12 minute read

Seven Dutch hopefuls in battery technology

The Dutch high-tech ecosystem has sprouted seven companies that are looking to improve lithium-ion battery technology, or market completely different battery designs.

Paul van Gerven

Advertisement

The battery has entered a golden age. It has already been indispensable for a range of applications, but with the anticipated transition to electric driving and increasing adoption of renewable energy sources, the world is rushing to increase battery manufacturing capacity. For example, global lithium-ion cell manufacturing is expected to rise from 95.3 GWh per year in 2020 to 410.5 GWh per year in 2024, according to market research rm Globaldata. e world will also need better batteries. Researchers and companies are frantically trying to improve the lithium-ion cells or come up with alternative technology that’s better suited for particular applications. After all, bu ering supply and demand in the electrical grid is a di erent ball game than getting an electric car to drive as far as possible on a single charge. e Netherlands plays no role in battery manufacturing. ere are several companies, such as Cleantron, SuperB and Eleo, that assemble battery modules for niche applications. VDL Nedcar is considering automotive battery pack assembly as part of its e orts to replace the impending loss of the BMW business. But there’s no battery cell or A-to-Z battery manufacturing in the Netherlands.

On the technology front, however, seven Dutch companies have emerged that have something to contribute. e applications they target are remarkably varied, ranging from materials and components to full- edged batteries and manufacturing equipment.

Battolyser

A spino from Delft University of Technology (TU Delft), Battolyser has developed, well, a battolyser. is device stores electricity like any battery, but it can also split water into hydrogen en oxygen when it’s fully charged. A simple combination of a regular battery and an electrolyzer could do the same, but the battolyser “does it better and at lower costs in situations where it really matters,” says its inventor, Fokko Mulder, professor at TU Delft’s Chemical Engineering department. e key is the ability to quickly react to electricity price uctuations, which are expected to become more pronounced as more renewable energy sources are installed. While conventional electrolyzers can’t easily be turned on and o , the battolyser can instantly switch between hydrogen production and discharging the battery. So, when electricity prices are low, the battolyser is put to work for producing (green) hydrogen, a valuable compound used in a range of (cleantech) applications. When prices are becoming too high, the device can not only discontinue hydrogen production, but it can actually start selling electricity by discharging the battery.

Battolyser, headquartered in Schiedam, is backed by Koolen Industries, Proton Ventures and Delft Enterprises (which is part of TU Delft) and has been commissioned to install a device at Nuon’s Magnum power plant in Eemshaven.

Delft IMP

Batteries are just one application for the powder coating process developed at TU Delft and currently being commercialized by spino Delft Intensi ed Materials Production (Delft IMP). Coating cathode and anode materials enhances their durability, resulting

Credit: Holst Centre

Lionvolt’s 3D solidstate lithium-ion state lithium-ion battery on foil. battery on foil.

in extended battery life. Other advantages include higher energy density, increased battery safety and the option to use cheaper materials without performance loss.

Delft IMP adapted the atomic layer deposition (ALD) process to give powder particles a ‘nanoshell’ of desired thickness. While traveling through a tubular reactor, the particles come into contact with gaseous precursors, which react with their surface. us, a coating is formed atomic layer by atomic layer, the thickness of which depends on the diameter and length of the reactor’s tubes. is process is continuous and capable of industrial production rates. e company sells the reactors, not the coated materials.

Elestor

Elestor’s mission is to build a storage system with the lowest possible storage costs per kWh. To accomplish that, the Arnhem-based company is building on technology that was developed by NASA decades ago: the redox ow battery. Lithium-ion cells are no match for these devices when it comes to grid-scale energy storage, on account of their scalability, superior lifetime and cost of ownership.

In a nutshell, these redox ow batteries ‘store’ electrons in a chemical compound, which is synthesized whenever there are electrons (ie electricity) in excess. e electrons are released when needed through the same chemical reaction in reverse. Elestor’s ow battery turns hydrogen bromide into hydrogen and bromine when charging. ese active materials are readily available, cheap and enable both a high energy and power density.

Supported by the European InnoEnergy fund, Elestor was founded in 2014. e Arnhem-based company later attracted investments from Koolen Industries and Enfuro Ventures.

E-magy

e focus of Broek-op-Langedijk-based E-magy is on lithium-ion battery anodes. ese are traditionally made from graphite, even though it has been known for a long time that silicon would be vastly superior in terms of energy density. e reason is that silicon can’t handle the mechanical stress associated with repeatedly taking in and letting go of lithium ions.

E-magy’s parent company, RGS Development, created a casting process that results in ‘nanosponge’ silicon, which doesn’t crack under the pressure of entertaining guests. is material can achieve a 40 percent higher energy density than traditional graphite anodes while shortening charging times and reducing the cost of production.

Focusing on the electric-vehicle market, E-magy currently has one production facility operational and is making preparations to expand. e company is targeting to churn out 3,000 tons of nanoporous silicon annually, enough to supply up to half a million EVs each year.

Credit: E-magy

Leydenjar

Like E-magy, Leydenjar has set its sights on silicon anodes for lithium-ion batteries. Unlike E-magy, however, it’s not selling the material but the manufacturing equipment. e company’s core technology was originally developed by PV research institute ECN in hopes of obtaining better-performing solar cells. e nanotextured silicon, produced using a plasma-enhanced chemical vapor deposition (PECVD) process, didn’t do well in that particular application but, as it turns out, makes for ne anodes. Leydenjar claims an increase in energy density of up to 70 percent compared to graphite anodes. e Leiden-headquartered company initially spent a lot of time to prove the real-world advantages of its anode manufacturing process, as well as its commercial viability. Next, it established a pilot production line in Eindhoven, allowing for customers to put in a sample order to get a taste of the technology. e nal step will be to develop roll-to-roll deposition equipment optimized for production.

Lionvolt

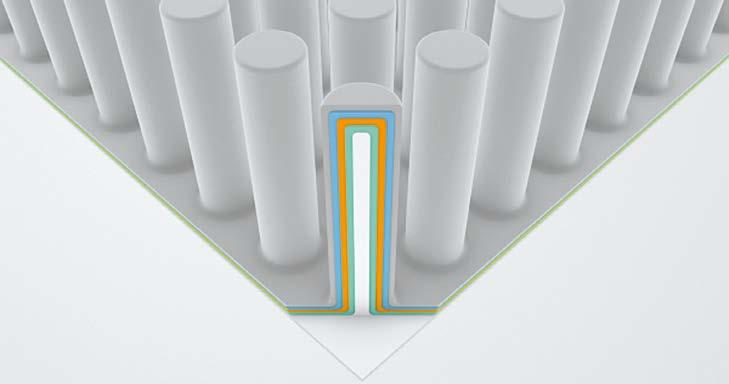

Lionvolt wants to become the rst Dutch manufacturer of battery cells – but not just any battery cells. e Holst Centre spinout has successfully demonstrated a proof of concept of a 3D solid-state thin- lm lithium- ion battery. It consists of a foil, covered with an array of micropillars, each coated with thin layers of battery materials: lithium-storing electrodes sandwiching an electrolyte. For simplicity’s sake, each pillar can be considered a tiny battery. is design has three main advantages. One: the lithium ions need to travel relatively short distances, translating into faster charging and de-charging times. Two: there’s no liquid electrolyte involved, meaning a longer lifespan and little to no danger of res or explosions. And three: the design is inherently lightweight.

Leveraging these advantages, Lionvolt will initially target the wearables market. In the longer term, larger versions of the 3D solid-state batteries will be developed for automotive and other markets.

Electron microscope image of E-magy’s nanoporous silicon.

SALD

Eindhoven-based SALD has a lot of similarities with Delft IMP. Both companies are developing ALD production equipment for a variety of applications. When used for contemporary lithium-ion battery manufacturing, the tools of both companies are used to apply a protective coating to the electrode materials. e processes involved are quite di erent, however.

SALD’s core technology is another ALD variety capable of high-throughput production, called spatial ALD. It involves leading a moving substrate past di erent precursor- gas zones, thus step by step building up a nanolayer.

Unlike Delft IMP, SALD applies the coating after depositing the powdered electrode materials on a substrate. is means that the particle surfaces are not covered entirely. For example, where particles touch, no coating can grow. According to SALD, this improves the ease with which electrons can move through the electrode.

Joining the Dutch workforce can be fraught with challenges, especially when coming from another country. While some cultural norms are easy to notice, learn and understand, others can be a little shocking or even frustrating for those with green behind their ears. In the Dutch work culture, it’s often that you need to look no further than communication.

According to ASML design engineer Marco Allegri, who joined the Dutch work culture from Italy, the transition can be a little frustrating. But, he says, once you learn where it stems from, you’ll learn to appreciate the typical Dutch communication style.

hightechinstitute.nl/dutch-culture

Anton van Rossum anton.van.rossum@ir-search.nl

Ask the headhunter

B.T. asks:

I’ve been working as an analog IC designer in the Netherlands for almost two years now. I did my bachelor’s at a university in Tamil Nadu, India, where I was born. I then worked for about four years as a PCB and layout engineer, before I had saved enough to move to Delft and do my master’s there. After completion, I started in my current position.

Recently, my manager told me my department will be closed in six months. The activities are relocated to Arizona, where my company is now recruiting plenty of staff. Of course, I think it’s a shame. I have great colleagues and I’ve learned a lot here. On the other hand, I know that there’s always work to be found for my specialism and I’m open to anything.

When I applied for a position at a large chip company in Eindhoven, I soon received a phone call from an HR employee, inviting me for a screening. Initially, he was very positive about a follow-up video interview, but the next day, he called me to cancel. Under the existing knowledge migrant legislation, they would be obliged to give me a higher salary than allowed by their classification based on education and experience.

I didn’t take it completely seriously at first, but it turns out to be the case. According to the applicable rules, because I only have two years of work experience after my master’s and turned thirty this year, I’d have to earn 4,752 euros gross per month with a new employer in the Netherlands, which is 61,586 euros per year. This salary is considerably higher than what I get now.

According to the HR employee who brought it up, this could make it very difficult for me to find a job in the Netherlands. For most companies, I’m ‘too expensive’ compared to other engineers with my experience. Can you help me find an employer for whom the salary limit isn’t a problem, or can you offer an alternative solution?

The headhunter answers:

The Netherlands enforces an agedependent salary criterion for highly skilled migrants: a minimum of 45,153 euros under the age of 30 and 61,586 euros above that. This criterion is a nuisance to you and many others. You’ll be subject to it as long as you continue to work for the same employer – even after you turn 30. When moving to another company, your age at that time applies. That’s what the HR employee saw on the IND website and what he based his conclusion on.

What he’s overlooking, however, is that there’s an exception to this rule for highly skilled migrants who qualify for the reduced salary criterion. This continues to apply, even if a migrant subsequently moves to another employer. The reduced salary criterion isn’t age-dependent; it applies if you meet the condition for the “orientation year for highly educated persons” and if you apply for a residence

permit for work as a highly skilled migrant within three years after your graduation or promotion date or the date on which the residence permit for scientific research expired.

The reduced salary criterion also applies if you didn’t get a residence permit for the orientation year for highly educated persons, but do meet the conditions for that purpose of residence. Because you graduated less than three years ago, you’re eligible. If I were you, I’d contact that HR employee again – maybe you can still get an interview for the position.