international

21 shows worth watching out for this spring

Awesome AI: What impact will Sora have?

How the global content business is pivoting

PLUS: Launching fledgling IP on social pla orms | The role of Middle Eastern money in struggling Western media Everything about content Spring 2024

Your unfair advantage CONTENT STRATEGIES NIGERIA Content CONTENTL A

STRATEGIES

Content

Content

Your unfair advantage CONTENT

NIGERIA

CONTENTL A Drama Kids TV NIGERIA

8X25’

UPFRONT

Mediapocalypse now?

Not so long ago, everyone was floating down an endless stream of great TV. But the past 18 months have shown us that stream led to a fairly large waterfall, down which the traditional TV industry now appears to be falling.

The bottom has dropped out of mid-budget programming in the US and many European markets, leaving producers and freelancers reeling.

Many of those working in this area of TV are being encouraged to pivot to other genres and industries, with branded content studios among the most logical destinations.

and budgets have been eviscerated. Tim Davie, director general of the BBC, recently warned that US and Chinese algorithms are “the potential tastemakers of the future,” but that era may have already arrived. Some are calling this the ‘mediapocalypse’ and the prevalence of the #opentowork hashtag on LinkedIn illustrates just how hard times are for many working in the entertainment industry today.

Nothing that airs in daytime and early evening slots can be classed as unmissable. But this is the bread and butter of TV production and the industry is now on the Atkins diet. Attention has shifted to social media

THE C21 CONTENT TRENDS REPORT:

Spring 2024

C21’s quarterly look at main business trends looks at what we can do to make sure we survive, and maybe even thrive, between now and 2025.

OpenAI’s recently unveiled text-to-video AI tool Sora has sparked shock and awe across the entertainment business. Does it herald the dawn of a new age of content creation?

With new TV shows o en going undiscovered thanks to the competition for audiences, launching fledgling IP on social pla orms such as Roblox, TikTok and YouTube could be the answer.

RedBird IMI’s acquisition of All3Media and the former’s bid to buy UK newspaper The Telegraph have highlighted the growing role of Middle Eastern money in Western media.

CONTENT STRATEGIES: Mega

Scripted helped the Chilean net become a leader, but changing audience habits mean it must evolve to stay on top.

NEXT BIG THINGS: 21 on 21

Our selection of the 21 shows you can’t a ord to miss this spring.

AHEAD OF THE CURVE: AI

Are generative AI tools simply enabling producers to o er channels more for less, or are they in danger of cutting creatives out of the business?

Spare a thought for those in the kids’ TV business, for whom this has been the status quo for a while now. As one veteran exec put it on LinkedIn: “The kids’ media business has been in the shitter for over 18 months with no sign of turnaround.”

It was clear at Series Mania in Lille in late March that the scripted industry feels far more shielded from the economic headwinds battering the business,

CONTENTS

CONTENT STRATEGIES: TF1

France’s TF1 is seeking to push boundaries with new unscripted paper formats and reality reboots as it hunts for hybrid ideas to o er linear audiences and grow its new digital streamer.

DEVELOPMENT SLATE: Listen

‘Visualised podcasts’ are emerging as a new cost-e ective way for commissioners to get content on screen and help cash-strapped broadcasters.

CONTENT STRATEGIES: AMC Networks International UK Sam Rowden of AMCNI UK talks through her original true crime commissioning mission in the UK and outlines her priorities for the EMEA arm of the business.

CONTENT STRATEGIES: Free Documentary Quintus Studios is building a content partnership and revenue-sharing model for acquired and original unscripted content with its AVoD brand Free Documentary and its spin-o s, powered by YouTube.

THREE-YEAR PLAN: Cream Productions

David Brady’s Toronto-based ou it is basing its strategy on the financial incentives of tax breaks, coproductions and a beneficial exchange rate to make it an attractive partner.

perhaps due to factors like tax credits for high-end scripted and ‘must-watch’ TV often tending to be dramas. But everyone is feeling the pinch right now.

That will be abundantly clear at the last ever MipTV, as RX swaps the French Riviera for a new event in London in February 2025 – another sign of a business in flux – although Mipcom is staying put in the Palais come October.

But all is not lost. You will notice an unfamiliar logo adorning this issue, as we endeavour to provide you the intel and analysis that will hopefully help you adapt to survive and, eventually, thrive in 2025.

Could embracing artificial intelligence, social storytelling, visualised podcasts and alternative funding sources such as brands, private equity, grants and soft money provide the lifeboat you need in these choppy waters? Read on to find out more.

Nico Franks

DRAMA

AHEAD OF THE CURVE: UK high-end TV

As belt-tightening at US streamers and local broadcasters’ financial woes expose the UK HETV drama industry’s reliance on Hollywood, we ask whether the sector will bounce back or plateau.

NEXT BIG THINGS: Kidcos moving into content

Kids’ companies of all kinds are launching production and entertainment arms, as broadcasters and streamers seek shows based on known IP.

CONTENT STRATEGIES: Amazon Kids+

The curated children’s service is engaging with social media influencers and seeking IP with universal appeal.

DEVELOPMENT SLATE: Folivari

Internationall

Melissa Vega discusses the newly formed French studio’s strategy and its mission to secure global partners.

THREE-YEAR PLAN: Ellipse

Animation

Caroline Audebert and Lila Hannou on their European expansion and finding ways to reach young audiences.

PRESENT IMPERFECT FUTURE TENSE

C21’s Jordan Pinto asks if a third US stoppage in two years would confirm fears the business is entering an era of rolling strikes.

Channel21 International | Spring 2024 | Issue #318 CONTENTS 9

51 61 65 69 71 72 34 36 40 43 48 10 12 14 16 18 21 29 61 43 29 FACTUAL KIDS FORMATS

Survival strategies

The C21 Content Trends Report, a quarterly outline of the biggest trends in the business, continues in this issue with a look at what we can do to make sure we survive, and maybe even thrive, between now and 2025. By Nico Franks

“If we can all hold our nerve to the spring, hopefully we can come through this,” said Daniela Neumann, MD of London-based indie Spun Gold TV, in the last issue of this magazine. With green shoots emerging outdoors, can we say the same for the international TV industry?

“There are signs of hope with the ad market picking up a little in Q1 and some buyers’ frozen budgets beginning to thaw,” says Will Stapley, head of acquisitions at Dynamo is Dead distributor Abacus Media Rights, while admitting times remain tough for most.

featuring execs lining up to provide some reasons to be cheerful to weary delegates.

The end of TV’s “boom” period following the arrival of global streamers does not necessarily mean a period of “bust” is on the way, according to Sony Pictures Television president of international production Wayne Garvie. “Everyone knows not as much drama is being commissioned as was being commissioned. But more drama is being commissioned now than at most times in human history. That’s still great if you’re a drama producer or writer. It’s a wonderful time,” Garvie said.

Nevertheless, freelancers are leaving the industry in their droves and companies are going out of business. So what can those hanging on in there do to ensure they’re still around come 2025?

It’s easy to feel as if the content industry is in the midst of some doomsday, extinction event – and perhaps it is. While some hoped the pressures facing the business would be cyclical, there’s mounting evidence – particularly in the world of unscripted – that the industry is undergoing fundamental change that will ultimately result in fewer things being commissioned and fewer jobs.

Distribution execs heading to the final MipTV in Cannes are calling for more flexibility when it comes to how broadcasters and platforms manage rights. Dylan Casella, head of acquisitions and coproductions at O the Fence, believes there needs to be a “much more generous attitude towards sharing rights as the whole industry shifts to a more coproduction-

“The polarisation between premium event television on the one hand and returnable, cost-e ective, long-running shows on the other has never been greater, and the demand for mid-range content is significantly reducing,” says Emmanuelle Namiech, CEO of Passion Distribution, seller of shows such as Help! We Bought a Hotel

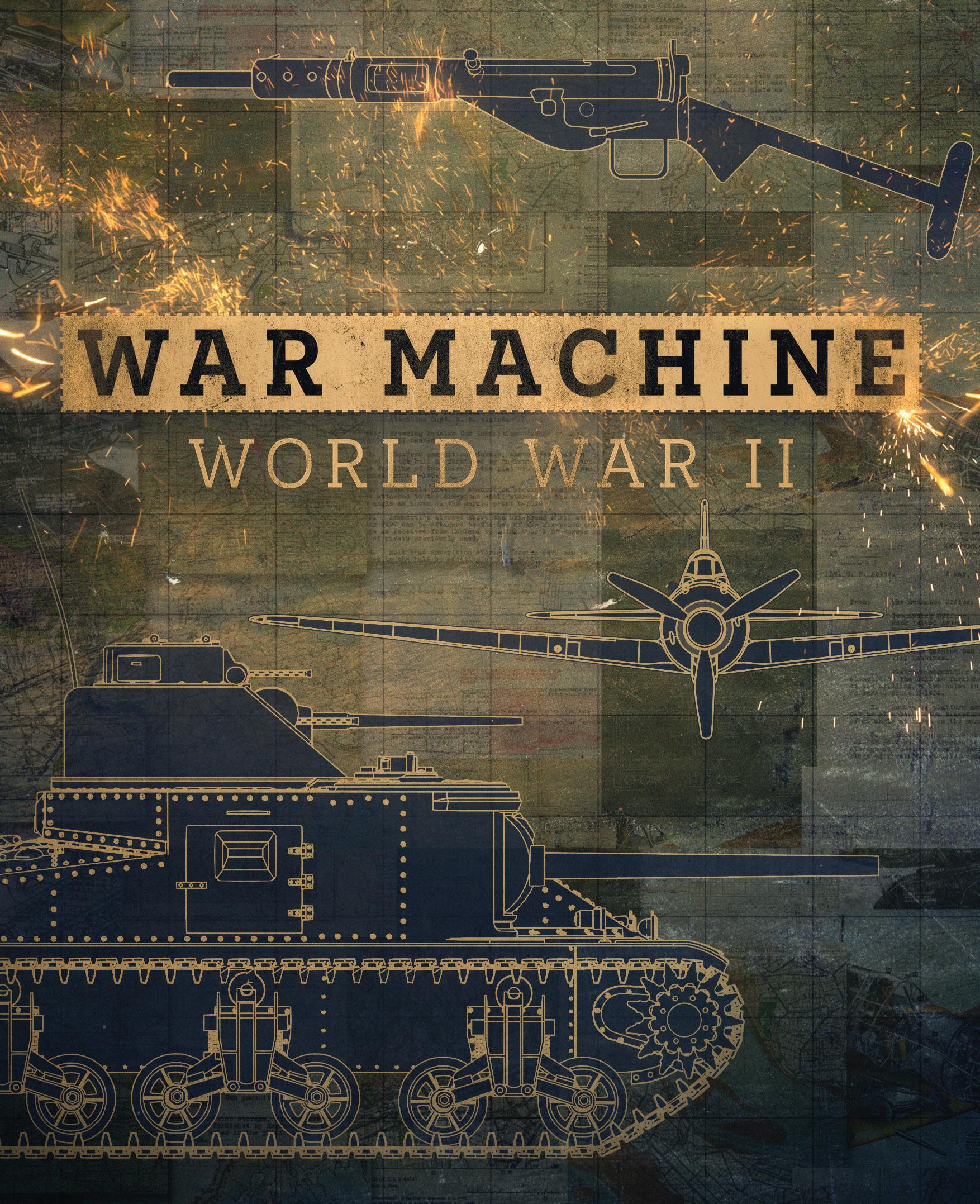

O the Fence is leaning into history with series

There are reports of award-winning unscripted entertainment workers in the US turning to Uber and DoorDash to make ends meet due to Hollywood cuts and a severe shortage of work as the industry contracts.

and a severe shortage of work as the industry contracts.

as we have known it since the inception of colour unscripted workers in their thousands signed a shifts focused approach.”

North American unscripted TV veteran Phil Gurin declared in February that “the television industry as we have known it since the inception of colour broadcasting is dying,” while across the pond, UK unscripted workers in their thousands signed a petition similarly claiming “UK TV production is dying.”

In scripted, things appear a little less dire, with panels at Series Mania in March

10

THE C21 CONTENT TRENDS REPORT: Spring 2024 Channel21 International | Spring 2024

Dynamo is Dead

The Connected Set’s Dating in the Metaverse

such as Flying Knights, which looks at the history of aviation and is timed to coincide with Steven Spielberg’s Apple TV+ series Masters of the Air, a ‘miniseries’ with a US$250m-plus budget.

Some producers, such as UK-based The End TV, are adapting by moving from traditional broadcast TV to specialising in branded content. James Lessell, MD and founder at The End TV, explained on LinkedIn recently how he made the shift and amassed a new network. The company now produces formatted TV shows for brands.

“I created a database of contacts and a status. Name, company, date of last contact and where I am with them. I update it every day,” wrote Lessell, adding: “I like to build rapport before scheduling meetings. Yes, I ask for a chat, but I never try to schedule a meeting in my first contact. It has never worked on me.

James Burstall, CEO of Argonon and author of The Flexible Method: Prepare to Prosper in the Next Global Crisis

In an era of permacrisis, where producers and content companies are facing both structural and economic challenges, a strong development pipeline needs to focus on both today and tomorrow. Our twin-track strategy of high and low is bearing fruit, as we develop high-end projects to drive long-term growth as well as low-cost, highvolume commissions to plug gaps in libraries and schedules, and keep our talented teams busy.

Emmanuèle Pétry Sirvin, producer and head of international, Dandelooo Keep breathing. In and out... deeply. Dark days are always followed by sunny ones. My own way is to stay focused on the horizon and push back doom and gloom. More specifically, in our studio – Ooolala in Valence, France – we are thinking about how AI integration can help increase the competitiveness of our pipeline.

“Success takes time; I try not to rush the process. It won’t happen overnight, so be patient. Most importantly, be adaptable, kind, honest and don’t give up.”

Jason Mitchell, founder of Dating in the Metaverse producer The Connected Set, has encouraged the TV world to embrace the latest wave of AI tools to become more e cient and stay ahead of the curve. He recently travelled to LA for meetings with networks, streamers and producers and was pleasantly surprised by what he found.

“On this trip it’s become clear there’s creative dealmaking to be done around rights, territories and alternative funding models. With so many energising conversations from this trip, I’d say it’s a great time to be exploring the US market, especially if you’re feeling gloomy about the state of commissioning in Britain,” said Mitchell.

Bailey Mackey, CEO, Pango Productions

We want to see where we can collaborate and gain scale. We would love to look at potentially merging with or acquiring other businesses. For us to gain scale, it can’t just be about coproduction; sometimes the best way is through M&A. We’re looking long and hard at that as a strategy. Also, all sports are looking at moving from being business-to-business to business-to-consumer and see content as a way of engaging audiences and building connections with their fans and fandom.

Andy Harries, co-founder, Left Bank Pictures

This country needs a TV industry that remains distinctive, independent and competitive with US global media companies. Let’s work together to find an inventive way to ensure all our public broadcasters are a continuing part of the national debate with their drama, and they have some protection and the funds to make the shows that can shine a light on our lives in the UK and, sometimes, make a di erence.

Monica Levy, co-chief of distribution, Federation Kids & Family

Navigating the rapidly evolving television industry necessitates taking proactive steps. We are encouraging team members to take swift and independent decisions, which not only enhances productivity but also fosters resilience in the face of challenges, ensuring a positive and motivated team spirit.

Kate Beal, founder and CEO, Woodcut Media

A diverse content o ering to multiple clients is key. If one

Off the Fence history series Flying Knights

genre becomes more favourable then we will absolutely lean into it, but not at the cost of our other programming strengths. Television fashion can be fleeting, as can your relationships with key networks. Hence it makes sense to have excellent contacts with multiple buyers at any one time. Never rely solely on your best friend at one network to keep your business in good health, as executives do change companies and roles from time to time. Judicious investment in content is crucial for any production company this year to keep the production wheels turning.

Will Stapley, head of acquisitions, Abacus Media Rights

Everyone in the market is having to be creative in finding cost-e ective models for funding productions, whether through gap financing, pre-sales, distribution advances or attaching brands, private equity, grants or soft money via international coproductions. On occasions, we bring in thirdparty financiers to help fund bigger budgets. We are seeing some producers o setting expensive development costs through creating digital shorts and podcasts that can then be pivoted into TV features/series.

Tim Du y, meditation teacher and former senior Viacom (now Paramount) exec

Entertainment industry workers must take it upon themselves to adapt and move forward with their lives. It’s time to let go. Are you in post-production? Flow towards AI companies, in-house brand studios and so on. A producer/director? Flow towards brands, or use your skills as a team leader and critical thinker to solve problems that inspire you in growth industries. A development executive? Business development and sales are your skills: flow towards growth industries that need you.

Channel21 International | Spring 2024 THE C21 CONTENT TRENDS REPORT: Spring 2024 11

Sora coming

OpenAI’s recently unveiled text-to-video AI tool Sora has sparked shock and awe across the entertainment business. Does it herald the dawn of a new age of content creation?

In the last edition of Channel 21 International magazine in January we wrote that while OpenAI – the Microsoft-backed company behind ChatGPT and DALL-E – hadn’t announced anything yet, the expectation was that its groundbreaking AI technology would soon be “capable of converting text or voice prompts into multimedia instantaneously.”

War II soldiers and Vikings, for example, as people of colour.

By Jonathan Webdale

By Jonathan Webdale

On February 15, CEO Sam Altman unveiled Sora, “an AI model that can create realistic and imaginative scenes from text instructions.” While the description of this new tool was somewhat understated, the reaction from certain quarters of the film and TV industry was swift and emphatic.

A week later, Tyler Perry – the US actor and filmmaker who established his own studio in Atlanta almost a decade ago, which has gone on to host shows including The Walking Dead and hit movie Black Panther – told The Hollywood Reporter that having seen Sora, he had put a planned US$800m expansion of the facility on hold.

The interview was published a day after James Hawes, director of Apple TV+’s Slow Horses, told a government inquiry into the future of the UK film and high-end TV business that Sora meant the “genie is out the bottle” and it will be possible for AI to generate entire TV series within three to five years.

Altman’s unveil (via X) took the wind out the sails of Gemini 1.5 – the latest tool to emerge from Alphabet’s Google DeepMind AI division – which launched on the same day but was met with a very different response, not least because its image generator made a string of embarrassing gaffes, depicting German World

While Alphabet gets its house in order, OpenAI is pushing ahead with Sora’s development, though –the company insists – doing so in concert with key stakeholders within the creative industries. The tool, which for the time being can create videos of up to one minute from whatever prompts it is given, isn’t yet available to the public and is in the hands of select OpenAI ‘red teamers.’ Access has also been granted to “a number of visual artists, designers and filmmakers.”

The aim, according to the company’s website, is “to gain feedback on how to advance the model to be most helpful for creative professionals. We’re sharing our research progress early to start working with and getting feedback from people outside of OpenAI and to give the public a sense of what AI capabilities are on the horizon.”

Read into this what you will but bear in mind that, at the same time, the New York Times is suing both OpenAI and Microsoft for copyright infringement in a case that is growing increasingly ugly, with Microsoft in response accusing the newspaper of acting like Hollywood in its futile 1970s fight against VCRs.

The big question over Sora, of course, is what material its AI model is being trained on. According to OpenAI, this is data from publicly available content and content the company has licensed. While the New York Times is going down the path of litigation, Germany’s Axel Springer is an example of a media group that has reached a formal agreement with the

12

THE C21 CONTENT TRENDS REPORT: Spring 2024 Channel21 International | Spring 2024

A new level of realism: all of these images are stills from videos generated by Sora based on text prompts

Mustafa Suleyman, co-founder, DeepMind, co-author, The Coming Wave

AI is far deeper and more powerful than just another technology. The risk isn’t in overhyping it; it’s rather in missing the magnitude of the coming wave.

Jeffrey Katzenberg, co-founder, DreamWorks Animation

In the good old days, it took 500 artists five years to make a world-class animated movie. I don’t think it will take 10% of that three years from now. If you look at how media has been impacted in the last 10 years by the introduction of digital technology, what will happen in the next 10 years will be 10 times as great. AI as a creative tool has so much opportunity around it.

Tyler Perry, actor, filmmaker, founder, Tyler Perry Studios

I was in the middle of an US$800m expansion at the studio, which would’ve increased the backlot a tremendous size – we were adding 12 more sound stages. All of that is currently and indefinitely on hold because of Sora and what I’m seeing.

Kenton Allen, CEO, Big Talk Studios

When you see Tyler Perry cancelling an US$800m investment in Atlanta because he’s seen Sora and what that delivers, that’s alarming, but AI is a tool that we do use and will use more. It’s a huge threat to the VFX industry but it will enhance what we do.

James Hawes, vice-chair, Directors UK

My worry is that if we don’t get up to speed with this then the AIgenerated stories will come from elsewhere. We need to take note and act on it now. Silicon Valley is way ahead.

Richard Osman, producer, TV presenter and host of podcast The Rest is Entertainment

The industry will be hollowed out. At the top end there will always be projects with gatekeepers, done by people already in the industry who already have connections, and at the bottom end there will be loads of scrappy producers and content creators. It’s the stuff in the middle that goes – linear television, the background stuff we watch day to day.

Jes Brandhøj, director of sales and series acquisitions, Nordisk Film; co-founder, Prompt Collective

Sora videos are impressively realistic. Imagine the possibilities if we no longer needed expensive shoots for breathtaking scenes – less need to, say, travel to faraway places to hurl Tom Cruise off a cliff on a motorcycle.

tech firm, at least regarding ChatGPT.

Those that have taken the same route with Sora are yet to be revealed, but the unfolding story is looking a lot like that of YouTube and how, once Google bought the business in 2006, Viacom sought US$1bn in damages for copyright infringement. The two parties finally settled after seven years. In the interim, Google took steps to appease other concerned IP owners and persuaded them to engage with its technology to find new ways of monetisation together.

When Netflix moved into streaming in 2007, the threat to Hollywood perhaps wasn’t taken all that seriously, or, rather, the licensing dollars the firm was offering proved irresistible at a time of economic crisis.

In 2024, global financial markets are again on a knife edge. Hollywood is once more in flux – slashing costs after belatedly investing heavily in streaming and still reeling from six months of strikes, with

Marques Keith Brownlee (aka MKBHD), YouTuber

This does feel like another ChatGPT/DALL-E moment for AI. Maybe I’m overreacting because I’m a video creator, so an AI that’s actually doing my job maybe feels a little more threatening. But I’m particularly impressed by it – this stuff is really good.

advertising too in a potential death spiral. There has arguably never been a greater imperative to extract value from the vast treasure troves of content amassed during the past decade, and the window of opportunity to do this is perhaps narrowing.

Indeed, if you believe AI maximalists, Sora may offer established media players their last opportunity for a sizeable pay cheque before the industry gets swept away in a tsunami of usergenerated content, the like of which YouTube has never seen before. Whether they are willing to accept will depend on the amount OpenAI is offering, how desperate they are and the degree to which they buy the existential warnings.

Channel21 International | Spring 2024 THE C21 CONTENT TRENDS REPORT: Spring 2024 13

Social storytellers

With new TV shows o en going undiscovered by audiences whose attention is more divided than ever, launching fledgling IP on social pla orms such as Roblox, TikTok and YouTube could be the key to finding relevancy in a fragmented digital landscape. By Nico Franks

It never hurts to pay particular attention to the children’s media sector. Many of the problems it has faced, like its viewers deserting linear TV for on-demand in the 2010s, are ones that inevitably rock the wider industry a few years later.

‘Social storytelling’ is a term that has begun being spoken about more and more in children’s media in response to its audience’s overwhelming preference for online game platforms such as Roblox and Minecraft over traditional TV.

on the platform, with Twilight Daycare: The Show!

maximise engagement over just watching, they’re more likely to drive the social storytelling audience back to their platform. Engaging snippets that leave viewers curious can serve as an e ective tra c driver. By strategically intertwining social storytelling with a broadcast or subscription-based model, traditional networks might attract a new audience by using social storytelling strategies,” says Redfern.

As delegates at Content London 2023 heard from Chad Nelson, a consultant for Open AI and creator of the artificial intelligence-generated short film Critterz: “The younger generation live in a Roblox/ Minecraft world and think of entertainment as a sandbox that everyone should be able to manipulate and play with.”

Although talk about the metaverse has died down considerably since 2022, it’s clear anyone targeting a youth demographic has to develop with social platforms in mind rather than committing all their funds to a traditional 26x11’ or 6x30’ series.

“Social storytelling is a great way to extend narratives across multiple channels to reach younger audiences, creating a transmedia flywheel that is emerging as an alternative way to build IP at a time when streamers and broadcasters are largely closed for business,” says Jo Redfern, MD at Wind Sun Sky Entertainment.

An ideal-case scenario for social storytelling would see, for example, a shortform animated IP made available on social platforms like Roblox and YouTube to allow young audiences to shape the story themselves.

“It encourages direct interaction between creators and the audience. It allows for realtime feedback, and that can be valuable in informing the future direction of the narrative,” adds Redfern.

The Vancouver-based company is on board an episodic scripted series based on the Roblox platform game Creatures of Sonaria, having already made the first-ever animated series produced fully

David Levine spent 16 years at The Walt Disney Company, leaving in 2020, a few months before the media giant’s linear TV channels Disney Channel, Disney Junior and Disney XD were axed in the UK as the Mouse House went all-in on Disney+. He then spent time at Blippi and CoComelon producer Moonbug before setting up his own company, Lightboat Media.

Moreover, the doors are not closed to broadcasters, as long as they’re open to a flexible approach to launching programming.

“If a broadcaster can

The firm recently consulted with the producer of an animated series that has become popular on YouTube. To deepen engagement with viewers, as well as entice traditional broadcasters towards the IP and a potential new series, Lightboat developed a digital-first shortform series based on the property.

Working with the original creators and using a lower-cost studio to replicate the original

Shortform scripted platform Reelshort

14 THE C21 CONTENT TRENDS REPORT: Spring 2024 Channel21 International | Spring 2024

Gecko’s Garage

company is on board an

Roblox

2D designs, it drew heavily on viewer data to understand which characters, storylines and setups would resonate best on YouTube, giving the new series a better chance to succeed.

So what advice would Levine give to broadcasters and networks looking to get involved in social storytelling?

“It’s not just clips; the content needs to fit the platform. It doesn’t need to be the fully blown iteration of the IP, honing the content to the core characters, relationships and set-up to start,” says the exec.

“Tap into producers and creators that know the platforms and understand how to make content for those platforms. Even if the final product is envisioned to be CG, start out with lower-cost 2D; as the IP moves up the ‘food chain’ the format can evolve. Great examples of this are Moonbug’s Gecko’s Garage and Morphle.”

Meanwhile, an eight-hour saga of a marriage

gone wrong, titled Who TF Did I Marry?, may sound like something you see while scrolling through the Netflix carousel, but it was actually uploaded in 50x5’-10’ episodes on TikTok by creator ReesaTeesa in February.

Teesa became an overnight internet celebrity, capturing the attention of millions with her tale of a toxic relationship while highlighting the power of bitesized social storytelling. Meanwhile, Chinese shortform scripted platform Reelshort seems to be succeeding where Quibi failed by adding gamification elements and rewards for watching.

“Young people haven’t got shorter attention spans, they’ve just got shorter interest spans,” says Redfern.

With this in mind, in New Zealand, writer and video games and interactive experiences director

Mark Loughney, senior consultant, Hub Entertainment Research

There’s no doubt that younger viewers are not as devoted to traditional TV and movies as previous generations have been. This presents one more challenge to legacy media companies as they navigate the future of the video ecosystem. It would be futile for them to try to claw back time from non-traditional platforms, so instead media companies should look to social media as opportunities to reach GenZ with premium content.

Evan Shapiro, media universe cartographer

We’re in a magic moment when the creator-led community, the community economy, is going to wind up being the most important part of the content ecosystem. The most important, diverse, inclusive, representative and inventive stories are going to come from artists using technology to empower themselves. There have never been better tools to compete with the studio system, which is limping. They are in danger and a lot of them won’t be here in five years.

Todd Lichten, head of entertainment partnerships, Roblox

It’s clear that the Kung Fu Panda franchise has found a perfect home on Roblox, but success on a competitive UGC [user-generated content] platform requires more than just a beloved IP. Props to Universal Pictures’ digital marketing and media teams for their innovative approach to delighting discerning fans – and to Sawhorse Interactive for crafting a compelling two-player obby [obstacle course] that’s set a new bar for theatrical marketing on the platform. So much other great work is coming from entertainment in the next few months on Roblox.

Alexander Swords is hosting an introduction to ‘narrative design’ in Auckland in April.

Narrative design is described as the process of understanding a story as a system to allow storytellers to better connect to both play and interactivity, for games, extended reality and live choice-driven experiences. It also gives a look ‘under the hood’ at how story functions on a meta and micro structural level, which can help linear storytelling move away from rigid conventions.

So prepare to see ‘narrative designer’ or ‘social storyteller’ on a few more (digital) business cards in the years ahead. Who

Jo Redfern, MD, Wind Sun Sky Entertainment

Consider a scenario where a YouTube animated series introduces characters and plotlines that seamlessly transition into a Roblox experience. Kids then contribute to the narrative with their activities in-game. With good monitoring, this could help inform subsequent storytelling by informing writers which characters, vehicles, animals and scenarios are engaged with most within the game. Then they could be up-weighted in subsequent episodes.

Rob Doherty, media executive and consultant

Our audience is no longer where it used to be, nor as passive, and we are struggling to reach it with traditionally executed content. The new generations of audiences are better informed, better equipped and far more in control of what they want. Not only that but in their social virtual universes they can now create their own content more easily than ever before. Engaging them in new ways, through social storytelling and other means, should be the primary focus of the industry right now.

David Levine, founder and consultant, Lightboat Media

Developing brand new IP has never been more challenging, and creating a digital-first iteration of the idea/concept/ IP as a way to build awareness for it is clearly a way to lower the risk involved. Given the low RPM [revenue per mille, representing how much money is earned per 1,000 video views] for YouTube kids content, finding a way to create an all-audience IP, appealing to a broader advertiser set with higher RPM, as a backdoor pilot for a kids IP, would be an interesting way to go. The cost to enter into Roblox is lower than the YouTube/animated series route, with faster ways to generate views, but it’s challenging as a recoupment model.

15

Marry?

TF Did I

|

Channel21 International

Spring 2024

THE C21 CONTENT TRENDS REPORT: Spring 2024

Twilight Daycare: The Show!

Expanding gulf

RedBird IMI’s acquisition of All3Media and the former’s attempts to buy influential UK newspaper The Telegraph have highlighted the growing role of Middle Eastern money in financially challenged Western media and entertainment.

By Jonathan Webdale

By Jonathan Webdale

The long-running saga over the ownership of All3Media ended in February when private investment company RedBird IMI agreed a £1.15bn (US$1.45bn) deal for the European production and distribution group behind series including The Traitors, Squid Game: The Challenge, Fleabag, Midsomer Murders and many more.

All3 was by no means short of suitors, and after UK newspaper The Telegraph (more on this shortly) revealed in June last year the firm was being auctioned by joint-venture parents Warner Bros Discovery and Liberty Global, a string of interested parties were linked to the sale, including Banijay, ITV Studios, Peter Chernin’s The North Road Company, Sony and Goldman Sachs.

Some of these bidders are said to have baulked at All3’s £760m

debt burden, but not RedBird IMI –a joint venture between US private investment firms RedBird Capital Partners and Abu Dhabi-based International Media Investments, established in December 2022 with former CNN boss Jeff Zucker at the helm as CEO. New York-based RedBird Capital,

led by founder and managing partner Gerry Cardinale, previously helped finance a number of media and entertainment ventures. It backed a new Ben Affleck and Matt Damon prodco called Artists Equity, took a minority stake in Maverick Carter and LeBron James’s The SpringHill Company and has invested in David

Spring 2024

Anthony Hopkins at the 2024 Joy Awards

All3Media’s The Traitors

Ellison’s Skydance Media – a potential acquirer of Paramount Global.

IMI, meanwhile, is a private company owned by Sheikh Mansour bin Zayed Al-Nahyan, vice president and deputy prime minister of the United Arab Emirates and, since 2008, owner of English Premier League club Manchester City. IMI holds investments in digital and linear entities including The National, Sky News Arabia, CNN Business Arabic and The Grid. Former CNN high-flier Rani R Raad was appointed CEO in September last year, taking over from Nart Bouran.

Mansour, brother of the current UAE president Sheikh Mohamed bin Zayed Al Nahyan, is 75% owner of RedBird IMI, with RedBird Capital retaining the rest. Aside from All3, the company last summer helped establish New York-based non-fiction producer EverWonder Studio, founded by former Time president and chief operating officer Ian Orefice, and this January invested in Media Res, the Michael Ellenberg-led prodco behind programmes such as Apple TV+ series The Morning Show and Pachinko

The deal that has attracted most attention, however, has been RedBird IMI’s attempt to buy The Telegraph and sibling political magazine The Spectator. The company’s move to pay off £1.2bn of debt on these entities in advance while a formal bidding process was still underway inevitably drew the ire of rivals. UK journalists, too, uneasy at the UAE’s track record on impartiality and human rights, have voiced concerns. Politicians, particularly those among the ruling Conservative Party, to which the right-wing Telegraph and Spectator lean, have moved to block the transaction, seeking to ban foreign governments from owning UK newspapers or magazines.

RedBird IMI’s Zucker argued in a recent interview with The News Agents podcast co-host John Sopel that IMI is not a government sovereign wealth fund, rather a commercial entity, and that the UAE doesn’t need to own a UK newspaper to exert influence since

it is already a close ally. While the drama was still playing out at the time of writing, the story highlights Middle Eastern investors’ growing appetite for Western media and entertainment businesses and their ability to offer vast sums in order to achieve these ends at a time when such enterprises are struggling.

Of course, the concept of ‘soft power’ is nothing new and Hollywood is arguably one of its greatest purveyors, propagating American culture and values around the world, with Skydance blockbuster movie Top Gun: Maverick cited by some as a recent case in point. And the UAE is by no means alone in seeking a piece of the action but its increased interest, along with that of fellow Gulf states such as Saudi Arabia and Qatar, is notable, mostly for its investments in sports but also in broader entertainment.

Abu Dhabi-based MBC Group, the Middle East’s largest broadcast and media outfit, relocated its headquarters to Riyadh 18 months ago, with both hosting the annual Joy Awards, which this February attracted stars including Anthony Hopkins, Kevin Costner and Mark Wahlberg. Last year’s Red Sea International Film Festival in Jeddah drew Johnny Depp and a host of others, and, through its foundation, is helping finance the Pirates of the Caribbean star’s next feature, having funded others including Michael Mann’s Ferrari. The two events have been growing over the past three years.

Meanwhile, Saudi Arabia’s Crown Prince Mohammed bin Salman’s sovereign wealth fund reportedly paid US$200m for a stake in Penske Media, owner of US trade publications Deadline, Variety and The Hollywood Reporter, in 2018. US talent agency Endeavor (now Fifth Season) received US$400m from the same source around that time but, following Saudi Arabia’s connection to the brutal murder of Washington Post journalist Jamal Khashoggi later that year, returned the funds in 2019.

Elsewhere, Vice Media has been accused of going soft on the kingdom, having initially pulled out of the Middle East after Khashoggi’s death but subsequently opening an office in Riyadh in 2023 under former CEO Nancy Dubuc and forging ties with MBC shortly before filing for bankruptcy.

Rani R Raad, CEO, International Media Investments

Our ambition is crystal clear: to build IMI into a forwardthinking global media powerhouse. We already own and operate some of the strongest media properties in the region encompassing both international and local brands. We now have the opportunity to grow these assets, expand our audiences and operate at more of a global level. With the way the MENA region has developed over the last few years, it is now the right time to play a bigger role in the global media sector.

Gerry Cardinale, managing partner, RedBird Capital

Our job as private equity investors is to grow the value of our businesses, not to influence content or editorial direction. We don’t tell David Ellison what movies to make or not make at Skydance; we don’t tell Ben Affleck or Matt Damon what movies to make or not make at Artists Equity; and we don’t tell LeBron James and Maverick Carter what projects to take on or not take on at The SpringHill Company.

Jeff Zucker, CEO, RedBird IMI

Red Bird IMI was set up more than a year ago as a commercial joint venture that was looking for media opportunities across news and information and entertainment across the global landscape. The UAE doesn’t have to own a newspaper in the UK to have influence and the fact is that IMI is not the UAE, it’s a business of one of the leaders of UAE that is set up for commercial returns.

Lewis Goodall, co-host, The News Agents

We are living in a world where we are seeing the rapidly growing influence of Middle Eastern money. It is infusing every walk of life and industry across the West, and in that context it would be odd if big legacy media titles weren’t on the table, particularly in a world where it is so difficult for them to compete. This is a foretaste, potentially, of what’s to come.

Jane Turton, CEO, All3Media

Joining forces with Jeff [Zucker] and the RedBird IMI team is an exciting next step for us as we continue to build All3Media. Our strategy remains to work with the world’s best talent, developing and producing high-quality, popular programmes, and RedBird IMI’s support and investment will be key in helping us deliver this.

Michael Eilenberg, founder and chairman, Media Res

This investment will allow us to build on what we started, fuelling Media Res’s growth as a marquee supplier of premium storytelling to platforms across the globe. We are thrilled and honoured to be partnering with RedBird IMI and the incredible Jeff Zucker, who shares in our passion and vision.

Ian Orefice, founder, EverWonder Studio

It is a dream come true to have the opportunity to create a home for the world’s most talented creatives, partnering with one of the most prolific storytellers of all time in Jeff Zucker and now RedBird IMI.

Nancy Dubuc, former CEO, Vice Media Group

MBC Group is the leading media platform in the region and we are happy to help extend its reach while highlighting the vibrant, emerging youth culture in the Kingdom of Saudi Arabia.

Channel21 International | Spring 2024 THE C21 CONTENT TRENDS REPORT: Spring 2024 17

Mega takes a bite

With three slots for original local drama and five for acquired scripted content, Chile’s Mega is not your typical free-toair (FTA) television channel. At least not one that aims to be top of the ratings.

The formula seems to work, however, as shown by its o cial ratings: the network ended 2023 as the most watched television channel in Chile, after almost a decade of uninterrupted dominance.

The achievement is especially meaningful considering how fierce the competition is in the country, a relatively small market of 20 million people but recognised internationally, and especially within Latin America, for its creativity.

It is not for nothing that large international groups such as Discovery Communications, which held a stake in Mega itself between 2016 and 2023, or Paramount, which currently owns its main competitor, Chilevisión, have looked to Chile to invest.

“Our strategy is clear: we have been very insistent that scripted is the core of the channel. And on top of that add news, politics, current a airs and sports programming,” says Javier Villanueva, CEO of Chile’s Megamedia group.

Mega is the main channel of the group, which owns other FTA channels, pay TV networks, the Mega Go streaming platform and free, adsupported streaming TV channels.

And although today it enjoys an almost undisputed leadership in the market, its success is relatively recent and follows a strategic shift that began in 2013 with the reactivation of its drama department and the purchase – risky at that time – of the first Turkish drama to be broadcast in Latin America: 1001 Nights, distributed by Global Agency.

,

Today, of the five international series that Mega has on air, four are Turkish –a style of content that works especially well in Latin America and still shows no signs of flagging. Villanueva, however, hasn’t closed the doors to content from elsewhere.

Chile’s Mega has become a ratings leader in its local market by betting on local and acquired scripted. But changing audience habits mean it must evolve to stay on top. By Gonzalo Larrea

platforms. So when evaluating our programming needs, the first thing we ask ourselves is what we want to produce to feed the di erent platforms,” Villanueva explains.

“What we can’t do is to keep thinking that we are a traditional channel that needs a series for a certain block. That path leads us nowhere.”

Megamedia’s proposal is to instead think of its main channel, Mega, as the first window for its productions and maximise the return on investment from windowing on third-party streaming platforms, its own platform or its pay TV channels.

This content factory is also linked to the international strategy of the group, which has a distribution arm in Mega Global Entertainment and last year revealed plans to become an international producer.

The idea is to not just sell its scripted formats but also to produce them in other local markets, such as Peru, where it has already collaborated with local channel Latina on an adaptation of its series Papá a la deriva (Dad Adrift).

“The traditional model is based on the sale of finished programmes or formats. What Megamedia is trying to sell beyond its borders is also executive production. Since the ideas are ours, we want the adaptations to continue having the Megamedia seal.”

from Turkey, Romania or the

“I always challenge my acquisitions team to look for good content, whether it’s from Turkey, Romania or the Czech Republic. It doesn’t matter where it comes from.

and generate emotions, both

What we are looking for are shows that connect people and generate emotions, both in fiction and entertainment. Why would we refuse a good idea?”

A success with audiences in Chile in 2015, Papá a la deriva tells the story of a widowed father of four, the captain of a naval frigate, who meets a woman who changes his life.

than what it can acquire, thanks to a change in mentality by which it aims to start seeing itself as “a content factory”

“We define ourselves as a content factory that distributes through our own platforms or third-party

instead of as a channel. as factory that distributes through our own platforms or third-party entertainment.

But Mega is currently focused on what it can produce rather

Its Peruvian adaptation repeated the same formula last year and achieved similar results, to the extent that Latina and Megamedia will repeat the exercise with a second production, Pituca sin lucas, again based on a Chilean idea.

The model is doubly beneficial for Megamedia, which retains an ownership stake in the remakes. The Peruvian adaptation of Papá a la deriva has also

I always challenge my acquisitions team to look for good content. It doesn’t matter where it comes from. What we are looking for are shows that connect people and generate emotions, both in fiction and entertainment. Why would we refuse a good idea?

Javier Villanueva, Megamedia

Javier Villanueva, Megamedia

CONTENT STRATEGIES: Mega Channel21 International | Spring 2024 18

La cabaña (The Cabin)

made its way back to Chile, aired by Mega alongside its Turkish drama imports.

To continue promoting this strategy in international markets, Megamedia has made agreements with production companies such as Mexican giant BTF Media and Fabula in Chile, led by Oscar winner Pablo Larraín, following its participation in Content Americas in Miami in January.

The idea, Villanueva explains, is to join forces with powerful local partners and go in tandem to international platforms or local broadcasters, taking advantage of the more than 30 series the channel has produced in the past 10 years.

“We have good stories and we know how to produce them, but we need to generate a network of local producers so that together we can have a much more robust product to o er,” he says.

In addition to BTF and Fabula, Megamedia is already negotiating with other production companies, including some in Spain, while it has also done deals with the likes of Netflix.

The Chilean group entered into a new partnership model with the streaming service in March, through which its primetime

series Al sur del corazón (South to the Heart) is being carried on Netflix throughout Latin America, including Chile.

“We are recognised for our television series in Chile and some other markets. But when you place your product on Netflix you reach the entire region. Many have seen the platforms as a threat, but we see it as an opportunity. It is a union of marketing and content and it is much deeper than simply broadcasting a product,” Villanueva says of the alliance.

In addition to fiction, Mega Media also works on the creation of entertainment formats. Today, its main channel doesn’t have any international formats on air. However, it does broadcast its own original shows, the latest being La cabaña (The Cabin).

The channel has a long history of developing, producing and broadcasting originals, such as Elegidos (Chosen Ones), which combines fiction, documentary and current a airs; Los 100 indecisos (The Undecided 100), aired around elections with live debates; and ¿Volverías con tu ex? (Would You Go Back to Your Ex?), which was a ratings juggernaut in 2016 and is under “constant evaluation” for a possible return, according to Villanueva.

“We have several formats in the drawer, such as ¿Volverías con tu ex?, and we always assess whether it is a good time to launch them or not. These decisions depend on the moment of the channel, the company and the country,” he says.

Addressing its apparent reluctance to acquire international formats, Villanueva says there is no directive or decision by the group to not adapt foreign ideas. However, the development and production of originals is its current priority.

“You should never say never, but one of the mandates we have here is to create our own IP. When you create your own IP you can maximise your return on investment. That does not mean if a tremendous format appears from outside, we do not evaluate it. We cannot isolate ourselves from what is happening in the rest of the world and that means we always have these types of conversations. But if there are two equally good alternatives on the table and one is our own, we opt for our own,” says Villanueva.

Everything, in the end, translates into the realisation by the group that times have changed, and that FTA must change its model as well as its slotbased mentality.

“We are living in a world where our competitors are no longer the other TV channels from Chile. We compete in the economy of time use, with device attention, with TikTok. And to face that change you have to adapt internally,” says Villanueva.

Channel21 International | Spring 2024 CONTENT STRATEGIES:

Papá a la deriva (Dad Adrift)

Al sur del corazón (South to the Heart)

Genre: Paranormal

Duration: 10 X 60’

Genre: Paranormal

Duration: 10 X 60’

Genre: Paranormal

Duration: 8 x 60’

www.grbmediaranch.com l info @ grbmediaranch.com 300-hours of holy $%#@!

Spring surprises

Dealing with existential crises, the marvels of train travel and the supernatural are among the trends popping up in shows launching in the international market this season. By Nico Franks

Alan Cumming’s Most Luxurious Train Journeys: Scotland (4x60’)

Producers: 14th Floor Productions, GroupM Motion Entertainment

Distributor: Abacus Media Rights

They say: “It’s a beautiful piece of access and given Alan’s already a huge fan of these railways, there’s no one better to go behind the scenes and bring it all to life.”

We say: Fronted by the Scottish actor and The Traitors US host, this Channel 4 commission takes viewers on one of the world’s great rail journeys on board the iconic Royal Scotsman, and comes as the climate crisis forces us to re-think how we travel.

Cooking Buddies (10x20’)

Producer: The Jamie Oliver Group

Distributor: Cake

They say: “All about exploring new hobbies with friends and embarking on a culinary adventure: it encourages young viewers to try new things and shows you can have a great time with each other whilst doing it.”

We say: Presented by 13-year-old Buddy, son of celebrity chef Jamie Oliver, this fun cooking show with a twist follows Buddy Oliver’s success on YouTube with his Cooking Buddies channel, which has amassed over seven million views.

Eva & Nicole (8x50’)

Producers: Atresmedia TV, Good Mood

Distributor: Atresmedia TV International Sales

Living on a Razor’s Edge (8x45’)

Producers: AfroReggae Audiovisual, Formata Produções e Conteúdo, Globoplay

Distributor: Globo

They say: “More than a classic biopic, as it very delicately paints the portrait of a key political figure, a communist activist hunted down by the military dictatorship during the 60s and 70s and forced to go into exile.”

They say: “Tells the story of two powerful, highclass women from Marbella in the 1980s, who are facing each other due to a common past that haunts them.”

We say: One of the 10 titles selected for scripted showcase event MipDrama in Cannes in April, this series from Antena 3 in Spain promises plenty of salacious scheming in the sunshine with its plot of jealousy and revenge.

We say: The first Brazilian production selected in competition at Canneseries in April, this drama charts the struggle of sociologist Herbert de Souza, also known as Betinho, an activist who faced AIDS and haemophilia while challenging inequality and a military dictatorship.

Channel21 International | Spring 2024 NEXT BIG THINGS: 21 on 21 21

Titanic in Colour (2x45’)

Producer: Woodcut Media

Distributor: Woodcut International

They say: “The cutting-edge colourisation techniques employed will take your breath away. It was also a humbling experience to speak to some of the children of those who survived the Titanic disaster and feature in the 1912 footage.”

We say: Pre-bought by Channel 4 in the UK and SBS in Australia, this two-parter brings to life the lavish interiors of the Titanic, artefacts and clothing from passengers alongside fascinating interviews with relatives of those who sailed on the doomed liner.

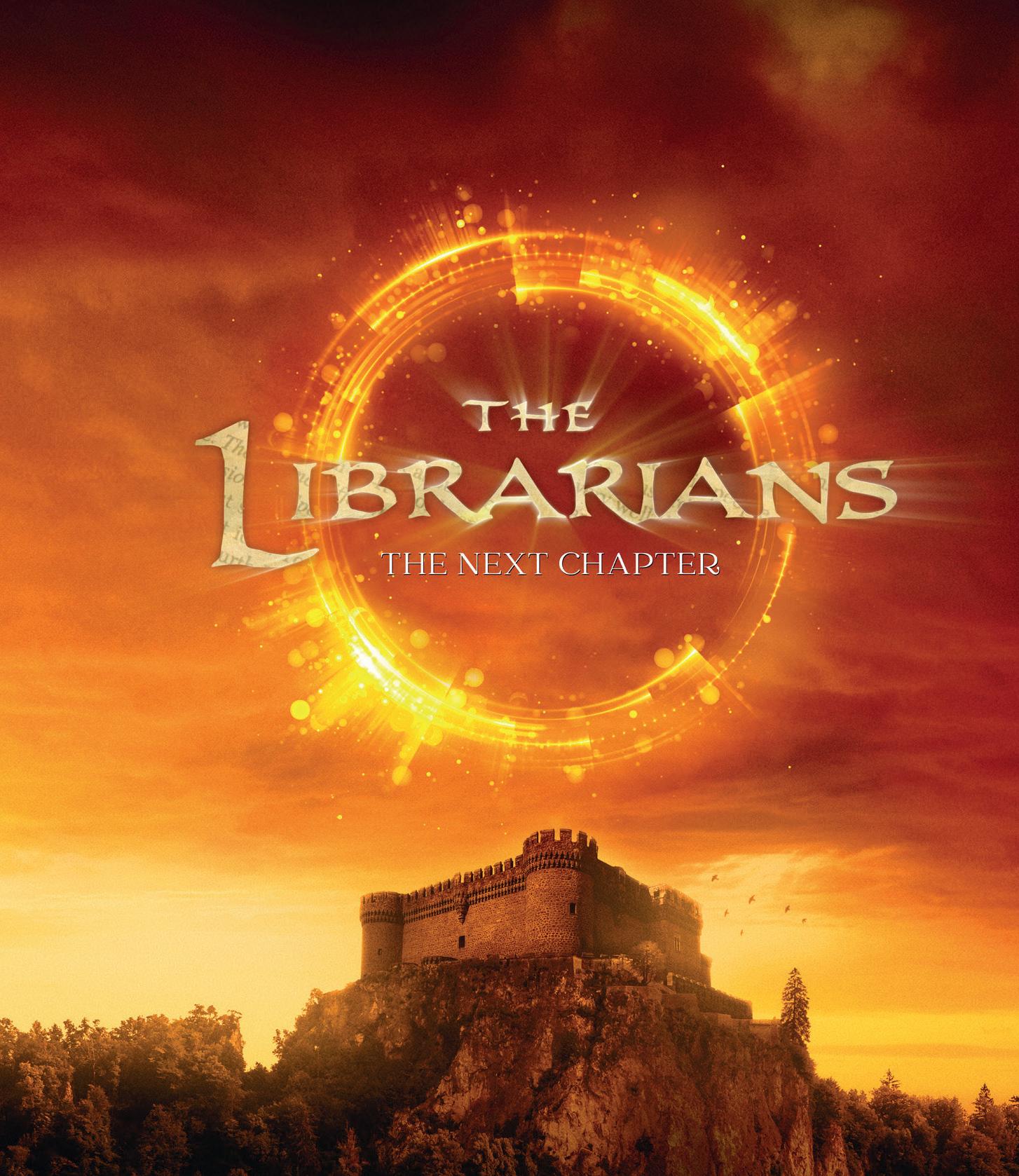

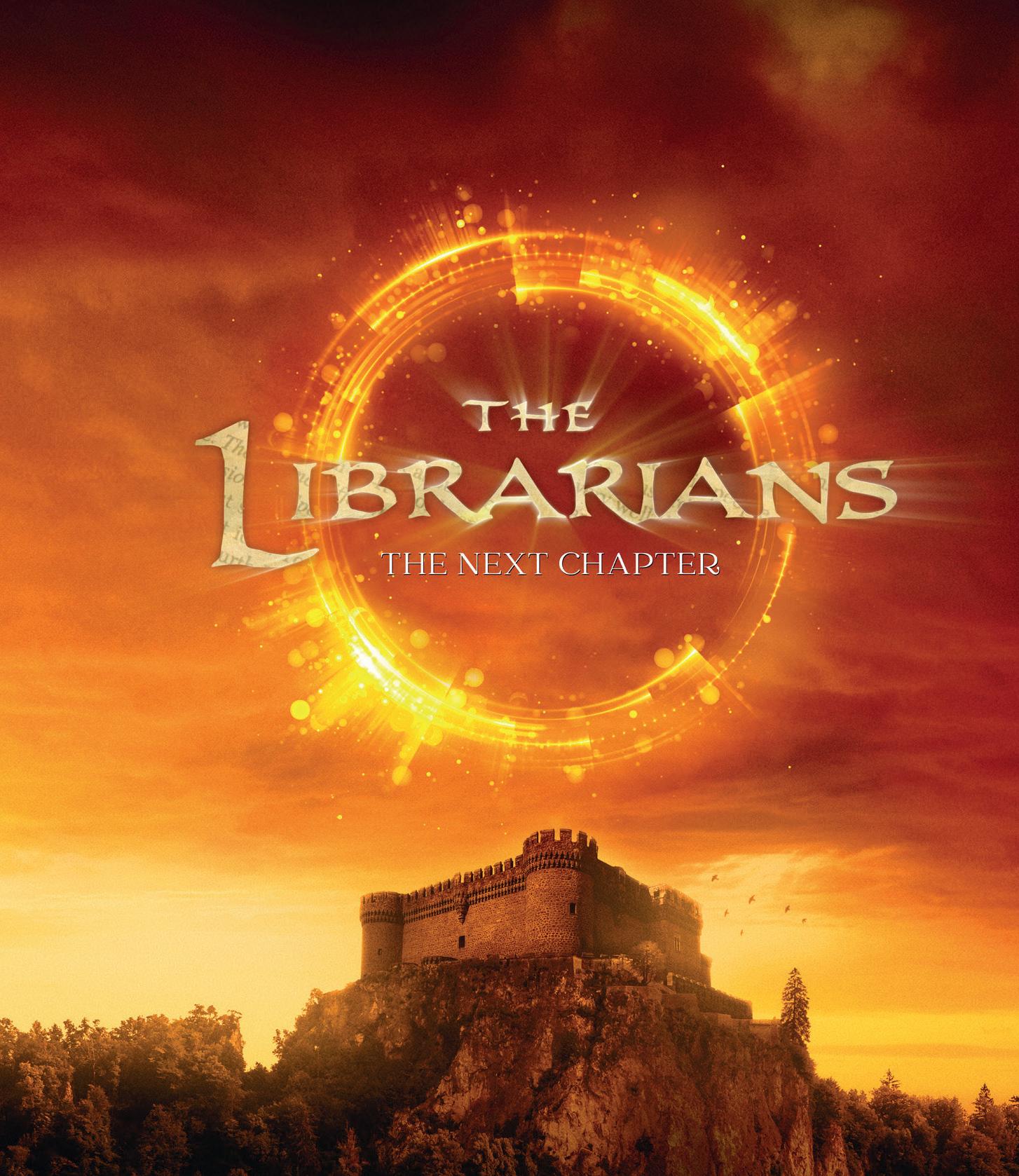

The Librarians: The Next Chapter (12x60’)

Producers: Electric Entertainment, Balkanic Media

Distributor: Electric Entertainment

They say: “Centres on a ‘Librarian’ from the past, who time-travelled to the present and now finds himself stuck here.”

We say: This spin-off from the cult fantasy adventure series, about an ancient organisation dedicated to protecting an unknowing world from magic, comes from showrunner Dean Devlin and sees the welcome return of Noah Wyle (ER) to our screens.

We Shall Live Together (6x45’)

Producers: Telewizja Polska (TVP), MTL Maxfilm

Distributor: TVP

They say: “Like a piece of modern history, reflecting Poland’s ties with Ukraine and its people.”

We say: The first series produced in Poland set during the ongoing war in Ukraine, this series chooses to focus on comedic and touching moments created by political turbulence rather than the brutality of war, with heartwarming results.

The Curse of Sugar (2x52’)

Producer: Hauteville Productions

Distributor: Arte Distribution

They say: “Reveals a global system still fuelled by the exploitation of land and people that is rooted in its original sin: slavery.”

We say: This two-part documentary series will leave a sour taste in the mouth of anyone unaware of the ills of the sugar industry and continues the relationship between the European broadcaster Arte’s sales arm and Hauteville Productions after The Blob: A Genius Without a Brain and Thatcher’s Not Dead

FGirl Island (format)

Producers: STX Entertainment, The Year of Elan

Distributor: Warner Bros International Television Production

They say: “It’s time to ‘flip the script’ and celebrate women in control in this new version of the unique social experiment-meets-dating format, where three men must avoid choosing an FGirl.”

We say: Sexually liberated, ambitious and empowered women play the men off against each other for sport in this twist on the dating show FBoy Island, one of the most popular reality originals on Max in US when it launched.

, one of the most popular reality

NEXT BIG THINGS: 21 on 21 22

The Listeners (5x60’)

Producer: Element Pictures

Distributor: Fremantle

They say: “Explores the seduction of the wild and unknowable, the human search for the transcendent and the desire for community and connection in our increasingly polarised times.”

We say: Part of the BBC’s drama department’s ambition to take risks, this intriguing psychological thriller explores the rise of conspiracy culture in the West and stars Rebecca Hall as a mother tormented by a sound it seems no-one else can hear.

In Memoriam (8x60’)

Producers: Passez-Go, C3 Media

Distributor: Cineflix Rights

They say: “Hits a lot of the content beats global buyers are looking for, echoing similar themes explored in some of the biggest drama hits of the past few years.”

We say: Succession meets Squid Game in this French-language psychological thriller for Crave in Canada, in which rival siblings battle each other to inherit their estranged father’s untold wealth in an increasingly sinister competition.

Rivers at Risk: The Global Water Crisis Unveiled (2x45’/1x90’)

Producer: Kinescope Film

Distributor: Autentic

They say: “Explores the central themes of the global water crisis through the captivating stories of international protagonists from Spain, France, the US, Egypt and India.”

We say: As humanity faces existential conflicts over the use and distribution of water, this investigative documentary for Radio Bremen, Arte and Nordmedia should make us more mindful when it comes to our use of the most important resource on the planet.

Families Like Ours (7x45’)

Producers: Zentropa Entertainments, Zentropa Sweden, Film i Väst, Sirena Film, Ginger Pictures, Saga Film, Canal+, TV2 Denmark, ARD Degeto, NRK, TV4, M7

Distributor: StudioCanal

They say: “A riveting tale of the pain of farewells and a testimony to the unyielding will of human beings to survive, hope and love.”

We say: This epic dystopian drama, set during a summer in Denmark when climate change catches up dramatically and rising water levels force the population to be evacuated, is well worth seeing, not least because it marks the first TV series from Academy Award and Bafta winner Thomas Vinterberg (Another Round).

Producers: Ludo Studio, Since1788

Production

Distributor: DCD Rights

They say: “This thrilling new First Nationsled production will take advantage of iconic road trip locations through the central corridor of Australia, showcasing some of South Australia’s stunning Outback landscapes.”

We say: Ludo Studio created Bluey, one of the best-loved TV series ever, so it’ll be fascinating to see if this 1980s-set Stan drama about a young Aboriginal delinquent on the run continues its winning streak.

Thou Shalt Not Steal (8x30’/4x60’)

Tarot (7x30’)

Producers: LG Uplus, Studio X+U

Distributor: Studio X+U

They say: “A gruesome horror mystery, where people living their everyday lives suddenly encounter the ominous fate predicted by tarot cards.”

We say: The international reputation of K-drama continues to grow and this anthology series stars Parasite’s Cho Yeo-jeong in one episode and has been praised for its artistic flair.

Channel21 International | Spring 2024

SLL on a global roll

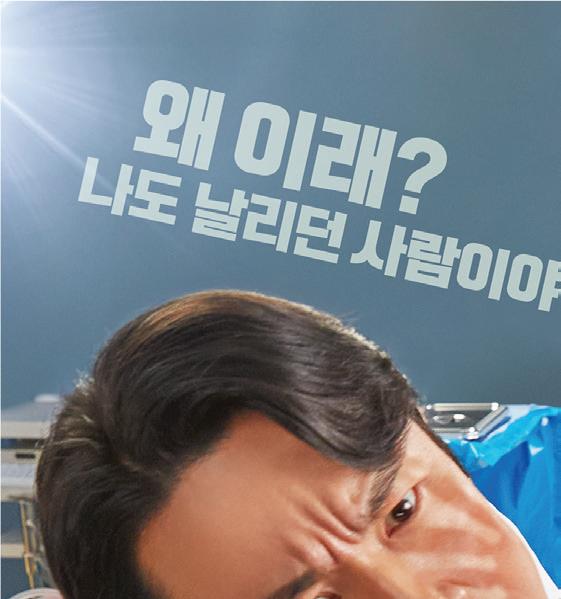

South Korea-based production studio SLL has continued its booming year in 2024 a er achieving notable global success in 2023.

SLL, a global creative studio within the JoongAng Group alongside JTBC Channel, and formerly known as JTBC Studios, enjoyed remarkable success across various platforms in 2023, including TV and OTT. As this year unfolds positively, it’s intriguing to consider what 2024 holds for the company.

Renowned as Korea’s foremost studio, SLL operates extensively, covering everything from video content production to investment and distribution. Breaking into the global content market, SLL transcends platforms like TV, multiplexes, and OTT, embracing diverse genres such as dramas, movies, and entertainment.

Armed with a prestigious catalogue of original IPs and creators worldwide, SLL leads content trends, crafting high-quality productions that generate significant buzz. The company has acquired 15 competitive production labels, including LA-based wiip, renowned for producing hits like The Summer I Turned Pretty and Mare of Easttown, as well as B.A. Entertainment, the powerhouse behind Disney+ original series Big Bet; Climax Studio, creators of Netflix series Hellbound and D.P.; Perfect Storm Film, producers of Netflix series Narco-Saints; and Film Monster, responsible for the Netflix series All of Us Are Dead

According to What We Watched: A Netflix Engagement Report, which o ers a comprehensive look at what Netflix subscribers viewed on the platform over the six months to June 2023, the SLL series Doctor Cha racked up a staggering 194.7 million viewing hours, making it the third most-watched drama after The Glory among Korean drama.

TVING original series Death’s Game hit the top 10 list on Prime Video in 43 countries, holding strong in about 78 countries, including Australia, Japan, Indonesia, Brazil and Peru through January 2024. It even claimed the number two spot on Prime Video’s global TV show ranking (English-speaking regions included) on January 7.

This year, SLL presents a diverse array of titles, ranging from captivating dramas like Doctor Slump, Queen of Divorce, Hide, Frankly Speaking, The Atypical Family, The Tale of Lady OK (wt), and Good Boy, to the thrilling Netflix films Badland Hunters and My Name is Loh Kiwan. Also in the line-up are TVING original series Pyramid Game and the Netflix series The Frog, alongside feature films The Roundup: Punishment and The Woman in the White Car

As of March 21, Doctor Slump has maintained its position in the Netflix global top 10 TV (non-English) category for eight consecutive weeks,

showcasing its enduring popularity. Meanwhile, Badland Hunters has dominated the films (non-English) category, holding the number one spot for three weeks straight. Notably, My Name Is Loh Kiwan swiftly climbed to the top position in its second week of release, demonstrating its rapid ascent in viewership. In addition to these successes, Pyramid Game received special recognition with a screening at Series Mania, while The Roundup: Punishment was honoured with an o cial invitation to the prestigious Berlinale Special Gala at the 74th Berlin International Film Festival, a rming its global acclaim and recognition.

Park Joon-suh, head of the production division at SLL, proudly stated: “With the acquisition of 15 competitive production labels, SLL has emerged as one of Korea’s foremost production powerhouses. Throughout 2023, we introduced 28 unique projects across various global platforms, and we’re poised to unveil over 30 titles in 2024. Moving forward, we’re committed to delivering compelling local content through our US and Japanese entities. Please stay tuned for what’s in store!”

ADVERTORIAL

Doctor Cha

Death’s Game

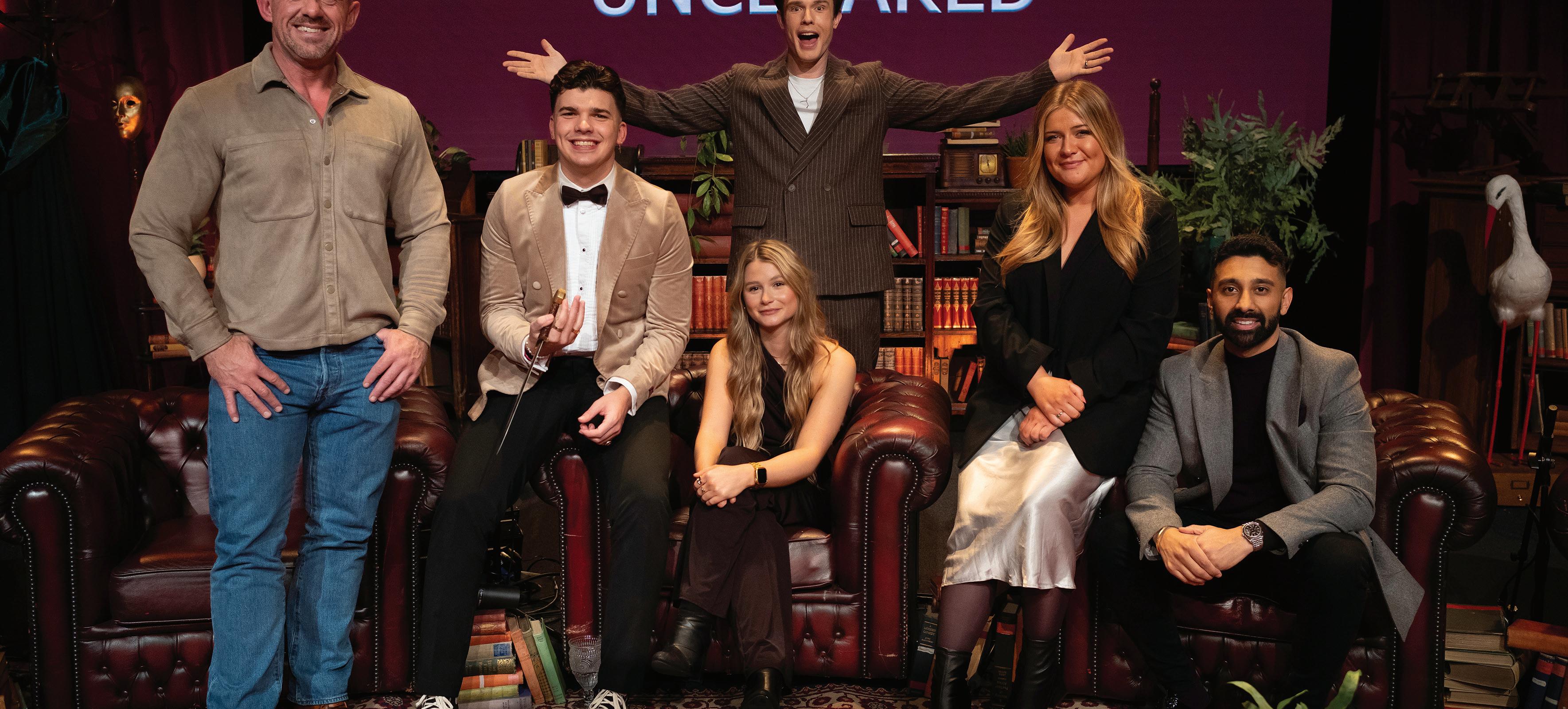

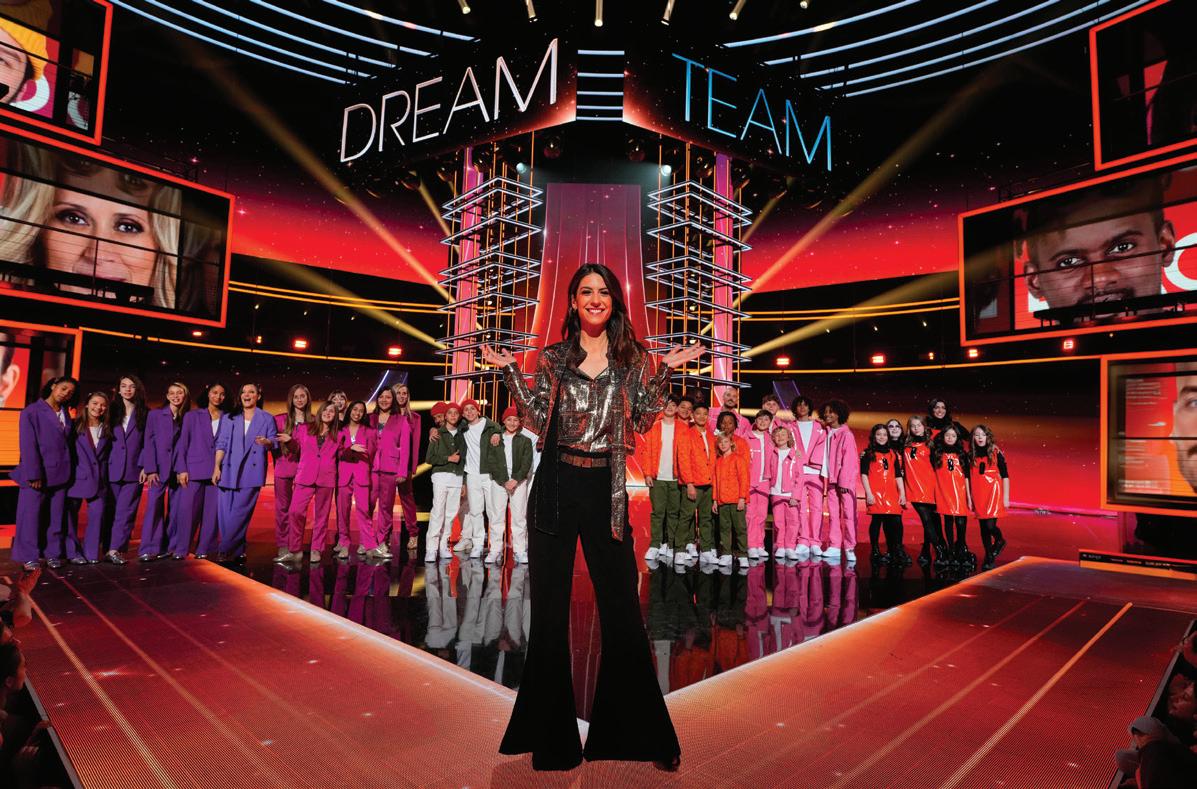

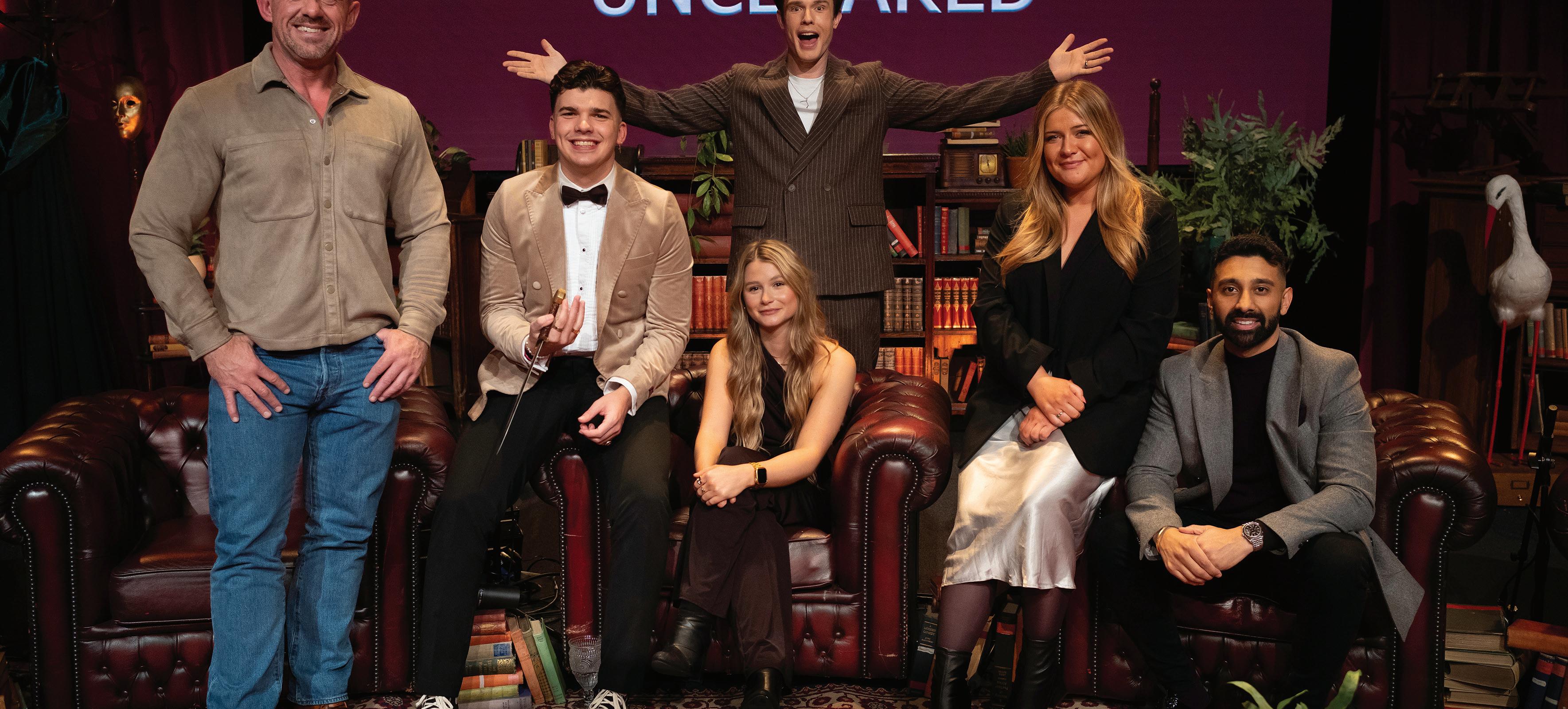

Uncanny (format)

Producer: BBC Studios Specialist Factual Productions

Distributor: BBC Studios

They say: “Featuring re-enactments alongside historical research and scientific analysis, this spine-chilling format will leave you wondering: are you a sceptic or are you a believer?”

We say: Another example of the now wellestablished podcast-to-TV commissioning route, this format has been spooking BBC Two viewers in the UK and is now ready to investigate the supernatural in markets around the world.

Reversing the Climate Disaster (1x52’)

Producers: The Great Courses Studios, Blue Chalk Media

Distributor: West One International

They say: “An informative and inspiring adventure into how everything we do needs to be done differently to adapt to rising sea levels, droughts and other climate-related challenges.”

We say: Inspired by Bill Gates’ bestselling book, this doc comes as humanity confronts one of the greatest challenges we’ve ever faced and explores the revolutionary technologies tackling the climate crisis, as well as the people behind them.

All & Eva (6x47’)

Producer: Warner Bros International TV Production

Sweden

Distributor: Viaplay Content Distribution

They say: “Eva doesn’t believe in love, but when she least expects it, she meets it in Mads. The only problem is that she is already pregnant, with his child, although he doesn’t know about it.”

We say: This series offers a fresh take on the dramedy genre, blending humour with poignant, emotional moments as it tells the story of a 40-year-old woman, played by Tuva Novotny (The Abyss), whose journey to find her sperm donor takes her through unforeseen twists and turns.

Whodunnit: Easter or Die (format)

Producer: Magga og Anders AS

Distributor: Lineup Industries

They say: “A celebrity murder mystery reality format featuring funny, holidaythemed challenges.”

We say: Recently launched on NRK in Norway over Easter, this series could be adapted to suit other holiday seasons and sees celebs ‘murdered’ in overly theatrical ways, often with a nod to a well-known film, as they race to solve the murderer’s identity by paying attention to hints left at the crime scenes.

Olga Da Polga (28x11’)

Producer: Maramedia

Distributor: Boat Rocker Studios

They say: “Follow the adventures of a loveable and highly imaginative guinea pig heroine and her animal friends in this funny, colourful and heartwarming live-action series.”

We say: Based on the bestselling books from Michael Bond, creator of the beloved Paddington Bear, this CBeebies series capitalises on the inherent cuteness of the humble guinea pig.

Eurostar: Minding the Gap (1x52’)

Producers: RMC Production, RMC Films, RMC Decouverte

Distributor: Kwanza

They say: “As 2024 marks the 30th anniversary of the Eurostar, come aboard and discover what it takes to keep everything running.”

We say: A triumph of railway technology and international relations, the Eurostar train revolutionised travel between London and Paris, linking two iconic cities via the world’s longest underwater tunnel. This stylish doc looks at how it was done.

NEXT BIG THINGS: 21 on 21 Channel21 International | Spring 2024 26

Formats

AI generates hopes and uncertainty Everything about

Listen sees a future for the visual podcast

TF1 looks for paper formats and reboots

content Spring 2024

Are generative AI tools cost- and time-saving devices enabling producers to o er embattled channels more for less, or is this tech coming to cut the creatives out of the business entirely?

AHEAD OF THE CURVE:

Threat and opportunity

By Clive Whittingham

By Clive Whittingham

If there’s one thing people fear more than change, it’s the unknown.

When it comes to artificial intelligence (AI) and the content business, we know change is coming because it’s already here and it’s happening at extreme speed. One minute you’re being shown how good AI is at dubbing your gameshow into foreign languages, the next you’re watching as Sora shows the potential to create and visualise a ‘new’ one after a few prompts.

Who knows what things might look like even 18 months from now, but it appears as if the industry is approaching a fork in the road.

o ered and stay alive. What if AI could strip away the banal, menial, time-consuming, costly bits of making television, allowing prodcos to turn out more content, quicker, for less money? How timely, thank God you’re here.

“ Time-saving should be the focus because it translates to saving money – you can deliver sooner, rent equipment for less time and do more projects in a year.

six-part murder mystery please; the detective is a female from Scandinavia who wears a lot of chunky knit,’ and it can produce it for you with the precise audience desires factored in from the algorithm, there’s a big chance they’ll choose to pay one prompt engineer as opposed to a whole writers room.

Wesley Block is a filmmaker turned co-founder and CEO of Kino AI, an AI tool that organises footage, speeding up the process for editors – very much part of that best-case scenario. “Development is the least logical place AI will and could make its impact,” he said during a panel at Realscreen Summit in New Orleans in February.

aren’t watching it and

The best-case scenario is AI is something of a saviour. The collapse of the ad market, declining subscriptions, rapid inflation, pandemic upheaval and more have left the traditional TV business on its knees. Channels cannot commission new content because people aren’t watching it and advertisers won’t pay for it. Producers cannot make their shows at the budgets being

Wesley Block Kino AI

why on earth would these budget-poor channels

Meanwhile, the worstcase scenario is if AI keeps accelerating at this rate, why on earth would these budget-poor channels need to pay producers, writers, talent, creatives at all? If you can literally say to a computer, ‘I’d like a

“Whether it can and what’s possible versus what will actually be the reality is a distinction often missed. We approach the conversation passively: there’s this high level of technology that will advance, there’s nothing we can do about it, market forces will drive it and audience tastes will adapt. As opposed to the other side, which is people are the industry. What do we want it to look like? What innovations do we want to see and drive? That’s how we should approach it. In the technical sense, you should

assume anything is possible if you give it enough time and data.”

Irad Eyal, co-creator of Netflix gameshow format Floor is Lava, has more recently turned his hand to launching Quickture, an AI editing tool that helps analyse footage and find the story within it. Speaking on the same panel, he said: “I’ve been doing reality television for 25 years. What makes reality TV special is we all know we’re dealing with real people. We have to go out there and find characters, film the real story, and that is going to continue, with AI tools helping. I don’t think you’ll see a situation where documentary characters are replaced by computergenerated ones.”

Benjamin Field, an exec producer at Deep Fusion Films in the UK, who is also on UK producers association Pact’s working group trying to navigate the ethics and practicalities of how AI can and should be used, said: “Just because something is possible, does that mean we should automatically jump into it? Creative people are in the industry because they want to be creative. I don’t really see a drive for us to kill our own industry by purely making things because they’re financially viable. Creative people will endeavour to continue to be creative. AI can form part of that as another tool. Do we want to use those tools? Because they may harm our industry. We have responsibility to ourselves and a future generation of TV and film makers.

“We’ve been playing in this area for a couple of years and, as a creative producer and writer, there is an element of AI fatigue already. I use certain tools to make processes happen but actually I’ve now got to the point where I want independent creative control back because I feel distant from the project. I want control of my show because it’s my show.”

Realistic? Optimistic? Naïve? We’ll only know in time, but it’s the context of the current economic situation in the industry that potentially tips the balance towards foe rather than friend. Believing we’ll do what’s good and right versus the financial incentives forgets the fact it’s called showbusiness for a reason.

Eyal said: “If you do want a prediction of doom then where I see doom coming to the industry is in scripted studios, because now an individual person can make a

actors. big-

movie or TV show that has Marvelor Star Wars-quality visual e ects and a cast of known or invented actors. In terms of scripted and bigbudget programming, you will see a flattening where anybody can create that. But I maintain reality TV might be immune because we have to go and film real people.”

“ Where I see doom coming to the industry is in scripted studios, because now an individual person can make a movie or TV show that has Marvelor Star Wars-quality visual e ects and a cast of known or invented actors.

Irad Eyal Co-creator of Floor is Lava

However, Field countered: “Yes, you can make stu like that for TikTok and get a couple of thousand views but it’s a very di erent market from TV and film, where broadcasters and commissioners have a duty of care. There are processes in place to make sure high-quality content remains high-quality content. It’s not going to accidentally happen.

“Broadcasters and producers have the ability to work within set guidelines. The conversations we’re having with the BBC, ITV and Channel 4 are about us taking control of this narrative, ensuring we behave responsibly and these things don’t happen. Legislation is very slow; we need to be self-motivated.”

Oz Krakowski, chief business development o cer at Deepdub. ai, an AI dubbing company aimed at helping content owners and producers unlock monetisation opportunities for their content in new markets, is also mindful of the legal framework currently lagging behind AI advances, but believes it will eventually “catch up.”

“All these things we can do but shouldn’t are eventually going to line up and the industry will get to a point where it’s defined what you can do and what you can’t. There will always be outliers but it will stabilise and

extend our work, not be a dystopian future where everything is doomed.”

Let’s use this as a jumping-o point for the best-case scenario and look at where AI can help producers and broadcasters allay the economic fears that have led to a commissioning stalemate. Block said the most useful and impactful tools are the ones everybody is on the same page about – translation, searching footage, dubbing.

“If I had a production company, the first thing I would do is lay out the entire workflow step by step and look at where we can save time,” he said. “Time-saving should be the focus because it translates to saving money – you can deliver sooner, rent equipment for less time and do more projects in a year. For the creatives and editors staying up late every night to get work done, it matters a ton to their quality of life. The entire conversation around implementing AI into a creative workplace

Channel21 International | Spring 2024 AI and formats

Netflix gameshow format Floor is Lava

Clockwise from top: Oz Krakowski, Phil Gurin and Benjamin Field

should be around saving time in the workflow.

“Post is the most important thing to focus on. Unscripted producers capture everything and then, once they have all the footage, they craft a scene in a creative way. If you shot it over months and years, where were the golden moments? Computers can be extremely helpful with that.

“If you’re in an edit room thinking, ‘She’s great, get me everything we shot of her on this day,’ that’s a menial task somebody would have to spend a day doing. The computer can do it [in an instant]. Once it gets to the AI saying, ‘I think this is the best one,’ then it’s wrong. I’m uninterested in automated decision making. We are the storytellers, but it’s very good getting me the options.”

Raja Khanna, founder of Canadabased Dark Slope, which uses AI to create TV content including

good-quality material in the stu you have. If a network says, ‘Let’s focus on this bit about his grandmother,’ you know that would be back to the edit suite for three days. But something like Quickture could produce a sample of that much quicker.”

Is this, however, doing away with exactly the sort of entry-level jobs people use to access an industry that’s notoriously hard to get into, particularly for minorities, workingclass kids, and people who live outside major production centres – the exact people we’re meant to be trying to involve more?

and that will be awful for people everywhere. As with every evolution and revolution, it’s inevitable.”

Krakowski added: “If you don’t use it to your advantage, someone else will use it to theirs.” His point was echoed by Khanna, who said: “If we don’t, somebody will.”

This rather paints the situation as an either/or. As long as the ‘goodies’ embrace this and use it for pure means, the ‘baddies’ won’t get their hands on it and ruin everything. The reality is it will be both. For every embattled production company using AI ethically to cut costs and survive an economic crisis, there will be someone else using it to cut creatives out of the process entirely.

Telling C21 about his experience with a sitcom-writing friend who prompted AI to produce a comedy pilot script, format veteran and Frapa co-chair Phil Gurin says the show it came back with was “not that bad. In fact I’ve worked on worse.”

“ To help with research, structure ideas, organise reams of data… you’re wasting time if you’re not using it today. That’s a fact. It can save you hours and hours a month for your research and development teams.

Raja Khanna, Dark Slope

Gurin also believes AI is capable of not only producing a copycat of, say, Who Wants to be a Millionaire?, but also making just enough changes so it complies with Frapa’s scoring system on IP theft and avoids legal action –potentially destroying the formats business overnight. Bearing in mind markets such as China were embroiled in a series of format copycat rows before any of this, it’s inevitable some businesses are going to be using that opportunity if it’s available to them.

Field told a story of a quickturnaround doc his company produced where ChatGPT was able to provide information on a topic they knew little about, answers to potential interview questions and generate mock contributors with di erent voices to present at the pitch within two days.