More than 200,000 small to medium-sized businesses depend on BenefitMall’s guidance and leadership for employee benefits solutions—and for good reason. BenefitMall leverages innovative technology, backed by our human expertise to provide brokers with the fastest, easiest, and most trusted benefits selling experience.

From quote to enrollment and more, BenefitMall will help you support and retain your clients. Join us and let’s grow business together! Scan to Request to be Broker Partner

August 20 to 22, 2024 at Pechanga Resort Casino, Temecula, CA

e BEST lineup of speakers are scheduled to educate you about growing your medicare business

Stan Morrison will be our Keynote Speaker on August 21, is a renowed basketball coach who has a lot of business savvy to explain how to use the rules of sports in devloping your business to gain more medicare clients.

On August 20, another powerful Keynote Speaker, Michael Fahey III, former Marine who is now the district manager for Colonial Life. His inside knowledge of the industry will enlighten you. Michael will teach you the tricks he has learned to be a successful agent.

is will be a very informative summit. e CEO of NABIP, Jessica Brooks-Woods and the incoming president of CAHIP, Rosamaria Marrujo, will share what some of the new rules will be in a panel discussion for medicare for 2025.

Register today for this important Medicare Summit! A full 3 days of educational certi cations and CE classes, informative panel discussions plus several other guest speakers who are sure to give you all the tools you will need to be a successful Medicare agent. Plus breakout sessions and exhibitors including various insurance carriers, medical groups, and supplemental bene t providers all ready to share their information.

Breakout Sessions, Training Programs, and discussions about the new Medicare Legislation both state and federal for 2025

Visit our website: theseniorsummit.net

8

PUBLISHERS NOTE

Read an introduction to our Medicare Issue which describes our commitments and goals for our readers in this issue.

By Phil Calhoun

17

MEDICARE FMO

The Value of Field Marketing Organizations

Learn about Field Marketing Organizations, referred to as FMOs, which provide benefits to agents, carriers, and consumers with the variety of services they provide.

By Tiffany Stiller

18

MEDICARE BUSINESS DEVELOPMENT

5 Automation Ideas for a More Profitable Medicare AEP

Learn about 5 automations tools that Martin & Associates Insurance Services that brokers have found to be extremely useful, more efficient, and profitable during AEP.

By Elliott Martin

20

MEDICARE BUSINESS DEVELOPMENT

Interview with Steve Kuhtz from Sierra First Insurance Services

Learn about First Sierra Insurance through an interview with Steve Kuhtz and our publisher Phil Calhoun.

By Steve Kuhtz

Cal Broker’s commitment is to be the leading source of news and information for California brokers and agents operating in the health, life, and annuity industry. We are committed to connecting Life and Health insurance professionals to valuable resources and solutions they can provide to their insurance clients.

22

MEDICARE BUSINESS DEVELOPMENT

What Does LOA Stand for in Insurance?

Read everything you need to know about licensed only agents: pros and cons, structuring compensation for LOA agents, structuring LOA contracts, and more.

By John Hockaday

25

MEDICARE BUSINESS DEVELOPMENT

What Does MedPAC Does The Medicare Payment Advisory Commission (MedPAC) advises Congress on a range of issues affecting Medicare, including payments, services, access, and regulations.

26

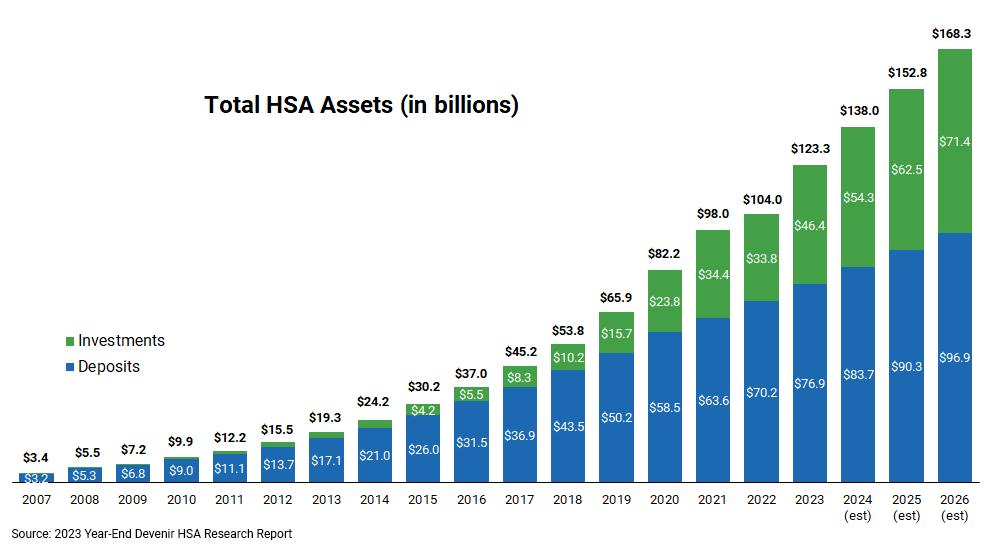

MEDICARE AND HSA’S

Selling Health Savings Accounts to CPAs and Financial Professionals in California: A Guide for Health Insurance Brokers

Here is a guide on effectively selling HSAs to CPAs and financial professionals in California

By Genna Armanini

28

MEDICARE MARKETING

Embracing the Digital World: A New Era for Independent Life and Health Insurance Agents & The Changing Landscape of Client Interaction

Learn about how to embrace the digital world and seize the vast potential that a borderless market offers.

By Elka Soussana

30

MEDICARE MARKETING

Start Planning Now for AEP 2024

This coming Annual Open Enrollment Period (AEP) is promising to be one of the most challenging and crazy times.

By Maggie Stedt, C.S.A, LPRT

32

MEDICARE MARKETING

Medicare 101: 2025 Drug Coverages for Medicare Part D

The Inflation Reduction Act (IRA) of 2022 has led to many changes to drug coverage, and more are coming in 2025.

By CalBroker Mag

34

MEDICARE MARKETING

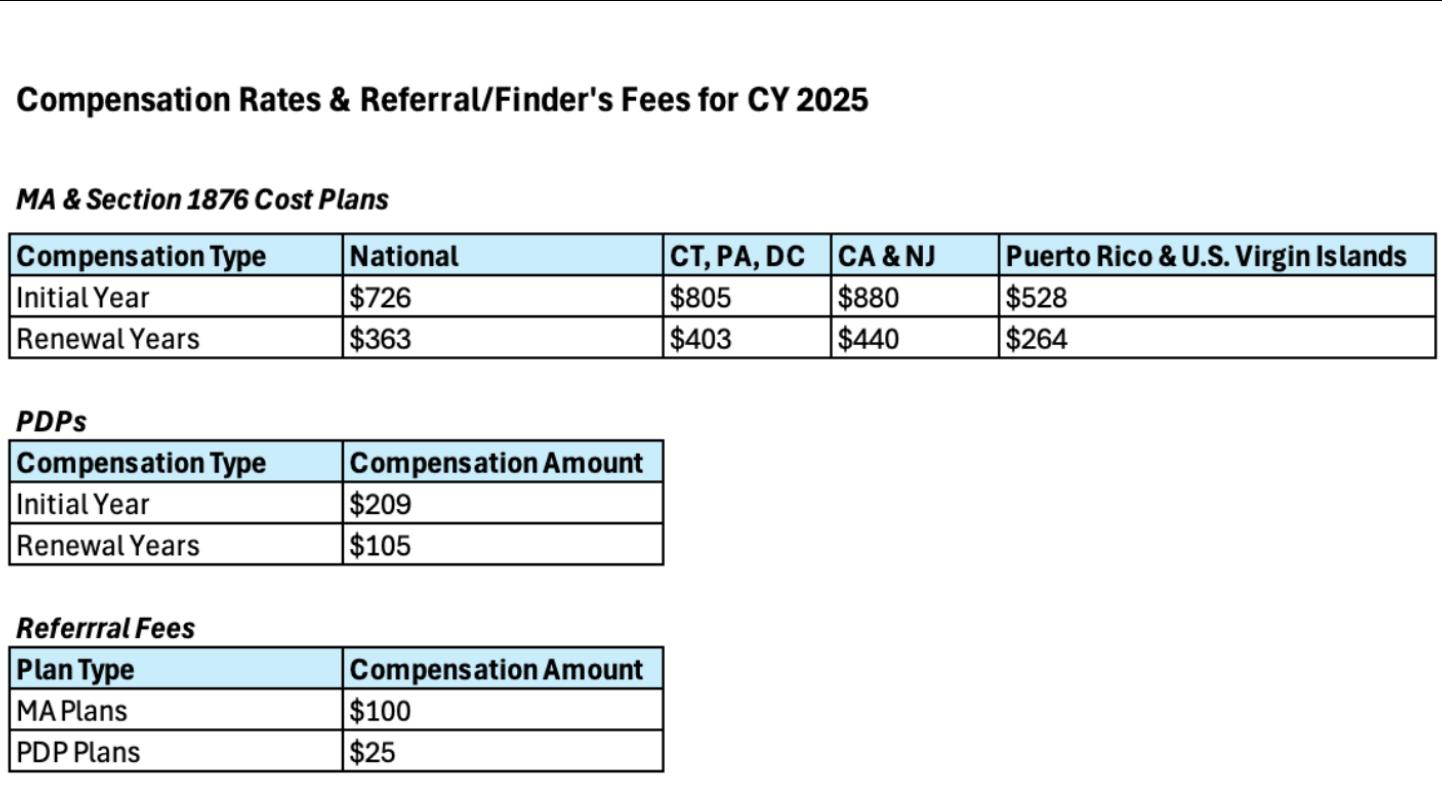

Medicare 101: CMS Marketing & Compensation Changes for 2025

In April 2024, the U.S. Centers for Medicare and Medicaid Services (CMS) released the Contract Year 2025 Medicare Advantage and Part D Final Rule.

By CalBroker Mag

MEDICARE MARKETING Planning For Medicare While Still Working Full-Time

Learn how to best guide your clients in planning for Medicare while still working full-time to avoid unnecessary complications such as coverage gaps and enrollment penalties.

By CalBroker Mag

38

MEDICARE & LONG TERM CARE

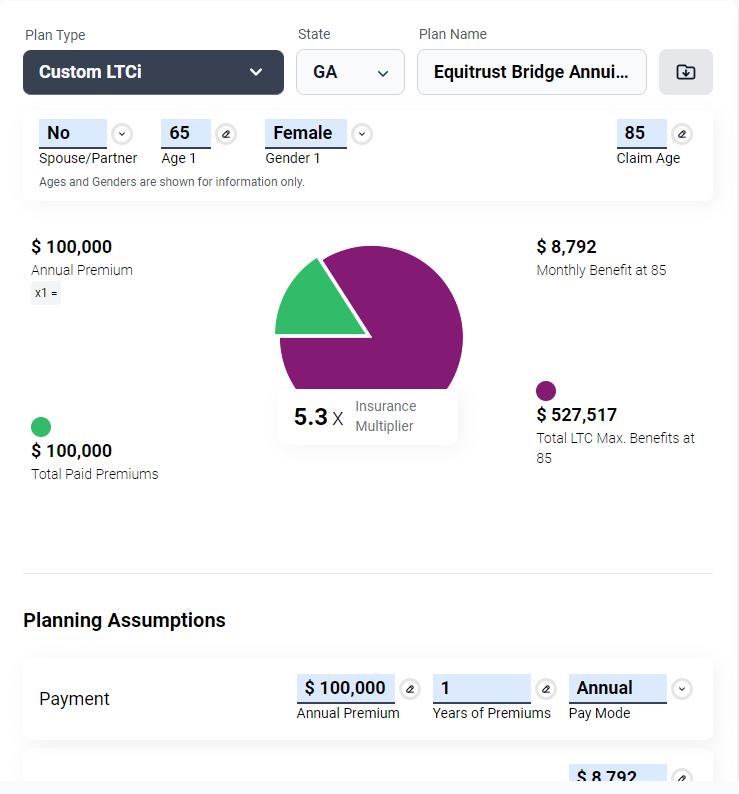

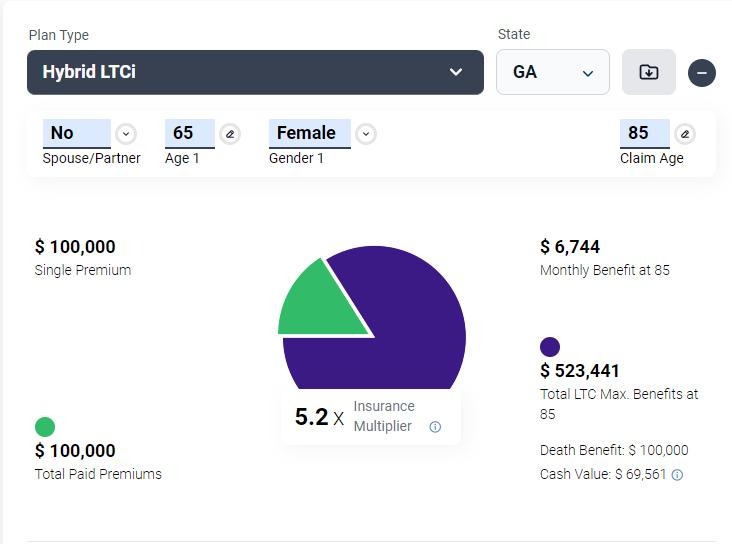

LTC Insurance Alternatives for Your Medicare Clients That May Surprise You

Explore the insurance alternatives that have emerged to fill the gap as other solutions.

By Marc Glickman

40

MEDICARE REFERRALS

To Get More Medicare Referrals –Think Process Over Products

Find out how it can to achieve more Medicare referrals.

By Bill Cates

41

MEDICARE AND GROUP

New innovative Health plan reduces employer premiums by 30%

Learn about Vitori Health’s self-insured alternative.

By Eric Trost

44

MEDICARE COMMISSIONS

Planning Decisions this Time of Year: Protect, Grow, and Sell Health Commissions

As an Active Broker, learn all about planning and commission protection in this article.

By Phil Calhoun

46

MEDICARE HEALTH TOPICS Vision & Eye Health

Understanding vision conditions, symptoms, and the typical medical care can help you find the best vision insurance for your clients.

By CalBroker Mag

48

MEDICARE HEALTH TOPICS

Bone & Joint Health

Health insurance professionals can promote bone and joint health by educating clients about the importance of preventative services and routine checkups.

By CalBroker Mag

50

MEDICARE HEALTH TOPICS

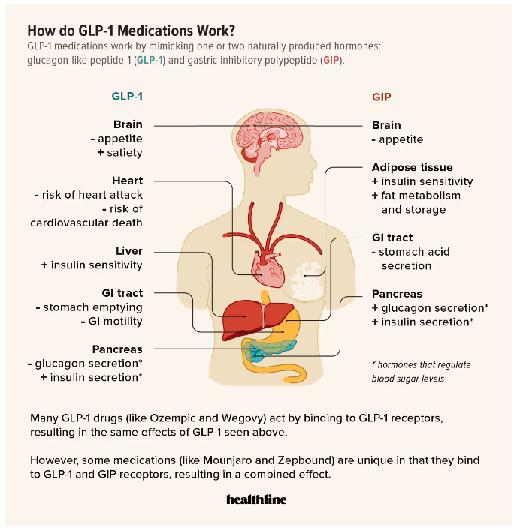

GLP-1 Transforming Obesity Treatment and Insurance Coverage

Discover the groundbreaking potential of GLP-1 agonists in tackling obesity.

By Misty Baker

52

MEDICARE HEALTH TOPICS Aging Powerfully

Learn three tips for aging with power.

By Megan Wroe MS,RD,CNE,CLEC

54

MEDICARE PATIENT CARE

Top Five California Hospitals for Medicare Patients

Here’s a roundup of the top five hospitals in the state that stand out for their commitment to Medicare.

By Emma Peters

PUBLISHER

Phil Calhoun Health Broker Publishing, LLC publisher@calbrokermag.com

ART DIRECTOR Randy Dunbar Randy@calbrokermag.com

PRODUCTION DIRECTOR

Zulma Mazariegos Zulma@calbrokermag.com

DIGITAL DIRECTOR Carmen Ponce Carmen@calbrokermag.com

PUBLISHER'S ASSISTANT Emma Peters Emma@calbrokermag.com

CIRCULATION

zulma@calbrokermag.com

120,000 subscribers 12,000 monthly website visits

ADVERTISING

Health Broker Publishing 14771 Plaza Drive Suite C Tustin, CA 92780 714-664-0311 publisher@calbrokermag.com

publisher@calbrokermag.com

Subscriptions: U.S. one year: $24. Send change of address notification at least 20 days prior to effective date; include old/new address to:

Health Broker Publishing 14771 Plaza Drive Suite C • Tustin, CA 92780 714-664-0311

California Broker (ISSN #0883-6159) is published monthly. Periodicals Postage Rates Paid at Burbank, CA and additional entry offices (USPS #744-450).

POSTMASTER: Send address changes to California Broker, 14771 Plaza Drive Suite C • Tustin, CA 92780

©2024 by Health Broker Publishing. All rights reserved. No part of this publication should be reproduced without consent of the publisher.

No responsibility will be assumed for unsolicited editorial contributions. Manuscripts or other material to be returned should be accompanied by a self-addressed stamped envelope adequate to return the material. The publishers of this magazine do not assume responsibility for statements made by their advertisers or contributors.

PUBLISHER'S NOTE

BY PHIL CALHOUN

Thank You’s—Thank you to our article contributors as collectively we have put together this Medicare Special issue. We hope you will enjoy the information in our Medicare Special issue covering sales and marketing, compliance and legislation, and valuable and timely tips on ways to be the best client advocate possible.

Let us know what you think — publisher@calbrokermag.com

In this Issue:

With the amount of change proposed and approved by CMS for Medicare in 2025, one thing is clear, the impact will be felt at all levels of the Medicare insurance industry. We have tried to cover as many topics as possible that we feel health insurance professionals will find valuable.

Please stay connected to and learn from insurance carriers, healthcare providers, FMOs, and General Agencies about these changes as the impact is clarified and the industry responds.

Our GOAL:

Our Goal is to help Medicare insurance professionals access news and stories they need to help their clients navigate Medicare changes in 2025. Please contribute your ideas and share tips you feel will help all in the industry to both focus practices during the coming 2025 Annual Election Period.

Our Commitment:

California Broker media is committed to help provide current an to assist health insurance professionals to be the best advocat this issue and always, we source health insurance industry news and local sources. Since 1981 Cal Broker has been the industry have provided information to our subscribers in our weekly and

Our subscribers, currently totaling 110,000 licensed life and health insurance agents and brokers, represent 75% of Medicare beneficiaries in California.

We are proud to state that our subscribers include ALL California licensed life and health insurance professionals.

• 50% of Cal Broker subscribers offer Medicare plans

• 65% of Cal Broker subscribers offer both Group and Medicare plan

At the time of this publication deadline, the most recent Medic included. Our eNewsletters also will have updates as they beco

Please let us know how you enjoy Cal Broker email us.

CMS Increases broker compensation for 2025 MAPD and PDP. Learn More on page 35

Many people with Medicare Part D drug coverage—in particular those who reach the catastrophic coverage phase may experience unexpected costs and significant confusion as their out-of-pocket obligations change throughout the year.

The Inflation Reduction Act (IRA) brings much-needed consumer protections and predictability to these coverage phases, limiting financial exposure for everyone and generating significant savings for those with extreme costs.

As of 2024, Part D enrollees are no longer required to pay 5% coinsurance after they reach catastrophic coverage. This threshold is set at $8,000 in what’s called “true out-of-pocket,” or TrOOP costs. These amounts include what the beneficiary spends on covered prescriptions, what others, like family members, friends or certain charitable organizations spend on their behalf, and any manufacturer discounts during the coverage gap phase. This calculation is different than what’s called “total drug costs,” which includes TrOOP amounts plus the what the Part D plan has paid.

Most people will pay roughly $3,400 of their own money by the time they reach $8,000 in TrOOP costs. After this point, they will pay $0 for covered Part D drugs for the rest of 2024. Exactly how much a person will pay before they reach the TrOOP limit of $8,000 depends on their plan design, and the mix of brand name and generic drugs they take – this is because while the brand-name manufacturer discount in the coverage gap is included in TrOOP, the government-funded generic discount is not. If a person takes only brand-name medications, they will pay around $3,300 before they hit the catastrophic cap, while a person who takes an average amount of brand and generic drugs will pay about $3,400. A person who takes only generic drugs will pay close to the full $8,000 before they reach the catastrophic phase.

Further savings and simplifications are coming. Starting in 2025, beneficiary drug costs will be capped at $2,000, indexed annually for growth in Part D. There will be no change of payment responsibility in the coverage gap, and no differential treatment of the manufacturer discounts for brand and generic drugs. Instead, out-of-pocket expenses will be defined in a way that more closely matches the usual understanding of that term, and once a beneficiary spends $2,000 in the deductible and initial coverage phases, they will pay $0 out-of-pocket for the rest of the year.

To illustrate the impact of these changes, a recent KFF report examined three commonly taken cancer drugs, each priced at well over $100,000 a year. In 2023, Medicare Part D enrollees who used any of these drugs for the entire year faced nearly $12,000 in out-of-pocket costs. In 2024, they will no longer be responsible for $8,000 to $9,000 of that amount. And next year, when the $2,000 cap takes effect, they’ll save even more.

The IRA’s Part D redesign will help millions of current and future enrollees afford needed care. These reforms come on top of the law’s other beneficiary cost saving provisions, many of which have flown under the radar—such as vaccines without cost sharing, reduced insulin costs, expanded access to “Extra Help,” and the drug negotiation program that is already underway and in 2026 will bring down prices for some of the most expensive Part D drugs. Medicare Rights applauds these reforms and urges policymakers to build upon them, to make high quality coverage more available and affordable for more Americans.

By Richard Eisenberg

It may be months before the calendar flips to 2025, but not for Medicare. The Centers for Medicare & Medicaid Services (CMS), which runs the program, just announced two major changes for 2025 you’ll want to know about. Next year, Medicare will also dramatically alter the maximum amount beneficiaries will need to pay out-of-pocket for their covered medications.

Here’s the lowdown on these three ways Medicare will operate differently in 2025 and what they’ll mean for you.

1. A crackdown on agents and brokers who sell three types of Medicare policies

Currently, salespeople sometimes get incentives like exotic vacations and hefty bonuses when they enroll Medicare beneficiaries into private insurers’ Medicare Advantage plans (alternatives to traditional Medicare), or Medigap (Medicare supplemental), or Part D prescription drug plans. CMS hopes to end sales incentives in 2025 for Medicare Advantage and Part D plans. “This announcement is a big win for seniors because it strengthens protections against deceptive and high-pressure marketing practices,” Senate Finance Committee Chairman Ron Wyden (D-Ore.) said in a statement. The new clampdown, in CMS’s 1,327-page final rule for Medicare in 2025, states that it aims to “ensure that agent and broker compensation reflect only the legitimate activities required by agents and brokers” selling those plans. That means the salespeople can no longer be offered incentives to enroll people. In addition, the rule says, Medicare middlemen known as third-party marketing organizations won’t be able to offer incentives that “inhibit an agent or broker’s ability to objectively assess and recommend the plan that is best suited to a potential enrollee’s needs.” Marvin Musick, whose MedicareSchool.com sells Medicare policies, tells Fortune, “I think it’s a really good idea, because the agents should not be incentivized to favor one company or another.” The new rule also says it will stop brokers and agents from receiving “administrative fees” above Medicare’s fixed compensation caps. In most states, that cap has been $611 for new Medicare Advantage signups and $306 for renewals. Part D plans have had lower caps: $100 for initial enrollment and $50 for renewals. In 2025, the government will increase the compensation for initial enrollments in Medicare Advantage and Part D plans by $100—more than three times higher than CMS initially proposed. “It’s much higher than most people in our business were anticipating,” says Musick. Consumer activists at the Center for Medicare Advocacy and the Medicare Rights Center believe that even with the rule changes, brokers and agents will still have a significant incentive to steer people into Medicare Advantage plans.

That’s because the rule will continue letting salespeople earn far more selling those plans than stand-alone Part D prescription drug plans, which some people with traditional Medicare buy along with Medigap policies. “This won’t really address the issue of pushing people toMedicare Advantage,” says David Lipschutz, associate director of the Center for Medicare Advocacy. “What I think it will do is restrict or limit people from being steered toward

one particular plan because that agent or broker is trying to get a particular bonus or other incentive.” Philip Moeller, author of the forthcoming book Get What’s Yours for Medicare, says the new rule “simply reinforces the need for consumers to ask some basic questions when they’re dealing with a broker.” Agents and brokers don’t sell every Medicare Advantage, Part D, or Medigap plan available in a local area, he noted, just a selection of them. Once you know which plans your broker can sell, Moeller advised, “go to Medicare’s Plan Finder tool and look at the available products in your zip code and see what’s missing” from the salesperson’s choices.

2. A new midyear notification to Medicare Advantage policyholders reminding them about their plan’s unused supplemental benefits That’s coming because people in these plans often don’t take advantage of some benefits.

This is somewhat surprising since Medicare Advantage plans often tout the coverage that they provide and traditional Medicare can’t—dental, vision, hearing, and fitness benefits. Most Medicare Advantage plans offer at least one supplemental benefit, and the median number provided is 23, according to CMS.

But a February 2024 Commonwealth Fund study discovered that three in 10 Medicare Advantage members didn’t use any of their supplemental benefits in the past year. And CMS’s statement about its 2025 rule said that “some plans have indicated that enrollee utilization of many supplemental benefits is low.”

The Commonwealth Fund found in 2022 that supplemental benefits were the most common reason people cited for choosing a Medicare Advantage plan over traditional Medicare.

So, starting in 2025, Medicare Advantage plans will be required to send policyholders each July a personalized “Mid-Year Enrollee Notification of Unused Supplemental Benefits.”

READ FULL ARTICLE https://bit.ly/3xEV9Ou

By David Garcia, Co-Chair of CAHIP’S Medicare Committee

Here is an easy way to remember how this applies directly below. Medicare –Part B, Does NOT view Cobra (including Cal-Cobra) as Creditable coverage.

Medicare Products – Medicare Supplement, Medicare Advantage and Part D, Does View Cobra (including Cal-Cobra) as Employer Sponsored Coverage

Example 1 – Employer Sponsored coverage ended 12/31/23 – employee has 8 months, through 8/31/24, to enroll in Part B of Medicare without penalty

• The employee will use losing/leaving employer sponsored coverage to enroll in Medicare Part B

• Same employee above enrolled in Cobra because of a younger spouse or dependents

• Reaches out to you, 9/1/24 or later – does not have access to enroll in to Part B of Medicare until Medicare General Enrollment Period 1/1/25-3/31/25

• For a first of the following month effective date

• Why? Because Cobra is not creditable coverage for Part B

Example 2 – An existing Cobra enrolled reaches out to you, however, while on Cobra, they already activated Part B of Medicare

• Can apply for Medicare Supplement and Part D with any carrier when they decide to leave, creditable (for Part D purposes) Cobra/Cal-Cobra or Cobra/Cal-Cobra ends

• Either way doesn’t matter

• Will be guarantee issue with All Medicare Supplement and Part D carriers

• The scenario above will also create a guarantee issue in to ANY carriers Medicare Advantage plan using Leaving/Losing Employer Sponsored coverage SEP

By Lindsey Copeland

While most older adults are automatically enrolled in Medicare Part B because they are receiving Social Security benefits at age 65, a growing number are not. In 2016, only 60% of Medicare-eligible 65-year-olds were taking Social Security, compared to 92% in 2002.

Several factors are responsible for this shift, including the decoupling of the Medicare and Social Security eligibility ages, changing demographics, and evolving employment patterns. For example, more older adults are working later in life and deferring Social Security, though they may not realize that doing so impacts their Medicare enrollment and coverage. Others may choose—appropriately or not—to delay Medicare in reliance on other coverage, such as an employer-based plan.

Unlike those who are automatically

enrolled, when this cohort signs up for Part B they must actively navigate a thicket of complicated Medicare rules and stringent deadlines. Mistakes are common and carry serious consequences, like harsh late enrollment penalties.

The Part B late enrollment penalty (LEP) was designed to encourage individuals to enroll in Medicare when they are first eligible, rather than waiting until they are sick and more costly to insure, and ultimately to guarantee a balanced Medicare risk pool. But because Medicare enrollment rules are so complex, many people end up paying the LEP due to honest error. The impact on these beneficiaries is significant. For as long as they have Medicare, they must pay their monthly Part B premium plus an additional 10% for each year they delayed signing up. In 2021, an estimated 779,400 Medicare beneficiaries were paying the Part B LEP, with the average penalty

increasing their monthly premium by nearly 30%.

A recent issue brief from the AARP Public Policy Institute (PPI) examines these delays, penalties, and opportunities for reform.

Ease Access to Medicare Savings Programs — When an individual is enrolled in a Medicare Savings Program (MSP) that pays their Part B premium, they do not have to pay a Part B penalty. However, the MSPs are chronically under-enrolled, while outdated systems and eligibility rules further hinder access. Streamlining rules and otherwise increasing program uptake would expand participation and protect more people from costly LEPs.

READ FULL ARTICLE

https://bit.ly/3VHVRmq

BY RYLEE WILSON

Across racial and ethnic groups, MA enrollees report broadly similar experiences but wide disparities in outcomes.

CMS published its annual report on disparities in healthcare among Medicare Advantage enrollees May 2. The report reviews patientreported experiences and Healthcare Effectiveness Data and Information Set measures.

The report identified the widest disparities among groups in behavioral healthcare and diabetes care.

Here are 10 numbers to note:

1.In 2023, Asian American and Native Hawaiians and Pacific Islanders, Black, Hispanic, and multiracial people with Medicare were more likely to be enrolled in MA than American Indians and Alaska Native and white people with

Medicare in 2023. Female Medicare beneficiaries were also more likely to enroll in MA than male beneficiaries.

2.Disparities on clinical care outcomes were most significant among American Indian/Alaska Native and Black enrollees. American Indian/Alaska Native enrollees had outcomes below the national average on 10 of 27 measures, and Black enrollees had outcomes below the national average on 18 of 41 measures.

3.American Indian/Alaska Native enrollees had the largest deficits compared to the national average among diabetes care measures.

4.Black enrollees had wide disparities in behavioral care, cardiovascular care, diabetes care and care coordination.

5.Clinical care scores were more mixed among Asian American and Native Hawaiian/Pacific Islander and Hispanic populations. Asian American and Native Hawaiian/ Pacific Islander enrollees had outcomes lower than the national average on 5 of 41 measures, and higher than the national average on 13 measures. Hispanic enrollees had outcomes below the national average on 11 measures and above the national average on 12 measures.

6.For Asian American and Native Hawaiian/Pacific Islander beneficiaries, the largest deficit compared with the national average was treatment for alcohol and drug addiction.

7.Among Hispanic populations, the widest disparities were in alcohol and drug addiction treatment and cardiac rehabilitation.

8.CMS uncovered fewer significant differences across patient experience measures. Black and multiracial enrollees had flu vaccination rates considerably below the national average, according to the report.

9.Asian American and Native Hawaiian/Pacific Islanders reported difficulty getting appointments and care quickly at higher rates than other groups.

10.CMS is targeting policies to improve access to behavioral healthcare and diabetes care, the areas with the widest disparities among racial groups, according to the report.

By David Garcia, Co-Chair of CAHIP’S Medicare Committee

Every now and again you’ll get a request from an active member about an issue they’re having with Medicare. Who should you/they contact when this happens? The info below provides some detail as to who should be contacted and for which circumstance. Medicare and Social Security are inextricably linked. Beneficiaries and agents have long been confused by whom to call for a given situation. Below are a few of the more common Medicare and Social Security questions that arise and whom to call for answers. Medicare (www.Medicare.gov; 1-800-Medicare)

1. What is covered under Medicare Part A and Part B

2. Original Medicare’s deductibles and other costs

3. Information on how to appeal a Medicare claim

4. Authorize another person to oversee your account/talk on your behalf, assist with claims

5. Find doctors and other providers who accept Medicare

6. Research Medicare Part C and D plans on the Plan Finder

7. Find supplement (Medigap) companies in a particular state

8. Find quality-of-care information on nursing homes, hospitals, home health agencies and dialysis centers

9. Download or request the annual “Medicare and You” booklet be mailed

10. Research a library of pamphlets to download or be mailed on Medicare benefits and some Medicare regulations

11. Request a new Medicare card (links you to Social Security)

Social Security (www.ssa.gov; 1-800-772-1213)

1. Enroll in Part A and B of Medicare

2. Find out if eligible for Medicare

3. Find out premiums for Part A, if applicable, and Part B

4. Appeal Income Related Monthly Adjustment

5. Apply for the Extra Help Program (Part D financial assistance based on income)

6. Report a death

7. Search a library of pamphlets to download or be mailed on Social Security topics

8. Set up direct deposit

9. Change name, address, phone and bank

10. Request a new Medicare card

11. Print proof you do not receive benefits

12. Request a replacement Social Security or Medicare number

13. Get personalized retirement benefit estimates for yourself and spouse

14. Information on disability and when eligible for Medicare

Millions of People with Medicare Will Benefit from the New Out-ofPocket Drug Spending Cap Over Time

A KFF analysis shows that a new out-ofpocket spending cap in Medicare Part D could translate into savings for well over 1 million beneficiaries when it takes effect next year, including more than 100,000 people each in California, Florida and Texas, based on analyses of drug

spending in 2021.

The $2,000 cap, part of the Inflation Reduction Act of 2022, will lead to thousands of dollars in savings for Medicare patients who take high-cost drugs for cancer, rheumatoid arthritis, and other serious conditions.

This new limit follows the elimination this year of a longstanding requirement that Part D enrollees pay 5% of their drug costs out-ofpocket after their drug

expenditures reach a certain threshold.

Based on KFF’s review of Part D drug claims data, if the cap been in place in 2021, 1.5 million Medicare beneficiaries would have benefited because their out-of-pocket costs for prescription drugs exceeded $2,000. Of the total 1.5 million, about 200,000 Medicare beneficiaries spent $5,000 or more for their prescriptions that year, while another 300,000 expended

between $3,000 and $5,000. The rest spent between $2,000 and $3,000.

By Juliette Cubanski, Tricia Neuman, and Anthony Damico

In 2025, Medicare beneficiaries will pay no more than $2,000 out of pocket for prescription drugs covered under Part D, Medicare’s outpatient drug benefit. This is due to a provision in the Inflation Reduction Act of 2022, which included several changes to the Medicare Part D program designed to lower patient out-of-pocket costs and reduce what Medicare spends on prescription drugs. This new $2,000 cap (indexed annually to the rate of change in Part D costs) comes on top of the elimination of 5% coinsurance in the catastrophic coverage phase of the Part D benefit, in effect for 2024, which translates to a cap of about $3,300 out of pocket for brand-name drugs. These benefit design changes will save thousands of dollars for people who take highcost drugs for cancer, rheumatoid arthritis, and other serious conditions.

If a $2,000 cap on out-of-pocket drug spending had been in place in 2021, 1.5 million Medicare beneficiaries enrolled in Part D plans would have saved money because they spent $2,000 or more out of pocket on prescription drugs that year. This estimate is based on KFF analysis of Medicare Part D prescription drug claims data for enrollees without Part D low-income subsidies in 2021 (the most recent year available for this analysis). Among these 1.5 million enrollees, most (1.0 million or 68%) spent between $2,000 and $3,000 out of pocket, while 0.3 million (20%) had spending of $3,000 up to $5,000, and 0.2 million (12%) spent $5,000 or more out of pocket.

Over the course of several years, however, far more Part D enrollees will stand to see savings from this new out-of-pocket spending cap than in any single year. A total of 5 million Part D enrollees had out-of-pocket drug costs of $2,000 or more in at least one year during the 10-year period between 2012 and 2021, while 6.8 million Part D enrollees have paid $2,000 or more out of pocket in at least one year since 2007, the first full year of the Part D program (Figure 1).

In most states, tens of thousands, if not hundreds of thousands, of Medicare beneficiaries will feel relief from the new Part D out-of-pocket spending cap (Table 1). In California, Florida, and Texas, more than 100,000 Part D enrollees faced out-of-pocket

costs of $2,000 or more in 2021, and in another 6 states (New York, Pennsylvania, Ohio, Illinois, North Carolina, and New Jersey), between 50,000 and 82,000 did so. As at the national level, more Part D enrollees in each state will benefit over time. For example, in Iowa, Louisiana, and Maryland, 73,000 Part D enrollees faced out-of-pocket costs of $2,000 or more in at least one year between 2012 and 2021. In Michigan, New Jersey, and Georgia, 148,000, 158,000, and 159,000 Part D enrollees, respectively, spent $2,000 or more in at least one year over this same 10-year period. In Texas, 364,000 Part D enrollees did so; in Florida and California, around 400,000 enrollees or more.

Capping out-of-pocket spending will help Part D enrollees with relatively high drug costs, which may include only a relatively small number of Part D enrollees in any given year but, as this analysis shows, a larger number over time. People who will be helped include those who have persistently high drug costs over multiple years and others who have high costs in one year but not over time. While a cap on out-of-pocket costs will help millions of Part D enrollees over time, higher plan costs to provide the Part D benefit could also mean higher plan premiums, a dynamic that the Inflation Reduction Act’s premium stabilization provision was designed to mitigate. Although KFF polling shows that a relatively small share of older adults is aware of the Inflation Reduction Act’s $2,000 cap on out-of-pocket drug costs for Part D enrollees that takes effect in 2025, millions of them will benefit from this cap in the years to come.

By Nancy Ochieng, Jeannie Fuglesten Biniek, Meredith Freed, Anthony Damico, and Tricia Neuman

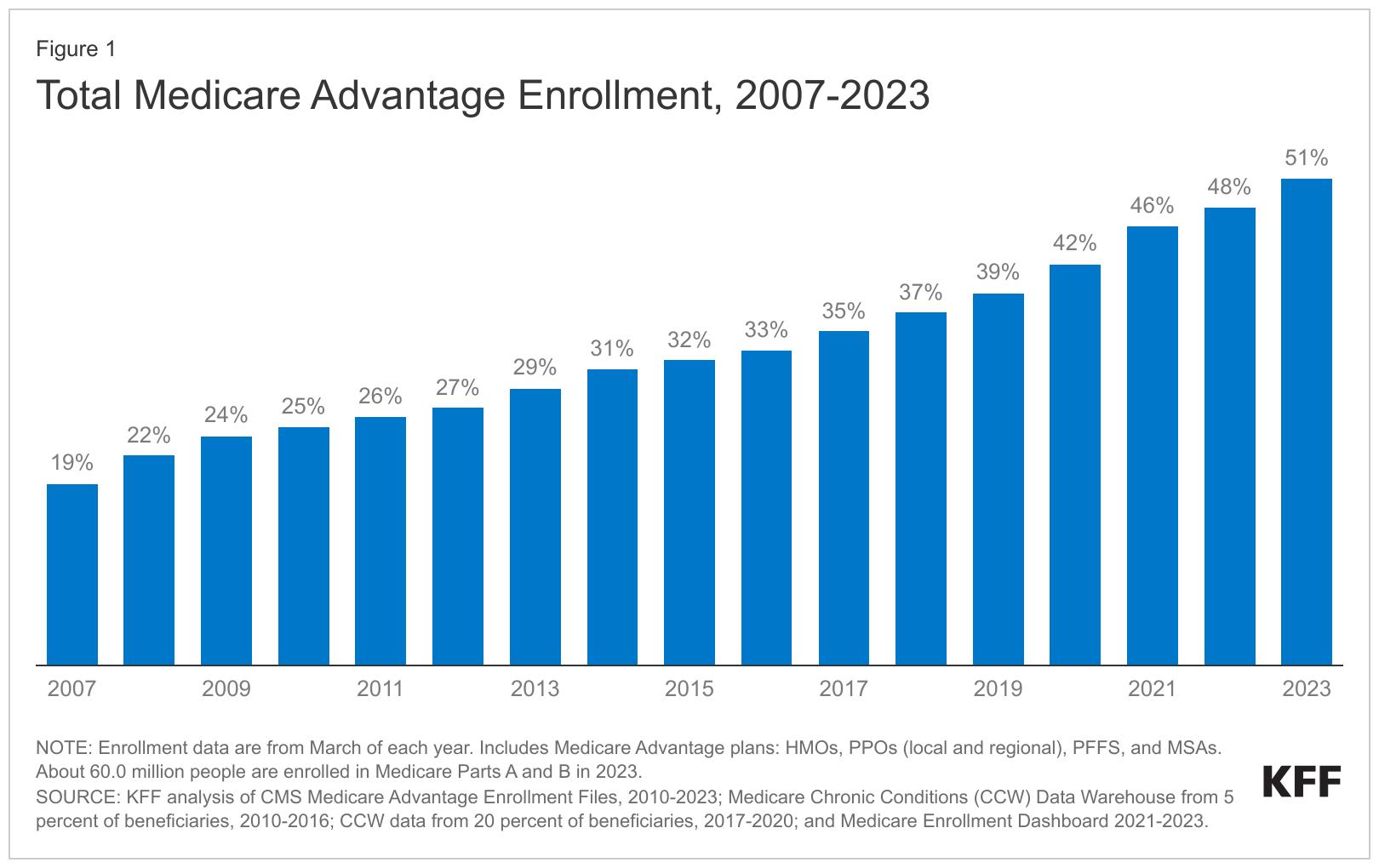

Medicare Advantage enrollment has been on a steady climb for the past two decades following changes in policy designed to encourage a robust role for private plan options in Medicare. After a period of some instability in terms of plan participation and enrollment, The Medicare Modernization Act of 2003 created stronger financial incentives for plans to participate in the program throughout the country and renamed private Medicare plans Medicare Advantage. In 2023, 30.8 million people are enrolled in a Medicare Advantage plan, accounting for more than half, or 51 percent, of the eligible Medicare population, and $454 billion (or 54%) of total federal Medicare spending (net of premiums). The average Medicare beneficiary in 2023 has access to 43 Medicare Advantage plans, the largest number of options ever.

To better understand trends in the growth of the program, this brief provides current information about Medicare Advantage enrollment, by plan type and firm, and shows how enrollment varies by state and county. A second, companion analysis describes Medicare Advantage premiums, out-of-pocket limits, cost sharing, extra benefits offered, prior authorization requirements, and star ratings in 2023.

Key highlights include:

More than half (51%) of eligible Medicare beneficiaries are enrolled in Medicare Advantage in 2023.

The share of Medicare beneficiaries enrolled in Medicare Advantage varies widely across counties. In 2023, nearly one third (31%) of Medicare beneficiaries live in a county where at least 60 percent of all Medicare beneficiaries are enrolled in Medicare Advantage plans, while 10% live in a county where less than one third of all Medicare beneficiaries are enrolled in Medicare Advantage plans. The wide variation in county enrollment rates could reflect several factors, such as differences in firm strategy, urbanicity of the county, Medicare payment rates, number of Medicare beneficiaries, health care use patterns, and historical Medicare Advantage market penetration.

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana account for nearly half (47%) of all Medicare Advantage enrollees nationwide, and in nearly a third of counties (32%; or 1,013 counties), these two firms account for at least 75% of Medicare Advantage enrollment.

More than half of eligible Medicare beneficiaries are enrolled in Medicare Advantage in 2023

In 2023, more than half (51%) of eligible Medicare beneficiaries – 30.8 million people out of 60.0 million Medicare beneficiaries with both Medicare Parts A and B – are enrolled in Medicare Advantage plans. Medicare Advantage enrollment as a share of the eligible Medicare population has jumped from 19% in 2007 to 51% in 2023 (Figure 1).

READ FULL ARTICLE

https://bit.ly/4c2Tlhp

By Juliette Cubanski and Tricia Neuman

Changes in 2025 include a new $2,000 out-of-pocket spending cap, elimination of the coverage gap phase, a higher share of drug costs paid by Part D plans in the catastrophic phase, along with a new manufacturer price discount and reduced liability for Medicare in this phase, and changes to plan costs and the manufacturer price discount in the initial coverage phase.

Out-of-pocket drug spending will be capped at $2,000

Beginning in 2025, Part D enrollees’ out-of-pocket drug costs will be capped at $2,000. This amount will be indexed to rise each year after 2025 at the rate of growth in per capita Part D costs. (This cap does not apply to out-of-pocket spending on Part B drugs.)

For Part D enrollees who take only brand-name drugs, annual out-of-pocket costs at the catastrophic threshold will fall from around $3,300 in 2024 to $2,000 in 2025 (Figure 3). In other words, Part D enrollees who take only brands and have drug costs high enough to reach the catastrophic threshold could see savings of about $1,300 in 2025 relative to what they will spend in 2024.

The coverage gap phase will be eliminated

The coverage gap phase, where Part D enrollees had faced 100% of their total drug costs under the original Part D benefit design and currently face 25% of costs for brand and generic drugs, will be eliminated in 2025. This means that Part D enrollees will no longer face a change in their cost sharing for a given drug when they move from the initial coverage phase to the coverage gap phase, which is the case in most Part D plans today, since most plans charge varying cost-sharing amounts, rather than the standard 25% coinsurance, in the initial coverage phase.

Medicare Summits

August 14

@10:00am-5:30pm CAHIP-LA Medicare on the LaLa Land Stage-The Sequel, REGISTER

August 20-22 NABIP Senior Summit @ Pechanga Resort Casino, REGISTER

August 28 @8:00 am-4:00pm, 2024 SAHU Business Medicare Expo, REGISTER JULY

July 11

@2:30-4:30pm:(EPI-OC) Helping Owners Reduce Risk With Business Continuity Planning @Costa Mesa, REGISTER

July 17 @11:00am-1:00pm: (EPI-Conejo Valley) Showdown: Trivia for the Top Guns @Westlake Village, REGISTER

July 17@2:30pm-4:30pm, (EPI –SD) Helping Owners Reduce Risk With Business Continuity Planning @San Diego, REGISTER

July 24 @2:30pm-4:30 pm, (EPI-LA) Aligning Generations: Family Governance in Business and Philanthropy @Los Angeles, REGISTER

July 25 @2:30-4:30pm, (EPI-IE) The Nuts and Bolts of a Family Transaction @Ontario, REGISTER

Virtual Trainings

July 2 @1:00pm-2:00pm EST: (EPI) Quality Earnings and the Exit Planning Process, REGISTER

July 3 @10am, Strategies for Successful Client Retention, Join Live Webinar

July 9 @1:00pm-4:00pm PT: BuddyIns & Amada Senior Care Present: Partnerships for a Winning Team, REGISTER

July 9 @1:00pm-2:00pm EST: (EPI) The Hidden Risks & The Role of Cybersecurity in M&A, REGISTER

July 16 @1:00pm-2:00pm EST: Strategies of the Ultra-Wealthy: How They Increase Net Worth, Maximize Wealth Transfer, and Minimize Estate Taxes, REGISTER

July 17 @3:00pm NABIP Medicare Moments: Compliance and Cyber Security, REGISTER

July 18 @8:00am-9:30am, (CAHIP LA) Breakfast Bytes: Long Term Care, Retirement Planning & Financial Wellness, REGISTER

July 22-25,BBSI Benefits Golden State Brokers Tour, Location: Varies; REGISTER

July 23 @1:00pm-2:00pm, Growing Enterprise Value Through Aligned Executive Compensation Planning, REGISTER

July 25 @11:30am, NAIFA-LA, Q3 – Annuities: Master Annuities and Grow your Sales, REGISTER

October 6-8 NAIFA e3 Conference @ Sonesta Redondo Beach &

By Tiffany Stiller, SVP Carrier Relations and Individual & Senior Division, BenefitMall

Field Marketing Organizations, referred to as FMOs, provide benefits to agents, carriers, and consumers with the variety of services they provide. Bringing together a myriad of products, educational support, and technology tools, FMOs elevate an agent’s ability to offer choice to their clients while streamlining and simplifying the enrollment process. This applies to all products an FMO might represent but is especially relevant when navigating the complexities of the Medicare space.

For carriers, FMOs assist in containing costs by taking on several services such as agent education, marketing, certification and agent contracting support as well as enrollment and issue resolution. They assist the carrier in casting a wider net and exposing more agents and their clients to a carrier’s product offering. FMOs only get paid when a sale is completed and without this variable cost support, carriers would have to increase staffing and support driving up costs.

Agents enjoy the support of sales executives within an FMO that help them identify their target market, direct them to the appropriate carriers to partner with for that segment, and introduce them to new and competitive products that can better support their clients and expand their market reach. End Pullquote. These sales executives can also assist in getting a new agent up and running in the senior space, guiding them through all the steps it takes to get ready to sell and working on a strategy with the agent that will help them to penetrate the market and succeed in the marketplace.

Technology is an essential part of our business, and for many agents the cost of this technology could be a barrier to entry. FMOs provide access to both proprietary and partner tools often shouldering the cost, allowing the agent to invest in other aspects of their business. Quoting, enrollment, contracting/appointment, provider search, and client management are all examples of the electronic capabilities made available to agents by FMOs. Marketing is also an area where an FMO can assist an agent with business costs. Most will provide co-op dollars helping an agent to promote their services and the products they represent, and many will also provide templates for agents that allow them to create their own marketing campaigns.

Information is key in this business and an FMO supports their carrier partners in pushing news out to the agent community and giving agents a single source to keep up to date on the market. This ranges from information about new products, new tools, benefit changes and regulatory updates. Several mediums are utilized including email blasts, newsletters, blogs, social media, and in-person educational events. Many FMOs also provide compliance support, helping to navigate the ever-changing world of benefits and legislative updates. At its best, an FMO is a partnership with its carriers and agents and is only successful when they’re successful, making them top priority. The result is a consumer connected with a large variety of options, allowing them to make the best choice for their unique needs--truly a win for our industry and the customers we serve.

Headquartered in Dallas, BenefitMall is the largest employee benefits general agency, working with a network of 20,000 brokers to deliver employee benefits to more than 200,000 small and medium-sized businesses. Through its Individual and Senior Division, BenefitMall also provides brokers with access to individual and family life, health and ancillary plans, Medicare Advantage, and Medicare Supplement insurance programs. Founded in 1979, BenefitMall leverages innovative technology backed by human expertise to provide a seamless selling experience for its carriers, brokers, and their clients. BenefitMall is part of CRC Group’s Life, Retirement and Benefits Solutions division, a leading national wholesale distributor of specialty insurance products.

Tiffany Stiller has been with the BenefitMall team since 1999. In her current role as Senior Vice President she oversees Carrier Relations, BenefitMall Individual & Senior Division (ISD), Product, Compliance and the Learning & Development team. As part of BenefitMall’s Executive Leadership her focus is on driving both the growth and culture of the organization.

Prior to joining the BenefitMall team, she spent four years as Vice President of Business Development with Secure Dental, where she was responsible for negotiating General Agency contracts, resolving general agency and broker issues, product advertising and promotion, plan design, and monitoring sales and distribution in 17 states. Previously, Stiller was Marketing Director for a large group of orthopedic surgeons in Southern California and Nevada.

Stiller worked on a bachelor of science degree in Health Science at California State University, Northridge, and earned her bachelor of arts degree from Arizona State University (ASU). She is a member of the National Association of Benefits and Insurance Professionals (NABIP) and The Council. She is Life and Health licensed in all 50 states. Stiller also serves as an advisor for Kappa Kappa Gamma Fraternity. In her free time, she is a competitive equestrian and devoted dog mum.

By Elliott Martin Martin & Associates Insurance Services, Inc.

Have you ever pushed a fax machine so hard to the point where it overheats?

Believe it or not, that was the error message my brother Mo and I were getting while trying to fax in all the Part D applications that had come in the mail that day during AEP not too long ago.

Yes, we were using an actual printer/fax machine!

Our dad, Ray, has been in the insurance industry for over 30 years and has focused on Medicare more specifically for over the last 25+ years. Being in the business for that long means lots of clients to serve during AEP. Eventually we got to the point where our current systems were being pushed to their limits.

We knew there had to be a better way and there was, but we just had to execute on it.

Then the pandemic hit, and we had no choice but to find a better way to keep up with the volume or inquiries coming in. It was time to bring our agency properly into the 21st century and incorporate some of the technological advances within the industry and incorporate automation into our systems.

Since then, we’ve been able to increase our revenue, streamline our processes and toss the fax machine in the dump. In fact, having systems gets you results and the better your systems, the less stress, less labor and faster you get to your goals.

Keep reading, this is VERY important! I’m going to share with you the systems we’ve developed that if you implement them will take you to the next level.

Here they are, the 5 automation tools that we have found extremely useful at making us more efficient and more profitable, especially during AEP:

When it comes to CRMs for Medicare specific agencies, what we’ve discovered (and you may have as well) there’s not really one system that does it all. Some do everything, except the actual enrollments. Some do everything else but can’t track commissions. If you are anything like us, you’ve had to piece together different systems.

The main automation features we’ve been able to find in the CRM we’ve selected include automated emails to clients as their policies are approved, profile creation based on opt-in from landing page forms and appointment requests, commission tracking and automated task creation for internal tasks to be completed by other members of our team. You must have a SMART system to help manage your clients.

You must have systems that organize, automate and replicate results over and over without your labor!

Get in touch with your FMO! They may have tools at their disposal including systems like Lead Advantage Pro, Sunfire and others that allow you to create profiles for your clients, save their prescription lists, send pre-generated emails to clients to update their prescriptions, sending Scope of Appointments and most importantly, sending/submitting electronic enrollments as well as self-service enrollment tools for your clients too. I can’t tell you how much time this has saved us!

If you do not have an online calendar service (Acuity or Calendly come to mind) that syncs with your email service calendar (Outlook, Google) and allows prospects and clients to schedule phone/Zoom/ Teams or even in-person meetings with you, drop everything you are doing now and start working on this.

Talk about time saving! Having a system that allows a prospect (and clients) to select the time on your calendar when you decide to be available is huge. Think about that, you don’t have to talk on the phone (saved 1 phone call) to schedule a meeting with the prospect. They select the meeting time themselves!

One way we’ve been able to capture contact information from prospects interested in our services has been using an automated service that can easily create landing pages. There are services that have user friendly drag and drop options where you can create your own landing page or website. This allows you to easily create a spot online for folks to request information and content from you (think guides, books, tutorials, webinars, articles, etc.) in exchange for their contact information.

We’ve been using landing pages as a great lead generation system and once the prospective person requests the information they want, we capture their information, and they go into our automated pipeline to receive e-mails, invitations and even e-birthday cards. This makes us stand out from the other marketing noise prospects.

The last automation tool that helps piece together a lot of the systems above is a service called Zapier. For example, we use Zapier to relay information from the landing pages and online calendar into our main CRM system so that we DO NOT have to duplicate data entry. Can you say, ‘TIME SAVER’. That’s huge! Zapier is an automated service that glues everything together. Think of it like the electrical system in your car, everything works together once you turn on the juice.

It’s fine to have goals to reach, but goals alone won’t get you the results you want. As many of the most successful business leaders will tell you, systems are the key! You must have systems that organize, automate and replicate results over and over without your labor!

You should start today, seek to implement these systems NOW, before AEP gets here. I promise you it will have a dramatic change to your business and results for this AEP and beyond.

Good luck to you and your team this AEP!

Want to get a complete list of the automation tools we’ve adopted or are looking to adopt for our Medicare business?

www.martinmedicare.lpages.co/automate/

Elliott Martin is an agent at Martin & Associates Insurance Services, Inc. based in Irvine, CA, the company his father Ray Martin founded. He has been insurance licensed and involved in the Medicare space since 2014.

Elliott has helped thousands of individuals with personal Medicare insurance needs and has also helped Martin & Associates develop and improve the agency systems and automations. In his free time Elliott enjoys playing in a men’s slow pitch softball league, pickleball and spending time with his wife Kaycee and daughter Avery.

BY PHIL CALHOUN

Phil: Steve welcome to Cal Broker and special issue for July focused on Medicare.

We want to get to know you and First Sierra. We also want to dive into your thoughts about the upcoming challenges for Agents going into the 2025 Annual Election Period.

Steve: First Sierra Insurance Services provides top level Value Based Services to its independent agents.

Our why story is very simple. We are an agency built by agents for agents. We found a need in the market and we were able to address that need because of our experience being agents in the field.

We have over 300 agents spread out throughout California and Nevada. Over the years we have added additional internal support staff to assist our agents. We have also added tools such as a multi-carrier enrollment and quoting platform and an integrated CRM system all available to our agents.

Phil: What are your biggest challenges and how will you work through them?

Steve: The biggest changes we see coming are from the Carrier challenges with the changes being delivered by CMS. The work through is that everyone will be expected to deliver better service to the Beneficiaries. Efficient use of our agents time will be the key to keeping a stable book of business.

Phil: Well it's unique to have a FMO like your agency that is a fit for all brokers, new to Medicare and also those seasoned brokers with experience and an existing book of business.

Steve: We Provide Services that are focused on the value our brokers need and find helpful and not on simply on the volume of services offered. We find that this provides better outcomes, excellent performance and greater success for our agents.

Phil: As a Value Based Agency what solutions do you provide agents?

Steve: We provide the following:

• Online quoting and enrollment platforms that allow for side by multi carrier comparison for the Agent and Beneficiary. Allowing for the Beneficiary to make the best decision for their needs.

• CRM systems that provide a secure encrypted storage of client PHI.

• Access to a back office to answer questions regarding Marketing Compliance, Contracting, Training, Commissions, general questions, application issues and client service issues

• Updates to the markets as new information hits the streets so agents are informed, and

• Commission Protection Options for agents.

Phil: OK. To learn more about First Sierra our subscribers can go to www.firstsierrainsuranceservices.com

Now let’s turn to your take on 2025 changes in Medicare plans.Tell us about the Part D plan changes---

Steve: The Inflation Reduction Act of 2022 requires several changes to plans in 2025

• Out of pocket cost will be limited to $2,000

• Plans will allow patients to pay deductibles over 12 Months.

• Recommended Vaccines will be required to be available at no cost.

The Part D changes will impact the structure of the plans offered by the carriers. Changes coming in 2025 will affect premiums, formularies and plans offered. Brokers need to be informed by their trusted advisors about the changes and what options clients will have to get the coverage they neeed.

Phil: So brokers need support and assistance to provide what their clients need.

Steve: Yes, we are planning to provide the resources our agents and brokers need as this will be a big challenge to agents with a lot of active PDP’s. To help we have our multi-carrier quoting, and enrollment platform will provide agents the opportunity to quickly and efficiently run prescription drug cost comparison quotes. It will allow them to assist members virtually in a quick and compliant manner. I wish we had a crystal ball to know exactly how broker comp and premiums will change, but in our opinion, we feel that there will be a general increase in plan premiums and some carriers could cease broker comp completely. The good news is that by October 1, or maybe just before we will have a better understanding of what the changes will look like.

Phil: WHAT About MAPD and the drug coverages?

Steve: The CMS Final Rule for 2025 and Inflation Reduction Act of 2022 regarding MAPD Plans is still being digested by carriers.

Other challenges to Carriers will be:

• SSBCI - Also known as Value Added Benefits in plans.

• Carriers will now need to prove the utilization of the benefit in the plan. From what we are hearing the carriers will have to show high utilization of those benefits and then somehow relate that back to improved member health. Possibly showing that cost savings allows them to afford routinely picking up medications and not putting off other health services.

• Carriers will also need to prove the equity of the benefits in the plan. This means does it increase the health and wellbeing of the beneficiaries in the plan.

If the carriers cannot prove the above as adding value they will need to remove the benefit. The impact on brokers will be that benefit plans will change drastically and they will need to either explain why

they beneficiary should remain on this plan or give them a similar alternative.

Phil: WE HEAR Star Ratings are going to be impacted in 2025.

Steve: YES, reductions and methodology changes to the plans will mean plans have received Star Rating reductions and this will drive down plan reimbursement and cause major plan benefit changes from the 2024 to 2025 plan year. Brokers wlll need to prepare as more clients will be shopping plans.

Methodology changes can also affect plan reimbursements again. With plan benefit changes from the 2024 to 2025 plan year, clients will be shopping plans.

Phil: What about the Dual Market changes?

Steve: There will be several including:

Going back to monthly (SEP)changes vs Quarterly changes. Clients can change plans more frequently.

Also, there will be a large push for beneficiaries into the Aligned Dual Plan. This will givee us more opportunities in this market space.

There is currently talk about these changes may end up with individuals being passively enrolled in the aligned Dual Plans. Agents will be bypassed by Medicare auto enrolling beneficiaries. This will leave agents without compensation and beneficiaries without an advocate they have enjoyed in their relationship with their agent.

Another impact expected is how the changes will limit the number of Dual Plans in services areas, by removing the Dual look a like plans. Personally we feel that this is actually is good for Medicare beneficiaries, specifically in counties with aligned plans. It also helps agents with the stability of their book of business, less plan switching by the beneficiaries.

Phil: In the past few changes have impacted the Medicare Supplements. What is new here?

Steve: We expect to see larger than usual rate increases on the Medicare Supplement Plans. Recently multiple large carriers have announced large increases in their premiums. Agents will need to make sure they are up to date on premium increases and will need to be more proactive in running rate checks for their clients and keeping them informed. If rates continue to increase we may see more beneficiaries moving from Med Sup to MAPD especially in counties with large network support, even if the MAPD has a premium.

Phil: Marketing Compliance was a major issue this past year. What is up for 2025?

Steve: Call recording has not changed and remains the same as last year. Best practice is to record all enrollment calls/calls that discuss plan benefits for MA and PDP. Agents are responsible for securely storing that data for 10 years. We provide a call recording feature that also securely stores the data for the required time frame and can be easily accessed. Also, our online enrollment and quoting platform offers call recording and storage. In addition to the tech we also provide in-depth training to all of our agents on all of the compliance updates that directly affect them.

Phil: It can be confusing to determine what is considered Marketing and what is considered communication? we definitely suggest that brokers do their research to look up the definition of both.

Steve: Right we also see the confusion. From the disclaimers that are required to the need to get marketing tools approved. At First Sierra will review any marketing materials our agents plan to use or are using. If it is a marketing piece that needs CMS approval we will inform the agent and assist in getting the CMS approval.

Phil: What about scope of appointments (SOA) and PTC?

Steve: No real changes here, seems to be staying the same as last year.

SOA are good for a year from the date of signature or less if the beneficiary asks them to not reach out. SOAs need to be securely

stored for 10 years. They can be obtained through a paper version and also electronically. Our electronic enrollment platform does offer agent the ability to obtain an electronic SOA and will also store this for the agent for the required 10 years. We do also have approved PDF versions of SOA’s and PTC cards that agents can use. For storage we recommend agents store them securely in either their own CRM system or in the one provided to them through us.

Phil: Protecting private health information (PHI) is anorther concern.

Steve: Seems Blue Shield is one of the few carriers performing broker enrollment audits. We see PHI and brokers this way: There has been a focus on recent audits for agents on how they control and protect PHI. Typically in these situations carriers are asking the agent what steps they are taking to protect the information. We highly recommend the use of a CRM system. We have done many webinar trainings on compliance, making agents aware of what is to be protected and how they should be protecting that information. We also provide tools to our agents such as our multi-carrier online enrollment platform and most recently added CRM system. These are of course optional for agents to use, but do provide the data protection level that is being asked for.

Phil: Thank you Steve... for this insight into 2025 AEP. Sounds like First Sierra provides a wide range of service and support for agents and brokers.We look forward to your input in the coming months as more CMS details are revealed so we can keep our subscribers informed. If a subscriber wants to connect and learn more please go to www.firstsierrainsuranceservices.com

Steve: Thank you for the opportunity to share the services we offer at First Sierra. We are committed to helping more agents and we encourage those interested to contact us. We feel it is important to work with Cal Broker and continue to provide subscribers with up to date and valuable information so they can be a trusted advisor to their clients.

Steve Kuhtz is a Clovis native and holds a Bachelor of Science Degree in Business Administration from California State University, Fresno. He has been in the Insurance and Financial Services industry since 1993.

In 2002, Steve saw a need for a higher standard of client service, so he started a new insurance agency with Robert Diehl. Kuhtz Diehl Insurance has been dedicated to maintaining high standards of service ever since.

In 2009, Steve and Rob started First Sierra Insurance Services, a Medicare General Agency. Offering outstanding agent service and support, First Sierra Insurance has grown to approximately 400 agents throughout California, Nevada, and Oregon. In addition to the home office in Fresno, First Sierra Insurance has offices in Sacramento, Bakersfield, Pasadena, Manhattan Beach, and San Jose.

Outside of work, Steve enjoys sailing, participating in triathlons, snow skiing, water skiing, boating, backpacking, biking, swimming, and travel.

Steve@myseniorsales.com 559-251-0501 Office www.myseniorsales.com 2150 N. Winery Ave. Fresno, CA 93703

There’s no magic to it –it’s up to the agency owner to be fair. And it needs to be crystal clear: what does the agent get, and what value is that agent bringing to the agency?

By John Hockaday

LOA stands for licensed only agent, which is a captive agent – in our case, an agent who sells insurance products – who assigns their commissions to another individual or company.

Note: The acronym LOA also stands for line of authority, or the types of insurance products an agent is licensed to sell. But in this article, we’re referring to licensed only agent.

The individual or company receiving the commissions will keep a certain percentage, called an override. You can think of an override almost like an administrative fee. In exchange, the LOA gets a lot more support, structure, and training than an independent insurance agent doing everything on their own.

For example, an LOA might get office space, a secretary, and a maintained website without having to pay outright for any of that.

It’s probably more common to see people talking about captive agent’s vs independent agents.

A captive insurance agent is the same exact thing as a licensed only agent (LOA). It’s just different terminology.

Another term commonly used in this space is “street level” agents or “sub-street level” agents. This is not the same thing as a licensed only agent.

Every carrier has a street level commission. If you come in at street, it means you don’t need proof of production to get that commission rate. If you have proof of a high level of production, you can sometimes get commission above street level.

However, there’s also a level below street, and that›s sometimes referred to as «sub-street level.»

A sub-street level agent still owns the business he writes, and the carrier pays the commission directly to that agent.

Some agencies prefer to have sub-street level agents instead of licensed-only agents because they don’t have to handle commission payments. Being responsible for all the accounting and tracking commissions is a huge job, and this way, the carrier takes care of it.

However, usually only a very, very small agency would do that. It would also typically only be for a short time; for example, perhaps an agent is helping a new agent get on their feet.

The mentoring agent may put the new agent below street level and take a few commission points as they help that agent get started. When the new agent is ready to go on their own, the mentoring agent would cut them loose and let them get their own contract.

In the world of insurance, things can get complicated as there are several levels between an LOA agent and the actual insurance company.

But here’s the long story short: Insurance Company > FMO > Independent Agent > Agency > LOAs.

Insurance companies have products to sell, but they may not have the distribution – they need agents to sell their stuff! FMOs step in to help market those products, while also providing independent agents with support.

Independent agents may decide they want to grow beyond just themselves, so they may start an agency. And that agency may choose to have licensed only agents, or LOAs.

At the top of this “food chain,” the overrides are very small. Each step down the chain, the override rises as the level of support increases. We’ll get into commission splits and agreements a little later in this article.

Pros of the LOA model:

You can do a lot of production with just 10 captive agents

It’s a natural next step for growth

Bigger impact in your community as you can reach and help more people

Lifelong friendships – we have agents at our local agency that have been with us for decades and are lifelong friends; we don’t think we’ve done something right to warrant that.

Cons, or more so challenges, of the LOA model:

Pressure and responsibility of being an agency owner

Shifting from a sales role to management

Figuring out how to retain agents who become successful and want to leave to become independent

Getting the vesting agreement right

Determining the compensation agreement and how you will structure the commissions

Your own time, money, and effort required to get a brand-new agent up and running

Deciding on what value you have to offer agents in exchange for your override

Figuring out if the book of business will be yours or the LOAs (i.e: will they be able to take that book of business with them if they decide to leave?)

There’s so much to consider before just jumping into the idea of recruiting agents.

I’d start with being honest with yourself: are you prepared for the pressure and responsibility of being an agency owner?

I remember not being able to sleep at night – I’d lay awake thinking about whether my agents were making a living. It’s a lot of pressure, and you feel the responsibility for it.

You also need to ask yourself if you’re cut out to be an agency owner. It takes the right person to be good at this. In my opinion, if you’re a good producer and you enjoy that, that gig is hard to beat.

When you start recruiting agents, you shift from sales to management. I see a lot of producers try it, and they should’ve just stuck with personal production because they ended up hating it.

If you’re a highly successful producer, I’d first consider hiring someone to help you. Keep doing what you do best. People in support roles can help you with the things you don’t like to do.

In sum, you must be management and coaching-inclined to be good at this.

Plus, if you’re a good salesman, you fight the thought that you could be selling everything yourself. You end up being a babysitter, and that may not be what you’re looking for.

So, that’s my word of caution for anyone thinking about starting an agency – seriously think it through first. We took that step and have an agency, but it’s not for everyone.

If you’re ready to start an agency and recruit some agents, one of the first things you need to think about is how to structure the agent compensation agreement.

We’ve tried to be as generous as we can at our agency because we know it’s hard, especially when you’re first starting. So, we give our agents all that we can.

The commission split or structure can really vary, and you can also get creative with it. It could be 60/40 – meaning the LOA gets 60% and the house gets 40%, it could be 70/30, 80/20, or it could be graduated depending on how many years that agent has been with you.

A graduation of commissions can make a lot of sense because a brand-new agent requires a lot more support than an established agent. As they “graduate” and need less help, the agency owner can then give them more commissions, because they’re doing less for them.

I’ve seen agents come up with all kinds of commission splits, but the key is making sure that what you’re doing for the agent is enough to justify your override. Both sides must be fair.

If you provide office space and secretarial administrative help, that agency owner deserves more than the person that just gives a contract and tells you to work out of your home. And yet sometimes, those spreads are the same!

There’s no magic to it – it’s up to the agency owner to be fair. And it needs to be crystal clear: what does the agent get, and what value is that agent bringing to the agency?

The vesting agreement is also an important piece to include in your agreement.

When an independent agent gets appointed, they’re vested Day 1, meaning whatever commissions they earn, they continue to receive until that company’s vesting requirements are satisfied.

As an example, some companies say you’re vested Day 1, and those are your commissions if your commission amount is at least $300/year.

An LOA assigns their commissions up. If that agent leaves after a year, do they take anything with them, or are they just out?

Some agencies will have a vesting period up to 10 years, but around 3 years is the most common.

You really need a vesting period in your agreement, because those first few years require a ton of time, money, and effort. Getting an agent started is an enormous task.

You may even be in the hole, especially in the first year, so is it fair for that agent to get all the training and support from you and then be able to leave once they’re done? You need protection as an owner.

You need a lawyer to put together the initial LOA contract. Then, you’ll have a template you can use for agents moving forward. It’s always best to make sure you don’t leave anything out, especially in today’s world.

A few items to make sure you include:

• Vesting agreement

• Commission split – whether it’s a split or graduation of commissions

• Non-compete based on a radius around your business

• Who owns the block of business – the agent or the agency?

The vesting agreement and commission split are simple – decide what’s fair and include it.

Non-Compete — You can train a person and teach an agent a lot, but if you don’t have a non-compete, they can start a business in an office next door and be your competition.

In your LOA agreement, I’d suggest you have a radius that they cannot do business within so many miles of you.

If I’m looking from the agent’s point of view, I want to know if the customers are mine or the agencies. If I bring in 100 policyholders, do I own that business or not?

That’s a key difference – if I’m the agent, I want that business to be mine.

I personally think the agent should be protected in the business they bring. They should own it and have the right to do with it what they want.

When the agent retires or if they have a change of heart and decide they don’t like it, they have a block of business worth something. There ought to be a buyout agreement.

That’s the way we’ve always done it, and I think it’s fair. It allows agents to grow and not feel like they are stagnant. They are building something of value that’s theirs.

Sometimes, the agent has no idea what they’re signing, and they don’t realize that the agency is taking advantage of them until it’s too late.

Say you want to break away and work somewhere else. Suddenly, they may say you can leave, but you don’t get any of your business. We’d never do that, but a lot of people in this business do, so be aware.

If you’re taking a piece of commission from an agent, you should be offering something of value to earn it.

Here are some examples of things you can provide to agents to make it fair for both sides:

• Office space

• Secretarial support

• Mentorship and professional advice from seasoned pros

• Access to computers, fax machines, copy machines, a phone system

• Postage

• Website

• Leads – often, agency owners will supply leads to new agents, so they have people to call on and go see.

• Software and tools, like MedicareCENTER – if you work with an FMO like us that supplies valuable resources, such as this important tool for quoting and enrollment, that also provides value to your agents.

• Compliance help – training your agents and being a resource in this world of ever–changing compliance is critical.

• Weekly meetings – we have a Monday morning meeting where we go over the production scoreboard, share insurance industry announcements, and connect with everyone to kick off the week.

A person brand new to the business will have trouble making it on their own with no support system, and that’s part of why becoming an LOA is so attractive.

The biggest drawback of the LOA model is that the agents you nurture, and train can eventually leave you. After a while, they feel that if they leave, they can make more by going out on their own.

How are you going to navigate those waters? It’s important to have a game plan upfront before you start. For the agents that make it, how will you keep them and ensure they feel they can continue to grow?

For us, it’s been a mix of providing a lot of value and ensuring our agents own their book of business. It’s an important topic to sit down and really think about before you invest a ton of time and money in new agents.

The key to starting an agency with the Licensed Only Agent (LOA) Model is having a clear understanding of expectations on both sides.

What is the owner bringing to the table, and what is the agent going to bring? What’s the succession plan if the agent wants out?

I never wanted a person to feel like once they came on, they could never grow. If you don’t consider this, I think you’ll end up losing all the agents you bring on.

I hope this was helpful. While we don’t have any cookie-cutter templates and we don’t do consulting on this topic, we’re happy to help however we can.

Good selling!

Hey there, my name is John Hockaday, and I’m the COO & Principal of New Horizons Insurance Marketing and the co-Founder of Sams/Hockaday & Associates. I’ve been business partners with Jeff Sams since 1981.

Back in the 80s, I started out by servicing clients as an agent out in the field.

After a few years, it was clear that Jeff and I needed to expand, so we started an agency and grew it to a staff of 30+ people.

Twelve years later, we started this senior insurance marketing company, New Horizons.

I specialize in the “everyday” flow of the insurance business, spending most of my time talking to senior market agents. Where I help agents, the most is in underwriting. I know what each carrier will and won’t take, so I can help you place those tough cases.

On occasion, I contribute to our blog, and you’ll also find me on our YouTube channel.

Regardless of what level you’re at, I can assure you that I’ve been there and know exactly what you’re dealing with firsthand.

jhockaday@nhmteam.net

217-233-8000 Ext. 106

The Medicare Payment Advisory Commission (MedPAC) is an independent congressional agency established by the Balanced Budget Act of 1997 (P.L. 105-33) to advise the U.S. Congress on issues affecting the Medicare program. In addition to advising the Congress on payments to private health plans participating in Medicare and providers in Medicare’s traditional fee-for-service program, MedPAC provides information on access to care, quality of care, and other issues affecting Medicare.

The Commission’s 17 members bring diverse expertise in the financing and delivery of health care services. Commissioners are appointed to three-year terms (subject to renewal) by the Comptroller General. Appointments are staggered; the terms of five or six Commissioners expire each year. For more information on the commissioner appointment process, please click on ‘Medicare Payment Advisory Commission (MedPAC)’ on this page. The Commission is supported by a career staff who typically have backgrounds in economics, health policy, public health, or medicine.