Thanks for picking up the latest edition of Business Leader magazine. Feels like only a few days ago we were listening to Chris Rea and Noddy Holder and munching mince pies. But business never sleeps and we’re already powering our way through 2023.

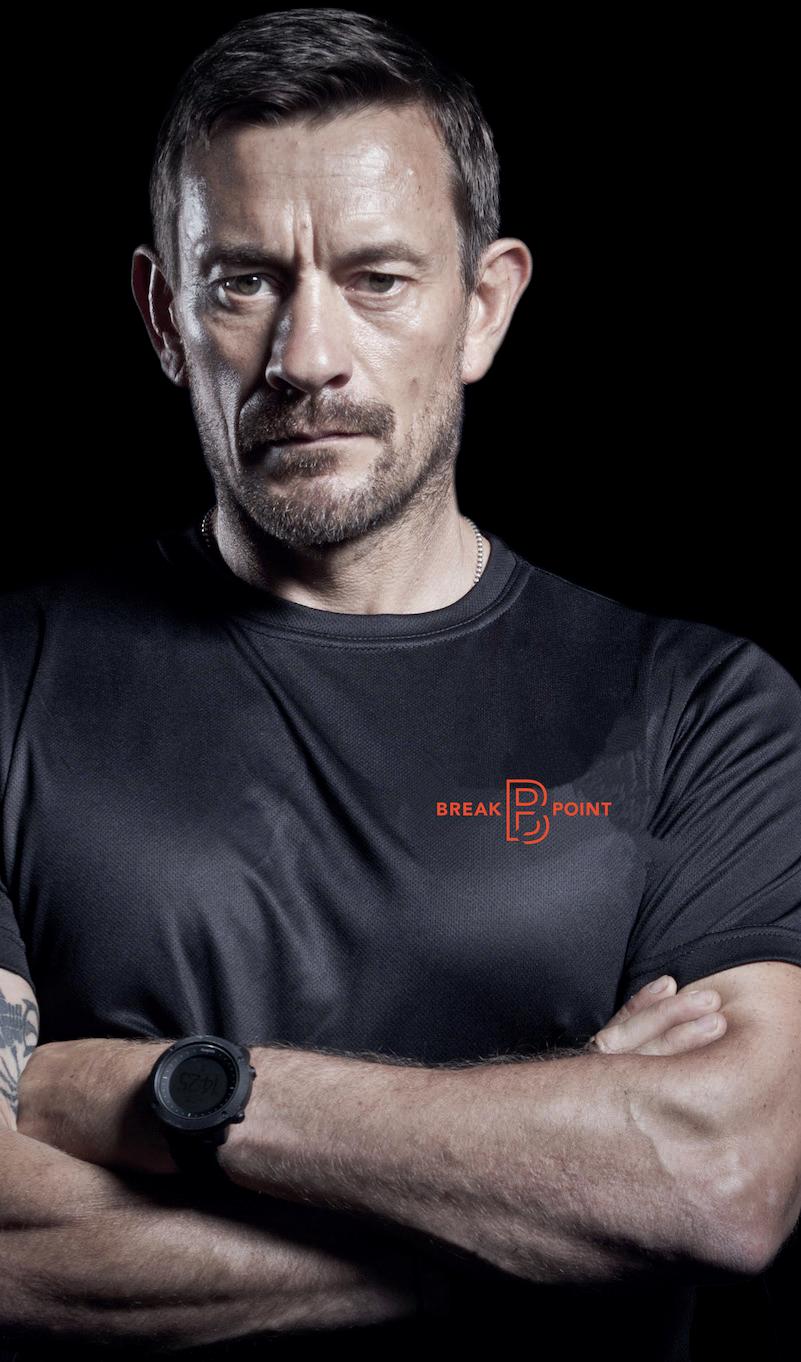

From our in-depth discussion with YouTube superstar-turned-investor-extraordinaire Caspar Lee and overcoming breaking point with SAS: Who Dares Wins star Ollie Ollerton, to a deep dive into the jobs of the future and looking into the M&A and funding forecast for the next 12 months, we’ve packed this edition with a mix of inspiration and analysis from some of the UK’s leading experts.

We’ve also entered an exciting time of our events calendar here at Business Leader, with our Scale-Up Awards and Business Leader South West Awards open for entries. The awards are a perfect opportunity to celebrate your company’s success, win new business, and get recognised alongside some of the country’s leading companies. Head to our website for more details.

Our parting thought - in a meeting with a prominent business leader earlier in the year, he said that his company wouldn’t be participating in the recession. Despite what the mainstream outlets are saying, this is a sentiment shared by many dogged entrepreneurs we’ve spoken to for this edition. Business leaders hold the key to recovery from this economic uncertainty, so go forth and grow, despite what the ‘leaders’ in Whitehall may say.

Oli Ballard Director Editor@businessleader.co.uk | @Oli_BLeaderEDITORIAL

Oli Ballard - Director

E: oli.ballard@businessleader.co.uk

James Cook - Digital Editor

E: james.cook@businessleader.co.uk

Serena Haththotuwa - Digital Editor

E: serena.haththotuwa@businessleader.co.uk

Alice Cumming - Digital Editor

E: alice.cumming@businessleader.co.uk

DESIGN/PRODUCTION

Adam Whittaker - Head of Design

E: adam.whittaker@businessleader.co.uk

SALES

Sam Clark - Head of Awards Sponsorship

E: sam.clark@businessleader.co.uk

DIGITAL & WEB

Josh Dornbrack - Head of Multimedia

E: josh.dornbrack@businessleader.co.uk

Nick Barnes - Video Editor

E: nick.barnes@businessleader.co.uk

Gemma Crew - Social Media & Community Manager

E: gemma.crew@businessleader.co.uk

Rosie Coad - Marketing Executive

E: rosie.coad@businessleader.co.uk

Joshua Phillips - Website Development

E: joshua.phillips@businessleader.co.uk

CIRCULATION

Adrian Warburton - Circulation Manager

E: adrian.warburton@businessleader.co.uk

ACCOUNTS

Jo Meredith - Finance Manager

E: joanne.meredith@businessleader.co.uk

MANAGING DIRECTOR

Andrew Scott - Managing Director

E: andrew@businessleader.co.uk

Business Leader Magazine is committed to a zero carbon future and supports the World Land Trust by using recyclable paper wrap rather than plastic polywrapping. Carbon-balanced PEFC® certified paper, which is sourced from responsible forestry, is produced in an environmentally-friendly way to offset our CO2 emissions.

CONNECTING BUSINESS LEADERS THROUGH NEWS, INTERVIEWS & EVENTS.

Want to stay on top of business news?

Leading journalists and contributors provide us with the information and analysis that directly impacts your business. Join our community of business owners, professionals and leaders that are driving the UK forward.

It’s more than just a magazine, join the Business Leader Network.

SUBSCRIBE TODAY

6 Editions £34.95

12 Editions £59.95

(VOLUME DISCOUNTS AVAILABLE) / CANCEL ANYTIME

BUSINESSLEADER.CO.UK/SUBSCRIBE

Dragons’ Den star Steven Bartlett has announced the launch of his new $100m Flight Story Fund, with the mission of accelerating the next generation of European Unicorns. Capital markets, and in particular private equity, took a huge hit in 2022. The launch of the Flight Story Fund has been timed to exploit the dislocation and disruption in the economy.

A study, commissioned by the Venture Capital Trust Association (VCTA), among 240 senior decision makers in charge of recently launched small businesses less than seven years old and employing up to 250 employees, reveals a strong appetite for growth despite the economic challenges facing the country. An overwhelming majority (92%) of respondents said they are likely to consider raising equity through a Venture Capital Trust.

In a clear sign that businesses of this type are pursuing a pro-growth agenda, the most popular reasons for requiring equity finance are to invest in R&D (48%), new technology (45%), and equipment and machinery (42%).

Over a third (36%) plan to use the funding to hire new talent and around a quarter (23%) to launch a new product or service. Just 17% of respondents said the fresh capital would be needed to improve their cash flow, which can be a sign of distress.

Over the last financial year, VCTA-backed businesses delivered £12.5bn in revenues, generating £3bn in exports and investing £548m in R&D. Over 75% of post-2015 VCT investee companies have invested in R&D.

Will Fraser-Allen, Chair of the VCTA, commented: “It’s encouraging to see such a strong level of demand for equity capital among early-stage businesses across all parts of the country.

“That businesses plan to deploy new capital to fund areas such as R&D, new technology and recruitment speaks to their pro-growth mindset. With the UK facing an uncertain future, their contribution is particularly important as many larger companies are under pressure to reduce costs and shelve investment plans.

“Young businesses, run by entrepreneurs with ambitious expansion plans, are supporting the health of our economy. We strongly believe that VCTs are ideally placed to continue funding this growth.”

Powered by Bartlett and other successful entrepreneurs, the Fund will be targeting individual investments between $1m-$10m in high-growth companies in six emerging categories – blockchain, biotech, health & wellbeing, commerce, technology and space

– and must have the potential to become Europe’s next Unicorn.

Bartlett comments: “Throughout the last decade, I developed an immense network of the most successful entrepreneurs in Europe. Flight Story Fund connects the founders to the investment and tools they need to catapult them through their growth trajectory to accelerate their timeline to Unicorn status.

“I’ve been on the journey myself and now I am helping other skilled founders succeed in the same way. The launch of the Flight Story Fund is an invitation to Europe’s best entrepreneurs from Europe’s best companies – come and take flight with us.”

Following a year of growth through 2022, cult British jewellery brand, Astrid & Miyu look to continue their ongoing investment into physical retail, opening the doors to 7 stores across the UK and Europe during Q4 (2022) and Q1 (2023).

“Community and experiences are a huge part of what makes Astrid & Miyu unique, and opening physical stores will enable us to deepen our relationship with our customers and the wider community. This has become more evident post-COVID with a shift to consumers wanting reallife experiences, warmth and a sense of belonging.” notes Connie Nam, Founder & CEO.

GPE has recently announced that the jewellery maker, Pandora, has signed a lease for a new concept store in London within 70/88 Oxford Street, taking the retail space to 96% let.

Pandora will occupy the prime corner unit of the Oxford Street development, located directly opposite the Tottenham Court Road Elizabeth Line exit, on Dean Street. The renowned jewellery brand has acquired space across two floors, with fantastic double-height signage immediately visible from the station exit.

The new unit will be Pandora’s third on Oxford Street, but its first one east of Oxford Circus. Pandora will join Boom: Battle Bar, the competitive socialising escape room concept, which opened at the end of 2022, and well-known fashion retailer Reserved, occupying 19,645 sq ft, at 70/88 Oxford Street, set to open Q3 2023.

Sarah Goldman, Senior Portfolio Manager at GPE commented: “We are thrilled to announce that Pandora has chosen 70/88 Oxford Street as its latest store location in London. As a hugely popular and globally recognised brand, Pandora will add to the premium retail offering across our wider West End portfolio.

“Together with Boom: Battle Bar and Reserved, the development is becoming a prime destination on the doorstep of the Elizabeth Line station at Tottenham Court Road. We look forward to welcoming Pandora and to the buzz and attraction the site will bring to London’s West End this year.”

The global provider of travel risk management and international medical, security, and travel assistance services found five top risks for businesses in 2023 in its annual Risk Outlook for 2023.

1. Energy Crisis

2. Deepening political polarisation

3. Increasing cyber risks

4. Diversification of global extremism threats

5. Climate risk

Chris Job, Director of Risk Management Services at Healix International, comments:

“Business leaders will be well aware of the various disasters and emergencies playing out on the global stage, yet some are inadequately equipped to mitigate the risks they pose to business assets and personnel.”

MGISS, one of the UK’s geospatial technology companies, has launched a new project, part-funded by the European Space Agency (ESA), to help minimise nationwide disruptions to gas and water supply. The project, Interruption Prevention Alert Service (IPAS), will use cuttingedge technology to identify and locate development risks within close proximity of critical utility assets. Gas and water outages caused by developments are a growing problem and IPAS will offer a preventative solution, using satellite data and services to automatically detect changes to the built environment.

The challenges that utilities providers face are also likely to intensify with the Government’s anticipated easing of UK planning laws as part of the Levelling Up and Regeneration Bill, along with proposed additional investment in infrastructure and housebuilding.

Michael Darracott, Managing Director at MGISS, said: “I’m looking forward to working with our partners to promote the value of capturing, using, maintaining, and leveraging accurate and reliable geospatial data.

“We already have a significant amount of interest from operators within the water and gas sectors, and we envisage wider potential in other sectors of the UK and global economies.”

Real Business Rescue analysed ten years’ worth of data to uncover whether director disqualifications have increased or decreased.

In the financial year 2021/22, a total of 802 disqualification orders and undertakings took place, a 31% decrease on the total number in FY 2011/12 (1,165).

Unfair treatment of the Crown is by far the most common allegation over the

last 10 years and is associated with 37% of director disqualifications in FY 2021/22.

The last three months of data also show that at least 125 fraudulent cases of the Buy Back Loan Scheme have been recorded. With each disqualification sentence averaging at eight years per director, these cases account for 1,003 years’ worth of bans.

Media and marketing company, the Ascot Group, has announced it will be sponsoring an Olympic hopeful in 2023.

The Ascot Group, which is made up of seven companies including Business Leader, will be wholeheartedly supporting young Judo star, Lele Nairne, as part of its ongoing commitment and investment to make a positive impact on the wider community.

Born and raised in the South West of England, Lele is an incredible athlete, and the Ascot Group has agreed to support her ambitions of becoming an Olympic medallist and Judo world champion.

Andrew Scott, CEO and Founder of the Ascot Group, said: “I’m delighted to announce that we will be sponsoring and financially backing Lele’s training and worldwide competitions throughout the year.

“Lele is a fantastic athlete who has trained in Judo for most of her life. She has already ranked 23rd in the world and now has her sights firmly set on the 2024 Paris Olympics.

Icelandic deep tech company Treble Technologies, which specialises in sound simulation for real-world application as well as bringing hyper-realistic audio soundscapes to the metaverse, has raised €8m (£6.9m). Treble’s proprietary technology aims to disrupt the world of sound: how it is understood, modelled, and moulded.

The seed round was led by leading Nordic VC Frumtak Ventures, with participation from NOVA (the venture arm of Saint-Gobain, the Fortune 500 company that is one of the world’s largest building materials companies) and various angel investors.

“Lele is someone we can really get behind and be incredibly proud of. Her drive and passion for Judo is inspirational, it’s clear that she lives and breathes everything associated with the sport.

“I can’t wait for the whole Ascot team to show its support for Lele as she embarks on this exciting journey to Olympic success.”

Lele Nairne comments: “It’s amazing to have the Ascot Group and its group of companies agree to be a sponsor. I’ve got some really exciting things in the pipeline for the next 12 months and with the support from Andrew and his team, I’ll be a step closer to achieving my goals.”

Embracing YouTube before most people had even heard of it, through perseverance and grit, Caspar Lee rose to become one of the biggest content creators on the planet.

From his bedroom as a teenager in South Africa, he built his channel amassing a seismic following and leading him to collaborate with many of the world’s biggest stars including Dwayne ‘The Rock’ Johnson, Anna Kendrick, Ed Sheeran and Kevin Hart. Caspar leveraged his success and cofounded a global influencer marketing business. The company operates globally with 100+ employees and boasts many of the world’s leading brands as clients, including Coca-Cola and Google. He also co-founded Creator Ventures, a $20m VC fund investing in start-ups alongside a syndicate of top creators, musicians, athletes and actors.

We met at his company Influencer’s offices for an exclusive discussion about his transition from YouTuber to entrepreneur, tips for raising investment, failure and much more.

CAN YOU TELL US MORE ABOUT YOUR BACKGROUND?

I was grew up in South Africa. When I was sixteen, I launched a YouTube channel, and my family and friends didn’t think it was very good. After two years, I only had one thousand subscribers, but I stuck with it, and it began to improve.

I started to collaborate with other YouTubers and eventually built an audience of over six million subscribers and I was able to travel around the world. The creator economy opened lots of opportunities for me.

WHAT ARE YOU DOING NOW?

I have a business I founded called Influencer. We have over a hundred employees, five offices around the world and we work with brands like Google and Coca-Cola.

I also have a talent management company with Joe Sugg and an investor fund called Creator Ventures, which has $20m to invest in consumer internet companies and those in the creator economy and social media space.

IT MUST HAVE BEEN DIFFICULT BEING ONE OF THE FIRST YOUTUBERS AND PEOPLE TELLING YOU IT WASN’T A CAREER?

Yes, it was. When I was sixteen, people were saying ‘Caspar why don’t you just stop and get a proper job?’ Within the last three years, I have noticed a big change in the space, and it’s now seen as a ‘legitimate’ career where you can make money and be successful, whereas it wasn’t when I started out.

WHAT WOULD YOU SAY IS THE SECRET TO SUCCESS IN THE FIELD?

Collaboration, consistency, and creativity. The most important is collaboration, not only within creating content but now within business and brand building too.

Creativity also means just putting things out there and throwing ideas into the world. People don’t care if every video is perfectly produced and how it performs. It’s about being consistent and getting stuff out.

WHAT DO YOU SAY TO A BUSINESS OWNER WHO SAYS THAT SOCIAL MEDIA ISN’T FOR THEM?

I would say it is becoming relevant to all businesses. For example, I have a student accommodation company in Cape Town. It’s a traditional sector but we’re using social media to build a brand because our current and future customers are looking at brands online and their social media accounts before they buy.

If you walk up the street and see a gross coffee shop, you’re not going to go in. It’s the same if you come across a bad Instagram or Facebook page for a business – you might not engage with them. It just needs to be good enough because it may not be your primary source for business but it’s there in the background. It needs to be good because people will find it and search for these pages whilst they are checking out your company.

HOW HAS IT BEEN TO ADAPT FROM BEING A CONTENT CREATOR TO AN ENTREPRENEUR?

There are many differences but also so many similarities. When you are an entrepreneur, you are forced to build a team but as a content creator, you can get away with doing everything on your own.

Also, with a business that has one hundred people, I can take a step back and have weekends to myself as I know that together we are building something, and I am not relying just on myself.

As a creator, when you become successful, people want to work with you and you can create cashflow easily. However, when you start a business, you realise how difficult it is to make money. Even if you do an amazing job, you can still lose clients. This forces you to create a different structure and surround yourself with the best talent. HAS BEING IN BUSINESS CHANGED YOU?

I feel as though I am always learning and adapting. I’m currently focusing on taking the ego out of things and not trying to create narratives around people, as in life we can be quick to judge and create personas of people that aren’t as they should be. People can have a bad day but that shouldn’t define them. It’s not about

anecdotal feelings you have, it’s about what somebody is achieving day-to-day and the results they are delivering.

IT IS CURRENTLY A TOUGH TIME FOR MANY BUSINESS LEADERS – ARE YOU FEELING THIS TOO?

It is a tough time in the AdTech space, but influencer marketing is growing. We’re doing well but it’s not always been by design and I can’t say that I have planned all of the good things that have happened.

In business, things can happen outside of your control, but you must deal with them. I find it frustrating when you see people who are successful in business saying how great they are and how they planned it. But when things go wrong, they blame outside factors. You need to be consistent.

CAN YOU SEE YOURSELF SETTING UP ANY OTHER BUSINESSES?

Yes I can, because I don’t need to go in and be the expert and run all of the operations. The skills I have are around marketing, social media and content creation and they are transferrable to other sectors. I have been lucky enough to have people that understand the sector they are working in, and they want to bring me in to collaborate.

Social media is so important for both consumer and B2B businesses – I have partners who will know the market and I can add value with my expertise.

YOU HAVE A $20M FUND YOU ARE INVESTING IN COMPANIES – WHAT ARE YOU LOOKING FOR?

It’s seed to Series A funding and we’re looking for companies that already have traction and we will deploy between £100k and £500k into a business, alongside other investors. Who the lead investor is will influence our decision because having good people alongside will make a difference.

We also want to make sure we can help the business – do they understand social media and marketing and do they need the help of content creators? We invest in businesses where we can add value.

“AS A CREATOR, WHEN YOU BECOME SUCCESSFUL, PEOPLE WANT TO WORK WITH YOU AND YOU CAN CREATE CASHFLOW EASILY. HOWEVER, WHEN YOU START A BUSINESS, YOU REALISE HOW DIFFICULT IT IS TO MAKE MONEY.”

You will see that we also bring famous actors or sports stars – like Patrice Evra –into deals and this makes our fund unique.

DO YOU BELIEVE THE TREND OF TECHNOLOGY COMPANIES CELEBRATING A FUNDRAISE WILL CHANGE AND FOCUS MORE ON MAKING MONEY?

Yes, I do. It is no longer as cool to raise money at a crazy valuation. People have realised that many of the businesses that do this end up falling over. By pushing yourself to have a high valuation, you’re shooting yourself in the foot because you need to prove to investors you can justify this. Start at a lower valuation and have consistent growth and don’t put that pressure on yourself.

People are so fixated on numbers and you can raise capital at a huge valuation but what is the point if you have given away tonnes of equity and you may not get to see any return? You’ve essentially trapped yourself, but many people are drawn to doing this because they can announce it online.

The devil is in the detail. Make sure you’re aligning yourself with a partner that will give you and your business a strategic benefit. Don’t give deals and discounts to some investors and not others too because it can look bad.

You also need to put a lot of effort into learning your presentation and preparing the questions you may be asked. Don’t pitch for somebody’s money without knowing the product inside out.

WHAT WOULD YOU SAY IS YOUR ‘WHY’?

To have fun, to learn, and to make a difference. I will also say that money will not make you happy. There is a study that shows that if you earn $70,000 you can be comfortable in life and earning anything additional doesn’t bring further happiness.

Of course, if you have no money, then money can help, but generally more and more won’t bring you happiness. In fact, lots of wealth is meant to give people freedom but it can sometimes do the opposite.

“SOCIAL MEDIA IS SO IMPORTANT FOR BOTH CONSUMER AND B2B BUSINESSES – I HAVE PARTNERS WHO WILL KNOW THE MARKET AND I CAN ADD VALUE WITH MY EXPERTISE.”

It’s unlikely that the next General Election will be held in 2023 because Rishi Sunak wants time to turn the Conservative’s fortunes around – but it is the year in which it will be decided.

The last election was 12th December 2019 which means the Prime Minister can go as late as, but no later than, 24th January 2025. It’s highly unlikely that he’d leave it until then, not least because it gives him no room to manoeuvre should some major events occur.

If I were a betting man, and I’m not, I’d say he’ll have it pencilled in for May 2024. This gives him the flexibility to call it before or after that. If we enter 2024 and the economy and Conservative polling has improved, he can go to the country in say March. If the situation still hasn’t improved enough by May 2024, he can leave it until the autumn of that year.

All the opinion polling has Labour 20 points ahead but, I would argue, this is due to the Conservative government’s poor performance, rather than Kier Starmer’s top team doing well.

It’s hardly surprising that the public don’t currently have faith in the Conservatives after changing Prime Ministers, Chancellors, and numerous other ministers, several times in the last three years.

The economy is in a terrible state, we’ve got industrial action throughout the country, an energy crisis, and people are feeling the effects of both high inflation and interest rates.

Labour have started making policy announcements, and will use 2023 to continue, but it’s all incredibly cautious, even boring. Late last year they announced reform of the House of Lords, like anyone cares, then in his New Year speech, Starmer said they’d devolve more power to local authorities – is that really a good idea? They’ve recently announced some modest changes to Universal Credit

and how to get people back into work, and they’re consulting on what to do with the NHS.

Starmer’s shadow cabinet has got some good performers in it, like Wes Streeting (Shadow Health Secretary) and Rachel Reeves (Shadow Chancellor), but there is also some dross. With a number of former Labour MPs looking to make a comeback at the next election some shadow ministers will be worried that they’ll be replaced by what is known as re-treads.

Douglas Alexander, the former Transport Secretary, is hoping to stand, and even Ed Balls and David Miliband have been rumoured to be interested.

What Starmer needs to do is offer a convincing vision for where he’ll take the country, just not being the Conservatives isn’t enough for him to win the election. He also needs to start winning in Scotland, still no easy feat.

Since becoming Prime Minister in October, Sunak has created some much-needed political and economic stability. Whilst Labour is continuing to suggest there is a psychodrama playing out in the Conservative Party, the truth is Sunak has calmed the situation and most of his MPs

are giving him the time and space to get their election chances back on track. I don’t see a comeback for Boris Johnson this year, or next.

If Sunak gets inflation under control, helps reduce mortgage rates, and gets public services into better shape he could improve the Conservative’s chances. He has clearly chosen a fight with striking workers, presumably believing the public are going to back him rather than them. He wants voters to see Labour as being in the pocket of those striking unions.

promises: halving inflation, growing the economy, cutting debt and NHS waiting lists, and stopping migrant boats crossing the Channel. If he delivers on all these, the Conservatives will certainly be in a better place.

One significant challenge Sunak has got is the Reform Party. Led by Richard Tice, businessman and former Member of the European Parliament, this party of the right are saying they’ll stand candidates in every parliamentary seat.

They’re currently polling around 10%, like the Liberal Democrats, and if that translates into votes at the election, whilst it wouldn’t mean they will get any parliamentarians elected, it could deprive Conservative MPs of their majorities.

As the year progresses, we will also see attacks on the Labour Party, and its candidates, intensify. Many will be justified, like their inability to define what a woman is, being too close to the trade unions, and not being tough enough on immigration.

Sunak’s New Year speech talked about practicalities, delivering on five key

Whilst many think Labour have got the next general election in the bag, I’d wager that it’s too close to call. I would even have a punt on the Conservatives returning to parliament in 2024 with a small majority.

The Leader of the Labour Party, Sir Keir Starmer and Shadow Chancellor, Rachel Reeves, loudly attended the World Economic Forum in January. Reeves said Labour would “work in partnership with business” to boost investment and that the party wanted to ensure the UK was “a world leader in the climate transition.”

The World Economic Forum meeting, hosted in Davos, Switzerland, brought together politicians, businesspeople and other influential figures. The current UK government was represented at the event by Business Secretary Grant Shapps and International Trade Secretary Kemi Badenoch.

Sir Keir Starmer said that foreign investment has declined sharply since the Tories took power in 2010 and cited United Nations figures which show that between 1997 and 2010 the UK accounted for 8% of world Foreign Direct Investment (FDI), but that fell to 4% between 2010 and 2021.

However, Grant Shapps highlighted a survey conducted by accountancy firm PwC which suggested that Britain was the third “most important” place in the world for businesses to invest, behind the US and China.

A spokesperson for the Treasury was also quoted by the BBC saying: “As a central part of our plan to grow the

economy we are supporting business investment, including by permanently setting the Annual Investment Allowance at its highest ever level of £1m from April, and through our generous £13.6bn package of business rates support.”

“THE ECONOMY IS IN A TERRIBLE STATE, WE’VE GOT INDUSTRIAL ACTION THROUGHOUT THE COUNTRY, AN ENERGY CRISIS, AND PEOPLE ARE FEELING THE EFFECTS OF BOTH HIGH INFLATION AND INTEREST RATES.”

2022 saw an uncertain time for M&A and business investment. As businesses prepared for a looming recession, so too did buyers and investors. Inflation, soaring interest rates, and a recession put an end to the buying spree that followed Covid-19 lockdowns.

Economic strain made buyers and investors more cautious about where they were putting their money. Despite this, M&A and investment experts remain positive about what’s in store for 2023. We spoke to leading experts to find out what they think will be significant trends in M&A and investment in the coming year…

M&A activity in 2022 was close to historical averages. In spite of this, the M&A market had cooled considerably from the previous year – through the first seven months of 2022, deal volume had fallen 13% compared with the same time in 2021, while deal value fell by 32%.

A major event that determined the rate and volume of deals slowing towards the end of last year was the fleeting government led by Liz Truss, and its chaotic Autumn Statement.

Matt Eves, Head of M&A South at EY, feels the deals put on hold as a result of the budget are likely to take place in 2023 – potentially causing a boom in M&A deals this year. He comments: “Particularly after Liz Truss’ Autumn Budget and increased interest rates, the market became much tougher to get transactions delivered because the cost of funding went up for people. After Truss’ short-lived government, quite a few deals ended up being put on hold until this year. I’m expecting to see the stronger, more-resilient businesses that have been put on hold due to an uncertain environment come to market and be transacted.”

Andrew Charnley, Managing Director at Assetz Capital, believes the Truss government also drastically impacted international confidence in UK firms at the time. He comments: “From a macrolens, there has been a slowdown of M&A activity in the second half of the year. The ‘Trussonomics’ mini-budget impacted the last part of the year and overseas confidence in UK PLC. Business owners are looking for value and I think that will drive activity throughout 2023.”

The Bank of England raised interest rates to 3.5% in December 2022 – the highest it had been in 14 years. This was the ninth time in a row last year that interest rates were increased to tackle soaring inflation, currently at a historically high 10.7%. Increased interest rates impact everything from mortgages to loans, credit cards, and

savings. In the M&A space, how buyers fund their deals has been markedly impacted and is likely to continue into 2023.

Eves continues: “Businesses that have enjoyed funding themselves on very low levels of interest rates now can’t, therefore when a business comes up for refinancing in 2023/2024, their funds are going to cost a lot more. It impacts their cost of doing business, just in terms of their underlying debt service, but it also impacts their ability to invest, and they’re probably less likely to make acquisitions. That being said, this gives potential investors who are sat on cash quite attractive opportunities.”

Charnley feels there may be an increase in businesses seeking funding from alternative funders as a result of the economic situation. He says: “I think high street lenders will be much more conservative in 2023 and that gives opportunities for alternative lenders. I also think overall lending could be subdued as risk appetite tightens across multiple sectors, but I think that also gives the opportunity for highnet-worth individuals, pension funds and potentially overseas investors looking to deploy capital into the UK.”

Despite appetite tightening across sectors, experts expect international interest in UK business to strengthen, continuing from last year. Simon Glover, Senior Manager at BCMS, believes the weakening sterling has had a part to play.

Eves says some of the macroeconomic factors we are currently witnessing will drive dealmaking niches. He comments: “There are interesting macroeconomic factors that are coming into place. I foresee a large amount of activity in anything that has an ESG angle. The environmental space is going to be a very circular economy and it’s going to be a very strong market in my opinion. There will continue to be an appetite for business-critical software, digital transformation businesses, healthcare and life sciences.”

“It’s very hard to get transactions completed in the consumer space because the pressures on the consumer’s wallet have become evident. Inflation, the cost of debt, and the cost of mortgages are making it hard to transact consumer businesses. Also, any business with high energy intensity may experience a decline in deals because of a spike in energy prices – people are less likely to invest because they don’t know what you have to pay for your costs.”

Indeed, soaring energy prices will have an impact on which businesses are likely to receive interest. Glover comments: “Rising energy prices around the world will lead to higher demand for companies offering products and/or services which reduce energy consumption. While tighter labour markets will spur appetite for businesses active in Human Capital Management.”

Caution became a common feeling in the M&A and funding space last year and while inflation rose, business confidence took a dive. As a result, many experts have highlighted the importance of confidence going into the new year.

He says: “As ever, US buyers are leading the charge, but buyers from European countries including Germany, France and Switzerland have also been very active.

Doubtless, this increased M&A activity from overseas will have been driven in no small part by the weakness of sterling during 2022, which made UK assets much cheaper for international buyers.”

Eves says: “I think it’s just about expectations. If you’ve been wanting to sell your business in the last 12 months, you’ve been hearing about all the crazy prices that your friends down the road at the golf club have been getting. Then it becomes hard for you to think that your business is suddenly worth 20%/30% less – just because the world outside has changed but your business hasn’t. Buyers can’t pay what they were going to pay before because it’s not costing them 2% to borrow money, it’s costing them 7% to borrow. Businesses need confidence.”

Charnley comments: “Consumer confidence translates into business confidence. Also, political stability and a settling down of the interest rate environment will hopefully lead to a falling inflationary environment by the time we get into summer, and this may boost confidence.”

Consumer-facing firms will struggle while ESG businesses will boom Inflationary pressures and the cost-of-living crisis continue to strain consumer-facing businesses and energy-intensive firms. Despite this, experts see a boom in a variety of established and emerging industries. Cont.

Another area is rising debt and servicing costs. A lot of businesses have borrowed extensively from 2008. The financial crash of low-interest rates and levels of quantitative easing have been on a level that nobody could have forecast. That is well and truly over now. Whilst there was a movement panic off the back of Truss’ mini-budget, I think that cycle was always going to happen.”

Glover comments: “At the broadest level, M&A activity is directly linked to boardroom confidence; where this is low, it is a safer call for a potential acquirer to retain the cash on their Balance Sheet. But we are seeing that in spite of the multiple adverse factors at play during 2022 - rising interest rates, volatile public markets, double-digit inflation and geopolitical instability, to name just a few – there is an unrelenting appetite for high-quality UK businesses.”

Like the M&A space, inflation, high-interest rates and political instability impacted business funding and investment last year. According to the Office for National Statistics, business investment fell 2.5% in the UK in the third quarter of 2022, more than its initial estimation of 0.5% – but will investors remain cautious in 2023?

Julia Elliott Brown, investment expert and Founder of Enter The Arena, comments: “After a very buoyant end to 2021 following the pandemic, 2022 has seen a very significant drop of 24% in the number of venture deals done in the UK, with the amount of capital invested plummeting by 52% in the last 12 months. The current economic climate is undoubtably taking its toll. In challenging times, investors often hold back, double down on their existing portfolio of investments, take less risks on early-stage businesses, and tend to back founders and industries that they feel most familiar with.”

Kerry Sharp, Director of Entrepreneurship and Investment at Scottish Enterprise, comments: “In addition, there has been a fall away in the number of large £100m+ deals that we saw in 2020 and 2021 in the UK, especially in London and surrounding regions. Our data is showing that deals are taking longer to agree, the terms are harsher, and full amounts sought are not always being raised. We are also seeing a

greater reliance on existing investors, making it harder for companies at earlier and higher risk stages. These are challenges we are hearing reported across the UK and not unique to our experience in Scotland.”

WHAT TRENDS MIGHT WE SEE IN 2023?

Elliott Brown feels that those businesses solving a problem will shine in the new year. She comments: “The turbulent financial environment looks set to be a continuing theme for the year ahead. It won’t be easy for early-stage start-ups to get funded. It will be more challenging for D2C businesses, as investors shy away from e-commerce and other consumer-focused sectors which are more likely to be impacted by the cost-ofliving crisis. But those businesses that are solving long-term pressing problems in the world, shaking up industries, and making real innovations will still be of interest to investors, especially those who are looking for a return over the medium- and long-term.”

Ewa Chronowska, VC investor and CEO at Vestbee, comments: “No doubt the biggest winner will be AI, which will become increasingly integrated into businesses of all kinds. Due to the numerous fraudulent activities and blow-ups, crypto and web3 will suffer the most in 2023 as it will take a considerable amount of time for the community to re-establish trust. I expect some heavy regulations to be imposed onto crypto.”

Chronowska highlights the impact of economic pressure on investor confidence.

She comments: “After the record-breaking 2021, the pace of venture investment and late-stage tech valuations have been declining throughout most of 2022. However, early-stage investment activity is still solid while waiting for public market turbulence to settle down. Against this backdrop, investors urged portfolio companies to reduce cash burn and seek other ways to extend their runway by cutting expenses, e.g., overheads.

“Nevertheless, VC firms have accumulated record levels of dry powder and will be overcautious with its deployment until the

hyper uncertainty disappears from the markets. As a result, we should expect a moderate cool down at early stages, more reasonable valuations, proper deal diligence and decreased deal velocity. Although macro remains volatile, VCs will still invest in earlystage companies, just at a reduced pace.”

Sharp comments: “The impact of the economic downturn on investment is already with us - while equity investors are patient and take a long-term perspective, it is clear that VC and corporate investors, globally, are now responding to changing macro-economic conditions.

“Even though there is restraint at play, investors are continuing to focus their attention on companies operating in new and growing sectors, such as net zero, renewables and health technologies, where changing market conditions and consumer demand creates opportunities and the prospect of strong international growth.”

Elliott Brown feels that exercising your pitching muscles is important now more than ever. She comments: “Empowering yourself with the skills to perform at your very best on all these elements will help you cut through, along with having the right professional support along the journey. Raising investment is like climbing Everest. You wouldn’t attempt it without training and preparation in advance, a well-thoughtthrough strategy and plan on how you’re going to attempt the expedition, or an experienced sherpa to guide you to the peak.”

While Charnley raises the importance of businesses not steering away from what they do best during an economic crisis. He comments: “It’s important for businesses to stick to what they’re good at and not break into new markets or explore what is outside of their expertise. All of this is underpinned by confidence levels. Confidence is key in the new year. I think it’s easy for people to be downbeat now. That’s what’s very different from the crash in 2008. Some businesses will fail, but those with great service, a USP and are good at managing their supply chain will succeed.”

FEATURED DEAL

Business Leader highlights a selection of significant deals that have taken place in the last few months.

Arthur J. Gallagher & Co. has announced an agreement to acquire the partnership interests of BCHR Holdings, L.P., dba Buck. The transaction is expected to close during the first half of 2023, subject to customary regulatory approvals, for a gross consideration of $660m or approximately $585m net of agreed seller-funded expenses and net working capital.

Buck is a provider of retirement, HR and employee benefits consulting and administration services. The organisation has a long history, dating back more than 100 years, with a diverse client base by both size and industry. With over 2,300 employees, including more than 220 credentialed actuaries, Buck primarily serves customers throughout the US, Canada and the UK.

Tata Communications, a global digital ecosystem enabler, announced it has entered into a definitive agreement through its wholly owned international subsidiary Tata Communications (Netherlands) B.V. to acquire The Switch Enterprises LLC. The Switch is a global end-to-end live video production and transmission services provider with reach to top-tier sporting venues in North America.

Trioworld Group has signed an agreement to acquire the Canadian-based Malpack Ltd. and US-based Malpack Corp. (collectively, Malpack), a player in solutions for highperformance stretch film in the transit packaging segment. Malpack supports customers in the areas of distribution, beverage, food, consumer goods, e-commerce, and other industrial packaging.

Burges Salmon has advised the shareholders of Regular Music on their partial sale to German promoter, venue operator, and ticketing conglomerate Deutsche Entertainment AG (DEAG). The deal, through DEAG’s UK subsidiary Kilimanjaro Group, sees DEAG continue to increase its international promoter network.

Fox Group has announced the multi-millionpound acquisition of B&W Plant Hire & Sales Limited, a major Plant Hire company with

depots in Blackburn, Keighley, Northwich, and Southampton. Established in 1963 by Bill and Mary Whitwell, the Fox Group started with just one piece of equipment, a JCB 3C.

Seven Search and Selection Ltd, a recruitment solutions provider based in Leeds, announced it has signed a deal to transfer full ownership across to its employees. The team at Seven were supported by Andy Francey and Brad Adams (Freeths LLP) and Ian Meek (Buckle Barton Chartered Accountants) in the Employee Ownership Trust sale.

Arrowpoint Advisory and Rothschild & Co’s Consumer team have jointly advised AG Barr plc on its acquisition of Boost Drinks, a branded drinks business, on a debt-free, cash-free basis, funded from internal cash reserves. The IRN-BRU maker has paid an initial £20m for Boost, whilst additional considerations of up to £12m will be payable, depending on Boost’s future performance.

Mobeus has announced that it has backed the management buyout of GW Global Insights (GWGI), the provider of industry news, data, and events to the industrial gases market and the fast-evolving hydrogen economy. GWGI represents the second investment from Mobeus’s latest UK-focused small-cap buyout fund, Mobeus V, following its investment in Gungho Marketing earlier this year.

After a record-breaking year for IPOs in 2021, 2022 saw activity shift in the other direction. According to EY’s Global IPO Trends 2022, global IPO volumes fell 45%, with proceeds down by 61% YOY because of increased market volatility and unfavourable market conditions. In total, 1,333 IPOs raised $179.5bn, with Asia-Pacific accounting for 67% of global IPO proceeds.

The International Monetary Fund (IMF) has predicted that a third of the world will fall into recession in 2023, meaning IPO activity could continue to decline this year. However, there remains some big IPOs which could be set to happen in 2023 and we’ve profiled five of them for you.

Zopa, the firm credited with inventing the concept of peer-topeer lending, has made no secret of their plans for a public listing, although a date for one is yet to be set. They raised £220m in October 2021 but said they wanted to raise another $100m before launching. However, Sky News reported they were looking to raise another round of funding in October 2022, so 2023 might be the year where their IPO plans fall into place.

There has been speculation that Chime Financial will go public for a few years now, yet the company remains private and no date for an IPO has been set. The US fintech unicorn Chime, which offers a financial app that acts like a bank, had a valuation of $25bn in 2021, but with stock valuations taking a hit in 2022, it’s likely a 2023 IPO would have a lower valuation.

One of the UK’s biggest retailers, the EG Group had revenues of $26.5bn in 2021 and has more than 6,300 petrol stations and convenience stores spread around the world. An IPO from the Blackburn-headquartered firm could be one of the biggest in the world this year. However, the firm’s owners, billionaire brothers Mohsin and Zuber Issa, are yet to outline any solid plans for an IPO.

PureGym is the UK’s largest gym and fitness operator, and the firm first announced IPO plans all the way back in 2016 but shelved them because of Brexit. In December 2021, IPO plans were also shelved in favour of a £300m equity investment from PE giant KKR to focus on expansion. An IPO date still hasn’t been set, but estimates suggest it could value the firm at £1.5bn.

Many were expecting Huel to go public last year after the direct-to-consumer meal replacement company hired Goldman Sachs and JP Morgan to advise a dual-track process considering both the sale of the business or an IPO, with reports emerging that an IPO was the preferred option. If Huel were to go public in 2023, IG estimates a market cap of £1bn.

THE THINGS YOU NEED TO KNOW

Organisations are looking for a bit of certainty as they navigate the current financial climate. Goalposts being moved are not helping with business woes.

Fortunately, HMRC’s move to delay Making Tax Digital (MTD) for income tax until at least April 2026 has brought with it a clear sense of relief for many. Compulsory entry into the scheme has also been staggered rather than bringing everyone under the same rule simultaneously.

Many will have plans in place to digitise their systems, but these efforts haven’t been wasted. MTD will give businesses a more structured method of approaching their finances via real-time data. With this comes significant advantages, such as clarity around tax liabilities and what tax is owed quarterly rather than a hefty tax bill come year-end.

Sole traders, who may use their bank account as the only gauge of their finances, will benefit greatly. For landlords too there are clear advantages. Amidst changes to mortgage tax allowances and shifting tenancy regulations, landlords can have all the data they need to make informed decisions.

So, there are clear positives but what remains to be seen is who will be impacted and when.

Another issue not yet addressed is around year-end reporting. Businesses who don’t work to HMRC’s tax year will need to be accommodated, avoiding having a year-end in one period and then reporting on it in another. The government needs to utilise the delay to understand these real issues faced by businesses and work with accountants to iron out solutions before the deadline. While these grey areas are clarified, Monahans is working hard to ensure our clients have the most up to date information. It is not just a case of ticking the MTD box, rather we’ve already identified numerous clients who will substantially benefit from digitising their systems. Businesses should use these two extra years to prepare for MTD rather than delay the inevitable.

If you need support with your MTD accounting, please get in touch today and we’d be more than happy to help: monahans.co.uk/contact-us.

T: 01793 818300

www.monahans.co.uk

Marc Deschamps is the Co-Head at DAI Magister, a leading investment bank for global climate tech and tech development in emerging markets. Marc co-founded his first business venture at 17 and is known for pioneering broadband in Europe and the UK. We spoke to Marc about his distinguished career, the differences when working in executive roles for corporate companies and start-ups, and much more.

In short, I’m an AI geek and engineer-turned-entrepreneur, then a corporate leader, and finally, an investment banker to help others. At the core of that, I’ve always been convinced that tech would change the world. That’s the motive and the drive. It changes cognitive inclusiveness, efficiency, and the creativity of people, and that’s what I’ve focused on.

Throughout my career, I’ve created programs for others, and I sold my first company at 19. Later on, I created a company that became the first broadband provider in Europe, then a unicorn company with a big IPO that had Bill Gates as an investor. I also led UK broadband and brought it to the UK as COO of Broadband at BT, and 18 years ago I founded an investment bank that became one of the leading tech investment banks in Europe.

Recently, my focus has been on climate tech and meeting the challenges that climate tech poses to our society. But actually, I’m going back to the beginning because I’m born in the Canadian forest, so I’m a born tree hugger!

A child’s dream, yes. But it’s true! And I think a career is like that. It’s how you can fulfil some dreams, ones that you have initially or ones that you evolve or create,

and how to put those dreams into plans, actions, teams, objectives and creations!

WITH THAT IN MIND, HAVE YOU ALWAYS WANTED TO LEAD YOUR OWN BUSINESS OR DID THE DESIRE DEVELOP OVER TIME?

I was lucky right from the start in the sense that my friends and I discovered something that needed help and we took it as a challenge to go and meet that. At that time, it was the timing in Formula One, which was done with young guys doing the math, so we said: “Let’s apply a machine to this.” This helped me to create something, put teams together and deliver, and this empowered me. There are probably some situations in life like that, where creatives think there’s potential there and I’d like to be the one to orchestrate it. So, I think it’s something you probably have somewhere, but you grow and learn your discipline, and I’ve come to appreciate it more over the years.

There are things that have changed and others that have stayed. As a leader, you need to have a certain drive, and an optimism, even naivety, in a way that you think problems are simple. But then you learn the systemic way of how to bring that into issues, challenges, and tactical points to go and deliver and assign teams to do that. So, whilst you learn that very quickly, at one point you learn how to make people work together because you like it, and you like the people.

But society and the way people work have changed, so the way you transmit good efficiency habits to people has changed. I would say my style has moved from what some people call an enlightened command style to a trust, empowerment and visionary style but where you have to keep the pace and objectives in line at the same time.

Certainly! I still have a lot to learn when it comes to delivery, even though I’ve done lots of projects, and in the balancing of life - my family and friends will confirm that! Through that journey, I’m learning how efficiency brings you the time and mindset so you can balance that, but you also learn from the challenges, failures and successes throughout your career, and also from the adaptation of working in different environments.

As an entrepreneur starting your company, there is a status of loneliness that you need to break very quickly. Whereas the corporate environment by default is not lonely, provided you can adapt to it. However, an entrepreneur’s loneliness changes because you build and surround yourself with others, but in a corporate environment, you structure the people and teams you work with to do what you need to do, so the starting point may feel different but the end point ought to be the same.

In a large corporation, you also have an aspect of management that is slightly different in the entrepreneurial world: upward management, for example. You feel like a funnel into your work and the difficulty of that is you need to make the delivery aspect your absolute priority and the upward flow as efficient as possible, but it needs to be there because people need to be transparent and help each other.

Absolutely not, but life has decided for me differently simply because I’ve been quite successful as an entrepreneur. So, I ought to like it, but I have to say I really adored my corporate years, both at BT and prior to that at Phillips. Great teams and challenges but not easy, and the people are top quality like they are in an entrepreneurial environment. I really liked and would recommend both,

although they are very fulfilling in different ways.

In today’s world, we will require and will see more serial entrepreneurs change the planet, but the corporates also have some very good attributes in the delivery of some of those changes, though they need to get more involved. Many corporate leaders have successfully created something that does not feel too dissimilar to the entrepreneurs. WHAT HAVE BEEN THE BIGGEST CHALLENGES YOU’VE FACED IN YOUR CAREER AND HOW HAVE YOU OVERCOME THEM?

I mentioned loneliness before and that is probably one of the big challenges. In the face of that, it’s the building of teams and trust, so you can manage and spread that vision, and trust, in people. That breaks loneliness, but it is a challenge and if you’re a good entrepreneur, you can break it. The other one is how to balance your work life and your aspirations, which sometimes come before anything else, and balance that with your personal life and your colleagues’ personal lives.

I’ve had experiences of seeing bullying environments and loneliness in other people, so I think inclusiveness, trust and empowerment are very important. That has been my biggest challenge and I’m trying to empower and take away that burden from those around me.

HOW ARE YOU TRYING TO DO THAT?

It’s in the management style of trusting people and listening, which is one thing that I need to improve. But also, in how to work in teams because when you have a temple with one pillar, it’s fragile, but when you have one with many pillars, it holds to any winds.

Considering the IMF is predicting a third of the world will go into recession this year, what are you expecting to see in 2023?

It’s a tough economic and financial trading environment to start with, and yet we have so much to do to bring back balance to our planet. My view is that the current challenges, such as supply chain failures, interest rate hikes and financial markets falling, have slowed down my work in climate tech, but luckily, the sector has been somewhat resilient.

There was about $15bn invested in Europe in 2021 and unlike the falling tech sectors, this was very similar in 2022.

However, everyone was expecting that to grow even further, and the planet needs it to grow if we want to deliver on our required net zero. But I’m an optimist and investments in climate tech are slowly

“AS A LEADER, YOU NEED TO HAVE A CERTAIN DRIVE, AND AN OPTIMISM, EVEN NAIVETY, IN A WAY THAT YOU THINK PROBLEMS ARE SIMPLE.”

growing back. So, I’m expecting this year will be better than the last for climate tech investments, although the first half of the year could be tough.

I’m motivated by many, including my family and friends who inspire me with their work, creations or balance. I would also say I’m inspired by corporate athletes, but more the athlete in general. This might be an art athlete and how they discipline themselves and push to excel, or in the world of sports where they must do 10,000 hours before becoming a star.

In terms of names, maybe Wayne Gretzky for sports - the Canadian coming out of me - maybe Mandela when it comes to politics and inspiring the world to be better, and maybe people like Bill Gates with their drive and technical vision. All those people are driving me in terms of what I can do with my own little steps for changing this planet.

David Foster, debt recovery expert at law firm Moore Barlow, highlights the options open to businesses for managing late payers and protecting cashflow.

The cost of doing business is ever rising – skyrocketing inflation, a weak pound and global materials shortages – making protecting cashflow as critical as it has ever been, particularly for SMEs.

But all of these problems only increase the likelihood of customers having their own financial issues that lead to late or unpaid bills. With April’s budget setting season on the horizon, it’s vital firms set themselves up for success and have the debt recovery processes they need in place.

It might seem obvious, but the temptation to jump on an opportunity for revenue, without doing the due diligence, is more acute than ever at the moment. But particularly at an economically volatile time, it’s essential to vet new partners, suppliers and customers to make sure they are financially sound before entering into contracts with them.

While there are statutory conditions for late payments, they are lenient, and businesses can weave far more robust conditions intro contracts that more fully protect them. This could include setting out when interest on payments will increase – for example, an increase of 1% for every month a payment is late. Another sensible inclusion is an agreement that the debtor will be liable for legal and agency costs if debt collection services are needed.

Easy, a huggable world. Huggable in the sense that it’s clean, sustainable, and balanced. And for that to deliver it needs corporate finance, investment banking, entrepreneurs, engineers, and the inventions behind it. So, I would like to bring a little bit of that to the planet.

Considering the work I’m doing now, which is trying to create the leading investment bank in climate tech globally, and helping funds and governments to get involved in climate tech and tech development in emerging markets, I hope it converts a lot of people out there to not just be ‘entrepreneurs’ but to be ‘entrepreneurs that make a difference to the planet’.

It’s important to get ahead of payment issues to reduce the likelihood of it snowballing into a significant cash flow issue. Having automated payment notifications set up is a good starting point, so that letters are sent out the moment payments are due, followed by periodic reminders, meaning less time is wasted chasing money owed. It can also facilitate conversations about cash flow, and whether repayment plans need to be in place to take the pressure off a struggling but valued client.

There is no silver bullet when it comes to ensuring customers pay on time. But these simple steps put a business in the best position to ensure money is flowing in and to protect cashflow.

If you need support with debt recovery and protecting cashflow, please get in touch on 01483 543210.

moorebarlow.com

Firms must set themselves up for success when it comes to debt recovery

“AS AN ENTREPRENEUR STARTING YOUR COMPANY, THERE IS A STATUS OF LONELINESS THAT YOU NEED TO BREAK VERY QUICKLY. WHEREAS THE CORPORATE ENVIRONMENT BY DEFAULT IS NOT LONELY, PROVIDED YOU CAN ADAPT TO IT.”

It’s been well-documented that the UK will be in recession during 2023, with other economies around the world also expected to suffer the same fate. Record inflation and high-interest rates continue to make the trading environment tough, whilst lockdowns in China are having a knock-on effect to the global economy. But is the economic outlook for 2023 as bad as first thought? We spoke to several experts to give an indicator of what you can expect this year.

The independent Office of Budget Responsibility (OBR) has warned that the UK is currently in recession and will remain so for the whole of 2023, with the UK economy contracting by 1.4% over the course of the year. A similar-sized contraction is supported by Goldman Sachs’ macro-outlook for 2023, which says there will be a shrinkage of 1.2%. Significantly, however, this figure is well below the other G-10 major economies, with the UK only marginally ahead of Russia, whose economy is expected to shrink 1.3% in 2023. Germany, with a contraction of 0.6%, is the next worst performer among major economies, according to the report.

Goldman Sachs also expects the UK economy to expand by 0.9% in 2024, with Russia and Germany’s economies growing by 1.8% and 1.4% respectively during this time. With the Organization for Economic Cooperation and Development also forecasting that the UK will lag significantly behind other developed nations in the coming years despite facing the same macroeconomic headwinds, there appears to be tough times ahead for the country.

However, according to Andrew Hodgson, Senior Partner, Corporate Finance at KPMG, such an outlook is not so bad when put in the context of past recessions.

He comments: “We think the UK economy is in the midst of a relatively shallow but protracted recession. Overall GDP is expected to fall by 1.7% from peak to trough, followed by a partial recovery in 2024. Despite this, the size of the UK economy will still be below its pre-pandemic level at the end of 2024. But, while the duration of the current downturn may be relatively long, the drop in activity is expected to be mild by historical comparisons.”

Although 2023 might not be a year of economic despair by historical standards, it’s significant that the UK is expected to be one of the worst-hit major economies. This begs the question of whether enough is being done to mitigate the recession. The Bank of England has continuously raised interest rates as it attempts to

tackle high inflation, taking them to 3.5%, the highest point in 14 years. But this appears to be in vain, so could the government do more to help bring them down?

According to Hodgson, the government does not have much power to alter interest rates.

He comments: “Market interest rates are determined by a range of factors: independent monetary policy, risk premia, and the balance between supply and demand for debt. The government has only a limited role in influencing interest rates. Political stability recently has helped bring down uncertainty and reduce gilt yields in the aftermath of the mini budget. But monetary policy will likely remain tight for the foreseeable future to counteract the effects of persistently high inflation. In addition, quantitative tightening (reversal of the Bank of England’s purchases of government debt in the form of QE) increases the supply of gilts and reduces demand, pushing up gilt yields.”

“OVERALL GDP IS EXPECTED TO FALL BY 1.7% FROM PEAK TO TROUGH, FOLLOWED BY A PARTIAL RECOVERY IN 2024. DESPITE THIS, THE SIZE OF THE UK ECONOMY WILL STILL BE BELOW ITS PRE-PANDEMIC LEVEL AT THE END OF 2024.”

Andrew Hodgson

High-interest rates are not the only challenge the UK economy is currently contending with, however. Inflation is at 10.7%, meaning it remains near a 40-year high, but Hodgson believes this could be alleviated by quickly resolving the conflict in Ukraine or a persistent improvement in supply chain pressures.

He continues: “And with a tight labour market, we think that unemployment could remain relatively low, providing important support to incomes. In the short run, government support will continue to mitigate the direct hit, but fiscal space is already limited after a prolonged period of pandemic-related spending.

As such, the government will probably want to limit the amount of support before it causes it to miss fiscal targets that are already very stretching.”

However, Russ Shaw CBE, founder of Tech London Advocates & Global Tech Advocates, says adequate government support for the tech industry is key for generating growth in 2023.

He comments: “Rishi Sunak’s commitment to supporting innovation across the UK is vital. Increasing public funding towards R&D in sectors, such as AI and green tech, signal that the government is willing to invest in the future success of the UK economybut more has to be done to protect the sector and the economy.

“With the capital holding firm as Europe’s leading tech hub, and flourishing regional hubs such as Bristol, Manchester and Birmingham going from strength to strength - the UK tech industry is well positioned to be a catalyst for growth across the whole economy if the government creates the right environment for the sector. Tech businesses are finding it increasingly hard to find and retain top talent, due to the tech skills shortage which costs the economy an estimated £63bn a year in potential GDP.

“To support the UK tech sector and business more broadly, the government will have to increase investment in digital skills training. The UK also needs to double its effort to strengthen ties with major economies, such as India, to create new trade opportunities. With a holistic economic strategy that makes the most of the UK’s strengths, the goal of creating sustainable growth can come within reach even during these uniquely challenging times.”

Although 2023 looks especially tough for the UK, the global outlook does not appear much better. The International Monetary Fund (IMF) is expecting a third of the world

to fall into recession this year, with the firm’s Head, Kristalina Georgieva, saying 2023 will be “tougher” than last year as the US, EU and China see their economies slow and that it will feel like a recession for millions of people living in countries that are not in recession too. According to the World Bank’s Global Economic Prospects Report, the global economy is also “perilously close to falling into recession,” and will grow by just 1.7% this year, which is the lowest growth figure since 1991.

Dr Maria Paola Rana, Lecturer in Economics and Finance at the University of Salford Business School, says this report also confirms the risk of a second global recession within three years.

She elaborates: “Forecasts for 2023 have been revised down for 95% of advanced economies and almost 70% of emerging and developing economies. Growth in advanced economies, in fact, is forecasted to decelerate from 2.5% in 2022 to 0.5% in 2023. While growth in emerging and developing economies (excluding China) is expected to slow from 3.8% in 2022 to 2.7% in 2023. The World Bank has also expressed particular concern for developing and emerging economies, stating ‘weakness in growth and business investment will compound the already-devastating reversals in education, health, poverty, and infrastructure and the increasing demands from climate change’.”

“INCREASING PUBLIC FUNDING TOWARDS R&D IN SECTORS, SUCH AS AI AND GREEN TECH, SIGNAL THAT THE GOVERNMENT IS WILLING TO INVEST IN THE FUTURE SUCCESS OF THE UK ECONOMY.”

Russ Shaw CBE

Rana says this means we could expect the UK to not be an exception when it comes to a tough 2023.

“If anything, the UK economy has additional reasons for concern, such as Brexit-related issues, including even higher inflation and tougher monetary policy, persistent high energy prices, further lockdowns in China, and the possibility that geopolitical tensions escalate,” concludes Rana.

However, Hodgson says a global economic slowdown will have implications for the UK.

He comments: “The global markets have already had a tough 2022, with growth slowing and financial conditions tightening. As a small open economy, the UK is not immune to the slowdown in the global economy. For example, UK exports are particularly sensitive to demand from our main trading partners, which is enough to outweigh any benefits from the weaker currency. Higher uncertainty about global prospects will also depress business confidence and keep a lid on investment.”

One of the reasons for the slowing global economy is China’s response to Covid-19. China previously had a strict lockdown

The latest data from XpertHR shows that pay awards are worth a median five percent in the three months to the end of December 2022. This is equal to the previous month’s figure and more than double that recorded in the same period in 2021 (2.3%). The gap between pay settlements and inflation remains substantial and will likely continue to be so over the coming 12 months.

The Consumer Prices Index rose by 10.7% in the 12 months to November 2022, slightly down from 11.1% in October, which marked a 41-year high. More than a quarter of all pay reviews take effect from January each year and whilst it is unlikely that pay will rise substantially in the coming months, the latest data shows that neither is there any sign of settlement levels dropping to where they were in the same period last year.

policy, but now that they’ve eased lockdown restrictions, there have been reports that hospitals in the country are under pressure due to Covid-related hospitalisations. According to UK-based research company Airfinity, its model estimates cases in China could reach more than three million a day in the first few months of 2023.

Dr Rana comments on the effects of this policy. She says: “Since China is the major producer and exporter of consumer goods in the world, the surge of Covid-19 infections the country is currently experiencing, due to recently lifting the strict restrictions the country had in place, will disrupt the Chinese manufacturing sector even further - at least in the short-term. This is likely to have a further impact on the global supply chain and, subsequently, on the global economy.”

Hodgson elaborates on this: “China is highly integrated into global supply chains. Shortages of even small components can cause bottlenecks and hold up production processes. This is, in turn, driving up inflation. For example, we’ve seen in the UK that a shortage of semiconductors for new cars has resulted in a spike in the price of second-hand cars. Global supply chain pressures have eased recently, although a combination of geopolitical and Covid-related risks mean they are likely to remain a background issue.”

Because of China’s importance to the global economy, their response to Covid in 2023, particularly over the winter months, could be an integral factor when it comes to improving economic outlooks around the world. However, the UK has its own problems to contend with in 2023, and although the incoming recession does not appear to be one of the worst on record, the UK needs to do more if it wants to avoid falling further behind the other major economies in the years ahead.

“FORECASTS FOR 2023 HAVE BEEN REVISED DOWN FOR 95% OF ADVANCED ECONOMIES AND ALMOST 70% OF EMERGING AND DEVELOPING ECONOMIES. ”

Dr Maria Paola Rana

In 2014, Simon Sinek’s cult book Leaders Eat Last shot to acclamation. Sinek highlighted the dynamics that inspire leadership and trust, asserting that for someone to be a leader as opposed to a dictator, they must first take care of their people, and only after should they think of themselves. As leaders, says Sinek, our sole responsibility is to protect our people. In turn, the people will protect each other and advance the organisation.

2022 saw business founders and those in executive and C-Suite positions tasked with making more difficult decisions than ever. Inflation, increased interest rates, hiked energy costs, strained supply chains and a cost-of-living crisis impacted the business world in a myriad of ways, putting pressure on leaders to prioritise long-term

sustainability and potentially cut jobs and bonuses.

That being said, some leaders have continued to receive bonuses and salary increases despite economic pressure, and some argue this is justified due to the economic and social contributions leaders make. Do business leaders deserve to receive bonuses, or should they continue to ‘eat last’, even in the face of economic strain? We investigate…

In the UK, we finished 2022 with an interest rate of 3.5% and an inflation rate of 10.7% - breaking records. A cost-of-living crisis has impacted consumer-spending rates and geopolitical events have caused an

energy crisis and disrupted supply chains. As a result, businesses from a variety of industries have had to re-evaluate where their finances go.

Business founders, CEOs, and those in other C-Suite and executive positions arguably contribute significantly to the business they reside in. Their positions are distinctive in that they offer a unique set of skills and knowledge that would be hard to find elsewhere. This can be compared, for example, to more junior roles or employees with less experience who could be replaced easier.

In the middle of last year, it was reported that the average pay of FTSE 100 managers increased to pre-Covid levels, disappointing some employees, many of whom may be struggling more because of the cost-of-living

crisis. In 2021, CEOs were also paid £3.62m on average, a marked difference from £2.78m in 2020 during the pandemic.

Gerry Lianos, CEO and co-founder of Raffolux, feels that differing pay rise allocations could damage employee motivation, and therefore the overall business. He comments: “During a recession, if it is not possible for both the leader and the staff to receive bonuses, then I do believe that the leaders should ‘eat last’.

“They have a responsibility to ensure the success of their company, and negative sentiment throughout a firm caused by unfair pay allocations can be far more damaging than a leader - even a good one - not receiving their proper bonus for a period. Any available finances to be put towards bonuses should be distributed in reverse, with base-level employees receiving the highest proportion of their usual bonus, and leaders receiving the least (or none).”

It can’t be denied that the size of a business matters when considering whether leaders should eat last. In a small business, every role matters as every individual has a notable amount of responsibility and ownership over their work in a way that likely doesn’t exist to the same extent in a large organisation. Therefore, justifying the importance of a founder or CEO over other roles in the company is harder to do.

While founders of small businesses and start-up companies tend to take modest salaries at the beginning of their firm’s growth anyway, with the main goal typically being to scale their business out of passion.

Riannon Palmer, founder and Managing Director at PR company Lem-uhn, feels that it’s important for businesses to be conscious of the ‘public mood’ from a PR perspective. She comments: “In terms of leaders of big corporations taking big pay rises and bonuses, the story is a little different. Larger companies aren’t as dependent on profits to secure pay rises for the big bosses. But companies must take into account the public mood. If the company is performing well, all employees should benefit, not just the CEO. Similarly, if the company is going through a downturn, then all employees including leaders should have equal treatment.

“Employees are at the heart of any company and companies need to look after them, or risk them leaving. From a PR perspective, bosses taking big raises and bonuses are also vulnerable to bad press not just for them but for the business too.”

David Rajakovich, serial entrepreneur and thought leader, echoes the sentiment

that the larger the organisation, the more they need to pay attention to public opinion and reaction. He says: “The larger the organisation, the more of a media spotlight there will be on them. Therefore, they need to be careful about how this plays out in the court of public opinion because CEOs of larger organisations are political by nature. Whereas for founders and earlier-stage business owners, this is less of a concern – it’s more about considering how you move your business forward.”

Indeed, the performance of a business also matters when determining whether higher positions deserve more remuneration for their work. From a founder’s perspective, the performance of their company is likely to determine how much of a payoff they receive at the end of each year. Despite this, some founders may want to maintain their salary, even if their business suffers from external pressures, which may lead to them making financial cuts in other areas of the business.

In contrast, if a company is in the lucky position of experiencing growth in an economic crisis, it might be more likely that a founder will give themselves and company execs a pay rise. However, some founders, especially those in retail and consumerfacing businesses, have needed to take a pay cut despite growth, as the cost of supplies and materials has gone up, leading to tighter profit margins. Nevertheless, some argue that if a business is performing well, it’s a result of everyone’s work and therefore, every employee should be paid, not only those in exec-level positions.