1 minute read

E. Price-to-Rent Ratio

the fifth-lowest median rent. However, its median rental growth rate of 5.64% is among the highest.

b. E. Price-to-Rent Ratio

A common metric used to measure the relative value of buying versus renting a home is the Price-to-Rent Ratio, which is the ratio of the median home price in a region to the median annual rent in the region. That is:

A higher ratio means that home prices are high relative to rents, and a low ratio means home prices are low relative to rents. A higher ratio means that a region is more favorable for renting, and when it is low, it is more favorable for home buying. Comparing regions gives a relative sense of whether renting or buying is more favorable.

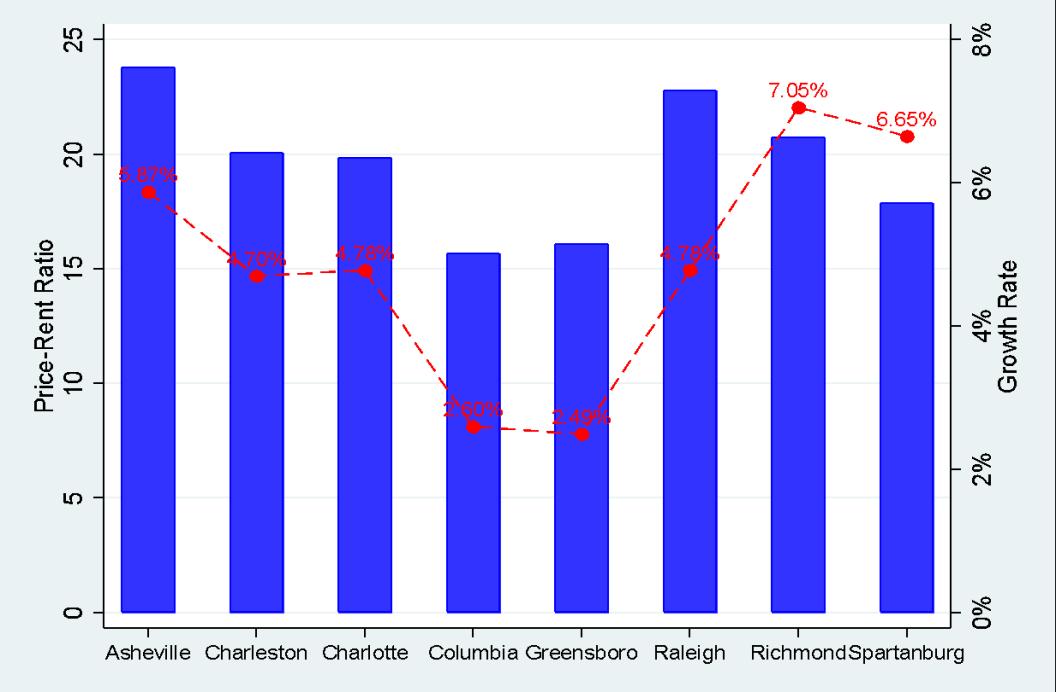

Figure V.9 Regional Competitor MSAs Price-Rent Ratio 2021 and Growth 2019 to 2021

The State of Housing in Charlotte Report 2022

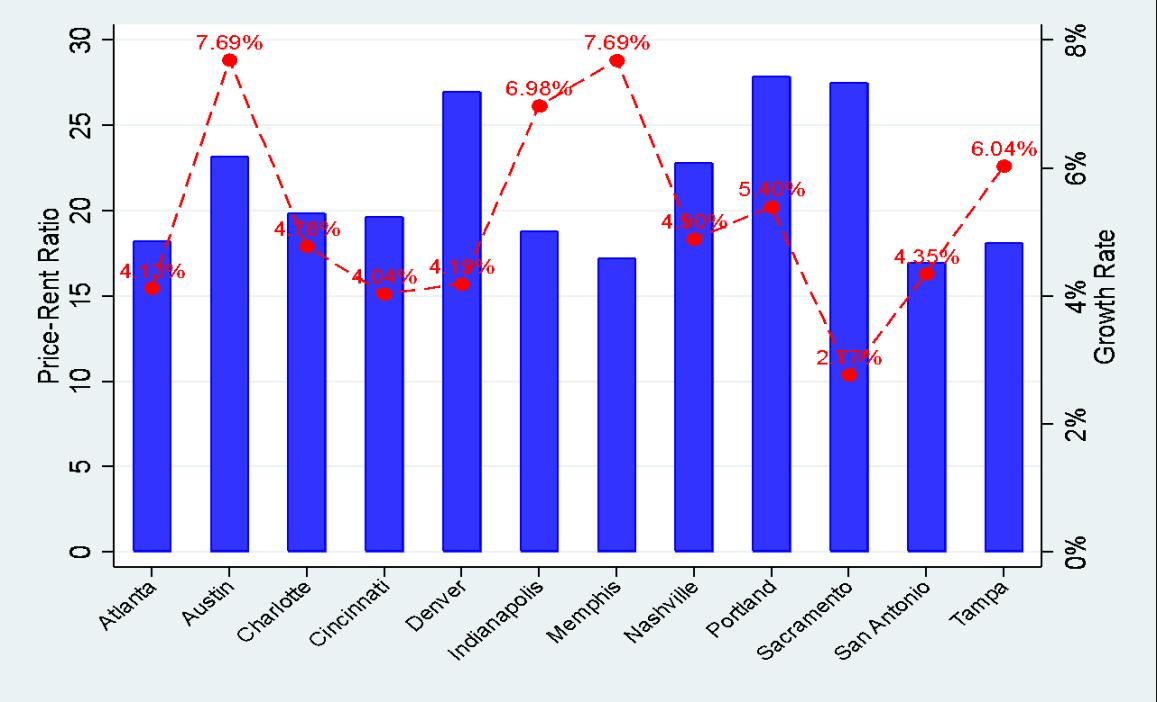

Figure V.10 National Competitor MSAs Price-Rent Ratio 2021 and Growth 2019 to 2021

Figure V.9 shows the Price-to-Rent Ratio for regional competitor cities in 2021. The ratio for Charlotte is lower than that for Asheville, Raleigh and Richmond. In contrast, Columbia, Greensboro and Spartanburg all have lower Price-to-Rent Ratios than the Charlotte MSA,

The State of Housing in Charlotte Report 2022