Drama

Will Japanese drama follow Korea’s path? Everything

PLUS: Risk-taking rules at Arte France | Lingo Pictures and Range Media Partners target international growth

Casey Bloys on the perils of the SVoD market

Local leads the way for Prime Video Nigeria

Casey Bloys on the perils of the SVoD market

Local leads the way for Prime Video Nigeria

about content Spring 2023

Bloys’ story

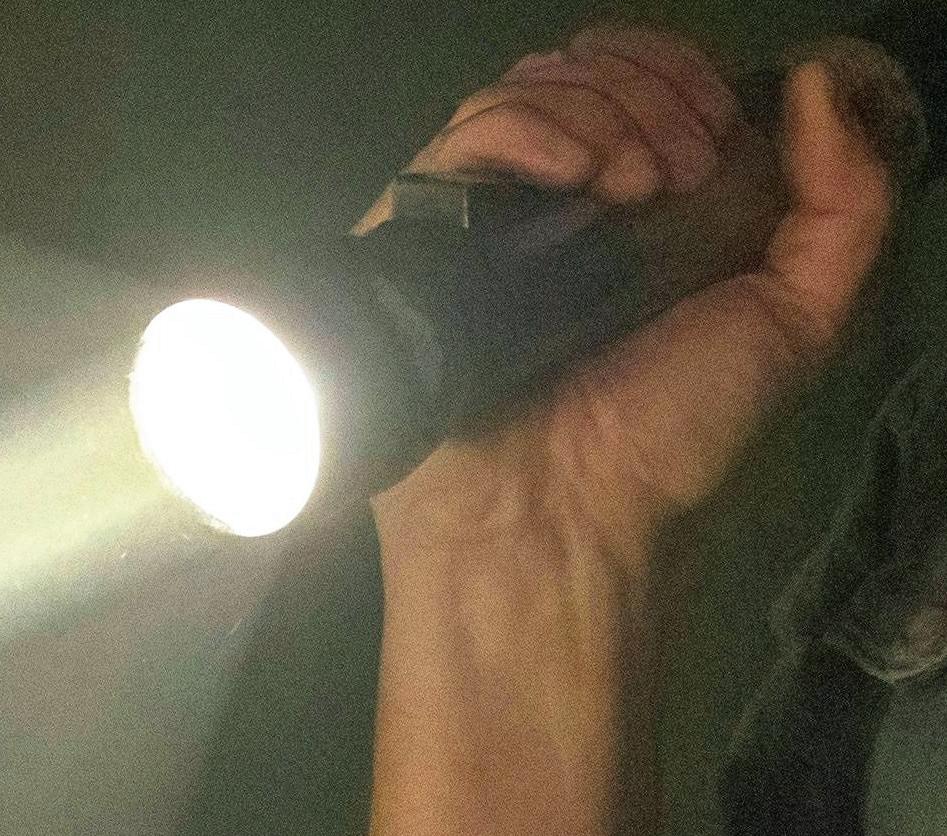

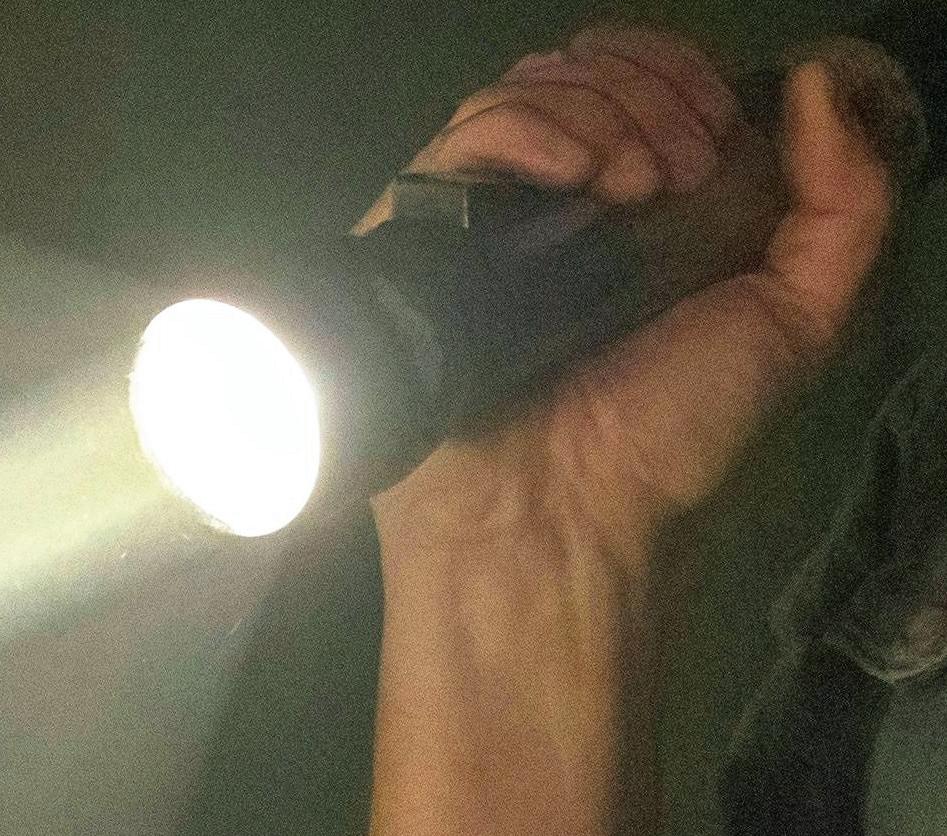

HBO content boss Casey Bloys on the challenges of matching his own high quality-control standards and launching a new streamer in a struggling SVoD market.

By Neil Batey

By Neil Batey

Launching a new streaming platform in an already oversaturated market rife with consolidation must be daunting – even if it’s backed by the most critically acclaimed premium cable network in the US.

That’s the challenge facing Casey Bloys, chairman and CEO of content at HBO and HBO Max. Since HBO parent company WarnerMedia’s merger with Discovery was confirmed last year, the industry has been eagerly awaiting the roll-out of a new OTT ‘mash-up’ offering, pooling the best content from HBO Max and Discovery+.

The as-yet-untitled streamer is due to launch this spring, with Bloys – speaking at the recent Series Mania event in Lille – adamant it must be profitable enough to secure HBO’s future for the next half-century.

“Historically, HBO has made a lot of money, which has allowed us to produce many great shows,” said Bloys. “So how do we make sure HBO is set for the next 50 years? There is a lot of upheaval in the market right now, so to make the transition from HBO being a cable TV company to streaming, we have to figure out how to make streaming a profitable business.

“The combined offering gives us a good way of doing that, because we want to build a product that appeals to as many people as possible. It’s kind of like replicating the idea of a cable bundle package – offering a wide array of programming for whatever mood the customers are in. Frankly, that’s what all streaming services are trying to figure out.”

Bloys emphasised the importance of integrating the complex international strategies of both sides of Warner Bros Discovery (WBD) – something he has been thrashing out with Discovery International boss Gerhard Zeiller. “The international market is very important,” Bloys said. “Gerhard and I, plus our teams, are trying to be co-ordinated and look at programme investment across the globe as one team. Where are we placing our bets and in which shows?

“HBO has produced all over the world, but previously there hasn’t been much contact regarding programming between our domestic and international departments; they’ve been very separate. Discovery also has a huge overseas operation, so bringing them together is one of the things we really want to do.”

HBO’s commitment outside of the US has been an ongoing concern since 1991, when it launched HBO Latin America as

a partnership between Warner Bros and Omnivision, which was later joined by Sony and Disney. HBO Europe, based in Budapest, was rolled out that same year, with Singaporeheadquartered HBO Asia debuting in 1992.

The company’s programming is also distributed through third parties and is available across the globe through operators such as Fox Showcase in Australia, M-Net Binge in sub-Saharan Africa and Sky in European territories including Italy, Germany, the UK and Ireland. In total, HBO programming is sold in more than 155 countries and its branded services are available in more than 85 territories across Asia, Europe, Latin America and the Caribbean.

Of course, the streaming era has made non-Englishlanguage and localised content more popular than ever, but Bloys is somewhat sceptical that content can be created for a specific territory with the intention of creating a breakout international show.

“It’s very hard to engineer something that works in this market but also travels well internationally,” he said. “The US shows that travel tend to be tentpole content like House of the Dragon and The Last of Us, not comedies. Though there are exceptions to the rule, such as Call My Agent from France, which has done very well globally.

“A show can feel like HBO content for a lot of different reasons: is it a spectacle? Does it push boundaries? Is it thematically interesting? Is it weird and unlike anything that’s been seen before? Taking risks is part of our DNA.

Channel21 International | Spring 2023 THOUGHT LEADERSHIP:

Casey Bloys HBO

HBObCBlh

q y a S B g

TH THOUOUGHGHT T Casey Bloys

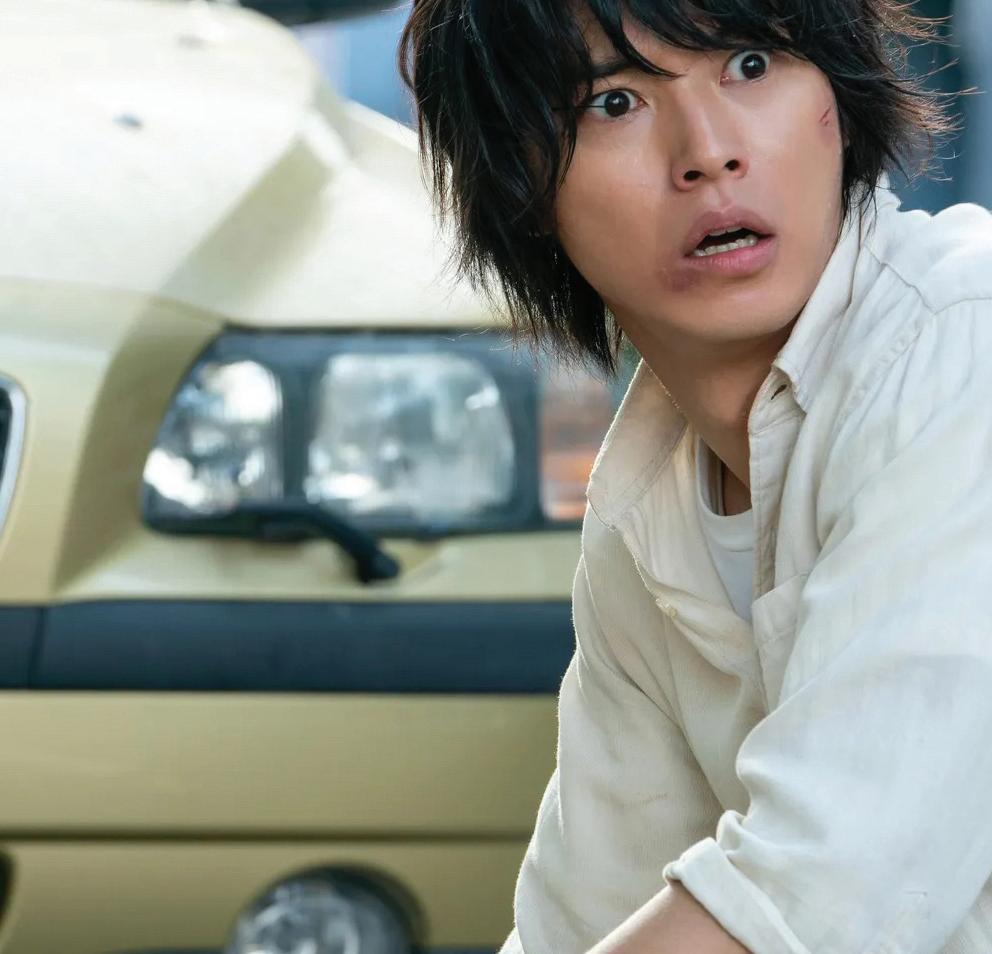

The Last of Us

Casey Bloys at Series Mania

Succession’s fourth and final season recently debuted on HBO

“My feeling is that if you commission a local show, you should service the market it’s intended for; then if it breaks out, that’s a bonus.”

In the US, subscribers access HBO content on the linear HBO channel, HBO on Demand, the HBO app and HBO Max (soon to be folded into the aforementioned combined VoD platform). The company also operates seven 24-hour networks on pay TV, including HBO Family, HBO Comedy and HBO Latino.

Although it’s been a household name in the US for decades, HBO only came to the wider world’s attention during the late 1990s and 2000s. That’s when the company coined the memorable marketing slogan “It’s not TV. It’s HBO” and backed up its braggadocio with critically acclaimed series such as mafia drama The Sopranos, Baltimore crime series The Wire, prison-set Oz, war epic Band of Brothers and edgy rom-com series Sex & The City, to name but a few.

name

That remarkable hot streak practically invented the prestige drama genre and contributed to birthing boxset binge culture – raising the bar for scripted higher than ever and creating the template for the kind of viewing experience subscribers would soon expect from the nascent streamers.

“The biggest source of stress and anxiety for me is to continue adding shows that are worthy of that legacy,” said Bloys, a CBS and WassStein Productions alumnus, who joined HBO in 2004. “Our biggest competition at HBO is our own record and how we can live up to it. People often ask me about my personal favourite HBO

shows and it’s like choosing your favourite kid. But I always cite Eastbound & Down, which was a hard comedy that everyone at HBO hated. I put my neck out and said, ‘No, this is good.’ Luckily for me, it turned out I was right.

“As a programmer dealing with different departments such as marketing, scheduling and publicity, sometimes you have to advocate for a show. That was a good lesson for me and very important for me in terms of the arc of my career.”

It’s hard to believe that much advocacy was needed for HBO’s recent output, which has included hits such as allconquering fantasy Game of Thrones, novel adaptation Big Little Lies, period drama Chernobyl, Michaela Coel’s uncompromising I May Destroy You, a copro with the BBC, and universally lauded drama Succession, which is currently in its fourth and final season.

Looking ahead, there’ll be a third season of runaway hit The White Lotus; a new True Detective project starring Jodie Foster; a spin-off from last year’s The Batman movie titled The Penguin, in which Colin Farrell will reprise his role from the film; plus limited series The Palace, starring Kate Winslet. It’s an eye-catching slate full of big names that would be the envy of almost every buyer in the world and begs the question of how Bloys organises HBO’s commissioning strategy and release schedule, given the potential hits at his disposal. “I carry around my schedules for 2024 to 2026 and it’s a kind of rolling admissions process,” he said. “I see what’s on deck and what looks good, then try to get an idea a couple of years ahead of the type of content we’re looking for.

“I might think, ‘This show is a great candidate for late 2025,’ but then I’ll get a great script that changes my mind. So it’s kind of an iterative process. But by doing it that way, it makes me ask if we have too much of a particular genre, or if we need more of another, which in theory helps me get the most diverse mix possible.

“A show can feel like HBO content for a lot of different reasons: is it a spectacle? Does it push boundaries? Is it thematically interesting? Is it weird and unlike anything that’s been seen before? Taking risks is part of our DNA, but then we’ve always been a subscription service, so we have to think, ‘Will someone pay $15 a month for this?’

“The truth is you never know what’s going to resonate, but I’m confident we’ve got some good stuff going forward.”

THOUGHT LEADERSHIP: Casey Bloys Channel21 International | Spring 2023 78

a practic scripte th nascent

stre sho

liv perso

streamers.

Stein Productions alumnus, competi own record and how we can

Game of Thrones spin-off House of the Dragon

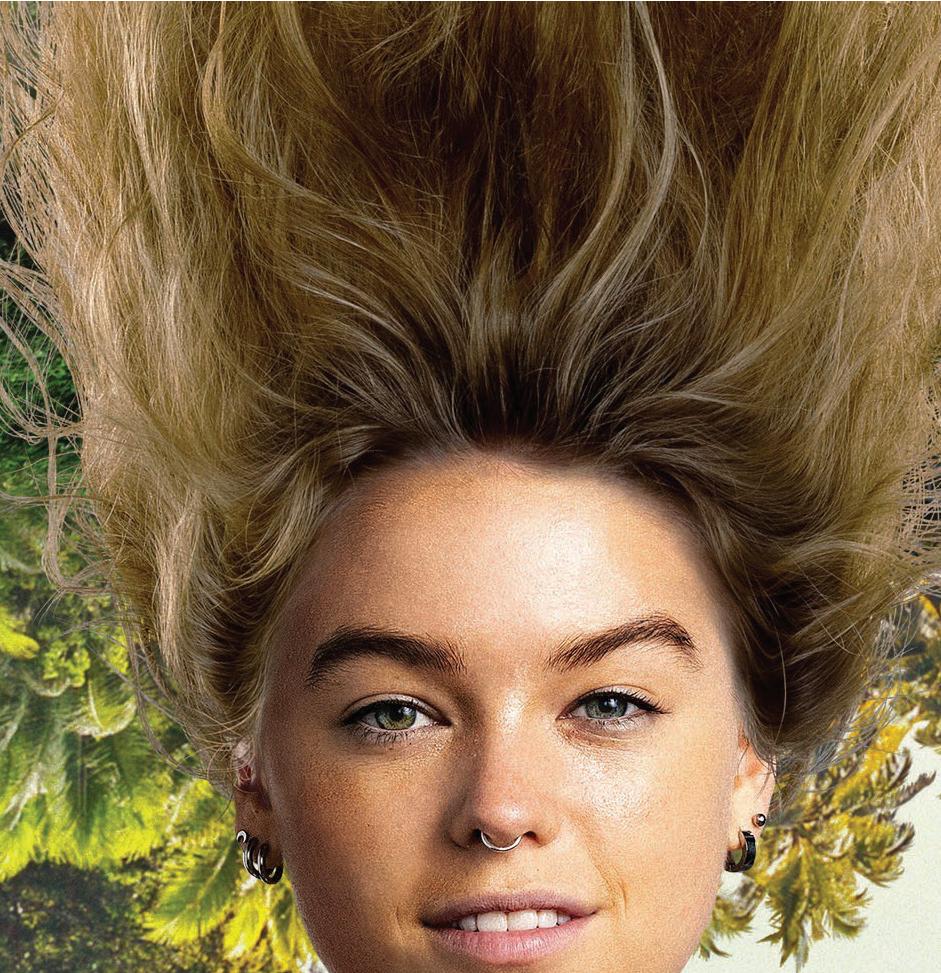

Kate Winslet in forthcoming drama The Palace

Riding the J-wave

Japan’s increasingly outward-looking scripted industry is looking to embrace international collaborations and take ‘J-drama’ around the world.

When asked to name successful Japanese TV exports, most people would probably think of anime series such as Demon Slayer and Attack on Titan, or cult hits such as Takeshi’s Castle, Ninja Warrior and Old Enough!

And while it would be fair to say that anime and unscripted formats still dominate content coming from the Land of the Rising Sun, its scripted content is quietly becoming a force on the international stage too.

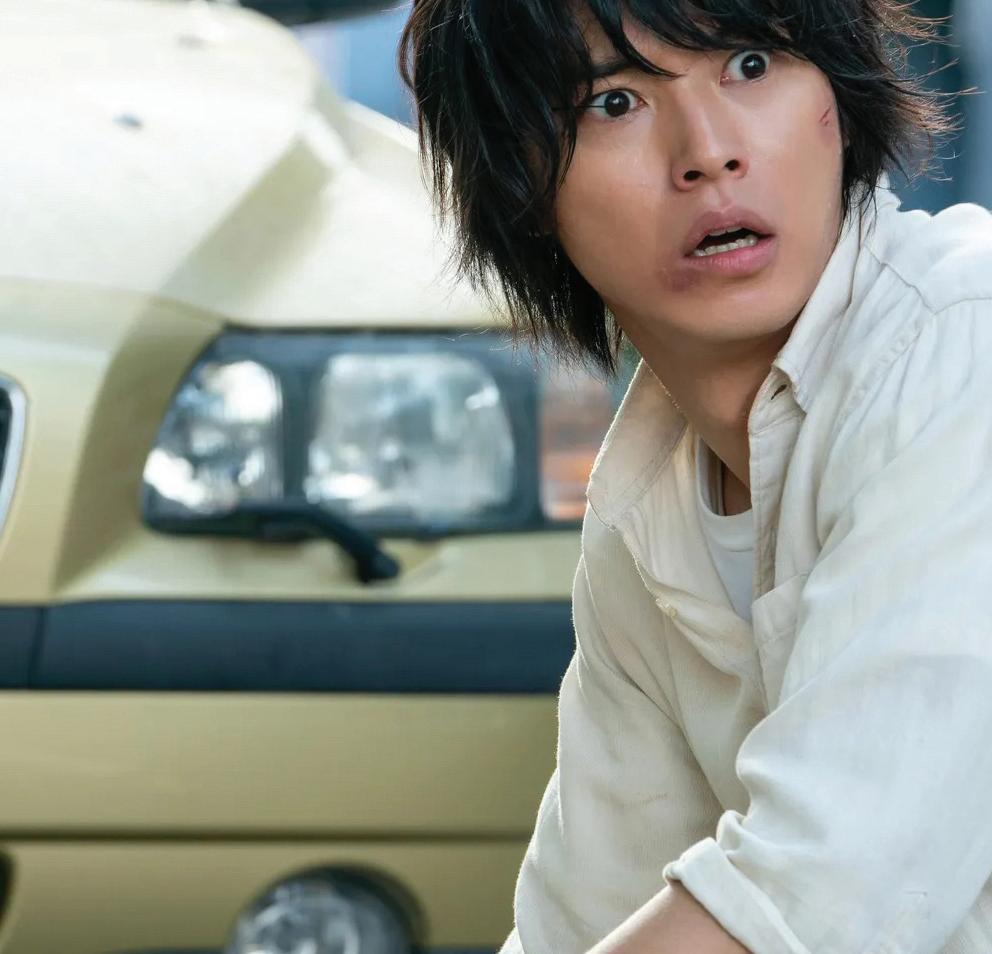

J-dramas such as Nippon TV’s Mother and Netflix sci-fi thriller Alice in Borderland have attracted millions of viewers, while pubcaster NHK recently agreed to its first international scripted remake. The move will see South Korean prodco Big Ocean ENM adapt NHK’s 2010 romcom I’ll Still Love You Ten Years From Now for local audiences.

“NHK’s dramas have been selling well internationally, and we’ve always hoped to license more scripted formats. This deal will give us momentum to do more,” says Yonemura Yuko, NHK Enterprises’ general manager of content distribution.

Commissioners and buyers are increasingly opening their chequebooks for programming made by the best creatives working out of Japanese production hubs like Tokyo and Osaka.

It’s a far cry from the days when the island nation was largely considered a closed market by the international TV industry – hard to sell into and seemingly unconcerned with anything other than serving its own domestic audience.

“For a long time Japan has been a self-sufficient market and could generate enough revenue without going to the effort of international cooperation,” says Aratani Noriko, head of international content development at NHK, which operates two terrestrial and four satellite channels.

Yashiki Yotaro, NHK’s head of drama and entertainment production, says: “There was undeniably a time when it was difficult for foreign dramas to go worldwide because of subtitles and dubbing. In Japan, we used that as an excuse to give up trying to go worldwide.

“However, with the rise of streaming platforms, plus Korean and Turkish dramas becoming so

popular around the world, there is more space and openness for foreign dramas. Squid Game proves that language can no longer be used as an excuse.”

With a national population close to 125 million, it’s hardly surprising that Japanese broadcasters didn’t feel the financial imperative to seek alternative revenue streams overseas.

The country has six major networks: TV Tokyo, TV Asahi, Fuji TV, TBS, Nippon TV and NHK, which is the only channel to be funded by a licence fee.

Netflix and Hulu – the latter owned and

factors make Japanese series unique but relatable at the same time and I foresee more drama travelling globally.”

Established just over 70 years ago, Nippon TV has played an integral role in the rise of J-drama with international breakthrough hit Mother. Originally aired in 2010, it stars Yasuko Matsuyuki as an elementary school teacher who takes an abused pupil into her care.

Although Mother only ran for one season of 11 episodes, its influence was significant, becoming

“ The fierce competition of having six network TV stations makes Japan a unique place for drama and there are many competitions for new scriptwriters to compete in. All these multi-dimensional positive factors make Japanese series unique but relatable at the same time.

Sayako Aoki, Nippon TV

controlled by Nippon TV in Japan rather than Disney – are two of the biggest streamers operating in Japan, but a host of rival online platforms have sprung up, including U-Next, dTV, TVer and Paravi.

“The storytelling strength keeps evolving to adjust to the savvy audiences, with series having a much longer life than before on digital platforms,” says Sayako Aoki, head of scripted formats at Nippon TV.

“The fierce competition of having six network TV stations makes Japan a unique place for drama and there are many competitions for new scriptwriters to compete in. All these multi-dimensional positive

the most adapted scripted format out of Asia, with seven local adaptations to date in Turkey, South Korea, Ukraine, Thailand, China, France and Spain.

“The story reached the emotions of the global audience with its thought-provoking universal theme,” says Aoki. “Furthermore, the Turkish version, titled Anne, was a record-breaking hit that was exported to almost all corners of the world, which was definitely a first for us.”

Emboldened by this success, Nippon TV has since created several scripted shows that have tapped into the international market.

Connected: The Homebound Detective, produced

By Neil Batey

COUNTRYFILE: Japan 80 p in a w

Cha aCh nne enn l21 International | Spring 2023

Nippon TV’s Mother

by Envision Entertainment, is the story of an agoraphobic young man who uses his computer skills to solve crimes without leaving his bedroom. It has been optioned for a US remake by ITV Studios-backed Tomorrow Studios.

“Connected was specifically designed to result in a number of localised versions, featuring diverse characters from different countries,” says Aoki.

live-action and anime, each year in Japan over the past two years, with the commissioning balance now more even between scripted live-action and anime.”

In 2021, Netflix partnered with Tokyo Broadcasting System Television (TBS) to release two homegrown scripted projects globally: J-pop drama I Will Be Your Bloom and eco-themed drama Japan Sinks: People of Hope

The collaboration was strengthened last year when Netflix, hoping to ride what it calls the “J-wave,” teamed up with TBS-owned prodco The Seven to make multiple original live-action titles to be streamed in 190 countries.

“There is a growing appetite for well-produced Japanese programming, both domestically and internationally, and together with The Seven, we’ll deliver our best shows and best stories to our members,” said Netflix last November.

r network Fox

n: My ns

In addition, Nippon TV drama Without Family has been adapted in Turkey by Istanbul-based prodco MF Yapim for free-to-air network Fox Turkey, while a version of Woman: My Life for My Children ran for three seasons in the same country and Abandoned was adapted for Line TV in Thailand.

d for Line TV in TV will

At MipTV in April, Nippon TV will shop youth-skewing time travel comedy international buyers. Executives believe IP mined from Japan’s rich cultural history can inspire a new wave of original content for international audiences.

y Rebooting to elieve IP mined y a

r international dy s Aoki. “There eries based on ions that ure are ecome a y

“There is a vast treasure chest of everlasting novels and mangas that are already appreciated by people around the world,” says Aoki. “There is a huge possibility in creating series based on those magnificent stories. Situations that may sound particular to a Japanese culture are actually understood by the global audience.”

Recent years have seen Japan become a key market for international streamers. According to London-based research firm Ampere Analysis, in 2019 live-action scripted content accounted for just 17% of commissioning in Japan by SVoD services Netflix, Disney+ and Amazon Prime Video. But following the Covid pandemic, that share rose sharply to 46% last year.

re Analysis, t accounted pan by SVoD zon Prime ndemic,

ear

ed for content iants in st halved

Interestingly, anime accounted for 65% of all original Japanese content commissioned by the streaming giants in 2019, although that figure had almost halved to 33% in 2022.

“Netflix continues to be the biggest international investor in Japanese scripted content overall,” says Alice Thorpe, a senior analyst at Ampere. “It has commissioned around 20 series and movies, in both

a senior sioned both

Akira Morii, who produced both seasons of Alice ix, leads development and production at the label. It has access to a state-ofthe-art studio lot in Yokohama, which the streamer said will result in productions that are “best in

,NN bo in Borderland for Netflix, d at the label. It has a the-art studio lot in said will result in productions class.”

“TBS Group has 10 studios at our headquarters ve more at Midoriyama Studio City in Yokohama, but they are only capable of TV production in Japan and not to the specs usually required from global OTT platforms,” says Fumi Nishibashi, manager of global business at TBS and director of business development at The

has 10 studios a in Tokyo, plus five more at M City in Yokohama, but they are not to plat globa and director of business d Se S ven

“A lot of elements, including script writing, pre-, post- and actual production, budget, tech specs and censorship are different from the ones for TV production in Japan. The new studio lot for The Seven is equipped for global requirements, thus very important for our future production abilities.”

“A lot of element b and censor th producti new s Seven globa th t us

o our abilit Roman T Times, wh ni in Januar Japan on P pick release b

Romantic fantasy Why Didn’t I Tell You a Million , which debuted in a Friday night slot on TBS in January, is streamed in Japan on Paravi and has now been picked up for global release by Netflix, which recently began streaming lm Unlocked, a

thriller film

Channel21 International | Spring 2023 COUNTRYFILE: Japan 81

Woman: My Life for My Children

Kansai TV crime thriller Elpis: Hope or Disaster

Nippon TV time travel comedy Rebooting

South Korean remake of TBS’s 2018 feature Stolen Identity

“We are open to partnering with anyone to entertain the world,” says Nishibashi. “Last year we partnered with Craig Plestis and Smart Dog Media to launch our dating show format Love by AI. It was our first co-development with a US prodco and now The Seven is in discussion with studios outside Japan for potential scripted copros.”

Netflix Japan also carries investigative crime thriller Elpis: Hope or Disaster, launched by commercial broadcaster Kansai TV with a world premiere at last October’s Mipcom.

Inspired by real events, it tells the story of a disgraced TV news anchor fighting to free a falsely convicted man on death row. The show has been sold to Viu in Hong Kong, Wavve in South Korea and KKTV in Taiwan, with platforms in the US and Europe also showing an interest, according to Kazu Sato, director of global sales at Osaka-headquartered Kansai TV.

“I started my career with Kansai around 20 years ago and at that time I could not have imagined that our dramas would be distributed overseas. This is a new era for Japanese content and we hope to further develop our IP to extend to the international market,” says Sato.

“According to a survey by the Japanese government, 85% of broadcasted content exports are in the anime space, with drama amounting to just 5%. It’s hard to catch up, but I believe there is room to grow the scripted share to between 10 and 15%.

“Competition is very tough in Asia. Thai and Taiwanese content is very popular, while Chinese studios have invested huge sums in drama production. Here in Japan, our government assists with the promotional and PR process but doesn’t

give direct financial support for production,” adds Sato.

“We have limited budgets, which is a dilemma because if we want to compete in the global market we need to find a way to share financing through coproductions.”

Yuko Oki, MD of global partnerships and chief marketing officer at Rakuten TV, the European streaming and free ad-supported streaming TV (FAST) channels division of Japanese e-commerce and fintech giant Rakuten, is another exec keen to see the Japanese government back its audiovisual exports industry in the same way countries such as South Korean have.

“The Japanese industry needs to involve the government to promote Japanese culture and content as an organised effort. There is a discussion about this back in Japan, how to export soft content to other regions,” says Oki, who operates out of Rakuten TV’s European headquarters in Barcelona.

“It’s about maximising Japan as an asset, which has already been proven successful in fashion and art. It’s a uniqueness we can leverage. I’d like to see Rakuten TV drive more Japanese content, so those seeking rare content and very old movies from Japan can go to Rakuten TV. If we can build that positioning, that would be great.”

However, Oki says Rakuten TV’s desire to offer more Japanese content to European audiences is being held back by Japanese distributors’ resistance to the revenue share model that is being embraced by FAST and other AVoD platforms in Europe and North America.

“There are huge numbers of communities in the UK, France and Italy who are genuinely interested in Japanese culture and content and are actively looking for something Japanese. Demand is bigger

than supply at the moment, so Japanese content is a really big opportunity for us,” says Oki.

“We always get enquiries from customers requesting Japanese anime or drama, so that’s definitely something we want to explore, but it has to be a joint effort. There are different business customs. When I talk to content providers in Japan, the revenue share model that is common for us in Europe is not so common in Japan yet.

“They’re always looking for partners who buy exclusive deals in perpetuity. But that’s quite an old way to acquire content in the US and Europe. There’s definitely some content providers in Japan who need to catch up with the latest business trends,” claims Oki.

NHK’s Noriko affirms the broadcaster is committed to expanding its international presence. “We see great potential in overseas markets, and we intend to keep growing our sales for scripted formats.

“Japanese content has evolved in its own unique way, separate from global currents and is therefore full of creative originality. Japanese companies are now drawing on this strength to develop formats, remakes and other IP, along with international coproductions.”

Recent programming trends in Japan have seen love stories, light-hearted comedy and suspenseful dramas that tackle social issues all attract good viewing figures.

“One of the characteristics of Japanese drama is the sensitive emotional portrayals of individual characters, though that may be regarded as slowpaced by Western audiences,” says Yotaro.

An alternative idea is that J-drama should stop trying to second guess what international audiences expect from it.

“To be honest, I don’t care about the ‘Japaneseness’ of our content,” says Sato. “The quality of scripts, storylines and production are the most important factors to break the boundaries of language and culture internationally.”

It’s a view echoed by Yukiko Kimishima, chief executive of business management at the Broadcast Programme Export Association of Japan.

“The survival of the fittest is intensifying,” she says. “The nationality and language of the content is no longer a point of concern, but rather it’s now more about whether the content is interesting and good. We have high expectations that Japanese content will travel to more regions.”

Channel21 International | Spring 2023 COUNTRYFILE: Japan 83

Channel21 International Spring 2023

Akira Morii (top) and Fumi Nishibashi

Alice in Borderland

Connected

Meet Us @P-1.L54

Works of Arte

Navigating a sea of heavyweight streamers and fierce competition for eyeballs, FrancoGerman cultural public broadcaster Arte’s scripted strategy is successfully exploiting a distinct gap in the market.

Arte France’s director of fiction, Olivier Wotling, doesn’t believe the global glut of scripted content is delivering variety and diversity of choice. And it’s precisely where Arte’s own drama strategy sets itself apart, he argues.

“Our impression is that the spectrum of choice and proposals is shrinking as far as TV shows are concerned. There are more and more cop shows and thrillers and our feeling is Arte’s role in bringing original and new takes to its programmes is just as interesting as it was two or three years ago,” says Wotling. “Our mission is to keep a distinctive, even peculiar voice in a world with more and more platforms and streamers, and maybe channels, but where the diversity of programmes isn’t growing.

“Unlike others, we’re not looking for genres or subject-driven issues. Especially with public broadcasters, it’s often the case that they need a show about, for instance, today’s youth, or a show about the ill-treatment of kids today. We don’t work like that at all.”

Viewers won’t find the usual cop drama on Arte and it will only consider thrillers if there’s a new take on the genre, says Wotling. “We start with a writer and a point of view. It’s the light that is cast on the issue that makes the project interesting or not, and not the subject itself.”

While its heartland remains contemporary drama

ta v d B

By Gün Akyuz

infused with social issues, Wotling says Arte has recently been looking for a more positive spirit and human warmth in its shows.

Italian stories, which Arte boards as a minority coproducer, is a bonus, says Wotling.

Last year Arte launched Black Butterflies (Les Papillions Noirs), a thriller about a serial-killer couple which is now showing on Netflix. On Arte, the series attracted 3.3 million digital views and an average of 827,000 viewers and a 4.6% share on linear. “It was a real success, but that’s not a reason to try to look only for more thrillers. We’re staying cool-headed. While the success is wonderful, we have to go elsewhere and not repeat ourselves,” says Wotling.

Arte’s mission to keep offering fresh, new

Its remake of Israeli scripted format In Treatment (En Therapie) a couple of years ago was the turning point in that strategy. “We think there is de opportunity to grab the audience, not only through mysteries, thrillers and dark stories but also through feel-good stories that are positive, very human and very warm,” says Wotling.

Across its digital and linear feed combined, Arte airs a mix of homegrown original titles, coproductions and acquisitions, releasing a new title every fortnight.

Wotling’s department generates three or four French fiction series per year on average –each typically of six to eight episodes – out of a development slate of between 10 and 12 projects at any given time. In addition, it partners on three or four international coproductions as a minority coproducer.

Offering Arte’s viewers European content comprising UK, Norwegian, Spanish or

n definitely an nly lso human and combined, ginal titles, g a new title or four rage –– out 0 and ition, onal ent or

Cultural public broadcaster Arte France is pushing its successful drama strategy into new areas by taking risks, which it sees as vital to finding new stories and distinctive voices.

Channel21 International | Spring 2023 CONTENT STRATEGIES: Arte France 85

Le Monde de Demain

Serial killer drama Black Butterflies

stories isn’t a risk, he argues. Rather, Arte has “been able to go for shows we knew probably wouldn’t match our audience tastes or expectations but that we felt had to be done, such as Le Monde de Demain [Reign Supreme],” he says.

A copro between Arte France and Les Films du Bélier in association with Netflix, the series is set in the late 70s and early 80s and centres on France’s first hip-hop band, NTM.

The 2022 French audiovisual reforms changed the way the country’s public broadcasters, including Arte, are funded, moving away from a licence fee and towards direct government funding through taxation.

Under this shake-up, Wotling says his budget remains stable. The big change, he says, is that “the digital platform is more important than the channel.”

Wotling says fiction series are an important driver in attracting viewers to Arte’s digital platform. “Right now we are in development with or even shooting projects that two years or three years ago we wouldn’t have done if we’d been thinking only of the [linear] channel,” he says.

Currently shooting is Machine, a six-part 30-minute format best suited to a digital platform. “We’re going with [shorter formats] now because the platform is definitely leading,” Wotling says.

Machine, which centres on an anonymous woman skilled in martial arts, taps into the current “air of rebellion” present in France, and “a growing feeling of anger – it’s not revolution but people are [anticipating] a fight, and I’m sure this show will strike a chord with the French,” says Wotling. Amazon’s Prime Video is onboard as a pre-buyer for a second window in France.

is Italian true crime drama Esterno Notte (Exterior Night) from Marco Bellocchio, about the kidnapping and killing of statesman Aldo Moro by terror group The Red Brigade in 1978, where it “wouldn’t make any sense” to have given the series a French angle.

At the other end of the spectrum are Frenchoriginated projects Arte is keen to get international foreign partners involved in at an early stage. “We are happy to share development and writing, and we believe we are stronger when

there are more of us,” says Wotling. “We learn from working with other European countries, writers and producers, and French fiction can only be enriched by [such partnerships].”

A prime example is Arte’s hit French-Israeli copro No Man’s Land, about the Syrian-Kurdish-ISIS war, which has just finished shooting a second season. The Arte and Hulu copro is produced by Haut et Court TV, Masha and Spiro Films in coproduction with Fremantle.

Another is upcoming series Rematch from Unité, along with Federation, which dramatises the duel between chess champion Garry Kasparov and the IBM super computer Deep Blue. The series, set in New York and filmed in English and Russian, is currently at the edit stage and is expected to launch in 2024.

Arte unveiled five new French-led projects at Series Mania in March, including Franco-Belgian series De Grâce (Haven of Grace, 6x52’), political satire Sous Contrôle (Under Control, 6x30’), serial killer comedy murder mystery Polar Park (6x50’) and The Girl Who Learned To Kneel (working title, 6x52’). The latter comes from Israeli writer Hagai Levi, who wrote the original Israeli version of In Treatment

In autumn 2020, Arte launched an additional tier of acquired digital-only scripted offerings. The latest selection includes UK comedy-drama Pure, Lebanese drama Awake, Russian series An Ordinary Woman, Croatian show The Last Socialist Artefact and Stephen Frears’ State of the Union, written by British novelist Nick Hornby.

Meanwhile, launching across linear and digital in May is UK drama Black Earth Rising, a BBC-Netflix copro from Hugo Blick exploring international war crimes. Wotling says he would have liked Arte to be a coproducer on the series to secure an exclusive first-window for France. “That’s exactly the kind of mixture we love, with a very intimate, dramatic story, a family story and a really important and tragic page of history.”

While conceding the challenge of being a niche player with a small commissioning slate, Wotling argues that, with the narrowing of scripted choices globally, Arte can “show people, other broadcasters and our partners that you can do really original things or take risks.” It means thinking about a project in terms of its spirit, such as being warm, witty or positive, rather than in genres, he says.

p

Arte regularly partners with global streamers who typically join as pre-buyers without seeking editorial or artistic input. “They’re happy with it because Arte offers something edgy for a niche in their wide spectrum of offering. We’re like a research and development lab to buy shows they’re thinking of making from,” says Wotling.

When it comes to coproducing with or pre-buying from Arte, Wotling says projects and partnerships can come from anywhere. “For us, it goes in both directions – from foreign countries to France and with us as minor coproduction partners but still intending to play a role in the writing and development process,” he says.

Where Arte participates as a minority partner, it does not insist on adding French elements to a project. A current partnership in this category

s who ditorial cause wide h and ng uying ships both ance but and ner, to ory

For Wotling, the challenge is less about increasing scripted output and more about offering a curated service that gives viewers something special they can’t see elsewhere, and securing longer rights to the shows it does have in the free VoD landscape, where competition is heating up.

For increa offeri some secur in the heatin

“We w on the but we becaus launch “Wha platform mi new on

“We launch one new show every second week and we have about 200 to 300 hours of shows on the platform,” he says. “We’ll never be Netflix but we don’t think it’s about bringing more content, because we have a critical mass and enough new launches on a regular basis to attract people.

“What’s new is that people now come to the platform, not only to catch up with a programme they missed on the channel, but to check what’s new on the platform. For us, that’s perfect.”

Channel21 International | Spring 2023

Arte partnered on Italian drama Esterno Notte about the kidnapping of Aldo Moro

CONTEENNT T S STRARATTEEGGI

S:

e France ce

IEES

Arrtte

“ Our mission is to keep a distinctive, even peculiar voice in a world with more and more platforms and streamers, but where the diversity of programmes isn’t growing.

Olivier Wotling Arte France

Stephen Frears’ State of the Union

As the streaming market heats up on the African continent, Amazon Studios and Prime Video’s head of Nigerian originals, Wangi Mba-Uzoukwu, is keen to find “hyper-local” stories and voices across scripted, unscripted and movies to differentiate Amazon Prime Video in the territory and diaspora.

The veteran audiovisual exec and her team are currently building a slate of local originals for the streamer’s Nigerian service, which launched last August.

Taking the experience of more established Prime Video markets such as Germany, the Nigerian service is after “a really hyper-local way of seeing the market” rather than a “onesize-fits-all” approach, Mba-Uzoukwu told the European Film Market Berlinale in February.

Although Mba-Uzoukwu and her team are still developing a slate of shows, Amazon is aiming for Prime Video in Nigeria to be different to other local services because of its focus. It is keen to “skew towards different genres we feel appeal to the customers in our market,” she said when discussing the service’s content priorities.

“We want to be able to appeal to and get many people to come in to see all the various things we have, including all the international content, and the way to do that is to do content that actually brings everybody in,” she said.

This is likely to veer towards “genres that are a bit more comedy and action, as well as mainstream drama, because in Nigeria that’s what people already have,” Mba-Uzoukwu said. “At the same time, we push boundaries with some new genres that they may not know they wanted but they’ve not experienced it for various reasons.”

-Uzoukwu said. “At e nres ted arious reasons.” exec has identified or , about the future, are st tell those stories. o

In particular, the exec has identi a gap in Nigeria for “light, optimistic stories about hope, about the future, about what can be. We’re in a place in Africa where there are all these dark stories, and we must tell those stories. But we also have to remember what it is that entertains us, what makes us feel good about ourselves, and I think we’re missing that.”

Delivering Nollywood

Amazon-owned Prime Video Nigeria is building up a distinctive slate of originals by targeting hyper-local storytelling and partnering with local talent. By

Gün Akyuz

or escape in the Yoruba language, and refers to people leaving for a better life. “We have a lot of that, so when I say local, I’m not talking about territory. The first point is the local customer, wherever they may be, because ours is slightly nuanced in that sense.”

As well as being customer-led, the service also does things in different languages, said the exec. “We’re looking at how to make sure we’re hyper-local enough, as long as there’s a true story – the telling of an authentic story to capture wherever a Nigerian is, whether it’s in the US or UK or Nigeria.”

crime genres as having become ubiquitous in Nigeria. “But recently we’ve seen more action content. We’ve always known that action in Nigeria and Africa does well, but it’s always been international action.”

Last September saw the theatrical release of the Nollywood action-thriller movie Brotherhood. It was acquired by Prime Video and launched on the streamer at the end of January.

First off the blocks from that deal is Prime Video Nigeria’s first scripted original, the high-profile feature film Gangs of Lagos, produced and directed by Osiberu, along with Kemi Lala Akindoju as producer and Akin Omotoso as coproducer. The story focuses on a group of friends growing up in a gang-run district of Lagos and is inspired by real people. MbaUzoukwu says the film is “a different take on action in a very hyper-local way.”

,

Highlighting comedy as a favourite genre among audiences, she also identified

“It’s just amazing the engagement that we’ve seen,” commented MbaUzoukwu. Brotherhood’s Nollywood producer and director, Jade Osiberu, and her production company, Greoh Studios, also struck a deal with Amazon Studios to create and develop TV shows and movies exclusively for the platform.

The next original to launch will be unscripted comedy series LOL: Last One Laughing Naija. It’s the latest iteration of the Japanese format which has so far launched successfully on the streamer in Germany, Spain, Italy, France and Sweden, as well as in Latin America, Canada, India, Australia and the Netherlands.

rselves, and I think ” ons es, Mba-Uzoukwu uanced” service ur s she hting the pa,’

While Prime Video Nigeria’s original commissions are primarily for local audiences, Mba-Uzoukwu pointed to the “nuanced” way the Nigerian service defines itself. “Our local audience is also a diaspora,” she explained, highlighting the Nigerian phenomenon of ‘japa,’ meaning to run

Mba-Uzoukwu likens Prime Video Nigeria’s originals strategy to that of the Nordics, due to the multiple languages and different audiences to cater to. Also in common with other local Prime Video services, Nigeria’s ambition is to develop 12 to 14 originals a year across scripted, unscripted and

on the streamer in G Sw in Latin Amer N M o to that of t to the multipl different audien Nig scripted movies.

“The unique part is that Nollywood is quite vibrant, so on the acquisitions side, we are seeing a lot of great content coming in on the movie side. We’re focusing on adding variety and value on the unscripted and the series side. At the same time, we’re also still doing movies,” she said, in a nod to

side, we are on ad unscripte side. At the same tim s Gangs of Lagos

She also observed that the arrival of

CONTENT STRATEGIES: Prime Video Nigeria Channel21 International | Spring 2023 88

LOL – Last One Laughing Naija

zdf-studios.com R7.D 5 Meet us at MIPTV stand no.

streamers like Netflix and Prime Video to Nigeria, has led to local creatives “being a little bit more bold or taking risks.”

While it’s too early to talk about how originals will be shared across scripted or unscripted, as the slate is still being developed, she said: “I can tell you scripted for TV and unscripted is a big chunk and movies then support that.

“We’re in the period when we’ll see more unscripted because they’re faster, and then our fully blown originals will probably start coming a few years down the line. But that’s where I feel the value-add is.”

Mba-Uzoukwu emphasised that Prime Video in Nigeria is keen not to muscle in on “what is already there and what’s good” but “to improve things for producers” and the local audiovisual industry. In particular, Amazon Studios is keen to support producers to get better at producing series, she said, highlighting a gap in local production for high-end series.

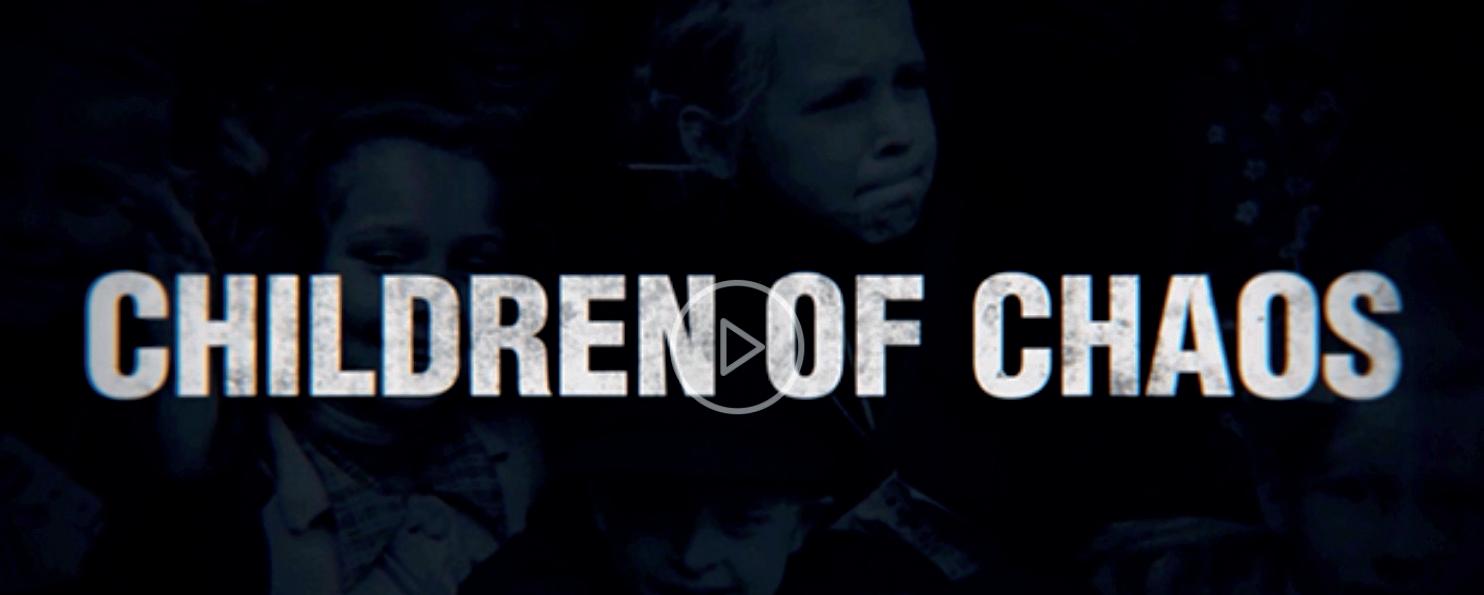

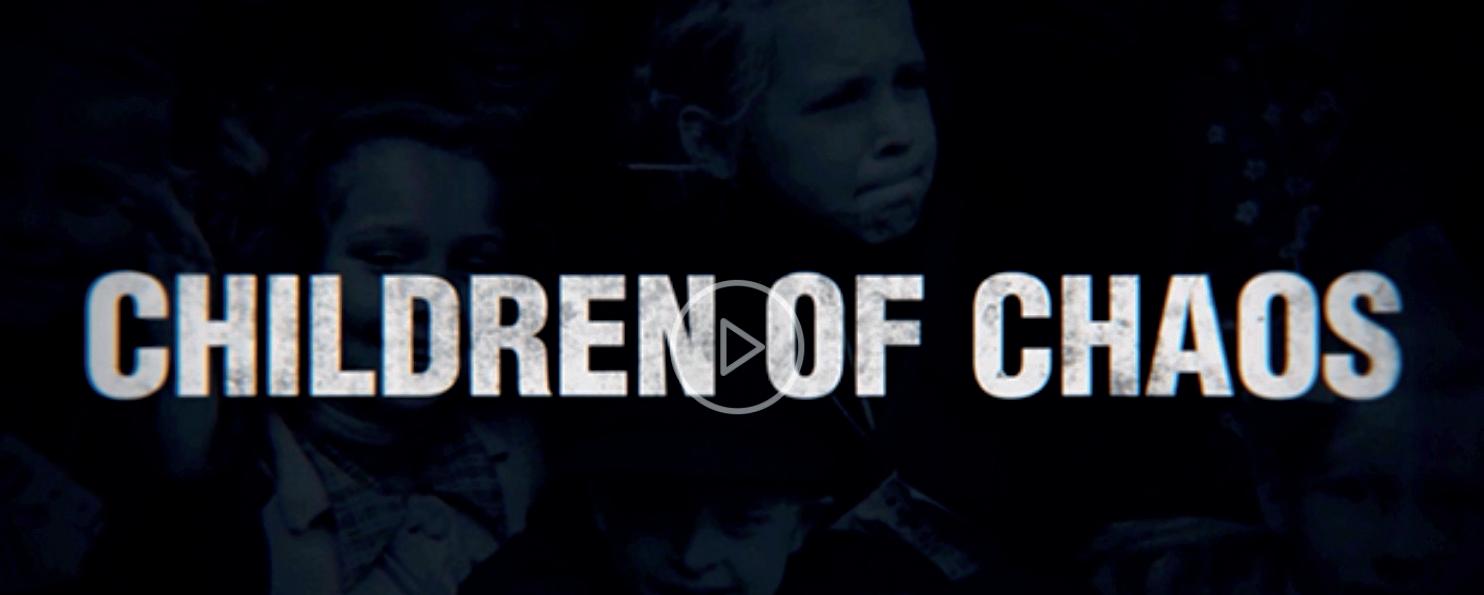

There’s no specific focus on commissioned documentaries at Prime Video Nigeria, but MbaUzoukwu believes they would benefit the territory and pointed to acquired documentaries that are already part of the mix, such as Prime Video’s recently launched doc Super Eagles ’96. The film follows the Nigerian men’s football team, including during the year they surprised the sporting world by winning gold at the Olympic Games in Atlanta, turning the team into local superheroes. Made by London-born director Yemi Bamiro, the doc premiered at last autumn’s London Film Festival.

“It’s such a brilliant story that archives a certain time in Nigeria’s

politics and sports that’s very relevant for today,” said Mba-Uzoukwu. “So whilst we say ‘no documentary,’ when we do see the right story, we might champion it.”

As for content that targets specific demos, Mba-Uzoukwu said: “It’s not so much about targeting young adults or whatever, it’s more about something that can have a broad appeal at the same time. If you look somewhere in Africa, in Nigeria, the use of music is really big across the continent. So there’s the music for young adults, but all of us enjoy Afrobeats music, right?

“So it’s looking for those sort of key points where you can leverage something that everybody comes along to. In Nigeria, extended families watch together. So what stories can you tell that actually brings people together, young and old?”

When pitching finished content to Prime Video in Nigeria, MbaUzoukwu’s extensive background as

a buyer means she remains the “point person” within her small team for acquisitions. “We confer a lot because we have to align the strategy to make sure that we’re actually delivering for the customers that we’re there for,” the exec added.

Projects brought to Mba-Uzoukwu should preferably consist of a logline and a short one-page outline of what the show is about. “We prefer that just because we’re hand-holding along with an infant industry. With the experience that we have, we can work together to bring it to where it’s going, and part of that is storytelling and life stories.”

As well as movies, Mba-Uzoukwu is keen to bring in more series. “The stories don’t have to be dark. History is good, but those are usually big and epic. What we’d like are life stories about ourselves, to see us as we are, so that when I watch it, I want to see myself in there,” she said.

Amazon Studios and Prime Video

“ We’re looking at how to make sure we’re hyper-local enough, as long as there’s a true story – the telling of an authentic story to capture wherever a Nigerian is, whether it’s in the US or UK or Nigeria.

Wangi Mba-Uzoukwu

Gangs of Lagos was Prime Video Nigeria’s first scripted original

Channel21 International | Spring 2023 CONTENT STRATEGIES: Prime Video Nigeria 2023 Prime Video

Football doc Super Eagles ’96

C O N T E N T B U D A P E S T

Kempinski Hotel • 27-29 June 2023 Act Local Think Global

ITV Studios (ITVS) bought a majority stake in Lingo Pictures last November, making it the first scripted prodco from Australia to be acquired by the production and distribution arm of ITV. Now the company has revealed its newly scaled-up content strategy, which includes literary adaptions.

Recent years have seen US networks and streamers get out their chequebooks to acquire the rights to bestselling novels by Australian authors, including Big Little Lies, Nine Perfect Strangers and The Husband’s Secret.

However, Lingo now aims to develop Aussie literary IP in its native land and bring local stories to global audiences.

“We do feel a little protective of our territory; we’re often fighting off American producers for the rights to Australian books,” says Jason Stephens, creative director and co-owner of Lingo Pictures. “Aussie authors can get a bit dazzled by the US market, as American studios have book scouts operating around the world and they’ve focused on Australia in recent years.”

Lingo MD Helen Bowden previously founded Matchbox Pictures, where she developed awardwinning 2011 drama The Slap, based on a novel by Australian Christos Tsiolkas, for ABC1.

At Lingo, she has overseen production of psychological thriller The Secrets She Keeps, inspired by New South Wales writer Michael Robotham’s 2017 novel, for Network 10. It was also the first Australian drama in 35 years to be given a primetime slot on the UK’s BBC One and was the fifth most watched drama on BBC iPlayer last year. A second season has been produced for Paramount+, BBC One and Sundance/AMC.

“We’ve done a lot of adaptations at Lingo and we have great relationships with writers like Michael Robotham,” says Bowden. “It’s one thing for authors to sell the rights to their novels to US companies, but that doesn’t mean it will actually go into production.

“It’s about getting a show made, so we’ll wait a

Development Slate Lingo Pictures

ITV Studios-owned Australian prodco Lingo Pictures plans to expand its international footprint by protecting antipodean IP from big-spending US studios.

By Neil Batey

while and then say to the author, ‘Hey, come to us, we’ll make it happen.’”

Lingo’s first two dramas delivered since joining ITVS are 8x30’ anthology series Erotic Stories, for SBS in Australia, and six-parter After the Party, for New Zealand’s TVNZ and ABC in Oz.

With ITVS now handling international distribution and injecting cash into the company, Lingo says it is able to “turbocharge” its production output.

“Coming into the ITV Studios family allows Lingo Pictures to flex its muscles and continue making high-end Australian drama that will sell well internationally,” says Stephens.

Lingo currently has two shows in pre-production, an equal number in post-production and one shooting. Although coy about revealing too many details at this stage, one confirmed project is 8x60’ drama Prosper

“It’s a rather large show for us, which starts shooting very soon, and we see it as being a returnable series,” says Stephens. “It’s a dynasty story set in Sydney about a family who run a successful mega-church.”

Also on the slate for 2023 is Queen of Oz, a 6x30’ comedy coproduction with ABC and the BBC. Former Doctor Who actress Catherine

Tate executive produces and stars as Princess Georgiana, a disgraced member of a fictional British royal family who is sent to live in Australia to keep her out of harm’s way.

Meanwhile, ABC has commissioned Lingo’s The Messenger, an eight-part drama adapted from Markus Zusak’s novel of the same name. It tells the story of a teenager who stops an armed robbery and becomes an accidental hero but begins to receive mysterious playing cards the following day, taking him on an unexpected journey.

With the second season of Aussie dramedy Upright, starring Tim Minchin and Milly Alcock, returning to European giant Sky and Fox Showcase down under recently, Lingo’s content is in high demand, both at home and away.

“Being part of ITVS will simplify our business a whole lot,” says Bowden. “It gives us more time to work on making the shows rather than signing up with individual distributors for each project. We’ll get rapid intel on what the market is doing and advice on how we can tweak content for it to perform better internationally.

“We can now turbocharge the company to make the best of the opportunities that are out there for Lingo.”

Channel21 International | Spring 2023 BACKEND 91

Mil M ly y Alc l ock and T dT d im m Min Mi chi ch n i n n Upr Up U igh ig i t. Abo A Abbove: v Ja Jason on St S eph ph p ens ns and an He H len l Bo Bowde d n

Range Media Partners International, the London-based production arm of US talent management firm Range Media Partners, is one of the more compelling entities to launch in the UK market over the past two years.

Led by co-presidents Thomas Daley and Oliver Riddle, the company has been staffing up and building a curated development slate over the past 18 months, with several projects announced recently and more on the way.

At a time when TV projects increasingly need toptier talent attached to grab commissioners’ attention, and with the cross-pollination between the European and US content markets only growing, Range Media Partners International has the enviable benefit of being directly connected to some of Hollywood’s biggest power brokers.

“We are an independent studio with development funds, the ability to sell anywhere and a real superpower, which is connections to the managers in LA,” says Riddle, who joined in October 2021 from Netflix, where he oversaw strategy and operations for the streamer’s international film team.

Its California-based parent company sent shockwaves through Hollywood in September 2020 when former CAA agent and Entertainment One chief strategy officer Peter Micelli and more than a dozen high-profile agents from the likes of CAA, WME and UTA told their employers they were resigning in order to form the new talent management outfit.

Around a year later, the London production arm was up and running, and while its impact has not been quite as dramatic, its progress has nonetheless turned heads following the recent announcement of several in-development projects.

Among them, Range Media Partners International, along with UK actor and producer Taron Egerton (Rocketman, Kingsman landed the film rights to LGBTQ+ psychological thriller HappyHead from UK author Josh Silver.

On the TV side, it partnered with A+E Networks, which owns a minority stake in Range Media Partners, to secure the rights to Swedish crime novel Blaze Me a Sun and follow-up Under the Storm from Christoffer Carlsson.

Daley, who joined in late 2022 after a two-year stint as senior VP and head of creative at Universal International Studios in London, and Riddle have been busy meeting with streamers and public broadcasters as they build out their slate of UKand European-focused content.

Three-Year Plan Range Media Partners International

Range Media Partners International is using its connections with major power brokers in the US to help fuel the growth of its UK and European slate.

By Jordan Pinto

Range Media has a separate US studio division, led by Heather Kadin, focused more squarely on the American market.

Daley says the company is hunting for “stories of scale” and is focused on “interrogating material as [it] builds a bespoke slate across TV and film.”

The split is roughly 70% television to 30% film, with Daley noting that one of the key goals in the coming years is to find “iconic characters at the heart of the material that can attract very significant talent.”

That talent does not necessarily need to be a client of Range Media Partners. It’s an added benefit and opportunity, certainly, but Daley and Riddle say they are just as eager to work with talent from outside its walls.

The London team

is “constantly talking” to the US executives and managers, says Daley. Riddle adds that that level of connectivity has been an invaluable asset as it builds from the ground up.

“The flow of information is powerful – to understand what the streamers, broadcasters or any individual actor, director or writer are looking for. Being so plugged into the Hollywood matrix, even if we’re removed from it, is a huge benefit to us,” he says.

Today, most of Range Media Partners International’s projects are being independently

Riddle, Range Media Partners Int’l

developed. Over the next six to 12 months, it plans to move into commissioned development on several titles, and hopes to be in production within 18 months.

“We’re new guys on the block in the UK. We know we’ve got a really interesting opportunity and we think it will work,” says Riddle. “Now it’s just about proving it. It’s finding great material, interrogating it, rolling up our creative sleeves and moving things into production. We know what the path is over the next two or three years, and now it’s about executing against it.”

“ We are an independent studio with development funds, the ability to sell anywhere and a real superpower, which is connections to the managers in LA.

BACKEND Channel21 International | Spring 2023 92

Oliver

Thomas Daley

Oliver Riddle

Harness the power of the world’s leading online programme market Visit C21Screenings.net to start screening now

Casey Bloys on the perils of the SVoD market

Local leads the way for Prime Video Nigeria

Casey Bloys on the perils of the SVoD market

Local leads the way for Prime Video Nigeria

By Neil Batey

By Neil Batey