“means

“means

By Andrew Weiland, staff writer

By Andrew Weiland, staff writer

Cookware manufacturer Regal Ware Inc. is planning to move its corporate headquarters from Kewaskum to an office building on the far northwest side of Milwaukee.

A permit application with the city of Milwaukee indicates that the company plans to establish an office in the One Park Plaza office building at 11270 W. Park Place. A commercial real estate industry source confirmed that the company plans to move its corporate headquarters to the 12-story building and will occupy about 20,000 square feet of space there.

In March, Regal Ware announced that it was selling its headquarters building at 1675 Reigle Drive in Kewaskum to the village of Kewaskum, which will use it for a village hall, police station, library and community programming.

At the time, Regal Ware indicated that it planned to move the employees from its headquarters to a new location, likely in the northwest part of Milwaukee County.

Regal Ware also has a manufacturing plant in West Bend. The facility, located at 1100 Schmidt Road, continues to grow with the addition of a second shift, the company said in March.

A spokesperson for the compa -

ny declined to disclose the plans for its headquarters, but said an announcement was coming soon.

The One Park Plaza office building in Milwaukee was built in 1984 and renovated in 2000. Last year, it was sold for about $21.8 million to a New Jersey-based entity.

A brochure for the building indicates that it has about 35,000 square feet of vacant space, including the entire 18,000-squarefoot eighth floor and 12,500 square feet on the seventh floor.

Other tenants in the One Park Plaza building include the corporate headquarters for A.O. Smith, The Manitowoc Company and Douglas Dynamics.

JLL handles office space leasing for the One Park Plaza buildings. Representatives of the firm could not be reached for comment.

One Park Plaza is part of what is considered by the commercial real estate industry to be the northwest suburban submarket for the metro Milwaukee office market. That submarket has a 26% vacancy rate, according to JLL’s first quarter Milwaukee office market report. That’s higher than the 23.7% office space vacancy rate for the metro area and the 24.3% office space vacancy rate for the suburbs. n

“I thought, ‘Did I want to start another company from the ground up?’ It’s a long process and it’s tough. It just so happened that one day my daughter broke her phone and I thought, ‘Wow, what a business that is.’”

“When I worked with uBreakiFix, I played a large part in growing the concept to over 700 locations across the nation. This is the kind of growth trajectory I see taking place for PayMore.”

THE FRANCHISE: Massapequa, New Yorkbased PayMore buys, sells, trades and recycles electronics through its brick-and-mortar stores and e-commerce platform. Launched in 2011 by founders Erik Helgesen and Stephen Preuss, Paymore has grown from a single storefront on Long Island to a fast-growing national franchise with 12 locations open and 77 in development.

2011:

Tim VenHaus’ life turned upside down after he was hit by a drunk driver one day while riding his motorcycle. Bedridden for two years, VenHaus was forced to let go of the auto body business he had owned for a decade and explore other options. The experience kickstarted a career in franchising, starting with electronic repair chain uBreakiFix as one of its first franchisees.

DECEMBER 2021:

Upon selling his seven area uBreakiFix stores, VenHaus wasn’t quite ready to retire. Some light research on top franchise brands led him to PayMore, which at the time only had a couple of locations on the East Coast.

MAY 2022:

VenHaus signed a multi-unit deal to bring the PayMore brand to Wisconsin. He saw a need for a retailer that would allow consumers to sell or recycle their old devices and purchase used electronics at a reasonable price.

“It was important that I understood what (PayMore’s founders) were doing but also that they understood this isn’t my first rodeo. I’ve been through this, and I can help them grow their franchise.”

NOVEMBER 2022:

PayMore’s first Wisconsin location opened. The 1,800-square-foot storefront is the first of three Milwaukee-area stores VenHaus plans to open in the months ahead.

THE FRANCHISE FEE: $35,000

LEADERSHIP:

Mag Rodriguez, founder and CEO

HEADQUARTERS:

Milwaukee

WHAT IT DOES:

EVEN’s platform allows musicians to sell their music directly to fans.

FOUNDED: 2022

EMPLOYEES: 12

NEXT GOALS:

Launch new platform features and continue to onboard new artists.

FUNDING:

$2.2 million

EVEN LABS INC. founder and chief executive officer Mag Rodriguez went from managing Milwaukee rapper IshDARR to helping some of the world’s most famous artists sell their work and connect with fans.

Through EVEN, a blockchain-based platform, artists can sell their music directly to fans before uploading it on traditional streaming platforms. Fans who use EVEN are given access to exclusive content, merchandise and ticket offers. The startup recently announced the completion of a $2.2 million seed round, an achievement that’s been built upon years of experience in the music industry.

“We’re not trying to recreate any wheel, we’re just trying to simplify an industry that’s been a little bit outdated for the past two to three decades,” said Rodriguez.

He’s worked professionally in the music

industry for a decade but has been making his own music since he was 10 years old.

“When I got to high school, that’s really when I started taking (music creation) more seriously,” said Rodriguez. “Some of my classmates were incredible artists. One of those artists was IshDARR, who was two years younger than me. We started releasing music and it really started to make waves.”

By the time he graduated from high school, Rodriguez found himself touring the world with well-known rapper Schoolboy Q and IshDARR. He spent six years managing IshDARR, playing every role from DJ to producer.

In 2018, Rodriguez was first introduced to the world of venture capital. While pondering a break from management, he was approached by startup accelerator gener8tor. The organization wanted to launch a music accelerator program in partnership with Radio Milwaukee. He was hired to help build the music accelerator from the ground up with these two organizations.

“I didn’t really know startups or venture capital before working with gener8tor,” said Rodriguez. “I didn’t know that was a thing. I knew all the pain points of the music industry. I didn’t know it was actually possible to work on fixing them.”

He began developing EVEN at the end of 2021 and pitched it to gener8tor co-founders Joe Kirgues and Troy Vosseller. That earned

Rodriguez his first $100,000 investment and he began developing the platform full time. EVEN officially launched last October and now has 30,000 users.

Rodriguez said the point of EVEN isn’t to be a streaming platform. It’s to help connect artists to some of their most loyal fans.

EVEN uses blockchain technology simply for the automatic execution of smart contracts. Artists are typically paid two to three months after every streaming period through popular platforms like Spotify. Blockchain technology allows EVEN to pay everyone from artists to their labels instantly after every transaction.

“It really opens up opportunities within the industry. You hear about these horrible record deals and part of the reason why these deals exist – and advancements in the industry – is because of the payment structure,” said Rodriguez.

EVEN allows artists to make money off projects before they hit traditional streaming platforms. They no longer need to take advancements to go on tour or pursue additional projects.

A large portion of the startup’s seed money has been used for hiring. The company is also working on building out new features for the platform.

Rodriguez hopes the company can complete 350 releases and onboard 600 artists before the end of the year. n

President and chief executive officer, Talus Solutions

As head of a Pewaukee-based cybersecurity firm, Mike Grall’s favorite tech-related products have a security and privacy slant to them, whether for personal use or to apply to corporate security concerns.

“With a plethora of cloud-based home automation tools out there, privacy concerns have risen about what parts of your information are being tracked. This open-source platform has evolved to be much easier to install and support without requiring as much technical know-how.”

“If you are bothered by all the ads that pop up on your tablets, smart TVs, smartphones and PCs at home, you can intervene at the network level versus trying to do it with browser plug-ins. Pi-hole’s opensource solution allows you to better protect your family from questionable content, malicious domains, phishing sites and online information tracking no matter what device you are using online while in your home. By blocking these undesirable ads, you may also improve your internet bandwidth and lower your data usage.”

“On the corporate front, there is a constant influx of new security technology. One area in the security space recently catching our attention is the injecting of security capabilities into the app/data source itself. For data lakes, an interesting technology to watch is Theom.ai, especially as you have more and more data in the cloud. Its early warning capabilities and fine-grained access controls gives users the ability to adopt next generation data protection strategies.”

“As it pertains to mobile applications, Zimperium’s zDefend solution allows developers to embed security into a mobile app so the app is protected and secure on any end user mobile device even if it doesn’t have network connectivity. This is very interesting when deploying your apps to devices you can’t manage.” n

“I have had the opportunity to grow with the agency over the past 18 years. Joining the team as the first account executive, learning everything from the ground up. I was eager to take on any challenge and became involved in the agency’s day-to-day operations. This has positioned me to lead the way like great leaders led me.”

“Catch-22 Creative truly cares about the people that make up the C-22 family, both employees and clients. We encourage employees to take their role within the company to where they’d like it to go, playing on everyone’s strengths and goals. And I did just that, evolving my role into what it is today.”

“Many see marketing as an expense versus an investment. Because of this, it is often one of the first line items within a budget to be cut or reduced when needed. Marketing and advertising, when done well, will have a far greater return than the initial investment. A key tool in present and future growth for businesses.”

“Do not let the confines of your job title determine your career path. Be eager to learn and share ideas. The world of marketing is changing every day and having the self-drive to continue to learn and develop new and existing skills is so important. A good leader will see this hunger and identify you as an invaluable member of the team.”

“My husband and I love visiting downtown Milwaukee to enjoy great food and attend live music concerts.” n

NIKKI WAGNER

President Catch-22 Creative

HOMETOWN: Plymouth

EDUCATION: Bachelor’s in business administration from the University of Wisconsin-Whitewater

PREVIOUS POSITION: Vice president of Catch-22 Creative

Stoughton-based startup The Virtual Foundry is making it possible to 3D print almost any material you can think of using the company’s patented product, known as Filamet.

With the Filamet process, a 3D printer originally intended to print plastic can be converted to also print metal and other materials such as ceramics and glass.

Founder and chief executive officer Brad Woods began creating The Virtual Foundry almost two decades ago. He was previously a software architect at American Family Insurance. While creating his sculptures as a personal hobby, Woods found himself trying to make metal parts. Without his own foundry, this proved to be an unrealistic task. So, he began looking into different ways metals can be manipulated by using chemicals, through methods like electroplating and electroforming. He eventually began working with metal powders. At around the same time, a friend gave him a 3D printer.

“It didn’t take long to realize that I could merge the two concepts,” said Woods. “We’re working with metal powders that are held together by plastic. All our products work the same and it’s fairly simple when you look at it that way.”

Using Filamets to 3D print metals and other materials is cheaper compared to the commercialized methods being used today. Woods said most people can begin 3D printing using Filamets for about $10,000.

He garnered the initial funding to officially launch The Virtual Foundry in 2015 through a Kickstarter campaign, which raised $32,000. The money was enough to purchase the commercial equipment needed to begin manufacturing Filamet products.

Filamet is a combination of two words: filament and metal. The first two Filamet products launched were copper and bronze.

The Virtual Foundry’s current materials catalog lists 13 stock Filamets, including aluminum, bronze, copper, high-carbon iron, stainless steel and tungsten.

The Kickstarter campaign, initially pitched as more of an art project, drew the attention of the Department of Defense and several aerospace companies and auto manufacturers. Engineers from Maryland-based Lockheed Martin even invited Woods to speak at the company’s campus.

“They looked at it and realized if you can do that with a sculpture, you can do that with

anything that’s metal,” said Woods.

Today, the bulk of The Virtual Foundry’s customers include different research organizations. Well-known organizations like SpaceX, Tesla and the United States National Lab System use Filamet for their research projects.

One of The Virtual Foundry’s customers is working on spinal implants using titanium. Another, a subcontractor for NASA, tapped the company for a Filamet to create a material that simulates moon dust.

“It’s unlike any other method of manufacturing that we’ve had before. What’s happening with 3D printing is it’s an opportunity to solve problems in a way that’s never been available before,” said Woods.

In the coming months, his most immediate goals are expanding marketing efforts and attracting new clients. n

• Mary Kellner, co-chair

• Gerard Randall Jr., co-chair, executive director, Milwaukee Education Partnership

• Ray Allen, president and CEO, Columbia Savings & Loan

• Lisa Bangert, attorney, Advocate, Attorney at Law LLC

• Anthea Bojar, dean emerita, Cardinal Stritch

• Marianne Burish, executive vice president, Transwestern

• Berdie Cowser, VP of housing and development, Center for Veterans Issues

• Sister Angelyn Dries, former Cardinal Stritch religious studies professor

• Most Rev. Jeffrey Haines, auxiliary bishop, Archdiocese of Milwaukee

• Jeff Hembrock, former president, Miller Brewing Co.

• Shandowlyon Reeves, founder and CEO, Emerita Project Hope Inc.

• Michael Hostad, executive director, Fork Farms Foundation

• Greg Kabara, superintendent, Nicolet Union High School

• Becky Pinter, president and CEO, MACC Fund

• Steve Rogers, founder and president, Rogers Consulting Inc.

• Thelma Sias, CEO, The Sias Group

• Tony Shields, president and CEO, Wisconsin Philanthropy Network

• Sr. Joanne Schatzlein, liaison to corporate ministries, Sisters of St Francis of Assisi

• Tom Tuttle, trust officer, VP and director, Provident Trust

Education:

Bachelor’s, Beloit College; master’s, Yale University

What was your first job, and what did you learn from it?

“Albert Lea Seed house (in Minnesota) – hard, physical work.”

What piece of advice has had the most significant impact on your career?

“Freedom consists not in doing what we like, but in having the right to do as we should.”

If you could have dinner with any two business leaders, who would you choose and why?

“Warren Brule passed away about eight years ago. He founded MJ Electric in Iron Mountain, Michigan. He was tough, generous, smart and hard working. I learned a lot just watching and being with him. My Uncle George Ehrhardt ran the Albert Lea Seed house. I worked for him for six summers in high school and college. He was incredibly hardworking, tenacious and had a great way with customers. In his spare time, he engaged a lot of troubled young men (including me).”

What are some of your favorite destinations or places to visit?

“Our home in Sturgeon Bay. I also really enjoy Spain.”

What is one book you think everyone should read?

“‘History of Christendom’ by Warren Carrol.”

What’s your hobby or passion?

“I love to work, garden and cook.”

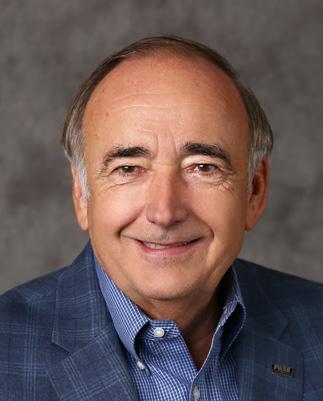

Bob Atwell co-founded Nicolet National Bank in 2000. He led the Green Bay-based bank as chief executive officer until 2021 when he transitioned to executive chairman. Under his leadership, Nicolet grew to 55 branches, with locations in northeast and central Wisconsin, the Upper Peninsula, northern Michigan and eastern Minnesota. In 2021, Nicolet made two acquisitions – Mackinac Financial Corp. and County Bancorp Inc. – which were followed by the acquisition of Charter Bankshares Inc. last year. Atwell has served as lead director for the AriensCo board and on the board of Hospital Sisters Health System, Great Northern Corp., Saris Cycling Group, Promotion Management Inc. and the University of Wisconsin Board of Regents. He is also past chairman and one of the founders of Relevant Radio, a national Catholic radio network.

What is your favorite Wisconsin restaurant and what do you order there?

“Three Brothers in Milwaukee. Great family-run Serbian place (cash only). Anything on the menu.”

What would people be surprised to learn about you?

“I have 11 children. It’s not as hard as you might think. God provides the strength we lack.”

What was your first car? How long did you drive it for?

“1978 Buick regal. 10 years.”

If you could take a one-year sabbatical, what would you do?

“Teach business.”

What’s the toughest business challenge you’ve ever faced?

“The Great Recession devastated the banking industry and many of our customers. We faced our problems honestly, worked with our customers and came out much stronger for the challenges. I lost a lot of sleep and my hair turned white, but it was the greatest period of professional growth I have had.”

What advice would you give to a young professional?

“Focus on helping people around you grow. Accept responsibility and spread the credit to others. Remember your history but don’t be paralyzed by fear. Put your heart into people.”

What has been your company’s most significant success over the past 12 months?

“We closed three acquisitions in 13 months and added a lot of new talent.”

What is one thing you would change about Wisconsin to make it even better?

“Our K-12 education system used to be best in the country.”

As you enter your office, what would you choose to be your walk-up or theme song and why?

“That doesn’t sound like my style at all.”

Is there a nonprofit cause that has special meaning to you?

“Anything that teaches young people faith, hope and love. I care about my Baby Boomer generation, but we are leaving young people an incredible mess. I feel an urgency to prepare them for the difficult times they face.”

What is the biggest risk you have ever taken?

“Quitting a great job with an established company to cofound Nicolet.”

What’s at the top of your bucket list?

“I don’t really subscribe to the whole bucket list thing. I just want to use my time well to grow in love of God and neighbor.”

What has you most excited about the future?

“Seeing my own children, grandchildren and other young people grow.” n

YOU CAN’T ARGUE with taste. Milwaukee-based Top Note Tonic has created a line of mixers and soft drinks with an award-winning flavor. Top Note’s Classic Tonic Water has won more awards than any other tonic water currently on the market, according to cofounder Mary Pellettieri.

She left a career of more than 25 years in the craft beer business to start Top Note Tonic in 2015, but not before gaining some experience by helping Chicago-based Goose Island Brewery launch a line of specialty sodas. Then, she tapped into co-founder Noah Swanson’s experience as a home brewer.

“I was bored on the weekend, so I started making these soda syrups, and over time I thought we should just make these and sell them at farmers markets,” said Pellettieri.

That’s how Top Note got its start. Pellettieri and Swanson worked in a commercial kitchen within the Lincoln Warehouse building in Milwaukee’s Bay View neighborhood to create their soda syrups. The company’s first flavors included bitter orange and lemon, an Indian tonic water and a ginger beer.

They used whole ingredients like grapefruit peel, herbs and lemon juice to create the flavors they desired.

“We went back to that idea that tonic could be kind of an herbal tincture, and we made a lot of herbal-style cocktail syrups,” said Pellettieri. “We take a craft, American approach to a very traditional category.”

The name Top Note references the first aromas and flavors that tickle a drinker’s senses when they have a glass of wine or another

“We did a blind tasting when we were formulating and it was kind of surprising how little actual flavor is in (competing products),” said Swanson. “There’s often times citric acid in there, a little bit of color and sweetness, and it drops off from there.”

Still in growth mode, Top Note uses local co-packers, including Sprecher Brewery, to make its soft drinks and mixers. The syrups are formulated

When Pellettieri and Swanson

531 S. Water St., Milwaukee

INDUSTRY: Beverage manufacturing

EMPLOYEES: 2 store.topnotetonic.com

initially began looking for manufacturers to recreate the syrups they were perfecting for use in ready-to-drink products, the pair were unhappy with how the products were turning out. They brought the formulation work back in-house and set about re-tooling them in their own kitchens.

Top Note relies on a handful of different flavor suppliers for its products; those flavors are often mixed on-site by the company’s co-packers. The company produces around 25,000 cases of its mixer and soft drink bottles per year.

“When you do ready-to-drink (products), no one is going to sit there with a kettle of herbs for your batch,” said Swanson. “It’s going to come from companies that make natural extracts.”

When concocting Top Note’s ginger beer formula, there were 30 different test batches at play. Perfecting the stability, flavor and color was key, according to Swanson.

Top Note is now pivoting into the craft soda market and will soon launch its take on a cola as well as a lemon-lime soda.

“One of our goals is to source everything from the USA if possible, and right now the bottles are not coming from the U.S.,” said Swanson, adding that the cost per

bottle has doubled since Top Note started.

“I’d like to be a national, even international brand someday, but we’ll start with local and regional and see where we go,” said Pellettieri. “It’s a growth mindset.”

Top Note plans to leverage its growth in 2022 into this year by expanding its selection of packaging into aluminum cans and entering new partnerships with distributors, beverage manufacturers and retailers across the U.S.

“In 2023, we look forward to servicing new opportunities, like retail stores who are focusing on non-alcoholic products and individuals seeking better-for-you soft drinks that happen to taste delicious as well,” said Pellettieri. n

WHEN MILWAUKEE officials unveil multi-year plans for key city neighborhoods, there is often a lot of fanfare – colorful drawings of ambitious projects eliciting excitement from residents and media alike.

But once the plan is approved and filed away as part of daily business, residents can often be left wondering when any of the grand, or even more practical, plans will come to fruition.

The recently unveiled draft of the “Connec+ing MKE - Downtown Plan 2040” is full of ambitious ideas for nearly every corner of the downtown Milwaukee area, from renderings showing a reimagined MacArthur Square with soccer courts and other amenities to as-yet unfunded plans to extend of The Hop streetcar to Westown, Bronzeville, Walker’s Point and the East Side.

But there are also plenty of projects that residents could see

taking shape as early as this year or next.

In Westown, construction will begin this year on Vel R. Phillips Plaza – a 30,000-square-foot gathering place at West Wisconsin and North Vel R. Phillips avenues designed to honor the late alderwoman, jurist, attorney and civil rights activist.

Slated to be completed by summer 2024 – in line with the completion of the Wisconsin Center expansion and the start of the Republican National Convention – the plaza will feature a 2,900-square-foot food and beverage retail space, a garden, a flex space that could host farmers markets, food trucks or other community events, public art installations, and a station to accommodate Milwaukee County’s Bus-Rapid Transit Line.

The $15.75 million financing package for the project, which comes from a tax increment financing district, also includes $4.35 million for infrastructure and lighting improvements in the area and $500,000 for the Commercial Revitalization Grant Program that provides financial assistance to commercial property owners for building renovations and improvements.

The project will coincide with street improvements along Vel R. Phillips Avenue, which will make the street more pedestrian friendly and reinforce its connection to the Deer District.

Speaking at a press event celebrating the passage of a funding resolution for the project, Alderwoman Milele Coggs, who considered Phillips a mentor, said the plaza will provide key amenities while teaching visitors about the local trailblazer.

“As we look at the nearly

half-billion-dollar expansion of the Wisconsin Center that is taking place right behind us and think about the tens of thousands of additional folks that will be coming to visit our great city of Milwaukee, it makes so much sense that as they come for the conferences and conventions that their experience is elevated by being able to see a wonderful plaza right across the street that helps to uplift and remind folks about one of our great treasures right here in Wisconsin, Ms. Vel R. Phillips,” Coggs said.

As work begins on Vel R. Phillips Plaza, streetcar crews should be well on their way to finishing the final pieces of The Hop’s Lakefront Line.

After years of delay tied to construction delays for The Couture, construction on the Lakefront Line quietly resumed in late April. Crews are working on the 800 block of East Michigan Street in the shadows of the rising apartment tower as they prepare to lay parts of the final half-mile horseshoe of track for a line that will eventually take streetcar passengers from Broadway east along Michigan Street, into a modern transit center on the ground floor of The Couture, and then west along East Clybourn Street to North Milwaukee Street.

The lion’s share of the $14.2 million spur was completed in 2019, but completion of the east end was delayed as officials and contractors waited until enough progress was made on The Couture to allow for the bones of the transit center to be laid. Developed by Barrett Lo visionary Development, the 44-story apartment tower is slated to be complete by early 2024, but some residents could begin moving in this fall.

Speaking about construction on the Lakefront Line, Department of Public Works commissioner

Jerrel Kruschke said the final leg of the spur is expected to be completed by the end of July. Once the track is completed, there will be a few months of testing. Service on the line is expected to begin sometime by the end of the year, he said.

“Right now, we are targeting the beginning of November,” Kru schke said. “We’re pretty excited.”

Once done, the spur will include three new stops: one at Jackson and Michigan streets, one at Jackson and Clybourn streets, and the stop at The Couture tran sit center. In addition to hosting the streetcar, the transit center will also serve as a key stop for the East-West Bus Rapid Transit line, which is also expected to be ready for riders later this year.

As the transit center at The Couture takes shape, project watchers can also keep their eyes peeled for a 142-foot-long, 28-foot-tall curved “LED wall screen,” slated to be erected sometime this fall.

Another near-term goal of Connec+ing MKE - Downtown Plan 2040 is to redevelop the northwest corner of East State and North Water streets. That is currently the site of the Marcus Performing Arts Center parking ramp at 130 E. State St., but city officials are on the cusp of issuing

a request for proposals seeking redevelopment ideas for the site.

The new downtown plan calls for the sprawling parking structure to be replaced with “a new high-density, mixed-use development that adds density and vibrancy to the district.” The hope is that giving the site a more active use might spur development of underutilized sites in the area including surface parking lots along Water Street and the RiverWalk, the plan states.

Other “short-term” priority projects listed in the plan include extending the street grid north

of West Wells Street and west of North Sixth Street and providing ADA compliant pedestrian access near the terminus of East Kilbourn Avenue between North James Lovell and Sixth streets.

The plan also calls for the city to redesign several downtown streets to make them safer for pedestrians and bicyclists. Those slated to take place in the next few years include Sixth, Walnut, Van Buren, and East Wells Street from North Broadway to North Van Buren Street.

Officials with the city’s Department of Public Works and Wisconsin Department of Transportation are already in the design phase of the Wells Street reconstruc-

tion project, and construction is currently slated to take place sometime next year.

Those interested in reviewing the entire draft of the Connec+ing MKE plan may do so at www. milwaukee.gov/downtownplan. Dialogue is encouraged at www. connectingmke.com, where users can continue to participate in the virtual open house and provide feedback until May 22.

The plan will be presented to the City Plan Commission and the Milwaukee Common Council for adoption as part of the City’s Comprehensive Plan this summer. n

AS COMMUNITIES across the state continue to struggle with a dearth of single-family homes on the market, especially those affordable enough for working-class families, community-based efforts have sprouted to help subsidize new housing developments.

In Sheboygan County, where a housing shortage has made recruiting and retaining workers a struggle, several major employers including Johnsonville, Kohler Co., Masters Gallery Foods Inc. and Sargento Foods Inc. have provided $8 million to the Sheboygan County Economic Development Corp. to subsidize affordable, single-family home developments.

In Milwaukee, an affordable housing project slated to kick off soon in King Park will provide entry-level, single-family homes while also working to address racial disparities in housing that have long contributed to poorer health outcomes from Black and Hispanic communities.

Funded by a $6 million, competitive American Rescue Plan Act grant from the state, the infill development aims to construct at least 120 single-family homes over

A master redevelopment plan envisioned for the half-vacant Regency Mall in Racine could net up to $39.4 million over the next 27 years if proved successful.

Racine aldermen recently approved the “pay-go” deal as part of a new 138-acre tax increment financing district for the mall area. Under the agreement, Augusta, Georgia-based Hull Property Group, the owner of the mall, will work as a master developer, paying to raze 400,000 square feet of the more than 800,000-square-foot structure. While maintaining ownership of the downsized mall, Hull would then use increment-funded incentives to market the 36 acres surrounding the mall to developers.

“All of the risk is on us,” said John Mulherin of Hull Property Group. “If we don’t perform, we’ve lost a lot of money.”

DEVELOPER DEAL: $39.4 million pay-go TIF

DEVELOPER: Hull Property Group

LOCATION: Regency Mall, 5538 Durand Ave., Racine

GOVERNMENTAL ENTITY: City of Racine

the next three years in the near northwest side neighborhood.

Designed for first-time home buyers, the houses are expected to be about 1,000 square feet in size with three bedrooms and one bathroom and should be priced at around $100,000, said Jim Mathy, Milwaukee County’s housing division administrator.

The houses will be constructed on vacant single-family lots scattered throughout the neighborhood, spanning roughly from West Vilet and North 13th streets to West North Avenue and North 27th Street.

The county worked with the Community Development Alliance to issue a request for proposals for the project and two developers were selected: Milwaukee Habitat for Humanity and Emem Group LLC.

Habitat expects to begin construction on its 30 homes – as part of the first phase of the development – by early June. Those homes should be done by early 2025, Mathy said.

The county is still working on what the specific income restrictions will be for would-be buyers of the homes, but Mathy said a goal with the development is to improve the homeownership disparities that currently exist in the county among Black and Hispanic Families.

“The concept behind all of this is looking at housing through the lens of racial equity,” Mathy said.

According to data recently shared by Milwaukee County chief health policy advisor Dr. Ben Weston, only 27% of Black and 38% of Hispanic individuals in the county own their homes. That’s compared to a 56% homeownership rate among white individuals.

“Housing and health are inexorably linked. Neighborhoods and individuals with insufficient, unreliable or unstable housing are at risk for worse health outcomes,” Weston said. “For example, a Black person in Milwaukee County lives on average 13 years less than a white person in Milwaukee County.”

With the King Park homes project, the county is looking to help not only Black and Latino families, but also the neighborhood at large.

Any homes constructed as part of the project, for instance, will have deed restrictions that ensure they remain permanently affordable. Additionally, the county is spending another $1.5 million in county ARPA funds to make renovations to King Park itself, specifically the Dr. Martin Luther King Jr. Community Center.

The county decided to focus on the area as part of its effort to build a new Marcia P. Coggs Human Services Building on a vacant parcel at 1260 W. Cherry St., while also seeking ideas to redevelop the existing Coggs building just a few blocks away at 12th and Vilet streets, Mathy said.

“We wanted to see how we could really improve the surrounding neighborhood,” he said.

Brian Sonderman, executive director of Milwaukee Habitat for Humanity, said his organization is excited about the project but more developers, nonprofits, businesses and governmental entities need to step up to help fill the void.

“There is not enough new single-family home construction happening in the city, especially for homes under $350,000. There are very few builders constructing homes for less than that,” Sonderman said. n

Waukesha-based merchandising agency Sky High Marketing plans to build a new corporate headquarters.

After briefly exploring renovating the former Associated Bank building at North Grand and Wisconsin avenues in downtown Waukesha, the firm recently received city approval to construct a 38,960-square-foot facility on an 11.8-acre site in the Waukesha Corporate Center, a 90-acre business park on the city’s southern edge. Sky High is currently located at 259 W. Broadway in Waukesha.

The new building will feature a mezzanine office level with an outdoor deck as well as a spacious outdoor patio. The site also provides space for, eventually, a 60,000-square-foot addition, according to a news release.

OWNER: Sky High Marketing

SIZE: 38,960 square feet

ADDRESS: Waukesha Corporate Center, Highway 59 and Center Road

CONTRACTOR: Briohn Building Corp.

When there’s a lot at stake, it’s essential to work with a bank focused on delivering what businesses need without wasting your time. For more than 30 years, our focus on business has led to unmatched expertise, industry-leading service, and smarter financial decisions.

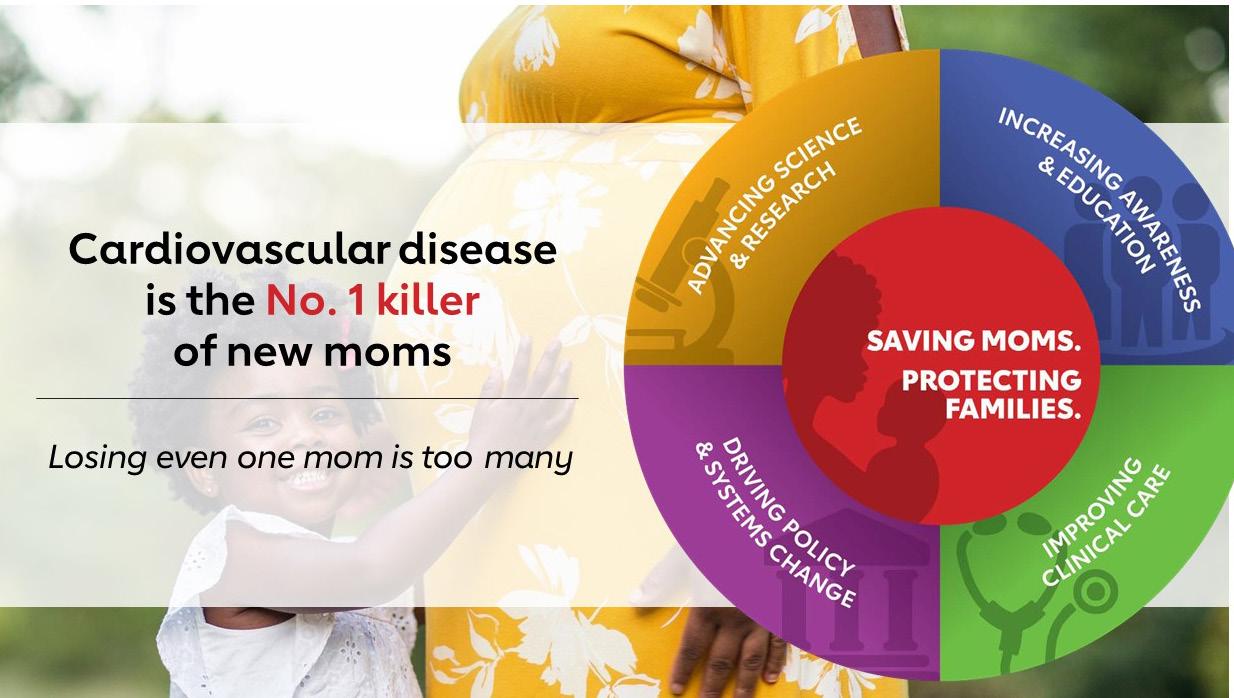

WHEN IT COMES TO PROGRESS with health equity in the workplace, and specifically for women, there has been some positive movements through the years.

But while those steps forward are significant, there’s still plenty of work to keep that momentum going – and that continues to be a focus for the American Heart Association.

The Milwaukee market will hold its annual Go Red for Women Luncheon on Friday, May 12, at The Pfister Hotel, where the focus will be on the Association’s continued initiative to increase women’s heart health awareness and to serve as a catalyst for change to improve the lives of women locally, nationally and globally.

At or near the forefront of issues that directly affect women is maternal health –and there currently is a movement in Wisconsin to extend health care coverage for thousands of mothers to a full year. This state is currently one of just 10 without that currently in place.

“Not all women are mothers, but the whole continuum of health care for women is so important, especially if they choose to have families,” said Francesca Martinez, national director of health equity for the American Heart Association. “Whether it’s prenatal care ensuring that women have access when they have a pregnancy, to also that care during pregnancy, ensuring that the care is equitable, that they have access to health care, which is so important.”

And it’s not just during pregnancy where there is a gap, it’s afterward. In Wisconsin, mothers currently lose their coverage just 60 days after they give birth, even though there are still so many risk factors they face when it comes to health.

According to the Centers for Disease Control, the United States has the highest maternal mortality rates among developed countries, and pregnancy-related deaths in the U.S. have risen 140 percent in the last three decades.

“Post-partum, we want to ensure that both mother and child are healthy and are able to receive the care,” Martinez said. “But also looking at the follow-up. There’s new research that’s emerging if a woman has a high-risk pregnancy, what does that mean for her 10, 20, 30 years down the road? Or even immediately following pregnancy? Women’s health is so important, and how does that impact the child’s health as they’re growing up?”

An added element to the women’s health piece is the role they generally carry as the family’s main caregiver, Martinez said.

And that already had its struggles with an additional burden and stress even before the COVID-19 pandemic, which of course, altered life before, during, and after as we know it.

“Before the pandemic, we were seeing that women were carrying a lot more stress, the mental stress was increasing,” Martinez said. “And during the pandemic, that was exacerbated.” ♥

As an organization, the American Heart Association continues to take steps toward reaching that health equity-for-all-goal. Some of those include:

• Investing $100 million in science-based solutions to end structural health inequities.

• Launching a nationwide blood pressure initiative for Black, Hispanic, and Indigenous communities with the Department of Health and Human Services.

• Helping employers identify and dismantle structural racism.

• Improving access to quality care for under-resourced and rural communities.

• Discovering new connections between social determinants and health.

• Investing in local entrepreneurs who are breaking down the social and economic barriers to health equity.

But it’s important for every organization across the country to continue improving in this arena, Martinez said. “The leaders who are sitting at the table making decisions for companies, must ensure that there are more women voices, and women who are representative of all communities,” she said. “Just like one man can’t speak for all men, we know that one woman can’t speak for all women. It’s important that all dimensions of diversity are represented.

“There’s still so much opportunity, because we’re on a journey. Diversity, equity inclusion, justice, is a journey. There’s always an opportunity for us to ensure that all voices are included in decisions, at the table and all feel they have a place in our companies, organizations and communities.”

Dr. Patty Golden, DO, clinical president of Ascension Wisconsin

• Kim Hastings, president, CJ and Associates, Inc.

• Dr. Janice Litza, MD, FAAFP, regional chief medical officer, Ascension All Saints Hospital

• Adrienne Pedersen, communications professional

• Christy Stone, director of strategic partnerships and customer service, Milwaukee Public Schools

For more information visit heart.org/goredmilwaukee

It’s hard to fault anyone who saw news of Silicon Valley Bank’s failure in March and had flashbacks to the onset of the Great Recession.

It wasn’t hard to imagine the bank’s failures leading to troubles for hundreds if not thousands of businesses and their employees. Add in the failures of Signature Bank and First Republic, plus recent news that PacWest is considering a sale, many are worried about a contagion in the banking sector, which would have a devastating impact on the economy.

Nearly half of Americans say they are concerned about the safety of their money at banks or other financial institutions, according to a recent

Gallup poll.

The growing concerns about the banking sector have some remembering what happened in 2008. It took time to unfold. Bear Stearns failed in March of that year, but the bankruptcy of Lehman Brothers and bailout of AIG didn’t take place until September.

Despite growing concerns for the U.S. banking industry, in Wisconsin, many bankers express confidence in the strength of the banking sector and point to their steady, more conservative approach to business and focus on customer relationships as reasons they are well positioned.

“People need to realize that all banks are bet-

ter capitalized with stronger balance sheets than they were heading into the Great Recession. This is especially true of Wisconsin banks/banking,” said Mike Daniels, president and chief executive officer of Green Bay-based Nicolet National Bank.

Others also described Wisconsin’s banks as strong and on solid footing or noted the state has well-run companies, strong business leaders and a growing economy.

“The people of Wisconsin can take comfort in knowing our sensible, Midwest approach to business carries through to the way our banks operate,” said Bryan Johnsen, executive vice president and chief financial officer at Oak Creek-based Tri City National Bank.

“Overall, I view our state as a bit more conservative, which tends to avoid the highs and lows of some other markets,” said Kevin Kane, southeastern Wisconsin market president at Madison-based First Business Bank.

Wisconsin banks also generally look much different than Silicon Valley Bank, which had grown to more than $200 billion in average assets by the end of 2022. While U.S. Bank and BMO Harris Bank – both of which have a significant presence in Wisconsin – are larger, the biggest Wisconsin-based bank is Associated Bank, with just under $40 billion. Interestingly, a decade ago, Associated and SVB were nearly identical in size based on average assets at around $23 billion.

Fueled by deposits from venture capital-backed firms that were in turn invested in securities with longer-term maturities, SVB’s rapid growth posed a challenge for regulators, a Federal Reserve review of the failure found. The review also highlighted that SVB’s board and management failed to manage their risks.

“Managing a bank is never easy,” said David Schuelke, CEO of Brookfield-based Spring Bank. “The failure of SVB highlighted a few of the issues that banks face each day. Those being managing liquidity and the bank’s investment portfolio.”

Among the issues identified in the Federal Reserve review were incentives focused on shortterm profits, using less conservative stress testing assumptions to mask risks, making counterintuitive modeling assumptions about the duration of deposits and removing interest rate hedges.

“In sum, when rising interest rates threatened profits and reduced the value of its securities, SVBFG management took steps to maintain shortterm profits rather than effectively manage the underlying balance sheet risks,” the Federal Reserve review says.

To get a clearer picture of the health of southeastern Wisconsin’s banking sector, BizTimes Milwaukee reached out to more than 30 banks in the region with a series of questions about what doing business has been like since SVB’s failure, the impact of rising interest rates, potential for additional regulation and other areas of concern, like stress

in commercial real estate. In total, 14 responded.

Many reported taking additional customer calls in the aftermath of SVB. Others took the opportunity to reach out. They all highlighted the importance of having a relationship with their customers.

“It’s been an interesting several weeks, to be sure,” said Jim Popp, president and CEO of Racine-based Johnson Financial Group. “Technical things that we as bankers think about all the time – like capital ratios and liquidity – have become part of the discussion in coffee shops, sporting events and everywhere else. These are complex issues, and we’ve tried hard to provide all the transparency necessary to tell the story and present the strength and stability of our position without getting too deep in the weeds.”

The following are excerpts from responses provided by leaders of banks with a presence in southeastern Wisconsin:

BizTimes: Have you changed anything in the way you operate following the failure of Silicon Valley Bank?

Jim Popp, president and CEO, Johnson Financial Group: “We have not changed any of our fundamental, everyday processes or procedures. If we were watching inflows and outflows of deposits daily, we probably watched them hourly for the first several days after the news broke. Other than that, the news really hasn’t changed the way we are doing things.”

Scott Huedepohl, president and CEO, Community State Bank: “Not really, we only invest in very safe instruments that provide cash flow for us on a regular basis. Every bank, insurance company and mutual fund has invested in lower yielding investments that they wish they didn’t have, but those investments only lose money if you sell them.”

Jay McKenna, president and CEO, North Shore Bank: “North Shore Bank follows the same safety and soundness practices and high-touch customer service principles that have built thousands of trusted personal and business relationships throughout our history.”

Mike Daniels, president and CEO, Nicolet National Bank: “No – it is business as usual for us.”

Scott Cattanach, president and CEO, Peoples State Bank: “Peoples regularly balances risk contingencies with customer needs, so nothing sig-

nificant has changed specifically following the SVB failure. However, since interest rates began to increase in early 2022, we have reduced our purchase of new securities and targeted new securities with faster repayment speeds to reduce our exposure to unrealized market value losses.”

Edward Schaefer, president and CEO, First Federal Bank: “Not really.”

Kevin Anderson, market president and business banking president, Old National Bank: “No. The collapse of these niche institutions affected the operating environment for all banks. Specifically, it shined a spotlight on some traditional areas of strength for ONB, including granular deposits and loans (meaning we have many smaller-sized deposit accounts and a diverse balance sheet with an average loan size of approximately $1 million), low loan-to-deposits ratio, strong credit underwriting and low loan charge-offs.”

Steve Schowalter, executive chairman and CEO, Port Washington State Bank: “Certainly larger transactions get more review and scrutiny to determine if it is something in the ordinary course of business for an institution of our size or if it is something that warrants a contact to the customer or company to determine if there are any questions or concerns. Money is certainly moving around due to the rate environment and all banks are more protective of their core deposit base as those monies are generally less expensive than brokered or borrowed funds.”

BizTimes: What are the specific actions you and your bank take on a day-to-day basis to manage cash inflow and outflow?

Jay McKenna, North Shore Bank: “Our finance team tracks our liquidity positions in real-time. That along with planning for the inflows and outflows of the business allows us to be prepared for both the short- and long-term cash flow situations.”

Scott Huedepohl, Community State Bank: “We manage cash flow every day and have forever. We have taken a conservative approach in what we invest in. Whenever you have rapid rate adjustments you have to just spend more time on it.”

Mike Daniels, Nicolet National Bank: “We certainly prepared for the potential of some deposit outflows, which we never materially saw. It makes sense for all banks to have a deep understanding of their liquidity sources in a crisis, so what happened gave us a chance to go back and review those. While we were prepared, nothing really materialized.”

Scott Cattanach, Peoples State Bank: “Our bank has long maintained liquidity contingency

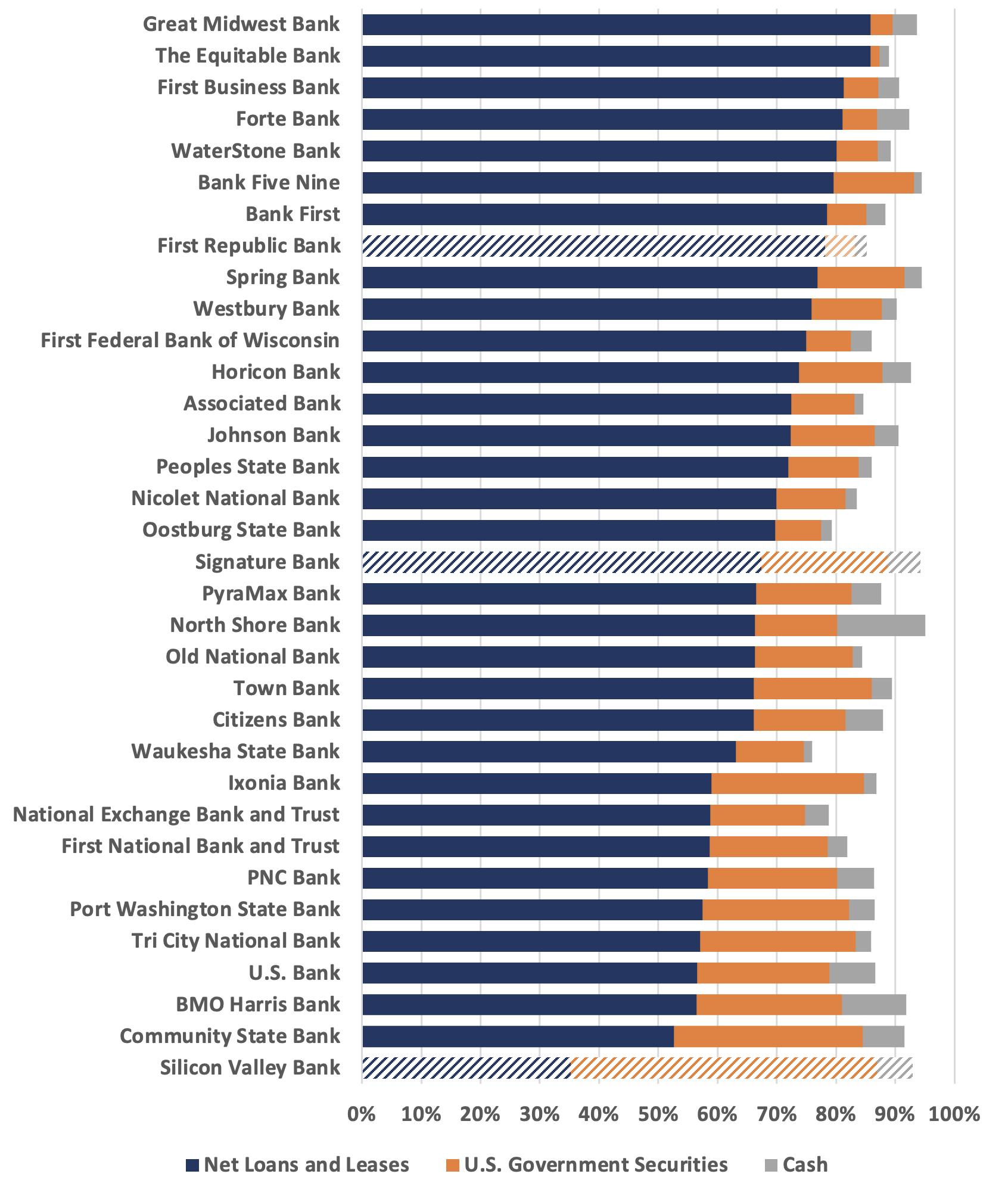

Sizing up southeast Wisconsin banks: Banks serving southeastern Wisconsin come in a wide range of sizes with many of them much smaller than Silicon Valley Bank and other banks that have failed recently. Others not on this list include JPMorgan Chase and Wells Fargo. Data on deposit growth includes acquisitions. Banks in bold provided respondes to BizTimes Media's questions on the health of the sector. * Data as

plans to support our normal and stressed operations, and we have always conducted quarterly liquidity stress tests. As part of our normal daily procedures, our CFO reviews our listing and maturity of out-of-area funding sources and works with our lending team to project cash and liquidity needs.”

John Hazod, regional chief financial officer, Town Bank: “The key component for managing cash inflow and outflow is having an understanding of your customer base and remaining in constant communication with our clients. We keep abreast of market trends relative to interest rates to ensure we offer competitive interest rates on deposits and loans. Our management team operates the bank in a conservative manner to ensure the bank maintains appropriate levels of liquidity to meet our clients’ cash needs.”

Greg Larson, CEO, Ixonia Bank: “We take very seriously the responsibility to meet the financial needs of our customers and the expectation that we will be there whenever called upon. That drives us to ensure we are well capitalized and ready with the resources, services and products necessary to take care of the financial needs of the people and businesses we serve.”

Jim Popp, Johnson Financial Group: “At JFG, we have always kept an eye on day-to-day cash inflows and outflows as a part of our daily process. In fact, it’s not uncommon for us to see swings in liquidity from time to time for various reasons, some related to customer activity and some related to our own balance sheet management. We model various interest rate, capital and liquidity scenarios regularly and operate with a robust set of protocols in place to help us manage our positions actively. We obviously can’t think of everything, but our team works very hard to create as predictable a set of outcomes as possible.”

BizTimes: How has the ease of transacting with technology changed the way your bank operates?

Scott Huedepohl, Community State Bank: “You have to offer the products and services that our customers want which includes technology that makes it easy to transact business. Where in the past when someone wanted to take money out you knew about it, while today you might not until it has happened.”

David Schuelke, CEO, Spring Bank: “We recognize that clients can move balances more quickly, but aside from reducing the transactions completed through a personal banker, we haven’t changed in significant ways in how we operate.”

Scott Cattanach, Peoples State Bank: “The ability to move money digitally can increase the potential liquidity volatility associated with large deposits held by retail customers, but digital tools can also make business deposits more stable as our technology tools are closely tied to their invoice collection, accounting and fraud systems.”

BizTimes: How have rising interest rates altered your strategy in allocating your balance sheet?

Bryan Johnsen, executive vice president and CFO, Tri City National Bank: “There is uncertainty on what the Federal Reserve may do and how the economy reacts to the rapid increase in rates. We are taking a cautious approach with liquidity planning.”

Jay McKenna, North Shore Bank: “Going back a year or two, we saw rates rising significantly and made a decision to ‘keep our powder dry’ for investment purposes and stayed more in cash. This may have hurt our earnings a bit at the time, but it has paid off in the longer term.”

Kevin Kane, southeast Wisconsin market president, First Business Bank: “Unlike most banks, we don’t attempt to capitalize on the typically upwardly sloping yield curve by lending longer and funding shorter term. We don’t believe in taking interest rate risk as we can’t control or even affect interest rates, and we don’t like banking on (no pun intended) things we can’t control or at least affect. Additionally, we have always tried to maintain a smaller shorter-duration investment portfolio as we earn more for our shareholders by allocating our assets to making commercial loans, which we believe is our core competency, so that hasn’t changed either.”

David Schuelke, Spring Bank: “In a rising interest rate environment, net interest margins are squeezed, but our strategic focus doesn’t change. Within our loan portfolio we have been leaning towards more floating-rate loans versus fixed-rate loans in the current environment.”

Scott Cattanach, Peoples State Bank: “While the business press has talked a lot about these balance sheet impacts, the banking industry is simply doing what it was designed to do: be a financial intermediary. … To help offset the negative impacts of acting as the rate change intermediary for customers, we have invested in securities and business loans with shorter fixed-rate periods, typically fixed for the first five years or less.”

Steve Schowalter, Port Washington State Bank: “Rising interest rates have certainly impacted balance sheet strategies. At this point in time,

Bank Balance Sheet Mix: One of the issues contributing to Silicon Valley Bank’s failure was the amount it invested in government securities. While a generally safe investment, rising interest rates meant that securities purchased with lower rates lost their value if the bank wanted to sell them. Graph data is as of Dec. 31, 2022, with recently failed banks highlighted.

as our lower yielding bond portfolio amortizes and matures, the funds are being redirected into lending of all types at better rates to offset the increase in deposit costs. As a community bank, we originate all categories of loans with an emphasis on residential mortgage lending. When long-term fixed rates started to rise, we found renewed interest in variable-rate loans, which we are funding both with cash on hand and maturing bond portfolio dollars.”

Tom Richtman, Wisconsin commercial banking head, U.S. Bank: “We are focused on the

strength and stability of our balance sheet, ensuring that we continue to have healthy liquidity levels and to do the right thing for the communities and constituents we serve. Key to that is the strength of our well-diversified deposit base and business mix across consumer, corporate and commercial clients and services. If the industry

Insured deposits: Silicon Valley Bank’s failure put a spotlight on the FDIC’s deposit insurance, as around 5% of its deposits were insured and nearly 37,500 of its accounts exceeded the $250,000 threshold. The percentage of insured deposits and number of accounts exceeding the threshold can be shaped by a variety of factors, including customer mix. There are also many ways to increase the insured total beyond $250,000.

Estimated percentage of insured deposits and number of deposit accounts exceeding $250,000

have been appropriately focused on interest rate and liquidity risk. I expect that to continue. The banking industry continues to be in excellent shape, so I don’t expect any drastic changes to the community bank sector from a legal or policy standpoint.”

Mike Daniels, Nicolet National Bank: “I think increased regulation will be two-fold. First, larger banks will be more heavily regulated, and rightfully so. Whether that is banks above $100 billion, $50 billion or something else, I think all of those banks are preparing for additional scrutiny from regulators. Second, the SVB failure shone a spotlight on bank liquidity. Again, this really isn’t a concern for community banks, but we see the regulators either imposing additional liquidity requirements or guardrails in place, or placing much greater emphasis on that area when banks undergo their regulatory examinations.”

David Schuelke, Spring Bank: “My position is that the banking industry is highly regulated today. SVB had a unique business model. Additional new regulations would be costly. Bank clients will bear a portion of the cost, which hurts consumers. The failure of SVB will cost the FDIC insurance fund billions of dollars. The FDIC insurance fund is supported 100% by banks, not taxpayers. A special assessment will most likely be required to replenish the insurance fund. I want to see a special assessment placed on large regional and large national banks. Community banks should be spared the cost of a special assessment.”

disruption in March showed us anything, it’s that our long-term planning efforts contributed to our resiliency during times of uncertainty.”

BizTimes: Do you expect to see regulatory changes in the wake of the SVB failure and as a result of the industry turmoil? If so, what changes do you expect or want to see?

Jim Popp, Johnson Financial Group: “It’s hard to speculate about what changes we might see but safe to assume that the regulatory environment is not likely to soften in the near future.”

Kevin Kane, First Business Bank: “Yes, it’s a bit of a natural reaction, and there will certainly be more rigorous regulations, like stress testing for

large regional banks. More so, we would expect regulators to be more diligent on digging into the interest rate risk and related mitigation strategies at all banks, not necessarily through new regulation, but as part of the normal exam process.”

Bryan Johnsen, Tri City National Bank: “I expect a refresh on how the regulators view deposit modeling assumptions in different rate environments.”

Jay McKenna, North Shore Bank: “Bank regulators in recent years

Scott Cattanach, Peoples State Bank: “There appears to be momentum to move today’s ‘biggest bank’ special regulations to the smaller asset-sized regional banks. That said, I don’t believe community banks with assets under $10 billion will see much change based solely on what has happened recently. However, I would not be surprised if the FDIC insurance limit was increased, even to reflect inflationary impacts, since it last was increased in 2010. A case can be made for the benefits of a $500,000 FDIC insurance level.”

Steve Schowalter, Port Washington State Bank: “I don’t expect many regulatory changes in the wake of SVB but perhaps increased emphasis by examiners on the stress testing and best practice guidance already out there, at least that would be my hope.”

BizTimes: Do you anticipate customers moving toward large banks in the wake of the SVB failure? What kind of challenge does that pose for regional and community banks?

Kevin Anderson, Old National Bank: “Just the opposite, we see clients moving to banks like ours who have a solid history.”

Tom Richtman, U.S. Bank: “While movement may have happened at a larger scale across the banking industry in the wake of the events in March, we’ve seen more and more clients – whether individuals, families or businesses – looking to earn more on their deposits due to rising interest rates as well as identifying banks that offer them the stability they are looking for.”

Bryan Johnsen, Tri City National Bank: “There will always be trends in customer behaviors. I’m confident that community banks have a lot to offer and will prosper as a vital role in any community for a long time.”

Scott Huedepohl, Community State Bank: “Community banks have been the cornerstone of most small- to mid-sized towns in America. We tell our customers what we will do and, more importantly, will not do with their money when they trust us with it. … I see it going the other way in fact and you will see community banks continue to grow.”

Mike Daniels, Nicolet National Bank: “Yes, there was some deposit outflows from community banks last quarter, but not nearly to the degree that people were concerned with. ... I really think you’ll see some of that money come back to community and regional banks given the rates they are paying over the large banks. It is important to understand that community banks are safe and offer a value proposition that many of the large banks cannot.”

John Hazod, Town Bank: “There may be some movement of funds to larger banks; however, we anticipate that to not significantly impact our financial institution. … Wintrust has a granular consumer and business deposit portfolio and does

Shifting Bank Deposits: The failure of regional banks like Silicon Valley Bank has fueled speculation that consumers will shift deposits to larger banks. While many Wisconsin bank leaders think their higher rates and customer relationships will win out, there is some evidence of a shift to larger banks in Federal Reserve data. Deposits have been trending down as consumers deal with inflation. From March 2022 to February 2023, the decline was faster at the 25 largest U.S. banks, but since February, the rate of decline has been faster at all other banks.

Total deposits (billions, seasonally adjusted) 25

not have any material, at-risk deposit concentrations. … Regional and community banks play a critical role to small businesses and consumers. Local banks have built strong relationships with their client base as these banks have and will continue to be an important component to the economic strength and growth of the communities they serve.”

Jim Popp, Johnson Financial Group: “We have seen and heard of customers moving to the perceived safety of large banks in the wake of SVB. At JFG, we haven’t experienced any major outflows related to the SVB news. For the regional and community banks who have strong liquidity and capital positions, the challenge is to explain a complex issue to customers who, by all rights, shouldn’t need to worry about those things.”

BizTimes: The past few years have brought many changes to the commercial real estate world. Do you see increased risk for banks with office buildings being distressed?

Tom Richtman, U.S. Bank: “Commercial real estate is an area of a lot of emphasis and focus for the banking industry as a whole as there’s activity occurring in tenant and sponsor behavior changes. It’s something that we are focused on as well. However, as a company, we have been prudent in our approach in the commercial real estate space. Com-

mercial real estate makes up 2% of our total loans.”

John Hazod, Town Bank: “The commercial real estate segment has been challenged over the past few years due to COVID. Most banks maintain a diversified loan portfolio that should mitigate the potential exposure to certain asset classes. A key component is identifying the risk profile of the portfolio, engaging with your clients and remaining in communication on the status of repayment ability and understanding the strategies to maintain an appropriate level of debt relative to the collateral value.”

Kevin Kane, First Business Bank: “If banks haven’t been careful about who they partner with, haven’t spent the time to get to know an owner or developer, or go into markets they don’t understand, perhaps that creates risk for them in certain asset classes like office buildings. We see this as an issue in the very large urban markets on very large office towers. A lot of this debt is held outside of the banking system and given the size of those loans, what is held at banks is primarily at the large institutions.”

Mike Daniels, Nicolet National Bank: “Yes, but much more so for banks that have office exposure in larger cities. As our markets are almost exclusively small- and mid-sized cities and towns, our office exposure is minimal. While it is something we are watching, we are not overly concerned at this point.”

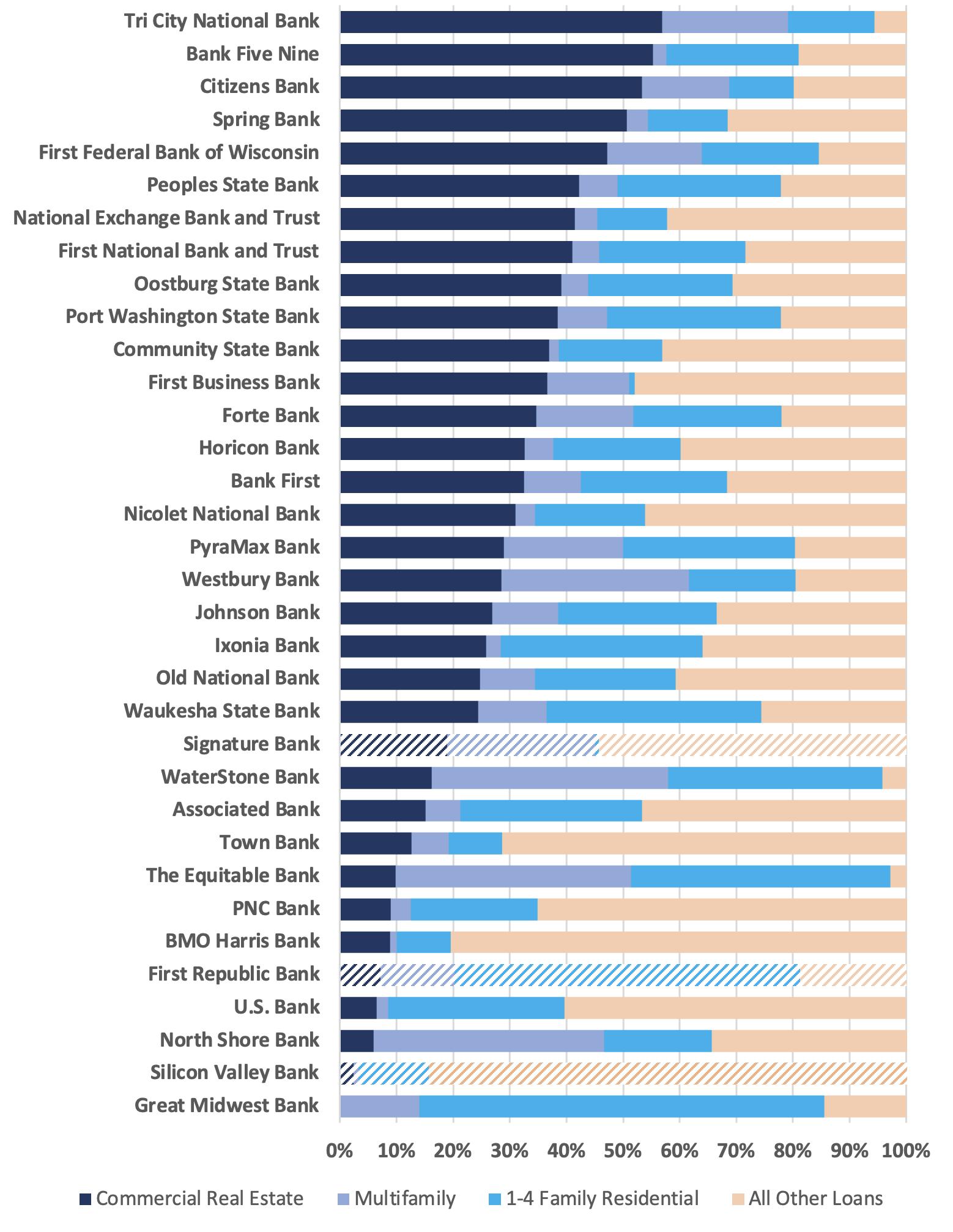

Bank loan mix: Commercial real estate, especially office buildings, is one potential area of concern for the banking sector moving forward. This graph, with data from Dec. 31, 2022, shows how area banks have allocated real estate loans as a percentage of their total net loans and leases.

er-occupied which helps a lot. This was done on purpose as it reduces the risk. Ten years from now it will be something else causing heartburn, so don’t put all your money into one industry.”

BizTimes: Given uncertainty in the general economy and issues raised by the SVB failure, are you tightening or making any changes in your approach to lending and credit?

Kevin Kane, First Business Bank: “We want to be consistent. To be a good banker means to understand and get to know the people, businesses and sectors you work in and stick with fundamentals in terms of underwriting and risk management.”

Bryan Johnsen, Tri City National Bank: “We maintain the same credit standards regardless of the economic outlook. It’s a big reason we have continued to grow throughout our 60 years. There has been less deal flow because of the higher rate environment, so I expect loan growth to slow in 2023 compared to 2022.”

David Schuelke, Spring Bank: “We have not tightened significantly in our underwriting of new commercial loan opportunities. Spring Bank is giving greater attention to maintaining our net interest margins and adjusting loan pricing for risk given existing economic forecasts.”

Scott Cattanach, Peoples State Bank: “Our changes were in ways that increased customer options and enhanced our risk position. For example, we launched a new SBA 7a guaranteed loan program to provide an additional source of credit during volatile times or declining collateral values so locally owned businesses can continue to grow.”

Edward Schaefer, First Federal Bank of Wisconsin: “Not really, but with interest rates increasing we must stay focused on our net interest margin. Customers have not seen loan rates in the 6%-9% (range) in years.”

Edward Schaefer, First Federal Bank of Wisconsin: “The office market appears to be tough. Also, a lot of low-rate commercial real estate loans are going to reprice in the next two years. We have a diversified commercial and residential real estate loan portfolio that is quite strong.”

Jay McKenna, North Shore Bank: “We have very little exposure to this sector, but it certainly seems that there may be some stress there around

the country. Generally speaking, banks are very well capitalized today so hopefully the situation can be managed without too much disruption to the broader economy.”

Scott Huedepohl, Community State Bank: “It’s obvious just driving around that many of these buildings are not filled. Diversification is key to working through any collateral types over time. The majority of our commercial real estate is own-

Steve Schowalter, Port Washington State Bank: “As for any changes in our lending and credit decisions given the economy and rate environment, they are few. We have increased owner equity requirements in some categories of lending and are likely more proactive with borrowers exhibiting stress or unusual late payment habits.”

Jim Popp, Johnson Financial Group: “As lenders, we talk a lot about the need to be consistent in our approach. We can’t turn it on when things are good and turn it off when things get tough. If we stay consistent in how we approach risk, underwriting and our overall credit process, we don’t need to change much in reaction to changes in the economy.” n

Recently, the banking industry has been painted with a very broad brush. It has provided an excellent opportunity to talk about the safety and soundness of Wisconsin banks, especially the role of community banks. At National Exchange Bank & Trust, we are committed to a disciplined approach in both good times and those periods with greater challenges.

National Exchange Bank & Trust is an independent, family-owned financial institution that has been held in high regard as one of the highest rated financial institutions in the Midwest for many years. We want to make a statement on the strength and stability you receive when choosing National Exchange Bank & Trust as your banking partner.

Our closely held ownership makes decisions based on the long-term health of our organization. Evidence of that is shown through our balance sheet and asset management.

National Exchange Bank & Trust has one of Wisconsin’s strongest balance sheets. Recent examinations by our federal regulator the Office of Comptroller of Currency have demonstrated top ratings in the key indicators of a healthy bank including Capital, Asset Quality, Management, Earnings, Li-

quidity and Sensitivity to Market Risk.

• Our capital ratio is three times the regulatory minimum.

• We have a diverse and non-concentrated asset and investment portfolio.

• Our loan to average deposit ratio at the end of 2022 was 73%; reflecting appropriate liquidity to support fluctuations in cash demand. Our liquidity is also supported by access to Wholesale Funding to support variations in cash needs.

• Our customer base is diversified by industry and geography.

National Exchange Bank & Trust currently has in excess of $2.6 billion in assets and operates offices in communities throughout Southeastern Wisconsin. The bank is privately owned by NEB Corporation, a family-owned holding company located in Fond du Lac, Wis. NEB Corporation has substantial cash reserves in addition to the bank’s financial strength.

We encourage you to visit nebat.com/why-nebat for more information about our history and to see our Statement of Condition. If you have any questions about the bank, please do not hesitate to reach out to Dick Hensley, Southeast Market President at our Waukesha office.

MILWAUKEE-BASED Scathain has garnered a reputation for its custom interior furnishings –such as antique mirrors, silver-plated wood tiles and patinated bar tops – visible at many of the city’s high-profile venues, including Fiserv Forum and the soon-to-open Trade Hotel, as well as in the homes of some celebrities. But after nearly 15 years of producing pieces to the specifications of clients, the design-build firm is leaving its own mark.

Scathain recently launched its first residential furniture line, featuring dining tables, chairs, mirror frames and consoles, all available for purchase through its website. The line will debut at the International Contemporary Furniture Fair in New York City, May 21-23.

“I’ve always felt that the essence of our work deserves that place where people can look at it and say, ‘Ah yes, that’s a Scathain,’” said owner John McWilliam, who founded the company in 2008.

Ever since Scathain started making custom furnishings, McWilliams would always view each piece as a prototype that could one day be replicated.

“Along the way, it seemed like it would be a good business plan to repeat and not have to redesign and not have to figure out how to make (each piece), so more of a sustainable business plan really seemed like a great idea,” he said.

Ultimately, the goal is to scale the line to 80% of the business, with custom work making up the remaining 20%. That won’t happen overnight. Just moving the concept from the ideation to execution stage took several attempts, usually taking a backseat to Scathain’s bread-and-butter custom projects.

But last year, McWilliam enlisted head designer Tim Stoelting to get the ball rolling, and after purchasing a booth for the 2023 International Contemporary Furniture Fair, there was no turning back.

“That really lit the fire, everywhere,” said Stoelting. “Our dates suddenly became extremely close. … (The fair) was our finish line from the beginning. If we’re going to do this thing, we have to make a really big splash.”

Leading up to the launch, Scathain’s three-person design team spent six months researching trends and gleaning inspiration from the company’s years-long portfolio of custom work to determine what elements make up a “Scathain” piece of furniture. Throughout the planning process, the design team held regular workshops in which any staff member could weigh in and voice their opinions on the forthcoming line.

“We had to field an insane amount of data, some extremely opinionated and some indifferent,” said Stoelting. “We had to pull details from that to try and find a common ground to develop the Scathain identity and this direction.”

Working to find a balance between “function, fabrication and aesthetic,” said Stoelting, the design team was sometimes sent back to the drawing board.

“There were some pieces we designed that our metal fabricator looked at and goes, ‘This is impossible to make,’” he said.

As much as the new furniture line is about standardizing Scathain’s signature design, the element of customization is still at play. Items are available in various sizes and in five different wood species or stains. Customers looking for a

more specific look can choose from an additional two dozen different iterations of each stain.

“And if none of those are to your liking, we can develop something completely unique to that, too,” said Stoelting.

For comparison, McWilliam, who has a background in music as a recording and performing artist, pointed to the work of iconic guitar manufacturer Gibson Brands.

“You can buy a standard Les Paul or standard SG, but the real connoisseurs will go to Gibson and have something either bought from their custom shop or have it custom made. There’s a big market for that,” he said.

McWilliam has high hopes for the launch of the line, especially as what will be the company’s first-ever major marketing push (word of mouth has always been its primary driver of business). Riding that wave, he expects gross sales to double in the next year to year and a half.

And with the anticipated influx of business, the company has room to grow, both in terms of staffing and physical space. Currently, Scathain has around 30 employees at its 40,000-squarefoot shop at 422 S. 4th St. in Walker’s Point.

“There’s a pretty long line of people that would like to work at Scathain, so we can open the doors and hire, we can grow within the space that we have,” he said, adding the company has plans to increase its physical footprint.

“We’re pretty well poised to just explode,” he said. “It’s not without a lot of work, though.” n

Be a part of GPS Ed’s immersive Education Center & Youth Apprenticeship Program today! Join your community and together we can prepare more students with the essential hard and soft skills applicable to the workplace and everyday life.

To learn more scan here or visit GPSEd.org/ YA4Business

BY ASHLEY SMART, staff writer

BY ASHLEY SMART, staff writer

THE WISCONSIN Economic Development Corp. thinks the state could become a critical epicenter of the global supply chain for electric vehicles.

That’s according to a recently released report in which WEDC proposes six strategies Wisconsin can use to achieve this vision. They include enhancing productivity through automation and upskilling, scaling up the middle-skill workforce pipeline, building connections between innovators and industry, aligning EV policymaking with economic development interests, and preparing for the future of mobility and sustainability.

With the caveat that there is still much work to be done in the areas of workforce development and incentivizing innovation, some Wisconsin companies are also optimistic in the opportunities that lie ahead for manufacturers of EV parts and components.

Specialty vehicle manufacturer Oshkosh Corp. has already introduced patented electrification technology within all of its businesses, and the company has no plans to slow down its electrification efforts. Its recent innovations include the Pierce Volterra fire truck; the Oshkosh Striker Volterra ARFF hybrid EV; a fully integrated, electric refuse collection vehicle; and the Next Generation Delivery Vehicle for the U.S. Postal Service.