As I write this it’s the middle of Dry January, or as my wife calls it, “the only thing the New York Times is writing about this month.”

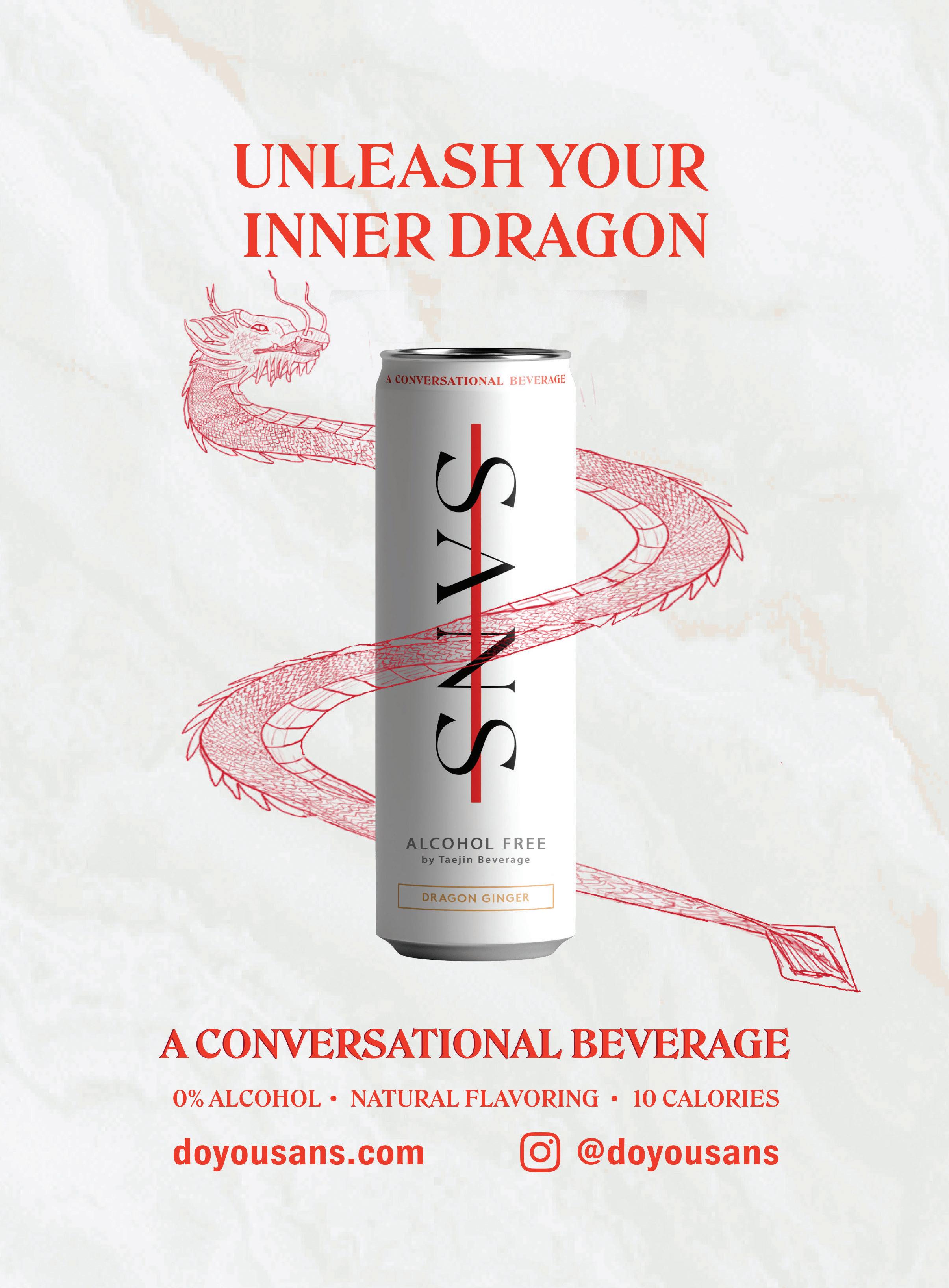

Just about everyone in the CPG business is aware of the cultural force that this month-long voluntary draught has become since it started early last decade, but in case you aren’t aware of it, send me your email and I’ll make sure you are able to access the 700 or so press releases I’ve gotten in the past three months referencing it as a trend, re-introducing non-alcoholic spirit brands, offering up mocktail recipes, explaining the exponential growth of NA products, and generally letting me know that January is about renewal and clean living and this product has taken the market in a sober storm.

(Of course, the storm is only sort-of sober – I’m also being reminded quite regularly by a variety of THC-added beverage brands of the factoid that, according to at least one poll, about one in five participants in Dry January are getting through it while using cannabis).

Sobriety is certainly hip amongst the young folk, with Gen Z leading the charge and twice as likely to abstain than millennials. Now, since Gen Z includes kids born in the late 2000s and 2010s, we know that many in that generation are legally required to abstain, but we know that attitudes seem to be changing. One of my favorite quotes about it came during an interview on NPR’s Marketplace with Little Saints founder Megan Klein, who said she had heard a kid from Gen Z call alcohol “Boomer Technology.”

In the past couple of years we’ve seen the growth of alcoholfree bars, alcohol-free spirits stores, and my personal favorite, alcohol-free hard seltzers. We know we’re expecting to see even more offerings in the future. But, in a question that many drinkers face themselves, how much is too much? Let’s look at the opportunities vs. the hype.

One good aspect of this near-universal disarming of drinks has been the massive renaissance in the alcohol-free beer industry. Watching companies like Athletic Brewing become one of the fastest growing craft breweries in the country, tasting products from established breweries like Dogfish, enjoying the craft nature of beer analogs from Hoplark has helped establish that good beer doesn’t necessarily have to have alcohol in it. And that’s great, because beer is a year-round drink, one that often is consumed repeatedly during a particular drinking “session,” and one that has near infinite scale and variety as a category.

In other words, the success of NA beer relies more on brewers’ ability to produce a terrific product with repeated use occasions that lines up with more than just a month of sobriety.

As an aging beer drinker, I’ve started to join the ranks of those who occasionally mix in an alcohol-free beer into my sessions because I know that it’s good to take breaks, particularly at my age. Pacing is important. Not only are there lots of aging beer drinkers, there are lots, and lots, and lots of beer drinking occasions. The growth of NA beer makes sense because it covers more than just the occasional cocktail party or bar outing, but that enormous range of situations when beer is the default drink of choice. As a product derived over the centuries in large

part for refreshment (even hydration!), beer is ubiquitous. The notion that one could engineer booze out and still create that refreshment, and the ability to put it in so many of the places that beer already thrives, is so good that it isn’t even revolutionary –the trick to so many of these products isn’t that they’re alcoholfree, it’s that they’re a massive improvement on the alcohol-free beers that consumers have previously become resigned to. Just like the craft beers that came before them were a qualified improvement over many of the beers already on the market.

Despite massive growth seen at places like the Fancy Food Show, and even predictions from the experts that we’re going to see a massive expansion in brands and sober lifestyles, the idea that we’ll see a big set of winners in NA spirits isn’t as clear to me. For one, it still seems to be powered by the idea that it’s what’s missing that counts, as opposed to a quality improvement on what exists already. First, let’s look at pre-mixed drinks: there are a vast array of non-alcoholic products – soft drinks – that don’t have alcohol already and tend to substitute for highballtype cocktail blends. That’s not to say that the idea of a nonalcoholic gin and tonic or Paloma isn’t totally unpalatable, but rather that so many tall drinks have soda or soft-drink based analogs that it cuts pretty heavily into the total potential market. You get the impression that there’s a thundering herd of brands heading for a tiny hole in the fence. One or two might squeeze through, but don’t expect them to create a massive market.

Now, let’s talk basic spirit substitutes, or the Lyres and Seedlips of the world. Can there be complex, interesting spirit substitutes that have a solid price point and are viable in a “treat” environment – both for the temporary abstainer or the long-term teetotaler? Sure. Judging by my inbox, there are dozens aiming to fill that role, but their existence is constantly pegged to a market that appears, Brigadoon-like, every January. An optimistic reading is that Dry January’s long-term effect is to create a market among an expanding set of sober-by-choice consumers, but even then the growth is hardly going to sustain the number of brands we’re seeing right now.

More concerning for me is that there’s a hint of opportunism that creates a market out of those who are sober because they have to be, as opposed to by choice. There’s already some medical data that indicates these kinds of products are likely to cause relapses for those in recovery, and a lot of them just won’t risk it, anyway. This kind of product shouldn’t be used to create social pressure for those in recovery to stick around in places where they might not otherwise want to be. Sobriety can be hard enough without wandering through a thicket of products that claim to offer an accurate substitute for one’s addiction.

That also applies for NA beers, of course, but there’s a market for active drinkers there as well. How many “flexitarian” beer drinkers there are will ultimately determine the size of that market, and I’m betting its many pallets bigger than those who are going to spend the dollars to habitually nurse a bottle of faux gin, no matter how close it might be to the real thing. Naturally, there will be winners, but basing a gold rush on one dry month is going to lead to a long hangover indeed.

As I write this, it’s Martin Luther King Jr. Day. I love that we have an opportunity, annually, to commemorate the extraordinary life he led. His impact on society was both concrete and inspirational. He set an example of what can be accomplished when you have goodness of heart, and clarity of purpose. The fact that it has morphed to a “National Day of Service” is the best way to honor his legacy.

The day got me thinking about the role of the beverage business in helping to change the world for the better. Over the years I’ve met with so many entrepreneurs, from the largest of companies to the smallest of brands. They are an impressive lot. Our conversations have almost always touched on how they started their brands, their strategies, logistics and distribution, but the best ones also focused on the “why” of the decision. We broached their difficulties and failures with honesty. I guess when it comes to sharing a journey, I’m a comforting person. There have been so many success stories, some modest, some bona fide jackpot winners, but as we all know, the failure rate of beverages is high. One thing I always find reassuring, however, is that for so many entrepreneurs, while the

focus is always on the success of their brands – as it should be – they want to do more than just make a ton of money.

It is well documented how the major beverage companies support so many causes, way too numerous to mention. Combined, it’s hard to find a charity or cause that they don’t have their signature on. Aside from being the right thing to do, it’s also smart marketing and positioning. Doing good for their communities is the right business. Hopefully the motivation is pure, but either way, good comes out of it.

Nevertheless, I look to the small brands that really set an example for what I think really comes from the heart. So many of these innovative brands align with charities and causes. They set aside a percentage of their revenues and/or profits to help organizations of every ilk. Whether it’s environmental causes, agricultural movements, or illuminating the plight of people in need, beverage companies have always stepped up to the plate. It is an admirable trait of these special people. I hope that someday every company will help contribute to society, but for now, I thank those that do, from the bottom of my heart.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall NEWS EDITOR, BREWBOUND jkendall@bevnet.com

Carol Ortenberg EDITOR, NOSH cortenberg@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer ACCOUNT SPECIALIST jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO & EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS 65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE 1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

So now we’re in financial market with a completely different vibe than just 18 months ago. The same investors, it seems, whose exuberance blew newly public issues into stratospheric valuations have suddenly turned very sober, holding those same targets to standards of financial discipline that never were mentioned during their road shows. Less visibly, it hasn’t been much different on the private side, with the recipients of tens of millions now taking severe haircuts on valuation. Look at oatmilk giant Oatly: never a word said about immediate profitability in its road shows (and never a word asked, that I recall), yet it arguably underpriced a share offering that soared from a valuation of $10 billion to $13 billion upon its debut. Oatly’s executive team could not have been clearer that all discretionary cash flow would go toward building new plants all over the world, following its highly integrated production model. Now of course, it’s getting hammered on the Street, despite generally meeting its commitments on sales growth and continuing that global plant buildout with surprisingly few glitches, given the current period of supply chain snarls. Like others, it’s now pursuing an asset-light model (or asset-lighter, anyway) and assuring investors it’s aiming for profitability.

Shifts like these are all the more necessary because of a complementary shift occurring on the side of the strategics who’re usually the ultimate buyers of emerging beverage brands. Many have come to the realization, perhaps with an extra nudge from the portfolio prioritizing that the pandemic demanded, that their old model of partnering with early-stage brands to build the next big platforms didn’t really work. At least, not in any way meaningful to multibillion-dollar multinationals that need serious growth increments, and quickly, not modest additions that add complexity but not enough topline heft to impress investors. We’re still seeing deals getting done, with Keurig Dr Pepper particularly active with its Athletic Brewing and Nutrabolt alliances, but even those are explosively growing brands and, in C4 Energy’s case, beyond trivial size.

From this perspective it doesn’t hurt to look at Coca-Cola’s influential Venturing & Emerging Brands incubation unit, whatever exactly is left of it these days. In over 15 years of existence, it’s plied a conscientious course trying to uncover trends driving consumer behavior and the outside brands that might fill them. From what I’ve heard it’s always operated honorably and has been an enthusiastic champion of beverage innovation (including by sponsoring BevNET’s own Showdown competitions). Yet what does it really have to show for all the hard work? It may have fumbled some key investments, like the coconut water brand Zico, but it also did pretty well by its Honest Tea investment, carefully onboarding it into the broader bottling system, maintaining its organic credibility and commitments to the growing community. At least, until this past year, when it shocked the beverage world by announcing that this brand would be sunsetted. Even after a decade-plus in Coke’s grip, Honest was well shy of the billiondollar sales level by which the company measures innovation successes and simply wasn’t worth the - minimal - focus and space on the trucks any more. So even what might be viewed as VEB’s best success proved inconsequential to a behemoth like Coke.

That’s a sobering conclusion. There seems to be a similar rethinking going on among most of the big beverage and beer players. After all, why should they expect different outcomes?

For those in the innovation space there’s a very interesting offshoot of those twin forces. If most of the strategics are disillusioned with the incubation model, and the investors are risk-averse, then early-stage brands need to come up with a new model beyond blowing up the top line at any cost to win the notice of would-be acquirers. Lately, several operators and deal-makers have been pointing to the emergence of this model as a kind of safe space where brand-builders now can ply their craft unmolested by deep-pocketed multinationals with priorities that can shift on a whim. Not a backwater, exactly, but at least a more placid pool where the big guys are less likely to fish, either as acquirers or by launching knockoffs. At Vita Coco that’s explicitly underpinning their ambition of becoming a multiplatform player in coconut water and adjacent categories. At the recent ICR investor conference, CEO Martin Roper spoke of how even a $100 million brand might be viewed as “niche” in the current climate. So the longer-term plan he’s hatched with executive chairman/co-founder Mike Kirban is to grow or acquire one or several brands in that range that move through similar channels to the core coconut waters. Those are “niches the big guys wouldn’t worry about,” he figures.

Zico’s founder (and restored owner) Mark Rampolla, who runs the PowerPlant Ventures investment shop, sees the planets aligned for a range of operators who can be stewards of these mid-range brands. The strategics, he blogged, are “clearly not interested in managing hundreds of small, niche brands under their existing umbrellas – and we’re starting to see roll-up companies fill the void. Before long, I expect there will soon be a new group of public, multi-brand companies that take over and fill this void.” Or privately held ones, I would add.

Of course, beverage roll-ups haven’t exactly had a brilliant history. New Age Beverage alone would have been enough to tarnish that notion with its discredited push to acquire troubled brands cheaply with a view to tapping synergies. That never materialized, and the company veered into the get-rich-quicker realm of multilevel supplement marketing and eventually spiraled into bankruptcy. But it never really invested in those brands, and some already had had their shot and failed. There’s a wry comment I’ve heard over the years about how this idea of pooling a pair of weakened brands in the hope they can unlock some synergies is not much different than two drunks propping each other up at the bar. Platform operators like Vita Coco with a sizable, established brand and demonstrated history of responsible fiscal stewardship are a different story. Talking Rain and AriZona Beverages might similarly qualify, but so would a bunch of earlier-stage companies trying to suss out their ultimate goals.

This changed landscape likely will preference a different breed of entrepreneur, those who’re not just about the adrenaline rush of blowing up the topline for a quick flip – “carpetbaggers,” I sometimes call them – but rather those who genuinely enjoy engaging in the daily challenges of the business without any timeline of when to move on.

Just in the iced tea business we can point to the likes of AriZona, Milo’s and Joe Tea as patient, family-run businesses that have demonstrated impressive commitment and staying power. And hey, those young surf dudes at acai pioneer Sambazon have certainly surprised me by how long they’ve stuck around – 22 years and counting. Personally, I’d like to see more of these patient, long-term players “out here in the middle,” to cadge a song title from James McMurtry. As the smalltown paramour sings to his big-city girlfriend in that classic, “Wish you were here, my love.”

Colorado-based beverage maker Hoplark is separating into two subsidiaries: Hoplark, which will oversee the core brand as it currently exists, and Hoplark Labs, a tech-driven division that will launch new beverage brands and products under the leadership of the company’s founder, Dean Eberhardt.

The restructuring, announced to employees, which went into effect on January 1, represents a significant new chapter for Hoplark, which debuted its flagship line of non-alcoholic hopped teas in 2018. Created by Eberhardt as a flavor-forward alternative to craft beer, the brand has become one of the fastest-growing names in natural CPG, and has since expanded nationwide into categories including sparkling water and nonalcoholic ‘beer.’

Hoplark Labs is intended to use the company’s learnings from the past four years as fuel to continue pursuing beverage innovations that go beyond the core brand proposition, Eberthardt told BevNET in December. In turn, the move will put the Hoplark brand in experienced hands of former DRY Soda and General Mills executive Betsy Frost, who was promoted from Chief Commercial Officer to Hoplark CEO.

“It’s a super exciting thing for me because it’s really my core passion and the thing I love more than anything,” Eberhart said. “It’s not a normal thing to do four and a half years into a crazy beverage startup, but I think it’s the right thing — clearly the right thing for me and I think clearly the right thing for the company.”

Over the years, Hoplark has built its identity around creative flavors, unique label designs and limited edition varieties like its “explorer” series, and Eberhardt remains committed to those as foundational elements. But he also acknowledged that his “desire to push the envelope on stuff might be a bit distracting.” At the same time, promoting Frost, who joined the company in May, to the top job brings operational expertise at a time when Hoplark is doing “way more than we’ve ever done,” including onboarding 3,000 new doors in an eight-month period.

Eberhardt will remain in his executive chairman role at Hoplark and continue to “support the team at the executive level and at the innovation level,” as well as tinkering with process engineering as needed.

“That cultural separation allows for, most importantly, the Hoplark brand to really finds its identity and lose a bit of some distracting elements of trying all the stuff that we try and different things that have been going on and really focus directly on this incredible market opportunity,” he said.

In Eberhardt’s new role, creating “distractions” is unlikely to be an issue. Though the two subsidiaries will share the same parent company and ownership, he explained that Hoplark Labs plans to create its own brands and products in other beverage categories that will “probably” be separate from the Hoplark brand, in addition to designing and creating beverages for

clients. The Hoplark brand will continue to run its own R&D department, but there will be some “overlap” between the two organizations, and Eberhardt didn’t rule out Hoplark Labs developing a product that “gets reinserted back” into its eponymous brand.

“We’re picking our spots for where we think we have a really strong brand voice and perspective, but going to also create it for others,” he said.

As for what may come out of Hoplark Labs, Eberhardt said to expect drinks featuring “real ingredients brewed with craft techniques,” and created with patented tech IP and applications. The past four years have yielded significant learnings on how to work with fresh ingredients — the company does not use flavorings, extracts or concentrates — that have encouraged Eberhardt to push further into bold flavor experiments, some of which require going further downstream in the supply chain. He cited the challenge of finding fresh juniper berries — hard to find in a market set up for dried berries used in gin.

“The other thing that we’re able to do with the technology is extract different layers of flavor than other people are extracting right now,” he said. “So we can extract fresher, brighter flavor notes and characteristics because of how we process it, and because of how we source it to actually turn an ingredient that might be thought of a certain way into a completely different experience.”

Hoplark Labs officially got off the ground in January, but Eberhardt has already laid the groundwork for new partnerships that will be announced within the next few months, he said, likely followed by “thoughtful” product rollouts in specific regions by summer.

On a personal level, the pivot has been unexpectedly revealing for Hoplark’s founder, particularly after spending the last 16 years operating his family’s manufacturing business.

“Although I may be really quite good at (operating and building businesses) the unexpected result of launching Hoplark might be that it’s possible that I’m great at developing innovative taste experiences that connect to market opportunities. I did not totally see that coming.”

Keurig Dr Pepper (KDP) has entered a strategic partnership with C4 Energy producer Nutrabolt and will invest $863 million for a 30% ownership stake in the brand, along with distribution rights, the company announced in December.

Based in Texas, Nutrabolt produces a variety of fitness and workout powders and supplements, including C4 Pre-Workout and post-workout recovery brand XTEND. C4’s ready-to-drink energy line, introduced in 2018, has become its fastest growing product – with retail dollar sales up 140.4% to $299.2 million in the 52-weeks ending November 19, according to NielsenIQ.

According to a press release, the deal is expected to “meaningfully increase retail availability and household penetration” for C4 as KDP onboards the energy drink for mainstream retail distribution. The transition will begin next year.

Nutrabolt will continue to distribute C4 both directly and through its existing distributors for the specialty, health club and fitness channels, as well as continuing to work with some of its existing beverage distribution partners in select markets.

“This partnership represents a win-win transaction between our two companies,” KDP CEO Bob Gamgort said in a statement. “KDP gains significant presence in the rapidly growing performance energy drink market and Nutrabolt gains access to a strategic investor with extensive sales and distribution capabilities to further accelerate its growth.”

KDP’s cash investment was expected to close by the end of the year and will reflect approximately $740 million net of anticipated cash tax benefits. The conglomerate will receive preferred equity with 5% annual coupon paid in cash or inkind and its 30% ownership stake will make it the second largest investor in Nutrabolt, behind founder, chairman and CEO Doss Cunningham.

The investment “represents a multiple below 4x estimated 2023 net sales” of C4, which are expected to surpass $650 million, the release noted.

KDP will also have the opportunity to “earn additional equity tied to in-market execution” and will gain seats on Nutrabolt’s board of directors. KDP also will have the ability to increase its ownership stake in the future “under various capital raising scenarios.”

“This strategic partnership will supercharge C4 Energy’s current growth trajectory by accelerating household penetration, enhancing distribution and strengthening our overall

commercial capabilities. We will also be partnering with a talented and ambitious leadership team who shares our values, our competitive spirit and has a similar philosophy of disciplined growth and maximizing overall value creation,” Cunningham said in the release.

The deal marks another major shift in the performance energy space, following PepsiCo’s breakup with Bang Energy and its subsequent $550 million investment and exclusive distribution agreement with CELSIUS last summer. It may also be another blow to independent beer distribution houses who have been subjected to major flux over the past several months as CELSIUS exists and Bang has worked to rebuild its independent network.

It wasn’t immediately clear what the role of influential New York DSD house Big Geyser may be for C4 in the future. While Nutrabolt said it intends to retain select distribution partners for C4, no specific companies were named. Big Geyser previously secured an exception to CELSIUS’ PepsiCo partnership in order to continue distributing the brand.

Among the top selling brands in the new generation of better-for-you and performance energy, C4 was one of the few without a strategic partner. As the space has accelerated, corporations like Anheuser-Busch (GHOST) and Molson Coors (ZOA) have aligned with independent brands.

C4 is not the only performance energy brand in KDP’s portfolio either; the company previously partnered with entrepreneur Lance Collins to launch A Shoc in 2019 and serves as the brand’s national distributor. While A Shoc closed a $29 million Series B funding round in 2022, the brand has often struggled to break out within the crowded energy category. According to IRI, A Shoc sales were down -18.9% to $51.5 million in the 52-weeks ending October 2.

The announcement comes over a year after KDP said it intended to increase M&A activity and improve its distribution network, during an Investor’s Day webcast in October 2021. The company previously acquired Canadian non-alc canned cocktail brand Atypique in June.

An August report that KDP was in talks to acquire Bang Energy at a $2 to $3 billion valuation was swiftly denied by the company.

Ahead of the partnership, Nutrabolt boosted its leadership team; in November the company announced a new CMO, veteran marketer Robert Zajac, and new EVP & Chief Growth Officer Sabba Naserian.

Powered by Real Food From the Ground Up has acquired Velocity Snack Brands Opco, LLC (VSB), the owners of puffed chip company Popchips.

Terms of the deal, which closed in November, were not disclosed. Amit Pandhi, CEO of VSB, as well as executives from Powered by Real Food From the Ground Up declined to comment for this story.

“This addition expands our roster of brands and positions us to be your go-to partner for better-for-you snacks,” a notice sent to retailers late last month said. “Adding Popchips to the portfolio is true to our beginning, we never stop evolving, and striving to give consumers what they want. It’s been a core value to our company from day one. The expanding Powered by Real Food From The Ground Up portfolio positions us to meet all your needs.”

Entrepreneurs Keith Belling and Patrick Turpin founded Popchips in 2007, a year later selling venture firm TSG a reported 30% stake in the company for $25 million. Belgian private equity firm Verlinvest went on to purchase the majority of the company, including TSG’s shares, in 2012.

Popchips had less than $5 million in sales when TSG invested, but, boosted by celebrity endorsers like Katy Perry and a sales team laden with veterans of the Vitaminwater brand,grew annual sales to $75 by 2012. However, at the time of the acquisition by VSB, Popchips was reportedly struggling with distribution and manufacturing issues, both impacting sales.

As of March 2022, when the VSB began investigating new financing options, Popchips reported 234 trade points of distribution, according to the U.S. MULO SPINS/IRI data included in the prospectus. The company reported 4% household penetration, far lower than the 26% and 8% of other better-for-you snack brands SkinnyPop and Popcorners, respectively. With a 29% increase in dollar velocity growth year-over-year, compared to the 15% seen in the “better-for-you” snack category, there was potential to see dollar gains by driving distribution.

“As the pioneer in BFY snacking, Popchips enjoys strong consumer awareness and is highly coveted by the most desirable cohort of snacking shoppers,” the prospectus said. “Popchips remains one of the only independent snack brands of scale and is well positioned for long-term growth.”

VMG was “open to a variety of alternatives” regarding financing, ranging from an outright sale of the brand to partnering with a new investor as they “strongly believe[d] in the long-term potential of the brand,” the prospectus noted.

Despite impressive growth, Popchips faced a limited pool of publicly traded strategic acquirers. PepsiCo acquired Popchips competitor Popcorners in 2019, while Hershey’s Amplify has been noticeably quiet when it has come to acquisitions in recent years. B&G previously announced its intentions to exit the snacking set and is seeking to sell its Back to Nature snack brand.

Under Pandhi’s leadership, Popchips achieved its first profitable quarter ever in 2021 and first profitable year in 2022, reporting roughly $50 million in sales, according to a prospectus sent to potential acquirers.

Those gains have come against the backdrop of $4.5 million in cost savings generated by cutting payroll and switching from company-owned manufacturing to a co-packer. Freight and warehousing expenses were also cut 11%, under VSB’s ownership, while over 120 employees were dismissed. VSB executives also slashed the company’s SKU count from 64 to 21 by streamlining pack size options and dropping the company’s Nutter Puffs and Ridged Chips in order to focus on the core product line.

The snack brand also is a private label partner for Aldi, Kroger, and Safeway.

Enter Powered by Real Food From the Ground Up Founded in 2018 as a portfolio company of investment and incubation platform Halen Brands, the company produces grain-free, vegetable-enhanced salty snacks under its Real Food From the Ground Up brand, as well as its newly launched You Need This brands. Halen Brands, and the firm’s founder Jason Cohen, exited the company in 2022, with president and CEO Aaron Greenwald subsequently assuming control.

When VMG announced the acquisition of Popcorners, and creation of the VSB, the firm planned to acquire and build a platform of snacking brands that could share common back office functions, such as finance and operators while also offering a portfolio of snacking options during a single sales call. However, that path never came to fruition. The capital for VSB came from VMG’s fund IV, and once the VC group moved onto Fund V in 2021, the potential for any future investment or acquisitions became unlikely.

VMG general partner Wayne Wu declined to comment as to the history of VSB or the Popchips sale.

Less than two years after the baking mix brand was sold to Sovos Brands, Birch Benders announced in January it had been acquired by baking platform Hometown Food Company.

Details of the transaction were not disclosed.

“The Birch Benders acquisition is a wonderful addition to Hometown Food Company’s portfolio of brands and it increases our footprint in the betterfor-you, breakfast and baking categories,” said Tom Polke, president and CEO of Hometown Food Company in a press release.

Hometown, owned by private equity firm Brynwood Partners, manages a baking product portfolio that includes the Pillsbury Baking Co., Funfetti, Hungry Jack, Arrowhead Mills, White Lily, Jim Dandy, Martha White, and De Wafelbakkers -- all formerly part of the J.M. Smucker Company. Hometown operates a 650,000 square foot plant in Toledo, Ohio.

Birch Benders will expand its offerings in the better-for-you baking set and complement legacy brand Arrowhead Mills within the overall portfolio, Brynwood executives said in a release.

The move positions Hometown to compete with brands like protein-enhanced baking and snack maker Kodiak Cakes, which was sold to private equity firm L Catterton in 2021.

Birch Benders was sold to Sovos brands in August 2020 by its co-founders Lizzi Ackerman and Matt LaCasse for $151.4 million. At the time of that deal, Sovos said Ackerman and LaCasse would have a five year “consulting agreement” with the low-sugar and low-carb brand.

Though Sovos has tried to expand Birch Benders into new categories, launching shelf-stable cookies last year, the brand has struggled. On its third quarter earnings report in November, Sovos reported a roughly 34% decline in net sales for Birch Bend -

ers due to a softening of both the pancake and waffle mix categories as well as waning consumer interest for ketocentric products, a core point of differentiation for many of the baking brand’s SKUs.

Birch Benders represented only 5% of Sovos’s net sales in the third quarter, compared to Italian food brand Rao’s which represented 64% of sales. In a press release, Sovos CEO and president Todd Lachman said the divestment would allow the company to focus attention around a smaller subsegment of brands.

“[The] announcement reflects Sovos Brands’ continued commitment to growing our core Rao’s and Noosa brands and, in particular, accelerating Rao’s to $1 billion in net sales and beyond,” Lachman said. “As we look ahead, Sovos Brands will be a more focused business that is better-positioned to drive sustainable sector leading growth for years to come.”

Backed by $70 million in new growth capital, plant-based food and beverage company NotCo is aiming to build a business-to-business food technology platform “that operates like Coca Cola.”

Since launching in 2015, the Chilean company’s funding has totaled nearly $433 million. The latest round, announced in December, was led by existing investor Princeville Capital, with additional participation from Bezos Expeditions, Tiger Global and L Catterton, among others.

According to co-founder and CEO Matias Muchnick, NotCo will continue to operate and make growth decisions with the heightened inflation and currency exchange rates, as well as the geopolitical environment and overall global economic climate, in mind. Against the backdrop of those challenges, he also highlighted the value of having Marcos Galperin, founder and CEO of MercadoLibre, the largest Latin American tech company, on board as an investor.

Galperin will serve as Muchnick’s “potential favorite mentor in the world,” he said, noting he has admired Galperin’s ability to stay at the helm of his company for the past 22 years.

Establishing the B2B platform will be essential to executing that long-term goal, but will also allow NotCo to scale its technology quickly and efficiently, a strategy Muchnik believes is essential for NotCo to “capitalize on its uniqueness,” which he said is rooted in its technology and artificial intelligence platform named Giuseppe. Developing the B2B arm will help take the company “out of the shadows” of what Impossible, Beyond and Oatly are capable of doing, he claimed. In 2022, the company announced a joint venture with the Kraft Heinz company and just launched its first co-branded product, NotKraft Singles, in October.

Muchnick declined to speak to the entirety of NotCo’s relationship with Kraft, citing confidentiality agreements, but he confirmed that all future NotCo partnerships will develop co-branded products. NotCo will have control over how its technology is applied, work on product R&D and everything else it takes to

get the item to shelf, but once launched, the partner company will be charged with scaling up manufacturing, distribution and commercializing the new ‘NotProduct.’

“The physical world is a very difficult world – supply chain issues, scalability, manufacturing – all of that really brings a lot of headaches,” said Muchnick. “For us, a licensing agreement brings two things: simplicity of the business and an angle to our business unit and revenue streams at very high gross margins. [We are] focusing on margin contributions and bringing NotCo, in the next two years, to be a profitable company.”

Cobranding products offers value to both parties, Muchnick explained. In the seven years since the company launched, it has capitalized on the work of its own brand and the technology and artificial intelligence capabilities it has built. After the joint venture with Kraft was announced, Muchnick said slews of large food companies began reaching out with requests the company make a “Not” version of their product.

“All of the requests were actually considering the brand on the front of the pack because what they can’t do as a corporation, multinationals cannot connect to a [newer] generation of consumers,” he said. “They have had a hard time doing that. With the element of the branding of NotCo and calling it ‘Not’ they can connect to a consumer that maybe in the past they couldn’t.”

That branding seems to be resonating with Kraft consumers: though currently in just 30 stores, sales of NotKraft singles are 1900% higher than expected, said Muchnick, adding that the partnership has worked incredibly well because

both sides have strong self-awareness to their respective roles. Looking to 2023, the joint venture will see NotKraft products enter four new categories.

The company has also partnered with foodservice operators throughout Latin America including Starbucks in Mexico with NotMilk and Burger King in Chile which Muchnick claims sells 32 NotMeat units per store, per day. In December, it was announced that Dunkin’ will roll out two plant-based NotDonuts.

“This is the real chance of making a democratic plant based industry and not just the Ivy League of it, not just the premium product,” said Muchnick. “It makes sense to jump on the shoulders of our distribution partner like Kraft with the commercialization platform that they also already have.”

This approach is already supported by how NotCo functions within its own operations. The company has managed to scale by outsourcing its manufacturing and distribution and currently works with 50 different co-packers around the world, an approach inspired by the Coca-Cola model. By selling its technology the way Coke sells its concentrate, NotCo has been able to position itself to “out compete” all of its “comparables” (Beyond Meat, Impossible Foods and Oatly) in terms of the strength of the business, he explained.

He aims to operate NotCo with half the business dedicated to branded products and the other half from co-branded partnerships in the next five years. Muchnick believes with this approach NotCo is poised to outcompete plant-based leaders across categories, citing the likes of Beyond Meat, Impossible Foods and Oatly. Since the company’s start, he emphasized it has focused on building the business with an efficient profit/loss ratio and high gross margins.

“We always understood that if we don’t operate very efficiently, then we’re not going to make it,” said Muchnick. “For us, it’s about moving the needle towards sustainability as fast as possible because this fucking world needs it, very fast. The only way to do that is with speed and we needed to understand how to do it very efficiently.

U.S. craft breweries saw a “varied recovery” in 2022, with volume returning to pre-COVID-19 pandemic levels, but not all channels bouncing back and margins tightening, according to the Brewers Association’s (BA) annual Year in Beer report.

“The maturing craft industry continues to grow more competitive, facing both internal business pressures and externally the continued growth of new beverage alcohol competitors,” BA chief economist Bart Watson said in a press release. “While these challenges are daunting, craft brewers are known for their innovation and flexibility, and will need both as they evolve to meet the next generation of beer lovers with new beers and new occasions.”

More than 9,500 breweries operated in the U.S. at some point in 2022, according to the BA. The trade group estimates more than 550 breweries opened during the year, while more than 200 closed. In 2021, an estimated 710 breweries opened while 176 closed, according to the BA’s 2021 report.

The numbers indicate slowing brewery growth, which is not entirely due to the COVID-19 pandemic, but rather a continued pattern of a “maturing industry,” Watson said during the Brewbound Live conference in Santa Monica in December.

While craft beer volume has returned to 2019 levels, not all channels have “bounc[ed] back equally,” Watson said in a video accompanying the Year in Beer report.

On-premise establishments have “continued their long and unsteady recovery in 2022,” and business has returned, but draft sales are still recovering.

In a similar sentiment, small and local brewpubs and taprooms have “proved nimble” and are faring well despite “continued supply disruptions,” while micros and regionals have struggled, tackling fights for shelf space “in an increasingly competitive distribution climate.”

The BA highlighted its 2022 legislative and regulatory battles for small brewers, including several fights against lowered excise tax rates for spirits-based ready-to-drink canned cocktails (RTDs) in Arizona, New Jersey, Washington, Vermont, Illinois, New Jersey, California and Colorado.

Excise tax changes have been spearheaded by the Distilled Spirits Council of the United States (DISCUS), which argues that “alcohol is alcohol” and RTDs with a similar ABV to malt-based beverages should be taxed at the same rate.

The BA also applauded the U.S. Department of Treasury’s report on competition in beer, wine and spirits, published in February. The BA shared comments with the Treasury, the Department of Justice (DOJ) and the Federal Trade Commission (FTC) prior to the

report expressing concerns over “wholesaler consolidation, unfair state franchise laws, and restrictions on direct-to-consumer sales” and later applauded the report for its recognition of laws that “inhibited the growth and competitiveness of craft producers.”

The BA will continue to advocate for regulatory changes and against lower excise tax rates in 2023, as well as for the United States Postal Service (USPS) Shipping Equity Act (H.R.3287/S.1663), which would allow the USPS to ship alcoholic beverages. Bills were introduced into the House and Senate in 2021.

The BA also highlighted the continuation of its mentorship program, which has now matched 102 mentors with 124 mentees, as well as its mini grant program, which has donated more than $150,000 to diversity, equity and inclusion (DEI) organizations and advocates.

Additionally, the trade group celebrated the return of the Great American Beer Festival (GABF) after a two-year hiatus. More than 40,000 attendees celebrated the 40th anniversary of the event, held October 6-8, which featured 500 breweries and more than 2,000 beers. The first GABF in 1982 featured 24 breweries and 47 beers, according to the BA.

Supply chain challenges will persist into 2023, as barley and hops face “unprecedented challenges created by climate change,” according to the BA.

“Although the 2022 harvest improved, the severe depletion of stocks in 2021 kept barley supplies and prices high in a very dynamic and changing market,” the BA wrote.

While the U.S. – which recorded the largest hop acreage in 2021 – is expected to record an average hop crop yield for 2022, Germany – which boasted the second largest hop acreage in 2021 – is expected to record a hop yield -20.4% below 2021 levels and -18% below its average yield, according to global hop supplier BarthHaas in an August report.

“As the economy ramps back up and on-premise beer and restaurant sales increase, so will demand for CO2,” the BA continued. “More brewers may feel the pain of facing curtailed production schedules or even full-scale shutdowns as some brewers did during the pandemic.”

“2023 will be a reset for many brewers as the maturing craft industry continues to grow more competitive, facing both internal business pressures and externally the continued growth of new beverage alcohol competitors,” Watson said. “While these challenges are daunting, craft brewers are known for their innovation and flexibility, and will need both as they evolve to meet the next generation of beer lovers with new beers and new occasions. “

The BA’s predictions for 2023 include:

• Brewery openings in the U.S. will be “the lowest in over a decade”;

• “Distributed craft volume will not grow”;

• The supply chain “will remain rocky,” although average prices “will come down from 2022 peaks;

• And “total brewery employment will still grow.”

Industry veteran John Mallett will depart from Bell’s Brewery next month, after more than 20 years with the Comstock, Michigan-based brewery.

News of the departure comes exactly a year after Mallett was placed in the role of VP of brewing and quality for both Bell’s and New Belgium Brewing, helping oversee the integration of the two companies after Bell’s was acquired by New Belgium’s parent company, Kirin-owned Lion Little World Beverages.

Now that the integration is complete, Mallett has made the decision to “take a step back and devote more time to his family and hobbies, such as skiing and sailing,” a Bell’s spokesperson told Brewbound.

“John’s contributions to Bell’s, and to the entire craft beer community, are truly impossible to measure or even say out loud,” Bell’s EVP Carrie Yunker said in a press release. “He’s a brilliant brewer and a visionary operator who brings a strong sense of passion and a willingness to bust through constraints to every beer he makes and every life he touches.”

Mallett has been brewing craft beer for more than 35 years, holding positions at Commonwealth Brewery (Boston) and

Old Dominion Brewing Co. (Ashburn, Virgina), before joining Bell’s in 2001. At the time, Bell’s was breaking ground on its now-main brewing facility in Comstock, Michigan. Bell’s grew to be the sixthlargest Brewers Association-defined craft brewery by volume in 2021, producing 490,000 barrels of beer.

While at Bell’s, Mallett was a “driving force behind the commitment to both quality and safety that the company is known for today,” helping to establish “robust teams and processes focused specifically on best-in-class quality standards and safety-always protocols,” according to the release.

“As volume growth continued to demand numerous expansions and build outs of the Comstock, Michigan, brewery, Mallett remained committed to growing manufacturing capabilities responsibly, with a focus on protecting our resources for generations to come,” the company wrote.

In 2021, Bell’s celebrated Mallett’s 20th anniversary with the company by launching the John Mallet Scholarship, which helps fund an individual’s studies at the Master Brewers Association of the

Americas. Bell’s committed to funding the scholarship – which debuted in 2022 – for the first three years, including covering registration and travel for the awardee. Bell’s founder Larry Bell also donated $125,000 to the fund “in an effort to permanently endow the scholarship,” according to a press release.

“As I reflect on my 20+ years of working out of Comstock, the brightest point by far is the relationships I’ve built with coworkers, beer fans, farmers, researchers, suppliers, tradespersons, students, the media, publicans, design professionals, educators, distributors, regulators and fellow brewers,” Mallett said in Wednesday’s release. “I can say without hesitation or doubt, that this has been an experience beyond my wildest dreams. The brands and breweries we’ve built together are impressive, but the people and teams behind these achievements deserve a far greater spotlight.”

There are no plans to fill Mallett’s position at this time, according to the Bell’s spokesperson, noting that “the impact John’s had on the brewery – and the craft beer community – is irreplaceable, but he has done an excellent job of training and preparing the leaders in place at Bell’s today to continue this work in his absence.”

The Brewers Association (BA) will increase the cost of membership for the first time in nearly two decades, the organization reminded members.

New prices – which are tiered according to brewery size –were scheduled to go into effectFebruary 1. The increase was first announced in November.

Annual dues will increase $30 for both breweries producing between 0 and 500 barrels, which will see their rate increase to $225, and breweries producing between 501-2,500 barrels, which will see their rate increase to $325.

Larger breweries pay both a flat fee and a per-barrel fee. Breweries with production volume between 2,501-60,000 barrels will see their flat fee increase by $30, to $325, and their perbarrel rate increase by $0.01, to $0.11 per barrel beyond 2,500.

The flat rate for breweries with annual output between 60,001-150,000 will increase $605, to $6,650. The per-barrel rate for those breweries will increase $0.0065, to $0.0715 per barrel beyond 60,000.

The largest breweries – those producing between 150,000 and 2 million barrels – will see their flat rate increase $1,200, to $13,200; the per-barrel rate will increase $0.0005, to $0.0055 per barrel beyond 150,000.

Only the 14 largest BA-defined craft breweries produced more than 150,000 barrels in 2021, according to the BA’s May/June edition of the New Brewer. They included D.G. Yuengling and Son Inc., Boston Beer Company (Samuel Adams, Dogfish Head), Sierra Nevada, Duvel Moortgat USA (Firestone Walker, Boulevard, Brewery Ommegang), Gambrinus (Shiner, Trumer), Bell’s Brewery, CANarchy (Oskar Blues, Cigar City, Deep Ellum, Wasatch, Squatters, Perrin), Artisanal Brewing Ventures (Victory, Southern Tier, Sixpoint), Stone, SweetWater, Deschutes, New Glarus, Brooklyn Brewery, and Matt Brewing (Saranac).

Of these, Yuengling is not a member, according to the BA’s member directory. Lion Little World Beverages’ 2021 acquisition of Bell’s may preclude the brewery from full membership moving forward.

The BA defines independent craft breweries as those who hold brewers licenses from the U.S Department of Treasury Alcohol and Tobacco Tax and Trade Bureaus (TTB), produce fewer than 6 million barrels annually, and are not more than 25% owned by another “beverage alcohol industry member that is not itself a craft brewer.”

In addition to professional brewery memberships, the BA offers memberships to allied trade businesses and organizations ($495), distributors ($395), craft beer retailers ($95) and individuals

($175). Dues for these memberships are not increasing in 2023, a BA spokesperson told Brewbound.

Membership dues make up the BA’s second largest source of annual revenue behind events. Membership dues in 2021 – the most recent year numbers were available – totaled $4,508,011, a decline of $345,347 from the $4,853,358 that the organization generated in 2020, according to the group’s 2021 annual report.

The 2021 membership revenue figure marks a five-year low for the BA, falling just below 2016’s membership revenue of $4,678,181, when the organization counted 8,882 total professional members.

Membership revenue has declined $640,676 in the five-year period since 2019, which represented a highwater mark for the BA with dues accounting for $5,148,687 in revenue. The BA counted 10,966 members across all classes that year. Membership revenue topped the $5 million mark for the first time in 2018, as the organization collected $5,122,013, with 10,739 members across all classes, the last year in which the organization shared membership numbers.

The news of membership dues increases follows the BA announcing in December that it has ceased one of its four signature events, the SAVOR beer-and-food pairing event that was held annually in Washington, D.C.

SAVOR along with the Great American Beer Festival (GABF), Craft Brewers Conference (CBC) and the American Homebrewers Association’s HomebrewCon made up the BA’s big four events. In 2019, the year before the COVID-19 pandemic forced the BA to cancel the in-person versions of its events, events generated

$16,173,153 in revenue for the organization, more than double the events revenue from 2021 when the BA brought in $7,294,944. In 2020, with the pandemic in full effect canceling in-person events, the BA’s events revenue dipped to $1,701,215, according to the group’s 2020 stewardship report.

For more stories, check out brewbound.com

With Sierra Mist sales on the decline, PepsiCo has repositioned itself to compete against CocaCola’s Sprite with the debut of a new lemon-lime soda, Starry. “With one product dominating the category, consumers deserve another option,” said PepsiCo Beverages North America chief marketing officer Greg Lyons in a press release. Starry comes in both Regular and Zero Sugar varieties and is available at retailers and food service outlets nationwide. For more information, visit starrylemonlime.com.

MTN DEW announced the reemergence of its Pitch Black flavor, slated to roll out in January 2023. The LTO first launched in 2004 before returning to store shelves from 2016 to 2019. Now, the third iteration will also be offered in Zero Sugar and Energy formats. For more information, visit mountaindew.com.

Monster expanded its energy drink lineup with the addition of Monster Energy Zero Sugar. Available in the brand’s flagship flavor, each 16 oz. can boasts 160mg of caffeine and has just 10 calories. Monster Energy Zero Sugar is currently available on Amazon for $26.93 per 15-pack with a full launch coming by the end of Q1 2023. For more information, visit monsterenergy.com.

Austin, Texas-based better-for-you energy drink maker SOMI splashed into the new year with three new flavors: Osaka Redberries Matcha, Fancy Mango Matcha and Yuzu Lemonade Matcha. The zero sugar, matcha-based energy drinks feature ceremonial grade matcha and L-theanine and boast 140 mg of caffeine per 12 oz. can. All three flavors are available online for $42 per 12-pack and will soon make their debut at Central Market. For more information, visit drinksomi.com.

Portland, Oregon-based CBD-infused sparkling water brand Aprch introduced the first edition of the Aprch Partner Project, Mint+Cucumber, made in partnership with snow goggle and helmet maker SMITH. According to the brand, the #WeRunCold cans are a tribute to SMITH’s #WeRunCold

Winter campaign features a mountain scape designed by Ryan Schmies. The limited-edition offering is available online for $12.99 per 12 oz. can. For more information, visit drinkaprch.com.

While its name might imply summery vibes, THC-infused cannabis beverage Endless Coast is ready to head indoors this winter with its new seasonal flavor release Spiced Apple, which pairs crisp apple notes with familiar notes of holiday spices. Available in 4-packs at adult-use cannabis stores across Massachusetts, each can contains 5mg of THC per 12 oz. can. For more information, visit endlesscoastseltzer.com.

MIXOLOSHE expanded its lineup of non-alcoholic soft seltzers with three new products: Blueberry Gin & Tonic, Cosmic Bitter Spritz and Orange Old Fashioned. All of the drinks come in 12 oz. cans and have just 50 calories. Additionally, the brand will soon roll out three nonalcoholic spirits, including Gin, Whiskey and Tequila. The seltzers are available for $29.99 per 12-pack and the non-alcoholic spirits will be available for $29.99 per 750ml bottle. For more information, visit mixoloshe.com.

Siren Shrub Co. released a new limited edition flavor, Currant. The wine alternative features flavor notes of jam and is crafted with currants, organic apple cider vinegar and organic cane sugar. Siren Shrub Co. Currant will be available exclusively online for $22 per 16 oz. bottle. For more information, visit sirenshrubs.com.

Dr. Zero Zero has launched its non-alcoholic iteration of the Amaro, AmarNo. The new offering is formulated with extracts of sage, wormwood, Chinese rhubarb, quassia and orange. Dr. Zero Zero AmarNo is available online for $34.99 per bottle. For more information, visit drzerozero.com.

Sparkling water maker Spindrift announced the launch of four new varieties: Nojito, Peach Strawberry, Mint Green Tea and Mango Black Tea. The Nojito marks the brand’s first foray into the mocktail category and its first integration of an herb, mint. For more information, visit drinkspindrift.com.

Well, here’s a Dry January special for you if there ever was one: the NA Beer category, which is an incredible amalgamation of legacy brands, craft companies, and new entrepreneurs. There’s no doubt that Heineken and Bud are benefiting from increased interest in the category, but it’s also clear that the interest is being driven from below, where companies like Athletic have done the heavy lift ing to energize NA products. New brands from craft companies like Boston Beer, Brooklyn, Brewdog, and Lagunitas are on the rise — will they have the momentum to overcome the big guys’ mass sales advantages when we look at the category next year?

SOURCE: IRI, a Chicago-based market research firm-@iriworldwide% 52 Weeks through 01/01/23

SOURCE: IRI, a Chicago-based market research firm-@iriworldwide% 52 Weeks through 01/01/23

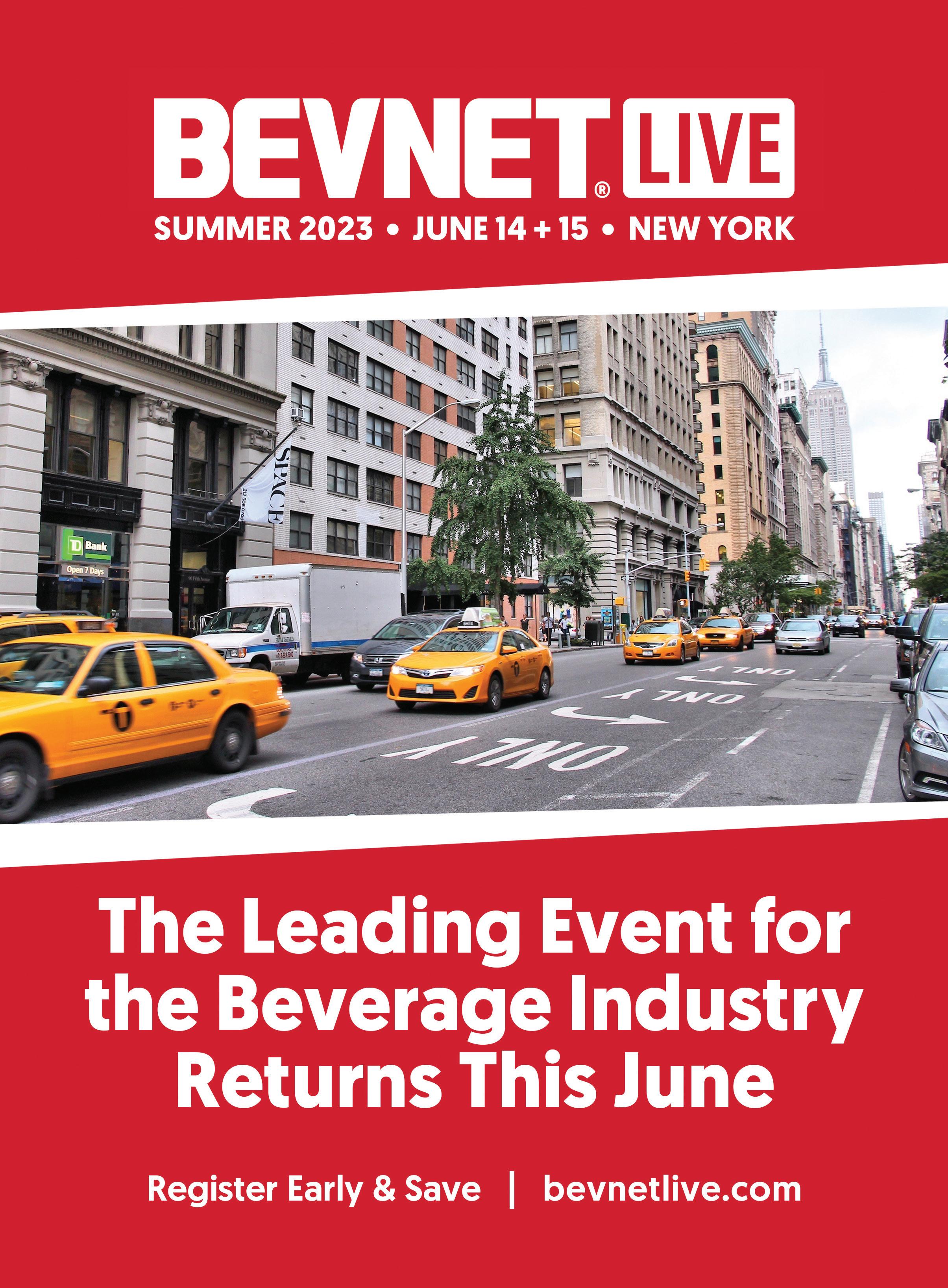

After a year of upheaval and uncertainty, beverage brands and entrepreneurs must be more active, adaptable, and careful than ever before as they seek to reach consumers with their unique products. That theme permeated the presentations and discussions across drink categories during BevNET Live Winter 2022, held December 5-6 in Santa Monica, California.

At the start of 2022, the world was still emerging from two years of living with COVID-19, and still grappling with fears of more variants bringing new waves of infection. But after the invasion of Ukraine sparked a global inflation crisis and concerns over spiraling costs-of-living, beverage brands have new challenges to take on.

During the opening day’s first presentation, Janica Lane, managing director at Piper Sandler, cited the impact of a potential forthcoming recession as a chief macroeconomic stressor of food and beverage companies today. Within an interconnected economy, that has had knock-on effects on the stock market and companies’ ability to access growth financing. And while economic cycles are nothing new, Lane noted that “it feels like every year since 2020 has been more uncertain than before.”

“If you guys are looking at the sell-through data and looking at growth from pricing versus volume in almost every single category, it’s price and not volume that’s driving the growth,” she said.

Examining how pricing has influenced his brand’s recent gains, Sanzo founder and CEO Sandro Roco explained how his product has benefitted from intentionally starting from a higher price point ($2.49 per 12 oz. can). That decision was partly driven by margins, but also helped to stress test the brand’s potential.

“It was also a challenge to say hey, is this product, is the brand unique enough? Can we build a community around this that justifies that level of premium, so that we aren’t having to have these conversations that other brands may be having?”

Later, Fawn Weaver, the CEO of Uncle Nearest Premium Whiskey, discussed her personal and corporate mission to diversify and disrupt the primarily white, primarily male spirits industry.

Founded in 2017, Uncle Nearest is named for Nathan “Nearest” Green, the first Black American master whiskey distiller. The company is on track to report $100 million in revenue for 2022 and launched a $50 million venture fund in 2021 to support BIPOC and women-owned alcohol brands. So far, Uncle Nearest has invested in bitters producer Hella Cocktail Co. and The Equiano Rum Co., with a third investment expected to be announced in the near future, Weaver said on stage.

“When I look at the industry overall, there have been six spirit conglomerates that more than 90% of the volume – at least in our country – is controlled by,” Weaver said. “They are all white male founded, owned and most continued to be led, at least at the highest level they’re still led [by white men]. There has never been an opportunity for a spirit conglomerate to be built by someone who wasn’t a white male

– until now. I don’t have a whole lot of time to get that done in my lifetime, so I don’t have the flexibility or the luxury of not being this energized.”

As both a brand owner and an investor, Weaver said she’s not interested in quick exits and will likely never sell Uncle Nearest, having repeatedly turned down past offers from various suitors. Likewise, for her investments she has no requirement for brands to exit, preferring to instead nurture them into large independent companies with the potential to exist indefinitely (although, she clarified, she is not opposed to her portfolio brands selling should they choose to).

After much anticipation, BevNET Live Winter 2022’s mystery guest was revealed to be actress and Goop founder Gwyneth Paltrow, who sat down alongside Equitea cofounder Quentin Vennie to discuss the canned tea brand’s mission to make better-for-you products available to consumers of all backgrounds.

Vennie discussed founding the brand after his own yearslong health and wellness journey, which began after surviving a drug overdose and multiple suicide attempts. Vennie said he embraced exercise, clean eating and meditation, helping him to find a new balance in life. But it was when his son was diagnosed with ADHD at age 7 that Vennie said he set out to create Equitea in order to provide a natural aid to mental health struggles so his son wouldn’t one day experience the same crises he did.

“There’s no separation for me between self care and survival,” Vennie said. “As someone who lives with debilitating anxiety, someone who was struggling with a life-threatening addiction, showing up for myself better prepares me to show up every day for my family, for the people I love, for my business, and for those that I serve.”

Paltrow came on board Equitea as an investor while seek-

ing to support minority-owned businesses during the Black Lives Matter protests in 2020. After connecting with Vennie through social media – “I believe I slid into his DMs,” Paltrow said — she is aiming to support the brand however she can, but is cautious not to overshadow Vennie or the brand with her celebrity name recognition.

“I think I’m just like, kind of a – I don’t know – fairy godmother in the corner,” Paltrow said. “Quentin is the most incredible founder, the brand is incredible, and for me it’s really just about Quentin being able to have a platform to tell his story. Watching the way he works and goes store by store, telling the story, I’m just in the reserves to kind of help out where needed.”

During the event’s Best Of Awards presentation, Liquid Death was recognized as Brand of the Year following a breakout 12 months which saw the company expand its distribution, secure growth capital, bring on new key partners and reveal its ambition to evolve into a bigger, broader beverage platform. Accepting the award on stage, Liquid Death founder and CEO Mike Cessario attributed much of the brand’s success to its team.

Also honored during the show was Seth Goldman, cofounder of Eat the Change and the driving force behind Just Ice Tea. Having watched his former brand Honest Tea get discontinued by Coca-Cola over the summer, the CPG veteran quickly assembled a new supply chain and route to market for his second foray into the tea category, going from concept to launch in a matter of months. That decision proved fortuitous for consumers seeking a lightly sweetened organic tea option, but also retailers and growers who had been blindsided by Coke’s decision.

During the first day of NOSH Live Winter 2022, held December 1-2 in Santa Monica, California, Melissa Urban, founder and creator of elimination diet Whole30, opened the show with a sitdown discussion on building a brand through community.

Throughout the conversation, Urban emphasized the deliberate choices the Whole30 team made to create the cult following the nutritional philosophy has today, which enabled the platform to later extend into the world of CPG with a line of salad dressings. As an elimination style diet, she said followers often use Whole30 as a “self-experiment” with the understanding that it is not a diet intended to be a continuous part of their lifestyle. Even so, consumers keep coming back year after year. According to Urban, those who revisit Whole30 often do so because of the support of the community and the inclusivity that has been fostered by the brand’s leaders.

She also highlighted the importance of rhetoric when it comes to every aspect of copy associated with the brand. Citing an example from Whole30’s early days where the program labeled foods as compliant, she explained the word “compliance” gave a “militant” connotation leading the team to later adopt the phrase “Whole30 compatible” instead. The brand has made the conscious decision to be outspoken about topics that span beyond food, but impact the lives of many of its followers, which further helped develop a sense of community around the program. Urban explained that in taking an active stance on social media, the team knew it may lose portions of its audience but made the deliberate decision to do so anyway and it paid off.

Following Urban, Jared Stein, co-founder of Los Angeles-based private equity investment firm Monogram Capital Partners, spoke about capital efficiency, stating that it had not been a major factor for many investors until recent years. He said a business that has grown efficiently without taking on outside finds is alluring to many investors in today’s market, as it shows grit and a willingness to build a business no matter what.

Supply chains have now become a point of interest for investors when assessing a brand’s health and long term sustainability. Stein said in today’s market, an analysis of each piece of the puzzle that gets a product to market is required to assess the overall health of a business. This includes relationships with co-manufacturers which are increasingly being offered to join investors in fundraising rounds. Giving a co-manufacturer a financial stake in the business can help with a brand’s margins and help “whittle out” the toll rates that come with outsourced production. Meanwhile businesses that self-manufacture bring an added complexity when it comes to an investor assessment as these brands are often running two businesses under one roof. Many may want to see plans to diversify how the manufacturing business operates outside the brand itself, such as with private label products or offering comanufacturing for other businesses.

Day one of the event also featured a presentation from YouTube sensation-turned-entrepreneur Emma Chamberlain, who provided insight into how she turned a love of coffee that she developed “at an inappropriately young age” into a rapidly growing CPG brand that has a multitude of SKUs, ranging from whole bean coffee blends to flavored matcha. Chamberlain, who has amassed a social media audience of more than 35 million followers, emphasized during the discussion the importance of establishing a brand that could stand on its own. The 21-year-old said it was important for her that the specialty coffee brand’s audience didn’t just “see

her face everywhere” when they visited its social media pages.

Additionally, Chamberlain stressed the importance of recognizing when you need help, especially in the situation of creators making their first foray into the CPG world. Last year, she brought on Christopher Gallant as CEO. Following Gallant’s appointment, Chamberlain Coffee raised a $7 million dollar funding round to fuel omnichannel business growth.

For the second day of NOSH Live, better-for-you foods made with functional or upcycled ingredients were a common theme as speakers on Friday brought up the importance of reaching consumers who are shopping for natural products that are good-foryou and good-for-the-world.

Frozen Greek yogurt maker Yasso’s CEO Craig Shiesley shared insights from a 30-year career helping build sustainably-grown CPG food businesses. His brand-building strategy follows a sixpoint plan: Brand Power, Loyal Consumer Base, Distribution Upside, Industry-Leading Margins, Growth Potential and Strong Fundamentals. Shiesley laid out Yasso’s progression to becoming a $240 million company in 2021. It followed a three-phase approach utilizing his brand building strategy, leading the brand to a place where it can utilize its margins to maximize growth potential through innovation and prove its strong fundamentals.

Ex-professional skateboarder and TV personality turned CPG investor Rob Dyrdek also took to the stage on day two to discuss how he balances his investment strategy with his life philosophy.

“The same way you do a five-year projection on the growth of your business, you should have the same design and focus in your life, so you will grow your business and your life together,” Dyrdek said. “When you find success in business, you find success in life.”

In 2016, Dyrdek launched his venture creation studio Dyrdek Machine, which has invested in 16 brands and exited six companies so far. The portfolio runs the gamut from apparel to wellness and beauty to food and beverage; the latter group includes Muertos Coffee Co., THC-infused beverage brand Leisuretown, Outstanding Foods and functional snack brand Mindright.

Outstanding Foods produces dairy-free, plant-based cheese ball snacks and Mindright makes nootropic-infused snack bars and chips that promote brain health. Even though Dyrdek regularly wakes up between 3:30 a.m. and 5 a.m., he cautioned entrepreneurs that maintaining energy and not “running on the edge” will provide more clarity to building a business. Many entrepreneurs can run into the problem where they fall in love with the idea of their product and assume that consumers will automatically love it too, he said. The key is doing the work to understand why a consumer will connect with and see value in a product.

Most important to Dyrdek’s investment strategy is connecting with the founder and finding products that have the highest probability of success. This starts with finding partners who are focused on a business’ fundamentals.

“Creating a business is the most exciting, incredible thing in the world – unless it doesn’t work,” he said. “Then it’s a nightmare. An ongoing, chaotic psychotic nightmare that you hang on to until you finally lose belief and give up.”

With economic uncertainty on the horizon and an industry in flux amid convergence and consolidation, fortifying businesses and fostering people-first workplaces were among the focuses of the 2022 Brewbound Live business conference in December.

Bell’s Brewery EVP Carrie Yunker opened the event with a keynote speech on the opportunities and challenges created by people-focused businesses. One simple question -- “What do you think?” -- can unlock a new level of engagement with your workforce, Yunker said.

Yunker shared her nearly 20-year journey from receptionist to heir apparent to founder Larry Bell.

“I don’t come from an MBA program. I don’t come from the sales and marketing side of the business. I didn’t start or inherit the business,” she said. “I came from the people side of the business.”

The work of creating an inclusive business can be challenging, “hard” and “scary,” Yunker acknowledged, even for companies with dedicated resources. And “there is no

finish line.” She encouraged leaders to set aside their fears, “be brave and willing to take action” and “commit to practice over perfection,” acknowledging that sometimes they’ll get it wrong.

Beyond being the right thing to do, leading with a people-first mindset is the best way to drive revenue and hit business targets, Yunker added. This type of work is noticed by consumers, who are as focused on who they buy from as what they are buying.

“People power your business, and your business will only thrive as your people

With nearly 9,500 breweries operating in the U.S., the surest way to stand out is to have a strong and authentic brand identity.

Talea Beer Co. co-founder LeAnn Darland, Funkytown Brewery co-founder Rich Bloomfield and Shojo Beer Co. co-owner and head brewer Haidar Hachem shared how they’ve each created strong brand identities to fill the gaps for underrepresented groups in craft beer.

Hachem and his wife Marilyn Orozco launched Shojo Beer Co. in 2021 as a Japanese-inspired craft brewery with influences from the couple’s Lebanese and Nicaraguan heritages.

thrive,” she said.

Schilling Cider CEO Colin Schilling bookended Day One with a talk stressing the importance of workplace culture in hiring and retaining employees. Toxic workplaces are more than 10 times more powerful of a factor in predicting employee turnover than any other factor, including compensation, Schilling said. As a result, companies must look at their workplace culture and determine what adjustments need to be made to improve and become more profitable.

Schilling Cider recently transitioned from a “strategy-driven” to a “people-first” organization, and while Schilling doesn’t consider himself a “culture expert,” the shift provided him with a “roadmap” that he shared with conference attendees. A key to that map is knowing that cultural change has to “be driven from the very top.”

“This is not a process that you can toss over to HR and say ‘Hey, let me know when this is done so I can come up and give a speech about it,’” Schilling said. “The CEO has to drive this conversation; the entire executive team has to be very aligned on this.”

Also important is distinguishing between culture and morale, he said.

“Culture is something that’s much more lasting and enduring,” Schilling added. “And it’s really one of those things that is harder to change.”

“The biggest thing that we try to accomplish is there’s the difference between appreciation or appropriation,” Hachem said. “Appreciation, you try to share a story and build cross-cultural connections with other people by broadening the general public’s knowledge of other heritages and cultures and all those things. Versus appropriation, where I’m taking everything that’s either Nicaraguan or Lebanese or Japanese and just like, ‘Hey, this is mine.’”

Darland and co-founder Tara Hankinson started Talea in Brooklyn, New York, to create a winery-style experience for craft beer that is approachable for new consumers.

“The physical space is key for us: It’s bringing our brand to life,” Darland said. “That’s on top of the liquid that we’re putting in the cans and the packaging design. It’s all a huge effort and strategy to speak authentically to non-beer bros.”

Funkytown Brewery, a Chicago-based Black-owned brewery, has focused heavily on establishing its local presence with community events and other engagement opportunities. The company seeks out consumer feedback on brand styles and flavors when creating its offerings, which include a variety of styles such as an Irish red ale, Belgian witbier and oatmeal milk stout.

“You have to show how it fits into their lifestyle,” Bloomfield said.

Leaders guiding three of the beer category’s top brands -- Firestone Walker’s 805, Constellation Brands’ Modelo and Sierra Nevada’s Little Thing -- shared insights on building those brand families.

Firestone Walker has found success beyond its core brand with 805 blonde ale, the brewery’s best-selling offering in off-premise retailers. Despite not having nationwide distribution, 805 is the No. 12 best-selling craft brand in IRI tracked channels.

Since its 2012 launch, 805 has maintained a brand identity that is distinct from the Firestone Walker portfolio. The company launched a sister brand, Mexican-inspired lager 805 Cerveza, and while both 805s look and feel similar, they target different consumers.

“If you’re creating an incremental product, the idea is incremental customers,” Hinz said. “The last thing that we want to do is trade a Cerveza drinker into an 805 drinker.”

Meanwhile, Sierra Nevada’s Hazy Little Thing, which launched in 2018, has eclipsed flagship Sierra Nevada Pale Ale to become the third best-selling craft brand in IRI-tracked off-premise retailers. However, Hazy Little Thing proved to be “highly divisive,” even internally, Ingram said.

“It was not popular with a lot of folks inside our walls, because they felt like we were maybe chasing a fad or it wasn’t congruent with the traditional Sierra Nevada mold,” he said. “So, we felt like that was all the more reason to give it its own identity and pull it apart from what people have come to expect from Sierra Nevada. And I think that a large part of its success, frankly, is that it did stand out, it did stand alone.”

For the Modelo brand family, incremental growth has come from its Modelo Chelada line extension, which launched nearly 10 years ago and now includes several fruit-forward offerings in addition to its original traditional tomatobased offering.

“We really felt like we could come into that segment with a strong brand that brought really strong authentically Mexican credentials, deliver a really high-quality product in a new segment that was valuable and at the same time, strengthened back to our master brand,” Gallagher said.