SDI Biocarbon Solutions' Decarbonization Strategy

Page 12

SDI Biocarbon Solutions' Decarbonization Strategy

Page 12

Reviewing the 2025 Pellet Producer Map Data

Page 18

Establishing a Pellet Market in Pakistan

Page 22

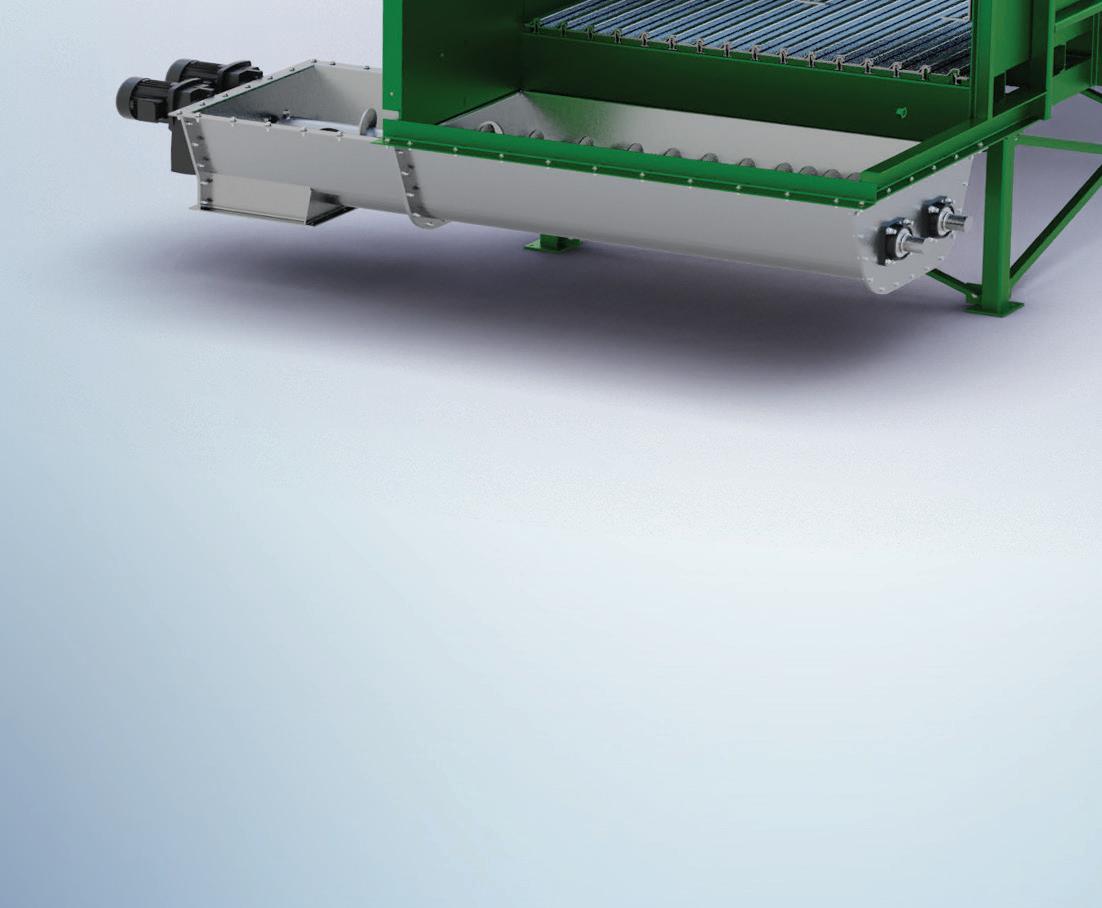

DeRisk your projects. A start up project has lots of components from financing, locating equipment and contractors, and managing the day to day operations. BE&E o ers complete construction management ser vices to take the risk out of this process. We have prequalified vendors and two decades of experience in the biomass bulk handling sector. Keep your project on track with a supplier that will take you from planning to startup.

Manufacturers of the VIBRAPRO™ line of vibrator y conveyors. Works in conjunction with the SMART™ system. Designed to sort, seperate and move bulky materials from receiving stage to distribution.

• Construction of facility operations building

• Base rock and concrete machinery foundations

• Finished access roads and work area access pads

• Supply of all electrical components, controls and machinery

• Electrical connections from transformer

• Installation and startup

•Training on all supplied machinery

• CMMS maintenance program

•Technical support

12

The Cutting Edge of Cutting Carbon

As part of its decarbonization strategy, Steel Dynamics has partnered with Aymium for the construction of a biocarbon pellet plant.

By Lisa Gibson

Pellet Mill Magazine reviews the data sets from its recently completed 2025 Pellet Producer Map.

By Anna Simet

22 GLOBAL MARKETS

and Challenges of Wood Pelleting in Pakistan

A wood pellet producer reflects on the challenges and rewards involved in the journey of establishing a successful wood pellet operation in Pakistan.

By Fazal Allahwala

Steel Dynamics and Aymium have partnered to construct a biocarbon wood pellet plant, SDI Biocarbon Solutions, in Columbus, Mississippi. The facility will produce over 200,000 tons of biocarbon annually.

Anna Simet EDITOR asimet@bbiinternational.com

In the previous issue of Pellet Mill Magazine, I wrote a feature article about the European Union Deforestation Regulation. While I didn’t get into the extreme minutiae, the main point was that although well intended, there has been considerable controversy surrounding the EUDR. This has been largely stoked by a delay in the issuance of much-needed guidance regarding key provisions, as well as the short amount of time (and cost) to prepare, among other factors. Under the regulation, operators and traders who place certain commodities, including wood pellets, on the EU market or export from it must provide proof that the products haven’t originated from or contributed to deforestation. Operators must collect information, documents and data showing that the product is deforestation-free and legal, such as geolocation coordinates, quantity and country of production. The geolocation requirement is perhaps the biggest challenge for wood pellet exporters, considering the often complex supply chain when it comes to wood fiber feedstocks. As for an update on this, in mid-October, the European Commission proposed a year-long delay. Although it seems likely, the European Parliament still has to vote on the proposal. That’s expected to happen in mid-November, so stay tuned.

As for our cover story in this issue, we’re pleased to include “The Cutting Edge of Cutting Carbon,” by Lisa Gibson. In the page-12 article, Gibson details Steel Dynamics’ efforts to cut carbon emissions at its steel production plants across three states. The plan is unfolding with the construction of a biocarbon pellet plant that will produce fuel to replace coal in the steel manufacturing process. Says Jim Mennell, CEO of technology provider Aymium, “I’ve spent my entire career looking for better and more sustainable ways to do things. In metals specifically, I had worked with a couple large iron and steel producers and saw an opportunity to create a replacement product into these operations that could have significant reductions in carbon—we’re also reducing mercury and sulfur dioxide emissions by more than 90%.” Steel Dynamics and Aymium are confident that the project, SDI Biocarbon Solutions, will serve as a great example of what’s possible when it comes to decarbonizing the steel industry.

On the note of project development, be sure to check out our page-22 contribution, “Opportunities and Challenges of Wood Pelleting in Pakistan.” Written from a wood pellet producer’s perspective, the article details the opportunities and challenges that the company, Rockey Choolha, faced when working to scale up operations in Pakistan. Though the company found success in sourcing equipment, upgrading technology and securing a biomass supply chain, said Director Fazak Allahwala, educating the public, industrial sector and policymakers on the benefits of biomass energy is a critical and difficult challenge that the company is working to overcome. A special thanks to Holger Streetz at Bathan AG for submitting the article.

As we near the end of October—which has largely been an extension of summer here in Minnesota—U.S. producers in most regions are anxiously waiting on and wishing for the cold. A frigid La Niña winter is predicted, but only time will tell if it plays out like expected, and as the industry hopes it will. We’ll have a very good idea of where things stand by the next issue—we look forward to reporting on low inventories and strong sales.

MARCH 18-20, 2025

Cobb Galleria | Atlanta, GA

EDITOR

Anna Simet | asimet@bbiinternational.com

ONLINE NEWS EDITOR

Erin Voegele | evoegele@bbiinternational.com

ASSOCIATE EDITOR

Katie Schroeder | katie.schroeder@bbiinternational.com

VICE PRESIDENT, PRODUCTION & DESIGN

Jaci Satterlund | jsatterlund@bbiinternational.com

GRAPHIC DESIGNER

Raquel Boushee | rboushee@bbiinternational.com

CEO

Joe Bryan | jbryan@bbiinternational.com

PRESIDENT

Tom Bryan | tbryan@bbiinternational.com

VICE PRESIDENT, OPERATIONS/MARKETING & SALES

John Nelson | jnelson@bbiinternational.com

DIRECTOR OF SALES

Chip Shereck | cshereck@bbiinternational.com

ACCOUNT MANAGER

Bob Brown | bbrown@bbiinternational.com

CIRCULATION MANAGER

Jessica Tiller | jtiller@bbiinternational.com

MARKETING & ADVERTISING MANAGER

Marla DeFoe | mdefoe@bbiinternational.com

Now in its 18th year, the International Biomass Conference & Expo is expected to bring together more than 900 attendees, 160 exhibitors and 65 speakers from more than 25 countries. It is the largest gathering of biomass professionals and academics in the world. The conference provides relevant content and unparalleled networking opportunities in a dynamic business-to-business environment. In addition to abundant networking opportunities, the largest biomass conference in the world is renowned for its outstanding programming— powered by Biomass Magazine—that maintains a strong focus on commercialscale biomass production, new technology, and near-term research and development. Join us at the International Biomass Conference & Expo as we enter this new and exciting era in biomass energy.

(866)746-8385 | www.biomassconference.com

JUNE 9-11, 2025

Chi Health Center | Omaha, NE

Capturing and storing carbon dioxide in underground wells has the potential to become the most consequential technological deployment in the history of the broader biofuels industry. Deploying effective carbon capture and storage at biofuels plants will cement ethanol and biodiesel as the lowest carbon liquid fuels commercially available in the marketplace. The Carbon Capture & Storage Summit will offer attendees a comprehensive look at the economics of carbon capture and storage, the infrastructure required to make it possible and the financial and marketplace impacts to participating producers.

(866)746-8385 | www.CarbonCaptureStorageSummit.com

Chi Health Center | Omaha, NE

The Sustainable Fuels Summit: SAF, Renewable Diesel, and Biodiesel is a premier forum designed for producers of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to learn about cutting-edge process technologies, innovative techniques, and equipment to optimize existing production. Attendees will discover efficiencies that save money while increasing throughput and fuel quality. Produced by Biodiesel Magazine and SAF Magazine, this world-class event features premium content from technology providers, equipment vendors, consultants, engineers, and producers to advance discussions and foster an environment of collaboration and networking. Through engaging presentations, fruitful discussions, and compelling exhibitions, the summit aims to push the biomass-based diesel sector beyond its current limitations. Co-located with the International Fuel Ethanol Workshop & Expo, the Sustainable Fuels Summit conveniently harnesses the full potential of the integrated biofuels industries while providing a laser-like focus on processing methods that deliver tangible advantages to producers. Registration is free of charge for all employees of current biodiesel, renewable diesel, and SAF production facilities, from operators and maintenance personnel to board members and executives.. (866) 746-8385 | www.sustainablefuelssummit.com

BY TIM PORTZ

After a promising June that saw near record sales for the month, premium wood pellet sales in July returned to the well-below-average trend the sector has been mired in since late last spring. So far in 2024, June stands alone for months that have topped their five-year averages, and producers are trimming their production throttles, reticent to build wood pellet inventories larger than those already on the ground. As June closed, U.S. total inventory settled at 393,404 tons, the highest position since October 2017. Summertime production totals reveal that plant management teams have considered full storage sites and slow early buying activity, trimming their output to just 235,000 tons in June and July, well off the 304,352 tons produced during the same time period last summer. Wood pellet inventories create more than just problems of space for producers. Each ton brings with it costs of production and storage, locking up precious cash flow until shipped. As July closed, the wholesale value of wood pellets in producer inventories topped $72 million. Balancing inventories with expected monthly sales and planned production has been an industry balancing act that, until 2016, was done without access to any reliable data about what the rest of the sector was doing. Prior to 2016, producers gathered what information they could from their customers and wood suppliers, and by visually inspecting their competitors storage sites. Upon the launch of the U.S. Monthly Densified Biomass Fuel Report by the U.S. Energy Information Administration, producers gained access to critical industry production, sales and inventory information and immediately began using this newly gained intelligence in their operational decisions. Just six months after the report was launched in 2016, inventory levels had swollen to over 600,000 tons of inventory. As production and sales data accumulated in 2016 and early 2017, it became clear that 600,000 tons was too much inventory for the sector to carry. For the following 18 months, producers trimmed inventory levels, settling out around 373,000 tons at the end of July, more or less where the industry found itself this July.

The success of this season and the financial consequences or rewards of building the industry’s highest inventory position in over five years will depend upon the length and depth of winter, and the resulting rate of depletion on the amassed inventory. Depending upon the

year, wood pellet sales begin to outstrip total production in August or September. To make up for the difference, producers draw upon their accumulated inventory and the process of depletion begins. This up-and-down cycle finds producers with their highest inventory positions in July and August and their lowest in early spring (February and March), and has played out like this since inventory positions stabilized into this pattern in 2018.

In July 2018, inventory levels were 373,693 tons, and in just six months, the bulk of the 2018-’19 heating season—all but 46,642 tons of inventory—had been sold a drawdown of over 300,000 tons. In the East, there were some nervous retailers as inventory levels dipped to just 18,448 tons, a stunning departure from the February 2017 regional position of 350,982 tons. Last year’s inventory drawdown was blunted by mild temperatures across the predominant wood pellet-burning regions of the country. Inventories fell slowly from August through January, dropping just 70,000 tons before inventories began to build again in February.

The premium wood pellet sector has its best heating seasons whenever the industry sees multiple months with 200,000 tons or more in sales. During the 2018-’19 heating season, producers eclipsed 200,000 tons in sales in September, October, November and January. Both August and December were over 190,000 tons. At press time, summertime temperatures had yet to yield to those first brisk morning and overnight lows that have customers turning up their thermostats and filling those burn pans with wood pellets.

Whether or not these near-historic inventory levels are a boon for producers in the context of a long and prolonged winter during which they are happy to have every last ton, or an albatross around their necks next spring, all hinges on what kind of winter weather shows up this year.

Author: Tim Portz Executive Director, Pellet Fuels Institute tim@pelletheat.org

www.pelletheat.org

BY IAN R.H. TAILYOUR

Last year, I published an article setting forth why Mississippi is rapidly becoming a wood pellet-producing powerhouse due to its wealth of sustainable forest products and abundant water transportation resources.

What I’ve seen and experienced since then confirms my bullish outlook for Mississippi and its timber farmers, and I wanted to share with you the reasons for my excitement.

In published comments and during conversations with me, Matthew Goodwin, director of the European Pellet Council, expressed confidence that demand for wood pellets and cellulose feedstocks for bioenergy to produce electricity and sustainable fuels, including aviation fuel, will substantially increase over the next five years. Confirming Goodwin’s bullish prognosis for sustainable aviation fuel (SAF), United Airlines announced on July 31 it has become the first airline to purchase SAF at Chicago’s O'Hare.

Wood pellets are the most sustainable form of biomass energy production. Mississippi tree growers are “farmers” who replace every tree they harvest by planting new trees. These growing trees consume more CO2 than mature trees of equal mass. New studies have shown that using wood pellets to produce energy contributes much more to decarbonization than burning fossil fuels. In fact, the amount of CO2 released in the use of wood pellets produced in Mississippi is recaptured within one year by our bountiful forests.

Former Mississippi Gov. Phil Bryant, founding partner of BSS Global, is especially encouraged by the growing use of Mississippi forest products for energy production rather than cardboard, paper, construction and furniture production, which have been traditional end uses. “This is especially true in the European markets,” Bryant said. “The movement in European markets from traditional uses of wood products toward using Mississippi wood products to produce sustainable, clean en-

ergy is a game changer for Mississippi tree farmers, and this movement is being accelerated by the deforestation restrictions (the European Union Deforestation Regulation) on domestic European producers that are coming online in 2025.”

The European Commission is requiring mandatory due diligence under the EUDR for operators and traders selling and importing wood products into the EU. The regulation was set to begin on Dec. 31, but a one-year compliance extension has been proposed and is likely to pass. Once the EUDR in is effect, operators will need to prove that wood products exported or imported into the EU have not caused deforestation or forest degradation.

Bryant sees the EUDR restrictions as a benefit to Mississippi producers. “Mississippi-grown trees are being replaced as fast as they are harvested, and they are contributing more to decarbonization abroad than ever before. The future for our wood pellet producers is bright, especially given the improving infrastructure of our ubiquitous waterways,” Bryant added.

Improvements in Mississippi’s water transportation facilities are due primarily to developments at Port Pascagoula, one of the largest deepwater ports in the Gulf of Mexico. New Port Director Bo Ethridge is committed to welcoming new projects and businesses, including expanding the port’s role in exporting Mississippi’s wood pellets to Europe and Asia.

I urge each timber farmer and wood product producer in Mississippi to learn how to profit from the fastgrowing wood pellet industry, which will add value to the beautiful forests that cover much of our great state.

Author: Ian R.H. Tailyour Senior Advisor, BSS Global Partners

662-202-4730

ian@bssglobal.com

A new economic analysis conducted by MNP, one of Canada’s leading professional services and research firms, has found that Drax Group contributed $1 billion toward the Canadian economy and supported more than 3,000 jobs in 2023.

The study measured the economic impact of Drax’s Canadian operations, which includes 10 pellet plants across British Columbia and Alberta, and producing sustain-

able biomass wood pellets to generate renewable power in the United Kingdom and Asia. The report also showed Drax’s commitment to sourcing from local suppliers by purchasing nearly 75% of its goods and services from those based within the respective province of their operations. Of the purchases made from suppliers outside of the province, more than 90% are from Canadian businesses.

The total employment supported by Drax’s operations (3,101 jobs) is approximately equivalent to the employment supported

by the construction of 1,447 new homes in Canada.

Thousands of jobs are supported by Drax’s activities across Canada in a wide range of sectors, including high-skilled manufacturing of industrial components, engineering and technical machinery and transportation, many of which are in rural communities. According to the report, in the Entwistle and Burns Lake communities where Drax’s pellet plants are located, Drax provides 26% and 18% of their total employment income.

The European Commission has proposed a one-year extension for implementing the EU’s anti-deforestation regulation (EUDR), responding to feedback from member states, trade partners and industry stakeholders, according to an announcement from Bioenergy Europe. The new proposal would delay the compliance deadline to Dec. 30, 2025, for large companies and June 30, 2026, for smaller enterprises.

Under the EUDR, operators and traders who place certain commodities, including cattle, wood, cocoa, soy, palm oil, coffee and rubber on the EU market or export from it, must be able to prove that the products do not originate from recently deforested land or have

not contributed to forest degradation. This includes collecting information, documents and data, such as geolocation coordinates, quantity, country of production and more, showing that the product is deforestation-free and legal.

The delay is not effective yet, Bioenergy Europe cautioned. For the Commission proposal for a delay to work, the European Parliament and Council also have to agree to it, and conclude inter-institutional negotiations within three months.

Bioenergy Europe said it welcomes the extension, which provides time for effective implementation. The additional months allow businesses to align with the new standards without unnecessary disruption, especially in the case of small-scale businesses. Bioenergy Europe added that it continues to support the EUDR’s goals, offering constructive contributions for a successful implementation.

A report released by the International Energy Agency on Oct. 9 notes that global residential pellet appliance sales have already begun to recover from last year’s low levels as pellets become more affordable again.

The IEA’s Renewables 2024 briefly addresses the global market for wood pellet heating and appliances, noting that the use

of wood pellets for heating has been growing rapidly over the past decade, particularly in the European residential sector.

The report notes that the European Union is the world’s foremost pellet market, accounting for 44% of wood pellet production and approximately 50% of wood pellet consumption last year. Much of that volume is used for residential heating. “After two decades of continuous market expansion for pellets and two years of record sales for pellet-based appliances, global pellet production stalled in 2023 and the market for pellet appliances is facing headwinds,” states the report.

The agency explains that the EU’s 2022 embargo on forestry products from Belarus and Russia resulted in a consumer rush to stock up on pellets during the energy crisis, which led to supply shortages in the EU and a sharp increase in pellet prices. Those factors affected consumer confidence and choices through 2023, according to the IEA. The agency also cites policy changes in France and Italy as impacting consumer behavior. In addition, reduced construction activity and a particularly mild winter contributed to fewer heating appliance sales and higher interest rates, and other economic factors caused households to postpone large investments.

As a result of these factors, EU pellet appliance sales fell by more than half last year.

Sales of wood log stoves, however, increased. The IEA notes that Poland was a notable exception, experiencing steady sales of pellet stoves and boilers due to available incentives aimed at replacing coal-fired boilers. The IEA also notes that sales of large-scale appliances were less affected by pellet price volatility and remained strong throughout the year.

According to the IEA, the downward market trend in residential heating appliances was temporary. Increased pellet production and other factors led to declining pellet prices during the first half of last year, and residential appliance markets have already mostly recovered. Pellet prices, however, still remain higher than pre-2022 levels, which the IEA primarily attributes to production costs that are impacted by higher electricity prices.

U.S. manufacturers produced approximately 910,000 tons of densified biomass fuels in June, according to the September edition of the U.S. Energy Information Administration’s Monthly Densified Biomass Fuels Report. The same production volume was reported in June 2023.

Sales of densified biomass fuel reached 900,000 tons during the month. The EIA collected data from 77 operating manufacturers

of densified biomass fuel, who reported a collective production capacity of 13.32 million tons per year and the equivalent of 2,568 full-time employees.

Respondents purchased 1.6 million tons of raw biomass feedstock in June. Production included 136,296 tons of heating pellets and 776,257 tons of utility pellets.

Domestic sales of densified biomass fuel in June reached 167,210 tons at an average price of $251.91 per ton. Exports in June reached 734,710 tons at an average price of $193.92 per ton.

Inventories of premium/standard pellets fell to 327,721 tons in June, down from 393,404 tons in May. Inventories of utility pellets expanded to 639,592 tons in June, up from 512,502 tons in May.

Data gathered by the EIA shows that total U.S. densified biomass fuel capacity reached 13.43 million tons in June, with all of that capacity listed as currently operating or temporarily not in operation. Capacity included 1.97 million tons in the East, 10.67 million tons in the South, and 797,200 tons in the West.

France-based electric utility EDF announced in September that it will no longer pursue plans to convert its 1,200-MW Cordemais power plant from coal to biomass due to technical and economic conditions related to the Ecocombust project.

The Ecocombust conversion project was led by France-based waste management company PAPREC, with support from EDF. The project aimed to manufacture fuel pellets from waste wood for use as an alternative to coal. According to EDF, analysis has shown the economic and technical conditions necessary to carry out the project cannot be met. As a result, EDF will not be able to completely replace coal with pellets.

EDF said it will cease electricity production at the Cordemais plant in 2027, but hopes to develop other industrial activities at the

plant site. Information previously released by EDF indicates the Cordemais power plant has two coal production units, each with a 600MW capacity. The plant was commissioned in 1970.

United States wood pellet exports fell to 775,856 metric tons in August, down from both 874,596 metric tons exported the previous month and the 1.01 million tons exported in August 2023, according to data released by the USDA Foreign Agricultural Service on Oct. 8.

The U.S. exported wood pellets to nearly a dozen countries in August. The United Kingdom was the top destination for U.S. wood pellet exports at 447,397 tons, followed by Japan at 200,990 metric tons and Estonia at 50,000 metric tons.

The value of U.S. wood pellet exports was $136.6 million in August, down from $156.44 million in July and $183.02 million in August of last year.

Total U.S. wood pellet exports for the first eight months of 2024 reached 6.51 million metric tons at a value of $1.21 billion, compared to 6.28 million metric tons exported during the same period of last year at a value of $1.16 billion.

* After testing

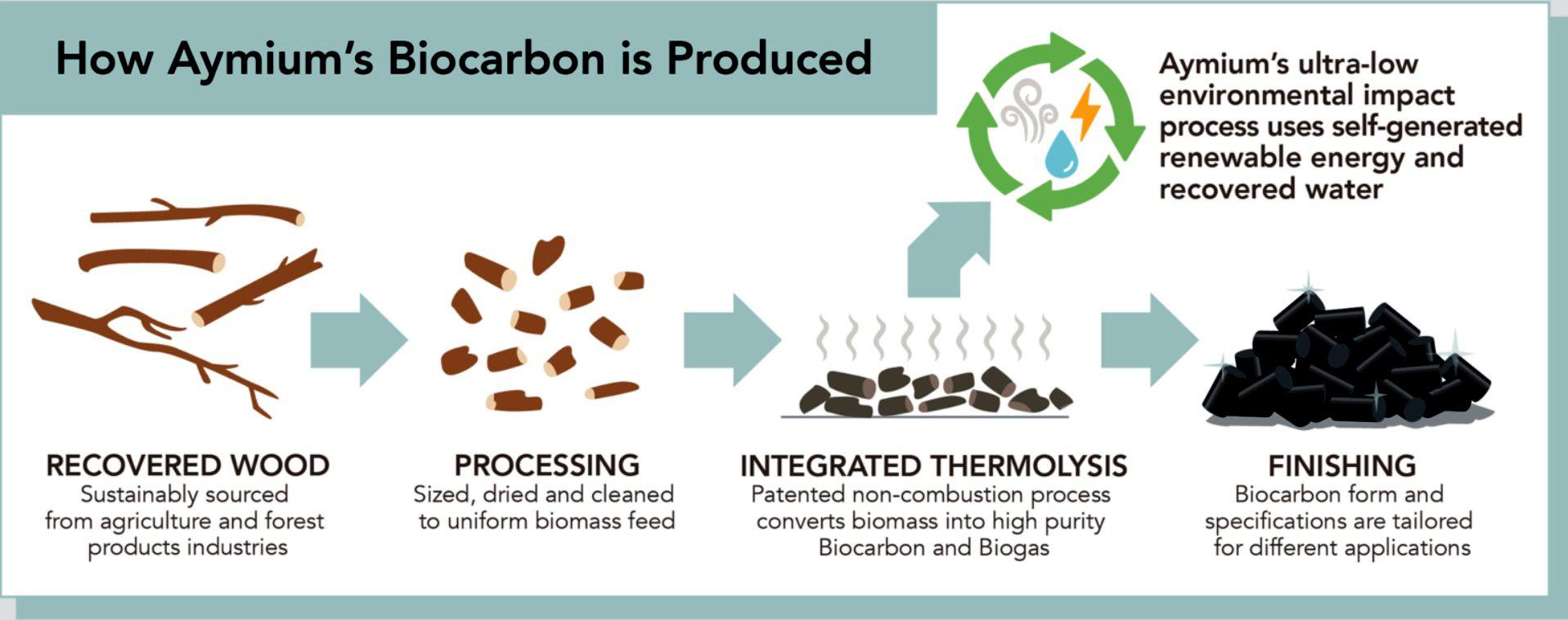

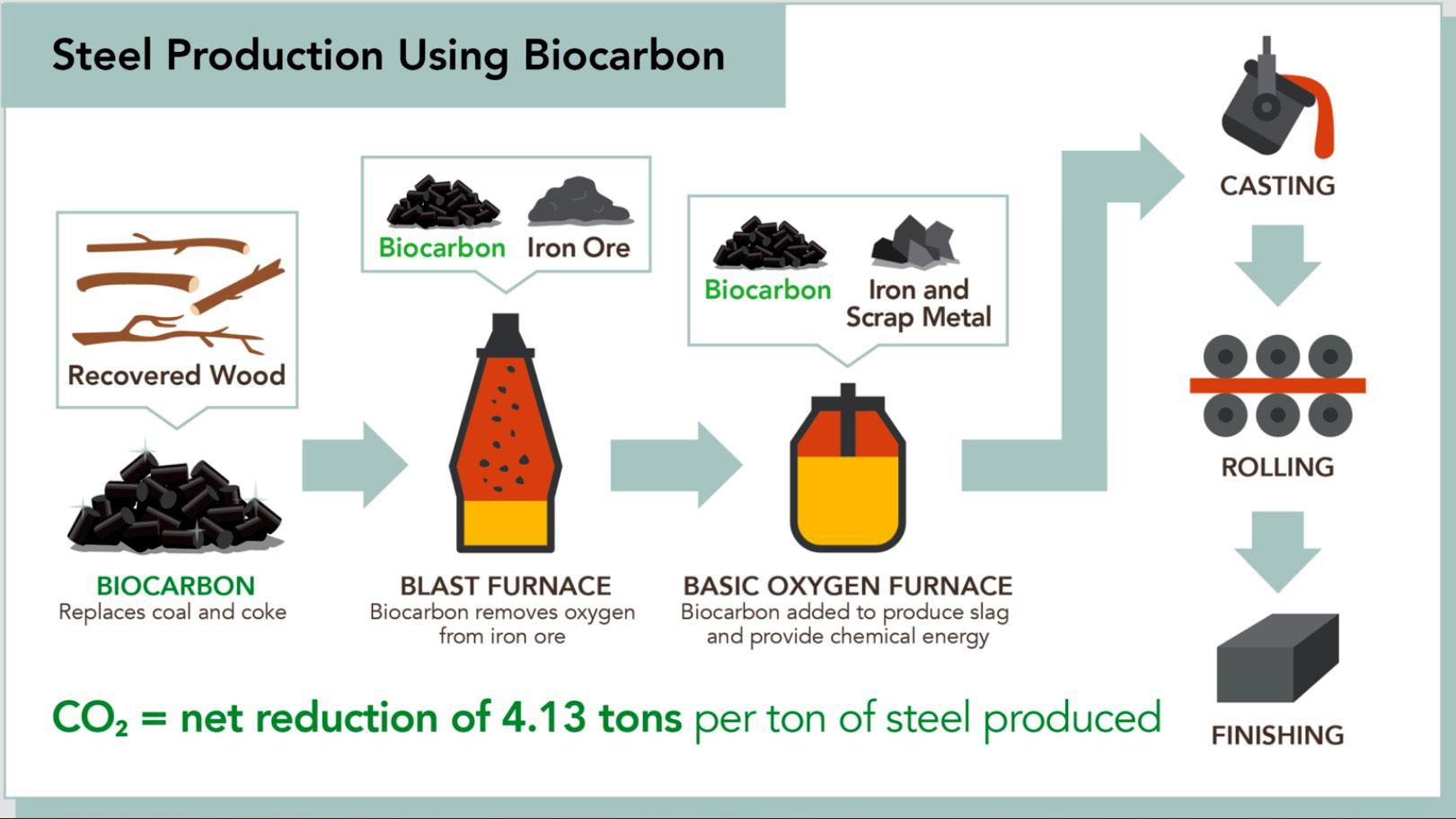

Steel Dynamics Inc. and Aymium have teamed up to develop a low-carbon steel manufacturing process, using biocarbon produced from sustainably sourced wood in lieu of coal.

BY LISA GIBSON

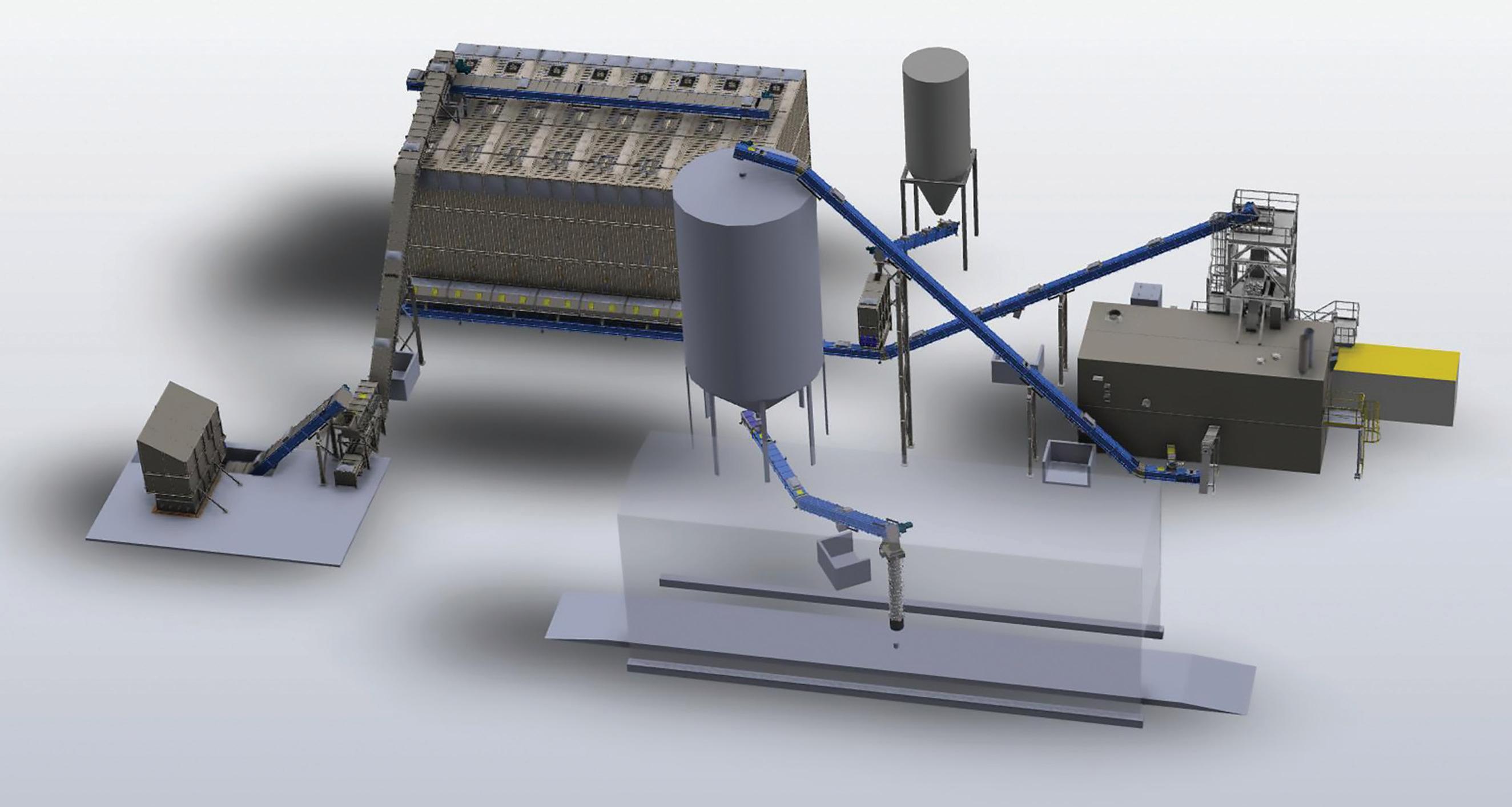

SDI Biocarbon Solutions, a joint venture between Steel Dynamics Inc. and Aymium, is set to be commissioned by the end of the year. The goal is to replace the anthracite coal used in Steel Dynamics’ production with biocarbon from woody biomass.

Steel Dynamics Inc., the country’s fourth-largest steel manufacturer, has always emphasized sustainability, using recycled metals in its electric arc furnaces. But its newest endeavor with technology partner Aymium takes its environmentalism to another level.

SDI Biocarbon Solutions, under construction in Columbus, Mississippi, will produce over 200,000 tons of biocarbon annually, enough to supply Steel Dynamics’ plants in Mississippi, Indiana and Texas, and cutting the company’s scope 1 emissions by up to 35%.

It’s a one-for-one replacement of anthracite coal for Steel Dynamics, according to Jeff Hansen, the company’s vice president of environmental sustainability. “It’s a needle-mover for us, but we also see it as a needle-mover for the steel industry,” he says. Steel Dynamics aims to be carbon neutral by 2050.

Construction on SDI Biocarbon Solutions is well underway, on track for commissioning by the end of the year. The partners anticipate that the low-carbon technology will make a splash in the steel industry, which accounts for about 8% of global greenhouse gas emissions, primarily from the traditional integrated process. “We’re pretty excited about the technology and what it can do for overall decarbonization, and specifically excited for its application in the steel industry,” Hansen says.

The founding principle behind Marquette, Michigan-based Aymium is to replace fossil imports in steel and metal production, says Jim Mennell, CEO. “I’ve spent my entire career looking for better and more sustainable ways to do things,” he says. “In metals specifically, I had worked with a couple large iron and steel producers and saw an opportunity to create a replacement product into these operations that could have significant reductions in carbon—we’re also reducing mercury and

sulfur dioxide emissions by more than 90%. The goal is to find superior technologies that are economically viable, creating performance and cost advantages while being environmentally friendly.

“And we believe we have the lowestcost, fastest way to decarbonize the metals industry.”

Aymium’s biocarbon technology produces metallurgical carbon using lignocellulosic biomass. The technology can handle a spectrum of feedstocks, including ag harvest residues, forest and sawmill residues, etc., but the company uses only sustainably sourced, third-party certified materials, Mennell says.

As for the process, biomass is heated through pyrolysis to reduce it to a very pure carbon. The carbon is then converted to an ideal form for the end user. For SDI, Aymium’s product will be an injectable carbon for electric arc furnaces. “What we’re after is the carbon content and taking out extraneous molecules so it can be a true dropin replacement and requires no capital or physical changes for customers,” Mennell says. The gas produced in pyrolysis is used to provide energy to the process itself.

Aymium’s technology is a natural fit for the decarbonization goals of Steel Dynamics, Hansen says, and the companies’ teams are working well together. Both Hansen and Mennell say the companies have a “great relationship,” with closely aligned values and goals. Because Steel Dynamics uses primarily recycled scrap metal as a raw material and deploys electric arc furnaces, the company already has a carbon footprint about 60% lower than steel producers using integrated furnaces. “We’re in a position of strength to begin with when it comes to our GHG reduction footprint,” Hansen says. “We’re already among the lowest in the industry.

“We take pride in our circular manufacturing model, and look for opportunities to take things from the end of life and bring them back from a resource standpoint to produce products.”

‘What SDI is doing is cutting -edge for the steel industry, as well as the biomass and wood pellet industries.’

- Ken Upchurch, Bruks Siwertell

SDI Biocarbon Solutions will be the largest bioreactor in the world, Mennell says, costing just over $260 million and processing 1.1 million tons of forest and sawmill residues. Biocarbon will be shipped via rail to Indiana and Texas, and by truck to the adjacent Mississippi facility.

Proof of concept for SDI Biocarbon Solutions was completed in Aymium’s large Michigan plant, located inside a B52 hanger. “The scaleup to where we’re at from where they’re already at is not a huge leap,” Hansen says.

Exhaust air purification technology will come from Scheuch’s deconox solution, which combines regenerative thermal oxidation with low-nitrogen oxide selective catalytic reduction. “Scheuch is proud to support SDI on its journey to reduce the carbon footprint of steel production,” says John Rothermel, president of Scheuch USA. “As we look to the future, Scheuch's industry-leading technologies are designed to help SDI and other clients, meet compliance, improve efficiency and achieve pro-

duction goals. About the SDI Biocarbon project, Scheuch is delivering a cost-effective solution that we believe will help SDI take the lead in sustainability."

Sweden-based Bruks Siwertell will contribute the raw materials handling process on the front end, producing a microchip from the biomass feedstock and delivering it to the SDI Biocarbon Solutions drying process. The biomass is then dried and pelletized for Aymium’s technology. “What SDI is doing is cutting-edge for the steel industry, as well as the biomass and wood pellet industries,” says Ken Upchurch, senior vice president of sales and marketing for Bruks Siwertell. “They are the first steel supplier in the U.S. that I’m aware of that is producing their own biocarbon pellets for their own consumption.”

Like Steel Dynamics, Scheuch and Aymium, Bruks Siwertell is focused on sustainability and carbon reduction. “So, our philosophy and our vision align very well with what SDI is doing,” Upchurch says. “We’re really proud that we are the selected supplier, and I think it suits us well in our ability to handle the diverse raw materials they’re bringing in. We know we’re the right

partner for them and we’re looking forward to their continued growth, and to being an ongoing partner for them. It’s just really exciting.”

Mississippi happens to be a great spot for forest harvest and sawmill residual biomass, Mennell says. “There is much, much more biomass being grown on private lands for utilization than is being used today.”

SDI is partnered with aggregators that specialize in removing trees and residuals from farms, and there is no concern about acquiring the 1.1 million tons needed to sustain the facility annually. “We’ve done extensive fiber studies, and we have a very experienced fiber team,” Mennell says. Resource assessments for the Mississippi facility were also confirmed by third parties, he adds. “We spent a lot of time in each of these markets. The most important part of our process is the sustainability and cost of that supply, and so we focus quite a bit on making sure there is a more-than-sufficient supply for what we’re looking to do in these markets.”

Long-term feedstock supply contracts are already in place, Mennell says, and can be augmented with ag residues that are traditionally degraded or burned in fields. “We’re taking that and making a product that replaces fossil coal and decreases CO2 emissions, and creates jobs and creates a local sustainable input into iron and steel production.” As SDI will pay for its feedstock, it also provides a new revenue source for suppliers who previously had to find ways to dispose of their waste, sometimes at a cost to them. “We think that that’s a good way to ensure a positive relationship to everybody in the cycle of that material,” Mennell says.

Hansen adds that the local excitement around the project has been significant and feedstock suppliers are eager to contribute. The site will have the capacity to store enough feedstock to support about two weeks of production, he says.

“It is unique in that our background is in the steel industry and we’re creating relationships in the forestry and timber industry–the first time these industries have really had the chance to overlap and collaborate,” Hansen says.

“The philosophy behind the technology was to create embodiments that could match and improve upon fossil coal,” Mennell says. “So, basically, treatment with heated biomass materials to create carbon levels that are equivalent to coal or coke, but that have other performance and environmental advantages.”

And it’s not just for steel. Aymium has entered into the largest biocarbon contracts in history in the energy, silicone, iron and titanium markets, Mennell says. The company has also contributed its biocarbon to water purification projects benefiting 20 million people in 75 cities across North America, replacing coal-based activated carbon.

“When you’re purifying drinking water for tens of millions of people, you really have to be perfect at what you do, and our team does a really great job in synthesizing high-performance products for high-value

and important applications like clean water, clean air, etcetera,” Mennell says.

“There are many ways we can manipulate the carbon molecule to do different things, and in each case, we’re replacing fossil inputs that were historically used in these markets, improving the environmental impact, creating a circular product, and creating a net environmental benefit as we go,” Mennell adds.

Upchurch is eager to see how the process can boost the wood pellet industry. “This really opens the door to other manufacturers,” he says. “If SDI is successful, it really could be a shot in the arm for the wood pellet industry as a whole. ... It’s going to be a challenge for them, and we’re going to do everything we can to see this project forward, because we really need this to be successful, not only for us, but for the industry.”

SDI Biocarbon Solutions is up for the challenge. “We’re very bullish on the technology,” Hansen says. “One thing I get excited about ... I believe there’s an application for biomass and decarbonizing the steel industry beyond what we’re doing here. I don’t know that it’s gotten the attention of the overall industry up to this point, but that’s part of what we’re intending to do here—to be an example for the industry.”

Contact: Anna Simet asimet@bbiinternational.com

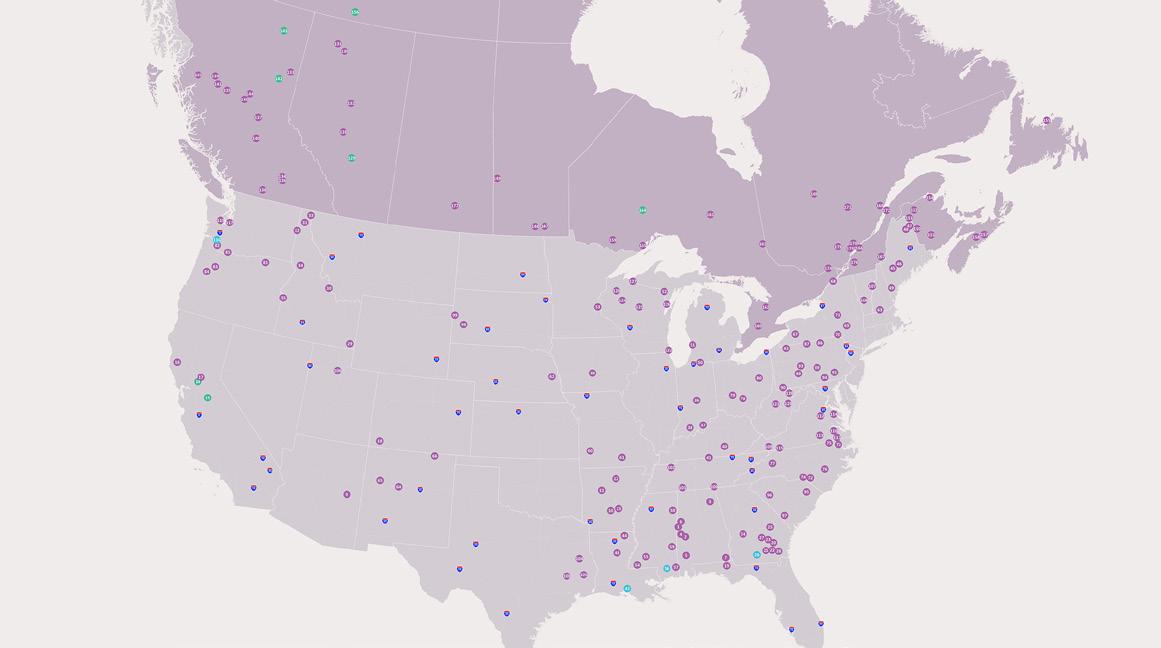

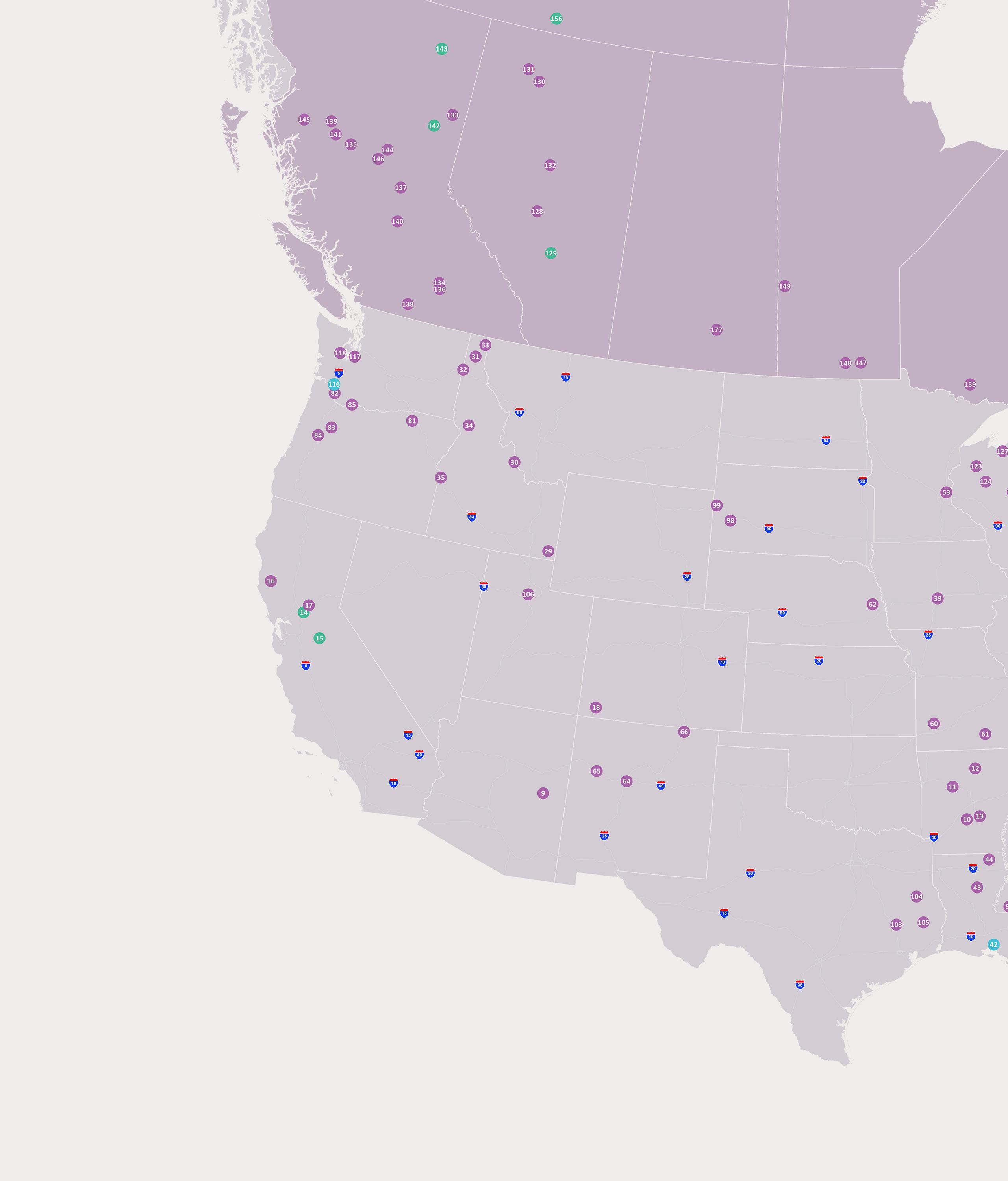

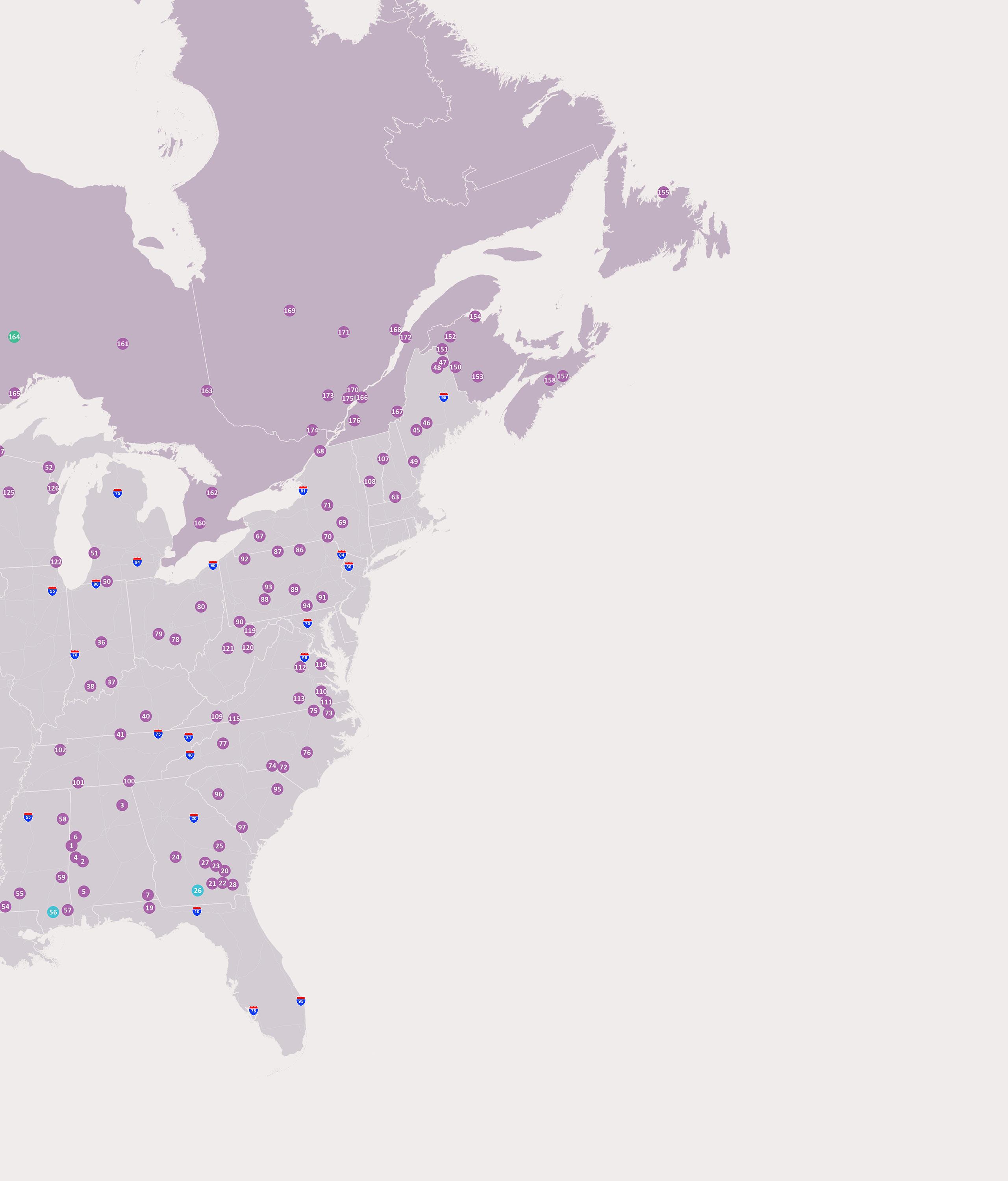

Pellet Mill Magazine tallies the results from its 2025 U.S. and Canada Pellet Producer Map.

BY ANNA SIMET

Warmer winters combined with a multitude of market forces resulted in stagnant wood pellet demand last heating season, for both the residential and commercial sectors. While global markets have begun to normalize, both domestic and export pellet producers sit on large stockpiles of inventory, according to the most recent edition of the U.S. EIA Monthly Densified Biomass Fuel Report.

Going into 2025, construction activity in the United States is at approximately 2.3 million metric tons (mt), though construction of Enviva’s 1.1-million-metric-ton plant in Bond, Mississippi, is currently halted. Plants under active construction include Drax’s Longview, Washington, plant, which will have a capacity of 450,000 mt, as well as Spectrum Energy’s plant in Adel, Georgia. The Spectrum facility is being built at the site of an existing particleboard mill and is using much of the existing equipment, according to the company.

Graduating from construction to completion included multiple expansions at CM Biomass plants, as well as Peak Renewable’s 150,000-ton plant in Dothan, Alabama. This facility was officially opened in June, built adjacent to project partner Rex Lumber’s operation.

U.S. operational capacity has reached an all-time high at 16.7 million mt, a jump of more of than 1.42 million mt from 2024 capacity.

For proposed capacity, Golden State Natural Resources’ two plant proposals in Nubieber and James-

Georgia

8 Facilities

2,614,800

by Capacity

town, California, remain on the to-be-built list. A recent update on the company website indicated the Draft Environmental Impact Report for the projects is publicly available until Dec. 23. The plants would have capacities of 700,000 and 300,000 mt, respectively.

As for Cananda, which historically experiences much smaller capacity increases from year to year, operational capacity is at 4.69 million mt, up 75,000 mt from the previous year. No plants are currently proposed or under construction, according to to BBI International’s knowledge. A new plant added to this year’s map is Biomass Fuels Canada, owned by Patterson Global Foods in Rosser, Manitoba. The plant has a production capacity of 25,000 mt, the company reports.

Over the past five years, U.S. operational wood pellet capacity has increased by approximately 2.7 million mt, or 19.3%. For Canada, capacity has increased by roughly 413,000 mt, a 9.6% increase.

Author: Anna Simet asimet@bbiinternational.com

BY FAZAL ALLAHWALA

The journey of establishing a successful wood pelleting operation in Pakistan has been both challenging and rewarding. As a producer, the experiences Rockey Choolha encountered offer valuable insights into the broader potential of biomass energy in the country. With the rise of global concerns around climate change and the demand for cleaner energy, wood pellets present a viable and sustainable alternative, especially in a country like Pakistan where there is a wealth

of untapped natural resources. However, the road to scaling up this industry is riddled with both opportunities and hurdles that need to be addressed.

One of the first and most significant challenges we faced when we embarked on our wood pelleting journey was sourcing reliable raw materials. In Pakistan, wood waste

and other biomass materials such as agricultural residues, sawdust and forestry leftovers are abundant. However, accessing these materials consistently and at scale was an entirely different story. The key to ensuring the sustainability of a pellet production operation lies in forging strong relationships with suppliers of raw materials. We had to collaborate with waste collectors, farmers and sawmills, many of whom lacked a structured approach to handling biomass waste. Establishing a reli-

CONTRIBUTION: The claims and statements made in this article belong exclusively to the author(s) and do not necessarily reflect the views of Pellet Mill Magazine or its advertisers. All questions pertaining to this article should be directed to the author(s).

able supply chain took time and patience, but it was crucial for our long-term viability.

Like many developing countries, Pakistan has significant amounts of underutilized biomass resources. According to various studies, the country generates millions of tons of agricultural waste annually, most of which is either burned in open fields, contributing to air pollution, or left to decompose. Wood pelleting offers a way to turn this waste into a valuable energy source, which can be used for heating, power generation and even cooking. However, collecting this waste and transforming it into usable biomass involves intricate logistics, and that was our first major hurdle.

In the early days, we relied heavily on locally manufactured machinery, which presented its own set of challenges. The machines available in the local market were often not designed for large-scale operations, and maintaining consistency in pellet size and quality was a daily struggle. Additionally, breakdowns were frequent, and finding spare parts or technical assistance could be quite difficult. As a result, our productivity was often compromised, and we experienced frequent delays in fulfilling orders.

Despite these challenges, we remained determined to persevere. Our focus at that

time was primarily on small-scale industries, such as bakeries and textiles, where the demand for biomass energy was slowly growing. These sectors are heavily dependent on thermal energy, and biomass provided an alternative to traditional fuels like coal and natural gas, both of which contribute heavily to air pollution and greenhouse gas emissions. Through trial and error, we managed to achieve some success with local machinery. However, the limitations were evident, and we knew that to scale up, we needed to look for better technology. The turning point came when we invested in an imported industrial plant. This new equipment significantly boosted our efficiency and output. The imported machinery ensured consistency in pellet size, improved fuel efficiency, and reduced maintenance costs. More importantly, it allowed us to more reliably meet the growing demand from larger industries.

Upgrading our machinery was a critical step forward, but we realized that the growth of the biomass energy industry in Pakistan was not just a technological issue. It was also an educational one. Public and industrial awareness of the benefits of biomass energy remains low. For instance, many small- and medium-sized enterprises (SMEs) are unaware

of the economic and environmental advantages of using wood pellets as a fuel source. This is where the role of awareness campaigns, seminars and partnerships becomes essential.

Biomass energy has immense potential to combat climate change, reduce smog and contribute to energy security, but its adoption remains slow. In a country like Pakistan, where

coal and other fossil fuels have dominated the energy market for decades, convincing industries to switch to renewable alternatives is an uphill battle. Many industries are reluctant to adopt biomass energy due to the upfront costs associated with transitioning from established systems to newer technologies like biomass burners.

To counter this, we’ve begun organizing seminars and awareness sessions to educate both industry leaders and the general public about the advantages of biomass energy. Our plan is to organize workshops, both online and in person, focusing on topics such as the economic viability of biomass energy, its environmental benefits and the technological advancements in pellet production. By highlighting case studies and providing practical demonstrations, we hope to change perceptions and promote the wider adoption of biomass energy across the country.

Despite our efforts in promoting biomass energy, one factor remains key to the long-term success of the industry: government support. The government’s energy policy will play a crucial role in determining whether biomass energy becomes a mainstream energy source in Pakistan. Currently, fossil fuels like coal and natural gas are heavily subsidized, making them cheaper in the short term compared to renewable alterna-

IMAGE: ROCKET CHOOLHA

tives. This price disparity is a significant barrier to the widespread adoption of biomass energy.

To foster the growth of the biomass energy sector, the government must introduce policies that incentivize the use of renewable energy. This could include offering subsidies for biomass energy projects, reducing import duties on high-quality biomass machinery, and providing grants or loans to SMEs looking to switch to biomass energy. Moreover, the government can play a pivotal role in raising awareness by partnering with industry stakeholders, organizing public campaigns, and integrating renewable energy education into national curriculums.

The environmental and economic benefits of biomass energy cannot be overstated. Biomass energy not only helps reduce greenhouse gas emissions but also provides a solution to Pakistan’s growing waste management problem. By converting agricultural and forestry waste into usable energy, we can reduce air pollution, mitigate deforestation and promote rural development. These benefits align with Pakistan’s commitments to the Paris Agreement and its broader sustainability goals.

As we look toward the future, one of our primary goals is to collaborate with like-

minded individuals and organizations that share our vision for biomass energy. The biomass industry in Pakistan is still in its infancy, and there is much to be learned from international best practices and innovative technologies. We are actively seeking partnerships with experts, researchers and industry leaders who can help us further optimize our operations and expand our reach.

We are also exploring opportunities for regional collaboration. Pakistan's neighboring countries, like India and China, have made significant strides in the development of biomass energy. By fostering cross-border partnerships and sharing knowledge, we can accelerate the growth of the biomass sector in Pakistan and contribute to a cleaner, more sustainable future for the entire region.

Wood pelleting in Pakistan offers tremendous potential for both economic growth

and environmental sustainability. However, the journey toward realizing this potential is fraught with challenges, from sourcing raw materials to raising awareness and navigating the complexities of local markets. Nevertheless, with persistence, innovation and collaboration, we are confident that the future of biomass energy in Pakistan is bright.

As a producer, we remain committed to advocating for biomass energy as a viable solution to Pakistan’s energy needs. Through partnerships, technological advancements and government support, we believe that biomass energy can become a mainstream energy source in Pakistan, contributing to a greener and more sustainable future for all.

Elevate your biomass operations with the AMANDUS KAHL Pellet Mill! With nearly a century of experience, dating back to the mid-1920s, we have honed our expertise in designing and manufacturing pellet mills for various industries. Our cutting-edge technology efficiently transforms wood chips, sawdust, and agricultural waste into premium pellets, ensuring both efficiency and sustainability. Contact us today to learn more!

curci@amanduskahlusa.com

470-421-0970 www.akahl.com

Biomass Magazine’s Biomass Industry Directory is the most comprehensive list of industry suppliers, producers, researchers and government agencies available in the world. The directory is an invaluable resource to help find the contact information you are looking for, and help others find you.

directory.biomassmagazine.com

866-746-8385 service@bbiinternational.com

Biomass Magazine’s podcast series offers insightful discussions on the latest advancements and trends in the biomass industry. Each episode features industry experts sharing updates on renewable natural gas, biomass power, pellets, biogas, sustainable aviation fuels, and innovative biomass technologies. The podcast series provides valuable information for professionals and enthusiasts alike.

866-746-8385 service@bbiinternational.com https://biomassmagazine.com/ podcast

A Biomass Jobs subscription provides targeted exposure to biomass industry professionals through prominent listings on biomassmagazine.com, including homepage placement, monthly job-focused emails, and newsletter listings. This maximizes visibility, reaching a highly relevant audience for faster, more qualified candidate connections.

www.biomassmagazine.com/jobs 866-746-8385 service@bbiinternational.com

Change Service Requested