanol Producer Magazine decided that today’s surging CCS movement doesn’t make our industry’s legacy fleet of merchant CO2 suppliers less important to track and report on, but more. The CCUS fleet includes them. So we set out this fall to track down data on every ethanol plant we know of doing some form of carbon capture for merchant use, enhanced oil recovery, sequestration and transformation.

We ended up with a list of 120 plants—60% of the total fleet—that are, or intend to be, engaged in some form of CCUS. The list is a work in progress and, for now, is only being shared with ethanol producers requesting it, but what it ultimately shows is an industry that could soon be capturing over 22 million metric tons of CO2 annually, for all the purposes already stated. We have identified nearly 70 plants that are ready and waiting to do “Long, Aggregate, Interstate” CCS (via pipeline); more than a dozen planning to do “Onsite, Nearby, In-State” CCS—three already doing it; two doing EOR; two readying to transform their CO2 into fuels or chemicals; and 40 capturing for merchant use (a handful of which may be converting to CCS soon). It’s the start of a fascinating data project that is partially revealed in “The CO2 Report,” on page 14.

Our CO2 thread continues in “Capturing What’s Out There,” on page 20, a story that hardly mentions ethanol but manages to allude to our industry’s historic CCS opportunity at every turn. At a time when it seems like regulatory red tape is holding back CCS pipelines every bit as much as opposition groups and reluctant landowners, this story reminds us that the government wants CCS to happen, having invested $1.5 billion over the last four years alone in projects related to carbon capture, use, transport, storage and removal.

Indeed, all signs right now point to CCUS being a broadly supported, unstoppable movement, not only in ethanol production, but all around it.

Enjoy the read.

Each quarter, the Renewable Fuels Association works with a national polling firm to survey registered voters about their attitudes toward ethanol, policies like the Renewable Fuel Standard, and even proposed legislation like the Next Generation Fuels Act, the Nationwide Consumer and Fuel Retailer Choice Act and the Flex Fuel Fairness Act. Over the past decade, these polls have consistently shown that the majority of Americans support ethanol and believe our nation should do more to expand the production and use of renewable fuels. Our surveys have generally shown that at least three out of five voters support ethanol and policies like the RFS, while only one in five oppose them. The other roughly 20% of voters don’t have an opinion or aren’t sure.

The polling results also routinely show that ethanol has bipartisan appeal—something that is increasingly rare in an era of extreme political division.

With the November election just around the corner, we asked more than 1,800 registered voters a new question in our September polling. We wanted to know how important certain energy policies were to them as they thought about the election and what candidates would get their vote: “With the 2024 general election just two months away, energy policy issues are gaining more attention from presidential and congressional candidates. Based on your perspective, how important are the following energy policy issues to you as you decide how to cast your vote for candidates in the November election?”

We then provided four options for them to consider: 1) boosting America’s energy supply with increased fossil fuel production; 2) limiting fossil fuels and boosting clean energy to combat climate change; 3) adopting a balanced “all the above” approach to U.S. energy production, including both renewable energy and fossil fuels and; 4) protecting the American consumer’s ability to choose the type of vehicle and fuel that works best for their values and budget.

The last two options were the most popular choices among those polled; 79% believed that protecting consumer fuel and vehicle choices was either very or somewhat important to them, and 70% felt the same about an “all of the above” approach. The least popular policy option across the entire sample was limiting fossil fuel production and boosting clean energy.

Diving deeper into the demographics, it was interesting to note that about the same share—80%— of Democrats and Republicans said energy policies that protect consumer choice are important to them. Meanwhile, the demographic data also reveals that the ethanol attributes most important to voters vary somewhat by party affiliation. Most attractive to Republicans is ethanol’s affordability and the fact that it is made in America. For Democrats, ethanol’s carbon footprint was most important, followed by its efficiency and affordability.

Perhaps the most eye-opening numbers from the latest polling showed that more than one-in-five registered voters still don’t know about, or have an opinion about, ethanol and the policies that support our industry. That means we still have work to do to educate American consumers about the many economic and environmental benefits of renewable fuels.

But overall, these are good numbers for the ethanol industry. No matter how you slice-and-dice the stats, they speak well for ethanol, because it is an American-made, low-carbon liquid fuel that fits neatly within each of these four categories. Even if voters are not as familiar with ethanol as we may like, they see its value—whether they vote as Republicans or as Democrats.

Enter a new era of ethanol production with FermaCore™ Propel, the LATEST INNOVATION IN LIQUID YEAST OFFERINGS. Featuring extreme robustness and the fastest fermentation kinetics we’ve ever o ered, FermaCore™ Propel is a true breakthrough designed to MAXIMIZE ETHANOL YIELDS AND INCREASE ENZYME REPLACEMENT — leading to LOWER CARBON INTENSITY. Whatever form you need it to take, you can expect more from FermaCore™ Propel. Because at LBDS, fermentation is at our core.

START SHAPING THE FUTURE OF ETHANOL PRODUCTION

With the acceleration of decarbonization efforts, the aviation sector is seeking solutions like sustainable aviation fuel (SAF) to decrease greenhouse gas emissions. The U.S. Grains Council is responding by ramping up efforts and engagement within the global aviation community to advocate for U.S. industry access.

Total jet fuel demand, including SAF, is at 101 billion gallons and is expected to reach 136 billion gallons by 2035. SAF is estimated to displace 9% of worldwide jet fuel demand by 2035, or around 13 billion gallons.

Within this significant expansion of demand, alcohol-to-jet is projected to become the second most predominant production pathway internationally, driven by a surge in investments and building of ATJ facilities that is supported by the SAF policy targets set and by complimentary international airlines and airport commitments.

This demand for ethanol as a feedstock for ATJ is aligned to become an alternative and growing demand source to support farmer income in the coming years. The Council’s estimates predict that stable area and trendline corn yield could increase corn production by about 1.4 billion bushels. This additional corn production would translate to nearly four billion gallons of additional ethanol supply to provide for the global ATJ market.

To supply international markets, U.S. ethanol is well positioned in terms of cost and carbon intensity score depending on the model used. Additionally, CI value can be further lowered using climate-smart agriculture and renewable energy sources. Demand for this low-CI ethanol is the primary driver to keep corn acres stable and sustain farm income in the U.S.

One of the most widely recognized and impactful low-CI pathways is carbon capture and storage technology coupled with renewable energy inputs at the ethanol and ATJ production site. Driven by IRA credits and industry investments, U.S. ethanol production capacity via CCS is expected to be nearly 9 billion gallons per year by 2030, a well-regarded talking point within international SAF consumers.

Global SAF consumption growth creates demand for more feedstocks. A recent Council study found the required feedstock and cropland to satisfy future SAF demand is more easily met by U.S. corn than soybean production. Incremental, anticipated domestic SAF production would need 14.6 million acres of soybeans or 3.4 million acres of corn. This is primarily due to SAF yield from corn, estimated at 4.4 times the SAF yield from soybeans.

With robust yield growth and stable corn acres in the U.S., domestic ethanol supply could increase significantly. This would create opportunities for global SAF and fuel exports.

While there is opportunity, the Council is cognizant of varying global and international models related to corn ethanol’s ATJ competitiveness and default scoring. A main example is that the International Civil Aviation Organization’s CORSIA model does not recognize CCS or climate smart agriculture. This creates major roadblocks for domestic and international prospective producers and consumers, disincentivizing the adoption of U.S. corn ethanol-based SAF.

The Council is collaborating within a multistakeholder approach to strengthen our advocacy efforts within CORSIA modeling to suit the needs of current regions and production pathways, thereby empowering nations to make meaningful progress toward a decarbonized aviation future.

Blue Biofuels Inc. announced that it was awarded a Phase 2 Small Business Innovation Research grant from the U.S. Department of Energy amounting to $1.15 million. This significant funding will support the final stages of scaling the company’s patented cellulose-to-sugar process, a “groundbreaking technology that efficiently

converts plant-based cellulose into sugars,” which are fermented into ethanol to be used as sustainable biofuels. This Phase 2 grant follows the successful completion of Phase 1, where Blue Biofuels demonstrated the feasibility and effectiveness of its CTS process, paving the way for this Phase 2 grant.

SAFFiRE Renewables LLC broke ground on its pilot plant at Conestoga Energy’s Arkalon Energy facility in Liberal, Kansas, marking a significant step in SAFFiRE’s journey to transform corn stover into a low-carbon feedstock for sustainable aviation fuel.

The plant will be capable of processing 10 tons of corn stover daily, yielding cel-

lulosic ethanol that can be upgraded into SAF with a carbon footprint at least 83% lower than conventional jet fuel. SAFFiRE utilizes exclusive technology developed by the Department of Energy’s National Renewable Energy Laboratory with funding from Southwest Airlines and the DOE’s Bioenergy Technologies Office.

NewEnergyBlue, the clean-technology designer of biomass refineries that turn agricultural waste into highly decarbonized biofuels and biochemicals, has finalized its purchase of Inbicon biomass-conversion technology from Ørsted, a renewable energy company based in Denmark. NewEnergyBlue's acquisition extends its scope of

operations worldwide, includes ownership of Inbicon's international patent portfolio, and conveys global licensing rights for the bioconversion technology.

“Corn stalks from America, wheat straw from Canada and Europe, sugar bagasse in Brazil and India—all over the world, billions of tons of botanical waste

With the successful completion of the Phase 2 project, all stages of the process— from biomass collection to ethanol production—will be fully integrated, optimized and scaled up, according to the Floridabased company.

“Today’s groundbreaking event marks a significant milestone for SAFFiRE Renewables,” said Tom Nealon, CEO of SAFFiRE Renewables. “Our priority now is to complete the construction of our pilot plant, with a target of Q4 2025, and begin operations.”

are left behind after annual harvests,” says Albury Fleitas, president of NewEnergyBlue. “And on the horizon, perennial grasses grown in the planet’s expanding arid regions where food crops no longer thrive. They’re all ideal feedstocks for our biomass refineries[.]”

Gevo Inc., a leading developer of netzero hydrocarbon fuels and chemicals, announced that it has entered into a definitive agreement to acquire the ethanol production plant and carbon capture and sequestration assets of Red Trail Energy LLC for $210 million. The Adjusted EBITDA1 from Red Trail Energy ethanol and CCS assets, when combined with Adjusted EBITDA1 from

Gevo’s renewable natural gas business, and other businesses, including Verity, is expected to make Gevo’s Adjusted EBITDA positive in 2025. The purchase price includes the ethanol production asset and the CCS asset. Gevo expects that its capability of marketing carbon abatement in conjunction with delivery of advanced liquid fuels should deliver superior value to shareholders.

LanzaTech Global Inc., the carbon recycling company transforming waste carbon into sustainable fuels, chemicals and materials, has signed a master license agreement with Sekisui Chemical Co. Ltd. to deploy a jointly developed, commercial-scale platform that converts syngas derived from municipal solid waste and industrial solid

waste into ethanol. Sekisui intends to build multiple facilities in municipalities across Japan, which incorporate equipment packages, engineering and advisory services, consumables and intellectual property provided by LanzaTech.

Sekisui expects its first commercialscale facility to produce 10 to 12 kilotons

Summit Next Gen LLC announced that it has reached financial close on site acquisition for the future development of its previously announced sustainable aviation fuel (SAF) production platform that will “revolutionize” the global aviation industry by providing a scalable supply of low-carbon jet fuel. Strategically located on the Houston Ship Channel, the selected

60-acre site will provide Summit Next Gen optionality to leverage existing and planned marine, pipeline, rail and other logistics infrastructure, to cost competitively source ethanol feedstock for the facility and deliver produced SAF to all major demand markets on behalf of its offtake customers both domestically and internationally.

On an annual basis, the 65 MMgy ethanol plant is capturing and storing 160,000 metric tons of CO2 in the Broom Creek formation. However, the facility has pore space sufficient for 1 million metric tons of CO2 storage per year, providing room for CCS growth.

of ethanol annually. The ethanol output is synthetic alcohol (Japan Alcohol Association Standard) and can be converted into ethylene and kerosene for use as sustainable aviation fuel as well as widespread material and chemical applications.

The site acquisition was financed via equity from a successful development capital fundraising round, with support from existing and new investors in Summit Next Gen.

EPM has collected information on 120 U.S. ethanol plants that are capturing their fermentation carbon dioxide—or intend to—for one of three principal purposes: conventional utilization, sequestration or next-gen transformation.

Fermentation CO2, the most elemental offshoot of grain ethanol production, is no longer the industry’s quiet, behind-the-scenes byproduct, but its most discussed, chased and controversial output. The current race and clamor over CO2—sequestration, in particular—would have been hard to foresee 15 years ago when capturing the gas, no matter the reason, went largely unnoticed. That is, unnoticed by virtually everyone but those processing and utilizing the byproduct. Commercial CO2 sent “over-the-fence” from ethanol plants to purification partners has been a vital industry function for decades, and ethanol plants remain the nation’s leading source of top-grade CO2. While hard to nail down every merchant operation—offtake legalese and NDAs abound—the compressed, purified product is upgraded for food and beverage use, healthcare and dry ice production at more than 40, maybe as many as 50 U.S. ethanol plants.

Now, this legacy fleet of merchant suppliers is joined by a new breed of CO2 catchers, including those capturing to sequester, capturing to utilize and capturing to transform. These CO2 newcomers aren’t measuring their facility’s capture in metric tons per day like their merchant counterparts, but hundreds of thousands, even millions of metric tons per year.

By Tom Bryan

This fall, Ethanol Producer Magazine set out to collect as much information as possible on U.S. ethanol plants engaging—right now or down the road—in carbon capture, utilization or sequestration (CCUS), from legacy merchant suppliers to future interstate pipeline participants. Ultimately, we collected information on 120 ethanol plants that currently capture CO2 or intend to soon. More than 80 of the facilities on our CCUS list are future carbon capture and storage (CCS) pipeline participants—at least 55 of them associated with a single high-profile aggregation effort—Summit Carbon Solutions—but many others doing onsite, nearby or in-state CCS. A vast majority of CCS projects on our list are classified as “Planned” or “Under Development,” with only five facilities—three doing CCS and two doing enhanced oil recovery (EOR)—tagged as “Operational,” meaning those CCUS facilities are running or ostensibly able to run as designed. The production figures reported in this story are based on either actual volumes or, in the case of unavailable data, conservative estimates by EPM staff.

Here’s what we know about CCUS in the U.S. ethanol industry right now.

In the category of “Large, Aggregated, Interstate CCS” (i.e., planned pipelines crossing state lines, spanning large distances and typically

connecting to multiple CO2-producing sources), EPM’s research turned up a total of 68 engaged or committed facilities, four of which are also categorized as current or historically active merchant CO2 capturers (that intend to convert to sequestration in the future by joining an interstate pipeline). At least 55 facilities on our list have publicized their intention to join the planned Summit Carbon Solutions pipeline, representing a conservatively estimated 13.5 million metric tons per year of stored CO2. Note: Summit’s sequestration figures are significantly higher than EPM’s; this publication opted to use a more conservative CO2 capture/ storage calculation to avoid overestimating volumes, which are planned and approximate.

Summit’s ethanol plant partners include biorefineries in Iowa, Minnesota, North Dakota, South Dakota and Nebraska. The Iowabased company plans to collect, compress and channel CO2 from this committed fleet of plants to North Dakota, where the liquefied greenhouse gas will be permanently stored deep within the earth. In June, the Iowa Utilities Board approved Summit’s application for the pipeline, largely clearing the way for the project once its new “laterals” (i.e., expansion spurs to more facilities) are accepted. At press time, public information meetings on the expansion spurs were wrapping up. Summit has acquired easements from landowners along nearly threefourths of its route in Iowa. However, in addition to lingering opposition to the 2,000-mile

pipeline, the project still awaits regulatory rulings and approvals in North Dakota, South Dakota and Minnesota. The company’s CEO, Lee Blank, recently stated at the ACE annual conference in Omaha that Summit remains more focused on permitting than construction at this stage in the project. For these and other reasons, all Summit-related CCS projects are categorized as “Planned” in EPM’s database.

Another 3 million metric tons of future CO2 storage is represented in the Large, Aggregated, Interstate CCS category by Wolf Carbon Solutions, which is principally tied to one producer—Archer Daniels Midland Co. Specifically, Wolf has been focused on bringing CO2 from ADM’s ethanol plants in Iowa to its existing CCS site in Illinois. In 2022, Wolf signed a letter of intent with ADM to develop, own and operate a connecting CCS system that would capture, compress and transport—via a 280-mile pipeline—CO2 produced at ADM’s Clinton and Cedar Rapids, Iowa, facilities to ADM’s sequestration operation in Decatur. The plan: to store the CO2 permanently underground at a fully permitted and already-operational sequestration site—a storage reservoir deep within the Mt. Simon Sandstone geologic formation—near ADM’s Decatur campus where CCS has been happening for a decade. But last November Wolf withdrew its permit application for the pipeline work—which it had submitted in mid-2023—with the Illinois Commerce Commission, stating that it would update and refile the application in early 2024. Ten months later, there appears to be no indication that the application has been refiled with the ICC, as of press time.

Adding a layer of complexity to the project, the U.S. EPA reportedly launched an enforcement action against ADM’s carbon storage enterprise due to an apparent leak within one of its sequestration wells. According to several media reports, sequestered CO2 migrated out of the approved storage site in mid-2024 but remained at least 5,000 feet below the surface and did not affect local drinking water. ADM has asserted that its ability to identify the issue early is evidence that its well monitoring equipment is effective and working as designed. It is unclear how this development will impact the ADM-Wolf project, if at all. Assuming it is still conducting CCS, ADM’s Decatur facility remains one of three “Operational” ethanol industry CCS projects in the U.S.—the other two being in North Dakota

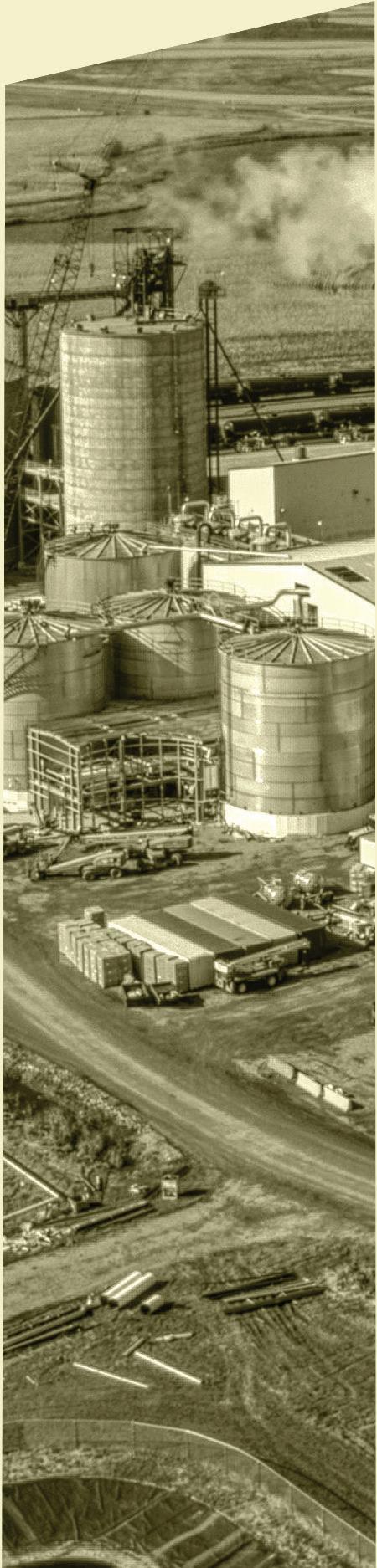

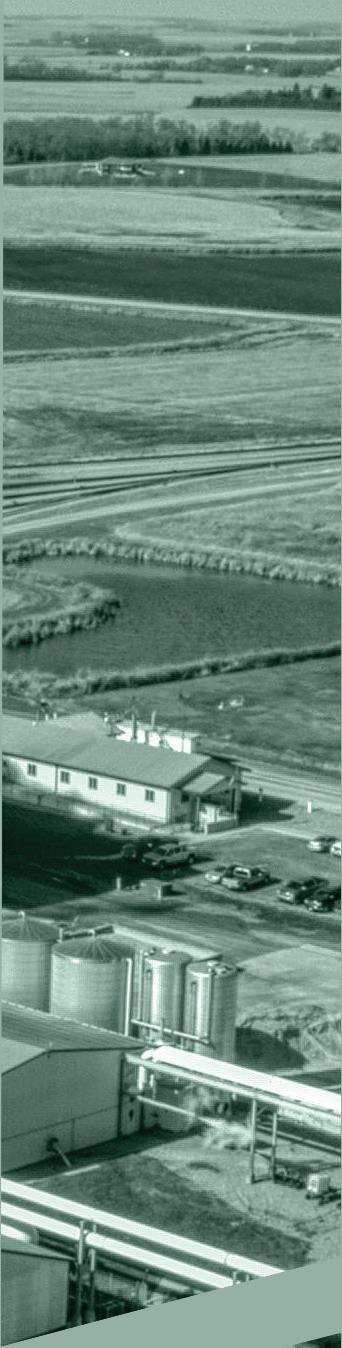

BLUE SKY OPPORTUNITIES: While the merchant CO2 capture in the ethanol industry, led by companies like POET, top, remains robust, it is being somewhat overshadowed by a surging movement to capture fermentation CO2 for sequestration, like Blue Flint Ethanol, bottom, and Marquis Energy, middle.

PHOTOS: POET, MARQUIS, BLUE FLINT

(see Red Trail Energy and Blue Flint Ethanol below).

While every facility committed to joining the Summit pipeline stands to deliver important volume to the CO2 aggregation effort, multi-plant producers bring the most weight to the project. Notables include Glacial Lakes Energy (four plants in South Dakota) representing 885,000 metric tons of CO2 annually. Green Plains (four plants in Minnesota and Iowa)—and the company has three more facilities involved with Tallgrass (see below)— representing 760,000 metric tons of CO2.

The addition of POET and Valero plants—25 combined—to the Summit pipeline in early 2024 made big news and recharged the multi-billion-dollar project. In January, POET, the world’s largest ethanol producer, committed 17 of its plants to joining the pipeline, representing about 4 million metric tons of CO2 per year. The South Dakota-based company, which also has 10 to 12 merchant CO2 producing plants, had previously partnered with another pipeline proposed by Navigator CO2, which was cancelled in late 2023 amid regulatory challenges.

Valero, too, now comprises a big share of the planned Summit pipeline, with eight facilities ready to contribute about 3 million metric tons of CO2 per year. Valero, which also previously connected to Navigator, signed on with Summit in March, less than two months after POET came on board.

Several large, stand-alone plants also bring notable volumes of CO2 to Summit, including producers like Little Sioux Corn Processors, an Iowa plant that produces 400,000 metric tons of CO2. Also in Iowa, Homeland Energy will bring half a million metric tons of CO2 to the project each year; and North Dakota’s

From idea to install, Sam Carbis Solutions Group keeps your product transfer process safer and more efficient. Loading arms, cage systems, and platforms engineered to work together ensuring compliance with mandates and easier loading and unloading.

See how we have helped other organizations with their safety needs at CarbisSolutions.com

Tharaldson Ethanol will bring 450,000 metric tons. Dozens of plants will bring 200,000 metric tons or more, and almost all of the facilities planning to link to the pipeline will deliver more than 150,000 metric tons per year.

Delivering about 940,000 metric tons of annual CO2 sequestration in the Large, Aggregated, Interstate CCS field is the interstate pipeline being spearheaded by Tallgrass. The Tallgrass project is unique because it is not a greenfield pipeline but a conversion of the company’s existing Trailblazer natural gas pipeline. The 400-mile pipeline would serve as the backbone of a regional CO2 transporta-

tion system that would allow the company to move and permanently sequester more than 10 million metric tons of CO2 per year from ethanol plants and other CO2-emitting facilities in Nebraska, Colorado and Wyoming. The CO2 on the Tallgrass pipeline would be sequestered within a commercial-scale storage hub in southeastern Wyoming.

It has been widely reported that Tallgrass is working closely with Green Plains, which has committed three of its facilities (representing some 740,000 metric tons of CO2) to the Trailblazer pipeline. In August, Green Plains CEO Todd Becker said compression

CAPTURE QUESTS: While many U.S. ethanol producers are eyeing CCS, few are currently doing it. Red Trail Energy in North Dakota (soon to be acquired by Gevo Inc.) is one of three U.S. ethanol plants capable of sequestering fermentation CO2 today. Beyond storage, some producers are looking at CO2 transformation; Kansas Ethanol, for example, is evaluating a project with HYCO1 to turn its CO2 into syngas for the production of green fuels and chemicals.

equipment needed for its three Nebraska plants connecting to the Trailblazer project had been ordered. The project remains on pace for startup in the second half of 2025, he added. These indications give the Tallgrass/ Green Plains project the status of “Under Development” on EPM’s CCUS list. Tallgrass is also reportedly working with KAAPA Ethanol in Minden, Nebraska, and looking to also connect to KAAPA's other two Nebraska plants in Ravenna and Aurora.

Another player in the Large, Aggregated, Interstate CCS pipeline category is Carbon America, a Colorado-based project that could

have easily been placed in the “Onsite, Nearby, In-State CCS” category had it not been for the fact that one of the three plants involved with the project is located in neighboring Nebraska. Carbon America is working with Colorado Agri Products, or CAP, which owns and operates facilities in Yuma and Sterling, Colorado, as well as Bridgeport, Nebraska, just an hour north of Sterling. According to Carbon America, the CO2 storage site is about 10 miles southwest of Yuma (and just a few miles away from CAP’s Yuma plant). A geologic test well was drilled there in 2023 to scientifically validate the location (4,000 feet underground)— and it checked out. Together, the three plants would sequester an estimated 350,000 metric tons of CO2 annually. The company is still aiming for project completion in 2025, according to its website.

The category with the most here-andnow activity is “Onsite, Nearby, In-State CCS,”

Our team of experts have over 20 years of ethanol plant maintenance expertise. We o er full service and parts for all Fluid Quip equipment to ensure peak performance.

• OEM Parts Warehouse

•$2 million+ inventory on-hand

•Factory Trained & Certified Techs

•MZSA™ Screens

•Paddle Screens

•Grind Mills

•Centrifuges

•Gap Adjusters

characterized by smaller, shorter-distance and/or local storage projects that enjoy a certain speed to market with streamlined permitting and project execution timelines. In fact, two of the three operational pure-play ethanol plant CCS projects in the nation right now, both in North Dakota, fall into this category.

North Dakota’s Red Trail Energy, a 65 MMgy ethanol plant in Richardton, North Dakota, came online with CCS in mid2022—the first project of its kind allowed under what is called “state primacy” rules. The company made news earlier this year when it entered the voluntary carbon market, becoming the first ethanol plant to be issued CO2 removal credits, or CORCS, within a global marketplace. Then, in September, it was announced that longtime biofuels producer Gevo Inc. had entered into a definitive agreement to acquire Red Trail—both the ethanol plant and its CCS assets—for $210 million. Gevo plans to add net-zero sustainable aviation fuel (SAF) production capacity to the site, which is currently sequestering 160,000 metric tons of CO2 annually but has the capacity to store 1 million metric tons per year.

Also in North Dakota, Blue Flint Ethanol, a Harveststone Low Carbon Partners facility that produces 72 MMgy, brought its own CCS project online in 2023—just 100 miles northeast of Red Trail. The facility is actively capturing and storing about 200,000 metric tons of CO2 per year—near the plant. Blue Flint’s CO2 is permanently stored deep underground in what’s known as the Broom Creek formation.

Harvestone’s two other plants, Dakota Spirit Ag Energy in North Dakota and Iriquois Bio-Energy in Indiana, are also being eyed for CCS opportunities. The company has stated that it prefers sequestration options that are similar to its setup at Blue Flint.

In Illinois, Alto Ingredients is working with a company called Vault 44.01 on a localized CCS plan for its Pekin ethanol production campus where three facilities produce, conservatively speaking, 625,000 metric tons of CO2. Last reported, the companies were continuing to negotiate the terms of the partnership while working on permitting, financing, system design, community outreach, vendor negotiations and equipment scheduling requirements.

Vault is also working with Cardinal Ethanol in Indiana, which intends to sequester half a million metric tons of CO2 annually. Cardinal currently shows up as a merchant CO2 producer on EPM’s CCUS list, but it will likely be transitioning to CCS completely or splitting CO2 output between CCS and commercial processing. The same can be said of Front Range Energy in Colorado, which is also a longtime merchant CO2 supplier, but like Cardinal, has plans to sequester.

One Earth Energy, a Rex-owned ethanol plant in Illinois, is moving forward with what it calls One Earth Sequestration, an Under Development project to capture and sequester 420,000 metric tons of CO2 annually. Also in Illinois, Marquis Energy, which operates the largest ethanol plant in the nation in Hennepin—producing 400 million gallons per year—is making headway on its own onsite/ nearby CCS project ready to capture and store about 1 million metric tons of CO2 annually.

In California, Aemetis is moving ahead with its proximity-to-production CCS project, which will reportedly accept CO2 from both of its biofuels facilities in the Golden State. The company’s ethanol plant in Keyes will sequester about 200,000 metric tons of CO2 per year, as will the company’s other biorefinery.

Finally, Chief Ethanol continues to work with its in-state CCS partner, Catahoula Resources, on developing a short-distance CO2 pipeline connecting Chief’s ethanol plants in Hastings and Lexington to a sequestration site within the state. “The use of proven carbon capture infrastructure targeting nearby, lowcost storage is a compelling plan for investment in the local economies of Nebraska,” said Jeff Rawls, CEO of Catahoula Resources.

There are likely many ethanol producers looking at CO2 transformation, but only a couple that are committed to it right now. Adkins Energy and Kansas Ethanol have both stepped up, daring to be early-to-market with CO2-based fuels and chemicals. As reported by EPM in 2023, Adkins Energy, an Illinois ethanol plant that produces 60 MMgy, is redirecting its fermentation CO2 (250,000 met-

ric tons per year) to the production of green methanol (about 84,000 metric tons per year), a low-carbon shipping fuel. The project remains “Under Development.”

Similarly, Kansas Ethanol is working with a company called HYCO1 to turn the 200,000 metric tons of CO2 it produces annually into low-carbon, chemical-grade syngas that can be converted into myriad downstream products.

The use of CO2 for enhanced oil recovery is not a new concept, but it isn’t making headlines like it once did. That, however, has not stopped two U.S. ethanol producers from continuing to leverage the value of their CO2 for applicable EOR needs in their region. Arkalon Energy and Bonanza BioEnergy, both in Kansas, are actively engaged in supplying fermentation CO2 for EOR. While both plants are owned by Conestoga Energy, they are actually working with different EOR partners. Arkalon is partnered with Capture Point to utilize the ethanol plant’s fermentation CO2 for EOR in the panhandles of Oklahoma and Texas. The CapturePoint Arkalon facility has the capacity to capture 250,000 metric tons of CO2 annually. CapturePoint transports the captured CO2 through its 170-mile regional network of dedicated pipelines to over 75 active injection wells the company uses for EOR. Once EOR operations cease, the CO2 is permanently stored underground.

Similarly, Bonanza BioEnergy is paired up with Gary Climate Solutions, which is using the plant’s 150,000 metric tons of annual CO2 output for EOR in an oil field in southwest Kansas.

Both EOR projects are listed as “Operational” on EPM’s CCUS list.

Commercial, or “merchant” CO2 predominantly undergoes compression, water removal, refrigeration and purification to achieve various grades of CO2, from pipeline spec to food-and-beverage grade, according to frequent EPM contributor Sam Rushing, who has previously reported in EPM that some 75 percent of all merchant CO2 in the U.S. (40% of which comes from ethanol plants), is directed to the food and beverage sector. From that, Rushing says, about 50% is dedicated to food

chilling, freezing and preservation. Non-food uses for CO2 range from metallurgy to health care; plus, industrial sector usage continues to grow, with new uses frequently emerging. “Ethanol is the most important source type for a good-quality, highly concentrated form of CO2 feedstock for liquefaction/purification, and it serves an impressively large and diverse marketplace,” Rushing reported in EPM last year.

Due to an abundance of confidentiality agreements, EPM’s reporters faced challenges finding details on the ethanol industry’s merchant fleet of CO2 suppliers, those plants suppling fermentation CO2 “over the fence” to purification and processing partners like Airgas/Air Liquide, Air Products, Continental Carbonic Products and others. Difficulties aside, staff research did yield useful results. Our CCUS list now includes 40 U.S. ethanol plants that currently have the operational capability to capture and supply CO2 to an onsite/nearby processing partner. Note: industry analysts like Rushing generally peg the number closer to 50.

New EFIF Research shows path to further decarbonize transportation sector with bioethanol.

POET, making up about a fourth of the entire fleet of merchant CO2 suppliers in ethanol production, has at least 10 facilities supplying and processing CO2 for commercial use. This not only makes POET the largest commercial CO2 supplier in the ethanol industry, but one of the largest of its kind in the nation.

Many of the other merchant CO2 suppliers in the industry are independent plants and/ or ethanol production companies with two or three facilities, such as The Andersons and ACE Ethanol/Fox River Ethanol.

By EPM staff estimates, the 40 plants on our radar engaged in the merchant CO2 industry are contributing to the supply of at least 13,000 metric tons per day of CO2. This equates to roughly 4.5 million metric tons of merchant CO2 per year. How federal incentives for CCUS will impact the ethanol industry’s legacy fleet of merchant CO2 capturers remains to be seen, but at least six merchant facilities on EPM’s CCUS list are showing interest in transitioning to CCS.

EPM’s CCUS list is available to ethanol producers upon request.

Author: Tom Bryan Contact: editor@bbiinternational.com

Millions in federal funding is available to help carbon dioxide producers manage their CO2 and maximize their capture.

By Luke Geiver

Carbon management is experiencing exponential growth, according to the leading U.S. government agency responsible for overseeing and developing infrastructure for it. While the U.S. Department of Energy has many offices working on carbon sequestration, the Office of Fossil Energy and Carbon Management, or FECM, has invested roughly $1.47 billion over the past four years into a range of projects, spanning carbon capture, use, transport, storage and removal.

FECM currently has available funding to help industrial, power generation and legacy carbon dioxide producers study the possibilities of CO2 transport to locations for geo-

logic storage or conversion to useful products—and ethanol plants qualify. The CO2 can be transported by several means, including pipeline, rail, truck, barge or ship.

FECM’s overall goal isn’t just about capturing and transporting CO2. The DOE wing consistently points out that performing such a substantial scale-up of infrastructure in the next decade will not only support the growth of the carbon management industry, but also create high-paying jobs and protect communities across the country.

Last year, FECM made a funding opportunity announcement (FOA 2730) of

$27 million to support front-end engineering and design (FEED) studies for regional CO2 transport networks. It was the second round of funding for such projects. That $27 million outlay was part of a larger opportunity with $100 million allocated from the Bipartisan Infrastructure Law to help kickstart CO2 transport projects. While some of that funding has been awarded, FECM has reopened its funding opportunities again for another round. In May, another $24 million funding round was announced.

“To date, the current number of projects selected and associated funding under the FOA 2730 falls below that threshold ($100 million), which means there is more funding that can be deployed to support future FEED studies,” a FECM spokesperson says.

Seven total selections have been previously identified through FECM selection announcements, representing a range of potential industries including power generation, gas processing, refining and chemical production, FECM says, and funding will continue through 2026.

During the first round of funding, three recipients were chosen. Each funding recipient received the full $3 million available from FECM. In Michigan, Carbon Solutions LLC was awarded for the purpose of studying a commercial-scale pipeline to transport quantities of anthropogenic CO2 through a multipoint pipeline delivering the compressed gas to multiple geologic storage locations.

In Texas, Howard Midstream Energy Partners LLC was awarded funding to help study a 600-mile regional and commercial

scale pipeline for moving supercritical anthropogenic CO2 from various sources to multiple CO2 sinks on the Gulf Coast.

In Georgia, Southern States Energy Board will study a pipeline system across the Houston-Galveston region to decrease the region’s CO2 emissions using a 60-mile pipeline.

For the second round of FEED study funding through FOA 2730, FECM awarded four recipients.

BKV dCarbon High West LLC out of Denver, was awarded roughly $2.5 million to look at a CO2 barge operation for the Gulf Coast of Louisiana, Mississippi and Alabama.

Carbon Solutions LLC (also a recipient through the first round of funding) was awarded $3 million to study an open-access,

488-mile CO2 pipeline to transport up to 32 million metric tons of CO2 per year across Montana, North Dakota and Wyoming.

In Florida, Overseas Shipholding Group Inc. got $2.5 million to study a CO2 transport system based on an articulated tug and barge operation from a proposed multimodal hub at Port Tampa Bay to an existing tank terminal near Sunshine, Louisianna.

And the last recipient of the second round of funding was ZuCO2 Transport LLC out of California. The company will study a West Coast barge CO2 project that would take CO2 from Washington, Oregon and California to a storage site in the San Joaquin Delta of California.

While the FECM spokesperson, citing procurement sensitivities, declined to say what, if any, insights new applicants

might gain from previous awardees, the office did offer this: “Following the selections announcements, it is apparent that there is market interest in pipeline and waterborne shipping for CO2 transport,” they stated, adding that each mode of transport has a unique opportunity and potential advantage in certain circumstances to support the future large-scale deployment of CO2 transportation infrastructure.

The funding can be used for studying a variety of factors, including scale, terrain,

region, size, volume, power supply, CO2 capture, conversion and storage parameters. Studies should be in the range of $750,000 to $3 million and must show technical merit, commercial and regulatory viability, and strategic value to the CCUS and CDR industries, FECM says. While applicants are encouraged to propose projects with the consideration for the creation and integration into a huband-cluster configuration, an applicant can offer a different approach.

“The funding opportunity has now matured to be inclusive of all modes of transport and supporting interconnections, and we would like to encourage applicants to take advantage of that inclusivity,” the spokesperson says.

Applicants for funding must also address other impacts of CO2 infrastructure development and operation, including community engagement. In a 2023 EPM interview with Brad Crabtree, assistant secretary at FECM, about carbon management and its

place in ethanol, he was quick to point out the need for infrastructure plans to address the community aspect.

In its recently released, “Heartland Regional Report: Building A Clean and Industrial Economy and the Supporting Role of the U.S. DOE’s Office of Fossil Energy and Carbon Management,” FECM explained an issue it has seen with CO2 transport pipelines proposed to move ethanol-based CO2. Although leading ethanol producers see the potential and need for CO2 pipeline in-

frastructure, there are mixed views amongst landowners, the report said. “National advocacy organizations that oppose both ethanol as an alternative fuel and the carbon capture and storage industry have aligned themselves with local landowners who are strongly opposed to the use of eminent domain to secure the land rights needed for pipeline construction,” the report noted. Because of that, developers need to consider alternative methods to eminent domain while continuing to negotiate purchases or leases.

FUNDING FLOW: A Denver company was awarded roughly $2.5 million to look at a CO2 barge operation for the Gulf Coast of Louisiana, Mississippi and Alabama.

Other concerns with CO2 infrastructure linked to ethanol production include pipeline safety, as many rural communities believe they might not be well equipped to handle an issue should it arise. FECM advocates for education, training and engagement on all fronts of the pipeline story.

In its FEED study funding requirements, applicants must include a community benefits plan. The plan should include: a quality of jobs plan, a community, labor and stakeholder engagement plan development proposal and more. In 2023, Crabtree said that many landowners don’t understand carbon or related infrastructure. And, he said, projects won’t be accepted without local support.

The policy framework for carbon management has advanced significantly in the past few years and FECM sees a future with major operating facilities and clear benefits to both industry and communities. In 2021, the passage of the BIL expanded the DOE’s budget for carbon management from less than $500 million per year to more than $12 billion spread out between 2022 and 2026.

“With this expansion, the DOE’s activities shifted from primarily research, development and small-scale demonstrations to include large-scale pilots, demonstrations and deployments,” the spokesperson says. The reformation of the 45Q tax credit, which offers incentives for carbon management activities, in conjunction with the current market environment for carbon, puts FECM carbon management funding at the center of transformational industrial change.

Just look at CO2 pipelines. The DOE says there are roughly 5,000 miles of CO2 pipelines across the U.S. with projections of significant scale up of transport capacity demand. In the long-term (i.e., by 2050), DOE believes more than 13,000 miles of CO2 transport trunk lines and over 52,000 miles of spur pipelines will be required to service and store 1 billion metric tons of CO2 per year. And, in the near-term, “development of that infrastructure must begin within this decade.

In addition to funding studies, FECM and its parent entity, the DOE, have invested an average of $400 million a year since 2021. For the development of technologies used to capture CO2 directly from a source or from the air, funding of $54.4 million has been made available.

For help with carbon storage, the DOE has provided $574 million to 49 projects as part of its Carbon Storage Assurance Facility Enterprise (CarbonSAFE) initiative.

Their valuable contents are at risk. But if your site planning included J.C. Ramsdell secondary containment systems, you’re protected from the unthinkable. Your contents are safe— the environment is safe. Ramsdell has been protecting them both since 1988.

And through its Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) program, FECM has made $500 million available to projects that will expand CO2 transportation infrastructure to help reduce CO2 emissions.

FECM isn’t just funding studies that will help bring infrastructure into existence. The office is also helping to build the demand side for CO2 as well. In mid-2023, FECM announced $100 million in funding to support states, local governments and public utilities, “in purchasing products derived from converted carbon emissions.”

The goal of the funding is simple: to speed up the adoption of carbon management activities and create a market for CO2linked products. The funding should help advance the market for sustainable alternatives in fuels, chemicals and building products. The funding provided can vary between $50,000 and $500,000, with a minimum of a 50% cost-share from awardees.

According to the DOE, the grants must illustrate how incumbent products can be replaced or supplemented with alternatives derived from transformed CO2.

“These grants will illustrate that more sustainable alternatives are viable and will promote the deployment of these products even after the grant ends,” DOE said in its overview of the funding.

“Our goal is to help achieve FECM's mission,” an office spokesperson says, “which is focused on minimizing the environmental and climate impacts of fossil energy production and use, [as well as] key industrial processes, while working to achieve net-zero emissions across the U.S. economy.” The spokesperson adds, “As a part of that mission, we anticipate that as today’s carbon management projects transition into operational facilities, their full emissions reduction potential and broader environmental, economic and jobs benefits will become evident to industry, workers and communities across the U.S.”

Author: Luke Geiver Contact: writer@bbiinternational.com

• Delivers up to 15% increased corn oil recovery

• Enables pathway to produce low-CI cellulosic gallons

• Dewaters corn kernel fiber for reduced natural gas consumption

• Maximizes plant operability

To learn more, contact your account manager.

Increasing the ethanol industry’s market by decreasing the biofuel’s carbon intensity score was a major theme at the 2024 ACE conference as key industry players spoke to the industry's challenges and opportunities.

By Katie Schroeder

The American Coalition for Ethanol’s 2024 conference, themed “The Gold Standard,” featured important figures with industry impact, including representatives from Summit Carbon Solutions and the U.S. Department of Agriculture. Held in Omaha, Nebraska, this year’s general session speakers spoke on key topics weighing on the minds of U.S. ethanol producers, such as climate-smart agriculture, carbon

capture and sequestration pipelines and ethanol’s inclusion in the developing SAF market.

Dave Sovereign, chairman of the board for ACE, introduced the general session, encouraging ethanol producers to stay engaged with policymakers. “When we, as industry representatives, meet with our elected officials, they quickly pick up on the integrity, character and passion in [our] conversation, and [they] realize how our industry has benefitted their constituents,” he said. “And thereby, we earn their support, but we can’t take this support for granted.

And as an industry, we must keep these lines of communication open.”

Following Sovereign’s remarks, Brian Jennings, CEO of ACE, updated the assembly on the success attained “at long last” for the eight states that opted out of the federal government’s Reid vapor pressure (RVP) regulations, bypassing a rule that prevented E15 from being sold during the summer throughout much of the country. “The optouts from key Corn Belt governors combined with summertime ... emergency waivers for E15 in conventional gasoline areas—the third consecutive year

EPA has invoked its emergency authority I would add—should help set the stage for coast-to-coast availability,” he said. While encouraging more states to follow the path of those that opted out of the RVP rule, he advocated for Congress to step in and make E15 available year round, nationwide without the need for an emergency waiver, sharing that ACE is optimistic about “the opportunity to get E15 legislation across the finish line before the end of the year.”

The RFS has also been on an encouraging trajectory under this administration, Jennings said, citing fewer conflicts with

refiners over annual blending obligations due to the relatively timely release of annual volume obligations and the current administration’s reluctance to approve unwarranted small refinery waivers (SREs). However, he also emphasized the need for vigilance in defending the RFS due to recent court battles with refiners and a D.C. court requiring EPA to reassess each SRE denial. He also highlighted the focus put on decarbonization and the role that low-carbon fuels could play in this national objective.

In his remarks, Jennings also shared updates on the Regional Conservation Part-

nership Program, which incentivizes farmers to implement climate-smart practices.

The program launched in 2021 when ACE was awarded funding by USDA, allowing the program to get its start in South Dakota, incentivizing the adoption of lowcarbon and regenerative farming practices on 18,000 acres, according to Jennings. This year, more funding was granted, expanding the program’s reach to 10 states and 13 to 14 ethanol companies with the funding to incentivize climate-smart ag practices on an additional 100,000 acres.

“The sites for this larger project were deliberately chosen to provide the Department of Energy with robust data regarding the greenhouse gas benefits of conservation practices in different soil types and climates,” Jennings said. “Already, more than 500 farmers have attended meetings we have hosted in seven of the 13 ethanol grain sheds, and those farmers have expressed interest in enrolling nearly 250,000 acres in our project, meaning initial farmer interest is approaching five times available funding.”

The goal of the project is to help address the real and perceived information gaps surrounding the GHG reduction benefits of climate-smart agriculture; helping farmers get credit for standalone practices—no-till farming, for example—rather than only getting a maximum 10-point reduction credit through the bundling of three requisite practices (cover crops, notil and enhanced efficiency fertilizer use), as this year’s 40B guidance from Treasury

required. “Ultimately, we are focused on helping ethanol companies sell new and valuable products to diversify their profit potential and earn premium prices in the regulated fuel markets that are being stood up all over the globe,” he said.

Following Jennings’ remarks, Ron Lamberty, chief marketing officer with ACE, gave an update on the Higher Blends Infrastructure Initiative Program, or HBIIP. He explained that the program was undersubscribed in its first three rounds, oversubscribed in its last round and on track to be oversubscribed for the current round as well.

Lamberty discussed the importance of educating marketers—who, in turn, educate consumers—about ethanol and its margin benefits. “That’s been our focus when we go out to trade shows, when we go out to meet with people; it’s to talk about the fact that you can make more money selling ethanol,” he said. “And the most successful retailers you’ll find are the ones that have figured that out and are making more money.” State incentives for selling higher blends “do a world of good,” he explained, pointing out that sales are surging in Iowa, Nebraska and California. The slowdown in electric car sales is driving automaker interest in developing hybrid and flex-fuel hybrid vehicles, Lamberty explained.

The keynote address of the general session was given by Summit Carbon Solutions CEO Lee Blank. In his remarks, he updated the assembly on the progress of the company’s carbon capture and sequestration (CCS) pipeline project. Blank did not avoid acknowledging the challenges the project has faced in the past year, starting with the initial siting permit for the injection site in North Dakota being denied by the state’s Public Service Commission in August 2023.

“September of 2023 was a very interesting time [for] Summit Carbon Solutions,” Blank said. “It was a time when we really had to reflect on [whether we] were going to get this thing accomplished or not? And so, we doubled down on efforts, we did very hard things around our company, and what I mean by that is we reduced our company down to 40% of what we were when we got started.” The company adapted to the challenge by switching from construction mode to permitting mode. He explained that the Iowa Utilities Commission permit process has finished, and Summit has been issued an order for

the permit, which will be granted to them once certain conditions are met. Things aren’t over in North Dakota; the state has taken “time to rehear our permit,” Blank said, explaining that with those hearings finished, the company is waiting on a ruling.

An encouraging development for the project happened in Minnesota, when Min-

nesota’s Department of Natural Resources completed an environmental impact study (EIS) on a three-mile line of the project that crosses the Ottertail River, determining the project benign. “That is going to be used across our entire footprint as we move forward, as we work, state by state by state ... that will resonate,” Blank said. “Because

if you can get a benign EIS in Minnesota, that’s saying something about the project itself, so I’m really pleased for that.”

The permitting process in Iowa will need to restart with the addition of several POET and Valero facilities joining on, he explained. The “order for permit” was awarded to the “base route,” so landowner meetings will restart in Iowa for those additional laterals.

Blank reiterated the “why” of the pipeline project as well as the importance of communicating this information to ethanol producing communities. “South America is taking our exports,” Blank said. “And it’s not going to change; they are doing a bangup job on growing crops. We have got to internalize the usage of our corn crop, and we have a way to do that, and it starts with a pipeline, it makes all the difference in the world.”

The final speaker of the general session was Tom Vilsack, Secretary of USDA. Vilsack affirmed the importance of the RCPP project, calling it “an opportunity to show the power of collaboration” through bringing land grant universities, ethanol facilities, NRCS officials and DOE officials together to enable implementation of climate-smart practices. “Understanding and appreciating that in asking farmers to take a chance and a risk in adopting climate-smart or sustainable practices that there’s a cost associated with that, and it would be difficult for farmers to take that leap without partnership,” Vilsack said.

This project helps continue building a database that allows farmers to further take advantage of market opportunities by gathering statistically significant and localized data on the impact of climate-smart and regenerative ag practices.

Vilsack also expressed that the project’s data helps USDA make a “more powerful case” for the importance of ethanol’s inclusion in SAF. Ethanol plays a valuable role in promoting domestic energy security and

preserving small to medium-sized American farmers, thereby benefitting rural communities, according to Vilsack. “I owe, personally and in my capacity as Secretary of Agriculture, a debt of gratitude to all of you for your willingness to be part of this extraordinary industry,” he said.

The shrinking population of rural America and reduction in small family farms are among Vilsack’s concerns. A disproportionally large number of U.S. military personnel come from small towns across America, and if those populations continue shrinking, it becomes a national security threat, he explained. Making the “right choices” to support the ethanol industry is important to the administration.

“Now we come to one of the big choices, while this is a 15-billion gallon industry—important, significant—we now recognize that we’re not going to have battery-powered planes and ships, we’re not going to have hydrogen-powered planes and ships for quite some time,” Vilsack said. “And so, the world needs this industry to help it create low-carbon intensity marine and jet fuel.”

40B was part of an effort to make choices that support SAF. However, Vilsack recognized that bundling climate-smart ag practices in 40B guidance was not well-liked, but called an “effort to introduce the world to the fact that agriculture can make a difference, that ethanol can make a difference[.]” Establishing that was important, according to Vilsack, and it was also important that the false science around indirect-land-use change be corrected.

Ethanol’s inclusion in the “36-billion-gallon opportunity” that is SAF production matters for the energy transition, but it also matters because of its role in preserving the family farm, explained Vilsack. In closing, Vilsack emphasized that choices need to be made to ensure the ethanol industry’s continued access to the IRA and the continuance of small-to-mid-size family farms. “Seems to me there’s a better choice, recognizing the importance of production in agriculture and [continuing] to support that as we should, and we are. But also recognizing that there needs to be ways in which that farm family can generate more than one check, if you will, from what’s done on the farm[.]”

From working with farmers to drive down corn’s GHG emissions to championing nationwide, permanent availability of E15, ACE’s focus on expanding ethanol’s reach is evident. Jennings laid it out plainly: “Our goal: to make ethanol the undisputed gold standard clean fuel of the future.”

Author: Katie Schroeder Contact: katie.schroeder@bbiinternational.com

More than 35 years of tackling the most dif cult silo cleanout projects in 30+ countries worldwide.

Professional service technicians are MSHA and OSHA-certi ed and adhere to a rigorous continuing education program.

We conquer the most dif cult cleanout projects in the world with our proprietary silo cleaning technology.

10 /2 2 02 25 4

An Iowa State University Extension tool gives a glimpse at how much climate-smart farming practices could shave off corn’s CI.

By Susanne Retka Schill

Corn growers might soon be supplying more than yellow dent corn when their trucks roll over the scale and dump at the ethanol plant down the road. A carbon intensity (CI) certificate—potentially worth serious money—could be their new deliverable.

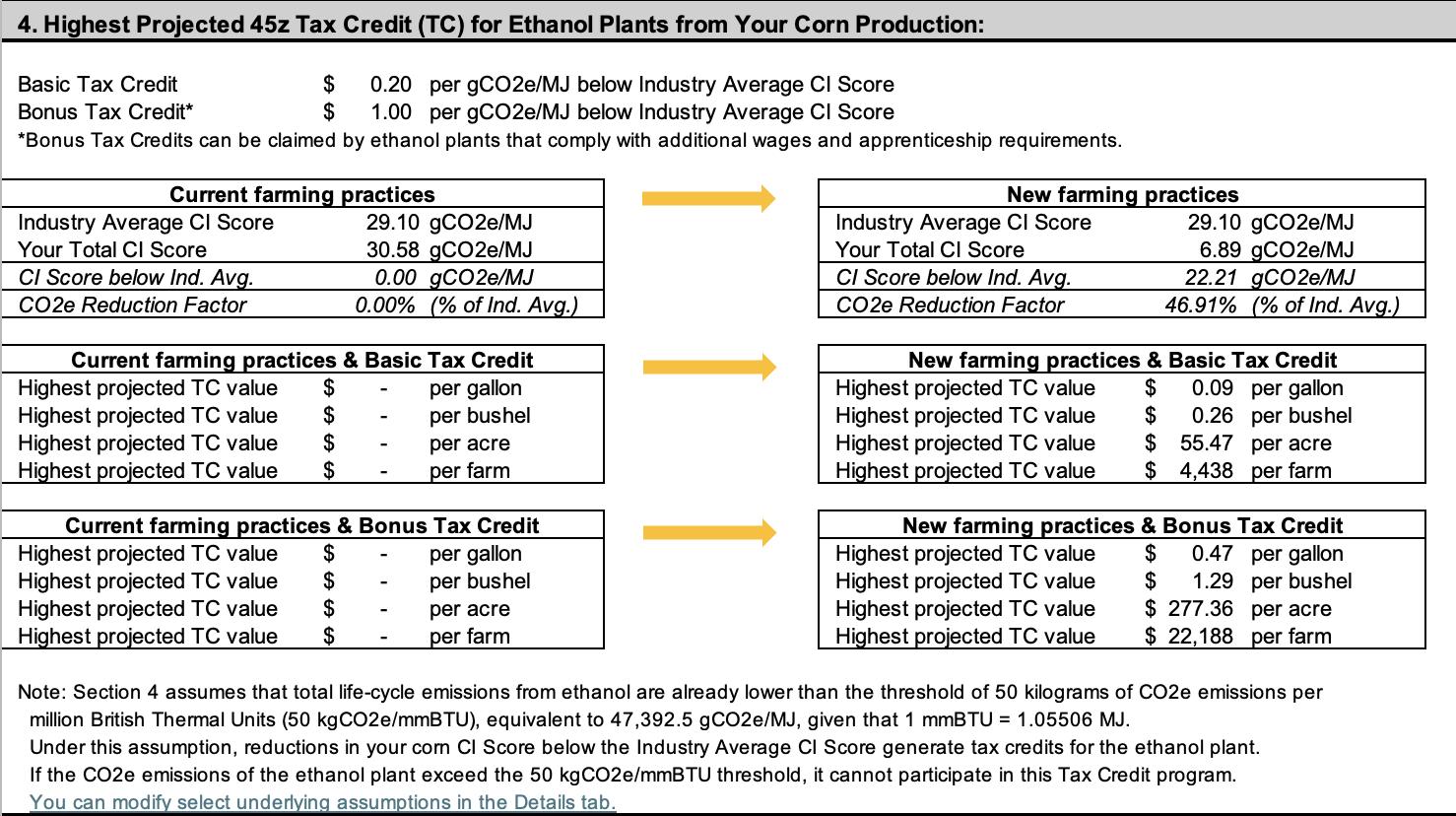

Impressive 45Z tax credit incentives promise to reward ethanol producers who succeed in driving their CI below the qualifying threshold in the Inflation Reduction Act. The incentives are potentially even greater for those who figure out how to buy low-CI feedstock grown with climate-smart agriculture practices.

Just how much that tax credit could be worth is generating some excitement in corn country. Former ISU Extension Economist Alejandro Plastina designed a Carbon Intensity Score Calculator for corn farmers based on the GREET R&D model. “We don’t know what the model for the 45Z tax credit will be like,” he says, “but most think it will be an improvement, and the basic structure will be similar.” (See sidebar for more details on the calculator.)

Plastina calls the ISU calculator an educational tool, giving corn growers a glimpse into low-CI corn’s value to ethanol plants, and also assisting policymakers in understanding the aggregate effect of these measures.

There are limitations to this Version 1.0 tool. The biggest one is that the details of the final GREET model to be used, along with other 45Z guidance, were still unknown when the tool was released (and at press time). Another is that while it calculates potential tax credit values, the calculator doesn’t account for costs. ISU provides

a separate decision tool for farmers to evaluate the cost of changing farming practices, which enables them to compare that to the potential net return when selling carbon credits, Plastina says.

For ethanol plants buying corn from several hundred farmers, the question becomes: how many farmers have to be willing to adopt climate-smart practices, and with what sort of CI reductions, to make it worth doing? “That’s a great question and one we plan to address once the final model comes out,” Plastina says.

“By itself, changing practices in corn production will not change the scoring of ethanol enough to make a traditional ethanol plant qualify for these tax credits,” he says. “There has to be additional investment by the plant to have a CI score below the 50 [kg of CO2 equivalent per MMBtu] threshold for the tax credits to begin.”

The plant will want to recover that investment, he points out, with the next question being how much of the tax credit will get passed through to the farmer once the costs for record keeping and third-party certification and verification get covered. “And although an ethanol plant can measure feedstock into the system as an average carbon intensity,” he says, “it’s a big call to make on how to calculate what portion of the tax credit is due to Farmer X’s corn versus Farmer Y’s corn.”

“On paper, these tax credits look like something that could be a big source of revenue for farmers,” he adds. “In reality, it will de-

pend on how the regulations allow for keeping track of the carbon intensity of corn from different sources. That’s why I didn’t jump into the aggregate analysis. It will depend on how these contributions get measured on whether it will make sense for farmers to invest in changing practices to reduce carbon intensity or not.”

A report from another ISU department offers hints on what those 45Z regulations might look like. The Center for Agricultural Law and Taxation dug into the guidance for 40B—the sustainable aviation fuel (SAF) tax credit that gets folded into the 45Z program when it starts—to give insight into what 45Z requirements might look like. The center’s Ag Docket blog, “Unpacking the Section 45Z Clean Fuel Production Credit,” listed requirements for feedstocks supplied under the Climate Smart Agriculture pilot program for 40B, summarized below:

• CSA farmers must meet specific and detailed record keeping for each practice.

• Each practice must be certified by an unrelated party.

• The farmer must have a contract with the SAF producer and the SAF producer must maintain records.

• Records must demonstrate supply chain traceability.

• Unrelated party certifiers must verify CSA practice and supply chain traceability.

• The unrelated party certifiers must be accredited and be a certified crop advisor or USDA technical service provider.

• The farmer must provide a certificate to the SAF producer supporting the farmer’s claim.

• Farmers must certify that they have not and will not sell carbon credits elsewhere for the same acreage.

• Farmers must attest they intend to continue the practices on the same acreage.

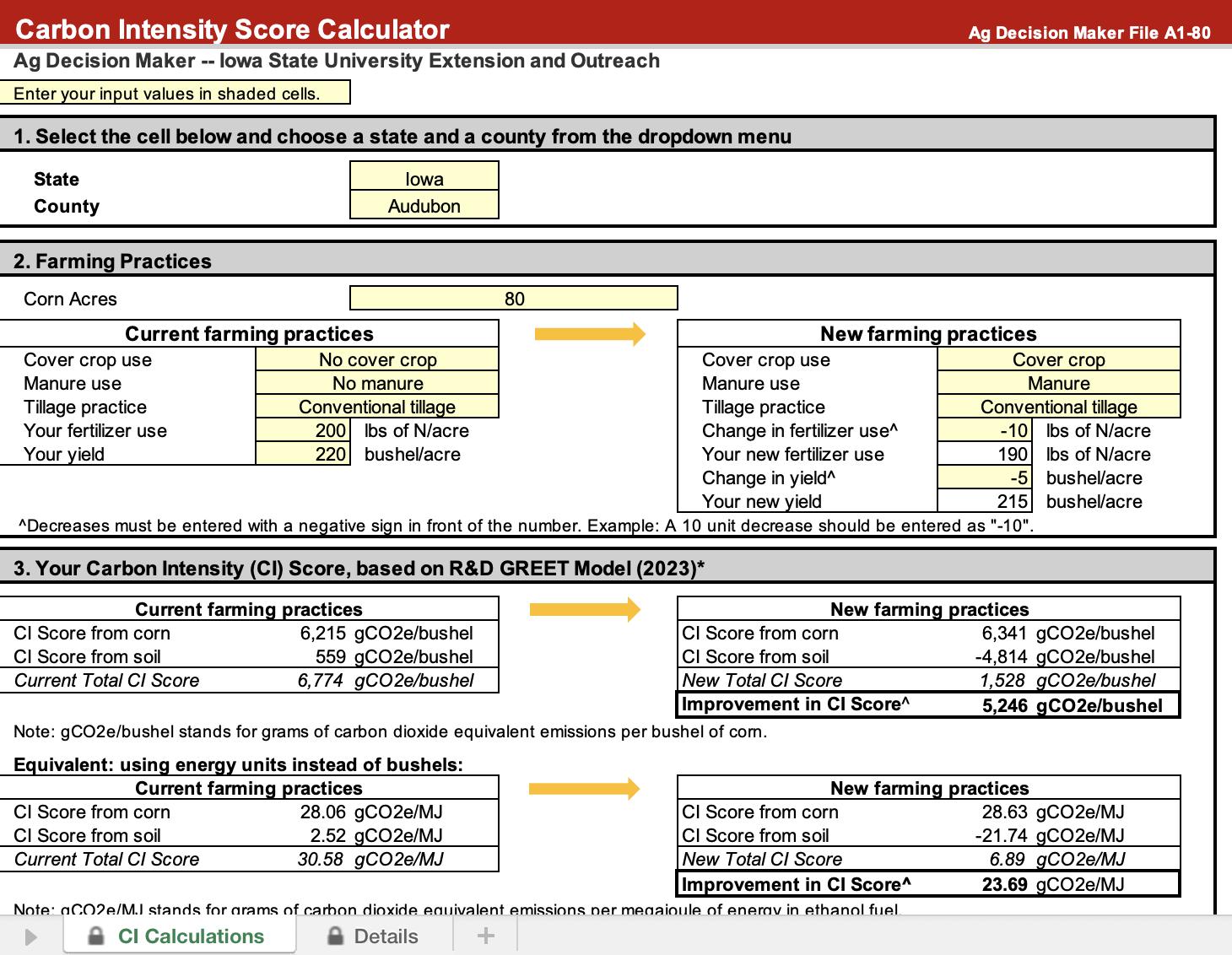

A simplified version of the GREET R&D, the Iowa State University Carbon Intensity Score calculator (shown above and to the right) compares a farmer’s carbon intensity (CI) using current farming practices versus new farming practices, calculating the potential value in 45Z tax credits. How closely this version will match the final GREET version for 45Z awaits final guidance, expected by the end of 2024.

ISU’s adapted version assumes each farm is identical to the baseline GREET farm in a specified county and asks for five variables: fertilizer use, corn yield, cover crop use, manure use and tillage practice. Multiple other variables found in the full GREET R&D model are assumed fixed for the county and state chosen in a dropdown menu in the spreadsheet—22 states are included.

The downloadable spreadsheet can be found by searching for “ISU Extension, Carbon Intensity Score Calculator A1-80 Decision Tool.” The spreadsheet is populated with example data with the cells highlighted in yellow where users enter data specific to their farm.

The example pictured here shows a southwest Iowa farm that remains conventional till; but adds a cover crop and manure while reducing nitrogen by 10 pounds per acre and lowering yield by 5 bushels to 215 bushels per acre. Converting the score from CI per bushel to a score in gCO2e/MJ, the corn’s CI score of 30.58 g is reduced to 6.89 g—a serious reduction that the calculator suggests would be worth 9 cents per gallon of ethanol, or 26 cents per bushel of corn under the basic 45Z tax credit.

If an ethanol plant qualifies for the bonus tax credit, which requires prevailing wages and apprenticeship programs, the potential return is nearly five times higher. The final guidance will indicate just how difficult it will be to qualify for those bonus tax credits.

The big unknown, of course, is how much of that total value can be passed through to the farmer after the recordkeeping and third-party certification and verification costs are recovered— something that Plastina suggests will need a robust educational effort to explain to corn growers and others who don’t understand the complexities of the system.

Playing with various combinations reveals cover crops and manure application result in the greatest CI reductions.

Examples:

Cover crop, manure and conventional tillage: CI of 6.89 9 cents/gal. (26 cents/bu.)

Cover crop only. No manure, conventional tillage: CI of 19.72 4 cents/gal. (11 cents/bu.)

Manure only. No cover crop, conventional tillage: CI of 17.30 5 cents/gal. (14 cents/bu.)

Reduced tillage only. No cover crop and no manure: CI of 28.06

0 cents/gal. (1 cent per bu.)

No till only. No cover crop and no manure: CI of 25.06 2 cents/gal. (5 cents/bu.)

Cover crop and no till. No manure: CI of 8.36 9 cents/gal. (24 cents/bu.)

Cover crop, manure and no till: CI of -4.01 14 cents/gal. (38 cents/bu.)

Kelvin Leibold, a recently retired ISU Extension regional specialist and long-time farmer, says the deal breaker for him would be a requirement to segregate qualifying bushels in a separate bin. There’s great potential for these tax credits to reward farmers, “but I’m not sure how it’s all going to work out.”

He hopes the farmers’ certificates will function like RINs—the renewable identification numbers assigned to each gallon of ethanol that are used to demonstrate compliance with the Renewable Fuel Standard. He hopes these certificates will be easily transferrable. “If you had an ethanol plant close to you that didn’t accept certificates and you had some, maybe you can trade them with another ethanol plant or trade with another farmer who sells to a different ethanol plant.”

He has numerous other questions: “What’s the startup cost on all of this for the farmer and ethanol plant? How quickly can they put together the paperwork so it’s understandable? Is it a simple system?” He expects it will take quite a bit of work for an ethanol plant to calculate the value of the certificates and come up with what they are willing to pass along.

Then there is the question of what happens after the program’s first three years is up, Leibold says. “How long is the funding going to last? Do these carbon credits stay out there? I’m not sure this is a flash in the pan, or something long term, but I’m not going to change my farming operation a whole lot to get this credit for just a couple of years.”

The value of the tax credits could range from around $50 an acre up to $270 per acre—if the ethanol plant qualifies for bonus tax credits—he points out, but the question remains how much of that gets passed through to the farmer.

When the final guidance comes at the end of the year, Plastina will update the calculator, he says, publishing it through his new position as the director of the Rural and Farm Finance Policy Analysis Center at the University of Missouri-Columbia. Supported by the USDA Office of the Chief Economist, RAFF provides farm income projections and other economic analyses. Plastinia hopes the updated calculator will be published in collaboration with his former colleagues at ISU Extension. He also intends to expand the calculator to include soybeans used for biodiesel and renewable diesel, and other biofuel feedstocks.

Author: Susanne Retka Schill Contact: writer@bbiinternational.com

A lot can happen while you wait for your lab results

Say goodbye to expensive and hazardous eight hour waits between samplings, and take back control of your process - with the revolutionary IRmadillo™ from KEIT

This highly robust, ‘fit and forget’ process monitor, installs directly into your line and vessels to give you unprecedented 24/7 instant analysis at multiple stages of your process.

Using ground-breaking static-optics FTIR technology, IRmadillo™ allows you to make adjustments based on up-to-the-minute data to stop burning your profits, improve liquefaction and fermentation, reduce energy wastage in distillation, and completely remove the potentially catastrophic hazards of excess ethanol in your waste stream.

Already successfully operating in over 20 plants, the IRmadillo™ is boosting bottom lines across the US Email enquiries@keit.co.uk today for details of your local agent - because if you’re not in control of your process - you’re not in control of your profits.

Through federal and state funding incentives, higher ethanol blend infrastructure is going in—and ethanol gallons sold are going up.

By Luke Geiver