On the Move

The First Drop

By Jeffrey KlinemanBoffo Box Office, But What About the Beans?

With respect to celebrity coffee brands, we are all Vladimir Ivanov now.

Who in the name of Krampus’ barn is Vladimir Ivanov? He’s a fictional Russian saxophone musician, played by Robin Williams in the early 1980s low-key chestnut “Moscow on the Hudson.” Ivanov defects to America while on a goodwill tour, and freaks out at the abundance of the American supermarket while on a grocery trip. The trigger? Coffee brands. Trying to make a choice – the first time he’s ever been able to do so around coffee – his hands go to his face, he mutters to himself with his Russian accent, louder and louder, finally shouting: “Coffee. Coffee! COFFEE!” while pulling boxes from the shelves, crazed and afraid.

It’s a funny scene, but it’s getting sad, because at this point, it’s as if every agent and talent manager in the world heard Ivanov’s cry, only they mixed it up with an order. And they decided that their clients are just the ones to satisfy that order.

In the past couple of years, we’ve seen a rainforest of celebrity coffee brands, either invested in, named for, or otherwise prominently associated with everyone from Robert Downey, Jr., Emma Chamberlain, Tom Hanks, and Korn to Hugh Jackman, Jimmy Butler, Snoop Dogg (didn’t last long), and Jadakiss. There has been coffee from singers Ghostface Killah and Machine Gun Kelly, some gamer named Jacksepticeye, the preppie designer Ralph Lauren, and the weirdo auteur David Lynch. Earlier this year, there was a feud at television’s 6666 ranch, when Yellowstone showrunner Taylor Sheridan’s coffee brand, Basque Ranch, sued actor Cole Hauser’s brand, Free Rein, over IP infringement. Sue ‘em, Cowboy!

The day before I wrote this we were looking at two new introductions: Throne Sport Coffee (I’ll be the one to say it: the brand name is rather… evocative) from Chiefs’ QB Pat Mahomes and BodyArmor veteran Mike Fedele, as well as Rudy Coffee – and no, not the football movie “Rudy” (he already had a sports drink, by the way) but beans licensed with the inspiring image of indicted political gremlin Rudy Giuliani.

Creating a more exhaustive list - because you can - is enough to cause one to down a bottle of celebrity tequila, which may be the only product category that is potentially more significantly star-splashed than coffee.

At a recent beverage industry event, as I watched a panel on celebrity-based branding, it occurred to me: if the first 20 years of this century were defined by an evolution in food and beverage brands toward healthy lifestyles, the next 20 years are likely to be marked by a makeover of grocery aisles by casting directors rather than category captains. Investors, manufacturers, and even retailers seem fully sold on the idea that a few thousand TikTok or IG followers can light a brand on fire, regardless of its other qualities. Soon, you won’t decide on brands by their calorie content, but by their Q rating. Is this really our trip to Flavortown? Unless the coffee actually tastes like Cole Hauser, how much should anyone care?

Of course, to slip the accusation that these folks are simply shilling to extend their financial footprints, we keep hearing about the passion that these founders have, not just for their brands, but for the product types themselves. How they have practiced,

refined palates, exquisite sensory awareness, deep interest in the business, respect for the hard work that goes into brand building, and are involved every step of the way. I don’t doubt that’s the case for some of these “celebrepreneurs,” but it’s a formula of attestation that’s been repeated so often, by so many of them, that it’s clear that it’s just not the case: after all, movies and TV shows are still getting made, Mahomes is in training camp, and Rudy’s still on the lam. If these celebrities were all that fully invested, our collective national entertainment menu would be reduced to “Diff’rent Strokes” reruns.

I understand the reasoning. People have pulled it off a few times. Vitaminwater was able to really accelerate with 50 Cent as a celebrity investor, and the idea of him developing his own variety supercharged interest in the brand. George Clooney did make a lot of money off his tequila. And yes, I do believe that Emma Chamberlain truly loves coffee and is a generational avatar for her fans to the point where it seems like a logical outgrowth.

I also understand the enthusiasm. One thing about entrepreneurs – they are incredible supporters of the ideas that brought them to the table. I’ve seen founder after founder not just swear, but swear to the life-changing attributes of their products. Athletes, with their incredible drive to win, and celebrities, with their practiced ability to play a role, are great partners as founders in that regard. The confidence, aura, personality can provide a lot of the swagger of inevitability when they put their names or signatures on a can. The problem is, athletes lose a lot, celebrities pick bad roles, sing crappy songs, and don’t always know their roasts or their beans. Of course, they are passionate and as capable of succeeding at a side gig as the rest of us. But so many entrepreneurs have learned that their product isn’t what they say it is but what the consumer interprets it as being; for them, that celebrity tie-up may actually constrict brand development.

I have, of course, interviewed my share of celebrities who are working with brands in a variety of roles over the years; some have been delightful and insightful, some have been dull and rote, but it’s always been something I’ve approached a little warily (too warily, in the eyes of my bosses, who are rightfully aware that they do sell tickets). I’ve seen what they add to the room from an entertainment, energy, buzz standpoint. Some are terrific business people who just happen to inhabit the body of a minor deity, and who really do have a nose for coffee, tea, tequila, or whatever else they’re selling. But an organic fit isn’t always easy, and that’s why you see so many flash-in-the-pan arrangements, short-term cash grabs that are dreamed up and packaged with the same marketplace logic that puts stars and directors together with producers to justify massive budgets that nevertheless result in a total flop.

But that’s also, in a way, why the celebrity game is so fascinating: we can speculate how far that elite aura extends into the marketplace, and how the celebrity will react if they face the same execution challenges that vex every founder, famous or not.

At this point, however, it might be time to think of a new strategy, before we’re all paralyzed at the cooler, looking at all the different showbiz faces, overwhelmed by the fame, muttering to ourselves in our own panicked accents.

By Barry Nathanson Publisher Toast

AriZona Never Disappoints

In May, I took a trip to the land of AriZona Beverages. It is a drive out to Long Island I’ve taken dozens of times in my 32 years of chronicling the business. AriZona started around the time I came into the industry. I met Don Vultaggio early in my career, and it was the start of a friendship that has endured for all these years and is just as strong today. In those early days, were both novices in the world of soft drink marketing. Don came from the beer wholesaler’s universe and I had been the publisher of a trade magazine about cosmetics and fragrances.

From the first meeting, I was intrigued by the brand and their vision. They saw the success of Snapple and said “It can’t be so hard, the marketplace has room for many other brands, so let’s jump in.” Don and his thenpartner, John Ferolito, took a leap of faith in launching AriZona and never looked back.

They went against conventional marketing and had great formulations, graphic designs and packaging as their centerpiece. AriZona worked in a bubble. They determined what they thought would work, executed all aspects of the new brand and did it at warp speed. They did it with no

research, outside advisors, trial balloons or test runs or anything to impede getting it to market. If they liked the idea, they took a chance. The success speaks for itself.

What has impressed me most is that Don and his team, including his two sons, still work that way. I have seen hundreds of brands in my 32 years, I can’t think of any other company that has achieved sustained success, and continued to innovate, as much as this special company. I have seen so many companies achieve short term success and then disappear. I’ve seen brilliant entrepreneurs over these 32 years, but none with the longevity of AriZona.

In my few hours at their headquarters, I was introduced to a bevy of products on the drawing board or that are about to be launched. They don’t rest on their laurels, or play it safe. Creativity is the DNA of AriZona. It is infectious being around their team. They are like new kids on the block trying to jump into the beverage arena, not the titans they are.

It has been a pleasure to have AriZona Beverages around for my entire beverage career. It has made my job a better experience.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall EDITOR, BREWBOUND jkendall@bevnet.com

Monica Watrous MANAGING EDITOR, NOSH mwatrous@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer SENIOR ACCOUNT EXECUTIVE jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY

BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO / FOUNDER / EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS

65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE

1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

By Gerry Khermouch

By Gerry Khermouch

It’s Not You, and Other Emotional Advice for Beverage Entrepreneurs

It’s been a difficult time on the innovation side of beverages, with many companies struggling to raise capital from investors who seem frozen by uncertainty. That has coerced some founders into shotgun marriages with other brands or into rollup plays that may or may not yield their anticipated synergies. For entrepreneurs who’ve spent years dealing with the stress, long hours and uncertainties of this gig, it can be a sobering denouement. After all, their brand has made it this far, continually adapting to market and investor feedback, and maybe deserves a bit more consideration than a brand-new entry making its pitch at the BevNET Live New Beverage Showdown. Feelings of frustration and inadequacy are only compounded by headlines about companies like Liquid Death or Ripple Food endlessly pulling in new capital rounds in the tens of millions of dollars. I’m well aware that journalists like me, excitedly heralding these rounds, do our share to contribute to this missing-theparty feeling. Indeed, a loyal subscriber to my newsletter Beverage Business Insights explained he’d stopped renewing a few years ago entirely because he couldn’t bear to keep reading about people bringing in all these big raises. (True, it’s possible he found the newsletter worthless and was just being polite. But he’s always been straightforward with me.)

So in this column I’ll offer a bit of perspective – solace, even – to founders who’re feeling bothered, bewitched and bewildered by the down rounds and staff cutbacks and retail retreats they’re being forced to endure as they hang in there awaiting better times. My core message is that it’s not only about you: there are forces out there that may be beyond your control, and even the most conspicuous successes often benefited from some element of serendipity, though you might not ever hear about it.

For starters, it helps to remember that beverages have always comprised a difficult segment. In even the best financial or economic climate the overwhelming share of new entries fail, some quickly and some after years of revamps, pivots and recapitalizations. That’s true in any CPG segment but beverages seem to bring their own particular challenges beyond those of adjacencies like food or personal care. After all, their basic arithmetic isn’t conducive to strong margins and financially sustainable businesses on account of the expense of distribution, particularly DSD, and the sheer clutter to be cut through. At the recent Beverage Forum in Manhattan Beach, Calif., I encountered the cofounder of a recently established fund and asked him whether he’s found ways to deploy the money yet. I got a goodnews/bad-news answer: Yes, he’s made a half dozen or so investments so far, but none in beverages on account of these challenges. So even informed investors who’re assertively in the hunt have reason to shy away from

this category. In other words, it’s not necessarily you keeping investors away, it’s the category.

Beyond that, there’s the matter of exit envy. What do those successfully exited founders have that the rest of us don’t? It may be comforting to realize that the answer is “not as much as you assume.” There’s more than sheer brilliance at work in the outsize exits that attract so many entrepreneurs to the beverage business in the first place. History, as Winston Churchill may or may not have said, is written by the victors, and in beverages those histories often obscure the sizable elements of timing and luck that may have been crucial to the founders’ ultimate success. That’s not to quibble at the brilliance most of them do exhibit – after all, it takes insight and agility to respond well to the random opportunities that fortune throws your way. But absent those flukes of timing or good fortune, that blazing exit might not have ever occurred.

That realization came to me years back while covering the launch and subsequent struggles of South Beach Beverages – rebranded as SoBe during one key pivot. Even in its home market around New York, the brand couldn’t quite break out. But it got a break in Southern California when AriZona, one of the brands it was challenging, terminated its network of Anheuser-Busch distributors. Furious at the indignity (after all, it’s much harder for a beer brand to terminate its wholesaler) the Bud guys picked up SoBe with retribution on their minds, and they did a great job. That became the market where SoBe ignited, and eventually momentum built enough for the brand to win a lucrative exit to PepsiCo. That turning point never seems to come up when members of the founding team recount their story, and why would it? After all, almost by definition, founders are in the business of mythmaking. In fairness, it took skill and fortitude to pounce on the opportunity. Still, had that random event not happened, it’s unclear that the brand would have been able to hang in there much longer.

Timing matters too. Vitaminwater marketer Glaceau benefited, in my view, by the ascent at Coca-Cola of Muhtar Kent, who wanted to make a statement on his rise to the CEO job about KO not being complacent about attacking white space in beverages. So the company won an outsized $4 billion exit that arguably paid off for Coke just in the enhanced respect it garnered for years on Wall Street. Absent that timing, that exit might not have occurred. That’s not to say founder Darius Bikoff and his right-hand man Mike Repole weren’t at the top of their game. Then there’s the flip side: beverages that don’t break out because they’re too far ahead their time. Though nominally failures, those founders in some ways deserve more credit than those who prosper by riding the subse -

quent wave. During a recent shared drive, this magazine’s publisher Barry Nathanson and I were sharing affectionate reminiscences of Ed Slade, a former Fiji Water executive whose roles at entrepreneurial ventures included a brand called Twelve that as early as 2008 anticipated the subtly crafted alcohol-alternatives that are flooding the market these days. Created with the chef David Burke, it was positioned as being versatile enough for many occasions spanning the 12 hours from morning to midnight (M2M, it styled it), with a subtle recipe that melded juice, herbs and tea to create subtle and complex flavor notes worthy of a premium imbibing occasion. That sounds like a description of dozens of brands that have hit the market the past five years, right? Poor Ed never had a chance to see how far he could take Twelve because he succumbed to cancer at an early age in 2011. In truth, he was nearly a decade away from the sober-curious movement of today, swimming against the tide.

As it happened, I recently learned that I myself – unwittingly – was part of a serendipitous turn of events that led to a milestone for a beverage brand. Over beers during Expo West, the founder of a familiar brand told me an anecdote dating back 25 years earlier in our history together in beverages. Back in the brand’s early days in the 1990s, he and his partner got an approach from private-equity titan Nelson Peltz. They had no serious interest in a partnership but politely met with him to hear him out. Since they were certain nothing was going to come of it, they didn’t think it warranted mentioning to their employees or investors. That’s where I come in: an item I dropped in my magazine, Brandweek, about the meeting caused considerable consternation within the company: employees freaked out at the thought that the company was entertaining buyers behind their back (though that wasn’t actually the case) and investors were miffed that they wouldn’t be informed. Of course, the founders weren’t too happy with me for running that item. But guess what happened? As I just learned over those beers, the article resulted in overtures from several key strategic players, one of them actually a good fit, and it emerged as a minority investor and strategic partner. That’s how business works sometimes, and founders might ease some of their mental burdens if they park in a corner of their mind the notion that their own future success rides as much on the whims of the gods as on their own tenacity and skill.

Longtime beverage-watcher Gerry Khermouch is executive editor of Beverage Business Insights, a twice-weekly e-newsletter covering the nonalcoholic beverage sector.

Super Coffee Founder Jordan DeCicco Named

Interim CEO

Super Coffee’s new CEO is a familiar face: founder and chief operating officer Jordan DeCicco was named interim chief executive in early May following Tyler Ricks’ departure to frozen food brand Caulipower. Ricks, meanwhile, is the new CEO at frozen food brand Caulipower.

Ricks joined Super Coffee as an investor and board member in 2018 before moving to day-to-day operations full-time as the company’s president in March 2022. He was promoted to CEO in December 2022, and remains an investor in the company.

“I came in two years ago in what I thought would be a shorter term consulting role to help get the business from a highgrowth, highly unprofitable company to more solid footing in this financial environment,” he said, citing an 80% reduction in EBITDA losses as one of his top achievements. “Now that we have the business really starting to turn the corner, it seemed like a logical time to transition to a new CEO that will stick to the strategy we laid out but also bring some new ideas to the table.”

Appointing Jordan DeCicco as CEO – in addition to being a “really nice story” for the founder – puts the company in the hands of someone who’s been a “huge driver of the transformation,” said Ricks.

“I think we really achieved a lot of what Tyler was brought on to help us do,” DeCicco said. “We feel we have a foundation and team and product strategy to keep that going. So I’m ready for it.”

Launched as a keto-friendly alternative to protein-rich “Bulletproof”-style coffee, Super Coffee’s identity evolved as its product range and channel spread expanded. The brand, which has a national distribution partnership with Anheuser-Busch, has grown into a major player in RTD coffee, with

a presence in over 50,000 stores nationwide, but has struggled to temper persistent losses.

At the end of Ricks’ run, though, Super Coffee was about “85-90%” to executing its strategic shift towards profitability, the outgoing CEO noted. With an eye on recalibrating efficiencies after several years of heavy spending, the company has cut personnel and marketing spend by 70% and 80%, respectively, DeCicco said.

This year has seen the Austin, Texas-based brand revamp its flagship 12 oz. drink with new packaging and formulation. That product is part of a growing portfolio of lines directed at specific channels, such as newly relaunched 11 oz. Super Espresso for foodservice, 15 oz. Super Coffee XXTRA for convenience stores, and 48 oz. multiserve bottles for grocery.

DeCicco cited encouraging Q1 numbers – total brand velocity is up 7% from January to March, trending up ahead of the expected warm-weather bump – even as the revamped products are still working their way through distribution networks. Ricks estimated they are currently at around 45%, with full expansion being a major priority in the near-term.

Looking ahead, Ricks said Super Coffee’s next permanent CEO should be an “experienced operator” and someone who can provide the company’s braintrust with “the guidance of a good strong thought leadership partner who can help consider all of the different aspects of a decision.”

When asked if he was interested in becoming Super Coffee’s next permanent CEO, Jordan DeCicco was unequivocal.

“Yes, definitely,” he responded. “I think the CEO role obviously will belong to the best person, so we’ll run a search and we’ll hopefully bring some great candidates to the table, and the board, my brothers and myself will hopefully make the best decision long-term for the company. If it turns out to be me, I’d be grateful and I take the responsibility incredibly seriously. But also, if there’s somebody out [there] similar to Tyler who we’d be happy to bring on, we think that would be a great win for the company, too.”

Casa Azul Wins Trademark Case Against Clase Azul

A judge ruled in favor of Casa Azul, the tequila company founded by beverage innovator Lance Collins, in a trademark trial against long standing tequila brand Clase Azul.

On April 15, U.S. District Judge Lee H. Rosenthal in Houston, Texas denied Casa Tradicion, the maker of Clase Azul, the motion for a permanent injunction following a bench trial.

The suit was initially filed in September 2022, after Casa Azul launched a canned tequila soda that summer. Clase Azul filed a trademark infringement action in federal court arguing that the new brand caused undue confusion with its flagship tequila, a high-end brand sold in a handmade ceramic bottle which has retained its trademark since 2008.

Following an unsuccessful effort at mediation, the case moved forward with full discovery with each side filing several pre-trial motions. On November 3 2023, the judge granted Casa Azul Spirits’ motion to dismiss Clase Azul’s claims for monetary relief, and struck its demand for a jury. The rulings narrowed the issues remaining for trial and set up a bench trial this year.

The court found and concluded that because of the dissimilarity between the two brands, as well as other evidence, Clase Azul failed to establish a likelihood of confusion and failed to establish trademark infringement, unfair competition, or trademark dilution.

“We are grateful that the judge so clearly decided in Casa Azul’s favor and this outcome reaffirms our confidence in the distinctiveness of Casa Azul’s brand name, world class products and our commitment to upholding its integrity with USDA Certified Organic Tequila,” said Collins in a statement.

Since releasing the tequila soda, Casa Azul has turned its attention towards its high end tequila of the same name and has recruited a roster of celebrity investors. Those include Mexican-born actress Eiza González, football player Travis Kelce, U.S. Women’s Open Champion Michelle Wie West, among others.

Casa Azul was the first alcohol-based release from a team of beverage industry veterans whose latest innovations have made their marks in the wellness and energy drink categories. NOS Energy Drink, part of FUZE, and BodyArmor Super Drinks sold to the Coca-Cola Company in 2007 and 2021 respectively, with BodyArmor, which Collins co-founded with Mike Repole, ranking as the beverage giant’s largest acquisition at the time at $5.6 billion. Core Hydration was acquired by Keurig Dr. Pepper in 2018.

Clase Azul, on the other hand, made its mark on highend tequila when it launched in 1997, helping to spearhead the segment. The brand has several tequila and mezcal expressions, ranging in price from $150 to $2,000 and founder Arturo Lomeli’s unique bottle has since found a spot on shelves in over 80 countries.

Nutrabolt Bolsters Leadership Team With Former Red Bull, Hostess Execs

Nutrabolt, the parent company of C4 Energy and Cellucor, revamped its leadership team in May with three new executivelevel appointments including Red Bull veterans Louisa Lawless and Jason Cantelli as EVP of commercial marketing and sales and EVP of commercial operations, respectively, and Jack Harnedy as VP of revenue growth management.

Lawless arrived at her new role at Nutrabolt with over 20 years of experience in brand building and management, most recently a stint at wellness beverage incubator Stratus Group, where she served as chief strategy officer building brands like KÖE Kombucha and Perfect Hydration. Before that, Lawless held leadership positions at beverage giants such as Red Bull North America and Core Nutrition, where she helped guide the $525 million sale of Core Nutrition to Keurig Dr Pepper (KDP).

As EVP of commercial marketing and sales, Lawless will oversee the company’s marketing, strategy, and nutritional sales functions across all revenue segments. Meanwhile, Cantelli most recently spent 15 years at Red Bull in leadership roles for key accounts, distribution and marketing. Prior to that, he spent seven years at the Boston Beer Company in distribution management and key accounts. In his new role as EVP of commercial operations, Cantelli will take charge of food service, specialty retail and beverage distribution.

Harnedy comes to Nutrabolt from snack giant Hostess Brands, where he established the RGM function and “achieved significant revenue growth through efficient and engaging promotions, trade programs and data democratization.” At the supplement and energy drink company, he will be responsible for pricing and promotion scheduling and the analysis of new brands and innovations.

“As they say, ‘Embrace the new, for it’s a path to growth.’ With incredible brands in explosive growth categories, I look forward to contributing to Nutrabolt’s continued success,” wrote Harnedy in a LinkedIn announcement.

Founded in 2002, Nutrabolt first gained momentum among performance athletes and fitness enthusiasts. Over time, the company has expanded into mainstream retail and introduced new lines – such as C4 Smart Energy and its rebranded C4 Workout Powder – to reach everyday consumers who prioritize healthy, active living.

In January, the Austin, Texas-based nutrition supplement maker acquired a 20% ownership stake in TikTok-favorite greens and superfood brand Bloom Nutrition. Aligning with Bloom will help Nutrabolt broaden its au-

dience to include female consumers within the greater health and wellness space; the greens brand is primarily targeted at females between the ages of 18 and 34.

Nutrabolt’s portfolio – which includes energy drink C4, post-workout recovery XTEND, and sports nutrition Cellucor – is currently distributed in over 125 countries, sold online through the brand’s website and Amazon and in-store at retailers like Walmart, Target, 7-Eleven, and Walgreens, among others.

In the two-week period ending April 6, Nutrabolt’s C4 Energy brand posted 35.3% sales growth, according to Goldman Sachs Equity Research’s latest analysis of NielsenIQ data. Additionally, based on Q1 2024 results, C4 claims to have moved into the No. 4 spot in the U.S. energy drink market.

Monster Co-CEO Rodney Sacks Announces Succession Plan in Q1 Earnings Call

Monster Beverage Corporation chief executive Rodney Sacks laid out a likely succession plan in early May that will eventually see co-CEO Hilton Schlosberg taking over the role entirely, as Sacks is “considering” reducing his day-to-day duties sometime next year.

The announcement arrived in connection with a corporate initiative to commence a modified “Dutch Auction” tender offer of up to $3 billion in common stock at a to-be-determined price range. The company plans to use around $2 billion in cash on hand and an additional $1 billion from a new revolving credit facility and delayed draw term loan. A start date for the auction was not given.

Speaking during the company’s Q1 2024 earnings call, Sacks said that he and Schlosberg intend to participate in the buyback offer for “investment diversification and estate planning purposes.”

Sacks said he is “considering” reducing his responsibilities at Monster beginning in 2025, “while continuing to manage certain areas of the company’s business for which I’ve always been responsible.”

“My participation in particular may provide me some flexibility to consider my own potential options, which may also help the company continue succession planning for its next phase of leadership,” Sacks said.

Sacks didn’t clarify how long this wind-down period would last, but said the end goal will be for Schlosberg to take over as the sole CEO of the business while Sacks will remain chairman of the board.

Asked during the call’s Q&A session, Sacks said the decision to initiate a Dutch Auction came in response to “recent softness in the market” providing “an opportunistic time to execute at scale a transaction of this nature” where Monster can “repurchase a greater number of shares and do so more quickly than we could under the programs which we’ve implemented.”

Monster previously issued a Dutch Auction in 2016.

Born in South Africa, Sacks and his business partner Schlosberg acquired legacy beverage manufacturer Hansen Natural Corporation in 1990. Sacks served as CEO of the business until 2021 when Schlosberg joined him as co-CEO.

The company launched Monster Energy Drink in 2002, which quickly became its premier product and is today the largest energy drink manufacturer in the U.S. with annual revenue of over $7 billion, in addition to a global beverage operation.

Better Booch Looks to ‘Future’ of Fermentation With New Ingredient, Brand Vision

With the winds of change at its back, and a novel new ingredient in tow, Better Booch is powering forward under a new North Star of holistic wellness via the microbiome.

As with other fermented foods and drinks, probiotics have long been one of kombucha’s primary callouts, and also, crucially, one of the simplest for consumers to understand. And for the decades in which the category was outside the mainstream, that was largely enough.

Upon gaining broader market traction, kombucha makers – without the ability to make further functional claims on packaging – leaned into highlighting probiotics for digestion at the expense of further exploring the drink’s broad range of benefits, said Better Booch co-founders Ashleigh and Trey Lockerbie.

That’s changing, they noted, as the close relationship between the human microbiome and overall wellness has been extensively detailed over the past decade in scientific journals and university research, and broadly popularized through books like New York Times bestseller Gut and Netflix documentary series “Hack Your Health: The Secrets of Your Gut.”

Of particular interest was a Stanford study that found a diet rich in fermented foods significantly increased the diversity of gut microbes. The study also found these foods decreased 19 inflammatory proteins in the blood, including some linked to chronic diseases, while a high-fiber diet did not significantly affect the diversity of gut microbes or decrease inflammatory proteins.

“I think that science is finally catching up to what we’ve known innately for 12 years now, which is that the microbiome is sort of the key to overall health – physical, mental and even emotional,” said Trey, adding that the company is “seeing a lot of heavy lifting (on education) coming from elsewhere.”

Better Booch has seized on those favorable conditions to reposition under its new identity – Future Beverage Group –as a gut-health beverage platform brand. Its new hero ingredient, Native+, will be key to unlocking that change. Defined as a “combination of a prebiotic soluble fiber, nine strains of proven clinically-studied probiotics strains and a clinicallystudied post-biotic,” Native+ aligns with research emphasizing the added benefits of having a diversity of strains, and is now part of every existing and future beverage product from the company.

Kombucha already produces pre-, pro- and post-biotics through natural fermentation, Trey acknowledged, but Native+ further enhances the benefits while helping the product stand out from the crowd.

“Gut health has become such a buzzword in itself to where it’s almost lost its meeting because you have so many companies making claims about gut health, so I’m really excited about this next wave of documentaries and research about fermented foods, specifically, and the way that they can improve gut health,” Ashleigh said. “We’re going to start to see a lot more clarity in that space.”

Within the new brand architecture, the individual roles for each of Future Beverage Group’s products are coming into sharper focus. LIVE Organic Living Soda, acquired last year, plays towards traditional soda aficionados with familiar flavors and more approachable branding, though the founders hope it can serve as a “gateway product” for the company.

The five-SKU refrigerated line, now in 12 oz. cans rather than glass bottles, remains popular within its limited distribution footprint in Texas, and is set to enter SoCal via DSD house LA Distributing soon. A major design overhaul led by Montreal’s Wedge Studio, is set to debut in June.

Elsewhere, award-winning sparkling tea line CHA, currently seeding in SoCal stores, provides a different take on elevated natural refreshment with its four-SKU range of 12 oz. cans. CHA is available at regional chains like Lassens and Bristol Farms, with some DSD service as well.

Both Live and CHA have allowed Future Beverage Group to branch out without adulterating its flagship line, though there are some notable changes. The kombucha is moving from a 16 oz. to a 12 oz. can, a move partly intended to encourage people to pick up a second drink rather than just consuming just one per day; on the downside, it also required a UPC change. The smaller size drops the price to around $3.49 per can, down from a high of $3.99. There’s also a new spring seasonal release coming, Mango Delight, made in collaboration with Florida-based artist Gabriel Alcala.

But maybe the best indication of the company’s future goals comes from a product whose availability is the most limited. Inspired by their decision to ditch alcohol last year, the Lockerbies used a kombucha ferment as the base for developing a non-alcoholic “wine” akin to champagne, dubbed Native. The fledgling project, which sold out of its initial run of 750 ml bottles offered exclusively online, will add a second Rosé-inspired flavor in the near future.

Jay-Z’s Marcy Venture Partners Backs

The

Finnish Long Drink

Jay-Z’s Marcy Venture Partners is the latest group to invest in ready-to-drink brand The Finnish Long Drink, the company announced in May.

Marcy Venture Partners— the firm co-founded by rapper/mogul Shawn “Jay-Z” Carter, CEO of RocNation Jay Brown, and Larry Marcus—has made a “significant investment in the brand to support the Finnish Long Drink’s continued momentum within the U.S. market,” read a statement.

Carter, a noted investor and entrepreneur in addition to his music career, has history in the alcohol business, having acquired U.S. distribution rights in 2002 for Scottish vodka maker Armadale in his role as co-founder of RocA-Fella Records. Last year, a year-long legal dispute with Bacardi was resolved when the spirits giant announced it has agreed to acquire the majority of Cognac venture D’ussé, with Carter retaining a significant ownership stake through his company SCLiquor.

Now his firm joins a roster of other celebrities like actor Miles Teller, DJ Kygo, and professional golfer Rickie Fowler backing one of the highest-selling RTD brands, inspired by a Finnish gin cocktail. Since debuting in 2018, the brand has closed multiple fundraising rounds, the largest reaching $25 million in July 2021. Other backers include Founders Brewing Company co-founder Mike Stevens and a number of athletes and entertainment industry figures.

Launched by the Finnish trio of Sakari Manninen, Mikael Taipale and Ere Partanen, alongside American entrepreneur Evan Burns, the brand offers four interpretations of the beverage it describes as a citrus soda with real liquor. Those expressions include traditional, zero (sugarfree and carbless), cranberry, and strong (which ups the ABV from 5.5% to 8.5%). It’s one of a few RTDs that have found success becoming the call brand through building their respective stories around very specific cocktails that haven’t yet hit the mainstream.

Since its U.S. launch, The Finnish Long Drink has doubled its sales each year, reaching nearly 2 million nineliter case sales in 2023, according to the brand. The RTD increased dollar sales 91.9% in NIQ-tracked off-premise channels in the last 52 weeks ending April 20, outpacing the total RTD category at 36.6%.

Marcy Venture Partners has made other headlines recently, as it is reportedly close to finalizing a billion-dollar merger with the investment arm of Pendulum Holdings. Marcy Venture includes a diverse range of businesses in its portfolio from Rihanna’s Savage Fenty, to chicken nugget startup Simulate, and to the parenting resource Babylist. The firm has also invested in allergen-friendly cookie maker Partake Foods, and outside of MVP, Carter has investments in Oatly and Impossible Foods Inc.

Sound Acquired by PE Partner, Restocks After Dry Spell

Sparkling beverage brand Sound is back in supply after its acquisition in May by operating partner Next in Natural, a New York-based private equity firm specializing in better-for-you CPG.

According to the company, Next in Natural CEO Jeff Lichtenstein has been appointed Chairman of the Board for the brand “to assist with strategic guidance” as Sound founders Salim Najjar and Tommy Kelly remain with the business. Financial terms of the deal were not disclosed.

“Sound epitomizes what’s next in natural – delicious, organic, clean, functional ingredients, and no sugar are aligned with consumer demand for just that, in a convenient format,” Lichtenstein said in a release. “Salim and Tommy have an amazing story having met as Nuclear engineers that decided to make the mother of all pivots, into Organics! They are very talented executives, and the Next In Natu-

“We

ral shared services platform is designed to help them thrive with the cross-functional comprehensive support team and resources that NeNa surrounds them with.”

Lichtenstein previously founded Gourmet Guru, which was acquired by UNFI, and has worked to scale brands such as Chobani, Stumptown and Hu.

“Sound is on track to propel the company’s growth by leveraging Next In Natural’s cross-functional team and expertise in production, R&D, business development, and marketing, which will help us evolve and reach new audiences,” Kelly added in the release.

The company was founded in 2015 and initially produced a line of carbonated teas in glass bottles, before pivoting to cans with a rebrand in 2021 that repositioned the drinks as sparkling waters made with tea and botanicals.

The acquisition follows a quiet period from the brand, which had ceased posting on social media last fall while consumers have reported out of stocks across channels during that period. But as of today Sound is back in stock online via its website, and the company said it is also available in select retailers nationwide and online via Thrive Market.

Next In Natural, which focuses on operations support and strategy for food and beverage companies, announced in March that it had expanded its M&A division, appointing Keto & Co. founder Ted Tieken as Chief Future Officer. In a press release, the firm said its ideal candidates for acquisition are in the $5-$50 million revenue range and “preferably in the beverage and salty snack space, with founders at an inflection point” with “a proven product but need support reengineering or scaling their business.”

Play To Win”: Former BodyArmor Exec, Patrick Mahomes Launch Sport Coffee

It’s not quite football season yet, but as we detailed earlier, threetime Super Bowl-winning quarterback Patrick Mahomes announced in May that he’s looking for a new arena to conquer.

Mahomes is entering the beverage business, joining former BodyArmor executive Michael Fedele to launch Throne Sport Coffee in a venture that seeks to disrupt the RTD coffee category. Behind Fedele, the Kansas City Chiefs QB is the second largest shareholder in the brand.

“I wake up every single morning and I’m getting coffee,” Mahomes said. “It gets a little bit more during the season than in the offseason but I drink a lot of coffee.”

Fedele, who left BodyArmor in December 2022 after over 10 years with Coca-Cola, had been developing a “sport coffee” formulated for athletes and sent Mahomes prototype samples.

“I was able to try those out and know that I was drinking coffee which I love, but a healthy version,” Mahomes added. “I could drink it during the season and didn’t have to worry about the effects of how I feel after [or] if I would be sluggish after the coffee has worn off.”

Throne Sport Coffee is targeting health-conscious coffee drinkers, not energy drink consumers, Fedele said, but is doing it with a product that balances flavor with ingredients that speak to an active lifestyle.

The 4-SKU, NSF Certified for Sport line – available in Black, Mocha Java, Salted Caramel and French Vanilla – come in 11 oz. cans with 150mg caffeine, B vitamins, electrolytes and branchedchain amino acids for recovery. The cans will retail for $3.99. Throne’s flavored varieties are sweetened with pure cane sugar (8g added), are dairy-free and have 50 calories.

The brand initially will be in about 3,000 outlets in 20 states as well as on the company’s website and Amazon. Convenience chain Casey’s and Hy-Vee are two of Throne’s major launch part-

ners as the brand focuses on c-stores and some conventional retailers in the Midwest and Plains regions.

Positioning as a better-for-you coffee product was important because athletes like Mahomes rely on coffee to fuel their active lifestyle, Fedele said.

Finding a niche in RTD coffees is no easy task as the category grows with celebrity-backed brands like Happy and Chamberlain Coffee targeting young consumers while artisan roasters (La Colombe, Verve and Equator) expand deeper in the set.

The active-lifestyle coffee drinker is not untapped territory either. Super Coffee has been positioning its high-protein, lowsugar RTD canned drinks to these consumers for nearly a decade with a variety of SKUs. Chocolate milk maker Slate has found traction among fitness-focused individuals seeking protein-rich, caffeinated drinks with its latte line.

Throne is betting that having the clout and reach of one of the best football players in the league will help propel the brand forward. Mahomes is no stranger to endorsement deals. Over the years, he has put his personal brand behind Essentia, PRIME, and BioSteel, but Throne is the first beverage brand that Mahomes has taken an active ownership stake in and has been part of the formulation and launch strategy.

“More than the investment you have to believe in the product and think that the product’s going to take off to another level,” he said.

Setting the brand up for that kind of success, Fedele has built his team with beverage industry professionals, many of whom worked with him at BodyArmor.

“Our team is a group of competitive people,” Fedele said. “From Patrick [Mahomes] to myself to the team that’s behind this brand, we play to win.”

Meati Raises $100M, Locks In Kroger Deal As ‘Path to Profitability’ Accelerates

Meati announced a trio of big moves in May, headlined by the closing of a $100 million investment led by Grosvenor Food & AgTech along with existing investors Prelude Ventures, BOND, Revolution Growth and Congruent.

The news is accompanied by a new distribution agreement that will bring three of Meati’s mycelium-based altmeat products to 2,000 Kroger doors nationwide. Additionally, the company shared that co-founder and chief innovation officer Tyler Huggins has moved into an advisory role, passing day-to-day duties off to recently appointed CEO Phil Graves.

“When Justin Whiteley and I founded Meati, we set out to harness the power of nature to make awesome products that were a positive force for good in the world,” said Huggins. “It’s inspiring to see how far we’ve come in a short period of time, and I’m ready to pass the day-to-day running of the company to Phil Graves and the leadership team to take it to the next level.”

As for that next level, Graves said Meati will use the new capital to maintain its “high growth momentum” and continue scaling in U.S. retail. The new agreement with Kroger will expand access for its Classic cutlet as well as its Classic and Carne Asada steaks to both Kroger flagship and banner stores including Ralphs, Mariano’s, City Market, King Soopers, Dillons and others.

Those gains bring Meati to 6,000 stores nationwide in just over a year since its retail launch. The Boulder-based company also sells a Crispy Cutlet product, and its offerings are available at Super Target, Whole Foods Market, Sprouts Farmers Market, Meijer and Wegmans. Meati claims that nearly 40% of its customers have chosen its products as their first plant-based meat alternative purchase and said it sees a repeat purchase rate of “as high as 60%.”

In addition to continuing to grow the business, Graves said Meati will also use the new funds to keep building awareness for its MushroomRoot ingredient, primarily working to share how it’s differentiated from other plantbased meats available on the market. The company has a stacked roster of celebrity investors it could also tap in support of those efforts, including former Olympian Aly Raisman and NBA All-Star Chris Paul, who joined in December.

“Compared to a traditional steak, creating MushroomRoot uses 89% less water and has an 88% lower carbon footprint,” Graves said. “From a health perspective, Meati is a front runner in the alternative protein space – we’re a super food, a whole food protein free from saturated fats and cholesterol that provides significant daily fiber and nutrients.”

Meati has also garnered support from MLB Hall of Famer Derek Jeter, chef and restaurateur Tom Colicchio, TV personality Rachael Ray, and Sweetgreen co-founders Nicolas Jammet and Jonathan Neman.

But those gains haven’t come without compromise. While the company has raised upwards of $365 million in the seven years since it was founded, it has also conducted three rounds of layoffs in the past twelve months alone.

Meati last raised $50 million in September and subsequently laid off 10% of its employees, telling Nosh at the time the funds would be used as an “economic cushion.” Graves elaborated that the funds were primarily used to finish construction on its Colorado-based “Mega Ranch” production facility. The company also closed its pilot manufacturing plant during that time.

In February, Meati hired Graves as the company’s CFO, and just two weeks later, he was promoted to CEO. That change was made so that Graves could help “right size” the company, a spokesperson told Nosh at that time, which included laying off 13% of its workforce as it made another push towards profitability. According to Graves, those efforts are now showing returns.

“The actions we’ve taken have reduced our burn rate by 40% and have significantly accelerated our path to profitability,” he said. “Specific measures include streamlining our operations, eliminating unnecessary ingredients, reducing waste and moving away from temp labor.”

Graves said he anticipates no further changes to the team following this latest capital raise. He believes the company is in the right place to continue to grow and cited his time at Patagonia, where he helped establish and run the outdoor company’s corporate venture fund and analyzed over 3,000 companies that applied for funding.

“From my experience, I can confidently say there is no company more sustainable and scalable than Meati,” Graves emphasized. “Our MushroomRoot can produce the equivalent of hundreds of cows’ protein in just a few days from only a tablespoon of spores… Meati is truly unique and is poised to change the alternative protein industry.”

Tyler Ricks Named CEO at Caulipower

More on Tyler Ricks joining Caulipower as CEO: He has been a member of Caulipower’s board of directors since 2022, and replaces departing CEO Marc Seguin, who helmed the company over the past two years, succeeding founder Gail Becker in the role.

Ricks’ appointment comes as Caulipower is entering a new growth phase. The frozen food company, which generated $120 million in retail sales over the past year, recently expanded its portfolio of gluten-free pizzas, chicken tenders and bites, pastas, meals and more, sold at 25,000 stores nationwide.

“I’m not a disruptive founder; I’m the guy who can figure out how to really partner with the disruptive founder and help unlock their potential to really continue to impact the business,” Ricks said in an interview with Nosh.

Ricks has invested in more than 40 businesses and sits on more than a dozen boards. He previously held leadership positions at Peet’s Coffee and Bear Naked Granola, among other brands, and joined Super Coffee as an investor and board member in 2018. He became president of the beverage brand in March 2022 and was elevated to CEO later that year.

During his tenure, he brought the business – what he described as “a high-growth, highly unprofitable company” – to solid financial footing. He remains an investor and advisor to the company.

“My biggest concern was making sure that we could get Super Coffee to the place it needed to be to make this transition,” Ricks told Nosh, adding, “I wouldn’t have been able to say that six months ago, where I would have felt comfortable walking away.”

Becker added, “I’ve actually had my eye on Tyler for quite some time. If there’s one thing I’ve learned, timing is everything in business.”

In October, Caulipower unveiled nine new items, including frozen pinsa-style pizzas and baked pizza bites featuring a cauliflower crust, marking its largest-ever “innovation announcement.” Ricks intends to draw on decades of brand management and operational experience to support these launches while providing a “fresh lens” to new product development opportunities.

“It’s really about finding those best practices, those systems, those tools, those frameworks, those processes ... just enough of that stuff to help keep the wheels on the bus when you accelerate growth,” he said.

Seguin, who previously held sales and marketing leadership roles at GT’s Living Foods, popchips and Paramount Farms, will step down following a transitional period. Becker said she plans to remain involved in all aspects of the business, partnering with Ricks and the team on innovation, brand, consumer touchpoints and sales to drive continued growth of her eight-year old company.

“I’m really proud that I created and built the company to over $100 million,” she said. “I don’t have anything left to prove.”

Walmart Doubles Down On Private Label With Premium, Accessible bettergoods Debut

The country’s largest grocery retailer is setting up to capitalize on consumers’ growing affinity for private label offerings amid continued, heightened food prices.

Walmart debuted its new store brand, bettergoods, in April with over 300 unique products spanning frozen, dairy, snacks, beverages, pasta, soups, coffee, chocolate and more. The mass retailer claims this is its largest private label food brand launch in nearly two decades and the fastest it has brought a new brand to market.

“Today’s customers expect more from the private brands they purchase – they want affordable, quality products to elevate their overall food experience,” said Scott Morris, SVP of private brands, food and consumables at Walmart, in a press release. “Bettergoods is more than just a new private brand. It’s a commitment to our customers that they can enjoy unique culinary flavors at the incredible value Walmart delivers.”

While store brands are historically better value alternatives to brand name products, Walmart is aiming to align lower prices with demand for the premium, upscale items. According to Walmart, bettergoods will sit on-shelf for between $2 to $15; the vast majority of offerings will be available for around $5.

Additionally, Walmart claims that unlike most private offerings, which are often modeled after popular name brand foods, many bettergoods items are unique to Walmart and created by its in-house product development team, in collaboration with global suppliers. Bettergoods products are housed under three broad categories – Culinary Experiences, Plant-based and “Made Without” – and include everything from hot honey seasoning to a four ingredient, Sweet Cream Dairy Creamer.

According to Kelly Criswell, founder and principal of strategic creative and brand design agency Mudge, the overall look for this

expansive range does “a fine job at feeling like a modern private label brand.” She said her initial reaction was that “Walmart made a more approachable version of Target’s Good & Gather.”

The line has also drawn similarities to Trader Joe’s “dupe culture” approach to private label products due to the flavor variety, like frozen chicken wings with a Brown Sugar BBQ dry rub. On the product-specific design front, she noted that the culinary experience items could have been made more distinct with less generic food photography, stating the “designs are expected, and not differentiated.”

“It’s a real challenge when designing a system for a portfolio so big across so many different categories,” Criswell said. “Their choice of using color to delineate categories (plant based, etc) is a good one, but… it may be harder for the consumer to quickly differentiate flavor from SKU to SKU… It’s such a broad design system that they likely made some concessions and sacrificed the shopability of some categories for consistency across the lines.”

Either way, the unified product range, and speed to which it was brought to market, signals that Walmart sees a significant opportunity to grow with a broad ranging private label food platform while competing with Target’s Good & Gather brand, among others.

Earlier in April during a webinar with Jefferies analysts, Jeff Wojtkowiak, president of In The Loop Consulting and a former Kroger executive, explained that private label business will likely be key revenue growth drivers for retailers moving forward.

Not only that, he emphasized that these offerings will serve as an opportunity to bring more consumers into stores, specifically for mass retailers like Walmart and Target, while highlighting that the differentiated private label approaches from discounters like Trader Joe’s and Aldi will serve as a guide.

Wilde Protein Chips Pumps Up With Muscular Investment

Wilde Brands has landed an eight-figure investment from previous backers and new investors who see a future for the protein snack brand to expand further in retail as it eyes international markets

The chicken chip maker announced in April it had secured over $20 million in a round led by existing investors KarpReilly and Bill Moses that also included new investments from the Family Fund and performing artists Jack Harlow and Machine Gun Kelly.

Harlow and Kelly were brought into the round by venture studio Grey Space Group, which — along with making investments in brands like Wilde and Koia — bridges the gap between CPG brands and cultural entities like athletes and celebrities.

Wilde has taken a long and winding road to getting to where it’s at now.

Initially, Wilde Brands started by making meat snack bars but began its pivot into a crunchier protein delivery format in 2017 when it launched its chicken chips. Eventually discontinuing the bars and going through multiple packaging refreshes, founder and CEO Jason Wright finally landed on Wilde’s current branding and recipe made from chicken breast meat, egg whites and bone broth.

“I like the fact that we’re offering protein chips with real food,” Wright told Nosh. “Wilde gives the customer something totally different. We’re giving you a culinary experience and a flavor profile that you’re not gonna get with a powdered [protein] product.”

The brand has seven flavors (Nashville Hot, Chicken & Waffles, Buffalo, Barbeque, Salt & Vinegar, Himalayan Pink Salt and, its latest addition, Spicy Queso that all lean into the flavor profile of its hero ingredient while leaving plenty of room for new innovation.

Wright hinted that the brand is toying with Chamoy and Jalapeño Ranch varieties as well as another flavor launch in the works linked to a partnership with “the Holy Grail of chicken.”

Although consumer-friendly flavors might be driving adoption, growth is coming from the brand’s ability to reach shoppers in multiple channels and even in multiple store parts.

In the last year, sales picked up when Wilde expanded its distribution from natural channel stores like Whole Foods and Sprouts into mass and club partnerships with Target, Walmart and Costco. At Target, Wilde has placements in two categories: The four-packs of 1.34 oz. bags are in the Sports Nutrition set and are expanding into all 1,600 Target stores while its 2.25 oz. bags are in about 500 locations in the Alternative Snacking grocery category.

The brand is gearing up for a summer program in Costco that begins in June and will expand its footprint in the club chain’s warehouses. In total, WIlde is in about 20,000 doors including conventional retailers like Publix as well as online platforms like Gopuff and Amazon.

In an effort to “become a household name,” Wright said, the brand has also partnered with fitness events like Tough Mudder to build brand awareness.

Yet, the U.S. might not be the only place to run wild.

After recently returning from a trip to Germany to talk to equipment providers, Wright made a stop in Dubai to talk with a venture group about potentially bringing Wilde abroad. Along with Europe and the Middle East, the brand is looking north with ongoing conversations with Canadian retailers as well.

Though the plans are in their “very early stages,” Wright said that it has been a goal from the beginning “to prove that Wilde can be successful in another country.”

“Everything that you see here is happening there,” he said, referencing his time in Germany and Dubai. “People really want snacks that work for them, and protein is something that is filling and full of energy. All around it’s a better source than just 100% carbs.”

With some added capital, Wilde is well-positioned to dig deeper into that trend. The brand operates its own manufacturing plant in Lexington, Kentucky, and feels like it has the scale to expand both domestically as well as abroad.

For now, Wilde is focused on going deeper with its current retail partners but is watching how it can further differentiate itself from the other high-protein chips that are starting to fill out the snack set.

Competition is building with brands like ZeroCarb Lyfe bringing its own chicken-based protein chips to market last year. Quest Nutrition and Legendary Foods also have protein chips (both using milk protein isolate).

Although Wilde sees its use of animal protein as a differentiator in taste and texture from protein powder-based brands, Wright said more competition is not necessarily a bad thing when building a high-protein set out of the salty snack category.

“If you look at salty snacks right now it’s dominated by carbohydrates,” Wright said. “And I think: how many barbecue potato chips do you need?”

Highlights from the 2024 Craft Brewers Conference

Craft brewers decamped to Sin City in April for the 2024 Craft Brewers Conference (CBC) and BrewExpo, hosted by the Brewers Association.

Here are highlights from the event in Las Vegas:

KEYNOTE: Uncle Nearest’s Fawn Weaver On Why Staying Small Wasn’t an Option

Uncle Nearest Distillery founder and CEO Fawn Weaver disregarded the advice of the spirits industry’s old heads on the way to building a billion-dollar brand, she shared during her fireside chat with Crowns and Hops Brewing co-founder and CEO Beny Ashurn on the opening day CBC.

“Literally every single thing that everyone told me, ‘This is what you do not do,’ we did,” Weaver said.

The path less traveled for Weaver included launching in control states when others suggested that she start in open states; expanding distribution nationwide within two years when others told her to try to focus on her home state for five to seven years before expanding; and leaning into awards instead of a brand story, when others told her that no one cares about awards.

“No person of color has ever succeeded [in the industry],” she said. “No woman at the top has ever been at the top. So why would I listen to what has always worked?”

Five years later, Weaver is lauded for her success in building the Uncle Nearest brand. The road to more than 1,100 awards for a brand that celebrates the story of the first known African-American master distiller is about being authentic and representing women and people of color in a predominantly white male dominated business, Weaver shared.

“I realized that if I could break through every ceiling, every barrier in this white male industry, that everybody else can do it in every other industry,” she said. “So I wasn’t representing hope for the spirits industry; I was representing women and people of color, period.”

When Uncle Nearest launched in 2017, Weaver’s womenled team was met with indifference and silence from supplier companies, retailers and distributors who wouldn’t return their calls. Weaver leaned on her husband, a Sony Pictures executive, to get through to decision makers.

When her husband reached out, those decision makers either took his call immediately or returned it by the end of the day. The decision makers had two questions for Weaver’s husband: Do you play golf? And do you drink beer?

Weaver said this allowed her to fly below the radar, which informed her strategy behind landing news stories in Uncle Nearest’s early days. In those stories, she wasn’t referred to as founder and CEO, but the chief historian, because “that’s something America could swallow at that time.”

Her true role as the driving force behind Uncle Nearest didn’t become public until 2019. And even then, the fact that the company was women-led and Black-owned didn’t come out until 2020.

“Why?” she said. “Because the juice can speak for itself. And if all ego is cast aside – don’t care what my color is, don’t care what my gender is – and if all of that wasn’t put aside so the juice spoke for itself, I would not be sitting here right now.”

The juice attracted consumers but the story kept them engaged, Weaver continued.

Through its growth period, Uncle Nearest has remained independent and resisted investment from strategics and

private equity, including a $2 billion offer for the company, Weaver claimed. Instead, the company has relied on investment from 170 individual investors.

To build the brand, Weaver shared that she needed $230 million.

“What beer brand needs to do that?” she asked.

The decision to lean on individual investors has created 170 brand ambassadors who act as “an extension of myself,” Weaver said. And they have helped secure multiple national accounts.

Over the last year, Uncle Nearest has turned into an acquirer. In October 2023, the company acquired cognac maker Domaine Saint Martin. The company appears poised for more deal making, as Weaver teased an acquisition of a craft spirit brand – one that attempted to stay small but ultimately will be sold to Uncle Nearest once due diligence is completed.

“With craft distillers, there’s always been this pride in staying small,” she said. “The company that I’m acquiring – phenomenal company that was trying to stay small. The problem is you stay small too long, you will die or you will have to be acquired, and you will be acquired at a loss because you never had a goal or a dream to be bigger.”

Several times throughout the discussion, Weaver challenged the notion that brands should remain small. She added that there’s a piece of the craft beverage movement “that is so hung up on ego” and a desire to do everything themselves.

“There isn’t that much pride in doing your own accounting,” she said. “There is nothing great about aspiring to be small. It’s hard to be big when little’s got you.”

The commentary highlighted a striking difference between the trajectory of craft distillers and craft brewers, with the majority of the 9,683 small brewers producing fewer than 1,000 barrels of beer annually. The BA has championed those small and independently owned craft beer makers, while excluding those who have been acquired by a larger bev-alc producer from its ranks.

Weaver also shared that Uncle Nearest is trying to lift up other BIPOC companies along the way The company hosted 130 BIPOC founders, who were afforded the opportunity to pitch “all of the gatekeepers” in the industry, from distributors to retailers to investors.

“If we can make it to the top, we’re bringing everybody with us,” Weaver said.

Weaver concluded that success doesn’t make the work easier.

“The higher you go up, the thinner the atmosphere, the more difficult it is for you to breathe,” she said. “If you’re looking to get to this moment of easy, drop out now. If you’re going to the next level for purpose, then nobody can knock you off that mountain that you’re climbing.”

For craft breweries to return to growth, they have to do more than just make great beer, BA chief economist and VP of strategy Bart Watson said during his state of the industry address on Day 2 of CBC.

Small and independent craft production declined -1% in 2023, according to the BA’s annual production survey. More than half (54%) of surveyed breweries recorded a decline in production, and the gap between openings (495) and closings (418) narrowed.

Much of craft’s decline is due to demand, which has followed a “textbook” S-curve pattern of increasing rapidly 10+ years ago, to now becoming static as product is easily accessible and no longer new. From 2012 to 2019, the number of craft drinkers was growing an average of +3.5% annually. From 2019 to now, that growth has compounded to +1.6%.

The cost to make, market and sell beer has also continued to increase, as “pretty much everything has gone up in cost in recent years,” and craft revenue has been unable to keep up.

“The crux of this challenge is not necessarily the input price increases [for operations], but the combination of that with our inability to follow them up in pricing,” Watson said.

“When you look at other consumer product goods categories, some of them would just pass those prices on to the customer,” he continued. Craft’s hesitancy to do so is a response to the state of supply and demand, and how relevant companies feel their brand is “relative to the total category.”

There is still room – and reason – for optimism, according to Watson. Forty-four percent of craft breweries who responded to the survey, recorded an increase in production in 2023.

“That 44% represents thousands of companies that faced all those challenges that I already laid out for you, and still found ways to rise above and find growth,” he said.

Craft breweries are also starting to redefine what “growth” means to them.

“When I talk to brewers about distribution in the past, it was always, ‘Where can I go next? How much beer can I sell?’” Watson said. “This year, I’ve heard a lot of reframing around where are the places and brands that I can sell that are actually going to make me money.

“Craft is entering its era of operations,” he continued “People are recognizing that it’s not just about the great beer you make, but you have to have a profitable business behind it.”

Craft has the ability to “restart” growth as a segment, but it will rely on companies either finding more occasions for their brands, or bringing new drinkers into the segment. Both pathways require companies to lean into what makes them different in a sea of choice across not just beer, but all bev-alc.

“It made a lot of sense in that era of rapid growth to stick close to the herd, to do what was working, to make the styles that everyone else was making, to have the industrial chic warehouse taproom that everybody would expect with craft,” Watson said. “That said, in an era of incremental growth, that’s not going to work for everyone collectively.

“To find those new customers, win those new occasions, we’re going to need companies to find different paths, find their own unique paths,” he continued.

NB2A: Black-Owned Breweries Are Growing Based on Craft’s Original Playbook – Authenticity and Community

While craft finished 2023 in decline, Black-owned craft breweries were able to grow, according to National Black Brewers Association (NB2A) executive director Kevin Asato in a press conference ahead of the World Beer Cup award ceremony on Day 3.

More specific numbers on Black-owned breweries’ sales and impact will be released in late May, but Asato gave a preview of what to expect from that report, including that Black-owned craft breweries are consistently outperforming both the overall craft segment and total beer.

“What is the secret sauce that these individuals hold?” Asato asked. “Very simple: It’s their authentic self. It’s the culture. It is very simple that in the beer industry, what these individuals are doing, and the association that we’re trying to bring together, we are bringing culture to the

cup, and it’s exactly the same recipe that actually had craft beer grow before.

“When you think about how craft beer grew, it was an iconic piece of community property,” he continued. “Craft beer was that local place within a community that people would come to, and that people would have a desire to congregate together, share a pint, talk about life, talk about what’s going on in the community. Craft beer exploded with that, because it had a community that supported it.”

That “authentic” connection to community is happening now with Black-owned businesses. Yet they are still an incredibly small portion of the overall craft pie.

Of the 9,683 craft breweries that operated in the U.S. in 2023, only 85 breweries were Black-owned – less than 1%, Asato said.

“There are 13% Black Americans in the United States,” Asato said. “There are 8% of the [Americans] who drink that are Black. How do we get away and allow this industry that we love to only have less than 1% of Black ownership in these breweries? How do we let that happen?”

There is also a major disparity between Black consumers who drink bev-alc, and Black consumers who drink beer – more than any other demographic group, Asato said. About 88% of Black Americans who drink bev-alc drink spirits, while only 46% of the same population drink beer. That’s equivalent to about 16 million consumers who drink alcohol, but don’t drink beer, according to Asato.

“I can assign a very simple consumption model to this: one beer a day, two times a week, all of a sudden that volume starts to really start to materialize into something significant,” he said. “The craft beer industry, the beer industry as a whole, actually has an avenue of new drinkers that could be introduced into this market, and they are Black.”

NB2A president and Weathered Souls co-founder Marcus Baskerville echoed these remarks and the potential impact Black consumers could have on craft beer if there were more breweries for them to connect with. Baskerville emphasized that supporting Black-owned craft breweries doesn’t just help those individual businesses, it helps all craft breweries, as Black-owned breweries help introduce craft beer to consumers that can then spread their dollars and support across the segment.

“Craft beer isn’t oversaturated at this point, craft beer is oversaturated with white males,” Baskerville said. “There’s a completely whole different demographic that we have not even been able to hit yet.”

Black-owned breweries cannot do it on their own and need the support of fellow industry members, NB2A first VP and Brooklyn Brewery brewmaster Garrett Oliver said.

“America propagates this toxic idea that there is such thing as a self-made man,” Oliver said. “This is always a lie.

“If you’re a self-made man, or a self-made woman, is that even a thing to aspire to?” he continued. “I’m gonna say that it isn’t, because if you’re self-made, you show up alone. Alone. By yourself. Is this really what beer is about? Is this what we want it to be? No.”

JUICE

Just in time for the on-the-go summer season, Naked Brand has unveiled a new line of lower sugar smoothies. Available in three flavors – Berrylicious, Glorious Greens, and Tropical Sunrise – each 15.2 oz. bottle has 9 grams of fiber and contains 50% less sugar than the leading smoothies on the market, the brand claims. Naked Lower Sugar Smoothies are available nationwide including Albertsons, Walmart, and Target for $3.99 each. For more information, visit nakedjuice.com.

Mott’s has introduced a new fruit-flavored hydrating juice beverage specifically formulated for kids, Mott’s Active. Available in two flavors – Blastin’ Berry and Watermelon Burst – the product features naturally sourced electrolytes and is free of added sugars and artificial flavors. Mott’s Active is now available in 8 oz. 6-packs at mass and grocery retailers nationwide. For more information, visit motts.com.

SPORTS DRINKS

7-Eleven is seeking to bring the “first taste of midnight” to its stores with a new limited edition flavor of Gatorade Thirst Quencher: Midnight Ice. What does Midnight Ice taste like? Well, you’ll have to find out for yourself, as no details have been released on the flavor profile of the beverage. Gatorade x 7-Eleven Midnight Ice is exclusively available in 28 oz. bottles at participating 7-Eleven, Speedway, and Stripes. For more information, visit gatorade.com.

POWERADE has announced the launch of its new summer-only product, POWERADE SOUR. Available in three flavors – Blue Razz, Watermelon Lime, and Green Apple – the 28 oz. sports drinks contain 50% more electrolytes than Gatorade’s Thirst Quencher, the brand claims. POWERADE SOUR is now rolling out to stores nationwide. For more information, visit powerade.com.

COFFEE

Starbucks has released a slate of new products, including two new Cold Brew Concentrate flavors: Dark Chocolate Hazelnut and Sweetened Black. The concentrate is designed to be combined with equal parts water and poured over ice. Starbucks’ Cold Brew Concentrates are available at retailers

nationwide with a SRP of $10.99 per 32 oz. bottle. Other new releases include Starbucks Iced Coffee Blend Naturally Flavored Vanilla ($9.99/10-count) and Iced Coffee Blends Signature Black ($10.99/12 oz. bag). For more information, visit Starbucks.com.

Just in time for summer campfire season, Dunkin’ has unveiled its latest innovation: S’mores Artificially Flavored Cold Brew Concentrate. The concentrated coffee is said to feature “bold, smooth notes of chocolate, graham cracker and toasted marshmallow” and comes in a 31 oz. bottle. For more information, visit dunkinathome.com.

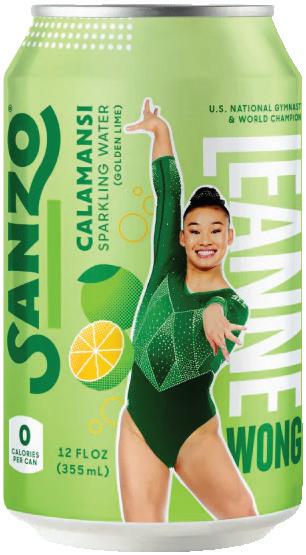

Kansas City Chiefs QB Patrick Mahomes is a three-time Super Bowl champion, so he knows a thing or two about taking a hard tackle, but is he ready for the rough and tumble of the beverage business? With former BodyArmor exec Michael Fedele by his side he’s got a seasoned teammate heading into the game as the two partnered to launch Throne Sport Coffee , an NSF Certified for Sport canned coffee line containing 150 mg of caffeine, B vitamins, electrolytes and BCAAs in each 11 oz. can. Available in Black, Mocha Java, Salted Caramel and French Vanilla flavors, the cans will retail for $3.99 each. For more information, visit sportcoffee.com.

CSDs

To celebrate the (upcoming) arrival of grilling season, Pepsi has joined forces with grill master and chef Bobby Flay to launch two new flavors “designed to elevate the taste of BBQ foods.” The new LTOs – Pepsi Peach and Pepsi Lime – were crafted to provide a sweet flavor that enhances the smoky, savory flavors created on a grill. Both varieties will soon be available for purchase nationwide in 12 oz. cans and 20 oz. bottles. For more information, visit pepsi.com.

LEVO is the latest entrant seeking to make a splash in the rapidly growing prebiotic soda space. Available in six flavors – Cotton Candy, Splice, Cosmic Punch, Root Beer Float, Orange Creamsicle and Voodoo Cola –each 12 oz. can contains 5 grams of dietary fiber and 5 grams of cane sugar. LEVO Soda will soon be available for purchase via the brand’s website for $32.99 per 12-pack. For more information, visit levosoda.com.