Greater Than turned 14 years old in August. Or maybe it turned five, given its rebirth in 2019. Either way, there’s a new mom there to help it celebrate.

If you’d have met Greater Than’s founders around the time they launched, however, it would have strained your credulity to bet the brand would still be around. It’s just not that Mark and Jon Sider were young, and raw – although that was part of it for sure, i.e. after one of the Sider brothers took the stage at BevNET Live an observer compared him to Eminem in “8 Mile” – but also that the timing and approach weren’t quite there.

After all, they were launching a coconut-water based sports drink brand a few years after the big companies had already bit on the concept with the first generation of brands like Zico, ONE, and Vita Coco, and it wasn’t clear how they were going to get funded, get distribution, get much of anything done at all.

Although another entrepreneur, Mike Repole, would eventually make billions selling a coconut water-based sports drink to Coke about a decade later, at the time Greater Than leaned a little too heavily into the coconut water space, and its “>” branding evoked math homework more than it did the Nike Swoosh.

But despite the obstacles, the Sider brothers, sports nuts, young (their parents came to trade shows with them), but clever kids from Chicagoland, proved surprisingly determined. They pushed their product locally, wearing out the shoe leather and cleverly working with the one influencer they could find – Brian Scalabrine, a bench-warming basketball forward with a great nickname (White Mamba) and a future in broadcasting – to make a couple of viral videos.

“If you embodied the brand, you were a winner,” said Jon Sider. “I think we excelled in being the brand. We were brand animals, and we took that approach to trying to build a beverage business in the Chicagoland market.

They battled on throughout the 2010s, never going out of business but getting quieter with each iteration.

Meanwhile, Heather Howell kept watching the brothers from her own business, Rooibee Red Tea, a bottled fizzy tea startup that she had brought to market starting in 2010. A former NCAA Volleyball player, Howell wasn’t able to make her own brand a success, but she found that success elsewhere: she folded the business on her own in 2015 to take a plum job devising innovation strategy at Brown Forman. That gig eventually took her up the corporate ladder there, until she was working on Jack Daniels, where she produced award-winning work. She left late last year, tired and approaching burnout.

In 2019, things unexpectedly changed for the Siders via a key insight: somehow, their brand’s hydration blend had found its way into the consciousness of nursing mothers – a group that is as in need of hydration as any elite athlete. There was a potential new path for Greater Than, one that diverged strongly from their jock-y roots, and to their credit, the Siders followed it.

By Jeffrey Klineman

Gone was shoe leather and sports; now it was direct to consumer and Mom’s Choice Awards.

It wasn’t easy; business never is. Younger brother Jon, the CEO, doesn’t work with Mark anymore, but the Sider family – with parents on board – retains the majority ownership stake. The company cycled through different executives, part-time advisors, searching for steady ground.

Howell left Brown Forman last year; she acknowledges that she couldn’t have continued at the pace she was running.

“I knew if I kept working like that, I wouldn’t live to 55,” she said. “I had no more gas in the tank. They’re still using the work, and that tells me everything.”

She took a few months, evaluated her options. Some of Greater Than’s investors approached her, and she remembered a moment. She’d been at a conference in New York, there hadn’t been a seat for her. The Siders’ father had stood up so she could sit. She was amazed.

She met with Jon, his parents. They were still kind, generous, the kinds of people she liked. With the nursing mother aspect, she liked what she saw.

“They’ve cracked that code, which is difficult to crack,” says Howell, who joined the company in January, as its president.

There’s a long way to go – even 14 years after Greater Than started, the assignment Howell has taken on as President is to bring steadiness to the company. That’s a recognition that after all this time, some professional process is needed to go with Jon’s still-youthful determination.

“There wasn’t a day that we didn’t wear the brand, both with our enthusiasm, as well as physically,” Jon Sider said of its early years. “Today, how we approach the business is that we identify the customer who cares about the product as much as we cared about it.”

“You don’t need to be the brand in the real world, you need to be it in the digital world,” he added. “What being the brand was turned out to be something entirely different. [Instead of] being ‘Greater Than’ in athletics, we learned in fact that moms are the world’s greatest athletes, and they’re using that in a way that’s much more powerful than we ever could have imagined.

The kid brother has two young kids of his own now. Howell’s own kids will both be in college in the fall, but before the youngest goes, Howell’s driving her up to Chicago. They’ll go to Lollapalooza. They’ll go visit the Siders.

The mission now is to lock down the direct to consumer business and, amazingly, once again determine the right brick-and-mortar channels for Greater Than. To innovate on the opening that nursing mothers have given the brand.

“There’s something here,” Howell said, “and we are really talking to the consumer that’s purchasing the product. We are doing it, and we just need to open it up. At the end of the day, we want to see them get their due.”

By

I grew up in the 1950s, a post-war Baby Boomer. It was a simpler -- and to my, mind, better -- time than today in so many ways, but that’s for another conversation. My column will only deal with one aspect of it, a beveragecentric one. Among my fondest memories was coming home from a day of sports and play, opening the refrigerator and taking out an ice cold Coke, in those iconic glass bottles (I often accompanied them with a liverwurst and onion sandwich, which made for some excellent entertainment. There was nothing better than that. Cane sugar was the sweetener of choice, actually the only choice. Life was good back then.

A few years later, the diet drink era began. Artificial sweeteners entered into the equation, but while weight control was a noble intent, there was little thought of the consequences and impacts of these formulated alternatives. We now know that most of them were bad for us. My mother put three saccharine tablets in every cup of coffee -- until the day the government emphatically told consumers how bad they were. She did live to 90, so I can’t blame saccharine for her demise, but it certainly didn’t

help, and the evidence was there and the sweetener was phased out.

Fast forward to today. We are in a sweetener revolution, necessitated by epidemic obesity. As it gets worse, we are constantly rolling out “new and improved” sugar substitutes. Sadly, many still don’t do enough research first. Too often we hear scares, and beverages are pulled on the grounds that their sweeteners - or other ingredients - might be harmful. Marketers then have to scramble and reformulate to keep their brands alive.

While the intentions are good, marketers are still shooting craps with efficacy, and we all suffer: the consumer, the investor, the brand, the industry. There is no trust, and there needs to be. Stronger industry and government regulation would give us a greater sense of well-being, but we must also tackle this in a holistic way. A little less consumption of “crap” would go a long way. So would healthy exercise habits.

I’m not hopeful for my generation, but the ones to follow should heed the clarion call to take care of yourself. Let’s drink, real stuff, to a healthier life.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall EDITOR, BREWBOUND jkendall@bevnet.com

Monica Watrous MANAGING EDITOR, NOSH mwatrous@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer SENIOR ACCOUNT EXECUTIVE jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY

BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO / FOUNDER / EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS

65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

Worldwide Member, June 2007

By Gerry Khermouch

As someone who’s spent quite a few years watching oncepromising “new-age” categories like iced tea and bottled water devolve into price-driven, innovation-starved commodities as they’ve gone mainstream, the energy segment has been nothing less than a marvel. To my eyes, the main reason that has been the case has been that the most vital category leaders like Red Bull, Monster and Celsius have continued to operate independently, free of the constraints and inertia of the so-called strategics. True, some of them have aligned themselves with global beverage giants, as Monster has with Coca-Cola, Celsius has with PepsiCo, C4 has with Keurig Dr Pepper and Ghost has with Anheuser-Busch. But crucially, they operate independently, making their own decisions on innovation, marketing and pricing. Yes, they need to align their strategies with those of their strategic partners, with the tradeoffs and frustrations that doubtless entails on both sides. But it makes for a healthy creative tension that keeps both sides honest, not the stultifying stasis that would occur were they to be absorbed into the corporate maws of those bureaucracies. So the segment keeps motoring forward, evolving new sub-categories, such as naturally formulated “clean energy” players and focus-enhancing entries, while maintaining its premium pricing.

Is that golden era coming to an end? That’s been the fear lately among some industry watchers who’ve seen overall growth stall in recent months. Among the publicly traded players, Monster Beverage shares have subsided by 20% from their spring peak, albeit still at double the pre-pandemic val-

uation, and Celsius Holdings has crashed by about half since its spring peak, even though its year-and-a-half old alliance with Pepsi is going as well as could reasonably be expected. (And utterly brilliantly in comparison to the disaster that was the Pepsi/Bang alliance.) Recent scanner data reveals an undeniable slowing in category growth, with both volume and dollar sales growth in slightly negative territory lately. Still, in the crucial convenience-and-gas channel that still accounts for the lion’s share of energy drink sales, buyers seem undaunted.

For my part, I think some comedown from the earlier frothy valuations of the public players likely was warranted. And in any case, many of the concerns about the category’s health are overblown. For starters, we’re not seeing anything that reads like panicked price cuts or deep promos. Though these are premium items that might seem to be a reach for some stretched American consumers, we shouldn’t forget that they’re an affordable luxury, and their caffeine is an addictive ingredient. Indeed, it looks like Monster is going ahead with a modest price increase. That’s not the action of decision-makers who fear their category is about to tank.

Further, what’s going to usurp those occasions? It’s not as though the corporate giants suddenly have got their own mojo going in energy. PepsiCo’s internal brands, including its acquired Rockstar brand, continue to sag. By now, Coca-Cola, KDP and Anheuser-Busch have entirely outsourced their energy strategies to their partner brands.

It’s not as though other categories seem to be encroaching

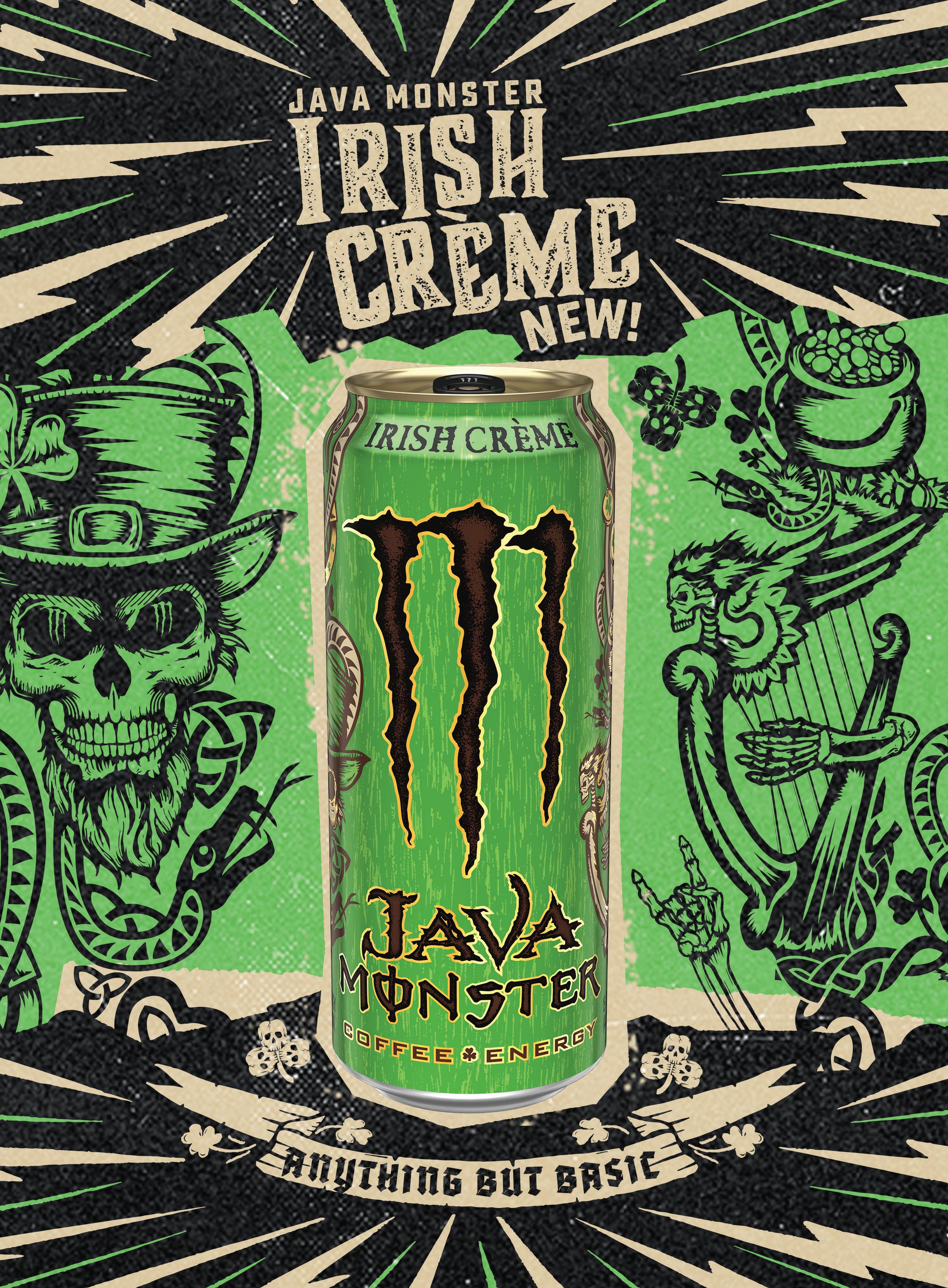

on energy drink occasions, either, though there was a time I actually thought that might happen. That was back when the first wave of cold-brewed coffees arrived. That initial wave, recall, included many entries without cream or sugar, meaning they were sugar- and fat-free, and often had great stories behind them in terms of their sourcing, their beans and their process. That led me to wonder whether they might prove an alternative for younger consumers who weren’t heading into the Red Bull and Monster franchises with the same alacrity as prior generations. But the cold-coffee category moved in a different direction, toward indulgent offerings with cream and sugar and toward multiserve offerings targeting at-home rather than on-the-go users. Even the established energy/ coffee hybrids, Starbucks Doubleshot and Java Monster, have been trending down. And I couldn’t help but notice that fastgrowing coffee chains like Dutch Bros offer an entirely separate tier of energy beverages, rather than relying on coffeebased beverages to scratch that itch, which suggests that those remain different segments and occasions. Even coffee giants Starbucks and Dunkin are entering the energy fray lately, offering further recognition that energy moves as a different dynamic than coffee.

Meanwhile, unaligned brands like Congo’s Alani Nu continue to grow briskly. And one can’t help but be dazzled by the array of new entrants that are lending both dynamism to the category and an alternative play to beer wholesalers who’ve seen mainstay brands like Monster, Rockstar, Bang, Celsius and C4 head into the soda networks. Some are following the path of C4 and Ghost and emerging from the supplement space, like Redcon1, helmed by an able ex-Bang exec. Some, like Bucked Up, Gorilla Mind and Lucky, seem pretty unique. Others are forays from brands playing in other segments, from Odyssey (originally a mushroom coffee) to Super Coffee (a Bulletproof-like functional coffee). As always in beverages, it’s hard to predict the winners and losers. Prime Hydration’s energy extension is looking like a loser. The Molson Coors horse in the race, Zoa, hasn’t shown the bounce one hopes for after a total restage, though its corporate partner continues to double down. Ditto Lance Collins’ A Shoc, nestled within the KDP portfolio alongside C4. Well-crafted entries like Rowdy Energy, with Nascar driver Kyle Busch as the frontman, have called it quits. So even in a non-alcoholic beverage business where churn is a fact of life, the comings and goings in energy seem supercharged. With a lift from beer wholesalers who need new winners to offset their flat beer and hard seltzer portfolios, who knows which of these might emerge as the next big winner? Like many of my oldest friends in beverages, I’ve been humbled enough by its unpredictability to lose the confidence to project who. But energy seems like a category that remains exceedingly robust to me. There’s no need to release the lifeboats now.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

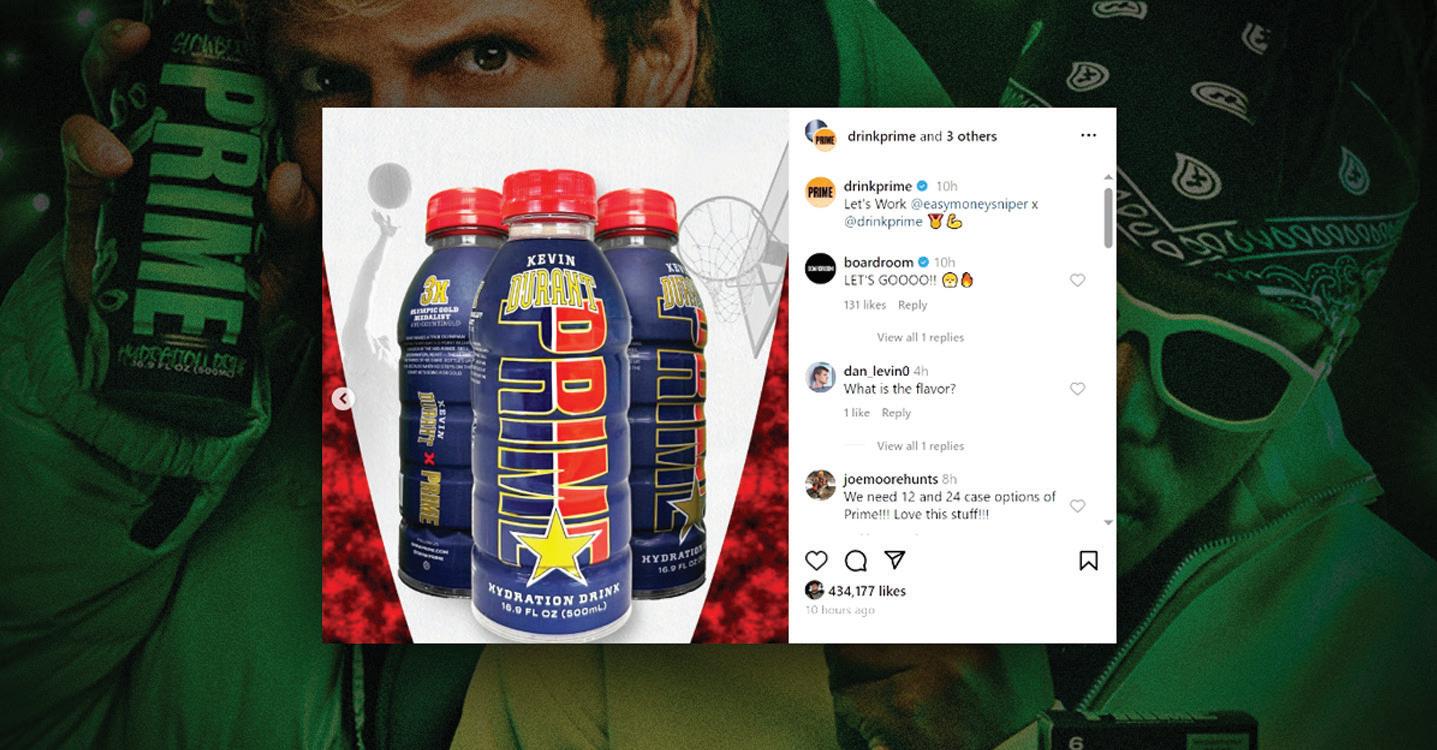

Logan Paul and KSI’s PRIME Hydration has caught the ire of the U.S. Olympic & Paralympic Committee (USOPC), which filed a lawsuit against the sports drink brand in July alleging it violated the committee’s trademarks on the packaging of its recent collaboration with NBA star and Team USA member Kevin Durant.

Earlier in July, PRIME announced a limited time ver sion of its Cherry Freeze flavor in partnership with Du rant. Copy on the side of the bottle called out the NBA champion’s record as a three-time Olympic gold medal ist, asking “What makes a true Olympian repping Team USA?” and concludes that “when KD steps on the court, he’s going for gold.”

While that text could appear innocuous to the average consumer, the USOPC is alleging that PRIME engaged in “deliberate and willful” violation of its trademarks, including rights to the terms “Olympic,” “Olympian,” “Team USA” and “Going for Gold.” The complaint also claims that PRIME also called the LTO the “Kevin Du rant Olympic Prime Drink” in marketing copy and social media posts. Despite decease and desist claims by the USOPC, the complaint states that the brand failed to remove all offending social media posts and was still in violation of its marks.

and Powerade. In June, PRIME was subject to another trademark lawsuit, this one from Hi-Tech Pharmaceuticals, Inc. which alleged the brand was violating its trademark for the name “Prime Nutrition.”

Further complicating matters is that the USOPC has an exclusive partnership with The Coca-Cola Company for use of Olympics related branding in beverage marketing.

“By its conduct, Prime Hydration has caused the USOPC damage and irreparable injury for which it has no adequate remedy at law, and Prime Hydration will continue to do so unless restrained and enjoined by this Court from further infringing the USOPC’s marks and confusing the public,” the complaint states.

Currently, the LTO drink does not appear to be available for purchase on PRIME’s website and an Instagram post promoting it cited by the complaint is no longer viewable on the brand’s profile.

PRIME has recently embraced athlete and sports partnerships such as the Durant flavor, offering similar products in collaboration with stars like New York Yankees slugger Aaron Judge and with organizations like the WWE.

Congo Brands, operator of PRIME, did not immediately return a request for comment.

The lawsuit is the latest in a line of controversies surrounding the beverage brand, which has established itself as a serious challenger to top sports drinks brands such as Gatorade, BodyArmor

The brand has also been subject to a number of class action lawsuits from consumers, including one filed in the United States District Court for the Southern District of New York taking aim at its energy drink line, alleging PRIME Energy cans contained more caffeine than advertised.

In recent months, NielsenIQ retail scanner data has suggested sales of PRIME are sliding: in the two-week period ending June 29, U.S. retail dollar sales for PRIME’s sports drink fell -29.7% to around $604.2 million while its energy drink line dropped -67.9% to around $100.8 million. However, that data does not include ecommerce and does not cover all product lines, such as powder sticks.

BuzzBallz has made its spherical bottles an essential part of the brand – and it’s not eager to share.

The wine-, spirit- and malt-based cocktail brand filed a lawsuit against The Beverage Ranch, alleging the rival company copied its patented packaging for its new SlamZees line.

The complaint was filed in the U.S. District Court for the Western District of Texas on June 21, and centers on a U.S. Patent No. abbreviated as “the 955” patent, which was issued to BuzzBallz founder Merilee Kick in 2022 and pertains to the design of BuzzBallz’s unique containers. BuzzBallz claims that SlamZees, which also come in truncated, round, plastic containers, directly infringe on at least two claims of the BuzzBallz patent.

BuzzBallz was started in 2009 when founder Merilee Kick was a high school teacher, studying for her MBA. In the following decade, the brand has grown into a more than $1 billion company with distribution in all 50 states and in 27 countries. Spirits giant Sazerac announced plans in March to acquire BuzzBallz and its parent company Southern Champion’s ready-to-drink (RTD) portfolio.

According to the complaint, BuzzBallz sent a cease and desist letter to The Beverage Ranch in January after a member of The Beverage Ranch team promoted SlamZees on Instagram prior to the product being widely available. BuzzBallz reiterated the company’s stance in March with a second notice, meanwhile the Beverage Ranch moved forward selling SlamZees on a wider scale.

The new “party drinks” come from a Texas brand incubator co-founded by Rhett Keisler, the co-founder and former president of Texas-based Revolver Brewing, and Ryan Baird, previously co-founder and CEO of Houston’s Yellow Rose Distilling. The incubator’s portfolio also includes agave-wine Watertight Cocktails and wine-based honey cocktails Meridian Hive.

SlamZees’ launch was announced via press release in partnership with RNDC in May. At 15% ABV, the products are described as fulfilling “consumer demand for higher alcohol single serve options in nostalgic, fruity and decadent flavors.” Made in Dripping Springs, Texas, and described as uniquely resealable and stackable, the initial six flavors include Watermelon Kiwi, Sour Strawberry, Cherry Limeade, Cookies and Cream, Banana Pudding and Fruity Cereal.

BuzzBallz is asking the court to grant injunctive relief to stop The Beverage Ranch from manufacturing and selling any products that infringe on the patent, and is claiming damages. A summons was issued June 24 requiring The Beverage Ranch to respond in 21 days.

While energy drinks as a category have been growing, much of those gains have been fueled by brands -- Celsius, C4, Alani Nu, among others -- with roots in sports nutrition. In contrast, several recent big-brand experiments in natural energy, such as Vita Coco’s Runa and Starbucks’ Baya Energy, have fizzled.

Guayakí has managed to buck that trend; despite over 20 years on the market, the yerba mate company’s approach has rarely felt as deliberate and coordinated as it does now. With sales momentum still rising and fresh leadership at the helm, the brand is chasing opportunities to diversify (and add to) its 45,000 total doors across the U.S. and Canada.

Why now? After 20-plus years of building the brand in natural grocery stores, Guayakí consumers began to demand greater availability, explained head of distribution Jared Riddle on a call in June. Efforts to expand ran up against the company’s ambitious plans to build The Yerba Mate Co., a national self-distribution system staffed by formerly incarcerated workers. That network still exists in California -- it’s about 32% of the company’s total business, he said -- but attempts to build broadly outside of its base at Whole Foods proved complicated.

In contrast, the brand’s current distribution strategy is more conventional, if no less ambitious. Nationwide, Guayakí has on-boarded over 130 distributorships in the last 16 months as it looks to plug gaps in grocery while dipping further into new channels as well.

The numbers reflect that shift: the natural channel was once 70% of the business, said Riddle, but is now around 17%, with convenience representing north of 40%; the vast majority of Guayakí’s 18,000 c-store footprint runs from Colorado to California. Nationwide, dollar sales growth in the channel is up 22% year-to-date, according to the brand.

“If you think about it from a day-part perspective, consumers are most likely to pop into a convenience store to get that lift that they need,” said Riddle. “Whether it’s in the morning or the afternoon, when they need that little lift, they know they can buy Guayakí there now.”

The company is responding by doubling-down on c-stores this summer. Guayakí’s drinks can now be found in over 3,500 7-Eleven locations nationwide, with Florida (900 stores), Texas, Utah, and Nevada all coming online. It’s also currently being tested at QuikTrip stores in Texas and Arizona, while ampm is taking the product into 1,000 locations across Arizona, Nevada and California.

Within the channel, Guayakí’s noncarbonated 15.5 oz. cans (150mg of caffeine each) are well-positioned for cold grab-and-go energy occasions across the day, but the drinks are still typically merchandised alongside teas, coming in at the higher end of the price spectrum at $3.29 each.

On the other end of the retailer spectrum, Costco has emerged as an increasingly active partner. Guayakí is now in all 200-plus stores in the big-box chain’s Northern California division, with a footprint in Southern California and potentially more stores in the Pacific Northwest on the way. One of its promo -

tions landed the drinks a coveted spot on the first pallet as customers walked into stores.

Strong performances onshelf have also earned Guayakí a tight relationship with Target in recent years; the brand outsold all but five other energy drinks at the chain in 2023, though it’s categorized as a tea, said Riddle. This year, Guayakí moved from 900 stores to all U.S. Target locations, and is currently in the midst of a nine-week end cap display program.

Even Walmart, which Riddle admits remains “not completely sure that their consumer aligns with our product,” has put Guayakí in 860 stores, up from 251 last year.

As for Guayakí’s consumers, Riddle said their top request is for more lower-calorie options. The brand responded with its first 20-calorie (2 grams of sugar) flavor, Peach Revival, last year, followed by Berry Lemonade this spring, which has already climbed to the company’s fourth mostpopular SKU. Next up is a low-calorie variety pack set to launch within weeks in Costco’s NorCal division.

The moves come against the backdrop of leadership changes at the company, as former Harmless Harvest CEO Ben Mand joined in March. But the new boss isn’t under immediate pressure to produce results: as it approaches nearly 30 years in business, Guayakí holds 85% market share in RTD yerba mate, dwarfing newcomers like Yachak, Yerbae and Clean Cause. Its ability to stretch across tea and energy markets is also unique; Guayakí dollar sales growth is outperforming the energy category in core trade channels across all U.S. regions, per the company.

“I think first of all it’s important that the leadership and our distribution teams are all fully aligned against our mission and values,” Riddle said. “And one of the beautiful things is that with the most recent change in leadership we’re still hitting our goals that we set out last year. We have not deviated whatsoever.”

The biggest name in bottled water is getting bigger.

In June, Primo Water Corporation and an affiliate of BlueTriton Brands announced the two water giants have entered a definitive agreement to merge, creating a new combined entity, effectively taking the largest manufacturer of bottled water in the U.S. public.

Shareholders in Primo, which is focused on bulk water and water dispensers, and owners of the Mountain Valley and Crystal Springs brands, will hold 43% of fully diluted shares in the combined entity, leaving BlueTriton’s shareholders with the remaining 57%. The company is expected to have combined net revenue of $6.5 billion for the 12-month period ending March 31 and will be dual headquartered in Tampa, Fla., and Stamford, Conn.

BlueTriton chairman Dean Metropolous will serve as non-executive chairman of the business, while Primo chief executive Robbert Rietbroek will be the CEO. Primo CFO David Hass and BlueTriton COO Rob Austin will also continue in their roles at the new entity.

“The increased presence, diversified product portfolio, focus on free cash flow generation, strong balance sheet and estimated cost synergies provide the foundation for long-term value creation for our shareholders,” Metropoulos said in a statement.

BlueTriton initially formed in 2021 following the $4.3 billion acquisition of the former Nestlé Waters North America bottled water portfolio (plus ReadyRefresh) by One Rock Capital Partners and investment firm Metropoulos & Co. According to NielsenIQ, U.S. retail dollar sales of BlueTriton’s bottled water portfolio were up 1.9% to over $4.2 billion in the 52-weeks ending June 1 – trailing only the $6.4 billion private label segment.

According to Axios, publicly-traded Primo had a $3.6 billion market cap prior to the announcement of the merger, and had nearly doubled in value from this point in 2023.

While ReadyRefresh has previously placed BlueTriton in the water jug business, Primo is poised to fully round out its capabilities in the dispenser category. Meanwhile, Primo has made reducing single-use bottle waste a key piece of its messaging, but BlueTriton has likewise sought to emphasize sustainability initiatives – launching a recyclable aluminum bottled line at Expo West this year, joining plastic-packed portfolio counterparts across all of BlueTriton’s core brands.

Koia has built its reputation in the cold box, but in order to achieve its next stage of growth the company is breaking onto the dry shelf with June’s launch of Koia Nutrition Shakes, its first shelf-stable offering.

Though similar in some respects to the brand’s core, refrigerated protein shake line, the Nutrition Shakes come in 11 oz. Tetra Pak cartons and feature 20 grams of protein, 3 grams of sugar and 21 vitamins and minerals per serving, as opposed to the core’s 12 oz. plastic bottles with 18 grams of protein and 4 grams of sugar. The Nutrition Shakes come in three flavors – Vanilla Bean, Cacao Bean and Chocolate Banana – and are sold only in multipacks for $44.99 per 12-pack.

The launch marks Koia’s first significant push into ecommerce, with the shakes now available on Amazon and directto-consumer, as well as an added multipack option for consumers, which CEO Chris Hunter said has been a long time coming for the eight-year-old beverage brand.

Due to the complicated logistics and high costs of shipping cold chain products online, Koia’s ecommerce channel business had previously been limited to platforms like Instacart and Amazon Fresh that could facilitate immediate delivery, but it lacked a shipping option like standard Amazon. While the company did temporarily offer directto-consumer for its refrigerated shakes during the pandemic, Hunter said it was an unprofitable endeavor and the option was ultimately discontinued.

Despite this, the brand was netting roughly 6,000 searches on Amazon per month, with no option to generate sellthrough, and Hunter said his team would often discover resellers offering unauthorized products online at a markup.

The company launched the shakes on Amazon a week prior to its official announcement on June 6. Hunter said that even without promotion there were “immediate” sales and after an email blast and social media campaign began those sales jumped 10x.

Koia’s core protein shake line is sold primarily as a singleserve product in grab-and-go coolers, but the Nutrition Shakes

also add a new multipack option for brand loyalists. Hunter said around 50% of Koia’s consumers tend to purchase four or more bottles per trip, indicating demand from daily users.

That insight is also driving the brand’s next iteration: a 32 oz. multiserve bottle.

Koia initially tested the larger format around 18 months ago in Sprouts stores, Hunter said, but the business was in the process of transitioning to a new company-owned manufacturing facility and didn’t have the capability at the time to produce a full run of 32 oz. bottles. That line will be launching this year in Sprouts with Vanilla Bean and Cacao Bean flavors – the top two sellers for the core Koia shakes.

While protein shakes tend to be associated with singleserve packaging with use occasions like post-workout and meal replacement, Hunter said Koia has found that many of its consumers are using the drinks as an ingredient as well –from mixing with coffee for a caffeine kick to using it as a base for smoothies, puddings and overnight oats.

The mix of Koia with coffee has been bolstered by the brand’s launch into Starbucks stores nationwide earlier this year, and by collaborations with the cafe chain on social media marketing built around a rising “protein coffee” trend on platforms such as TikTok.

Koia previously launched an “enhanced” coffee line in 2019, but that offering, which Hunter characterized as “always in a long tail from a velocity perspective,” failed to catch on and was later discontinued. However, around nine months ago he said sales of the brand’s Cold Brew flavor for its refrigerated shakes rose to become its number four best-selling SKU. There’s no immediate plans to relaunch that line, but Hunter said it is an option the company may consider in the future.

The Starbucks expansion has also helped Koia expand in foodservice and, including those accounts, Hunter said the brand is now sold in around 30,000 doors nationwide across all channels.

The brand has also grown its footprint in convenience in chains like 7-Eleven and Wawa, the latter of which recently added its top four flavors.

Hunter said Koia surpassed $100 million in sales last year and is now on a “clear path” to double that. According to Circana, annual U.S. retail dollar sales of Koia’s refrigerated shakes in MULO and c-store were up 12.4% to around $35.2 million in the 52-week period ending April 21, 2024.

With Nutrition Shakes and a multiserve option now underway, Hunter said that looking forward the company has several more innovations it’s looking to launch by the end of the year, including new additions that go beyond just new flavors.

Flow Water and BeatBox Beverages are extending their manufacturing agreement for a further year while raising its high minimum total revenue by nearly $100 million, the companies announced in August.

The deal is being financed by BeatBox’s commitment to purchase a $2 million convertible note by October 31 secured against the assets of Flow, a publicly traded company on the Toronto Stock Exchange.

The upgraded projections – with minimum total revenue increasing from $115 million to $213 million over the five-year term – will require the addition of two production lines at Flow’s Aurora, Ontario facility “to satisfy the increased demand for co-manufacturing from BeatBox, in addition to other co-manufacturing agreements recently announced and to accommodate anticipated growth in the Flow brand.”

Though the deal was announced last November, BeatBox did not officially begin commercial production at the Aurora facility until June, due to the installation of a fourth TetraPak line and additional equipment to accommodate the increased volume.

For Flow, the move reflects its decision to take the facility off the market. Flow founder/CEO Nicholas Reichenbach had previously spoken about how co-packing deals with brands such as Joyburst and Biosteel were intended to boost the plant’s value to prospective buyers.

“We are thrilled to be expanding our relationship with BeatBox by helping them scale in a sustainable way,” said Reichenbach in a press release. “Our co-pack operation has achieved a number of milestones in the past year, which include welcoming new partners, adding a fourth production line and upgrading the Aurora production facility to produce alcoholic beverages.”

BeatBox sells its ready-to-drink boozy punch (11.1% ABV) in 16.9 oz./500 ml TetraPak cartons in more than 83,000 stores in North America.

“As we continue our industry-leading growth, we are excited to expand our partnership with Flow, securing our capacity needs well into the future, and doing so with a partner that shares our commitment to environmental and social responsibility,” said BeatBox CEO Justin Fenchel. “Our mission is to make the world more fun while doing right by our people and the planet, and this milestone is a significant step towards achieving that.”

For 31 years, Colorado-based Chromatic Technologies Inc. (CTI) has been a leader in beverage packaging innovation, pioneering temperature-sensitive thermochromic inks for products like Coors Light’s famous color-changing cans. Now, under new leadership for the first time since its founding in 1993, the firm is working to scale operations and keep its innovation pipeline full.

CTI was founded by entrepreneur Lyle Small, who served as the company’s president until stepping down from dayto-day duties in January to focus on Lahjavida, a research firm he started in 2018 to study cancer treatments. That month, Daniel Wachter, who joined CTI as Chief Commercial Officer in 2020, was named its CEO.

Soon after, in April, the company hired former 3D Systems Corporation VP Edwin Hortelano as its Chief Technology Officer, and in May it announced an investment from Molson Coors-aligned CPG incubator L.A. Libations.

Speaking with BevNET, CTI’s chief marketing officer Maria Del Rio said that although the company has undergone a significant shift in leadership this year, its growth trajectory has remained unchanged as the company looks to extend its sales both in and outside of food and beverage with upcoming product launches, while targeting expansion in sectors such as healthcare, industrial and security and anticounterfeiting.

Despite three decades in business CTI is still considered a startup with under 40 employees, Del Rio said, but the company has customers in 55 countries including high profile partnerships with conglomerates like Molson Coors, Constellation Brands, General Mills, and The CocaCola Company, as well as younger rising businesses like Congo Brands. She said CTI has experienced recent success in developing the glow-in-the-dark bottles for Congo’s breakout brand PRIME.

However, the company has no restrictions for the size of the businesses it works with, she noted, and services entrepreneurial startups alongside industry giants.

CTI’s flagship product is thermochromic ink, which changes color when chilled or heated for both aesthetic appeal and for practical purposes: letting consumers know when a can of beer has reached the right temperature for drinking, for example, or when a hot cup of coffee has cooled to room temp.

Other inks offered by the company include glow-in-thedark and photochromic – which changes color in sunlight.

“We always try to have a reason,” Del Rio said. “We really analyze what is the consumer journey, so that we make sure that when we put our ink somewhere in that artwork or in that packaging it brings either an emotional connection and memorability … or it improves the decision that the consumer wants to make.”

Del Rio called CTI’s inks an “interactive” experience for consumers, intended to further engage them in the prod-

ucts they are using. In recent years, social media has given the business a big boost as well, as unique designs can easily draw more attention on platforms like Instagram and TikTok.

“Brands like PRIME are doing an amazing marketing job with that, as they not only use celebrities, but they are dependent on social media so much and they get a lot of earned media … because consumers are constantly engaging with the brand,” she said. “[They are] showing what they can do with interactive inks and they are targeting Generation Z, and they are very successful with Generation Z, which is hard nowadays.”

But CTI has also developed more practical innovations, such as high-pressure processing (HPP) ink which can let manufacturers know whether a bottle has been processed or not.

CTI’s latest innovation, Hybrid Ink, blends the thermochromic and photochromic technologies to create labels that change colors based on both temperature and sunlight, with four different color variations (indoors and warm, in sunlight and cold, etc.)

“It’s really cool technology,” she said. “Imagine the amount of marketing concepts that can accompany that.”

With scaling now the goal for the foreseeable future, Del Rio said CTI is investing in automating more of its processes and embracing A.I. behind the scenes to develop better color palettes, as well as growing its commercial and R&D teams. The company is also working to improve its sustainability initiatives, she added, looking to secure third party certifications to ensure its labels are washable and non-pollutants.

“We are making sure that we are expanding the current technologies, including Hybrid, as much as we can,” she said.

Canadian hemp food producer Manitoba Harvest Hemp Foods has acquired The Humble Seed in an asset purchase that includes IP, brand and formulations. The terms of the deal were undisclosed.

Manitoba Harvest, one of the largest hemp food producers in the world, had been exploring how it could move deeper into the snacking category either by building a brand itself or “looking for a partner with a running start,” said company president Jared Simon.

As Manitoba’s first foray into crackers and the snack category under its Fresh Hemp Foods Ltd. division, The Humble Seed — which makes three varieties (Sea Salt, Everything and Garlic Herb) of crackers made from a blend of sunflower, flax, pumpkin, sesame, chia and hemp seeds — ticked a lot of boxes for Manitoba from a nutritional and sustainability standpoint as well as being a “seed-forward” brand, he added.

Launched in 2022, The Humble Seed had grown its retail footprint over its two years into 2,000 stores including Sprouts, H-E-B, Fresh Thyme, The Fresh Market and HyVee with a SRP of $5.99 per 4.25 oz. box. But at the beginning of 2024, the Denver-based brand had reached an “inflection point” in its growth trajectory, said co-founder Sarah Meis, who was running the brand with partners Steve Shaffer and Jennifer Mancusco.

“We were prepared to continue to run the brand,” she said, but were exploring “what the next stage looked like for us.”

What started as a dialogue about a partnership between the two brands at Expo West in March developed quickly into “ongoing conversations” about how Manitoba Harvest could put more resources into “shepherding” the grain-free crackers into a “new phase of growth,” Meis said.

It is telling of an increasingly difficult environment for startup brands to operate independently and raise new capital.

“It’s no surprise that young brands need financial resources in order to grow. Growth doesn’t come without that cost,” she said. “It is one of the challenges where small brands are always very disadvantaged. We don’t have the supply chain relationships and the sort of purchasing power that a larger umbrella organization could.”

Founded in 1998, Manitoba Harvest produces a variety of hemp seed ingredients including granola, oatmeal, oil and powdered supplements. The company was acquired from Compass Diversified Holdings in 2019 by cannabis company Tilray.

Simon said that Manitoba Harvest will leverage its logistics, sourcing and procurement resources to begin to scale the cracker brand. Initially, The Humble Seed will not be produced by Manitoba because it doesn’t currently have cracker making equipment, though there are plans to innovate within the hemp seed company’s “snack-

making capabilities.”

Manitoba Harvest owns two production facilities in Canada.

The hemp food producer plans to “infuse” some investment in the cracker brand while utilizing Manitoba’s sales team and network of brokers to “accelerate” The Humble Seed’s retail footprint.

Snacking appears to be ripe terrain for acquisitions. Newly launched CPG private equity firm Forward Consumer Partners snatching up cracker maker Firehook Bakery and Dallas, Texas-based tortilla chip and salsa brand Xochitl between April and May. Dried fruit maker RIND vertically integrated its supply chain by acquiring Vermont granola manufacturer Small Batch Organics at the end of 2023.

As for Meis, who previously held senior level positions at Good Karma, Lily’s Sweets, Purely Elizabeth and Van’s before founding The Humble Seed with Shaffer and Manusco, she will no longer be involved with any decision making for the grain-free snack brand. For now, Meis will be taking a little time off but plans to announce what’s in store for her next chapter soon.

“One of the things that I learned about being a founder was, honestly, I missed working on a team,” said Meis. “I had my co-founders, but there’s a lot of being an entrepreneur that’s pretty solitary.”

Thirty-year-old Lotus Foods has weathered plenty of challenges with minimal outside investment. But now the regenerative and heirloom rice, noodle and ramen producer is going after growth, after announcing in July it has raised $22.5 million from San Francisco-based firm Grounded Capital to “scale its impact,” Lotus CEO Andrew Burke told Nosh.

“What makes [Lotus founders] Ken [Lee] and Caryl [Levine] very unique is they take the long view – we wanted to make sure that we found the right partner,” Burke said, explaining that the team spent nearly three years searching for the right investor.

Stephen Hohenrieder, CEO of Grounded Capital, and William Culler-Chase, principal, will join Lotus’ board of directors as part of the deal.

Burke said internal conversations about how to finance the company’s next stage and scale its smallholder farming network have been simmering for a long time. He joined Lotus in 2019 as the company’s first c-suite executive, serving as president and COO, before moving into the CEO spot in 2023.

The investment decision was based around the idea of increasing consumer exposure while deepening the company’s ability to positively affect its base of regenerative farmers, Burke said.

“We had two decisions: go seek outside capital to accelerate that, or continue what they were already doing.”

The new funds will be deployed in three main areas: First, Lotus intends to deepen its investment within its existing farmer supply network and support those partners’ continued transition to regenerative agricultural practices. Lotus farmers currently use a unique growing method known as System of Rice Intensification (SRI) which it claims uses half the amount of water and 90% less seed and emits 40% less methane while producing two to three times greater yields.

Second, the company will expand its supplier network and its growing method to new regions. That means Lotus’ will begin to bring its unique growing practices, a process which it has trademarked under the name More Crop Per Drop, to new countries. Currently, Lotus sources from farmers across Cambodia, Thailand, Indonesia, China and India.

And third, the funds will be put towards the company’s own infrastructure, Burke said, which will “allow us to broaden our customer base so that we can bring these great products to more people.” In practice that will see Lotus expand to additional retail doors, grow its portfolio and place a greater focus on engaging with consumers.

“We want to bring the Lotus story to a lot more people… we haven’t been able to interact with people and to make sure they understand what we are all about [in the past],” Burke said. “This investment enables us to do that from consumer understanding to consumer marketing, to the development of new, innovative platforms that use our products and present them to a consumer in a more convenient way. All of those things will be considered.”

Currently, Lotus Foods sells a lineup of over 40 SKUs spanning rice, rice noodles, ramen, heat-and-eat pouches and soup cups. The products are distributed to 9,000 stores across the U.S. including Whole Foods, Costco, Walmart, Wegmans, Safeway and Publix; the company also distributes to Canada.

Burke highlighted the environmental impacts that the industry as a whole has been faced with over the past few years, noting that it was another factor that weighed on the agriculture-based business’ financing decision. He said navigating those challenges further supported that Grounded is the “perfect partner” for Lotus because “they truly take an improving food systems approach to their investments – they think very broadly and thoughtfully, and it is very refreshing.”

With over two decades of industry experience, including serving as CEO of TCHO Chocolate and holding a range of senior positions at companies like E&J Gallo Winery, Diamond Foods and Nature Box, Burke knows a thing or two about guiding a CPG business through a period of growth. While he noted the current climate for investment is tough, he believes there are key focal areas that set a business apart from the competition.

“You have got to focus on the proposition. You have to focus on what your value offering is. You have to focus on what your impact is and how you’re going to make something different that consumers are going to want more than another product because of particular attributes it has. It gets into storytelling, it gets into building systems – it gets into building a brand.”

A combination of rising ingredient prices, raw material shortages and downsized product portfolios has left creativity in short supply for many CPG companies. According to a new Mintel report, only 35% of global CPG launches spanning the food, drink, household, health and beauty industries in 2024 have been genuinely new products –the lowest rate of innovation since Mintel began tracking new products in 1996.

The global downturn in CPG innovation is most prominent in North and Latin America. In the U.S., only 25% of CPG launches were new products in the first five months of 2024, compared to the global average of 35%.

What’s more? Food and beverage has seen the greatest innovation decline of all CPG sectors, accounting for only 26% of new products across all CPG innovation between January and May 2024 versus 50% in 2007. Per the report, F&B companies are favoring a renovation approach – like reformulations, new varieties, range extensions and new packaging – to offer consumers new, yet familiar, choices.

In the past few months alone we’ve seen an influx of brand refreshes from Lexington Bakes, Barritt’s Ginger Beer and MOSH as well as line extensions from Kooshy, Laoban, PLEZi and more.

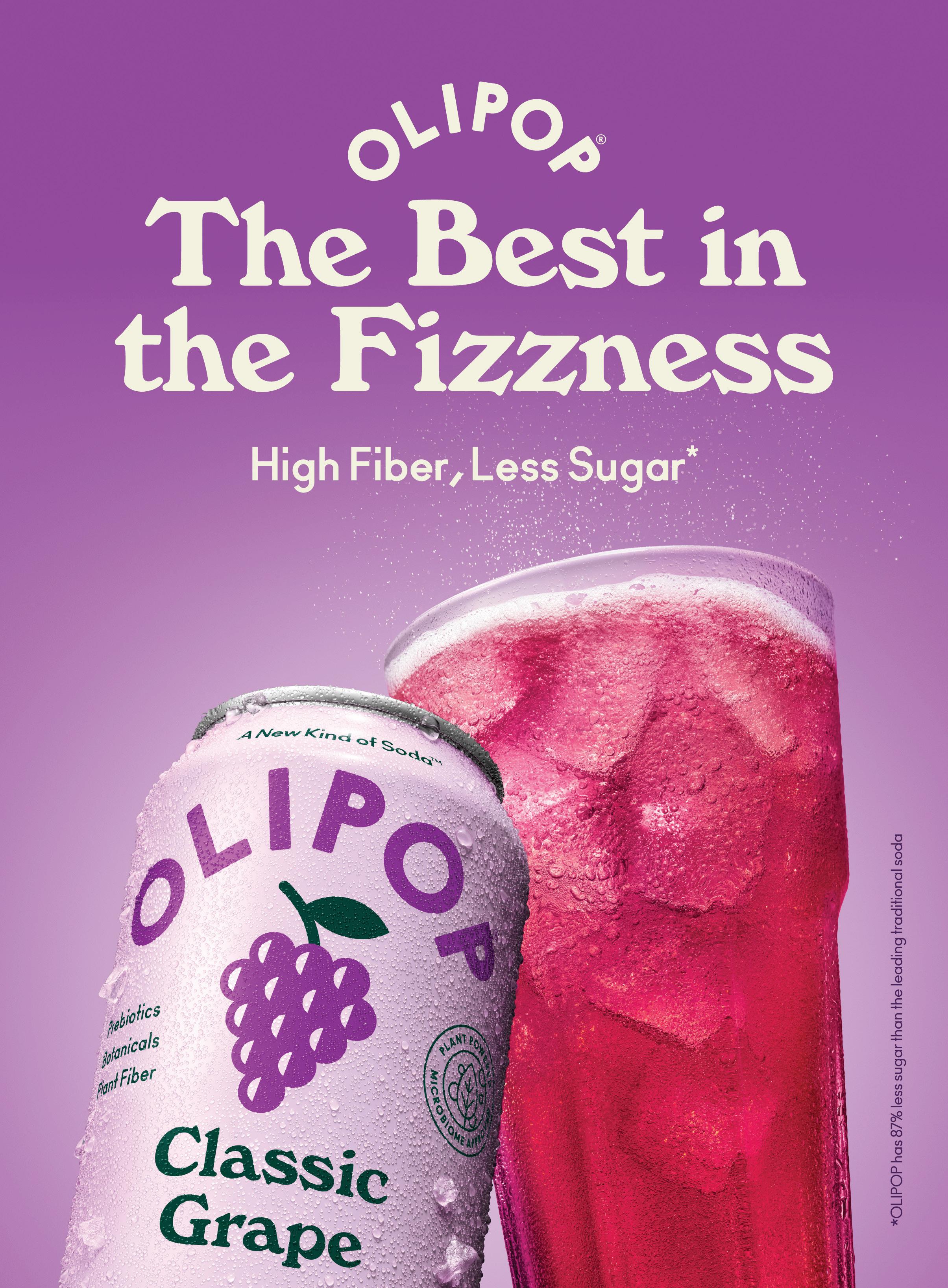

There’s some good news for smaller brands: Bigger no longer equals better. A lack of R&D investment from large brands after the 2008 financial crisis created an environment in which startups like OLIPOP tapped into the rise of digital technology and gained a foothold in their categories. According to NielsenIQ data, 45% of growth in CPG between 2016 and 2020 was driven by small- and medium-sized brands, while private label captured 30%.

“As the digital transformation of CPG gathers pace, the old adage ‘innovate or die’ will never be truer, especially given that big brands have been growing more slowly than challenger brands and private-label. If big players fail to innovate more, this trend will dramatically increase as we enter the late 2020s,” the report reads.

Should Big CPG make an innovation comeback, it will face two key hurdles:

Asian sauce and noodle brand Omsom announced in June it has been acquired by growing multi-Asian food brand platform DayDayCook. The deal will consist of a combination of DDC cash and stock which will be paid out over a four-year term.

Five non-executive employees of Omsom have been granted 160,000 shares of DDC’s Class A Ordinary Shares as part of their employment package. Omsom co-founders and sisters Vanessa and Kim Pham will remain involved with the company following the close of the transaction as a strategic advisor and in a “fractional capacity,” respectively, according to their LinkedIn posts.

Joining forces with DDC will allow Omsom to accelerate new product development, according to the announcement, with the brand expecting to be able to slash its R&D timeline in half under the ownership of the Asian food platform. The news also marks a continuation of DDC’s M&A streak over the past year. The company, which went public in November, acquired noodle kit and meal brand Nona Lim in August and Asian sauce maker Yai’s Thai in December.

“Our presence in the U.S. is rapidly growing with the addition of Omsom to our U.S. family of brands,” said DDC founder Norma Chu, in a press release. “Having three notable Asian food brands in our portfolio will create enhanced synergies and resource integration, and make our operations more efficient and profitable.”

Omsom, which produces a 7-SKU line of sauces and expanded into the noodle category last May with three varieties of its Saucy Noodle line, is well positioned to capitalize on the growing manufacturing and operational infrastructure behind DDC.

artificial intelligence (AI) and private-label brands. Here’s the lowdown:

• The rapid emergence of AI and ecommerce has lowered the barriers to entry for emerging brands, allowing them to build brand equity and sales online before shifting into brick-and-mortar retail. Also, tech advancements have cut year’s long innovation cycles down to just months.

• Continued inflation has supported a switch to private-label alternatives (see: recent private label refreshes from Walmart and CVS). In May, 31% of U.S. adults said they purchased more store brands over the past two months.

Without genuine innovation, will consumers automatically return to big brands once they feel more financially secure? According to Mintel, unless the current innovation drought is reversed, the future profitability of, and potentially the survival of, established CPG industry players remain at risk.

DDC was founded in Hong Kong in 2012 as a content and recipe platform and used its acquisition of Nona Lim to expand its reach into the U.S. The company, which sells its own line of ready-toeat meals internationally, seeks to build a platform where emerging Asian food brands can grow through shared operational resources, telling Nosh in February it aims to become the “General Mills for Asian food” in the U.S.

“In the last couple years, our rowdy branding, damn delicious flavors, and unapologetic perspective have illuminated the way –and now, those same values are showing us to our next chapter,” said Omsom co-founder Kim Pham, in a press release. “They say, ‘If you want to go fast, go alone, but if you want to go far, go with others,’ and that’s what we’re excited to do with DayDayCook.”

DTC-native Omsom has been steadily growing its presence in U.S. retail since its launch in 2020, growing revenue in the grocery channel 324% year-over-year, and is now sold in over 2,000 stores nationwide including Whole Foods Market, Target, Sprouts and The Fresh Market. But as the brand looked to continue growing, it returned to its digital roots and, like others within DDC’s portfolio including Nona Lim, struck up a discussion of a potential deal via social media.

“It all started with a LinkedIn message to Norma, when we first read about DayDayCook’s vision and mission, we knew we had to get in touch immediately,” said Omsom CEO and co-founder Vanessa Pham, in a press release. “We are thrilled that Omsom, which has been built brick-by-brick with heart and intention, will continue to thrive in partnership with DayDayCook.”

Better-for-you bread is turning into a big business. Hero Bread announced in June the closing of a $21 million funding round co-led by Cleveland Avenue, DNS Capital and Composite Ventures. The round, in which existing investor Greatpoint Ventures also participated, brings the company’s total funding to over $68.5 million to-date.

Despite the challenging investment climate for growthminded CPG brands, Hero Bread CEO YuChiang Cheng said investors responded positively to the product’s disruptive positioning and market validation it has garnered in just two years since launch, allowing the company to close this latest round in less than three months.

“The numbers don’t lie,” Cheng said. “As [our investors] dug into the market share, the repeat rates, the velocity at the retailers we have, the fact that we’re top of the category in all our sets and have a ton more demand from more retailers, they felt with that momentum, and that the product is really superior to everything else out in there, that it really stands head and shoulders above everyone else – and in a very large category that addresses everybody.”

He credits that performance to the product’s taste, texture and nutritionals, the latter of which were confirmed after the company’s investors ran independent third-party tests without their knowledge. In order to continue capitalizing on its momentum, Hero will invest heavily into consumer education and particularly sampling, as Cheng acknowledged many consumers have gone stale on betterfor-you breads due to historically sub-par taste, texture and nutritionals.

This funding round may also send signals around how investors are assessing CPG ventures in the current climate. Cheng pointed to the category itself as a point of differentiation and validation, emphasizing that bread is a regular purchase for most consumers, rather than a novelty like many plant-based protein alternatives.

Hero Bread produces a 6-SKU line of alternative breads made from a combination of resistant wheat starch, wheat protein, milled flaxseed, fava bean protein, allulose and monk fruit in addition to a limited-edition array of items such as Cheddar Biscuits and Croissants. The bread loaves retail for between $9 to $10 while the tortilla format costs about $8 per pack.

While initially aimed at the carb-avoiding keto crowd, the brand has extended its appeal to the point where about 50% of its purchasers are non-keto folks. The product’s nutritional profile – between 0 to 2 grams of net carbs and no sugar, plus lower calories, but more protein and fiber per serving than conventional bread – has helped.

As for its new funds, Hero intends to put the cash towards building up inventory, supporting existing retail partners and growing its footprint in physical retail; currently, the brand is on-shelf in over 4,000 doors nationwide – a large jump from 20 stores at the start of 2023. It has also now established a greater presence in conventional grocery stores, which contribute slightly more than 50% of retail sales in MULO.

In the natural channel, Hero’s new capital will support existing retail partnerships, particularly with Sprouts and Fresh Thyme as well as Publix.

“We wanted it to perform in all the different channels, and it’s proven out to a larger degree than we would have thought,” Cheng emphasized.

For further validation of the brand’s goal to build a loyal following, Cheng pointed to the brand’s repeat rates of 50% at retail within a month of purchase and to the fact that Hero’s average ecommerce consumer places upwards of three orders per year. He also said the price point keeps the items accessible, only tagged slightly above the premium conventional alternative, while noting its customers have an average annual household income of $60,000.

These focal points are also indicative of the brand’s strategy looking ahead. When Hero Bread first launched, it aimed to align itself as the “Beyond Meat of better-foryou bread,” but Cheng said that position no longer holds up. Now its focus is on traditional bread baking techniques, rather than something grown in “a lab tube.”

Cheng took over as CEO from Hero founder Cole Glass in November as its retail presence was ramping up. He originally became involved as an investor while working with The Family Fund (that of TikTok-famous family The D’Amelio’s), but was “almost immediately” asked by the board to serve as the brand’s CMO.

He said the move to the top spot came after some “self reflection” from Glass and the core team that the business could, and should, move faster: “There’s just a lot of patterns and success routines that I can bring to the table [quicker],” Cheng said.

Those routines will see the business balance growth with a sustainable mindset, Cheng said, explaining that while it is taking “calculated growth opportunities,” Hero could be profitable if it wanted to be since the business’ basic fundamentals are solid.

Brewers Association (BA) president and CEO Bob Pease will retire next year after more than three decades with the trade association, the organization announced July 10.

Pease will step down from his role in early 2025 “once his successor is in place,” according to the announcement.

The BA’s board of directors has retained Kittleman & Associates, a search firm dedicated to executive searches for nonprofit organizations, to lead the recruitment of a new president and CEO.

“After careful consideration, I believe it is time to help this great association transition to new leadership and for me to move on to new endeavors,” Pease said in the release. “Over the last three decades, I have witnessed the Brewers Association grow from a small, narrowly focused association to one that is now a power player on important issues facing the industry domestically and internationally.

“Throughout my time at the helm of the Brewers Association, we have helped our members navigate explosive growth and unprecedented challenges. In doing so, we have put the BA on the map as a political force. Representing this iconic community, its brands, and the incredible people who embody passion in their craft has been an absolute honor. I look forward to seeing continued success in the industry.”

BA board president and Right Proper Brewing co-owner Leah Cheston called Pease “an unwavering advocate for small and independent brewers.”

“He spearheaded the organization during a critical time for the industry, growing the craft beer market share to 13% and supplying countless tools to help the craft brewing community thrive, from professional resources and tax savings, to hosting world-class events,” she said in the release.

“We thank Bob for his steadfast leadership and look forward to partnering with him to ensure a smooth transition and search for his successor.”

Pease has spent more than 32 years at the BA, and has served as CEO since 2014. He first joined the trade group in 1993 as a customer service manager, and later held roles including operations director, vice president and COO.

New Belgium will take over production of Kirin Ichiban and Kirin Light in the U.S. when the Japanese lager brand’s contract brewing agreement with Anheuser-Busch InBev (A-B) expires later this year, announced New Belgium, which is a subsidiary of Kirin-owned, Australian-based Lion.

A-B will continue to brew and distribute the Kirin brands through the end of 2024.

Starting in January 2025, New Belgium will begin marketing, sales and production of Kirin Ichiban and Kirin Light at its facilities in Fort Collins, Colorado, and Asheville, North Carolina. The company is working to “identify any potential distributor alignment needs that may arise in early 2025,” according to a New Belgium spokesperson.

Shaun Belongie, New Belgium CEO, thanked Kirin in the announcement “for entrusting New Belgium as stewards of Kirin Ichiban and Kirin Light across the United States.”

“We’re excited to grow our production portfolio and we’re confident in our capacity to expand upon the success of these powerful brands,” he said.

Masakazu Ashida, Kirin Brewery GM of overseas business department, added: “We appreciate AnheuserBusch’s many years of strong business partnership supporting Kirin Ichiban and Kirin Light in the U.S. Moving these brands to New Belgium is a logical decision as we consider the strategic direction of our business in the U.S for years to come. We are grateful for all parties’ collaboration and commitment to ensuring continued success of our brands during this time of transition.”

arrangement with A-B began in 1996. In August 2006, A-B announced an expansion of its “10-year alliance” with Kirin, taking over marketing and sales for the Kirin brands, while Kirin retained the trademarks for its brands.

Kirin’s U.S. brewing and distribution

At the time, Kirin’s beers were brewed at A-B’s Los Angeles brewery and distributed by the company’s 600 distributors. A Facebook page states that the beer brands are “brewed under Kirin’s strict supervision … in Los Angeles, CA and Williamsburg, VA.”

Fast-rising non-alcoholic beer maker Athletic Brewing Company has closed a $50 million “equity financing round” led by private equity firm General Atlantic, with several key investors from previous fundraising rounds also participating.

The latest funding round comes 21 months after a $50 million Series D round led by Keurig Dr Pepper (KDP) that closed in November 2022.

Following the latest capital infusion, General Atlantic will receive a seat on Athletic’s board. Although the full composition of Athletic’s board has not been publicly disclosed, investment firm TRB Advisors, which Athletic co-founder Bill Shufelt described as Athletic’s “largest investor across multiple rounds,” KDP and private equity firm Alliance Consumer Growth each hold seats on the board.

The new equity financing round is being earmarked to “drive continued long-term growth,” including Athletic’s purchase of another San Diego-based Ballast Point production facility, as well as expanding international sales of its NA beer.

tors onto our cap table, and really importantly, is they have a very long-term vision, no time horizon, they’re super excited about the category we’re trying to innovate in and and really great people.”

General Atlantic’s portfolio covers several sectors, including climate, consumer, financial services, healthcare, life sciences and technology. Existing investments include data firm Fintech, taco chain Torchy’s Tacos and luxury brand Tory Burch.

Shufelt told Brewbound that Athletic is now well-positioned to finance capital projects from either “equity debt or cash flow from operations.”

“Interest rates are so high these days, [so] equity made sense in this instance [for] funding a great project that solidifies our capacity for the future,” he explained. “But also a big part of the reason we wanted to do equity was we had the chance to invite one of the most respected world-class inves-

Andrew Crawford, General Atlantic managing director and global head of consumer, in a statement in the announcement called Athletic “the category-defining brand in non-alcoholic beer.”

“We intend to leverage our international platform and capabilities across technology, digital marketing, and merchandising to help the business achieve its potential,” he continued.

Across six funding rounds, Athletic has now raised around $225 million, including a $75 million Series C round in May 2021 (led by TRB Advisors, private equity firm Alliance Consumer Growth and more than 25 existing investors), a $17.5 million Series B round in 2020 (including TRB and more than 25 existing investors), a $3 million Series A round (including TRB, Tastemaker Capital, and Blake Mycoskie), and a $3 million angel round in 2017.

A Wall Street Journal report on the equity financing round valued Athletic at $800 million. The Journal added that Athletic’s sales topped $90 million in 2023.

Sapporo-Stone Brewing is officially making Zach Keeling its new CEO.

Keeling was appointed interim CEO in January when then-CEO Maria Stipp stepped down from the role after guiding the Escondido, California-headquartered brewery through its 2022 acquisition by the Japanese brewing giant and through its integration.

Keeling previously served as CFO and VP of strategy. The company credited him with establishing the integrated company’s “long-term strategic plans.”

“Sapporo-Stone is on an impressive trajectory, and I’m honored to lead this talented team toward becoming a top 10 brewery by volume in the U.S.,” Keeling said in the announcement. “I’m committed to driving our growth while prioritizing people and culture.”

The appointment follows the completion of phase one of a $60 million brewery expansion that increased capacity

across the company’s production facilities in Escondido and Richmond, Virginia, to around 700,000 barrels annually.

In 2023, Sapporo-Stone ranked as the 12th largest U.S. brewery by volume. The company operates bicoastal brewing facilities, five taproom locations and two Stone Brewing World Bistro & Gardens spaces. The company has 850 workers.

Artisanal Brewing Ventures (ABV) has laid off about two dozen employees this week, Brewbound has learned.

The craft rollup – which includes Victory Brewing, Southern Tier, Sixpoint Brewery and Bold Rock Cider –primarily eliminated jobs in sales, according to a person with direct knowledge of the situation whose identity Brewbound has agreed not to reveal.

ABV did not share how many people were affected by the layoffs. A spokesperson shared the following statement with Brewbound:

“Industry headwinds and high levels of inflation have impacted our business and like so many others in the industry, we are right sizing the organization to fit current volume conditions. The reorganization will allow us to be more operationally efficient and position the company for future growth in the alcohol beverage industry. Those impacted by the changes will be receiving severance, medical benefits and outplacement services.”

Many of the affected employees were offered severance packages that represented one week of pay per two years of service, according to Brewbound’s source.

ABV restructured its sales force in December 2022 to

reorganize its efforts on off-premise retail. That round of cuts affected “a handful” of jobs, CEO John Coleman told Brewbound at the time.

ABV was the seventh-largest craft brewery in the country by volume in 2023, according to the Brewers Association (BA). Last year, its input increased +1%, to 394,676 barrels of beer, which accounts for 1.69% of the BA-defined independent craft beer sold in the country.

Popular and controversial social media platform TikTok recently opened advertising on its platform to beverage-alcohol brands in the United States, due in part to its user base aging up.

At least 73.8% of TikTok’s users are of legal drinking age (LDA), according to the Distilled Spirits Council of the United States (DISCUS), which sets guidelines for members’ usage of social media for marketing, as do other bev-alc trade groups.

The Beer Institute (BI) and Brewers Association (BA) both require members to ensure audiences for advertising are at least 73.8% LDA. The BI amended its advertising code to include the 73.8% metric in September 2023.

The 73.8% ratio represents the percentage of LDA adults that make up the country’s population, and is adjusted with each decennial census. DISCUS chief legal officer Courtney Armour said the organization has added TikTok to its list of approved social platforms after it “confirmed their demographic data.”

As it begins to allow advertising from bev-alc brands, TikTok has published its own rules governing U.S. advertising for alcoholic products, mixers and accessories, and events sponsored by alcohol brands.

In all instances, advertisers must target users 25 or older, be registered in the region where their ads are targeted (for example, U.S.based brands can only advertise in the U.S.), work with a TikTok sales rep to confirm eligibility, and “comply with all applicable laws and regulations.” In addition, both products and mixers/accessories may be required to provide government-issued license documents.

TikTok still prohibits ads for several alcohol-adjacent products or avenues to sales:

• Alcoholic beverages with “addins,” such as THC or CBD;

• Hangover relief products;

• Homemade alcoholic beverages;

• And “retail or e-commerce ads, [which] are those that promote the sale or delivery service of alcoholic beverages.”

“Advertising on social media platforms is the most common and popular format to talk to consumers in today’s marketplace,” DISCUS wrote on its social media policy page. “Beverage alcohol advertising is no different in this regard, but suppliers must take precautions to minimize the risk of exposure to those under the legal purchase age.”

Juvee has unveiled Orange Dream as its newest “rejuvenating” energy drink flavor. The zero-sugar SKU has 127.5mg of caffeine and five calories per 12 oz. can. Juvee Orange Dream is available for purchase via the brand’s website for $29.99 per 12-pack. For more information, visit drinkjuvee.com.

Bloom, best known for its Greens & Superfood Powder, has made its first foray into the RTD space with its Sparkling Energy Drink line. Available in four flavors at launch – Raspberry Lemon, Cherry Lime, Peach Mango and Strawberry Watermelon – each 12 oz. can has 180mg of caffeine from coffee beans, prebiotic fiber and holistic ingredients like ginseng, L-theanine, lychee extract and B vitamins.

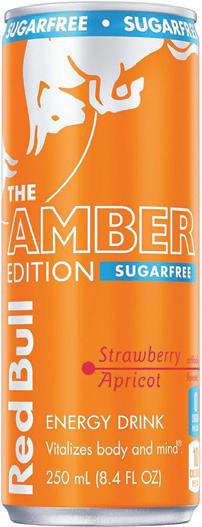

Red Bull has expanded its zero-sugar lineup with the addition of two new flavors: Red Edition (watermelon) and Amber Edition (strawberry apricot). Both offerings are available in 8.4 oz. and 12 oz. single-serve cans or in 4-packs. For more information, visit redbull. com/us-en.

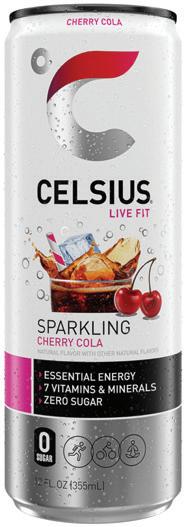

Celsius is taking inspiration from a classic soda flavor with its latest energy drink variety, Sparkling Cherry Cola. Each 12 oz. can of the zero-sugar energy drink packs 200mg of caffeine and has just 10 calories. Celsius Cherry Cola is now available on Amazon for $24.99 per 12-pack. For more information, visit celsius.com.

Welch’s has introduced Grape’ade, a new 16 oz. on-the-go “refreshing juice beverage” made with Niagara green grapes and no added sugar. Offered in three varieties – Strawberry, Mango, and Green Grape – Grape’ade is available at all Publix locations in the Southeast as of June 1, with plans to roll out nationally in early 2025. For more information, visit welchs.com.

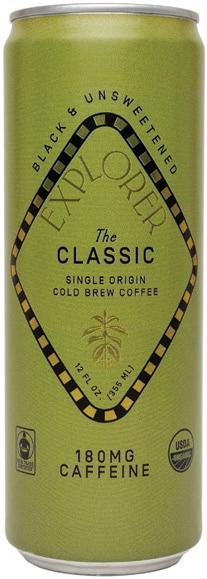

Brooklyn, N.Y.-based Explorer – a New Beverage Showdown finalist – has unveiled its latest product line of ready-to-drink cold brew beverages in The Classic (180mg caffeine), The Seeker (65mg of caffeine) and The Daydreamer (99.9% caffeine-free) varieties. All

three varieties are available for nationwide shipping on the brand’s website for $43.19 per 12-pack of 12 oz. cans. For more information, visit explorercoldbrew.com.

Stumptown Coffee and animation studio LAIKA have partnered on a special-edition canned cold brew celebrating the 15th anniversary of “Coraline.” The partnership between the two Portland, Ore.-based companies goes beyond the nitro cold brew cans and into select Stumptown Cafe locations where a Coraline Coconut Cream Cold Brew drink will be offered for a limited time along with co-branded gear like totes and mugs. For more information, visit stumptowncoffee.com.

New York-based cold brew maker Wandering Bear has unveiled its latest product creation, 3-to-1 Cold Brew Concentrate. According to a LinkedIn post by the brand, the new offering is “a powered up version of the Wandering Bear you know and love” and is “endlessly versatile.” As the product’s name suggests, consumers can mix three parts water to one part concentrate for a glass of cold brew. For more information, visit wanderingbearcoffee.com.

Hot on the heels of its rebrand, Flyers Cocktail Company has announced its line of Sunset Spritz Hemp THC Cocktails. Available in three flavors – Mango Guava, Grapefruit Lime and Watermelon Mint – the zero proof cocktails are built from the brand’s best-selling Apéro Spritz variety and are available in 12 oz. cans. Each can contains 5 mg of THC. For more information, visit drinkflyers.com.

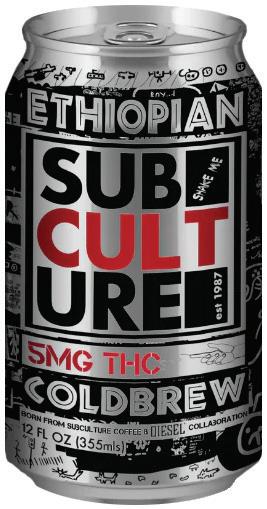

Caffeine? THC? Por qué no los dos? Subculture Delta Beverages Inc ., a joint venture between Subculture Coffee and Diesel Beverages, has launched a shelf-stable, canned cold brew coffee infused with 5 mg of Delta-9 THC per 12 oz. can. Available in original and Oat Milk varieties, these cold coffees are looking to get you toasty. The drinks can be purchased online for $39.00 per 4-pack and are also available at Subculture Coffee stores in Florida.

Ripple has unveiled its two-SKU line of Shake Ups Protein Shakes. The kid-positioned Tetra Pak drinks come in Viva Vanilla and Choco -

lotta flavors and have 13g of pea protein, 3g fiber and are free of the top nine allergens. A 12-pack of 8 oz. shakes are $29.99 on the company’s website and Amazon. For more information, visit ripplefoods.com.

Chobani has launched its first ever shelf-stable, low-fat dairy milk, dubbed Chobani Super Milk – but you won’t find it in stores. Developed to help the Red Cross and Chobani’s local food bank and pantry partners, each 32 oz. carton of Super Milk has a 9-month shelf life s and offers 13 grams of protein, 7 grams of prebiotic fiber and 400mg of calcium. For more information, visit chobani.com.

Sports nutrition brand Raw Nutrition has introduced a new RTD product to its portfolio, the Raw Protein Shake. Offered in Vanilla Milkshake, Chocolate Milkshake, Mocha Latte, and Salted Caramel varieties, each 12 oz. bottle has 30 grams of protein from grassfed whey and contains 150 calories. Raw Protein Shakes are available at GNC and on GNC. com for $49.99 per 12-pack. For more information, visit getrawnutrition.com.

Jocko has expanded its lineup of protein powders with the addition of Cookies & Cream. The new offering is crafted with a timedrelease blend of four proteins: whey concentrate, whey isolate, micellar casein, and egg. Each serving packs 22 grams of protein and has just 2 grams of sugar. Jocko Cookies & Cream Molk Protein Powder is now available for purchase via the brand’s website for $44.95 per 31-serving bag. For more information, visit jockofuel.com.

After being put on pause due to a TetraPak recall, ALOHA has relaunched its Protein Drinks in new PET packaging. Available in three flavors – Vanilla, Chocolate Sea Salt and Coconut – each 12 oz. bottle contains 20 grams of plant-based protein and is non-GMO Project Verified. ALOHA’s Protein Drinks are available for purchase online for $39.99 per 12-pack. For more information, visit aloha.com.

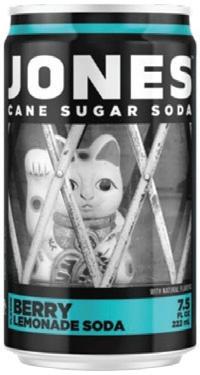

Can they do it? Yes, they can! Jones Soda has made its first foray outside of glass bottles with the launch of 7.5 oz. mini cans. Avail-

able in four of the brand’s most popular flavors – Root Beer, Orange & Cream, Berry Lemonade, and Cream Soda – the mini cans are currently available at 700 Walmart stores nationwide with more retailers to follow. For more information, visit jonessoda.com.

Cold-pressed juice maker Evolution Fresh has announced the launch of its newest platform, Real Fruit Soda. Available in five flavors at launch – Orange Squeeze, Strawberry Vanilla, Lemon Lime, Tropical Mango and Berry Burst – the soda is crafted with organic, real squeezed fruit. Each 12 oz. can has 5 grams of sugar and 45 calories or less depending on the variety. For more information, visit evolutionfresh.com.