2 minute read

D. Median Rents

“affordable,” a median multiple between three and four is considered “moderately unaffordable” and a median multiple above four is considered “unaffordable.”

Figure V.5 plots the median multiple for the regional competitor MSAs in 2021 and the annualized growth rates of the multiple from 2019 to 2021. The Charlotte MSA is above the “unaffordable” level of three in 2021 for the first time. Among the eight MSAs in the chart, the Charlotte MSA is in the middle of the pack. So, while the median house price in the Charlotte MSA is high, the median income is also relatively high. Asheville has the highest median multiple among the eight MSAs. However, a concerning issue for Charlotte is that the median multiple is increasing very fast. From 2019 to 2021, the median multiple increased at an annual rate of 7.02% from 3.52 to 4.03. The growth rate is among the highest across regional competitor cities.

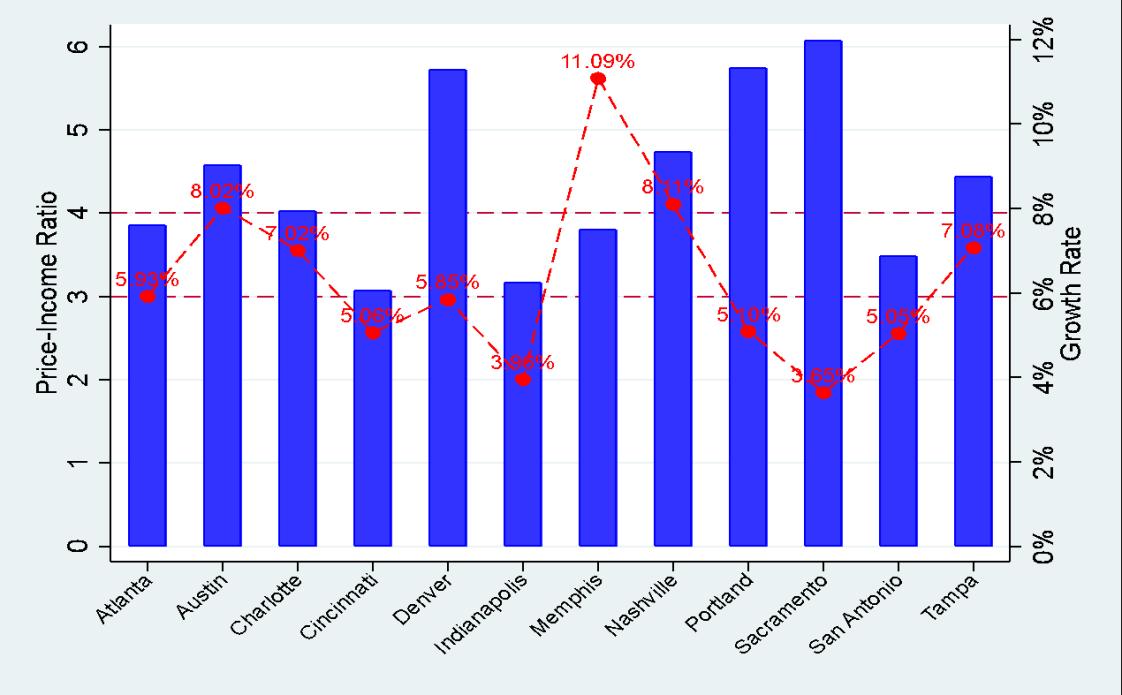

Figure V.6 shows the median multiple for the national competitor MSAs. Compared with other national competitor cities, Charlotte appears to be in the middle regarding the median multiple. Denver, Portland and Sacramento have the highest level of the median multiple, that is, the highest level of “unaffordability.” The median multiple in Charlotte is also lower than Austin, Nashville and Tampa, but slightly higher than Atlanta, Memphis and San Antonio. All MSAs have seen an increase in the median multiple from 2019 to 2021. However, Charlotte is among the cities that have the highest levels of growth of the median multiple.

a. D. Median Rents

The comparisons above all focus on the owner-occupied markets. The rental markets are a significant component of the housing market in every city and are another helpful metric for comparing housing markets across regions. Figure V.7 plots the median rent for each of the regional competitive MSAs in 2021 and the annualized growth rate in rents from 2019 to 2021. Note that the U.S. Census Bureau tabulates these median rents for all renters, so this includes households renting single-family homes and duplexes, as well as those renting apartments. The Charlotte MSA has the third-highest median rent of the regional competitors. Only Charleston and Raleigh were higher. Furthermore, Charlotte has the highest growth rate of median rent from 2019 to 2021.

Figure V.5 Regional Competitor MSAs Median Multiple 2021 and Growth 2019 to 2021

The State of Housing in Charlotte Report 2022

Figure V.6 National Competitor MSAs Median Multiple 2021 and Growth 2019 to 2021

Figure V.7 Regional Competitor MSAs Median Rent 2021 and Growth 2019 to 2021

The State of Housing in Charlotte Report 2022

Figure V.8 National Competitor MSAs Median Rent 2021 and Growth 2019 to 2021

Figure V.8 plots the median rents relative to the national competitor cities. At the national stage, the Charlotte MSA median rent is moderate. Among the 12 MSAs, the Charlotte MSA has

The State of Housing in Charlotte Report 2022