DAVID BASHEER

Are we on the verge of a major victory for small business, their workers and our industry? It certainly seems so.

The AHA|SA and our National Body welcomes the Federal Coalition’s policy proposal to introduce a capped tax deduction - for small business only – to the tune of $20,000 for business-related meal and entertainment expenses.

This Fringe Benefit Tax relief for small business and their workers is something that the AHA has spent years advocating for in Canberra.

At a time when our small and family businesses have been thrown numerous cost challenges, this policy is a win for common sense and equity.

The big end of town are able to utilise their fully-catered, inhouse private boardrooms and avoid the exposure to the tax. But family-owned business and their workers don’t have the privilege of rewarding their staff or entertaining clients at their local at the end of the week as a reward without the business and worker being hit with additional taxes.

It is a commonsense controlled policy devoid of the excesses of

the 1980’s because alcohol is excluded. That means highly paid CEOs won’t get a deduction on their bottle of Grange. But a plumber can get a deduction for thanking his apprentice for a job well done with a Parmy.

It is a reminder that much of the work the AHA performs does not play out publicly. In this case, our national office deserves enormous credit for the quality, quantity, and consistency of the advocacy and the ‘never give up approach’ they executed that has seen the Coalition adopt, as policy, our proposal.

We encourage and welcome all parties to support these changes that is a desperately needed win for small business.

We continue to prosecute our case for excise relief at every opportunity.

We have many friends in Canberra on this issue, with the National Party announcing a 40% reduction on excise on alcohol served from a keg inside a pub.

Our target is now to get the two major parties to offer the same concession.

My plea to all our members and their staff is to assist us with our efforts.

We all know that in the lead up to an election, politicians and candidates love visiting pubs so they can be seen mixing with the locals and coming across as the sort of person you would vote for.

They need to hear our message loud and clear. When it comes to excise, tell them “enough is enough”!

These are the messages we want the political class to hear:

• Australia now has the 3rd highest rate of alcohol tax in the world.

• There have been 83 rises since 1983. It has gone up again in February and will continue to rise indefinitely. Who knows what unaffordable price a pint of beer will rise to in a few year’s time?

• A reduction on excise would be a massive cost of living relief for our 11 million voting customers.

• We are asking for relief in on premise only. Our proposed 40% cut in on premise excise represents a mere 2% of the Federal Government’s excise receipts.

• Providing relied to on premise is

“That means highly paid CEOs won’t get a deduction on their bottle of Grange . But a plumber can get a deduction for thanking his apprentice for a job well done with a Parmy.”

critical, as on premise is where the jobs are.On premise drinking is carried out in a controlled and regulated environment with trained and licensed staff and is the safest form of drinking

• On premise drinking promotes mates are talking to mates and a critical remedy to the devastating impact of loneliness and mental health.

Political aspirants hearing our message at the coalface and carrying it back to Canberra is a powerful vehicle in assisting all of us achieve our goals.

Please watch our membership profiles in this edition, who explain how the excise is simply economic madness.

Finaly, having an adequate labour force remains critical to our members being able to operate viable businesses.

Hospitality venues always want to hire Australians first.

But there just aren’t enough Australians available to do the jobespecially in many regional areas.

So, hotels have to rely heavily on overseas workers to keep pub kitchens open and accommodation beds available.

To maximise business productivity and satisfy customer demand, we need to ensure hospitality venues are able to open the doors, prepare meals and service customers seven days a week.

That relies on hospitality having sufficient skilled overseas workers such as chefs, cooks and hotel managers to fill the gaps.

Neither side of Government appear willing to embrace these views, and this remains a key advocacy issue for us in the lead up to the upcoming Federal election.

This year, we will be looking at

promotional opportunities with industry trainers in an effort to raise the profile of our standout cooks and bar staff who play an incredibly vital role in South Australia's vibrancy.

Congratulations to Dr Tim Cooper on his retirement. He has always had the best interests of the SA public at heart and his personal energy went into every keg.

His legacy ensures the Coopers brand remains strong in our venues.

The industry wishes Tim and Barb every success and thanks them for their friendship over many years.

Be sure to read Dr Tim's industry reflection in this edition of Hotel SA.

David

Basheer,

AHA|SA President

ANNA MOELLER

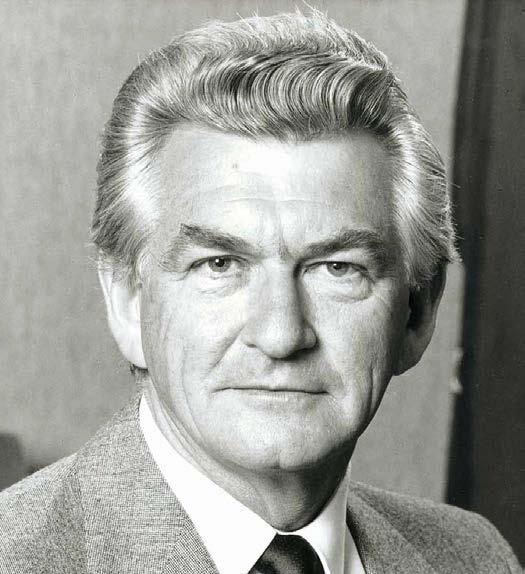

As a News Corporation journalist once pointed out:

"Bob Hawke famously set the world record for sculling a yard of beer in 1954 – putting away 2.5 pints of ale in 11 seconds – and later remarked this feat, and his penchant for a drink, helped to endear him to the Australian public. Australians love beer and our politicians love posing with it."

How true!

The issue of beer excise is just one of the key concerns that the AHA|SA has taken to Canberra for many years – but now we are in over-drive as campaigning for the Federal election hots up.

Much of this issue is devoted to those issues, so I won’t list them here. However, I would urge you to read the viewpoints of the AHA|SA Councillors – all of them hotel owners and senior managers – who have contributed their experience and insight.

The issues we are talking about – skills shortages, rising costs etc – have galvanised our sector.

Never before have I seen the entire industry, from family-owned businesses to large operators, all grappling with the same issues.

Our ongoing member profiles on social media are a perfect and consistent example of what they deal with day to day.

It is significant to hear members, independently of one

another, highlight the same concerns. This is more proof that these are not isolated problems but sectorwide issues that must be addressed by policymakers.

This election presents an incredible opportunity for political parties to step up and fix some of these longstanding issues once and for all. It’s time for decisive action, not just empty promises.

In his column, David Basheer has sounded a rallying call to members to use every opportunity to push the AHA's position when they have politicians in their venues.

I couldn't agree more.

Politicians of all colours love having their photos taken in our pubs. They realise that it resonates with communities and the average person.

So, there’s no such thing as a free lunch (or a free beer). If pollies are in your pub, please urge them to take our message to Canberra.

I started by quoting Bob Hawke and I will conclude on the same theme.

The beer excise – a biannual tax hike – was ironically introduced by Bob Hawke in 1983. But it has now reached the point where the cost of a pint is pricing everyday Australians out of having a social drink in a local hotel.

“Bob

Hawke famously set the world record for sculling a yard of beer in 1954 –putting away 2.5 pints of ale in 11 seconds – and later remarked this feat, and his penchant for a drink, helped to endear him to the Australian public. Australians love beer and our politicians love posing with it.”

One can only wonder what Hawke - perhaps Australia's most famous beer lover - would think about the price of a beer?

I think he would be horrified.

Having a beer at the pub with mates, once the cornerstone of Australian social life, is becoming a luxury.

And that is simply un-Australian.

Anna Moeller, AHA|SA CEO

You know that you’ve got something worth having when someone else wants to take it off you. At least our interstate friends weren’t left hanging for long with the announcement this month that Adelaide will be the home of LIV Golf until 2031!

On top of that, the North Adelaide Golf Course, in its perfect location, will undergo a Greg Norman transformation that will ensure it is one of the world’s best public courses!

The boost this event provides is a massive win for pubs and accommodation, but most importantly for the state’s profile, vibrancy, and economy. It is the world-wide advertisement that money simply can’t buy. This event has contributed $136 million to the state’s economy over the past 2 years and almost 80,000 visitor nights last year alone. And it just keeps getting better! South Australia – The Destination State!

The AHA|SA’s calls for reforms to policies governing Airbnb has been taken up by a series of political figures.

Last December, AHA|SA President David Basheer called for “a bold approach” to fix the housing shortage caused by Airbnb and other short stay platforms.

“In South Australia, Airbnb removes 7,772 homes from the long-term rental market,” he said.

“Since its launch in Australia 12 years ago, Airbnb has grown at a phenomenal pace- with 8,836 listings in South Australia alone.

“But shared houses make up only 12% of all listings.

“There exists a rare opportunity for South Australia to take a bold approach and lead the nation, to quickly return those 7,772 homes back to renters.”

New York has resolved that Airbnb hosts must register with the City and physically share the living quarters with the guests for the duration of their stay.

This has returned more than 18,000 dwellings for long term renters - in just a matter of months.

In Montreal, Vancouver and Toronto, that figure is 19,000 homes.

In Barcelona the Mayor has called for a total ban on Airbnb by 2029 to end his city’s housing nightmare, claiming: "We are confronting what we believe is Barcelona's biggest problem”.

In late January, The Advertiser reported: “The SA Council of Social Service and Lord Mayor Jane Lomax-Smith are supporting a Greens SA move to take action after data results from January 21 showed that, in contrast, there were just over 2,500 long-term rentals available.”

“When parliament resumes next week, Greens housing spokesman Robert Simms will call for a vote on his motion to establish a select committee to look into the impact of short-stay accommodation on the rental crisis.

“He wants regulatory options or incentives explored to prompt more homeowners to turn holiday homes into long-term rentals.”

“Ms Lomax-Smith said that in June 2024, Adelaide City Council introduced a 20 per cent rate increase for shortstay accommodation rented out for 90 days a year – but this option needed to be explored further.

“’The problem is an equity issue – this is a statewide issue’,” she said.

After years of lobbying, the issue of Fringe Benefits Tax (FBT) relief is again being taken seriously in Canberra.

The AHA|SA and our national body has welcomed the Coalition’s policy proposal to introduce a capped tax deduction for small businesses of $20,000 for business-related meal and entertainment expenses.

Leader of the Opposition, Peter Dutton, said small businesses with a turnover of up to $10 million will be ligible, however, alcohol will be excluded from the policy.

The measure will run for an initial two years and be exempt from Fringe Benefits Tax.

He said there were dual benefits to this policy.

“This is a win for the small business spending the money on their staff or clients, and a win for the hospitality venues who will see an increased spend in their businesses. It will help businesses recover from a horrible period under three years of Labor,” he said.

“Cafés, restaurants, clubs and pubs are the lifeblood of so many local economies around the country.

“Hospitality is a huge part of the economy and yet like so many

businesses at the moment, they are hurting under Labor. Skyrocketing electricity, gas and insurance prices. A local coffee shop creates important local jobs, but they are also spending money buying supplies from other local businesses.

“Small business is in our DNA as Liberals and Nationals and we want to help those businesses survive Labor’s time in office and thrive when we get back into Government.”

Shadow Treasurer Angus Taylor said the new deduction would apply to meal and entertainment expenses that have a connection with business activity and income, including dining and entertainment provided to clients, vendors, and employees.

“This is a fiscally responsible downpayment on our commitment to lower, simpler, fairer taxes and rebuilding Australian businesses,” he said.

“It builds on our commitment to rebuild small business by making the Instant Asset Write Off permanent, saving more than 98 per cent of businesses the hassle of dealing with depreciation schedules when they invest in their businesses.”

AHA National CEO Stephen Ferguson, said the Association has spent years pushing for FBT relief for hard-pressed small businesses and their workers.

“This policy proposal by the Coalition is a win for commonsense – especially during a cost of living crisis,” he said.

“Why shouldn’t a boss be able to take his hard-working team down to the pub and shout them a meal and use it as a deduction? Everyone wins.

“The current structure of the FBT means the boss cannot take their workers to a hotel, club, or restaurant at the end of the week as a reward without the business and worker being hit with additional taxes.

“Of course, it’s a different story for the big end of town – which has work arounds including fully catered in-house board room lunches and baristas – something a familyowned business and their workers don’t have the privilege of doing.

“It’s great to see the Coalition has listened and supports our proposal.”

The AHA|SA is intensifying its advocacy in the lead-up to the Federal election due in or before May 17 2025, as well as the State Election in 2026.

This is part of our commitment to your business, representing our Publicans, and being a Voice for the Hotel Industry.

While a broad list of issues has been identified, nationally the Association is seeking long-overdue reform in eight critical areas:

1. Alcohol Excise

2. Fringe Benefit Tax relief

3. Industrial relations

4. Immigration

5. International student caps

6. Core skills

7. Cost of living and housing crisis

8. Accommodation

“In the coming months, our association will be engaging with candidates and political parties, to ensure these issues are heard and addressed,” said David.

“We are calling on all political parties to make clear,

“Hotels play a critical role in Australia’s economy, culture and community,” said AHA|SA President, David Basheer.

“We are calling on political parties and individual politicians to commit to a range of policies that will support continued growth and sustainability.

“Naturally, our primary focus is on national issues as we head for a Federal election, although we aren’t taking our eyes off the ball and we will continue to pursue all issues. As the State election draw closer, State issues will be prioritised.”

AHA|SA CEO, Anna Moeller, reinforced the need for a focused strategy.

“Our association’s 153-year history reminds us that changing industry landscapes bring new challenges alongside existing ones,” she said.

“Our team is well equipped to engage directly with government and their advisors, and other stakeholders.

“We do this through a strong foundation built on networking and relationship management, formal submissions, as well as indirect methods such as social media, conventional media, and informal discussions,” Anna said.

actionable commitments that will guide create a stronger, more resilient future for our sector.

“We urge all political leaders to prioritise these issues and take decisive action in the lead-up to the 2025 Federal Election and 2026 State Election.”

The hospitality industry is facing significant challenges in attracting and retaining skilled workers. We urge all parties to commit to overhauling training, including reducing the length of a chef’s apprenticeship from four years to three. We desperately need industry-driven training that aligns with the evolving needs of the workforce.

ANNA HURLEY, Hurley Hotel Group

The shortage of qualified kitchen staff is an acute issue for many hotels, particularly in the regions. For the first time in the history of the Hurley Hotel Group, last summer we were forced to close the restaurant in Port Lincoln on a Saturday night due to a lack of qualified staff. Along with education, immigration is critical to resolving the shortage of qualified hospitality staff.

Immigration policy seems to be based on issues in Sydney and Melbourne with little regard for the regions and no understanding of our needs in South Australia. We will be asking politicians to consider different needs for different parts of the country when forming

In addition, we are advocating for reforms to immigration policy that would streamline the process for skilled migrants, ensuring our sector can access the skilled workers it desperately needs. This includes expanding the list of eligible occupations for skilled migration, particularly for chefs, kitchen staff and other hospitality professionals, as well as making it easier for temporary workers to stay and contribute to the economy.

immigration policy. It is not good enough to cut total immigration numbers based on overcrowding in the Eastern states while some of our regions are crying out for skilled labour.

In addition, governments at both state and federal level are focussed on skills needs in defence and construction. While this is understandable, there needs to be a recognition that hospitality is an important industry for the economy and the community. While housing may be a priority, nobody is going to be happy if there aren’t enough chefs to cook you a Parmi at the local pub!

The increasing cost of living is having a direct impact on discretionary spending, with fewer Australians able to afford to go out. Our political leaders must implement policies that alleviate financial pressures on consumers, including addressing housing affordability, energy prices and other cost-of-living factors. Reducing these pressures will encourage Australians to spend more in the hospitality sector, benefitting local businesses and communities.

MILESI, Murray Bridge Hotel

Some key points which are facing our industry and regional hotels in particular.

The reduction in consumer spending has a significant impact on a hotel business in a time of high cost of living. We rely on the discretionary spend of a business, family, individuals, low income earner, middle and high. When times are tough rather than dine out at the hotel a family and/or individual would up-spec their grocery shopping for a special occasion and stay home. Corporate business are having working lunches and afternoon drinks in the office.

Labour shortages and wage pressures contribute to the increasing operational costs for hotel businesses. Competing for staff and in a lot of cases essential unskilled labor has become the most difficult to bed down and retain. Nationally the industry has suffered an exit of qualified chefs over the past number of years combined with the low retention rate of apprentices.

As an industry we are working to seek from the Government strategies to entice and retain apprentices.

Could we reduce the four years to three or less and more align the skills required for a hotel Chef? Is it more attractive and beneficial for an individual apprentice to specialise after that time in skills of their choosing? Does a cheffing apprenticeship really need to be four years and should we give that option to the individual?

Talks by the Federal Opposition to introduce a tax deductible business lunch has given hope of a renewed market for our businesses not seen since the mid 80’s.

The rise of food and supply costs has had an enormous impact. Freight costs have more than doubled in my experience. The reasoning being that my business is in a regional area. There is only so much that can be absorbed without affecting profitability.

A moratorium on the twice yearly excise on draught beer would be music to everyone’s ears. Combine that with the introduction of the tax deductible business lunch could be – and hopefully will be – something to celebrate in 2026!

IR: The hospitality industry is burdened with complex and often onerous taxation and regulatory requirements. We call for a review of current policies and a commitment to simplifying these processes to make it easier for businesses to operate, innovate and grow. This includes reforming licensing laws, reducing red tape and offering financial incentives for investment in local communities.

Accommodation: A major issue is the housing shortage preventing potential staff from finding accommodation, especially in the regions. Short stay businesses like Airbnb are to blame and the problem could be fixed overnight with decisive government action to return short stay accommodation back to its ‘second bedroom’ intent. This and other changes to immigration laws are desperately needed.

MICHAEL KOSCH, The Commodore

Employment and the shortage of skilled workforce, including chefs and professional housekeeping managers and supervisors, is a problem in our regionally based accommodation hotels.

As we approached the important and busy Christmas period, two of our senior kitchen team each holding a near-to-expiry Visa, had received an invitation from the State to apply for a permanent visa, and were left waiting up to the expiry date (and beyond in one instance and relinquishing their working rights) for a decision from Immigration. Of course, this creates uncertainty for the employee and additional stress for the operator trying to fill out a roster.

Whilst the Government attempts to balance the housing shortages with immigration polices, these jobs will become vacant and remain vacant for some time – but our sector desperately needs skilled people now to deliver a quality offering expected by our customers.

The skills shortage extends to and beyond housekeeping managers and supervisors who currently cannot be accommodated under the skilled occupation lists. Even the role of Restaurant Manager was removed from the skilled occupation list in December!

These are critical jobs in our businesses, managing large teams of people. However, the roles appear to have lost attractiveness following the pandemic.

The Skilled Migration Income Threshold further challenges employment, as the demand for skills at the supervisory and newly qualified levels pushes salaries above what has been considered normal for their local counterparts. This of course comes at a time when cost of doing business has escalated quickly and sharply.

Most importantly, the industry attractiveness issue for employment needs to be addressed by building skills through apprenticeships and traineeships and recreating awareness of the industry for unskilled work, be that in housekeeping, the front office or casual food and beverage attendants.

Pubs play a vital role in our community. We endeavour to provide a warm, welcoming environment for anyone who walks through our doors, and often, it's the publican and their family working on the floor or in the bar who drive that vision.

Unfortunately, the ever-growing list of legislation and compliance measures compiled onto business owners by multiple levels of government has us off the floor and in the office like never before, taking valuable time away from us focusing on what makes our pubs great.

We are not alone in carrying the burden; our staff do as well. Increasing compliance measures are taking staff away from their duties to do a training session or understand new legislation, which not only adds extra costs to running a business but also puts unnecessary pressure on workloads.

Additionally, the time and effort that goes into training managers and office staff about the Hospitality Industry General Award is extraordinary. This award is outrageously complex, with its long list of classifications, allowances, penalties, and break structures. It doesn't meet the industry's realistic needs on the ground level and, at times, feels like you need a bachelor's degree to understand it.

We are at a point where upholding compliance is negatively impacting productivity, which operators just can't afford. We need an approach that minimises red tape, simplifies our operating procedures, and allows us and our staff to focus on growing our business for a sustainable future for our industry.

We commend the SA Government for resisting any Federal push to unreasonably cap South Australia’s overseas student intake.

Any cut would not only reduce our staffing pool – but also reduce the dollars that students - and their families – pour into our economy. Andrew Kemp outlines our position in detail below.

The hospitality industry is a cornerstone of the economy, providing jobs, supporting tourism, and driving local and regional development. International students have long played a pivotal role in this ecosystem, contributing diverse skills, cultural insights, and resources for part-time, entry-level, and seasonal roles. However, the sector continues to face significant challenges in recruiting, training and retaining this valuable workforce.

Our customers demand strong standards of service and quality in the food we produce, so it is essential to our industry that we can reliably roster strong teams in every department of our business to ensure those expectations are met. International students play an important part in ensuring a positive customer experience, however, immigration restrictions and capped working hours can limit availability, particularly during peak seasons.

When transitioning from a student visa into a suitable work visa, there can be significant obstacles, which limits their ability to remain in the industry postgraduation. Likewise, the capping of student hours creates unintended barriers to fully utilise these resources particularly during peak demand periods. For operators, the consequences of such barriers can be significant whether it is under-manned rosters, loss of customers due to inadequate service, staff burnout or turnover of key people due to these factors. When seeking access to training or internships, these too can be difficult due to visa restrictions, cultural barriers, or language proficiency issues, limiting their ability to contribute effectively.

Compounding with those issues above, the cost of living on reduced hours combined with the lack of affordable housing, can make the situation somewhat unworkable. Added to those costs are the fees associated with applying for permanent residency and the limited pathways to be approved, which all lead to an exceptionally low retention opportunity for appropriately skilled, motivated workers who provide essential support to our industry.

In order to reduce some of these negative impacts, we can look to our government for greater support to advance the cause of international students in the following ways:

Relaxation of Work Hour Limits: advocate for more flexible work-hour policies beyond a 20 hour per week cap for international students, especially during peak seasons or school breaks, to align workforce availability with industry demand.

Streamlined Visa Processes: simplify visa application and transition processes for international students, allowing them to move seamlessly from student to work visas.

Pathways to Permanent Residency: introduce industryspecific pathways to permanent residency for international students in hospitality-related roles.

Government-Supported Training Programs: provide subsidised or government-funded training programs tailored to international students, including language and technical skills development.

Affordable Housing Initiatives: collaborate with local governments to develop affordable housing solutions near hospitality hubs for workers, including international students. This may include a strong focus on regional areas where availability is particularly difficult.

The FBT is a hot election issue. Read the story on page 9 for the AHA's policy position.

TOM HANNAH, Kent Town Hotel

A tax on (and therefore the eradication of) taking staff out for a thank you meal and drink, or to drive new business.

The AHA is calling for a 40% reduction on the tax levied on all keg beer and spirits served to a customer in the pub. That translates into a mere 2% reduction in the $8 billion annual excise receipts but will make a real cost of living difference to the customers at the pub, our family hoteliers, and our unfortunate young staff who constantly bear the brunt of patron anger.

I remember when FBT was introduced by Treasurer Keating in 1986. We were in our first pub in the difficult West End of the city. The new FBT was devastating for all of us. Hard times, especially with interest rates at 19%! Let’s look at some numbers.

• In 2022/2023 total Government tax revenue was up $67.6 billion to $756 billion.

• Total FBT in that total was $4.147 billion.

• Of that FBT, the greatest contributor by far, was cars, one way or another.

• So FBT contributed .0055% of total tax income, with minimal contribution of that from dining out. On those numbers why wouldn’t you prop up an important industry that had taken some big hits?

I get it. Benefits given in lieu of salary needed to be taxed. (Obviously, the Victorian AFL clubs didn’t get the memo).

And have you ever met an employee that is willing to swap part of their salary package for getting taken out to lunch? Or even think that such expenditure should even be part of their salary package!?

But apart from making sure all income or benefits are taxed, the reasons for tax are to pay for the running of the country, to reduce the use of harmful products, or to protect Australian industry. (Tariffs). So, despite a

lot of FBT hitting the target, what did FBT on dining out achieve in the above categories, if everyone stopped doing business over lunch making that tax a non-event?

Of course, there’s the immeasurable amount of loss of tax deductions for these expenses on company tax returns. But hang on, they still get 10% GST on all that extra dining out! Oh, but GST goes to the States.

And there’s the problem.

The Commonwealth giving up income in the form of minimal dining out FBT, and allowing company tax deductions, at the expense of the States getting more GST income.

So, could the Federal Govt now say, “no more FBT but we’ll reduce the GST of $86.2billion distributed to the states by a total of $4.147 billion (4.8%), since Stamp Duty, Land Tax and Payroll Tax didn’t get abolished by State governments as they were supposed to when GST came in?

Or does everyone just claim the FBT they pay on dining out off their Land Tax or Payroll Tax bills?

Sounds simple to me.

This is about helping to make our important, “big” industry prosperous and safe. To give more staff more hours during the week at lunch times, not just nights and weekends. To increase the number of jobs in our industry, an industry which was considered guaranteed and growing until COVID, and the subsequent bashing we were dealt. We need a bipartisan approach on this, to drive our industry forwards and the State with it. It’s not rocket science. Everyone can see what happens when this State hosts events, and the wonderful atmosphere of optimism and joy that comes from a full hospitality venue bulging out onto sidewalk dining. Whatever any of these community elected decisions makers can do to that end, just do it. If it makes sense, just do it.

Taxing dining out is Un-Australian.

The high and never-ending excise on alcohol is placing an unnecessary financial burden on Australian consumers. There is a significant groundswell of opinion against this tax. The AHA nationally is calling for a reduction – or a freeze –to assist the everyday person and help support local businesses.

The AHA is calling for a 40% reduction on the tax levied on all keg beer and spirits served to a customer in the pub.

That translates into a mere 2% reduction in the $8 billion annual excise receipts but will make a real cost of living difference to the customers at the pub, our family hoteliers, and our unfortunate young staff who constantly bear the brunt of patron anger.

A punter, a publican, and a politician walk into a bar. The punter orders three pints. The publican says, “That’ll be $45.” The politician gasps, “Why so expensive?” Then laughs.

When a bad joke becomes reality... and it’s all thanks to an outdated and unfair tax.

Every publican in Australia has seen it – the look of shock when punters get the bill. No wonder 11 million beer drinkers are being driven away from pubs and hospitality venues.

It’s time for the government to rethink, freeze, or better yet, scrap this tax. Pubs aren’t just businesses; they’re the heart of communities. They’re where mates catch up, families celebrate and locals unwind. Pushing people towards unregulated drinking at home isn’t just short-sighted – it’s bad policy.

Australia now has the third-highest alcohol tax in the world. It’s crippling jobs, shutting down venues, and piling pressure onto an already struggling industry.

Pubs and bars that once provided steady jobs and incomes are disappearing, never to return. With the cost of living soaring, people are being forced to stretch their dollars further, and hospitality is paying the price.

Meanwhile, countries like the UK have taken a smarter approach—cutting beer taxes to support their pubs and breweries. If we want a thriving hospitality industry, we need to take a page from their book.

Overtaxing an industry can lead to unintended consequences. Take tobacco, for example. Heavy taxation was meant to reduce smoking, yet it has fueled a thriving black market. In Australia, illicit tobacco sales now make up a significant portion of the market, with underground dealers avoiding taxes entirely. The result? Feuding rivalries and arson attacks –105 stores burned in Victoria alone in just 18 months. If alcohol keeps heading in the same direction, how long before illicit traders add it to their stock list?

If the government keeps taking the easy road—sticking to a tax framework that’s failing – they’re not just abandoning everyday Aussies, they’re actively harming an industry that’s part of our national identity.

Pubs are still the safest and best place to drink responsibly. We have trained professionals to step in when needed – something you don’t get in an unmonitored setting.

There used to be a saying: "Champagne taste, Beer money/budget." At this rate, the next version might be another excise hike and no beer at all. Maybe they just want us to go thirsty?

“We’re 18 months into owning this pub. We’re more settled now and a lot more comfortable – protecting ourselves and patrons.”

“Advocacy wise, it’s all about the alcohol excise for us! Once pints get too expensive across our industry, patrons will be faced with tough decisions. We’ve always absorbed the alcohol excise into our

“We’re proud to be a part of our local community. We support them because they support us. When you walk into a pub, all the social barriers come down and you feel like you belong. We especially love our venue – no one’s better than anyone else. We’re a team.”

“Last year, we gave about $30,000 back to the community through sponsorships and we can see the positive flow-on effects from that.”

“Alcohol excise, electricity, and increases in supply costs are the biggest issues for us.”

“There’s a fine line we need to tread between absorbing costs into the business and putting prices up for

“Tourism is going gangbusters and people know we’re a prime destination. The Premier is doing a good job bringing in tourism but that’s not enough – we need lower taxes so we can keep costs down and people having a good time. We need to bring back the front bar vibe.”

“When I look at the alcohol excise, which is our biggest issue, I think we’re taxed enough. It’s just endless. We need a Prime Minister that will take the bull by the horns and get rid of this excise. We absorb these costs into our business and

our customers. When we look at the number of taxes our industry pays, we often ask ourselves, doesn’t the government realise this puts prices up for customers - Don’t they want us to trade more? Ultimately, higher costs for us means less turnover, which means less money into the economy. We do feel like the industry is making more noise about things like excise and that’s good to see.”

“We have a shortage of staff and skills in our industry. The Government also needs to look at changing the skills system a bit and maybe look at rebates to help employers support younger people looking at getting a job in hospitality.”

only increase beer prices once per year to help keep costs down for patrons.”

“We support local beer and cider brewers wherever we can but they’re doing it tough too.”

“The other big issue for us is migration. I’ve spent tens of thousands of dollars trying to get people in on working visas only for them to be ‘stuck in the system’. Add on wages, fees, annual leave, and the cost becomes massive. Skilled migration seriously needs to be looked at.”

operating costs to avoid passing it onto customers but doing that is becoming problematic.”

“We’re looking forward to growing the business further. We’re building a new beer garden and it’s being landscaped – that’s happening very quickly and the AHASA helped us a lot with getting the licensing and council approvals for that.”

“We’re so proud of our food and service. What we deliver to patrons is excellent and has come a long way.”

“The cost of living is having an impact on our locals though. Small country pubs like ours are still recovering from the losses we suffered during Covid. On top of that, CPI is going up, and beer prices are going up because of the alcohol excise. The Government and some people don’t realise that we absorb a lot of these increasing costs into our business to keep prices from going up for patrons. The alcohol excise in particular is actually a

tax on socialising and jobs. It’s a hidden tax.”

“So many events are being attracted to South Australia, and that’s great but to grow further, we need a break from high costs.”

“Leading up to Christmas last year, trading went really well, but it’s inconsistent throughout the year. We need to get people back into pubs and socialising.”

“The AHASA help us out a lot - I can lean on Council members like Sam McInnes for advice and staff are always a phone call away.”

“The alcohol excise is the biggest issue we face as a small country pub. When you look at all the other

taxes and operating costs we pay, we think – We’re taxed enough. When will it stop?”

“We’re growing and building a new beer garden to attract more people into the venue. We’ve engaged architects and local builders to keep the garden within the aesthetic of the town – keeping that rural feel with picket fencing, as well as easy access and exit points on the perimeter.”

“Regulation and compliance take up too many resources for us at a time when we’re trying to grow.”

“Inflationary pressures and the twice per year alcohol excise doesn’t just hurt us, it hurts customers. The more we see our customers hurting, we have no choice but to find cost saving measures that essentially just ‘rob Peter to pay Paul’. We need at least a freeze on the excise. We can offer loyalty programs and happy hours but again, those saving measure just increase costs for us elsewhere in the business.”

"We are a small country pub. The AHA|SA help us out a lot."

The Blacksmith's Inn takes great pride in delivering a country feel not far from the outer suburbs of Adelaide. The venue has come a long way since its beginnings as One Tree Hill's blacksmith circa 1860, to its conversion as a pub in 1999, and now owned by Wendy Parsons and her family. This AHA|SA member is a great example of the important role our hotel industry plays in communities - bringing people together and supporting locals. The cost of doing business is having an impact on lots of pubs in South Australia right now, including high energy prices and the Federal Government's alcohol excise, putting a strain on operating costs. They're just two of the many issues our association will continue to advocate on, ensuring that pub owners, like Wendy, are given a fair go and continue to serve their community!

Hotels are the centre of our cities and towns – they give back to their communities, create a space for music and creativity, and are vital to South Australia's vibrancy! The Exchange Hotel in Gawler has a 153-year history and has evolved with a vision to help attract more events to the region. AHA|SA member and Owner, Damian McGee, shares his story, passion for the Gawler community, but also the issues our industry continues to advocate on.

In French, s’ébruiter means to spread or disseminate.

It is a term that explains why Le Mas Barossa is no longer one of South Australia’s best kept secrets.

Tucked away at Rowland Flat on the short trek between Tanunda and Lyndoch, Le Mas is a petite, Provenceinspired boutique lodging already winning international acclaim… and with even loftier ambitions.

It is the reverie of the property’s founder Geraldine Frater-Wyeth and her husband Llewellyn Wyeth.

Geraldine oversees Le Mas while running her company Event Gallery which produces glamorous runway fashion shows, including the Melbourne Fashion Festival.

Llewellyn is area manager for Accor in South Australia and sits on the advisory board of Accommodation Australia, which offers sage business advice to its members, including Le Mas.

The word is out on Le Mas in no small way to their decision to align with ‘Small Luxury Hotels of the World’ in November, 2023.

“That was to get us more exposure nationally and internationally. It has been wonderful for us and fits in with our ethos as well, so we’re part of something bigger and not just on our own in the Barossa,” Geraldine said.

But you could forgive them if ‘surrounded’ is how they feel.

Le Mas, pronounced ‘Le Mass’ as is custom in the south of France (rather than ‘Le Mar’ as it is said in the north) is like a landlocked French enclave in the vast Germansettled realm of the Barossa.

Although a couple of nearby neighbours help maintain the spirit of Les Bleus.

“Just around the corner you have Novotel Barossa which is Accor, a French company, and then across the road you have Pernod Ricard so there’s this little French quarter in Rowland Flat that you don’t have anywhere else in the Barossa.”

Le Mas’ charter of tantalising the senses of its guests will soon expand further when Geraldine inevitably crystallises her next goal.

“That was to get us more exposure nationally and internationally. It has been wonderful for us and fits in with our ethos as well, so we’re part of something bigger and not just on our own in the Barossa.”

She plans to host concerts at the site, showcasing everything from contemporary artists to electronic and even classical music.

“We’ve already got the infrastructure in place.

“For us it would be something where you’d have a beautiful food and wine village celebrating winemakers in the region and then you’ve got music as well.

They already have approval to add a day spa and an additional six rooms to the property taking it to a total of 10 and are searching for a builder to start the project.

Le Mas was indeed once true to its English translation of merely being ‘the farmhouse’ – the result of Geraldine’s mother’s desire to find a little home away from home.

Marie-France was “probably the biggest silk importer in the 80s and 90s across Australia”.

When she retired, she sought a little patch of Australia with a similar climate and lifestyle to Provence’s and stumbled across it in the Barossa on a property laden with century old grenache vines.

“A lot of my childhood years were living six months in France and the other six months back in Melbourne,” Geraldine said.

“Llewellyn and I were married at the property in 2013 so for us, it was always a place where we would host friends and gatherings.”

Around that time, the newlyweds assumed custodianship of the property.

“We read a gap analysis report commissioned by the South Australian Tourist Commission which highlighted the Barossa had minimal luxury offerings.

“So that’s really how the idea came about. It was to have a luxury boutique property that celebrated Australian heritage but highlighted French hospitality and touches, based on my connections to France.

“Work began in 2014 and it was five years of development.

“A lot of approvals were needed, there were quite a few obstacles and at times we thought that we were not going to be able to make it happen’.”

“There was a lot of red tape in order to re-zone the Barossa Valley Floor which is a protected Vine growing area into tourism accommodation.

“It really isn’t an area where accommodation normally would take place.”

“There were fears within the community that we were going to overdevelop and pull out vineyards, and understandably so given we are on rare ground however we have ensured that the vines remained central to the concept.

“For us, it’s about celebrating the nature and land that we’re in. It’s low impact and very environmentally sustainable.”

“Our French hosts are experienced sommeliers as well, so there’s that education, that European provincial warmth, that French hospitality you get in the south which is very much a part of their stay.”

After a seemingly endless road, Le Mas finally opened –in September, 2020, six months into the pandemic.

But their determination and belief in the project never wavered.

“It’s been every day for 10 years but it hasn’t felt like work because it’s been a passion project.”

Geraldine said the biggest cost of creating a little pocket of Provence in the Barossa was having to forego the real thing.

“When we started realising this dream, our trips to France became a little less frequent but that’ll hopefully change later this year.”

Visitors to Le Mas inevitably leave tongue-tied, struggling to find enough superlatives to describe the French chic experience.

Geraldine describes it as the ‘culture and soul of the property’.

“Usually it’s the ambience, the space and the hospitality.

“As soon as you step onto the land, there is this sense of calm and relaxation being totally immersed in nature, being surrounded by vineyards, the architecture, how everything has been put in place and is pleasing to the eye.

“Because we are a small boutique property, everything is very much tailored to each guest.

“Our French hosts are experienced sommeliers as well, so there’s that education, that European provincial warmth, that French hospitality you get in the south which is very much a part of their stay.”

Now with greater visibility, their guests arrive from both home and abroad.

“20% of our guests are from NSW, 15% from Queensland and 40% from greater Adelaide and now that flights are returning to relative normality, we are seeing guests from Asia, America and Europe,” she said.

“Our challenge is the Melbourne market as they have some wonderful wine regions there too but in saying that, slowly but surely it’s starting to pick up a little.

“Of those who come to stay with us, almost all are seeking a wine experience or have an affiliation with a winery within the region.”

Le Mas operates with just six full-time staff, whose duties include servicing the rooms. Contracted gardeners and groundskeepers lift the number closer to 12, however this is seasonal.

“At the beginning it was very difficult because we opened in COVID and being a new business, we didn’t have the staff already in place.

“Since then, we’ve had consistency with our team."

Executive Chef Ryan Edwards, who joined the team in December, 2023, owns a duck farm in nearby Williamstown and sells his poultry to many of Australia’s top restaurants.

His produce adds a unique flavour to Le Mas’ menu, which features a host of French classics such as Steak Tartare and Lobster Bisque as well as the property’s own grenache.

"We also bring in some beautiful teas, biscuits and chocolates from France—little treats that instantly take you back. It’s something our French guests love, and a nice touch for anyone who adores France."

Now on the verge of the Barossa’s historic foray into AFL football, Geraldine is anticipating even more eyes on the Valley.

“It’s great for the awareness of the region, so I hope that Gather Round continues for years to come.

“I think every business in the Barossa is welcoming the investment and more importantly the exposure that it will give the region. It’s an exciting time ahead.”

And she welcomes more competition in the Barossa’s premium accommodation sector.

“We would love more luxury and high-end quality experiences as that would build a stronger market for us to provide the traveler a greater experience whilst in the Barossa” she said.

“There’s so much to showcase in the Barossa. More luxury accommodation is needed for travelers who want to experience the Barossa with all the beautiful wineries that are here and enjoy those private bespoke experiences with winemakers.

“It’s great to have more people believe in the Barossa as a destination, so there are a lot of new things that are bubbling away.”

The AHA|SA and Gaming Care have seen enormous success with our Responsible Service of Gaming (RSG) Training, seeing our 500th trainee complete through us.

Gaming Care Manager, Tom Owens, said, “It is wonderful to see so many have booked in Responsible Service of Gaming Training with AHA|SA and officially pass our 500th trainee milestone.

“There has certainly been a consistency in the training delivered by our Gaming Care staff, who live and breathe your hotels. They are not only the people who conduct the training, they are the faces that you continue to see in your businesses.

“We'd like to thank those who have done their RSG training through us. We appreciate how much time it takes away from your operations. This remains an important part of our industry's identification and monitoring of patrons at risk.

“Training does continue to book out weeks in advance and I highly encourage members to contact us to find a spot that suits your staff's needs and schedules.

“Again, on behalf of the AHA|SA and Gaming Care, I would like to personally thank our staff's efforts in delivering training of this quality,” Tom said.

Training & Development Specialist, Adam Moore, said, "This 500th trainee milestone demonstrates our ability to create a safe and customised learning experience to accommodate all backgrounds and learning styles.

"The AHA|SA is currently working to develop new programs alongside RSG training for members.

“We are interested in feedback from the hotels industry on other desired training that will benefit your venue and further develop your teams.

"Hotels may be familiar with my previous role in Gaming Care, but with my extended background and passion in training, and more broadly in hotels and casinos, my new role as Training Development Specialist with the AHA|SA is ideally placed to expand what our association offers.

“I look forward to seeing what we develop in the future,” Adam said.

If members would like to contact Adam: training@ahasa.asn.au

If members would like to contact Tom: towens@gamingcare.org.au

Mawson Lakes, nearly 20km north of Adelaide’s CBD, might seem an odd location for a premium hotel.

But nothing about the rise of Crowne Plaza Adelaide Mawson Lakes has been left to chance.

Every detail of the IHG Hotels & Resorts’ eco-friendly, high-tech over $70m hotel has been meticulously planned, from the “wow factor” of its lobby offering breathtaking views of the Adelaide Hills through floorto-ceiling windows to the choice of smallest details like teaspoons in each of its 155 rooms.

The hotel’s position is equally as strategic. It is just over 20 minutes from the city, 25 minutes from Adelaide Airport and half an hour from the Barossa Valley which hosts its first AFL matches during April’s Gather Round.

The location is also in the heart of the Mawson Lakes business precinct. This thriving business hub is home to an ever-increasing number of local and international defence businesses, while perfectly primed to capitalise on its proximity to Technology Park, Parafield Airport and university campuses at Mawson Lakes and Roseworthy.

“Our vision is clear – to make a long-term investment in the community by bringing Northern Adelaide its first premium hotel and introducing a globally recognized brand. Mawson Lakes has long been a place of opportunity, and we are proud to play a role in shaping its next chapter." said general manager Faisal Sayed.

“Whilst northern Adelaide or the Salisbury region is considered the heart of the South Australian economy, there was nothing to serve them. So this hotel is an incredible addition to this side of the city.

“There is so many opportunities here. The future is incredibly bright given the indications from the current trend in terms of the demand we have, the curiosity from the neighbourhood, the pride everyone’s got and the feedback we have received.”

The locals now also have a local.

“There was only one bar in Mawson Lakes,” he said.

"Our Aviator Bar now will serve as a premium destination, offering an elevated experience for guests from northern Adelaide and beyond. With its unique setting overlooking Parafield Airport, it will provide both

locals and visitors a perfect place to unwind and enjoy the stunning views."

“They can bring their families, they can sit at the bar and overlook the Adelaide Hills and they can see Parafield Airport where there are planes flying frequently.

“We’re really proud of what we have built.”

The official opening took place on February 10, two months after the hotel’s ‘soft’ opening which Faisal said was anything but that.

“Everyone wanted to come and trial it,” he said.

"We anticipated a gradual ramp-up, but from day one, we have been non-stop, with people eager to try our accommodation, as well as our food and beverage offerings at Ember & Vine, which features a modern Australian cuisine, and Aviator Bar, a nod to the classic style of bar offerings. We have also been amazed by the response to our state-of-the-art conference and event facilities. We are thrilled with the overwhelming demand for guests to stay and experience everything we have to offer."

Managing the unprecedented demand, while ensuring the highest level of service and adequate staffing, posed an immediate challenge for Faisal.

"Crowne Plaza Adelaide Mawson Lakes is set to attract a diverse mix of guests, including corporate travelers seeking premium accommodations close to key business hubs, leisure guests exploring northern Adelaide, and event attendees drawn to our state-ofthe-art conference and event facilities. With premium amenities, exceptional dining experiences, and a prime location, we aim to be the preferred destination for both local and international travelers."

The hotel offers over 442 square metres of dedicated event space across four areas in addition to a dedicated pre-function area that can accommodate more than 250 attendees, each offering state-of-the-art technology.

“It’s an incredibly special space for people to come together.”

Hence the naming of the Inparrila Atrium, taken from the Kaurna word meaning “a place to connect and meet for a purpose”. It is a lavish pre-function area with 17m high ceilings that services the conference rooms while acting as a unique space in its own right.

Leisure travelers haven’t been forgotten and have been encouraged to sample the sparkling new jewel of the north, with many promotional offers to choose.

“I think the biggest advantage is the continuity, operational stability, and a seamless transition, leveraging deep knowledge of the hotel, team, and market. This leads to stronger team culture, better guest experiences, and long-term success.”

But whether guests stay for business or pleasure, this fully integrated smart hotel promises they’ll check out without leaving a lasting footprint on the environment.

“Our vision is be one of the most sustainable, eco-friendly hotels in South Australia,” Faisal said.

“With a goal that the whole hotel will be run on green energy.

"Our guests are increasingly eco-conscious, and we are committed to meeting their expectations responsibly.

We strive to be future-ready while challenging the status quo to create meaningful, sustainable change."

“Our thinking is futuristic.

“It needs to be appealing to the consumer of today and future.”

"The hotel has embedded industry best practices and is leveraging technology to enhance eco-friendly operations, minimizing its carbon footprint while promoting sustainability."

The hotel is also in the process of installing 100kW solar panels on its roof. Even more remarkably, that roof may also play host to its own beehive – its produce to be offered as a breakfast spread with toast and coffee.

“We are working with a local beehive management company. They will build the whole ecostructure for us and once every two to three months, they will collect the honey.”

“Our guests are increasingly eco-conscious, and we are committed to meeting their expectations responsibly. We strive to be future-ready while challenging the status quo to create meaningful, sustainable change.”

There are also plans for the hotel to have its own herb garden, supplying ‘home grown’ freshness for the fare at its Ember & Vine restaurant and garnishing cocktails at the bar.

"Faisal Sayed was appointed as the pre-opening General Manager and has successfully led the transition to a fully operational hotel. He takes great pride in what his team has achieved, with the support of the hotel owners, IHG, and the local community. Confident in the hotel's future, he believes Crowne Plaza Adelaide Mawson Lakes will become one of the most loved hotels in South Australia."

“I think the biggest advantage is the continuity, operational stability, and a seamless transition, leveraging deep knowledge of the hotel, team, and market. This leads to stronger team culture, better guest experiences, and long-term success.

“You can really conceptualise it and bring your vision to life, and that to me has been incredibly fulfilling and I really celebrate that.

“It’s now the conclusion of our pre-opening journey and the beginning of our legacy for many years to come.

Membership renewals for 2025 have been strong and the AHA|SA thanks to those who have already renewed their membership for 2025.

The winner of the Early Bird Prize has now been drawn!

Congratulations to the William Creek Hotel on the Oodnadatta Track for taking home $7,000!

The AHA|SA is pleased to now offer a Second Chance Prize of $3,000 worth of goods from an AHA|SA Corporate Partner.

To be eligible for this draw, payment of the 2025 membership fee must be received in full by the AHA|SA by 28 February 2025. The winner will receive $3,000 in goods from an AHA|SA Corporate Partner of their choice but limited to those Corporate Partners which

provide kitchen goods, furniture, AV equipment, first aid supplies or similar products.

All members who qualified for entry into the Early Bird Prize draw, will receive automatic entry into the Second Chance Prize Draw.

Members should contact Scott Vaughan, Membership and Business Services Manager: svaughan@ahasa.asn.au should they have any queries in relation to 2025 renewals or general membership questions.

Congratulations again to the William Creek Hotel and thank you to all those members who have renewed their membership for 2025!

Over 100 guests enjoyed an exclusive dinner at 2KW Bar and Restaurant, to celebrate the ongoing and generous support of the AHA|SA Major Corporate Partners.

In its 10th year, the award-winning venue was the perfect rooftop location with guests including Diamond, Platinum, Gold, and Silver level partners, along with the AHA|SA Council and other major hotel group representatives.

We welcome and celebrate our new partners, including:

• Gold – EML Group, McCain Foods Australia, Paynter Dixon, and Suntory Oceania

• Silver – ServiceFM and Rockfort Global

The AHA|SA is highly appreciative of the generous support of our 95 Corporate Partners, and we look forward to a busy year of events and networking.

AHA|SA Corporate Partnership opens doors to a wellestablished and influential network within the South Australian hotel industry.

Partners gain privileged access to more than 580 hotel members, representing 90% of the industry, from boutique establishments to major accommodation chains.

The partnership program actively promotes connections between partners and members through exclusive industry events, regional meetings and tailored networking opportunities.

These avenues provide Corporate Partners with direct access to key decision-makers, allowing them to showcase their products and services to potential clients actively seeking quality suppliers.

Aligning with AHA|SA offers brand credibility.

Diverse communication channels, including Hotel SA magazine, e-newsletters, social media platforms and industry forums, ensure that Corporate Partners receive high-impact exposure.

Furthermore, Gold and Silver Corporate Partners enjoy premium promotional benefits, including advertising opportunities, event sponsorships, and digital marketing support.

The ability to feature in AHA|SA’s communications and online platforms amplifies a partner’s reach and influence within the industry.

Beyond brand visibility, Corporate Partnership provides businesses with insights into the ever-evolving hospitality landscape. And the advocacy the AHA|SA undertakes is not just for members, it is for the benefit of its partners, too.

Corporate Partners are given access to exclusive industry briefings and regular communications, helping businesses stay ahead of market trends, regulatory changes and emerging opportunities.

The value of AHA|SA Corporate Partnership is evident in the tangible return on investment (ROI) experienced by partners. With 95 partners now on board, businesses recognise that their investment in the program is not just a marketing expense but a strategic growth initiative.

By participating in AHA|SA’s corporate network, businesses gain new clients, strengthen existing relationships, and position themselves as industry leaders. The structured partnership levels - Gold, Silver, Bronze and Associate - allow companies to tailor their engagement based on their specific goals and target audience within the hospitality industry.

For members, it is important to recognise that Corporate Partners are more than just suppliers - they are invested stakeholders in the industry’s success.

Many Corporate Partners extend preferential pricing, tailored service packages, and superior customer support to member hotels, reinforcing their commitment to the sector.

By choosing to work with AHA|SA Corporate Partners, hotel owners are not only securing high-quality products and services but also contributing to the ecosystem that strengthens South Australian hospitality. Corporate Partners play an integral role in industry initiatives, training programs, and community support efforts, further cementing their value to AHA|SA members.

With a record number of 95 Corporate Partners, AHA|SA continues to demonstrate the power of collaboration in driving industry success. This milestone underscores the hotel industry’s and the incredible benefits of being part of the AHA|SA network.

For those who are already part of this thriving community, the benefits speak for themselves.

If you would like to know more about the AHA|SA Corporate Partnership, contact Lucy Randall, Manager – Events & Partnerships lrandall@ahasa.asn.au

2025 is shaping up to be a year filled with opportunities for South Australian hotels to capitalise on. Have you thought about your marketing though?

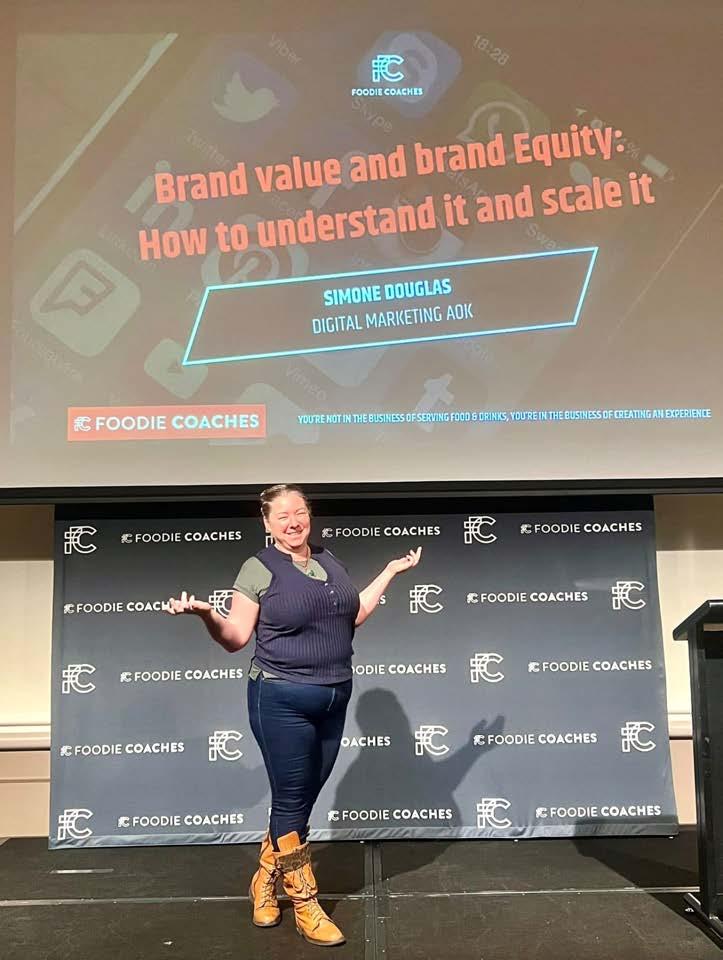

The AHA|SA will continue running a series of free Digital Marketing workshops throughout the first half of this year specific to the hospitality and tourism industry, run by Simone Douglas, proud publican and CEO of SA’s internationally recognised, Digital Marketing AOK.

With a wealth of knowledge to share, Simone is not only a Certified Practicing Marketer with the Australian Marketing Institute, but she also understands the challenges your businesses face every day and provides practical solutions.

• Measuring Marketing Performance

• The Marketing Ecosystem and Sales and Marketing Plans The Rise of AI and Reward Psychology

• Google Business, SEO Basics, and Community Footprint

Simone said, “One of the challenges for venues is that they tend to stick to traditional forms of marketing – things that we’ve seen forever including ‘parmi and pint deals’, point of sale posters, and even email marketing and social posts. The template doesn’t change much. The problem with that is we end up in a situation called ‘industrial blindness’ and customers stop seeing the messages because they’ve seen it so many times.

“One of the things that venues need to get really good at is using their staff and the characters in their pubs to tell stories which help with promotional pieces.

“The most effective thing that venues can do is start capturing those stories through videos or photos. You’ll get much better engagement on your social media and newsletters. If you put people front and centre rather than focusing solely on the products, customers develop an emotional attachment. You customers then start thinking more – I want to go to the pub to see my friends or the staff.”

“Pubs are about placemaking. We want to be the second lounge room for many families and the way we do that is by increasing engagement. The main way of doing that is through our social media channels. By having your customers sharing meaningful content about your venue, you increase the likelihood of brand recall and loyalty. That’s what you want.

“When the Duke of Brunswick took home the AHASA Best Marketed Hotel Award some time ago, we spent a very small amount of money to make that happen. It was all about content, engagement and reward psychology to trigger emotion first and action second.

“The mistake that we often make in the hotels industry is constantly trying to trigger that ‘action’ first –

Buy our stuff, here’s our deals, buy more things from us! People want to connect with the business on an emotional level though. People do business with others that they like, know, and trust.

“The people who work in my pubs are what I would call Social Media Superstars now and they know that’s part of their job. My staff have become the champions who send photos and videos to me to post on the company pages and it’s great for them and ultimately means more customers through the door who are connecting with staff.

“One of my managers said to me, we’re in the business of selling 90 minutes of lifestyle at a time, and it’s true. If we can foster that attitude in our hotel teams and empower them, that’s great. Often, we tell people to get off their phones though, so it is a juggling act, but finding a happy medium of creating content and getting every staff member involved somehow to capture moments is wonderful. Even if it’s things like sharing ‘Joe the local’ who comes in five days a week. Think, is Joe a character who tells funny jokes? Or is there a local sports celebrity in your pub who’s won a medal? That’s storytelling and it’s occurring in your venues.

“The workshops we’re running for the first half of this year are all about building on that footfall traffic and creating a strategic marketing plan that builds on that storytelling and integrates performance measurements, sales, artificial intelligence, Google Business and SEO. This all helps to increase your community footprint, Simone said.

Speaking about the upcoming workshops, Simone said,

“Our Measuring Marketing Performance workshop is all about looking into your social media and website analytics and gauging what success looks like.”

“The Marketing and Ecosystem, and Sales and Marketing Plans workshop will look at how far

out you need to start looking at marketing and the elements of that ecosystem. It’s important so you know where to put resources into your marketing, and so your plan is informed by sales targets.

“Artificial Intelligence is empowering businesses to claim back time. When you get time back, you have room to think and be creative and enjoy your job. The Rise of AI and Reward Psychology workshop is all about creating triggers and reminders that keep people coming into your business and spending money they might not have otherwise spent.

“Lastly, our workshop on Google Business, SEO, and Community Footprint, will look at who the different people in your networks are and how use those networks to build your business footprint. It will also look at search engine optimization on your website and making Google Business work better for you.”

“One of the benefits of having a publican deliver these free workshops is you’ll get real world examples and practical tips that you can implement straight away.

“We’ll teach you technical and practical skills to implement things effectively, quickly, and in a way that drives results for your venue.

“This is a fantastic initiative and partnership between the AHA|SA and the Office for Small and Family Business. It’s fully funded by the government and it’s one of those rare opportunities where you can get your teams trained up for free with relevant content to hotels,” Simone said.

Register for the sessions here .

Watch our full 10-minute interview with Simone below to get more insights into the current landscape of hotel marketing and what the training will deliver for your team.

The AHA|SA’s Marketing Workshops, as part of the Small Business Fundamentals Program, are supported by the Government of South Australia’s Office for Small and Family Business and SA Small Business Strategy 2023 – 2030.

For more information, please contact Natarsha Stevenson, AHA|SA Manager – Policy and Industry Affairs: nstevenson@ahasa.asn.au

Watch Video

The AHA|SA has had several wins in the Licensing Court of South Australia, fighting noise claims against hotels. In significant victories for hotels and licensed premises, recent court rulings have underscored the importance of balancing community expectations with the social and economic benefits that hotels provide.

With urban infill and development bringing residential areas closer to established venues, noise complaints have become an increasing concern. The legal team engaged by the association successfully argued that licensed premises, particularly those with long-standing operations, should not be unfairly penalised for simply conducting normal business activities.

These cases have reaffirmed the principle that while residents have the right to quiet enjoyment of their homes, they must also accept a reasonable level of noise from established businesses.

One such case involved the Lord Exmouth Hotel (fondly known as The Monkey House), a historic pub first licensed in 1859. The court ruled that the hotel, which has long hosted live music, was not in violation of noise regulations.

The judge’s ruling also reinforced the necessity of supporting the live music industry and recognised the broader community benefits hotels provide.

Another key case revolved around the Elliston Hotel, which expanded its music offering after a change in ownership.

Nearby residential apartments made a noise complaint, but the court dismissed exaggerated claims of disturbance from various parties. It labelled as "preposterous” an assertion that noise from a batterypowered speaker could be heard 400 metres away to the extent it was likely to lead to the closure of a local caravan park.

The rulings confirmed that complaints must be substantiated and that businesses cannot be unduly burdened by frivolous objections.

The association’s legal team has also highlighted upcoming legislative changes that could further protect hotels from unreasonable complaints.

Under proposed amendments to the Liquor Licensing Act, complaints will need to be backed by signatures from 10 separate residences, preventing a small group of individuals from manipulating the process.

Additionally, new provisions will reinforce the "I was here first" principle, acknowledging that longstanding venues should not be penalised when new residents move into an established entertainment area.

If your venue is subject to noise complaints, you should immediately contact Gary Coppola or Sarah Legoe at the AHA|SA.

Beyond courtroom victories, the association continues to advocate for practical solutions, helping members engage in constructive negotiations with residents where possible.

One recent case saw an inner-city hotel resolve complaints amicably by implementing minor modifications, demonstrating that cooperative approaches can benefit all parties.

These legal triumphs highlight the tangible benefits of association membership, saving hotels substantial legal fees, while ensuring their ability to operate without undue restrictions.

As noise complaints remain a persistent challenge, the industry’s proactive strategy serves as a critical safeguard for the future of hospitality and entertainment venues.

In the case of Elliston Apartments v Young Grey Nomads Pty Ltd trading as the Elliston Hotel heard in the Licensing Court of South Australia, His Honour Judge BP Gilchrist noted:

"In deciding where that balance should be struck it must be accepted that all licensed premises can reasonably be expected to generate noise and disturbance; of all types of licensed premises, the level of noise and disturbance emanating from a traditional hotel can reasonably be expected to be the greatest; and that hotel generally, and especially those in small country towns, can provide a significant community service. As a result of this, "otherwise legitimate grievances by individual members of the relevant committee might need to yield for the common good.”

HOSPITALITY & CATERING PUBS, CLUBS & RESTAURANTS COMMERCIAL KITCHEN PROJECTS

Bunzl is your one-stop-shop for all commercial catering requirements – from everyday essentials to specialised project expertise.

KITCHENWARE

GUEST AMENITIES

KITCHEN ESSENTIALS

FOOD & BEVERAGES

CLEANING & HYGIENE

HOSPITALITY EQUIPMENT

TABLE SERVICE & BARWARE

FOOD SERVICES DISPOSABLES

Contact your Bunzl representative today. www.bunzl.com.au

Brewing icon and Managing Director of Coopers, Dr Tim Cooper, has announced his retirement.

As part of a planned succession strategy, the fifthgeneration family member will step down from of the largest Australian-owned brewery after 23 years at the helm.

Michael Shearer, currently General Manager, will take on the position of Managing Director.

The company will continue to be family owned and run, with the Board, chaired by fifth generation family member Mel Cooper, having a majority of Directors who are members of the Cooper family. Dr Tim Cooper will stay on as a Director and Chief Brewer where he will

continue to provide his input on brewing and technical matters.

The transition, effective from March 1, comes with Coopers at a notable stage of development, having recently opened its $70 million “new home” at Regency Park and growing beer sales across the country and overseas.

Following an increase in beer sales of 1.5% for the 2024 financial year, sales have grown year-to-date by 3.7%, while the national beer market continues to contract.

“To lead Coopers Brewery over the past 23 years has been both a privilege and a fulfilment. We have an impressive team at Coopers and together we

have achieved more than what any of us could have imagined,” Tim said.

“My aspiration when I joined the brewery in 1990 was to carry on the family legacy. Prior to taking over as MD from my father Bill, I had the rewarding responsibility for the design and development of the new brewery at Regency Park.

“However, no one could have predicted our growth after relocating the brewery. We embraced leading edge technology, a positive culture and a passion for beer quality. We took a strategic direction in 2002 to establish an interstate sales business which grew our beer distribution strongly. Our national market share increased from 1.5% to 5% within 15 years.

“Our growth did not go unnoticed by our competitors. We faced a hostile takeover bid in 2005, which we endured with the loyal support of our shareholders and a vigorous defence by our legal team.